Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Economic and Management Sciences

On-line version ISSN 2222-3436

Print version ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.20 n.1 Pretoria 2017

http://dx.doi.org/10.4102/sajems.v20i1.1486

ORIGINAL RESEARCH

Exploring women's perceptions regarding successful investment planning practices

Elmarie Venter; Janine Kruger

Department of Business Management, School of Management Sciences, Nelson Mandela University, South Africa

ABSTRACT

BACKGROUND: Compared to men, women are not as confident and knowledgeable about financial and investment matters. As a result, women often do not conduct investment planning until it is too late, and they are confronted with a financial crisis or a life predicament such as a divorce or death. In addition, limited scientific research exists on the investment planning practices of women in South Africa. This study contributes to the body of knowledge on investment planning by better understanding the unique financial needs and challenges of women. Recommendations made by this study will assist women and financial planners to make more informed investment decisions as they progress through life.

AIM: Therefore, the primary objective of this research was to investigate the factors that influence women's perceived successful investment planning in the Nelson Mandela Bay area. After conducting a comprehensive literature study, six factors (independent variables), namely, values, attitudes, time horizon, personal life cycle, risks and returns, and investment knowledge, were identified as influencing the perceived successful investment planning (dependent variable) of women.

SETTING: As this study focussed on the perceptions of women concerning the factors that influence successful investment planning, the target population was all women in the Nelson Mandela Bay area older than 20 years with some investment experience.

METHODS: A quantitative research methodology was followed, and data were collected from 207 women using a structured self-administered questionnaire.

RESULTS: The results of the multiple regression analysis revealed that only one independent variable emerged as having a significant influence on perceived successful investment planning of women, namely, investment knowledge.

CONCLUSION: Based on the empirical results of this study, several recommendations have been made in an attempt to assist women to make more informed investment decisions and manage their investment planning more effectively as they progress through life.

Introduction, problem definition and research objectives

It is important for individuals to engage in financial planning and set financial goals because this will assist them to persevere in difficult financial times and flourish in good times (Gitman, Joehnk & Billingsley 2014:16). In order to achieve these financial goals, several types of planning need to occur, and investment planning is one of them (Gitman et al. 2014:27). A proper investment plan will help individuals, regardless of gender, to achieve their specific financial goals, such as contributing to an education fund or building a reasonable retirement fund. Investment planning involves investing money in various investment vehicles, such as ordinary shares, government or corporate bonds, collective investment schemes and real estate. Various risk levels are associated with each of these vehicles; therefore it is wise to engage in investment planning to ensure that a balance is maintained between individuals' goals, risk tolerance levels and the chosen investment vehicle (Botha et al. 2015:579).

Despite the importance of undertaking financial planning in general and investment planning in particular, Mhlanga (2012) highlights that many women still do not engage in such planning. In addition, studies conducted by Hung, Yoong and Brown (2012:5-6, 10), as well as Aegon (2014:2, 10), point out that although most women manage the daily finances and take short-term financial decisions at home, they are not involved with long-term financial planning as they spent most of their time caring for their families (Why money is different for women 2014).

In addition, a study conducted by Goldsmith and Goldsmith (2006:64) found that women have less knowledge and skill than men in managing their personal finances and investments. Therefore, many women may be reluctant to involve themselves in investment planning because they are afraid of losing their investments (Fisher-French 2013; SA women keep secret savings - survey 2012). Willows (2013:38-39) concludes that women are more risk-averse than men when it comes to handling financial matters, including investments. It has also been found that the general lack of confidence in investing and the avoidance of more risky investments are prevalent in the global environment (Fisher-French 2013). Mhlanga (2013) is of the opinion that women would rather focus on repaying debt and closing store accounts than on investing for retirement, which remains a major concern for many women. A study by Visa found that fewer than 2% of South African women invest directly into equity, and that many of those doing so regard this action as a poor investment decision (Lammas 2014).

Furthermore, Eikmeier (2007:6) and Blayney (in Schulaka 2015:10-11) caution that women are exposed to unique financial challenges that may differ from those of men, as well as from each other. These challenges include, amongst others, women typically earn less than men, they work fewer years than men, they work in entrepreneurial and non-traditional enterprises, they need more late-in-life care and they live on average 5 years longer than men.

Even though Falahati and Paim (2011:1765) suggest that financial satisfaction and its effect on the quality of life have received considerable attention in recent decades, Plagnol (2011:45) points out that limited research is available regarding financial satisfaction and how it changes over an individual's life cycle. Furthermore, no scientific research has been conducted on women's perceptions of investment planning practices in South Africa in general and in the Nelson Mandela Bay in particular. Previous research on women's perceptions concerning financial and investment practices are based on in-house reports from financial institutions, such as banks and insurance companies, as well as articles published in non-academic media sources. Therefore, the primary objective of the present research is to investigate the factors that influence women's perceived successful investment planning in the Nelson Mandela Bay area, situated in the Eastern Cape province of South Africa.

This study will contribute to the body of knowledge on investment planning by better understanding the unique financial needs and challenges of women. Recommendations made by this study will assist women and financial planners to make more informed investment decisions as they progress through life.

Literature review and hypotheses development

Based on the existing literature on financial and investment planning, several factors influencing women's perceived successful investment planning have been identified (Harbour, n.d.; Malcolm 2012:5; Watters 2011). These factors are values, attitudes, time horizon, personal life cycle, risk and return as well as investment knowledge. The hypothesised relationships and proposed hypothesised model are depicted in Figure 1.

Perceived successful investment planning (dependent variable)

As illustrated in Figure 1, the dependent variable of this study is perceived successful investment planning of women. For the purpose of this study, this variable refers to the degree of satisfaction women experience with the growth, income or profits of their investments that will enable them to stay in control of their finances as well as to plan and achieve their financial goals and objectives. Williams (1997:77) suggests that people only perceive their investment planning as successful when they are able to control their finances and investments through engaging in investment planning. In addition, Budgar (2011:22) states that individuals only experience and perceive their investment planning as successful when they receive some form of income, profits or growth of their investments.

Factors influencing investment planning (independent variables)

Figure 1 illustrates six factors that potentially influence women's perceived success when investment planning is undertaken, as identified from the literature and previous empirical studies. A discussion of these factors, namely, values, attitudes, time horizon, personal life cycle, risk and return and investment knowledge, will follow. The theoretical support for each of these hypothesised relationships between these factors (independent variables) and the dependent variable (perceived successful investment planning) will be discussed.

Values

According to Hockenbury and Hockenbury (2007:34), individuals' goals are a reflection of their personal values. Values are relatively permanent personal beliefs about what everybody regards as important, worthy, desirable or right in the way they live and work (Giraldi & Ikeda 2008:171-176). Values tend to reflect an individual's upbringing, and change very little without a conscious effort from her or him. For example, some families and individuals regard happiness as having a very high value; for others, power or status may be a greater value (Bobowik et al. 2011:488).

Kreie and Cronan (2000:66-67) are of the opinion that values should determine people's priorities in general and investment planning in particular. When it comes to investment planning, women's values are often guides on which to base their investment goals. While setting up personal investment goals, women become more specific about how they want to achieve their goals and how to judge whether their goals are realistic (Kohli 2014; Swenson 2013:13). For instance, if a woman values her independence in terms of finance, she will invest in an investment portfolio to gain adequate funding to buy her own car or house. In other cases, if a woman's most important value is her children, she will invest funds in her children's health or education (SA women keep secret savings - survey 2012). Tengler (2014) suggests that women can achieve success in their investment planning when setting clear goals that are linked to their values. Values-based goals assist investors to achieve their life plans, dreams and personal values, while achieving success in their investment planning (Irving 2012:51; Knight 2010; Liersch 2013:9). For the purpose of this study, values refers to women's personal, family, religious, ethical and cultural values that guide them when investing. The following hypotheses are thus formulated:

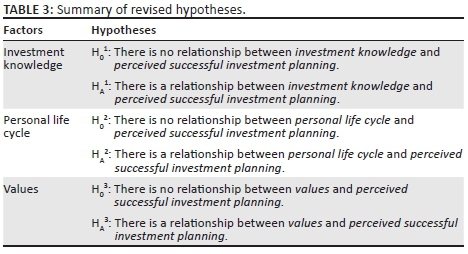

H01: There is no relationship between values and perceived successful investment planning.

HA1: There is a relationship between values and perceived successful investment planning.

Attitudes

According to Chaiklin (2011:31), there is no universally accepted definition of 'attitude'. Waits (2012:21) states that psychologists define attitudes as a learned tendency to evaluate objects in a certain way. This can include evaluations of people, issues, objects or events. Such evaluations are often positive or negative, but they can also be uncertain at times. For instance, a little girl may have mixed feelings about a particular person or issue. However, in social sciences, an attitude often refers to a mental position with regard to a fact or a state, or a feeling or emotion towards a fact or a state (Chaiklin 2011:32). In addition, attitudes reflect a position individuals have taken with regard to their values, and are much more flexible than values (Boninger et al. 1995:159).

According to Maio and Haddock (2015:4), attitudes are an overall evaluation of an object based on information that may be a thought, a feeling or past behaviour. Therefore, attitudes may emerge because of direct personal experience, or they may result from observation (Marcus 2011:34). Social roles and social norms can have a strong influence on attitudes. Social roles relate to how people are expected to behave in a particular situation or context. Social norms involve society's rules for which behaviours are considered appropriate (Boninger et al. 1995:159). Therefore, women's attitudes towards investment planning are partially influenced by the cultural and social expectations of how they should manage their finances as women. Before 1950, women were expected to engage in early marriage and look after their families as a universal norm. Men were expected to be the main wage-earner in the family who catered financially for their wives and children (Davey 2008:121).

Over the past few decades, however, more women have entered the workforce and helped to support their families financially together with their husbands (Campey 2012:7; Goudreau 2012:15; Hira & Loibl 2006:2; Mellon 2015). Research shows that in some cultures, men view women as better budgeters and possessing greater self-control. A culture's expectation dictates gender roles and different attitudes towards managing finances and investments. Therefore, women find themselves more focussed on short-term finances than engaging in investment planning (SA women keep secret savings - survey 2012).

The survey result of Visa (SA women keep secret savings - survey 2012) supports the findings of Arti, Sunita and Julee (2011:5) that female investors tend to display less confidence in their investment decisions, owing to a lack of knowledge and being risk-averse, and therefore have lower satisfaction levels. Female investors are also more cautious with regard to investment in shares, especially if the availability of their funds is low. The reason is that they feel uncomfortable investing in shares which are associated with higher risk levels than other investment vehicles. Hira and Loibl (2006:65) comment that many women find making investment decisions stressful, difficult and time-consuming. As a result, it is suggested that women's attitudes towards investment planning have a direct effect on their involvement and success in this planning. For the purpose of this study, attitudes refers to women being comfortable and confident when making investment decisions. Based on the discussion, the following hypotheses have been formulated:

H02: There is no relationship between attitudes and perceived successful investment planning.

HA2: There is a relationship between attitudes and perceived successful investment planning.

Time horizon

Time horizons are simply the length of time for which investors place funds in different investments in order to obtain their investment goals (e.g. capital growth or regular income from withdrawals of investments, or both) (Droms & Strauss 2003:73; Jaeger, Rausch & Foley 2010:12-18). Sometimes time horizon is also referred to as investment horizon. A time horizon can be as short as a few seconds or it can constitute a period that lasts for decades (Constable 2014). Setting a time horizon for any investment usually has to do with the goals of the investor. Investment time horizons can be categorised as short-term, intermediate-term and long-term (Jaeger et al. 2010:16).

Women can maximise their financial security in the short-term and the long-term without any conflict between the two if they correctly identify the time horizons of each investment goal (Young 2013:2). For instance, if a female investor is seeking to invest in short-term vehicles as a way of financing the purchase of a home in 5 years, this goal will help to define the parameters of her investment activity. The investor will actively look for ways to invest funds in investment options that will generate a sufficient return at the end of this 5-year period to allow for the purchase of a home within a specified price range (Parker 2011:6).

At the same time, a longer time horizon may be more in line with the investor's goal of creating a solid financial base for the retirement years. In this scenario, the investor will probably move towards investments that show a consistent growth pattern over the years, with little to no downturns anticipated. The time horizon for this approach may span 30 years or more (Zugang & Jia 2010:323). For the purpose of this study, time horizon refers to the knowledge and preference women have of the time horizon (length) of their investments, which are less than 4 years (short-term horizon), from 4 to 9 years (intermediate-term horizon) or longer than 10 years (long-term horizon) when investing. Consequently, the following relationships are hypothesised:

H03: There is no relationship between time horizon and perceived successful investment planning.

HA3: There is a relationship between time horizon and perceived successful investment planning.

Personal life cycle

It appears that people's financial priorities change as they move through the different phases of their personal life cycle (Overton 2010:385). In support, Plagnol (2011:52-53) has found that individuals' priorities and preferences will change as they move through the life cycle stages; not only do their financial priorities change, but also their perception of financial satisfaction.

According to Cooper and Worsham (2009:23) and Swart (2002:145), people go through five separate phases in a personal life cycle, based on different age categories: the young years, the family years, the career years, the pre-retirement years and the retirement years (Cooper & Worsham 2009:23). It is important they should know that throughout the five life stages, continuous and diverse investments should be made to match specific investment needs at each stage.

Caldwell (2012:20) notes that women's life situations reduce the chances of their attaining certain investment goals because of unexpected events such as becoming a single mother, getting divorced, or becoming a widow (Uglanova & Staudinger 2013:265). After such a life situation, the investment needs of a woman will change, and the investment plan needs to be adapted accordingly (Hira & Loibl 2006:72). Therefore, it is important for women to practise, monitor and alter investment planning throughout different stages of their life cycle to achieve and maximise their success in investment planning (Uglanova & Staudinger 2013:265-286). For the purpose of this study, personal life cycle refers to women being aware that their investment needs, priorities and goals change as they move through different life stages, as well as different age groups; therefore, women need to monitor and change their investment planning accordingly. Based on this discussion, the following hypotheses have been formulated:

H04: There is no relationship between personal life cycle and perceived successful investment planning.

HA4: There is a relationship between personal life cycle and perceived successful investment planning.

Risk and return

According to Droms and Strauss (2003:72), one of the key steps in investment planning is the assessment of women's risk tolerance so that an investment portfolio (i.e. a combination of two or more investment instruments) can be structured that is consistent with their willingness to trade risk for reward. Hsin-yuan, Dwan-fang and Shang-yu (2010:39) agree that it is necessary to consider investment risks and returns when doing investment planning. In doing so, women will be able to maximise the possibility of reaching their financial goals and protecting their portfolios (Weatherholt 2009:12).

Lee (2013) defines risk as the possibility of suffering a loss, implying that there is a chance that the return on an investment may be lower than was anticipated. Return refers to the income or profit on an asset or the possible loss involved in owning such an asset or investment (Jordan, Miller & Dolvin 2012:2). In general, an investor will anticipate a higher return on an investment with a high risk, and a lower return on an investment with a low risk. Risk and return are, therefore, positively correlated. In other words, the higher the risk, the higher the anticipated return, while the lower the risk, the lower the anticipated return. Time plays a major role in risk and return, because the longer the investment period, the greater the anticipated risk and the greater the anticipated return on an investment or asset (Swart 2002:132).

A number of studies focussing on risk-taking in investments point out that there are differences between men's and women's risk tolerance levels. Charness and Gneezy (2012:50) note that women are more risk-averse than men. Mittal and Vyas (2011:45) suggest that women's attitude towards risks is less aggressive than their male counterparts, because they generally have less confidence than men in making investments. As a result, women often take a more conservative approach to making investment decisions, which in turn leads to lower returns on their investments (Hira & Loibl 2006:73). Similarly, Rutterford and Maltby (2007:313) find that women have a low tolerance towards investment risks. However, women who possess some level of education, financial knowledge and/or wealth are willing to accept more investment risks than others.

For the purpose of this study, risk and return refers to women's awareness of risks and returns as well as their positively correlated relationship (i.e. the higher the risk, the higher the return) when investing. Therefore, the following hypotheses are formulated:

H05: There is no relationship between risk and return and perceived successful investment planning.

HA5: There is a relationship between risk and return and perceived successful investment planning.

Investment knowledge

According to Miller (2005:124), more women than men admit that they are not very knowledgeable about investment planning. Therefore, women tend to feel less confident than men in their understanding of investment products as well as the current economic conditions that influence their ability to make investment decisions (Malcolm 2012:5). The only way for women to achieve some form of success in investment planning is for them to gain basic investment knowledge, such as knowing the types of existing investment vehicles (Fisher-French 2013:11; Rogers 2011:4).

It is important for women to familiarise themselves with the different types of investment vehicles available to them, the risks and returns, as well as the fees related to each investment vehicle. Fees can include brokerage commissions and advisory fees, and every effort should be made to avoid unnecessary costs that can limit the gains on their investments (Bellingsley, Gitman & Joehnk 2016:249; Carney 2009:10).

Women should also understand and make use of diversification when engaging in investment planning. Hira and Loibl (2006:15) maintain that women are less likely than men to diversify their investments, because of the liquidity level and low risk. However, the lack of knowledge about diversification leads everyone in general and women in particular to accept lower returns and higher risks (Hira & Loibl 2006:15).

For the purpose of this study, investment knowledge refers to women having knowledge about the different types of investment vehicles, knowing the investment length and cost implications of each investment, past investment experiences and s knowing how and where to obtain help and relevant investment information in making investment decisions. Based on the discussion presented above, the following hypotheses have been formulated:

H06: There is no relationship between investment knowledge and perceived successful investment planning.

HA6: There is a relationship between investment knowledge and perceived successful investment planning.

Research design and methodology

Population, sampling procedure and response rate

As this study focussed on the perceptions of women concerning the factors that influence successful investment planning, the target population was all women in the Nelson Mandela Bay area older than 20 years with some investment experience. Owing to the unavailability of a database containing the details of women investing in the Eastern Cape, non-probability convenience and snowball sampling techniques were adopted to draw the sample for this study. Client databases of female investors are confidential, and therefore access to these databases was not possible with investment firms and financial institutions. Sekaran and Bougie (2010:276) note that convenience sampling is particularly useful during the exploratory stage of a research project.

Financial and investment institutions in the area, such as First National Bank, Standard Bank, Old Mutual, Sanlam, Consolidated Financial Planning, Spectrum Group and South City, agreed to assist the researcher in approaching possible respondents. Research contacts, family members and friends in the area were also requested to identify any suitable respondents who could participate in this study. The size of the sample was further increased by referrals made by the participating respondents through follow-up communications via email. Potential respondents were provided an electronic link to complete and return the questionnaire. In total, 965 respondents were identified to participate, and 225 completed questionnaires were returned by the respondents, but only 207 were usable for further statistical analysis, indicating a response rate of 23.31% for the study.

Scale development

The measuring instrument employed consisted of a cover letter and a questionnaire, comprising four sections. A detailed description of the purpose of the study and type of information requested was provided in the cover letter. The cover letter also addressed the issues of the respondents' confidentiality, anonymity and opt-out options and emphasised that the completion of the questionnaire was voluntary. The required ethical clearance to conduct the research was also carried out.

Section 1 of the self-administered questionnaire consisted of 49 statements (items) that were adapted from previously used scales designed to measure the factors influencing respondents' perceptions of successful investment planning. The items and the scales used are listed in Table 1-A1. A seven-point Likert-type interval scale was adopted, because it excels in objective accuracy, perceived accuracy and ease of use (Finstad 2010:108). The respondents were requested to indicate the extent of agreement with each statement by placing a cross in the appropriate column. The scale ranged from 1 (strongly disagree) to 7 (strongly agree).

Section 2 of the questionnaire requested demographic information of the respondents, namely, their age, ethnic background, marital status, highest education level, occupation, investment experience, involvement in investment planning and type of investment instruments owned. Section 3 requested information relating to the respondents' actual engagement with investment planning. Both sections 2 and 3 used nominal scales. Section 4 provided an open-ended question to gather respondents' suggestions and comments relating to investment planning. Results from sections 3 and 4 were used to support and possibly justify the empirical results of section 1.

As far as possible, valid and reliable items were sourced from previous studies, but were rephrased to fit the context of the present study. Each variable was operationalised in terms of the scale, and are summarised in Table 1.

Methods of data analysis

The collected data were analysed by using Microsoft Excel and Statistica Version 12. According to Quinlan (2011:336), the questionnaire and scale designed by the researcher must be a valid measure of the phenomenon being studied. According to Collis and Hussey (2014:53), there are a number of different ways in which the validity of research can be assessed. In this research, the face validity was ensured by approaching female academics with investment experience while the questionnaire was piloted amongst 20 female investors to ensure content validity (Struwig & Stead 2013:146-150). In addition, an Exploratory Factor Analysis (EFA) was conducted to assess the construct validity of the scales measuring the independent and dependent variables (Hair et al. 2014:115). Cronbach's alpha coefficients were calculated to assess the reliability of the measuring instrument. In this study, a Cronbach's alpha coefficient value greater than or equal to 0.7 was deemed as reliable (Hair et al. 2014:123). The data were analysed by using descriptive (mean and standard deviations) statistics (Struwig & Stead 2013:159). Inferential statistics, namely, the Pearson product-moment correlation coefficients, were calculated to determine links between the dependent and independent variables (Lind, Marchal & Wathen 2012:463) and multiple regression analysis was performed to test the hypothesised relationships (Hair et al. 2014:157).

Ethical considerations

Ethics clearance was obtained from the Nelson Mandela University, with ethical clearance number: H13-BES-BMA-029.

Empirical results

Sample demographics

The majority of the respondents were between the ages of 40 and 49 (32%), followed by those between the ages of 30 and 39 (23%) and between the ages of 50 and 59 (22%). Only a few respondents were between the ages of 20 and 29 (14%) or older than 60 years (9%). With regard to ethnic background, most of the respondents were white (71%), whereas a small group was Asian (3%) or Indian (3%). The remaining ethnic groups, namely, black (11%) and mixed race (11%) participated equally. Three respondents (1%) were not willing to indicate their ethnic affiliation.

Most of the respondents were married (64%). A few respondents indicated that they were single (18%), divorced (10%), in partnerships (5%) or widowed (3%). Regarding the respondents' highest qualifications, most indicated that they held a post-graduate degree (45%), followed by respondents who had a diploma (24%). Some of the respondents had a bachelor degree (15%), grade 12 certificate (14%) or a grade 10 and tertiary certificate (2%). The great majority of respondents were employed full-time (84%), whereas a small group were employed on a part-time basis (8%). The remaining respondents indicated that they were retired (3%), homemakers (1%), students (1%), employed on contract or self-employed (3%). Nearly half of the respondents had investment experience in excess of 10 years (45%), between 1 and 5 years (31%) and between 6 and 10 years (17%). Only 7% of the respondents indicated having investment experience of less than 1 year.

Results of the validity and reliability assessments

After face and content validity were assured, an EFA was undertaken to assess the construct validity of the measuring instrument. Items with loadings greater than 0.5 that loaded onto one factor only were considered significant in this study (Hair et al. 2014:115). Factors with loadings of two or less items were excluded from further analysis (Suhr 2006:4). In order to verify the reliability of the measuring instrument, the Cronbach's alpha coefficients were calculated. Cronbach's alpha coefficient values of at least 0.7 (Hair et al. 2014:123) were regarded as reliable for the purpose of this study. The factor structure of the dependent and independent variables, as well as the Cronbach's alpha values are provided in Table 2.

Despite only five of the seven items originally developed to measure investment knowledge loading onto this factor, its name remained unchanged, because the other items that loaded onto it also referred to women's knowledge about making investment decisions. The items' loadings onto investment knowledge ranged between 0.558 and 0.822, and the factor explained 17.22% of the variance in the data. The Cronbach's alpha of the investment knowledge was 0.924.

As five of the six items originally used to measure personal life cycle loaded together, the name for this factor remained unchanged. The items' loadings onto personal life cycle ranged between 0.669 and 0.839, and the factor explained 7.95% of the variance in the data and the factor was regarded as reliable (Cronbach's alpha = 0.839).

Six of the seven items originally developed to measure values loaded onto this factor. Therefore, the name for this factor remained unchanged and the factor was regarded as reliable (Cronbach's alpha = 0.793). The items' loadings onto values ranged from 0.584 to 0.742, and the factor explains 6.69% of the variance in the data.

Despite only five of eight items originally expected to measure perceived successful investment planning loading onto this factor, the name remained unchanged. The items' loadings onto perceived successful investment planning ranged between 0.504 and 0.728, and the factor explained 7.13% of the variance in the data. The Cronbach's alpha for this factor was 0.793.

According to Suhr (2006:4), only factors with three or more item loadings that were reliable would be considered for further analysis. Therefore, the factor time horizon was excluded from further analysis (only two items remained after rephrasing the one item with the negative factor loading). Similar to the factor time horizon, the factor risk and return was excluded from further analysis as only two items loaded onto this factor. Even though the loading of the factor attitudes provided a valid result and there were more than two items loaded onto this factor, the Cronbach's alpha coefficient for attitudes of 0.480 indicated that the factor was unreliable. Therefore, the factor attitudes was excluded from further analysis.

Based on the EFA, the operationalisations of the various constructs were reformulated, and the original hypothesised model (see Figure 1) and hypotheses (Table 3) were revised.

Results of the descriptive statistics

In order to describe the sample data, descriptive statistics consisting of the mean, standard deviation and frequency distribution for the sample as a whole were calculated. The response options relating to the statements measuring all the independent variables and the dependent variable (Table 4) varied between 'strongly disagree' to 'strongly agree'. These responses were re-categorised as 'disagree' (1.00 ≤ × < 3.00), 'neutral' (3.00 ≤ × ≤ 4.00) and 'agree' (4.00 < × ≤ 7.00).

From Table 4 it can be seen that the factor personal life cycle produced the highest mean score of 6.064. Therefore, the majority (97.59%) of respondents agreed that the personal life cycle factor has a strong influence on investment planning. A mean score of 5.156 was reported for the factor Investment knowledge. The majority (76.81%) of respondents considered the factor Investment knowledge as important to them when planning their investments. The factor values returned a mean score of 4.463. Only half of the respondents (57.01%) agreed that values should be taken into account while doing investment planning. The remainder were neutral (22.71%) or considered the factor values as not important (20.29%) to them when planning their investments.

The dependent variable perceived successful investment planning produced a mean score of 5.112. The majority (73.91%) of respondents agreed that they considered their investments successful, and were satisfied with their current investment planning. Only 6.28% of the respondents perceived their investments as unsuccessful, with 19.81% being neutral regarding the statements measuring perceived successful investment planning.

Results of the Pearson product-moment correlation coefficient

The Pearson product-moment correlation coefficients were calculated to measure the linear association between the dependent and independent variables. The Pearson product-moment correlation coefficient indicated positive significant correlations between most variables in the study. The strongest positive significant correlation was reported between perceived successful investment planning and investment knowledge (r = 0.541; p < 0.05). The associations between personal life cycle and investment knowledge (r = 0.192; p < 0.05), values and investment knowledge (r = 0.185; p < 0.05), perceived successful investment planning and personal life cycle (r = 0.172; p < 0.05) were regarded as weak but statistically significant. The associations between values and personal life cycle (p > 0.05) and perceived successful investment planning and values (p > 0.05) were both not statistically significant.

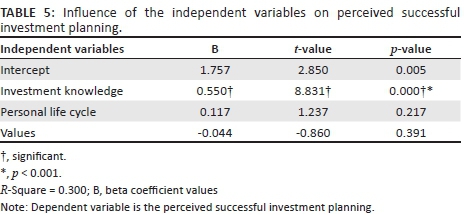

Results of the multiple regression analysis

Multiple regression analysis was performed to determine the influence of the various independent variables (i.e. investment knowledge, personal life cycle and values) on perceived successful investment planning (dependent variable) (Table 5).

According to Table 5, the three independent variables explained 30% of the variance in the dependent variable perceived successful investment planning. Only one independent variable emerged as having a significant positive influence on perceived successful investment planning of women, namely investment knowledge (b = 0.550; p < 0.001). In other words, if respondents increase their investment knowledge, it is likely that they will be more successful with their investment planning. Table 6 summarises the acceptance decisions of the three formulated hypotheses.

Only the investment knowledge of the respondents had a significant influence on whether the respondents were satisfied with the income and growth they received from their investments, as well as being able to achieve their financial goals through investing. However, whether the women considered the personal life cycle and values as important or not, had no influence on their perceptions of the success of their investments.

Discussion, conclusions and recommendations

The findings of the study revealed the existence of a significant positive relationship between investment knowledge and perceived successful investment planning. In other words, women who are comfortable and confident with making investments, having knowledge of investment trends, the different types of investment vehicles, knowing the investment risks involved and length of each investment, as well as knowing how and where to obtain help and relevant investment information in making investment decisions, are likely to be satisfied with the income and growth they receive from their investments, as well as being able to achieve their financial goals through investing. The results of this study are consistent with that of other researchers who have also found a positive relationship between investment knowledge and success (Goldsmith & Goldsmith 1997:236; Goldsmith & Goldsmith 2006:57; Olsen & Cox 2001:30).

In order to obtain and develop knowledge about investments, women should consider becoming more knowledgeable about topics related to investments, and reduce their fear and their lack of confidence when making investment choices, as well as not feeling obliged to invest with a particular advisor or a particular investment vehicle. By obtaining more knowledge about investments, women can make better and more informed investment decisions without the influence of their emotions. In particular, they should equip themselves with knowledge about the different investment vehicles available to them, their growth rates and possible risks, and possible fees related to each investment vehicle, as well as investments that cater specifically for women. In addition, they should be aware of the tax implications of investment vehicles to minimise unnecessary costs.

Women should consult with financial and investment advisors in order to get assistance and guidance on how to make correct investment decisions and monitor their investment more effectively. This applies especially to women who are not confident themselves about making investments or have limited time to take care of their investment planning. However, they should still be aware of the performance and management of their investments by requesting regular up-to-date reports on the performance of each investment.

If women want to manage their investments themselves, it is advisable that they attend investment workshops, short courses, seminars or conferences presented by investment experts in order to gain practical investment knowledge, and tips and strategies on how to make good investment decisions. Reading investment books and magazines which provide useful information about investments could assist women to get started in investment planning, and to increase their confidence in making investment decisions.

Based on an analysis of the open questions in the questionnaire, the majority of the respondents agreed that it is important to start investing from an early age. One respondent stated that to start investing early before marriage helps women learn how to become financially independent of their spouses. In addition, the earlier women start investing and take out life insurance, disability and dread-disease cover, the cheaper the cost of these investment vehicles will be. Furthermore, it is important for women to educate their children about the benefits of saving and investing from a young age. The respondents in this study stressed that access to reliable investment options that suit individual needs should be more easily available to women. One respondent suggested that investment options should be made to be more easily withdrawn, with fewer penalties imposed, while other respondents recommended that investors should not be given a choice to terminate their investment plans.

The results of the multiple regression analysis did not show a significant relationship between personal life cycle and perceived successful investment planning in this study. Previous researchers Hira and Loibl (2006:10), Malhotra and Crum (2010:43) and Uglanova and Staudinger (2013:265) however suggest that the life cycle of a person influences investment planning. A common conclusion from all these researchers has been that it is important for women to practise, monitor and alter investment planning throughout different stages of their life cycle to achieve and maximise their success in investment planning. A possible explanation for the non-significant relationship could be the demographic profile of respondents in this study. As the majority of women in this study were between 30 and 59 years of age (77%), one can assume that they were in the phase of their life cycle where they were engaged in making investments as they take greater responsibility for their financial well-being.

In this study, no significant relationship was found between values and perceived successful investment planning. However, value-based goals are important as they could assist women to gain happiness in life by being able to live according to their values, but also to achieve success in their investment planning.

Limitations of the study and recommendations for future research

Although the present study has attempted to make a significant contribution to financial and investment planning literature, some limitations were encountered. Firstly, because non-probability convenience sampling was used, the results of the study cannot be generalised with absolute confidence to all women in South Africa. In order to make the research more valuable, future research concerning women's perceptions on investments should extend to other areas of the Eastern Cape or to the other regions of South Africa.

Secondly, several of the factors identified as influencing perceived successful investment planning in the literature did not load together as expected when undertaking the EFA, and had to be eliminated from further statistical analysis. In future studies, the scales developed to measure the various factors identified in the literature as influencing perceived successful investment planning should be reconsidered and redeveloped to ensure that the influence of those factors can be assessed.

Thirdly, this study focusses only on six variables that influence women's perceived successful investment planning, namely, investment knowledge, personal life cycle, values, time horizon, attitudes, and risks and returns. However, the literature suggests that it is also necessary to consider women's involvement in the seven steps of the investment planning process, which could influence the possible level of success in such planning.

The majority of respondents that participated in this study were white (71%) and married (64%) with previous investment experience. These results showed that the demographic characteristics of the respondents in this study were homogeneous. Future studies should make use of a stratified or a quota sampling method in order to avoid the problem of over-representation of one particular ethnic group, for example. Future research could also be conducted amongst women with and without investment experience.

Despite the limitations mentioned, the research still provides a significant contribution to the existing literature of research on financial and investment planning. Most previous research focussed on different components of financial planning such as retirement planning or risk management other than investment planning. Only limited research has addressed women's perceptions of investment planning. In addition, suggestions were made to assist women to make better investment decisions and manage their investment planning more effectively.

Acknowledgements

The authors would like to acknowledge the contributions of Ms. T.A.T. Dao in the completion of this article.

Competing interests

The authors declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

Authors' contributions

Both authors, E.V. and J.K., contributed equally in terms of the theory, empirical analysis, discussion and recommendations. E.V. initiated the article and was mainly responsible for corrections.

References

Aegon., 2014, 'The changing face of retirement' - Women: Balancing family, career & financial security, pp. 2, 10, viewed 09 May 2017, from https://www.transamericacenter.org/docs/default-source/global-survey-2014/tcrs2014_sr_global_women_report.pdf [ Links ]

Andrew, Y., 2012, 'Commentary: Choosing a financial advisor no easy task', Daily Record, 1 January, p. 10. [ Links ]

Anspach, D., 2013, '5 steps to make an investment plan', Money over 55 Guide, 12 March, p. 3. [ Links ]

Arti, G., Sunita, S. & Julee, A., 2011, 'Difference in gender attitude in investment decision making in India', Research Journal of Finance and Accounting 2(12), 1-7. [ Links ]

Bobowik, M., Van Oudenhoven, J., Basabe, N., Telletxea, S. & Páez, D., 2011, 'What is the better predictor of students' personal values: Parents' values or students' personality?' International Journal of Intercultural Relations 35(4), 488-498. https://doi.org/10.1016/j.ijintrel.2011.02.006 [ Links ]

Boninger, D.S., Krosnick, J.A., Berent, M.K. & Fabrigar, L.R., 1995, The causes and consequences of attitude importance, Lawrence Erlbaum, Hillsdale. [ Links ]

Botha, M., Rossini, L., Geach, W., Goodall, B., Du Preez, L.D. & Rabenowitz, P., 2015, The South African financial planning handbook 2015, Lexis Nexis, Durban, South Africa. [ Links ]

Brenner, S.A., 1995, 'Why women rule the roost: Rethinking Japanese ideologies of gender and self-control', Finance Journal 1(1), 19-50. [ Links ]

Budgar, L., 2011, 'Inflation's shadow: Investment offsets and their risks', Journal of Financial Planning 24(6), 22-28. [ Links ]

Caldwell, M., 2012, 'Six major financial steps of your life', Financial Mail, 3 May, p. 20. [ Links ]

Caldwell, M., 2013, 'Before you begin investing: Five things to consider', Money in your 20s Guide, viewed 5 October 2015, from http://moneyfor20s.about.com/od/reasonsandwaystosave/bb/begininvesting.htm [ Links ]

Campey, A.B., 2012, 'Women's financial management: The truth about women's attitude towards money', Money Smart, 28 May, p. 7. [ Links ]

Carney, J., 2009, '12 things you absolutely must know before investing again', Business Insider, 19 August, p. 10. [ Links ]

Chaiklin, H., 2011, 'Attitudes, behaviour, and social science', Journal of Sociology and Social Work 38(1), 31-54. [ Links ]

Charness, G. & Gneezy, U., 2012, 'Strong evidence for gender differences in risk taking', Journal of Economic Behavior & Organization 83(1), 50-58. https://doi.org/10.1016/j.jebo.2011.06.007 [ Links ]

Confidential Questionnaire, 2014, Mayes financial planning, Unpublished business documents, Mayes Financial Planning, Carlsbad. [ Links ]

Constable, S., 2014, 'Why the time horizon matters: When it comes to investing, you can't ignore the clock', The Wall Street Journal, 3 August, viewed 15 September 2015, from http://www.wsj.com/articles/why-investment-time-horizon-matters-1407106296 [ Links ]

Collis, J. & Hussey, R., 2014, Business Research: A practical guide for undergraduate and post-graduate students, 4th edn., Palgrave-Macmillan, Basingstoke. [ Links ]

Cooper, R.W. & Worsham, C.B., 2009, Foundations of financial planning: An overview, Thomson, New York. [ Links ]

Davey, J., 2008, 'What influences retirement decisions?' Social Policy Journal of New Zealand 33, 110-125. [ Links ]

Droms, W.G. & Strauss, S.N., 2003, 'Assessing risk tolerance for asset allocation', Journal of Financial Planning 16(3), 72-77. [ Links ]

Eikmeier, B.J., 2007, 'Trends drive opportunities for financial planning for women', Journal of Financial Planning, April Supplement 20, 6. [ Links ]

Ehow, 2012, How to get personal financial planning, viewed 15 May 2012, from http://www.ehow.com/how_2084644_get-personal-financial-planning.html [ Links ]

Falahati, L. & Paim, L., 2011, 'Gender differences in financial well-being among college students', Australian Journal of Basic and Applied Sciences 5(9), 1765-1776. [ Links ]

Financial Independence of Women, 2013, viewed 10 June 2014, from https://www.womenandmoney.com/2013/02/01/financial-independence-for-women [ Links ]

Finstad, K., 2010, 'Response interpolation and scale sensitivity: Evidence against 5-point scales', Journal of Usability Studies 5(3), 104-110. [ Links ]

Fisher-French, M., 2013, Money, maintenance and female purses, viewed 10 June 2015, from http://www.news24.com/Archives/City-Press/Money-maintenance-and-female-purses-20150430 [ Links ]

Giraldi, J. & Ikeda, A., 2008, 'Personal values dimensions: A study on Brazilian executives', Latin American Business Review 9(2), 169-187. https://doi.org/10.1080/10978520802520035 [ Links ]

Gitman, L.J., Joehnk, M.D. & Billingsley, R.S., 2014, Personal financial planning, 13th edn., South-Western, Cengage Learning, Mason, OH. [ Links ]

Goldberg, S.T., 2005, 'Funds to get you to your goal', Kiplinger's Personal Finance 5(9), 18-25. [ Links ]

Goldsmith, R.E. & Goldsmith, E.B., 1997, 'Gender differences in perceived and real knowledge of financial investments', Journal of Psychological Reports 80(1), 236-238. https://doi.org/10.2466/pr0.1997.80.1.236 [ Links ]

Goldsmith, R.E. & Goldsmith, E.B., 2006, 'The effects of investment education on gender differences in financial knowledge', Journal of Personal Finance 5(2), 55-69. [ Links ]

Goudreau, J., 2012, 'The best jobs for women in 2013', Forbes Women, 26 December, p. 15. [ Links ]

Harbour, S., n.d., What are factors affecting individual choices for investing money?, viewed 8 September 2015, from http://budgeting.thenest.com/factors-affecting-individual-choices-investing-money-25067.html [ Links ]

Hair, J.F., Black, W.C., Babin, J.B. & Anderson, R.E., 2014, Multivariate data analysis, 7th edn., Pearson, Essex, England. [ Links ]

Hira, T. & Loibl, C., 2006, 'Gender differences in investment behavior', Milestone 3 Report 1(1), 1-109. [ Links ]

Hockenbury, D. & Hockenbury, S.E., 2007, Discovering psychology, Worth, New York. [ Links ]

Hsin-Yuan, C., Dwan-Fang, S. & Shang-Yu, C., 2010, 'A framework for assessing individual retirement planning investment policy performance', Journal of Wealth Management 13(3), 38-49. https://doi.org/10.3905/jwm.2010.13.3.038 [ Links ]

Hung, A., Yoong, J. & Brown, E., 2012, Empowering women through financial awareness and education, OECD Working Papers on Finance, Insurance and Private Pensions, No 14, OECD Publishing, Paris, France. [ Links ]

Investment Personality Questionnaire, 2013, Unpublished teaching materials, Western University, London. [ Links ]

Investment Discovery Questionnaire, 2006, White lighthouse investment management, Unpublished business documents, White Lighthouse Investment management, Lausanne. [ Links ]

Irving, K., 2012, 'The financial life well-lived: Psychological benefits of financial planning', Australasian Accounting Business & Finance Journal 6(4), 47-59. [ Links ]

Jaeger, R.A., Rausch, M. & Foley, M., 2010, 'Multi-horizon investing: A new paradigm for endowments and other long-term investors', Institutional Investor Journals Spring (1), 12-23. [ Links ]

Jefremovas, V., 2000, 'Women are good with money: The impact of cash cropping on class relations and gender ideology in Northern Luzon, Philippines', Finance Journal 1(1), 131-150. [ Links ]

Jordan, D.J., Miller, T.W. & Dolvin, S.D. 2012. Fundamentals of investments: Valuation and management, 6th edn., McGraw-Hill, New York. [ Links ]

Journey, N.W., 2010, 'The importance of financial Goals', Personal Finance, 21 December, p. 14. [ Links ]

Klos, A., Weber, E.U. & Weber, M., 2005, 'Investment decision and time horizon: Risk perception and risk behavior in repeated gambles', Journal of Management Sciences 51(1), 1777-1790. https://doi.org/10.1287/mnsc.1050.0429 [ Links ]

Knight, A., 2010, A values-based approach to financial planning, viewed 10 September 2015, from http://www.stuff.co.nz/business/money/3838661/A-values-based-approach-to-financial-planning [ Links ]

Kohli, J., 2014, Financial planning and its importance for women, 30 September, viewed 11 September 2015, from http://m.moneycontrol.com/investor-education/article.php?autono=1081881&page=2 [ Links ]

Kreie, J. & Cronan, T., 2000, 'Making ethical decisions', Communications of the ACM 43(12), 66-71. https://doi.org/10.1145/355112.355126 [ Links ]

Lammas, C., 2014, 'Are women losing out on fabulous wealth?' FANews 5 August, viewed 10 June 2015, from http://www.fanews.co.za/article/life-insurance/9/general/1202/are-women-missing-out-on-fabulous-wealth/16480 [ Links ]

Lee, T., 2013, 'Defining your investment risk', US News & World Report, 01 April, viewed 11 September 2015, from http://money.usnews.com/money/blogs/the-smarter-mutual-fund-investor/2013/04/01/defining-your-investment-risks [ Links ]

Liersch, M., 2013, Women and investing: A behavioral finance perspective, Merrill Lynch Wealth Management Institute. [ Links ]

Lind, D.A., Marchal, W.G. & Wathen, S.A., 2012, Statistical techniques in business & economics, McGraw-Hill, New York. [ Links ]

Maio, G.R. & Haddock, G., 2015, The psychology of attitudes and attitude change, 2nd edn., Sage, Thousand Oaks, CA. [ Links ]

Malcolm, H., 2012, 'Women's financial power grows faster than savvy', USA TODAY, 17 August, p. 5. [ Links ]

Malhotra, N. & Crum, H., 2010, 'The dilemma of investment planning for female investors', Journal of Diversity Management 5(4), 43-46. https://doi.org/10.19030/jdm.v5i4.342 [ Links ]

Marcus, J., 2011, 'You can't tell me anything', Times Higher Education 2(22), 34. [ Links ]

Mayo, H.B., 2011, Introduction to investments: International edition, 10th edn., Cengage, Los Angeles. [ Links ]

Mellon, B.N.Y., 2015, The value of women in the workforce, viewed 10 September 2015, form http://www.womenomicstoday.com/the-value-of-women-in-the-workforce/ [ Links ]

Mhlanga, D., 2012, 'Tips on taking control of your money', Property24, 16 August, viewed 10 June 2015, form http://www.property24.com/articles/tips-on-taking-control-of-your-money/16064 [ Links ]

Mhlanga, D., 2013, 'How SA women spend their money', Property24, 9 January, viewed 9 June 2015, from http://www.property24.com/articles/how-sa-women-spend-their-money/16921 [ Links ]

Miller, J.W., 2005, 'Talk to her', Financial Planning 35(10), 123-124. [ Links ]

Mittal, M. & Vyas, R.K., 2011, 'A study of psychological reasons for gender differences in preferences for risk and investment decision making', IUP Journal of Behavioral Finance 8(3), 45-60. [ Links ]

Nkulski, B.J., 2014, Investment Discovery Questionnaire viewed 8 September 2015, form http://www.nikulskifinancial.com/pdf/IPS_Investment_Fact_Finder.pdf. [ Links ]

O'Keefe, B. & Burke, D., 2008, 'Hot commodities', Fortune International (Europe) 157(13), 79-84. [ Links ]

Olsen, R.A. & Cox, M.C., 2001, 'The influence of gender on the perception and response to investment risk: The case of professional investors', Journal of Psychology and Financial Markets 2(1), 29-36. https://doi.org/10.1207/S15327760JPFM0201_3 [ Links ]

Overton, R.H., 2010, Investment planning, Unpublished presentation transcript, University of Malaysia, Pahang. [ Links ]

Parker, T., 2011, 'Understanding your time horizon and risk tolerance', Personal Finance, 19 December, p. 6. [ Links ]

Plagnol, A.C., 2011, 'Financial satisfaction over the life course: The influence of assets and liabilities', Journal of Economic Psychology 32(1), 45-64. https://doi.org/10.1016/j.joep.2010.10.006 [ Links ]

Quinlan, C., 2011, Business research methods, 1st edn., Cengage Learning, Hampshire. [ Links ]

Rogers, K., 2011, 'Battle of the sexes: How men and women view money', Fox Business, 30 September, p. 4. [ Links ]

Rutterford, J. & Maltby, J., 2007, 'The nesting instinct: Women and investment risk in a historical context', Accounting History 12(3), 305-327. https://doi.org/10.1177/1032373207079035 [ Links ]

'SA women keep secret savings - survey', 2012, Fin24, 23 October viewed 9 June 2015, from http://www.fin24.com/Money/Home/SA-women-keep-secret-savings-survey-20121023 [ Links ]

Schulaka, C., 2015, 'Eleanor Blayney on the unique planning needs of women, educating consumers, and redefining retirement', Journal of Financial Planning 28(3), 10-15. [ Links ]

Sekaran, U. & Bougie, R., 2010, Research methods for business: A skill building approach, Wiley, New York. [ Links ]

Statman, M. & Weng, J.A., 2009, Investments across cultures: Financial attitudes of Chinese-Americans, Report on Academic Surveys. Santa Clara University, Santa Clara. [ Links ]

Struwig, F.W. & Stead, G.B., 2013, Research: Planning, designing and reporting, 2nd edn., Pearson, Cape Town. [ Links ]

Suhr, D.D., 2006, Exploratory or confirmatory analysis? Unpublished SUGI Conference papers, University of Northern Colorado, Greeley, CO. [ Links ]

Swart, N., 2002, Personal financial management: The Southern African guide to personal financial planning, 2nd edn., Juta, Cape Town, South Africa. [ Links ]

Swenson, B., 2013, 'Ten investment tips for women', All Business, 30 March, p. 13. [ Links ]

Tengler, N., 2014, The women's guide to success investing: Achieving financial security and realizing your goals, Palgrave-MacMillan, Basingstoke. [ Links ]

Uglanova, E. & Staudinger, U., 2013, 'Zooming in on life events: Is hedonic adaptation sensitive to the temporal distance from the event?' Social Indicators Research 111(1), 265-286. https://doi.org/10.1007/s11205-012-0004-1 [ Links ]

Waits, K., 2012, 'Six attitudes that breed financial failure', Personal Finance, 20 June, p. 21. [ Links ]

Wanyana, B., 2011, 'Investor awareness, perceived risk attitudes, and stock market investor behaviour: A case of Uganda securities exchange', Unpublished Masters Dissertation, Makerere University, Business School, Kampala. [ Links ]

Watters, T.J., 2011, Investing through life's stages, PlannerSearch.org, viewed 8 August 2015, from http://www.wattersfinancial.com/article-archives.html [ Links ]

Weatherholt, J.E., 2009, 'Choosing investments', Alaska Business Monthly 25(10), 12-14. [ Links ]

Why money is different for women, 2014, A newsletter by Liberty Advisory Services, August, viewed 10 June 2015, from http://yourlife.liberty.co.za/newsletter/2014-08/article-2.html?utm_source=newsletter&utm_medium=email&utm_campaign=august19_ eng&clickorigin=title [ Links ]

Williams, J.O., 1997, 'Maximizing the probability of achieving investment goals', Journal of Portfolio Management 24(1), 77-81. https://doi.org/10.3905/jpm.1997.409627 [ Links ]

Willows, G., 2013, 'Investing with him VS her?', AccountancySA, 01 February, pp. 38-39. [ Links ]

Young, G., 2013, 'Investing: How to choose which investment products are right for you', Personal Finance, 16 February, p. 2. [ Links ]

Zugang, L. & Jia, W., 2010, 'Time, risk, and investment styles', Financial Services Review 19(4), 323-336. [ Links ]

Correspondence:

Correspondence:

Elmarie Venter

elmarie.venter@nmmu.ac.za

Received: 13 Oct. 2015

Accepted: 04 May 2017

Published: 22 Aug. 2017

Appendix 1