Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Economic and Management Sciences

versão On-line ISSN 2222-3436

versão impressa ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.20 no.1 Pretoria 2017

http://dx.doi.org/10.4102/sajems.v20i1.1307

ORIGINAL RESEARCH

Firm characteristics and excellence in integrated reporting

Natasha Buitendag; Gail S. Fortuin; Amber de Laan

School of Accountancy, University of Stellenbosch, South Africa

ABSTRACT

BACKGROUND: Integrated reporting has attracted much attention in the past few years, and South Africa has taken the lead in its development worldwide. An annual survey is published by Ernst & Young regarding the quality of the integrated reports of the top 100 entities listed on the Johannesburg Stock Exchange (JSE).

AIM: The study on which this article is based was aimed at determining whether the assessment of an entity's characteristics can predetermine the quality of the integrated report generated by that entity.

SETTING: This article focuses on an analysis of the integrated reporting of the top 100 entities listed on JSE for the financial years ending in 2013, 2014 and 2015.

METHODS: Comparison of categorical variables, mixed-model repeated measures ANOVA and generalised estimating equations were applied to identify the best classificators to distinguish between excellent integrated reporting and those reports where progress could still be made.

RESULTS: The results show that the type of industry the entity finds itself in, the size and profitability of the entity, as well as the composition of the members of the board, have an effect on the quality of the integrated report.

CONCLUSION: Our results indicated that the type of industry, size of an entity, the profitability and composition of the board of directors, all have an effect on the quality of the integrated reporting. Our evidence will assist current and prospective stakeholders in evaluating the expected quality of an entity's integrated report, through the evaluation of certain firm characteristics.

Introduction

Integrated reporting has evolved quite rapidly in South Africa since 2010, leading to the release of the world's first International Integrated Reporting Framework at the end of 2013. South Africa has contributed significantly to the development of integrated reporting worldwide, starting with the establishment of the King Commission by Nelson Mandela and Professor Mervyn King. The King report has grown from a report disclosing a balanced overview of the business to one defined as 'a holistic and integrated representation of the entity's performance in terms of both its finance and stability' (Druckman 2013). Professor Mervyn King has also contributed to integrated reporting on a global basis as chairman of the International Integrated Reporting Council, promoting the adoption of integrated reporting by businesses worldwide.

Since 2010, Ernst & Young (EY) South Africa has given all listed and state-owned South African entities the opportunity to have their integrated reports analysed to improve the quality of these reports in the future (Ernst & Young 2013, 2014, 2015). The annual EY Excellence in Integrated Reporting Survey is realised as a result of this opportunity, where the top 100 entities as listed on the Johannesburg Stock Exchange (JSE) are evaluated (with reference to their market capitalisation) based on their integrated reports (Ernst & Young 2013, 2014, 2015). The entities' integrated reports were ranked as 'Excellent', 'Good', 'Average' or 'Progress to be made', and the top 10 entities in the 'Excellent' category were also identified to enable a separate discussion of their reports (Ernst & Young 2013, 2014, 2015).

This study carried out an empirical evaluation of the firm characteristics of the entities that produced an 'Excellent' report, as well as the entities that produced a report where progress can be made in the future. This study, therefore, made the following contribution to the accounting literature: Stakeholders are interested in obtaining sufficient information from an entity's integrated report to facilitate efficient decision-making. Our evidence will assist current and prospective stakeholders in evaluating the expected quality of an entity's integrated report, through the evaluation of certain firm characteristics.

The purpose of this study was to determine whether the assessment of an entity's characteristics such as entity size, profitability, generation of cash flow and number of directors can predetermine the quality of the integrated report generated by that entity.

The rest of the article is structured as follows: 'Literature review' section provides a critical overview of previous literature regarding integrated reporting in the industry, as well as a description of the different entity characteristics evaluated in the study. 'Research methodology' section focuses on the research methodology of the study, followed by a discussion of the findings in 'Results' section. In 'Conclusion' section, the final section, some conclusions are offered.

Literature review

Integrated reporting

We find ourselves living in a day and age where large entities dictate important and often crucial facets of our daily lives. Big supermarkets dictate, directly or indirectly, our eating habits with premiums on select foods. Corporate infrastructure giants dictate our lives by supplying 'necessities' such as electricity and communication. One might even go so far as to say that such corporations dictate what society deems acceptable through their use of social and other media (Eccles & Armbrester 2011).

The question is: What guides these corporations to lead us in a certain direction? Many believe that the boards of major entities are stakeholder-driven. Academics and commentators may still be arguing about what constitutes a stakeholder. A further question might be whether a 'Stakeholder Approach' is feasible. Should we rather say that management is focused on 'Stakeholder Return' (Scholes & Clutterbuck 1998)? This begs the question: How do we as users prevent corporates from trading without morals and values?

In recent years, the focus has shifted to reporting. Increasingly, markets around the world are focusing their accountability on more detailed disclosures. On the forefront of these disclosures is the principle of integrated reporting. Many economic pundits believe that for an entity to be sustainable, one can not only focus on financial disclosures or only disclose information needed by financial stakeholders. It is rather believed that sustainability requires disclosure of a much broader spectrum of information.

A country taking the lead in this regard is South Africa. Through the King Commission, headed by Professor Mervyn King, South Africa has been focusing heavily on this type of reporting. The first report presented by the King Commission is known today as the King I report. The findings in this report led to further investigations, upon which the King II and finally the King III report were published in 2009. The King III report does not constitute legislation, but rather encourages entities to make use of good integrated reporting. The findings in the King III report focus mainly on maximising shareholder information and providing disclosure to enable a user to obtain a better understanding of the entity as a whole.

Integrated reporting attempts to reveal the relationship between financial and non-financial performance and how these interrelated dimensions create or destroy value for shareholders and other stakeholders (Institute of Directors in Southern Africa, IoDSA 2009).

Firm characteristics

Firm size

Kansal, Joshi and Batra (2014) stated that larger entities need to disclose more because they receive more attention from the general public, undertake more activities and make a greater impact on society, and therefore need to exhibit greater social responsibility and improve their corporate image due to their higher visibility. Larger entities also experience more pressure from various stakeholder groups to disclose their social activities. It can be expected that the entity size will have an influence on the corporate social responsibility disclosure, which forms part of the integrated report. It was found that larger entities disclose corporate social responsibility information to a greater extent than smaller entities (Aras, Aybars & Kutlu 2010; Hossain & Reaz 2007; Kansal et al. 2014; Siregar & Bachtiar 2010).

Firm size can be represented by total assets, net sales or market capitalisation. These three measures have been used in numerous previous studies to determine the associational relationship between corporate size and the level of disclosure in corporate annual reports (Wallace & Naser 1995). It is also noted that market capitalisation represents an externally determined measure of an entity's importance as seen by the investing public, whereas asset size and sales are internally determined measures.

The following hypotheses were tested in order to determine the prevailing situation in South Africa during the period under examination:

H1a: Entities with a higher level of revenue can be expected to deliver more excellence in integrated reporting than entities with a lower level of revenue.

H1b: Entities with a higher level of net assets can be expected to deliver more excellence in integrated reporting than entities with a lower level of net assets.

H1c: Entities with a higher level of market capitalisation can be expected to deliver more excellence in integrated reporting than entities with a lower level of market capitalisation.

Growth

It is expected that entities with greater growth opportunities tend to disclose more information than entities with lower growth opportunities (Murcia & dos Santos 2012). Entities that have greater growth opportunities are likely to need resources in the near future. These entities tend to adopt better corporate governance mechanisms, through better disclosure practices, to be more transparent for better investor protection. Entities with good growth opportunities that need to raise external financing will improve their governance mechanisms as better governance and minority shareholder protection will be likely to lower their costs of capital (Khancel 2007). Consequently, investors would be more likely to finance these types of entities.

The following hypothesis was tested in order to determine the prevailing situation in South Africa during the period under examination:

H2: The quality of the integrated report of entities with a higher growth rate can be expected to deliver more excellence in integrated reporting than entities with a lower growth rate.

Profitability

It is expected from the signalling theory that where entity performance, measured by profitability (profit after tax) and return on investments, is good, entities would wish to signal their quality to investors (Watson, Shrives & Marston 2002). It is therefore expected that the entity performance would be an important determinant of ratio disclosure. Entities with high profitability disclose more information than those with lower returns. It may also be argued that entities performing poorly may disclose less information to conceal their performance from stakeholders.

This view is emphasised by Inchausti (1997) from the perspective of the agency theory that management of a very profitable entity will use information in order to obtain personal advantages. Therefore, management will disclose detailed information as a means of justifying their position and compensation package (Singhvi & Desai 1971).

Khlif and Souissi (2010) found that higher performance allows managers to be more convincing to shareholders of their superior managerial abilities. Therefore, by disclosing more information, managers can obtain higher degrees of confidence from investors. Better performance allows managers to distinguish themselves and their entities in the labour and stock markets. This is confirmed by Singhvi and Desai (1971) who revealed that profit margins and earnings returns are variables that both have a positive association with the extent of corporate disclosure.

Ng and Koh (1994) argued that more profitable entities will be subject to greater public scrutiny and will therefore apply self-regulation mechanisms, such as voluntary disclosures in an attempt to avoid external regulation.

The following hypothesis was therefore tested:

H3: The quality of entities with a higher profit margin can be expected to deliver more excellence in integrated reporting than entities with a lower profit margin.

Generation of cash flow

The ability of an entity to meet its short-term financial obligations without having to liquidate or cease operations is important for interested parties such as investors, lenders and regulatory authorities in the evaluation of an entity, because the inability of an entity to meet its current obligations may lead to bankruptcy (Wallace & Naser 1995). Entities therefore tend to give more detail in their annual reports about their ability to meet financial obligations as they fall due and about the fact that the entity is a going concern, in order to relieve the fears of interested parties. It is expected that a highly liquid entity is most likely to provide more information (Watson et al. 2002).

The cash-generating ability of the entity plays an immense role in the liquidity of the entity. The entity with the better cash-generating ability can be measured in two ways: firstly, as the entity with the ability to generate higher cash flow from operating activities relative to revenue, and secondly, as the entity that succeeds in transforming its profit into cash. The more liquid entity will be in a better financial position to allocate resources to the preparation of useful integrated reports.

The following hypotheses were therefore tested:

H4a: The quality of entities with a higher cash inflow from operating activities as a percentage to revenue can be expected to deliver more excellence in integrated reporting than entities with a lower cash inflow.

H4b: The quality of entities with a higher cash inflow from operating activities as a percentage to net assets can be expected to deliver more excellence in integrated reporting than entities with a lower cash inflow.

H4c: The quality of entities with a higher transformation of profits into cash can be expected to deliver more excellence in integrated reporting than entities with a lower cash inflow.

Governance

Entity governance has long been a topic of interest, and the impact of corporate governance is still largely unknown (Ntim & Soobaroyen 2013a). Prior studies have found that there are two large categories of corporate governance that have an effect on disclosure decisions, namely ownership structures and the board composition (Fifka 2011).

The disclosure of South African entities is largely affected by their ownership (Ntim & Soobaroyen 2013b; Ntim, Opong & Danbolt 2012a). Studies have found that depending on the shareholder make-up of an entity, the entity will choose different disclosure strategies. There should be a clear distinction between institutional, government and block shareholders (Eng & Mak 2003). Larger shareholders (such as block holders and institutional holders) can be expected to have larger managerial monitoring and to strive for less information asymmetry. They would therefore require more voluntary disclosure. Entities with government shareholding (for example the Public Investment Corporation) have access to resources and information other entities might not have, but also have the risk of increased political cost. One could therefore expect that entities with government shareholding disclose more information voluntarily (Ntim et al. 2012b).

Larger boards are seen to be less cohesive, and it could be expected that these entities have lower quality disclosure as there are no clear reporting structures or communication channels. On the contrary, larger boards will have increased managerial power and might increase the focus on reporting as the number of executive members on the board is increased. South Africa has a unique corporate environment, and one, therefore, needs to consider characteristics of the environment that might influence the disclosure decisions, such as duel leadership entities (separate CEO and chairperson of the board of directors) and directors of colour (Ntim & Soobaroyen 2013b). Entities in South Africa are mandated to improve the number of previously disadvantaged individuals employed by them in management, as well as develop these individuals' skills. This is largely referred to as black economic empowerment (BEE). It would therefore be expected that entities with higher BEE levels (directors of colour and female directors) relating their board would disclose more voluntarily in an attempt to be more transparent and legitimate.

The following hypotheses were therefore tested:

H5a: Entities with a block/institutional or governmental investment can be expected to deliver more excellence in integrated reporting than entities that do not possess this type of investment.

H5b: Entities with more members on their board of directors can be expected to deliver more excellence in integrated reporting than entities that have fewer members on their board.

H5c: Entities with more BEE-driven directors (female directors and directors of colour) can be expected to deliver more excellence in integrated reporting than other entities.

Research methodology

Dependent variables

The EY Excellence in Integrated Reporting Awards survey was selected for the years 2013, 2014 and 2015. This survey ranked the top 100 entities based on their market capitalisation at 31 December of each year. Due to the ranking based on the market capitalisation, the entities included in the 3-year period may vary. The top 100 entities are supposedly the larger entities listed in South Africa and account for approximately 94% of the total market capital, but there is still quite a large difference in the size of these 100 entities. Entities from all sectors were included in the EY survey, but pure holding companies were excluded.

Each of the integrated reports of the entities was given a separate mark, according to a pre-determined mark plan. The mark plan included specific aspects that should be present in an integrated report (Ernst & Young 2013, 2014, 2015), and a mark was given for each of the International Integrated Reporting Council's five guiding principles, namely strategic focus, connectivity of information, future orientation, responsiveness and stakeholder inclusiveness, and the conciseness, reliability and materiality of the information. In explaining the marking process, it was emphasised by the authors that the quality of information presented was important by stating: 'crisply presented information that highlights relevant facts was given more credit than the same information needed to be extracted from less relevant information' (Ernst & Young 2013, 2014, 2015).

A final ranking was awarded to the entities based on the average of the adjudicators' marks. Large variations in the marks were examined in order to make sure that nothing had been omitted. The adjudication process culminated in each entity's integrated report being classified into one of the four groups: 'Excellent', 'Good', 'Average' and 'Progress to be made'. Although the adjudicators acknowledged that the degree of subjectivity involved in marking could lead to a different ranking, the conclusion reached stated that there was a clear distinction between those entities with excellent integrated reporting and those where integrated reporting should be improved (Ernst & Young 2013).

Building on the above survey, this study accepted the conclusion reached with regard to detailed ranking that might differ as a result of subjectivity in the measuring instrument; however, the classification at the extremes of the classification outcomes, Excellent (EXC) and Progress to be made (PTBM), should be clear. The outcome of the classification of the integrated reports, as being either EXC or PTBM, was therefore used in this study as the dependent variable.

Independent variables

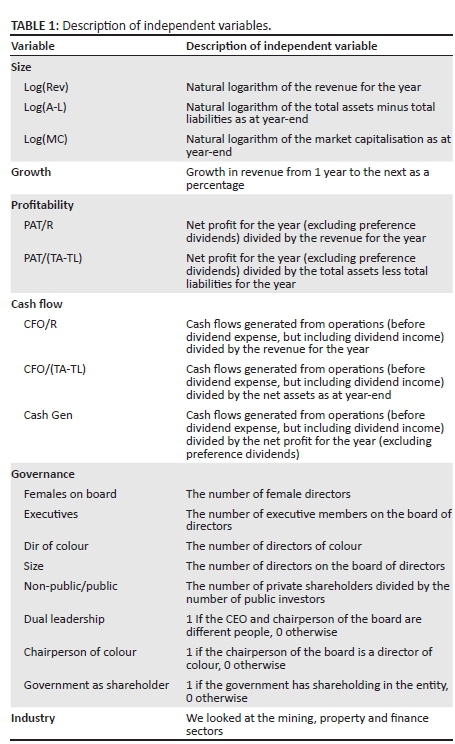

The independent variables that were tested in this study were selected from previous studies performed on disclosure of information in annual reports of entities as discussed in 'Firm characteristics' section. The values of these independent variables were taken from the annual reports of the individual entities that were in the EXC and PTBM categories as classified in the EY survey (Ernst & Young 2013). The annual reports of the previous year were selected for a specific EY survey, as the surveys were conducted on the previous year's reports. The 2012 annual reports were therefore selected for the 2013 EY survey. The independent variables were not available in the EY survey. The descriptions of the independent variables are provided in Table 1.

Research design

Comparison of categorical variables (such as the mining sector) with integrated reporting was done using cross-tabulation and the chi-square test. Mean scores of the continuous variables (e.g. revenue) were compared between the two groups using mixed-model repeated measures ANOVA. Here the integrated reporting groups and year were treated as fixed effects and the companies as random effects. A generalised estimating equations analysis was conducted to test the combined influence of the continuous variables on the binary (yes/no) outcome of the integrated reporting variable. To further investigate the predictability of the binary integrated reporting variable by all the independent variables, a variable selection procedure was applied to select a subset of predictor variables that best predicted the binary outcome using discriminant analysis.

Results

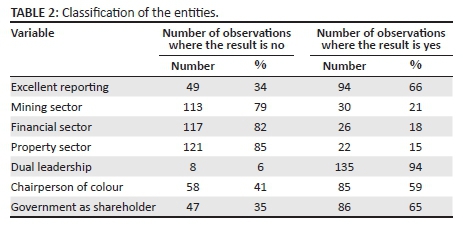

Table 2 presents the descriptive statistics for the dichotomous variables of our test. In Table 2, it can be seen that approximately 66% of the entities presented excellent integrated reporting. Of the entire sample of our tests, approximately 21% belonged to the mining industry, 18% to the financial industry and 15% to property sector. When looking at the governance characteristics, it can be seen that 94% of the entities had a chairperson on the board that was not the CEO and therefore had dual leadership. Approximately, 59% of the entities had a chairperson who was a director of colour on the board and 65% had the government as a shareholder.

Table 3 shows how the different variables influence the outcome of the integrated report. Of the mining entities represented in Table 3, 93% presented excellent integrated reporting, while only 58% of the non-mining entities presented excellent integrated reporting. This is in line with prior literature. As per Deegan and Gordon (1996), environmentally sensitive entities are entities that received greater attention from environmental lobby groups. The coefficient provides statistical significant evidence that the environmentally sensitive entities would more likely present excellent integrated reporting to legitimise their business. Only 50% of the entities in the financial sector had excellent reporting compared to 69% of those that do not in the financial sector. This is an indication that not all of the sectors are concerned with the quality of their integrated reporting. The results further indicated that only 36% of the property entities had excellent reporting, while 71% of the non-property entities had excellent reporting. Consistent with prior literature, the results presented above indicate that environmentally sensitive sectors, like the mining sector in our sample, deliver integrated reports of excellent quality compared to the other sectors.

Based on the results of the corporate governance factors, it is evident that 54% of the entities with EXC integrated reporting had a chairperson of colour to lead the board of directors, while 83% of the entities with a chairperson who was not a person of colour had EXC reporting. This provides statistically significant evidence (p < 0.01) that the chairman of a company does have a role in the results of the integrated reporting and that a chairperson of colour does not necessarily improve the results of the integrated reporting. Contrary to what has been reported in earlier literature, no significant evidence was obtained when looking at the government as a shareholder of an entity.

Table 4 represents the results of the mixed-model repeated measures ANOVA. Based on the results, it can be seen in Table 4 that the entities with EXC reporting are larger with respect to greater revenue, net assets, market capitalisation and total assets to total liabilities than those in the PTBM category. This finding is consistent with the prior literature, which indicates that larger entities disclose more because they receive more attention from the general public, undertake more activities and make a greater impact on society. All of these aspects were highly significant. However, the EXC entities had a smaller growth rate than those with the PTBM rating. We therefore did not find that entities with greater growth opportunities tend to disclose more information than entities with lower growth opportunities.

Our results also found entities ranked as EXC might not be more profitable than those ranked as PTBM. Based on our sample over the 3-year period, it is evident that PTBM entities are significantly more profitable than those that fall in the EXC category. However, entities with excellent reporting do generate more cash flow as the cash flow variables in this category are greater compared to the entities in the PTBM category.

When looking at the corporate governance characteristics, it is evident that the entities in the EXC category have significantly more females and more directors of colour (black, Indian and coloured), with significantly less executive directors on their board. This finding is consistent with the results of earlier literature of Ntim and Sabooroyen (2013b). The size of the board was also slightly larger compared with the entities in the PTBM category, but the results were not significant. We found, however, that the entities delivering excellent integrated reporting had significantly fewer public shareholders than those in the PTBM category, which is inconsistent with findings in earlier literature.

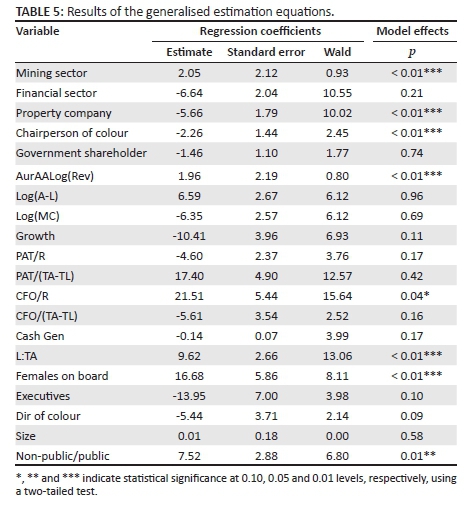

The results of the generalised estimation equations (Table 5) revealed that the industry of the entities does have an effect on the quality of the integrated reporting as significant results were found for the entities in the mining and property industries. This suggests that entities in the mining industry are more likely to present excellent integrated reports. Entities in the property industry are, however, more likely to present integrated reports in the PTBM category as 85% of them were classified in that category. No significant results were obtained for the financial industry.

Entities that have chairmen of colour on their board are more likely to present excellent integrated reports. Significant results were obtained for only three of the financial indicators. Entities with larger revenue as well as those with larger total assets to liabilities are more likely to have excellent integrated reports. Significant results at a lower level were obtained for the cash flow generation of the entities.

With regard to the corporate governance characteristics, significant results were only obtained for the number of females on the board as well as the number of non-public shareholders. This is an indication that entities that have more females as well as non-public shareholders on their board are more likely to present excellent reporting.

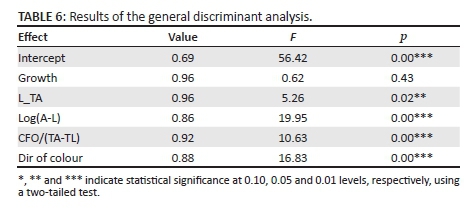

Table 6 shows the variables selected by the variable selection procedure to best predict the binary integrated reporting variable. The general discriminant analysis (Table 6) provided significant results for all the selected variables except for growth. This is consistent with the results in the previous tables, which indicates that entities with excellent reporting are likely to have larger net assets, larger total assets to liabilities and larger cash flow generation to the net assets. This is also applicable to entities that have more directors of colour on their board.

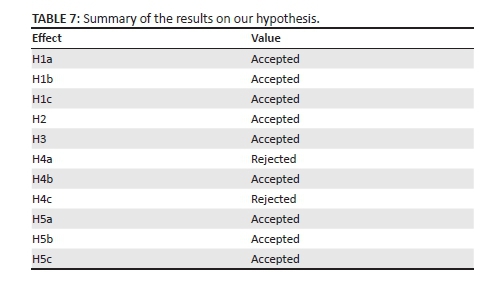

Table 7 shows a summary of our results for each of the hypotheses developed in our study. Based on the summary of our hypotheses, we did not obtain significant results to indicate that the quality of entities with a higher cash inflow from operating activities as a percentage to revenue can be expected to deliver more excellence in integrated reporting than entities with a lower cash inflow and that the quality of entities with a higher transformation of profits into cash can be expected to deliver more excellence in integrated reporting than entities with a lower cash inflow.

Conclusion

The study reported in this article was conducted to determine whether the assessment of an entity's characteristics, such as entity size, profitability, generation of cash flows and number of directors, can predetermine the quality of the integrated report generated by that entity.

Our investigation has shown that the type of industry an entity finds itself in does have an effect on the quality of the integrated report produced. Our results confirm that an entity whose business has an effect on the environment will produce a more detailed integrated report legitimising its business, compared with an entity that does not affect the environment.

When investigating the financial characteristics of an entity and their effect on the quality of the integrated report, it was seen that larger entities (determined by the revenue for the year, net assets, market capitalisation and total assets compared with total liabilities) have better resources to allocate to the integrated report and therefore produce a better report.

It was also found that entities that are more profitable tend to produce integrated reports that need progress to be made and that cash flow plays an important role in obtaining resources for the integrated reporting process, as those entities with greater cash flow tend to produce integrated reports of a higher quality.

Our results for the corporate governance characteristics showed that entities with more females and directors of colour provided better integrated reports than their counterparties. These entities also had fewer executive directors on their board. It was, however, interesting to note that the entities with less public shareholding had better integrated reports, which contradicts findings reported in earlier literature.

Our study experienced some limitations that should be considered. The entities we tested in our sample are only the entities which fell in the EXC or PTBM categories of the EY Excellence in Integrated Reporting Survey, thus limiting the number of industries that were tested to three: property, mining and financial. It also limited the number of entities used in our sample as there are two more categories (average and good), which also contain a large number of entities. These categories were, however, not considered.

It is suggested that future research flowing from this study could include a study on all the entities in the EY survey, covering all the categories mentioned above. More industries could also be included in the data, which might provide a clearer picture of the reporting style of different industries. Future studies could also extend the variables used in this study to introduce a more holistic view of entities and their reporting styles. As integrated reporting becomes more prominent in our society, further research questions could include: How do stakeholders react to integrated reporting and the quality of the report itself? How is the decision-making process of stakeholders affected when entities do not produce integrated reporting at all compared with situations where integrated reports are delivered - does the quality of the report have a significant impact in this instance? Since integrated reporting is still a relatively new area whose research has not yet been saturated, there is ample scope for future research.

Acknowledgements

We thank Maricia Krige, Wilna Bruwer and Prof. Martin Kidd (Stellenbosch) for their assistance with the article.

Competing interests

The authors declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

Author's contributions

The authors contributed equally to the existing research on integrated reporting by determining characteristics which might enhance the quality of integrated reporting.

References

Aras, G., Aybars, A. & Kutlu, O., 2010, 'Managing corporate performance: Investigating the relationship between corporate social responsibility and financial performance in emerging markets', International Journal of Productivity and Performance Management 59(3), 229-254. https://doi.org/10.1108/17410401011023573 [ Links ]

Deegan, C. & Gordon, B., 1996, 'A study of the environmental disclosure practices of Australian corporations', Accounting and Business Research 26(3), 187-199. https://doi.org/10.1080/00014788.1996.9729510 [ Links ]

Druckman, P., 2013, South African reflections on integrated reporting, viewed 10 June 2016, from http://www.theiirc.org/2013/09/19/south-african-reflections-on-integrated-reporting [ Links ]

Eccles, B.R.G. & Armbrester, K., 2011, 'Integrated reporting in the cloud', IESE Insight 8, 13-20. https://doi.org/10.15581/002.ART-1890 [ Links ]

Eng, L.L. & Mak, Y.T., 2003, 'Corporate governance and voluntary disclosure', Journal of Accounting and Public Policy 22(4), 325-345. https://doi.org/10.1016/S0278-4254(03)00037-1 [ Links ]

Ernst & Young, 2013, EY's excellence in integrated reporting awards 2013, viewed 15 July 2016, from http://www.ey.com/Publication/vwLUAssets/EYs_Excellence_in_Integrated_Reporting_Awards _2013/$FILE/EY%20Excellence%20in%20Integrated%20Reporting.pdf [ Links ]

Ernst & Young, 2014, EY's excellence in integrated reporting awards 2014, viewed 15 July 2016, from http://www.ey.com/Publication/vwLUAssets/EY-Excellence-In-Integrated-Reporting-2014/$FILE/EY-Excellence-In-Integrated-Reporting-2014.pdf [ Links ]

Ernst & Young, 2015, EY's excellence in integrated reporting awards 2015, viewed 15 July 2016, from http://www.ey.com/Publication/vwLUAssets/ey-excellence-in-integrated-reporting-awards-2015/$FILE/ey-excellence-in-integrated-reporting-awards-2015.pdf [ Links ]

Fifka, M.S., 2011, 'Corporate responsibility reporting and its determinants in comparative perspective - A review of the empirical literature and a meta-analysis', Business Strategy & the Environment 22, 1-35. https://doi.org/10.1002/bse.729 [ Links ]

Hossain, M. & Reaz, M., 2007, 'The determinants and characteristics of voluntary disclosure by Indian banking companies', Corporate Social Responsibility and Environmental Management 14, 274-288. https://doi.org/10.1002/csr.154 [ Links ]

Inchausti, B.G., 1997, 'The influence of company characteristics and accounting regulation on information disclosed by Spanish firms', European Accounting Review 6(1), 45-68. https://doi.org/10.1080/096381897336863 [ Links ]

Kansal, M., Joshi, M. & Batra, G.S., 2014, 'Determinants of corporate social responsibility disclosures: Evidence from India', Advances in Accounting 30(1), 217-229. https://doi.org/10.1016/j.adiac.2014.03.009 [ Links ]

Khancel, I., 2007, 'Corporate governance: Measurement and determinant analysis', Managerial Auditing Journal 22(8), 740-760. https://doi.org/10.1108/02686900710819625 [ Links ]

Khlif, H. & Souissi, M., 2010, 'The determinants of corporate disclosure: A meta-analysis', International Journal of Accounting and Information Management 18(3), 198-219. https://doi.org/10.1108/18347641011068965 [ Links ]

Murcia, F.D. & dos Santos, A., 2012, 'Discretionary-based disclosure: Evidence from the Brazilian market', Brazilian Administration Review 9(1), 88. [ Links ]

Ng, E.J. & Koh, H.C., 1994, 'An agency theory and probit analytic approach to corporate non-mandatory disclosure compliance', Asia-Pacific Journal of Accounting 1(1), 29-44. https://doi.org/10.1080/10293574.1994.10510464 [ Links ]

Ntim, C.G., Opong, K.K. & Danbolt, J., 2012a, 'The relative value relevance of shareholder versus stakeholder corporate governance disclosure policy reforms in South Africa', Corporate Governance: An International Review 20(1), 84-105. https://doi.org/10.1111/j.1467-8683.2011.00891.x [ Links ]

Ntim, C.G., Opong, K.K. & Danbolt, J. & Thomas, D.A., 2012b, 'Voluntary corporate governance disclosure by post-apartheid South African corporations', Journal of Applied Accounting Research 13(2), 122-144. https://doi.org/10.1108/09675421211254830 [ Links ]

Ntim, C.G. & Soobaroyen, T., 2013a, 'Corporate governance and performance in socially responsible corporations: New empirical insights from a neo- institutional framework', Corporate Governance: An International Review 21(5), 468-494. https://doi.org/10.1111/corg.12026 [ Links ]

Ntim, C.G. & Soobaroyen, T., 2013b, 'Black economic empowerment disclosures by South African listed corporations: The influence of ownership and board characteristics', Journal of Business Ethics 116, 121-138. https://doi.org/10.1007/s10551-012-1446-8 [ Links ]

Scholes, E. & Clutterbuch, D., 1998, 'Communication with stakeholders: An integrated approach', Long Range Planning 31(2), 227-238. https://doi.org/10.1016/S0024-6301(98)00007-7 [ Links ]

Singhvi, S.S. & Desai, H.B., 1971, 'An empirical analysis of the quality of corporate financial disclosure', The Accounting Review 46(1), 129-138. [ Links ]

Siregar, S.V. & Bachtiar, Y., 2010, 'Corporate social reporting: Empirical evidence from Indonesia Stock Exchange', International Journal of Islamic and Middle Eastern Finance and Management 3(3), 241-252. https://doi.org/10.1108/17538391011072435 [ Links ]

The Institute of Directors in Southern Africa (IoDSA), 2009, The King report on corporate governance for South Africa, September, viewed 30 May 2016, from http://www.pwc.co.za/en/king3/ [ Links ]

Wallace, R.S.O. & Naser, K., 1995, 'Firm-specific determinants of the comprehensiveness of mandatory disclosure in the corporate annual reports of firms listed on the Stock Exchange of Hong Kong', Journal of Accounting and Public Policy 14, 311-368. https://doi.org/10.1016/0278-4254(95)00042-9 [ Links ]

Watson, A., Shrives, P. & Marston, C., 2002, 'Voluntary disclosure of accounting rations in the UK', British Accounting Review 34, 289-313. https://doi.org/10.1006/bare.2002.0213 [ Links ]

Correspondence:

Correspondence:

Natasha Buitendag

natasha@zinplex.co.za

Received: 21 Jan. 2015

Accepted: 28 Nov. 2016

Published: 28 Feb. 2017