Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Economic and Management Sciences

On-line version ISSN 2222-3436

Print version ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.19 n.4 Pretoria 2016

http://dx.doi.org/10.17159/2222-3436/2016/v19n4a6

ARTICLES

Analysis of Nigerian insurers' perceptions of climate change

Zelda Anne ElumI; Judith Bosede SimonyanII

IAgricultural and Animal Health, University of South Africa

IIAgricultural Economics, Michael Okpara University of Agriculture, Umudike, Nigeria

ABSTRACT

In recent times, global agricultural productivity has been increasingly affected by climate change. It is believed that societal adoption of insurance as an adaptive response to climate change can have significant implications for insurers. The study investigates empirically insurers' perceptions of climate change and the challenges they face in Nigeria. It examines the proposition that insurance firms in Nigeria are not mindful of the impact of climate change. The study applied the use of descriptive statistics, Kendall's coefficient of concordance and principal component analysis on collected primary data. It was found that insurers in Nigeria were highly aware of climate change and its impact but did not believe it affects their operational costs and payments of claims. Although there is great scope for insurers to increase their client base in the Nigerian market, insurers face challenges of insurance rate-cutting, low patronage and environmental factors. The study concludes that there is a need for insurance regulators to enforce a level playing field for all firms. It also advocates for public support of private insurers to enhance insurance coverage for agriculture, the largest employer of labour in the country.

Key words: Nigeria, climate change, insurance, adaptation, agriculture, factor analysis.

JEL: Q54, N37, 57, Z19

1 Introduction

Climate change is the change in state of the climate that can be associated with changes in the mean and/or variability of its properties and which persists over an extended period of time (Gosain & Rao, 2003). Climate change affects health, agriculture, water, machinery and housing amongst a host of others. It has been noted that climate change presents a great threat to current African production systems, infrastructures and markets and, as such, farmers' livelihoods. Africa has been identified as being highly vulnerable to the impact of climate change because of prevailing factors such as poverty, illiteracy and lack of skills, weak institutions, limited infrastructure, lack of technology and information, poor health care, armed conflicts, population increase and land degradation (UNFCCC, 2007). These effects have been of concern to both national and international governments (Muller, Cramer, Hare, Lotze-Campen & Kates, 2011). The presence of greenhouse gases (GHGs) in the atmosphere naturally warms the earth at a level suitable for habitation. These GHGs, mainly responsible for the natural warming of the earth, are water vapour, carbon dioxide, methane, nitrous oxide and chlorofluorocarbons. However, scientists believe increased concentrations of the GHGs have caused an imbalance in the natural greenhouse effect. Karl and Trenberth (2003) have also identified various causes of climate change emanating from anthropogenic activities that interfere with the natural flow of energy. These causes include carbon dioxide from burnt fossil fuels, production of nitrous oxide from the use of inorganic fertilizers on farms and nylon production, respiration from humans and animals as well as production of methane when vegetation is burnt, digested or allowed to rot in the absence of oxygen, from animal farms, rice paddies, coal mines and landfill sites.

Insurance is an adaptation strategy which has the potential to reduce the impact of climate change on insurance policy holders but with significant implications for insurers. Insurance activities contribute to economic growth by improving the functioning of financial systems both as a provider of risk transfer and indemnification and as an institutional investor (Arena, 2008). The insurance industry is made up of direct insurers who sell policies to customers; brokers who link customers to insurers; adjusters who evaluate and administer claims; and reinsurers who provide insurance to the direct insurers (Haufler, 2012). It is on record that in most developing countries, domestic insurers are dominant, but the demand for insurance services remains low in a large number of these countries (Outreville, 1990). The insurance industry, which controls more than $23 trillion in global investments (Ceres, 2011), covers about 4 per cent of losses in the world's poorest countries, mainly because the cost of insurance products is beyond the reach of the poor or because the products are not appropriately designed to cover their needs (Schipper, Cigaran & Hedger, 2008). Although insurance is mainly created to provide relief after losses have occurred, it could be used to motivate and encourage risk reduction efforts among consumers (Schipper et al., 2008). This means that, if insurers were of the view that their cost of operations was being affected by climate-related losses, the industry could brace up, rise to the challenge and drive research or practices that policy holders could adopt to limit their losses. By doing so, the industry could also protect itself from insolvency. Insurers commonly respond to excessive risks by either withdrawing temporarily or permanently from a risky region or raising their premium prices to offset high losses and maintain profitability (Haufler, 2009). But where this is not the case, insurers will be faced with increasing claims resulting from climate-related disasters.

Reportedly, climate change activists recognised in the early 1990s that the insurance sector would be significantly affected by natural disasters and, as such, the sector should have an interest in preventing climate change (Haufler, 2012). The insurance sector, according to Mills (2005), is regarded as the world's largest industry but increasing global warming poses a challenge to the insurance market which could lose its strong position as a result. This is because climate change can have adverse effects on the affordability and availability of insurance and lead to slow growth of the industry, thereby shifting more of the burden onto governments and individuals. In a similar vein, the Chartered Insurance Institute Climate Change Report (2009) stated that climate change increases the possibility of large-scale insurance market failure which could take the form of inadequate capital, denial of cover in high-risk areas, inability to pay claims or failure to contract.

In the light of this background, it becomes imperative to study the preparedness of the Nigerian insurance industry to deal with challenges related to climate change. To this end, this study examines Nigerian insurers' perceptions of climate change and specifically researches the factors influencing their perceptions in the study area in addition to identifying the major challenges they face. The paper has been organised in the following way: this section introduces the study focus; the second section covers a review of the literature and related studies; the third section details the methodology adopted in the study; and the fourth section discusses the results of the analysis. Section five concludes the discussion and findings of the study.

2 Literature review

Maynard (2008) asserted that the insurance industry worldwide is already being negatively affected by climate change, although this situation also offers business opportunities. Climate-related risks have been categorised into social, environmental and economic risks. Climate change will affect insurance firms through its impact on health, life, agriculture and property, amongst other things. For instance, Panda (2009) stated that climate change will put millions more at the risk of "vector-borne" diseases and it has been projected that illnesses like malaria and dengue fever will increase. Considering that the Nigerian public health system is not as strong as it should be, it seems likely that healthcare spending will increase and those who cannot afford it will suffer. However, those who are prone to such illnesses will buy insurance (due to information asymmetry) and the insurers will be faced with more health and death claims. If insurers respond to such a scenario by increasing premiums, then malaria-prone people will most likely purchase insurance while those that are less prone will opt out of coverage. Thus, climate change poses a threat to insurability (Lamond & Pening-Rowsell, 2014). It is commonly assumed that when premiums are high, the poor will be excluded from purchase and coverage. Since the vast majority of the Nigerian populace is employed by the agricultural sector and many are small-scale farmers, there is a high likelihood that reduction in their income as a result of the effects of climate change or high premiums could discourage many from taking out health insurance policies.

Studies have shown evidence of the impact of climate change on agriculture and the need for appropriate action to combat its negative effects. Howden, Jean-Francois, Tubiello, Chhetri, Dunlop and Meinke (2007) are of the opinion that agriculture in its many different forms and locations remains highly sensitive to climate variations. Similarly, Brown and Funk (2008) note that some of the severe and direct effects of changing climate in the next few decades will be felt in agricultural and food systems. Muller et al. (2011) also believe that climate change will compromise agricultural production especially in smallholder systems with little adaptive capacity and that this is the prevailing situation in many parts of Africa. Developing countries are more vulnerable to climate change due to their limited capacity to adapt to change as a result of their locations, socio-economic, demographic and policy trends (Morton, 2007). In a country like Nigeria where agriculture employs more than 60 per cent of the population, the implications of climate change are that the yield will become less certain, and many will be discouraged from agriculture; and increasing yield variability will prompt insurers to increase their premiums or consider withdrawing coverage from certain crops that would most likely be negatively affected by climate change. Increased premiums may discourage farmers from purchasing insurance while low premiums may force insurers out of business. According to IPCC (Panda, 2009), the productivity of rice, maize and wheat will decline considerably due to climate change. Considering that the Nigerian government is intensifying efforts to increase the domestic supply of these crops so as to reduce importation; it would therefore be important to encourage farmers to take out insurance to safeguard their income and provide incentives for them to continue growing these crops.

Furthermore, climate change will affect the level and flow of water due to its effects on temperature and rainfall. It has been documented that about 250 million people in Africa would be exposed to water stress by 2020 (UNFCCC, 2007) and changing rainfall patterns could result in drought or flooding. Melting glaciers may cause flooding and soil erosion while rising temperatures will cause changes in growing seasons and an increased incidence of pest and diseases (Chambwera & Stage, 2010). Hydrologic extremes of drought and flood can have a serious effect on human health, agriculture, energy production, infrastructure and recreation. For instance, as air temperature increases, land surface drying will increase and more water would be used in agriculture with a consequent reduction in the water table. Drought could lead to shortages of food and drinking water. Increasing atmospheric water vapour will lead to increased precipitations that result in flooding. Reduced irrigation due to water scarcity threatens healthy living, and a poor standard of living means that people might become too poor to buy insurance. Such loss of market share may force insurers to close or relocate their businesses. Although increased risk of payouts for weather-related losses can be projected and integrated into current premiums to ensure sustainability and profitability of the insurance firms, this often does not happen as most insurers are obliged by regulators to base their premiums on historic price data (Haufler, 2012). Evidence of the impact of climate change on agriculture has thus necessitated the need for appropriate action such as the adoption of insurance to combat the negative effects on livelihoods. Therefore, the insurance sector plays a vital role in climate change adaptation, especially in a country like Nigeria that is regarded as an agrarian society. However, due to wideranging issues, the insurance industry in Nigeria covers less than one per cent of the entire population of farmers in the country (Farayola, Adedeji, Popoola & Amao, 2013).

In addition, housing and property insurers are not immune to climate change effects. Increasing temperatures could lead to an increasing incidence of fires which can destroy houses and in turn lead to more frequent payouts. Increased tropical storms affect livelihoods through destruction of housing and physical capital. Incidents of flooding, erosion and landslides are likely to increase damage to railways, roads, and communication structures. Furthermore, extreme heat will lead to increasing pipeline ruptures. As stated in the Climate Change Research Report (2009), climate change will damage the environment as well as non-earning segments of the population and create social stresses like migration, which could in turn result in lack of employment and higher levels of crime. Associated costs will affect insurers through increased claims. Mills (2005) noted that the Association of British Insurers has identified extreme changes in weather events to be driving UK property losses up by two to four per cent annually. It is thought that insurers in a developing country like Nigeria would be even more affected by climate change because of the presence of more vulnerable infrastructure arising from non-enforcement of building codes, high dependence of the populace on coastal and agricultural economic activities, political instability and the inability to invest in disaster-resilient adaptation projects. Kepler (2013) reports that property and agriculture lines of insurance face greater climate change related risks than other insurance lines such as motor and life/health insurance.

Panda (2009) noted that the level of vulnerability to climate change in any country will be determined by the presence of appropriate mitigation and adaptation measures. Similarly, Mearns (2010) identified two major strategies for reducing climate change and its effects: mitigation (the reduction of greenhouse gas emissions); and adaptation (the adaptation to unavoidable change). Mills (2005) was of the view that insurance is a form of adaptive capacity for the effects of climate change but the sector itself will have to adapt in order to sustain its business. Adaptive strategies in use by insurers include: reducing risk by withdrawing from high-risk areas; pricing risk correctly by using GIS to discriminate risk; transferring risk through reinsurance; diversifying risk base through multiline insurance portfolios; and expanding the risk pool by buying portfolios from competitors (Climate Change Research Report, 2009). The insurance systems according to Doherty (1997) work on one of two principles: spreading the cost of those suffering losses over those commonly exposed to the possibility of loss (cross-sectional distribution); and spreading each individual's costs from random losses across time (inter-temporal redistribution). However, there are challenges to a thriving insurance market and the common ones have been identified as moral hazard (when a policy holder do not make effort to prevent loss or minimize risk after being insured) and adverse selection (Carter, Galarza & Boucher, 2007). According to Mills (2005), insurers are also faced with technical and market-based risks. Technical risks include shortening times between loss events, changing absolute and relative variability of losses, and changing the structure of types of events amongst others; while market-based risks include using historically-based premiums that do not reflect current and actual losses, failure to keep or foresee changing customer needs arising from the effects of climate change and unanticipated changes in the patterns of claims; and inability to adjust prices in order to maintain profitability, amongst other factors.

Insurance is regarded as an adaptation measure, however, in the light of climate change, insurers may decide to leave their premiums and coverage unchanged or choose to adapt by revising their terms and conditions (Maynard, 2008). Globally, it has been observed that the costs of weather-related natural disasters are rising and there is a decline in the capacity of the insurance industry to absorb these (Mills, 2005). Thus, the manner and extent to which insurers view the effect of climate change on their businesses will inform the mitigative and adaptive responses they make. Although Hecht (2008) notes that it is not clear if insurers will work towards adapting their basic products to a world of climate change, it is believed that increasing climate-related losses could accelerate the increase of premiums to a level that is too high for many to afford (Maynard, 2008). Nonetheless, insurers' perceptions of climate change can influence the use of insurance as a strategy for mitigating climate change effects. A study on insurance companies' perceptions of climate change, as reported by Kepler (2013), showed that reinsurers and multi-line insurers considered themselves the most at risk while in a Ceres Report (2010), a survey of risk managers' perceptions of climate change indicated that nearly half of the respondents did not believe their firms could be affected by climate-related physical risks, even though they were well aware of such risks.

In the view of Ceres (2011), climate change presents significant financial risks for the insurance industry yet very few insurers see the need to take effective steps to manage these risks. On the other hand, Mills (2009) stated that mainstream insurers are increasingly seeing climate change as a material risk to their businesses and are therefore partnering with the scientific community to carry out research towards building better risk models that take climate change into consideration.

The insurance company in Nigeria is highly regulated by the National Insurance Commission (NAICOM) through the enforcement of the Insurance Act and decrees that have been enacted over time, from the Insurance Company Act of 1961 to Decree No 2 of 1997 (NAICOM, 2014). It would appear that Nigerian insurers have not paid adequate attention to the impact of climate change as there is no evidence to show that they have invested in any known research to investigate the potential effects on the industry by examining the link between climate change and weather-related losses. This attitude may stem from their belief that there is no link between climate change and indemnity claims. Consequently, meaningful discussion among insurers on the effects of climate change is yet to be seen in Nigeria. There is thus limited focus on the spillover effects of climate change on the Nigerian insurance industry. Consequently, given the emerging financial consequences of climate change globally, it becomes pertinent to study the implications of these fallouts on the insurance industry in Nigeria.

This paper, therefore, seeks to provide empirical evidence of the beliefs of Nigerian insurers on how climate change affects their businesses. Considering that rising financial costs have given rise to debates among researchers on whether insurers should be allowed to base their premiums on future projections of climate change as opposed to traditional pricing that is based on historical data, the study attempts to investigate if frequency of insurance payouts has increased over time and also examines the proposition that insurance firms in Nigeria are not mindful of the impact of climate change. By exploring these issues, it is hoped that this study will add to the existing body of knowledge on the Nigerian insurance industry.

3 Methodology

The study was carried out in Rivers State, Nigeria. The study population was made up of all the insurance firms operating in the State and that were also listed in the directory of the National Insurance Commission (www.naicom.gov.ng). Although there were 58 of such registered insurance firms, an online search on the platform of a "vconnect" website (a credible source which provides information on local businesses in Nigeria) showed that 34 (58.6 per cent) out of the 58 firms were operating in Rivers State. Of this number operating in the State, only 22 (64.7 per cent) of the insurance companies provided responses to the administered questionnaires. An extensive literature review was done to identify the areas that could be affected by climate change and these formed the framework of the survey schedule. Primary data was obtained from the firms with the aid of a structured schedule made up of 24 selected statements. The statements were designed in a 4-point Likert-type scale using the following order of values: strongly disagree- 1; disagree- 2; agree- 3; strongly agree- 4. This gave a total ranking score of 10 and a mean value of 2.5. The lower and upper limits for the rankings were taken as 2.45 and 2.55 respectively. A cutoff point was established by finding the average attitude score for the firms with the formula:

Where X is the mean of attitude test score for the firms, Σχ is summation of rank scores of the firms for an item and n is the number of firms that scored the particular item. Therefore, mean attitude scores that are higher than 2.55 will indicate a positive opinion (that is, firms agree about the impact of climate change and the threat on their businesses) while scores below 2.45 would mean a negative opinion on climate change effects. However, those with scores that fall between 2.45 and 2.55 would be suggestive of a neutral attitude.

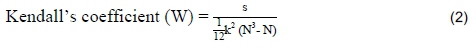

The qualitative data was also analysed with Kendall's coefficient of concordance to determine the degree of association among the rankings given by the insurance firms. This coefficient indicates whether there is perfect agreement or no agreement among the set of rankings. When perfect agreement occurs between the firms, Kendall's coefficient is equal to 1 but when there is maximum disagreement, it is equal to 0. It was computed using the formula:

Where s is the squared deviation of sum of ranks for each statement from the mean rank sum, k is the number of insurance firms and N is the number of statements ranked. The significance of W is tested for with chi-square value. The null hypothesis of independence is rejected if the calculated chi value is greater than the chi-square table value at a 5 per cent level of significance.

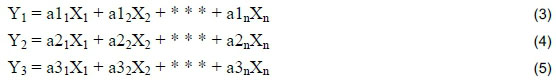

Furthermore, an exploratory factor analysis was employed in identifying important factors of climate perception among the insurers in the study area. Principal component factor analysis with varimax-rotation and factor loading of 0.30 was used. As in Amusa, Enete and Okon (2011), variables with factor loading of less than 0.30 and variables that were loaded in more than one factor were discarded. The principal component factor analysis model is stated thus:

* = *

* = *

Yn = an1X1 + an2X2 + * * + anXn

Where,

Y1, Y2 .. .Yn = observed variables / perceptions of climate change among insurers.

a1 - an = factor loadings or correlation coefficients.

X1, X2, . Xn = unobserved factors underlying perceptions to climate change among insurers.

4 Results

It could be observed from Table 1 which shows the result of statistical characteristics of the surveyed insurance firms that the total office branches owned by the 22 surveyed insurers numbered 458 and on the average, a firm had about 20 office branches. The study revealed that insurance firms have been operating for an average of 35 years in Nigeria although the oldest was established 93 years ago and the youngest 5 years ago. As at 10 years ago, there were a total of 259 branches owned between the surveyed insurers. However, these increased substantially by 77 per cent to about 458 operational branches by 2014.

It was also revealed that each insurance firm, on average, operated in only 14 states out of the 37 states (including the federal capital) of the country. This indicates that there is large scope for market expansion and wider insurance coverage. This supports UNFCCC (2007) that although insurance is a vital instrument in developing countries; its operation is very limited, mostly due to insurers' lack of funding and inability to access available funds. Additionally, the premiums are tied to the risk profiles of individuals. It was also observed that most of the surveyed insurance firms had more branches in the west, followed by the southern and northern regions, while the eastern region had the least number of insurance branches. However, the case of the western region was not surprising considering that Lagos, as the economic power house and commercial hub of the country, as well as Ibadan, the largest city in West Africa, are located in the western region. However, the presence of oil multinationals and federal capital might be responsible for the presence of many insurance branches in the south and north respectively. About 91 per cent of the surveyed insurers were private insurance firms and they were mostly involved in insurance policies or products that did not include the agriculture sector. The proportion of the surveyed firms that offered agro-insurance was just 9 per cent. This is an indication that most private insurers exclude farmers from coverage, either knowingly or unknowingly. Therefore, excluded farmers who may be interested in insurance cover are unable to adopt agricultural insurance as an adaptation measure by which they can protect their income against destabilisation from numerous risk factors such as the catastrophic effect of losses arising from climate-related hazards. In addition, Farayola et al. (2013) asserted that despite the existence of the government insurance scheme in Nigeria and the efforts of the Nigerian Agricultural Insurance Corporation, there is still a high level of apathy by farmers towards taking out insurance policies. This is the result of negative perceptions about insurers' commitment to paying claims and also, in the case of small farm holdings, farmers' belief that it is uneconomical to pay insurance premiums. Thus, the result supports the literature (Farayola et al., 2013) on the insignificant share of the Nigerian farmers' population covered by insurance. Nevertheless, insurers can tap into the market offered by the country's large population of farmers if insurance products are tailored to meet farmers' specific needs and efforts are made to address all negative public perceptions.

4.1 Factor analysis of insurers' perceptions of climate change in the study area

Factor analysis uses mathematical procedures for the simplification of interrelated measures to discover patterns in a set of variables (Child, 2006). The aim of factor analysis is to discover the simplest method of interpretation of observed data (Harman, 1976). Factor analysis operates on the notion that measurable and observable variables can be reduced to fewer latent variables that share a common variance and are unobservable, which is known as reducing dimensionality (Bartholomew, Knott & Moustaki, 2011). These unobservable factors are not directly measured but are essentially hypothetical constructs that are used to represent variables (Cattell, 1973). Thus, factor analysis is used when a researcher wants to discover the number of factors influencing variables and to analyse which variables 'go together' (DeCoster, 1998). In our own study, these variables have been grouped into three categories (institutional, technological and financial) based on reduction in dimension. For something to be labelled as a factor it should have at least three variables, although this depends on the design of the study (Tabachnick & Fidell, 2007).

Accordingly, the results in Table 2 show the factor analysis of the insurers' perceptions of climate change in the study area. Factor analysis of the data obtained revealed three significant loadings that could be classified as institutional, technological and financial factors. The result agrees with Zhao (2011) that the role of insurance depends on insurance regulators, governments, consumers and capital market working together. These factors represent the major perceptions of climate change among insurers in the study area.

Factors which were loaded under institutional perceptions were: firm is aware of climate change and its effects (0.387); life insurers and pension funds are affected by climatological effects on human health (0.793); climate change has increased the frequency and number of insurance claims in recent years (0.917); insurers encounter liquidity problems in the course of paying claims (0.373); and here should be public funding of insurance policies on agribusinesses (0.856).

Factors which were under technology were: climate change affects automobiles, marine vessels and aircraft (0.380); and insurers consider the impact of climate change when fixing premiums (0.697).

Factor loadings under finance include: firm has initiated policies based on climate change (0.538); insurers should participate actively in negotiations and conferences on climate change issues (0.8120); and areas susceptible to flooding and drought should not be covered by insurance (0.364).

4.2 Insurers' perceptions of climate change

The analysis of the insurers' attitudes towards climate change data by summated rating presented in Table 3 showed that Nigerian insurers are aware of the effects of climate change but do not believe climate change can impact negatively on their businesses and so do not base their premiums on projected futures losses that might be related to climate change. The implication of this finding is that, as pointed out by Schipper et al. (2008), if it is not recognised that climate change poses new threats, then measures to prevent loss will not be prioritised and this may be to the detriment of the Nigerian insurance industry in the future. This also highlights the warnings of Mills (2005) that though the insurance sector is presently regarded as the world's largest industry, as global warming intensifies, the insurance market could in future diminish in size and profitability.

Although insurers were aware of climate change effects, they were of the opinion that insurers have not stayed away from areas prone to drought and flooding. Insurers agreed that there should be public support for the provision of coverage for agribusinesses as most insurers do not offer coverage to agribusinesses due to the risky nature of agriculture. They also advocated for more active participation on their part in discussions and debates on climate change issues. On this basis, it can be inferred again that if insurers do not view climate change as an increasing threat to their business, they may not adopt practices that will mitigate their costs so as to maintain profitability (Schipper et al., 2008). Also, insurers who believe that recent natural disasters such as flooding, drought and hurricanes are the result of climate change would want to base their prices on future-oriented estimates that are determined by climate change forecasts and would buy reinsurance so as not to experience liquidity problems in the face of rising or frequent claims.

4.2.1 Test of hypoth esis

A Kendall's coefficient of concordance was done to ascertain if the insurers applied the same standard in assessing the statements. The Kendall's coefficient of concordance (W) was 0.01 with a calculated chi value of 5.06, as shown in Table 4. Therefore, the null hypothesis of independence among rankings was not rejected and it was inferred that the insurance firms did not apply the same standard in ranking the statements. However, it was observed that among the statements rated most highly and regarded as most important by all the firms was the need for public funding of insurance policies on agribusiness (100 per cent) and the call for insurers (86 per cent) to participate actively in negotiations and conferences on climate change issues.

4.3 Challenges faced by Nigerian insurers

Furthermore, the responses to an open-ended question on the major challenges faced by the insurers were collated and these are presented in Table 5. The major challenges faced by Nigerian insurers included low awareness of insurance products among the farmers and the general public which has led to low customer base; and clients having poor knowledge about insurance benefits. In addition, there is prevalence of insurance rate-cutting due to increasing competition among insurers; regulatory constraints (for instance, the insurers' regulatory body does not permit insurers to base premiums on future or projected losses or above certain amounts) and environmental challenges such as communication barriers and low wages of potential clients which makes it difficult for insurers to capture potential clients as people do not have adequate information or cannot meet premium costs. This result reinforces the result of the factor analysis earlier presented in Table 2 and which corroborated the findings of Zhao (2011) that the role of insurers depends on insurance regulators, governments, consumers and capital market working together.

5 Conclusion

The study focused on insurance as an adaptation strategy to climate change and examined the perceptions of Nigerian insurers of climate change. Without doubt, climate change presents serious challenges to the livelihoods of people in developing countries. It also plays an important role in the rising costs of natural disasters. Considering that insurance makes a risk that is large for one person smaller by spreading it over a large number of persons, its importance to the Nigerian nation which is characterised by many poor, cannot be over- emphasised. Although it is evident that the insurance industry is facing imminent threats from climate change, the study showed that Nigerian insurers did not believe climate change has spillover effects on their businesses and as such did not base their premiums on anticipated weather extremes. The findings of the study also showed that there is great scope for insurers to increase their client base in the Nigerian market as not all of them operated in all the states of the country.

Based on the insurers' responses, the study suggests that government should support private insurance firms so that they would be more willing to provide insurance to agricultural businesses through relevant policies that would encourage public-private partnership. Literature has shown that when private investors bring their expertise and efficiency to bear on projects, this promotes the sustainability of such projects. In addition, there is a need for Nigeria's insurance regulators to ensure a level playing field for all firms so as to protect weaker firms from being disadvantaged in insurance rate-cutting competition, one of the challenges being faced by insurers, as shown in the study. Lastly, if insurers initiate awareness campaigns to sensitise the populace on the existence and benefits of their insurance products, it would bring about a wider coverage of potential clients. However, the study creates a need for further research on a larger scale which would investigate the factors constraining the establishment of insurance firms in the eastern part of Nigeria.

References

AMUSA, T.A., ENETE, A.A. & OKON, U.E. 2011. Socioecomic determinants of cocoyam production among small holder farmers in Ekiti State, Nigeria. International Journal of Agricultural Economics & Rural Development, 4(2):97-109. [ Links ]

ARENA, M. 2008. Does insurance market activity promote economic growth? A cross country study for industrialized and developing countries. The Journal of Risk and Insurance, 75(4):921-946. [ Links ]

BARTHOLOMEW, D., KNOTTS, M., & MOUSTAKI, I. 2011. Latent variable models andfactor analysis: A unified approach (3rd ed.) West Sussex, UK: John Wiley & Sons. [ Links ]

BROWN, M.E. & FUNK, C.C. 2008. Food security under climate change. Science New Series, 319(5863): 580-581. [ Links ]

CARTER, M.R., GALARZA, F. & BOUCHER, S. 2007. Underwriting area-based yield insurance to crowd-in credit supply and demand. Savings and Development, 31(3):335-362. [ Links ]

CATTELL, R.B. 1973. Factor analysis. Westport, CT: Greenwood Press. [ Links ]

CERES. 2011. Climate risk disclosure by insurers: Evaluating insurer responses to the NAIC. Climate disclosure survey. www.ceres.org/resources/reports/naic-climate-disclosure [accessed September 2015]. [ Links ]

CERES. 2010. Climate change risk perception and management: A survey of risk managers. http://docplayer.net/3477914-Climate-change-risk-perception-and-management-a-survey-of-risk-managers.html [accessed September 2015]. [ Links ]

CHAMBWERA, M. & STAGE, J. 2010. Climate change adaptation in developing countries: Issues and perspectives for economic analysis. International Institute for Environment and Development. www.iied.org/pubs/display.php?o=15517IIED [accessed April 2015]. [ Links ]

CHILD, D. 2006. The essentials of factor analysis (3rd ed.) New York, NY: Continuum International Publishing Group. [ Links ]

CLIMATE CHANGE RESEARCH REPORT. 2009. Coping with climate change, risks and opportunities for insurers. The Chartered Insurance Institute Climate Change Report. http://www.cii.co.uk/knowledge/policy-and-public-affairs/articles [accessed April 2015]. [ Links ]

DECOSTER, J. 1998. Overview of factor analysis. http://www.stat-help.com/notes.html [accessed March 2012. [ Links ]]

DOHERTY, N. 1997. Insurance markets and climate change. The Geneva Paper on Risk and Insurance, 22(83):223-237. [ Links ]

FARAYOLA, C., ADEDEJI, I.A., POPOOLA, P.O. & AMAO, S.A. 2013. Determinants of participation of small scale commercial poultry farmers in agricultural insurance scheme in Kwara state, Nigeria. World Journal of Agricultural Research, 1(15):96-100. [ Links ]

GOSAIN, A.K. & RAO, S. 2003. Impact of climate change on the water sector. In PR Shukla, SK Sharma and RP Venkata (eds.) Climate change and India-vulnerability assessment and adaptation. Universities Press. [ Links ]

HARMAN, H.H. 1976. Modern factor analysis (3rd ed.) Chicago, IL: University of Chicago Press. [ Links ]

HAUFLER, V. 2012. Insurance and reinsurance in a changing climate. The Canadian Institute of the Woodrow Wilson International. http://www.eoearth.org/view.article/153847 [accessed April 2014]. [ Links ]

HAUFLER, V. 2009. Insurance and response to climate change risks. The Canadian Institute of the Woodrow Wilson International. http://www.eoearth.org/view.article/153847 [accessed April 2014]. [ Links ]

HECHT, SB. 2008. Climate change and the transformation of risk: Insurance matters. UCLA Law Review, 55:1559-1620. [ Links ]

HOWDEN, S.M., JEAN-FRANCOIS, S., TUBIELLO, F.N., CHHETRI, N., DUNLOP, M. & MEINKE, H. 2007. Adapting agriculture to climate change. Proceedings of the National Academy of Sciences of USA, 104(50): 19691-19696. [ Links ]

KARL, T.R. & TRENBERTH, K.E. 2003. Modern global climate change. Science New Series, 302(5651): 1719-1723. [ Links ]

KEPLER CHEUVREUX 2013. Adaptation: Underwriting risks for (re)insurers. ESG Research. http://keplercheuvreux.com/pdf/research/EG_EG_231158.pdf [accessed September 2015]. [ Links ]

LAMOND, J. & PENNING-ROWSELL, E. 2014. The robustness of flood insurance regimes given changing risk resulting from climate change. Climate Risk Management, 2:1-10. [ Links ]

MAYNARD, T. 2008. Climate change: Impacts on insurers and how they can help with adaptation and mitigation. The Geneva Papers on Risk and Insurance, Issues and Practice, 33(1):140-146. [ Links ]

MEARNS, L.O. 2010. Quantification of uncertainties of future climate change: Challenges and applications. Philosophy of Science, 77(5):998-1011. [ Links ]

MILLS, E. 2009. A global review of insurance industry responses to climate change. The Geneva Papers, 34: 323-359. [ Links ]

MILLS, E. 2005. Insurance in a climate of change. Science, 309(5737):1040-1044. [ Links ]

MORTON, JF. 2007. The impact of climate change on smallholder and subsistence agriculture. Proceedings of the National Academy of Science of USA, 104(50):19680-19685. [ Links ]

MULLER, C., CRAMER, W., HARE, W.L., LOTZE-CAMPEN, H. & KATES, R.W. 2011. Climate risk change for African agriculture. Proceedings of the National Academy of Science of USA, 108(11):4313-4315. [ Links ]

NATIONAL INSURANCE COMMISSION (NAICOM) 2014. Our History. http://naicom.gov.ng/content?id=37 [accessed 2014-05-25]. [ Links ]

OUTREVILLE, J.F. 1990. The economic significance of insurance markets in developing countries. The Journal of Risk and Insurance, 57(3):487- 498. [ Links ]

PANDA, A. 2009. Assessing vulnerability to climate change in India. Economic and Political Weekly, 44(16):105-107. [ Links ]

SCHIPPER, ELF, CIGARAN, M.P. & HEDGER, M.C. 2008. Adaptation to climate change: The new challenge for development in the developing world. An Environment and Energy Group Publication. [ Links ]

TABACHNICK, B.G. & FIDELL, L.S. 2007. Using multivariate statistics (5th ed.) Boston, MA: Allyn & Bacon. [ Links ]

UNITED NATIONS FRAMEWORK CONVENTION ON CLIMATE CHANGE (UNFCCC) 2007. Climate change: Impacts, vulnerabilities and adaptation in developing countries. www.unfccc.int/resource/docs/publications/impacts.pdf [accessed May 2014]. [ Links ]

VCONNECT 2015. Local businesses in Nigeria. www.vconnect.com/ [accessed September 2014]. [ Links ]

ZHAO, Z. 2011. Natural catastrophe risk, insurance and economic development. Energy Procedia, 5:23402345. [ Links ]

Accepted: June 2016