Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

South African Journal of Economic and Management Sciences

versión On-line ISSN 2222-3436

versión impresa ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.18 no.1 Pretoria 2015

http://dx.doi.org/10.17159/2222-3436/2015/v18n1a9

ARTICLES

Multinational corporations as channels for international technology transfer: Evidence from the South African innovation survey

Nazeem MustaphaI; Pedro MendiII

IHuman Sciences Research Council

IINavarra Center for International Development and Department of Business, Universidad de Navarra

ABSTRACT

In this article, we investigate the importance of South African subsidiaries of foreign multinationals as channels to introduce foreign innovations in the South African market. We use firm-level data from the 2008 wave of the South African Innovation Survey, which covers the period 2005-07. We find that subsidiaries of foreign multinationals are significantly more likely to introduce product and process innovations, as well as foreign new products and processes than domestic firms. However, we also find that they are not more likely to introduce foreign innovations developed in collaboration with or mostly by another firm outside their own multinational, or innovations that are new to the South African market.

Key words: international transfer of knowledge, international transfer of technology, new economy, technology adoption, R&D, innovation, technological innovation

1 Introduction

A large body of literature in Economics and Business has regarded multinational corporations (MNCs) as essential channels for the international diffusion of new technologies. In this article we evaluate the performance of South African subsidiaries of foreign MNCs in terms of innovativeness, and as vehicles in the international diffusion of technology, in comparison with domestic firms. For this purpose, we analyse data from the 2008 South African Innovation Survey. This survey, conducted at the enterprise level, makes use of the same methodology as that in the Community Innovation Surveys (CIS), and covers innovation activities carried out between 2005 and 2007.

In particular, we inquire into whether subsidiaries of foreign MNCs are more or less likely to innovate than domestic firms, as well as to introduce products that are new at least to the South African market. These questions have been addressed in a large number of studies that make use of CIS-type data. Additionally, we make use of a question included in the South African survey, but not in most comparable surveys, of the geographical origin of the product or process innovation, whether in South Africa or abroad. Hereby we will assess whether South African subsidiaries of foreign MNCs are more likely to introduce innovations developed outside South Africa, and by third parties outside South Africa. Finally, we test whether the impact of expenditure on internal R&D is different for South African subsidiaries of foreign MNCs.

The remainder of the paper is structured as follows: Section 2 provides some background discussion on innovation and the role of MNCs; Section 3 proposes the hypotheses to be tested; Section 4 discusses the data used in the present study; Section 5 presents the results from the econometric estimations; finally, Section 6 includes some concluding comments and discussion of the limitations of the present study.

2 Background

The introduction of new products and processes is an important source of welfare gains. New products bring about increases in consumer surplus through greater product variety, as argued theoretically in Dixit and Stiglitz (1977). Similarly, new processes imply access to superior technology, which is an engine for productivity growth. Indeed, Jones (1995) finds that cross-country differences in per capita incomes may be explained largely by differences in total factor productivity. In this line, Coe and Helpman (1995) link the international diffusion of technology with international trade, and Mendi (2007) finds evidence of trade in disembodied technology positively affecting the importing country's total factor productivity. Thus, the process of technological diffusion has very relevant consequences for economic growth. Particular in the case of less developed countries (LDCs), the effect may be one of abandoning a situation of underdevelopment and catching-up with more advanced economies.

The use of foreign technologies by domestic firms, especially subsidiaries of foreign MNCs, may bring about productivity gains to other domestic firms (Blalock & Gertler, 2009). Indeed, positive spillover effects of foreign direct investment (FDI) are what would be expected in the "pipeline" model of technology diffusion most commonly used as a framework for understanding the process by which FDI has a positive effect on a host economy. This model posits that innovation capital and assets are produced at the headquarters of technologically advanced MNCs. The action of foreign subsidiaries of such MNCs is to take the knowledge capital and assets in a relatively unchanged form into the foreign environment. That environment is assumed to be sufficiently different to the more attractive technological culture of the MNC or its subsidiary to the extent that local firms would seek to draw value from interactions with the subsidiary. Such engagement would be successful in generating enhanced economic growth provided the local firms are receptive enough to technology transfer and have the ability to incorporate the enhanced capabilities brought on through its interactions with the foreign subsidiary of the MNC. In this way the foreign subsidiary is seen as a conduit for the transference of innovative capability produced by the head of the MNC. Another mechanism through which the presence of a subsidiary of a foreign MNC could generate economic growth is through a perturbative effect on local firms who would find it necessary to compete harder with the more technologically developed foreign subsidiary thus promoting knowledge growth in local firms that are sufficiently technologically astute.

Marin and Bell (2006) argue that under some circumstances there is no conclusive evidence for positive effects on the local economy by the presence of foreign subsidiaries of advanced MNCs particularly for LDCs. More recently, Marin and Sasidharan (2010) argued for the importance of distinguishing subsidiaries according to their orientation to carry out creative versus exploitation activities in the economy of developing countries. They used an unbalanced panel data approach on manufacturing firm-level data in India to support their view that subsidiaries that are oriented to technologically creative activities have a significantly positive effect on technology transfer, whereas those engaged in exploitation activities have none and sometimes even generate negative effects.

In view of the positive effects of technological diffusion on growth, a recurrent question in the literature in Economics and Business is the study of the channels and the nature by which international technology diffusion takes place, for instance merchandise trade, movement of people, trade in machinery, reverse engineering, or trade in disembodied technology (Coe & Helpman, 1995; Fosfuri et al., 2001; Xu & Wang, 1999; or Zhu & Jeon, 2007). Transfers of knowledge within multinationals stand out as a particularly relevant channel, see Lichtenberg (2001), or Keller and Yeaple (2013) for a recent contribution. In fact, in a similar way as trade in goods, most trade in disembodied technology takes place within multinational corporations (see BEA, 2013 for US data). This paper takes precisely this point and focuses on the role of multinationals in the process of international technology transfer. Notwithstanding the mixed evidence from studies conducted in a developing economy context on 'demand-side constraints' (Marin & Bell, 2006), the potential gains from foreign spillovers may greatly depend on the level of absorptive capacity of domestic firms, i.e. their ability to acquire and make use of external knowledge (Zahra & George, 2002), and on their level of engagement with foreign subsidiaries in innovative activities (Marin & Sasidharan, 2010).

Many contributions to the literature have searched for evidence of subsidiaries of foreign MNCs acting as key players in the process of technological diffusion. In a pioneering empirical study, Mansfield and Romeo (1980) analyse the transfer of technology from US-based MNCs to their overseas subsidiaries, focusing on the nature of the technology being transferred and the evaluation of the benefits to the host country. Later studies use survey-level data, typically from OECD countries, to analyse the determinants and consequences of firms' innovation activities. For instance, Veugelers (1997), and Veugelers and Cassiman (1999) study the determinants of firms' decisions whether to make or buy technology. In this line, Cassiman and Veugelers (2006) find evidence that there are complementarities between external and internally-developed knowledge. In a contribution closely related with ours, Veugelers and Cassiman (2004) analyse the role of subsidiaries of foreign MNCs as effective channels for the acquisition of foreign technology. They use survey data from the Belgian Community Innovation Survey, to test whether Belgian subsidiaries of foreign MNCs are more likely than domestic firms to transfer technology locally. The authors control for the fact that subsidiaries of foreign MNCs could more easily source technology from other countries. They find that subsidiaries of foreign MNCs have an easier access to foreign sources of technology but, controlling for access to foreign technology, they are less likely to transfer it locally. Un and Cuervo-Cazurra (2008) compare the performance of Spanish firms and subsidiaries of foreign multinationals in terms of R&D expenditures to find that the latter invest less on R&D than Spanish firms, a result that is driven by lower expenditures on external R&D, not internal R&D. The question of whether multinationals acquire the most efficient firms and what the effect is of foreign acquisitions on innovation performance, has also attracted attention from research scholars. In this line, Stiebale and Reize (2011), using data from German firms find a negative effect of foreign acquisitions on the propensity to perform innovative activities and on R&D expenditures of innovative firms. Guadalupe and Kuzmina (2012), using a dataset of Spanish manufacturing firms find that multinational firms acquire the most efficient firms and that the effect of foreign acquisition on the introduction of new products and processes is positive.

Generally for countries outside the OECD, lack of data has been an impediment to the conduction of similar studies. One exception is Oerlemans and Pretorius (2006), which analyses firm-level data from the 2001 South African Innovation Survey to study the determinants of innovation outcomes. The authors stress the importance of an educated workforce for innovation, although R&D intensity seems not to have a significant impact on innovation, albeit the effect varies across industries. They also find evidence of foreign-owned firms generating better innovation outcomes. The characterisation of innovation in South Africa is that of incremental innovators working in imitation mode. The South African economy has been described as mixed in that it has aspects of developed economies as well as those of less-developed economies, which creates an interesting backdrop for an investigation of the effect of FDI on the host economy.

3 Multinationals and innovation

Despite the growing importance of arm's-length transfers of technology, i.e. those that involve two unaffiliated parties, see Arora et al. (2002), the process of international diffusion of technology is predominantly conducted within the framework of MNCs. Although far from being cost-free, as documented in Teece (1977), internal transfers of technology are considered to be less problematic than arm's-length transactions. Similarly, Buckley and Casson (1976) argue that knowledge will typically be diffused internally, given that it is easily transferred and difficult to protect, although it is also acknowledged that internal transmission costs depend on factors such as distance. As argued in Arora (1996) within an MNC, the scope for opportunistic behaviour is smaller, especially when knowledge has an important tacit component.

In fact, Kogut and Zander (1993) argue that multinationals arise because of their greater efficiency in transferring knowledge internationally, especially know-how. The firm is viewed as a repository of knowledge that consists of how information is coded and action coordinated. Thus, the mode of technology transfer is influenced by the characteristic of the advantage that motivates the growth of the firm across borders. The relative advantage of the multinational is especially relevant when tacit knowledge complements codifiable technology. In fact, Cantwell (2001) argues that technology has two elements - it is codifiable and tacit, specific to particular firms. Of course, the second element is difficult to transfer between independent firms, and will be the object of transfer within MNCs.

By their very nature, MNCs are exposed to a richer variety of knowledge sources, which may be more efficiently transferred internally to other parts of the MNC than through arm's-length agreements. Thus, subsidiaries of foreign MNCs are expected to have access to a wider pool of knowledge and to information channels within the MNC that make the acquisition of information external to the subsidiaries more efficient than in the case of stand-alone firms. In this line, Gupta and Govindarajan (2002) find empirical evidence for knowledge inflows into subsidiaries depending on richness of transmission channels, motivational disposition to acquire knowledge, and the capacity to absorb incoming knowledge. Therefore it is reasonable to expect that the access to a wider pool of knowledge and to information from the parent firm or other subsidiaries within the MNC will make subsidiaries of foreign MNCs more active innovation players than comparable domestic firms.

These arguments lead us to formulate a number of hypotheses to be tested using data from the 2008 South African Innovation Survey. First, if MNCs are indeed more efficient in the internal transmission of knowledge, and have access to a wider pool of knowledge, we expect them to be more innovative overall than domestic firms, as well as being more likely to introduce innovations that are new to the domestic economy. This will be formally stated as Hypotheses 1A and 1B.

H1A: South African subsidiaries of foreign MNCs are more likely to innovate than domestic firms.

H1B: South African subsidiaries of foreign MNCs are more likely to contribute to novel innovations than indigenous South African companies.

The next two hypotheses emanate from the expected greater relative efficiency of subsidiaries of foreign MNCs as channels for the diffusion of foreign technologies into South Africa. The existence of communication channels within the MNCs makes it more likely that South African subsidiaries of foreign MNCs be more aware of products developed outside of South Africa, whether within the MNC or by foreign external parties. This is materialised into Hypotheses 2A and2B.

H2A: South African subsidiaries of foreign MNCs are more likely to introduce innovations developed outside South Africa than domestic firms.

H2B: South African subsidiaries of foreign MNCs are more likely to introduce innovations developed by third parties outside South Africa than domestic firms.

Finally, local R&D is important to absorb foreign technology and to adapt existing products and/or processes to the domestic environment. It is likely that R&D performed by local subsidiaries complements tacit and codified knowledge developed elsewhere within the MNC. Additionally, the performance of internal R&D increases the absorptive capacity of the firm that performs it, and it is likely that the local research carried out by subsidiaries of foreign MNCs complements R&D carried out elsewhere. Thus its impact on the novelty of innovations, as well as on the likelihood of adapting knowledge developedelsewhere is greater. In this line, we formulate Hypotheses 3A and 3B:

H3A: The impact of internal R&D expenditures on the likelihood of introducing innovations new to the South African market is higher for South African subsidiaries of foreign MNCs.

H3B: The impact of internal R&D expenditures on the likelihood of introducing innovations developed outside South Africa and by third parties outside South Africa is higher for South African subsidiaries of foreign MNCs.

4 The data: The South African innovation survey

The 2008 South African Innovation Survey was conducted by the Centre for Science Technology and Innovation Indicators (CeSTII) of the Human Sciences Research Council, on behalf of the Department of Science and Technology (DST) of South Africa. This is the second wave of innovation surveys conducted by the CeSTII following the same guidelines as the Community Innovation Survey (CIS), after the 2005 survey. Previous efforts to use CIS-based surveys include the 1996 Survey of Innovation in South African Manufacturing Firms and the South Africa Innovation Survey 2001; see Oerlemans et al. (2004).

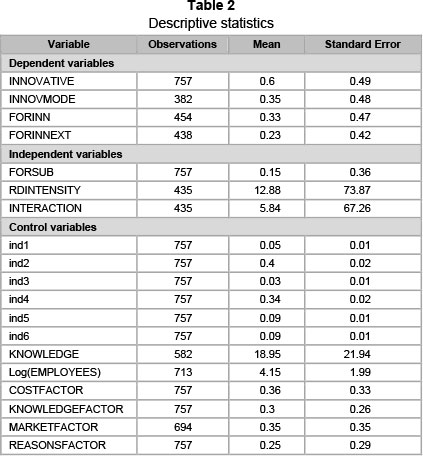

The population in the 2008 survey was 22,849 enterprises. Out of these, a stratified sample of 2,836 enterprises was selected, successfully collecting information from 757 firms on their innovation activities from 2005 to 2007. The main results from the analysis of the survey data, reported by CeSTII (2011), suggest that the population of South African firms sampled have a relatively high rate of innovation at 65 per cent. This is comparable to the rate of innovation of firms in OECD countries, although it is observed to be very sensitive to firm size. We assess here the role of subsidiaries of foreign MNCs as channels for local diffusion of foreign technologies.

Table 1 lists the main variables used in the present study, distinguishing between dependent, independent, and control variables. The variables that will appear as dependent variables in the econometric specifications that will be estimated are INNOVATIVE, FORINN, FORINNEXT, and INNOVMODE. The INNOVATIVE variable takes the value one if the firm had introduced at least one product or process innovation in 2005-07, or had some on-going innovation activities in 2007, even if it was not a successful innovator in 2005-07. INNOVMODE takes value one if the innovation represents a novelty at least in the South African market, zero otherwise. FORINN is an indicator variable that takes value one if the firm introduced an innovation -whether product of process- that originated abroad during 200507, zero otherwise. To the best of our knowledge, this is the first time the FORINN variable has been used in an analysis of the determinants of innovation. FORINNEXT is also an indicator variable that takes value one if the firm introduces an innovation originated abroad and that was developed in collaboration with or mainly by third parties.

Regarding the independent variables, FORSUB is a binary variable that takes value one if the firm is a subsidiary of a foreign MNC, zero otherwise, RDINTENSITY is expenditures onR&D per employee, and INTERACTION is the product of RDINTENSITY and FORSUB.This interaction term is introduced in the econometric specifications in order to search for incremental effects of R&D on performance variables within subsidiaries of MNCs, relative to domestic firms. We control for industry fixed effects by including six industry dummies as control variables (The South African Innovation Survey uses SIC, Rev. 3). As additional control variables, Log(EMPLOYEES) is the logarithm of the number of employees in 2005, a proxy for firm size, whereas KNOWLEDGE is the percentage of the firm's employees with higher education. Finally, the COSTFACTOR, KNOWLEDGEFACTOR, MARKETFACTOR, and REASONSFACTOR variables reflect the firm's perceptions on the importance of different categories of obstacles to innovation. The questionnaires contain a number of questions in each category, expressed as a 4-point Likert scale, ranging from one to four. Using these responses, these four variables have been normalised to be between zero and one and represent the average importance of cost, knowledge, and market factors as obstacles to innovation, as well as the importance of reasons not to be innovative. Specifically, if a category of obstacles j includes Njitems and if sijis the score of item i, then the constructed variable takes value equal to the sum of the scores of the Njitems minus the number of items, Nj, and divided by three times Nj. For instance, since COSTFACTOR includes three items, N=3, which implies that COSTFACTOR equals the sum of the scores of each item minus three, divided by nine.

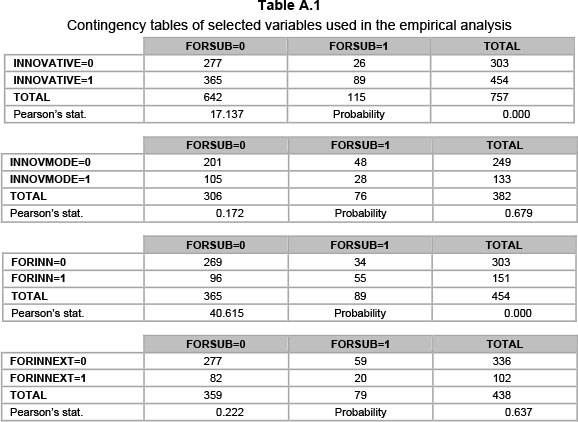

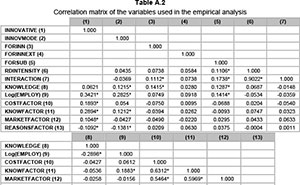

Table 2 displays descriptive statistics of the variables used in the present study. Out of the 757 observations, 454 firms introduced at least one product and/or process innovation in 200507, or had some on-going innovation activities in 2007. This represents 60 per cent of the total number of observations. 151 of these introduced either a product or a process innovation that was originated abroad (FORINN=1). This is 20 per cent of the observations, and 33 per cent of innovative firms. Regarding foreign ownership, 115 of the firms in the sample are subsidiaries of foreign MNCs. Most firms in our sample are in manufacturing (40 per cent) and wholesale and retail trade (34 per cent). Finally notice that, while 757 valid responses were obtained, the number of observations actually used in the different econometric specifications will be lower, due to the fact that some variables are not observed for all firms. Appendix Table 1 presents contingency tables of selected binary variables, specifically INNOVATIVE and FORSUB, INNOVMODE and FORSUB, FORINN and FORSUB, and FROINNEXT and FORSUB. Appendix Table 2 is a correlation matrix of all the variables used in the analysis, excluding pairs of binary variables.

5 Empirical analysis

In this section, we describe the econometric analysis that is carried out to test the hypotheses laid out in Section 3, and present the results obtained. Probit regression results are presented for all industries, as well as conditional on non-services industries (mining and quarrying; manufacturing; electricity, gas and water supply) and services industries (wholesale and retail trade; transport, storage and communication; financial intermediation, computer and related activities, research and development, architectural, engineering and other technical activities). In some of the specifications, correction for sample selection will be introduced, whenever the dependent variable is observed conditional to the firm being innovative. The statistical analysis was conducted using STATA and checked with SAS.

Table 3 reports estimated marginal effects of a probit model where the dependent variable is INNOVATIVE, and FORSUB is the independent variable. Additionally, we control for industry fixed effects, size, the percentage of workers with higher education, and obstacles to innovation activities (COSTFACTOR, KNOWLEDGEFACTOR, MARKETFACTOR and REASONSFACTOR). According to Hypothesis 1A, we expect the coefficient on FORSUB to be positive and statistically significant.

The first column of Table 3 reports estimated coefficients using observations from all industries. Consistent with Hypothesis 1A, the effect of FORSUB, is positive and significant, suggesting a higher propensity to innovate by subsidiaries of foreign MNCs. Although in the case of the services industries the effect of FORSUB is positive and significant, with non-services industries the effect, while positive, is not statistically significant. A number of other results are obtained in Table 3. Firstly, the probability of a firm being innovative is strongly and positively associated with firm size, consistent with the statistically significant coefficient of Log(EMPLOYEES) across all industries and when subset by non-services and services industries. Secondly, the presence of a large number of employees with a high level of education, is positively associated with innovative firms as can be seen from the positive and significant coefficient for KNOWLEDGE but not significant for non-services industries, as seen in column (ii). The factors recorded in the survey hampering innovation or influencing the decision not to innovate, were cost-, knowledge-, and market factors as well as some other reasons. This finding is consistent with previous findings in similar studies, such as Baldwin and Lin (2002), or D'Este et al. (2011), that suggest that precisely innovative firms are the ones most aware of the how various obstacles hamper innovation. In all three cases thecoefficient REASONSFACTOR indicated thatinnovative firms' successful innovations relate to their need to innovate.

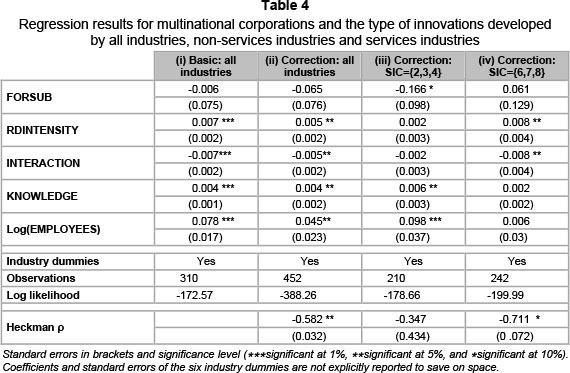

Following the evidence that South African subsidiaries of foreign multinationals are more innovative than domestic firms, we examine the issue of the novelty of these innovations. Hypothesis 1B predicts that subsidiaries of foreign MNCs are more likely than local firms to introduce products that are new at least to the South African market. For this reason, the first column of Table 4 reports estimated coefficients of a probit model where the dependent variable is INNOVMODE and the independentvariables are FORSUB, RDINTENSITY, andINTERACTION. Notice that INNOVMODE is observed only if the firm is innovative, and thus only observations from innovative firms is used, reducing the number of observations to 310. The results fail to support Hypothesis 1B, since the coefficient on FORSUB is negative and statistically insignificant. Furthermore, thecoefficient RDINTENSITY is positive and statistically significant, while INTERACTIONis negative and statistically significant. This is contrary to Hypothesis 3A, which predicts a greater relevance of internal R&D activities for subsidiaries of foreign MNCs.

The fact that INNOVMODE is observed forthe subset of innovative firms only, calls for correction of sample selection with INNOVATIVE being the selection variable. For this reason, we estimate a probit model with sample selection, as described in Maddala (1983). Sample selection is corrected for by including an inverse Mill's ratio, obtained from the selection equation, where the dependent variable is INNOVATIVE and the independent variables are FORSUB, KNOWLEDGE, Log(EMPLOYEES),COSTFACTOR, KNOWLEDGEFACTOR, MARKETFACTOR, REASONSFACTOR, aswell as industry dummies. This method is more computationally efficient than using maximum likelihood estimation, but it is known that the resulting estimates, although consistent, are not asymptotically efficient under normality assumption. Subsidiaries of multinationals are expected to be able to draw more easily on the innovative processes and practices of their parent companies, and therefore transfer of foreign technology new to the South African market. Therefore, we expect a positive relationship between a firm being a subsidiary of a foreign MNC and the probability of the firm introducing a product or process innovation that is of high novelty value, at least in South Africa. The estimated marginal effects computed using the estimated coefficients in the regression equation (where the dependent variable is INNOVMODE) are displayed in columns (ii), (iii), and (iv) of Table 4, whereas the estimated coefficients in the selection equation (where the dependent variable is INNOVATIVE) are not reported.

The marginal effect of FORSUB is found to be statistically insignificant in specifications (ii) and (iv), and negative and statistically significant in specification (iii). The significant and positive coefficient for RDINTENSITY in column (ii) indicates that R&D-intensive firms in the overall sample contribute positively to the propensity for innovation that is new to theSouth African market or the world. Thus, the introduction of innovations that are new to the market seems to be driven mainly by the firms' internal capabilities. However, the coefficient on INTERACTION is negative and statistically significant in specifications (ii) and (iv). This suggests that internal capabilities are not as important for subsidiaries of foreign multi-nationals, which implies that these firms are simply transferring already-developed technologies without much contribution from the local subsidiary. Therefore, we do not find evidence of subsidiaries of foreign multi-nationals being significantly more active than local firms in the introduction of technologies that are new to the South African market. Like in the previous case (Table 3), firm size and the percentage of employees with higher education have a positive effect on the introduction of products new to the South African market, which influences sectors throughout and the sub-case of non-services industries (Table 4).

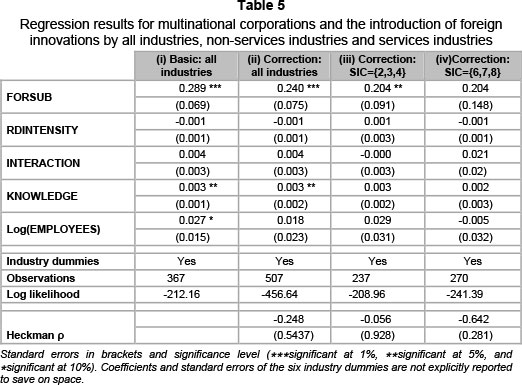

We now compare the propensity to introduce innovation developed outside South Africa between local firms and subsidiaries of foreign MNCs. In order to do so, we estimate a probit model where the dependent variable is FORINN, an indicator of the innovation being developed outside South Africa and FORSUB,RDINTENSITY, and INTERACTION as independent variables. In addition to the industry dummies, we include Log(EMPLOYEES) as well as KNOWLEDGE as control variables.

On the one hand, Hypothesis 2A predicts a positive estimated coefficient on FORSUB, and in column (i), (ii) and (iii) of Table 5 we indeed obtain a positive and statistically significant coefficient on this variable. On the other hand, Hypothesis 3B predicts a positive and statistically significant coefficient onINTERACTION. However, the marginal effectsof RDINTENSITY as well as of INTERACTION both fail to be statistically significant in all cases.

The fact that FORINN is observed only if the firm is innovative, calls for correction of sample selection, in a similar way as we did in columns (ii), (iii) and (iv) of Table 4. The selection equation has INNOVATIVE as the dependent variable, and industry dummies, FORSUB, KNOWLEDGE, Log(EMPLOYEES), COSTFACTOR, KNOWLEDGEFACTOR, MARKETFACTOR, and REASONSFACTOR as independent variables. In columns (ii) and (iii), the marginal effect of FORSUB is positive and statistically significant, but that of RDINTENSITY and INTERACTION is found to be insignificant. These results support Hypothesis 2A, but not Hypothesis 3B. Regarding the control variables, KNOWLEDGE is positive and statistically significant in columns (i) and (ii), whereas Log(EMPLOYEES) is positive and statistically significant in column (i) only.

We finish our empirical analysis by studying the determinants of FORINNEXT, the indicator of the foreign technology being developed outside the multinational in collaboration with or mainly with other enterprises as dependent variable. According to Hypothesis 2B, we expect a positive relationship between a firm being a subsidiary of a foreign MNC and the probability that the firm introduces an innovation originated outside South Africa and developed outside of the MNC. According to Hypothesis 3B, we expect the impact of R&D carried out internally, to be greater in the case of subsidiaries of foreign MNCs, and thus the coefficient of INTERACTION is expected to be positive and statistically significant.

Table 6 presents estimated coefficients of different specifications where FORINNEXT is the dependent variable. In a similar way as in the previous tables, the first column reports marginal effects of a probit specification without correction for sample selection. In this case, contrary to Hypothesis 2B, the marginal effect of FORSUB is found to be negative and statistically significant. The marginal effects of RDINTENSITY and INTERACTION are found to be statistically insignificant.

Like in the previous case, the nature of the variable calls for correction for sample selection. Columns (ii), (iii) and (iv) of Table 6 report estimated marginal effects of econometric specifications where the regression equation has FORINNEXT as the dependent variable, and FORSUB, RDINTENSITY, and INTERACTION as independent variables. The selection equation has FORINN as dependent variable, and FORSUB, KNOWLEDGE, and Log (EMPLOYEES) as independent variables. We fail to obtain statistical significance of the marginal effects of FORSUB and INTERACTION in the selection equation, thus failing to confirm Hypotheses 2B and 3B.

6 Concluding comments

This paper has analysed the innovation propensity of South African subsidiaries of foreign multinationals, in comparison with indigenous firms. Our empirical findings on the role of subsidiaries of foreign MNCs in the process of technological diffusion are mixed.We do indeed find that subsidiaries of foreign MNCs are more likely than domestic firms to not only innovate but also to introduce innovations originally developed in foreign countries. However, we do not find evidence of these subsidiaries being more likely to generate innovations that are new to the global or to the South African market, or developed by foreign actors external to the MNC.

These results suggest that South African subsidiaries of foreign multinationals specialise in the transfer of technologies developed within its own multinational, and show no particular advantage in transferring foreign technologies developed by third parties. Furthermore, internal R&D capability seems to stimulate innovations, while R&D expenditure of subsidiaries of foreign multinationals seems to impact negatively on the propensity for novel innovations.

Hence, policies based on the promotion of FDI are likely to mostly attract knowledge developed within MNCs, and not that developed by other external players. For this task, domestic firms seem to be better suited, and their expenditures on internal R&D seem to have a greater return.

A number of limitations to this study could be mentioned. First, from a methodological perspective, the use of survey data poses the risk of common-method bias. With survey data, false correlations may arise if respondents provide answers to unrelated survey questions that make them appear consistent with each other. This problem is most acute when both the dependent and independent variables are perceptual and come from the same source (Chang et al., 2010). We believe that this could be the case for obstacles to innovation variables, but less for the rest of the variables, which are more objective by nature. In any case, the obstacles to innovation variables are used as controls in the main regression (see Table 3) and in the selection equations of the rest of the specifications. Another important limitation is that we do not have information on the productivity of firms. The present study simply assessed the relative performance of South African subsidiaries of foreign MNCs in the dimensions that were observable given the available data. However, no distinction could be made regarding the actual impact on productivity of the different innovations introduced by the firms in the sample, say within the group of innovations that are new to the South African market. This type of limitation calls for the use of more detailed, perhaps industry-specific data.

Acknowledgements

We thank the associate editor of SAJEMS, as well as an anonymous referee for their comments, which substantially improved the quality of the manuscript. We also thank comments from participants at the Second Navarra Development Week. Mustapha thanks the South African Department of Science and Technology for research funding. Mendi gratefully acknowledges financial support from Ministerio de Economia y Competitividad (ECO2010-18680), as well as from Fundación CAN.

References

ARORA, A. 1996. Contracting for tacit knowledge: The provision of technical services in technology licensing contracts. Journal of Development Economics, 50(2):233-256. [ Links ]

ARORA, A., FOSFURI, A. & GAMBARDELLA, A. 2002. Markets for technology: the economics of innovation and corporate strategy. Cambridge, MA: MIT Press. [ Links ]

BALDWIN, J. & LIN, Z. 2002. Impediments to advanced technology adoption for Canadian manufacturers. Research Policy, 31:1-18. [ Links ]

BLALOCK, G. & GERTLER, P. 2009. How firm capabilities affect who benefits from foreign technology. Journal of Development Economics, 90(2): 192-199. [ Links ]

BUCKLEY, P.J. & CASON, M.C. 1976. The future of the multinational enterprise. London: Macmillan. [ Links ]

BUREAU OF ECONOMIC ANALYSIS. 2013. Survey of current business. [ Links ]

CANTWELL, J. 2001. Innovation and information technology in MNE. In Rugman, A.M. and Brewer, T.L. (eds.) The Oxford handbook of international business. Oxford: Oxford University Press. [ Links ]

CASSIMAN, B. & VEUGELERS, R. 2006. In search of complementarity in innovation: Internal R&D and external knowledge acquisition. Management Science, 52:68-82. [ Links ]

CeSTII. 2011. Main results of the South African innovation survey 2008: Reference period 2005-2007. Pretoria: Department of Science and Technology. [ Links ]

CHANG, S., VAN WITTELOOSTUIJN, A. & EDEN, L. 2010. Common method variance in international business research. Journal of International Business Studies, 41:178-184. [ Links ]

COE, D. & HELPMAN, E. 1995. International R&D spillovers. European Economic Review, 39:859-887. [ Links ]

D'ESTE, P., IAMMARINO, S., SANOVA, M. & VON TUNZELMANN, N. 2011. What hampers innovation? Revealed barriers versus deterring barriers. Research Policy, 41:482-488. [ Links ]

DIXIT, A. & STIGLITZ, J. 1977. Monopolistic competition and optimum product diversity. American Economic Review, 1977:297-308. [ Links ]

FOSFURI, A., MOTTA, M. & RONDE, T. 2001. Foreign direct investment and spillovers through workers' mobility. Journal of International Economics, 53:205- 222. [ Links ]

GUADALUPE, M. & KUZMINA, O. 2012. Innovation and foreign ownership. American Economic Review, 02(7):3594-3627. [ Links ]

GUPTA, A.K. & GOVINDARAJAN, V. 2000. Knowledge flows within multinational corporations. Strategic Management Journal, 21:473-496. [ Links ]

JONES, C.I. 1995. R&D-Based models of economic growth. Journal of Political Economy, 103(4):759-84. [ Links ]

KELLER, W. & YEAPLE, S. 2013. The gravity of knowledge. American Economic Review, 103:1414-1444. [ Links ]

KOGUT, B. & ZANDER, U. 1993. Knowledge of the firm and the evolutionary theory of the multinational corporation. Journal of International Business Studies, 24(4):625-645. [ Links ]

LICHTENBERG, F. 2001. Does foreign direct investment transfer technology across borders? Review of Economics and Statistics, 83:490-497. [ Links ]

MADDALA, G.S. 1983. Limited dependent and qualitative variables in econometrics. New York: Cambridge University Press. [ Links ]

MANSFIELD, E. & ROMEO, A. 1980. Technology transfer to overseas subsidiaries by US based firms. Quarterly Journal of Economics, 95(4):737-750. [ Links ]

MARIN, A. & BELL, M. 2006. Technology spillovers from foreign direct investment (FDI): the active role of MNC subsidiaries in Argentina in the 1990s. The Journal of Development Studies, 42(4):678-697. [ Links ]

MARIN, A., & SASIDHARAN, S. 2010. Heterogeneous MNC subsidiaries and technological spillovers: Explaining positive and negative effects in India. Research Policy, 39:1227-1241. [ Links ]

MENDI, P. 2007. Trade in disembodied technology and total factor productivity in OECD Countries. Research Policy, 36:121-133. [ Links ]

OECD. 2005. The measurement of scientific and technological activities (Oslo Manual): Guidelines for collecting and interpreting innovation data (3rd ed.) Paris: Organisation for Economic Cooperation and Development. [ Links ]

OERLEMANS, L. & PRETORIUS, M. 2006. Some views on determinants of innovative outcomes of South African firms: an exploratory analysis using firm-level data. South African Journal of Science, 102:589-593. [ Links ]

OERLEMANS, L., PRETORIUS, M., BUYS, A. & ROOKS, G. 2004. Industrial Innovation in South Africa, 1998-2000. Pretoria: University of Pretoria. [ Links ]

STIEBALE, J. & REIZE, F. 2011. The impact of FDI through mergers and acquisitions on innovation in target firms. International Journal of Industrial Organization, 29:155-167. [ Links ]

TEECE, D. 1977. Technology transfer by multinational firms: The resource costs of transferring technological know-how. Economic Journal, 87:242-261. [ Links ]

UN, C. & CUERVO- CAZURRA, A. 2008. Do subsidiaries of foreign MNEs invest more in R&D than domestic firms? Research Policy, 37:1812-1828. [ Links ]

VEUGELERS, R. 1997. Internal R&D expenditures and external technology sourcing. Research Policy, 26: 303-315. [ Links ]

VEUGELERS, R. & CASSIMAN, B. 2004. Foreign subsidiaries as a channel of international technology diffusion: Some direct firm level evidence from Belgium. European Economic Review, 48:455-476. [ Links ]

VEUGELERS, R. & CASSIMAN, B. 1999. Make and buy in innovation strategies: Evidence from Belgian manufacturing firm s. Research Policy, 28:63-80. [ Links ]

XU, B. & WANG, J. 1999. Capital goods trade and R&D spillovers in the OECD. Canadian Journal of Economics, 32:1258-1274. [ Links ]

ZAHRA, S. & GEORGE, G. 2002. Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2):185-203. [ Links ]

ZHU, L. & JEON, B. 2007. International R&D spillovers: Trade, FDI and information technology as spillover channels. Review of International Economics, 15:955-976. [ Links ]

Accepted: October 2014

1 The South African Standard Industrial Classification uses ISIC Rev. 3 as its parallel.

Appendix