Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

South African Journal of Economic and Management Sciences

versión On-line ISSN 2222-3436

versión impresa ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.18 no.1 Pretoria 2015

http://dx.doi.org/10.17159/2222-3436/2015/v18n1a2

ARTICLES

Derivation of a framework for annual financial statements of a property-casualty insurance firm: From Adam Smith to the modern insurance firm

Robert W Vivian; Hugh-David Hutcheson

School of Economic and Business Sciences, University of the Witwatersrand

ABSTRACT

This article derives a framework for annual financial statements of a property-casualty insurer from first principles using Adam Smith's statement of the operation of an insurer as the point of departure. The derivation incorporates current standard accounting principles and regulatory requirements. In the end it will be seen that a substantial correlation exists between the final derived framework and current published statements of a modern property-casualty insurer. It remains to be seen if a similar correlation will continue to exist once the long awaited international accounting standard for insurers is finalised. The article accordingly demonstrates that Adam Smith's statement can be used to derive a workable framework for the accounting and hence management of modern property-casualty insurers. A number of important conclusions flow from the article. Firstly the distinction between provisions and reserves must be understood and maintained failing which solvent insurers may be portrayed as being insolvent, second a new provision should be raised, a Year to Close Provision where it is unclear that existing provisions adequately cover outstanding liabilities and third the IBNR provision should be restricted to claims in the pipeline for the year under consideration.

Key words: insurance accounting, insurance provisions, insurance reserves, International Accounting Standards Board's (IASB) Insurance Contracts, IFRS 4's Insurance Contracts, Incurred But Not Reported provisions (IBNR), solvency of insurers, long tail legal liability risks, Solvency Assessment and Management (SAM), Solvency II, Risk Based Capital (RBC)

1 Introduction

This article derives a framework for the Annual Financial Statements (AFS) of a short-term insurance firm (for simplicity sake referred to as insurers), a uniquely South African term used to describe insurers which Americans call a property-casualty insurers (Cummins & Venard, 2008). This article uses the more widely used American term. In the case life companies, assurer is sometime used (Benfield, 2013). The derivation follows a first principles approach, recording each transaction as these logically occur following the accounting process. The point of departure is Adam Smith's (1776) statement on insurance which is no more than common sense and is as relevant today as it was when first made in 1776. Other researchers also have used this statement as a point of departure (Borch, 1985, 1990; Ghossoub, 2011:5) but for more limited purposes. Borch regarded as one of the founders of economics of insurance, for example used it to develop a theory of insurance premiums. It has not previously been used to develop a comprehensive framework of the operation of an insurer which is encapsulated in the annual financial statements. Applying an accounting process is useful since this process embodies both revenue and balance sheet items. If the accounting process is not used, then probably only income-expenditure items would be used which could result in a less beneficial outcome in practice as well as for some theoretical applications. The use of the accounting accrual system also results in the final outcome being more in line with reality. For example, if an insurer incurs a loss of say R1bn in the last week of the financial year, clearly this claim will not be settled by the end of the financial year but has to be brought into account in the year in which the liability arose to determine the solvency of the risk pool as discussed below. Applying the accrual system, using the income-expenditure statement and the balance sheet, overcomes with great simplicity what could otherwise be a complex mathematical problem.

The process used to arrive at the final framework is straightforward. Adam Smith's verbal statement is incrementally restated, developed and expressed symbolically as a series of equations taking transactions into consideration following the normal accounting process. By following this process the final framework is arrived at. The process quickly becomes too complex to express in the form of evolving equations and is more easily expressed as a double entry spreadsheet. The process is complete when all the elements in the framework are identified and accounted for. As an illustration the various elements of the spreadsheet are compared with entries taken from the Annual Financial Statements of Santam Ltd and Mutual & Federal Insurance Company Ltd South Africa's two largest property-casualty insurers. The outcome demonstrates a high degree of correlation between the framework derived in this article and actual published statements of modern property-casualty insurers. Since the correlation exists the article can also fulfill useful pedagogical purposes by anyone wishing to understand the complexities of the accounting of the modern property-casualty insurer.

The framework derived herein has further uses. Currently a generally accepted insurance accounting standard does not exist either nationally or internationally. A great deal of work involving insurance accounting and other management aspects of insurers has been taking place in South Africa and internationally. This includes developing international accounting standards which, once complete, are due to be applied to South African insurers. Bearing these developments in mind it is thus not surprising to note a renewed interest in property-casualty accounting (Horton & Macve, 1996; Simonet, 2000; Tosetti et al., 2001; Lindberg & Seifert, 2010, Foroughi et al., 2011). This article is not a discussion of these current developments or accounting standards but the framework derived herein can provide a useful basis to analyse and discuss many of these current developments. Examples of the current developments include the announcement by South Africa's Financial Services Board (FSB) the regulator inter alia of insurance industry, that a new method of determining the Statutory Reserve Requirement (SRR) of property-casualty companies is to be implemented. This initiative, announced in early 2007 was initially called the Financial Condition Reporting (FCR) system which has mutated into the current initiative named the Solvency Assessment and Management (SAM) system due for implementation in 2016.These systems mimic American's Risk Based Capital (RBC) system and Europe's Solvency II. Another example of ongoing work is the work of the International Accounting Standards Board (IASB) in preparing accounting standards for insurance companies. International Financial Reporting Standards (IFRS 4) Part I has already been implemented and work is progressing on Part II. Comments on the second exposure draft closed on the 25th October 2013. It is anticipated the final standard will be published in 2015 and be operational in 2018 (KPMG, 2014).

2 Adam Smith's statement on insurance

Adam Smith's often quoted statement concerning the requirement for a successful insurer is a useful point of departure. He wrote (1776: Bk 1.121):

In order to make insurance, either from fire or sea-risk, a trade at all, the common premium must be sufficient to compensate the common losses, expense of management, and afford such a profit as might have been drawn from an equal capital employed in any common trade. The person who pays no more than this, evidently pays no more than the real value of the risk, or the lowest price at which he can reasonably expect to insure it.

Risk pool - income and expenditure

Implicit in this statement is that a specific period of time is involved and the statement refers to the position at the end of that period. The common premium, referred to as the earned premium, can be regarded as income deposited into the risk pool from which the cost of claims and expenses of operating the insurer, attributable to the same period, are paid. The financial statements at the end of the period must demonstrate the viability or otherwise, of the risk pool. The financial year end of the risk pool and the anniversary dates of the very many individual insurance contracts must not be confused. These are unlikely to coincide, a significant fact which must be taken into consideration in the accounting system.

Capital

Adam Smith's reference to capital is interesting and needs further consideration. Note, he wrote the operation will afford such profit as might have been drawn from an equal capital employed in any common trade.' The statement refers to capital but does not indicate the purpose of the capital. Nowadays claims are paid, as the statement correctly indicates, out of the pooled premiums (revenue) and not capital. If the premiums are adequate to cover the cost of claims and expenses there does not appear to be much need for capital.

Historically the first insurance institution to require the holding of capital was Lloyd's, a necessity because of its unusual method of individuals (called Names) forming syndicates and providing insurance backed by the capital of the Names. If a syndicate incurred a loss its Names would have to make good the loss. A problem could arise if it turned out the individuals did not have the funds to make good this loss. In the early 1800s Lloyd's required new members provide guarantees. However in 1857 a member expressed an aversion against providing a guarantee on behalf of a new Name and offered instead to deposit a sum of £5 000, which was reluctantly accepted. By the 1900s Lloyd's realised that before distributing profits syndicates should maintain capital reserves sufficient to cover running off current accounts, of individual Names (Raynes, 1948:329). Thus a purpose for holding reserves is to cover possible run-off costs. Gradually deposits became the norm for all insurance companies (Gibb, 1957:129). In 1870, after the collapse of the Albert life insurance company it became a statutory requirement for life companies to have reserves and is was extended to all companies in 1909. South Africa emulated the UK legislation from the late1800s onwards. Thus as a statutory requirement it has been an obligation for a long time for insurers to hold some capital as a reserve.

The most often quoted reason to hold "capital", in reserve (owners' equity), is in case the risk pool runs at a loss, especially in the event of abnormal losses. For example two of the most well-known reinsurers, Munich Re and Swiss Re experienced annual underwriting losses after the September 11, 2001 attack on the World Trade Center, an incident which produced abnormal losses. In any event abnormal losses are usually first covered by reinsurance, then investment income and only thereafter by reserves. The annual loss can also be an aggregate loss from what is referred to as a bad year. As suggested by Kemp (2008) this too is a reason to hold a reserve. In nature this "capital" is more a type of contingency reserve than capital, in the sense to which economists refer to capital.

Initially, during the first year of operation, owners' equity (OE), should have an initial reserve RES which must be equal to or greater than the minimum capital requirement (MCR). For purposes of this derivation it is accepted that the owners' equity, did exist, kept as cash or near cash, but held as a long-term investment. This initial start-up reserve is then augmented (or occasionally depleted) as time progresses by retained earnings (or losses), (RE) and possibly by capital injections. When an insurer has been in existence for a long time the question of start-up capital is no longer an issue and the reserve is the ongoing reserve funded largely out of retained earnings. Some South African insurers can trace their roots back over 200 years (Vivian, 1995).

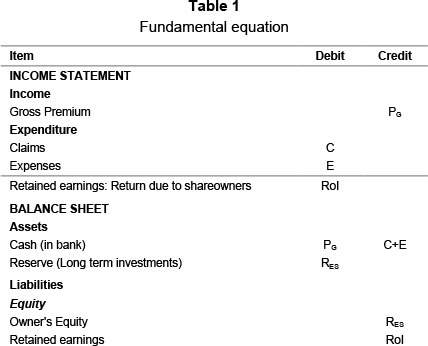

2.1 Fundamental equation

Adam Smith's statement can be expressed, symbolically, in the familiar symbols of the income statement of an insurer but substituting return on investment for Smith's profit:

Gross Premiums (PG) = Cost of Claims (C) + Expenses (E) + Return on Investment (RoI) or;

RoI, once earned at the end of the accounting period, is distributed three ways. Firstly taxes are paid, secondly dividends are distributed and thirdly the balance is retained to strengthen the insurer's reserves as indicated above.

Equation E1 illustrates the usefulness of invoking the accounting system in this analysis. E1 does not incorporate the reserve, and is therefore an incomplete statement of the financial position of the insurer. It needs to be augmented by balance sheet items, such as the reserve, to complete the picture. If claims are abnormally large and hence claims plus expenses exceed the income, E1 is still valid but RoI becomes negative. The loss experienced by the risk pool will then be covered by the reserve. To complete the picture the reserve must be included.

E1 is incomplete in other aspects. Premiums are known since these are set and collected in advance. However, a portion of the collected premium may belong to future accounting periods to future risk pools. These timing differences are not apparent from E1. As explained below introducing the balance sheet also resolves this problem.

Further, claims C do not all occur at the same time, these occur at any time during the accounting period. Once they occur and the insurer is notified, at best an estimate only of the final value of the claim is known. It is the final value which must be included in the risk pool. E1 treats values of the claims C, as if they are all known, not taking into consideration that they take time to finalise. A further fact not reflected in E1 is the problem that payments made to insureds to settle claims may well be made in different accounting periods. If C represents provisions for claims and not actual values or payments of claims made, then it does not matter where in the period they occur, or whether the value is known or when the claims payments are in fact made. These problems are also catered for by introducing the balance sheet into the process explained below.

Equation (E1), for the first year of operation, is shown in tabular form, in Table 1, involving both the income statement and balance sheet, ignoring at this stage taxation and dividends.

The standard industry term Underwriting Profit (PU) is used in the place of Return on Investment (RoI). Smith's statement can thus be written as:

or since more often than not it is underwriting profit which is being determined, equation (E2) can be rewritten so as to express the underwriting profit:

PU is in any event the dependent variable with the others being independent variables. Accordingly PU can be negative.

3 Income - expenditure statement

The various items in the fundamental equation are examined in greater detail, starting with the income items.

3.1 Income

Gross premiums

The trading income or revenue of the insurer are the gross premiums (PG). These are the aggregate premiums from the host of insureds for all classes (or lines) of insurance accruing over the accounting period. Transactions are accounted for as and when they occur not when the cash is received. As soon as individual premiums accrue, the insurer can issue an invoice. Generally insurers do not issue invoices especially for personal lines insurance, preferring in this case to collect premiums via debit orders. The absence of an invoice can raise VAT issues which have vexed insurers for some time, hopefully resolved in part by the issue of BindingGeneral Rule (BGR) 14 (2013) which cameinto operation on 1st November 2013. Once payment is received (PREC) debtors are credited and current assets (the bank) debited. The difference, or balance of the debtors' folio, is trade debtors. Where an invoice is not issued transactions can be captured from bank records of debit orders; the income statement is credited with amounts received and the bank account debited.

The smooth operation of insurers requires that the premiums be collected as soon as possible after the insurer accepts the risk. Premiums are paid in advance of claims because the income is needed to pay claims as and when these arise. Accordingly in principle insurers do not extend credit to insureds. Insurers should have very low levels of outstanding debts in the form of outstanding premiums. Indeed for some time the prompt payment of premiums has, been regulated in South Africa, to ensure that once an insurer is at risk, the cash reaches the insurer as quickly as possible. It was first regulated by the insertion of section 20bis into the insurance Act in 1965.

Often premiums are collected by brokers, which raises an important question. Should the insurer be placed in liquidation, who owns the premiums held by brokers; the insured or the insurer? In an unreported test case in South Africa it was held correctly it is submitted, that the premiums belong to the insurer (Vivian, 2002). A further problem raised by brokers collecting premiums is that they may abscond with them. It is therefore required that brokers take out fidelity insurance to cover the premiums in their custody. In many cases, especially where smaller brokers are involved the insurer insists that premiums be deposited directly into their own bank accounts. Cases of theft of premiums occur by persons purporting to be intermediaries (Millard, 2014:9).

3.1.2 Investment income

Insurers also earn investment income (II), an issue which does not appear in the above statement of Adam Smith. Investment income is derived from a number of sources. As pointed out above, insurers must hold an initial reserve which is augmented by retained earnings. This total constitutes the insurer's capital or reserve. The reserve which insurers are required to hold is regulated by legislation (s29 of Act 53 of 1998) which refers to the reserve as the additional amount. Before the current risk based capital initiative, the additional amount had to be greater than 15 per cent of net premiums. After the liquidation of the AA Mutual in 1986, the Melamet Commission (1988) which was appointed to investigate the collapse of the AA Mutual, recommended that a further catastrophe reserve equal to 10 per cent of net premiums be held by insurers.

Insures usually have capital in excess of the statutory minimum constituting the Owner's Equity. Thus the Owner's Equity has to be equal to or greater than 25 per cent of the net premiums. This mandatory reserve is a source of investment income. Other sources come from holding assets covering the various provisions. As will become clearer below, insurers raise numerous provisions which could produce an investment income which are covered by assets.

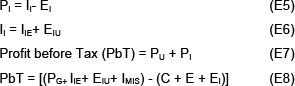

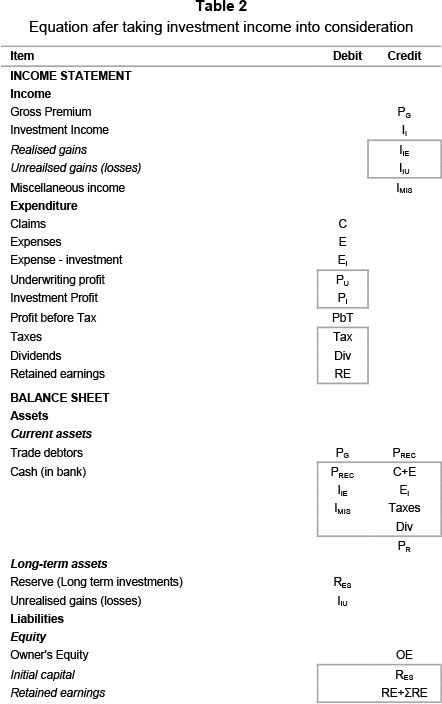

Nowadays the investment income is divided into earned income (IIE) and unrealised gains (IIU) (or losses) which arise from changes in market prices of financial assets. These movements are currently taken through the income statement and shown as unrealised fair value gains or losses. Investment expenses EI, such as fees paid to asset managers and other consultants, are incurred in managing the investment portfolio. The difference between investment income and expenses is the investment profit (PI).

In addition to investment income an insurer will also almost certainly earn income from miscellaneous sources, IMIS, which is not important for the purposes of this article.

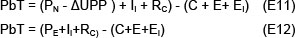

Accordingly, Smith's equation can be expanded to take investment income into account:

Where investment profit (PI) is the investment income (II) less investment expenses (EI).

PbT thus comes from two sources underwriting activities and investment income. Adam Smith's observation that the operation of the insurer must be such as to 'afford such a profit as might have been drawn from an equal capital employed in any common trade' is important at this stage. The profit from the insurance operation is not only the underwriting profit but the total profit from the operation; the sum of both underwriting and investment profits. If the profit falls below 'what can be drawn from ... capital employed in any [other] common trade' then clearly investors will not be interested in investing in insurers. The profit must be adequate to attract investors and, being related to the market return fairly constant in practice. This rate of return is the cost of capital. A fairly constant rate of return implies that as one of the two sources increases, the other decreases. Investment profits could augment underwriting profits. The mathematical function of underwriting profits of property-casualty insurers, in particular the cyclical nature of these profits, or the so-called [profit] underwriting and insurance cycles has been extensively studied (Venezian, 1985; Cummins & Outreville, 1987; Doherty & Kang, 1988; Gron, 1990).

PbT is used to pay taxes, dividends and the balance is retained earnings (RE) used to increase the existing reserves. Insurers' reserves can be held for the long term and hence not all assets of insurers need to be held in cash or near cash. Some investments can be and are usually held as non-current assets. Equation 8 is shown in Table 2 in the familiar tabular accounting form.

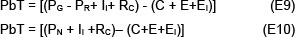

3.1.3 Cession of income for reinsurance

Insurers frequently reinsure part of their exposure. In the industry reinsurance premiums are not referred to as having been paid to reinsurers but as having been ceded to reinsurers. This transaction must be brought into account. A portion of gross premium is ceded to reinsurers. The reinsurance premium is not treated as an expense (payment/ deduction) but as a portion of the gross premium income ceded, or passed on to reinsurers. The insurer's gross income is accordingly reduced by the amount ceded to reinsurers (PR). The ceded portion is subtracted from the gross premium, and the difference is the net premium (PN).

3.1.4 Reinsurance commission (RC)

Although a loss is reinsured, the direct insurer remains responsible for the full value of the loss (unless co-insurance is involved). The primary (also referred to as the direct) insurer thus incurs expenses in dealing with the claims, including dealing with the reinsurers' portion of the claims. It is customary for the reinsurer to pay the direct insurer a commission, in the same way that an insurer pays the broker a commission (as part of its acquisition costs). The reinsurance commission received from the reinsurer (RC), forms part of the direct insurer's income.

3.1.5 Unearned premium provision (UPP)

Premiums may accrue at any time during the accounting period as and when policies are issued. In most cases the period of the policy is also a calendar year, starting from the date of the policy inception. A modern innovation was the introduction of the monthly debit order payment of premiums (Vivian, 2001:120). It is unlikely that the inception date coincides with insurer's accounting period. Provision must thus be made to account for premiums which accrue in one accounting period but a portion of which belongs in another. Thus assume an insured pays an amount p for one year's (365 days) cover, n days into the insurer's accounting period, also usually a year. Only a portion of that premium, p. [365 - (n-1)]/365, belongs to the insurer's current year, the balance belonging to the next year. A further example of premiums received in one period but belonging to a different period, is where an insurer receives a single premium which covers several years. Credit life insurance was an example which could cover say the outstanding purchase price of a motor vehicle. A single premium used to be paid up-front, covering the entire credit period, of say five years. Single premiums are no longer permitted in South Africa (s106 of Act 34 of 2005). This single premium would then have to be apportioned over the five year period. A further example is project insurance, such as the building of Eskom's power-stations, which is taken out at the beginning of the project and covers the duration of the project. Multi-billion rand projects can run over several years and it is inadvisable to change insurers during the course of project. The allocation of the premium over the duration of the project can also not be on a linear basis, since during the early part of the construction period the value of the completed work (the value at risk) is relatively small. These examples make it clear that a provision, the Unearned Premium Provision (UPP) must be raised against the accrued premiums to cater for income apportioned to other insurance periods. The raising of this provision is required in South Africa in terms of s32(1)(b) of Act 53 of 1998.

The income statement is debited with the UPP and the balance sheet is credited in terms of IFRS terminology to Insurance liabilities with the same amount. Since the insurer is a going concern, a UPP exists on the balance sheet on a continuous basis and accordingly, the debits to the income statement constitute increments in the total UPP provision which total is maintained on the balance sheet. The income statement thus reflects the effects of increments in the Unearned Premium Provision raised on the gross premium (ΔUPP). Since, as pointed out above accrued premiums are ceded to reinsurers, a provision must also be raised to cater for the effects of the portion Unearned Premium Provision on the ceded premiums (ΔUPPR). The provisions on the balance sheet are also adjusted accordingly. The method of determining the UPP is set-out in BN 169 of 2011. Since as a general rule the quantum of premiums increase on a year-to-year basis, the ΔUPP is expected to increase on a year-to-year basis. What is left after the unearned premium provision adjustment is subtracted is the earned premium PE.

3.2 Expenditure

3.2.1 Claims provisions

As indicated above, C does not represent claims paid but provisions raised for claims.

3.2.1.1 Provision for incurred and reported claims (CP)

When a claim is reported to an insurer the accrual principle requires that the income statement be debited with a claim provision (CP), which is the provision for a incurred and reported claim, the value of which is based on the best estimate at that time when the report is received. It is a statutory requirement to raise this provision (s32(1)(a) of Act 53 of 1998). This is done as a matter of course on a case by case basis. This provision is associated with an actual claim reported to the insurer. A balance sheet item is credited with the same provision, which in terms of the IFRS requirement is labeled Insurance liabilities. It is possible that the accounting year in which the claim is reported will also not be the year in which the final payment in settlement of the claim is made. Interim payments may be made and other payments may be made in years subsequent to the year when the claim was first reported. Some claims, especially legal liability claims, may take years, if not decades to settle. However, once a provision has been raised it does in fact not matter in which year payments are made. What matters is that the provision is adequate.

Longtail liability claims

Legal liability risks and claims pose particular problems, the implications of which are generally not understood. The accounting treatment of long liability risks requires a separate in-depth discussion which is beyond the scope of this article. Accordingly the problem is only briefly touched on. Legal liability claims can arise from an event in the distant past. Take for example the R400 million out of court settlement made by Gencor for asbestosis related claims (Meeran, 2003). Some claims may well be due to events occurring 40 or so years prior to the year of settlement. At that time, 40 years previously, no legal liability claim would have been possible in law. These are thus legally retrospective claims. Provisions for these claims were not raised at the time. When these claims were finally settled, they were settled at current day values. The aggregate cost of the claims exceeded the total revenue ever generated by the asbestos sales forty years previously. If covered by insurance the ultimate cost of these claims would have exceeded insurance premiums collected at the time. It should be clear that these types of claims can cause an industrial company or insurer to face insolvency. As a consequence of the American liability crisis of the 1980s liability policy wordings were changed to cater for this problem by changing wording from: the occurrence wording to the claims first made wording. Currently the system is that only claims reported during the year of insurance, need to be provided because of the claims first made wording.

Liability claims can also be long tail, in the sense they can take a long time to settle. When a claim is first notified, the available information may be insufficient to raise an accurate provision. In theory, the initial provision should equal the final settlement or the difference will be borne in subsequent years. Additional information about the claim may only become available in subsequent years and if a variation is passed during these years, this will result in amounts being charged to successive years, which have nothing to do with these claims. Expenditure and income will be mismatched. When the claim is finally settled, the cost in some cases could be many orders of the initial estimate. Again it should be clear that if the aggregate cost of claims is many orders of the initial estimate this could cause insolvency of an insurer.

As pointed out above, the manner in which long tail liability claims should be accounted for, is currently poorly understood and is best dealt with as a separate study. It should be clear however, that a case by case provision may in many instances be inadequate to cater for long tail-to-settle liability risks. Specifically where long tail to settle claims exists, the insurer should raise a further provision, the Year to Close provision, to cater for claims which cannot be accurately estimated on a case by case basis. The Year to Close provision could result in the initial year's loss ratio of a liability insurer exceeding 100 percent, with the bulk of the claims expenditure forming part of the Year to Close provision.

A further problem associated with long tail liability policies could be the realisation that future claims may arise against insurance policies issued in the past. The question then arises what accounting transactions, if any, must be raised should this realisation dawn? It can be argued that this was the source of the financial difficulties that Lloyd's faced in the late 1980s into the early 2000s. These problems were associated with asbestosis and pollution claims. Once the common law was reinterpreted allowing for the possibility of insurers becoming liable for possible future claims against past policies, the financial problems facing Lloyd's became inevitable. There may in fact not be any actual reported claims but a concern exists about the cost of claims which may be instituted in the future. It is suggested the estimated cost of these concerns should form part of the insurer's reserve requirements and no provisions should be raised and if some allowance is to be made for these, it forms part of the Unexpired Risk Reserve (UPR), or some may argue Unexpired Risk Provision (URP). In South Africa the URP is governed by s32(1)(d) and (2) of Act 53 of 1998, discussed further below. Where this happens it should be dealt with in a note on the balance sheet.

3.2.1.2 Provision for reinsurance recoveries

Where a claim is subject to a reinsurance recovery (RR) a provision is raised to reflect the recovery. This provision is credited to the income statement to offset the estimated debited cost of the reported claim. In South Africa this is regulated by s32(1)(a)(ii) of Act 53 of 1998. An identical amount is debited on the balance sheet as an asset to reflect the amount due by reinsurers. These reinsurance assets often form a substantial part of the assets of the insurer. With large claims, reinsurers do not pay direct insurers when the claim is reported, but will generally make payment to coincide with the direct insurer's payment to the insured. Assume for example that the direct insurer agrees to settle say a R500million claim and the reinsurer is liable for R450million. The insurer could issue a cheque for R500million to the insured and back to back the reinsurer will deposit R450million into the insurer's bank account. The reinsurer will not deposit the R450million on the mere notification of the claim. Until settlement, the R450 million appears as an asset on the insurer's balance sheet.

With smaller claims the insurer prepares what is known as a bordereau of claims which is submitted to the reinsurer rather than submissions on a claim by claim basis. The bordereau is a schedule of claims. The reinsurer issues a payment to cover the bordereau.

3.2.1.3 Incurred But Not Reported (IBNR) provision

Insurers only become aware of a claim when the claim is reported. In most cases, especially where policies utilise the occurrence wording, the insurer is liable when the loss event occurs, and not when the claim is reported. Clearly, there is a delay between the date of occurrence of the event and date the claim is reported to the insurer. An insurer must raise a provision to account for these incurred but not (yet) reported claims; this is the Incurred But Not Reported (IBNR) provision. There is a statutory obligation in South Africa to raise this provision (s32(1)(ii) of Act 53 of 1998 and BN 169 of 2011).This provision is not matched to an existing notified claim as for example those that appear in a bordereau of claims. The IBNR refers to possible existing claims in the pipeline. In concept every notified claim first existed as an IBNR provision. The insurer raises an IBNR provision and at the same time raises a provision for any reinsurance recoveries associated with these not yet reported claims. As with other provisions, the IBNR exists every day and not only at the end of the year, since every day there are claims in the pipeline. Consequently an IBNR provision exists on the balance sheet as an element of Insurance liabilities and the income statement indicates changes in the IBNR provision. An insurer should regularly check if the IBNR provision on the balance sheet is adequate and if not, pass an adjustment to the IBNR provision on the balance sheet via the income statement. Claims attributable to the income statement thus include the change in the IBNR provision (ΔIBNR) with the corresponding IBNR provision on the balance sheet. Since claims in the pipeline could be subject to reinsurance a similar provision for reinsurance recoveries must be raised.

There is unnecessary confusion as to what should be included in the IBNR provision. The asbestosis crisis can be used to illustrate why this can be so. As the American courts began first to reinterpret the common-law to recognise these claims and then reinterpret insurance contracts to recognise asbestos liabilities, long tail liabilities, some insurers appear to have begun to account for these possible liabilities. Some appear to have included estimates for these possible long tail liabilities as part of the IBNR provision instead of these forming part of the reserves as suggested above. It is suggested that it is incorrect to include possible unknown unreported claims as part of the IBNR provision. The IBNR provision should be confined to claims in the pipeline attributable to the previous financial year. Unreported claims beyond the previous year cannot be regarded as existing claims in the pipeline. It is thus recommended that IBNR provisions should be confined to the previous financial year. Care should be taken not to raise provisions when in fact a reserve and not a provision is appropriate. To do so can result in a solvent insurer being portrayed as insolvent (Vivian & Britten, 2012). The IBNR by definition is not attached to any known claims, since the provision is to account for unreported claims in the pipeline. If more than a year has lapsed and no claim has been reported serious doubts must exist as to the actual existence of these claims.

3.2.1.4 Year to Close (YtC) or the run-off provision

When all claims for a particular year are settled there may be a short-fall. If at the end of a year insurers are not convinced the above provisions are adequate they could raise an additional Year to Close provision to cover a possible short fall. It is not usual for insurers specifically to raise a YtC provision. Lloyd's is an exception. Because of the particular nature of the liability facing individual Names Lloyd's syndicates covered the possibility of a short-fall by taking out Reinsurance to Close (Davidson, 1987; Hindley et al., 2000). On the other hand the syndicates that provided reinsurance, found with the mounting concern about long term liabilities that they faced a crisis. In the end this problem was resolved, after much effort, by Lloyd's establishing a special purpose vehicle, Equitas, to take over these risks.

3.2.1.5 Settling claims - closing variations

Settling claims, if raised as provisions, involve balance sheet items, not income-expenditure items. Payments made to insureds cover the total cost of the claim including amounts recovered from the reinsurer. When a claim is settled and the insured is paid, CPD, Insurance liabilities is debited and the bank credited. When a reinsurance recovery is involved, a payment from the reinsurer is also received (RREC) with respect to the claim. With respect to this transaction the bank is debited with the recovery and reinsurance recoveries, credited. After the settlement of the claim has taken place there could be a balance, claims variance, CV because the original estimate was slightly out. This balance should be posted to the appropriate Year to Close provision. If in the end when all claims for the specific year are settled and if a balance remains on that year's Year to Close provision, this final closing balance can be posted to the then current year income statement. This is often referred to as releasing provisions. By monitoring the balance of the Year to close provision for each year, it can be determined whether or not the claims estimates were accurate and if the risk pool for that year was in fact viable. It can take decades to settle some claims and thus to finally close off a year. A year can be considered to be closed when there are no unfinalised reported claims left for that year. The profitability of each year, or Adam Smith's risk pool then becomes known.

3.2.1.6 Unexpired risk provision (URP)

There is another provision, the Unexpired Risk Provision (URP) which is sometimes raised. It can happen that the risk continues in circumstances where it is known that the premiums are insufficient to cover the remaining period. Under these circumstances a provision, the URP, is raised to cover the unexpired portion of the risk. As indicated above confusion can exist between the URP and required reserves especially where possible long tail liabilities exist. The treatment of this kind of risk is left for a more detailed article on that problem.

Summary of claims provisions of the income-expenditure statement

The claims entries on the income-expenditure statement can thus be summarised as follows:

Provision for reported claims: CP

Change in the provision for IBNR

claims ΔIBNR

Less: Reinsurance recoveries (RR)

Less: Change in the reinsurance

provision for IBNR claims (ΔIBNR)

Year to close provision YtC

3.2.2 Expenses

As indicated in Adam Smith's statement, expenses need to be accounted for in addition to claims. Four main categories of expenses are usually identified or E can be sub-divided into four categories. Firstly there are acquisition costs (EA). In most cases and especially in South Africa, which traditionally is regarded as a predominantly broker market, the bulk of insurance business is introduced or acquired via insurance brokers. The second category of expenses are the management costs, the costs of running the insurer (EM). Thirdly there are claims handling expenses (EC). These costs are not always easy to separate from general claims expenses or even in some cases management expenses, EM. Claims handling costs could be apportioned to claims or management costs. The claims handling costs are not always shown as a separate expense category but form part of the cost of claims. This could be important since some of these costs are then recoverable from reinsures.

Finally, the fourth class of expenses already discussed, is investment expenses. Since the investment profit may be as large as and often larger than the underwriting profit, investment expenses (EI) should be indicated as a separate category.

2.3 Statutory reserve requirement (SRR)

As indicated in South Africa until recently insurers were required to hold what the Short- term Insurance Act called an additional amount of assets in excess of liabilities equal to 15 per cent of net premiums and a catastrophic reserve of 10 per cent of net premiums giving a total additional amount of 25 per cent of net premiums. Currently there is no accepted theoretical basis explaining the basis on which this additional amount was determined. The current ratio of 25 per cent is referred to as the solvency ratio. Insurers are thus required to have a solvency ratio of not less than 25 per cent when the catastrophic reserve is included. The phrase 'solvency ratio' is however deceptive since it implies that if the ratio falls below this figure the insurer is or faces insolvency or has a solvency problem. This is of course incorrect. Any value of Owners' Equity greater than zero means that the insurer is technically solvent, ie it can meet every known outstanding liability. The failure to understand this, as happened in South Africa with the AA Mutual and IGI insurance companies, results in regulators applying to court to wind-up perfectly solvent companies. The AA Mutual was declared insolvent by press headlines (Star, May 29, 1986; Citizen, May 30, 1986). In reality it was always solvent, having a substantial surplus at the end of the 20 year winding-up process (Vivian, 2006). To avoid confusing solvent companies with insolvent companies, it is recommended that the word solvency be avoided and the phrase Statutory Reserve Requirement (SRR) be used instead. The entire issue of reserves is under review in Europe as Solvency II and in South Africa as SAM.

Clearly at all times the insurer must check if its Statutory Reserve Requirement is above the prescribed limit and if not steps must be taken to improve it. Where the Owners' Equity exceeds the statutory requirement, the excess can be distributed to shareowners. Most insurers maintain reserves well in excess of the SRR.

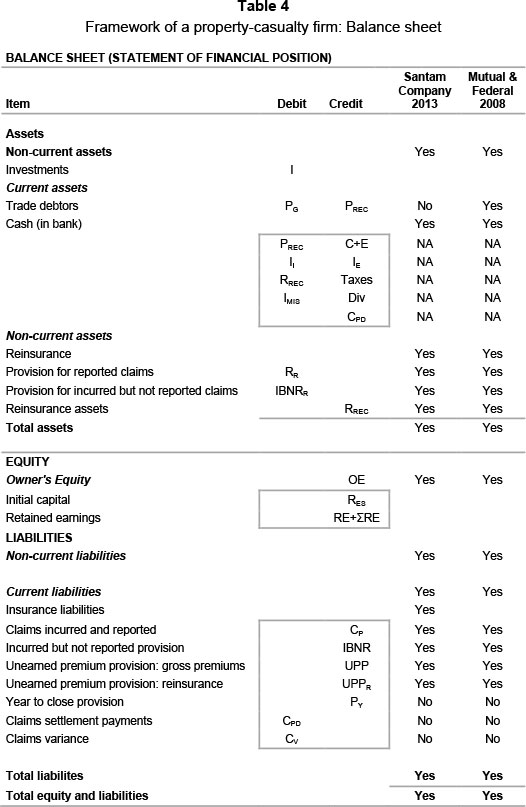

4 Final framework: Correlation with existing annual financial statements

The above completed framework of income and expenditure of a property-casualty insurer is set-out in Table 3 and for balance sheet items in Table 4. The framework is correlated against items which appear in the annual financial statements of Santam Ltd and the Mutual & Federal Insurance Company Ltd. These insurers are selected because they are South Africa's two largest property-casualty insurers that collectively account for 34 per cent of the market (Vivian, 2007:722). Mutual & Federal's 2008 annual financial statements are used since these were the last set, published independently. The Mutual & Federal (M&F) was a publicly quoted company which was formed in the early 1970s as a merger of the South African insurance interests of the then Royal Group with those of the Old Mutual. Old Mutual acquired the controlling majority. The Royal more recently disinvested fromSouth Africa and in 2009 Old Mutual decidedto acquire all outstanding shares. M&F then became a wholly owned subsidiary of the Old Mutual. M&F's financial statements are now integrated into those of the Old Mutual.

As a general conclusion from Tables 3 & 4 it is clear that, currently, the annual financial statements of property-casualty insurers in South Africa closely accord to the framework which can be derived from Adam Smith's statement as explained in this article. Currently annual financial statements of insurers can be said to rest on a sound theoretical basis.

Notes

1S

In the industry the premium income of an insurer is usually referred to as the Gross Written Premium (GWP) (sometimes written Gross Written Premium WCP). Clearly the word written is unnecessary and so the gross premium can be referred to simply as Gross Premium. Santam refers to it as the Gross Written Premium.

IM

Mutual & Federal refers to the gross premiums as Gross Premiums. To cater for both options Table 3 refers to Gross [written] premiums.

2S & 2M

After subtracting reinsurance ceded Santam refers to Net Written Premiums (NWP) while Mutual & Federal refers to Net Premiums.

3S & 3M

After subtracting changes in the unearned premium provision Santam refers to Net Income while Mutual & Federal refers to Earned Premiums. Clearly Earned Premiums is more descriptive than Net Income and more in keeping with the traditional terminology.

4S & 4M

Santam refers to Income from reinsurance contracts ceded while Mutual & Federal refers to Commission Income

5S & 5M

Santam refers to Investment Income while Mutual & Federal refers to Investment returns Both give the breakdown by way of notes. Santam deals with this under note 27 and Mutual & Federal with note 25. Santam shows the net gain on financial assets and liabilities at fair value through income on the financial statement while Mutual & Federal included this in the note.

6S & 6M

As indicated from the nature of the insurance operation claims in the financial statements can only refer to provisions raised for claims. Two different provisions are involved. Provision for claims incurred and reported and provision for claims incurred but not reported. That this is the case is not clear from either insurer's financial statements. Santam (note 29 breaks claims into two categories, claims paid and movement in the expected cost of outstanding claims. Mutual & Federal does something similar and divides the costs into claims paid and change in provision for outstanding claims. This could translate into a Year to Close Provision.

5 conclusion

Using Adam Smith's statement of the operation of an insurer it is possible, as demonstrated in this article, to derive a practical framework for the annual financial statements of a property-casualty insurer and hence also a system useful for the managerial operation of insurers. As it turns out the derived framework coincides largely with the current insurance accounting statements. Adam Smith's statement can result in each accounting year effectively being treated as a risk pool. From this analysis two recommendations can be made that will result in current accounting practices being more clearly aligned to Adam Smith's statement. These recommendations are not current practice. Firstly, the IBNR provision should be clearly restricted, to provide for claims in the pipeline for the year under consideration and not for more remote uncertain claims. The IBNR should not cater for possible unknown and unreported future claims especially where these are attributable to past policies. Accordingly IBNR provisions should be limited to claims from the accounting year under consideration. Secondly, a new but not altogether unknown provision the Year to Close provision, should be introduced where this is regarded as appropriate. Contributions made to this provision, the outstanding balance on a year to year basis and the final closing balance will give a good indication as to the profitability of each year, or the profitability of Adam Smith's annual risk pool.

Acknowledgement

The article has benefited from useful and insightful comments by two anonymous reviewers.

References

BENFIELD, B.C. 2013. Life assurance company management (2nd ed.) Johannesburg, South Africa; Primary Asset Administrative Services (Pty) Ltd. [ Links ]

BORCH, K.H. 1985. Risk theory and insurance premium. Blatter der DGVM, 17(2):85-92. [ Links ]

BORCH, K.H. 1990. Economics of insurance. Amsterdam, The Netherlands; North-Holland. [ Links ]

CUMMINS, J. & OUTREVILLE, J.F. 1987. An international analysis of underwriting cycles in property-liability insurance. Journal of Risk and Insurance, 54(2):246-262. [ Links ]

CUMMINS, J.D. & VENARD, B. 2008. Insurance market dynamics: Between global developments and local contingencies. Risk Management and Insurance Review, 11(2):295-326. [ Links ]

DAVISON, I.H. 1987. A view of the room - Lloyds change and disclosure. London, England; Weidenfeld and Nicolson. [ Links ]

DOHERTY, N.A & KANG, H.B. 1988. Interest rates and insurance price cycle. Journal of Banking and Finance, 12:199-215. [ Links ]

FOROUGHI, K. BARNARD, C.R., BENNETT, R.W., CLAY, D.K., CONWAY, E.L., CORFIELD, S.R., COUGHLAN, A.J., HARRISON, J.S., HIBBETT, G.J., KENDIX, I.V., LANARI-BOISCLAIR, M., OBRIEN, C.D. & STAKER, J.S.K. 2011. Insurance accounting: A new era? - A discussion paper, Institute and Faculty of Actuaries, 11th April 2011. [ Links ]

GHOSSOUB, M. 2011. Contacting under heterogeneous beliefs. PhD thesis in actuarial science. University of Waterloo Canada (unpublished). [ Links ]

GIBB, D. 1957. Lloyds of London. London England; MacMillan & Co Ltd. [ Links ]

GRON, A. 1990. Property-casualty insurance cycles, capacity constraints, and empirical results. Unpublished PhD dissertation, Massachusetts Institute of Technology. [ Links ]

HINDLEY, D.J., ALLEN, M., CZERNUSZEWICZ, A.J., IBESON, D.C.B., MCCONNELL, W.D. & ROSS, J.G. 2000 The Lloyds reinsurance to close process. Paper presented to the Institute of Actuaries, March 27th. [ Links ]

HORTON, J. & MACVE, R. 1996. Accounting for insurance OECD Seminar on Accounting Reform in the Baltic Rim; Olso 13th 15th November 1996. [ Links ]

KEMP, C. 2008. Financial condition reporting. Cover, 20(8):34-37. [ Links ]

KPMG. 2014. Evolving insurance regulation - the kaleidoscope of change. March 2014 [ Links ]

LINDBERG, D.L & SEIFERT, D.L. 2010. A new paradigm of reporting on the Horizon - International financial reporting standards (IFRS) and the implications for the insurance industry. Journal of Insurance Regulation, 29(2):229-252 [ Links ]

MEERAN, R. 2003. Cape Plc: South African mineworkers' quest for justice. International Journal of Occupational Health, 9(3):218-228. [ Links ]

MELAMET COMMISSION. 1988. Report of the Commission of Inquiry into the winding-up of the short-term insurance business of the AA Mutual Insurance Association Ltd. [ Links ]

MILLARD, D. 2014. Jutas insurance law bulletin, 17(1):9-13. [ Links ]

RAYNES, H. 1948. A history of British insurance. London, England; Sir Isaac Pitman & Sons Ltd. [ Links ]

SIMONET, G. 2000. Insurance and private pensions compendium for emerging economics - Insurance Accounting principles OECD. [ Links ]

SMITH, A. 1776. An inquiry in to the nature and causes of the wealth of nations. University of Chicago Press 1976. [ Links ]

TOSETTI, A, BÉHAR, T., FROMENTEAU, M. & MÉNART, S. 2001. Insurance: Accounting, regulation, actuarial science, Geneva Papers on Risk and Insurance. Issues and Practice, 26(2):232-251. [ Links ]

VENEZIAN, E. 1985. Ratemaking methods and profit cycles in property and liability insurance. Journal of Risk and Insurance, 52(3):477-500. [ Links ]

VIVIAN, R.W. 1995. The story of the Mutual & Federal 1831-1995. Private Publication. [ Links ]

VIVIAN, R.W. 2001. Morgan history of the insurance institute movement in South Africa 1898-1999. Private Publication [ Links ]

VIVIAN, R.W. 2002. More about good faith. Cover, 14(12):9-10. [ Links ]

VIVIAN, R.W. 2006. The liquidation of the AA Mutual was inappropriate. Cover, 18(10):25-26. [ Links ]

VIVIAN, R.W. 2007. in Cummins, D. & Venard, B. Handbook of international insurance, between global dynamics and local contingencies. [ Links ]

VIVIAN, R.W. & BRITTEN, J. 2012. Knowing the difference between provisions and reserves. FA News, June. [ Links ]

Accepted: October 2014

Annexure A

Symbols and abbreviations

BN Board notice

C Cost of claims

CA Claims adjustments

CE Claims estimate

CP Claims provision for incurred and reported claims

CPD Claims paid

CV Claims variations

Div Dividends paid

E Expenses

Ec Claims handling costs

Ea Cost of acquiring, servicing and retaining business. Brokers' commissions

EI Investment expenses

Em Management or administrative costs of the insurer

EMlS Miscellaneous expenses

FCR Financial condition reporting

GWP Gross written premiums

IASB International accounting standards board

IBNR Claims Incurred but not reported provision

ΔIBNR Adjustment to claims incurred but not reported provision

ΔIBNRR Adjustment to claims incurred but not reported provision for reinsurance recoveries

IFRS International financial reporting standards

IGF Intermediaries guarantee fund

II Investment income

IIE Earned or realised investment income or gains

IIU Unearned or unrealised investment income or gains

lO Income from insurance operations

lP Investment profit

lMlS Miscellaneous income

n Number of days into an insurer's financial year

MCR Minimum capital requirement

NWP Net written premiums

OE Owners' equity equal to assets minus liabilities

PbT Profit before tax

PE Earned premiums

PG Gross premiums

Pl Investment profits

PM Miscellaneous profits

PN Net premiums

PR Premiums ceded to reinsurers

Prec Premiums received

PU Underwriting profits

PY Year to close provision

p Premium paid by an individual

RBC Risk based capital

Rc Reinsurance commissions due to the insurer

RE Retained earnings

Res Reserve at the beginning when the insurer was established

RR Reinsurance recoveries for reported claims

Rrec Reinsurance payments received in settlement of claims

Rol Return on investment toshareowners

RR Reinsurance recoveries

SAM Solvency assessment and management project

SCR Solvency capital requirement

SRR Statutory reserve requirement

UPP Unearned premium provision

UPPR Unearned premium provision for reinsurance

ΔUPP Adjustment to the unearned premium provision

ΔUPPR Adjustment to the unearned premium provision for reinsurance

URP/R Unexpired risk provision/reserve

Tax Taxes paid

YtC Year to close provision