Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

South African Journal of Economic and Management Sciences

versión On-line ISSN 2222-3436

versión impresa ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.15 no.1 Pretoria ene. 2012

ARTICLES

Firm age, collateral value, and access to debt financing in an emerging economy: evidence from South Africa

Abel Ezeoha; Ferdi Botha

Department of Economics and Economic History, Rhodes University

ABSTRACT

This paper applies the Blundell and Bond system generalised method of moments (GMM) two-step estimator to examine the impact of age and collateral value on debt financing, using a panel of 177 non-financial companies listed on the Johannesburg Stock Exchange over the period 1999 to 2009. The results show that South African firms have target leverage ratios and adjust their capital structures from time to time to achieve their respective targets, that the relationship between firm age and debt financing is nonmonotonic, and that firms with higher collateral value are likely to face fewer constraints on borrowing and therefore have greater access to medium-term and long-term debts. Robustness tests also reveal that during start-up and maturity stages, a firm's access to debt markets is significantly influenced by investments in assets that are acceptable to external creditors as collateral. These findings suggest that debt financing policies could be more critical for firms in the start-up and maturity stages.

Key words: firm age, collateral, leverage, debt financing, South Africa

JEL: D22, G30

1 Introduction

Among the most dominant corporate financing challenges in most developing economies is the persistent scarcity of loan capital. The near lack of long-term debt financing in these economies, for instance, exposes firms to high risk of liquidation and creates room for opportunistic creditors to use the threat of liquidation to expropriate the profits of even the healthy firms (Huyghebaert, 2003). This problem is less prevalent in developed economies where the financial system is relatively more efficient and where there are strong institutional frameworks that support the functioning of markets. However, Caprico and Demirguc-Kunt (1998) have argued that firms in developing countries may have less long-term debt than firms in developed countries, not necessarily because of deficiencies in credit markets but mostly because they have different characteristics. Caprico and Demirguc-Kunt cited evidence from the work of Titman and Wessels (1988) which showed that the mix of long-term and short-term debts among highly leveraged firms varies according to the firm's characteristics. Among the most studied, and indeed the most complicated of these firm-specific characteristics, are firm age and collateral value.

Using a richly constructed panel dataset from listed South African companies and the Blundell and Bond system generalised method of moments (GMM) two-step estimation technique, this paper strives to determine (1) whether a firm's access to long-term debt financing decreases with its age, (2) whether a firm's collateral value enhances its access to long-term debt, and (3) whether the influence of collateralisation on debt financing is dependent on firm age. The results show that South African firms have target leverage ratios and do change their capital structures from time to time to achieve the targets; that both the speed and timing of such adjustment depends on firm age - with adjustment policies reflecting whether a firm is in the start-up, growth, consolidation or maturity stage of their life cycle, and that the factors that are considered most crucial in this adjustment process, especially in the case of market leverage, are firm age, collateral value, size, level of information asymmetry, and growth opportunities.

From a theoretical standpoint, advancement in age should give a firm an opportunity to take advantage of benefits associated with corporate reputation and experience. Hypothetically, older firms stand a chance of building a strong asset base, gaining attractive industry reputation, and acquiring experience on the workings of macroeconomic structures and markets. In terms of access to funding, Petersen and Rajan (1994) posit that such firms may possibly have acquired some quality reputation to be able to attract funds more easily and more cheaply from financial markets. By implication, the financing benefit of long years of existence can be optimised only if a firm is able to build strong collateral value to hedge itself against possible risk of bankruptcy. Loderer and Waelchli (2009) argue similarly that agedness might result to structural rigidity and asset decay which in turn is capable of eroding the gains of corporate reputation and value.

Arising from this controversy is the claim that an interactive relationship exists between a firm's life cycle and its capacity to grow tangible assets, and that this interaction affects a firm's debt structure. Unfortunately, not much literature is available that has tested the likelihood of this interaction. Most studies on this subject only incorporated firm age and asset tangibility as some of the control variables in their capital structure models (e.g. Titman & Wessels, 1988; Booth et al., 2001), whereas others examined the separate impact of age mostly as it affects small- and medium-scale firms (La Rocca et al., 2009). There is also significant disparity in the study of financial leverage patterns of firms in major emerging markets, with many of the studies focusing on China (Chen, 2004; Li, 2009) and India (Chakraborty, 2010). To the best of our knowledge, there is no study yet that has investigated whether the claimed impact of collateral on debt financing depends on a firm's life cycle. In addition, despite South Africa's position as one of the largest emerging-market economies in the world, the financing patterns of firms in the country remain loosely understood. No research, to our knowledge, exists that specifically explored whether age and collateral value interact to influence financing decisions of firms in the country. Considering the economic prominence of South Africa as an emerging market, this paper adds to the existing capital-structure literature by using a dynamic and robust approach to strive to address issues concerning how firms in fast-growing emerging markets can manage their internal structures to ease difficulties of access to external financing.

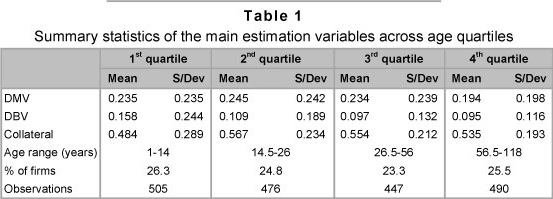

South Africa presents an interesting case for analysing corporate financing patterns in an emerging economy. The country has very interesting features that should ordinarily make it easier for firms to gain access to funding. In addition to being the only African member of the G-20, South Africa is also the only emerging market in the sub-Saharan region. The country also has one of the largest and comparatively most-developed financial systems in Africa. In terms of the financing patterns of firms, South Africa's statistics compare favourably with other emerging-market economies. With the exception of bond issues where the country is lagging behind, the average percentage of its equity securities to total financing from 1970 to 1999 was 48.4 percent compared to the emerging markets average of 24.2 percent (Davis & Stone, 2004). That of loans to total financing was 44 percent compared to 44.5 percent of the emerging market average. That of loans to total financing was 44 percent compared to 44.5 percent of the emerging market average (Davis & Stone, 2004). Based on the 2009 World Economic Forum Financial Development Report, the ratio of equity financing in South Africa, at 70.1 percent as at 2008, was the highest among its emerging market peers. Excluding Brazil that recorded a private debt ratio of 9.9 percent, South Africa's debt ratio, at 6.2 percent, was 3.8 percent and 1.6 percent higher than those of India and China, respectively. The age distribution of South African companies in terms of years of listing also makes an interesting case. Despite the fact that its stock exchange is over 113 years old and that about 49 percent of the listed firms have been in existence for a range of 26.5 to 118 years since either formation or incorporation (see Table 1 below), as much as 81 percent of the companies are less than 25 years old in terms of years of listing. Of that 81 percent, roughly 45 percent are less than 10 years old since listing, whereas only 2 percent are more than 75 years old since listing. These numbers are an indication that the majority of the listed companies in South Africa might have had to rely historically on bank-based debt financing in the absence of access to the external equity market.

2 The research hypotheses

2.1 Age-leverage relationship

There is theoretical ambiguity concerning the exact relationship between a firm's age and its debt financing pattern. Some theories postulate that age and debt financing are positively correlated. The justification for this is based on the gains of long corporate existence that arise from strong reputation (Berger & Udell, 1995; Nico & Van Hulle, 2010; Sakai et al., 2010), possible establishment of lender-borrower relationship (Sakai et al., 2010), and lower transaction costs (Bernasconi et al., 2005). According to Nico and Van Hulle (2010), older companies have a longer track record and stronger reputation and should have better relationships with lenders, lowering the cost of debt. By their lasting reputation, older firms, unlike newer ones, may be faced with fewer adverse selection and moral hazard problems and relatively lower degrees of uncertainty which endear them to investors and lenders (Huygebaert, 2003). In a similar vein, Petersen and Rajan (1994) suggest that older firms should maintain higher leverage given their relatively implied higher quality. Sakai et al. (2010) equally illustrate that as a firm ages, its relationship with lenders facilitates various types of information exchange between borrowers and lenders, alleviating information asymmetries and improving the efficiency of credit allocation.

Another aspect of the debate argues that the level of debt financing declines as a firm gets older. The basis of this argument is that older firms may face structural rigidities and asset deterioration, which may erode corporate value, and by so doing negatively affect growth (Loderer & Waelchli, 2009). By growing its productive level, a firm is able to accumulate internal equity which allows it to reduce its reliance on debt (Petersen & Rajan, 1994; Pfaffermayr et al., 2008; Huynh & Petrunia, 2010). Older firms may also face fewer problems regarding uncertainty and information asymmetry and so might view that as a justification for alternative financing sources like equity (Berger & Udell, 1995).

Available empirical evidence is divided along similar lines of argument. Huyghebaert (2003), for instance, finds that once firms grow older, they will probably generate more stable, positive cash flows and obtain easier access to reasonably priced bank loans. Based on the lower transaction costs principle, Bernasconi et al. (2005) find that older firms may incur lower transaction costs associated with borrowing because such firms are less likely to go bankrupt and are expected to suffer lower agency debt costs.

Contrary to the empirical evidence presented above, another set of studies report negative age-leverage relationships and defend that, under normal circumstances, a firm that has remained in the market for a long period of time might have built up a reasonable amount of reserves and retained earnings that could serve as a good alternative to debts (Petersen & Rajan, 1994; Pfaffermayr et al., 2008). In line with the growth hypothesis, Loderer and Waelchli (2009) investigate the impact of age on performance and find that profitability levels decline and costs go up as a firm gets older. Pfaffermayr et al. (2008) demonstrate that the adjustment processes that take place in the capital structure of a firm over time make the relationship between age and debt U-shaped, meaning that as firms grow and mature, they become much more strategic over their choice of debt financing until such a time that they are well matured to explore the external equity market. This is consistent with the proposition of Berger and Udell (1995) that a firm's financial needs are determined by its current phase in the business life cycle, as well as availability of funds and the prevailing cost of capital.

As shown above, evidence on the actual effect of age on corporate debt financing is presently inconclusive. Our first hypothesis is therefore aimed at determining whether a firm's access to long-term debt financing decreases as the firm gets older in an emerging economy, or whether the relationship between age and debt is non-monotonic.

2.2 Collateral-leverage relationship

Collateral-based lending is prevalent in environments of market imperfections (Berger & Udell, 1995) essentially because of the role of collateral in dealing with the problems associated with adverse selection and moral hazards (Cassar, 2004; Jimenez et al., 2009). Jimenez et al. (2009) illustrate that lenders also use collateral to hedge against high credit risks associated with lending to relatively small and young firms, implying some interaction between the way age and collateral affects debts. It follows that asset tangibility might positively influence debt financing via the collateral channel (Rajan & Zingales, 1995; Caprico & Demirguc-Kunt, 1998), transaction/ agency cost channel (Ovtchinnikov, 2010; Nico & Van Hulle, 2010), or through the asset match principle of Caprico and Demirguc-Kunt (1998).

According to Caprico and Demirguc-Kunt (1998), valuable assets that are acceptable as collateral considerably ease borrowing constrains. Availability of tangible assets to a firm provides an injection to its collateral value, making it possible for the firm to increase the levels of debt in its capital structure (Ovtchinnikov, 2010). In addition, given that firms with large investments in tangible assets have lower agency and transaction costs of debt financing, chances are that such firms may rely more heavily on debt financing. This is in line with the trade-off theory which, in the presence of financial distress and bankruptcy costs, proposes that tangible assets ought to be easier for outsiders to value at relatively cheaper costs than intangible assets (Frank & Goyal, 2009). The earlier theoretical framework of Jensen and Meckling (1976) also predicted a positive relationship on the basis that collateral protects lenders from the moral-hazards problems associated with debt financing. Based on the asset match proposal, Caprio and Demirguc-Kunt (1998) argue that since firms normally strive to match the maturity of their assets and liabilities, only firms with long-term assets are likely to have a longer maturity structure of debts. Consequently, it is expected that longer debt maturity is only affordable to firms with higher collateral values in terms of long-term assets. Unfortunately, whereas land and buildings constitute the largest proportion of assets that banks accept as collateral from firms, a much smaller proportion of these assets are held by firms in their total asset compositions (Safavian et al., 2006).

The majority of available empirical evidence supports the positive role of collateral value on debt financing. Some of the studies that find a positive relationship between collateral and leverage are Titman and Wessels (1988), Chen (2004), Frank and Goyal (2009), and Li et al. (2009). Although the results remain the same irrespective of the country case studied and method adopted, it is interesting to note that none of these studies focused on developing or emerging economies. This is an important issue because unlike the case in advanced economies, financial structures of firms in the latter are dominated by short-term debts, which do not necessarily need to be collateralised. Indeed, Booth et al. (2001) focused on developing economies found a negative relationship between debt and tangibility. This again shows how contentious the debate has been. To verify whether this holds in the case of South Africa, we hypothesise that the higher the proportion of a firm's tangible assets, the more its reliance on long-term debt financing.

2.3 Interactive impact of age and collateral

A firm's life cycle is expected to be correlated with its capacity to grow its assets. Expectedly also, older firms have a competitive advantage in terms of their capacity to grow assets compared to relatively newer firms. We are unable to find previous evidence on how this interaction affects a firm's debt structure. Interestingly, a study by Caprico and Demirguc-Kunt (1998) in the case of Ecuador, demonstrated that lack of collateral as well as the age of firms are probably factors that have jointly denied small firms access to the long-term debt markets. Based on foregoing, we hypothesise that the influence of asset tangibility on debt financing is dependent on the age of the firm.

3 Variable definition and construction

We define the dependent variable, debt ratio, in two ways - market-value debt ratio (DMV) and book-value debt ratio (DBV). To arrive at the DMV, we scale the sum of medium-term and long-term debts by the sum of market equity plus total debt (Ovitchinnikov, 2010). For the DBV, we scale the sum of medium-term and long-term debts by book value of assets. Because short-term debts are not always collateralised, we excluded loans whose maturity periods fall due within one year. This is unlike medium and long-term loans that are conventionally collateralised in most cases. In line with the main objectives of this paper, we hypothesise that a firm's debt ratio is positively influenced by its age and level of collateral value, but that the positive impact of collateral value varies according to a firm's age.

3.1 Firm age

Firm age can be defined in terms of years of formation, incorporation or listing. The three definitions reveal an interesting trend in a firm's life cycle. The first stage of a firm's existence is at formation. This is followed by incorporation and then being listed on a stock exchange if it meets the listing requirements of the exchange.1 Each of the three stages of existence has some implications on the financing structures of the firm. Thus, the relationship between age and leverage may be dependent on the definition adopted. For instance, studies that define age in relation to number of years since formation find some positive and significant effects (Archer & Faerber, 1966), while Gwatidzo and Ojah (2009) define age in terms of number of years since incorporation and find no significant effects. Moreover, Pfaffermayr et al. (2008) define age as number of years since incorporation and find a significant negative effect.

The problem with these earlier definitions, however, is that they fail to recognise that the significant outcome of either firm formation or incorporation is not reasonably felt at the base-year. They also do not acknowledge that, in some cases, the difference between incorporated and listed companies can be significant. Due to the inconsistencies in the age classifications of South African firms, we adopt an alternative definition of firm age that accounts for firm age since formation and since incorporation. We avoid the use of years of listing, since that would have led to the exclusion of a good number of firms from our sample.2 It is therefore possible that the relationship can be positive, negative or even non-linear. A cross-country case study by Gwatidzo and Ojah (2009) fails to establish any significant effect of age on debt financing. This later study is however a general study on capital structure determinants and merely controlled for firm age. Our own study focusing mostly on the impact of firm age tries to make use of a more robust definition by combining the definitions of Loderer and Waelchli (2009) and Sakai et al. (2010), and estimating firm age as an average of one year plus number of years elapsed since the year of incorporation and one year plus number of years elapsed since the year of formation.

3.2 Collateral value

The second hypothesis of this study focuses on the impact of collateral value on debt financing. Because asset tangibility also measures the size of a firm's collateral value, the two terms -tangibility and collateral value - have been used interchangeably in the corporate finance literature. However, collateral value is used as a collective term to refer to the sum of investments in fixed assets, inventories and other intangible assets. On the other hand, tangibility is sometimes used only in the sense of tangible assets (Frank & Goyal, 2009). Considering that our main dependent variable includes both medium and long-term borrowings, we choose to define collateralisation in terms of collateral value. This is considering the fact that medium-term loans may not necessarily be collateralised by fixed assets, but sometimes by inventories and other non-fixed assets. We adopt a general definition given by Booth et al. (2001) and Rajan and Zingales (1995) and define collateral value (or tangibility) as total assets minus current assets, divided by total assets.

The collateral-leverage relationship can, however, create some simultaneous equation bias because debts are used in the procurement of tangible assets, and tangible assets that are acceptable to lenders as collaterals guarantee the firm access to more long-term loans. To resolve this problem, collateral value is treated as a predetermined variable in our dynamic estimation equation.

3.3 The control variables

In line with the general practice in capital structure studies, and in order to make our results more comparable to those of previous studies, we control for the effects of size, profitability, growth opportunity, and level of information asymmetry. It is expected that firm size affects leverage positively because the size of a firm plays an important role in determining the kind of relationship it enjoys within and outside its operating environment. Following Booth et al. (2001) and Pandey (2004), we define firm size as the natural logarithm of sales. Also in accordance with the pecking-order theory, we predict a negative relationship between profitability and leverage, with more profitable firms tending to rely more on internal equity than on external debt financing (Pandey, 2004). We define profitability as the ratio of operating income (earnings before interest, tax and depreciation) to total assets. Growth opportunity is expected to have significant positive effect on leverage because it may increase lenders' confidence in the firm (Myers, 1977), but can also have a negative effect considering that firms with few growth options may have more long-term debt. Consistent with Chen (2004), we measure growth opportunity as the ratio of average sales growth to total asset growth. To capture the effect of information asymmetry on leverage and in accordance with Kale et al. (1991), we include a ratio of ending inventory scaled to the firm's total assets. The higher the level of information asymmetry, the higher is the expected reliance on debt financing.

4 The research data and descriptive results

The dataset used in this study is sourced from Thomson Datastream, which contains information covering equities, accounting, fixed-income, indexes, commodities and macro-economic variables for both developed and developing economies around the world and for over long time series. It is perhaps the largest database for academic research in terms of number of series covered in each market and particularly, it does a better job in reflecting capital structure changes (Ince & Porter, 2006). For South Africa, the database has equity information on over 250 listed companies. To minimise outliers and maintain a good level of consistency in the debt ratios across companies, we excluded firms from traditionally highly leveraged sectors such as banks, insurance companies, finance houses, and mortgage companies. Although panel series in Thomson Datastream date back beyond 1990, the majority of listed South African companies only have data available from 1999. Taking these constraints into consideration, we are only able to construct our dataset from 177 firms over a period of 1999 to 2009. The choice of 1999-2009 can also be justified considering that political and economic freedom was only enthroned in South Africa in 1994, following the end of apartheid and shift to majority rule. Financial reporting by companies before and immediately after 1994 was therefore non-standardised and lacked transparency.

Our sample is therefore made up of a total of 1947 observations. Because the dynamic panel data estimation technique is applied here, differencing both the dependent and the exogenous variables to get suitable instruments for the model caused significant reduction in the number of observations to 1710 and 1704, for both the market-value panel and the book-value panel, respectively.

Table 1 compares the levels of debt financing and collateral values across different age quartiles. It shows that the market-value debt ratio (DMV) is slightly at the highest level for firms in the 2nd quartile (14.5-26 year), but lowest for firms in the 4th quartile age range (56.5-118). This suggests that the relationship between age and the debt ratio is U-shaped. However, the book-value debt ratio seems to progressively decrease as firms move from the first to the last quartile age limit. On the other hand, the relationship between collateral and the debt ratio appears also to be U-shaped. Firms in the 2nd quartile have higher collateral value (56.7 percent) as against those in the last quartile, which have 53.5 percent. The above results give an impression that the impact of age and collateral value on debt financing is stronger for firms within the age limit of 14.5-26 years.

Table 2 contains results of the summary statistics and correlation analysis for all the variables. For the whole sample, DMV and DBV average 22.7 percent and 11.5 percent, respectively. Collateral value averages 53.4 percent, whereas the average profitability level is 12.8 percent. Both measures of the debt ratio are positively correlated with collateral, but negatively correlated with age.

5 The empirical model and analysis

5.1 The model

For a panel model, firms' target debt ratio (Debtit) can be modelled as a function of a set of explanatory variables X for firm i at time t, time-invariant unobservable firm-specific effects νi, a set of time-specific effects that change over time but are common to all firms ηt, and a serially uncorrelated time-varying disturbance term εit. This relationship can be represented as:

To allow for the possible effect of the autoregressive process on the stochastic term, a one-year lagged dependent variable (Debti,t-1) is included in equation 1 (Devereux & Schiantarelli, 1990) and then fitted into an autoregressive model where:

There is, however, a high probability that vi, which is unobservable and hard to measure, is correlated with some elements in Xi,t. Although, according to Antoniou et al. (2008), this can be dealt with by taking the first differences of the variables and thus eliminating time-invariant fixed effects, the resulting correlation between Δ(Debti,t-1) and Δεit makes the results of non-dynamic estimation techniques (such as OLS) biased and inefficient. Time-invariant firm-specific characteristics, which are combined in ηt and εi,t, are also likely to correlate with some of the explanatory variables.

One possible solution to the inconsistency of OLS results would be to make use of the two stage least square (2SLS) estimation technique. This would mean finding appropriate instruments for the exogenous variables which are correlated with neither the error term nor any of the exogenous variables. In this regard, Flannery and Hankins (2010) argue that a traditional instrumental variables approach becomes an unviable option in most areas of corporate finance where finding reliable instruments can be very difficult. This leaves us with an option of using the Arellano-Bond dynamic generalised method of moments (GMM) panel data model, which addresses more efficiently the problem of simultaneity or endogeneity, while at the same time accommodating the assumptions of dynamic capital structure theory (Arellano & Bond, 1991). The advantage of GMM over the traditional 2SLS model is that, instead of focusing on weak instruments, it optimally exploits all the linear moment restrictions specified by the model (Antoniou et al., 2008). Dynamic panel methods also allow for robust inference of lagged dependent variables in the presence of unobserved heterogeneity (Huynh & Petrunia, 2010).

There are two versions of the Arellano-Bond dynamic panel data (GMM) - the difference-GMM earlier developed by Arellano and Bond (1991) and system-GMM expatiated by Blundell and Bond (1998). In the absence of the residuals not having second-order serial correlation, the difference-GMM uses the lagged exogenous variables' values as legitimate instruments for the first-differenced lagged dependent variable (Flannery & Hankins, 2010). On the other hand, the system-GMM uses the differencing as in the difference-GMM plus the lagged exogenous variables' first differences as instruments in an equation of the level-variables. This becomes necessary especially when the information provided by the lagged variables is likely to cause substantial loss of efficiency in models estimated in first differences using instruments in levels (Arellano & Bover, 1995). We apply the two-step version of the system-GMM technique developed by Blundell and Bond (1998) which is found to have the capacity to control for the correlation of errors over time, heteroskedasticity across firms, simultaneity, and measurement errors due to the utilisation of orthogonal conditions on the variance-covariance matrix (Antoniou et al., 2008). More specifically, our choice of the system-GMM over the differenced-GMM is motivated by three considerations, namely: the nature of our dataset (smaller size of T = 10, relative to a larger size of N = 177); the possibility of the variance of the time-invariant unobservable firm-specific effects (νi) increasing relative to the variance of the serially uncorrelated time-varying disturbance term (εit); and the likelihood of the autoregressive parameter (Debtit-1) or the adjustment speed (α1) approaching unity. In the presence of these considerations, Blundell and Bond (1998) establish that the system-GMM estimator becomes more useful in reducing the finite-sample biases associated with the differenced-GMM estimator.

The essence of the dynamic trade-off theory is that capital structure decisions are adjusted in accordance with the level of adjustment cost which in turn is determined by transaction costs as well as the market value of the stock of the firm (De Miguel & Pindado, 2001; Ozkan, 2001; Gaud et al., 2005). The fact that the debt ratio is dynamic renders equation (2) quite unsuitable for estimating the real impact of Xi,t on the debt ratio. In reality, a firm's readiness to adjust its leverage towards a preferred level depends on the transaction costs of doing so - a factor that restricts the frequency of adjustment to an average of once a year (Leary & Roberts, 2005).

In the presence of transaction costs, De Miguel and Pindado (2001) demonstrate that firms' debt ratios adjust automatically but follow a target adjustment process, where:

Solving for Debtit the actual debt ratio then becomes:

where Debti,t-1 is the previous year debt ratio for firm i; αi stands as a measure of transaction cost, and Debt*i,t is the target debt ratio for firm i. Also factoring equation (1) into equation (4) and observing that Debt*i,t = 1/α[Debti,t - (1-α)Debti,t-1], the actual debt ratio can be interpreted as a function of the hypothesised determinants. That is:

To make equation (5) more explicit based on our research hypotheses, we substitute Xit with both the main regressors and the control variables as follows:

where, Φit and γ are vectors of the control variables (profitability, size, growth opportunity and information asymmetry) and their respective coefficients, νt is an unobserved individual effect, and εi,t is the random error heteroskedastic term. The main focus is on β1, β2, and β3, namely the coefficients of firm age, square of firm age, and collateral value, respectively. The inclusion of a quadratic functional form for the age-leverage relationship is in line with Pfaffermayr et al. (2008) and is aimed at allowing us to test for the postulated non-linear relationship between age and leverage. As a decision criterion, β1 and β2 are compared (expectedly β1 < 0 and β2 > 0), and a conclusion reached for a non-monotonic effect of age on leverage if the two coefficients yield opposite signs.

Taking other factors into consideration, (1 - αi)Debti,t-1 implies that a firm gradually adjusts its previous year's debt ratio towards an optimal (target) level at a rate (1 - αi) per year. The (1 - αi) term can take a value ranging from 1 for no adjustment cost to 0 for a highly expensive adjustment process (Gaud et al., 2005). A positive and below-unity coefficient of Debti,t-1 suggests that a firm has a target leverage ratio and revises its capital structure over time to achieve that. A coefficient greater than one, on the other hand, implies that the firm does not have any target debt ratio.

For the system-GMM model, we treat the two age variables, firm size, growth opportunities, and information asymmetry as exogenous, and profitability and collateral variables as predetermined. Although Ozkan (2001) has argued that firm-specific characteristics are not strictly exogenous, we find no theoretical justification to treat the above independent variables as endogenous factors in our model. In addition, the likely endogeneity bias that could arise is expected to have been addressed by the structural specificity of the dynamic panel GMM model. However, collateral value is treated as predetermined because debt can be used to procure fixed assets, and fixed assets that are acceptable to lenders as collaterals guarantee a firm's access to more long-term loans. It is therefore possible that there is causality between collateral and debt financing. For profitability, studies such as Claessens et al. (2000) have established that financing patterns of firms also have an influence on operating performance. By definition, Φit in equation (5) above can be partitioned into the hypothesised exogenous components (size, information asymmetry and growth) and the predetermined components (profitability and collateral).

5.2 Results

Table 3 contains the results of the system-GMM estimations based on equation (5). In all the function system-GMM estimations represented in columns 1 to 6, we treated collateral value and profitability as partly endogenous variables. This is in line with the postulations of the trade-off and pecking order theories, and the likelihood that some form of causality exists between each of these factors and financial leverage. Similarly, the instruments used in the equation include the lagged differences of the regressors (collateral value, profitability, age, size, information asymmetry and growth opportunities), as well as the first difference of the dependent variable. In all, as shown in Table 3, the total number of instruments used ranges from 187 to 189.

The diagnostics reported in Table 3 confirm the validity of the two-step version of the system-GMM technique. Specifically, the outcome of the Sargan test presents strong evidence consistent with the null hypothesis that the overidentifying restrictions are valid, even in the case of the differenced-GMM. The evidence of first-order serial correlation does not invalidate the model since rejection of the null hypothesis of no serial correlation at order one in the first-differenced errors does not imply that the model is misspecified (Arellano & Bond, 1991). The important factor considered here is the arising evidence of absence of second-order serial correlation which shows that the model is correctly specified. Finally, the Wald 1 tests of the joint significance of estimated coefficients and the Wald 2 of the joint significance of the time dummies are both significant at the 1 percent level.

For all the models, the coefficients of Debti,t-1 are positive and below unity, which suggests that South African firms have target-leverage ratios and do revise their respective capital structures over time to achieve the targets. Using the market-level debt ratio as dependent variable in models 1 to 3, the positive coefficients of the lagged dependent variable suggest that, in order to obtain a target-leverage ratio, firms adjust their capital structure by roughly 43 percent per year. For models 4 to 6 with the book-value leverage ratio as the dependent variable, the adjustment of capital structures is about 56 percent per year. This implies that about 43 percent of the deviation of the actual market-value leverage ratio from its optimal level and 56 percent of the deviation of the actual book-value leverage ratio can be eliminated within a year. Assuming a constant speed of adjustment, this result suggests that it takes an average South African company less than two years to be able to adjust about half of the deviation caused by the exogenous leverage shocks.3 The adjustment speed found in the case of South African firms, especially for market leverage, is close to the limit found for UK firms - 43 percent (Ozkan, 2001) and US firms -47 percent (Shyam-Sunder & Myers, 1999). It is however higher than the 28 percent reported for Swiss companies (Gaud et al., 2005), 34 percent reported for Brazilian firms (Correa et al., 2007), and 18.5 percent reported for Chinese firms (Qian et al., 2009), but quite smaller than over 79 percent reported for Spanish firms (De Miguel & Pindado, 2001). One would have expected the adjustment speed to be roughly the same as that of China or Brazil which share the same economic characteristics with South Africa. Possible reasons for this lag could be the relatively easier access to credit in South Africa compared to what prevails in those other emerging economies, as demonstrated in the introductory part of this paper.

When excluding age squared in model 1, the age coefficient is negative. Inclusion of the age-squared variable in models 2 and 3, however, results in a significant reversal in the sign of the coefficient, indicating that the effect of firm age on access to debt financing is non-linear. Accounting for the non-linear effect, the positive coefficient on the linear age term is an indication that debt financing should increase with age in the early years of a firm's life. The negative coefficient on the quadratic term suggests however that a rise in debt financing subsequently levels off and decreases with age. When using DMV as dependent variable, the results confirm our first hypothesis and the earlier findings of Pfaffermayr et al. (2008) that the relationship between age and debt financing is nonmonotonic. Consistent with the conclusion of La Rocca et al. (2009), moreover, the results show that listed firms in South Africa use debt as a critical financial resource to sustain their business in the start-up and the growing stages, but gradually reduce their reliance on debts in the consolidation period.

Collateral exhibits a positive and significant relationship with the market-value leverage ratios of firms (model 1 and 2). These results are in accordance with our second hypothesis and suggest that firms with higher collateral value are indeed likely to face fewer constraints on borrowing and therefore have greater access to long-term debt financing. The positive effect of collateral on debt financing is also similar to previous studies such as Frank and Goyal (2009) and Li (2009). Consistent with the positions of Chakraborty (2010) and Jimenez et al. (2009), the result confirms that the existence of collateral value enhances a firm's access to debt financing by helping to eliminate financing barriers such as incomplete financial contractibility, information asymmetry, adverse selection and moral hazard.

We find no evidence to support our third hypothesis that the impact of asset tangibility on debts is dependent on firm age, as the interaction terms in models 3 and 6 are not statistically significant. At least for the firms in our sample, therefore, the ability of a firm to expand its assets does not increase with time. Thus, although a firm's life cycle may be correlated with its capacity to enhance its collateral value, such interactive tendency does not have a significant impact on debt financing.

Turning to the control variables, profitability has the expected negative sign for DMV as dependent variable, but the results are largely insignificant except for model 3. For the most part though, we can conclude that there is no relationship between leverage and profitability. This result is not surprising given that our proxy for debt financing excludes short-term debt which accounts for up to 38 percent of the financing structure of listed firms in South Africa (Gwatidzo & Ojah, 2009). The result simply suggests that profitability is not a key determinant of medium and long-term financing decisions among listed South African firms.

There is evidence to suggest that leverage and firm size are positively related. Thus, consistent with the results of previous studies (Rajan & Zingales, 1995; Booth et al., 2001) and in line with the postulations of the tradeoff theory, debt financing increases as a firm gets bigger. Growth opportunity, in contrast, enters negatively with debt financing, which is consistent with the findings of Loderer and Waelchli (2009). It is also in accordance with the predictions of the agency and trade-off theories that firms with higher growth potentials tend to borrow less than firms holding more tangible assets because growth opportunities are difficult to collateralise (Myers, 1977; Chen, 2004).

With respect to information asymmetry, the coefficients have a negative sign, but are only significant determinants of the book-value leverage of firms. In accordance with our expectation, therefore, the higher the levels of asymmetric information on a firm's assets, the higher would be the reliance of the firm on external debt. The reason for this may be because, due to late listing, the majority of listed firms in South Africa have had to rely historically on collateralised bank-based debt financing. This also conforms to the explanation offered by Berger and Udell (1995) that banks typically solve asymmetric information problems by producing and analysing information and by setting loancontract terms to improve borrower incentive to repay. However, the inconsistency in the results (especially between both measures of the debt ratio) could be due to the inability of the proxy to capture the subtle effects of information asymmetry on debt financing and so should be interpreted with caution (Kale et al., 1991).

Does the speed of adjustment to target leverage and the length of time for such adjustment vary across age groups in the case of South African firms? Table 4 presents the adjustment coefficients of firms' debt ratios disaggregated by different years of firm age. The results indicate that, in general, the lagged financial leverage coefficients are positive and less than unity for each age quartile and the sample as a whole. Equally assuming a constant speed of adjustment, the last two columns of Table 4 give an indication that it takes approximately one year for an average South African company to be able to adjust about half of the deviation caused by exogenous leverage shocks. However, the length of time taken to adjust to target leverage is least for companies within the last quartile age limit and highest for firms in the second quartile age limit. This corresponds with the fact that the adjustment speed for last quartile age category at 70.1 percent is highest among all age groups, as against that of the second quartile group which at 46.1 percent is the least. It can therefore be deduced that listed South African firms generally maintain debt financing policies that allow for gradual adjustment towards target leverage, although the speed and timing of such adjustment may depend on the stage of firm's life cycle. That is, firms change their financing policies consistent with whether they are at the start-up, growth, consolidation or maturity stage of their life cycle.

5.3 Robustness tests

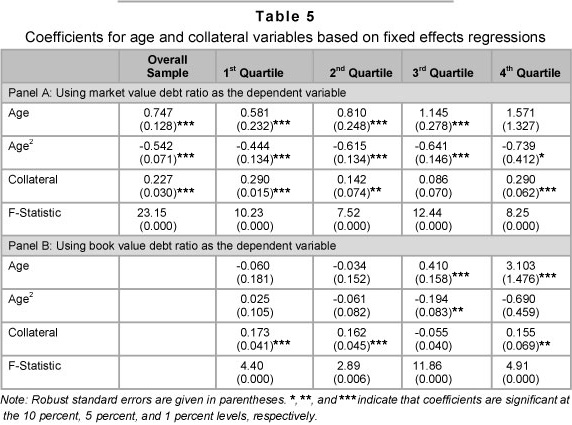

Given that firms considered in our sample belong to diverse industrial sectors and are of different age categories, it is possible that mere interaction of age and collateral value may not be enough to establish evidence of any interactive relationship. We therefore employ sub-samples to investigate this further. This we do by partitioning the firms according to quartile age groups and running fixed-effects regressions4 to examine if indeed the significance of collateral changes across the different groups. The choice of the fixed-effects model is motivated by the availability of relatively fewer numbers of observations arising from partitioning the sample into different age quartiles, which renders the use of dynamic models non-robust and in such a case inconsistent. In addition, the Hausman specification test carried out here proves that there is significant correlation between the unobserved person-specific random effects and the regressors - thus making the choice of a fixed-effect model more consistent and parsimonious over a random-effect model.

The results contained in Table 5 show that the impact of collateral is significantly higher for firms in the first and last quartile groups. Consistent with the financing life-cycle hypothesis, the results indicate that during start-up and maturity stages, a firm's access to debt markets is significantly dependent on their amount of investments in assets that are acceptable to external creditors as collateral for loans. The results can be explained by the fact that firms in both age quartiles have less access to the capital market and are more likely to rely on bank-based collateral debt financing. This result is consistent with the hypothesis that newer firms have less-attractive industry reputation and so suffer more information asymmetry problems, adverse selection and moral hazards, which result in a situation where lenders maintain increased collateral demand as conditions for lending to such firms (Cassar, 2004). Furthermore, start-up firms may have limited access to market-based funding sources such as bonds and external equity, and so tend to rely more on bank-based finances that are most often collateralised (Berger & Udell, 1995). This result also agrees with the conclusion of Jimenez et al. (2009) that lenders employ collateral to hedge against high credit risks associated with lending to relatively small and young firms. Interestingly, matured firms may also face problems associated with agedness such as structural rigidity and asset decay which also erodes the gains of corporate reputations, increases agency costs and constrains a firm's access to market-based financing sources (Loderer & Waelchli, 2009).

6 Conclusion

This paper has demonstrated that, as in most other developed and emerging economies, South African firms maintain target leverage ratios and do adjust their capital structures from time to time to achieve their respective targets. We find that the adjustment speed towards target leverage by listed South African firms is similar to those of the USA and UK, but relatively higher than those of China and Brazil. We attribute this outcome to the relatively easy access to credit in South Africa compared with other emerging economies. Assuming a constant speed of adjustment, it takes an average South African company less than one and a half years to be able to adjust about half of the deviation caused by exogenous leverage shocks, and that both the speed and timing of such adjustment depends on firm age - with adjustment policies reflecting whether a firm is in the start-up, growth, consolidation or maturity stage of their life cycle. Factors that are considered most crucial in this adjustment process, especially in the case of market leverage, are firm age, collateral value, size, level of information asymmetry, and growth opportunities.

Focusing on the key hypotheses of the study, we find evidence in support of our first hypothesis that, in terms of market leverage, the relationship between age and debt financing is non-monotonic. Thus, listed firms in South Africa use debt as a critical financial resource to sustain their business in the startup period, gradually reduce their reliance on debts during consolidation, and once more gradually increase debt financing during maturity. We also find evidence in support of our second hypothesis that firms with higher collateral value are likely to face fewer constraints in borrowing and have therefore greater access to long-term debt financing. This we attribute to the fact that the existence of collateral value enhances a firm's access to debt financing by helping to eliminate such financing barriers as incomplete financial contractibility, information asymmetry, adverse selection and moral hazards. Although we could not find any evidence to support our hypo-thesis that the impact of asset tangibility on debt is dependent on the age of a firm, our test for robustness reveals that during start-up and maturity stages, a firm's access to debt markets is significantly influenced by their amount of investments in assets that are acceptable to external creditors as collaterals.

The findings of this paper have some interesting policy implications, especially in its empirical attempt to provide evidence in demonstration of the fact that debt-financing policies are more critical for firms in the startup and maturity stages of their life cycles than for those in the growth and consolidation stages. Strategic investments in assets that can be collateralised for lending are crucial for such firms to be able to command the confidence and attraction of external creditors. A plausible policy option could be for firms to strike a balance between their respective internal financing capacity and their level of access to external financing at each stage in their life cycle. For example, under the circumstance demonstrated above, it could be more advantageous for a firm to maintain low dividend payout policy at both the start-up and maturity stages to be able to shore up its internal equity to a level that can help wage it against any arising financing constraints doing such periods.

References

ANTONIOU, A., GUNEY, Y. & PAUDYAL, K. 2008. The Determinants of capital structure: capital market-oriented versus bank-oriented institutions. Journal of Financial and Quantitative Analysis, 43(1):59-92. [ Links ]

ARCHER, S.H. & FAERBER, R.G. 1966. Firm size and the cost of externally secured equity capital. Journal of Finance, 21(1):69-83. [ Links ]

ARELLANO, M. & BOND, S. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58:277-297. [ Links ]

ARELLANO, M. & BOVER, O. 1995. Another look at the instrumental variable estimation of error component models. Journal of Econometrics, 68:29-51. [ Links ]

BERGER, A.N. & UDELL, G.F. 1995. Small firms, commercial lines of credit, and collateral. Journal of Business, 68:351-382. [ Links ]

BERNASCONI, M., MARENZI, A. & PAGANI, L. 2005. Corporate financing decisions and non-debt tax shields: Evidence from Italian experiences in the 1990s. International Tax and Public Finance, 12:741-773. [ Links ]

BLUNDELL, R. & BOND, S. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87:115-143. [ Links ]

BOOTH, L., AIVAZIAN, V., DERMIRGUC-KUNT, A. & MAKSIMOVIC, V. 2001. Capital structure in developing countries. Journal of Finance, 56(1):87-130. [ Links ]

CASSAR, G. 2004. The financing of business start-ups. Journal of Business Venturing, 19:261-283. [ Links ]

CARPICO, G. & DEMIRGUC-KUNT, A. 1998. The roles of long-term finance: theory and evidence. The World Bank Research Observer, 13(2):171-189. [ Links ]

CHAKRABORTY, I. 2010. Capital structure in an emerging stock market: the case of India. Research in International Business and Finance, 24(3):295-314. [ Links ]

CHEN J.J. 2004. Determinants of capital structure of Chinese-listed companies. Journal of Business Research, 57(12):1341-1351. [ Links ]

CLAESSENS, S., DJANKOVS, S. & XU, C.L. 2000. Corporate performance in the East Asian financial crisis. The World Bank Research Observer, 15(1):23-46. [ Links ]

CORREA, C., BASSO, L.C. & NAKAMURA, W.T. 2007. What determines the capital structure of the largest Brazilian firms? An empirical analysis using panel data. Available at SSRN: http://ssrn.com/abstract=989047 or http://dx.doi.org/10.2139/ssrn.989047. [ Links ]

DAVIS, E.P. & STONE, M.R. 2004. Corporate financial structure and financial stability. Journal of Financial Stability, 1(1):65-91. [ Links ]

DE MIGUEL, A. & PINDADO, J. 2001. Determinants of capital structure: new evidence from Spanish panel data. Journal of Corporate Finance, 7:77-99. [ Links ]

DEVEREUX, M. & SCHIANTARELLI, F. 1990. Investment, financial factors, and cash flow: evidence from U.K. panel data, in R.G. Hubbard (ed.) Asymmetric information, corporate finance, and investment. Chicago: University of Chicago Press. [ Links ]

FLANNERY, M.J. & HANKINS, K.W. 2010. Estimating dynamic panel models in corporate finance. Discussion Paper, University of Florida. Available at SSRN: http://ssrn.com/abstract=1108684 [ Links ]

FRANK, M. & GOYAL, V. 2009. Capital structure decisions: which factors are reliably important? Financial Management, 38:1-37. [ Links ]

GAUD, P., JANI, E., HOESLI, M. & BENDER, A. 2005. The capital structure of Swiss companies: An empirical analysis using dynamic panel data. European Financial Management, 11(1):51-69. [ Links ]

GWATIDZO, T. & OJAH, K. 2009. Corporate capital structure determinants: evidence from five African countries. African Finance Journal, 11(1):1-23. [ Links ]

HUYGHEBAERT, N. 2003. The capital structure of business start-ups: policy implications. Tijdschrift voor Economie en Management, 48(1):23-46. [ Links ]

HUYNH, K. & PETRUNIA, K.P. 2010. Age effects, leverage and firm growth. Journal of Economic Dynamics and Control, 34:1003-1013. [ Links ]

JENSEN, M. & MECKLING, W. 1976. Theory of the firm: managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3:305-360. [ Links ]

INCE, O.S. & PORTER, R.B. 2006. Individual equity return data from Thomson Datastream: handle with care! Journal of Financial Research, 29:463-479. [ Links ]

JIMENEZ, G., SALAS, V. & SAURINA, J. 2009. Organizational distance and use of collateral for business loans. Journal of Banking and Finance, 33:234-243. [ Links ]

KALE, R., NOE, T.H. & RAMIREZ, G.G. 1991. The effect of business risk on corporate capital structure: theory and evidence. Journal of Finance, 46(5):1693-1715. [ Links ]

LA ROCCA, M., LA ROCCA, T. & CARIOLA, A. 2009. Capital structure decisions during a firm's life cycle. Small Business Economics, Doi 10.1007/s11187-009-9229-z. [ Links ]

LEARY, M.T. & ROBERTS. M.R. 2005. Do firms rebalance their capital structures? Journal of Finance, 60: 2575-2619. [ Links ]

LI, K., YUE, H. & ZHAO, L. 2009. Ownership, institutions, and capital structure: evidence from China. Journal of Comparative Economics, 37(3):471-490. [ Links ]

LODERER, C. & WAELCHLI, U. 2009. Firm age and performance. European Corporate Governance Institute, Finance Working Paper No. 230/2009, Available at: http://www.fmpm.ch/docs/12th/papers_2009_web/A4b.pdf [ Links ]

MYERS, S.C. 1977. Determinants of corporate borrowing. Journal of Financial Economics, 5:147-175. [ Links ]

NICO, D. & VAN HULLE, C. 2010. Internal capital markets and capital structure: bank versus internal debt. European Financial Management, 16(3):345-373. [ Links ]

OVTCHJNNIKOV, A.V. 2010. Capital structure decisions: evidence from deregulated industries. Journal of Financial Economics, 95(1):249-274. [ Links ]

OZKAN, A. 2001. Determinants of capital structure and adjustment to long run target: Evidence from UK company panel data. Journal of Business Finance and Accounting, 28(1&2):175-198. [ Links ]

PANDEY, M. 2004. Capital structure, profitability and market structure: evidence from Malaysia. Asia Pacific Journal of Economics and Business, 8(2):78-89. [ Links ]

PETERSEN, M.A. & RAJAN, R.G. 1994. The benefits of lending relationships: evidence from small business data. Journal of Finance, 49(1):3-37. [ Links ]

PFAFFERMAYR, M., STOCKL, M. & WINNER, H. 2008, Capital structure, corporate taxation and firm age. Austrian Institute of Economic Research Working Paper, Available at: http://www.sbs.ox.ac.uk/centres/tax/Documents/working_papers/WP0829.pdf [ Links ]

QIAN, Y., YIAN, Y. & WIRJANTO, T.S. 2009. Do Chinese publicly listed companies adjust their capital structure towards a target level? China Economic Review, 20:662-676. [ Links ]

RAJAN, G.R. & ZINGALES, L. 1995. What do we know about capital structure? Some evidence from international data. Journal of Finance, 50(5):1421-1460. [ Links ]

SAFAVIAN, M., HEYWOOD, F. & STEINBUKS, J. 2006. Unlocking dead capital: how reforming collateral laws improve access to finance. The World Bank, Public Policy for the Private Sector Note No. 307. [ Links ]

SAKAI, K., UESUGI, I. & WATANABE, T. 2010. Firm age and the evolution of borrowing costs: evidence from Japanese small firms. Journal of Banking and Finance, 34:1970-1981. [ Links ]

TITMAN, S. & WESSELS, R. 1988. The determinants of capital structure. Journal of Finance, 43(1): 209-243. [ Links ]

Accepted: November 2011

1 Section 172 of the Companies Act, No. 61 of 1973 (as amended in 2008) specifies, for instance, that 'no company having a share capital shall commence business or exercise any borrowing powers unless and until the Registrar has under the provisions of this section issued under his hand and seal a certificate entitling the company to commence business'. A company can be registered as either private or public company, but the Act makes extensive provisions for conversion from private to public company and vice-versa. Also interesting about the South African case is that a formal legal framework for mandatory incorporation of companies commenced only in 1973 following enactment of the Companies Act.

2 As reported earlier in this paper, 81 per cent of these listed companies are less than 25 years old, and 45 percent of this number are less than 10 years since listing. Fitting those firms into the sample period of 1999 to 2009 would give rise to higher number of missing observations.

3 Following Qian et al. (2009), this is calculated using h = ln(1/2)/ln(1 - αi).

4 The choice of the fixed-effects model is based on the assumption that, based on age categories, firms in each group share some similarities and may not be randomly different from one another in terms of age, experience, size, etc. Essentially, the GMM results proved to be biased and inconsistent with the assumptions of no serial correlation and overidentifying restrictions when estimating the model for the different quartiles.