Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Business Management

versão On-line ISSN 2078-5976

versão impressa ISSN 2078-5585

SAJBM vol.55 no.1 Cape Town 2024

http://dx.doi.org/10.4102/sajbm.v55i1.4223

ORIGINAL RESEARCH

The role of management accounting in human capital management: Lessons from the services sector

Cornelis T. van der Lugt

Stellenbosch Business School, Faculty of Economic and Management Sciences, University of Stellenbosch, Stellenbosch, South Africa

ABSTRACT

PURPOSE: The article examines the role of management accounting in managing human capital, a key intangible asset for services sectors. Considering new expectations regarding the role of management accountants and human resource professionals, the article explores the ability of the disciplines to collaborate in becoming more strategic.

DESIGN/METHODOLOGY/APPROACH: The article considers literature on the evolution of the two disciplines, including archetype views on the role of management accountants, and presents case study analysis of a German information technology firm and a Dutch bank. Semi-structured interviews were conducted with senior managers from both the companies.

FINDINGS/RESULTS: From the interviews, it appeared that management accountants play the role of business partner but stop short of acting as comprehensive integrator of human capital information. While both companies have innovated in measuring and valuing human capital, human resources and finance analytics teams tend to work on their own and accountants remain ad hoc advisors.

PRACTICAL IMPLICATIONS: Efforts to refine the business case and value human capital fail to fully mainstream, as collaboration across departments remain loose. Innovations in soft management controls leave an impression of loose coupling between subsystems rather than comprehensively planned and integrated soft management control systems.

ORIGINALITY/VALUE: The study defines complementarity between two disciplines, both seeking to account for and manage intangible assets more effectively. It concludes with lessons for researchers and practitioners on the development action-to-value pathways, improving non-financial metrics and purposefully shaping soft control systems.

Keywords: management accounting; human capital; strategic human resource management; intangible assets; management control systems.

Introduction

Human capital (HC) as key intangible asset remains a prime factor in determining the market value of enterprises. It is of special interest in the service industries, ones strategically dependent on talented employees. In the last two decades, the management of HC has expanded in focus from topics such as education and skills to the topics of health and well-being (Flamholtz et al., 2020). New subjects of investigation include the extended availability of employees and remote working, which poses new health risks (Wendsche & Lohmann-Haislah, 2017).

The search for improved ways of measuring and managing HC has raised expectations with regard to the role of accounting. Human resource accounting (HRA) pioneers such as Eric Flamholtz (1999) introduced a quantitative approach that was not obsessed with financial statements. Defining a managerial accounting approach, the author worked with softer accounting information, assessing 'how' HC creates value (Flamholtz et al. 2020; Roslender & Monk, 2017). This required a new understanding of management accounting. Today management accountants remain challenged to take lessons from strategic management accounting (SMA) techniques and apply these to HC.

Exploring the role of management accounting (MA) implies new trends in the disciplines of both MA and human resource management (HRM). While the concept of SMA has struggled to establish itself (Langfield-Smith, 2008; Rashid et al., 2021), new case studies in SMA research since the 2010s illustrated innovative use of the balanced scorecard (BSC) and integrated performance measurement in the service industries (Rashid et al., 2020). What made the approach 'strategic' was among others defined as focussing on the longer-term future and incorporating non-financial information such as that found in HRA. New information technologies (IT) also brought the prospect of vast improvements in measurement and management.

Flamholtz (1974) identified a key objective of HRA as getting management to 'think people' versus simply considering 'labour' as 'costs' that need to be minimised. The later concept of strategic human resource management (SHRM) looked at employees as a source of competitive advantage (Bratton, 1994). It pointed to a 'targeted HRM system' (Jackson et al., 2014) with functional dimensions such as training and strategic dimensions such as teamwork, culture and organisational learning.

The ultimate role for the HR function today has been described as 'improving the performance of the organisation by improving managerial behavior and the quality of decision making about human capital management and organisational design' (Hossain & Roy, 2016). In this role, the HR manager needs a crucial partner, namely the management accountant, to define relevant connections and alignment with matters such as organisational value creation. Management accounting can help HR as a discipline to meet the expectations of SHRM (Becker & Huselid, 2006; Wright, 2008). In the eyes of many, HR has continued to be operationally focussed, not the strategic business partner it was expected to become. Human resource and MA managers may well collaborate in establishing greater credibility for their disciplines inside enterprises, becoming recognised business partners in planning and strategic interventions (Delany, 2016).

The following study seeks to find greater clarity on the role of MA in human capital management (HCM), based on analysis of two European service industry companies known for their innovative approaches to HC. It presents a qualitative, interpretative field study on the role of MA, examining the experience of a European IT firm and bank. The following section provides an overview of recent literature on the role of MA, followed by a focus on two challenging responsibilities in the measurement and management of HC. The subsequent section describes the methodology used, after which findings based in interviews with the two case companies are presented. The conclusion provides recommendations for improved practice and future research.

Emerging roles and challenges in managing human capital

The role of management accounting

Assessing the role of MA, the approach in this study was to focus on the substance of what HCM requires and getting views from managers of diverse departments. This left open the possibility of different managerial positions taking on MA functions, of accounting-type functions in sustainability played by managers of diverse technical backgrounds, as well as exploring the evolving role of the management accountant. Review of research on SMA has highlighted questions around the role of MA as discipline and management accountants as professionals. Studies often found that SMA tools, techniques and practices were implemented not by the accounting function but by others playing a 'shadow accounting' role (Hadid & Al-Sayed, 2021; Langfield-Smith, 2008). It may be that in SMA, the management accountants play more of a supportive role, working with multidisciplinary teams (Ma & Tayles, 2009). They are also expected to grow beyond costing and accounting expertise to fulfilling coaching and advisory roles.

Research on management accountants have often referred to three archetypes, namely that of 'bean counter', 'business partner' or 'information gatekeeper' (Byrne & Pierce, 2007; Goretzki & Messner, 2019; Schaltegger & Zvezdov, 2015; Wolf et al., 2015). Work on the business partner model focusses on a more strategic role, including use of new IT and digital capabilities (Andreassen, 2020). Work on the gatekeeper function has emerged from research related to the growing field of sustainability information (Ascani et al., 2021) and a facilitator role that management accountants may play across departments.

Looking at the role of management accountants in the new era of sustainability accounting, Smith (2017) highlighted their ability to quantify. They have a special role in the ability of companies to work with a multi-capital model, where they need to define, quantify and establish new capital accounts. Management accounting can complement various control structures, but the role of accounting in different configurations deserves more research (Frow et al., 2010). The results-driven approach of accounting has shown the risk of being overly mechanistic. Accounting is more easily associated with hierarchical, bureaucratic, and formalistic approaches. Yet, the role of accounting in promoting transparency and more predictability can also serve to build trusting relationships.

Analysis of the role of management accountants in HCM at large companies in the United Kingdom (UK) and Canada (Vedd & Kouhy, 2005) highlighted four categories of functions. These were: (1) strategy and business planning (including the development of HR analytics), (2) decision-making (including cost-benefit analysis for major projects), (3) measuring performance and reporting (including the definition key performance indicators [KPIs]) and (4) emerging roles (including inhouse consultant to HR managers). As the finance function becomes more digitised, management accountants need to improve their ability to provide data-driven decision support and become more familiar with new understandings of value creation. Surveying of management accountants of Oceania, however, signalled that management accountants are not playing a significant role in sustainability accounting (Mistry et al., 2014). This leaves a question mark behind the ability of the profession to conduct multi-capital accounting.

Surveys among Dutch management accountants in the early 2010s suggested a hybrid function emerging. Rather than the dominance of a stronger business partner, strategic MA function, the trend seemed to be a hybridisation in which internally focussed functions associated with 'score keeping' remain equally important (De Loo et al., 2011). This was in part influenced by regulatory developments (common for the banking sector), demanding more rules and controls. Feedback from German management accountants also highlighted increasing complexity in tasks and interactions. A survey from the late 2010s signalled role extension rather than role transition (Rieg, 2018), including a mix of roles such as internal consultant (advice), counterpart of management (critical questioning), navigator (steering), controller (cost controls) and bean counter (financial numbers).

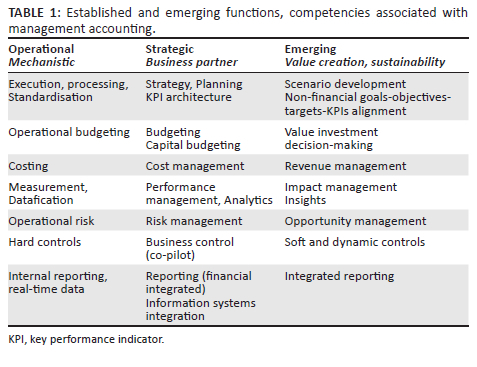

Table 1 gives an overview of MA functions, including established operational task areas, strategic responsibilities and emerging responsibility areas highlighted in the past decade. Our examination of two European enterprises will consider what emerging functions relate to HCM. Archetype roles that come up with respect to emerging functions include that of broker, integrator and standards harmoniser. All of these highlight a role that cuts across departments and requires multidisciplinary understanding.

In addressing alternative capitals such as HC, two responsibility areas that deserve special attention by management accountants are measurement and management. The following two sections highlight relevant literature, including new developments related to making the business case and pursuing improved control packages.

Measurement and making the business case

The case for improved HCM has been made with a focus on individual HC initiatives as well as HC as asset, exploring ways of valuing the collective attributes of employees. Valuation of HC can be cost based, income based or market based (Madhani, 2012; Merriman, 2017). Assessment of HC initiatives versus HC as asset has been described as a managerial accounting versus a financial accounting perspective (Flamholtz et al., 2020). Critiques of attempts to have HC assets reflected on balance sheets have concluded that determining reliable financial valuations of employees, individually or in aggregate, is an 'option (that) has been rejected by the majority of accounting academics who have had an interest in accounting for people for close to half a century' (Roslender & Monk, 2017, p. 53).

As interest in new aspects of HC emerge over the years, studies on the related return on investment (ROI) abound. Yet, despite the popularity of new initiatives such as wellness programmes since the 2000s, surveys found that HR departments often continued to invest in these without knowing the ROI (Barlow & Weber, 2012). There is no shortage of academic studies on the relationship between HCM (including HR analytics) and organisational performance (Marler & Boudreau, 2017; Van De Voorde et al., 2012). Human capital management research has also taken up multilevel analysis since the 2000s, addressing employee-level and organisational-level outcomes (Peccei & Van de Voorde, 2019). The research involved examination of mediating variables such as employee satisfaction, as well as use of employee surveys to aggregate employee sentiments and correlate these with macro level indicators such as profit.

The mapping of cause and effect between HC initiatives and financial results typically define a framework that sets out key variables involved. The Actions-to-Value Framework (Ballou et al., 2010) starts with managerial actions and related non-financial measures, which is then translated into financial indicators. Complications include time lags and uncertainty about the direction of causality. Business case mapping seeks to address the 'poorly articulated logic' that was found to undermine ROI calculations for healthy workplace programmes in the 2000s (Dimoff et al., 2014). Ultimately the search for meaningful metrics and mapping the business case has pointed to two approaches, the HRA tradition focussed on utility analysis and the HR strategy tradition focussed on overall organisational performance (Dimoff et al., 2014). Some seek to track linear, cause-and-effect relations that lead to certain economic results. Aware of the complexity of HC, others explore the dynamic involved in decision-making processes and use qualitative indicators in examining complex systems (Malina et al., 2010).

The strategy tradition is certainly more open to working with 'soft numbers', proxy indicators and what appears to be logical associations. During the 2000s, HR saw much interest in hard numbers such as participation in training, remuneration and turn-over rates. More holistic approaches since the 2010s have led to greater interest in softer factors such as relationships and well-being. The coronavirus disease 2019 (COVID-19) pandemic strengthened awareness of the health dimension, as well as the importance of preventative and leading indicators from 2020 onwards (Grossmeier et al., 2020; Ho & Brown, 2020). But measuring soft benefits is challenging, as they are difficult to quantify and have long-term financial impacts (Kreiss et al., 2017). Prioritising soft factors and analysing them in proper context points to the domain of management and having strategic control systems in place.

Management and applying innovative control systems

Introducing bottom-up approaches and multidirectional feedback, current-day 'agile HR' moves away from conventional standard operating procedures, control systems and top-down monitoring. The trend towards agility has also had its impact on MA. Interest in interactive tools in management control systems (MCSs) is influenced by a keen awareness of the need for organisational innovation (Lopez-Valeiras et al., 2016). The move from command-and-control to more flexible approaches has been described as an ongoing 'tension between control and flexibility' (Henri, 2006).

Perceptions of management control have also changed from it being detrimental to innovation, to it being beneficial to innovation and contributing to strategy development (Gond et al., 2012). The new perception explores approaches such as informal and indirect controls. Complementary use of formal and informal controls includes combinations of different styles of control use, for example, participative and empowering (Fagerlin & Lövstål, 2020). Digital technologies enable hybrid approaches in which flatter organisation, social controls and autonomy are more prominent. Survey questions can also be forward looking and provide the basis for an ongoing conversation (Buckingham & Goodall, 2019).

As our case companies will illustrate, not all social controls are informal or unplanned. While informal controls may not be explicitly pre-specified, managers can choose to intentionally steer them for the sake of advancing certain goals (Cardinal et al., 2017). This contrasts the view that being 'unplanned' is a key feature of informal controls (Tucker, 2019). Exogenous developments such as a global pandemic may cause informal control to increasingly display deliberate design and management intention. The COVID experience also raised interest in analytics on social networking among remote working employees.

New mechanisms involved point to different categories of controls, such as planning, measurement, procedures and social norms (Bedford & Malmi, 2015). Research on different configurations of controls highlight the existence of control environments such as 'hard' or 'soft MCS' (Tucker, 2019), reflecting degrees of deliberate design. The control package help employees to better understand how their work relates to their organisation's value chain (Wouters & Wilderom, 2008). The MCS enables the implementation of strategy, facilitating goal congruence and alignment (Tucker & Parker, 2015). It aligns the mindset of operations managers and financial professionals (Farris & Haskins, 2016), shaping a more holistic understanding of asset utilisation and value creation.

Limited attention to the conceptualisation of the overall MCS points to weak coordination and integration, accidental and 'loose coupling' among subsystems (Otley, 2016) as well as unit protectionism (Dimes & De Villliers, 2021). Management control systems in many organisations involve a package of control elements that have been separately designed and implemented without coordination (Mundy, 2015). The ideal control package needs to address both task-oriented technical dimensions and people-oriented social dimensions (Gackstatter et al., 2019). Companies need to find their best configurations of different control types, a question influenced by factors such as industry sector (Bedford et al., 2016). In the service industries with their high levels of strategic HC, one can expect greater use of non-traditional controls. What would be the case in a European IT firm and bank?

Methodology

Case study research and data analysis

The analysis in this paper is based on case study research on a German IT firm and a Dutch bank. Primary qualitative data were collected through semi-structured interviews conducted with senior managers from both the companies over 7 months. The study also involved qualitative desk research, revisiting existing theory about HC, and the role of MA. This was done to inform an inductive, interpretative approach in drawing lessons from the experience of two service industry companies. Based on the literature review, established and emerging roles for MA in HCM were defined and used as reference in assessing the experience of managers at the two case companies.

While grounded theory is a popular research method followed in qualitative research in accounting (Gurd, 2008), the study did not follow core canons of grounded theory such as following an iterative approach in data collection. Based on a literature study of new developments in HC and MA, a predetermined list of open-ended questions was prepared, and semi-structured interviews were done with senior managers. Following the interviews, a thematic analysis was done to determine significant insights and assess the applicability of theoretical perspectives from the literature covered. Interview feedback was complemented by examination of related reporting published by the companies, in particular their reporting on HC, related performance and valuation.

Online video interviews were done with the senior managers of each company (see Appendix 1), managers from HR, accounting and other departments. The 1-h interviews were recorded, transcribed, annotated, re-read several times, reviewed and analysed to identify common themes that emerged. Interviewees were presented with 10 questions related to organisation, valuation, processes and systems. They had the opportunity to respond more extensively to questions directly related to their responsibility areas. This enabled the researcher to obtain a complete overview and views from different departments. Feedback from diverse specialisations also allowed for comparison across two companies known for their innovative HC practices.

Attributes of the two industries involved

The service industries examined display firm-specific HC required for a particular sector. This means ongoing development of employees is critical. The use of select SMA techniques and applying them to HC by the two companies may be influenced by their sector, level of uncertainty and the type of strategy they pursue (Cescon et al., 2019). Both the IT company and the bank pursue a strategy of differentiation and operate internationally. The former has a strategy of expensive but high-quality services, while the latter as one of the three main banks in The Netherlands is seeking to differentiate itself with its sustainable finance offer. The IT firm faces the uncertainty of high-paced innovation and tight competition, while the bank faces uncertainty related to the implications of the digital revolution and economic disruption caused by systemic risks.

The attributes of 'strategic HC' (Widener, 2004) can be applied to the IT and banking sectors. Both display high levels of intangible assets. One would expect the IT sector to display high behavioural uncertainty and firm specificity (unique software knowledge). In the case of banking, one would traditionally expect low behavioural uncertainty (highly regulated industry) and low firm specificity. Yet, the digital revolution and sustainability agenda is changing this dynamic. A bank that is highly competitive may display higher behavioural uncertainty (routine tasks automated, customer-facing tasks more varied) and higher firm specificity (unique specialisation in certain areas of sustainable finance).

One would expect the IT firm to be well positioned to lead innovation in HRA, as past surveying on the use of advanced cost management systems in the German-speaking countries signalled the value of being supported by a highly integrated information system (Krumwiede & Suissmair, 2008). This points to good use of an enterprise resource planning (ERP) system, including its HR and MA modules. Research on a Canadian IT company in the 2010s highlighted the value of select HRM practices in securing the retention of expert employees (Renaud et al., 2015). Expert employees appreciate a stimulating and healthy work environment, implying physical and mental health. The sector understands that digitalisation can lead to increased stress and boundary-blurring (Nöhammer & Stichlberger, 2019).

Medical schemes at the US companies have caused their health and wellness programmes to be popular subjects of ROI studies. A health management initiative at Citibank showed that for every dollar spent on healthy workplace programmes, their medical and absenteeism costs fell significantly (Baicker et al., 2010). Looking at improved productivity, HC as an input factor is very telling in banking as this is a sector that tends to have little research & development (R&D) spending. Analysis of banks in Turkey and Australia has found that over several years HC efficiency and capital employed efficiency (including employment costs) have a positive correlation with the return-on-assets (ROA) ratio of banks (Joshi et al., 2013; Ozkan et al., 2017).

The case of two European service industry firms

Background

The German IT firm has over 100 000 employees and offices in 130 countries, while the bank has close to 20 000 employees based mainly in The Netherlands and other European countries. Both have implemented flagship initiatives over the last decade to support the employee experience, well-being and development. This included developing statements of core values and cementing a certain organisational culture. At the IT firm, its 'How We Run' principles are seen as providing continuity and focus, including emphasis on having a cooperative culture. At the bank, its 'Together & Better' performance management system is built on ongoing dialogue, regular check-ins and emphasis on aspects such as personal development and well-being.

Both companies have seen how the COVID experience expanded the focus on employee well-being initiatives to greater consideration of mental health and online support of employees working remotely. The IT firm has run a Business Health Culture Index (BHCI) for over 10 years, one developed based on questions about, for example, work-life balance asked in regular employee surveys. With the help of a consulting firm, it developed an index that enabled unpacking the business case and identifying the financial benefits that result from employee health activities. Also with the help of external consultants, the bank since 5 years assessed the value of its HC. This process led to the publication of an annual Impact Report, which includes metrics related to impact on its HC.

In the case of both institutions, their senior accountants have been challenged in showing the ability to work with non-financial information and co-steering the business. A chief controller at the bank described the expanding skillset and argued that: 'controllers in the business lines have quite a degree of freedom to take decisions and co-steer the business' (P11).

There is the need for understanding sustainable business when fulfilling tasks such as developing the organisation-wide key performance indicator (KPI) architecture. The chief accountant at the IT firm said: 'the task of our Intelligent Data & Analytics (ID&A) group is to make sure people talk about the same KPIs when referring to non-financial indicators such as employee engagement …' (P4).

With this comes a change in organisational culture, notably when sustainability is one of the key pillars of Group Strategy. An engagement manager at the bank elaborated:

'All units now have co-ownership of a strategic subject, and sustainability expertise must be built across the whole organisation … But there is still a mismatch in that management accounting is often seen as accounting for everything with a Euro sign in front of it and nothing more. The rest, such as People and GHG emissions, is seen as other people's work. Change is happening in the heads of Finance as investors and regulators start to ask more questions.' (P7)

Understanding of finance and accounting therefore needs to grow to also understand relevant business and sustainability (including HC) factors. This includes comprehension for the positioning of financial and non-financial KPIs on an equal footing.

The business case and valuation

The IT firm has spent the past decade refining the business case, with HR functions taking the lead. Using linear regression analysis to determine the financial impact of non-financial indicators, the IT firm knows that one percentage point change in its BHCI impacts the operating profit of the company by EURO 90-100 million. One sustainability executive commented:

'Reporting the financial consequences was a game changer. Managers now think of impact they have on their people as impact also on financial performance …' (P2)

Common issues raised with respect to making the business case are complexity in tracing cause-and-effect, difficulties with measurement, and accepting the fact that this involves a journey of trail-and-error over many years. The IT firm developed and improved its BHCI over 10 years. It developed a mapping of cause-and-effect indicators that progress from: (1) HC activities that support health (including sport and flexitime), to (2) related change in behaviour and perception, to (3) subsequent company impact (including employee productivity and retention), to (4) eventual impact on financial KPIs (revenue and profit).

Inevitably, the development of the business case is an iterative process, involving diverse departments. The feedback from the IT firm is that:

'[S]ome issues are hard to measure and defining correlations can be complex … to some extent there is simply a gut feeling that doing certain things make good sense.' (P2)

'Tracking the cause and effect involves collaboration between the human resources, health and sustainability departments… the accountants are not so involved yet …' (P1)

Going beyond flagship initiatives to an organisation-wide systems approach requires ongoing research and analytics. At the bank, this includes collaboration with a local university, where research has found that the best predictor for customer satisfaction is the employee net promoter score (eNPS). The HR director commented:

'If your employees are happy, so will be your customers. Of all possible antecedents, the eNPS is the best predictor. That implies a lot of money.' (P12)

At the IT enterprise, HR has developed a new KPI architecture with three levels of indicators, including a top level that covers the company-wide aspects such as employee engagement and a middle level of strategic impact measures such as talent pipeline indicators. The head of People Insights noted:

'We see HR managers struggle in making the business case. To advance measurable results, we invested a lot in creating a new KPI architecture. Managers recognise the need to define metrics that help them see what happens if option A or B is pursued, for example how satisfied the employee is with different compensation options.' (P3)

Is any valuation of HC at the companies cost based, income based or market based? From their responses, the accountants believe it is cost based. The subject experts, such as those working in HR, express an ideal in which the approach of their companies is rather a combination of these factors. With both companies, this is based on the experience of their flagship HC projects. The IT firm knows what a change of 1pp in its BHCI implies for operating profit. What the accountants underline is the need for credible and comparable data, which requires a standard nomenclature, recognised methodology and common taxonomy. Even though the cost-based approach is dominant, certainly in international financial reporting standards (IFRS) reporting, the accountants do not see this as inhibiting long-term investment in HC.

In 2018, the bank had a study done on the impact of investments such as EUR 50 million spent annually on training. An external consulting firm calculated EUR 600 million in HC value. Building on this, the bank started to publish its Impact Report. Related to impact on HC, its own and that of organisations in its value chain, the report covers flow metrics such as the well-being effect of employment, salary increases following training and learning and the value of employee time spent on work. The impact reporting has helped to advance thinking in terms of: 'human resources not just human costs' (P7). While the impact reporting content is not an integral part of how management steers the ship, Board discussions have recognised HC as a key material topic. The HC impact research has been followed by more investing in working conditions and well-being. While the accountants view HC as hard to measure, one reporting director recognised:

'One can have an indication, for example if it is green or red … the value of the HC valuation study was that it came up with a number, to start the discussion … The business is led by beliefs. This needs to be balanced by risk and finance, challenging beliefs on the basis of facts and knowledge …' (P10)

Discussing financial versus non-financial and 'soft metrics', one HR director commented:

'With the help of new digital functionalities, non-financial data can today be hard and reliable. The soft metrics are very relevant. When you don't develop these types of metrics, you're navigating blind.' (P12)

Information technology applications enable large organisations to produce and analyse data at scale. This needs to be accompanied by improvement in processes, getting more disciplined and systematic to deliver reliable sustainability performance data. The reporting director stated:

'Finance people don't own these numbers, and therefore they don't believe them. Organisation around sustainability information is less structured than financial processes. Accountants need to become more involved for these processes to become more reliable.' (P10)

The improvement of processes and systems needs to be reconciled with new agile working approaches that prioritise autonomy and social interactions. As one head controller commented:

'Mapping the cause and effect from motivation to financial performance is challenging. Consider FTEs and cost. Headcount may decrease, but again the workload increases. It is very difficult to do a proper analysis here. With the agile approach we can fix the capacity, say this is the capacity with which we are able to steer on business value. But performance measurement in an agile environment is difficult. You need to reach a certain maturity level …' (P11)

Evidently financial and non-financial professionals need to develop a greater understanding of the meaning of data emerging from their respective work areas. The HR manager concluded:

'Finance and Control must recognise that performance has much to do with people. A company is a group of people, and financial results have much to do with people. But that is not a commonly taught view in financial strategy.' (P12)

Evolution in controls

Controls and MCS imply bread and butter tasks of management accountants in Germany and The Netherlands. Banking has no shortage of formal controls related to compliance. Operational non-financial risk reported by the bank includes compliance risk and HR risk. The period post-financial crisis has seen change in how management controls are pursued, with accountability enforced at the level of not only outcomes (results) but also process (behaviour). Interviewees confirmed more focus on process instead of just financial outcomes. One reporting director recognised the distinct role of process:

'Important is not just the "what" in terms of financial outcomes, but more the "how". Behavioural aspects are really important here, the processes and systems linked to enforcing desired behaviour.' (P10)

At the IT firm, where almost a third of the workforce is based in R&D, the role of autonomy and innovation is highly appreciated. As a vice president commented:

'Within the framework of goals agreed by management, the employee has flexibility to decide what is best for a project and the company. You need mature employees with the personality and capability to decide and not simply follow what the boss says … this requires a high level of trust.' (P1)

The IT firm is committed to maintain its entrepreneurial spirit. It sees itself as: 'not a control-driven organisation but a network-based company' (P6). Building on feedback from thousands of employees in its surveys, it sees positive interrelations between its Leadership Trust Index, Employee Engagement Index and BHCI. Autonomy is accompanied by alignment, so the employee has clarity on the boundaries and strategy within which to operate.

Managers at the IT firm sees dynamic controls reflected in its open feedback culture, where seniority and hierarchy are not important. The sustainability officer highlighted the different meanings of controls:

'One needs a mix of formal, informal and dynamic controls. Feedback helps to eventually formalise, what are the desired controls and who leads. It is important to distinguish between controls as steering and controlling as a mechanistic function. There is a difference between being a business partner and advisor versus control simply being a senior breathing down your neck.' (P2)

The bank has also put significant effort into developing a culture of continuous feedback, and today it is reaping the fruits of a programme of lean management that was introduced in the 2010s. Its HR Transition Programme emphasised dynamic controls. But there remains tension between the tick-the-box mindset of formal controls and the less hierarchical approach of open feedback that goes with a culture of dynamic and informal controls. As the reporting director explained:

'Finance recognises that one cannot do without soft controls. It is the combination that makes an effective system work. In a crisis people tend to be very focused and there is more emphasis on formal controls. In a growing, experimental mindset one has to emphasise soft controls. On the commercial side, in the business lines, there is more attention to soft controls and less hierarchical ways of thinking. But financial managers always prefer the formal, and always expect a second pair of eyes to look and avoid sloppiness.' (P10)

New technologies enable innovative ways of promoting softer controls. An application on the smartphones of managers at the bank, for example, reminds them daily of compliance and ethical behaviour. It combines both soft and hard controls. New ways of working based on the principles of agile and lean include thousands of employees working in teams with scrum masters that operate as servant leaders. Human resource defines new archetypes of work. Human resource at the IT firm views its BHCI as a good proxy for whether the psychological contract with employees is working. Surveying employees is not only a tool for collecting data. The questions asked, the self-accounting and the manner of follow-up also leave employees with a sense of empowerment. An analytics team at the bank regularly does pulse measurements with over 1000 employees. They pose different questions every time to different people. The approach is complemented by significant investment in the development of employees, including online courses.

The COVID experience led to more intentional design of informal controls such as social events and well-being activities to support the physical and mental health of employees. Both the bank and the IT firm offer employees online activities such as coaching, advice, yoga, and wine tasting. The head of health and well-being at the IT firm commented:

'As we had a comprehensive approach to employee health & well-being in place pre-COVID and provided virtual services before, we did not really have to change the approach. What did change was greater awareness and demand for these services. HR has additionally put after work leisure activities in place …' (P5)

Though greater intentional design may emerge from the top, the extent to which these informal controls become formalised organisation wide, monitored and part of a soft MCS is unclear. It may reflect examples of loose coupling, with innovative activities designed by HR. Management accountants need to be more involved, using their umbrella view to ensure that various activities effectively fit within an overall control package by design. From our case companies, the involvement of MA as a profession appeared limited. As the chief controller at the IT firm described it:

'I have seen with country subsidiaries how employees benefit from offerings such as social events and sport activities. But I don't think activities like going to the gym are monitored or controlled, not at group level. I doubt that these activities are so well established that Control is involved in doing a cost benefit analysis. But we need to ensure that HR hears us …' (P6)

Discussion

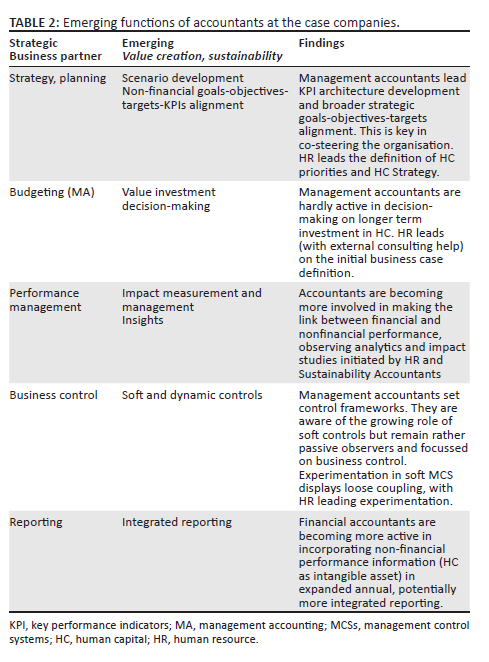

Feedback from the two companies signalled a combination of established and new roles of management accountants, including archetypes associated with having certain expertise and the ability to deal with financial and non-financial information. Accountants at the two companies appear to fall short of taking on emerging functions of their discipline identified (Table 2), roles in areas such as value investment decision-making, impact measurement and soft controls. They may be playing the role of business partner and ad hoc advisor but show limited evidence of acting as information gatekeeper or integrator of HC information. This points to shortcomings in their role in co-steering investment in HC as a strategic asset. Improvement requires an openness to alternative areas of expertise, improving frameworks for integration and a strategic look at organisational culture.

The need for accounting expertise, financial and nonfinancial

While past studies on the role of management accountants have often applied sociological and political analysis to assess the applicability of certain archetypes and self-perceived identities (Goretzki & Messner, 2019), this study has focussed on the task of what needs to get done in advanced approaches to HC management. This points to lessons for the education of different types of accountants and different subdisciplines of accounting that delivers 'hybrid accountants' (Wolf et al., 2015) as our case study has shown.

The application of analytics and accounting expertise (albeit that of external consultants) by the two companies has facilitated the shaping of more insightful accounting information for decision-making, for example, improved clarity on the impact of employee health on earnings and the value of training provided to employees. In this respect, the 'business partner' or co-pilot role of the management accountants involved can expand into more strategic assessment of investment in HC in different businesses. Our two cases also illustrated the limitations of accountants who may have business understanding but lack of expertise in HR. As a result, HR departments have taken the lead in contracting and developing their own analytics capacity, recruiting non-financial data scientists to develop their own people metrics and Sustainability Accounting expertise. In this scenario, the service provider role of the management accountant is one of translating HC metrics into financial metrics and aligning with key organisational performance indicators.

Establishing architecture and frameworks for integration

The IT firm has focussed on the business case behind different HC initiatives, while the bank has sought to determine the value of its HC as asset. In both cases, a key lesson from the experience was 'how' (process) HC creates value and how this can be strengthened. They advanced not only utility analysis but also SHRM by looking at organisation-level performance outcomes, tracing how non-financial performance indicators translate via specified mediating operational variables into strategic financial consequences. The action-to-value frameworks they developed and applied over many years helped to improve their ability to illustrate positive associations and a better articulated logic. By leading the creation of the KPI architecture and relevant frameworks, management accountants establish systems and boundaries within which HR managers can innovate.

While management accountants were hardly active in the business case and valuation initiatives, functional units such as HR played a 'shadow accounting' role. If anything, internal management accountants served as ad hoc challengers to provide a reality check, challenging beliefs with facts. Their role of inhouse gatekeeper needs to strengthen for the initiatives to establish themselves as core business in the eyes of executive management. Management accountants should be involved in improving integrated tracking systems and cost-benefit analysis, advising HC on, for example, considerations behind a focus on HC flows versus stocks. They should also familiarise themselves with the valuation methodologies that can be employed.

Shaping a strategic culture requires hard and soft controls

Responsibilities of MA in management include monitoring and control with tactical consideration of planning, budget and strategy. In fulfilling these functions, management accountants display the role of methodological and organisational experts (Schaltegger & Zvezdov, 2015). Our cases have shown that MA operates in an ecosystem with diverse stakeholders (including HR, operational and financial managers). The role of broker or gatekeeper (Ascani et al., 2021, Schaltegger & Zvezdov, 2015) in the hierarchy is important as senior management accountants have strategic interaction with chief financial officers (CFOs) in steering businesses. Our two listed companies indeed reflect the greater complexity of larger organisations - a contingency factor (Rieg 2018) - for which well-functioning MCSs are critical. This includes MCSs with intentional design that is not mechanistic but dynamic, supporting a culture of trust and innovation.

The evolving MCSs of the IT firm and bank include soft dimensions, showing an interactive and empowering use of MCSs. Employees can self-account and their evaluation involves diverse metrics. While belief controls are built into statements of value, the two companies also intentionally organise social and well-being events to boost employee motivation and social networking. These shape the more sophisticated MCSs one would expect of service industries today. It challenges management accountants to develop an understanding of the dynamic tension between formal control and flexibility, and MCSs that not only enforce discipline but also drive strategy. Management accountants need to work with HR managers in designing and improving soft MCSs to shape the desired business ecosystem.

Conclusion

Our study considered how improved collaboration between HR managers and management accountants can improve the ability of their specialisations to become more integrated and strategic. This includes overcoming obstacles in the advance of HC management, including a lack of knowledge of HR costing and accounting, doubts about the reliability of business case calculations, as well as organisational culture. Based on interviews with senior managers at the German IT firm and Dutch bank, the study considered MA responsibilities related to defining the business case and developing more sophisticated MCSs.

Interview feedback left the impression of management accountants at the two companies playing a strategic role, but falling short of a more advanced, emerging role of conducting multi-capital management and shaping a new understanding of value creation. In as far as they introduce innovative approaches to the control package, the overall impression remains one of loose coupling among subsystems. Human resource departments introduce their own analytics teams, which involve participants from various departments and generate new insights into HC value and impact. However, the analysis is not firmly rooted in the core management of the business. The MCSs involved reflect dormant technical integration but not full integration.

As regard to business case development, the feedback confirmed challenges experienced in working with 'soft' numbers and causal relations that take time. Yet, through their mapping of the business case and HC impact, they illustrate the usefulness of a strategic managerial accounting perspective, one that is not limited to financial statement calculations of 'how much' but also seeking better understanding 'how' HC creates value. In doing this, they confirmed the importance of being able to define strategic associations rather than simplistic causality.

As far as the ideal control package is concerned, feedback from the two companies showed the tension between control and flexibility, between standardisation and innovation. Both companies have gone through processes of introducing agile management, and there is wide recognition of the value of working in teams and a networked way. The accountants interviewed recognised that an effective MCS requires a combination of hard and soft controls. In their own work, they respect working in a culture of ongoing feedback. They do this while appreciating the discipline of financial accounting.

The study highlights important lessons for the development of action-to-value pathways, improving non-financial metrics and purposefully shaping soft MCSs. All of these imply an extended role for the management accountant, including the archetypes of internal consultant, integrator and business partner in co-steering the organisation. There is recognition of the need to become more involved in accounting for non-financial capitals, as well as the need for HR accountants and analysts to learn lessons from the traditional accounting disciplines. The study focussed on two European service industry companies. Future research can examine peers, conducting longitudinal research and collecting feedback from a broader range of practitioners. Future research can also address collaboration between the disciplines of HR and MA, encouraging multidisciplinary research, holistic education and bridging gaps in the science.

Acknowledgements

Competing interests

The author declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

Author's contributions

C.T.v.d.L. is the sole author of this research article.

Ethical considerations

Ethical clearance to conduct this study was obtained from the Stellenbosch University Social, Behavioural and Education Research Ethics Committee (No. SBS-2022-26143).

Funding information

Grant funding by the Institute of Management Accountants (IMA) Research Foundation.

Data availability

Data sharing is not applicable to this article as no new data were created or analysed in this study.

Disclaimer

The views and opinions expressed in this article are those of the author and are the product of professional research. It does not necessarily reflect the official policy or position of any affiliated institution, funder, agency, or that of the publisher. The author is responsible for this article's results, findings, and content.

References

Andreassen, R. (2020). Digital technology and changing roles: A management accountant's dream or nightmare?. Journal of management control, 31(3), 209-238. https://doi.org/10.1007/s00187-020-00303-2 [ Links ]

Ascani, I., Ciccola, R., & Serena Chiucchi, M. (2021). A structured literature review about the role of management accountants in sustainability accounting and reporting. Sustainability, 13(2357), 1-25. https://doi.org/10.3390/su13042357 [ Links ]

Baicker, K., Cutler, D., & Song, Z. (2010). Workplace wellness programs can generate savings. Health Affairs, 29(2), 1-8. https://doi.org/10.1377/hlthaff.2009.0626 [ Links ]

Ballou, B., Heitger, D.L., & Schultz, T.D. (2010). The actions-to-value framework: Linking managerial behavior to organizational value. Management Accounting Quarterly, 11(4), 1-10. [ Links ]

Barlow, R.G., & Weber, D. (2012). Determining the value of wellness programs. Benefits Quarterly, 28(3), 8-15. [ Links ]

Becker, B.E., & Huselid, M.A. (2006). Strategic human resources management: Where do we go from here? Journal of Management, 32(6), 898-925. https://doi.org/10.1177/0149206306293668 [ Links ]

Bedford, D.S., & Malmi, T. (2015). Configurations of control: An exploratory analysis. Management Accounting Research, 27, 2-16. https://doi.org/10.1016/j.mar.2015.04.002 [ Links ]

Bedford, D.S., Malmi, T., & Sandelin, M. (2016). Management control effectiveness and strategy: An empirical analysis of packages and systems. Accounting, Organizations and Society, 51, 12-28. https://doi.org/10.1016/j.aos.2016.04.002 [ Links ]

Bratton, J. (1994). Human resource management in transition. In J. Bratton & J. Gold (Eds.), Human Resource Management - Theory and Practice (pp. 3-31). Macmillan.

Buckingham, M., & Goodall, A. (2019). Reinventing performance management. In M. Buckingham et al. (Eds.), Harvard business review - Must reads on reinventing HR (pp. 47-60). HBR.

Byrne, S., & Pierce, B. (2007). Towards a more comprehensive understanding of the roles of management accountants. European Accounting Review, 16(3), 469-498. https://doi.org/10.1080/09638180701507114 [ Links ]

Cardinal, L.B., Kreutzer, M., & Miller, C.C. (2017). An aspirational view of organizational control research: Re-invigorating empirical work to better meet the challenges of 21st century organizations. Academy of Management Annals, 11(2), 559-592. https://doi.org/10.5465/annals.2014.0086 [ Links ]

Cescon, F., Costantini, A., & Grassetti, L. (2019). Strategic choices and strategic management accounting in large manufacturing firms. Journal of Management & Governance, 23(3), 605-636. https://doi.org/10.1007/s10997-018-9431-y [ Links ]

Delany, K. (2016). Human capital management in complex organizations: Is it time to challenge some conventional wisdom?. International Journal for Research in Management, 1(1), 68-75. [ Links ]

De Loo, I., Verstegen, B., & Swagerman, D. (2011). Understanding the roles of management accountants. European Business Review, 23(3), 287-313. https://doi.org/10.1108/09555341111130263 [ Links ]

Dimes, R., & De Villiers, C. (2021). How management control systems enable and constrain integrated thinking. Meditari Accountancy Research, 29(4), 851-872. https://doi.org/10.1108/MEDAR-05-2020-0880 [ Links ]

Dimoff, J.K., Kelloway, E.K., & MacLellan, A.M. (2014). Health and performance: Science or advocacy? Journal of Organizational Effectiveness: People and Performance, 1(3), 316-334. https://doi.org/10.1108/JOEPP-07-2014-0031 [ Links ]

Fagerlin, W.P., & Lövstål, E. (2020). Top managers' formal and informal control practices in product innovation processes. Qualitative Research in Accounting & Management, 17(4), 497-524. https://doi.org/10.1108/QRAM-02-2019-0042 [ Links ]

Farris, P.W., & Haskins, M.E. (2016). Aligning operations with value-created insights: Facilitating the financial task. Management Accounting Quarterly, 17(3), 17-23. [ Links ]

Flamholtz, E.G. (1974). Human resource accounting: A review of theory and research. Journal of Management Studies, 11(1), 44-61. https://doi.org/10.1111/j.1467-6486.1974.tb00872.x [ Links ]

Flamholtz, E.G. (1999). Human resource accounting, advances in concepts, methods and applications. Kluwer Academic.

Flamholtz, E., Johanson, U., & Roslender, R. (2020). Reflections on the progress in accounting for people and some observations on the prospects for a more successful future. Accounting, Auditing and Accountability Journal, 33(8), 1791-1813. https://doi.org/10.1007/978-1-4615-6399-0 [ Links ]

Frow, N., Marginson, D., & Ogden, S. (2010). 'Continuous' budgeting: Reconciling budget flexibility with budgetary control. Accounting, Organizations and Society, 35(4), 444-461. https://doi.org/10.1016/j.aos.2009.10.003 [ Links ]

Gackstatter, T., Müller-Stewens, B., & Möller, K. (2019). Effective accounting processes: The role of formal and informal controls. Journal of Management Control, 30, 131-152. https://doi.org/10.1007/s00187-019-00281-0 [ Links ]

Gond, J-P., Grubnic, S., Herzig, C., & Moon, J. (2012). Configuring management control systems: Theorizing the integration of strategy and sustainability. Management Accounting Research, 23(3), 205-223. https://doi.org/10.1016/j.mar.2012.06.003 [ Links ]

Goretzki, L., & Messner, M. (2019). Backstage and frontstage interactions in management accountants' identity work. Accounting, Organizations and Society, 74, 1-20. https://doi.org/10.1016/j.aos.2018.09.001 [ Links ]

Grossmeier, J., Imboden, M., & Noeldner, S. (2020). The HERO health and well-being best practices scorecard. Retrieved from https://hero-health.org/wp-content/uploads/2021/01/HERO-2020-Progress-Report.pdf.

Gurd, B. (2008). Remaining consistent with method? An analysis of grounded theory research in accounting. Qualitative Research in Accounting and Management, 5(2), 122-138. https://doi.org/10.1108/11766090810888926 [ Links ]

Hadid, W., & Al-Sayed, M. (2021). Management accountants and strategic management accounting: The role of organizational culture and information systems. Management Accounting Research, 50(1), 100725. https://doi.org/10.1016/j.mar.2020.100725 [ Links ]

Henri, J. (2006). Organizational culture and performance measurement systems. Accounting, Organizations and Society, 31(1), 77-103. https://doi.org/10.1016/j.aos.2004.10.003 [ Links ]

Ho, D., & Brown, A. (2020). How the 2020 Covid-19 pandemic has disrupted wellbeing and work environments. Report published by the Virgin Pulse Institute. Retrieved from https://community.virginpulse.com/covid-pandemic-report

Hossain, U., & Roy, I. (2016). Human capital management: The new competitive approach. International Journal of Commerce and Management, IV(5), 1020-1034. [ Links ]

Jackson, S.E., Schuler, R.S., & Jiang, K. (2014). An aspirational framework for strategic human resource management. Academy of Management Annals, 8(1), 1-56. https://doi.org/10.1080/19416520.2014.872335 [ Links ]

Joshi, M., Cahill, D., Sidhu, J., & Kansal, M. (2013). Intellectual capital and financial performance: An evaluation of the Australian financial sector. Journal of Intellectual Capital, 14(2), 264-285. https://doi.org/10.1108/14691931311323887 [ Links ]

Kreiss, C., Nasr, N., & Kashmanian, R. (2017). Making the business case for sustainability: How to account for intangible benefits - A case study approach. Environmental Quality Management, 26(1), 5-24. https://doi.org/10.1002/tqem.21478 [ Links ]

Krumwiede, K., & Suessmair, A. (2008). A closer look at German cost accounting methods. Management Accounting Quarterly, 10(1), 37-50. [ Links ]

Langfield-Smith, K. (2008). Strategic management accounting: How far have we come in 25 years?. Accounting, Auditing & Accountability Journal, 21(2), 204-228. https://doi.org/10.1108/09513570810854400 [ Links ]

Lopez-Valeiras, E., Gonzalez-Sanchez, M.B., & Gomez-Conde, J. (2016). The effects of the interactive use of management control systems on process and organizational innovation. Review of Managerial Science, 10(3), 487-510. https://doi.org/10.1007/s11846-015-0165-9 [ Links ]

Ma, Y., & Tayles, M. (2009). On the emergence of strategic management accounting: An institutional perspective. Accounting and Business Research, 39(5), 473-495. https://doi.org/10.1080/00014788.2009.9663379 [ Links ]

Madhani, P.M. (2012). Intangible assets: Value drivers for competitive advantage. In G.N. Gregoriou & N. Finch (Eds.), Best practices in management accounting (chapter 10). Palgrave Macmillan.

Malina, M., Norreklit, H., & Selto, F. (2010). Relations among measures, climate of control and performance measurement models. Contemporary Accounting Research, 24(3), 935-982. https://doi.org/10.1506/car.24.3.10 [ Links ]

Marler, J.H., & Boudreau, J.W. (2017). An evidence-based review of HR Analytics. The International Journal of Human Resource Management, 28(1), 3-26. https://doi.org/10.1080/09585192.2016.1244699 [ Links ]

Merriman, K.K. (2017). Valuation of human capital: Quantifying the importance of an assembled workforce. Palgrave Macmillan.

Mistry, V., Sharma, U., & Low, M. (2014). Management accountants' perception of their role in accounting for sustainable development: An exploratory study. Pacific Accounting Review, 26, 112-133. https://doi.org/10.1108/PAR-06-2013-0052 [ Links ]

Mundy, J. (2015). An investigation of the inter-relations between management controls. In Working paper, University of Greenwich presented at British Accounting and Finance Association conference, Manchester, 23-25 March 2015.

Nöhammer, E., & Stichlberger, S. (2019). Digitalization, innovative work behavior and extended availability. Journal of Business Economics, 89(8), 1191-1214. https://doi.org/10.1007/s11573-019-00953-2 [ Links ]

Otley, D. (2016). The contingency theory of management accounting and control: 1980-2014. Management Accounting Research, 31, 45-62. https://doi.org/10.1016/j.mar.2016.02.001 [ Links ]

Ozkan, N., Cakan, S., & Kayacan, M. (2017). Intellectual capital and financial performance: A study of the Turkish Banking Sector. Borsa Istanbul Review, 17(3), 190-198. https://doi.org/10.1016/j.bir.2016.03.001 [ Links ]

Peccei, R., & Van de Voorde, K. (2019). The application of the multilevel paradigm in human resource management-Outcomes research: Taking stock and going forward. Journal of Management, 45(2), 786-818. https://doi.org/10.1177/0149206316673720 [ Links ]

Rashid, M., Ali, M., & Dewan, H. (2021). Strategic management accounting practices: A literature review and opportunity for future research. Asian Journal of Accounting Research, 6(1), 109-132. https://doi.org/10.1108/AJAR-06-2019-0051 [ Links ]

Rashid, M., Ali, M., & Hossain, M. (2020). Revisiting the relevance of strategic management accounting research. PSU Research Review, 4(2), 129-148. https://doi.org/10.1108/PRR-11-2019-0034 [ Links ]

Renaud, S., Morin, L., Saulquin, J-Y., & Abraham, J. (2015). What are the best HRM practices for retaining experts? A longitudinal study in the Canadian information technology sector. International Journal of Manpower, 36(3), 416-432. https://doi.org/10.1108/IJM-03-2014-0078 [ Links ]

Rieg, R. (2018). Tasks, interaction and role perception of management accountants: Evidence from Germany. Journal of Management Control, 29, 183-220. https://doi.org/10.1007/s00187-018-0266-0 [ Links ]

Roslender, R., & Monk, L. (2017). Accounting for people. In J. Guthrie, J. Dumay, F. Ricceri & C. Nielsen (Eds.), The Routledge companion to intellectual capital (pp. 40-56). Routledge.

Schaltegger, S., & Zvezdov, D. (2015). Gatekeepers of sustainability information: Exploring the roles of accountants. Journal of Accounting & Organizational Change, 11(3), 333-361. https://doi.org/10.1108/jaoc-10-2013-0083 [ Links ]

Smith, S.S. (2017). Sustainability: How accountants can add value and deliver results. Management Accounting Quarterly, 19(1), 19-30. [ Links ]

Tucker, B.P. (2019). Heard it through the grapevine: Conceptualizing informal control through the lens of social network theory. Journal of Management Accounting Research, 31(1), 219-245. https://doi.org/10.2308/jmar-52064 [ Links ]

Tucker, B.P., & Parker, L.D. (2015). Business as usual? An institutional view of the relationship between management control systems and strategy. Financial Accountability and Management, 31(2), 113-149. https://doi.org/10.1111/faam.12050 [ Links ]

Van De Voorde, K., Paauwe, J., & Van Veldhoven, M. (2012). Employee well-being and the HRM-organizational performance relationship: A review of quantitative studies. International Journal of Management Reviews, 14(4), 391-407. https://doi.org/10.1111/j.1468-2370.2011.00322.x [ Links ]

Vedd, R., & Kouhy, R. (2005). Interface between management accounting and strategic human resource management: Four grounded theory case studies. Journal of Applied Accounting Research, 7(3), 117-153. https://doi.org/10.1108/96754260580001043 [ Links ]

Wendsche, J., & Lohmann-Haislah, A. (2017). A meta-analysis on antecedents and outcomes of detachment from work. Frontiers in Psychology, 7, Article 2072. https://doi.org/10.3389/fpsyg.2016.02072 [ Links ]

Widener, S.K. (2004). An empirical investigation of the relation between the use of strategic human capital and the design of the management control system. Accounting, Organizations and Society, 29(3-4), 377-399. https://doi.org/10.1016/S0361-3682(03)00046-1 [ Links ]

Wolf, S., Weißenberger, B.E., Claus Wehner, M., & Kabst, R. (2015). Controllers as business partners in managerial decision-making. Journal of Accounting & Organizational Change, 11, 24-46. https://doi.org/10.1108/JAOC-10-2012-0100 [ Links ]

Wouters, M., & Wilderom, C. (2008). Developing performance-measurement systems as enabling formalisation: A longitudinal field study of a logistics department. Accounting, Organizations and Society, 33(4-5), 488-516. https://doi.org/10.1016/j.aos.2007.05.002 [ Links ]

Wright, C. (2008). Reinventing human resource management: Business partners, internal consultants and the limits to professionalization. Human Relations, 61(8), 1063-1086. https://doi.org/10.1177/0018726708094860 [ Links ]

Correspondence:

Correspondence:

Cornelis van der Lugt

cornis.lugt@usb.ac.za

Received: 22 Aug. 2023

Accepted: 13 Dec. 2023

Published: 29 Feb. 2024