Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Southern African Journal of Entrepreneurship and Small Business Management

versão On-line ISSN 2071-3185

versão impressa ISSN 2522-7343

SAJESBM vol.15 no.1 Cape Town 2023

http://dx.doi.org/10.4102/sajesbm.v15i1.612

ORIGINAL RESEARCH

Financial literacy competencies of women in agribusiness and their financial experiences during a pandemic

Lilian GumboI; Ferina MarimuthuII; Edson VengesaiIII

IDepartment of Entrepreneurial Studies and Management, Faculty of Management Sciences, Durban University of Technology, Durban, South Africa

IIDepartment of Financial Accounting, Faculty of Accounting and Informatics, Durban University of Technology, Durban, South Africa

IIIDepartment of Economics and Finance, Faculty of Economic and Management Sciences, University of Free State, Bloemfontein, South Africa

ABSTRACT

BACKGROUND: Women have generally lower levels of financial literacy than their male counterparts, regardless of country of origin. This financial literacy gender gap makes women more vulnerable to the effects of pandemics, like the coronavirus disease 2019 (COVID-19) pandemic.

AIM: This study sought to examine financial literacy competencies of women in agribusiness and their financial experiences during the COVID-19 pandemic.

SETTING: The study was carried out in five agricultural districts namely, Gweru, Masvingo, Mutoko, Mount Darwin, and Mutare. The districts represented Zimbabwean agricultural regions.

METHODS: An embedded mixed methods research design was adopted where both qualitative and quantitative data were collected for analysis. Data were successfully collected from 216 women in agribusiness and follow-up interviews were conducted with 15 informants

RESULTS: Women in agribusiness have poor financial literacy competencies. Most women in agribusiness practised only a range of 2-3 good financial behaviours out of the eight examined concepts, with only 10% scoring above the minimum expected score of six. During the pandemic, women in agribusiness lost income and failed to take care of household and business expenses.

CONCLUSION: Women in agribusiness do not practise vital financial literacy competencies required for financial wellbeing and financial resilience. Therefore, the study recommends the implementation of training programmes that capacitate women with basic financial literacy competencies such as budgeting, saving, and retirement planning.

CONTRIBUTION: Financial literacy competencies were conceptualised together with financial experiences during a pandemic for the first time. More so, in the agribusiness sector which is crucial for economic development.

Keywords: financial literacy; financial behaviour; financial literacy gender gap; financial experiences; financial planning; financial literacy competences; retirement planning.

Introduction

Women represent a crucial and valuable resource in agriculture as farmers, entrepreneurs, and labourers. However, they face more severe constraints compared to men in terms of access to resources like credit, land, and farming technologies (Ugwu 2019). Women constitute 43% of the world's agricultural labour force (Team & Doss 2011), yet the labour burden of women surpasses that of men as it also involves a proportion of unpaid household responsibilities like preparing food, collecting fuel; and they are usually paid less than men for the same work (Ugwu 2019). Women's activities in agriculture range from crop production, food processing, marketing activities, and animal husbandry. Hence, women play a vital role in food production and food security at both the household and national levels (Ugwu 2019). Considering the relevance of women in agribusiness, it is crucial that women are equipped with the proper financial literacy skills needed to manage financial resources. This research prioritises the level of financial literacy of women in agribusiness because of the following reasons.

Firstly, literature has documented a persistent, large, and widening financial literacy gender gap between men and women; thus resulting in poor wealth accumulation between men and women (Bucher-Koenen et al. 2017). Worrisomely, gender differences were also noted among younger women in spite of the majority of younger women having higher education levels and labour force participation. Furthermore, single women like widows exhibited low financial literacy of basic concepts relevant to their day-to-day financial decision. Various authors concur that although financial literacy is low across various countries, there are certain vulnerable groups like women and the young with very low financial literacy who need urgent assistance (Potrich, Vieira & Kirch 2018). The Organisation of Economic Cooperation and Development (OECD) survey of 26 countries in Asia, Africa, and Europe during the coronavirus disease 2019 (COVID-19) pandemic revealed that generally women who are aged between 18-29 years have very low financial literacy compared to other groups and suggested policies targeting these vulnerable groups for financial education initiatives (OECD 2020). Financial literacy can potentially increase individuals' financial resilience against COVID-19 financial shocks and help individuals to make informed financial decisions about saving, borrowing, retirement planning, budgeting, managing debt, and making more informed purchase (Klapper & Lusardi 2020). However, consequences of financial ignorance involve poor selection of loan options, incurring higher interest, paying of high transactional fees, over-indebtedness. and falling victim to financial frauds (Lusardi 2019).

Secondly, the COVID-19 pandemic revealed that women were the most vulnerable people during the pandemic as they were the primary providers of childcare and home-based care for infected individuals (O'Neill & Gillen 2021). Globally, the COVID-19 pandemic caused a direct reduction in employment, an increase in international transaction costs, a loss of income, a decline in travel and a decline in demand for services, which required physical proximity (O'Neill & Gillen 2021). Individuals and households were not financially prepared for the adverse effects caused by the pandemic because of a lack of savings for emergencies and low financial literacy (Chhatwani & Mishra 2021). Resultantly, most households failed to meet basic needs like food and medical expenses (Akinleye et al. 2020). The pandemic also resulted in the adoption of advanced financial technology innovations, which replaced the distribution of financial services from physical interactions to virtual banking (Mahmood-ur-Rahman 2022). Added to this, the adoption of blockchain, distributed ledger technologies, big data analytics, artificial intelligence (AI), and machine learning (ML) in the financial services industry is on the rise.

Finally, the level of food insecurity in Zimbabwe amid pre-COVID-19 macroeconomic challenges and financial exclusion among agribusiness farmers is quite high. Mutambara (2016) documented high levels of financial exclusion among smallholder rural farmers in Zimbabwe. About 70% of the farmers surveyed had no bank accounts and this was a major barrier to loans access and other financial services. Farmers with access to loans lacked faithfulness in loan payments and thereby supporting the reluctance of financial institutions to extend loans to farmers. Famine Early Warning System Network (FEWSN) forecasted food insecurity among various districts because of below average 2021-2022 crop production (FEWSN 2022). Smallholder farmers rely more on grain sold on the markets at a time when prices remain volatile and out of reach for poorer households. Famine Early Warning System Network (2022) argued that household coping strategies usually include reducing consumption, skipping meals, labour migration, selling more livestock, casual labour, petty trade, and informal mining.

Although authors like Bonga and Mlambo (2016) conducted a survey of methods that can be used to improve financial literacy among women in Zimbabwe, they did not assess current financial literacy competencies. There remains a gap in the assessment of financial literacy competencies of women in agribusiness in Zimbabwe and their financial experiences during the COVID-19 pandemic. Around 70% of the Zimbabwean population derives its livelihood from agriculture-related activities and most of this population are women who are usually left at the farms and family homesteads while men migrate to towns and neighbouring countries in search of employment.

The concept of financial literacy is behaviour based, and thus a financially literate competent individual should be able to make sound and informed financial decisions. This study adopted OECD (2020) conceptual framework, which measured financial behaviour through assessing an individual's involvement in financial decision-making, budgeting, saving, emergency preparedness, setting financial goals, retirement planning, and financial resilience.

The rest of the paper is organised as follows: section 'Literature review' reviews literature, section 'Research methods and design' presents research methodology, followed by discussion of results in section 'Results and discussion'. The last section concludes and provides recommendations of the study.

Primary objective

To determine financial literacy competencies of women in agribusiness and their financial experiences during the COVID-19 pandemic.

Secondary objectives:

-

To examine the financial literacy competencies of women in agribusiness.

-

To determine the financial experiences of women in agribusiness during the COVID-19 pandemic.

Literature review

There is no consensus in the literature on the definition of the concept of financial literacy. Financial literacy was primarily defined as a form of financial knowledge required to inform financial decisions (Huston 2010). However, propositions of the prospect theory, the theory of reasoned action, and the theory of planned behaviour proved that there are other factors crucial for effective implementation of knowledge like intentions, attitude, and psychological biases. Organisation of Economic Cooperation and Development (2018) developed a comprehensive definition by describing financial literacy as a combination of awareness, knowledge, skill, attitude and behaviour necessary to make sound financial decisions, and ultimately achieve financial well-being. However, the definition does not recognise the evolving nature of the concepts required to adapt to continuous changes in financial markets. This study defines financial literacy as an evolving state of competency that enables each individual to respond effectively to ever-changing personal and economic circumstances (Kadoya & Khan 2017). In the midst of the COVID-19 pandemic, financial institutions are digitalising their services and operations, leading to the introduction of complex financial services and a change in the financial landscape to suit the new normal. Accordingly, the need for acquiring new financial competencies and recognising financial literacy as an evolving and ever-changing financial capability.

The concept of financial literacy competencies in this study was guided by Ando and Modigliani theory of the lifecycle hypothesis (Ando & Modigliani 1963). The theory postulated that individuals generally maximise utility subject to available income and resources. However, the individual utility was assumed a function of aggregate consumption in current and future periods, thus individuals allocate their resources for both current and future needs (Ando & Modigliani 1963). The life cycle hypothesis was categorised into three stages where in the early life of an individual there is negative net saving, followed by net saving in the working years, and finally dissaving in the retirement age (Ando & Modigliani 1963). Reilly and Brown (2012) applied the theory and argued that during childhood, adolescence to emerging adulthood, individuals grow physically; strive to get an education and seek employment, mainly to satisfy current needs. However, middle-aged individuals, between 40 years to 65 years, accumulate wealth for use in the future as these individuals have already bought cars, and houses and have already paid fees loans in the consolidation phase. In the spending or retirement phase, individuals survive from savings made in the past (Reilly & Brown 2012).

Styles (2018) considered budgeting, saving, retirement planning, and wealth accumulation as the most crucial financial literacy competencies that a financially literate individual should be able to perform. In the same vein, OECD (2020) added the competence of financial well-being and financial resilience. Considering the existence of global pandemics and financial crises, the OECD (2020) argued that financially literate individuals' capabilities in budgeting, saving, and debt management should capacitate them to prepare for financial emergencies and live a comfortable life. Madura (2014) considered saving as a primary step for wealth accumulation because financial assets like houses and other long-term investments cannot be bought through impulse buying but through deliberate saving. Because of changes in the nature of pension schemes from defined benefit to defined contribution, where pension pay-outs depending on the amount of money an individual contributes and the performance of the pension scheme investments, retirement planning is crucial (Lusardi 2019). Tomar et al. (2021) documented a trend of poverty among women after retirement. Hence, the need to examine the existence of such competencies among women. Chen, Jiang and Liu (2018) documented high loan defaults and poor investment assessment among women in the peer-to-peer lending marketplace in China. Women were likely to default; and even if they invested money in the loan pool the loans invested by female investors were more likely to default and have lower loan returns in the future than loans invested by male investors (Chen et al. 2018). Benefits of financial literacy include making informed decisions, wealth accumulation, retirement planning, debt management, financial resilience, financial inclusion, and reduction in poverty (Grohmann, Khuhs & Menkhoff 2018; Lusardi 2019; OECD 2020).

Klapper and Lusardi (2020) documented the existence of a financial literacy gender gap across nations and demographic environments. The authors measured financial literacy of 150 000 respondents randomly selected from more than 140 nations, and established that just one-third of the surveyed population were financially literate and financial literacy varied with country, region, age, income, and government regulations. Across all the surveyed countries, women, the poor and those with low levels of education recorded lower financial literacy. These results concurred with Niu, Zhou and Gan (2020) who established that women, the elderly, and the under-educated people in China lacked financial knowledge. Bottazzi and Lusardi (2020) further investigated the existence of gender differences in financial literacy among high school students in Italy. The study established that there are large gender differences in financial literacy among the young across all regions in Italy, and gender differences in financial literacy were related to parental background like the role of mothers, the social and cultural environment, and the family structure. These results were in tandem with the propositions of the family financial socialisation theory by Gudmunson and Danes (2011), which postulates that through socialisation and discussing financial issues with parents, children learn financial concepts, attributes and skills that can influence their financial behaviour.

In contrast to many studies that documented the existence of a gender gap in terms of financial literacy, Grohmann et al.'s (2021) study of middle-class women, who earned at least a minimum wage in Bangkok, Thailand, established that women showed the same high level of financial literacy as men, in terms of financial knowledge and financial behaviour. The authors argued that the countries' gender equality principles in school enrolment, involvement of women in financial matters and high employment ratios of women explain the missing financial literacy gender gap (Grohmann et al. 2021). Thus, providing equal opportunities in education, employment and household decision-making can assist in closing the gender financial literacy gap. However, Bucher-Koenen et al. (2017) established gender differences among younger women in spite of the majority of younger women having higher education levels and labour force participation. An in-depth analysis of the influence of gender on the components of financial literacy showed that gender has a strong influence on the financial behaviour component of financial literacy while age influenced financial knowledge and the level of education on both financial knowledge and behaviour (Cossa, Madeleno & Mota 2022). Thus, demographic factors have different influences on financial literacy. Authors usually examine the influence of demographics on financial literacy instead of analysing its influence on individual components of financial literacy.

The agricultural sector has not been an exception to the effects of the COVID-19 pandemic. Literature documented that COVID-19 mitigation measures such as mandatory closure of some sectors and limited working hours for essential sectors contributed to more financial harm than that caused by health guidelines (Zhou et al. 2020). These mitigation measures caused reduced food consumption (Hammond et al. 2022), labour hiring challenges, contraction in vegetable production, price volatility (Kai, Yu & Zhou 2023), high levels of food insecurity (Stephens et al. 2022), and increase in the cost of production (Rahman et al. 2022). Hammond et al. (2022) cited the closure of farm markets, low sale price, low demand, buyers not visiting the market, care burden, and low remittances as major causes of income losses among smallholder farmers. Food purchase disruptions were caused by a lack of cash, high prices, a lack of stock, closed markets, social distancing and a lack of transport among smallholder farmers in Burundi, Kenya, Rwanda, Tanzania, Uganda, Vietnam, and Zambia (Hammond et al. 2022). Akinleye et al. (2020) documented worsening and devastating food insecurity and fall in income among Nigerian households during the COVID-19 pandemic. Food is a basic human need for their survival and therefore, a lack of it threatens the life of the individual. In the same vein, Osita, Kekeocha and Ojimba (2020) established that travel restrictions related to the pandemic negatively affected small to medium enterprises' importation of goods, the exportation of manufactured products, marketing of products, and incomes.

Literature has documented the existence of a gender gap in financial literacy and the resultant poor wealth accumulation, poverty during retirement, indebtedness, and poor financial decision-making among women. Added to this, women were more vulnerable to the effects of the recent COVID-19 pandemic (O'Neill & Gillen 2021). Women constitute 65% of the smallholder farmers in Zimbabwe; therefore, they are the main contributors to food production and food security in the country (Mazhawidza 2010). However, their financial experiences and competencies have not yet been explored in a Zimbabwean cultural and societal setting.

Research methods and design

Research methodology relates to the various steps that are generally adopted by a researcher in studying the research problem along with the logic behind the methods (Kothari 2017). This section explains the study design, sampling procedures, data collection procedures, validity and reliability issues, and ethical considerations.

Study design

The study employed a mixed method research approach where both qualitative and quantitative research methodologies were employed to allow data triangulation. An embedded mixed-method research design was adopted where questionnaires were first administered to measure financial literacy competencies and later a qualitative strand of follow-up interviews were conducted among women sector leaders to investigate financial experiences during the COVID-19 pandemic.

Setting

Zimbabwe's agricultural activities depend on climatic conditions like rainfall and temperatures across the country. Thus, the total population was first categorised into five clusters that represented the five agricultural regions in Zimbabwe; and from these clusters, five districts were randomly selected through the fishbowl draw randomisation technique. The selected districts included Mutare, Mt Darwin, Mutoko, Gweru, and Masvingo.

Study population

The Ministry of Lands, Agriculture and Rural settlement (2018) and Scoones et al. (2011) documented that there are 1 304 000 commercial and smallholder farmers in Zimbabwe. Because the total population was widely spread, multi-stage sampling was used to demarcate the population into five agricultural region or clusters. Through the fishbowl draw randomisation technique, one agricultural district was selected from each cluster namely, Mutare (28 707 farmers), Mt Darwin (25 704 farmers), Mutoko (39 310 farmers), Gweru (29 600 farmers), and Masvingo (48 900 farmers). Women constitute 65% of the communal farmers in Zimbabwe (Mazhawidza 2010); however, because of previous communal land laws and uneven distribution of land between men and women during the Fast Track Land Reform Programme, women usually own land through their spouses and sons. In most cases, men were the ones with names registered on the offer letters/permits issued to new settlers by the government (Scoones et al. 2011). Therefore, the study estimated a population of 111 944 (0.65 × [28707 + 25704+39310 + 29600 + 48900]) agribusiness women in Zimbabwe.

Using Yamane's (1967) sample size formulae which states that n = N/(1 + N (e2); where n is the sample size population, N represents total population and e represents margin of error, the sample size population was calculated as:

n = 111,944/(1 + 111944 (0.52) = 400.

Therefore, a sample of 400 was considered for women in agribusiness and questionnaires were self-administered by the researcher and research assistants. Research assistants were trained on ethical issues, research fundamentals, and what was expected of them in the field. Quota sampling was then used in the selection of the actual research population considering a fair representation of every district. Concerning qualitative interviews, 15 interviews were successfully conducted. The sample size was determined by the saturation of information during data collection. Wide ranges of questions were asked to allow an in-depth investigation.

Data collection

This research adopted and adapted financial behaviour questions from the OECD (2018) toolkit. Financial behaviour questions were considered as they directly reflect practical financial literacy competencies (Gumbo, Mutengezanwa & Chagwesha 2022). Hence, this study only adopted questions related to financial behaviour to assess the financial literacy competencies of women in agribusiness. The questions have also been adopted by Mutengezanwa (2018), Kadoya and Khan (2017), and Feng and Reich (2021).

Validity and reliability: To ensure face and content validity, each question formulated showed a logical link with an objective in the study. The instrument was also sent to a panel of academic experts in the field of personal finance to ensure that the instrument covered the full range of the concepts being measured. The criterion used in this research was adopted and compared to already established studies such as OECD (2018 & 2020) and Lusardi (2019). Organisation of Economic Cooperation and Development (2018 & 2020) questions that were adopted in this study are internationally accepted as reliable and valid measures of financial literacy, as the questions have been tested and corrected over the years (Feng & Reich 2021; Kadoya & Khan 2017; Mutengezanwa 2018). The research triangulated qualitative and quantitative data to ensure the internal validity of the research. A pilot study was first conducted among a population of 50 respondents selected purposively for testing the reliability of the questionnaire.

Data analysis methods

The questionnaire was checked for completeness and answers from related questions were checked for consistency. Out of the questionnaires distributed, 238 questionnaires were returned. However, only 216 questionnaires were usable after data cleaning; therefore, the response rate was 72%. A response rate above 50% is generally acceptable for questionnaire surveys (Nulty 2008).

Analysis of quantitative data: Categorical information from the questionnaire was coded into numerical values for quantitative analysis. Concerning demographic variables, the data were coded based on the scale used to collect data (nominal, ordinal or ration). Concerning the eight questions on financial literacy competencies, a score of one was awarded for a correct answer while a score of zero was recorded for an incorrect answer. Continuing from this point, a numerical financial behaviour score was developed to measure the financial behaviour literacy of women in agribusiness. Out of the eight questions ranging from financial decision-making, budgeting, saving, emergency preparedness, setting financial goals, retirement planning and bad farming season resilience, a composite financial literacy score was created. According to OECD (2016, 2018, 2020), an individual should score above 70% to be considered financially savvy for the examined concept. Only individuals who scored above six out of the eight examined questions were considered financially literate. Data were analysed by IBM SPSS (Statistical Package for the Social Sciences) version 27 with descriptive statistics and inferential analysis used to describe the data.

Analysis of qualitative data: Qualitative data from interviews were analysed separately through a thematic process, and emerging patterns, themes, and sub-themes from qualitative information were identified for analysis. Once the main themes that emerged from the descriptions given by respondents were identified through content analysis, a code was then assigned to each theme, and a count of how frequently each theme has occurred was recorded for analysis. A codebook with a set of rules for coding was developed and documented for consistent application. After pretesting the code book, coding was done on an excel sheet for IBM SPSS analysis.

Ethical considerations

Ethical clearance to conduct this study was obtained from the Durban University of Technology, Research Ethics Committee (FREC).

Research participants of this study related to women in agribusiness who were selected through sampling procedures discussed above to provide information to help the researcher gain an understanding of the phenomenon under study. Before collecting information, the researcher obtained an ethical clearance of the relevant faculty. Participants were provided with adequate information on the purpose of the research, information being sought, how the study will affect them, and how they were expected to participate. Written informed consent from research participants was also obtained.

The type of research did not cause any harm, discomfort, harassment, or invasion of privacy on the part of the participants. However, because of COVID-19, World Health Organization (WHO) and the Zimbabwean government health guidelines were followed throughout the data collection process. The letter of information also provided additional information about social distancing, sanitisation, and wearing of masks during the research process. The researcher ensured the confidentiality of research participants by protecting and disassociating letters of consent from the questionnaires. The information gained from the research was used for research purposes only, and the researcher maintained objectivity in reporting research findings. No reward or inducements were provided to participants before and after the research process.

Results

Research findings are presented, analysed, and discussed in this section. Quantitative data were analysed through descriptive statistics, and graphs, while qualitative data were analysed through content and thematic analysis.

Demographics

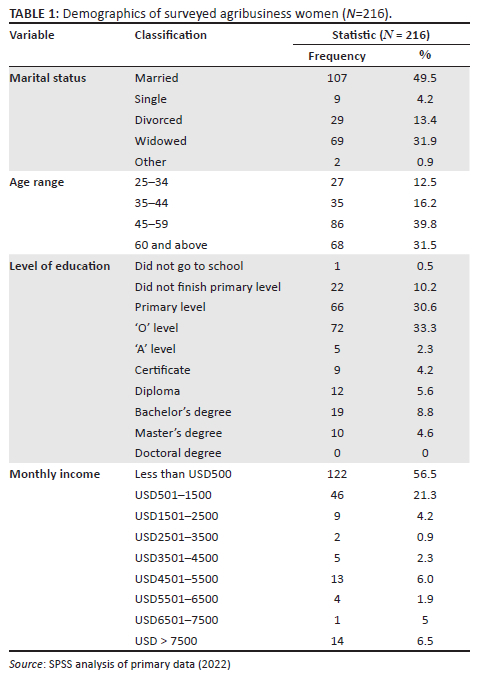

Apart from assessing financial literacy competencies of women, the study was also interested in the age, marital status, level of education, and income of women in agribusiness. Various authors concur that apart from gender, demographics like age (Lusardi 2019), marital status (Bucher-Koenen et al. 2017), level of income, and level of education (Cossa et al. 2022) have an impact on financial literacy competencies. Table 1 presents the demographic composition of the respondents of this study.

The population of this study was composed of women only. Table 1 shows that concerning the marital status of the surveyed women, the majority were married (49.5%) followed by widowed (31.9%), and divorced (13.4%). The marital status of the population can be justified by the age of the surveyed women. The majority of the women in agribusiness were aged between 45-59 (39.8%), followed by those above 60 (31.5%). Generally, the majority of people in those age ranges are either married, widowed, or divorced. Considering the level of education of women in agribusiness, 74.5% of the surveyed population have no tertiary education, the majority of the women obtained an ordinary level qualification (33.3%), only finished primary level (30.6%), or did not finish the primary level (10.2%). Policies targeting women should consider that the majority of the women are middle to old aged and only have basic education. Table 1 shows that, with regard to income earned from agribusiness activities, the majority of the population (56.5%) earn monthly income less than USD500. Income was calculated by dividing annual income by 12 or seasonal income by the number of months the planted crops take time to mature. Literature documented that income has a strong positive relationship with financial literacy competencies like saving and wealth accumulation (Lusardi & Mitchell 2014). Thus, income could be a major financial constraint to women in agribusiness.

Financial literacy competencies of women in agribusiness

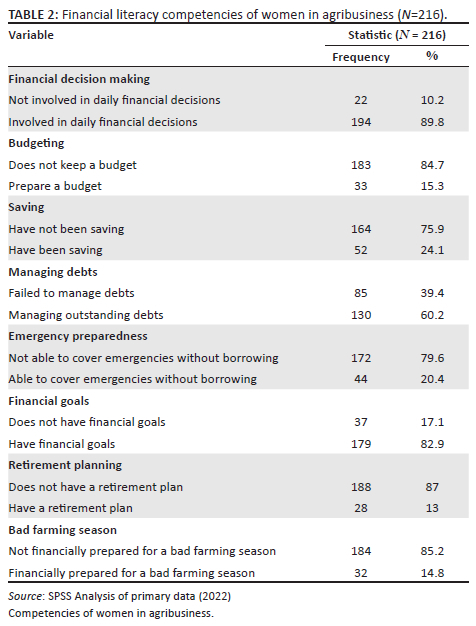

This section analyses the financial literacy competencies of women in agribusiness (refer to secondary objective 1) using financial behaviour questions developed by OECD (2018, 2020). Households and individuals are responsible for day-to-day financial decisions regarding household purchases, investing, and saving. Table 2 shows financial literacy competencies of women in agribusiness.

Financial decision-making

The majority (89.81%) of women in agribusiness were involved in the day-to-day management of their personal finances with their partners, other family members, or on their own. These results concurred with Potrich et al. (2018) who established that women participate more in the labour market, manage daily financial decisions, make debt decisions, and are now often heads of households. Tan et al. (2022) extended the concept of financial decision making to land transfer by farmers and concluded that financial literacy has a significantly positive effect on farmers' households' land transfer. Tan et al. (2022) argued that higher financial literacy enables families to evaluate the opportunity cost and other benefits of retaining/transferring land rationally, which helps reduce farmers' excessive worries about risks.

Budgeting

Budgeting is a fundamental money management skill that individuals/households should practise (Styles 2018). Table 2 shows the proportion of individuals who prepared a budget before utilising income. The majority of women in agribusiness did not keep records of their incomes and expenditures (84.72%) indicating that income is spent without having a clear plan for what it should cover, and mental estimates are usually used to allocate income to various expenses. These results concur with Falahati and Paim (2011), who established that university students in Malaysia even spend borrowed money to buy luxuries without budgeting.

Saving

A quantitative closed-ended question and a follow-up open-ended question were posed to assess savings practices of the respondents. Very few (24.07%) women in agribusiness managed to save money in the last two years reflecting that women in agribusiness were using all the earned income for current use without saving for future needs. However, women indicated that apart from saving in monetary terms, because of hyperinflation, they were saving by converting local currency into United States Dollars and saving the money in a wallet or by buying physical assets that can be turned into cash easily. The results concur with Gumbo et al. (2022) who established that university students in Zimbabwe do not save and usually run out of money before receiving the next income.

Managing debts

Women in agribusiness were further asked if they have debts they have failed to pay in time. Delaying payment of debt increases interest costs and attracts penalties. The majority (60.2%) of the surveyed women indicated that they did not have debts that they have failed to pay in time. However, this could be a result of higher levels of financial exclusion noted in the sector (Mutambara 2016). Women generally borrow from relatives and friends to make ends meet and payment terms offered by friends and relatives is usually flexible and accommodating as compared to terms and conditions offered by financial institutions. Women in agribusiness also rely on the sale of livestock and poultry to make ends meet. Thus, women in agribusiness were not overindebted and were managing their debts effectively.

Emergency preparedness

The study also sought to assess the proportion of women who were able to save for emergencies and those who failed to save for emergencies during the COVID-19 pandemic. The majority of the surveyed women in agribusiness (79.62%) indicated that they were unable to cover emergencies without them having to borrow from close relatives and friends and this is largely attributable to the lack of savings. Organisation of Economic Cooperation and Development (2020) added financial resilience as a vital financial literacy competence where individuals need to save for emergencies and other unforeseen events. Chhatwani and Mishra (2021) also documented a lack of savings for emergencies and low financial literacy among households.

Financial planning

Financial planning is the foundation for effective personal financial management (Madura 2014). Individuals with clear and stipulated financial goals can save towards achieving set goals. The results from Table 2 indicate that majority of women (82.9%) in agribusiness have financial goals that they want to achieve. This shows good financial planning behaviour among women in agribusiness. In contrast, OECD (2016) established a tendency of individuals to focus only on the short term as relatively very few people indicated that they have long-term financial goals that they want to achieve. Improvements in financial competencies of agribusiness women can assist in achieving set goals.

Planning for retirement and a bad farming season

The study established that the vast majority of the women in agribusiness do not have any form of retirement plan as only 13% of the sample had a retirement plan of one form or another. Majority of respondents indicated that in farming there was no need for retirement and thus they will work until they die and pass on the farming business to a family member preferably a male child to manage or employ someone to manage the farming business. The bulk of the respondents (85.2%) indicated that they were unable to meet their day-to-day expenditure in the event of a bad farming season, which is largely because of a lack of savings in one form or the other. Lusardi and Mitchell (2011) documented that individuals were more vulnerable to suffering financial challenges after retirement and, hence, the need for retirement planning. Mijatović (2010) argued for mandatory farmers pension insurance for farmers and rejected farmers' opinions that they will work for the rest of their life even at old age because it is inefficient to do farm work at old age.

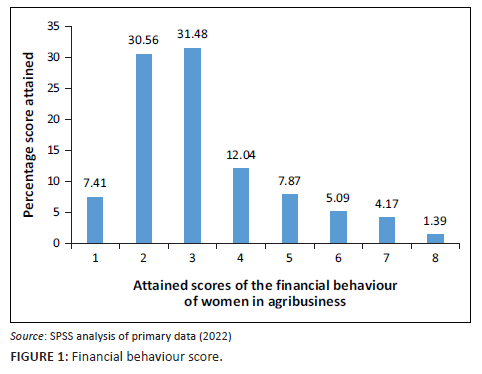

Financial behaviour score

A financial score was created as the summation of all the eight financial literacy competencies explained above. Only individuals whose scores were between 6-8 were considered financially literate in terms of their financial behaviour (OECD 2020). Figure 1 shows the financial behaviour scores of women in agribusiness.

The majority of women in agribusiness practised a financial behaviour score ranging between 2-3 out of the 8 examined concepts; only 10% of the participants scored above the minimum expected score of 6. These results are in line with OECD/International Network of Financial Education (INFE) (2020) results which established that generally few people exhibited all of the behaviours assessed. However, the scores of women in agribusiness were quite low as 50% of the respondents surveyed by OECD/INFE (2016) attained the minimum score. Thomas and Subhashree (2020) argue that financial literacy is a great influencer of entrepreneurship and hence poor financial behaviours of agribusiness woman entrepreneurs also translate into poor entrepreneurial development in the sector.

Financial experiences of women in agribusiness

The study also sought to investigate the financial experiences of women in agribusiness during the COVID-19 pandemic (refer to secondary objective 2). The study did so by conducting interviews among 15 women in agribusiness who were considered rich informants because of their leadership role among agribusiness women. The interviews revealed that the COVID-19 pandemic has had a significant impact on the finances of women in agribusiness. Qualitative information was analysed through thematic analysis and the following themes were identified as the major financial experiences of women in agribusiness during the COVID-19 pandemic.

Theme 1: Loss of income

Business restrictions associated with the COVID-19 pandemic caused a loss of income for women in agribusiness. Women indicated that loss of income was a result of the reduced number of customers who were visiting the markets because of travel restrictions and limited operating hours. To cope with the changes, some farmers were forced to reduce the prices of their products.

One of the participants indicated:

'[W]e usually sell our products to informal vendors who hoard our products and sell in central business districts, now that the policy is not permitting informal unregistered traders our sales are very low.' (Participant 1, age 56, female)

Accessibility to markets by both farmers and customers was another challenge that facilitated income losses as women in agribusiness indicated that they faced challenges in getting travelling letters to get into town. The closure of schools and town canteens exacerbated the problem. Although the agriculture sector was regarded as an essential service, some women were afraid to contract the virus and voluntarily stopped business operations. These findings concur with Akinleye et al. (2020) who established loss of income by household heads in Nigeria during the COVID-19 pandemic.

An increase in general prices as a result of inflationary macroeconomic factors caused an increase in the cost of production and thus low incomes.

One woman stated:

'[T]he price of poultry feed, fertilisers and maize seed increased during the period however we could not increase our prices immediately due to competition from other producers and customers' low incomes.' (Participant 2, age 50, female)

Rahman et al. (2021) also documented an increase in the cost of production among farmers during the pandemic. The increase in cost of production and the associated failure to increase prices of farm produce resultantly lead to loss of income.

Theme 2: Challenges in paying employees

As a result of loss of income, agribusiness women indicated that they had challenges in paying farm employees. Women indicated that they hire a few full-time employees who take care of livestock and poultry management while part-time employees were hired during planting, weeding, and harvest periods. However, during the COVID-19 period, the majority of women had challenges in sourcing finance to pay the employees and provide them with adequate food. Famine Early Warning System Network (2022) also documented failure of smallholder farmers to sustain their businesses because of low farm yields and low incomes.

Theme 3: Food insecurity and increase in extended family financial support

There were high levels of food insecurity among women in agribusiness during the lockdown period. Households were expected to hoard food from local markets that could sustain them for a month or more.

A participant indicated:

'[O]ur yield for the season was low and could not sustain the family throughout the lockdown period especially after considering extended family members increasing need for food and financial relief support. Retailers also increased the prices for basic commodities basing on parallel exchange rates.' (Participant 5, age 65, female)

Because of low-income and low yields during the period, the majority of households did not have enough food to sustain their households. Food and transportation costs also increased during the pandemic, with the majority of retailers charging foreign currency for their goods and services. Stephens et al. (2022) also documented high levels of food insecurity among smallholder farmers during the COVID-19 pandemic. However, some women indicated that they survived through the produce from their farms and by cutting back on household consumption. Akinleye et al. (2020) also noted acute food shortages among households in Nigeria during the COVID-19 pandemic.

In addition to these challenges, there was a need for women in agribusiness to support extended family and friends who were facing financial and health challenges during the pandemic. Some indicated that they were forced to sell livestock and to use business savings to take care of the medical expenses of a sick relative. Women are the general providers of home-based care for the sick and thus the increase in COVID-19 cases increased the burden of support needed from women. These results concur with O'Neill and Gillen (2021) who posited that women were the most vulnerable people during the pandemic as they were the primary providers of childcare and home-based care for infected individuals.

Theme 4: Change in market dynamics and transportation of farm produce challenges

Women in agribusiness indicated that they failed to cope with the changes in market dynamics brought about by the COVID-19 pandemic. Because of lockdowns, market places moved from traditional town markets to markets in residential locations. There was a need for door-to-door marketing and delivery for agricultural produce in trucks or in marketplaces close to residential locations; however, the majority of women did not have the means to transport the produce to new markets. Hammond et al. (2022) also documented closed markets and a lack of transport among smallholder farmers in Burundi, Kenya, Rwanda, Tanzania, Uganda, Vietnam, and Zambia during the COVID-19 pandemic.

One participant indicated:

'[D]ue to lockdown people were not allowed to travel to our usual markets, there was need to transport the produce in residential areas. In the early months I hired a truck to transport vegetables and tomatoes to residential locations but the cost of moving around the location and hiring the truck were too high.' (Participant 10, age 48, female)

Because of lower incomes, change in market dynamics and travelling restrictions, women in agribusiness faced challenges in transporting their farm produce to local markets. Those who were able to move with their farm produce in residential locations earned more than those who were still relying on traditional market areas. O'Neill and Gillen (2021) also documented a decline in demand for services, which required physical proximity during the COVID-19 pandemic.

Theme 5: Difficulties in importing raw materials and massive losses in perishable goods

There was also a failure to import a wide range of inputs from neighbouring countries, which are normally at competitive prices and are in short supply locally like fertilisers and special seeds. This further affected the transactional cost of operations and thus planned financial goals were also disrupted by the pandemic. These results concur with Osita et al. (2020) who established that travel restrictions related to the pandemic negatively affected small to medium enterprises' importation of goods.

Massive losses were also incurred of perishable produce like tomatoes and bananas because of a depressed market and travelling restrictions on potential customers. However, some women in agribusiness benefitted from the increase in demand for their agricultural products and reduced competition from unauthorised vendors usually located in towns.

Theme 6: Failure to pay debts and policies

Agribusiness women also pay cash to funeral policy providers, such as Nyaradzo Funeral Services and some indicated that they had challenges paying for the policy because of a lack of sufficient funds.

A participant noted:

'I failed to pay for my Nyaradzo funeral policy for three months due to lack of funds and I risked the policy lapsing.' (Participant 8, age 47, female)

Very few women had bank loans; however, some indicated that they had challenges in paying debts from informal money lenders, family and friends, and had to sell a few possessions to pay back the money. Lusardi and Tufano (2015) also argued that individuals with low levels of debt literacy made poor choices of loan options and transacted in high-cost manners and resultantly become over-indebted.

Discussion

The study established that women in agribusiness were involved in the day-to-day running of their household finances. However, they exhibited poor savings behaviour, failed to cover emergencies without borrowing, have no retirement plan, and the majority cannot survive through a bad farming season. The exhibited poor financial competencies by women in agribusiness translates to poor financial management and entrepreneurial development in the sector Thomas and Subhashree (2020).

During the pandemic, women in agribusiness indicated that they earned low incomes, failed to pay farm employees, faced difficulties in importing raw materials, and some even failed to secure enough food for their households. These results concur with Hammond et al. (2022) who conducted a survey of smallholder farmers in seven African countries. The COVID-19 pandemic was associated with emergencies like illness, medical bills, death of relatives and loss of job, which required setting aside a portion of income for emergencies. Women in agribusiness were vulnerable to financial shocks associated with the COVID-19 pandemic because they did not have savings for such emergencies.

Low levels of retirement preparedness have been noted and women are more vulnerable to suffer financial challenges during old age. Retirement planning is very vital for women in agribusiness because it will provide some cushioning income when they are no longer active in the business (Lusardi 2019). The concept of having retired people responsible for the farming activities for the country may result in low productivity and food insecurity for the country in the future (Mijatović 2010).

Recommendations

The study recommends the implementation of training programmes that capacitate women with basic financial savvy behaviours. Training programmes should educate women in agribusiness on how they can create budgets and save towards achievement of their financial goals. Government initiatives of Pfumvudza and ploughing of small grains should be promoted as they improve the range of farming products that women can rely upon. Banks might need to review savings interest rates in relation to inflation in order to mobilise more savings and incorporate group savings like rotational savings as a formal bank service. Future research should consider other agricultural regions that were not covered by the scope of this study.

Conclusion

This study sought to examine the financial literacy competencies of women in agribusiness and to determine their financial experiences during the COVID-19 pandemic. The study concluded that women in agribusiness were involved in daily financial decision-making and have future financial goals. However, the majority of them do not keep a budget, have not been saving in the last 2 years, do not have a retirement plan, and were not able to cover emergencies without borrowing. During the pandemic, women experienced loss of income, failed to pay employees, had challenges in securing enough food, and some even failed to cope up with change in market dynamics.

Acknowledgements

This article is partially based on the author's thesis of the degree of Doctor of Philosophy Specialising in Business Administration in the Faculty of Management Sciences at the Durban University of Technology with supervisors Dr. Edson Vengesai and Dr. Ferina Marimuthu, available here https://openscholar.dut.ac.za/bitstream/10321/4828/1/Gumbo_L_2023.pdf

Competing interests

The authors declare that they have no financial or personal relationship(s) that may have inappropriately influenced them in writing this article.

Authors' contributions

L.G. conducted and drafted the research while F.M. and E.V. supervised the research project from onset to the end.

Funding information

The authors received no financial support for the research, authorship, and/or publication of this article.

Data availability

Data sharing is applicable to this article as there were new data created in this study.

Disclaimer

The views and opinions expressed in this article are those of the authors and are the product of professional research. It does not necessarily reflect the official policy or position of any affiliated institution, funder, agency, or that of the publisher. The authors are responsible for this article's results, findings, and content.

References

Akinleye, O., S Dauda, R.O., Iwegub, O. & Popogbe, O.O., 2020, 'Impact of COVID-19 pandemic on financial health and food security: A survey-based analysis', SSRN Electronic Journal 1-32. https://doi.org/10.2139/ssrn.3619245 [ Links ]

Ando, A. & Modigliani, F., 1963, 'The "life cycle" hypothesis of saving: Aggregate implications and tests', The American Economic Review 53(1), 55-84. [ Links ]

Bonga, W.G. & Mlambo, N., 2016, 'Financial literacy improvement among women in developing nations: A case for Zimbabwe', Quest Journals, Journal of Research in Business and Management 4(5), 22-31. [ Links ]

Bottazzi, L. & Lusardi, A., 2020, 'Stereotypes in financial literacy. Evidence from PISA', Journal of Corporate Finance 71, 101831. https://doi.org/10.1016/j.jcorpfin.2020.101831 [ Links ]

Bucher-Koenen, T., Lusardi, A., Alessie, R. & Van Rooij, M., 2017, 'How financially literate are women? An overview and new insights', Journal of Consumer Affairs 51(2), 255-283. https://doi.org/10.1111/joca.12121 [ Links ]

Chen, J., Jiang, J. & Liu, Y.J., 2018, 'Financial literacy and gender difference in loan performance', Journal of Empirical Finance 48, 307-320. https://doi.org/10.1016/j.jempfin.2018.06.004 [ Links ]

Chhatwani, M. & Mishra, S.K., 2021, 'Does financial literacy reduce financial fragility during COVID-19? The moderation effect of psychological, economic and social factors', International Journal of Bank Marketing 39(7), 1114-1133. https://doi.org/10.1108/IJBM-11-2020-0536 [ Links ]

Cossa, A., Madaleno, M. & Mota, J., 2022, 'Financial literacy environment scan in Mozambique', Asia Pacific Management Review 27(4), 229-244. https://doi.org/10.1016/j.apmrv.2021.09.004 [ Links ]

Falahati, L. & Paim, L.H., 2011, 'A comparative study in money attitude among university students: A gendered view', Journal of American Science 7(6), 1144-1148. [ Links ]

Famine Early Warning System Network (FEWSN), 2022, Zimbabwe food security outlook poor harvests and price volatility likely to result in early lean season and widespread Crisis (IPC Phase 3), FEWSN, Harare. [ Links ]

Feng, W. & Reich, R.W., 2021, 'Practice improves performance: The mediating interaction of active management on financial literacy and financial well-being', Journal of Applied Financial Research 10(1), 60-86, viewed 14 December 2021, from https://ssrn.com/abstract=4014822. [ Links ]

Grohmann, A., Hübler, O., Kouwenberg, R. & Menkhoff, L., 2016, 'Financial literacy: Thai middle class women do not lag behind', SSRN Electronic Journal 1-49. https://doi.org/10.2139/ssrn.2867919 [ Links ]

Grohmann, A., Klühs, T. & Menkhoff, L., 2018, 'Does financial literacy improve financial inclusion? Cross country evidence', World Development 111, 84-96. https://doi.org/10.1016/j.worlddev.2018.06.020 [ Links ]

Gudmunson, C.G. & Danes, S.M., 2011, 'Family financial socialization: Theory and critical review', Journal of Family and Economic Issues 32, 644-667. https://doi.org/10.1007/s10834-011-9275-y [ Links ]

Gumbo, L., Margaret, M. & Chagwesha, M., 2022, 'Personal financial management skills of university students and their financial experiences during the COVID-19 pandemic', International Journal of Financial, Accounting, and Management 4(2), 129-143. https://doi.org/10.35912/ijfam.v4i2.835 [ Links ]

Hammond, J., Siegal, K., Milner, D., Elimu, E., Vail, T., Cathala, P. et al., 2022, 'Perceived effects of COVID-19 restrictions on smallholder farmers: Evidence from seven lower-and middle-income countries', Agricultural Systems 198, 103367. https://doi.org/10.1016/j.agsy.2022.103367 [ Links ]

Huston, J., 2010, 'Measuring financial literacy', The Journal of Consumer Affairs 44(2), 296-298. https://doi.org/10.1111/j.1745-6606.2010.01170.x [ Links ]

Kadoya, Y. & Khan, M.S.R., 2017, 'Explaining financial literacy in Japan: New evidence using financial knowledge, behavior, and attitude', Sustainability 12, 9. https://doi.org/10.2139/ssrn.3067799 [ Links ]

Kai, L.I., Yu, J.I.N. & Zhou, J.H., 2023, 'Are vulnerable farmers more easily influenced? Heterogeneous effects of Internet use on the adoption of integrated pest management', Journal of Integrative Agriculture 22(10), 3220-3233. https://doi.org/10.1016/j.jia.2023.08.005 [ Links ]

Klapper, L. & Lusardi, A., 2020, 'Financial literacy and financial resilience: Evidence from around the world', Financial Management 49(3), 589-614. https://doi.org/10.1111/fima.12283 [ Links ]

Kothari, C., 2017, Research methodology methods and techniques, p. 91, New Age International Pty. Ltd., New Delhi. [ Links ]

Lusardi, A. & Mitchell, O.S., 2014, 'The economic importance of financial literacy: Theory and evidence', American Economic Journal Journal of Economic Literature 52(1), 5-44. [ Links ]

Lusardi, A. & Tufano, P., 2015, 'Debt literacy, financial experiences, and over-indebtedness', Journal of Pension Economics & Finance 14 (4), 332-368. [ Links ]

Lusardi, A., 2019, 'Financial literacy and the need for financial education: Evidence and implications', Swiss Journal of Economics and Statistics 155(1), 1-8. [ Links ]

Madura, J., 2014, Personal financial literacy, Pearson, Upper Saddle, NJ. [ Links ]

Mahmood-ur-Rahman, 2022, 'Effect of financial literacy on usage of unconventional banking and non-banking financial services across countries', Economics Letters 217, 110679. https://doi.org/10.1016/j.econlet.2022.110679 [ Links ]

Mazhawidza, P., 2010, Women's access to land and utilization patterns case of Zimbabwe. Progress report of women farmers land and agriculture trust, Food and Agriculture Organization of the United Nations, Harare. [ Links ]

Mijatović, B., 2010, Farmers pension insurance, USAID and Centre for Liberal Democratic Studies, Belgrade. [ Links ]

Ministry of Lands Agriculture Fisheries Water and Rural Resettlement, 2018, National Agricultural Policy, pp. 1-52, Government of Zimbabwe. [ Links ]

Mutambara, S., 2016, 'Smallholder irrigation farmers' financial exclusion in Zimbabwe: A resilience threat', International Journal of Agricultural Policy and Research 4(8), 256-270. [ Links ]

Mutengezanwa, M., 2018, 'Financial literacy among small and medium enterprises in Zimbabwe', PhD Thesis, pp. 1-228, University of KwaZulu-Natal. [ Links ]

Niu, G., Zhou, Y. & Gan, H., 2020, 'Financial literacy and retirement preparation in China', Pacific-Basin Finance Journal 59, 1-17. [ Links ]

Nulty, D.D., 2008, 'The adequacy of response rates to online and paper surveys: What can be done?', Assessment & Evaluation in Higher Education 33(3), 301-314. https://doi.org/10.1080/02602930701293231 [ Links ]

O'Neill, B. & Gillen, M., 2021, 'Personal finance rear in review', Journal of Financial Planning 34(1), 48-59. [ Links ]

Organisation for Economic Co-operation and Development (OECD), 2016, OECD/INFE international survey of adult financial literacy competencies, OECD, Paris. [ Links ]

Organisation for Economic Co-operation and Development (OECD), 2018, OECD/INFE toolkit for measuring financial literacy and financial inclusion, OECD, Paris. [ Links ]

Organisation for Economic Co-operation and Development (OECD), 2020, OECD/INFE 2020 international survey of adult financial literacy, OECD, Paris. [ Links ]

Osita, F.C., Kekeocha, M.E. & Ojimba, C.C., 2020, 'Succession planning and sustainability of small and medium enterprises (SMEs) in South East, Nigeria' International Journal of Research and Innovation in Applied Sciences (IJRIAS) V, 36-39. [ Links ]

Potrich, A.C.G., Vieira, K.M. & Kirch, G., 2018, 'How well do women do when it comes to financial literacy? Proposition of an indicator and analysis of gender differences', Journal of Behavioral and Experimental Finance 17, 28-41. [ Links ]

Rahman, M.S., Majumder, M.K., Sujan, M.H.K. & Manjira, S., 2021, 'Livelihood status of coastal shrimp farmers in Bangladesh: Comparison before and during COVID-19', Aquaculture Reports 21, 100895. https://doi.org/10.1016/j.aqrep.2021.100895 [ Links ]

Reilly, F.K. & Brown, K.C., 2011, Investment analysis and portfolio management (Text Only), Cengage Learning, Mason, Ohio. [ Links ]

Scoones, I., Marongwe, N., Mavedzenge, B., Murimbarimba, F., Mahenehene, J. & Sukume, C., 2011, 'Zimbabwe's land reform: Challenging the myths', Journal of Peasant Studies 38(5), 967-993. https://doi.org/10.1080/03066150.2011.622042 [ Links ]

Stephens, E.C., Timsina, J., Snow, V., Martin, G., Van Wijk, M., Klerkx, L. et al., 2022, 'The immediate impact of the first waves of the global COVID-19 pandemic on agricultural systems worldwide: Reflections on the COVID-19 special issue for agricultural systems', Agricultural Systems 201, 103436. https://doi.org/10.1016/j.agsy.2022.103436 [ Links ]

Styles, M., 2018, A financial epidemic: How financial literacy affects college students' financial management practices and the debt crisis in America, East Tennessee State University, Tenneessee. [ Links ]

Tan, J., Cai, D., Han, K. & Zhou, K., 2022, 'Understanding peasant household's land transfer decision-making: A perspective of financial literacy', Land Use Policy 119, 106189. https://doi.org/10.1016/j.landusepol.2022.106189 [ Links ]

Team, S. O. F. A., & Doss, C., 2011, 'The role of women in agriculture', ESA Working Paper No. 11-02, The Food and Agriculture Organization of the United Nations, Roma. [ Links ]

Thomas, B. & Subhashree, P., 2020, 'Behavioural and psychological factors that influence the usage of formal financial services among the low income households', Research in World Economy 11(5), 326-333. https://doi.org/10.5430/rwe.v11n5p326 [ Links ]

Tomar, S., Baker, H.K., Kumar, S. & Hoffmann, A.O., 2021, 'Psychological determinants of retirement financial planning behavior', Journal of Business Research 133, 432-449. https://doi.org/10.1016/j.jbusres.2021.05.007 [ Links ]

Ugwu, P., 2019, Women in agriculture: Challenges facing women in African farming. Project report of African Women in Agriculture, Johannesburg. [ Links ]

Yamane, T., 1967, Statistics: An introductory analysis, Harper and Row, New York, NY. [ Links ]

Zhou, J.H., Fei, H.A.N., Kai, L.I. & Yu, W.A.N.G., 2020, 'Vegetable production under COVID-19 pandemic in China: An analysis based on the data of 526 households', Journal of Integrative Agriculture 19(12), 2854-2865. https://doi.org/10.1016/S2095-3119(20)63366-4 [ Links ]

Correspondence:

Correspondence:

Lilian Gumbo

liliangumbo21@gmail.com

Received: 22 Aug. 2022

Accepted: 15 Aug. 2023

Published: 14 Dec. 2023