Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Southern African Journal of Entrepreneurship and Small Business Management

versão On-line ISSN 2071-3185

versão impressa ISSN 2522-7343

SAJESBM vol.15 no.1 Cape Town 2023

http://dx.doi.org/10.4102/sajesbm.v15i1.738

ORIGINAL RESEARCH

The role of investors in developing academic spin offs: The biotech sector in South Africa

Øystein S. HøvigI; Inger B. PettersenII; Adolph C. NeethlingIII; Brandon PaschalIV; Randi E. TaxtV

IMohn Centre for Innovation and Regional Development, Faculty of Engineering and Science, Western Norway University of Applied Sciences, Bergen, Norway

IIMohn Centre for Innovation and Regional Development, Faculty of Engineering, Western Norway University of Applied Sciences, Bergen, Norway

IIIDepartment of Business Management, Faculty of Economic and Management Sciences, Stellenbosch University, Stellenbosch, South Africa

IVCadence Lyfe Consulting, Stellenbosch, South Africa

VDepartment of Geography, University of Bergen, Bergen; and, Vestlandets innovasjonsselskap AS, Bergen, Norway

ABSTRACT

BACKGROUND: While research on commercialisation of academic research suggests that close interaction among academic entrepreneurs, technology transfer officers and investors can aid developing academic spin-offs, we argue that the role of investors is underdeveloped in the literature.

AIM: This paper aims to build new theoretical and empirical knowledge about the investor's role in developing academic spin-offs. Focus is put on the interaction and dynamic relationship between investors, academic entrepreneurs and technology transfer office executives in academic spin-off (ASO) development.

SETTING: The research is empirical in nature and conducted in the entrepreneurial ecosystem surrounding universities in the Western Cape area in South Africa.

METHODS: The research is qualitative with a focus on conducting research interviews with knowledgeable respondents. Fourteen semi-structured interviews were used to collect data from investors and other stakeholders in the entrepreneurial ecosystem in the Western Cape area in South Africa.

RESULTS: Four themes were uncovered. The study demonstrates a challenge of commercialising research-based inventions; both the team and the entrepreneur play an important role in the commercialisation process; investors can play a role in educating and coaching academic entrepreneurs and play a brokering role in attracting venture capital (VC) funding.

CONCLUSION: The study concludes that the pre-investment behaviour of investors, in relationship with technology transfer offices (TTOs) and academic entrepreneurs, may help mitigate assumed information asymmetries and uncertainty in ASO development.

CONTRIBUTION: The research contributes to the literature by showing how investors' perception, pre-investment behaviour and vision shape the development of ASOs in a dynamic interaction with technology transfer executives and academic entrepreneurs.

Keywords: investors; university funds; technology transfer; entrepreneurial ecosystem; academic spin-off; commercialisation of research; biotech; South Africa.

Introduction

Lately, we have witnessed an increased focus on commercialisation of knowledge and technology from universities and research institutions around the world (Hossinger, Chen & Werner 2019; Lockett & Wright 2005; Prokop, Huggins & Bristow 2019). Creation and development of academic spin-offs (ASOs), defined as a new company established by the exploitation of a research idea or technology generated within a university or research organisation (Nicolaou & Birley 2003; Smilor, Gibson & Dietrich 1990), are considered an important route in this regard, since they are considered important to generate new and often radical innovations (Lockett & Wright 2005). Most universities have set up technology transfer offices (TTOs) to facilitate and aid the development of ASOs, and this has also led to a scholarly interest in understanding the potential difficulties associated with university commercialisation and ASO development, and how to optimise the conditions for development of ASOs. Research on entrepreneurial ecosystems (Feldman, Siegel & Wright 2019) and TTOs (O'Kane, Cunningham, Menter & Walton 2020; Taxt, Høvig & Pettersen 2022; Wang 2018) suggest that a close interaction among various stakeholders such as academic entrepreneurs, TTO executives and investors can aid in developing ASOs. Commercialisation of ASOs requires specialised competence in many fields, and universities need to work closely with various stakeholders to acquire the necessary capabilities, as is it unlikely they have expertise in all areas of the research and market domain (Weckowska 2015). And while several researchers (Hossinger et al. 2019; Taxt et al. 2022) have argued for a more holistic approach in researching ASO development, emphasising the need to integrate the interplay of more actors playing a role in ASO development (Hayter 2016; Hossinger et al. 2019), we find that the role of investors is underdeveloped in this literature (Frimanslund & Nath 2022). This is surprising as investors could be seen as particularly critical for ASOs, given these firms' long-term development from early stage to market readiness and the need for substantial capital to grow and reach revenue.

In this paper, we respond to this knowledge gap by putting the investor at centre stage. Our aim is to illuminate what role investors play in developing ASOs. Taking a relational approach to technology transfer (Taxt et al. 2022; Weckowska 2015), we focus on the interaction and dynamic relationship between investors, academic entrepreneurs and TTO executives in ASO development. We emphasise on university commercialisation funds (UCFs) as a particular form of investor that target ASO companies (exclusively, or part of their mandate) to support ASOs in the early stages of technology and market validation phases.

The research is empirical, and a qualitative approach is deployed to examine the role of investors in the entrepreneurial ecosystems in South Africa. As an emerging economy, and a leading country in this domain in Africa (Kruger & Steyn 2020), it is timely to investigate the entrepreneurial ecosystems surrounding ASOs in South Africa. Most research on academic entrepreneurship, TTOs and entrepreneurial ecosystems are conducted in the United States of America (US) and Europe. Yet, emerging economies have a growing significance in driving global economic growth, entrepreneurship and innovation, and should also be under scrutiny for empirical research (Chan & Mustafa 2021). It is pivotal to test theories and assumptions in various contexts, as findings from one country need to be validated across contexts, recognising that contextual conditions highly affect phenomena such as academic entrepreneurship, TTO performance and investors' behaviour (Gubitta, Tognazzo & Destro 2016). Last, there is a need to enhance our understanding of the phenomenon in South Africa, which is a context less researched.

The following research question have been formulated:

RQ1: What characterises the investors' role in developing ASOs in interaction with academic entrepreneurs and TTO executives in the biotech sector in South Africa?

The paper is structured as follows: Section 2 outlines the theory. Section 3 outlines the research context and the methods used for this study. Section 4 presents results, and Section 5 discusses the findings, including theoretical and practical implications. At the end, some limitations of the study are outlined, as well as some suggestions for new areas for further studies.

Theory

This section outlines the theoretical framework for the study. Firstly, universities efforts and challenges to facilitate ASOs are contextualised in the light of the stronger emphasis put on technology transfer in the last decade. Secondly, a relational approach to technology transfer is introduced, where the investor is introduced as one important actor together with TTO executives and researchers in developing ASOs. Thirdly, the main part of this section discusses the role of investors in commercialisation processes.

Technology transfer and commercialisation of research

To shape incentives for universities and research institutions to increase the commercialisation focus, policymakers in many countries have implemented legislation like the US Bayh-Dole Act (1980), transferring ownership of publicly funded research from researchers to the university. This legislative came into effect in South Africa in 2010 (Barnett in LES 2022). The IPR Act has globally expanded the role of the universities and led to implementation of TTOs to handle intellectual property and commercialisation activities (Lockett & Wright 2005). One important commercialisation route for TTOs is the creation and development of ASO companies, defined as a new company established by the exploitation of a research idea or technology generated within a university or research organisation (Nicolaou & Birley 2003; Smilor et al. 1990). Academic spin-offs are considered important to generate new and often radical innovations, and supplement other routes such as licencing of technologies (Lockett & Wright 2005).

While TTOs have proven effective in enhancing the commercialisation activity in universities (Shane 2004b), the success stories or financial returns from ASOs have so far been low (Hossinger et al. 2019; Shane 2004a; Siegel, Waldman & Link 2003). Mixed performance has, according to Wright, Hmieleski and Siegel (2006), led to an interest in understanding the potential difficulties associated with university commercialisation and ASO development. The complexities of the problems involved in the development of ASOs are many. Academic spin-offs are likely to meet significant barriers when they enter the business world, including a lack of entrepreneurial capabilities, knowledge and resources (Colombo & Piva 2012; Hossinger et al. 2019). Financial access and investors seem to be a dominant factor impeding ASO development (Granz, Lutz & Henn 2021; Prokop et al. 2019; Wright et al. 2006). New firms are known to be resource constrained and need to obtain external financing in order to pursue their opportunities (Shane & Cable 2002). Academic spin-offs experience substantial difficulty to attract venture capital (VC) financing (Munari & Toschi 2011). The marked uncertainty and significant monitoring costs of assessing early-stage seed investments in technology and science-based fields mean that few VC investments are made before a proof of concept becomes available (Lockett et al. 2002). Also, academic entrepreneurs, being bright and excellent in research, might have a shortage of commercial skills which may hamper venture development (Granz et al. 2021). In addition, Wright et al. (2006) claim that investors have a funding bias regarding ASOs that arises from the complexity of advanced scientific research and academic entrepreneurs' shortage of commercial skills. Given the prominent position finance and investors play in developing and growing ASOs, we find it is timely to investigate investors' role as a central stakeholder in studies of technology transfer and commercialisation of research.

The role of investors in technology transfer processes

In the TTO literature, the role of TTOs has traditionally been described as specialised and transaction-oriented, with an overall focus on patenting and licencing (Siegel & Wright 2015). Technology transfer offices are traditionally understood to be engaged in transaction-focused commercialisation proactively following a linear innovation process where commercialisation activities are performed sequentially (Weckowska 2015). In this model, once an academic discloses an invention, the TTO secures the intellectual rights and then the output (e.g. a product or a service) is marketed to potential investors or licensees. Investors and commercial buyers are perceived as 'buyers' and are not approached until the product is believed to be 'ready' because the TTO must:

[F]ully understand the economics of the new product and the scalability of it' in order to be 'able to give them [investors] a fuller picture so they have fewer questions to ask and fewer reasons to say no. (Weckowska 2015:68)

The investor assignment or intellectual property licence (IPL) is seen as an end in itself.

However, other scholars have challenged the linear view of the technology transfer process, suggesting an interactive model where TTOs engage in interactive learning processes in order to acquire the necessary knowledge to develop ASOs (Rasmussen & Borch 2010; Sadek, Kleiman & Loutfy 2015; Taxt et al. 2022). Commercialisation is a complex task and requires specialised competence in many fields, and TTOs need to work closely with external partners to acquire the necessary capabilities. This is because the TTO is unlikely to have expertise in all areas of the research and market domain (Weckowska 2015). This practice is underpinned by a belief that competent pursuit of commercialisation entails building and managing complex relations between stakeholders during all commercialisation activities. This relational approach acknowledges that the innovation process is not linear, but interactive, and that scientific discovery must match industry needs. Hence, long-term, interactive communication between academia, industry and market experts is crucial. O'Kane (2018) suggests that TTO executives can take on an intermediary role between the university and various external partners outside the university sphere, such as investors (Hossinger et al. 2019). In this model, investors are perceived to take a broader role than just providing capital in exchange for equities. Investors are often approached at an early stage, and they may take a co-creation role, working together with TTO executives and academic entrepreneurs in giving informal advice and input in the commercialisation process (Taxt et al. 2022; Weckowska 2015).

In sum, based on the above acknowledgement, we argue that investors are important system players in ASO development together with TTO executives and academic entrepreneurs, but more research is needed to fully understand the concrete mechanisms and roles investors play in this system (Frimannslund & Nath 2022). We now discuss what role investors can play in such commercialisation practice.

Role of investors in commercialisation of academic spin-offs

Academic spin-offs may attract funding from different types of sources, ranging from 'friends, fools and family' to angel investors and venture capital funds (VCFs). However, ASOs face difficulty in attracting VC financing (Munari & Toschi 2011). Gubitta et al. (2016) argue that for ASOs, traditional early-stage venture markets are inefficient and that most university innovation is too risky for VC investors. Few VC investments are made before a proof of concept is available (Lockett et al. 2002). Consequently, various forms of public support for spin-off companies that compensate for this funding gap exist, including public venture funds, commercialisation grant programmes, and seed-capital funds with the participation of governments, universities, and foundations (Gubitta et al. 2016:390). These forms of support can be put under the umbrella term university commercialisation funds (UCF).

One can theorise that such university commercialisation funds contribute to ASO development in various ways. Apart from a financing gap, ASOs often suffer from a lack of skills, expertise and business know-how (an operational gap). This is particularly true in the case of ASO high-tech ventures (Festel & Cleyn 2013) as a result of difficulties associated with turning scientific results into marketable ideas. As such, besides supplying the funding that ASOs need, university funds are also able to pass on considerable value in the form of business expertise, industry experience and networking, all of which can be equally valuable as the financing support. This assistance is likely to involve several dimensions.

The first relates to commercial 'education' of academic entrepreneurs. Academic entrepreneurs, being bright and excellent in research, might have a shortage of commercial skills, which may hamper venture development (Granz et al. 2021). Also, in many cases, academic entrepreneurs lack realistic expectations about the commercial potential of their venture (Lerner 2005). They may have an inflated impression of their research discovery and fail to perceive why potential investors hesitate to provide themselves with funds (Lerner 2005). By drawing on their experience and placing the discovery in the context of other similar efforts, TTO executives and investors can help address these problems. Whether through informal counselling or more structured courses, TTO executives and investors might be able to help academic entrepreneurs come down the learning curve. Hellman and Puri (2000), studying the role of investors in Silicon Valley, uses the analogy of sports coaches in describing this role:

[T]hey [investors] are like the coaches, who choose which athletes get to play, who train and motivate them, and who try to create the most favorable conditions for them to succeed. (Hellman & Puri 2000:2)

Similarly, we can theorise that investors targeting ASOs can provide the mentoring and guidance that helps the academic entrepreneurs bridge some commercial knowledge gaps. This may again lead to the ASO becoming more investment ready.

University fund investment may also play a role in addressing the concerns of outside investors such as private VCFs. In many cases, venture capitalists and other financiers are overwhelmed with proposals from young firms, many of which may have difficult-to-assess claims. As a result, they may be reluctant to fund ventures that ask for investment without a formal introduction from a trusted intermediary (Lerner 2005). This is particularly challenging for ASOs, as it is shown that VCFs have a funding bias regarding ASOs (Munari and Toschi 2011; Wright et al. 2006). This funding bias may be because of the complexity of advanced scientific research, which is difficult for investors to comprehend, and as a result of the academic entrepreneurs' shortage of commercial skills. To overcome these challenges, TTOs and university funds may play an 'honest broker' role. By cultivating relationships with key external VC firms over time, they may build trust and an understanding of the potential and challenges of ASOs as an investment opportunity. Therefore, 'when they … reach out to one of these groups with an investment opportunity in an academic spin-out, the investors are likely to consider the new venture seriously' (Lerner 2005:54). Gubitta et al. (2016) argue along the same line when they show that TTOs and university funds can offer credible and effective signals to VCFs regarding the ASO's prospects and potential value, making it more likely for ASOs to attract private VC funding at a later stage.

Research context and method

Research context: Academic spin-off investing in South Africa

This empirical study is conducted in an entrepreneurial ecosystem surrounding universities in South Africa. In general, the level of spin-off activity remains low in South Africa. The Intellectual Property Rights Act (IPR Act) came into effect in 2010 in South Africa, and it gives guidelines for ownership of intellectual property from universities. In the years 2011-2020, Stellenbosch University was successfully granted 124 patents, while University of Cape Town had the second most at just over 100. In terms of ASOs, University of Cape Town (UCT), one of the first two universities in South Africa to start a TTO in 1999, reports 25 spinout companies over a 15-year period (Cyrus 2020). Stellenbosch University reports 37 spinouts over a 22-year period (Cyrus 2020). In comparison to counterparts in more developed economies, the number of patents and spin-offs is low.

Lack of entrepreneurial skills and risk capital are reported as important impeding factors holding back the South African entrepreneurial ecosystem (Global Entrepreneurship Development Institute [GEDI], n.d.). The nascent nature of the VC industry in South Africa partly explains the lack of risk capital. Having started in earnest in 2007, the industry is still gaining momentum, and although there has been a significant and steady increase in the availability of risk capital in the last decade, there is still a long way to go for the industry to become established. For ASOs, public funding institutions such as Technology Innovation Agency Seed Fund, as well as the University Technology Fund (UTF) are still the most popular sources of pre-seed and seed funding for ASOs spinning out of South African universities (Innovus n.d.). However, these are also new entities, with limitation in capital and resources that can be made available to spin-off companies.

In sum, both the VC industry and university spin-off industries in South Africa are very young. More requirements from research grant funders are including commercial feasibility, which should result in more commercial opportunities in these technologies as well as more capital made available to invest in these technologies.

Method

The research is qualitative with a focus on conducting research interviews with knowledgeable respondents. The research follows an abductive approach (Dubois & Gadde 2002), where the research process goes back and forth between empirical investigation and theoretical development (Jacobsen 2015). Four of the authors have conducted the data collection. All authors have varying degree of insider knowledge of the entrepreneurial ecosystem surrounding universities and TTO practice.

The research calls for a deeper analysis of the investors' role in entrepreneurial ecosystems with an emphasis on their perceptions and relationships to TTOs and academic entrepreneurs. These are complex questions. Our research approach in this study is based on case studies, as case study design is relevant when we seek to explain 'how' and 'why' a social phenomenon works, through an up-close, in-depth and detailed examination (George & Bennet 2005; Yin 2009). Moreover, case studies allow for a holistic approach to the phenomenon of interest by enabling us to explore the phenomenon in context, and thus deliberately uncover the contextual conditions that are believed to be important (George & Bennett 2005:19). As noted earlier, prior insight into the investors role in entrepreneurial ecosystem surrounding ASOs has been modest, which indicates a need for an exploratory research design (Ghauri & Grønhaug 2010).

Data collection and analysis

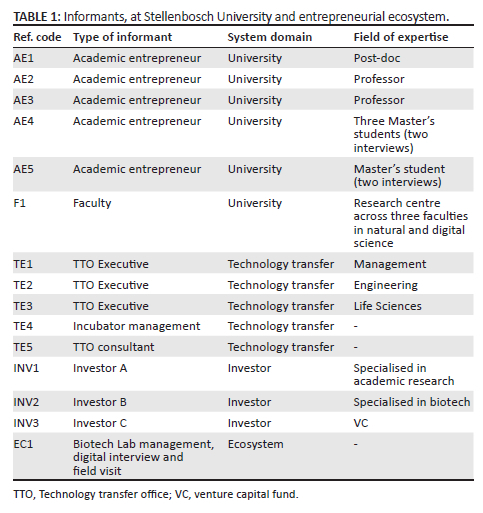

Semi-structured interviews were used to collect data from investors from the entrepreneurial ecosystem in the Western Cape area in South Africa. Three interviews were conducted with investors functioning like key informants for funds and VC organisations. Discussions revolved around topics such as experience with cooperation between TTOs and ASOs, perception of benefits, risk and challenges, criteria for investments cases and strategies, as well as motivation for cooperation and visions for ecosystem development. In addition, several semi-structured interviews were conducted with academic entrepreneurs affiliated to the university (five), TTO executives (three), one with the university incubator, one TTO consultant and one Biotech lab/Incubator. These interviews were conducted to gain more insight on the role of investors from other perspectives as well as to validate data the investors perspective. In total, 14 interviews were conducted (see Table 1 for an overview).

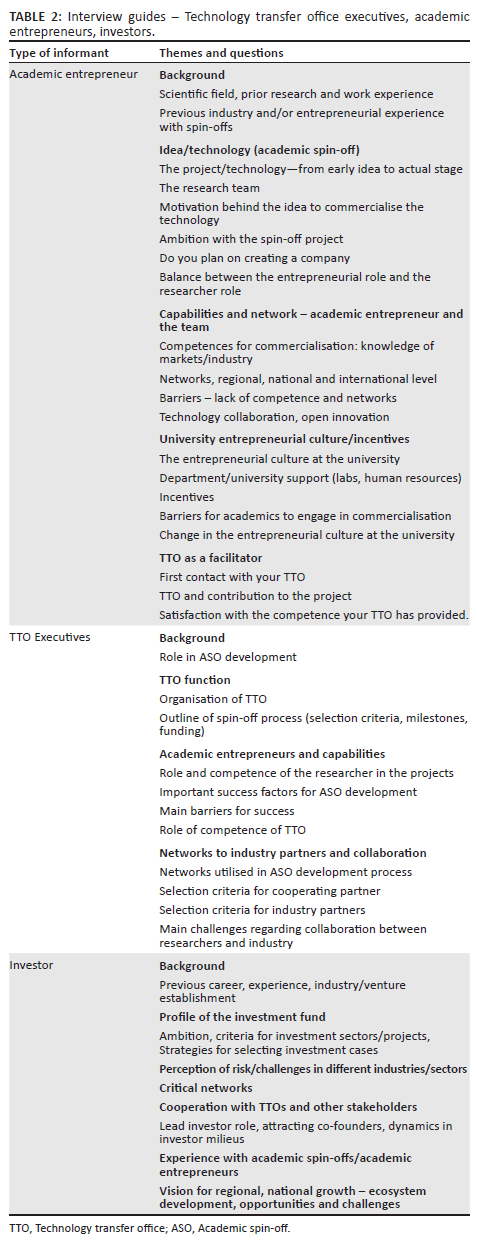

We developed research-based interview guides for all types of respondents (see Table 2 for an overview of themes and types of respondents).

Interviews were conducted in 2022. The interviews lasted between 60 and 90 min. All interviews were digitally recorded and fully transcribed. Confidentiality and anonymity of respondents have been ensured. Triangulation of information, described as the use of multiple methods or data sources in qualitative research to develop a comprehensive understanding of phenomena (Patton 1999) was achieved by studying websites and publicly available reports, and participating in TTO seminars. The data were analysed based on deductive coding based on the initial theoretical framework of the research and inductive coding as the analysis and interpretation of data emerged. From the initial theoretical framework, we analysed the role played by investors with reference to the commercial 'education' of academic entrepreneurs (Granz et al. 2021), the 'honest broker' role (Gubitta et al. 2016; Lerner 2005) as well as the relational dynamic between the investors and academic entrepreneurs and TTO executives (Taxt et al. 2022; Weckowska 2015). Additionally, all authors have varying degree of insider knowledge of the entrepreneurial ecosystem surrounding universities, which facilitated access to respondents and validated the research findings. Two authors, one from South Africa and one from Norway, have prior working experience in the ecosystem. These have had a special role in validating the data and research findings.

Ethical considerations

Ethical clearance to conduct this study was obtained from the EBIT Research Ethics Committee, Faculty Committee for Research Ethics and Integrity (No. SND/SIKT.)

Results

Great research - Challenges to commercialise

The investors acknowledged that universities could develop high-quality research and advanced new technologies as well as generating a great number of talents and high-standing researchers. Yet, the investors did also comprehend the inherent nature of basic research - for example, the fact that inventions discovered in university labs were driven by the passion of doing research and not driven by the effort of bring new products to market. Research-based inventions happened to be both early-stage and very far from market and customers' needs. Universities did also lack the necessary networks and capabilities to assist researchers to succeed with commercialisation, as experienced in many countries (Hossinger et al. 2019). Yet, South African universities are nascent in the process of transforming into entrepreneurial universities (Barnett, in LES 2022). Technology transfer offices that are responsible of protecting and commercialising research are also emerging, and the quality of TTOs in the country varies; for example, some focus entirely on patenting and licencing and legal issues, and have few commercial people onboard (Uctu & Jafta 2014).

Hence, the challenges of commercialising research-based inventions are substantial, and investors recognised the high risk and uncertainty related to research-based innovations. The investors were also aware of the time needed to develop research-based ideas to become investor and market ready. And innovations related to particularly life science and biotech did require substantial resources to reach the market stage, yet the potential for these industries was emerging and promising in the longer term in South Africa.

'South Africa has got really great science and kind of scientists and we know that in terms of our publication records, in terms of our University Rankings. But we don't do very well translating specifically the biotech stuff into companies.' (INV2, Male, Investor)

'You've got amazing things coming out of universities. However, it's often a solution looking for a problem to solve, right - rather than it's a solution to a problem.' (INV1, Male, Investor)

'So there's this fundamental belief that this brilliance in all universities are actually good, - very smart people obviously, bringing out incredible things, all we need to do is go and fund it, except what we've always found was genius research, very often driven not by a market need - but backed by, either a PhD desire or a sort of relatively niche request.' (INV3, Male, Investor)

Technology transfer offices executives (TE1, TE2, TE3) emphasised similarly the potential of advanced research and deep tech at Stellenbosch University (SU), working with the mandate to convert research into patents, and spin-off companies. The university was a leading TTO in the country, establishing effectual routines in scouting for ideas, communicating with researchers, building trust to support and incite the commercialisation route, that is, in line with the relational approach to technology transfer (Taxt et al. 2022; Weckowska 2015). Compensating for the lack of commercial background, entrepreneurship programmes and training were set up to educate and mentor academic entrepreneurs. Still, the TTO shared investors' perception of the difficulty of technology push, as compared to market pull.

Brilliant technology - But the team is everything

Investors were also preoccupied by the researcher and inventor that should act as the entrepreneur driving the process of converting the research to an attractive product in a market. Even though they recognised the value of the research and technology, somebody had to drive the process and have a talent for commercialisation and marketing.

'So some interesting innovations, no entrepreneurs are driving it, and very little understanding of how to take it out. And it's very often driven by the professors. Very seldom did you have a world class entrepreneur with world class technology at the same time.' (INV2)

Brilliant technology was important, but the team and the entrepreneur were ' everything'. Even though researchers could learn the skills and go through an entrepreneurial transformation, aided by programmes and coaching, it was rare to see a fusion of a brilliant researcher and entrepreneur in the same individual. Researchers and academic entrepreneurs were trained as researchers and educators and not entrepreneurs, and they lacked the competence and motivation to devote a lot of time doing entrepreneurial and managerial tasks. This finding is in line with Granz et al. (2021), who state that shortage of commercial skills among researchers and academic entrepreneurs may hamper ASO development. Moreover, universities lacked relevant business networks to be able to recruit the right entrepreneurial team to drive an ASO and venture, as such competence is often found outside the university sphere (Hossinger et al. 2019). Early-stage spin-offs situated in the university sphere were also often driven by a research team - and the university lacked the resources to recruit an external entrepreneur or businessperson to drive the company into the market sphere. According to investors' perception, early-stage ASOs therefore signalled additional risk, being both 'pre-revenue' and 'pre-entrepreneur'.

'Our experience says to us team is everything. And so it's definitely our perspective. Because the right team make the thing work. And you've seen many things that were not the best product out there, but more prolific than anything else. And so - the team - was always our priority.' (INV2, Male, Investor)

'You're going to find really smart individuals who've come up with some form of technology and believe that this is the Holy Grail of something, but they don't actually know what it's going to solve and so it's kind of funding that product market fit. And you need to drive those individuals and the team lacks the commercial basis, business development networks and finance.' (INV1, Male, Investor)

The importance of the spin-off team was also highlighted from the TTO side (TE1, TE2, TE3). The spin-off venture most often needed close connections to research milieus, in the early phases of patenting and prototyping; yet, the right individual to drive commercialisation, 'a champion with passion', was rarely a professor and established researcher. This is in line with the relational approach to technology transfer, which states that commercialisation is a complex task and requires specialised competence in many fields in order to succeed (Weckowska 2015). The TTO rather targeted post-graduate students (Master's, PhD, Post-docs) to drive commercialisation, as they had strong relations to research milieus (through supervisors) and were more motivated and apt to engage in an entrepreneurial venture. Some professors and academic entrepreneurs (AE2, AE3) did also perceive the academic spin-off route as one means to create jobs and opportunities to their students. At SU, many academic spin-offs were driven and managed by post-graduate students (exemplified by AE1, AE4 and AE5).

Educating and coaching researchers - 'Building' entrepreneurs

The investors empathised with academic entrepreneurs and could engage in long-time relationships to educate and coach researchers and academic entrepreneurs to potentially grow into high performing entrepreneurs, that is in line with the role of investors as 'sports coaches' guiding and mentoring academic entrepreneurs and bridging commercial knowledge gaps (Hellman & Puri 2000). One investor (INV1) saw the potential in young academics, like PhD candidates, as promising future entrepreneurs.

'Mostly we've seen young PhD students that have excelled and have got knowledge. They've also got a passion for entrepreneurship. They've got the risk-taking kind of ability and they're humble to the point where we know we're not perfect at everything and they now coming up and running these businesses on behalf almost of the creators.' (INV1, Male, Investor)

'The young academics he refers to had been trained as researchers within the university, mentored by high-class professors with positive attitudes to commercializing research. Taking the role as academic entrepreneurs in university spin-offs, they could capitalize on the good relationship with professors' (validated by AE1, AE5).

'Likewise, the professors are incentivized to commercialize research and simultaneously create a workplace for their PhD students, establishing companies/spin-offs.' (validated by AE2, AE3)

'They 've [professors] got a vested interest and they've got a relationship and they're mentors. So I think that's quite a nice pool. We've seen there's honesty between the peers. There's respect and no professor want to see their young, PhD graduates fail.' (INV1, Male, Investor)

The same investor did also underscore that the relationship to the university, researcher team and inventors was important for ASOs, even after market launch (validated by TE1, TE2 and TE3). This is because of the advanced nature of research-based technologies, which required a lot of expertise and continued research. Hence, the researcher and inventor signalled credibility and represented a continued pool of expertise for the academic spin-offs. Hence, it was important that the researcher and inventor was involved in some kind of role (e.g. CTO or member of the board, but not as an entrepreneur/CEO), to ensure continuity and credibility to the spin-off.

Another investor (INV2) established long-term relationships to individual researchers to potentially identify investment opportunities. The target group were graduates with an advanced degree, Master's or a PhD, who also exhibited 'an entrepreneurial kind of drive' (validated by TE1, TE2, TE3). The investor usually engaged with the candidates over time, getting to know them and their research interests. The best profile was a combination of industry experience and advanced degree, allowing the individual to have seen 'the way the working world works' and being 'kind of fed up with their job' wanting to establish a company, and becoming an entrepreneur. Another approach was to engage with researchers, coming up with an idea not directly linked to their research, but something interesting for innovation. The investor then engaged closely with the researcher to identify the market gap and potential, and how his/her expertise could be applied to create an investment case.

'So it's kind of a blend. It's working with the scientists, their background knowledge to come up with something that we think is interesting or that they think is interesting, but not using these ideas born in their research necessarily.' (INV2)

'With this approach, the investor learned to know the researcher over time, both the personality and the knowledge pool, which was critical before making any investments.'

'I mean, if we can know people better, we can make better calls and whether we think that they can be the personalities which will already be able to take things forward.' (INV2)

One investor (INV1), specialised in approaching academic spin-offs, had a mission to prepare researchers for encounters with VC and other type of investors, assumed to exhibit less empathy with potential investment opportunities and their founders. He meant it was harder to pitch to investors, being an expert in their research field.

'[Standing in front of investors] - That is quite intimidating. They're not for the most part, entrepreneurs. I don't think people actually understand it. I hope we have recruited the right fund managers - the right people to have the patience. I think you need to be mission driven.' (INV1, Male, Investor)

The same investor acknowledged that they spent a lot of time going to events, giving talks, and meeting people to create an awareness within the university ecosystem, to build relationships with TTOs and researchers. This is compared to some VC people, who give you 5 min for a pitch and then walk away. They, on the other hand, had regular meetings, set up 2-h sessions and the TTO bringing in 5 entrepreneurs/researchers presenting their research ideas. At this stage, 'we are not judging them', they were there to learn and to build relations to projects that may evolve into interesting investment opportunities later.

'[The researcher] - can present for 7 min what they've been working on and what their journey is. And we just ask questions well, why are you passionate about this where are you going? Those kinds of questions rather than how much money do you need? What's your commercial model? That's the stuff that they're not comfortable with.'

'[Later] we say, OK, bring us a pitch and they're comfortable to make mistakes, they're comfortable to ask the hard questions and they're comfortable, to be honest. And I think that's the biggest thing there. It's an effort to get involved because trust in this environment doesn't come overnight.' (INV1, Male, Investor)

All investors seemed to take an educative and long-term approach to finding investment opportunities. When searching inside of universities, they could find interesting technology and products, but the researchers and individual with advanced degrees did not necessary possess the right competence and background to pursue an entrepreneurial avenue. It was all about the team and the entrepreneur driving the process. Some researchers had the right drive and interest but needed coaching to grasp the realities of the market. Through meetings, pitching sessions and contact over time, the investors got to know the entrepreneurs, their personalities and capabilities.

'After a yearlong process we are pretty confident about the entrepreneurs and pretty confident about the science and certainly confident enough about the entrepreneurs' ability to execute on whatever they put in front of them - to then be able to be confident that if we make an investment, it's not gonna be squandered too quickly.' (INV2, Male, Investor)

Technology transfer office executives (TE1, TE2 and TE3) also highlighted the long-term relationship building with researchers, to establish trust and to learn about the research and potential for commercialising. The TTO started to engage with researchers at an earlier stage, scouting for ideas, and invited in investors at a later stage, creating a relational dynamic in the ecosystem (Taxt et al. 2022). The investors could complement and add value to TTOs' programmes and mentoring, and were highly recognised, as exemplified in the following quote:

'The [investor] mentor and guide the entrepreneurs in legal, finance, and entrepreneurial development. For us [TTO] it has been a game changer. We've seen better quality companies coming out of the investment, not just because of funding but the support that they give.' (TE3)

In sum, we find this is in line with the relational approach to technology transfer, where investors take a broader role than just providing capital in exchange for equities. Investors are often approached and play a role at an early stage, and they may as such take a co-creation role in ASO development, working together with TTOs and researchers in giving advice and input in the commercialisation process (Taxt et al. 2022; Weckowska 2015).

From a nascent industry to driving the economy? Biotech in South Africa

The investors had visions and passion for building new industries in South Africa, especially in sectors like life science and biotech, which would depend on university research and entrepreneurs with advanced degrees. South Africa had natural advantages in terms of the genetic diversity in its population as well as its biodiversity. Finding a lot of endemic species of plants and animals created both research and entrepreneurial opportunities for developing new drugs and medicines. Humanity emigrated from Africa and has resulted in many races and populations all over the world, meaning that 'the genetic diversity seen all over the world' is found in Africa. As a result of this genetic diversity, South Africa is also a good place to develop and test new pharmaceutical products.

'If you can get a drug that works on most humans - you would definitely do it in Africa because of the diversity of humans.' (INV1, Male, Investor)

This vision and recognition of resources in South Africa were shared with TTO executives and academic entrepreneurs. Several research-based biotech ventures did also originate from identified opportunities in South African endemic plants, resources and traditional knowledge (e.g. AE1, AE2, AE4). The TTO executives did also appraise the recent growth and attractiveness in the entrepreneurial ecosystem in Western Cape, including startup/spin-off communities around universities, increased business activities, and the establishment of techno parks, laboratories and VC, competing with the Gauteng area. Furthermore, the TTO executives highlighted the Western Cape's position as an innovation hub, growing as a dynamic entrepreneurship ecosystem attracting more and more international investors.

The investors acknowledged that South African universities produced advanced research with potential for new ventures and had laboratories with equipment to develop early-stage prototypes (validated by Biotech Lab). South Africa had also strengthened its position within the area of infectious diseases through human immunodeficiency virus (HIV) research and lately with coronavirus disease 2019 (COVID-19).

'South African scientists are the top scientists in the world when it comes to HIV research and HIV being a virus very similar to COVID…so in the face of a pandemic and other viral pandemics we are well equipped to be research leaders in that space. I do think that our fine performance in identifying new variants also - I'm certainly very proud as a South African and I think [this performance] further cemented our position as one of the world leaders in infectious diseases research.' (INV2)

'You know especially in the biotech space … the uniqueness of Africa from a gene perspective, and some of the solutions that have come out of our companies - they discovered and tracked the first variant of COVID - these guys have been able to do something amazing.' (INV1, Male, Investor)

Yet, biotech ventures still face substantial bureaucratic and financial barriers, as there are regulatory and scientific issues to handle as well as the need for financial actors to invest in long-term development of technologies (Munari & Toschi 2011). Nevertheless, it seemed that technological advances in the field had reduced time to market and the associated costs to develop and test new prototypes in laboratories; for example, sequencing of DNA and gene editing had become cheaper and more widely accessible (www.onebio.africa/press).

'So [Biotech] is long term and costly, but it is just becoming affordable enough that we can start creating early-stage progress with early prototypes. For the first time, we can afford to at least be in the game, not take it kind of all the way, because I think that requires still a lot of money and a lot of time.' (INV2, Male, Investor)

Thus, investors' interest in research-based biotech ventures had increased, because of a mix of factors: COVID-19 and increased value of research and biotech, awareness of genetic and biodiversity in South Africa, reduced development costs, and biotech success stories in Europe and the USA. Moreover, the same investors indicated South Africa could and should take a position in life science and biotech (for Africa and internationally). It was crucial to invest in technologies that could help animals, humans and the planet, and these issues should be the main drivers. With the genetic diversity in Africa and 'the strong science' in universities, Africa, as a continent had the potential to take the lead solving some of these problems.

'We see an opportunity to develop a new industry, but to realize that vision, we need to invest and become a global player.' (INV2, Male, Investor)

Concluding discussion

The empirical research highlights the need to investigate a variety of contexts (Gubitta et al. 2016), and South Africa is an intriguing and important context for understanding ASOs, potentials and challenges of commercialising research from universities (Kruger & Steyn 2020). The building of research-intensive universities and efforts to strengthen research-based commercialisation in South Africa through university funds, research laboratories, innovation spaces and the establishment of TTOs (Barnett in LES 2022; Kruger & Steyn 2020; Sibanda 2021) enhance the potential for successful high-tech spin-offs, radical innovations and regional growth. Yet, as seen in many countries, ASOs face regulatory barriers, and lack the necessary competence and networks needed to commercialise (Hossinger et al. 2019; Kruger & Steyn 2020; Uctu & Jafta 2014). Moreover, ASOs suffer from being less attractive in investor milieus, lacking the credibility and expertise as entrepreneurs. Nevertheless, brilliant research and technologies are developed in universities, and could represent attractive opportunities if developed in an interactive collaboration between relevant ecosystem actors, including investors, as suggested by Taxt et al. (2022).

Even though investors may have bias against ASOs, the use of advanced scientific knowledge is nevertheless a fundamental requirement for creating innovative products and solutions in many industries (Munari & Toschi 2011), such as life science and biotech, which are investigated in this research. There is also a growing awareness around 'science-based business' among investors (Munari & Toschi 2011), and our data suggest that investors' sentiments may have slightly changed through the COVID-19 pandemic, which highlighted the importance of research-based vaccine technologies, and their potential to create high value pharmaceutical products in global markets (Yang 2023). Still, while investors in the SU ecosystem may view the opportunities favourably, the nascent nature of capital markets in South Africa causes the capital to be risk averse and limited with regard to deployment of capital.

This background, alongside the funds' missions, might explain the pre-investment behaviours of investors, engaging in long-term relationships with TTOs and academic entrepreneurs, which help mitigating the assumed information asymmetries and uncertainty about ASOs (Munari & Toschi 2011). The investors interviewed had a special position, ability and role to support TTOs and academic entrepreneurs: to build trust, knowledge, to educate/coach to make the ASOs investor and market ready. Investors bring the expertise of how to get something into the market, how to grow its market share and expand to a new market.

Investors are also much better at ensuring that the business remains an investable entity. They can advise the TTOs and entrepreneurs how to navigate the funding scene to ensure that the founding team maintains enough ownership of the business for long enough to stay engaged in the venture and continue to build value for years to come. In the South African context, TTO executives and investors shared perceptions about and visions to establish spin-off companies, grow the regional economy and solve real problems. They engaged in a relational dynamic over time, complementing roles and competencies, to support and incite academic entrepreneurs. The research therefore deepens the knowledge on investors' role in ASOs, contributing to the literature, by taking an interactive, relational and 'ecosystem' perspective to spin-off development, as recommended by Hossinger et al. (2019) and Taxt et al. (2022).

The comprehensive role undertaken by investors, demonstrated in this research, may be explained by the nature of TTOs in South Africa, lacking in-house commercial competence, focusing mainly on patenting and licencing and less on establishing spin-offs (Barnett in LES 2022; Kruger & Steyn 2020; Uctu & Jafta 2014; Urban & Chantson 2019), and the very recent emergence of VC in South Africa, being less capable to invest in early-stage high-tech ventures.

The empirical research undertaken in an emerging economy, and in South Africa as one of the leaders in Africa (Kruger & Steyn 2020), is critical to understand ASOs development outside the USA and Europe, considering the contextual specificities as suggested by Gubitta et al. (2016). For example, Urban and Chantson's study (2019), investigating academic entrepreneurs in South Africa, suggests that the low rate of academic start-ups and low levels of commercialisation in South Africa can be ascribed to a lack of institutional and organisational factors. The role and maturity of TTOs and universities (as entrepreneurial universities), may, for instance, affect the role of investors, their degree of engagement in ASOs, including the educating and coaching role of investors, and how they might supplement TTOs role.

It is timely to explore the phenomena of entrepreneurial universities, TTOs, academic entrepreneurs and the role of investors in the emerging economy of South Africa, and new studies are needed to fully grasp the potential and challenges of research-based commercialisation.

Acknowledgements

Competing interests

The authors declared that they have no financial or personal relationship(s) that may have inappropriately influenced them in writing this article.

Authors' contributions

Ø.S.H., I.B.P., A.C.N., B.P. and R.E.T. contributed towards the conceptualisation, methodology, analysis, visualisation, writing review and editing of the article. Ø.S.H. and I.B.P. focused on the original draft of the introduction and conceptual section of the manuscript.

Funding information

The authors have disclosed receipt of financial support for the publication of this article. This work was supported by the Research Council of Norway through the INTPART project [Research Project Number 36024].

Data availability

The data that support the findings of this study are available from the corresponding author, Ø.S.H., upon reasonable request.

Disclaimer

The views and opinions expressed in this article are those of the authors and are the product of professional research. It does not necessarily reflect the official policy or position of any affiliated institution, funder, agency, or that of the publisher. The authors are responsible for this article's results, findings, and content.

References

Barnett, J., 2022, 'South Africa's technology transfer system', Les Nouvelles-Journal of the Licensing executive's society International LV11(2), 293-299. [ Links ]

Chan, W.L. & Mustafa, M.J., 2021, 'Journal of entrepreneurship in emerging economies (JEEE): Reflecting on the past five years while thinking about the future', Journal of Entrepreneurship in Emerging Economies 13(5), 791-818. https://doi.org/10.1108/JEEE-06-2020-0162 [ Links ]

Colombo, M. & Piva, E., 2012, 'Firms' genetic characteristics and competence-enlarging strategies: A comparison between academic and non-academic high-tech start-ups', Research Policy 41(1), 79-92. https://doi.org/10.1016/j.respol.2011.08.010 [ Links ]

Cyrus, C., 2020, Stellenbosch ignites five spinouts in 2020, viewed 12 May 2022, from https://globalventuring.com/university/stellenbosch-five-spinouts-2020. [ Links ]

Dubois, A. & Gadde, L.E., 2002, 'Systematic combining: An abductive approach to case research', Journal of Business Research 55(7), 553-560. https://doi.org/10.1016/S0148-2963(00)00195-8 [ Links ]

George, A. & Bennett, A., 2005, Case studies and theory development in the social sciences, MIT Press, Cambridge, MA. [ Links ]

Ghauri, P. & Grønhaug, K., 2010, Research methods in business studies, Financial Times Prentice Hall, Harlow. [ Links ]

Global Entrepreneurship Development Institute, n.d., The entrepreneurial ecosystem of South Africa: a strategy for global leadership 2017, viewed 12 May, 2022 from http://www.thegedi.org/tool. [ Links ]

Granz, C., Lutz, E. & Henn, M., 2021, 'Scout or coach? Value-added services as selection criteria in entrepreneurs' venture capitalist selection', Venture Capital 23(1), 5-40. https://doi.org/10.1080/13691066.2020.1824603 [ Links ]

Gubitta, P., Tognazzo, A. & Destro, F., 2016, 'Signaling in academic ventures: The role of technology transfer offices and university funds', The Journal of Technology Transfer 41, 368-393. https://doi.org/10.1007/s10961-015-9398-7 [ Links ]

Feldman, M., Siegel, D.S. & Wright, M., 2019, 'New developments in innovation and entrepreneurial ecosystems', Industrial and Corporate Change 28(4), 817-826. https://doi.org/10.1093/icc/dtz031 [ Links ]

Festel, G.W. & De Cleyn, S.H., 2013, 'Founding angels as an emerging subtype of the angel investment model in high-tech businesses', Venture Capital 15(3), 261-282. https://doi.org/10.1080/13691066.2013.807059 [ Links ]

Frimanslund, T. & Nath, A., 2022, 'Regional determinants of access to entrepreneurial finance: a conceptualisation and empirical study in Norwegian startup ecosystems', Journal of Small Business & Entrepreneurship, 1-28. [ Links ]

Hayter, H., 2016, 'A trajectory of early-stage spin-off success: The role of knowledge intermediaries within an entrepreneurial university ecosystem', Small Business Economics 47(3), 633-656. https://doi.org/10.1007/s11187-016-9756-3 [ Links ]

Hellmann, T. & Puri, M., 2000, 'The interaction between product market and financing strategy: The role of venture capital', The Review of Financial Studies 13(4), 959-984. https://doi.org/10.1093/rfs/13.4.959 [ Links ]

Hossinger, S.M., Chen, X. & Werner, A., 2019, 'Drivers, barriers and success factors of academic spin-offs: A systematic literature review', Management Review 70(1), 97-134. https://doi.org/10.1007/s11301-019-00161-w [ Links ]

Innovus n.d., About us, viewed 19 September 2022, from https://www.innovus.co.za/about-us/infographic.html. [ Links ]

Jacobsen, D. I., 2015, How to conduct research: introduction to social science research methods (Translated from Norwegian: Hvordan gjennomføre undersøkelser?: innføring i samfunnsvitenskapelig metode, Cappelen Damm akademisk, Oslo. [ Links ]

Jared, F., 2019, How biotech startup funding will change in the next 10 years, viewed 14 May 2022, from www.onebio.africa/press. [ Links ]

Kruger, S. & Steyn, A.A., 2020, 'Enhancing technology transfer through entrepreneurial development: Practices from innovation spaces', The Journal of Technology Transfer 45(6), 1655-1689. https://doi.org/10.1007/s10961-019-09769-2 [ Links ]

Lerner, J., 2005, 'The university and the start-up: Lessons from the past two decades', The Journal of Technology Transfer 30(1), 49-56. [ Links ]

Lockett, A., Murray, G. & Wright, M., 2002, 'Do UK venture capitalists still have a bias against investment in new technology firms', Research Policy 31(6), 1009-1030. [ Links ]

Lockett, A. & Wright, M., 2005, 'Resources, capabilities, risk capital and the creation of University spin-out companies', Research Policy 34(7), 1043-1057. https://doi.org/10.1016/j.respol.2005.05.006 [ Links ]

Munari, F. & Toschi, L., 2011, 'Do venture capitalists have a bias against investment in academic spin-offs? Evidence from the micro- and nanotechnology sector in the UK', Industrial and Corporate Change 20(2), 397-432. https://doi.org/10.1093/icc/dtq053 [ Links ]

Nicolaou, N. & Birley, S., 2003, 'Social networks in organizational emergence: The university spinout phenomenon', Management Science 49(12), 1702-1701. https://doi.org/10.1287/mnsc.49.12.1702.25116 [ Links ]

O'Kane, C., 2018, 'Technology transfer executives' backwards integrations: An examination of interactions between university technology transfer executives and principal investigators, Technovation 76-77, 64-77. [ Links ]

O'Kane, C., Cunningham, J.A., Menter, M. & Walton, S., 2020, 'The brokering role of technology transfer offices within entrepreneurial ecosystems: An investigation of macro-meso-micro factors', The Journal of Technology Transfer 46(6), 1814-1844. https://doi.org/10.1007/s10961-020-09829-y [ Links ]

Patton, M.Q., 1999, 'Enhancing the quality and credibility of qualitative analysis', Health Services Research 34(5 Pt 2), 1189. [ Links ]

Prokop, D., Huggins, R. & Bristow, G., 2019, 'The survival of academic spinoff companies: An empirical study of key determinants', International Small Business Journal 37(5), 502-535. https://doi.org/10.1177/0266242619833540 [ Links ]

Rasmussen, E. & Borch, O., 2010, 'University capabilities in facilitating entrepreneurship: A longitudinal study of spin-off ventures at mid-range universities', Research Policy 39(5), 602-612. https://doi.org/10.1016/j.respol.2010.02.002 [ Links ]

Sadek, T., Kleiman, R. & Loutfy, R., 2015, 'The role of technology transfer offices in growing new entrepreneurial ecosystems around mid-sized universities', International Journal of Innovation and Regional Development 6(1), 61-79. https://doi.org/10.1504/IJIRD.2015.067648 [ Links ]

Shane, S. & Cable, D., 2002, Network Ties, Reputation, and the Financing of New Ventures, Management Science, 48(3), 364-381. [ Links ]

Shane, S.A., 2004a, Academic entrepreneurship: University spinoffs and wealth creation. Edward Elgar Publishing, Cheltenham. [ Links ]

Shane, S., 2004b, 'Encouraging university entrepreneurship? The effect of the Bayh-Dole Act on university patenting in the United States', Journal of Business Venturing 19(1), 127-151. [ Links ]

Sibanda, M., 2021, NUTS & BOLTS, strengthening Africa's innovation and entrepreneurship ecosystems, Tracey McDonald Publishers. [ Links ]

Siegel, D.S., Waldman, D. & Link, A., 2003, 'Assessing the impact of organizational practices on the relative productivity of university technology transfer offices: an exploratory study', Research Policy 32(1), 27-48. [ Links ]

Siegel, D.S. & Wright, M., 2015, 'University technology transfer offices, licensing and startups', in A.N. Link, D.S. Siegel & M. Wright (eds.), The Chicago handbook of university technology transfer and academic entrepreneurship, pp. 22-61, University of Chicago Press, Chicago, IL. [ Links ]

Smilor, R., Gibson, D. & Dietrich, G., 1990, 'University spin-out companies: Technology start-ups from UT-Austin', Journal of Business Venturing 5(1), 63-76. https://doi.org/10.1016/0883-9026(90)90027-Q [ Links ]

Taxt, R.E., Høvig, Ø.S. & Pettersen, I.B., 2022, 'The relational dynamics in the extended teams of academic spin-offs: A Norwegian case-study', International Journal of Research, Innovation and Commercialisation 4(1), 31-51. https://doi.org/10.1504/IJRIC.2022.125895 [ Links ]

Uctu, R. & Jafta, R., 2014, 'Spinning-off or licensing? The case of academic technology transfer at two South African universities', Industry and Higher Education 28(2), 127-141. https://doi.org/10.5367/ihe.2014.0195 [ Links ]

Urban, B. & Chantson, J.J.T.J., 2019, 'Academic entrepreneurship in South Africa: Testing for entrepreneurial intentions', The Journal of Technology Transfer 44(3), 948-980. https://doi.org/10.1007/s10961-017-9639-z [ Links ]

Wang, L., 2018, The impact of TTO on institutional entrepreneurial culture formation - A case study of KU Leuven research and development, viewed 14 February 2022, from https://www.duo.uio.no/handle/10852/64240. [ Links ]

Weckowska, D., 2015, 'Learning in university technology transfer offices: Transaction-focused and relations-focused approaches to commercialization of academic research', Technovation 41-42, 62-74. https://doi.org/10.1016/j.technovation.2014.11.003 [ Links ]

Wright, M., Hmieleski, K.M. & Siegel, D., 2006, 'The role of human capital in technological entrepreneurship', Entrepreneurship Theory and Practice 31(6), 791-806. [ Links ]

Yang, S., 2023, 'The strategy research of pharmaceutical enterprises-taking Pfizer as an example', Proceedings of the 2022 4th International Conference on Economic Management and Cultural Industry (ICEMCI 2022), pp. 228-235. Held in Chongqing (Online) on 14-16 October 2022. [ Links ]

Yin, R.K., 2009, Case study research: Design and methods, vol. 5, Sage, Thousand Oaks, CA. [ Links ]

Correspondence:

Correspondence:

Øystein Stavø Høvig

oystein.stavo.hovig@hvl.no

Received: 31 Mar. 2023

Accepted: 29 Aug. 2023

Published: 28 Nov. 2023