Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Southern African Business Review

On-line version ISSN 1998-8125

Print version ISSN 1561-896X

SABR vol.27 Pretoria 2023

http://dx.doi.org/10.25159/1998-8125/11588

ARTICLE

Understanding Opportunity Evaluation Prototypes in Search of more Entrepreneurs

Marius PretoriusI; Ingrid le RouxII; Sollie MillardIII

IUniversity of Pretoria. South Africa. marius.pretorius@up.ac.za. https://orcid.org/0000-0001-9729-3716

IIUniversity of Pretoria. South Africa. ingleroux375@gmail.com. https://orcid.org/0000-0002-3885-5798

IIIUniversity of Pretoria. South Africa. sollie.millard@up.ac.za. https://orcid.org/0000-0002-6173-5452

ABSTRACT

BACKGROUND: In search of more entrepreneurs for economic development, academics and policy makers are continuously seeking ways in which the participation of potential entrepreneurs in the economy can be enhanced.

PURPOSE: This study investigates whether entrepreneurial prototype factors could be identified to inform how entrepreneurs evaluate opportunities.

DESIGN/METHODOLOGY: In an experimental design, participants were requested to evaluate a single start-up opportunity. They completed a questionnaire exploring their thinking of the single case. Participants included 193 nascent and novice entrepreneurs that evaluated the same opportunity. The questionnaire was administered, leading to factor and regression analyses.

FINDINGS: The factor analysis identified four prototype factors for potential use in selection. Discrimination was possible between the prototype factors (cognitive frameworks) of novice (first-time) and repeat (experienced) entrepreneurs for "positive financial model"; "uniqueness of the idea"; "big markets"; and "intuition." Significant differences for the identified factors were reported between those who decided for and against starting the venture. Regression analysis suggested further discriminatory value, with the prototype factors for the start-up decision contributing to a potential selection process by venture capitalists, as well as educators.

RESEARCH LIMITATIONS: The generalisability of the findings may be limited by the use of a single case evaluation.

ORIGINALITY/VALUE: Firstly, support was found for the effectiveness of the methodology in identifying the prototypes. Secondly, the study contributes by informing educators of entrepreneurs about the relevancy of cognitive frameworks that could be developed to meaningfully enhance opportunity evaluation.

Keywords: cognitive frameworks; entrepreneurs; opportunity evaluation; prototypes; start-up decision

Introduction

Entrepreneurship (and its development) is widely seen as the silver bullet for economic development. The plight of governments for more entrepreneurs to create jobs is widely known. In practice, however, success appears absent. Prospective entrepreneurs face rigorous interrogations by venture capitalists. Even in the entrepreneurial television series Dragon's Den, prospective entrepreneurs are often cross-examined for their limited thinking, reasoning and focus on irrelevant factors when they present their business ideas for obtaining investment funding. The venture capitalists (dragons) themselves are all entrepreneurs, but differ vastly as regards their experience, industry and the types of opportunities they pursue for investment. Such differences complicate generalisations, as the perceived elements of opportunities according to each dragon are also dissimilar. Development organisations, financiers and venture capitalists are always in search of ways to reduce risk before investing to enhance their yields. They judge the thinking of applicants about different issues associated with an opportunity.

Exploring the intersection between enhanced entrepreneurial activity and opportunity evaluation, this paper attempts to understand the variances in the way different entrepreneurs evaluate the perceived elements of an opportunity, a process that takes place after the opportunity has been identified/recognised. Mitchell, Mitchell, and Randolph-Seng (2014, 1) argue that entrepreneurial cognition has emerged as an important perspective in entrepreneurship research and is defined as the knowledge structures people use to make assessments, judgements or decisions involving opportunity evaluation and venture creation. Much of this research has concluded that differences in individual perceptions about a potential entrepreneurial action might play an important role in determining entrepreneurial activity (Simon and Houghton 2002, 106). According to Mitchell et al. (2002, 95), Mitchell et al. (2014, 6) and Urban (2010, 1512), the cognitive viewpoint acts as an effective tool to help us understand how entrepreneurs think, and why they do some of the things that they do. Pattern recognition (Baron and Henry 2010, 59) is often seen as the missing link in the identification of new business opportunities.

Baron and Ensley (2006, 1331) suggested that "prototypes" were associated with the evaluation/assessment of an opportunity. In their study, they proposed differences between what they termed the "prototypes"-also called "thinking capacities" (McKenzie et al. 2009, 209), "cognitive frameworks" (Baron 1998, 275) or "mental models" (Baron and Ward 2004, 553)-of novice (first-time) and repeat (experienced) entrepreneurs. Prototypes, as complex cognitive frameworks developed by experience, are now seen as playing an important role in pattern recognition, as they assist specific individuals to recognise connections between apparently independent events and trends and to detect "meaningful patterns in these connections" (Baron and Ward 2004, 553). Therefore, one can propose that these prototypes are used differently by different entrepreneurs when evaluating opportunities.

Problem Statement

Unemployment and under-employment remain key concerns for both the developing and developed world (Bowmaker-Falconer and Meyer 2022; Herrington, Kew, and Kew 2013). Academics and policy makers suggest that entrepreneurs, young or old, play a crucial role in addressing this unemployment crisis (Bowmaker-Falconer and Meyer 2022; Herrington et al. 2013). In entrepreneurship, pattern recognition is often seen as the missing link in the identification of new business opportunities. In turn, prototypes are suggested to play an important role in pattern recognition.

In South Africa, with its struggling economy, investigating prototypes of potential entrepreneurs can potentially enhance opportunity evaluation. When this is known, it could in turn contribute to enhanced participation by development organisations, venture capitalists and general funders (banks) in entrepreneurial endeavours. Understanding the decision-making and evaluation processes of potential entrepreneurs may furthermore assist trainers and educators in developing entrepreneurs who "will create and deliver value for stakeholders" (Urban 2014, 523).

Objectives

The approach followed in this study is that of investigating the feasibility of an experimental design to measure evaluation prototypes. A real-life case-study evaluation was used in which all the participants evaluated the same information associated with a venture opportunity.

The study that directed this paper firstly aimed to join the debate on the cognitive perspective and expand how entrepreneurs make decisions and evaluate opportunities in the venture creation process. The interest of the study is specifically focused on entrepreneurial education but may also benefit venture capital access. This is in line with a recent call for further research in cognitive development (Barbosa, Kickul, and Smith 2008, 435 in Urban 2012, 11741). Furthermore, Gregoire, Corbett, and McMullen (2011, 1456) postulate that many opportunities remain for the development of the cognition research field. Gregoire et al. (2011, 1443) argue that cognition is not static but situated within specific individuals and environments, and postulate that cognition has functional purposes (Mitchell et al. 2014, 17).

Secondly, the study attempted to identify and measure the prototype factors, using an experiential design based on a real-life case study. It is postulated that this experiential design may eliminate many contextual variations regarding industry-specific knowledge that might mask the prototype effects. Four prototypes were identified and the scope of this paper was limited to: 1) positive financial model; 2) uniqueness of the idea; 3) big markets; and 4) intuition. Highly significant differences in prototypes were reported between those making the decision to start and those not starting the venture. In line with Baron and Ensley (2006, 1333), this paper limits its scope to the differences in prototype factors between nascent, novice and repeat (serial) entrepreneurs when evaluating opportunities, resulting in the decision to start or not to start a business based on the proposed opportunity.

In doing so, this paper aims to better understand the opportunity evaluation prototypes in search of more entrepreneurs to contribute to economic growth in South Africa. On a methodological level, this paper also aims to illustrate how an experimental design, with complementary qualitative and quantitative methodologies, can open new ways of approaching research problems in entrepreneurship research.

Implications

The paper has important implications for both entrepreneurial training programmes and industry. The paper's contribution is twofold. Firstly, it contributes to the entrepreneurship debate on opportunity evaluation, using a real-life case study. This alternative method may assist those conducting entrepreneurial learning and training processes to give practice and develop participants' ability to recognise and differentiate between ideas and real opportunities. This may provide educators with the insights needed to develop prototype-based material for opportunity evaluation. Secondly, it may assist financiers and venture capitalists in the pre-investment selection of which potential entrepreneurs to fund.

The next section presents a literature discussion on the concepts of cognition, prototypes, novice, nascent and repeat entrepreneurs, leading to the formulation of propositions to guide the study. Finally, findings are reported and discussed, followed by notes on the limitations of the study and suggestions for future research.

Cognition and Prototypes in the Opportunity Evaluation Process

Experience plays a "crucial role in start-ups and entrepreneurial learning" (Politis 2008, 472). As stated by Wright, Robbie, and Ennew (1997, 251), entrepreneurship has been the subject of a long-standing debate, and the "creation of new ventures and the associated decisions have been the focus of many of these discussions." Despite the complexities of the field, Baron and Henry (2010, 49) suggest that the "field of entrepreneurship has long recognised the role of founding entrepreneurs in new venture creation and success." Starting a venture is, however, not easy and the creation of a new business is a process "fraught with difficulty and failure" (Gatewood, Shaver, and Gartner 1995, 372). The literature is further littered with attempts to use personal traits to explain the entrepreneurial phenomenon. Traits are currently seen as a "dead end" by some researchers in the field of entrepreneurship, and the research focus has moved towards examining entrepreneurial cognition and decision processes. This study, like that of Simon and Houghton (2002, 106), suggests that "individual perception and prototypes might play an important role in determining entrepreneurial activity," especially as far as opportunity evaluation is concerned.

This paper limits its scope to the differences in evaluation prototypes between nascent, novice and repeat (serial) entrepreneurs when faced with an opportunity, resulting in the decision to start or not to start a business based on the presented opportunity. Westhead, Ucbasaran, and Wright (2005a, 394) report differences in prototypes as "knowledge gaps" that exist between novice, serial and portfolio entrepreneurs. Many definitions are used to describe the entrepreneurial typology concepts. According to Westhead et al. (2005a, 393), novice entrepreneurs can be defined as individuals who have no prior minority or majority business ownership experience, either as a business founder or an inheritor or a purchaser of an independent business, but who currently own a minority or majority equity stake in an independent business that is either new, purchased or inherited. Westhead and Wright (1998b, 176) refer to two types of habitual entrepreneurs: serial and portfolio entrepreneurs. Serial (referred to as "repeat" in this study) entrepreneurs are defined as "entrepreneurs who exit their original business but at a later stage inherit, establish or purchase another business, and portfolio entrepreneurs are those who retain the original business and inherit, establish or purchase another business." According to Westhead and Wright (1998b, 173), founders in the novice category may themselves become repeat entrepreneurs.

For this study, prototypes are understood as "cognitive frameworks" (Baron and Ensley 2006, 1331), nascent entrepreneurs as potential future entrepreneurs who have "not yet started up but are considering it in the near future" (Autio 2005, 13), novice entrepreneurs as first-time starters, and repeat entrepreneurs as "persons who have started two or more new ventures"-also referred to as experienced entrepreneurs (Baron and Ensley 2006, 1332).

Pattern recognition is seen as the process through which individuals identify meaningful patterns in a complex array of information, events and trends. Baron and Ensley (2006) applied qualitative research methods to gather evidence on the potential role of pattern recognition in identifying new business opportunities, by comparing the cognitive frameworks of novice and experienced entrepreneurs. This article proposes to identify and measure such prototypes by using a quantitative method within an experimental design, to compare nascent, novice and repeat entrepreneurs on the basis of these prototypes and investigate the role of the prototypes in the start-up decision.

Westhead and Wright (1998a, 63) argue that in order to encourage innovativeness, competitiveness, wealth creation, job generation and local and regional development (Reynolds 1991, 50), governments in industrial countries and in developing countries like sub-Saharan Africa need to produce programmes and initiatives to encourage and help individuals to become self-employed or establish businesses with employees (Van Praag and Van Ophem 1995 cited in Westhead and Wright 1998a, 63). In recent years, many individuals have made the transition from being nascent entrepreneurs to novice entrepreneurs: that is, starting to exploit a recognised opportunity. If we accept that the prototype factors can be determined, we could assume that opportunity evaluation may be enhanced or limited by this recognition.

Opportunity Recognition versus Opportunity Evaluation

Prototypes are concerned with entrepreneurial awareness (Tang, Kacmar, and Busenitz 2012), entrepreneurial interpretation (Barreto 2012, 356), entrepreneurial alertness (Valliere 2011, 476) or reasoning (Cornelissen and Clarke 2010, 540), suggesting a preference for research in opportunity recognition. While the intersection with evaluation is unclear, this study attempts to limit its scope to the evaluation aspect.

The study of cognition concerns itself with the study of "individual perception, memory and thinking" (Mitchell et al. 2002, 96). Cognition describes the mental processing used by individuals to interact with their environment (Baron 2004, 221) and is relevant to the distinction between nascent, novice and repeat entrepreneurs. Le Roux, Pretorius, and Millard (2006, 51) reason that research into entrepreneurial cognition is about "understanding how entrepreneurs use simplified mental models" (prototypes in this study) to piece together previously unconnected information. This helps them to identify and invent new products or services and to assemble the necessary resources to start and grow businesses, as well as pursuing or declining opportunities. Because this situation is often associated with an information overload that makes entrepreneurs "extremely vulnerable to heuristics and biases in their decision making" (Le Roux 2005, 114), the understanding of prototypes becomes more relevant.

It is widely acknowledged that cognition research has added greatly to the understanding of the nature of opportunity recognition-the process through which specific people identify ideas for potentially profitable new business ventures (Baron and Ensley 2006). How opportunity recognition occurs in the minds of entrepreneurs has been speculative; it is now assumed that recognising new ventures does involve cognitive events and processes experienced by entrepreneurs. An entrepreneur's cognition can now be seen as an important component of entrepreneurial human capital. Entrepreneurial cognition is also associated with extensive use of heuristics and individual beliefs that impact on decision making (Westhead, Ucbasaran, and Wright 2005b, 75). Busenitz and Barney (1997, 9) found that entrepreneurs make use of heuristics more often than managers, and it is also accepted that the extent to which an entrepreneur relies on heuristics "can be shaped by the entrepreneur's level of experience" (Westhead et al. 2005b, 393), thus also when evaluating an opportunity.

Baron and Ensley's (2006, 1335) research indicates the potential role of pattern recognition in evaluating new business opportunities by comparing cognitive frameworks for the evaluation of novice and repeat entrepreneurs. Although several theories of pattern recognition exist, the prototype theory appears to offer important insights into quantifying the nature of opportunity evaluation. The theory suggests that individuals acquire prototypes through experience; when they encounter a new experience, the existing prototypes influence their perception of the events and the detection of connections between them. Westhead and Wright (1998a, 63) also refer to previous work experience as the single most important influence upon the ability of an individual to undertake an entrepreneurial venture. Based on this, one would expect nascent, novice and repeat entrepreneurs to measure differently for different prototype factors.

It can be postulated that prototypes act as templates in detecting recognisable connections. Vaghely and Julien (2010, 75) suggest that "schemata" represent a built-up repertoire of tacit knowledge that is used to impose structure upon, and impart meaning to, otherwise ambiguous social and situational information in order to facilitate understanding. According to Westhead et al. (2005b, 74), business experience "may bring a variety of assets, which may include managerial and technical skills as well as a network of contacts that can be utilised in subsequent ventures." They postulate that experienced or portfolio entrepreneurs owning a business in the same sector as their previous/current venture may be able to identify more clearly than novice entrepreneurs what is required to earn profits in the selected market. A deduction can be made that experienced entrepreneurs may, therefore, attempt to apply the same formula in changed circumstances, as opposed to novice entrepreneurs who are still developing their formulae by trial and error. According to Westhead et al. (2005b, 74), experienced individuals can "process information more effectively" than inexperienced individuals; thus, repeat entrepreneurs may be able to use their already formed prototypes to make a faster decision than nascent or novice entrepreneurs.

It is widely recognised that the prototypes change as experience increases. Among the changes are a shift in clarity, richness of content and the degree of focus on key attributes of the content domain (Baron and Ensley 2006, 1331). These authors also reason that changes in these respects would be visible in the business opportunity prototypes of novice and experienced entrepreneurs. They reason that this would provide evidence of the role of pattern recognition in the identification of new business opportunities (Baron and Ensley 2006, 1332). They hypothesise that the opportunity prototypes of experienced entrepreneurs will be more clearly defined, richer in content and more focused than those of novice entrepreneurs. According to Westhead et al. (2005a, 395), an entrepreneur's "stock of experience" includes both the depth and breadth of experience accumulated at a certain time and the extent to which the individual searches for relevant information and identifies business opportunities. It is thus reasonable to assume that the extent to which repeat entrepreneurs draw on their previous business experience for the opportunity evaluation process will exhibit more effective information-search behaviour than that of nascent and novice entrepreneurs. Less experienced novice entrepreneurs may conduct search routines that are narrower in terms of the amount of information collected (Westhead et al. 2005a, 397). It is from this background that the study proceeds to describe its approach, sets the hypotheses, reports the findings and discusses its relevance.

Research Methodology

This research study expands the findings of Baron and Ensley (2006, 1340), who first reported the prototypes of novice and repeat entrepreneurs. While their method of establishing the prototypes was ground breaking and content rich, the interview methodology is complex, time consuming and laborious and depends heavily on the skills and ability of the researchers/evaluators, which reduces its potentially wider practical application by practitioners and repetitive use during fund applications. The current research explores an experimental design to investigate whether prototype measurement can be achieved with a simplified method. The benefit of experimental design lies firstly in its reduction of external variables and secondly in its use as a discriminating selection tool for funding organisations that need to select potential entrepreneurs to support, or to identify gaps in the training of potential entrepreneurs.

Proposition and Hypotheses

To govern the thinking of the research in this process setting, one proposition and three hypotheses were used. The study only sought support for the proposition because if no prototype factors could be identified, there would be no sense in pursuing the hypotheses. The null hypothesis generally proposes that there is no relationship between the entrepreneurial types, prototype factors and the decision to start, while the alternative hypotheses state that relationships between the factors and the decision to start do exist. First, the focus was on the ability of the experimental design to identify the prototype factors leading to:

Proposition 1: The experimental design and instrument applied, favour the identification of prototype factors involved in evaluating an entrepreneurial opportunity.

If the experimental design and instrument can be used to identify the prototype factors, then the interest changes to whether the prototype factors identified can be used to discriminate between the entrepreneurial types, leading to the following hypotheses:

H01: There are no significant differences between nascent, novice and repeat entrepreneurs for the prototype factors used to evaluate an opportunity, thus μ1 = μ2 = μ3 (HAl: There are differences-for each factor individually tested).

If the prototype factors can be used to discriminate between entrepreneurial types, we need to know if there is a relationship between the entrepreneurial type and the decision to start or not, thus leading to:

H02: There is no relationship between the prototype factors of nascent, novice and repeat entrepreneurs and the decision to start a business or not (HA2: There is such a relationship).

Finally, whether or not entrepreneurial types differ or not as regards prototypes, we need to know whether those who support start-up (or not) differ as to prototypes, leading to:

H03: There is no significant difference in prototype factors of nascent, novice and repeat entrepreneurs between those who support start-up and those who do not support start-up (HA3: There is such a difference).

Experimental Design

By means of a procedure similar to that used by Simon, Houghton, and Aquino (1999, 113) and Le Roux et al. (2006, 51), a case study was designed that described a revolutionary new concept, namely animal fodder manufactured from cut lawn waste (kikuyu grass). A presentation described the proposed venture's product and market, and explained its processes, resource requirements and predicted/expected performance. The presentation provided both encouraging and discouraging information, as the product was a real one. The case was presented by one person to several groups of subjects who voluntarily participated while undergoing small business training, totalling 200 participants. A PowerPoint™ presentation lasting approximately 40 minutes contained information about the idea, process, market demand, potential, finance requirement, projected cash flow, threats and structures-similar to that contained in a standard business plan. The presenter was well informed (with in-depth product, technical, business and industry knowledge) about the detail, and answered all questions during or after the presentation.

Care was taken specifically to ensure that the same information was given consistently to all the groups. To eliminate potential information-framing effects by the presenter, such as attribute framing, goal framing and risky-choice framing, as described by Levin, Gaeth, and Schreiber (2002, 412), care was taken in the presentation of the case not to show bias towards a specific view about the product (such as that associated with "sales talk"). Positive and negative information, advantages and disadvantages and positive and negative facts and consequences were deliberately balanced. Time was purposely limited to allow for the use of biases and heuristics (potentially part of the prototypes) and to simulate the data overload that prospective entrepreneurs would face at this point in the entrepreneurial process. The presentation length (40 minutes) and its ambiguity and complexity required subjects to apply all possible information processing to make judgements and determine whether they would start the venture or not. There was no limit on the number of questions that subjects could ask, while the presenter attempted to ensure that all subjects could hear the responses to such questions. If key questions were asked, the presenter noted such points and ensured that the next presentation would make reference to the questions that were asked, thus attempting to provide the same information to all subjects.

Case and Design Strengths

The product in the case was unique and was related to the animal (ruminant specific = sheep and cattle) nutrition industry, which was known to less than 1% of the subjects. This, to a large extent, eliminated any influence of previous industry-specific experience and could be seen as one of the strengths of the chosen design. Using the single business case eliminated many of the environmental factors that make it difficult to compare individual thinking and behaviour associated with different entrepreneurs, macro and market environments, industries, competitive levels, venture characteristics and the like. Using the case method in experimental research further ensured that all subjects analysed the same venture opportunity and at the same level of complexity. Korunka et al. (2003, 26) suggest that research should always consider differences in environmental conditions in relation to entrepreneurial character, resources and organising activities, as they play a crucial role. This approach allows for some "control" of external effects that may influence perceptions.

Subjects and Sample

The final 193 subjects who took part were all participants in various small-business training courses offered by the University of Pretoria's Chair in Entrepreneurship to prospective and current loan holders of the Industrial Development Corporation (IDC). The case was presented on the afternoon of day three of a four-day course, and after the presentation the subjects completed the questionnaire. Thereafter it was used as discussion material for the training process. After completion of the questionnaire, each subject was interviewed individually to establish his or her exact status as nascent, novice or repeat entrepreneur, and also previous business and potential failure experience. Previous failure experience was later discarded for various reasons. Two researchers discussed the status and, once they had agreed, classified subjects as either nascent, novice, repeat or failed (see table 1 for typology classification by researchers).

Instrument

After the presentation and allowing for general clarification questions (about industry, product and use) and answers, subjects were given a questionnaire with 25 statements about the business opportunity. The statements were designed to tend strongly towards simplicity, based on those reported by Baron and Ensley (2006, 1334) as the basis of the factors and dimensions. Subjects evaluated simple direct statements aimed to extract perceptions regarding the presented business in the experiment on a 10-point Likert scale, where 1 = strongly disagree and 10 = strongly agree.

The decision to start the venture was determined by a single statement whereby subjects were asked to state their willingness to start versus not to start, on a 6-point Likert scale. A 6-point scale (1 = definitely not start and 6 = definitely start) was used to force a decision towards either start or not start, in an attempt to reduce the number of unsure responses. No option for "not sure" was given. Eventually, for this part of the analysis, the scale was converted into a no-yes scale by pooling the responses 1 to 3 together as "not willing to start" and 4 to 6 as "willing to start."

Data Analysis

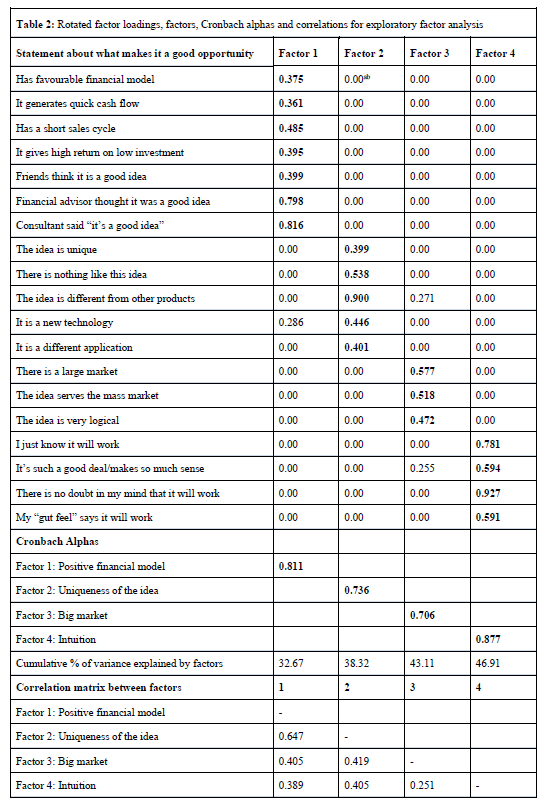

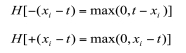

After collection and coding, the data describing how subjects evaluated the opportunity were subjected to exploratory factor analysis. Exploratory factor analysis was conducted to verify whether any evaluation factors (that represented distinct constructs) could be identified, and to assess the discriminant and construct validity of the measuring instrument used in this study. Exploratory factor analysis (with BMDP-Direct Oblimin) allows one to test specific propositions about the factor structure for a set of variables. Selection for variable inclusion was based on contribution to the Cronbach alphas and the correlation between items within each factor. After rotation, the factor analysis suggested the existence of four prototype factors. Oblique rotation was done because of the expected high correlations between the factors, as the literature review indicated a probable correlation between risk perception and misconceptions (Le Roux et al. 2006, 60). The results of the exploratory factor analysis provided evidence of the discriminant validity of the instrument used to measure the constructs, as it explained 46.91% of the variance (see also table 2). Nineteen variables (from the 25 originally included) loaded successfully. Thereafter a correlation analysis was done to determine the strength of the correlations between factors identified by the exploratory factor analysis, if such correlations existed, and thirdly, analyses of variance were executed to compare construct averages for entrepreneurial type groupings and start-up decision.

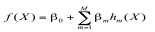

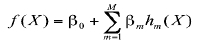

Though empirical in design, this study was also exploratory in nature, as the interest was also the usefulness of the experimental design. Finally, the data were subjected to a MARS analysis (Multivariate Adaptive Regression Splines). MARS is an adaptive non-linear and non-parametric regression procedure that was proposed by Friedman (1991, 1). The procedure makes no assumption about the underlying functional relationship between dependent and explanatory variables. MARS constructs models by fitting piecewise linear regressions; the non-linearity of a model is approximated by dividing the explanatory variable space into smaller regions, therefore using a distinct set of regression coefficients for each of these regions. The modelling procedure of MARS is in essence a recursive partitioning technique stemming from classification and regression trees and generalised additive models. MARS excels at finding optimal variable transformations and interactions, as well as complex data structures that often hide in data (Lee and Chen 2005, 743). A MARS model has the following general form:

with ßo-ßm the regression parameters and hm(X) the basis functions. The basis functions can take different forms, but usually are so-called "hinge functions" of the form:

with xi an explanatory variable and t indicating a knot location. Knots are determined by using an efficient search based on the observed data.

This makes the MARS analysis particularly suitable for problems with higher-input dimensions, that is, with a large number of explanatory variables (Hastie, Tibshirani, and Friedman 2009, 295). MARS analysis was done to determine circumstances (based on explanatory variable outcomes) that would either improve or decrease relative choice to start the venture (the dependent variable) or not, thus evaluated at the original 6-point scale. The performance of MARS models is generally known for predictive accuracy, computational speed and ease of interpretation (Migueis, Camanho, and Falcao e Cunha 2013, 6225).

Findings

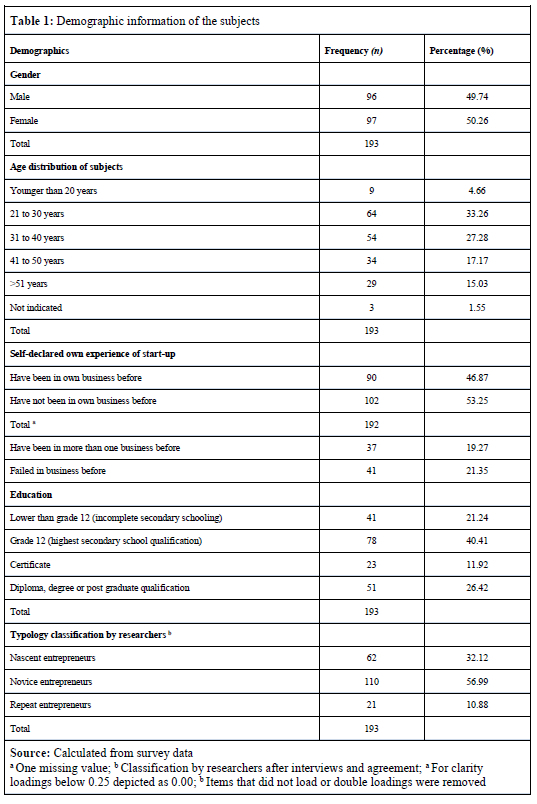

Table 1 shows the demographic information of the subjects as equally split between genders; less than 40% being younger than 30 years; and over 61% having an education of only grade 12 or less. The descriptive data point out various levels of experience, ranging from no experience (nascent) to experience of more than one business (repeat), as well as several subjects reporting previous failures. Only 10.88% of the subjects could be classified as repeat entrepreneurs, while 21% indicated that they had previously failed in attempts to start up or during the start-up of a business.

The subjects' self-declared business experience differed from the final typology allocation after the interview by the researchers that classified them as nascent, novice or repeat entrepreneurs. For example, if a respondent suggested that selling different product lines qualified him or her as a repeat entrepreneur, this classification was altered to novice entrepreneur because the lines were part of the same (first) business. In other cases, subjects had set up infrastructure, sold products and profited from sales but did not consider it as a business as it was not necessarily a "formal" business in their perception. Such endeavours were then re-categorised as novice entrepreneurs.

After cleaning of the data and removal of items that either did not load (less than 0.35) or double loaded (both loadings over 0.25 and less than 0.5), or once a loading was over 0.5, it was regarded as strong enough to support that specific factor. Four factors appeared (table 2) from the factor analysis, namely: positive financial model, uniqueness, big market and intuition, with Cronbach alpha values of 0.811, 0.736, 0.706 and 0.877 respectively as indicators of reliability. These suggest that in a repeat exercise by practitioners, similar values could be expected.

The positive financial model factor contributed significantly more to the total explained variance than the other three factors (32.67% out of a total of 46.91), suggesting a more important role of this factor when evaluating the opportunity and making the start-up decision. The uniqueness of the idea, having a big market and intuition made up the rest of the variation explained.

High correlations were found between the factors, as was expected. This study found highly significant relations between positive financial model and uniqueness of the idea (0.647), big market (0.405) and intuition (0.389). Uniqueness of the idea was also significantly related to big market (0.491) and intuition (0.405).

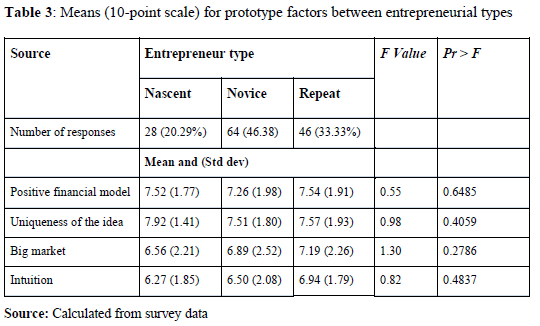

Table 3 shows differences between entrepreneur types in all four prototype factors, but none of them is significant.

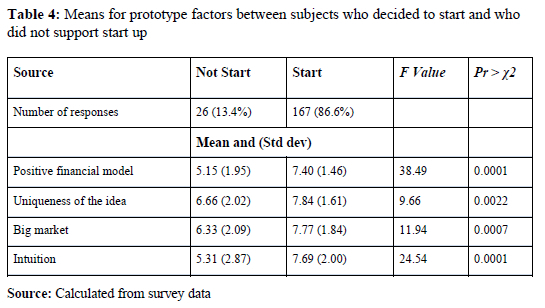

Table 4, however, shows highly significant differences in all four prototype factors between those who decided to start and those who decided against start-up. Those who supported start-up perceived the financial model more positively, thought more strongly that the idea was unique, evaluated the size of the market as larger and considered (used) their intuition more than those who were against the start-up. Those who did not support start-up generally perceived the financial model for the opportunity as weaker, evaluated the idea as "not so unique," the market potential as smaller and depended less on intuition than those in support of start-up. This is an expected result, but was not supported by the findings and methodology of this study (see table 3).

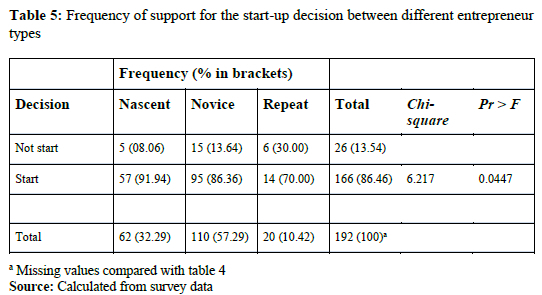

The question that arises from the "non-difference" observed between entrepreneurial types is whether the entrepreneurial types are the crucial differentiators, or whether the decision to start or not (apparently found within all entrepreneurial types) is the key issue to rather explore. The decision to start or not may be more important than entrepreneurial type, despite table 5, which shows the relationship to approach a significant contribution. The Chi-square (6.217 and p < 0.05) suggests some relationship between the type of entrepreneur and the decision to start up or not. As expected, more nascent entrepreneurs supported the start-up decision than novice entrepreneurs, while repeat entrepreneurs supported it the least. There seems to be an increase in the percentage not supporting start-up as experience increases, despite a large number still supporting start-up.

In conclusion, a multivariate adaptive regression splines (MARS) analysis was estimated to shed more light on the nature of the relationship between the factor variables, entrepreneurial types and demographics with the start-up decision.

A MARS model of the following form:

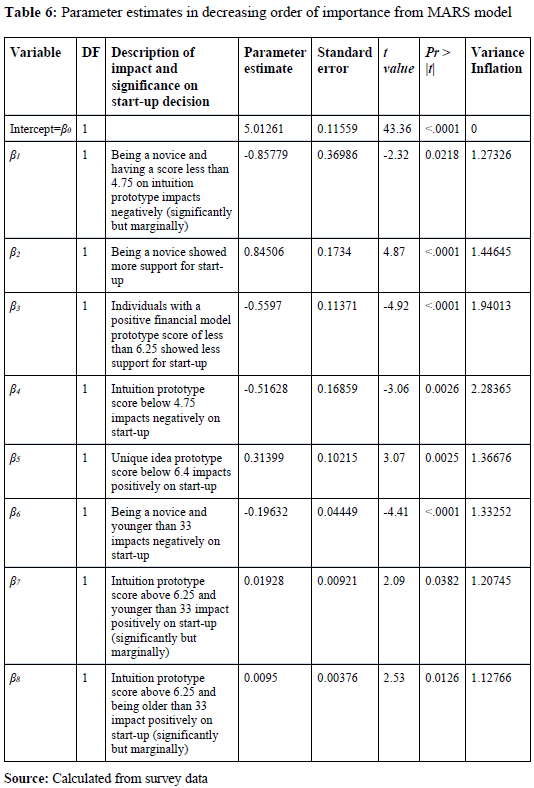

was fitted to the data. In this expression ßo-ßm are the regression parameters and hm(X) are the basis functions, transformed explanatory variables to accommodate smaller regions (Migueis et al. 2013, 6225) used in the analysis. The estimated model is significant (p-value < 0.001), with a reasonable fit yielding an R2 value of 0.533. In some MARS models, multicollinearity is found to be a problem. In the current model this is not the case (all variance inflation factors < 10). The estimated model is given below. Table 6 shows the associated parameter estimate values and directions (+ or -) for the relevant variables. Only significant variables are reported.

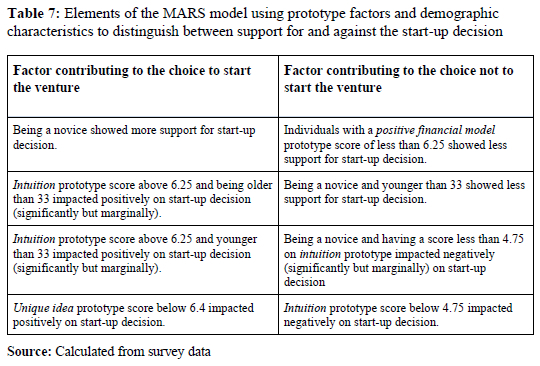

Table 7 finally puts the results of the MARS analysis in perspective by pointing out directives from this instrument towards support for start-up or not. Some of these directives are clear, with specific decision-support direction, but at first glance, some may appear to be contradictory. Using mainly the prototype factors for discrimination between the decision to start or not, it is clear that:

• Intuition prototype featured in 50% (4/8) of the regression terms, showing clear directions for or against start-up. Based on the parameter estimate, the effect of intuition prototype is almost double (0.01928) for age below 33 years compared with age above 33 years (0.0095).

• Unique idea prototype featured once, showing clear direction towards start-up.

• Financial model prototype featured once, showing clear direction towards not to start-up.

• Being a novice featured in 37.5% (3/8) of cases but shows "opposing" direction. (In such cases the higher parameter estimate will be the dominant regression term, suggesting the observation that supports novices as more strongly associated with start-up.)

The variable indicating the big market prototype was not significant, while clear directives were found for positive financial model, intuition and unique idea prototypes.

Discussion of Findings

The experimental method that was applied did identify prototype factors, and therefore support was found for the first proposition of identification of such factors. The findings suggest that the proposed experimental design was a relatively easy, quick and especially reproducible method of investigating prototype factors. Despite certain limitations (as pointed out later), the results pave the way for exploring the use of this methodology as an additional selection process of candidates by venture capitalists or funding institutions-something that has evaded the entrepreneurship research community since its inception as a research field. It could at least serve as a component of some screening processes to assist in the selection of candidates for financing. For example, the method could assist venture capitalists before funding an entrepreneur, by identifying prospective entrepreneurs' tendency (for all entrepreneurial types) to rely on intuition and the uniqueness of the idea only. The outcome of the MARS analysis introduced research to expand the method and determine benchmarks for comparison.

However, comparing the self-declared experience and typology classification (see table 1) showed, for example, that only 82% of novice subjects confirmed their classification in their self-declared statement when asked whether they had been in business before. In the same way, 19% of nascent entrepreneurs self-declared that they had been in business before but were classified as nascent after the interview, due to a lack of start-up evidence. Caution with interpretation is, therefore, warranted with regard to the classification of types. It might also be reasoned that the inclusion of the nascent entrepreneurs complicated the outcome rather than benefiting the study. Despite this, valuable information was gathered by including nascent entrepreneurs in the sample.

In this study, evidence could not be found to reject Ho1: that nascent, novice and repeat entrepreneurs measure the same on the prototype factors used to evaluate an opportunity (see table 3). While table 5 suggests some evidence of differences between the types of entrepreneurs, the results from the variance analyses did not confirm statistical significance. Baron and Ensley's (2006) findings were, therefore, not supported with regard to differences between the types of entrepreneurs (novice versus experienced). While evidence was found (based on table 5) for a relationship between the type of entrepreneur and the decision to start (HA2: There is such a relationship), it only points to the direction for future investigation. Several reasons could be found for this, including the fact that the accuracy of the difference between nascent and novice categories in the typology was not sufficiently verified by comprehensive investigation, but depended on the interview in which subjects were asked about their specific situations as the basis of the classification.

Hypothesis 3, that there is no difference between prototype factors as measured by the decision to start or not to start, is rejected based on results in table 4. Statistical evidence was found for the alternative hypothesis that stated there was such a difference. Those who did not support start-up generally perceived the financial model as weaker, evaluated the idea as not highly unique, the potential market as smaller and depended less on intuition, than those in support of start-up. The results give some support if one argues that those with more experience would not support start-up, but still not enough support to overcome the entrepreneurial type classification problem referred to earlier. More research to answer the question of differences between types is, therefore, warranted.

MARS analysis results from table 6 extended the investigation to expose some interesting interactions between prototype factors and the start-up decision as measured by the instrument used. It also creates additional questions for future research. Some of these findings are critical directives for a better understanding of the prototype effects. On a 10-point scale an intuition prototype score, for example, lower than 4.75 is associated with decreasing the likelihood to start a venture, and so does a positive financial model score of less than 6.25. A unique idea prototype score of higher than 6.4 is positively associated with the start-up decision. These values might be potential critical points on the scale by which to categorise subjects afterwards. However, it seems that the prototypes are affected (moderated) by being a novice and by age, with the age of 33 years being the critical point. There also appear to be interactions between entrepreneurial category and age, as these may affect the prototype impact, both separately and combined. However, this calls for further investigation. Intuition score, for example, may be more dominant at both higher and lower ages. This may allude to the role of experience in the use of intuition.

Finally, given its characteristics, the case study used for this research contains factors (idea novelty and uniqueness) that typically might lure the nascent, and potentially the novice, entrepreneur into pursuing the opportunity. Several subjects, after the presentation and completion of the questionnaire, enquired about obtaining "franchise rights" for such a business in their area. However, separate focus groups held with academics and practitioners as a control (Le Roux et al. 2006, 51) suggested that there would be hidden practical problems with the real exploitation of the idea (so-called opportunity), specifically related to practical logistics, dependence on collectors and serious potential quality control issues. These were overlooked by the subjects, probably because of the attraction of the unique idea and/or their potential overconfidence bias. While this information was supplied during the presentation, it apparently did not attract much attention from the subjects. From a research (and training) perspective, it seems to be an ideal case for subjects to tend to make the obvious mistakes, such as being lured by the uniqueness of the idea, later to be guided by the facilitator to reflect on the "thinking" mistakes that they made.

Study Limitations

This paper takes an important step in research on prototypes, pattern recognition and the opportunity evaluation processes of entrepreneurs in South Africa. However, it has to be taken into account that the alternative research design was based on only one experiment with 193 respondents and only one case-study evaluation. The generalisability of the findings may thus be limited by the use of a single case. Additional research based on this model can contribute even further to understanding this under-researched field in South Africa.

In this study, the following specific limitations were also identified: Firstly, objective reasoning may suggest that the case presented to subjects could be described as biased, "tricky" and probably requiring insight associated with more experience than one would expect from both nascent and novice entrepreneurs. One perspective is that this benefits the value of the experimental design as it supports the reasoning behind the process, while the opposite perspective is that it is "unfair" to expect subjects to meaningfully participate. However, it represents a typical situation that entrepreneurs face when they evaluate opportunities, particularly in an industry unfamiliar to them.

The second limitation is associated with the one above. The potential exists that the presenter was biased or appeared biased towards or against start-up, as well as not presenting the information in exactly the same way during all presentations. Despite much care taken to ensure no bias, this potential presenter bias constitutes a real limitation of the repeatability of the study by other presenters.

A third limitation of the experimental design used was the fact that the opportunity was not "real" to the subjects personally, as they were not in a real-life situation, and therefore, the consequences (personal risk of investment, fear of failure to exploit, etc.) of the start-up decision were also not "real" to the subjects. Subjects did not stand to lose (or gain) anything by taking the risk associated with the start-up decision. This might have influenced subjects to "start" the venture even though they were not sure, but chose to rather err on the positive side. Moreover, the research took place in South Africa, where the starting of new businesses is promoted from every possible platform as the right thing to do to overcome poverty (the only way out), and this makes the start-up decision even more appealing. It is known that simulated situations cannot replace reality. This type of problem is associated with laboratory experimentation.

Fourthly, subjects classified as novices were potential future loan applicants of the financial institution, and might have been thinking that the research was already some kind of a "selection tool," despite being specifically informed beforehand that it was purely for learning purposes and eventually informed about the research purposes. It is, therefore, speculated that they might have been biased towards the decision to start, partly explaining some of the non-differences in types.

Fifthly, the cumulative variance explained by the four factors identified was only 46.91%. This leaves a large amount of variance unaccounted for, and no meaningful explanation other than speculation about contextual issues can be offered at this point.

Sixthly, the percentage of the sample that was classified as repeat entrepreneurs is relatively small and may cast doubt over the significance of the findings. As this research was mainly aimed at investigating the experimental method, the number of subjects should be increased and balanced to overcome potential bias and sample skewness for further research. Despite this limitation, support was found for the effectiveness of the methodology in identifying the prototypes.

Finally, this methodology could not determine the reasoning of subjects as could an interview, where explanation and probing questions assist the researcher. Despite this limitation, the methodology appears useful both as a training tool and a screening technique with discrimination value. It could be enhanced by using follow-up with in-depth interviews after the initial selection.

Managerial Implications and Future Research

This research resulted in mixed findings regarding implications.

The identification of the factors is useful for researchers, as it supports earlier studies by confirming the prototypes under investigation and their contribution to variations in the evaluation of opportunities. Cognitive biases and heuristics in decision making are receiving much attention in the literature, and at the same time, the study reopens the research debate on finding differentiation criteria for more accurate selection of appropriate loan recipients. Decision-making frameworks have become the unit of investigation, with potential for further research.

Entrepreneurship trainers could also use the results to highlight the dangers associated with the evaluation of an opportunity and the need for criteria that are measurable. This would be useful when warning against these typical biases of entrepreneurs. Typically, novices appear more influenced by their intuition and the impressiveness of the idea (opportunity), while repeat entrepreneurs look beyond the idea towards the market size and cash flow associated with the opportunity. The results could also assist educators who use experiential learning to point towards key focus areas that students would typically overlook when evaluating opportunities.

Practitioners in funding organisations could further apply this approach when selecting prospective entrepreneurs to finance. Often applicants present business plan applications that have been compiled by consultants, without contributing their own insights. The methodology presents a possible way of selecting candidates with real insight over nascent and novice entrepreneurs who present standardised plans but might make the typical mistakes in practice.

Finally, the research could assist practising entrepreneurs to focus their thinking. Consciousness of the limitations of one's own thinking (which could be identified through the process used in this research) is beneficial at all levels. The case evaluation is a helpful way for potential entrepreneurs to improve their own thinking about business issues.

Future research should consider investigating the interactions between prototypes. High correlations were found in this study. No explanations are put forward for this at this point, as it rather presents more questions.

Entrepreneurs with "previous failure" experience data were later discarded from this study because of the low number of subjects with such experience, but this does raise the question of whether failure experience and repeat failure experience could lead to an alternative prototype. This warrants further investigation.

Conclusions

This research successfully measured prototypes used by entrepreneurs when evaluating a venture opportunity and thereby confirmed prototypes used in opportunity evaluation on whether to support start-up or not. It presents a methodology that is easily applicable and fairly cost-effective to execute.

During the process of evaluating an opportunity, entrepreneurs are influenced in their judgement by four main prototypes, namely: unique idea, positive financial model, big market and intuition prototypes. While the prototypes identified with the experimental approach used in this study could not discriminate between nascent, novice and repeat entrepreneurs (table 3), the theory did have discriminant value between those entrepreneurs who opted to start the (doubtful) venture and those who did not (tables 4 and 5). Generally, those who chose not to start this venture used less intuition and depended less on the uniqueness of the idea, but depended more on the market size and financial potential of the opportunity. Those who chose to start the venture were influenced more by the uniqueness of the idea and their intuition (table 7), which might give them a false representation of the potential opportunity.

Apart from its academic importance, the study could make a valuable contribution to two specific groups. Entrepreneurial educators could use the methodology to assist prospective (nascent and novice) entrepreneurs to develop awareness of the typical traps of focusing on the uniqueness of an attractive idea and depending on intuition, rather than researching the market size and confirming the cash-flow potential of the venture. Secondly, those responsible for awarding funding to promising entrepreneurs could use the methodology to aid their selection of those entrepreneurs whose judgement is sound and are thus more likely to reward funding by starting a successful venture.

References

Autio, E. 2005. "Global Entrepreneurship Monitor: Report on High-expectation Entrepreneurship." London Business School, Mazars. Accessed June 16, 2005. www.gemconsortium.org. [ Links ]

Barbosa, S. D., J. Kickul, and B. R. Smith. 2008. "The Road less Intended: Integrating Entrepreneurial Cognition and Risk in Entrepreneurship Education." Journal of Enterprising Culture 16 (4): 411-439. https://doi.org/10.1142/S0218495808000181. [ Links ]

Baron, R. A. 1998. "Cognitive Mechanisms in Entrepreneurship: Why and when Entrepreneurs Think different to other people." Journal of Business Venturing 13 (4): 275-294. https://doi.org/10.1016/S0883-9026(97)00031-1. [ Links ]

Baron, R. A. 2004. "The Cognitive Perspective: A Valuable Tool for Answering Entrepreneurship's Basic 'Why' Questions." Journal of Business Venturing 19 (2): 221-239. https://doi.org/10.1016/S0883-9026(03)00008-9. [ Links ]

Baron, R. A., and M. D. Ensley. 2006. "Opportunity Recognition as the Detection of Meaningful Patterns: Evidence from the Comparison of Novice and Experienced Entrepreneurs." Management Science 529 (9): 1331-1344. https://doi.org/10.1287/mnsc.1060.0538. [ Links ]

Baron, R. A., and R. A. Henry. 2010. "How Entrepreneurs Acquire the Capacity to Excel: Insights from Research on Expert Performance." Strategic Entrepreneurship Journal 4 (1): 49-65. https://doi.org/10.1002/sej.82. [ Links ]

Baron, R. A., and T. B. Ward. 2004. "Expanding Entrepreneurial Cognition's Toolbox: The Cognitive Perspective: Potential Contribution from the Field of Cognitive Science." Entrepreneurship Theory and Practice 28 (6): 553-573, Winter. https://doi.org/10.1111/j.1540-6520.2004.00064.x. [ Links ]

Barreto, I. 2012. "Solving the Entrepreneurial Puzzle: The Role of Entrepreneurial Interpretation in Opportunity Formation and Related Processes." Journal of Management Studies 49 (2): 356-380. https://doi.org/10.1111/j.1467-6486.2011.01023.x. [ Links ]

Bowmaker-Falconer, A., and N. Meyer. 2022. Fostering Entrepreneurial Ecosystem Vitality: Global Entrepreneurship Monitor South Africa 2021/2022. Stellenbosch University: Stellenbosch, South Africa. [ Links ]

Busenitz, L. W., and J. B. Barney. 1997. "Differences between Entrepreneurs and Managers in Large Organisations: Biases and Heuristics in Strategic Decision-making." Journal of Business Venturing 12 (1): 9-30. https://doi.org/10.1016/S0883-9026(96)00003-1. [ Links ]

Cornelissen, J. P., and J. S. Clarke. 2010. "Imagining and Rationalising Opportunities: Inductive Reasoning and the Creation and Justification of New Ventures." Academy of Management Review 35 (4): 539-557. https://doi.org/10.5465/AMR.2010.53502700; https://doi.org/10.5465/amr.35.4.zok539. [ Links ]

Friedman, J. H. 1991. "Multivariate Adaptive Regression Splines." The Annals of Statistics 19 (1): 1-67. https://doi.org/10.1214/aos/1176347963. [ Links ]

Gatewood, E. J., K. G. Shaver, and W. B. Gartner. 1995. "A Longitudinal Study of Cognitive Factors Influencing Start-up Behaviours and Success at Venture Creation." Journal of Business Venturing 10 (5): 371-391. https://doi.org/10.1016/0883-9026(95)00035-7. [ Links ]

Gregoire, D. A., A. C. Corbett, and J. S. McMullen. 2011. "The Cognitive Perspective in Entrepreneurship: An Agenda for Future Research." Journal of Management Studies 48 (6): 1443-1477. https://doi.org/10.1111/j.1467-6486.2010.00922.x. [ Links ]

Hastie, T., R. Tibshirani, and J. Friedman. 2009. The Elements of statistical Learning: Data Mining, Inference and Prediction, 2nd edition. Canada: Springer. https://doi.org/10.1007/978-0-387-84858-7. [ Links ]

Herrington, M., J. Kew, and P. Kew. 2013. "Global Entrepreneurship Monitor. Report for South Africa." http://www.gemconsortium.org/country-profile/108. [ Links ]

Korunka, C., H. Frank, M. Lueger, and J. Mugler. 2003. "The Entrepreneurial Personality in the Context of Resources, Environment and the Start-up Process: A Configurational Approach." Entrepreneurship Theory and Practice 28 (1): 23-42. https://doi.org/10.1111/1540-8520.00030. [ Links ]

Lee, T. S., and I. F. Chen. 2005. "A Two-stage Hybrid Credit Scoring Model Using Artificial Neural Networks and Multivariate Adaptive Regression Splines." Expert Systems with Applications 28 (4): 743-752. https://doi.org/10.1016/j.eswa.2004.12.031. [ Links ]

Le Roux, I. 2005. "Entrepreneurial Cognition and the Decision to Explore a New Venture Creation Opportunity." Pretoria: University of Pretoria. Unpublished PhD thesis. [ Links ]

Le Roux, I., M. Pretorius, and S. Millard. 2006. "The Influence of Risk Perception, Misconception, Illusion of Control and Self-efficacy on the Decision to Exploit a Venture Opportunity." Southern African Business Review 10 (1): 51 -70. [ Links ]

Levin, I. P., G. J. Gaeth, and J. Schreiber. 2002. "A New Look at Framing Effects: Distribution of Effect Sizes, Individual Differences and Independence of Types of Effects." Organisation Behaviour and Human Decision Process 88 (1): 411 -429. https://doi.org/10.1006/obhd.2001.2983. [ Links ]

McKenzie, J., N. Woolf, C. van Winkelen, and C. Morgan. 2009. "Cognition in Strategic Decision Making." Management Decision 47 (2): 209-232. https://doi.org/10.1108/00251740910938885. [ Links ]

Migueis, V. L., A. Camano, and J. Falcao e Cunha. 2013. "Customer Attrition in Retailing: An Application of Multivariate Adaptive Regression Splines." Expert Systems with Applications 40 (16): 6225-6232. https://doi.org/10.1016/j.eswa.2013.05.069. [ Links ]

Mitchell, R. J., R. K. Mitchell, and B. Randolph-Seng. 2014. Handbook of Entrepreneurial Cognition. UK: Edward Elgar Publishing. https://doi.org/10.4337/9781781006597. [ Links ]

Mitchell, R. K., L. Busenitz, T. Lant, P. P. McDougall, E. A. Morse, and J. B. Smith. 2002. "Towards a Theory of Entrepreneurial Cognition: Rethinking the People Side of Entrepreneurial Research." Entrepreneurship Theory and Practice 27 (2): 93-104. https://doi.org/10.1111/1540-8520.00001. [ Links ]

Politis, D. 2008. "Does Prior Start-up Experience Matter for Entrepreneurs' Learning?" Journal of Small Business and Enterprise Development 15 (3): 472-489. https://doi.org/10.1108/14626000810892292. [ Links ]

Reynolds, P. D. 1991. "Sociology and Entrepreneurship: Concepts and Contributions." Entrepreneurship Theory and Practice 16 (2): 47-69. https://doi.org/10.1177/104225879201600205. [ Links ]

Simon, M., and S. M. Houghton. 2002. "The Relationship among Biases, Misconceptions and New Venture Formation: How Individuals Decide to Start Companies." Journal of Business Venturing 14 (5): 105-124. [ Links ]

Simon, M., S. M. Houghton, and K. Aquino. 1999. "Cognitive Biases, Risk Perception and Venture Formation: How Individuals Decide to Start Companies." Journal of Business Venturing 15 (2): 113-134. https://doi.org/10.1016/S0883-9026(98)00003-2. [ Links ]

Tang, J., J. M. Kacmar, and L. Busenitz. 2012. "Entrepreneurial Alertness in the Pursuit of New Opportunities." Journal of Business Venturing 27 (1): 77-94. https://doi.org/10.1016/j.jbusvent.2010.07.001. [ Links ]

Urban, B. 2010. "Cognition and Motivation for New Venture Creation Decisions: Linking Expert Scripts to Self-efficacy, a South African Study." International Journal of Human Resource Management 21 (9): 1512-1530. https://doi.org/10.1080/09585192.2010.488457. [ Links ]

Urban, B. 2012. "Researching Entrepreneurship from a Cognitive Perspective: A Focus on Necessity Entrepreneurs in the Johannesburg Area." African Journal of Business Management 6 (48): 11732-11742. https://doi.org/10.5897/AJBM11.2669. [ Links ]

Urban, B., 2014. "The Importance of Attributes in Entrepreneurial Opportunity Evaluations: An Emerging Market Study." Managerial and Decision Economics 35 (8): 523-539. https://doi.org/10.1002/mde.2639. [ Links ]

Vaghely, I. P., and P. Julien. 2010. "Are Opportunities Recognised or Constructed? An Information Perspective on Entrepreneurial Opportunity Identification." Journal of Business Venturing 25 (1): 73-86. https://doi.org/10.1016/jjbusvent.2008.06.004. [ Links ]

Valliere, D. 2011." Entrepreneurial Alertness through Cognitive Schemata." Langkawi, Kedah, Malaysia: 2nd International Conference on Business and Economic Research, 14-16 March. [ Links ]

Wright, M., K. Robbie, and C. Ennew. 1997. "Serial Entrepreneurs." British Journal of Management 8 (3): 251-268. https://doi.org/10.1111/1467-8551.00064. [ Links ]

Westhead, P., D. Ucbasaran, and M. Wright. 2005a. "Experience and Cognition: Do Novice, Serial and Portfolio Entrepreneurs Differ?" Journal of Small Business Management 43 (4): 393-417. https://doi.org/10.1111/j.1540-627X.2005.00144.x. [ Links ]

Westhead, P., D. Ucbasaran, and M. Wrigh. 2005b. "Experience and Cognition: Do Novice, Serial and Portfolio Entrepreneurs Differ?" International Small Business Journal 23 (1): 72-99. https://doi.org/10.1177/0266242605049104. [ Links ]

Westhead, P., and M. Wright. 1998a. "Novice, Portfolio, and Serial Founders in Rural and Urban Areas. " Entrepreneurship Theory and Practice 22 (4): 63-66. https://doi.org/10.1177/104225879802200404. [ Links ]

Westhead, P., and M. Wright. 1998b. "Novice, Serial and Portfolio Founders: Are they different?" Journal of Business Venturing 13 (3): 173-204. https://doi.org/10.1016/S0883-9026(97)90002-1. [ Links ]