Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

SAIEE Africa Research Journal

On-line version ISSN 1991-1696

Print version ISSN 0038-2221

SAIEE ARJ vol.113 n.3 Observatory, Johannesburg Sep. 2022

Research on Payment Settlement Mode in Cross-Border Business Trade Based on Blockchain Technology

Xiaoyan Wang

Anhui Finance & Trade Vocational College, Hefei, Anhui 230601, China (e-mail: hy74x1@yeah.net)

ABSTRACT

Cross-border commerce trade is an important part of economic development, and its payment and settlement mode has received widespread attention. The traditional payment settlement mode has shortcomings such as low efficiency, high cost and poor security; therefore, it needs to be improved. In view of this, this paper studied the payment settlement model based on blockchain technology. This paper firstly introduced blockchain, then analysed its characteristics and composition and the possibility of its application in cross-border business trade, and finally took the Ripple payment settlement mode as an example for a case study. The analysis found that the Ripple mode had small time and capital costs, high transaction transparency and security, and simple and convenient processes. The analysis results verify the reliability of the blockchain-based payment settlement mode and its applicability in in practice.

Index Terms: blockchain, cross-border commerce trade, payment settlement mode, Ripple network

I. Introduction

BLOCKCHAIN technology, which originated from Bitcoin, is a decentralised, distributed shared network ledger technology based on computer cryptographic algorithms [1], involving technologies such as peer-to-peer (P2P) networks and Hash functions. At present, the development of blockchain is still in its infancy, but it has received extensive attention from researchers and has been very widely used in financial, monetary, and non-financial fields [2]. Choi et al. [3] analysed the application of blockchain in shipping logistics and proposed how to apply blockchain to explore supply chain operational risks. Claudia et al. [4] conducted a study on smart energy grid demand management, using a blockchain-based distributed ledger to collect energy production information, validated the method on the Ethernet platform, and found it be able to track demand response signals with high accuracy. Hammi et al. [5] designed an Internet of Things (IoT) identity verification system with the blockchain and found through experiments that the method could satisfy the demand of IoT. Zhu et al. [6] designed a storage system that made full use of the remaining space of the user's personal hard disk to store all information in the blockchain with high security. In cross-border business trade payment, the traditional payment settlement mode has many deficiencies. The introduction of blockchain has some unique advantages for cross-border business trade payment, which has the characteristics of less infrastructure and strong resistance to attack and can effectively improve the security and efficiency of payment; therefore, this paper studied the blockchain-based cross-border business trade payment settlement mode. This paper analysed the characteristics of blockchain and introduced a Ripple mode to examine its application possibility in cross-border business trade payment. This paper introduces the advantages of blockchain-based cross-border commerce trade payments through an analysis of the application of the Ripple model and briefly describes some of the limitations that exist in this payment settlement model. Most of the current research on blockchain technology is still focused on theoretical analysis, and there is little analysis of practical application scenarios. This paper not only elaborates more deeply on the blockchain-based payment settlement mode but also provides some theoretical references for the better application of blockchain technology in future payments.

II. Blockchain Technology And Payments

In cross-border business trade, risk is one of the biggest problems, especially payment risk. The current payment process needs to go through multiple enterprises and institutions, with high cost and low efficiency, which is a very complicated transaction settlement mode. With the rapid development of the economy, this traditional mode has become increasingly unable to meet the current demand, and finding a new payment settlement mode has become an inevitable choice for the development of cross-border business trade.

Blockchain is also known as a distributed ledger. When a transaction is performed, first, the transaction is defined by the counterparty, and a transaction block is established; then, the block information is disseminated to all nodes to jointly validate the transaction, the result is fed back to all nodes if it passes validation, and the nodes where the validation is completed is time-stamped to record the transaction. The features of blockchain include:

(1) decentralised [7]: no mutual trust is required for data exchange between nodes. Information exchange and transactions can be realised between any two points, and the withdrawal of any node will not affect the stability of the blockchain;

(2) trustless: all operation rules and data contents are disclosed, and nodes cannot cheat each other;

(3) collectively maintain: the data blocks are maintained by all nodes together;

(4) reliable database: modifications to the database by any node are invalid.

The underlying framework of blockchain technology is composed of three parts, including:

(1) Smart Contract [8]: It is a type of contract that is implemented electronically and is visible to all nodes, allowing all developers to write program logic.

(2) Encryption principle: It refers to the encryption technology of blockchain, generally hash function or elliptic curve algorithm.

(3) Consensus algorithm: It refers to the management mechanism used to confirm the validity and immutability of transactions, and the mainstream algorithms i[]nclude: 1 Proof of Work (POW) [9]; 2 Proof of Stake (POS) [10]; 3 Delegate Proof of Stake (DPOS).

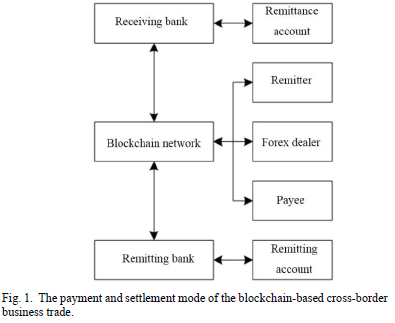

The payment and settlement model of the blockchain-based cross-border business trade can be simply described, as shown in Fig. 1. Through blockchain, buyers and sellers, banks and foreign exchange dealers in the payment process are involved in the network as nodes, and then the real currency is connected to the digital currency to complete the final payment and transaction. Blockchain greatly improves the transparency and feasibility of the transaction using common verification and confirmation, thus reducing the payment risk, and it also eliminates the need for synchronization of information from individual banks, reducing their time costs and thus improving payment efficiency.

III. Case Study Of Ripple Payment Settlement Mode

A. Ripple Payment Settlement Mode

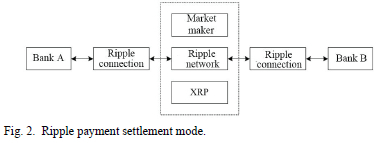

Ripple [11] allows direct peer-to-peer transactions that transfer any kind of currency, such as RMB, Euro, USD, Bitcoin, etc. Compared with the traditional mode, Ripple's cost is close to zero, the transaction is in seconds, no cross-border payment fees are required, and money can flow between any person or institution, which has attracted several banks to join [12]. The Ripple payment settlement mode is shown in Fig. 2.

In the mode, several key elements are as follows.

(1) Ripple connection: Ripple uses an independently developed connection protocol to connect to the Ripple network for payments and settlements.

(2) Distributed consensus mechanism: Ripple's consensus mechanism enables verification of nodes across the network, enabling 7 x 24 h payments and effectively improving payment efficiency.

(3) Market maker network: The presence of multiple banks in the Ripple network that can act as market makers enables more efficient exchange tasks to be completed.

(4) XRP [13]: Ripple uses XRP as a proxy currency to act as a medium of exchange between traditional currencies as well as digital currencies. In addition, Ripple requires each trading account to hold at least 20 XRPs, and each transaction permanently destroys 1 in 100,000 XRPs. When Ripple is attacked from outside, the volume of transactions rises dramatically and XRP is rapidly consumed. The cost of attack is extremely high for attackers; thus, they will choose to abandon the attack. In this way, Ripple payments can be effectively secured.

B. Case Study

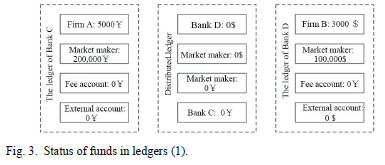

Suppose that Firm A in China needs to trade with Firm B in the United States, with A as the buyer and B as the seller. The payment amount is 100 U.S. dollars. A has 5,000 ¥ in Bank C, and B has 3,000 $ in Bank D. In the payment process, Bank C injects 200,000¥ into the account as a market maker, and Bank D injects 100,000$ into the account as a market maker. At this point, the funds in the three ledgers are shown in Fig. 3.

It is seen from Fig. 3 that:

(1) The ledger of Bank C: 5000Y for Firm A, 200,000¥ for the market maker, 0 Y for the fee account, 0 Y for the shadow account, and 0 Y for the external account.

(2) Ripple distributed ledger: 0 for each account.

(3) The ledger of Bank D: $100,000 for the market maker, $0 for the fee account, $0 for the shadow account, $0 for the external account.

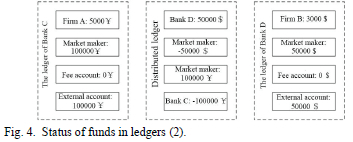

Next, the market maker asks the bank to make a payment to the blockchain, transferring 100,000 Y from Bank C to the external account and 50,000$ from Bank D to the external account. The funds of the three ledgers are shown in Fig. 4.

It is seen from Fig. 4 that:

(1) The ledger of Bank C: 5000Yfor Firm A, 100,000Y for the market maker, 0Y for the fee account, 0Y for the shadow account, and 100,000Y for the external account.

(2) Ripple distributed ledger: 100,000$ for the shadow account ofBank C, 50,000$ for the shadow account ofBank D,

and 100,000Y and 50,000$ for the Ripple account.

(3) The ledger of Bank D: $50,000 for the market maker, $0 for the fee account, $0 for the shadow account, and $50,000 for the external account.

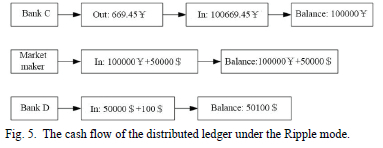

Then, A sends a request to C to pay $100 to D and B. Bank C, after receiving the request, connects the local Ripple connection to Bank D's Ripple connection and then makes a request to Bank D. After receiving the request, Bank D checks whether B is its customer and audits B for Know Your Customer/Anti-Money Laundering (KYC/AML) [14]. If the audit does not pass, it replies to Bank C that the transaction is terminated, and if the audit passes, it sends the calculated fees and information about B to C for review. After C receives D's reply, it looks for a market maker through Ripple to get the exchange rate, and then the market maker returns the exchange rate quotation: 100$ = 639.45 Y, in which the RMB is first converted into XRP and then converted into USD through XRP. The cash flow of the distributed ledger under the Ripple mode is shown in Fig. 5.

Both Bank C and D add the transaction fee. C provides A with the final list of fees, and after Firm A confirms it, Bank C sends a confirmation notice to the market maker as well as Bank D via Ripple connection to start the transaction. Meanwhile, Firm B submits a shipping statement to D. After D confirms it is correct, it informs the market maker as well as C that the seller has shipped the goods; after both parties confirm and verify the information, it indicates that all parties to the transaction have reached a consensus.

Finally, Bank C records in the system a debit to Firm A of 669.45 yuan, a credit to expense of 30 yuan, and a shadow account of 639.45 yuan. At the same time, Bank D sends a message to the Ripple network that Bank C's bookkeeping is successful and then tells the market maker through the Ripple connection that the bookkeeping is official. After the market maker closes the record in the shared account, it informs that all bookkeeping is finished due to the Ripple connection of Banks C and D. Bank D performs bookkeeping after receiving the settlement notice and then informs Bank C that the credit is successful. The above is the process of Ripple payment and settlement.

IV. Discussion

Cross-border business trade can be divided into three parts: purchase, transportation, and payment, among which payment is the foundation of the financial industry and plays a very important role in the growth of the economy. The goal of payment is no more than to improve efficiency and reduce costs, thus improving the quality of financial services. At present, the traditional payment and settlement mode is usually used, which has a complicated process, numerous procedures, high costs of settlement and management, and low payment efficiency [15]. The traditional mode cannot meet the needs of trade development more and more, therefore, it is very important to find a new payment and settlement mode [16].

The case study of the Ripple mode shows that it has many advantages over the traditional mode. The details are as follows.

(1) Security analysis: in the Ripple mode, authenticated buyers and sellers create a highly transparent marketplace where all participants have a complete copy of their transaction records, and the ledger is maintained and updated by the Ripple network. In such a case, it is difficult to falsify or tamper with the records. Traders can immediately reject transactions if an inauthentic transaction (a forged or falsified transaction) is found after checking, thus ensuring the security of the transaction.

(2) Cost analysis: in terms of computational cost, in the Ripple mode, transaction is settlement, saving steps of institutional liquidation and verification. Such a kind of peer-to-peer transaction confirms transaction in several seconds or minutes, breaking the time constraint of the traditional mode and significantly reducing computational cost. In terms of transaction cost, the peer-to-peer transaction saves the cost of third-party audit. A 2016 McKinsey report titled Blockchain: A Game Changer in the Banking Industry [17] points out that the Ripple mode can save 80% of the transaction cost, 23% of the operation cost, 60% of the reconciliation cost and 60% of the total processing cost.

However, the Ripple mode also has some shortcomings. The blockchain-based ripple mode is network-dependent and may be limited by network technology. In the practical operation process, if a malicious attacker forges nodes, it may lead to fraudulent transactions. Moreover, transactions on the blockchain are irreversible, and the Ripple mode only ensures security at the time of the transaction, but there is no guarantee for the legality of the transaction afterwards, nor can the transaction be revoked if the act is found to be illegal at the end of the transaction. In addition, the anonymity of the blockchain not only increases the difficulty of national tax collection but also increases the risk of illegal transactions and weakens the currency issuance function of banks. The form of digital currency also brings some risks to the operation of the market.

It is found from the research results that blockchain technology has great development potential in payment; therefore, more and deeper research on blockchain technology is necessary. Although the research in this paper has yielded some results, the Ripple mode still faces many challenges, for example, the technology of blockchain needs to be further matured, and there are many uncertainties in the financial industry. In future research, further works are needed to promote blockchain-based payment and settlement modes to develop in a more controllable and healthy direction to facilitate cross-border commerce and trade to develop better and faster.

V. Conclusion

This paper studied the blockchain-based payment settlement mode. The case study on the Ripple payment settlement mode found that the Ripple mode had some advantages in terms of cost and security and could meet the needs of cross-border business trade payments. Therefore, the Ripple model can be further promoted and applied in the actual cross-border business trade, and a sound legal system can be established to protect financial security. With the continuous exploration of blockchain technology, it will definitely serve the financial industry better.

References

[1] C. Lin, D. He, X. Huang, K. Khan, and K. R. Choo, "DCAP: A Secure and Efficient Decentralized Conditional Anonymous Payment System Based on Blockchain," IEEE T. Inf. Foren. Sec, vol. 15, pp. 2440-2452, 2020. DOI: 10.1109/TIFS.2020.2969565

[2] B. H. Lange, "Is Blockchain in Our Future?," SMPTE Motionlmag. J, vol. 127, no. 9, pp. 6-6, 2018.

[3] T. M. Choi, X. Wen, X. Sun, and S. H. Chung, "The mean-variance approach for global supply chain risk analysis with air logistics in the blockchain technology era," Transport. Res. E Log., vol. 127, no. JUL., pp. 178-191, 2019. DOI: 10.1016/j.tre.2019.05.007

[4] C. Pop, T. Cioara, M. Antal, I. Anghel, I. Salomie, and M. Bertoncini, "Blockchain Based Decentralized Management of Demand Response Programs in Smart Energy Grids," Sensors, vol. 18, no. 2, pp. 162, 2018. DOI: 10.3390/s18010162

[5] M. T. Hammi, B. Hammi, P. Bellot, and A. Serhrouchni, "Bubbles of Trust: a decentralized Blockchain-based authentication system for IoT," Comput. Secur., vol. 78, no. sep., pp. 126-142, 2018. DOI: 10.1016/j.cose.2018.06.004

[6] Y. Zhu, C. Lv, Z. Zeng, J. Wang, and B. Pei, "Blockchain-based Decentralized Storage Scheme," J. Phys. Con/: Ser., vol. 1237, pp. 042008-, 2019. DOI: 10.1088/1742-6596/1237/4/042008

[7] Z. Yang, K. Yang, L. Lei, K. Zheng, and V. C. M. Leung, "Blockchain-based Decentralized Trust Management in Vehicular Networks," IEEE Internet Things, vol. 6, no. 2, pp. 1495-1505, 2019. DOI: 10.1109/JIOT.2018.2836144

[8] R. Xu, Y. Chen, E. Blasch, and G. Chen, "Exploration of blockchain-enabled decentralized capability-based access control strategy for space situation awareness," Opt. Eng., vol. 58, no. 4, pp. 1, 2019. DOI: 10.1117/1.OE.58.4.041609

[9] W. Ren, J. Hu, T. Zhu, Y. Ren, and K. K. Raymond Choo, "A flexible method to defend against computationally resourceful miners in blockchain proof of work," Inform. Sciences, vol. 507, pp. 161-171, 2020. DOI: 10.1016/j.ins.2019.08.031

[10] L. C. Shi, and Z. Z. Guo, "Baguena: A Practical Proof of Stake Protocol with a Robust Delegation Mechanism," Chinese J. Electron,, vol. 29, no. 05, pp. 99-110, 2020.

[11] A. Di Luzio, A. Mei, and J. Stefa, "Consensus Robustness and Transaction De-Anonymization in the Ripple Currency Exchange System," 2017 IEEE 37th International Conference on Distributed Computing Systems (ICDCS), pp. 140-150, 2017. DOI: 10.1109/ICDCS.2017.52

[12] D. Genkin, D. Papadopoulos, and C. Papamanthou, "Privacy in Decentralized Cryptocurrencies," Commun. ACM, vol. 61, no. 6, pp. 78-88, 2018. DOI: 10.1145/3132696

[13] A. K. Tiwari, A. O. Adewuyi, C. T. Albulescu, and M. E. Wohar, "Empirical Evidence of Extreme Dependence and Contagion Risk between Main Cryptocurrencies," N. Am. J. Econ. Financ, vol. 51, pp. 101083, 2019. DOI: 10.1016/j.najef.2019.101083

[14] A. Weinman, "KYC/AML initiatives for the long-term compliance of trade," Trade Financ., vol. 17, no. 9, pp. 22-24, 2015.

[15] Q. Zhu, B. Liu, F. Han, and M. Lee, "The optimization effect of fuzzy factional-order ordinary differential equation in block chain financial cross-border E-commerce payment mode," Alex. Eng. j., vol. 59, no. 4, pp. 2839-2847, 2020. DOI: 10.1016/j.aej.2020.06.031

[16] J. Macknight, "Modernising cross-border payments: innovation," Banker, vol. 167, no. 1086, pp. 105-106, 2016.

[17] https://www.mckinsey.com.cn

Xiaoyan Wang, born in 1985, received the master's degree from the University of Sydney in 2010. She is teaching in Anhui Finance & Trade Vocational College as a lecturer. Her research directions are international accounting and blockchain.