Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.18 no.2 Meyerton 2021

http://dx.doi.org/10.35683/jcm21035.122

RESEARCH ARTICLES

Management of fiscal and monetary policies interdependence in South African economy: A Bayesian VAR approach

KA SanusiI, *; JH EitaII; DF MeyerIII

IDepartment of Economics, University of Johannesburg, South Africa Email: sanusikazeemabimbola@yahoo.com, kazeems@uj.ac.za; https://orcid.org/0000-0002-2695-2056;

IIDepartment of Economics, University of Johannesburg, South Africa Email: jeita@uj.ac.za; https://orcid.org/0000-0002-5859-7132

IIICollege of Business and Economics, University of Johannesburg, South Africa Email: dfmeyer@uj.ac.za; https://orcid.org/0000-0001-6715-7545

ABSTRACT

PURPOSE OF THE STUDY: This study revisits the management and interaction aspects between fiscal and monetary policies in South Africa using a Bayesian vector autoregressive model (BVA

DESIGN/METHODOLOGY/APPROACH: Monthly data on the inflation rate, interest rate, money supply, tax revenue, government spending and government debt for the period 2009 - 2019 were sourced from the South African Reserve Bank

FINDINGS: The impulse response analysis shows that positive shocks to money supply prompt monetary authority to raise the economy's interest rate, which increases the bank rate. Inflation does not respond to shock to government spending and could drive inflation in the South African economy from the supply side rather than the demand side. Tax revenue and money supply shocks are significant sources of variation in inflation. These variables account for 7 and 18 percent variation in government spending

RECOMMENDATIONS/VALUE: The study concludes that monetary authority must employ supply-side measures to manage the price level

MANAGERIAL IMPLICATIONS: Monetary policy makers must ensure that management of the economy is tailored towards the supply-side of the economy and remove the various structural rigidities in the economy in order to ensure the stability of the price and other macroeconomic fundamentals

JEL CLASSIFICATIONS: E42, E62

Keywords: BVAR; economy; fiscal policy; management; monetary policy.

1. INTRODUCTION

The coordination between fiscal and monetary policies has taken another dimension in macroeconomic policy management discussions. By policy coordination, we mean that both fiscal and monetary policies complement each other to achieve the predetermined economic objectives. However, policy conflict occurs when either fiscal policy or monetary policy does not complement each other and hinders the attainment of macroeconomic objectives. Monetarists earlier recommended government intervention and are opposed to unregulated policies (Nunes & Portugal, 2009), while Keynesians supports interventions (Daly, 2015 & Smida, 2016). The positions of both schools have detached arguments between the two policies. Accordingly, the empirical studies on monetary policy conduct were fair between rules and discretionary performance (Woodford, 1998). Fiscal policy was inherently supposed to play an insignificant part, while monetarist models supposed Ricardian management's presence, under which the budget of government was prone to repeated deviations. Any remaining debt is financed using taxes and inflation tax without interference with monetary policy (De Resende, 2007; Nunes & Portugal, 2009 & Sanusi & Akinlo, 2016).

Consequently, the fiscal authority is assumed to be good, and slashes in taxes funded by upsurges in debt level are recompensed by a surge in taxation at the latter date to ensure debt creditworthiness. Under this arrangement, the dispute on the coordination between the fiscal and monetary policies was said to be pointless (Hayo & Niehof, 2014). The customary duty of the central bank is to regulate price levels. Beginning from Fisher's (1911) work, the quantity theory of money formed the basis of studies on price determination. However, against the monetarist position, another line of thinking is known as the fiscal theory of the price level (FTPL).

The FTPL argued that price determination is a fiscal phenomenon rather than a monetary one. The quantity theory of money and the FTPL perhaps apparently at variance. They are not mutually exclusive theories (i.e. they are not theories that cannot occur simultaneously) but are somewhat different components of the same theory. Various economic models on fiscal and monetary policies disagree about the way economic policy is coordinated. This study re-examines interactions between fiscal and monetary policies in the South African economy using the Bayesian vector autoregressive model (BVA). The major question the current study addresses are, what are the dynamic responses among fiscal and monetary policies variables shocks in South African economy? Understanding the dynamic responses between the fiscal and monetary policies variables is particularly pertinent for efficient management of the economy and coming up with cutting-edge policies that would facilitate the attainment of macroeconomic stability in the midst of current instability as occasioned by Covid-19 pandemic. Meanwhile, the dynamic responses are examined within the Bayesian VAR framework. The advent of the Bayesian approach to VAR analysis led to a re-evaluation of the ordinary VAR procedure using Bayesian principles. The conventional VAR procedure was faced with some inadequacies, such as the over-fitting problem; in other words, the problem of over parameterisation and misspecification of degrees of freedom. The Bayesian school offers a resolution to this difficulty because it does not consider many model parameters. More specifically, the study contributes to the discussion on fiscal and monetary policies interact in the light of mounting price level in the South African economy, as the studies on fiscal and monetary policies are still primarily limited. The remainder of the study is organised as follow. Section 2 presents a review of the literature, Section 3 presents the methodology, Section 4 discusses the results, while Section 5 concludes the study.

2. REVIEW OF LITERATURE

The general conclusion of earlier studies on monetary policy is that fiscal policy management does not significantly affect monetary policy. They argued that fiscal policy's primary responsibility is to control the government's budget, while monetary authority should regulate the money supply and interest rate (Sargent & Wallace, 1981).

Hughes and Weymark (2005) investigated monetary and fiscal policy interactions in the UK and the euro area through regression analysis using instrumental variables. They argued that there was substitutability of monetary and fiscal policy interaction in the UK, while complementarity was found in the euro area. This was corroborated by Kirsanova et al. (2005) using a similar approach as they also found evidence of complementarity between fiscal and monetary policy variables. Subsequent empirical findings by Reade and Stehn (2007) and Daly and Smida (2016) came up with similar conclusions as Bianchi and Ilut (2017), using a Markov-Switching DSGE model, state that instability in US inflation can be explained by the interaction between the monetary and fiscal authorities. When the fiscal authority is the leading authority, fiscal imbalances generate long-lasting and persistent increases in inflation, and the monetary authority loses its ability to control inflation. The effects of these shocks last as long as agents expect the fiscal authority to prevail in the future. Therefore, if the monetary authority tries to dis-inflate without the fiscal authority's backing, inflation barely moves. However, when the fiscal authority accommodates the central bank's behaviour, inflation quickly drops, the economy enters a recession and the debt-to-GDP ratio increases. These features characterised the events of the early 1980s and can therefore be rationalised by the change in the policy mix itself.

According to Cekin (2013), using the Markov switching approach, concluded that monetary and fiscal policy switch is an essential requirement for monetary policy to ensure prices' stability as deficit shocks would be prevented from transmitting to inflation. Choudhri and Malik (2012) used a small-scale DSGE model for Pakistan to analyse monetary policy. Their empirical findings suggest changes in government expenditure crowd out private investment, and money supply changes do not significantly cause inflation. This was supported by the empirical submission of Coenen and Straub (2004). Dungey and Fry (2010) were worried about the possible effects of monetary and fiscal policy outcomes in Australia's economy. Their findings show that government expenditure impacts induce a much more significant rise in government revenue, resulting in a fall in the debt-to-GDP ratio. A similar study by Chatziantoniou et al. (2013) states that both fiscal and monetary policies affect stock markets' performance.

Jin (2013) examined the interactions among debt maturity management and monetary and fiscal policies using a DSGE model. His empirical conclusions show that debt maturities do not significantly influence monetary and fiscal policy interactions. He does, however, submit that longer average maturities of debt magnify the effects of monetary policy shocks on the prices of bonds. Ojeda-Joya and Guzman (2017) investigated the impacts of consumption shocks on GDP employing a panel analysis. They argue that the tightening of monetary policy habitually accompanies government consumption shocks. They also concluded that consumption shocks generate higher multipliers in developing countries.

Gnocchi and Lambertin (2013) examined the interaction between committed monetary and discretionary fiscal policy utilising Markov-Switching. Empirical findings show that there is a lack of commitment on the part of fiscal authority. This lack of commitment was believed to generate a steady-state debt level that a time-consistency problem would determine. They are of the view that fiscal indiscipline promotes tax rate volatility and inflation. Adam and Billi (2008) re-examine the impacts of inflation traditionalism on fiscal policy and taxation. Their empirical clarification reaffirms the roles of policy timing in affecting inflation. The DSGE model in an open economy with monetary and fiscal policy in a continuous-time framework was developed by Hayo and Niehof (2014) to analyse monetary and fiscal policy's interdependence during financial crises. The contagious effects on bond markets and real markets were analysed under different monetary and fiscal policies. They find evidence that the cost of inflation under the modified Taylor rule prevents crises most. However, there is no evidence for supporting either spending or austere fiscal policy. Depending on the inter-connectedness of markets, spending policy causes a crisis in the bond market instead of preventing the stock market crisis. They, however, could not find evidence that financial market crises will affect the monetary and fiscal policy interdependence. Nonetheless, Dixit and Lambertini (2003) and Galí and Perotti (2003) establish that monetary and fiscal policy interdependence is affected by financial market crises.

Gonzalez-Astudillo (2013) made use of Bayesian methods for nonlinear state-space models to estimate the policy rules with time-varying coefficients, endogeneity and stochastic volatility. Empirical results show that there is important persistence in policymaking with fiscal policy being slightly more persistent than monetary policy. There is also a degree of direct interactions between policies given by a positive estimated correlation between latent factors. They also find evidence that monetary policy switches more frequently than fiscal policy, and the former loosen during recessions. There is also evidence that taxes affect output, but the effects are attenuated concerning a pure fiscal regime.

Ehelepola (2014) provides empirical evidence on welfare maximising optimal monetary and fiscal policy rules in Sri Lanka using a DSGE model. A standard Taylor rule-type monetary policy reaction function where the nominal interest rate responds to inflation deviations and output gap was employed. A relatively simple fiscal policy reaction function in which tax revenue depends on total government liabilities is used. To conduct welfare analysis, equilibrium solutions to the model are approximated up to second-order accuracy. He proposes the optimal monetary and fiscal policy rules within a group of implementable and straightforward rules for the Sri Lankan economy. Philippopoulos et al., (2015) investigated monetary and fiscal feedback policy rules in a New Keynesian model under a non-open economy. Their empirical conclusions state that the monetary authorities should be concerned with inflation, while the fiscal authorities should adjust to changes in debt level. They find evidence to support the view that price stability should be the critical concern of monetary authorities.

The 2007/2008 global financial-economic crisis has awakened the discussion on the role of monetary and fiscal policy in fighting recessions or economic crises. Most of the recent empirical studies submit that government spending could be effective in fighting or combating financial crises. Devereux (2010) examined the role of debt and deficits in an economy with zero bound on nominal interest rates. His empirical evidence establishes that the wealth effects of deficits induce macroeconomic response or adjustments in lessening the impact of global financial crises. They argued that spending financed by deficits would be more expansionary than tax finance. The study concludes that a tax reduction would be more potent during the liquidity trap than when there is no liquidity trap. Following the thoughts of Hayo and Niehof (2014) on the role of monetary and fiscal policy in fighting recessions or economic crises, Valdivia and Valdivia (2019) investigated the effectiveness of fiscal and monetary policy coordination during the 2007-2010 global crisis using a DSGE model. The results show that fiscal and monetary policies shocks have unfavourable impacts on price stability and economic growth during a crisis.

Hohberger and Herz (2012) analysed macroeconomic responses of current accounts to different shocks. Their results indicate that inconsistent monetary policies make the economy vulnerable to shocks and lead to volatility in exchange rates, aggravating the current account conditions. They argue that stability in macroeconomic variables is associated with fiscal response to the current account. However, attempting to stabilise the current account using fiscal policy causes output to vary significantly in the short run. Valli and Carvalho (2010), in an attempt to broadening the implementation of fiscal policy, stretched the works of Coenen, et al. (2007) and Christoffel, et al. (2010). Valli and Carvalho (2010) assume a fiscal policy that aims at stabilising the debt level in an open economy. The empirical findings suggest that macroeconomic response to output growth worsened inflation. While the reaction of growth of money to the exchange rate shows inflation variability worsened to a lesser extent.

3. METHODOLOGY

3.1 Model estimation

Bayesian vector autoregressive (BVAR) is a development on the traditional vector autoregressive (VAR) model (Koop & Korobilis, 2010). BVAR makes use of Bayesian approaches to implement VAR (Gefang, 2014). Unlike traditional VAR models, in the BVAR model, parameters are assumed to be random, and prior probability values are assigned to the model (Gefang, 2014). The major superiority of the BVAR model is that it is not faced with the difficulties of collinearity and over-parameterisation which are peculiar to conventional VAR models because BVAR enforces priors on the autoregressive parameters.

Consider an autoregressive VAR (p) model of order p:

Where Yt = (Yit-1, Yit-2, Yit-3,........Yit-p) is a 6x1 matrix, which means the number of observations multiplied by the number of endogenous variables (inflation rate, interest rate, money supply, tax revenue, government spending and government debt). In a more specific form, equation (1) can be written as:

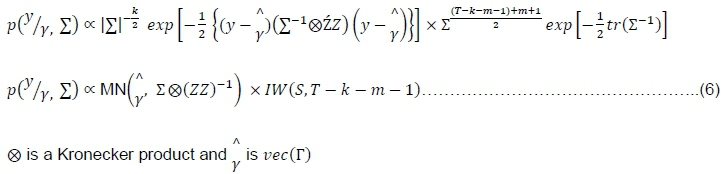

Where Yt = ( ct, Yit-1, Yit-2, Yit-3,........Yit-p) is a T by (1 + N*P) matrix. s is a stochastic term with nil and non-negative definite covariance matrix Σ . In other words, ε~iidN(0,Σ). The εtis assumed to be multivariate normal. The classical inference is followed by the Bayesian inference of the VAR model. The Bayesian econometric framework consists of the derivation of the likelihood function, among others. To derive likelihood function, consider the 5-dimensional Var(p) model,

Where k=mp+1 and is the number of parameters to be estimated while T is the number of the observations. If we stack the VAR coefficients into a vector, equation (3) could be written as follows:

And q=mk. If we assume that u~N(0,Σ ® IT), the likelihood function can be written as

The final form of likelihood function after solving for y and £ can be written as follows:

In BVAR estimation process, there are different types of prior probability distributions. According to (Koop, 2013). The present study employed a steady state prior.

3.2 Data sources and description of variables

Data on consumption, inflation, outstanding government debt, money supply, government spending, economic growth, tax revenue and interest rate were employed. Monthly data on the inflation rate, interest rate, money supply, tax revenue, government spending and government debt from 2009(1) to 2019(12) for the period 1981-2018 were sourced from the South African Reserve Bank.

3.2.1 Money supply

Money supply can be defined as an entire total currency stock and other liquid instruments circulating in the economy at a particular time (Friedman, 1968). The money supply includes cash, coins and balances held in checking and savings accounts. Money supply can also be defined as physical cash in circulation plus the money held in checking and savings accounts (Friedman, 1968). Central bankers across the globe primarily measure their money supply with M1 and M2. The most liquid form of money is M1 (Goodhart, 1994). Consequently, the present study uses M1 as a measure of monetary aggregates in estimating the degree of fiscal and monetary policies interdependence.

3.2.2 Inflation rate

Inflation is the increase in the Consumer Price Index (CPI). The CPI is a weighted average of prices for various goods (Akatu, 1993). The kind of goods included in the composition of CPI is determined by representative goods of consumers (Jhingan, 2007). There could be goods that experience a fall in prices while others had price increase, but the eventual value of CPI will be determined by each of the goods' relative weight. Annual inflation, used in the study as a monetary policy variable, is the percent change of the CPI relative to the previous year.

3.2.3 Government spending

Government spending can be defined as the government's purchase of goods and services (Bhattarai & Whalley, 2000). Government spending is undertaken to perform critical functions, such as national defense, education, subsidy for start-up industries or industries that cannot drive their operations with funding by the private sector, transfer payments in forms pensions, unemployment benefits, and financial and fiscal incentives to private firms to reinforce investment activity among others. These expenditures are financed with a combination of taxes and borrowing. Government spending is also used to inject extra spending into the macro-economy (Adams, 2008). This is primarily done to help achieve increases in total spending or aggregate spending in economic activity. This kind of stimulus is part of the discretionary fiscal policy of the government.

3.2.4 Government debt

Government debt is generally identified as the total debt obligations of a country. It is the country's total indebtedness, either internally or externally (Ayodele & Falokun, 2003). Government debt can be categorised by duration or maturity period. The maturity period for short term debt is within a year, while long-term debt is over ten years. Medium-term debt is, of course, longer than short-term debt but shorter than long-term. The study uses public debt, which is the summation of the government's internal and external outstanding debt.

3.2.5 Interest rate

The interest rate is an important monetary policy tool used to regulate the volume and direction of the economy's credit or money (Jhingan, 2007). An interest rate as an important monetary policy variable is measured in many ways. The rate at which the central bankers rediscount their bill to commercial banks is an interest rate called monetary policy rate (MPR). On the other hand, the rate at which money deposit banks, known as commercial banks, allocate credit to the public is called lending rate or interest rate (Nwezeaku & Akujuobi, 2010). This is a broader monetary policy tool as it encapsulates the monetary policy interest rate. Consequently, the study makes use of the banking interest rate in the study.

3.2.6 Tax

Tax is an important fiscal policy variable; it is a significant dominant source of revenue to finance government spending, especially in developed countries. The total amount of money that the government receives from taxation is termed tax revenue (Daniel, 2001). The tax revenue is the sum of the revenues of different kind of taxes such as the revenue of physical and juridical persons known as a direct tax, wealth and assets, the domestic economic transactions (indirect taxes such as VAT) and international trade transactions (import duties) (Ogunmuyiwa, 2008). The study uses revenue from all tax levies of the government.

4. FINDINGS AND DISCUSSION

4.1 Summary statistics

It is not uncommon in econometrics analysis to carry out descriptive statistics of the variables under investigations. Variables such as money supply (MS), bank rate (BR), inflation rate (INF), government debt (TD), government spending (EXP) and tax revenue (TR) are employed in the estimation process. The descriptive analysis presented in Table 1 reveals the underlying characteristics of all the variables.

Table 1 shows that the variables are characterised with a high level of internal consistency in the region of maximum and minimum values. Also, the standard deviation of the variables is low, which shows that the variances of the variables are not needlessly high. This is also corroborated by the skewness and kurtosis of the variables are minimal. The Jarque-Bera statistics capture the normality characteristic of the data. At one percent level of significance, the Jarque-Bera statistics of each variable accept the normality's null hypothesis. This position is confirmed by the closeness of both values mean and median. The nearer the mean and median values, the higher the probability that the series will be normally distributed.

Also, the movement of the variables over the study period is given in Figure 1. The graphical picture shows that government expenditure, tax revenue, government revenue and money supply have grown in the South African economy. At the same time, inflation and bank rate have been oscillating over the period.

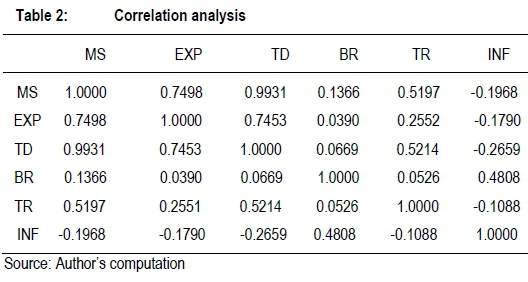

4.2 Correlation analysis

Table 2 and Figure 2 show the correlation relationship between the variables. The results show that the relationship among most of the variables is solid. For instance, the relationship between money supply and government spending, government revenue, and government debt is as substantial as the case for other variables. Only the bank rate has a fragile relationship with the rest of each of the variable.

4.3 BVAR lag length selection criteria

Table 1 shows the result of lag selection results for BVAR model. From Table 3., the appropriate lag order is one, based on the minimum value of Schwarz information criterion (SC). As such, we cannot take lags of more than one. Notably, SC (also known as Bayesian information criterion) has been chosen over the other information criteria due to its strengths. It is highly reliable and often employed to compare non-nested models. Comparison among different models can be made using SC. Moreover, the SC is significantly conservative regarding lag selection compared with other criteria (Korobilis, 2013).

4.4 Impulse response analysis

The results of impulse response analysis from Bayesian vector autoregressive as shown in Figure 3, is used to evaluate the dynamic interactions between fiscal and monetary variables and the results is discussed as follows:

4.4.1 Response of the variables to inflation shocks

The impulse response analysis shows that a positive shock to inflation expectedly leads to a positive response in the economy's price level. This has been the experience in the South African economy as the prices of goods and services have remained downwardly inflexible. A positive shock to inflation also provokes positive responses from the bank rate. This shows that positive shock to inflation leads to a positive response from the rate at which deposit money banks lend to the public. On the other hand, a positive shock to inflation shows adverse fluctuation in money supply level and government expenditure. The government expenditure and money supply level could be observed to be oscillating between positive and negative region. Similarly, inflation shocks primarily lead to a decline in tax revenue. This could be due to the fall in the profits of the businesses due to positive shocks to inflation and hence tax revenue. Lastly, a shock to inflation could be seen to largely lead to a fall in total debt.

4.4.2 Response of the variables to bank rate shocks

A positive shock to the bank rate causes inflation in the economy to rise. This is not unexpected as the increased cost of borrowing should be expected to increase the commodity prices. A positive shock to inflation causes an increase in money supply in the economy as monetary authorities respond to bank rate shocks by lowering the economy's interest rate. Also, bank rate shock is also seen to lead to an increase in government expenditure. A positive shock to bank rate is also observed to cause erratic fluctuation in tax revenue, with tax revenue essentially a negative response. Government debt is also seen to respond negatively to shocks to the bank rate.

4.4.3 Response of the variables to money supply shocks

As expected, impulse response analysis shows that positive shocks to money supply persuades the monetary authority to respond by raising the interest rate in the economy, raising the bank rate. Interestingly, a positive shock to money supply could not motive a significant response from inflation with just a slight decline, and outstanding government debt does not respond significantly to money supply shocks. Government spending is also observed to fluctuate in response to money supply shocks as it oscillates between the positive and negative region. At the same time, tax revenue is noted to respond positively to money supply shocks.

4.4.4 Response of variables to government expenditure shocks

Shocks to the government expenditure produce insignificant or zero response from a response from inflation. This shows that the South African economy's inflation is purely a monetary variable, and shocks to government expenditure do not produce a significant reaction from inflation. Also, evidence from impulse response analysis shows that shocks to government expenditure cause moderate fluctuation in money supply level while a slight decline is observed in bank rate. Expectedly, a positive shock to government expenditure is observed to cause a decline in tax revenue. An increase in the government's total outstanding debt could also be observed due to government spending shocks.

4.4.5 Response of the variables to tax revenue shocks

As noted earlier, inflation could be non-responsive to fiscal variables but rather monetary variables in the South African economy. Tax revenue shocks lead to an insignificant response from inflation, while moderate fluctuations in bank rate and money supply are visible due to tax revenue shocks. Also, tax revenue shocks cause significant fluctuation in government spending. Expectedly, the government's total outstanding debt could be seen to fall significantly due to positive shocks to tax revenue.

4.4.6 Response of variables to debt shocks

The empirical evidence also confirms that inflation in the South African economy is a monetary phenomenal debt shocks that could not provoke an increase in the economy's price level. A positive response from the bank rate is expected due to positive shocks to total government debt, while an insignificant positive response is observed from the money supply level. Also, debt shocks cause insignificant reactions in government spending and tax revenue.

4.3 Forecast error variance decomposition

Forecast error variance decomposition (FEVD) splits the variation in an endogenous variable into the component shocks of the BVAR model. In other words, variance decomposition gives information about each random innovation's relative importance affecting the variables in the VAR model. More specifically, FEVD provides information about the predominant sources of variation in all the variables in the system. Earlier empirical results on FEVD show that the dominant sources variation in all the system variables are the "own" shocks, and our results follow suit except tax shocks. The FEVD result is presented in Figure 4. The empirical results show that the dominant sources of variation in tax revenue are shocks to tax revenue. Tax shocks account for more than 99 percent variation in tax revenue.

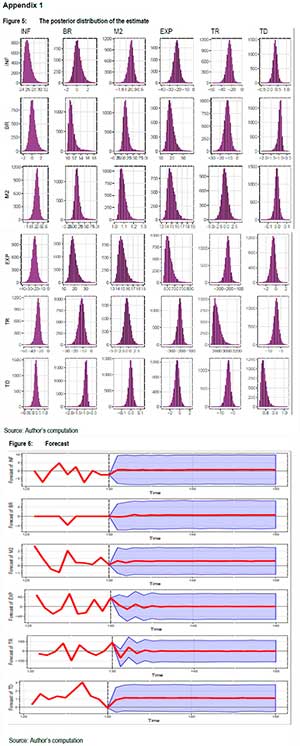

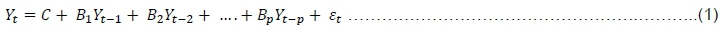

Further results in Figure 4 show that tax revenue shock is a significant source of government debt variations as it accounts for more than 10 percent variations in government debt. In addition, tax revenue and government debt shocks are important sources of variation in the money supply. Government debt and tax revenue shocks account for about 28 percent and 7 percent variations in government spending. Tax revenue and money supply shocks are significant sources of variation in inflation, with shocks to each of this variable accounts for 7 percent and 18 percent variation in government spending. Money supply and inflation rate account for about 4 percent and 5 percent forecast error variance in bank rate. The posterior distribution of the estimate is contained in Appendix 1 (Figure 5). The posterior distribution of the estimate characterizes the joint posterior distributions of the coefficients and innovations covariance matrix. Also, BVAR forecast estimates is also contained in Appendix 1 (Figure 5).

5. CONCLUSION

This study examined the management and interaction of fiscal and monetary policy in South Africa using Bayesian VAR. Monthly data on the inflation rate, interest rate, money supply, tax revenue, government spending and government debt for the period 2009 to 2019 were used. The data were sourced from the South African Reserve Bank. The conventional VAR procedure was faced with some inadequacies, such as over-fitting problem, in other words, the problem of over parameterisation and misspecification of degrees of freedom. The Bayesian school offers a resolution to this difficulty because it does not consider too model parameters. The impulse response analysis shows that positive shocks to money supply move the monetary authority to respond by raising the interest rate in the economy, raising the bank rate. Government spending is also observed to fluctuate in response to money supply shocks as it oscillates between the positive and negative region. At the same time, tax revenue is noted to respond positively to money supply shocks. Inflation did not respond to shock in government spending, and hence inflation in South African could be driven from the supply side instead of the demand side. Also, evidence from impulse response analysis shows that shocks to government expenditure cause moderate fluctuation in money supply level while a slight decline is observed in bank rate. Expectedly, a positive shock to government expenditure is observed to cause a decline in tax revenue. An increase in the government's total outstanding debt could also be observed due to government spending shocks.

The empirical results show that the dominant sources of variation in tax revenue shock are a significant source of government debt variations as it accounts for more than 10 percent variations in government debt. Government debt and tax revenue shocks account for about 28 percent and 7 percent variations in government spending. Tax revenue and money supply shocks are significant sources of variation in inflation, with shocks to each of this variable accounts for 7 percent and 18 percent variation in government spending. Hence, the study concludes that monetary authority must employ supply-side measures to manage the price level. The study concluded that management of the economy must be tailored towards the supply-side of the economy and remove the various structural rigidities in the economy in order to ensure the stability of the price and other macroeconomic fundamentals.

REFERENCES

Adams, C. 2008. Factors in choice of monetary policy regimes. Proceeding of the One-Day Seminar on Monetary Policy and Inflation Targeting, Central Bank of Nigeria, 1-8. [ Links ]

Adam, K., & Billi, R. M. 2008. Monetary conservatism and fiscal policy. Journal of Monetary Economics, 55(8):1376-1388. [https://doi.org/10.1016/j.jmoneco.2008.09.003]. [ Links ]

Akatu, P.A. 1993. The challenge of monetary policy since 1986. Central Bank Economic and Financial Review, 31(5):321-339. [ Links ]

Ayodele, A. & Falokun, G. 2003. The Nigerian economy: structure and pattern. Lagos: Lagos University Printoteque Press. [ Links ]

Bhattarai, A. & Whalley. J 2000. General Equilibrium Modelling of UK Tax Policy, in S. Holly and M Weale (Eds.) Econometric Modelling: techniques and applications. Cambridge: The Cambridge University Press. [ Links ]

Bianchi, F. & Ilut, C. 2017. Monetary/ fiscal policy mix and agents' beliefs. Review of Economic Dynamics, 26:113-139. [https://doi.org/10.1016/j.red.2017.02.011]. [ Links ]

Cekin, S.E. 2013. Monetary and fiscal policy interactions in Turkey: A Markov Switching approach. [Internet: stlouisfed.org, downloaded on 15 January 2020 1-56]. [ Links ]

Choudhri, E. & Malik, H. 2012. Monetary policy in Pakistan: confronting fiscal dominance and imperfect credibility. Carleton University and State Bank of Pakistan. 1-34 [http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.395.4068&rep=rep1&type=pdf; downloaded on 26 February 2020]. [ Links ]

Chatziantoniou, I., Duffy, D. & Filis, G. 2013. Stock market response to monetary and fiscal policy shocks: multi-country evidence. Economic modelling, 30:754-769. [https://doi.org/10.1016yj.econmod.2012.10.0051. [ Links ]

Christoffel, K., Jaccard, I. & Kilponen, J. 2010. Bond risk premium, fiscal rules and monetary policy: An estimated DGSE approach. European Central Bank, 1-43. [Internet: https://www.econ2.uni-bonn.de/downloads/christoffeljaccardkilponen.pdf; downloaded on 25 February 2020]. [ Links ]

Coenen, G. & Straub, R. 2004. Non-Ricardian households and fiscal policy in an estimated DSGE model of the Euro Area. European Central Bank International Monetary Fund, 25:1-37. [ Links ]

Coenen, G., Lombardo, G., Smets, F., & Straub, R. 2007. International transmission and monetary policy cooperation. In international Dimensions of monetary policy University of Chicago Press. [https://doi.org/10.2139/ssrn.1082739]. [ Links ]

Daly, H. 2015. Coordination of monetary and fiscal policies in France: An empirical overview. International Journal of Economics, Commerce and Management, 3(1):1-20. [ Links ]

Daly, H & Smida. 2016. Monetary and fiscal policy interaction in the Greece: a cointegration approach. International Review of Business Research Papers, 12(1):1-16. [https://doi.org/10.21102/irbrp.2016.03.121.01]. [ Links ]

Daniel, B. 2001. The fiscal theory of the price level in an open economy. Journal of Monetary Economics, 48(2):293-308. [https://doi.org/10.1016/S0304-3932(01)00077-0]. [ Links ]

De Resende, C. 2007. Cross-country estimates of the degree of fiscal dominance and central bank independence. Working Papers of Bank of Canada, 7(36):1-36. [ Links ]

Department of Finance, Republic of South Africa. 1996. Growth, employment and redistribution. A Macroeconomic Strategy. [Internet: www.numsa.org.za, downloaded on 16 January 2020]. [ Links ]

Devereux, M.B. 2010. Fiscal deficits, debt, and monetary policy in a liquidity trap. Globalisation and Monetary Policy Institute Working Paper,44:1-40. [https://doi.org/10.24149/gwp44]. [ Links ]

Dixit, A., & Lambertini, L. 2003. Symbiosis of monetary and fiscal policies in a monetary union. Journal of International Economics, 60(2):235-247. [https://doi.org/10.1016/S0022-1996(02)00048-X]. [ Links ]

Dungey, M, & Fry, R. 2010. Fiscal and monetary policy in Australia: an SVAR Model. CFAP Working Paper, 15:1-30. [ Links ]

Easterly, W. & Levine, R. 2003. Tropics, germs, and crops: how endowments influence economic development. Journal of monetary economics, 50(1):3-39. [https://doi.org/10.1016/S0304-3932(02)00200-3]. [ Links ]

Ehelepola, K. 2014. Optimal monetary and fiscal policy analysis for Sri Lanka: a DSGE Approach. Central Bank of Sri Lanka, International Research Conference, 1-44. [ Links ]

Fisher, A. 2011. Critical thinking: an introduction. Cambridge university press. [ Links ]

Friedman, M. 1968. The role of monetary policy. American Economic Review, 58(1):1-17. [ Links ]

Galí, J. & Perotti, R. 2003. Fiscal policy and monetary integration in Europe. Economic policy, 18(37):533-572. [https://doi.org/10.1111/1468-0327.001151]. [ Links ]

Gefang, D. 2014. Bayesian doubly adaptive elastic-net Lasso for VAR shrinkage. International Journal of Forecasting, 30:1-11. [https://doi.org/10.1016/Liiforecast.2013.04.004]. [ Links ]

George, E., Sun, D. & Ni, S. 2008. Bayesian stochastic search for VAR model restrictions. Journal of Econometrics, 142:553-580. [https://doi.org/10.1016/i.ieconom.2007.08.017]. [ Links ]

Gnocchi, S. & Lambertiniz, L. 2013. Monetary and fiscal policy interactions with debt dynamics. Bank of Canada, 1-30 [Internet: https://www.epfl.ch/en/, downloaded on 18 January 2020]. [ Links ]

Gonzalez-Astudillo, M. 2013. Monetary-fiscal policy interactions: Interdependent policy rule coefficients. MPRA Working Paper, 50040, 1-51. [https://doi.org/10.17016/FEDS.2013.58]. [ Links ]

Goodhart, C. A. 1994. Strategy and tactics of monetary policy: examples from Europe and the antipodes. Iin J. C. Fuhrer (ed.), Goals, Guidelines and Constraints Facing Monetary Policymakers, Federal Reserve Bank of Boston, 139-187. [ Links ]

Hayo, B & Niehof, B. 2014. Monetary and fiscal policy in times of crises: a new Keynesian perspective in continuous time. University of Hamburg joint discussion paper series in economics, l55, 1-33. [https://doi.org/10.2139/ssrn.2721753]. [ Links ]

Hohberger, S. & Herz, B. 2012. Fiscal policy, monetary regimes and Current Account Dynamics. Discussions paper,12, 1-41. [ Links ]

Hughes, A. & Weymark, D.N. 2005. Independence before conservatism: transparency, politics and central bank design. German Economic Review, 6(1):1-21. [https://doi.org/10.1111/j.1465-6485.2005.00119.x]. [ Links ]

Industrial Development Corporation. 2013. South Africa http://www.idc.co.za [ Links ]

International Budget Partnership, 2012.Economic Research Report. [Internet: https://www.internationalbudget.org/budget-work-by-country/ibps-work-in-countries/south-africa/, downloaded on 25 February 2020]. [ Links ]

IMF. 2010. Country and Regional Perspectives. World Economic Outlook. Chapter two. Washington, D.C, USA:IMF [ Links ]

Jhingan, M.L. 2007. Money, banking, international trade and public Finance. Vrind: Vrind a Publication Press. [ Links ]

Jin, H. 2013. Debt maturity management, monetary and fiscal policy interactions. Indiana University, 1-26. [ Links ]

Kirsanova, T., Stehn, S. & Vines, D. 2005. The interactions between fiscal policy and monetary policy. Oxford Review of Economic Policy, 21(4):532-564. [https://doi.org/10.1093/oxrep/gri031]. [ Links ]

Koop, G., & Korobilis, D. 2010. Bayesian multivariate time series methods for empirical macroeconomics. Foundations and Trends in Econometrics, 3(4):267-358. [https://doi.org/10.1561/0800000013]. [ Links ]

Koop, G. 2013. Forecasting with medium and large Bayesian VARs. Journal of Applied Econometrics, 28:177-203. [https://doi.org/10.1002/jae.1270]. [ Links ]

Korobilis, D. 2013. VAR forecasting using Bayesian variable selection. Journal of Applied Econometrics, 28(2):204-230. [https://doi.org/10.1002/jae.1271]. [ Links ]

Nunes, A.F.N. & Portugal, M.S. 2009. Active and passive fiscal and monetary policies: an analysis for Brazil after the inflation targeting regime. In Proceedings of the 37th Brazilian economics meeting. [ Links ]

Nwezeaku, N.C. & Akujuobi, A.B.C. 2010. Monetary policy and bank performance: the Nigerian experience. Interdisciplinary Journal of Contemporary Research in Business, 1(12):140-150. [ Links ]

Ogunmuyiwa, M. S. 2008. Fiscal deficit-inflation-nexus in Nigeria. Indian Journal of Economics, 3(10):558-580. [ Links ]

Ojeda-Joya, J. & Guzman. O. 2017. The size of fiscal multipliers and the stance of monetary policy in developing economies. Graduate Institute of International and Development Studies Working Paper Series, 81-24. [https://doi.org/10.32468/be.1010]. [ Links ]

Philippopoulos, A., Varthalitis, P. & Vassilatos, V. 2015. Optimal fiscal and monetary policy action in a closed economy. Economic Modelling, 48:175-188. [https://doi.org/10.1016/j.econmod.2014.10.045]. [ Links ]

Reade, J., & Stehn, J. 2007. Estimating the Interactions between Monetary and Fiscal Policy using the Co-integrated VAR methodology. mimeo, Department of Economics, University of Oxford. [Internet: http://www.econ.ox.ac.uk/students/james.reade/MonetaryFiscalInteractions.Pdf; downloaded on 16th January 2020]. [ Links ]

Sargent, T.J., & Wallace, N. 1981. Some unpleasant monetarist arithmetic. Federal Reserve Bank of Minneapolis Quarterly Review, 5(3):1-17. [https://doi.org/10.21034/qr.531]. [ Links ]

Sanusi, K.A. & Akinlo, A.E. 2016. Investigating fiscal dominance in Nigeria. European Journal of Sustainable Development, 8(?J:125-131. [https://doi.org/10.5539/jsd.v9n1p125]. [ Links ]

Sims, C.A., & Zha, T. 1998. Bayesian methods for dynamic multivariate models. International Economic Review, 949968. [https://doi.org/10.2307/2527347]. [ Links ]

Valli, M. & Carvalho, F.A. 2010. Fiscal and monetary policy interaction: a simulation-based analysis of a two-country new Keynesian DSGE Model with Heterogeneous Households. Banko Central Do Brazil Working Paper, 1-115. [https://doi.org/10.2139/ssrn.1985200]. [ Links ]

Valdivia, J., & Valdivia, D.D. 2019. Microfoundations of a Monetary Policy Rule, Poole's Rule. MPRA Working Paper, 95630:1-45. [https://doi.org/10.2139/ssrn.3436597]. [ Links ]

Woodford, M. 1998. Control of the public debt: a requirement for price stability? in the debt burden and its consequences for monetary policy Palgrave Macmillan, London. [https://doi.org/10.1007/978-1-349-26077-5_5]. [ Links ]

* Corresponding author