Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.10 no.1 Meyerton 2013

RESEARCH ARTICLES

A guiding framework for conducting focus group research

B Dube; M Roberts-Lombard

University of Johannesburg

ABSTRACT

Different versions of the process of conducting focus group research were identified as a source of confusion in the field of marketing research, with implications for the misuse of the process, thus rendering research quality control difficult. A seven-step guiding framework was conceived, based on the literature reviewed, and opinions of industry stakeholders on its scientific viability and relevance were sought through a qualitative study. A judgement sample was drawn, and in-depth interviews were conducted on eighteen respondents at their workplaces in the Gauteng Province. Based on findings of the study, the guiding framework was confirmed as a scientifically relevant intervention within the marketing research industry context, and deemed necessary for purposes of improving quality control in focus group research studies across industry disciplines.

Keywords: Focus groups; framework; guidelines; quality

1 INTRODUCTION

Different versions of the process of conducting focus group research may be a source of confusion in the field of marketing research, with implications for research quality. Where Malhotra (2007:148) cites an eight-step process, McDaniel and Gates (2006:84) stipulate four steps involved in conducting a focus group study, while Zikmund and Babin (2010:103-107) provide no specific steps, but emphasise core issues on focus group participant recruitment and moderation among other things. Similarly, Burns and Bush (2006:208) stipulate how focus groups work without citing a set of steps that ought to be followed.

The varied descriptions of the focus group process and the lack of industry-stipulated approaches to focus group research, provide local researchers with open options with respect to the correct research process to be followed. The implications for research quality can be dire. Maree and Wagner (2007:122) and Martin (2006:2-4) confirm that focus group research quality is often compromised due to the misuse of the focus group research process. Apart from that, the qualitative study revealed that lack of a streamlined focus group research process renders quality control difficult to enforce in practice. Given this background, a logical seven-step process for conducting focus group research was conceived, informed from the literature reviewed. A qualitative study was then conducted to provide empirical validation to the seven steps as a scientific process and guiding framework. In this regard, the study sought to determine the opinions of major industry stakeholders on the importance, appropriateness and scientific relevance of the seven-step process as a framework for guiding focus group research. The objective was to optimise research quality control in focus group research practice.

Based on the findings of the empirical study, the seven-step approach to conducting focus group research was confirmed not only as a solution to the confusion around different versions of the process, but also as scientifically relevant in the marketing research industry context. This statement is supported by the opinion of respondents who stated that "A guiding framework for focus groups is important and relevant and long overdue". More importantly, the seven-step guiding framework was proved to be necessary for purposes of improving quality control in the execution of focus group research studies. Based on the findings of this study, quick adoption and vigorous enforcement of the guiding framework by industry authorities are recommended. Penalties must be imposed on quality research transgressions by research suppliers in order to improve quality standards within the local practice of focus group research. However, a more conclusive, follow-on study on the seven-step framework was suggested in order to test and consolidate the findings of the qualitative study.

2 PROBLEM STATEMENT

Evidence exists in the literature reviewed, which suggests that the process of conducting focus groups in marketing research practice may not be deemed systematic or well streamlined, and various versions of steps are stipulated by different researchers. The different versions of the focus group process may be a source of confusion for marketing researchers across industry disciplines. The confusion around which process is the most appropriate one may have implications for the quality of the research supplied to marketing decision-makers at organisations across industries.

The different processes or versions for conducting focus group research also render the use of focus groups open to abuse, as confirmed in the literature studied. Martin (2006:2-4) and McDaniel and Gates (2006:104) argue that confusion around the correct version of the focus group process and the misuse of the method can result in quality control being compromised when executing focus group research studies.

3 AIM OF THE STUDY

The aim of the study was to develop a framework for guiding the process of focus group research practice in marketing research, given the different and non-well defined steps stipulated by some researchers in the literature reviewed. The objective was to determine research supplier and user opinions in the marketing research industry on the importance and scientific relevance of the proposed seven-step process. This process is proposed as a framework for conducting focus groups in marketing research in future.

A more streamlined approach to focus group research is critical for purposes of optimising research quality control otherwise not possible due to different versions of the focus group process currently being used in marketing research. As much as the study focuses on marketing research practice across industry disciplines, the proposed framework guidelines may be applied in other related environmental contexts.

4 SIGNIFICANCE OF THE STUDY

Although a more conclusive, follow-on study will be conducted, this qualitative study contributes to the general field of marketing research in that it provides a seven-step framework which entails a set of guidelines to streamline the focus group research process. The development of the seven-step process may serve to eliminate confusion around the appropriate and relevant version of the focus group process for South African practitioners. As a more streamlined process, the seven-step framework will also aid the implementation of quality control measures within the focus group process.

Quality control is a major requisite in marketing research practice, especially when evidence in the literature suggests the focus group research process is often abused in the pursuit of profit (Green & Green 2005:1-9; Wheeldon 2010:89). Martin (2006:2-4) and McDaniel and Gates (2006:104) postulate that the misuse of the focus group method may be attributed to the different versions of the focus group process (refer to section 7.1), hence the need for a more streamlined approach. The chronological seven steps may enhance researcher focus and due diligence per step when conducting focus group research studies, and in this way the standard of focus group research may be improved to the benefit of stakeholders across research disciplines.

5 RESEARCH PROPOSITIONS OF THE STUDY

The main assumptions of this study are that non-standardised approaches to focus group research are prevalent within the marketing research environmental context as postulated by Maree and Wagner (2007:122) and Martin (2006:2-4). Such approaches also contribute to the misuse of the focus group research method. Misuse of focus group research lead to research quality problems identified in the literature reviewed. In addition, ignorance of focus group research as a scientific process was empirically proved to be a widespread problem that requires attention and a well defined framework of guidelines to make it more credible.

6 RESEARCH METHODOLOGY

The study was qualitative in nature. Qualitative methodology helps discover deeper meanings and new insights from respondents (Zikmund & Babin 2010:92). Accordingly, the methodology design for the study included the research population, sample frame, size and selection criteria, as well as data analysis procedures followed.

6.1 Research population and sample frame

The population of interest for the study consisted of all organisations operating in South Africa that supply or use marketing research information generated through the use of focus groups. A sample frame of over 250 research suppliers and approximately 2 000 active research user organisations, both registered and unregistered with SAMRA (Southern African Marketing Research Association) were used (SAMRA 2010:77-99).

6.2 Sample size and selection criteria

The study sample consisted of two categories, namely, one for the research suppliers (n=8) after a point of saturation had been reached, and the other for research user organisations (n=10), for a total sample size of 18 individual respondents. The rationale for the use of research supplier and users was not only to achieve a balance in terms of representation of both research supplier and user organisations in the sample, but also to obtain perspectives from both sides.

A judgement sample was drawn. Malhotra (2007:343) defines judgemental sampling as a form of convenience sampling in which elements of the population are purposely selected based on the judgement of the researcher. In this regard, respondents from organisations currently active within the South African marketing research industry were considered. Only respondents from research supplier organisations that use focus groups, and research user organisations that have experienced or used research results derived from the use of focus groups, were involved. An informal screening procedure based on inquiries and checks on individuals' background was conducted to ensure quality within the recruitment process.

6.3 Data collection and research instrument

In-depth interviews were conducted for data collection purposes. The in-depth research method was deemed suited for this study because it offers unhindered conversations in a social sense. The in-depth interview method generates data in an unconstrained but vivid atmosphere (DeRosia & Christensen 2009:15-35; Lillrank 2003:691-703). The identity of respondents was treated as confidential to mitigate competitive rivalry among practitioners within the marketing research industry practice. Responses were manually coded using number codes for similar reasons.

A discussion guide was used as the data collection instrument, essentially to obtain pertinent opinions and views of representatives of both research supplier and user organisations. The discussion guide contained structured topics determined on the basis of issues arising from the literature reviewed. The discussion guide was deemed appropriate for purposes of the study because it allows for flexibility with respect to the use of in-depth interviews (n=18), where probing questions could be asked to get deeper and more elaborate explanations from the interview discussion (Zikmund & Babin 2010:108). The discussion guide was pilot-tested on a total of 4 respondents prior to the study being conducted, in order to refine the research topics.

6.4 Data processing and analysis

A qualitative data processing and analysis approach was employed, and entailed data cleaning and preparation for quality purposes. This process involved general editing by checking the data for consistency, correctness and completeness (Malhotra 2007:419; Nookabadi & Middle 2001:657-670). The data was coded manually using number codes, and data that fell outside the coding procedure and any ambiguities identified, were thus cleared to ensure reliability and accuracy of the data analysis process (Famili 2005:417-418; Segal, Hershberger & Osmonbekov 2009:70-82).

A qualitative content analysis was conducted on transcripts produced for the identification and categorisation of themes, trends, content and issues on quality challenges arising from the in-depth interviews (Ratcliff 2008:116-133; Stavros & Westberg 2009:307-320). As advocated by Keegan (2009:234-248), scientific rigour, reflection, analysis and interpretation of qualitative data were vigorously pursued for quality reasons.

7 LITERATURE REVIEW

As evidence in the literature indicated, the process of conducting focus group research may not be deemed systematic, standard, or scientific for purposes of controlling focus group research quality output. To address this anomaly, which has implications for research quality in marketing research, a more streamlined approach to focus group research was conceived. However, the seven-step framework ought to be viewed against a background of different non-standardised versions of the focus group process, propagated by different researchers active within the field of marketing research in South Africa.

7.1 Versions of the focus group process

There are different versions of the process involved in conducting focus group research, which may not be described as standard or systematic, because there is little evidence that supports a particular set of steps or guidelines in the literature reviewed. Different versions of steps followed in the focus group research process are stipulated by different researchers, perhaps based on the different characteristics of research studies, research questions or problems investigated. Malhotra (2007:148) cites an eight-step process that ranges from the setting of objectives through to writing a screening questionnaire, reviewing of tapes and data analysis to summarisation of findings, followed by follow-up research or action.

McDaniel and Gates (2006:84) stipulate four steps in conducting a focus group study that involve preparation for the group including recruitment of the participants, selecting a group moderator and creating a discussion guide. This is followed by conducting the group, and finally preparing the focus group report. Zikmund and Babin (2010:103-107) provide no particular chronology with respect to the steps involved in focus group research, despite emphasising core issues such as focus group recruitment and moderation, among other things. Similarly, Burns and Bush (2006:208) stipulate how focus groups work, without citing a set of steps that ought to be followed. However, core issues such as the assembling of a group of participants, the need for a group facility and moderators to conduct the sessions are discussed. This should culminate in a focus group report.

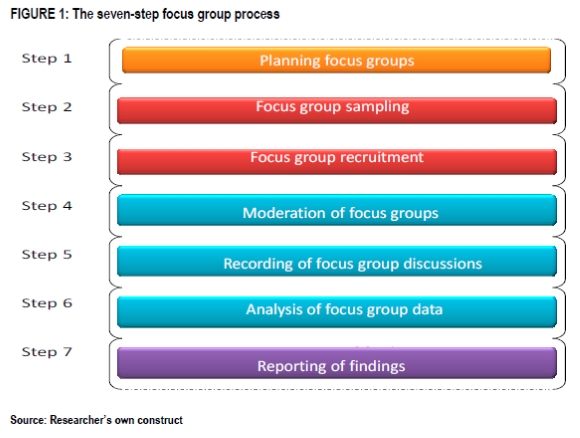

Considering this background of different versions of the focus group process, a systematic seven-step process can be considered comprehensive and appropriate for purposes of enforcing quality control per step. The seven step focus group process may comprise of key focus group research aspects identified in the literature reviewed such as planning, respondent sampling, recruitment, moderation, recording of focus group data and analysis of data, as well as reporting of research findings as major steps, as depicted in Figure 1.

In relation to Figure 1, the components of the seven-step focus group process can be explained in terms of their importance, appropriateness and relevance as stipulated in the literature reviewed.

Planning: Planning and preparation across the different steps of the focus group research process are key to the success of quality data generation through focus groups (Simon & Mosavel 2008:63-81). Planning helps identify important issues that can be addressed through focus groups (Courtois & Turtle 2008:160-166). Planning for focus group research essentially incorporates the examination of the objectives of the marketing research project. Each stage of the focus group process must be planned and specific objectives of each stage established for a streamlined execution of focus groups (Zikmund & Babin 2010:13).

Sampling: Sampling for research participants is essential for all kinds of research, but the purpose of sampling procedures in focus groups is to bring together suitable representatives of the communities in which the research is interested. The research sample is created to ensure representativeness of a target population in terms of participation (McDaniel & Gates 2006:137; Simon & Mosavel 2008:63-81). Focus group sampling entails a unique set of sampling procedures within the focus group process in order to create a desired research sample. The choice of the sampling approach or technique depends on the objectives of the focus group study (Welman, Kruger & Mitchell 2005:56,67).

Recruitment: Respondent recruitment is an important task that requires the skill of the recruiter as an effective communicator and in establishing rapport with the potential recruits. Recruitment involves a broad range of procedures such as planning and site selection (Kent 2007:95). Different approaches are used by qualitative research firms with respect to respondent recruitment in marketing research. Whereas some use field managers or supervisors, others may employ direct researcher-to-recruiter contact. Curiosity might be a major motivator for attendance on the part of many aspirant respondents (Heiskanen 2005:179-201; Walden 2006:76-93).

Moderation: A focus group discussion is typically led by a moderator (Courtois & Turtle 2008:160-166). A focus group moderator is usually an outside expert hired by a client or research firm to conduct the focus group, and must have a background in marketing or related field in order to execute focus groups efficiently (McDaniel & Gates 2006:85). In some cases two moderators are used. The use of two moderators offers the advantage of allowing one moderator to concentrate on conducting and stimulating group interview discussions, whilst the other records manually or operates the audio recorder and helps ask follow-up questions from time to time. Moderation of focus groups is therefore a key task, in particular given the increasing importance and preference for the use of focus groups in marketing research. Matching the moderator to the group profile in terms of age, gender or experience, may auger well for interaction and engendering rapport, and discussions may thus be fruitful (Simon & Mosavel 2008:63-81).

Recording: Recording of data generated through focus group research is a critical step within the focus group research process, and most tools suited for qualitative data recording are used (Symonds & Gorard 2010:121-136). A system of audio recording is usually used to record focus group interviews and may include tape and video recording. Tape recording entails making use of recording audio tapes and is probably the best way, although it tends to take a lot of time to transcribe the results. A good quality recorder is essential for tape recording focus group interviews, and must have a multidirectional microphone and be easy to place on the table. Video recording on the other hand offers the advantage of capturing body language as well as the verbal exchanges, but may be seen as intrusive, thus permission from participants is definitely required on video recordings (Emeraldinsight 2010:Internet).

Data analysis: The approach to data analysis for focus groups is largely determined and driven by the purpose and objectives of a research study (Simon & Mosavel 2008:63-81). Analysis of research in general, and focus group data in particular, must be conducted with scientific rigour, and transparency for logical and coherent research findings and conclusions arrived at by the researcher are vital (Doyle 2008:232-233; Walden 2006:76-93). Accurate analysis of group interactions and dynamics is also critical as part of a rigorous process in research, in order to avoid incorrect interpretation and arriving at distorted or invalid conclusions (Vicsek 2007:20-34). Features of group interactions must also be considered during data analysis. When respondents are particularly critical of one idea, it must be noted, analysed and interpreted within context (Aaker, Kumar & Day 2007: 200,201).

Reporting of findings: Reporting of research findings is the last stage in the seven-step focus group research process, and includes the interpretation of findings (Welman et al. 2005:237). Focus group research reporting is a useful skill as a specific account of reality must be related (Heiskanen 2005:179-201; Roe 2004:461-462). A typical marketing research report must be seen as the final product of all the research efforts expended on a project and might be the only research document that the client or other decision-makers get to see and use (Burns & Bush 2006:598). Accurate focus group research reporting and the credibility of findings thereof, are critical as they can be used to inform strategic and tactical decisions of business organisations (Heiskanen 2005:179-201; Roe 2004:461-462). For these reasons, the focus group report must communicate research findings effectively within the framework of study objectives and the methodology guiding the research (Simon & Mosavel 2008:63-81).

7.2 Validating the need for a systematic focus group research process

To corroborate findings in the literature relating to the need for a systematic guide to the process of conducting focus group research, a qualitative study was conducted. Thus, the in-depth qualitative study sought to provide empirical validation of the seven-step framework as a workable instrument. For this reason, the qualitative study determined and confirmed the importance and scientific relevance of each of the chronological seven-steps as components of the framework for conducting focus groups, and assessed whether or not the framework covered the full spectrum of focus group research activity. The culmination of both literature and qualitative research investigations and the corroborated findings thereof, resulted in the formulation of a guiding framework for conducting focus group research described in the next section.

8 FINDINGS OF THE EMPIRICAL STUDY

Findings of the study are discussed in this section, with particular emphasis on the most pertinent, appropriate and scientifically relevant issues pertaining to each of the seven-steps of the focus group process comprising the guiding framework as described by respondents in the qualitative study. Direct quotations from interview participants were used without direct attribution to the respondents in order to protect the identity of the participants.

Step 1 - Planning: Key challenges relating to focus group planning were cited as lack of knowledge of the target market, which sometimes forces some research suppliers to "shoot in the dark and say this is what we are thinking". Less regard to planning as an ongoing process, and refinement of research procedures followed for quality reasons, were evident. Tight timelines of focus group projects and incompetence on the part of some participants are other challenges.

Step 2 - Sampling: Most focus group research users adopt the hands-off approach to sampling, because they claim that they "pay a lot of money for research", therefore must not be expected to do more. Sometimes ignorance on the part of research users in terms of what goes on in sampling is a challenge. For this reason, the sampling practice has a challenge in determining the target market, especially if research users do not know much about their market, which is often the case. Lack of practitioner expertise coupled with often non-formalised procedures for sampling may constrain measures to counter 'cheating' by some respondents.

Step 3 - Recruitment: Research suppliers and users alike acknowledged that certain recruitment quality compromises were inevitable, due to the often rushed recruitment function, owing to tight project timeframes which stem from lack of proper planning. Resistance to recruitment in focus group research was acknowledged as a universal challenge by suppliers and users alike. Quality control over the recruitment function was acknowledged as a challenge, especially on issues of cheating and dishonesty by potential respondents.

Step 4 - Moderation: Some respondents believed moderation to be a creative process somehow unconnected to the practice of research science. Key considerations in moderation were cited as the skills and experience of the moderator, factors critical for quality reasons. However, some research suppliers claimed, "for us, customers come to us because they know quality is there". Challenges cited by most included incompetent moderators who led rather than guided the focus group discussions. The freelance nature of moderator operations meant they were in and out on a project, thereby contributing to a lack of consistency and continuity of the project, which often compromised quality control.

Step 5 - Recording: Many moderators tended to rely on their relationships with research suppliers on recording quality control which are fundamentally based on trust, and "we do get the value for our money". Other quality concerns cited included inadequately backed-up recording, which often led to quality problems, apart from the inability to accurately capture feelings and expressions conveyed by the groups during discussions.

Step 6 - Data analysis: Different versions of the data analysis approach emerged from those interviewed. Some respondents regarded the analysis as the stage where creativity could be most valued, and did not have to adhere to scientific procedures. However, many respondents claimed that lack of scientific procedures during the data analysis stage often led to clandestine data analysis operations. Apart from that, "sometimes clients want analysis two or three days after the group discussions have been done", hence planning and adherence to proposed guidelines are of importance.

Step 7 - Reporting: Challenges that impeded accurate reporting included the difficulty of acceding to appropriate levels of client receptiveness, because often, some "clients do not follow, don't understand the design, can be overbearing, or ask irrelevant questions" during the reporting sessions. Another challenge related to the lack of interest is not reading the word reports on focus group findings, often because they were viewed as being too lengthy.

To mitigate the numerous challenges impacting on focus group research quality, it is imperative that the research quality control guidelines provided in the next section be adhered to.

9 A GUIDING FRAMEWORK FOR THE USE OF FOCUS GROUPS IN MARKETING RESEARCH PRACTICE

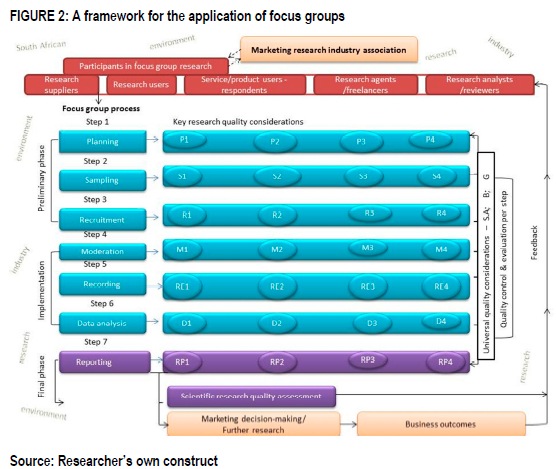

The framework designed for the use of focus groups in marketing research is presented as Figure 2, followed by an outline of guidelines with respect to the major research quality considerations necessary per step of the focus group process. Adherence to the stipulated framework guidelines may aid research quality control and improvement within the practice of focus group research. As respondents indicated, "We need a streamlined process, otherwise quality problems will persist". However, it must be noted again that the proposed guidelines may be relevant not only in marketing research practice, but also in other research settings across industry disciplines.

Figure 2 depicts the key components of the framework designed on the basis of the evidence contained in the major findings of the study, for purposes of guiding focus group research practice. Essentially, the stipulated guidelines comprise key research quality considerations to which attention must be paid in order to mitigate the various quality challenges inherent within the practice of focus group research. However, major role players are discussed first.

9.1 Major role players in focus group research

The major role players within the focus group practice were identified for purposes of the study as the following:

The marketing research industry association: An industry association such as SAMRA in South Africa may be the custodian of the marketing research practice, including focus groups. The industry association may also be the industry regulatory body, and has an obligation to set and monitor professional standards for marketing research practice (SAMRA 2009:38). The association may subscribe to the quality principles of other bodies such as the European Society for Opinion and Marketing Research (ESOMAR), which may provide technical marketing research support (Victor 2009: Interview).

Participants in focus group research: This entails all role players involved on the focus group project, and the major stakeholders in any project are the research users who request and pay for the research, and research suppliers who have the know-how and expertise to provide marketing information through focus group research. Research suppliers may outsource aspects of the project to their appointed agents or freelancers such as specialist recruiters and group moderators. Other major role players are the focus group respondents or interviewees who must possess service or product knowledge and experience. Research analysts or reviewers serve to scrutinise the research project processes and project outcomes for quality reasons.

9.2 Initial phase of focus group research

The initial phase may consist of the research problem and objectives, and decision-making on the choice of focus groups as a research method.

Research problem, purpose and objectives: The initial focus group phase must begin with the clear definition and elucidation of these three aspects of the research project, and may be explored through secondary or exploratory research undertakings. The rationale for due diligence on the research problem is firstly to create accurate understanding of the research phenomenon explored. Secondly, to indicate how the research problem would be managed. Thirdly, a clearly defined research problem can enhance accurate determination of the research purpose focussing on the research objectives of the study. Finally, the three aspects may serve to correctly inform decision on whether or not focus groups are the most appropriate research approach or method (Malhotra 2010:81).

9.3 Preliminary phase of focus group research

The preliminary phase comprises steps 1 to 3 in the focus group process.

9.3.1 Quality guidelines on planning for focus group research

P1 : Planning is key to closing quality gaps in focus group research and must be conducted from the outset. Planning must be continuous across all the research project stages.

P2: Planning is largely the responsibility of the research supplier for technical and quality reasons. Suppliers ought to possess technical expertise on the relevant focus group project(s).

P3: Streamlined, reasonable and flexible project timeframes are essential for project quality reasons, and thus focus group projects must be planned, considering potential project quality challenges.

P4: In-depth knowledge of the focus group method, its capabilities, merits and demerits will inform better project planning.

9.3.2 Quality guidelines on sampling in focus group research

S1 : Market knowledge on the part of the researcher and other players involved in sampling is crucial in identifying unconstrained, quality research samples.

S2: Sample selection ought to be undertaken as the responsibility of the research supplier, who must possess technical know-how on sampling for quality reasons.

S3: Technical know-how on focus group sampling is a key requisite for an unconstrained sampling process.

S4: Consistency in the application of procedures involved in sampling must be guaranteed to ensure quality sampling.

9.3.3 Quality guidelines on recruitment in focus group research

R1: Resistance to focus group participation may be overcome through transparent, honest and effective communication with target respondent communities, thus overcoming barriers of access to quality respondents.

R2: Proper use of incentives can be effective as a motivating factor to ease constraints in recruitment by encouraging participation of the required calibre of respondents.

R3: Exercise due control over the recruitment activities of agents hired on a focus group project to ensure quality recruitment outcomes.

R4: Efficient recruitment requires knowledge and expertise on the target market.

9.4 Implementation phase of focus group research

Steps 4 to 6 comprise the implementation phase of focus group research.

9.4.1 Quality guidelines on moderation of focus groups

M1: Moderation experience and skill are key requisites for the effective moderation of focus groups.

M2: The moderator ought to be part of the project from the outset, for purposes of consistency and quality assurance.

M3: Care must be exercised when freelance moderators or other agents are involved in order not to deter consistency and other aspects of the moderation process.

M4: It is advisable to train and develop in-house moderators as competent moderators are scarce and thus difficult to hire as and when required.

9.4.2 Quality guidelines on recording of focus group discussions

RE1 : It should be observed that the recording of focus group discussions is, for quality reasons largely the responsibility of the research supplier.

RE2: Back-up recording is essential in avoiding untimely disruptions during the recording of focus group discussions.

RE3: Constructive engagement of client observers adds value to group discussions and the quality outcomes thereof.

RE4: Advanced recording equipment might be an affordability challenge for some in focus group research, but may greatly enhance the quality of recording of focus group discussions.

9.4.3 Quality guidelines on data analysis in focus group research

D1: Inadequate timeframes for data analysis ought to be avoided because they contribute to a rushed and poor execution of the data analysis process, which often results in the research quality being the major trade-off.

D2: Scientific rigour on data analysis ought to take precedence over creativity, for research quality reasons.

D3: Involve data analysts (in-house or outsourced) in the moderation and recording stages of focus group research, in order to be familiar with the key issues covered, and to control the quality of the data transcripts produced.

D4: There is a need to promote development of expertise for data analysis and to assess the quality of focus group research from a knowledgeable point of view.

The following section relates to the final phase of reporting on focus group findings.

9.4.4 Quality guidelines on reporting of focus group findings

RP1: The use of PowerPoint presentation of focus group findings is preferred, and deemed the most effective as a reporting tool.

RP2: Client interference with the reporting of focus group must be borne in mind as a possible threat to quality.

RP3: Research suppliers must therefore be on their guard as they sometimes get prescribed to with respect to what the research reports must reflect, which may compromise the quality and credibility of the research findings.

RP4: Research reports must be read, analysed and used for purposes of informing decision-making processes of business organisations, or to inform further research. The culture of paid-for research project reports sometimes going unread in the local focus group practice must be mitigated.

9.5 Universal research quality consideration

The universal quality considerations relate to steps 1 to 7 across the focus group process, and the guidelines provided relate to scientific application of the focus group method, budget size of the project and general challenges identified in the study.

9.5.1 Quality guidelines on the scientific application of the focus group method

SA1: Educate and impart empowering knowledge on the scientific principles of the focus group method to counter the inherent challenge of incorrect use of the method.

SA2: Focus group research entails a scientific process rather than a creative one as believed by some in the industry, and must therefore be applied and practised as such.

9.5.2 Quality guideline on the budget size of focus group projects

B1: The correct size of the budget facilitates the efficient execution of the project. Inadequate budget sizes for projects may mitigate instances of taking shortcuts and omitting certain procedures, as well as overlooking some quality controls in order to complete the project within the limited budget available. The following guidelines relate to mitigation of general challenges in focus group research:

9.5.3 Quality guidelines on mitigation of general challenges in focus group research

G1: Ensuring quality in focus group research is a shared responsibility of all the participants within the focus group process. Hence, scientific focus group research practice ought to be the rule, rather than the exception, for quality reasons.

The following components of Figure 2 are also important as guidelines for the successful execution of focus group research projects.

• Scientific quality assessment of research findings: Rigorous adherence to methodological and other quality control measures ought to be exercised in order to attain optimum quality information of focus group research.

• Quality control and evaluation: Quality control and evaluation per step of the focus group ought to be enforced in order to ensure credibility and thus validation of the focus group study and its findings.

• Marketing decision-making, business outcomes and feedback: The ultimate role of marketing research, including focus groups, is to inform the decision-making processes of organisations. This way, the desired business outcomes of organisations can be attained. Accordingly, focus group research may fulfil this role either tentatively or by providing a platform for further, conclusive research. Similarly, feedback on the evaluation of business outcomes ought to be provided to the major stakeholders on the focus group project for appropriate redress or action.

10 CONCLUSION AND RECOMMENDATIONS

The seven-step process can be confirmed as a systematic framework that is scientifically relevant and necessary for guiding the process of conducting focus group research practice based on the following reasons. Firstly, research activities involved in conducting focus groups described in the literature reviewed, and perspectives of respondents based on the qualitative study were adequately covered within the spectrum of the seven-step framework. No evidence of activity overlaps or underfeed of research activity information within the framework of the seven steps was apparent.

Essentially, the seven steps of the guiding framework adequately covered all the aspects of focus group research activity from planning to reporting of findings. Secondly, evidence on the need for the framework, and the importance of each of the seven steps based on the literature reviewed were corroborated through the qualitative study. Finally, the confirmed importance and scientific relevance of the focus group framework augurs well for all industry stakeholders, because the stipulated guidelines offer enhancement of quality control that can be enforced per step and across the focus group process.

In the light of the many quality impediments and transgressions relating to the local industry practice of focus group research, compulsory registration and accreditation of all research suppliers ought to be enforced by industry authorities and penalties imposed for non-compliance. However, it is recommended that a further study be conducted in order to provide conclusive results on the scientific viability and validity of the seven step framework as an important guide for focus group research practice in marketing research in South Africa and beyond.

REFERENCES

AAKER DA, KUMAR V & DAY G. 2007. Marketing research. 9th edition. Hoboken, New Jersey: Wiley. [ Links ]

BURNS A & BUSH R. 2006. Marketing research. 5th edition. Hoboken, New Jersey: Prentice Hall. [ Links ]

COURTOIS MP & TURTLE EC. 2008. Using faculty focus groups to launch a scholarly communication programme. OCLC Systems and Services: International Digital Library Perspectives 25(3):160-166. [ Links ]

DEROSIA ED & CHRISTENSEN GL. 2009. Blind insights: a new technique for testing a priori hypotheses with qualitative methods. Qualitative Market Research: An International Journal 12(1):15-35. [ Links ]

DOYLE AC. 2008. On evidence. Medical Education, (42):232-233. [ Links ]

EMERALDINSIGHT. 2010. How to conduct focus groups: how to facilitate a focus group-Part 1-3. [Internet: http://search/guides/methods/focus.htm; downloaded on 23/09/2010. [ Links ]]

FAMILI A. 2005. Editorial. Intelligent Data Analysis, An International Journal 9(5):417-418. [ Links ]

GREEN J & GREEN M. 2005. Your qualitative recruiting: fact, fantasy or fiction:1-9. [Internet: http://papers-select.php?id=19; downloaded on: 19/07/2007. [ Links ]]

HEISKANEN E. 2005. The performative nature of consumer research: consumers' environmental awareness as an example. Journal of Consumer Policy 28(2):179-201. [ Links ]

KENT R. 2007. Marketing research: approaches, methods and applications in Europe. London: Thomson. [ Links ]

KEEGAN S. 2009. Practitioner perspective: "emergent inquiry"; a practitioner's reflections on the development of qualitative research. Qualitative Market Research: An International Journal 12 (2):234-248. [ Links ]

LILLRANK P. 2009. New research: the quality of information. International Journal of Quality and Reliability Management 20(6):691-703. [ Links ]

MALHOTRA NK. 2007. Marketing research: an applied orientation. 5th edition. Upper Saddle River, New Jersey: Prentice Hall. [ Links ]

MALHOTRA NK. 2010. Marketing research: an applied orientation. 6th edition. Upper Saddle River, New Jersey. Prentice Hall. [ Links ]

MAREE D & WAGNER C. 2007. Teaching research methodology: implications for psychology on the road ahead. South African Journal of Psychology 37(1):121-134. [ Links ]

MARTIN S. (ed). 2006. Creativity through consumer research:2-4. [Internet: http://196/19/11542.html; downloaded on:19/07/07. [ Links ]]

MCDANIEL C & GATES R. 2006. Marketing research essentials. 5th edition. Hoboken, New Jersey: Wiley. [ Links ]

NOOKABADI AS & MIDDLE JE. 2001. A knowledge-based system as a design aid for quality assurance information systems. International Journal of Quality and Reliability Management 18(6):657-670. [ Links ]

RATCLIFF D. 2008. Qualitative data analysis and the transforming moment. Transformation 25; Paternoster periodicals 2 & 3: 116-133. [ Links ]

ROE B. 2004. Research design and conduct-good practice and reporting. Journal of Advanced Nursing 47(5):461-462. [ Links ]

SAMRA. 2009. Corporate members: SAMRA Yearbook. 18th edition. Randburg: Southern African Marketing Research Association. [ Links ]

SAMRA. 2010. SAMRA Yearbook. 19th edition. Randburg: Southern African Marketing Research Association. [ Links ]

SEGAL MN, HERSHBERGER EK & OSMONBEKOV T. 2009. Rethinking assessment of marketing research skills and knowledge: a new approach. Qualitative Market Research: An International Journal 12(1):70-82. [ Links ]

SIMON CM & MOSAVEL M. 2008. Ethical design and conduct of focus groups in bioethics research. Empirical methods for bioethics: A primer advances in bioethics. Emerald Group 11: 63-81. [ Links ]

STAVROS C & WESTBERG K. 2009. Using triangulation and multiple case studies to advance relationship marketing theory. Qualitative Market Research: An International Journal 12(3):307-320. [ Links ]

SYMONDS JF & GORARD S. 2010. Death of mixed methods? Or the rebirth of research as a craft. Evaluation and Research in Education 23(2):121-136. [ Links ]

VICSEK L. 2007. A scheme for analysing the results of focus groups. International Journal of Qualitative Methods 6(4):20-34. [ Links ]

VICTOR N. 2009. Overview of the South African marketing research industry. [Interview: 11 June 2009 @10 am, with the then chairperson of the Marketing Research Association in South Africa. [ Links ]]

WALDEN GR. 2006. CBQ essay review: Recent books on focus group interviewing and mass communication. CBQ 37(2):76-93. [ Links ]

WHEELDON J. 2010. Mapping mixed methods research: methods, measures and meaning. Journal of Mixed Methods Research 4(2):87-102. [ Links ]

WELMAN C, KRUGER F & MITCHELL B. 2005. Research methodology. 3rd edition. Cape Town: Oxford University Press Southern Africa. [ Links ]

ZIKMUND WG & BABIN BJ. 2010. Essentials of marketing research. 4th edition. Baton Rouge, Louisiana: South-Western. [ Links ]