Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.10 no.1 Meyerton 2013

RESEARCH ARTICLES

The importance of the human capital attributes when accessing financial resources

M Matshekga; B Urban

University of the Witwatersrand

ABSTRACT

During the early stages of business development, access to finance is critically dependent upon the owner. Human capital attributes - including education, experience, and knowledge - have long been argued to be an important resource for accessing finance and spurring growth in entrepreneurial firms. Recognising the importance of demand-side factors of human capital when accessing funding, this study assembles a diverse sample of entrepreneurs in the greater Johannesburg area to determine empirically the relative importance attributed to each human capital variable when accessing funding. Results based on hypotheses testing indicate statistically significant findings and distinct clusters of human capital variables that illustrate the importance of knowledge, education and expertise when accessing funding. The results assist practitioners in understanding how the synergistic effects of knowledge, education and experience are helpful for acquiring financial resources.

Key phrases: education, experience, finance, human capital, knowledge

1. INTRODUCTION

Inadequate financial resources are often cited as a primary reason why emerging businesses fail (Herrington, Kew & Kew 2010:7; Rand 2007:2). A critical success factor for an entrepreneurial firm is to obtain sufficient access to external sources of finance, particularly in its growth phase. However in many emerging economies small and medium enterprises (SMEs) are still faced with challenges in accessing finance (Smallbone & Welter 2001:251). Sub-optimal capital levels in new firms due to credit constraints have a negative impact on firm survival and may impact the economy negatively as well (Astebro & Benhardt 2005:64; Netswera & Ladzani 2009:227).

Literature suggests that economic development and access to external sources of funding depends largely on the development of financial markets, and the regulatory environment within which financial institutions operate (Van Vuuren, Groenewald & Gantsho 2009:327). Contrary to the traditional finance perspectives where the supply and demand for finance are assumed to be in equilibrium, and where all value-creating projects are assumed to find sufficient finance, SMEs are often confronted with financial constraints and are not able to raise sufficient outside finance necessary to conduct all their value-creating investment projects (Seghers, Manigart & Vanacker 2009:7).

According to Gilbert, McDougall and Audretsch (2006:930), finance is one of the necessary resources required for entrepreneurial ventures to start and subsequently develop. Typical issues related to accessing finance are often associated with the lack of appropriate collateral, excessive outstanding debt and lack of proven business skills of the entrepreneur, particularly in the early stages of the business (Cook & Nixson 2005:73).

A deficit in financial resources has been linked with human capital, which is a critical contributor to business success, and where evidence is accumulating that entrepreneurs with high levels of human capital have greater financial wealth and greater levels of start-up capital (Astebro & Benhardt 2005:64). Human capital attributes, which include education, experience, and knowledge, have long been argued to be a critical resource for growth and success in entrepreneurial firms (Unger et al. 2011:344; Urban, van Vuuren & Barreira 2008:60).

2. PURPOSE OF STUDY AND AIMS

The problem of this study is drawn from the series of Global Entrepreneurship Monitor (GEM) reports, which highlight the lack of access to funding as a major hindrance to SME growth in South Africa (Herrington et al. 2010:7). The difficulty of accessing finance represents a major constraint to the creation of new SMEs in South Africa, where very few new SMEs are able to access bank loans. Furthermore, as many as two-thirds of applications for bank credit, submitted by new SMEs in South Africa, are rejected (SEDA 2007:32).

Scholars studying financial constraints within entrepreneurial ventures have largely stressed supply-side arguments, thereby putting the decision making process of investors in the foreground (Seghers et al. 2009:7). Within this perspective, prior research mainly focused on the role of information asymmetries and transaction costs in explaining why investors may refrain from investing in value-creating entrepreneurial ventures. However, as Seghers et al. (2009:7) argue financial constraints may also be driven by demand-side factors and more specifically by the levels of human capital of entrepreneurs.

Entrepreneurs are the driving force of important decisions and entrepreneurial human capital consequently plays an important role in explaining finance decisions (Cassar 2004:263; Fatoki & Odeyemi 2010:2765). Recognising the importance of demand-side factors as well as human capital factors to access funding for SMEs, the research focus of this study is to determine the perceived importance of the human capital variables of knowledge, education, and work experience when accessing funding.

Building on existing theory and empirical studies the overall research question of this study is to what extent are human capital variables of entrepreneurs perceived to be important in accessing external funding to ensure business growth? To address the research question a diverse sample of entrepreneurs in the greater Johannesburg area is assembled to determine empirically which human capital variables are significant when accessing SME funding. Consequently the relative importance attributed to each of the human capital variables is measured and distinct clusters are identified which illustrate the role of knowledge, formal education and expertise when accessing funding.

3. LITERATURE REVIEW

3.1 Access to finance and SME growth

Empirical evidence suggests that it is through improving financing access for enterprises that financial sector development makes an important contribution to economic growth (Schusseler 2009:3). Access to and use of finance, and the institutional underpinnings that are associated with better financial access, favourably affect firm performance along a number of different channels. If entry, growth, innovation, equilibrium size and risk reduction are all helped by access to and use of finance, it is almost inescapable that aggregate economic performance will also be improved by having stronger financial systems (Levie & Gimmon 2008:235).

Access to financial reserves has been identified as a critical factor in determining the success or failure of SMEs both in developing and developed countries. Adequate access to finance represents an important element of the ability of SMEs to invest in productive assets and the latest technology that is necessary for business expansion and to enhance competitiveness (Monks, 2010:24; Niewenhuizen & Kroon 2002:22). Access to finance in general and credit in particular are especially important for SMEs, since they are unable to finance themselves through retained earnings or equity financing (Seghers et al. 2009:7).

Entrepreneurs have to make key decisions, which have implications on their business operations, affect their risk of success or failure, and influence how the business performs and its potential for future growth (Gilbert et al. 2006:930). Moreover, the relationship between finance and growth are complex, where it has been argued that growth depends on the level of education and experience of the small business manager as well as the dynamism of the environment in which the business operates (Urban et al. 2008:60). Recognising the importance of access to finance and SME growth, in the first hypothesis it is proposed that:

Hypothesis 1 : Access to funding is perceived to be important for SME growth.

3.2 Human capital and SME funding

Scholars studying finance constraints within entrepreneurial ventures have largely stressed supply-side arguments, thereby putting the decision-making process of investors in the foreground. Within this perspective, prior research mainly focused on the role of information asymmetries and transaction costs in explaining why investors may refrain from investing in value-creating entrepreneurial ventures (Seghers et al. 2009:7). However, financial constraints may also be driven by demand-side factors, and more specifically by the characteristics of entrepreneurs.

The theory of human capital is rooted in the field of macroeconomic development theory, where Becker (1964:14) emphasised the social and economic importance of human capital theory and noted that the most valuable of all capitals is the investment in human beings. Becker (1964:14) distinguishes firm-specific human capital from general-purpose human capital, which includes expertise obtained through education and training in management information systems, accounting procedures, or other expertise specific to a particular firm. General-purpose human capital is knowledge gained through education and training in areas of value to a variety of firms such as generic skills in human resource development (Becker 1964:14; Baum & Silverman 2004:418).

3.3 Knowledge and SME funding

Unger et al. (2009:344) define human capital as skills and knowledge that individuals acquire through investments in schooling, on-the-job training, and other types of experience. Human capital is measured in terms of knowledge, skills, and behaviour that prove valuable to a particular firm. Hsu (2007:725) suggests that human capital has a direct effect on the ability of the entrepreneur to secure financial capital for the new business venture, and further conceives entrepreneurial ability as a form of human capital, which like other forms of human capital can be increased through education, training, and experience.

According to human capital theory, the ability to accumulate new knowledge provides individuals with superior cognitive abilities, which makes them more productive and efficient in a range of activities (Becker 1964:14). The ability to accumulate new knowledge is positively related to the existing stock of knowledge (Cohen & Levinthal 1990:131; Pienaar & Du Toit 2009:124), including both knowledge formally acquired through education and knowledge tacitly acquired while accumulating experience in a particular domain (Dimov & Shepherd 2005:5). The entrepreneur's capacity to gain new knowledge and abilities during the start-up process is seen as critical for new venture success and this knowledge is essential to control and apply to resources which may lead to superior performance (Urban 2011:14). Consequently, by building in the research direction of human capital theory it is proposed, in the first instance of human capital that:

Hypothesis 2a: The knowledge dimension of human capital is perceived as important for accessing SME funding.

3.4 Education and SME funding

The importance of education as a form of general human capital has been demonstrated in several studies, where for instance it is reported that higher educational levels indicate an increased likelihood to participate in a business start-up and demonstrate a significant impact on the performance of the new venture (Gimmon & Levie 2010:1219). Past research has also found a positive relationship between higher educational qualifications and business growth. Additionally, education helps to enhance the entrepreneur's exploratory skills and improves communication abilities and foresight (Dobbs & Hamilton 2007:300; Kozan, Oksoy & Ozsoy 2006:119).

Previous research has explored how managerial education affects access to credit, where, for instance Kumar and Francisco (2005:21) report a strong educational effect in explaining access to financial services in Brazil. Similar research suggests that entrepreneurs with undergraduate degrees are more likely to be less financially constrained than those with only a high school educational background (Unger et al. 2011:349). Based on these empirical studies and theoretical underpinnings, in the second instance in terms of human capital, it is proposed that:

Hypothesis 2b: The human capital dimension of education is perceived as important for accessing SME funding.

3.5 Work experience and SME funding

Previous research has also found positive relationships between management experience and business growth (Dahlquist, Davidsson & Wiklund 1999:9). Rauch, Frese and Utsch (2005:684) have argued that there are two ways in which a founder's previous experience impacts firm performance: First, it leads to the development of experientially acquired skills or expertise, which will lead in turn to more knowledgeable actions and decisions. Second, as founders are inclined to start businesses which are similar (e.g. in terms of industry, geographic area) to ventures with which they are familiar, experience influences start-up characteristics. Dobbs and Hamilton (2007:300) emphasised the positive effect of experience on small business growth by proposing that owner-managers with experience are more likely to avoid costly mistakes than those with no experience.

Moreover, entrepreneurs with work experience in accountancy or finance are more likely to have a broader and deeper knowledge of finance alternatives compared to entrepreneurs without experience in these areas (Seghers et al. 2009:7). Additionally, business ownership experience has been associated with assets like extended networks, increased expertise, and a solid reputation with financiers, customers and suppliers (Cassar 2004:263). Acknowledging the past research highlighting the importance of experience to accessing funding, it is proposed, in the third instance of human capital that:

Hypothesis 2c: The human capital dimension of work experience is perceived as important for accessing SME funding.

3.6 Perceived importances of human capital

It further emerges that the heterogeneity of the population is a fundamental factor in theories of entrepreneurship (Shane & Venkataraman 2000:221). Differences in interpretations of the same situations or insights are not necessarily due to differences in the perceived quality of the information that individuals receive, but to the different meanings that a given piece of information may induce. Perception and interpretation of the particular domain are in turn guided by the mental representations or cognitive maps that individuals develop.

Studies have shown that labour market experience, management experience, and previous entrepreneurial experience are significantly related to entrepreneurial activity, particularly when controlling for factors such as industry and gender (Urban 2011:34). Moreover, Smallbone and Wyer (2000:415) demonstrate that the entrepreneurs who possess the synergistic combination of education with industry managerial experience have the competencies and capabilities to access funding and manifest better results. Consequently, recognising that individual differences and combinations of different levels of human capital dimensions may influence access to funding it is proposed that:

Hypothesis 3: The three human capital dimensions of knowledge, education and experience are perceived differently in terms of importance for accessing SME funding.

Lastly, by acknowledging the unique nature of individuals in unique circumstances undertaking unique activities to start unique businesses, it is recognized that since individuals are heterogeneous in their assessment of entrepreneurial opportunities they may therefore be clustered on the basis of their demographics. This approach is in line with the archetype perspective, which suggests that a wide variety of factors or characteristics tend to cluster together, as gestalts. A gestalt would be a form or constellation of specific attributes that would characterize a different type of phenomenon (Gartner 2008:359). Consequently, the final hypothesis predicts that:

Hypothesis 4: The human capital dimensions of knowledge, education and experience are perceived differently in terms of importance for accessing SME funding based on demographic differences.

4. RESEARCH METHODOLOGY

The research study relies on a quantitative cross-sectional empirical approach, which is based on primary data sources. The study was concerned with measuring the perceptions of SME's founders and owners in terms of the main constructs and hypotheses under investigation.

4.1 Sample and data collection

Considering that SMEs in South Africa can employ up to 200 people (Van Aardt et al. 2008:32), and in line with the global entrepreneurship monitor (GEM) studies' operational definitions (Xavier et al. 2012:12), small and medium-sized ventures were targeted. These SMEs were represented by owner-managers who currently own and manage their business that have paid salaries for more than three months but not more than 42 months. The population for this study was based on a sampling frame of SME databases, which included Shanduka Black Umbrellas incubators (Shanduka Black Umbrellas 2011 :Internet), and Royal Fields Finance (an SME funding company) (Royal Fields Finance 2011 :Internet). A list of 740 SMEs was obtained from these two mentioned organisations in terms of email addresses, which were currently active on their system. Sample parameters, which served as control variables, included: (a) gender, (b) age, (c) education level, (d) ethnic group, (e) work experience, (f) business sector, and (g) firm employment size class.

Data was collected through a self-administered questionnaire, which was conducted online. The SMEs surveyed operated in a variety of business sectors including manufacturing, financial services, and retail and wholesale. After an initial wave of sending out surveys, altogether 129 questionnaires were returned. A number of respondents indicated that not all items were applicable to their situation and subsequently these responses were assigned as missing data, rendering a final sample of 83 complete responses (11.2 % response rate). To test for non-response bias (Cooper & Schindler 2011:34), SME size, age and sales growth were compared with non-responding firms by using secondary data obtained from the same sampling frame listings as mentioned above. Results of t-tests comparing these SMEs with the current study sample's mean scores on the variables revealed no differences (p > 0.10), suggesting that the sample appears to be representative of the population from which it is based (Cooper & Schindler 2011:34).

4.2 The research instrument

The questionnaire was divided into three different sections to address the hypotheses formulated in the study. The scales used the 7-point Likert scale, where one indicates the item is considered 'not at all important' to seven indicating item is 'extremely important'.

Section A was concerned with the demographics of the respondents and included measures on the sample parameters mentioned in the previous section. Section B addressed the human capital dimensions of knowledge, education and experience. All measures were informed by the theory on human capital discussed extensively in the literature review. Each construct had several items, which were used to measure the perceived importance in relation to access to funding. Knowledge was measured with eight items (Urban et al. 2008:60), education with four items (Kozan et al. 2006:119) and experience with six items (Seghers et al. 2009:7). Section C was concerned with SME growth and five items were used to designate levels of SME growth.

Entrepreneurship researchers have pointed to multidimensional nature of growth as the crucial indicator of entrepreneurial success (Davidsson & Wiklund 2000:28) and consequently, sales performance, return on assets (ROA), employment growth, return on investment (ROI), and operating profit were used to measure growth. The respondents were asked to consider firm performance in terms of these indicators over a period of five years.

Reversals were done on certain questions in order to test for the respondents' tendency to answer positively to all items, irrespective of their content. In order to ensure the overall instrument had face and content validity, a preliminary analysis, via a pilot test, was undertaken. This procedure ensured that the respondents had no difficulties in answering the questions and there was no problem in recording the data. Common method response bias was controlled for by safeguarding respondent anonymity, as well as ensuring that the questions relating to the dependent variables were located away from the independent and control variables in the instrument. Furthermore, the reliability of the scales was tested and item statistics were calculated for this sample of respondents.

4.3 Data analysis

Data analysis was conducted, where descriptive and inferential statistics were calculated using the STATISTICA software system, version 10 (StatSoft 2011).

Descriptive statistics included calculating measures of central tendency (the mean and median values, variability), the standard deviation, range, and distribution shape (skewness and frequency distributions), and internal consistency reliability of the scales, by reporting on their Cronbach Alpha values. To test the hypotheses ANOVA and t-tests were primarily used to compare the mean scores of the different human capital dimensions in terms of access to finance.

5. RESULTS AND ANALYSIS

5.1 Demographic profile of sample

Sampling characteristics indicate that almost two-thirds (70%) of the respondents were male, black (97%) and with more than half of the respondents (54%) occupying the 36 to 45 year age group. In terms of education, more than half (53%) of the respondents hold a bachelor's degree and 37% have either a certificate or a diploma. These relatively high levels of education are in line with human capital theory where higher education levels demonstrate a significant impact on the ability to accumulate new knowledge and improve the performance of the new venture (Baum & Silverman 2004:418).

In terms of experience, 32% of the respondents reported having one to three years' work experience, while 27% reported four to six years, with 25% reporting more than six years work experience. These demographics are relevant to this study as entrepreneurs with work experience are more likely to have a broader and deeper knowledge of alternatives and are more likely to avoid costly mistakes than those with no experience (Dobbs & Hamilton 2007:300).

In terms of SME size and age, approximately half (54%) of respondents employ in excess of 50 employees, while for firm age, the majority of firms (68%) had been in existence for more than 10 years. Approximately three-quarters (73.5%) of businesses had a turnover of more than R1 million per annum.

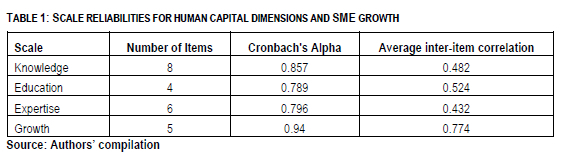

5.2 Scale reliabilities

The internal consistency reliabilities were evaluated using Cronbach's alpha coefficient and the average inter-item correlations were calculated for each scale measuring human capital items as well as the growth variables. The results in Table 1 indicate satisfactory scale reliabilities on both criteria since the Cronbach alpha values all exceed 0.7 and the average inter-item correlations all exceed 0.3 (Cooper & Schindler 2011:34).

5.3 Hypotheses testing

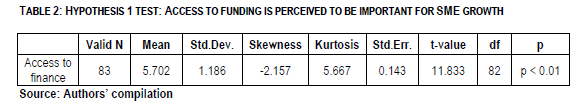

To test hypothesis 1, where it was predicted that access to funding is perceived to be important for SME growth, a directional single group t-test comparing the mean against the midpoint scale was used. The results in Table 2 indicate that the mean response is statistically positive with a value of t (82) = 11.833; p < 0.01. This significant result provides support for Hypothesis 1. This finding is not surprising considering that research (Cook & Nixson 2005:73) has confirmed the positive effects of venture capital funding on firm growth.

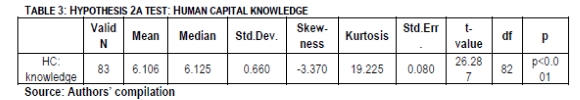

To test hypothesis 2a, where the knowledge dimension of human capital was predicted to be an important factor for accessing SME funding, a directional single group t-test comparing the mean against the midpoint scale was again employed.

The results in Table 3 indicate that the mean response is statistically positive where t (82) = 26.287; p < 0.001. This significant result provides support for Hypothesis 2a.

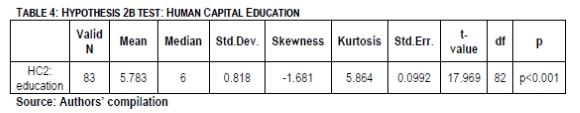

Similarly for hypothesis 2b, where education as a dimension of human capital was predicted to be an important factor for accessing SME funding, a directional single group t-test rendered statistically significant results, see Table 4, where t (82) =17.969; p < 0.001. This significant result provides support for Hypothesis 2b.

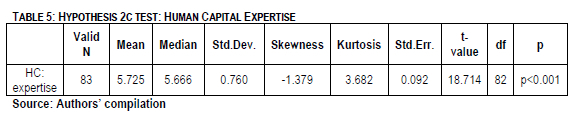

Hypothesis 2c was tested in the same manner where the results in Table 5 indicate that the mean response is statistically positive: t (82) = 18.714; p < 0.001. These significant results provide support for Hypothesis 2c insofar as expertise as a dimension of human capital is perceived as important for accessing SME funding.

Overall these positive and statistically significant results for all three human capital dimension in terms of access to SME funding are in line with existing research (Sheperd, Ettenson & Crouch 2000:452) where evidence points to the fact that education, general management competencies and industry-specific experience are important factors when accessing funding. Fatoki and Odeyemi (2010:2765) recognise that SMEs owned by individuals with higher education and related business experience are more likely to be successful in their application for trade credit.

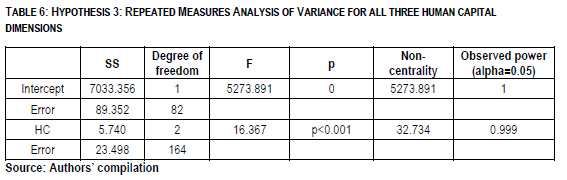

Hypothesis 3 focused on perceptual differences in rating the importance of the three human capital dimensions of knowledge, education and experience when accessing SME funding. The results of the three directional single group t-tests comparing the respective means against the midpoint scale indicate that the means were statistically positive at t (82) = 26.287; p < 0.001 for the knowledge dimension, t (82) = 17.969; p < 0.001 for the education dimension, and (82) = 18.714; p < 0.001 for expertise dimension of human capital.

Additionally a repeated analysis of variance (ANOVA) test for the related groups was computed to compare the mean perceptions of the respondents on the scales of knowledge, education and expertise. The results of ANOVA are presented in Table 6 and show a significant result where F (2,134) = 16.372, p < 0.001, providing support for Hypothesis 3. This was followed by the post-hoc Scheffe test to identify which pairs of differences were significantly different, and results indicate that all three human capital dimensions, knowledge, education and expertise, were significantly different at the p < 0.001 level. Furthermore, the results were validated using the results of the nonparametric equivalent Wilcoxon test in view of the severe skewness in the score distributions (not shown).

These test results were similar to the post-hoc test findings where knowledge is significantly higher (p < 0.001) than formal education and expertise, but where education and expertise are still regarded as important factors for accessing SME finance. These findings can be interpreted in conjunction with research, such as by Fatoki and Odeyemi (2010:2765) who finds that education plays a key role in human capital theory because it is viewed as the primary means of developing knowledge and skills.

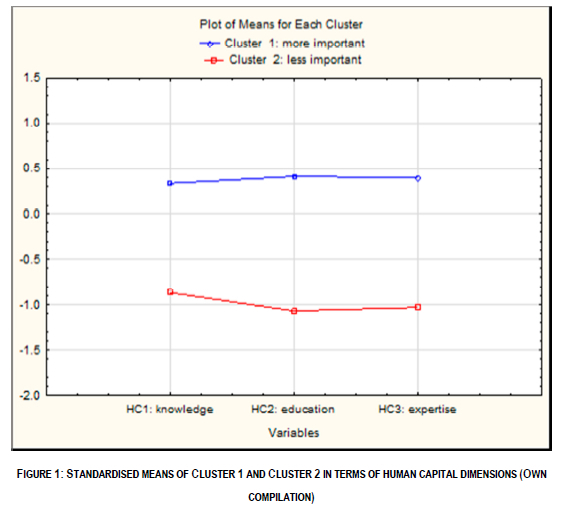

Hypothesis 4 anticipated that the human capital dimensions of knowledge, education and experience are perceived important for accessing SME funding in terms of different demographic variables of the sample. Based on the multiplicity of variables, a k-means cluster analysis was used to generate groups of respondents according to the similarity of their perceptions on the importance of each of the human capital dimensions for accessing SME finance. All the score distributions were standardised so as not to bias the derivation of the clusters to one rather than another of the three human capital distributions.

Figure 1 reveals the standardised means of the clusters where 'Cluster 1', which comprised 72% of the respondents, perceived all three human capital dimensions, knowledge, education and expertise, to be relatively more important for accessing SME funding than respondents in 'Cluster 2'.

Pearson Chi-square tests for the different demographics were calculated to test for independence and to discover whether there is a relationship between two clusters. On the gender variable, a non-significant Chi-square of (1) = 0.766, p = 0.381, was obtained; on age a non-significant Chi-square of (1) = 0.027, p = 0.867; for SME age another non-significant Chi-square (1) = 0.775, p = 0.378; and SME turnover rendered a non-significant Chi-square (1) = 0.006, p = 0.936. These results mean that Hypothesis 4 cannot be accepted as demographic variables result in non-significant differences in terms of human capital dimensions when accessing funding.

These results are somewhat surprising considering the obstacles that women entrepreneurs typically face when accessing funding, due to lack of collateral and ownership (Herrington et al. 2010:7), but considering this sample of entrepreneurs where levels of education, knowledge and experience are relatively high it is plausible that gender differences are negligible in this case. Additionally, the results are similar to findings reported by Fatoki and Odeyemi (2010:2765) where access to SME funding is not dependent on the demographics of the founders.

6. CONCLUSION AND IMPLICATIONS

Adequate access to finance represents an important element of the ability of SMEs to invest in productive assets and the latest technology that is necessary for business expansion and to enhance competitiveness (Monks 2010:24). The purpose of this study was, by building on existing theory, to empirical examine the perceived importance of several human capital variables when accessing SME funding. The survey results based on a diverse sample of SME owners in the greater Johannesburg area indicates that the human capital variables of education, knowledge and expertise are significant when accessing SME funding.

The relative importance attributed to each of the human capital variables were found to be statistically significant and distinct clusters were identified that illustrate the importance of knowledge, education and expertise when accessing funding. These findings are in line with prior research that demonstrates how human capital and finance strategies are linked (Urban 2011:34). Moreover, the human capital elements of entrepreneurs serve as a quality signal, which is valuable in an environment with high levels of information asymmetry when access to funding is sought. Such findings explain why ventures established by entrepreneurs with higher levels of human capital generally have less binding capital constraints (Astebro & Bernhardt 2005:64).

An important contribution of this study was the simultaneous examination of three human capital dimensions as they relate to access to SME funding. Studies have demonstrated the importance of human capital in entrepreneurial ventures, where entrepreneurs who possess a synergistic combination of education with industry managerial experience have the competencies and capabilities to manifest better results (Urban 2011:34). The ability to accumulate new knowledge is positively related to the existing stock of knowledge including both knowledge formally acquired through education and knowledge tacitly acquired while accumulating experience in a particular domain (Dimov & Shepherd 2005:5). Several authors have argued that resources and assets (both tangible and intangible) are accumulated throughout entrepreneurial careers and are important towards building a human capital base. Human capital represents an investment in education and skills and entrepreneurs provide tangible and intangible resources to a firm. These intangible resources are the property of individuals that have accumulated through education and experience (Gimmon & Levie 2010:1219).

There are important practitioner, policy and research implications related to the topic under investigation. Practitioners need to be aware of how previous experience impacts firm performance: First, it leads to the development of experientially acquired skills or expertise, which in turn will lead to more knowledgeable actions and decisions. Second, as founders are inclined to start businesses which are similar (e.g. in terms of industry, geographic area) to organizations with which they are familiar, experience influences the start-up characteristics (Unger at al. 2011:349).

The study results may further guide practitioners in understanding:

• How elevated levels of human capital are associated with entrepreneurial alertness preparing SME owners to discover specific opportunities that are not visible to other people.

• Human capital is positively related to planning and venture strategy, which in turn, positively impacts SME growth and success.

• Knowledge is helpful for acquiring other utilitarian resources such as financial and physical capital and can partially compensate for a lack of financial capital (Urban 2011:34).

It is evident from the literature that governments and firms are recognizing the transient nature of technology-based competitiveness, and are placing greater emphasis in creating sustainable advantage through the strategic management of human capital (Smallbone & Welter 2001:251). Policy makers must recognise that human capital is an invaluable asset in knowledge-driven economies where the different combinations of human capital are the engines of innovation and entrepreneurship.

The study is not without limitations of similar primary studies. For instance, there was an absence of analysis of firm survivor bias. This is, in principle, an important methodological issue because firm survival itself may be determined by human capital (Unger et al. 2011:349). Consequently, the results of the study cannot be generalized to survival and failure of business ventures. Future studies could build on the different configurations of human capital to assess how these clusters relate to firm survival rates. Researchers could also investigate how the human capital dimensions are complemented by social capital; particularly as social capital (Urban & Shaw 2010:498) is one of the most significant sources of knowledge for entrepreneurs. Finally, future studies could be extended to include specific contextual factors to help explain the venture formation process, and also identify variables, which may moderate levels of human capital and access to funding.

REFERENCES

ASTEBRO T & BERNHARDT I. 2005. The winner's curse of human capital. Small Business Economics 24:63-78. [ Links ]

BAUM J & SILVERMAN B. 2004. Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing 19:411-436. [ Links ]

BECKER GS. 1964. Human capital: a theoretical and empirical analysis, with special reference to education. Chicago, IL.: University of Chicago Press. [ Links ]

CASSAR G. 2004. The financing of business start-ups. Journal of Business Venturing 19:261-283. [ Links ]

COHEN WM & LEVINTHAL DA. 1990. Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly35:128-152. [ Links ]

COOK P & NIXSON F. 2005. Finance and small and medium-sized enterprise development. In: GREEN CJ, KIRKPATRICK CH & MURINDE V. (eds). Finance and development: surveys of theory, evidence and policy. Cheltenham: Edward Elgar. [ Links ]

COOPER DR & SCHINDLER PS. 2011. Business research methods. 11th ed. New York: McGraw-Hill/Irwin. [ Links ]

DAHLQUIST JP, DAVIDSSON P & WIKLUND J. 1999. Initial conditions as predictors of new venture performance: a replication and extension of the Cooper et al. study. 44th World Conference of the International Council for Small Business, Naples, 20-23 June. [ Links ]

DAVIDSSON P & WIKLUND J. 2000. Conceptual and empirical challenges in the study of firm growth. In: D SEXTON & H LANDSTRÖM (eds). The Blackwell handbook of entrepreneurship (pp. 26-44). Oxford: Blackwell Business. [ Links ]

DIMOV DP & SHEPHERD DA. 2005. Human capital theory and venture capital firms: exploring 'home runs' and 'strike outs', Journal of Business Venturing 20:1-21. [ Links ]

DOBBS M & HAMILTON RT. 2007 Small business growth: recent evidence and new directions. International Journal of Entrepreneurial Behaviour and Research 13(5):296-322 [ Links ]

FATOKI O & ODEYEMI A. 2010. The determinants of access to trade credit by new SMEs in South Africa. African Journal of Business Management 4(13):2763-2770. [ Links ]

GARTNER WB. 2008. Variations in entrepreneurship. Small Business Economics 31:351-361. [ Links ]

GILBERT BA, MCDOUGALL PP & AUDRETSCH DB. 2006. New venture growth: a review and extension, Journal of Management 32:926-950. [ Links ]

GIMMON E & LEVIE J. 2010. Founder's human capital, external investment, and the survival of new high-technology ventures. Journal of Research Policy 39:1214-1226. [ Links ]

HERRINGTON M, KEW J & KEW P. 2010. Tracking entrepreneurship in South Africa: a GEM perspective. Cape Town: Graduate School of Business, University of Cape Town. [ Links ]

HSU DH. 2007. Experienced entrepreneurial founders, organizational capital, and venture capital funding. Research Policy 36:723-741. [ Links ]

KOZAN MK, OKSOY D & OZSOY O. 2006. Growth plans in small businesses in Turkey: individual and environmental influences. Journal of Small Business 44(1):114-129. [ Links ]

KUMAR A & FRANCISCO M. 2005. Enterprise size, financing patterns and credit constraints in Brazil: analysis of data from the Investment Climate Assessment Survey. World Bank working paper No.49. New York: World Bank. [ Links ]

LEVIE J & GIMMON E. 2008. Mixed signals: Why investors may misjudge first time high technology founders. Venture Capital: A Journal of Entrepreneurial Finance 10(3):233-256. [ Links ]

MONKS PGS. 2010. Sustainable growth of SME's. Port Elizabeth: Nelson Mandela Metropolitan University. (Unpublished MBA Thesis. [ Links ])

NETSWERA FG & LADZANI W. 2009. Support for rural small businesses in Limpopo province, South Africa, Development Southern Africa 26(2):225-239. [ Links ]

NIEWENHUIZEN C & KROON J. 2002. Creating wealth by financing small and medium enterprises of owners who possess entrepreneurial skills. Business Dynamics 2(1):21-27. [ Links ]

PIENAAR JJ & DU TOIT ASA. 2009. Role of the learning organisation paradigm in improving intellectual capital. Journal of Contemporary Management 6:121-137 [ Links ]

RAND J. 2007. Credit constraints and determinants of the cost of capital in Vietnamese manufacturing. Small Business Economics 29:1-13. [ Links ]

RAUCH A, FRESE M & UTSCH A. 2005. Effects of human capital and long-term human resources development on employment growth of small-scale businesses: a causal analysis. Entrepreneurship Theory and Practice 29:681-698. [ Links ]

ROYAL FIELDS FINANCE. 2011. Home page. [Internet: www.royalfieldsfinance.co.za/memberlistings/; downloaded on 2011-01-22. [ Links ]]

SCHUSSELER M. 2009. Support programmes for SMMEs. Business Times July 10, p3. [ Links ]

SEDA. 2007. Review of trends on entrepreneurship and the contribution of small enterprises to the economy of South Africa, 2000-2006. Pretoria: Small Enterprise Development Agency. [ Links ]

SEGHERS A, MANIGART S & VANACKER T. 2009. The impact of human and social capital on entrepreneurs' knowledge of finance alternatives. Working papers of Faculty of Economics. Ghent: Gent University. [ Links ]

SHANDUKA BLACK UMBRELLAS. 2011. Home page. [Internet: www.shanduka blackumbrellas.co.za/; downloaded on 2011-01-22. [ Links ]]

SHANE S & VENKATARAMAN S. 2000. The promise of entrepreneurship as a field of research. Academy of Management Review 25(1):217-226. [ Links ]

SHEPERD DA, ETTENSON R & CROUCH A. 2000. New venture strategy and profitability: a venture capitalist's assessment. Journal of Business Venturing 15:449-467. [ Links ]

SMALLBONE D & WYER P. 2000. Growth and development in the small firm. In: CARTER S & JAMES-EVANS D. (eds.). Enterprise and small business: principles practice and policy. pp. 409-433. Harlow: Prentice Hall. [ Links ]

SMALLBONE D & WELTER F. 2001. The distinctiveness of entrepreneurship in transition economies. Small Business Economics 16(1):249-262. [ Links ]

STATSOFT. 2011. StatSoft Inc. Statistica, [Internet: www.statsoft.com; downloaded 2011-01-22. [ Links ]]

UNGER JM, RAUCH A, FRESE M & ROSENBUSCH N. 2011. Human capital and entrepreneurial success: ameta-analytical review. Journal of Business Venturing 26:341-358. [ Links ]

URBAN B. 2011. Perspectives in entrepreneurship: a research companion - advanced entrepreneurship higher education series. Book 2: The Entrepreneurial Mind-set. (editor) Cape Town: Pearson Education. [ Links ]

URBAN B & SHAW G. 2010. Social capital for business start-ups: perceptions of community support and motives. Journal of Contemporary Management 7:492-510. [ Links ]

URBAN B, VAN VUUREN J & BARREIRA J. 2008. High-growth entrepreneurs: the relevance of business knowledge and work experience on venture success. Journal of Contemporary Management 5:58-71. [ Links ]

VAN AARDT I, VAN AARDT C, BEZUIDENHOUT S & MUMBA M. 2008. Entrepreneurship and new venture management. 3rd edition. Cape Town: Oxford. [ Links ]

VAN VUUREN J, GROENEWALD D & GANTSHO MSV. 2009. Fostering innovation and corporate entrepreneurship in development fiancé institutions. Journal of Contemporary Management 6:325-360. [ Links ]