Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.9 no.1 Meyerton 2012

RESEARCH ARTICLES

Exploring the relevance of the financial management module at a South African university

C Rootman; J Krüger

Nelson Mandela Metropolitan University

ABSTRACT

Worldwide, tertiary institutions convey financial management information to students as future employees in financial departments. However, the question is whether the content of financial management modules at tertiary institutions is relevant in practice. This study focused on investigating the relevance of the content of the financial management module at a South African university by comparing it to national and international curricula as well as the perceptions of financial managers.

The results and recommendations can be used by tertiary institutions to adapt and update the content of their financial management modules. Relevant financial management modules may also increase the employability of students, and therefore it may be easier for businesses to find suitable and qualified employees with financial management knowledge.

Key phrases: capital budgeting, capita! structure, financial management, profit distribution, share capital and dividend policy issues, short-term financial planning

1 INTRODUCTION

According to McLaney (2009:4), business finance is a relatively new subject, and until the 1960s it consisted mostly of narrative accounts of financial decisions and how these decisions were reached. However, the importance of financial management in businesses is certain. Primary to the establishment of any business is the combination of the critical factors of entrepreneurship, capital, labour and natural resources, such as land and raw materials (Bosch, Tait & Venter 2011:11-13). The production factor capital leads to the financial management function. Financial management is regarded as one of the eight business functions necessary for businesses to operate (Bosch et al. 2011:28-29, 425). The fundamental understanding is that the financial function plays a critical role in maximising the value of a business as well as the wealth of the business owners (Brigham & Daves 2010:7-9; Els 2010:2; Gitman & Zutter 2012:10-13), which is the primary goal of businesses.

According to Ehrhardt and Brigham (2011:9-10), the most fundamental objective of businesses in the long-term is the maximisation of the wealth of their owners. Therefore, to ensure the maximisation of wealth the proper management of a business' finances is critical. The maximisation of the wealth of business owners predominantly takes place within the constraints imposed by considerations of liquidity and solvency (Els 2010:3-4; Lambrechts 1990:380), which means that financial constraints hinder wealth creation.

Despite these financial constraints, businesses remain important to the economy of any country. According to Tshabalala (2007:Internet), approximately 80% of South African businesses are categorised as SMEs and contribute 40% to the country's economic activity. When considering the unemployment rate in South Africa as per 4th Quarter 2011 at 23.9% (StatsOnline 2012:Internet), SMEs can help to alleviate this burden through job creation (Abor & Quartey 2010:223).

Businesses are essentially the cornerstones of the modern economy all over the world because they are the 'agents' for generating the wealth of nations. Businesses operate to provide products and services to consumers (Bosch et al. 2011:6) and as a result aim to maximise financial returns for business owners (Gitman & Zutter 2012:11). Thus, businesses realise profits and aim to maximise the wealth of their owners in the process. The maximisation of the wealth of business owners therefore becomes the fundamental objective of the financial management function (Els 2010:8; Gitman & Zutter 2012:11). The importance of business survival to both business owners and the South African economy is evident.

Following the above statements on financial management and businesses in general, it can be concluded that the survival of businesses often depends on their financial management systems, processes and the financial management skills of business owners/managers. According to Perks and Smith (2008:146), business owners/managers in South Africa often lack business skills, including financial skills, more than capital. It is also known that businesses often struggle with financial management. Firer, Ross, Westerfield and Jordan (2008:85) indicate that ineffective long-term financial planning is often a reason for financial distress and failure among businesses, regardless of size. Therefore it is important to establish the financial knowledge needed by business owners/managers.

Financial managers are responsible for acquiring and investing businesses' capital wisely. In other words, financial managers are accountable for the management of capital funds provided by business owners, who expect reasonable financial returns. It is important that businesses employ highly trained financial managers who are fully equipped to perform their financial duties and responsibilities with the highest level of diligence. In various businesses financial managers are working with large amounts of invested capital, annual turnovers and working capital (Lasher 2011:6-8). If a business seeks to realise higher operating profits, and consequently higher financial returns to business owners, it has to put in place a proper and coherent management of its financial affairs. Businesses therefore require the skills and expertise of highly trained and competent financial managers who will be able to properly execute well-defined financial policies and strategies (Clayman, Fridson & Troughton 2008:10; Ehrhardt & Brigham 2011:3).

The application of financial management concepts, tools and theories in businesses depends to a large extent on the manner with which this body of knowledge is treated in tertiary institutions and then practiced in the business environment. Tertiary institutions provide graduates to businesses to fill various job vacancies, including positions where the financial management of the business is the main concern and responsibility. These graduates, if they studied towards a business management qualification, gained a certain level of understanding of financial management in business with financial terms, conditions and activities taught to them. However, it is important to ensure that the financial management skills and information of these qualified students are sufficient to successfully contribute to proper financial management practices in business.

2 PROBLEM STATEMENT

The theory of financial management taught at tertiary institutions has to be relevant to the business environment because enterprises need skilled people at all levels within the enterprise. These skilled people include leaders who will have to develop and articulate sound strategic visions and managers who will be able to make value-adding decisions, design efficient business processes and raise the necessary funds for capital requirements. (Brigham & Daves 2010:8-9; Ehrhardt & Brigham 2011:3). It is therefore the fundamental task of tertiary institutions to provide comprehensive training and education to potential financial managers of the future. Thus, the relevance of financial management curricula is of utmost importance for its future applicability in businesses' financial management functions performed by graduates employed.

Therefore, the problem statement of this study can be formulated as the following question: "How relevant are the financial management curricula of tertiary institutions to financial managers in practice?" In other words, is there currently a need to adapt the content of financial management modules to fit the needs of the business environment in order for suitable, knowledgeable graduates to fill financial management positions in businesses to apply appropriate financial management principles?

The primary purpose of this study is to investigate the relevance of the financial management curriculum, as taught by a South African tertiary institution, in this case the Nelson Mandela Metropolitan University (NMMU), to financial managers in the dynamic and highly competitive business environment.

An assessment and evaluation of financial management modules at tertiary institutions should be done in order to establish modules' relevance to the application of financial management in the business environment. In examining this relevance, the study will consider the main areas of financial management as taught at the NMMU and determine whether there is a fit between the financial management theory conveyed and business practice. In order to evaluate the financial management module at a particular South African university, two approaches will be followed. Firstly, a comparative analysis will be conducted by identifying similarities and differences in the financial management modules offered at various national and international tertiary institutions; it will be important to consider the content of the financial management modules of other institutions to make sound comparisons with the curriculum of the NMMU. Secondly, the perceptions of financial managers who are currently applying the concepts, principles, tools and theories of financial management in businesses, as they perform their daily duties, will be gathered. The investigation of the perceptions of local financial managers will be a relevant approach to follow in order to obtain a clear indication of how the majority of financial managers perceive the NMMU financial management curriculum.

Findings will result in recommendations for the tertiary institutions on how to structure financial management modules, based on the comparative analysis among tertiary institutions and the perceptions of financial managers obtained during the empirical investigation. These recommendations will be made to the tertiary institutions to ensure that the financial management curricula meet or exceed high academic standards and the requirements of the business environment. In addition, recommendations will be made to financial managers regarding various financial management areas.

3 PURPOSE AND OBJECTIVES

The primary objective of this study is to investigate the relevance of the content of financial management modules offered at tertiary institutions to the requirements of financial managers in the business environment. In order to achieve this primary objective, a number of secondary objectives were pursued, namely:

• To provide a brief overview of financial management in general.

• To conduct a comparative study of the financial management models offered at national and international tertiary institutions.

• To empirically investigate the relevance of the content of the NMMU financial management module in the business environment.

• To report on the comparative study as well as the empirical investigation in order to make recommendations to the relevant stakeholders, that is tertiary institutions and financial managers of businesses.

4 LITERATURE OVERVIEW

Based on the objectives stated above, a literature overview was conducted concerning financial management decisions in businesses and the curricula of financial management modules currently offered by tertiary institutions nationally and internationally.

4.1 Financial management areas

In defining financial management, Megginson, Smart and Graham (2010:6) state that it is a set of activities that are involved in the management of cash flows in a business. Lasher (2011:6-8) and Ryan (2007:7) indicate that financial management is the management and control of funds and other money-related operations within a business. Therefore, the term financial management generally refers to the functions that the financial manager and the finance department of a business perform. These functions include keeping records, paying employees and suppliers, receiving payments from customers, borrowing, purchasing assets, selling inventory and distributing profits.

It is observed that financial management is the business function that has the primary responsibility for acquiring the funds or cash (making financing decisions) that is needed by a business for its operations (Brealey, Myers & Allen 2009:304; Vernimmen, Quiry, Dallocchio, Le Fur & Salvi 2009:1-4). According to Vernimmen et al. (2009:11), it is also the responsibility of a business' financial management department to direct those funds into meaningful projects (making investment decisions) that will maximise the value of the business and the wealth of its owners.

In its broadest context, financial management is concerned with three critical decisions that financial managers of businesses are obligated to make regularly. These are financing decisions, investment decisions and working capital management decisions. (Els 2010:5-6). The first of the three decisions revolves around the financing of the capital requirements of a business. Businesses' financing decisions are often referred to as the process of deciding on the capital structure. Profit distribution forms part of the financing decision as net profit after tax can either be reinvested in the business or paid out to the owners/shareholders of the business. (Bosch et al. 2011:492; Gitman & Zutter 2012:508).

For the purpose of this study, profit distribution will be investigated as a separate financial decision-making area. The second financial management decision is concerned with businesses' investments in assets. Businesses' investments in assets decisions are often referred to as the process of capital budgeting (Berk & DeMarzo 2011:183). The third category, working capital management decisions, is often referred to as short-term financial planning decisions and is regarded as part of businesses' investment decisions (Firer et al. 2008:577). However, for the purpose of this study, short-term financial planning is regarded as a separate financial decision-making area because of the vast financial aspects (e.g. current assets and current liabilities) it includes.

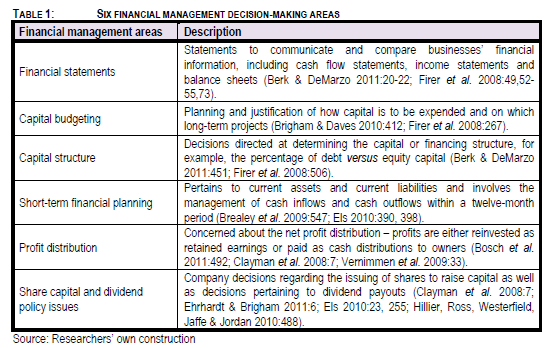

In addition to these three financial management areas, it is also essential to acknowledge the importance of financial statements in businesses. Financial statements give proof to financial decisions and transactions for the purposes of keeping records as well as for analyses to make interpretations that result in future well-informed financial decisions. In the case of companies, share capital and dividend policy issues also impact financial management decisions. Thus, as described in Table 1, six financial management decision-making areas are highlighted in this study.

As presented in Table 1, for the purpose of this study, the six financial management decision-making areas are financial statements, capital budgeting, capital structure, short-term financial planning, profit distribution, and share capital and dividend policy issues.

4.2 Comparative analysis of financial management modules at tertiary institutions

In order to determine whether the financial management modules offered by tertiary institutions are relevant to financial managers in practice, it is important to identify the content of financial management curricula and identify similarities and differences between the financial management modules of various tertiary institutions in South Africa and abroad. An evaluation of the different curricula and assessment of the strengths and weaknesses of each curriculum are pertinent.

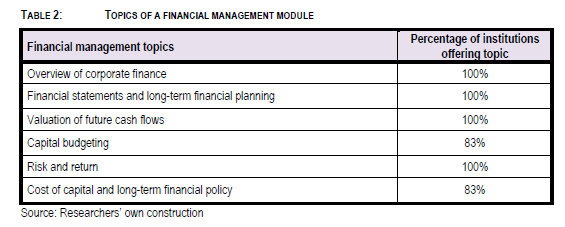

In order to make a sensible and easy comparison between the topics that are covered in the financial management curriculum offered by the NMMU and the topics covered by the curricula of other tertiary institutions (three national and two international institutions), Table 2 was constructed. It should be noted that the tertiary institutions selected for comparison are all offering, similar to the NMMU, financial management as a module and do not specifically offer a degree in financial management. Curricula information was obtained from the tertiary institutions' websites and accessible relevant study material. The comparison table uses the financial management topics that are offered at the NMMU as a basis for the comparison.

It is evident from Table 2 that most of the topics that are covered in the NMMU financial management module are also covered by other tertiary institutions. Therefore, there is not much difference between what is presented by the NMMU and what is presented by other tertiary institutions both in South Africa and internationally.

The only topics that are exceptions are risk and return and short-term financial planning and management, which are respectively covered in part 5 and part 7 of the NMMU curriculum. From the comparison in Table 2 it appears that the risk and return and the short-term financial planning and management topics are not covered by two tertiary institutions, one national and one international, respectively. However, it should be noted that these topics may be included and discussed as part of other curricula sections, although not specifically mentioned, in the cases of these two tertiary institutions.

The literature overview also provided some insight on topics that the NMMU will need to consider for future inclusion in its financial management curriculum in order to make it more aligned to national and international standards. It appears that there are certain topics that are not covered in the NMMU curriculum, although regarded as important sections in other tertiary institutions' curricula. The specific topics that are not covered by the NMMU curriculum include: Leasing, mergers and acquisitions, arbitrage theory, corporate valuation, international corporate finance, international financial markets, international banking, financial mathematics, financial engineering, real estate investment and behavioural finance.

5 RESEARCH METHODOLOGY

The study being reported here attempted to identify the relevance of the financial management module of the NMMU to financial managers in practice. In order to access the usefulness of the module's content, divided into six financial management areas, a questionnaire was used to gather financial managers' viewpoints. Therefore, the quantitative research design was used as the researchers aimed to analyse and interpret gathered data quantitatively (Salkind 2010:1125-1126; Zikmund 2010:94).

Both primary and secondary sources were used to collect information on the financial management modules offered by tertiary institutions in South Africa and the relevance of their content to financial managers in practice. Secondary sources included books, articles from journals and websites, while primary research was conducted by means of an empirical study. A self-developed and self-administered measuring instrument in the form of a structured questionnaire was distributed to a convenience sample of 300 financial managers in the Nelson Mandela Metropolitan area.

The population for the study includes all the people who are currently practising as financial managers, Chief Financial Officers (CFOs), financial executives, accountants and financial practitioners in various businesses within the Nelson Mandela Metropolitan area; thus, any employee who is responsible for the financial management activities of a business in the Nelson Mandela Metropolitan area could have been a respondent in this study. However, for the purposes of this study and for easy reading all respondents are referred to as financial managers, although their job titles or designations may vary because of the different terminologies used in various businesses.

The language of communication was English, and the questionnaire consisted of three sections. Section A gathered biographical and demographical data of the respondents, namely financial managers and their employer businesses. Section B consisted of statements based on the literature overview regarding financial management concepts and topics covered in tertiary institutions' financial management modules. Statements were sub-divided into six financial management areas. This section used a five-point Likert-type scale ranging from 'strongly disagree' (1) to 'strongly agree' (5) and gathered data on the relevance of six financial management areas as perceived by the financial managers. Section C was in the format of one open question to respondents. This question requested respondents to add additional topics, not covered in the questionnaire, that in their opinion should be included in tertiary institutions' financial management modules. The validity of the measuring instrument was ensured as experts in the field of financial management assisted with the questionnaire design.

Collected data was statistically analysed using the Microsoft Excel and Statistica (Version 9) computer programs. As this was an exploratory study with no hypotheses to test statistical data analyses were performed in two phases:

• Descriptive statistics, such as the mean and standard deviation scores as well as frequency distributions, were calculated to summarise the sample data distribution. Descriptive statistics have the function of providing an overall, coherent and simple picture of a large amount of data (Burns & Burns 2008:8; Salkind 2010:8).

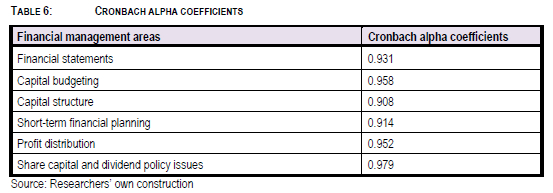

• Cronbach alpha coefficients were computed to evaluate the internal reliability and consistency of the questionnaire items with reference to the six financial management areas. It is recommended that a test should have a Cronbach alpha coefficient greater than 0.70, with the Cronbach alpha coefficients range being from 0 to 1 (Burns & Burns 2008:417; Hair, Babin, Money & Samouel 2003:172; Salkind 2010:162). The higher the Cronbach alpha coefficient above the 0.70 benchmark, the more reliable the questionnaire or test.

6 EMPIRICAL RESULTS

This section will elaborate on the empirical findings obtained from the statistical data analyses described above. The empirical results are categorised under two headings. Firstly, the descriptive statistics are described, including the biographical and demographical data of the respondents. Secondly, the reliability of the measuring instrument is evaluated through the Cronbach alpha coefficients.

6.1 Financial management areas

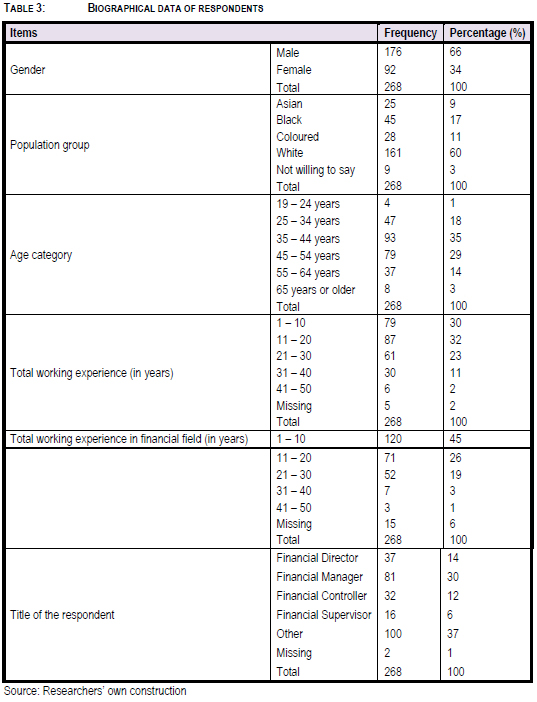

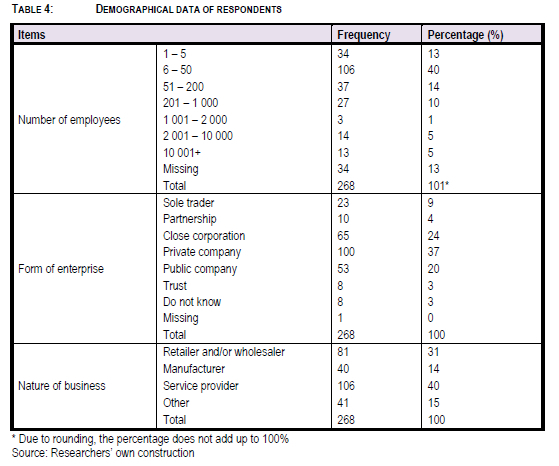

Tables 3 and 4 illustrate the descriptive statistics (both frequencies and percentages) of the biographical and demographical data of the respondents and their businesses.

As can be seen in Table 3, the majority of the respondents were males, namely 66%. Most of the respondents were between the ages of 30 - 39 (35%) and 40 - 49 (29%) years. The majority of respondents had a working experience of 1 - 10 (30%) or 11 - 20 years (32%). Furthermore, businesses' most popular title for people with financial management responsibilities is Financial Manager (30%). The majority of the businesses (40%) employed 6 - 50 employees, as evident from Table 4. Most of the respondents were employed in private companies, comprising 37% of the businesses. Service providers (40%) and retailers (31%) accounted for the bulk of the respondents' nature of business.

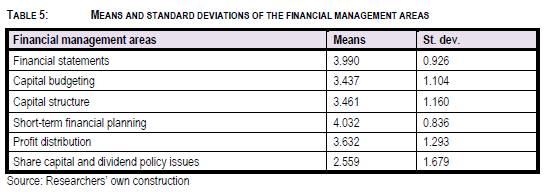

Table 5 represents the mean scores and standard deviations of the six financial management areas. The mean scores reflect the extent to which the respondents in general agreed or disagreed with certain statements and the standard deviation indicates the degree of dispersion around the mean.

Table 5 shows that the financial management area, short-term financial planning, obtained the highest mean score of 4.032, while share capital and dividend policy issues, achieved the lowest mean score of 2.559. This reveals that the highest agreement among respondents on the relevance of a financial management area was about short-term financial planning. Excluding share capital and dividend policy issues, the other mean scores, all above level 3 (neutral), indicate that the respondents agree that these five financial management areas (financial statements, capital budgeting, capital structure, short-term financial planning and profit distribution) are relevant for their businesses. Thus, they cover, include or use these aspects in their businesses' financial management functions. The low mean score for share capital and dividend policy issues was an interesting finding because this financial management area is only applicable to businesses in the form of companies, but over 56% of the respondents were from companies. The mean score of 2.559 indicates that respondents slightly disagree that this financial management area is of high importance to their businesses.

The high standard deviation scores illustrated in Table 5 show that the respondents varied extensively with regard to their viewpoints on the relevance of the six financial management areas. The financial management area, share capital and dividend issues, obtained the highest standard deviation score of 1.679, while the financial management area, short-term financial planning, obtained the lowest score of 0.836. These standard deviations show that respondents mostly differed in their viewpoints on share capital and dividend issues and mostly had similar viewpoints regarding short-term financial planning.

6.2 Reliability of the measuring instrument

The results illustrating the internal reliability of the measuring instrument, as measured by the Cronbach alpha coefficients, are shown in Table 6.

The Cronbach alpha coefficient scores indicate the reliability of the questionnaire items and the complete measuring instrument. As can be seen from Table 6, all the financial management areas obtained Cronbach alpha coefficient scores well above the recommended 0.70. The financial management area, share capital and dividend issues had the highest Cronbach alpha coefficient score of 0.979, in other words, the items measuring share capital and dividend issues can be regarded as the most reliable.

7 IMPLICATIONS

The empirical investigation led to a number of recommendations that can be provided to tertiary institutions with regard to their financial management modules' content and delivery methods, as well as to financial managers in various financial management areas. As seen from the empirical findings, short-term financial planning had the highest mean score as well as the lowest standard deviation score. This indicates that respondents attached the highest level of importance and relevance to this financial management area, and almost had homogeneous viewpoints on this financial management area.

Specifically, with regard to the NMMU, the aspect of short-term financial planning is well-covered in the university's financial management module's curriculum and there is no need to change the present content thereof. Based on the literature overview, other universities, with the exception of one, also explicitly cover the topic of short-term financial planning. The importance and relevance of the short-term financial planning financial area to financial managers shows businesses' focus on the management of current assets, including accounts receivable (debtors), inventory, short-term investments- and debt as well as cash in- and outflows. In addition, short-term financial planning also emphasise the management of current liabilities in businesses. Strategies such as decreasing the inventory turnover, inventory costs, number of inventory orders and the time taken to collect debts from debtors can all be used to enhance businesses' short-term financial planning. Short-term financial planning could also improve if businesses attempt to increase the time between the acquisition and selling of inventory.

Business owners/managers should be educated on setting cash budgets, creating an accounts receivable credit policy and on the negotiation process when purchasing on credit from suppliers. Businesses should source expert assistance when making investments in current assets, deciding on short-term investments, such as in marketable securities, and deciding on short-term debt options.

In this study it was shown that financial statements is the next financial management area that is regarded as most important and relevant to financial managers. Pro forma financial statements are important in terms of long-term financial planning; these needed to accompany a written financial plan, and therefore it is highly recommended that the establishment and use of pro forma financial statements are included in all financial management modules.

Tertiary institutions should ensure that students are equipped to set up pro forma financial statements. The relevant business management departments should include the exercise of developing pro forma financial statements in financial management modules without leaving this skill to be taught only by accounting departments. The relevance of financial statements shows that it is important for financial managers to keep adequate records of businesses' financial- situations and plans. Specifically, ratio analyses and the interpretation thereof are critical, and aspects such as liquidity, solvency, asset management, profitability and market value should be understood by the prospective financial managers.

The third most important and relevant financial management area is profit distribution. It is evident that tertiary institutions should fully inform students about and explain the various profit distribution options available to businesses. The importance of profit distribution to financial managers place greater emphasis on the need for adequate education of business owners/managers on the setting of clear well-regulated and regularly revised distribution policies.

Excluding share capital and dividend policy, as was shown earlier, the two remaining financial management areas regarding businesses' capital structure and capital budget were also found to be important and relevant to financial managers in practice. The tasks performed in each of these financial management areas should therefore be considered as key topics in tertiary institutions' financial management modules.

The relationship between these two topics and the overall impact on a business should also be emphasised by tertiary institutions. Financial managers' strategies to improve their businesses' capital structure would include the monitoring of payments to borrowers, negotiations to decrease interest rates payable on long-term debt and the determination of businesses' optimal financing structure. It is clear that financial managers should consider training to assist in the decisions of whether or when to raise equity and/or debt capital.

Capital budgeting strategies include the increase use of investment evaluation methods, such as the net present value, internal rate of return, discounted payback period, average accounting return and profitability index to evaluate investment opportunities. Financial managers should be trained on how to select the most appropriate investment evaluation method and understand its criteria to assist them with the acceptance and rejection of investment possibilities. When conducting capital budgeting, financial managers should be able to conduct and interpret scenario-, sensitivity- and simulation analyses as well as accounting-, financial-, and cash break-even points. In addition, capital budgeting could improve if financial managers are able to evaluate possible long-term investments' expected returns, variances, standard deviations and beta values as well as monitor the value of other businesses' share prices for possible long-term investments.

8 CONCLUSION

In this article insight has been given into the content of financial management modules in national and international tertiary institutions. More specifically, the article provided insight into the content relevance of a financial management module to financial managers in practice. As tertiary institutions are important contributors to South Africa's labour force, relevant module offerings are essential to ensure that these institutions can offer qualified, well-educated graduates with relevant, practical knowledge to businesses in search of employees. Therefore, tertiary institutions need to familiarise themselves with the financial management areas important to financial managers in order to incorporate these topics into their modules to ensure the dissemination of relevant knowledge to future employees.

The empirical findings of this study have established that five of the six investigated financial management areas are relevant to financial managers of businesses in the Nelson Mandela Metropolitan area. The short-term financial planning area was viewed by respondents as the most relevant topic to their businesses. Thereafter the topics financial statements and profit distribution are most relevant to financial managers in practice. It is clear that the most important discussions in the financial management modules of tertiary institutions should cover the management of current assets and current liabilities, income-, balance- and cash flow statements as well as the options of profit sharing among business owners.

One limitation of the study is the relative small geographic area within South Africa from where the sample was drawn. Another limitation includes the small sample size (300); a larger sample size from a greater geographical area might have provided different results. These limitations can be used as possible future research areas. Future research may include similar studies conducted in other areas of South Africa to possibly generalise the findings.

In conclusion, this article provides substantive evidence that tertiary institutions in South Africa, in particular the NMMU, are offering financial management modules relevant to financial managers in practice. The article gives practical recommendations to tertiary institutions on how they could slightly adapt their financial management modules' content by including additional topics. It also provides recommendations to financial managers on which financial management areas to focus on. Such knowledge and the implementation thereof by tertiary institutions and businesses could lead to higher pass rates of students, better qualified graduates sourced by industry and more successful businesses.

ACKNOWLEDGEMENTS

A special word of thanks to:

• Mr Vuyani Jim and Mr Mfanothukela Mdingane, for the interpretation of the empirical results and

• the third-year Financial Management students of the NMMU who assisted with the data collection.

REFERENCES

ABOR J & QUARTEY P. 2010. Issues in SME development in Ghana and South Africa. International Research Journal of Finance and Economics, 39: 218-228. [ Links ]

BERK J & DEMARZO P. 2011. Corporate finance. 2nd edition. Boston, MA: Pearson. [ Links ]

BOSCH J, TAIT M & VENTER E. (eds). 2011. Business management: An entrepreneurial perspective. 2nd edition. Port Elizabeth, EC: Lectern. [ Links ]

BREALEY RA, MYERS SC & ALLEN F. 2009. Principles of corporate finance. New York, NY: McGraw-Hill. [ Links ]

BRIGHAM EF & DAVES PR. 2010. Intermediate financial management. 10th edition. Mason, Ohio: South-Western Cengage. [ Links ]

BURNS RB & BURNS RA. 2008. Business research methods and statistics using SPSS. Los Angeles, CA: Sage. [ Links ]

CLAYMAN MR, FRIDSON MS & TROUGHTON GH. 2008. Corporate finance: A practical approach. New Jersey, NJ: Wiley. [ Links ]

ELS G. (ed). 2010. Corporate finance: A South African perspective. Cape Town, WC: Oxford. [ Links ]

EHRHARDT MC & BRIGHAM EF. 2011. Corporate finance: A focused approach. 4th edition. Mason, Ohio: South-Western Cencage. [ Links ]

FIRER C, ROSS SA, WESTERFELD RW & JORDAN BD. 2008. Fundamentals of corporate finance. 4th South African edition. London, England: McGraw-Hill. [ Links ]

GITMAN LJ & ZUTTER CJ. 2012. Principles of managerial finance. 13th edition. Essex, England: Pearson. [ Links ]

HAIR JF, BABIN B, MONEY AH & SAMOUEL P. 2003. Essentials of business research methods. New Jersey, NJ: Wiley. [ Links ]

HILLIER D, ROSS S, WESTERFIELD R, JAFFE J & JORDAN B. 2010. Corporate finance. European edition. London, England: McGraw-Hill. [ Links ]

LAMBRECHTS IJ. 1990. Financial management. Pretoria, Gauteng: Van Schaik. [ Links ]

LASHER WR. 2011. Financial management: A practical approach. 6th edition. Mason, Ohio: South-Western Cencage. [ Links ]

MCLANEY E. 2009. Business finance: Theory and practice. 8th edition. London, England: Pearson. [ Links ]

MEGGINSON WL, SMART SB & GRAHAM JR. 2010. Financial management. 3rd edition. Mason, Ohio: South-Western Cencage. [ Links ]

PERKS S & SMITH EE. 2008. Focussed training programmes for solving growth problems of very small businesses. Acta Commercii, 8:145-159. [ Links ]

RYAN B. 2007. Corporate finance and valuation. London, England: Thomson Learning. [ Links ]

SALKIND NJ. 2010. Encyclopaedia of research design. Thousand Oaks, CA: Sage. [ Links ]

STATSONLINE. 2012. Statistics South Africa. [Internet: http://www.statssa.gov.za/keyindicators/keyindicators.asp; downloaded 14-02-12. [ Links ]]

TSHABALALA DB. 2007. The strategic issues management by small businesses in the Mamelodi Metropolitan Areas. [Internet:http://etd.unisa.ac.za/ETD-db/theses/available/etd-06192008-51626/unrestricted/dissertation.pdf; downloaded 10-03-09. [ Links ]]

VERNIMMEN P, QUIRY P, DALLOCCHIO M, LE FUR Y & SALVI A. 2009. Corporate finance: Theory and European practice. Chichester, England: Wiley. [ Links ]

ZIKMUND WG. 2010. Business research methods. 8th edition. Mason, Ohio: South-Western Cencage. [ Links ]