Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Journal of Contemporary Management

versión On-line ISSN 1815-7440

JCMAN vol.9 no.1 Meyerton 2012

RESEARCH ARTICLES

Perceptions regarding the implementation of corporate governance practices within selected organisations

EE Smith

Nelson Mandela Metropolitan University

ABSTRACT

This article sets out to investigate the perceptions regarding the implementation of corporate governance practices in selected organisations within the Nelson Mandela Bay region of South Africa. Research literature on corporate governance has recently attracted a lot of attention due to governance scandals in major corporations across the globe. To be able to achieve the research objectives of this research project, both a literature study and an empirical investigation were conducted. The comprehensive literature study, mainly based on journal articles, formed the theoretical framework for collecting the primary data. One hundred and seventy five self-administered questionnaires were returned from organisations in the selected population. A total of 80 null-hypotheses were formulated and tested as to investigate the relationship between the 10 dependent variables (perceptions regarding corporate governance practices) and eight independent variables (demographical data). Only six null-hypotheses indicated statistically significant relationships between these variables and are reported in this article. With the increased responsibility and accountability of organisations to its stakeholders, there is a need to develop a code of corporate governance as to guide organisations towards appropriate stakeholder relations. Practical guidelines are provided as to ensure more effective implementation of corporate governance practices in the workplace of today.

Key phrases: corporate governance; demographical influences; King III Report; practices; stakeholder relations

"Greater market globalisation, ever-increasing competition and greater global interdependence and more profound shareholder activism pose demands for improved corporate governance ... aimed at higher shareholder return ... South Africa's unique socio-political context requires careful navigation and balance ... efforts to adhere to international best practices on corporate governance through the King Report..." (Kakabadse & Korac-Kakabadse 2001:305).

1 INTRODUCTION

The main purpose of this article is to investigate the perceptions regarding the implementation of corporate governance practices within selected organisations. According to Hussey (1999:190), corporate governance refers to the manner in which organisations are managed and the nature of accountability of managers to owners. Brajesh and Sara (2010:7) are of the opinion that corporate governance has succeeded in attracting a great deal of public interest as it is important for the economic health of an organisation and society. Chau (2011:7) concurs that there has been a remarkable increase among researchers and practitioners to study corporate governance.

The two main reasons for the upsurge in interest in corporate governance are: the economic liberation and deregulation of industries and the demand for a new corporate ethos (Joyner & Payne 2002:297). These assumptions are also supported by Michael and Gross (2004:32) who allege that world-wide concern has been expressed about the shortcomings in systems of corporate governance. This new paradigm for corporate governance is based on the demand for greater accountability of organisations to their shareholders and customers (Bushman & Smith 2001:237). Sethi (2002:20) concludes that corporate governance is aimed at creating a balance between economic, social and environmental goals of an organisation as to ensure efficient use of resources and accountability in the use of power.

The first aspects to be highlighted are the problem statement and research objectives to be achieved. Thereafter, a theoretical overview of corporate governance practices is provided. The next section outlines the research methodology followed in this research project and the results of the empirical investigation. Lastly, the main conclusions and recommendations of the study are presented.

2 PROBLEM STATEMENT

According to the Organization for Economic Cooperation and Development, OECD (2004), corporate governance involves a set of relationships between an organisation's management, board, shareholders and other role players as to set objectives and to monitor performance. Hendrickse and Hendrickse (2004) concur that it is a "partnership of shareholders, directors and management to provide wealth creation and economic well-being to the wider community of stakeholders and society." Recent emphasis on corporate governance stems mainly from two reasons: failure of governance mechanisms to effectively control top management decisions resulting in fraud and corruption and evidence that well-functioning governance and control systems can be a source of competitive advantage for an organisation (Le Breton-Miller & Miller 2006:731).

Keasey, Thompson and Wright (2005) further argue that there has been an explosion in both policy and academic research devoted to corporate governance which impact on a variety of disciplines such as economics, finance, accounting and management. Although various researchers (see for example Aguilera & Cuervo-Cazurra 2009:376; Harris 2009:191 ; Malhotra & McDonald 2011:201 and Yoshikawa & Rasheed 2009:388) attempted to investigate different aspects and dimensions of corporate governance, Filatotchev and Boyd (2009:257), on the other hand, argue that effective corporate governance practices are dependent on specific organisational context factors which require a more holistic and open systems approach.

Aras and Crowther (2008:433) concede that with the increased responsibility and accountability of organisations to its stakeholders, there is a need to develop a code of corporate governance as to guide them towards appropriate stakeholder relations. It also appears that although abundant international literature exists on corporate governance, limited studies have been conducted on corporate governance practices within South African organisations. This led to the following research question to be addressed in this article: "What are the perceptions regarding the implementation of ten corporate governance practices within selected organisations in the Nelson Mandela Bay region?"

3 OBJECTIVES

The primary objective of this article is to investigate the perceptions regarding the implementation of corporate governance practices in selected organisations. To help achieve this primary objective, the following secondary goals are identified:

• To clarify and contextualise the concept of corporate governance.

• To provide a comprehensive theoretical overview of corporate governance practices.

• To empirically investigate the perceptions regarding the implementation of corporate governance practices in selected organisations.

• To provide general guidelines for implementing corporate governance practices in organisations.

4 THEORETICAL OVERVIEW OF CORPORATE GOVERNANCE PRACTICES

4.1 Concept clarification

According to Hough, Thompson, Strickland and Gamble (2011:325), the word "governance" is derived from the Latin word "gubernare" which means to steer, thus referring to the process of running a government or an organisation. Aguilera, Filatotchev, Gospel and Jackson (2007:475) define corporate governance as "mechanisms to ensure that executives respect the rights and interests of stakeholders, as well as making those stakeholders accountable for acting responsibly with regard to the protection, generation and distribution of wealth."

An international standard created to guide governance of information technology (IT), specifically, is termed ISO-IEC 38500. It provides guiding principles for directors of organisations on the effective, efficient and acceptable use of IT within an organisation and include the following principles: establish responsibilities; providing supporting mechanisms; acquiring validity; ensuring conformance with rules; and ensuring respect for human factors (IT Governance 2012:1)

4.2 Nature of corporate governance practices

Kim and Nofsinger (2004) state that corporate governance originate as a result of corporate ownership and control being divided between two parties, namely stakeholders and management. Ireland, Hoskisson and Hitt (2011:252) concur that this separation and specialisation of ownership and managerial control should lead to the highest return for its owners. A result of good governance is that disclosure of information related to the organisation's financial-, social- and environmental performance is provided to all relevant stakeholders (Zahra, Gedajlovic, Neubaum & Shulman 2009:519). Banerjee (2008:51) argues that there is a definite shift from reporting only on financial matters to also include reporting on the organisation's social responsibility efforts and initiatives to preserve the environment (triple bottom line).

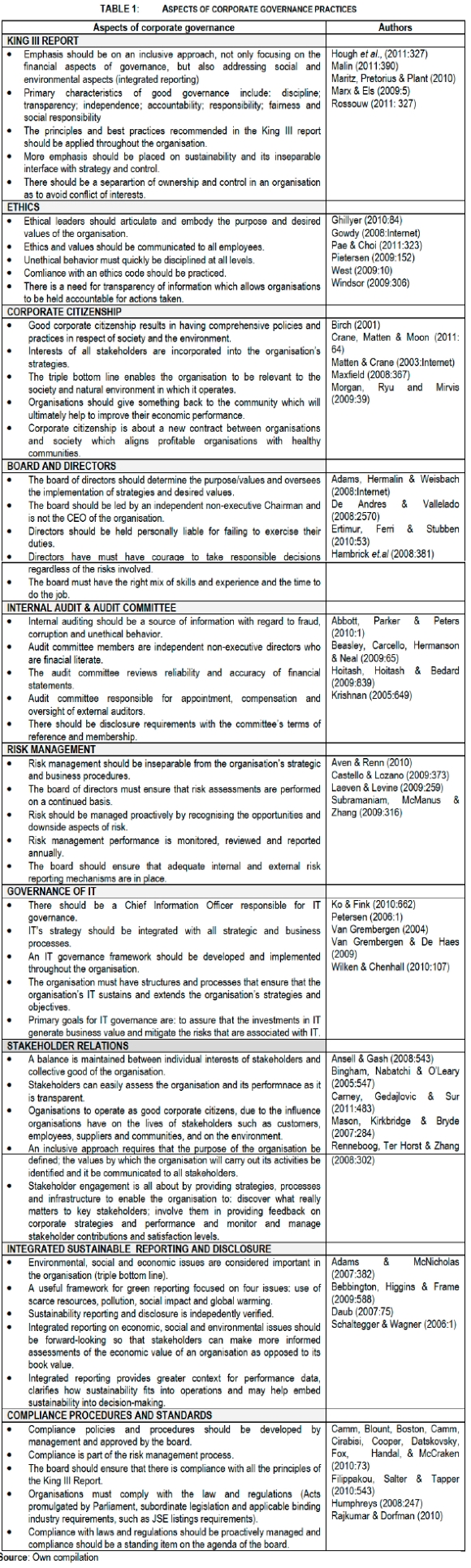

Various researchers (see for example Filatotchev & Boyd 2009:257; Hambrick, Werder & Zajac 2008:381 and Shipilov, Greve & Rowley 2010:846) attempted to investigate various corporate governance practices within different organsiational settings. For the purpose of this article, the following 10 corporate governance practices will be highlighted: King III Report, ethics, corporate citizenship, board of directors, internal auditing and audit committee, risk management, governance of IT, stakeholder relations, integrated sustainable reporting and disclosure and compliance procedures and standards. These practices, as indicated in Table 1, will also form the theoretical framework for conducting the empirical study.

5 INFLUENCE OF DEMOGRAPHICS ON IMPLEMENTING CORPORATE GOVERNANCE PRACTICES

In analysing the literature on the influence of demographic factors on corporate governance practices in organisations, it appears that various authors (see for example Kakabadse & Kakabadse 2007:169; Kiel & Nicholson 2003:189; Murphy & Mclntyre 2007:209 and Zimmermann & Stevens 2008:189) have divergent viewpoints on the effect of these factors on corporate governance. Brammer, Millington, Pavelin (2009:17) and Shropshire (2010:246) specifically investigated the role of organisational characteristics on the effectiveness of boards of directors. Authors (such as Dhir 2010:569; Ruigrok, Peck and Tacheva 2007:546 and Terjesen, Sealy and Singh 2009:320) focused on the role of gender, race and nationality and its influence on corporate governance practices and also identified conflicting results.

Cheng, Chan and Leung (2010:261), on the other hand, allege that various management demographic characteristics (such as education level, title, age and tenure) could influence corporate governance. Despite these notions, Minichilli, Zattoni and Zona (2009:55) postulate that there is often an over reliance on the use of demographic data.

Based on the abovementioned reasoning, 80 null-hypotheses were formulated as to test the relationship between the 10 dependent variables/factors (corporate governance practices) and the eight independent variables (classification data). Only those hypotheses that indicate a significant relationship between the dependent and independent variables are reported here.

The following null-hypotheses were thus formulated for this article:

H01: There is no relationship between the perceptions regarding the King III Report and the educational level of respondents.

H02: There is no relationship between the perceptions regarding the King III Report and the position of respondents in an organisation.

H03: There is no relationship between the perceptions regarding corporate citizenship and the educational level of respondents.

H04: There is no relationship between the perceptions regarding the role of internal auditing and the audit committee and the employment size of an organisation.

H05: There is no relationship between the perceptions regarding integrated sustainable reporting and disclosure practices and the educational level of respondents.

H06: There is no relationship between the perceptions regarding integrated sustainable reporting and disclosure practices and the industry type of respondents' organisations.

The research hypotheses (H1 to H6) can be stated as the exact opposite of these stated null-hypotheses.

6 RESEARCH METHODOLOGY

The following section provides an outline of the research methodology followed in this research project.

6.1 Research paradigm

The positivistic or quantitative research method is used in this study which is a form of conclusive research involving a large representative sample and structured data collection procedures and emphasising the quantification of constructs (Babbie & Mouton 2003:49). This is ensured by means of exploratory and descriptive research, aimed at describing the perceptions regarding the implementation of corporate governance practices in selected organisations.

6.2 Population

The unit of analysis will be CEO's and mangers of organisations. For the purpose of this research project, the target population consists of all medium-sized organisations (employing 51 to 200 employees) and large-sized organisations (employing more than 200 employees) mainly in the Nelson Mandela Bay region of the Eastern Cape in South Africa. The reason for the selection of this population is that these organisations are more likely inclined to implement corporate governance practices on a larger scale as compared to smaller organisations which might not implement these practices to the same extent.

6.3 Time horizon

The research project studied a particular phenomenon at a particular point in time thus making it a cross-sectional study (Collis & Hussey 2003:61). The study obtained information on variables in different contexts but at the same time.

6.4 Sampling

From this population a non-probability convenience sample of 200 organisations were drawn, based on accessibility and availability (Saunders, Lewis & Thornhill 2007:234). Clear instructions were given to fieldworkers as to ensure that the condition under which the empirical study was conducted, such as the time, place and manner is conducive for effective research.

6.5 Questionnaire design

A self-administered questionnaire was design and used during the survey. The statements in the questionnaire were developed and based on an extensive literature study. The questionnaire consists of two sections:

• Section A deals with statements regarding the perceptions of implementing corporate governance practices in the selected organisations. Ten factors (corporate governance practices) were tested, namely: King III report; ethics; corporate citizenship; board and directors; internal audit and audit committee; risk management; governance of IT; stakeholder relations; integrated sustainable reporting and disclosure and compliance procedures. A total of 50 statements were tested in this section. The type of ordinal scale used is by means of semantic differential scaled-response questions according to a five-point Likert-type scale (ranging from strongly agree to strongly disagree).

• Section B provides classification data (demographic characteristics) of respondents and contains a nominal scale of measurement, using categorical variables. Eight classification data variables were tested, namely: gender; highest education qualification; ethnic grouping; position in organisation; length of current employment; employment size; employment sector and industry type.

6.6 Pilot study

The questionnaire has been distributed to 10 organisations in the designated region and also to academics in the fields of management, ethics and statistics. Some problem areas were identified and suggestions for improvement were provided which ensure face validity of the questionnaire.

6.7 Data collection

A comprehensive literature study was conducted whereby secondary data was collected by means of text books, journal articles and the Internet. Primary data were collected by means of a survey during which 200 self-administered questionnaires were distributed. A total of 175 correct completed questionnaires were obtained, giving an effective response rate of 88%. Various measures were undertaken as to increase the response rate of this study, such as: prior appointments or arrangements were made with the respondents for taking part in the survey; an official cover letter was designed to make the survey more legitimate; the questionnaire was printed and presented in an attractive booklet format and some follow-up was done and reminders were sent to respondents to return questionnaires.

6.8 Data processing and analysis

Completed questionnaires were inspected, edited and coded. The data was transferred to an Excel spreadsheet and analysed by means of the SPSS statistical software package. The techniques used during the data analysis stage of the research project included: descriptive statistics (e.g. mean and standard deviation), frequency distributions (percentages), reliability testing (Cronbach's alpha), correlation coefficients and analysis of variance.

7 EMPIRICAL RESULTS

The main empirical results are outlined in this section.

7.1 Descriptive statistics

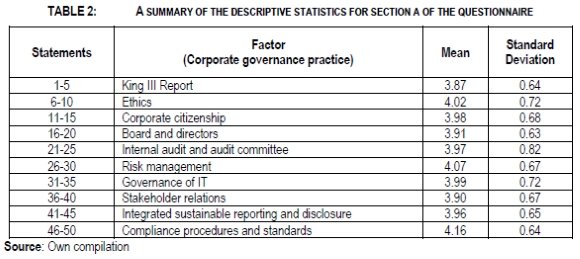

Table 2 provides a summary of the descriptive statistics for Section A of the questionnaire (perceptions regarding corporate governance practices).

With regard to the descriptive statistics of the 10 factors, no in-depth discussion is provided, as it falls beyond the scope of this article. Regarding the measure of central tendency (mean values) of the 10 factors, it appears that the values cluster around point four (agree) on the instrument scale. The highest mean value was obtained for the factor regarding compliance procedures and standards (4.16). None of the mean scores lies on the disagreement side of the scale (point one and two), indicating that most of the respondents agree with these statements related to corporate governance practices. The measure of dispersion used is the standard deviation. Al the scores are below one, indicating that responses did not vary much around the mean scores.

7.2 Demographic profile of respondents

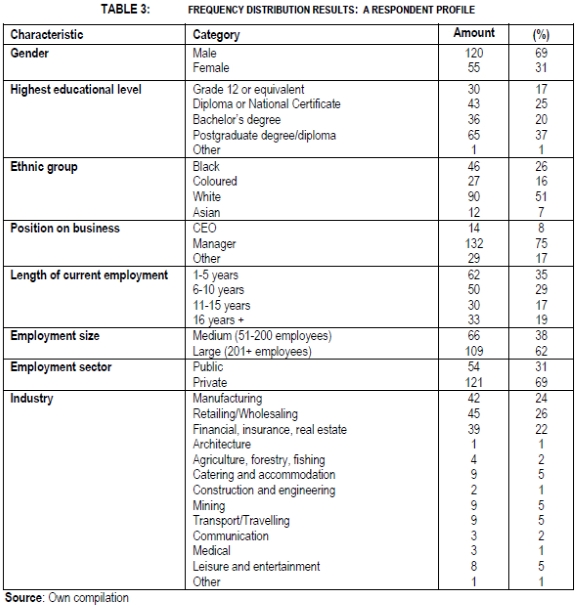

Table 3 provides a profile of the respondents of this study by indicating the frequency distribution results of the demographical data.

From Table 3, it is evident that the majority of respondents (69%) are males and 31% females. In terms of highest educational level, 45% of the respondents have a diploma, certificate or bachelor's degree, whilst 37% has a postgraduate degree/diploma. Based on ethnic classification, 51% of the respondents are white and 26% are black, respectively. Eighty three percent of the respondents indicated that they are owner/managers or CEO's. The majority of the respondents (46%) are employed in their current position for between six and 15 years. It also appears that the majority of the respondents are employed in large organisations (62%) and in the private sector (69%). Most of them are also employed in the manufacturing industry (24%), wholesaling and retailing (26%) and finance, insurance and real estate (22%) industries.

7.3 Reliability and validity of the measuring instrument

External validity refers to the generalisation of research results to other population groups and has been ensured by means of clear guidelines regarding the place, time and conditions in which the research was to be conducted. The internal validity of the instrument's scores is ensured through both face validity and content validity. Expert judgement by researchers in business management, ethics and statistics and a pilot study among 10 organisations in the designated region were undertaken.

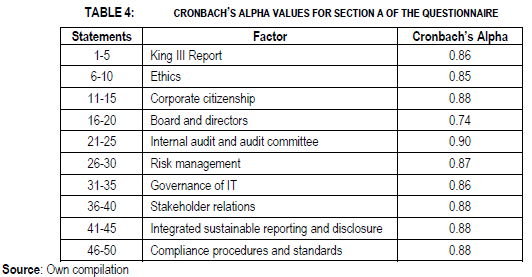

The statistical software package, SPSS, was used to determine Cronbach's alpha values for the 10 predetermined factors (perceptions regarding corporate governance practices) to confirm the internal reliability of these 10 factors (refer to Table 4). Cronbach's alpha is a measure of internal consistency indicating how closely related a set of items are as a group - it is a coefficient of reliability (or consistency) and can be written as a function of the number of test items and the average inter-correlation among the items (Gwet 2012:246).

To establish the reliability of the 10 factors, Cronbach's alpha values were calculated (indicating internal consistency). The reliability coefficients of Cronbach's alpha values for the 10 factors are all above 0.7. It can therefore be concluded that all 10 factors are internally reliable.

7.4 Correlation

Regarding the correlation between the variables which constitute each factor, an inter-item correlation exercise was conducted using the Pearson product-moment correlation coefficient. It appears that all the variables in each factor show strong positive relationships with each other. A positive correlation coefficient (r-value) indicates a strong or positive relationship among the variables. The full correlation matrix of these variables is not presented here as it falls beyond the scope of this article. None of the variables showed a negative/reverse relationship. All variables indicated strong inter-item correlation. The variable with the highest positive r-value (strongest positive relationship) were found in the stakeholder relations factor (0.7202), while the variable with the lowest positive r-value (weakest positive relationship) were found in the board and directors' factor (0.2167).

7.5 ANOVA

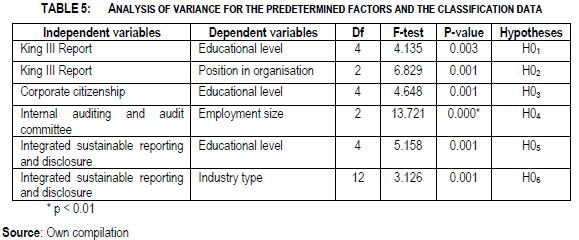

The purpose of this analysis is to investigate the relationship between the independent variables (classification data) and dependent variables (corporate governance practices) and to test the stated null-hypotheses. The ANOVA exercise was therefore done on the 10 predetermined factors and not on the 50 individual statements as stated in the measuring instrument. Eighty null-hypotheses were originally formulated, but only those six hypotheses indicating statistically significant relationships are elaborated on. The results of the analysis of variance tests are given in Table 5.

The ANOVA results clearly indicate the relationships between the independent variables (classification data) and dependent variables (corporate governance practices). The null-hypotheses, H01 to H02, can be rejected (p-value <0.05), indicating that there are significant relationships between perceptions regarding the King III Report and the educational level and position of respondents in an organisation. It also appears that there is a significant relationship between perceptions regarding corporate citizenship and the educational level of respondents and thus can H03 be rejected (p-value < 0.05).

There appears to be a highly significant relationship between perceptions regarding internal auditing and the audit committee and the employment size of an organisation (H04 rejected at significance level of 0.01). Both null-hypotheses, H05 and H06, can be rejected (p-values < 0.05), indicating that there is a significant relationship between perceptions regarding integrated sustainable reporting and disclosure and the educational level of respondents and industry type, respectively. The alternative hypotheses, H1 to H6, can in all cases be accepted. Further post-hoc tests (e.g. Scheffé's test) were conducted as to establish where the differences are, but not reported, as it falls beyond the scope of this article.

8 CONCLUSIONS AND RECOMMENDATIONS

Corporate governance has succeeded in attracting a great deal of public interest as it is important for the economic health of an organisation and society. World-wide concern has been expressed about the shortcomings in systems of corporate governance. This new paradigm for corporate governance is based on the demand for greater accountability of organisations to their shareholders and customers, aimed at creating a balance between economic, social and environmental goals of an organisation as to ensure efficient use of resources and accountability in the use of power. Recent emphasis on corporate governance stems mainly from two reasons: failure of governance mechanisms to effectively control top management decisions resulting in fraud and corruption and evidence that well-functioning governance and control systems can be a source of competitive advantage for an organisation.

Based on the analysis of variance results, the following conclusions and recommendations can be identified:

• There appears to be a significant relationship between perceptions regarding the King III Report and the educational level of respondents in an organisation (H01 rejected). Respondents with higher educational levels differ in their perceptions regarding the King III Report, as compared to respondents with lower levels of education. Organisations should thus endeavour to ensure that all employees, regardless of educational level, are being exposed and properly educated regarding the role and function of the King III Report in corporate governance.

• There appears to be a significant relationship between perceptions regarding the King III Report and position of respondents in an organisation (H02 rejected). It was found that owners, managers and employees have different views regarding the role and function of the King III Report in the governance of an organisation. Especially lower level managers and employees need to be educated regarding the important role of the King III Report in corporate governance.

• Perceptions regarding corporate citizenship and the educational level of respondents also appears to be significantly related (H03 rejected). Lower educated respondents might not be that familiar with the nature and practice of corporate citizenship. Organisations should thus ensure that all employees are being introduced to the nature of being a good corporate citizen.

• There appears to be a highly significant relationship between the perceptions regarding internal auditing and audit committees and the employment size of an organisation (H04 rejected). Larger organisations are more likely to have extensive internal auditing practices and an audit committee as compared to smaller organisations. The ideal scenario would be that all organisations, regardless of employment size, have proper internal auditing practices in place and a proper constituted audit committee.

• It was further indicated that there is a significant relationship between the perceptions regarding integrated sustainable reporting and disclosure and the educational level of respondents (H05 rejected). Employees and managers with lower levels of education might not have been exposed to the fairly new concept of integrated sustainable reporting and are thus unfamiliar with this practice. Proper training is thus required as to ensure that all employees in the organisation are being introduced to this practice.

• Results also shown that there is a significant relationship between the perceptions regarding integrated sustainable reporting and disclosure and industry type (H06 rejected). Respondents employed in financial and insurance industries are more likely to be exposed to the nature of integrated sustainable reporting and disclosure as compared to respondents in, for example, a catering or accommodation business. Organisations across industries should thus strive as to introduce employees to the nature of this practice.

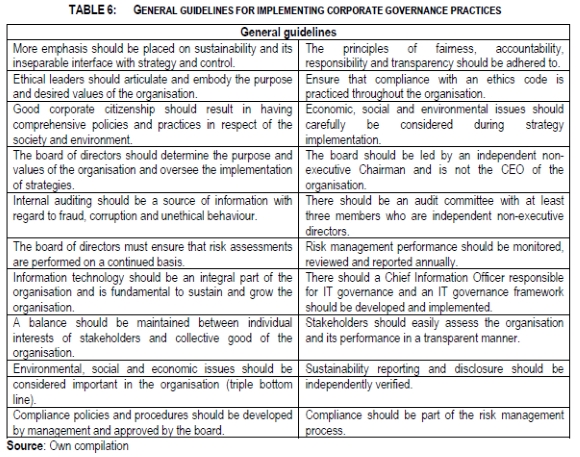

Some general guidelines for implementing corporate governance practices in an organisation are outlined in Table 6 below:

In conclusion, "... recent onslaught of corporate scandals has compelled the world to acknowledge the profound impact of corporate governance practices on the global economy . and is of particular concern in developing economies, where the infusion of international investor capital and foreign aid is essential to economic stability and growth ..." (Vaughn & Ryan, 2006:504).

REFERENCES

ABBOTT LJ, PARKER S & PETERS GF. 2010. Serving two masters: The association between audit committee internal oversight and internal audit activities. Accounting Horizons. 24(1):1-24. [ Links ]

ADAMS CA & MCNICHOLAS P. 2007. Making a difference: Sustainability reporting, accountability and organisational change. Accounting, Auditing & Accountability Journal. 20(3):382-402. [ Links ]

ADAMS R, HERMALIN BE & WEISBACH MS. 2008. The role of board of directors in corporate governance: A conceptual framework and survey. NBER Working Paper No. 14486. [Internet: http://www.nber.org/papersyw/14486; downloaded on 2012-02-02. [ Links ]]

AGUILERA RV & CUERVO-CAZURRA A. 2009. Codes of good governance. Corporate governance: An International Review. 17(3):376-387. [ Links ]

AGUILERA RV, FILATOTCHEV I, GOSPEL H & JACKOSN G. 2007. An organizational approach to comparative corporate governance: Costs contingencies and complimentaries. Organization Science. 19:475-492. [ Links ]

ANSELL C & GASH A. 2008. Collaborative governance in theory and practice. Journal of Public Administration Research and Theory. 18(4):543-571. [ Links ]

ARAS G & CROWTHER D. 2008. Governance and sustainability: An investigation into the relationship between corporate governance and corporate sustainability. Management Decision. 46(3):433-448. [ Links ]

AVEN T & RENN O. 2010. Risk management and governance: Concepts, guidelines, applications. Berlin: Springer-Verlag. [ Links ]

BABBIE E & MOUTON J. 2003. The practice of social research. Cape Town: Oxford University Press. [ Links ]

BANERJEE SB. 2008. Corporate social responsibility: The good, the bad and the ugly. Critical Sociology. 34(1):51-79. [ Links ]

BEASLEY MS, CARCELLO JV, HERMANSON DR & NEAL TL. 2009. The audit committee oversight process. Contemporary Accounting Research. 26(1):65-122. [ Links ]

BEBBINGTON J, HIGGINS C & FRAME B. 2009. Initiating sustainable development reporting: Evidence from New Zealand. Accounting, Auditing & Accountability Journal. 22(4):588-625. [ Links ]

BINGHAM LB, NABATCHI T & O'LEARY R. 2005. The new governance: Practices and processes for stakeholder and citizen participation in the work of government. Public Administration Review. 65(5):547-558. [ Links ]

BIRCH D. 2001. Perspectives on corporate citizenship. Sheffield: Greenleaf. [ Links ]

BRAJESH K & SARA HD. 2010. Competing human interest: The key domain for an effective corporate governance. Advances in Management. 3(11). [ Links ]

BRAMMER S, MILLINGTON A & PAVELIN S. 2009. Corporate reputation and women on the board. British Journal of Management. 20(1):17-29. [ Links ]

BUSHMAN RM & SMITH AJ. 2001. Financial accounting information and corporate governance. Journal of Accounting and Economics. 32:237-333. [ Links ]

CAMM J, BLOUNT S, BOSTON S, CAMM M, CIRABISI R, COOPER NE, DATSKOVSKY G, FOX C, HANDAL KV & MCCRAKEN WE. 2010. Under control: Governance across the enterprise. Germany: Springerlink. [ Links ]

CARNEY M, GEDAJLOVIC E & SUR S. 2011. Corporate governance and stakeholder conflict. Journal of Management and Governance. 15(3):483-507. [ Links ]

CASTELLO I & LOZANO J. 2009. From risk management to citizenship corporate social responsibility: Analysis of strategic drivers of change. Corporate Governance. 9(4):373-385. [ Links ]

CHAU SL. 2011. An anatomy of corporate governance. The IUP Journal of Corporate Governance. X(1):7-21. [ Links ]

CHENG LTW, CHAN RYK & LEUNG TY. 2010. Management demography and corporate performance: Evidence from China. International Business Review. 19(3):261-275. [ Links ]

COLLIS J & HUSSEY R. 2003. Business research: A practical guide for undergraduate and postgraduate students. London: Palgrave Macmillan. [ Links ]

CRANE A, MATTEN D & MOON J. 2011. The emergence of corporate citizenship: Historical development and alternative perspectives. Corporate Citizenship in Deutschland. 64-91. [ Links ]

DAUB C. 2007. Assessing the quality of sustainability reporting: An alternative methodological approach. Journal of Cleaner Production. 15(1):75-85. [ Links ]

DE ANDRES P & VALLELADO E. 2008. Corporate governance in banking: The role of the board of directors. Journal of Banking & Finance. 32:2570-2580. [ Links ]

DHIR AA. 2010. Towards a race and gender-conscious conception of the firm: Canadian corporate governance, law and diversity. Queens Law Journal. 35:569. [ Links ]

ERTIMUR Y, FERRI F & STUBBEN SR. 2010. Board of directors' responsiveness to shareholders: An evidence from shareholders proposals. Journal of Corporate Finance. 16(1):53-72. [ Links ]

FILATOTCHEV I & BOYD BK. 2009. Taking stock of corporate governance research while looking to the future. Corporate Governance: An International Review. 17(3):257-265. [ Links ]

FILIPPAKOU O, SALTER B & TAPPER T. 2010. Compliance, resistance and seduction: Reflections on 20 years of the funding council model of governance. Higher Education. 60(5):543-557. [ Links ]

GHILLYER AW. 2010. Business ethics: A real world approach. 2nd Edition. United States: McGraw-Hill. [ Links ]

GOWDY N. 2008. Definition of ethics. [Internet: http://www.angelfire.com/home/sesquiq/2007sesethics.html; downloaded on 2012-01-23. [ Links ]]

GWET KL. 2012. Third edition. Handbook of inter-rater reliability: The definitive guide to measuring the extent of agreement among multiple raters. Gaithersburg: Advanced Analytics, LLC. [ Links ]

HAMBRICK DC, WERDER A & ZAJAC EJ. 2008. New directions in corporate governance research. Organization Science. 19(3):381-385. [ Links ]

HARRIS J. 2009. Acceptance of good practices of corporate governance: A cause-based model from developing capital markets. Journal of Global Business Advancement. 2(1): 191-206. [ Links ]

HENDRICKSE J & HENDRICKSE L. 2004. Business governance handbook: Principles and practice. Cape Town: Juta. [ Links ]

HOITASH U, HOITASH R & BEDARD J. 2009. Corporate governance and internal control over financial reporting: A comparison of regulatory regimes. The Accounting Review. 84(3):839-867. [ Links ]

HOUGH J, THOMPSON AA, STRICKLAND AJ & GAMBLE JE. 2011. Crafting and executing strategy: Creating sustainable high performance in South Africa: Text, readings and cases. 2nd edition. London: McGraw-Hill. [ Links ]

HUMPREHYS E. 2008. Information security management standards: Compliance, governance and risk management. Information Security Technical Report. 13(4):247-255. [ Links ]

HUSSEY R. 1999. The familiarity threat and auditor independence. Corporate Governance: An international Review. 7(2): 190-197. [ Links ]

IRELAND RD, HOSKISSON RE & HITT MA. 2011. The management of strategy: concepts and cases. 9th edition. Sydney: South-Western Cengage Learning. [ Links ]

IT GOVERNANCE. 2012. ISO/IEC 38500: The new international standard for IT governance. [Internet: http://www.itgovernance.co.uk/media/article; downloaded on 2012-04-23. [ Links ]]

JOYNER BE & PAYNE D. 2002. Evolution and implementation: A study of values, business ethics and corporate social responsibility. Journal of Business Ethics. 41:297-311. [ Links ]

KAKABADSE NK & KAKABADSE AP. 2007. Chairman of the board: Demographic effects on the role of pursuit. Journal of Management Development. 26(2):169-192. [ Links ]

KAKABADSE A & KORAC-KAKABADSE N. 2001. Corporate governance in South Africa: Evaluation of the King Report. Journal of Change Management. 2(4):305-316. [ Links ]

KEASEY K, THOMPSON S & WRIGHT M. 2005. Corporate governance: Accountability, enterprise and international comparisons. London: Wiley. [ Links ]

KIEL GC & NICHOLSON GJ. 2003. Board composition and corporate performance: How the Australian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review. 11(3): 189-205. [ Links ]

KIM KA & NOFSINGER JR. 2004. Corporate governance. New York: Pearson Prentice Hall. [ Links ]

KO D & FINK D. 2010. Information technology governance: An evaluation of the theory-practice gap. Corporate Governance. 10(5):662-674. [ Links ]

KRISHNAN J. 2005. Audit committee quality and internal control: An empirical analysis. The Accounting Review. 80(2):649-675. [ Links ]

LAEVEN L & LEVINE R. 2009. Bank governance, regulation and risk taking. Journal of Financial Economics. 93(2):259-275. [ Links ]

LE BRETON-MILLER I & MILLER D. 2006. Why do some family businesses outcompete? Governance long-term orientations and sustainable capability. Entrepreneurship Theory and Practice. 30: 731-746. [ Links ]

MALHOTRA DK & MCDONALD MS. 2011. Recent trends in corporate governance practices in the USA. International Journal of Corporate Governance. 2(3):201-216. [ Links ]

MALIN CA. (Editor). 2011. Handbook on International corporate governance: Country analysis. United Kingdom: Edward Elgar Publishing Limited. [ Links ]

MARITZ R, PRETORIUS M & PLANT K. 2010. The interface between corporate governance and strategy-making: Where is the risk for responsible leaders in South Africa? Paper delivered at The Centre for Responsible Leadership Conference. University of Pretoria: 18-20 May 2012. [ Links ]

MARX B & ELS G. 2009. The role of the audit committee in strengthening business ethics and protecting shareholder's interests. African Journal of Business Ethics. 4(1):5-15. [ Links ]

MASON C, KIRKBRIDGE J & BRYDE D. 2007. From stakeholders to institutions: The changing face of social enterprise governance theory. Management Decision. 45(2):284-301. [ Links ]

MATTEN D & CRANE A. 2003. Corporate citizenship: Towards an extended theoretical conceptualization. [Internet: http://www.http://cosmic.rrz.uni-hamburg.de; downloaded on 2012-01-23. [ Links ]]

MAXFIELD S. 2008. Reconciling corporate citizenship and competitive strategy: Insights from economic theory. Journal of Business Ethics. 80(2):367-377. [ Links ]

MICHAEL B & GROSS R. 2004. Running business like a government in the new economy: Lessons for organizational design and corporate governance. Corporate Governance. 4(3):32-46. [ Links ]

MINICHILLI A, ZATTONI A & ZONA F. 2009. Making boards effective: An empirical examination of board task performance. British Journal of Management. 20(1):55-74. [ Links ]

MORGAN G, RYU K & MIRVIS P. 2009. Leading corporate citizenship: Governance, structure, systems. Corporate Governance. 9 (1):39-49. [ Links ]

MURPHY SA & MCINTYRE ML. 2007. Board of director performance: A group dynamics perspective. Corporate Governance. 7(2):209-224. [ Links ]

OECD. 2004. OECD Principles of corporate governance. Paris: OECD Publications. [ Links ]

PAE J & CHOI TH. 2011. Corporate governance, commitment to business ethics and firm valuation: Evidence from the Korean stock market. Journal of Business Ethics. 100(2):323-348. [ Links ]

PETERSEN R. 2006. Crafting information technology governance. EDPACS: The EDP Audit, Control and Security Newsletter. 32(6):1-24. [ Links ]

PIETERSEN E. 2009. Ethics in leadership in the African context. Cape Town: Juta & Co Ltd. [ Links ]

RAJKUMAR S & DORFMAN MC. 2010. Governance and investment of public pension assets: Practitioners' perspectives. Washington: World Bank. [ Links ]

RENNEBOOG L, TER HORST J & ZHANG C. 2008. The price of ethics and stakeholder governance: The performance of socially responsible mutual funds. Journal of Corporate Finance. 14(3):302-322. [ Links ]

ROSSOUW GJ. 2011. The ethics of corporate governance in global perspective. Corporate Governance and Business Ethics. 39(3):327-341. [ Links ]

RUIGROK W, PECK S & TACHEVA S. 2007. Nationality and gender diversity on Swiss corporate boards. Corporate Governance: An International Review. 15(4):546-557. [ Links ]

SAUNDERS M, LEWIS P & THORNHILL A. 2007. Research methods for business students. London: Pearson Education. [ Links ]

SCHALTEGGER S & WAGNER M. 2006. Integrative management of sustainability performance, measurement and reporting. International Journal of Accounting, Auditing and Performance Evaluation. 3(1):1 -19. [ Links ]

SETHI SP. 2002. Standards for corporate conduct in the international arena: Challenges and opportunities for multinational corporations. Business and Society. 107(1):20-40. [ Links ]

SHIPILOV AV, GREVE HR & ROWLEY T. 2010. When do interlocks matter? Institutional logics and the diffusion of multiple governance practices. The Academy of Management Journal. 53(4):846-864. [ Links ]

SHROPSHIRE C. 2010. The role of the interlocking director and board receptivity in the diffusion process. The Academy of Management Review. 35(2):246-264. [ Links ]

SUBRAMANIAM N, MCMANUS L & ZHANG J. 2009. Corporate governance, firm characteristics and risk management committee formation in Australian companies. Managerial Auditing Journal. 24(4):316-339. [ Links ]

TERJESEN S, SEALY R & SINGH V. 2009. Women directors on corporate boards: A review and research agenda. Corporate Governance: An International Review. 17(3):320-337. [ Links ]

VAN GREMBERGEN W. 2004. Strategies for information technology governance. London: Idea Group Publishing. [ Links ]

VAN GREMBERGEN W & DE HAES S. 2009. Enterprise governance of information technology: Achieving strategic alignment and value. New York: Springer Science and Business Media. [ Links ]

VAUGHN M & RYAN LV. 2006. Corporate governance in South Africa: A bellwether for the continent? Corporate Governance: An International Review. 14(5):504-512. [ Links ]

WEST A. 2009. The ethics of corporate governance: A (South) African perspective. International Journal of Law and Management. 51(1):10-16. [ Links ]

WILKEN CL & CHENHALL RH. 2010. A review of IT governance: A taxonomy to inform accounting information systems. Journal of Information Systems. 24(2):107-146. [ Links ]

WINDSOR D. 2009. Tightening corporate governance. Journal of International Management. 15(3):306-316. [ Links ]

YOSHIKAWA T & RASHEED AA. 2009. Convergence of corporate governance: Critical review and future directions. Corporate Governance: An International Review: 17(3):388-404. [ Links ]

ZAHRA S, GEDAJLOVIC E, NEUBAUM DO & SHULMAN JM. 2009. A typology of social entrepreneurs: Motives, search processes and ethical challenges. Journal of Business Venturing. 24(5):519-532. [ Links ]

ZIMMERMANN JM & STEVENS BW. 2008. Best practices in board governance: Evidence from South Carolina. Nonprofit Management and Leadership. 19(2): 189-202. [ Links ]