Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.9 no.1 Meyerton 2012

RESEARCH ARTICLES

An empirical investigation into customers' attitude towards usage of cell phone banking in Gauteng, South Africa

DK Maduku; M Mpinganjira

University of Johannesburg

ABSTRACT

The need to reduce operational costs and meet the increasing expectations of customers while remaining competitive has forced banks to deploy information technologies into the provision of banking services. The adoption rate of some of these electronic banking services is, however, not as good as initially hoped for. This study expanded the Technology Acceptance Model by including trust, subjective norm and demographic variables to understand the factors that influence retail banking customers' attitude towards cell phone banking services. Data was collected from retail banking customers in Gauteng, South Africa, using a self filling structured questionnaire. A total of 394 usable responses were received. Result of the analysis show that perceived usefulness, perceived ease of use, trust and subjective norm are all significantly related to attitude towards cell phone banking. Trust was, however, found to have the strongest predictive power on customers' attitude towards cell phone banking than all the other variables. Furthermore, attitude was found to contribute significantly to customers' intention to start using/continue using cell phone banking services. These findings have wider implications on efforts aimed at encouraging more customers to make use of cell phone banking and these have been highlighted in the paper.

Key phrases: cell phone banking, electronic banking, retail banking, South Africa, technology acceptance model

1 INTRODUCTION

Information technologies have introduced new business standards and are increasingly playing a significant role in changing the face of the banking industry (Grossman & Livingstone 2009:424; Laukkanen & Pasanen 2008:86; Wada & Odulaja 2012:69). As a result, the nature of selling and buying financial service products and other banking activities have undergone rapid changes and developments (Laukkanen & Pasanen 2008:86; Robinson & Moore 2012:Internet; Sharma 2008:45). The proliferation of Automated Teller Machines (ATMs), telephone banking, internet banking, electronic payments, security investments, information exchanges and more recently cell phone banking are a testament to the retail banking distribution changes brought about by information technologies. Electronic banking is an umbrella term used to describe the various types of retail banking technologies including products and services, with the use of technology (Kim, Adeli, Fang, Villalba, Arnett & Khan 2011:76).

Many reasons are given for the growing use of information technologies in banking. According to Hosein (2010:4) e-banking provides banks with significant opportunities to mitigate transactional costs. This is achieved through among other things the reduced need for front line staff as customers are able to serve themselves using e-banking services. Moreover, e-banking also helps to facilitate immediate two way communication between banks and their customers (Yu & Guo 2008:9). Also, as e-banking entails creation of customer databases, banks are now able to use their databases to provide more customised offerings to their customers (Yang & Fang 2004:304). As a result of these advantages and many more, the recent trend in the financial services industry has been to gradually replace over-the-counter-banking services with new technological delivery channels (Allen, Clark & Houde 2008:2; Gray 1996:57; Kim et al. 2011:76; Yu & Guo 2008:8).

Similarly, customers also stand to benefit from adoption of e-banking services. For example e-banking services give customers the opportunity to access their accounts at any time of the day without the need to visit a branch (Docstoc 2012:Internet). Customers are thus able to perform banking transaction from the comfort of their homes, offices or virtually anywhere (Bankingtopia 2012:Internet). This means that e-banking customers enjoy the advantage of the convenience of banking without place and time restrictions as well as the time-saving benefits that come with e-banking.

2 PROBLEM STATEMENT AND RESEARCH OBJECTIVES

Establishing and maintenance of electronic banking services involves significant deployment of resources on the part of banks. Alvarez (2010:Internet) reported that global IT spending by financial services in 2010 was $357.4 billion, with Europe (36.1%) and North America (33.1%) accounting for more than two thirds of this spending followed by Asia and the Pacific markets at 25.2%. Latin America and Africa together accounted for 5.7% of the spending. Campbell and Frei (2010:10) find that, although retention of profitable customers improves when customers switch to online self-service, companies' costs actually rise as a result.

Considerable customer acceptance of e-banking services is therefore a very important factor that influences banks' ability to recoup investments made into banking information technologies. It is thus important for banks to ensure that more customers make use of the electronic banking services available to them. Their ability to do this requires an understanding of customer attitudes towards such services and other factors that impact on their use of these services.

A review of literature on e-banking shows that most of the studies in this field are based on samples drawn from developed countries such as the UK, USA and Australia. Moreover, not many studies have been conducted in this field based on samples drawn from African countries. The review further shows that most of what has been published in the field of e-banking relates to internet banking and not cell phone banking. This may be partly due to the fact that cell phone banking as compared to internet banking is a new development in e-banking.

Cell phone banking, however, compared to internet banking presents enormous opportunities for expanding access to banking especially in the African context (CGAP 2010:Internet). This is because the penetration levels of cell phone in Africa is much higher than of internet (World Internet Statistics 2010:Internet; International Telecommunication Union-ITU 2009:Internet). The main objective of this paper is to investigate retail banking customers' attitudes towards the use of cell banking in Gauteng, South Africa. The specific objectives are to investigate factors that influence customers' attitude towards cell phone banking and to examine customers' behavioural intentions to start using or continue using cell phone banking.

3 LITERATURE REVIEW AND RESEARCH MODEL

Cell phone banking refers to the provision of banking services using cell phones. According to Goldstuck (2005:219) cell phone banking was first introduced in South Africa in 2005. As of 2009 it was estimated that 37 percent of banking customers in the country were using cell phone banking (Word wide worx 2011:Internet). While this presents tremendous growth over the period, banks have an interest to see continued growth in uptake of cell phone banking.

A review of literature shows that there a number of theories and models that have been developed over the years in order to help explain consumer behaviour or behavioural intentions. Most of the theories and models emphasise the importance of attitudes in understanding behaviour or behavioural intentions. According to Eagly and Chaiken (1993:1) attitude is a psychological tendency that is expressed by evaluating a particular thing with some degree of favour or disfavour. Attitude itself is in most cases a function of multiple factors.

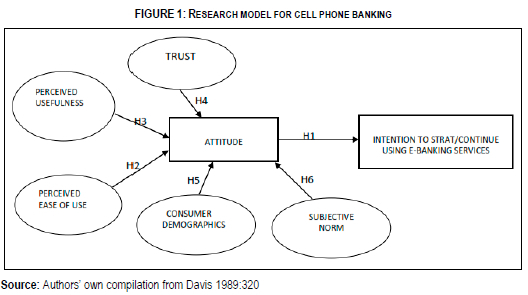

The Technology Acceptance Model (TAM) developed by Davis (1989:319) is one of the most commonly used models when it comes to understanding behaviour relating to use of information systems. According to the model, behavioural intention to use information systems is a function of an individual's attitude. This attitude is determined by two key variables namely perceived usefulness and perceived ease of use. Davis (1989:320) defined perceived usefulness as the degree to which a person believes that using a specific system will enhance his or her job performance. He defined perceived ease of use as the degree to which a person expects the system to be free of effort.

King and He (2006:740) performed a comprehensive review of published studies that have applied the TAM in an effort to understand and predict users' behaviour towards the use of IT. The results of their analysis showed that the TAM model is not only highly reliable and valid in understanding and predicting users' behaviour towards the use of IT but also it can be used in a wide range of contexts.

3.1 Attitude and behavioural intentions

Empirical findings by Al-Somali, Gholani and Clegg (2009:139); Al-Sukkar (2005:217); Lee (2009:139); Karjaluoto, Mattila and Pento (2002:269) and Pikkarainen, Pikkarainen, Karjaluoto and Pahnilas (2004:229) have all shown the importance of attitude in determining behavioural intention towards online banking. As a result, an individual's attitude towards cell phone banking service is expected to have a significant influence on his/her intention to start using/continue using the service. Hence the following hypothesis was proposed:

H1 There is a significant positive relationship between customer attitude and intention to start / continue using electronic banking.

3.2 Perceived usefulness

According to Frangos (2009:157) the ultimate reason why people exploit e-banking, is that they find the system to be useful for their transactions. Thus, customers anchor their e-banking intention to the beneficial outcomes that the system provides (Ndubisi 2006:12). Pikkarainen et al. (2004:224) noted that customers are satisfied with a system that meets their needs hence a system's success can be measured by how well it satisfies customers' needs. Chau and Hu (2001:716) found that users of a system are inclined to develop a positive attitude towards the system if they believe that using the system will enhance their productivity and performance. The study thus hypothesised that:

H2 There is a significant positive relationship between perceived ease of use and attitude towards cell phone banking.

3.3 Perceived ease of use

Perceived ease of use in e-banking may be described as the physical or mental effort that customers exert or are likely to exert during e-banking. Customers' perception of ease of use of e-banking system facilitates its adoption or otherwise. Ndubisi (2006:18) emphasize that a system that requires less technical skills and operational efforts will be more likely to be adopted. Based on this the following hypothesis was formulated for this study:

H3 There is a significant positive relationship between perceived usefulness and attitude towards cell phone banking.

Even though TAM has been widely accepted and used by researchers in understanding adoption and usage of information technologies, Davis (1989:334-335) recommended that further research should be done into variables that can help improve TAM's ability to predict acceptance of technology in the future. This entails the incorporation of other variables into TAM. A number of researchers have heeded to this call and investigated many additional factors that may have an impact on adoption of information technologies. Trust, consumer demographics and subjective norm are some of the factors that other researchers have found to be important in this regard.

3.4 Trust

According to Gao (2005:215) trust is of particular interest in e-commerce. Research has demonstrated that online purchase intention is positively correlated with trust (Delafrooz, Paim & Khabibia 2011:75). Metehan and Yasemin (2011:95) as well as Metzger (2004:Internet) also found that perceived trust or credibility of providers, in relation to Web systems, has a significant influence on customers willingness to participate in transactions involving exchange of sensitive personal information. According to researchers (Suh & Han 2002:250; Wada & Odulaja 2012:75) the possibility of hackers stealing information makes e-services inherently risky. Yousafzai, Pallister and Foxall (2003:852) found that trust in electronic banking and its infrastructure reduces customers' transaction specific uncertainty and related risks associated with the possibility that a bank might behave opportunistically. From the foregoing, it can be argued that trust can have a significant influence on attitude towards cell phone banking. Hence the following hypothesis was proposed:

H4 Customers' level of trust has a significant positive impact on attitude towards cell phone banking.

3.5 Consumer demographics

A review of literature concerning the demographic variables of a typical internet user suggests that older, less educated, minority and lower income individuals have lower internet usage rates than those of younger, highly educated, white and wealthier individuals (Porter & Donthu 2006:1004). This description seemingly holds for online banking which is regarded as the application of the internet technology to banking. For instance, Ian (2009:53); Karjaluoto et al. (2002:269) and Sathye (1999:332) in separate studies have found that a typical online banker is highly educated, relatively young and wealthy with a good knowledge of computers and especially the internet. Based on this background, the study hypothesised that:

H5 Customers' demographic characteristics (age, level of education and level of income) have a significant impact on their attitude towards cell phone banking.

In order to test this hypothesis, a number of three sub-hypothesis were developed. These are:

H5a: Younger customers have a significantly more positive attitude towards cell phone banking than older customers.

H5b: Customers with high levels of education have significantly more positive attitude towards cell phone banking than customers with lower levels of education.

H5c: Customers with high levels of income have significantly more positive attitude towards cell phone banking than customers with lower levels of income.

3.6 Subjective norm

Subjective norm underscores the influence of the social environment on behaviour. It is defined as a person's perception that most people who are important to him/her think that he/she should or should not perform the behaviour in question (Ajzen & Fishbein 1980:5). This subjective norm construct suggests people often act based on their perception of what others think they should do, and their intentions to adopt a behaviour is potentially influenced by people close to them. Davis et al. (1989:986) note that in some circumstances, people might use a technology to comply with others' mandates or expectations rather than their own feelings and beliefs. Hartwick and Barkit as quoted by Taylor and Todd (1995:149) found subjective norm to be important in affecting the adoption of an innovation in its early stages of introduction when users have only limited direct experience from which to develop attitude. Hence the study we formulated a hypothesis that:

H6 There is a significant positive relationship between subjective norm and attitude towards cell phone banking.

Based on the literature reviewed, there are many possible factors that may influence intentions to use cell phone banking. Figure 1 presents the research model used in this study. According to the model, attitude is a critical variable that affects the intention to start/continue using electronic banking. Attitude towards electronic banking is influenced by a potential user's assessment of the perceived usefulness, perceived ease of use, trust, subjective norm and demographic characteristics of the potential user.

4 METHODOLOGY

This study was cross-sectional in nature and data was collected from individual customers of the four major retail banks (Absa, Standard Bank, First National Bank and Nedbank) in South Africa through mall intercepts. These banks were chosen because they provide cell phone banking services to their customers and currently represent the largest percent share of the banking sector. The study was undertaken in the Province of Gauteng. Gauteng was chosen because it is known as the country's economic powerhouse, responsible for over a third of South Africa's GDP (CGLGSA 2011:6). It also ranks among the main centres in the world hierarchy of urban areas and it is the most urbanised province in South Africa (Shilowa 2005:Internet). The province is a microcosm of South Africa due to its cosmopolitan nature.

Due to the lack of a readily available sampling frame, the study made use of non-probability sampling in the form of convenience sampling in order to select respondents. The respondents were selected on the basis of the fact that they happened to be in designated malls where the survey took place as well as on their willingness to co-operate with the researcher. A total of six malls were targeted across Johannesburg and Pretoria. Deliberate efforts were taken to ensure that the respondents included people of different racial, gender and age groups.

Beri (2007:198) noted that one general approach that is followed with respect to non-probability samples is to get as large a sample as possible within the constraints of time and money. Others (Malhotra 2007:338; Zikmund & Babin 2010:465) noted that using a sample size similar to those used in previous studies is also very useful in estimating a suitable sample size. A total of 394 usable responses were collected in this study. This was in line with the time and financial limitations of the research as well as sample sizes used in previous related studies.

A self-completing questionnaire consisting of two main sections was used to collect data. The first section consisted of questions relating to the background characteristics of the respondents and their use of internet and cell phone banking services. The second section consisted of questions relating to customer's attitudes to and perceptions of internet and cell phone banking. A five point Likert scale ranging from 1 = strongly disagree to 5 = strongly agree was used to measure attitude and perceptions. Note that ordinal scales were used in measuring age, level of education and level of income. A cover letter was attached to the questionnaire, the purpose of which was to explain the research as all about, provide instructions on how to complete the questionnaire and to assure them of their anonymity. The focus of this paper is on cell phone banking. Out of the 394 respondents, 198 (50.3%) were users of cell phone banking while 196 (49.7%) were non-users. Of the 196 non-users, 70 were users of internet banking while 126 were neither using internet nor cell phone banking.

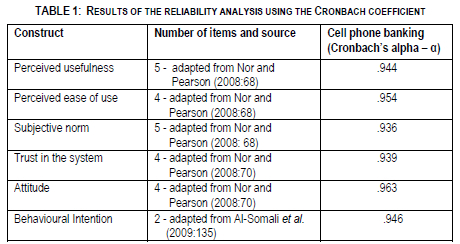

All the scales used in the study were tested for reliability before being used in the main analysis. The Coefficient alpha, commonly known as Cronbach's alpha (a), was used to measure reliability. According to Al-Dujaili (2011:11), the Cronbach's alpha (a) is widely believed to indirectly indicate the degree to which a set of items measures a single, uni-dimensional construct. The results of the reliability test for the measures used in this study are presented in Table 1. The results show that all the measures used in this study were highly reliable.

The collected data was analysed using version 18 of SPSS (Statistical Package for Social Sciences). A number of statistical techniques were used to analyse the data, including descriptive statistics, correlation analysis, independent sample t-testing and regression analysis.

5 RESULTS AND DISCUSSION

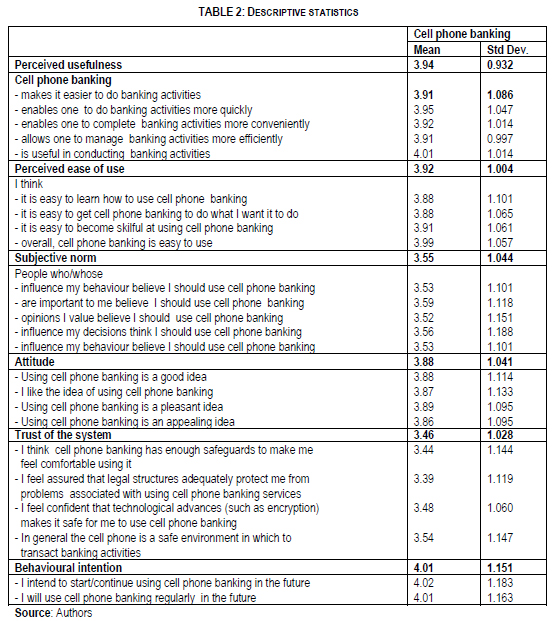

Table 2 presents descriptive statistics relating to customers attitude and perceptions towards cell phone banking. According to the results the respondents had positive perceptions regarding usefulness and ease of use of cell phone banking. The overall mean values for the two constructs were 3.94 and 3.92 respectively. All the items used to measure each construct had mean values of near 4 which means that respondents agreed with each of the statements. To be specific, customers felt that cell phone makes it easier to do banking activities, enables one to do banking activities more quickly, conveniently and efficiently and that it is useful in conducting banking activities. They also felt that cell phone banking is easy to learn, easy to get it to do what they would want it to do, easy to become skilful at using it and in general easy to use.

This finding on perceived usefulness of cell phone banking corroborates the observation made by Frangos (2009:157) that the primary reason that people use e-banking is because they find it useful in performing transaction. Banks can actually use findings on both perceived usefulness and ease of use in their marketing campaigns aimed at converting non-users into users by outlining the benefits associated with cell phone banking as well as emphasising the fact that it's a simple system to learn and be skilful at using. As noted by Ndubisi (2006:18) customers likelihood of systems uptake is higher where the system's usage requires less technical skills and operational efforts.

Results on subjective norm showed that although in general respondents did not disagree with the fact that other people exert influence on their decision to use or not use cell phone banking, the extent to which the other people do this is generally limited. This is evidenced by the fact that the overall mean for subjective norm is 3.55 which shows that respondents barely agreed. All the items used to measure subjective norm also had mean values that showed very low levels of agreement with the statements. This shows that a significant number of the customers make such decisions independent of their social acquaintances.

The results also show lower levels of trust in the system of banking using cell phones. The overall mean value for trust in the system was 3.46. The highest mean value on item to item basis was 3.54 while the lowest was 3.39. To be specific, respondents barely agreed that the cell phone is a safe environment in which to transact banking activities (3.54) and that they feel confident that technological advances (such as encryption) make it safe for them to use cell phone banking (3.48). They were however neutral of the fact that cell phone banking has enough safeguards to make them feel comfortable using it (3.44) and that they feel assured that legal structures adequately protect them from problems associated with using cell phone banking services (3.39). Lack of higher levels of trust in cell phone banking is an issue of concern to banks as customers become wary of using services that they consider risky. Suh and Han (2002:248) who noted that e-services are inherently risky from the viewpoint of security as vital information can be stolen by hackers and that this results in customers having low levels of trust in the system.

Despite lack of high levels of trust in cell phone banking, the results show that the respondents has positive attitude towards cell phone banking. The overall mean value for attitude was 3.88. In general, respondents considered cell phone banking to be a good (3.88), likable (3.87), pleasant (3.89) and appealing idea (3.86). The respondents were also positive in terms of their behavioural intentions to start or continue using cell phone banking as well as intentions to use cell banking regularly in the future. The mean value for behavioural intention was 4.01.

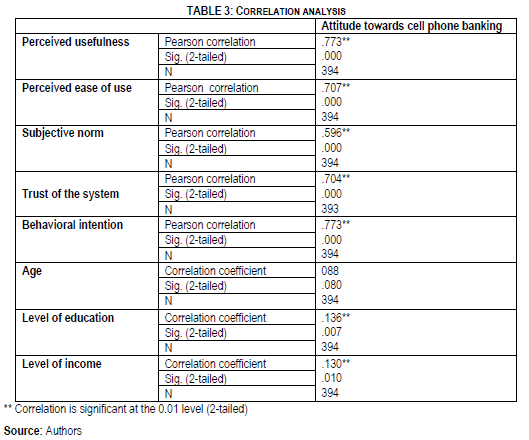

After looking at the results of the descriptive analysis, further analysis of the data was conducted in order to test the relationship between the different variables as stipulated in the research model. Pearson product moment correlation was used to test hypothesis 1, 2, 3, 4 and 6 while Spearman's Rho correlation was used to test hypothesis 5. It is important to note that, in interpreting correlation results, the coefficient is used to measure the size of an effect and that the sign (either positive or negative) of the coefficient must be considered.

According to Uys and Gwele (2005:96), or negligible, while a correlation between 0.1 and 0.3 (or between -0.3 and -0.1) is considered small/weak; a correlation between 0.3 and 0.5 (or -0.5 and -0.3) indicates a moderate effect and a correlation coefficient of 0.5 or larger (or < -0.5) is considered large. Jackson (2011:82) puts it succinctly by explaining that the closer the correlation is to 1 (or - 1), the stronger the relationship between two variables is. Table 3 presents the results of the correlation analysis.

According to the findings high levels of correlation were found between attitude and intentions to start or continue using cell phone banking; perceived usefulness of cell phone banking as well as perceived ease of use. This is consistent with propositions with the Technology Acceptance model as well as empirical findings by researchers such as Al-Somali et al. (2009) and Lee (2009). The results also showed high levels of correlation between attitude and trust of the system of banking using cell phone. This shows that customers with high levels of trust in the system had also high levels of positive attitude towards cell phone banking.

Significant but weaker relationship was, however, found between subjective norm and attitude. This shows that the influence that other people exert on individual customer's decision to use cell phone banking is not strongly in line with attitudes towards cell phone banking. Taylor and Todd (1995:167) observed that subjective norm affects adoption of an innovation more in its early stages of introduction. This they attributed to the fact that most consumers lack direct experience with the product from which to develop attitudes. Since cell phone banking was first introduced in South Africa 7 years ago, one can expect the influence of subjective norm to be lower as some of the customers have had personal experience with the product and do not need anyone to convince them.

The results on the relationship between attitude and demographic factors showed no significant relationship between age and attitude towards cell phone banking. Very weak relationship was found between attitudes and level of education as well as level of income. The findings thus show that demographic factors are not good predictors of attitude towards cell phone banking.

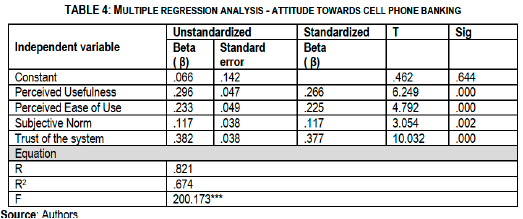

Multiple regression analysis was conducted in order to examine the extent to which perceived usefulness, perceived ease of use, trust and subjective norm help predict attitude towards cell phone banking. It is important to note that demographic variables were not entered into the regression model. This is mainly due to two reasons: the correlation analysis already showed low levels of correlation between demographic factors and attitude, and demographic variables were not measured using an interval scale.

According to these results as presented in Table 4, it can be noted that overall trust is the most important factor in explaining attitude towards internet banking. This is evident from the fact that trust has the highest standardised beta coefficient value (.489) compared to all the other predictors. Subjective norm was found to be the least important factor of the four considered in the model. It has the lowest standardised beta coefficient value (.051) compared to all other predictors. Additionally, its t-statistic is not significant at a less than .05 level of significance. Note that the R2 value of the model shows that, when combined, the four predictors have a high explanatory power as they are able to account for 67.4% of the variance in attitude towards cell phone banking.

6 CONCLUSION AND RECOMMENDATIONS

From the findings of this study it can be concluded that customers have positive attitude towards cell phone banking as well as positive intentions to start/continue using the service. They perceive cell phone banking as useful and easy to use. They, however, have low levels of trust in the system of banking through use of cell phone. The influence that other people exert on the decision to use cell phone banking is rather limited. In terms of how the different factors work together to influence attitude towards cell phone banking and intentions to use it, it can be concluded that perceived usefulness, perceived ease of use as well as trust are more important factors that influence attitude towards cell phone banking usage. Of these three factors, trust has the highest impact on attitude. Demographic factors on the other hand are not good predictors of attitude towards cell phone banking.

The findings in this study have wider implications on efforts by banks aimed at attracting more customers to take up cell phone banking and increase returns on their investment. It is imperative that banks understand the factors that affect and/or contribute to attitude towards cell phone banking services within their environmental context. For example 'perceived usefulness1 and 'perceived ease of use' are factors which are widely held to affect attitude towards adoption of new information technologies including e-banking systems. In this study, however, trust emerged as the most significant factor that influences attitude towards cell phone banking.

This suggests that banks must devote significant efforts in examining ways in which they can enhance trust. Banks can do this by, among other things, implementing measures to reduce electronic fraud as well as communicating to their customers the steps they are taking to enhance the security of e-services. This will serve to keep customers informed and may bolster their trust of the system.

This study also found that although differences in attitude may exist between customers in different demographic groups, demographic factors in general are not strongly related to attitude towards cell phone banking. These findings could be valuable to the banking industry, especially in relation to debunking myths surrounding the relationship between demographic factors and attitude towards e-banking. Thus, banks can use this information to begin to create marketing strategies to target all customers and, by doing so, increase their market share in e-banking.

While the study has major implications on understanding factors affecting adoption of cell phone banking, it is not without limitations. Specifically the fact that the study made use of non-probability sampling method using a sample of respondents targeted at shopping malls may limit the generalisability of the findings to the wider population of Gauteng. Further studies can therefore be conducted in other parts of the country and /or probability sampling methods can be used in order to test for any differences that may be there and improve on the generalisability of findings.

REFERENCES

AL-DUJAILI MAA. 2011. Knowledge systems: A catalyst for innovation and organisational learning support in decision making for efficiency improvement. International Journal of Human Resource Studies, [ Links ]

ALLEN J, CLARK R & HOUDE J. 2008. Marketing structures and diffusion of electronic banking. [Internet: www.ftc.gov/be/seminardocs/0221clark.pdf; downloaded on 15-12-2011. [ Links ]]

AL-SOMALI A, GHOLAMI R & CLEGG B. 2009. An investigation into the acceptance of online banking in Saudi Arabia. Technovation, 29:130:144. [ Links ]

AL-SUKKAR AS. 2005. The application of information systems in the Jordanian banking sector: a study of acceptance of internet. A published doctoral degree thesis. Wollongong: University of Wollongong. [ Links ]

AJZEN I & FISHBEIN M. 1980. Understanding attitudes and predicting social behaviour. New York: Prentice-Hall. [ Links ]

ALVAREZ M. 2010. Global financial services IT spending to grow 2.9% in 2010. [Internet: www.atelier-us.com/e-business-and-it/article/global-financial-services-it-spending-to-grow-29-in-2010; downloaded on 15-4-2010. [ Links ]]

BANKINGTOPIA. 2012. Benefits of e-banking. [Internet: http://bankingtopia.com/benefits-of-e-banking/;downloaded on 14-02-2012. [ Links ]]

BERI GC. 2007. Market research. New Delhi: Tata McGraw-Hill. [ Links ]

CAMPBELL D & FREI F. 2010. Cost structure, customer profitability, and retention implications of self-service distribution channels: evidence from customer behavior in an online banking channel. Management Science, 56(1):4-24. [ Links ]

CGAP. 2010. Micro finance and mobile banking: the story so far. [Internet: http://mmublog.org/wp-content/files_mf/fn62_rev2.pdf; downloaded on 15-02-2012. [ Links ]]

CGLGSA. 2011. South Africa: country overview. [Internet: www.cglgsa.org/SouthAfricacountryoverviewFeb2011.pdf; downloaded on 15-11-2011. [ Links ]]

CHAU P & HU P. 2001. Information technology acceptance by individual professionals: a model of comparison approach. Decision Sciences, 32(4):699-719. [ Links ]

DAVIS FD. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3):319-340. [ Links ]

DAVIS FD. 1993. User acceptance of information technology: system characteristics, user perceptions and behavioral impacts. Man-Machines Studies, 38:475-487. [ Links ]

DAVIS FD, BAGOZZI RP & WARSHAW PR. 1989. User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8):982-1003. [ Links ]

DELAFROOZ N, PAIM L & KHATIBI A. 2011. A research modelling to understand online shopping intention. Australian Journal of Basic and Applied Sciences, 5(5)70-77. [ Links ]

DOCSTOC. 2012. E-banking - a complete project. [Internet: http://www.docstoc.com/?doc_id=15875336&download=1; downloaded on 15-02-2012. [ Links ]]

EAGLY AH & CHAIKEN S. 1993. The psychology of attitude. Fortworth, TX: Harcourt Brace Jovanovich. [ Links ]

FRANGOS CC. (editor). 2009. Qualitative and Quantitative methodologies in the economic and administrative sciences. 2nd edition. Athens: Technological Educational Institute of Athens. [ Links ]

GAO Y. 2005. Web system design and online consumer behaviour. London: Idea Group. [ Links ]

GOLDSTUCK A. 2005. The hitchhiker's guide to going wireless: a South African handbook. Cape Town: Juta. [ Links ]

GRAY J. 1996. ATMs and EFTPOS swallow branches. The Australian Financial Review, 15(11):57-68. [ Links ]

GROSSMAN T & LIVINGSTONE JL. (editors). 2009. The portable MBA in finance and accounting. 4th edition. New Jersey: Wiley. [ Links ]

HOSEIN NZ. 2010. Internet banking: understanding consumer adoption rates among community banks. [Internet: www.aabri.com/LV2010Manuscripts/LV10038.pdf: downloaded on 25-3-2010. [ Links ]]

IAN S. 2009. Online banking and the role of CRM: the impact of internet as online business platform on CRM (study of online banking in the UK). A published master degree thesis. Norderstedf: Auflage. [ Links ]

INTERNATIONAL TELECOMMUNICATION UNION (ITU). 2009. African telecommunication/ICT indicators 2008: at cross roads. [Internet: www.itu.int/ITU-D/ict/publications/africa/2008/index.html; downloaded on 23-07 2010. [ Links ]]

JACKSON SL. 2011. Research methods - a modular approach. Belmont: Wadsworth/Cengage Learning. [ Links ]

KARJALUOTO H, MATTILA M & PENTO T. 2002. Factors underlying consumer attitude formation towards online banking in Finland. International Journal of Bank Marketing, 20(6):261-272. [ Links ]

KIM T, ADELI H, FANG W, VILLALBA JG, ARNETT KP & KHAN MK. (editors). 2011. Security technology. Berlin: Springer. [ Links ]

KING WR & HE J. 2006. A meta-analysis of the technology acceptance model. Information and Management, 43(6): 740-755. [ Links ]

LAUKKANEN T & PASANEN M. 2008. Mobile banking innovators and early adopters: how they differ from other online users? Journal of Financial Services Marketing, 13(2):86-94. [ Links ]

LEE M. 2009. Factors influencing the adoption of internet banking: an integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce and Application, 8 (3):130-141. [ Links ]

MALHOTRA NK. 2007. Marketing research: an applied orientation. New York: Prentice Hall International. [ Links ]

METEHAN T & YASEMIN Z. 2011. The effect of web vendor trust on Turkish online shoppers buying behaviour. Australian Journal of Business Management Research, 1(6): 87-96. [ Links ]

METZGER M. 2004. Privacy, trust and disclosure: exploring barriers to electronic commerce. Journal of Computer Mediated Communication, 9(4): 39-53. [ Links ]

NDUBISI NO. (editor). 2006. Marketplace behaviour of Malaysian consumers. Kuala Lumpur: Emerald Group. [ Links ]

NOR KM & PEARSON JM. 2008. An exploratory study into the adoption of internet banking in a developing country: Malaysia. Journal of Internet Commerce, 7(1):29-73. [ Links ]

PIKKARAINEN T, PIKKARAINEN K, KARJALUOTO H & PAHNILA S. 2002. Consumer acceptance of online banking: an extension of the technology acceptance model. Internet research, 14(3):224-235. [ Links ]

PORTER CE & DONTHU N. 2006.Using the technology acceptance model to explain how attitudes determine Internet usage: The role of perceived access barriers and demographics. Journal of Business Research, 59:999-1077. [ Links ]

SATHYE M. 1999. Adoption of internet banking by Australian consumers: an empirical investigation. International Journal of Bank Marketing, 17(7):324-334. [ Links ]

SHARMA D. 2009. India's leapfrogging steps from brick-and-mortar to virtual banking: prospects and perils. The Icfai Journal of Management Research, VIII (3):45-61. [ Links ]

SHILOWA M. 2005. Welcoming address delivered at the founding of Congress of the United Cities and Local Governments of Africa. [Internet: www.info.gov.za/speeches/2005/05051712451003.htm; downloaded on 23-02-2009. [ Links ]]

SUH B & HAN I. 2002. Effect of trust on customer acceptance of internet banking. Electronic Commerce Research Applications, 1:247-263. [ Links ]

ROBISON J & MOORE W. 2012. Attitudes and preference in relation to internet banking in the Caribbean. [Internet:www.cavehill.uwi.edu/bdoffice/documents/AttitudesandPreferncesinRelationtoInternetBankingintheCaribbean.pdf; downloaded on 15-02-2012. [ Links ]]

TAYLOR S & TODD PA. 1995. Decomposition and crossover effects in the theory of planned behavior: A study of consumer adoption intentions. International Journal of Research in Marketing, 12:137-155. [ Links ]

UYS L & GWELE NS. 2005. Curriculum development in nursing: process and innovations. New York: Reutledge. [ Links ]

WADA F & ODULAJA GO. 2012. Assessing cyber crime and its impact on e-banking in Nigeria using social theories. African Journal of Computing & ICT, 4(3):69-82. [ Links ]

WORLD INTERNET STATISTICS. 2010. World internet usage statistics, the big picture. [Internet: www.internetworldstats.com/stats.htm; downloaded on 17-2-2011. [ Links ]]

WORLD WIDE WORX. 2011. Cell phone overtakes PC for banking. [Internet: http://www.worldwideworx.com/?p=224; downloaded on 15-02-2012. [ Links ]]

YANG Z & FANG Z. 2004. Online service quality dimensions and their relationships with satisfaction: a content analysis of customer reviews of securities brokerage services. The International Journal of Bank Marketing, 15(3):302-326. [ Links ]

YOUSAFZAI SY, PALLISTER JG & FOXALL GR. 2003. A proposed model of e-trust for electronic banking. Technovation, 23:847-860. [ Links ]

YU J & GUO C. 2008. An exploratory study of ubiquitous technology in retail banking. Academy of Commercial Banking and Finance, 8(1):7-12. [ Links ]

ZIKMUND WG & BABIN BJ. 2010. Exploring marketing research. Mason: Thomson Higher Education. [ Links ]