Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.9 no.1 Meyerton 2012

RESEARCH ARTICLES

Factors inhibiting the South African automotive industry from fully contributing to local economic development

MJ NaudeI; JA Badenhorst-WeissII

IUniversity of Kwazulu-Natal

IIUNISA

ABSTRACT

This article reports on the findings of research that investigates supply chain factors that hinder the South African automotive industry from fully contributing to local economic development. In order to identify these factors, a literature review and empirical research were undertaken. The literature study includes an overview of local economic development and supply chain management. This is followed by a report on an empirical study consisting of two phases in the form of semi-structured interviews with participants at leading automotive assembly plants and an opinion survey done among automotive component manufacturers.

The interviews revealed that automotive assembly plants have to import too many parts as there is a lack of local suppliers in the markets. This situation is exacerbated by the fact that existing local suppliers are scattered across the country. The opinion survey revealed that the financial stability of suppliers, the high cost and inefficiencies of South African ports and the availability of skills are factors that prevent the South African automotive industry from fully contributing to local economic development. These factors are mainly caused by rapid developments in supply chain management, technological advancements, globalisation, intensified competition and the recent global economic recession. If handled correctly, these factors present opportunities for local economic development.

Key phrases: automotive industry, local economic development, supply chain management

1 INTRODUCTION

The automotive industry has consistently been one of the most global of all industries. The industry is a key sector of the economy of every major country in the world (Humphrey & Memedovic 2003:2). Globally, the automotive manufacturing sector requires the employment of about nine million people directly in producing the vehicles and the automotive components that go into them. This comprises over 5% of the world's total manufacturing employment. It is estimated that each direct automotive job supports at least another five indirect jobs, resulting in more than 50 million jobs globally owed to the automotive industry. For example, many people are employed in automotive-related manufacturing and services, as the automotive sector uses the goods of many industries such as steel, iron, aluminium, glass, plastics, carpeting, textiles, computer chips and rubber (AIEC 2011:12).

The automotive industry consists not only of original equipment manufacturers (OEMs) such as Toyota, Ford, BMW, but also a network of suppliers of parts (automotive component manufacturers or ACMs) at various levels. The different parties (OEMs and ACMs) form supply chains and together they have an impact on the local economy. To be internationally competitive, the focus is no longer on the management, survival, growth and competitiveness of individual organisations, but on entire automotive supply chains (BERA 2004:1).

In South Africa, the automotive industry contributes significantly to the local and national economy. The industry exports large volumes of components and completely built vehicles to various countries around the world. It is therefore imperative that the industry stays internationally competitive to prevent other international competitors from easily penetrating the South African market (AIEC 2011:6). For example, in 2010 the automotive industry contributed 6.17% of the GDP and exported 11.9% (to the value of R585 billion) of the total exports from South Africa, mainly to China, USA, Japan, Germany and the United Kingdom (AIEC 2011:7). However, the local content in vehicles produced in South Africa is only 35% (Pitot 2007:1). Increasing the local content - parts sourced by OEMs from ACMs - can have an impact in increasing employment opportunities and local economic development (LED). The development and growth of the local ACM supplier base is therefore important.

South Africa compares favourably to other developing countries with regard to infrastructure, raw material availability, emerging market cost advantages, flexible production capability and government support through the Motor Industry Development Programme (MIDP) and the new Automotive Production Development Plan (APDP). Despite the advantages mentioned above, the South African motor industry is not competitive. South Africa experiences problems such as high labour costs, poor infrastructure and dated technology. This is particularly true with regard to South African ACMs who compete against cheap imported parts and in some cases counterfeit parts (Moodley, Morris & Barnes 2001:12; Vithlani 1999:16). According to Venter (2009:1), on average, the South African automotive industry is 30% to 40% more expensive than China and India. The automotive industry contributes and has a potential to contribute more to LED. In South Africa, the main objectives of LED are employment creation, poverty alleviation and improvement in the quality of life (Hindson & Vicente 2005:5).

The purpose of the article is to provide a perspective on factors inhibiting the international competitiveness of the South African industry and thus their contribution to LED. The article is based on a descriptive and exploratory study, including review of existing literature, informal semi-structured interviews with OEMs and an opinion survey among ACMs.

2 LITERATURE REVIEW

This section includes an overview of the operating environment of the automotive industry, LED and supply chain management.

2.1 The operating environment of the automotive industry

The main role players in the automotive supply chains are ACMs, OEMs, original equipment suppliers (OESs) and the automotive retail and aftermarket (Naude 2009:3). Of these, OEMs are global companies and by default are the most powerful players in the automotive industry. As a result key decisions about South African automotive businesses are made in Europe, the USA and Japan (AIEC 2011:15).

Currently the automotive industry is experiencing the effects of change in an accelerated way due to the globalisation of production (Applegate & Collins 2005:1). The cost-cutting strategies by the OEMs, and consequently those of their suppliers are driven by certain strategic underlying global trends. Most notably the challenges are induced by market realities and consumer demands, mergers and acquisitions, global production overcapacity, outsourcing and sourcing strategies, new technology and innovation (Morris, Donnelly & Donnelly 2004:129). The increasing trend towards environmentally friendly products - low or zero emission rates of vehicles - adds to these challenges.

These realities have important implications for the automotive industry especially in developing countries such as South Africa. Developing countries are increasingly becoming integrated into the global economic supply chains of global role players. Not only do these countries have to deal with the direct impact of the major global trends but also they have to compete with each other for sourcing and outsourcing opportunities (Barnes & Morris 2008:32). It is within this fast changing environment that many developing countries, such as South Africa, are seeking to create for themselves a role as producers of vehicles and automotive components. When the domestic market is not large enough to absorb their production capacity, the focus is on exports. As indicated in AIEC (2011:12), the total automotive industry exports (motor vehicles and components) from South Africa increased nearly seventeen-fold from R4.2 billion in 1995 to R96.5 billion in 2010. This export growth has been made possible by major investments in best-practice assets and state-of-the-art equipment, skills upgrading, productivity gains and upgrading of the whole automotive supply chain (AIEC 2011:12).

Despite these investments in automotive supply chains, South Africa is not competitive compared to China and Europe (Venter 2009:1). Therefore one could question whether the South African industry's weak competitive position is caused by uncontrollable factors - global developments, logistics costs, raw material prices and currency movement - or whether the investments in the automotive supply chain were not sufficient.

2.2 Local economic development

The following are some definitions of LED by various authors:

"LED is a process where the local actors shape and share the future of their territory. We could define it as a participatory process that encourages and facilitates partnership between the local stakeholders, enabling the joint design and implementation of strategies, mainly based on the competitive use of the local resources, with the final aim of creating decent jobs and sustainable economic activities." (Canzanelli 2001:9)

"LED is the process by which public, business and non-governmental sector partners work collectively to create better conditions for economic growth and employment generation. The aim is to improve the quality of life for all."(World Bank Urban Development Unit 2003:4)

"LED is a process managed by municipalities (local government) in accordance with the economic component of their constitutional mandate to promote social and economic development." (Scheepers & Monchusi 2002:81)

From these definitions it is clear that government, businesses and the community each have a role to play in LED. LED can be viewed from a national and regional perspective and for the purpose of this article, the authors look at LED from a national perspective.

2.2.1 The importance of LED strategies

Rodrigues-Pose and Tijmstra (2005:40) identify potential social and economic benefits of LED as follows:

•LED combines an economic and social aspect, and aspires to achieve the aims of creating sustainable growth and addressing the needs of the poor in the areas in which it functions.

• As LED strategies are generally developed by the local government and a wide range of local players, they can assist in empowering the local residents and using local resources sensibly.

• The strategies enable local residents to adopt a more pro-active attitude towards their own future - even if they are living in a region that has no or little input or control over the economic activities in that area.

• The active involvement of a variety of players not only helps to develop a stronger local society, but can also play a role in making local institutions more transparent and accountable.

• Successful LED strategies can assist in creating an environment that stimulates the creation of employment opportunities.

These benefits may not come about if policies are poorly designed or implemented. For example, if a small group of role players dominates the policy-making process, LED strategies could be adapted to benefit the interests of a select few, rather than the interests of society as a whole (Rodriguez-Pose & Tijmstra 2005:40).

The importance of the contribution of the automotive industry to the South African economy and their contribution to LED is clear. The question that then arises is:

What inhibits the South African automotive supply chain from fully contributing to LED?

2.3 Supply chain management

Various definitions of supply chain management applicable to the automotive industry can be found (Heizer & Render 2008:434; Hugo & Badenhorst-Weiss 2011:57; Stevenson 2009:512). Naude (2009:60) describes supply chain management in the automotive industry as follows:

"The management of the process of manufacturing motor cars, including the integration of activities taking place among a network of suppliers and customers that purchase the inputs needed on each level of the supply chain, to be transformed into parts, modules and finished automotive motor cars, and deliver these to customers through a dealership. Inputs include information from customers, raw materials, equipment, machinery, labour and finances. The operations process transforms inputs into outputs in the form of finished goods and services that are delivered to the customer on the next level of the supply chain. This process is continued on all levels of the supply chain until the final product (motor car) reaches the final customer."(Naude 2009:60)

In view of the pressure put on OEMs by government to increase local content, the South African automotive industry can make a positive contribution to LED by extending and improving the local ACM supplier base. However, the solution to this problem is not simple, since it deals with complex issues.

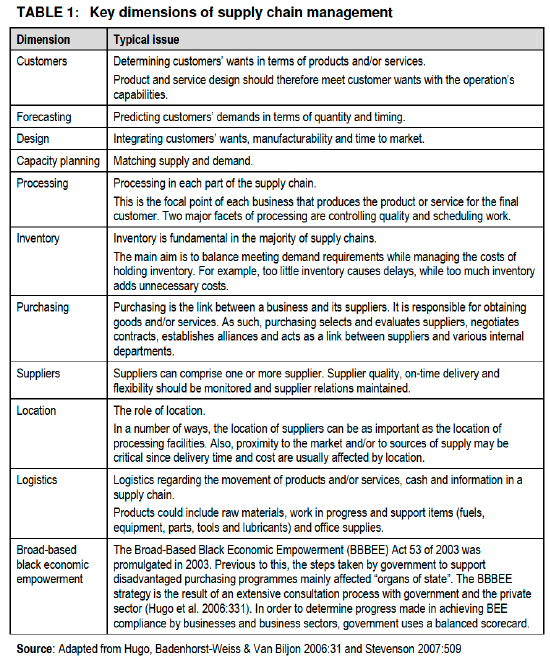

2.3.1 Key dimensions of supply chain management

Several dimensions of supply chain management that could inhibit the South African automotive industry to contribute fully to LED need to be explained. Table 1 lists some key dimensions and provides a brief explanation of each.

2.4 Methodology

2.4.1 Research methodology

In order to determine what inhibits the South African automotive supply chain from fully contributing to LED, empirical research was conducted. This empirical research consisted of two phases. This study is by nature descriptive and exploratory, and contains quantitative and qualitative aspects - known as triangulation.

The first phase of the primary data collection for the research consisted of semi-structured interviews with senior managers at two leading OEMs in the country. These interviews were conducted in order to obtain insight and identify possible supply chain problems facing ACMs in the country from the OEMs1 perspective. The knowledge obtained from the literature and the qualitative interviews was then used to design an opinion survey questionnaire.

The questionnaire consisted of two sections, namely section A and B. Section A consisted of the company profile and section B of a number of questions - using a seven-point Likert response format, varying from 1 (to a lesser extent) to 7 (to a greater extent) - identified from the literature review and the semi-structured interviews. The questionnaire also made provision for qualitative inputs in the form of an optional motivation for respondents' answers. The questionnaire was used as a tool to identify supply chain problems facing ACMs, to consider the reasons for and impact of these problems, and to seek solutions.

The second phase of the primary data consisted of sending out the questionnaire to all ACMs who were members of the National Association of Automotive Component and Allied Manufacturers (NAACAM). About 60% of the largest and most important ACMs are members of NAACAM. A total of 178 questionnaires were sent out and a response rate of 30.6% was achieved. Only the survey findings relating to problems that inhibit LED are dealt here.

2.4.2 Primary data analysis

Each interview was transcribed directly from digital voice recordings in a report format, after which it became possible to review, compare and combine the findings. The researcher checked the transcripts for accuracy and correctness by comparing them to the digital voice recordings.

Completed survey questionnaires were coded and the responses captured in Excel and exported into SPSS 17. Descriptive and mean response ratings were used to determine the significant supply chain problems of automotive supply chains.

3 ANALYSIS AND DISCUSSION OF THE FINDINGS

3.1 Interviews with the OEMs

The initial aim of the study was to determine the supply chain management problems that prevent automotive supply chains from operating efficiently to compete internationally. In this article only the problems that inhibit LED are dealt with. The participants indicated that they experience the following problems: a lack of local supplier base; the geographic location of suppliers; Transnet; JIT and supplier stability. Each of these is discussed in more detail.

3.1.1 Lack of local supplier base

There is a shortage of local ACM suppliers and because of this OEMs need to import many of their components requirements. According to the interviewees, this shortage of local ACMs suppliers is caused by a lack of technology uptake, global supply capability and cost-competitiveness. The components that are imported from Europe and South-East Asia are used to assemble motor cars in South Africa, and a significant percentage of these motor cars are then exported back into Europe. This results in additional cost. That is why ideally, more components should be sourced locally.

In many cases it is just not economically viable for a global supplier to localise production in South Africa. Suppliers with a global presence can concentrate volume production of specific components in one or two locations (Mondragon, Lyons, Michaelides & Kehoe 2006:551). A critical mass of components would need to be manufactured and supplied to all the OEMs in order for a global supplier to set up such a plant in South Africa. The challenge for the ACM is that OEMs use many different components and parts. For example, with their volumes of sales per car model, Toyota is one of the most attractive customers from the perspective of the ACMs. However international suppliers would not localise manufacture to South Africa while there are other growth areas in the world (Eastern Europe, India, China, and South America) that can compete favourably with South Africa.

This challenge is confirmed by Maile (2008:8) who acknowledges that the business environment for ACMs has changed in recent years, as OEMs are now sourcing components on a global basis. The benefit of this strategy is that OEMs are able to source components at the lowest possible cost. In order to survive, South African ACMs need to compete with the best in the world from a cost and quality perspective. In terms of LED - for example in Pietermaritzburg and Durban - increasing the local ACM supplier base presents an opportunity for entrepreneurs and therefore for LED.

3.1.2 Geographic location of suppliers

From the OEMs' perspective, it would be ideal for suppliers to be located close to their respective OEM plants. This would make it much easier to manage their supply chains. However the supplier base within South Africa is scattered across the country with its greatest concentration being in Port Elizabeth and Gauteng. Therefore the challenge in terms of the whole logistics supply chain is to determine how many days' finished inventory, and work in process inventory should be held. Increased stock holdings obviously affect overall costs.

This problem is complex and there are no simple solutions. The industry has grown organically over a considerable time, hence the present geographic spread of the suppliers. In South Africa, OEMs are based in Pretoria, East London, Port Elizabeth and Durban. As the supply and the manufacturing volumes in South Africa are small, it is not feasible for local ACMs to set up small plants all over the country, close to the OEMs, as this would affect their viability. Ideally, if OEMs were producing sufficient volumes, they would want their suppliers to re-establish plants in their respective areas. However, this supplier park concept would only bring about the required synergies and cost benefits if all suppliers were established within the supplier park, and not just a few of them.

In terms of LED, Toyota is deemed to be the largest automotive manufacturer in South Africa, and this presents opportunities for entrepreneurs in Durban and Pietermaritzburg to break into the market. Local entrepreneurs could possibly produce parts under licence agreement and explore the possibility of supplying the export market. The local automotive industry is able to manufacture a range of quality products at competitive prices because of lower input cost as South Africa has plenty of the raw materials that are needed to produce components. ACMs also have a competitive advantage from a flexibility viewpoint because they are labour intensive and are able to produce lower volumes compared to other countries where production is set up for long high-production runs (DTI 2003:41).

3.1.3Transnet

From the interviews, it was found that South Africa's ports are considered to be the most expensive in the world. However, OEMs' day-to-day working relationship with the port authorities is very good with both parties working together and supporting each other as much as possible. The interviewees further indicated that South Africa's rail infrastructure is not ideal, but they acknowledged that the infrastructure is being upgraded. Currently, OEMs use rail to transport just 10% of their motor cars, with the remaining 90% and all parts being transported by road.

3.1.4Just in time (JIT)

One of the interviewees indicated that a JIT environment requires a stable external business environment where there are no outside disruptions. He further commented that one challenge is the 'abnormalities' that arise within South Africa. The challenges for other automotive plants around the world are relatively small and tend to occur infrequently, such as disruption due to the forces of nature (e.g. typhoons or earthquakes). 'Abnormalities' that occur in South Africa are more frequent and the country regularly faces many disruptions such as for example, electric cable theft, load-shedding of electrical power by the supply authority and industrial action. These challenges inhibit LED. It is therefore suggested that for LED to be successful, solutions to these problems need to be found.

3.1.5Supplier stability

Supplier stability was identified as a challenge. Maxton and Wormald (2004:227) acknowledge that the financial stability of a supplier is essential to automotive manufacturers. An OEM being let down by an insolvent supplier can bring the production system to a standstill.

3.1.6Supplier capacity

Many suppliers tend to over-promise in terms of what they can deliver. An example given was of one supplier to three OEMs. The supplier was unable to meet the demand for a particular component to all its customers. It was only when one OEM found an alternative source of supply that the supplier was able to supply the remaining OEMs timeously.

3.2 Results of the questionnaire survey

3.2.1 Significant supply chain problems that inhibit or provide opportunities for LED

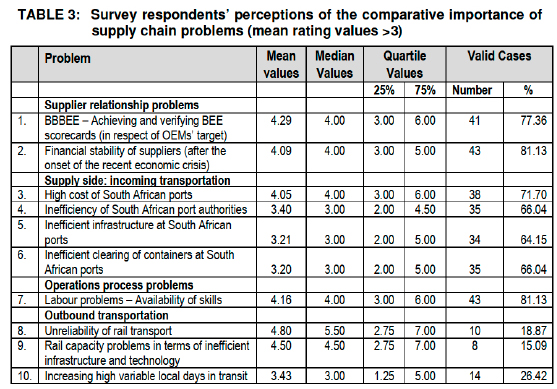

The findings of the opinion survey among ACMs to determine the problems they experience in the automotive supply chain are discussed in this section. Only the supply chain problems that have a negative effect on LED are dealt with. Table 2 lists the more important external problems where a mean rating score >3 for importance was found among survey respondents.

3.2.2Supply side: supplier relationship problems

BBBEE: In terms of BBBEE (mean rating: 4.29) the findings indicate that OEMs expect ACMs to achieve BBBEE targets which they cannot meet. This will continue to make things difficult for ACMs. ACMs should communicate this problem and seek assistance from the supplier development division of the Automotive Industry Development Centre.

Financial stability of suppliers: The financial stability of the suppliers was expected to be a problem (a mean rating: 4.09) due to the condition of the automotive industry -globally and locally - after the Global Financial Crisis of 2008. Governments in other countries took measures to avoid the collapse of their automotive industries and injected large amounts of financial resources into these industries. This did not happen in South Africa. The banking sector in South Africa was also reluctant to allow credit facilities to those companies within the motor industry affected by the economic crisis and in fact cut back on the credit extension to these companies.

From an LED perspective, the automotive industry could ask the government to intervene and provide relief to those suppliers in the automotive supply chains who are in financial difficulties as a result of the recent economic crisis. This could take the form of low interest-bearing loans until the economic situation improves.

3.2.3Supply side problems: incoming transportation

The high cost of South African ports (mean rating: 4.05) ranked as the highest supply transport problem. This finding is in line with an international port benchmarking study undertaken by the Automotive Industry Development Centre and the Technical Action Group Logistics, who set up a task group (Demont 2007:1). A basket of ports that are used most commonly by OEMs in South Africa was chosen and analysed for the study. The task group found that South African Port Operations (SAPO) and National Ports Authority (NPA) container tariffs are exceeded only by those of the North American Port Authority (Demont 2007:v). In addition, South Africa is the only country where ports still charge cargo dues - this is the main factor that causes South African ports to be globally uncompetitive. Cargo dues are used to build up cash reserves for infrastructure investments (Demont 2007:21).

Dave Powell (in Venter 2009:1) lamented high port charges in South Africa, citing US$821.6 to move one forty-foot container, as compared to Argentina at US$470, Brazil at US$364 and China at US$80:

"We have engaged Transnet on this over the years, but it has not delivered the desired results. We need a better partnership with Transnet. They are not addressing our needs. This is not intended as a confrontation, but we need faster progress on the issue." (Venter 2009:1)

Clearly the high cost of South African ports inhibits LED and cargo dues should be significantly reduced or eliminated in line with practice at other international ports. A joint approach by NAACAM, National Association of Automobile Manufacturers South Africa (NAAMSA) and the executive team in charge of Transnet port operations could endeavour to motivate for the elimination of cargo dues and stress the strategic importance of this for profitability and ongoing viability for the survival of the automotive industry in South Africa.

In terms of the inefficiency of the South African port authorities and the clearing of containers at South African ports, a mean survey rating of 3.40 and 3.20 respectively were found. The respondents indicated in their comments that cargo was sometimes stopped for customs inspections, even though the responding ACMs were importing the same product in all consignments on a continual basis. This resulted in increased lead times.

Another comment was that South African ports are inefficient and congested compared to their Asian and European counterparts. This congestion is not only caused by high volumes of containers but also by the poor work ethic and attitude of the workers. It is clear that the inefficiencies at Transnet have a negative effect on industries and individual businesses and consequently inhibit LED in South Africa.

It is recommended that Transnet seriously address these problem areas by employing world-class consultants to assist the company with global benchmarking and understanding the true level of the inadequacy of its operation. A key outcome of such an intervention would be a significant improvement in the operation performance.

3.2.4 Problems in internal operations

Availability of skills (mean survey rating: 4.16) was a significant problem indicated by ACMs. Respondents indicated that the work ethic and attitude of the workforce in South Africa is problematic, and that this needs to change. Both skilled and unskilled staff do not have the urgency to execute their tasks efficiently and effectively, which results in lower productivity, when compared with the labour in regions such as Asia. Consequently, many manufacturers resort to producing parts in the Far East as it is often cheaper. This importation of cheaper parts from the Far East translates into increased competition for local manufacturers, congestion at South African ports and ultimately, increased unemployment in the home country.

Supplier development in the automotive industry has been given a R23.5-million boost through a partnership between the Department of Trade and Industry (DTI) and the United Nations Industrial Development Programme (UNIDO). These monies are earmarked to improve the current business partnership programme run by UNIDO and the Automotive Industry Development Centre (AIDC) (SA Automotive Week 2009:Internet). Since its inception the programme has been implemented at 45 companies and more than 4 000 shop floor workers have received training on basic lean-engineering and world-class manufacturing principles. The recipients of this project are Tier 1 and Tier 2 component suppliers in the SA automotive industry (SA Automotive Week 2009:Internet).

From the above it is clear that ACMs are important and that there are opportunities for ACMs to improve. This type of programme should be expanded and promoted to make an even larger impact.

It was recommended (Naude 2009:280) that on an operational level, ACMs should increase their focus on training and developing their employees through the various industry SETAS, by effectively utilising the 1% training levy. In this way the training levy becomes more of a developmental tool used by the ACMs rather than the current situation where some ACMs see the levy as just another 'tax'. At a national level, it is suggested that government:

• should look at ways of developing skills and improving, revitalising and extending programmes such as the Automotive Experiential Careers Development Programme;

• should introduce other apprenticeships training programmes;

• should improve the training at technical colleges; and

• should focus on the training on auto industry skills.

These recommendations will assist LED in various ways. For example, there will be a local pool of skills available and entrepreneurs setting up new businesses will not have to consider 'importing' skills.

3.2.5 Distribution side problems: outbound transportation

Rail transport is not a popular mode of transport in the automotive industry. Less than 20% of the responding ACMs use it, but those that use rail transport indicate significant problems with it. The unreliability and inefficiency of rail transport (mean ratings each 4.80) were mentioned as significant problems. Responding ACMs noted that road transportation is the only real option open to ACMs as rail is so inefficient that it is not considered to be a viable option for transporting components and meeting JIT customer demands.

4 CONCLUSION

As the business environment has changed over the last number of years, there is pressure on businesses in the South African automotive industry to compete with the best in the world from a cost and quality perspective in order to survive. Automotive assemblers and component manufacturers face many supply chain problems that inhibit them from fully contributing to LED. These problems are mainly the direct result of rapid developments in supply chain management, technological advancements, globalisation, intensified competition and the recent global economic recession.

There is pressure on OEMs from government to increase local content drastically. The extension and improvement of the local ACM supplier base is therefore important and presents opportunities for LED in South Africa. The role of ACMs in both the competitiveness and the survival of the automotive industry has never been as prominent as now. ACMs are the main contributors to employment in the automotive industry and they can make a great contribution to the cost-competitiveness of the South African automotive industry.

The efficient management of the supply chain is regarded as the way to improve cost-effectiveness and customer value in today's increasingly competitive business world. The philosophy of supply chain management is to work with suppliers and customers to eliminate wasteful activities in the organisation as well as between suppliers and customers and to seek maximum value through cooperation and relationships. The research findings indicate that the factors inhibiting the South African automotive industry from fully contributing to LED are: a lack of a local supplier data base; the geographic location of suppliers; the non-reliability of rail transport; and the high cost of South African ports. For LED to be successful, solutions to these factors need to be found.

In conclusion, this article provides a number of insights, but these should be viewed in terms of the following limitations: (1) only component manufacturers who are members of NAACAM were included in the study and therefore the findings cannot be generalised to all ACMs in South Africa; and (2) the focus of the initial study was not on LED and not all factors that inhibit the South African automotive industry from fully contributing to LED have been identified.

The article makes a contribution in addressing the dearth of published research on the topic and in showing how the results included in the article can assist parties in the automotive supply chain to focus their attention on factors that may be within their control. If these factors are resolved this could result in increased LED. In other words, if the factors that inhibit the South African automotive industry to fully contribute to LED are handled correctly, these factors could present opportunities for LED.

REFERENCES

APPLEGATE LM & COLLINS EL. 2005. Covisint (A): The evolution of a B2B marketplace. Harvard Business School Press: Boston MA. [ Links ]

AIEC see Automotive Industry Export Council. [ Links ]

AIEC. 2011. Automotive Export Manual South Africa. Arcadia: AIEC. [ Links ]

BARNES J & MORRIS M. 2008. Staying alive in the global automotive industry: what can developing economies learn from South Africa about linking into global automotive value chains? The European Journal of Development Research 20(1): 31-55. [ Links ]

BERA see Business & Economics Research Advisor. [ Links ]

BUSINESS & ECONOMICS RESEARCH ADVISOR. 2004. The automotive industry. Modern Global Automobile Industry 2, Fall. [Internet: http://www.loc.gov/rr/business; downloaded on 2007-06-16]. [ Links ]

CANZANELLI, G. 2001. Overview and learned lessons on Local Economic Development, Human Development and decent work. Universitas Working Papers. [Internet: http://www.ilo.org/public/english/universitas; downloaded on 2011-06-11]. [ Links ]

DEMONT D. 2007. International port benchmarking study. Automotive Industry Development Centre (AIDC) for Technical Action Group Logistics. [ Links ]

DTI see Department of Trade and Industry. [ Links ]

DEPARTMENT OF TRADE AND INDUSTRY. 2003. Current developments in the automotive industry. 7th Report. DTI: Pretoria. [ Links ]

HEIZER J & RENDER B. 2008. Principles of operations management. 7th edition. Upper Saddle River, NJ: Prentice Hall. [ Links ]

HINDSON D & VICENTE V. 2005. Whither LED in South Africa? A commentary on the policy guidelines for implementing local economic development in South Africa, March 2005. Hindson Consulting: Whether LED? [ Links ]

HUGO WMJ & BADENHORST-WEISS JA. 2011. Purchasing and Supply Management. 6th edition. Pretoria: Van Schaik. [ Links ]

HUGO WMJ, BADENHORST-WEISS JA & VAN BILJON EHB. 2006. Purchasing and Supply Management. 5th edition. Pretoria: Van Schaik. [ Links ]

HUMPHREY J & MEMEDOVIC O. 2003. The global automotive industry value chain: what prospects for upgrading by developing countries. Vienna: United Nations Industrial Development Organisation (UNIDO). [ Links ]

MAILE G. 2008. Possible future of the South African component industry. National Association of Automotive Component and Allied Manufacturers (NAACAM) Newsletter, August 2007. [ Links ]

MAXTON GP & WORMALD J. 2004. Time for a model change: re-engineering in the global automotive industry. Cape Town: Cambridge University Press [ Links ]

MONDRAGON AEC, LYONS AC, MICHAELIDES Z & KEHOE, DF. 2006. Automotive supply chain models and technologies: a review of some latest developments. Journal of Enterprise Information Management, 19(5):551-562. [ Links ]

MOODLEY S, MORRIS M & BARNES J. 2001. Unlocking value in the "New Economy": the implications of B2B E-Commerce for South African apparel and automotive component firms. [ Links ]

MORRIS D, DONNELLY T & DONNELLY T. 2004. Supplier parks in the automotive industry. Supply Chain Management: An International Journal, 9(2): 129-133. [ Links ]

NAUDE MJA. 2009. Supply chain management problems experienced by South African automotive component manufacturers. Unpublished doctoral thesis. University of South Africa (Unisa): Pretoria. [ Links ]

PITOT R. 2007. NAACAM and the automotive component industry. South African Automotive Year Book. Definitive reference, statistics & data on the South African motor industry. Section 2: component manufacturing. 10th edition. Durban: Balgair Publications. [ Links ]

RODRIGUEZ-POSE A & TIJMSTRA S. 2005. Local Economic Development as an Alternative Approach to Economic Development in Sub-Saharan Africa. Unpublished World Bank report. [Internet: http://siteresources.worldbank.org; downloaded on 2011-06-11]. [ Links ]

SA AUTOMOTIVE WEEK. 2009. 11 October. Boost for suppliers. [Internet: www.saaw.co.za/News/09-10-11; downloaded on 2010/10/10]. [ Links ]

SCHEEPERS T & MONCHUSI P. 2002. Implementing the Law Relating to Local Economic Development in the Struggle against Poverty. Seminar Report No. 14. Johannesburg: Konrad Adenauer Stiftung. [ Links ]

STEVENSON WJ. 2007. Operations management. 9th edition. Boston: McGraw-Hill. [ Links ]

STEVENSON WJ. 2009. Operations management. 10th edition. Boston: McGraw-Hill. [ Links ]

VENTER I. 2009, 7 October. SA auto industry could be dead in 7 years, warns VWSA. Engineering News. [Internet: http://www.engineeringnews.co.za/article; downloaded 2010/10/10]. [ Links ]

VITHLANI H. 1999. The economic impact of counterfeiting. Organisation for Economic Co-operation and Development. [Internet: http://www.oecd.org/dataoecd; downloaded 2011/06/19]. [ Links ]

WORLD BANK URBAN DEVELOPMENT UNIT. 2003. Local Economic Development; LED Quick Reference. Bertelsman Foundation, Guetersloh; UK DFOD, London. The World Bank: Washington, D.C. [ Links ]