Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.8 no.1 Meyerton 2011

RESEARCH ARTICLES

South African automotive policy intervention (1924-2008): the case of an intelligently designed automotive support structure

N LamprechtI; S Rudansky-KloppersII; JW StrydomIII

INational Association of Automobile Manufacturers of South Africa

IIDepartment of Business Management, UNISA

IIIDepartment of Business Management, UNISA

ABSTRACT

A cause-effect relationship exists between government developmental automotive policy and the operations and market structure that apply to the domestic automotive industry. The overall regulatory regime in South Africa is very important in determining the actions of the domestic automotive firms. In the pre-Motor Industry Development Programme (MIDP) period, the South African government implemented a vast, complex set of tariffs and quantitative restrictions to encourage the development of a domestic automotive industry in recognition of the benefits of an automotive sector to the economy. In 1994, the small domestic market and the relatively large number of vehicle manufacturers operating in South Africa prompted a re-examination of the automotive sector, in line with the country's trade and economic liberalisation, to ensure its future viability. The lessons learnt from the automotive policy evolution contributed to the design of the MIDP. The new Automotive Production Development Programme (to be introduced in 2013) aims to double vehicle production to 1.2 million units by 2020. The aim will reflect a quantum leap in terms of the policy planning, processes and technologies used by the domestic industry currently - which can be ascribed to previous policy interventions by the South African government.

Key phrases: automotive policy, developing countries, export programmes, government, international competitiveness, light vehicles, Motor Industry Development Programme

1 INTRODUCTION

Historically, the motor manufacturing industry tended to be confined to developed countries such as the United States of America (USA) and the United Kingdom (UK). While the leading players, on a national basis, exported the finished product to other markets, the decentralisation of operations capability, particularly in the component area, was rare. Although certain motor industry giants owned manufacturing capability in countries other than their respective countries of origin, in general the development of the motor industry in developing countries was largely confined to assembly operations.

In general governments, driven by the desire to increase the local content of motor vehicles assembled in their countries, provided a powerful driving force that established a significant degree of localised automotive component manufacture. In many cases, these locally produced automotive components substituted progressively more of the imported automotive components. South Africa followed a programme of import substitution similar as what was adopted in other developing countries (Black & Bhanisi 2006:5; Byers 1990:3). The evolution of South African automotive policy is, hence, central to an understanding of the developmental path of the domestic automotive sector and the role played by government intervention in this process.

This article explores the cause-effect relationship that existed between the applied governmental automotive policy and the vehicle production and market structure in South Africa up to 2008. Secondary research by means of an extensive literature study has been used in this article. It also looks forward to review the vision to double vehicle production in South Africa to 1.2 million units by 2020. In order to do this, the article investigates why intelligently designed automotive policy support is needed to improve the competitiveness of the South African automotive industry internationally, without which vehicle manufacturing cannot be sustainable in South Africa.

The South African-based original equipment manufacturers (OEMs) have to compete for new model generation investments and export business against fierce competition from sister companies around the world. In common with other countries, the strategies of a few dominant OEMs, mainly operating from the Triad countries of North America, Japan and Western Europe, have a major impact on the developments of the domestic automotive environment. Vehicle development, design and international marketing functions, and thus the decision-making power, reside with the OEM parent companies. Consequently, OEM parent companies' decisions are generally developed by cost-parity exercises to determine where to allocate export-oriented, new-generation model investments. South African OEMs thus require all the support they can acquire in order to compete for such investments, as all have sister subsidiaries in closer proximity to the main markets.

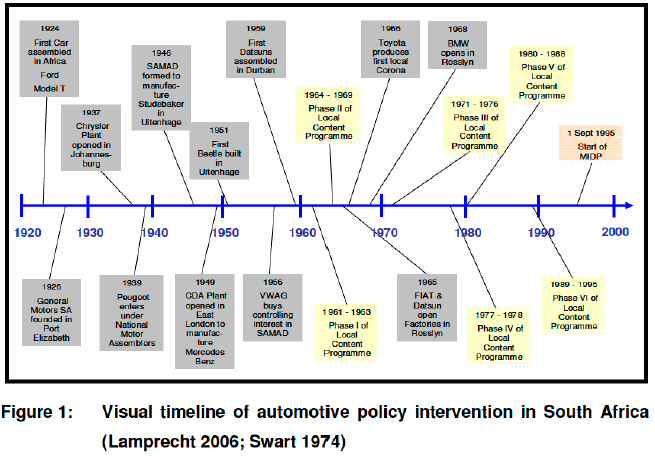

In the period leading up to the MIDP, the initial phase of automotive industry protection, lasting until 1961, was one of classic import substitution favouring simple vehicle assembly for the domestic market. High protective tariffs on imported vehicles fostered the development of an industry of small assembly plants. Relatively wide varieties of models in small volumes at high cost and with low local content were assembled. Running from 1961 to 1995, the domestic automotive industry was governed by six local content programmes (see Figure 1). Up to 1995 highly protective import duties and local content requirements were in place aimed at fostering the development of the domestic automotive industry.

Under the various local content programmes, the South African-based OEMs adapted and responded to policy requirements to avoid paying excise penalties on their domestic operations. Although Phase VI of the local content programmes introduced a new direction by counting exports as local content, light vehicle exports remained subdued. A wide variety of models, manufactured in small volumes at uncompetitive prices, as well as restrictive licence agreements, impacted negatively on light vehicle exports.

The MIDP was implemented to assist the domestic automotive industry's gradual integration into the global automotive environment. In essence, the aim of the MIDP was to provide incentives to rationalise vehicle production and, consequently, automotive component production. This rationalisation entailed the production of a smaller range of products in order to achieve economies-of-scale benefits, mainly from exports. The MIDP progressively exposed the domestic automotive industry to the pressures of international competition and the need for efficiency improvements. It was initially intended that the programme should end in 2002, but it was extended twice during the 1999 and 2002 reviews.

The 2005 MIDP Review aimed to provide longer-term policy certainty up to and beyond 2012 and to foster the momentum and sustainable future growth of the automotive sector in South Africa, which is seen as a developing country. In 2008, a new programme in the form of the Automotive Production Development Programme (APDP) was announced for introduction in 2013. The vision for the APDP is to double vehicle production from the 2006 level to 1.2 million units by 2020. The domestic industry's effectiveness in attaining this objective will depend on how well the new policy regime in the form of the APDP will be implemented.

2 VEHICLE MANUFACTURING AND THE DEVELOPING VERSUS DEVELOPED COUNTRY DEBATE

Broadly defined, a developing country is a country making an effort to change and improve its economy with the goal of raising its performance to that of the world's more advanced nations (Czinkota & Ronkainen 2007:116). The key reason for developing countries to promote a vehicle assembly industry is to encourage the development of a domestic automotive components industry. This, in turn, will create jobs, reduce the effect on the balance of payments, stimulate technological capability and produce a spill-over effect into other economic sectors (Black & Bhanisi 2006:3; Humphrey & Memedovic 2003:19).

Market growth in developing countries can sometimes be higher than in the Triad countries of North America, Japan and Western Europe, often as a result of higher population growth, and trade restrictions often forced companies to build local factories in order to access the local market. With the increasing trend toward global trade liberalisation, many formerly closed countries have opened their borders to imports. This has encouraged many more automotive firms to consider the emerging markets (Gillespie, Jeannet & Hennessey 2004:203-204).

In a South African context, the country manifestly lacks the attributes of a big emerging market, is not on the periphery of a major market and is not part of a significant trading block as far as the global automotive industry is concerned. In addition, South Africa lacks homegrown firms capable of driving a successful independent strategy (Black & Bhanisi 2006:3-5). These attributes, or rather the lack of them, have implications for the way South Africa is perceived by the major global decision makers and how they choose to position South Africa within their global supply chain networks. In terms of its market size, population, income level and economic growth rate, the country is at the lower end of what is required by the global motor vehicle manufacturers (OEMs) in respect of their expansion strategies for allocating production and increasing market share.

This article investigates the importance of South African government intervention via automotive policy in steering the development of the domestic automotive industry and the way forward in view of the announcement of the new automotive policy regime to replace the MIDP from 2013 onwards. Firstly, it is necessary to understand the evolution in automotive policy development.

3 THE EVOLUTION OF SOUTH AFRICAN AUTOMOTIVE POLICY

The origins of South Africa's inward-focused automotive industry developmental path can be traced back to the introduction of tariffs during the early part of the 20th century. In the pre-MIDP period, the South African government followed global trends and implemented a vast, complex set of tariffs and quantitative restrictions to encourage the development of a domestic automotive industry. The government at the time recognised the direct and indirect benefits of an automotive sector for the economy. Figure 1 reveals a visual historic timeline of government automotive policy intervention and industry actions in the domestic market.

3.1 IMPACT DERIVED FROM SOUTH AFRICA'S AUTOMOTIVE POLICY EXPOSITION FROM 1924 UP TO 1961

The initial phase of automotive industry protection, lasting until 1961, was one of classic import substitution favouring simple assembly for the domestic market. Ford, in 1924, and General Motors, in 1926, were the first wholly-owned subsidiaries of overseas parent companies to establish a manufacturing presence in the domestic market. The coastal allocation allowed for the easy importation of components (ITAC 1949:5). Production grew from 13 000 units in 1924 and peaked at 57 500 passenger cars and commercial vehicles before World War II in 1939.

The growth in the market led to a third assembly plant, National Motor Assemblers Ltd, in Johannesburg in 1939. The import and assembly of vehicles came to a standstill during World War II and was resumed again in 1946. After World War II, government targeted the automotive sector as an economic growth area. In 1947, the import duties were increased to 25% and 30% ad valorem (an import duty calculated as a straight percentage of the import price) on cars where the higher duties applied to the higher valued cars (ITAC 1949:63). Sales doubled in 1947 and reached 86 118 units in 1948. A high rate of imports led to problems with the balance of payments and import control was instituted through the granting of monetary quotas.

The boom in sales and the import control measures led to the establishment of another four assembly plants in the country. Sales averaged 36 000 units per annum between 1950 and 1954 due to the import control quotas and increased to 50 000 units per annum when the quota was increased. With the elimination of control measures in 1957, sales increased to 100 000 units for the first time ever (Swart 1974:164). Relatively wide varieties of models in small volumes at high cost and with low local content were produced. Production was aimed solely at the domestic market. South African assembly plants were kept isolated from the global production networks of the parent companies except as markets for completely knocked down (CKD) packs (unassembled original equipment component packs used to assemble the vehicles) (Black & Bhanisi 2006:5). In 1960, South Africa produced 120 000 vehicles, more than any other developing country. The local content level was only 20% (Black 2007:73).

The automotive sector was seen to have both growth potential and synergies with other economic sectors and recommendations were made to develop the automotive industry in South Africa. These recommendations included an increase in the duty on passenger cars and light commercial vehicles; levying an excise duty on domestically assembled vehicles and CKD kits; providing additional protection for domestic component manufacturers; and creating rebate provisions subject to local content requirements (ITAC 1960:85).

3.2 PHASE I OF THE LOCAL CONTENT PROGRAMME - 1961 TO 1963

By 1960, the South African economy was increasingly constrained by a shortage of foreign exchange (Black 2002:5). Phase I of the local content programme was introduced with the objective to increase local content in mass from 15 to 40% (ITAC 1988:4). The ad valorem duty on imported motor cars was set at 35% plus an additional percentage up to a maximum of 100%, depending on the value and the weight of the car. The level of excise rebates on motor cars varied between 15% (for a local content of between 25% and 30% by weight) and 75% (for a local content of more than 70%). Components generally attracted a duty of 20% ad valorem (ITAC 1965:2). Table 1 reveals the impact of government intervention in the form of Phase I of the local content programme.

In order to implement government's objective of higher local content, manufacturers of passenger cars had to undertake large-scale expansions to plant and equipment requiring a high level of capital expenditure. Independent component manufacturers also seized the opportunity to cater for the needs of the vehicle manufacturers. The result was that industry started to develop on a broad front and substantially contributed to the upsurge in the country's economy.

Generally, a close correlation exists between new vehicle sales and the GDP, hence, record new vehicle sales of 143 373 units were achieved with 50 basic models being assembled in the domestic market (ITAC 1965:7; ITAC 1966:7). A large number of these sales were on credit (Swart 1974:164). The main competition for the domestic vehicles at that stage stemmed not from imported cars, but from other domestically assembled vehicles with a lower local content. The position vis-ä-vis a competitor was broadly determined by the degree to which the cost premium attached to the higher priced domestically sourced components was offset by the additional excise rebates for the higher local content (ITAC 1965:2). An inherent risk associated with using weight as a criterion for increasing local content was that all the OEMs thus focused on the heaviest automotive components first (Swart 1974:241, 243). Hence, South Africa built the heaviest vehicles in the world.

3.3 PHASE II OF THE LOCAL CONTENT PROGRAMME - 1964 TO 1969

Phase II of the local content programme was introduced to increase the nominal local content in mass from 45% in 1964 to 55% in 1969. This was equivalent to a 50% net local content, as redefined when calculating the actual or true South African content. The determination of the net local content was complicated and required government approval for certain parts, sub-assemblies or materials as local content (ITAC 1965: 22; ITAC 1966:11; ITAC 1988:4). Table 2 reveals the impact of government intervention in the form of Phase II of the local content programme.

Government realised that the financial incentives would not have been sufficient to bring about the progress and adopted import control measures. The import control measures related to a quota on the import requirements of those models not achieving the required local content level under the programme and acted as a brake on the ability for the "assembled models" to compete with the "manufactured models" in the market (ITAC 1966:3,4). If import control measures had not been adopted, considerably more drastic protective measures and larger excise rebates would have been required for the attainment of the same result (ITAC 1969:4).

Government concluded that a volume of 20 000 units per annum should be considered as a minimum output that could be produced on an economic basis. Only two OEMs at the time supplied more than 20 000 cars per annum with a further two approaching that mark. In government's view, this meant that only a limited number of OEMs with a relatively high market share found the incentive scheme attractive (ITAC 1966:6, 7). In 1964, monetary measures introduced by the authorities were seen as the stimulus for the significant increase in new vehicle sales (ITAC 1966:6). In 1966, however, credit restrictions and an increase in the excise duty led to a drop of 10% in new vehicle sales. In 1968 sales nevertheless passed the 200 000 unit mark for the first time to reach 229 897 units. In view of the longer time frame, Phase II of the local content programme contributed to higher local content and higher employment levels but as a consequence also to increasingly heavier vehicles.

3.4 PHASE III OF THE LOCAL CONTENT PROGRAMME - 1971 TO 1976

At the beginning of 1971, Phase III of the local content programme was introduced with a minimum net local content of 52%, which was set to increase to 66% on 1 January 1977 (ITAC 1988:4). Table 3 reveals the impact of government intervention in the form of Phase III of the local content programme.

Phase III reflected a period of large capital expenditure, expansion of employment, acquisition of further expertise, and general development of the domestic industry dictated by the need for compliance with the minimum local content requirements. The operating plants of the 13 OEMs in South Africa assembled 39 models and were supplied by 300 automotive component manufacturers. In 1975, the GDP contribution of the automotive sector was 3.3% (ITAC 1977:8,33,70). Improved economic conditions between 1970 and 1975 resulted in the period for purchasing an average-priced car being reduced from 29 weeks to 27 weeks based on the improved net income of an average worker's earnings over this period (ITAC 1977:20).

An analysis of 16 models, representing small, medium and large cars without customs duty, reflected a weighted average price disadvantage ranging between 7.3 and 57.5% compared to the free on board (FOB) values of imported cars (ITAC 1977:73). In view of the impact of the higher oil prices, which had quadrupled to over US$12.00 by the end of 1974, the country's economic growth rate slowed down. Heavier cars, resulting from increased local content based on mass, resulted in increased fuel consumption during a period of higher oil prices. When new vehicle sales declined, the profit margins of the OEMs were under severe pressure indicating the sensitivity of the industry to volume changes (ITAC 1977:12; ITAC 1988:4; Williams, 2007).

3.5 PHASE IV OF THE LOCAL CONTENT PROGRAMME - 1977 TO 1978

Phase IV of the local content programme comprised a two-year standstill phase. This was to assist industry in consolidating its position after the severe narrowing of profit margins during the previous three years (ITAC 1988:4). The period from mid 1974 to 1976 was marked by severe economic upheavals throughout the Western world, including in South Africa. Worldwide inflation and the oil crisis were accompanied by price increases in steel and other materials and, in South Africa in particular, in sharp increases in wages and salaries, rise in interest rates and restrictive monetary and fiscal policies. The sales duty on motor vehicles introduced in 1969 at a rate of 5% was raised to 10% in 1970 and 12.5% in 1977 (ITAC 1977:52).

The rapid increases in costs, as well as the large investments required by Phase III, which had to be undertaken in conditions of rising costs of capital, resulted in serious financing and cash-flow difficulties for the industry (ITAC 1977:41). The GDP at constant 2005 prices for 1977 was -0.1% and for 1978 was 3.0%. Total new vehicle sales in the domestic market declined to 256 801 units in 1977 and reached 303 695 units in 1978 (NAAMSA). During this period, disinvestments by General Motors, taken over by Delta Motor Corporation via a management buy-out, and Ford, selling its shares to its holding company, Samcor, occurred owing to the United Nations led sanctions against South Africa (Gelb 2004:41-45).

3.6 PHASE V OF THE LOCAL CONTENT PROGRAMME - 1980 TO 1988

Phase V of the local content programme was introduced with a minimum net local content of 66% by mass, in respect of motor cars, and 50% by mass, in respect of light goods vehicles and minibuses (ITAC 1988:7). Table 4 reveals the impact of government intervention in the form of Phase V of the local content programme.

After having achieved record new vehicle sales in 1981, sales declined in succeeding years to levels below those of 1969 due to recessionary conditions, escalating domestic inflation and the significant devaluation of the rand. Crude oil prices also more than doubled, increasing from $14 in 1978 to $35 per barrel in 1981 (Williams 2007). Government's reasoning for higher local content related to, among other things, exerting more control over engineering development, vehicle specifications and a longer life of models in the country (ITAC 1977:85).

In order to achieve the higher local content level set for Phase V, the tendency was towards higher technology components being incorporated in the manufacturing process. The depreciation of the domestic currency at the time resulted in increased import prices and industry's reliance on imported tooling and designs, technologically sophisticated plant and machinery, as well as high-value automotive parts, contributed to the large outflow of foreign exchange (Damoense & Alan 2004:264).

Local sourcing of these components required large investments by the domestic industry. On average, the prices of motor cars increased by about 95 % from 1982 to 1986. General sales tax also increased from 4% in 1981 to 12% in 1985, while the number of OEMs decreased from 16 to seven and the number of models produced from 53 to 20. Certain OEMs began to lengthen the life of their existing models to increase the tooling amortisation per unit (ITAC 1988:8,27,63,64). All seven OEMs recorded losses in 1985 (ITAC 1988:26,63,64). In line with improved economic conditions in 1987 and 1988, however, new vehicle sales improved, enhanced by vehicle price increases below the inflation rate and a more stable exchange value of the rand (ibid 988:28).

3.7 PHASE VI OF THE LOCAL CONTENT PROGRAMME - 1989 TO 1995

In 1989, Phase VI of the local content programme was introduced and involved a radical change in the calculation of local content based on value as opposed to mass. Phase VI encouraged local OEMs to increase local content from an industry average estimated at 55% at the inception of the programme to 75% (including exports) by 1997. Phase VI sought to reduce the foreign exchange used by the vehicle manufacturing industry by about 50% over the period 1989 to 1997. Local content was defined as the ex-works price less foreign currency used, including profit and overheads. This meant that pricing could be used to create local content.

The import duty on aftermarket parts and components for motor vehicles was increased to 50% ad valorem and on passenger cars to 100% ad valorem, whether or not assembled. Exports were allowed and accounted for as part of the local content value. An excise duty of 40% on the value of locally assembled vehicles applied, of which up to 37,5% was rebated based on the local content level (ITAC 1989:26-33). A budgetary constraint was placed on Phase VI in that the programme had to be self-funded. Thus the ordinary excise duty and excise duty rebate had to be equal (ITAC1992:2). On 1 January 1994, there was a reduction of the import duty on passenger cars to 80% ad valorem, while the payment of a 15% surcharge on passenger cars and 5% on commercial vehicles was exempted. On 1 January 1995 there was a further reduction of the import duty to 75% ad valorem on passenger cars from 1 January 1995 (ITAC 1994:1). Table 5 reveals the impact of government intervention in the form of Phase VI of the local content programme.

The most beneficial element of the Phase VI programme appeared to be the incentive it gave to the development of an automotive export orientation. Exports under Phase VI received an effective subsidy in the form of a rebate of the excise duty of 50 cents in the rand. All exports were channelled via the OEMs and automotive component exporters had to negotiate the extent of the subsidy that they received. Automotive component manufacturers usually received 60 to 70% of the rebate or 30 to 35 cents per rand of exports. Rising exports gave the OEMs greater flexibility in their sourcing arrangements. If a domestic OEM was able to reduce its net consumption of foreign exchange by exporting, it was able to achieve a far greater degree of freedom with the local content it used on an individual model basis. Thus, calculations were corporate rather than model based (Black & Bhanisi 2006:7,10).

Samcor, which manufactured Ford and Mazda vehicles, exported vehicles from South Africa in 1991, Volkswagen in 1992 and BMW in 1994 (Damoense & Alan 2004:264). Price comparisons of passenger cars between South Africa and Germany, Japan, the USA, the UK and Australia reflected a South African price disadvantage of up to 72%. The lowest priced car category prices were competitive but in the higher priced categories the price inelasticity enabled OEMs to achieve higher margins (IDC 1993:15-17). Value added tax (VAT) was introduced in South Africa on 30 September 1991 at a rate of 10%. This was increased to 14% on 7 April 1993, impacting on new vehicle sales during that period.

On the surface, the programme appeared to favour those companies that were subsidiaries of overseas OEM parent companies. The foreign-owned subsidiaries could move goods, tooling and technologies backwards and forwards with greater ease than the wholly South African-owned OEMs. However, it did not address the major factor impacting on the scale of production in the automotive component sector and the proliferation of makes and models in the domestic market. In fact, the impact was rather the reverse. By increasing the flexibility of automotive component sourcing and hence reducing protection on automotive components, but at the same time maintaining the high nominal protection level on CBUs (completely built-up units), the effective rate of protection on CBUs increased sharply under Phase VI. The effective rate of protection for the industry was calculated to be in excess of 400%, which led predictably to an increase in the variety of models and makes being assembled domestically in spite of the stagnant market (Black 1998:6; Black & Bhanisi 2006:6,7,10; MITG 1994:31).

Phase VI came in for heavy criticism, resulting in frequent changes adding to the atmosphere of uncertainty. In October 1992, the Motor Industry Task Group (MITG) was appointed to re-examine the programme and the future development of the South African automotive industry (ITAC 1995:5). The MITG's recommendations led to the formulation of the Motor Industry Development Programme (MIDP).

4 THE MOTOR INDUSTRY DEVELOPMENT PROGRAMME

The MIDP, implemented on 1 September 1995, was the next and major stage in government intervention. The programme continued the direction of Phase VI and entrenched the principle of export complementation. However, it went a step further by abolishing local content requirements and introducing a tariff phase down (Black 1998:6). The critical component of the MIDP was the introduction of an import-export complementation scheme, which required that, for firms to gain competitive access into the small domestic market, they would need to export, either directly or indirectly, through their value chain. This was achieved by an administrative regime that was not overburdensome for users. It provided a relatively blunt series of incentives rather than the elaborate, intricate and often contradictory programmes used in other parts of the world that frequently had a series of adverse unintended consequences.

Moreover, by reducing the incentives over time, the MIDP represented a moving frontier, undermining the solidification of rents or economic waste, which has often impacted negatively on selective industrial policy. Initiatives such as the investment incentive in the form of the Productive Asset Allowance (PAA), implemented in 2000, provided incentives for capital goods imports, which are targeted at export markets and which favour economies of scale.

The main elements of the MIDP, therefore, were falling protection and export assistance derived from the ability to offset import duties. While nominal duties on imported vehicles remain moderately high, the ability to rebate import duties by exporting enables importers to bring in vehicles at lower effective rates of duty. Import-export complementation also enables assemblers to use import credits to source components at close to international prices, so declining nominal protection on vehicles has to some extent been offset by reduced protection for components. This means that there was still a significant incentive to assemble locally. The objective of the MIDP is to provide high quality affordable vehicles, provide sustainable employment and, through increased production, contribute to economic growth.

In 2008, all the South African-based OEMs operating under the MIDP were 100% foreign owned and had been fully integrated into the global networks of their parent companies. The MIDP's success in terms of growing employment, attracting massive local and overseas investments, rationalising the number of locally produced models, vastly improving production-capacity utilisation and improving overall operational efficiencies has generally been regarded as positive by industry spectators.

Since the implementation of the programme in September 1995, the South African automotive sector has grown in stature to become the leading manufacturing sector in the country's economy. In 2008, the sector's contribution to the country's GDP of R2 283 billion amounted to 7.29% (NAAMSA 2009:49). Total automotive exports (CBUs and automotive components) have grown from limited exports before 1995 to achieve record-breaking levels for several consecutive years thereafter. During 2008, the South African automotive industry exported a record 284 211 right- and left-hand-drive passenger cars and commercial vehicles to 79 countries around the world. The export growth of CBUs amounted to nearly 1 700% in unit terms and 3 066% in nominal value terms between 1995 and 2008. The export growth has been accommodated by major investments in best practice assets and state-of-the-art equipment, skills upgrading, productivity gains and upgrading of the whole automotive value chain (AIEC 2007:54,55; NAAMSA 2009).

On 4 September 2008, the Department of Trade and Industry (DTI) issued a media release on the MIDP Review and provided a framework for the new APDP to replace the MIDP from 2013 onwards. The DTI indicated that the revised MIDP would seek to provide the industry with a reasonable level of support in a market neutral manner (i.e. it can no longer be an export incentive as this might be inconsistent with World Trade Organization requirements, therefore there will be no discrimination between products sold domestically and those exported). Long-term development of the sector will be achieved by doubling production to 1.2 million vehicles by 2020 with an associated deepening of the local components industry. The new APDP would seek to shift the emphasis away from a narrow export focus to one that emphasises scale in the production of vehicles. In addition, the programme is intended to be supportive of the development of world-class automotive component manufacturing.

The aim for South Africa is to leapfrog six countries in the current global production stakes by increasing vehicle production to over one million vehicles. To achieve this stakeholders will need to closely evaluate the trade-offs of objectives inherent in each choice. The trade-offs relate to improved vehicle affordability, higher investment, increased global integration, raw material pricing, reduction in imports, improving the trade balance, generating jobs, different incentives, and competitive issues. Every choice will impact on other areas of the APDP and hence the industry's contribution to the country's GDP. The outcome of each trade-off will thus have to be considered recognising the fact that the rest of the world is also moving and is not static (Erasmus 2007:26-35). The lessons learnt from the previous policy regimes and the MIDP, hence, would be vital to ensuring the future growth and development of the domestic automotive industry.

5 CONCLUDING REMARKS

In the context of the South African automotive industry, the distinctive feature of industrial policy affecting the sector is the effective array of selective policies that were adopted. The evolution of the automotive policy regime in South Africa had a decisive impact on the actions of domestic automotive firms. Under the various local content programmes since 1961, the South African-based OEMs have adapted and responded to the mass-based local content requirements to avoid paying excise penalties on their domestic operations.

Unintended consequences of the programmes resulted in the domestic industry building the heaviest cars in the world. Although Phase VI of the local content programmes introduced a new direction by counting exports as local content, light vehicle exports began, but remained subdued. A wide variety of models, manufactured in small volumes at uncompetitive prices, as well as restrictive licence agreements, impacted negatively on light vehicle exports.

Since 1994, South Africa has had to abide by the new business rules that followed the country's economic and political liberalisation. The introduction of the MIDP in 1995 led to major structural changes in the domestic automotive industry, as the highly protected and inwardly focused South African automotive industry became fully integrated into the global automotive environment. The MIDP has to a large extent achieved its stated objectives and in general its contribution to the domestic automotive industry has been regarded as positive. The programme was not intended to be a miracle solution but an interventionist programme to guide a small, ineffective industry's integration into the global automotive environment.

The aim of the MIDP's replacement, the APDP, is to double vehicle production in South Africa by 2020 to 1.2 million vehicles, pushing the country's automotive industry up to an anticipated world market share of over 1%. The increase in market share would trigger additional interest and investment and generate additional export business. The APDP would incentivise automotive-related production, investment and large-scale vehicle manufacturing, while the investment incentive will also be accessible to more companies than was the case under the MIDP. These measures, and the notion of providing long-term policy certainty to enhance investor confidence and bid for long-term export contracts, should ensure that the domestic automotive industry remains in consideration for export-oriented, investment decisions.

The key conclusion is that intelligently designed selective policies can be effective in developing countries. Those companies able to abide by the new business rules of the policy regimes the quickest will be able to reap the benefits first.

REFERENCES

AUTOMOTIVE INDUSTRY EXPORT COUNCIL (AIEC). 2007. Automotive Export Manual 2007. Pretoria. [ Links ]

BLACK A. 1998. The impact of trade liberalisation on the South African automotive industry. Cape Town. School of Economics, University of Cape Town. [ Links ]

BLACK A. 2002. Policy in the South African motor industry: Goals, incentives, and outcomes. Cape Town. School of Economics, University of Cape Town. [ Links ]

BLACK A. 2007. Automotive policy and the restructuring of the South African industry, 1990-2005. Cape Town: University of Cape Town. November 2007: 95-96. [ Links ]

BLACK A & BHANISI S. 2006. Globalisation, imports and local content in the South African automotive industry. Development Policy Research Unit Conference 2006. Johannesburg. 18-20 October 2006: 1. [ Links ]

BYERS I. 1990. The South African motor industry in perspective: An overview of the industry. June 1990. Johannesburg. [ Links ]

DAMOENSE MY & ALAN S. 2004. An analysis of the impact of the first phase of South Africa's Motor Industry Development Programme (MIDP), 1995-2000. Development Southern Africa 21(2): 264, June. [ Links ]

DEPARTMENT OF TRADE AND INDUSTRY (DTI). 2000. Current developments in the automotive industry. September. Pretoria. [ Links ]

ERASMUS G. 2007. SAAW 2007: Special report. Autoinsight November: 26-35. [ Links ]

GELB S. 2004 Foreign companies in South Africa. Quarterly Journal for Trade Partners and Investors 4: 41-45. [ Links ]

GILLESPIE K, JEANNET J-P & HENNESSEY DH. 2004. Global marketing, an interactive approach. Boston, Mass: Houghton Mifflin. [ Links ]

HUMPHREY, J & MEMEDOVIC, O. 2003. The global automotive industry value chain: What prospects for upgrading by developing countries? Vienna: United Nations Industrial Development Organisation. [ Links ]

INDUSTRIAL DEVELOPMENT CORPORATION (IDC). 1993. Study of the competitiveness of the South African Motor Industry. December. Sandton. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1965. Review of the rebates of the customs and excise duties applicable to the industry manufacturing passenger cars in the Republic. Report 1120. March. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1969. Revised customs and excise arrangements applicable to passenger motor vehicles for the promotion of a larger measure of local content. Report 1190. May. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1977. An enquiry into the local manufacture of motor vehicles and components. Report 1777. April. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1985. Investigation into a South African content programme for heavy commercial vehicles. Report 2435. December. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1988. Investigation into the industry manufacturing passenger cars and light commercial vehicles. Report 2627. March. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1989. Investigation into a structural adjustment programme for the industries manufacturing motor vehicles and automotive components: Phase VI of the local content programme. Report 2767. January. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1992. Amendment of Phase VI of the local content programme for motor vehicles. February. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1994. Reduction of the customs duty and exemption from the payment of surcharge on passenger cars and goods motor vehicles and buses. Report 3469. April. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 1995. Revised customs dispensation for the motor industry. Report 3625. Augustus. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 2000. Midterm review and extension of the Motor Industry Development Programme for light motor vehicles. Report 4045. May. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 2003a. Amendment of the rates of duty on automotive components and light motor vehicles and the qualifying value of automotive exports under the Motor Industry Development Programme (MIDP) for light motor vehicles. November. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 2003b. Detailed information on import rebate credit certificates (IRCCs). December. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). (2003c) Detailed information on the Motor Industry Development Programme (MIDP) for light motor vehicles. December. Pretoria. [ Links ]

INTERNATIONAL TRADE AND ADMINISTRATION COMMISSION (ITAC). 2003d. Guidelines in respect of the Productive Asset Allowance (PAA). December. Pretoria. [ Links ]

LAMPRECHT N. 2006. An analysis of the Motor Industry Development Programme (MIDP) as a promotional tool for the South African automotive industry in the global automotive environment. Unpublished master's dissertation, University of South Africa, Pretoria. [ Links ]

MOTOR INDUSTRY TASK GROUP (MITG). 1994. Report and recommendations: Development Programme for passenger cars and light commercial vehicles. March. Pretoria. [ Links ]

NATIONAL ASSOCIATION OF AUTOMOBILE MANUFACTURERS OF SOUTH AFRICA (NAAMSA). 2009. NAAMSA draft annual report 2008/2009. Pretoria. [ Links ]

NEWMAN D. 2003. How the MIDP works. Engineering News 23(40) October 17-23: 60. [ Links ]

RUTHUN P. 2008. Pretorius warns industry on changing market trends. RMI Automobil. February 2008: 8. [ Links ]

SOUTH AFRICAN RESERVE BANK (SARB). 2010. South Africa's national accounts 1946 - 2009. An overview of sources and methods. Supplement to the South African Reserve Bank Quarterly Bulletin March 2010. Pretoria [ Links ]

SWART N. 1974. The South African Motor Industry: In an international context. Pretoria: The Afrikaans Business Association. [ Links ]

VOUTSINAS NK. 2006. Global niche player. Ward's Auto World: 23-38, August. [ Links ]

WILLIAMS JL. 2007. Oil price history and analysis. Energy Economist Newsletter. London. 2010, March. [ Links ]