Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.7 no.1 Meyerton 2010

RESEARCH ARTICLES

Institutions providing services to small micro and medium enterprises (SMMEs) in South Africa

E NjiroI; M CompagnoniII

ICentre for Small Business Development (CSBD), University of Johannesburg

IICentre for Entrepreneurship, Wits Business School

ABSTRACT

This research sought to identify the institutions that provide services to Small Micro and Medium Enterprises (SMMEs) then determine their accessibility to micro and very small enterprises in South Africa's townships. The study sought the nature of services provided and extents to which township entrepreneurs were satisfied with the services.

Lack of comprehensive and coordinated information about institutions that provide services to SMMEs in South Africa instigated this study. SMMEs In South Africa require services that address: (i) management constraints that hinder the growth of SMMEs form survivalist stage to higher levels, (ii) incapacity to cope with the rapidly changing global competitiveness and (iii) inability to leverage policy interventions that government has provides. Effective service would make SMMEs sustainable, able to address unemployment, redress inequality and make the South Africa's Gross Domestic product.

A review of documents and literature available in websites identified seventeen service providers to SMMEs. A structured interview was conducted and four different categories of institutions were identified. Researchers posed as SMME owners wishing to access services by browsing websites, using telephone and face to face enquiry.

A representative sample of support institutions was identified and four categories namely: State Agencies, NGOs, Not-for-Profit Organisations, For-Profit Organisations and Corporate found Businesses. Educational initiatives and social entrepreneurs were identified as being relevant as resources to the SMMEs.

Key phrases: Service providers Small Micro and Medium Enterprises (SMMES)

INTRODUCTION

Small, Medium and Micro Enterprises (SMMEs) form an important part of African economies. They are able to withstand global market instabilities and uncertainties; and they play a critical role in absorbing labour penetration, new markets and generally expanding economies in creative and innovative ways (McCormick et al 1997). Critically, SMMEs are generally more labour-intensive than larger firms and hence have a higher labour absorption capacity. Moreover, the majority of SMMEs operate in the non-traded sector (Berry et al 2002).

Concerns are expressed that whilst in Latin America, particularly Chile, there is evidence of dynamic growth of micro and very small enterprises, in Africa there has been little systematic growth of micro-enterprise into larger enterprises. 'One person' operations, which constitute the majority of very small and micro enterprises in Africa and growth has been elusive.

The South African government has placed SMMEs high on the agenda as vehicles to address the challenges of job-creation, economic growth and wealth distribution for equity in South Africa (Meston & Naidoo 1995). The stimulation of flourishing SMMEs is generally seen as part of an integrated strategy to take this economy onto the higher road of a diversified economy, productivity and enhanced investment (RSA 1995; ASGISA 2006). Several initiatives have been put in place to promote the spirit of entrepreneurship and support small businesses in South Africa, through the establishment of the following institutions: National Small Business Advisory Council (NSBAC) established in terms of the National Small Business Amendment Act 26 of 2003 (with the NSBAA replacing the NSBA 102 of 1996); the Accelerated Shared Growth Initiative for South Africa (AsgiSA); and the various National and Provincial Agencies and Corporations with the specific mandate of promoting the growth of and providing assistance to SMMEs.

Problem investigated

There is no comprehensive database of agencies and institutions providing services to SMMEs. In addition, many of the service providers in the SMME space tend to operate in isolation, with no deliberate efforts to co-ordinate their activities and to ensure the most cost effective delivery of quality services to entrepreneurs particularly those in South Africa's townships. As a result, there is an overlap and duplication of certain services and gaps in some areas.

Objectives of this research

The primary objective of this study is to identify and compile a list of representative sample of service providers to SMMEs and to determine the nature of the services offered. The secondary objective is to identify apparent areas of excellence among the various categories of service providers and opportunities for improving both operational and strategic services.

Significance of this paper

Establishing a basic list of service providers will lead to more comprehensive data base being developed; secondly, it provides initial pointers for specific areas requiring more in-depth analysis, including field research. This will contribute towards the establishment of a more authoritative database, in which profiles could include an assessment of the effectiveness and impact of the various service providers, as perceived by their respective clients, being the Entrepreneurs they serve.

REVIEW OF LITERATURE

The South African democratic government realised that the challenges of trying to grow viable small businesses beyond survivalist state and ensuring their sustainable growth are enormous, requiring strong legislative and policy support. Rogerson (1996) has clearly described the need to have the South African economy be more diversified where productivity and international competitiveness are enhanced, wage levels raised, investment stimulated and entrepreneurship flourishes, as it is seen as a condition to address these issues (RSA 1994, 1995 1996). A White Paper on National Strategy for the Development and Promotion of Small Businesses in South Africa and the National Small Business Act 102 (1996) assigned the SMME sector as the vehicle for the transformation of South Africa's socio-economic landscape.

SMMEs represent an important vehicle to address the challenges of job-creation, economic growth and equity in South Africa. According to Chalera (2007:79), the White Paper on National Strategy for the Development and Promotion of Small Businesses in South Africa, SMMEs are seen as vehicles for the following:

i) Address high unemployment levels in South Africa as they have high labour absorptive capacity.

ii) Activate domestic competition by creating market niches in which they grow by identifying new niches as they respond to demand changes and international competitiveness because of their flexibility.

iii) Redress inequalities from the apartheid period in terms of patterns of economic ownership and restricted career opportunities for black employees.

iv) Contribute to black economic empowerment by having SMMEs initiated, owned and controlled by those who were discriminated against in the past.

v) Play a crucial role in people's efforts to meet their needs in the absence of social support systems during restructuring of the macro economic sectors.

vi) The micro-enterprise segment and survivalist activities characterised by low entry barriers are open especially to inexperienced job seekers whose basic needs could be met.

The South African government suggests that the SMME sector with the help of government support is capable of fulfilling the objectives stated above and introduced a number of supply-side policies to promote SMMEs. The overall objective was to create an enabling environment and level the playing fields in terms of national, regional and local policy framework for SMME development. Mead and Liedholm 1998) have indicated that SMMEs have been known to grow. Chalera (ibid) identifies policy measures specifically intended to:

i) Address the obstacles and constraints faced by SMMEs and to promote their faster growth.

ii) Enhance their capacity to comply with the challenges of globalisation and the penetration of an internationally competitive economy.

iii) Strengthen their cohesion, to increase the leverage of policy measures.

Von Broembsen (2003:4-5) assessed the National Strategy for the Development and Promotion of Small Business (NSDPSB) and found that it outlined a comprehensive national strategy for SMME support and creation of an enabling environment for SMMEs.

The specific objectives are framed as follows:

i) Facilitating greater equalisation of income, wealth and economic opportunities;

ii) Creating long-term jobs;

iii) Stimulating economic growth;

iv) Strengthening the cohesion between small enterprises; and

v) Levelling the playing fields between big and small business.

Poverty alleviation is not one of the specific objectives and by contrast, economic growth and redistribution of wealth and opportunity (i.e., equity) are framed as specific objectives of the National Small Business Strategy (NSBS). Nevertheless, the objective of poverty alleviation is implied both by the programmes adopted by government's implementing agencies and by policy documents. The thinking behind the poverty alleviation objective is articulated by DTI in its annual "The State of Small Business" publication, as follows (Von Broembsen ibid)

In terms of economic development, SMMEs play a crucial role in enabling poor people to meet their basic needs and survive. Through the growth of the SMME sector, survivalist enterprises can become micro and small enterprises, creating jobs and raising the standards of living for hundreds of thousands and even millions of South Africans in urban and rural areas (Ntsika 2001:38)

The idea is that survivalist enterprises will firstly meet the basic needs of the 'owners' and then grow into micro and small enterprises, which not only will increase the income of the owner, but also provide jobs for others (Ntsika ibid). This seemingly logical progression from survivalist to micro to small enterprise lies at the heart of the NSBS's poverty alleviation objective. Von Broembsen (2003:5) argues that this premise is flawed because of two reasons: first, survivalist enterprises very rarely graduate to micro enterprises; secondly, the strategy of creating survivalist enterprises does not secure the fulfilment of basic needs, in that not only is too little income generated, but it also results in over-trading and creates insecurity for existing businesses.

The implementation of the National Small Business Support Strategy relies on a partnership of government (national, provincial and local), NGOs, parastatals, community-based organisations, business associations, the private sector and foreign donor agencies. The White Paper stipulates that government's role is one of facilitator as opposed to implementer.

Most of the Institutions providing services to SMMEs are found in Gauteng and Western Cape, making their location an impediment for SMME support. Analysis of the spectrum of NGOs that have been implementing the NSBS in seven of South Africa's nine provinces shows the following (Von Broembsen 2003:5):

i) Two-thirds of the organisations in the seven poorest provinces provide generic skills and/or business training.

ii) Most training organisations service only survivalist or micro-enterprises.

iii) No NGO is providing marketing assistance even though the central problem for survivalist businesses (and micro enterprises) is a lack of markets.

The implication is that the National Small Business Strategy has had little impact on poverty alleviation because of the following reasons:

i) The geographical spread of organisations assisting SMMEs is very limited particularly in the poorer provinces, rural areas and townships.

ii) The very short, technical and generic business skills courses offered by NGOs are seldom linked to defined market opportunities. Instead, survivalist businesses are generated to compete with other existing survivalist businesses in low-value added activities which occupy 'small, location-specific, low-income niche markets' (Rogerson et al 1997a:25). A cycle that develops is referred to as 'involutionary growth" by Rogerson et al (1997a), whereby as new survivalist enterprises enter the market, they result in the demise of others. This breeds insecurity on the part of survivalists, insecurity being an aspect of poverty that poor people find particularly debilitating.

iii) The programmes of NGOs in the SMME sector are not sufficiently sensitive to gender barriers or to household dynamics. These two issues are critical to any effective poverty alleviation intervention.

iv) The NSBS poverty alleviation mechanism has been implemented in the context of a broad development strategy that pays too little attention to the importance of demand side measure (including social assistance) in alleviating poverty.

An additional shortcoming is identified by Nieman (2001) who assesses entrepreneurial and small business training interventions in general as well as specific training objectives. He finds that most of the training by SMME service providers is more conventional general training other than entrepreneurial. According to him, entrepreneurship and business training are confused as being similar and there is a lack of effective monitoring and evaluation of the training programmes.

RESEARCH APPROACH AND METHODS

The approach, methods and limitations of the survey undertaken can be summarised as follows:

i) Given the lack of an existing comprehensive database for service providers to SMMEs, a 'desk-top' approach was undertaken as the most feasible avenue for this initial stage of research.

ii) Because analysis of documents alone cannot always be relied upon to be accurate or up-to-date, an invitation was e-mailed to the institutions whose contact details were accessible, requesting them to verify and validate the following main aspects of the profiles:

a) Objectives and structure of their organisations, including services they provided.

b) The extent of their footprint, i.e. location of head office and branches/offices;

c) Number of years in operations and significant milestones since inception.

d) The specific focus of their services, i.e.: who are their primary clients; any racial or age exclusions; specialisation in any particular industry/sector.

A very limited response was however received from the invitation. This was taken to indicate that the non-respondents were satisfied that the information available on their respective website was substantially correct and up to date.

The most significant response was from GEP, which provided a full copy of their latest Annual Report for 2008/2009, which was comprehensive and informative.

iii) The implication for the research findings set out hereafter however is that such findings must be considered to be preliminary and tentative. For this reason, we emphasise throughout this paper that such findings must be viewed as the first exploratory stage of the research into the resources available to the SMME economy. For this reason, the proposal for a more comprehensive study is included in the recommendations.

Therefore this survey is not intended to be a comprehensive and definitive study of all service providers to SMMEs, but rather a partial sample of the main categories under which service providers can be included, as listed in the Abstract.

RESEARCH FINDINGS

The research findings are set out under the following sections:

1 Relevant Legislation, which is indicative of the important role which government assigns to the SMME economy, as set out in the 'Review of Literature' section.

2 Overview of the four categories, under which the service providers have been profiled.

3 Profiles table of a representative sample of service providers listed under each of the above four categories, under the following headings: Name, Start Date, Primary Focus and Footprint.

4 Results from the survey of the service providers profiled in 3.

5 Conclusions drawn from the above results;

6 Recommendations, based on the results and the conclusions set out in 4 and 5.

7 Further Research.

For the sake of clarity and flow: 'Results', 'Conclusions' and 'Recommendations' are set out separately and consecutively rather than bunched under each heading. For easy cross-reference and consistency however, the same set of headings are used in all three sections.

1 Relevant Legislation

i) National Small Business Amendment Act 26 of 2003 (NSBAA replacing the NSBA 102 of 1996); and the National Small Business Advisory Council (NSBAC) established in terms of the NSBAA.

ii) National Empowerment Fund Act 105 of 1998.

iii) Preferential Procurement Policy Framework Act 5 of 2000 (PPPFA) and New Regulations published on 27 August 2009.

iv) Broad-Based Black Economic Empowerment Act 53 of 2003 (gazette no. 25899 dated 9 January 2004) and New Codes published on 9 February 2007.

v) The Accelerated Shared Growth Initiative for South Africa (AsgiSA).

vi) The National Youth Development Agency Act 54 of 2008.

2 Categories of Service Providers

The following is an overview of the main categories under which service providers have been listed:

2.1 State Agencies at National and Provincial level respectively. Although most Provinces have equivalent Small Business Development and Support initiatives, for the purposes of this paper we have only focussed on initiatives launched in Gauteng.

2.1.1 National

i) Department of Trade and Industry (DTI);

ii) Industrial Development Corporation (IDC);

iii) Khula Enterprise Finance Ltd and National Empowerment Fund (NEF);

iv) National Youth Development Agency (NYDA);

v) Small Enterprise Development Agency (SEDA), incorporating NTSIKA Enterprises Promotion Agency;

vi) Tourism Enterprise Partnership (TEP).

2.1.2 Provincial

i) Gauteng Economic Development Agency (GEDA);

ii) Gauteng Enterprise Propeller (GEP);

iii) The Innovation Hub (part of Gauteng Blue IQ: hi-tech industrial promotion agency);

iv) Development Agencies in other Provinces, e.g.: ECDC, FDC, INW, LIMDEV, MEGA, NCEDA, Western Cape Economic Development Agency (Wesgro), TIKZN.

2.2 Non-Government Organisations (NGOs), Not-for-Profit-making Organisations (NPOs) and privately funded service providers have been grouped together. In addition, a Public Private Partnership (PPP), of particular interest - the Tourism Enterprise Partnership (TEP) is included and highlighted in the Recommendations section, as an alternative model.

i) Branson School of Entrepreneurship;

ii) Business Place;

iii) Endeavor;

iv) Tourism Enterprise Partnership (TEP).

2.3 For-Profit Organisations (FPOs) / self-funding.

i) Business Partners;

ii) Raizcorp;

iii) A Business Hub (online based);

2.4 Private Business initiatives, mainly by large corporations.

i) Anglo Zimele: (business hubs; outsourcing; procurement);

ii) Financial Institutions, e.g.: major banks;

ii) SAB KickStart Enterprise Development.

In addition, educational initiatives by Universities, NGOs or private business funders, as well as Social Entrepreneurship support services are listed below for reference, although not included in the schedule which follows. However lessons will be drawn under 'Conclusions' and 'Recommendations', from educational initiatives as well as from organisations which support SMMEs in the social entrepreneurship field, where these are deemed to be relevant to service providers in the Small Business Development field.

2.5 Tertiary institutions

Business Enterprises at the University of Pretoria

Centre for Entrepreneurship (CfE) at the Wits Business School

UCT Centre for Innovation and Entrepreneurship (CIE) - GSB

UJ Centre for Small Business Development (CSBD) - Soweto Campus

2.6 Other Educational Initiatives

Junior Achievement SA (JASA)

The Raymond Ackerman Academy of Entrepreneurial Development;

Thuthuka Bursary Fund managed by the SA Institute of CA's (SAICA)

2.7 Social Entrepreneurship support: Ashoka

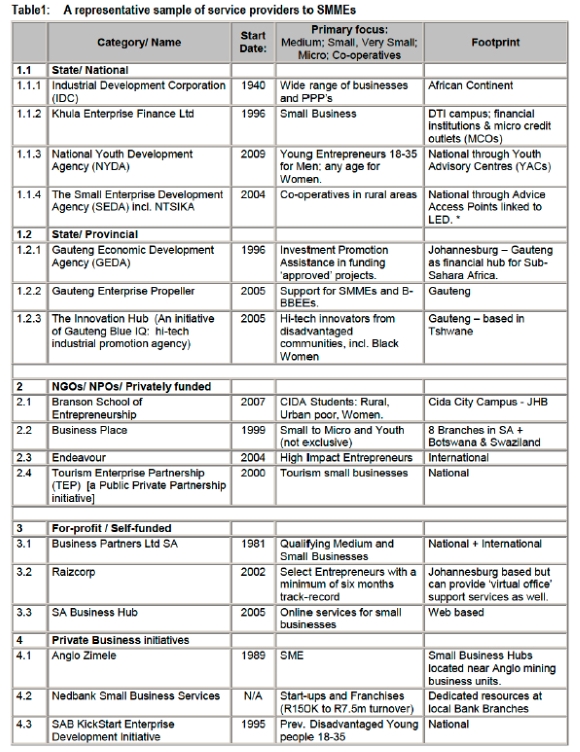

3 Profiles

The following ¡s a Table of brief profiles of a representative sample of service providers, listed under each of the four primary categories above. The Results are derived from an analysis of these service providers.

The above listing is not intended to be inclusive of all service providers, but rather to provide an up-to-date overview of a representative sample under each of the respective categories. For example, in the footsteps of Anglo Zimele, Sasol Chemical Industries established ChemCity in 2004 as a business incubator for SMMEs and have so far assisted in establishing 85 businesses/projects which in turn have created 1470 jobs.

Although only Nedbank Small Business Services has been listed, all major banks provide specific services to Small and Medium Enterprises by means of dedicated staff within their branches as well as the provision of other resources, such as providing guidelines for the drawing up of business plans, and assistance in overcoming challenges experienced by entrepreneurs, such as cash flow problems.

More extensive research would be required to provide a comprehensive listing under each of the above categories. Even from this limited survey however the following observations can already be made:

4 Results of the survey

4.1 Excellent Objectives

All Service providers have adequate to excellent and largely similar objectives, which include the following commendable aims:

i) Providing the transfer of Knowledge and Skills;

ii) Assisting in start-up activities and sourcing of funding;

iii) Providing networking opportunities for market access;

iv) Providing ongoing advice, coaching/mentoring and other support services to assist in growing the business and to ensure sustainability.

The major differentiator between the various service providers is the Quality of the assistance and support provided, with the ones based on business principles, with profit sharing elements, offering the best quality of personalised service, as part of their obsession with Value-adding, for the benefit of their clients.

The more recently established Government Agencies however, e.g. GEP and the Innovation Hub, have stated objectives of offering personalised service and aftercare service, e.g. through relationship managers. GEP have already followed this up with a survey on 'Customer Satisfaction'. This is a very promising development, bringing them in line with the successful model adopted by the 'for profit' service providers, such as Business Partners and Raizcorp as well as internationally privately funded Endeavor.

4.2 Clarity on the scope of services provided and on the qualifying criteria for accessing services and the

i) In perusing the publicly available profiles, there is a lack of clarity as to the services catering specifically for each of the following size enterprises respectively:

• Survivalist stage, Micro and Very Small

• Small and Medium

ii) There is also insufficient transparency on the applicable criteria used to decide what assistance and what services are provided to which enterprises or entrepreneurs, particularly in the case of taxpayers-funded agencies.

4.3 Measurement of Customer service as perceived by the Clients:

i) Very few of the service providers make available copies of testimonials (as provided by Endeavor and Raizcorp) or results of 'Customer satisfaction surveys' (as provided by GEP).

ii) The following finding from the research conducted by GEP during 2008 may have relevance for other service providers: "[Other] Service providers were not as well regarded by SMMEs as GEP. [Other] SP scores on all attributes were lower than GEP's scores" (GEP Annual Report 2008/2009:35).

4.4 Focus on Outcomes instead of Outputs only.

i) Much of the data provided by service providers focus on outputs rather than outcomes, i.e. such data as:

• Number of enquiries received / Number of 'walk-in' visitors.

• Number of Business plans sponsored.

• Number of Initiatives / Projects undertaken.

• Number of Training programmes and number of People trained.

• Number of Start-ups assisted.

• Value of funds disbursed.

ii) Very few however provide longitudinal studies, to identify the impact and outcomes of the above interactions, services and transactions, e.g.

• Number of start-ups as a ratio of business plans developed.

• Sustainability ratio's in respect of start-ups over 3+ year periods.

• Increases in Turnover and Profitability; as well as increase in the number of jobs created as a result of specific interventions or over a period of time.

• Increase in the number of tenders or contracts awarded / received.

iii) SAB Kickstart for example provides a three year comparative table (although not up-to-date) in respect of the following outcomes:

• Increase in Turnover

• Increase in Jobs

• Increase in value of contracts signed

iv) Service providers in the 'for-profit' category obviously monitor the performance of their partnership enterprises very closely and on a regular basis, as they generally take a shareholding in the respective businesses and therefore have a very real vested interest in their outcomes and success.

4.5 Corporate governance, compliance and transparency

i) In addition to generally applicable good corporate governance principles and the Companies Act, Government Agencies must comply with the specific legislation in terms of which a particular agency was established as well as the Public Finance Management Act of 1999 (No. 1 of 1999) as amended.

ii) Again GEP made available their very comprehensive and informative Annual Report for 2008-2009 and Business Partners make their Annual Report available through their website, but very few of the others appear to have adequate reference to corporate governance and compliance aspects.

4.6 Level of collaboration between Service providers

With the exception of collaboration between most service providers and funding agencies, such as Khula Enterprise Finance Ltd (Khula Fund), there is little evidence of active collaboration and sharing of resources between the various service providers.

5 Conclusions from the Results

The following conclusions can be derived from the results of this initial limited scope survey:

5.1 Excellent Objectives

Generally the objectives which service providers set themselves are admirable and cover most of the critical performance areas, as indicated in the research findings. The differentiator is the quality of implementation.

5.2 Clarity on the scope of services provided and on the qualifying criteria for accessing services.

i) There is a lack of clarity as to the services available specifically to Entrepreneurs in the Survivalist stage, Micro and Very Small Enterprise stages.

ii) The level of transparency as to the qualifying criteria for accessing services from State Agencies and Institutions appears to be inadequate in many instances.

5.3 Measurement of Customer service as perceived by the Clients:

i) With a few exceptions, there is a dearth of data on the level of satisfaction and Value-adding, as perceived by the Clients of service providers.

ii) There is therefore a need for field research on the quality and value-adding benefits of the assistance and services provided, as perceived by the Clients.

iii) To ensure that the responses are as objective as possible, it will be desirable that complete anonymity of individual respondents is built into the research methodology.

5.4 Focus on Outcomes instead of Outputs only.

i) There are service providers to SMMEs which have achieved a high level of effectiveness and Quality service. These however tend to be those service providers based on a 'for-profit' model and/or with a relatively limited footprint.

ii) Large-scale service providers, particularly state enterprises with a national footprint, measure their performance mainly based on the number of contacts and transactions. With a few exceptions as indicated in the Results, there is little evidence of measurements quantifying the quality and impact of their services.

5.5 Corporate governance, compliance and transparency

The results of the survey indicate that, with a few exceptions, there is inadequate public reporting on corporate governance aspects. This does not mean that there is a lack of compliance, but simply that there is insufficient disclosure of relevant information made available to the public. More in-depth research is required, including the perusal of Auditor General Reports in respect of government funded agencies, to confirm the extent of compliance amongst service providers.

5.6 Level of collaboration between Service providers.

There appears to be very limited collaboration between the service providers.

i) In contrast, educational institutions at tertiary level have pursued active sity of Johannesburg Centre for Small Business Development, based within the Soweto Campus: they have a working relationship with UCT GSB whereby they provide support services to the Raymond Ackerman Retail Academy/Goldman Sachs in Soweto. Similarly they have a close working relationship with the Centre for Entrepreneurship based at the Wits Business School and they jointly hosted a Symposium on SMME Service providers within the academic field in July 2009. GEP has an office at the CSBD in Soweto. Future plans for the Wits Business School include working with previously disadvantaged universities such as Fort Hare, to collaborate in facilitating entrepreneurship.

ii) Another example is the close co-operation between the University of Pretoria and the newly established Innovation Hub based in Tshwane.

ii) Through closer collaboration, different funding models more suited to the Survivalist and Micro enterprises could be explored. The funding model adopted by Ashoka for funding social entrepreneurs for example, whereby the entrepreneur rather than the enterprise is funded, may be an option worthy of consideration.

iv) A further welcome development in this regard is the Tourism Enterprise Partnership, which is collaboration between the initial funder - Business Trust, the Government and various SA Corporates interested in 'creating a legacy of change and growth in the tourism economy in a constructive and focused manner'. This type of Public Private Partnership could well serve as a model for similar initiatives in other sectors, in order to provide both a large presence (Government Agencies) and sector expertise (Private corporate businesses) to offer and promote effective and efficient services, to include Small, Micro and even Survivalist enterprises, to promote their growth and to ensure their sustainability.

6 Recommendations based on the Results and Conclusions

Based on the results and the conclusions, as set out above, the following recommendations are considered appropriate:

6.1 Measure achievement against stated objectives

On the basis that generally the aims and objectives set out by most service providers are adequate to excellent, it is recommended that the focus going forward must be on measuring to what extent the objectives have been achieved. This measurement must include measurements based on objective feedback from the beneficiaries and clients of the service providers.

6.2 Clarity of scope and on qualifying criteria for accessing services

i) It is recommended that service providers be more specific as to the focus and scope of their offerings, as well as providing a clear indication as to who they consider to be their primary target market. This will be most helpful in guiding potential Clients to approach the service providers who are most suited to their circumstances and requirements. This in turn will contribute to greater efficiencies, better utilisation of services, higher levels of perceived satisfaction and more productive outcomes.

ii) In the interests of good governance and transparency, it is recommended that each Service Provider should make readily available upfront, clear guidelines as to the criteria which clients need to meet in order to be able to access the assistance and services provided.

iii) In addition there should be as clear and transparent indicators as reasonably possible, spelling out the determinants of likely success in obtaining the stated assistance, including funding, products and services available from or through the service provider concerned.

6.3 Measurement of Customer service as perceived by the Clients

i) It is recommended that field research, involving Clients of service providers, on the perceived quality and value-adding benefits of the assistance and support received from service providers, be carried out. Whilst lofty objectives are a necessary foundation, they are not a sufficient guarantee of effectiveness. Effectiveness is best measured in terms of impact, outcomes and perceived benefits from the perspective of the clients.

ii) To ensure that the responses are as objective as possible, such research should be undertaken by third parties, and it should have complete anonymity of individual respondents built into the research methodology.

iii) It is therefore recommended that 'Customer satisfaction surveys' should be outsourced to independent research centres which in turn can guarantee anonymity to the respondents, and provide unbiased analysis and meaningful feedback to the respective service providers.

iv) Such an approach will also provide opportunities for benchmarking and a more effective gap analysis. The methodologies used by research organisations in the automotive industry have been developed and enhanced over a number of years and could well be adapted to suit the circumstances of service providers to the SMMEs.

6.4 Focus on Outcomes instead of Outputs only

i) In addition to output measures already disclosed by most service providers there should be a specific focus on tracking and publishing measures of quantifiable success from the perspective of the client, e.g. success ratio from request for assistance to successful start-up; growth in number of contracts or tenders, in turnover and profitability, in number of jobs, level of repeat business and business from new Customers.

ii) Such data should be tracked and disclosed, at least in aggregate, for a minimum of three year rolling periods.

iii) Although we cannot expect large tax-payer-funded agencies to be in a position to track all the entrepreneurs to whom they provide services, within the framework of their respective mandates, there should be a greater degree of evidence and accountability as to how effectively public funds have been spent.

6.5 Corporate governance, compliance and transparency

i) Service Providers should make adequate disclosure of their good governance standards and practices; and report their level of compliance with all relevant legislation and good governance principles, at least annually.

ii) Such disclosure should include posting up-to-date information on their good governance practices and compliance reports by service providers on their respective websites, as well as inclusion in their annual reports.

iii) More in-depth research should be undertaken in future surveys, including the perusal of Auditor General Reports in respect of government funded agencies, to independently confirm the extent of compliance amongst service providers.

6.6 Level of collaboration between Service providers.

i) The overriding objective of all service providers should be to optimise available resources for the maximum benefit of Entrepreneurs and Enterprises as the Clients and Customers respectively. To this end, each service provider should actively seek opportunities for collaborating with other service providers, whilst remaining within their legislated or funding mandates.

ii) Operating in isolated silos or duplicating services should be perceived as an anachronistic model and a waste of scarce resources. Defending one's own 'turf' for narrow self-serving interests, to the detriment of the most effective and efficient service delivery for the optimum benefit to the Entrepreneurs and Enterprises of the country, should be viewed as verging on sabotage.

iii) The feasibility of developing other Public Private Partnership initiatives, in addition to the current TEP initiative, should be explored.

iv) As a practical proposal, a model could be developed whereby the agencies with a larger footprint make their 'outreach' point facilities available to other service providers who have additional specific expertise which will benefit the clients currently under-serviced. This in turn will free up resources which could be deployed to better serve the needs of Micro and Survivalist enterprises, which may currently be either altogether neglected or inadequately serviced. Such a model could be the catalyst for a virtuous circle of greater coverage as well as higher impact skills transfer.

v) Another excellent example of a PPP initiative is the Thuthuka Bursary fund. This is one of the most successful educational support initiatives involving both the major auditing firms and major banks as funders and sponsors, five leading universities as service providers, together with the active support of the Departments of Education, the Department of Labour and the Department of Science and Technology.

7 Further Research

In order to identify the extent to which the above recommendations are already being implemented by service providers; as well as to identify success factors in the provision of services to SMMEs, including Survivalist and Very Small enterprises, a more comprehensive study to include appropriate field research is recommended, to establish the impact that such services have on the growth and sustainability of township businesses.

BIBLIOGRAPHY

ACCELERATED AND SHARED GROWTH INITIATIVE SOUTH AFRICA (ASGISA). 2006. Available at www.info.gov.za/asgisa Downloaded on 6-10-2009. [ Links ]

BERRY A., VON BLITNITZ M., CASSIM R., KESPER A., RAJARATNAM B. & VAN SEVENTER D. 2002. The economics of SMMEs in South Africa, trade and industry policy strategies (TIPS), Working Paper (Johannesburg, TIPS). [ Links ]

CHALERA C.S. 2007. Impact Analysis of South Africa's National Strategy for the Development and Promotion of Small, Micro and medium Enterprises. Doctoral Thesis Submitted to Department of Marketing and Communication University of Pretoria. [ Links ]

DEPARTMENT OF TRADE AND INDUSTRY. 2006. The Impact of Local Government Programmes on Small Micro and Informal Businesses. [ Links ]

DEPARTMENT OF TRADE AND INDUSTRY. 2001. The State of Small Businesses DTI Pretoria. [ Links ]

GAUTENG ENTERPRISE PROPELLER. 2008-2009. Annual Report. [ Links ]

MCCORMICK D., KINYANJUI M.N. & ONGILE G. 1997. Growth and Barriers to Growth among Nairobi Small and Medium-size Garment Producers. World Development, 25(7):1095-1110. [ Links ]

MEAD AND LIEDHOLM 1998 Small Firm Dynamics: Evidence from Africa and Latin America. Small Business Economics 18 (1-3) 225-240 Springer Netherlands [ Links ]

MESTON A. & NAIDOO R. 1995. The Business development Services (BuDS) Information and Networking Programme. A Brief. [ Links ]

NIEMAN G. 2001. Training entrepreneurs and small business enterprises in South Africa: Situational Analysis. Education and Training, 43(8):445-450 [ Links ]

NTSIKA ENTERPRISE PROMOTION AGENCY. 2001. Service Provider Directory for small-, medium- & micro enterprises. Ntsika Enterprise Promotion Agency: Pretoria. [ Links ]

REPUBLIC OF SOUTH AFRICA. 1995. White paper on national strategy for the development and promotion of small business in South Africa. Government Gazette, 357(16317). [ Links ]

REPUBLIC OF SOUTH AFRICA. 1996b. National Small Business Act, no 102 of 1996. Government Gazette, 377(17612). [ Links ]

ROGERSON C. 1997b. "SMMEs and Poverty Alleviation in South Africa." Input Paper for the National Project on Poverty and Inequality. Occasional Paper for an Independent Democracy Institute (IDASA) Cape Town. [ Links ]

ROGERSON C. REID K. & WICKSTEED S. 1997a. "SMMEs and Poverty Alleviation in South Africa." Input Paper for the National Project on Poverty and Inequality. Discussion Paper prepared for Ntsika Enterprise Promotion Agency, Pretoria. [ Links ]

ROGERSON C. 1996. "Re-thinking the informal economy of South Africa." Development Paper 84, Development Bank of Southern Africa (DBSA). [ Links ]

TOURISM ENTERPRISE PARTNERSHIP. 2009. A Study of South Africa's Small, and Micro Business Support in South Africa. Discussion Paper prepared for Ntsika Enterprise. [ Links ]

TOURISM ENTERPRISE PARTNERSHIP (TEP). 2008. A Study of South Africa's Small and Micro Enterprises: Towards 2010 and Beyond. [ Links ]

VON BROEMBSEN M. 2003. Poverty Alleviation: Beyond the National Small Business Strategy, IDASA budget Information Service, Available at http://www.idasa.org.za. Accessed on 22-11-2009 [ Links ]

Research related online publications covering SMMEs:

The Bulletin Online: A Newspaper for SMME's - Current Edition Downloaded on 10-10-2009 [ Links ]

Mr. Mokeyane says small and micro enterprises are in constant need of... Project Literacy, Siyaphambili and Media Works are the training service providers that... Recent research commissioned by the Merseta, which was conducted by the.bulletinonline.co.za/archives/smme/novsmme02.php Cached Downloaded on 20-09-2009. [ Links ]

Guidelines for the Equitable Accreditation of SMME Providers of... File Format: PDF/Adobe Acrobat - Quick View Downloaded on 19-10-2009. [ Links ]

Ntsika Enterprise Promotion Agency. (2001). Service Provider Directory for small-, .... research and thus also support the SMME accreditation process. ...www.saqa.org.za/docs/critguide/smme/smme03.pdfthedti/thedtiGroupofInstitutions/SpecialistServices/Ntsika ... Downloaded on 5-10-2009 [ Links ]

Ntsika Enterprise Promotion Agency. Mission statement ... Ntsika provides wholesale non-financial support services for SMME promotion and development. ... To develop/establish an effective Service Provider Network to implement and deliver ... monitoring and evaluation; Manage and/or conduct SMME related research. www.thedti.gov.za/thedti/ntsika.htm Cached Downloaded on 5-11-2009 [ Links ]

Seda - Small Business Monitor - Terms of reference Downloaded on 10-9-2009. [ Links ]

The Small Business Monitor covers three broad sections i.e. feature stories, case studies and academic SMME research articles. Section 1: Feature articles ... www.seda.org.za/content.asp?subID=921 - Cached Downloaded on 12-10-2009. [ Links ]

SMME Portal Blog Downloaded 9-11-2009. [ Links ]

We are service providers for the Eastern Cape Development Corporation's & research semantically based enterprise... smmeportal.com/blog/index.php Downloaded on 12-11-2009.

A STUDY OF SOUTH AFRICA'S SMALL, MEDIUM AND MICRO TOURISM ENTERPRISES Downloaded on 3-10-2009 File Format: Microsoft Powerpoint - View as HTML Why research? Need to understand the SMME market in tourism for 2010 - but ... little prospect of becoming meaningful service providers for 2010 or beyond. ... www.tep.co.za/documents/TEP%20Research%20Presentation.ppt Downloaded on 12-10-2009 [ Links ]

UCT research reveals digital divide amongst SMMEs Downloaded on 20-09-2009. 1 Jun 2009 ... Small, medium and micro enterprises in urban areas are almost... Futhermore, business training institutions and service providers must... www.skillsportal.co.za > Learning > Business Schools- Cached www.gsb.uct.ac.za/gsbwebb/default.asp?intPageNR=561 Downloaded on 23-10-2009. [ Links ]

Websites from which information on Service providers was accessed:

Anglo American Corporation: http://www.anglozimele.co.za/ Downloaded on 5-11-2009 [ Links ]

Branson School of Entrepreneurship: www.southafrica.info/business/trends/.../branson-271005.htm Downloaded on 12-10-2009. [ Links ]

Business Partners: www.businesspartners.co.za/ Downloaded on 13-10-2009. [ Links ]

Business place: http://www.thebusinessplace.co.za/aboutus.aspx Downloaded on 1-12-2009. [ Links ]

Endeavor South Africa: http://www.endeavor.co.za/ Downloaded on 26-11-2009. [ Links ]

Gauteng economic development agency: http://www.joburg.org.za/content/view/122/58/ Downloaded on 12/12/2009. [ Links ]

Gauteng Enterprise Propeller Annual Report: www.gep.co.za Downloaded on 12-12-2009. [ Links ]

Industrial Development Corporation: http://www.idc.co.za/ Downloaded on 2-12-2009. [ Links ]

Junior achievement South Africa: http://www.jasa.org.za/site/index.php Downloaded on 10- 10- 2009. [ Links ]

Khula Enterprise Finance Ltd: www.khula.org.za/ Downloaded on 12-10-2009. [ Links ]

National Youth Development Agency: www.nyda.gov.za Downloaded on 23-10-2009. [ Links ]

Nedbank Small Business Services: www.nedbank.com/website/content/sme/smeapp.asp Downloaded on 10/10/2009. [ Links ]

Raizcorp: www.raizcorp.co.za/offering.html Downloaded on 1-10-2009. [ Links ]

SA Business Hub: www.sabusinesshub.co.za/ Downloaded on 30-10-2009. [ Links ]

SAB Kickstart : www.sabkickstart.co.za/ Downloaded on 20-10-209. [ Links ]

Sasol Chemical Industries: http://www.chemcity.co.za/sasolchemcity/frontend/navigation.jsp?navid=1&rootid=1 Downloaded on 11-12-2009. [ Links ]

South African Institute of Chartered Accountants: http://www.saica.co.za/LearnersStudents/Thuthuka/ThuthukaBursaryFund/tabid/716/language/en-ZA/Default.aspx Downloaded on 4-10-2009. [ Links ]

The innovation hub: www.theinnovationhub.com Downloaded on 14-10-2009. [ Links ]

Tourism enterprise programme : http://www.tep.co.za/ Downloaded on 11-12-2009. [ Links ]

University of Johannesburg: http://www.uj.ac.za/LatestNews/tabid/3962/articleType/ArticleView/articleId/498/Default.aspx Downloaded on 20-10-2009. [ Links ]

University of Pretoria: http://www.be.up.co.za/asp/documents.asp?parentid=43 http://www.gibs.co.za/academic-programmes/full-time-entrepreneurship-mba.aspx Downloaded on 30-09-2009. [ Links ]

Wits University: http://www.wbs.ac.za/specialitycourses/cfe/ [ Links ]

http://www.wbs.ac.za/degrees/mm-entre-venture-creation/ Downloaded on 31-10-2009. [ Links ]