Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.5 no.1 Meyerton 2008

RESEARCH ARTICLES

High-growth entrepreneurs: the relevance of business knowledge and work experience on venture success

B UrbanI; J Van VuurenII; JD BarreiraIII

IFaculty of Management, University of Johannesburg

IIDepartment of Business Management, University of Pretoria

IIIUniversity of Pretoria

ABSTRACT

In Africa high-growth entrepreneurs are scarce, and in SA entrepreneurial activity is dominated by necessity entrepreneurship with low expectations of growth and job creation. The paper focuses on opportunity entrepreneurs who are responsible for job creation. The sample (n = 171) is randomly drawn from the JCCI population membership base, who qualify on established individual and organizational level criterion to represent high-growth entrepreneurs. Building on previous research on entrepreneurial characteristics, competencies, knowledge, work experiences, skills, capabilities, education, training, and success indicators, the study measures business knowledge and work experience and relates these to different levels of venture success. Various chi-square-based tests are used to detect the strength of the relationship between the variables; in particular, statistically significant relationships are found between employment growth, higher levels of education, previous work experience and successful venture indicators. Practical and policy implications follow.

Key phrases: High-growth entrepreneurs, business knowledge, work experience, venture success

1 INTRODUCTION AND PURPOSE

In Africa high-growth potential entrepreneurs are scarce, and South Africa's total entrepreneurial activity (TEA) rate, as measured by the series of Global Entrepreneurship Monitor (GEM) reports, is dominated by necessity entrepreneurs with low expectations of growth and job creation (Autio 2005:23). Moreover South Africa (SA) does not feature at all when it comes to patents granted to residents per million, as opposed to 663 in South Korea for 2006 (Luiz 2006:16). Based on international measures of human capital development, South Africa's human capital base for entrepreneurship has been consistently weak, and in terms of expected job creation, it is not the amount of necessity entrepreneurs which predominate that matters, but rather the quality of high-growth entrepreneurial activity as measured by growth expectations (Orford, Wood et al 2003:14; Autio 2005:25). Currently in SA most research and policy initiatives focus on necessity entrepreneurs, who represent the unemployed masses. Although micro enterprises or survivalists have entrepreneurial characteristics their ability to grow and create employment, are restricted by their scarcity of skills, business knowledge and resources (Pretorius & van Vuuren 2002:12).

The present study deviates from this trend by specifically focusing on opportunity entrepreneurs who have the pertinent characteristics that previous research has found to differentiate high-expectation from low-expectation entrepreneurs.

High-expectation entrepreneurs, although represented by only a small proportion of all entrepreneurial activity, are responsible for up to 80 percent of all job creation by entrepreneurs.

One of the most critical issues facing developing countries is to understand where entrepreneurs originate from and what characteristics are relevant to their success (Honing 2001:22).

In many emerging populations, several constraints limit entrepreneurship as well as the survival rate of new ventures, these include: the lack of pertinent entrepreneurial and organisational knowledge (Aldrich & Fiol 1994:645), lack of preparedness and failure to accurately estimate the cost of starting and running one's own enterprise, not creating and using network linkages, lack of technical knowledge (Lau & Busenitz 2001:7), and the general lack of accumulating resources (human and otherwise) to overcome difficulties (Aldrich & Martinez 2001: 50). Moreover many start-ups' lack of preparedness and knowledge is compounded by not having sufficient or relevant experience (Galbraith 1982:71; Meyer, Lenoir & Dean 1988:342).

Building on previous research on entrepreneurial characteristics, competencies, knowledge, work experience, skills, capabilities, education, training, and success indicators, this study focuses on business knowledge and work experience and relates these to levels of entrepreneurial success.

The study's aim is to operationalize these constructs and determine the extent of associations between these variables with entrepreneurial success of high-growth entrepreneurs.

2 ENTREPRENEURIAL COMPETENCIES

Starting a new venture is not a smooth, continuous, orderly process but a disjointed, discontinuous, unique event, which requires understanding of the change in the antecedent variables that trigger such an event. It may happen that small differences in the initial conditions produce very great ones in the final phenomena. In a simplistic form, entrepreneurs cause entrepreneurship, that is expressed formulaically E = f (e). Entrepreneurship (E) is a function of entrepreneurs (e). Initial factor that sets into motion entrepreneurial activity is the predisposition of the entrepreneurs (Bygrave 1989: 14). This individual level variation among people in their willingness to pursue opportunities is a major premise of this paper. By emphasizing individual differences, that is people are different and these differences matter, entrepreneurship can emerge as a legitimate field with its own distinctive domain (Venkataraman 1997:123).

A new venture has few resources other than the knowledge of the entrepreneur. The entrepreneur's capacity to gain new knowledge and abilities during the start-up process is seen as critical to new venture success (Gartner, Starr, & Bhat 1998:217). This knowledge is essential to control and apply to resources which may lead to a competitive advantage and superior performance (Chrisman & McMullan 2000:37).

Entrepreneurial competency, largely acquired on an individual basis, consists of a combination of skills, knowledge and resources that distinguish an entrepreneur from his or her competitors (Fiet 2000:103). Antecedents of entrepreneurial competencies include the entrepreneur's experience, training and education (Man, Lau, & Chan 2002:126). Entrepreneurial capital, based on Ulrich's (1998:15) definition of intellectual capital as a multiplicative function of competencies and commitments includes entrepreneurial competencies and entrepreneurial commitment, which may be regarded as the present value of generated future entrepreneurial behaviour (Erikson 2002:281). The presence of entrepreneurial commitment without adequate entrepreneurial competence may be regarded as a waste of both time and resources, since the most important resource and main competitive advantage of an emerging venture is competence (Erikson 2002:281).

Most entrepreneurs often start a new venture ignorant of many key dimensions of running their businesses and must obtain the necessary information if they are to survive (Shepard, Douglas & Shanley 2000:395).

Entrepreneurs who have built substantial companies have consistently developed a solid base and a wide breadth of management skills and know-how over a number of years, working in different functional areas (e.g. sales, marketing, manufacturing, and finance). Past research investigating the effects of expertise suggests that individuals often acquire important advantages as they gain increasing experience in performing various tasks, they become more efficient by learning to focus attention primarily on the key dimensions and learn to ignore extraneous variables (Shane, Kolvereid & Westhead 1991:432).

Technical and industry-specific competencies are often ignored in entrepreneurship settings, however these are pivotal because the domain they reflect - specific competencies - has significant direct effects on venture growth. An entrepreneur's technical and industry competencies are an important form of expert power that facilitates the implementation of the entrepreneur's vision and strategy. Industry-specific skills and relevant technical skills directly affect performance, and these combined entrepreneurial skills may serve as sources of competitive advantage that rivals find difficult to identify and imitate (Shane, Kolvereid & Westhead 1991:435).

3 ENTREPRENEURIAL KNOWLEDGE AND EXPERIENCE

Education, work experience, and specific technical or industry knowledge are seen as rudimentary endowments of the new venture (Vecchio 2003:305), these variables are now briefly conceptualised.

Education is central to high-growth entrepreneurs, as expressed by the human capital theory. Human capital theorists surmise that education is an investment that yields higher wage compensation in return for an individual's variations of skills, training, and experience (Honing 2001:34).

Work experience in the entrepreneurship domain includes having dealt with start-up problems such as generating sales, developing marketing avenues and tactics, obtaining external financing, and dealing with internal financial and general management issues (Wiklund 1999:37).

Entrepreneurs with limited experience may use simplified decision models to guide their venture start-ups, while the opposite is the case with experienced entrepreneurs.

Complementing work experience are business networks, which are considered the long-term business relationships that a firm has with its customers, distributors, suppliers, competitors and government, i.e., the actors in a business network (Vecchio 2003:307).

Low and MacMillan (1988) suggest that networks are an important aspect of the context and process of entrepreneurship. Studies indicate that networking allows entrepreneurs to enlarge their knowledge of opportunities, to gain access to critical resources, and to deal with business obstacles (McFarlin, Coster & Mogale 1999:65). Networking is also referred to as the entrepreneurs social capital base and social capital is crucial to entrepreneurs, encompassing both actual and potential resources flowing through a relationship network established individually or collectively, as well as consciously or unconsciously (Low & MacMillan 1988:14).

For the purposes of this paper entrepreneurial business knowledge refers to the ascribed roles for managerial expertise in entrepreneurial success and entails, to varying degrees, marketing, financial management/book-keeping, self-supervision, and, if applicable, the supervision of paid employees or unpaid family workers, among other activities (Boden & Nucci 2000:349).

Experience refers to the knowledge or ability of an individual gained through circumstances in a particular job, organization, or industry (McCall, Lombardo & Morrison 1988:46). It is important to note that when undertaking new ventures, potential high-growth entrepreneurs must ensure they can demonstrate business knowledge and work experience towards possible stakeholders, and they should be able to prove that they have supplemented their general qualifications with industry-specific experience as well as functional education and experience (Tegarden et al 2000:43).

4 HIGH-GROWTH VENTURES

The growth process of high-growth entrepreneurs provides solid arguments for advocating sales growth, as an indicator of success. The growth process is likely to be driven by increased demand for the firm's products or services. That is, sales increase first, thus allowing for the acquisition of additional resources such as employees or machinery. It seems unlikely that growth in other dimensions could take place without increasing sales. It is also possible to increase sales without acquiring additional resources or employing additional staff, by outsourcing the increased business volumes. In this case, only sales would increase. In conclusion, sales growth has a high generality (Wiklund 1999:43).

There has been widespread interest in the creation of new employment. This makes employment growth another important aspect to consider in high-growth ventures. In a process of rationalisation, it is possible to replace employees with capital investments. This could result in an inverse relationship between capital investment and employment growth.

Consequently, assets are another important aspect of growth. Measuring growth in terms of assets is often considered problematic in some sectors (e.g. the service sector) as an accounting problem (Yu 2000:180). This could translate in an expansion of intangible assets and would not be reflected on the firm's balance sheet. Thus in some sectors, the problem of studying growing assets in service industries for example, would relate to the difficulty in data collection rather than lack of relevance.

5 RESEARCH METHODOLOGY

The study attempted to understand how the effects of the two independent variables (business knowledge and work experience) associate with a dependent variable -entrepreneurial success. A hypothesis is formulated to reflect this investigation.

Hypothesis = Business knowledge and work experience are positively associated with entrepreneurial success of high-growth entrepreneurs.

An in-depth, structured, self-administered questionnaire was e-mailed and hand delivered to the respondents. The questionnaire consisted of administrative, classification and target indicators. Responses were recorded via multiple choice, fixed sum scales and a five-point Likert scale.

Measurement Instruments

Based on the extant literature reviewed, questions on constructs operationalised as business knowledge, work experience and entrepreneurial success were scanned for suitability and selected for this study. Firm size, firm age, industry type-Standard Industrial Classification (SIC) codes, and the venture founders' age and gender were included as control variables; variables similarly identified in previous studies (Wiklund 1999:40).

Although there is no consensus on the appropriate measure of firm performance (success), entrepreneurship researchers have pointed to growth as the crucial indicator of entrepreneurial success (Covin & Slevin 1997:100; Low & MacMillan 1988:145). It has also been argued that growth is a more accurate and easily accessible performance indicator than any other accounting measures and hence superior to indicators of financial performance.

By integrating measures reflecting the multidimensional nature of performance, this study concentrated on various growth indicators: specifically performance was measured in terms of sales growth, profit growth, employment growth, sales growth compared to competitors, and market value growth compared to competitors (all measured with a five-point Likert scale). The various firm performance indicators where collapsed into one category / variable labelled firm success, which was ultimately used for analytical purposes.

These performance indicators were surveyed in relation to a three year period, in order to allow for calculation of the compound performance for a cumulative period. The annual figures concerning each item could be averaged before summation. However in response to resistance by the respondents to hand over private financial information, the growth and financial ratio questions were structured instead to ask the opinion of the respondent on the various items on a five point opposite statement scale ranging from "significant decline" to "significant increase".

Furthermore these growth indicators/ratios measured entrepreneurial success, and personal indicators measured entrepreneurial satisfaction (overall importance of business activity, split between business and personal time, and personal wealth increases).

The entrepreneurial success construct has been found to have two distinct dimensions, economic success and the entrepreneur's satisfaction (Hisrich 2000:79).

Successful entrepreneurs were classified as successful based on an increase over the past three years in the following measures:

• Turnover

• Profit

• Employment

• Sales growth compared to competitors

• Market value to competitors

• Current ratio

• Fixed asset ratio

• Total assets turnover

• Profit margin ratio

• Return on assets ratio

• Return on equity ratio and

• A decline in the debt ratio

The annual growth rates were summarised by the respondents' own opinion from three adjacent years' sales figures. The study tried to capture only organic growth; nonetheless sales gains from mergers and acquisitions could not be ascertained without the presence of audited financial statements.

As a major premise of this paper, that high expectancy entrepreneurs are primarily responsible for creating employment, the controversy whereby mechanization possibly replaces employees with capital investments is counteracted with a direct measure of employment growth.

Furthermore, entrepreneurial success depends largely on competencies in marketing, financial management/bookkeeping, operational, human resources, legal, communication, strategic planning, leadership and persuasive skills and other related skills needed to set up a proper business (Vesper 1990:23; Boden & Nucci 2000: 350; Lévesque, Shepherd & Douglas 2002:201). Hence the items for business knowledge focus not only on the level of education, and subject knowledge across functions, but also whether experience has led to possible path dependency based on such knowledge gains (Shane & Venkataraman 2001:15).

Sampling and Data Collection

The population for the sample was composed of the membership database of the Johannesburg Chamber of Commerce & Industry (JCCI). A compact disk with the total membership database was obtained, and the necessary access codes obtained allowing access to the total population with their respective contact details. A total of six hundred (600) questionnaires where sent out into the field, and a total of one hundred and eighty one (181) questionnaires where returned. This translates to a response rate of approximately 30 percent. Selected respondents qualified on pre-established individual and organizational level criterion to represent high-expectancy entrepreneurs. Parameters of interest included respondents who had more than three years of entrepreneurial success in their firm, were founders of the firm, currently hold an equity stake of at least 10 percent in the firm, and are actively involved in strategic decision making (Ensley et al 2002:376).

Although there is no universally accepted definition of high expectancy entrepreneurs these criteria ensured that the final sample met the conditions of high expectancy entrepreneurs, as formulated for this study. The final sample (n = 170) comprised of founders (88.95 percent), who hold equity share greater than 10 percent (95.58 percent) and, partake in strategic decision making (95.58 percent).

5 RESULTS

Sample Characteristics

The respondents fell into two distinctive age groups: 42.54 percent in the 36-45 age group, and 43.65 percent in the 46-55 age group. For gender, 88.95 percent are men and 11.05 percent women. The sample covered a wide range of business categories, with the largest concentration in manufacturing (69.61 percent), services (13.27 percent), wholesale (9.94 percent) and the rest in retail (7.18 percent). Similarly the legal entities of the businesses were largest segment as a close corporation (44.75 percent), private company (44.2 percent), sole proprietor (6.63 percent), partnership (3.31 percent) and the rest as a public company (1.1 percent). The sample covered a wide range of business activities ranging from ferrous metal products (15.47 percent), food products (10.5 percent), industrial and commercial machinery (7.73 percent), leisure goods (6.63 percent), non-ferrous metal products, and automobiles (6.08 percent). The heterogeneity of these sample characteristics adds credence to the representativeness of the sample.

Statistical Results

Nonparametric measures of association were employed using cross-classification tables to assess the strength of the relationships between the test variables (Cooper & Schindler 2001:435). Various chi-square-based measures were used to detect the strength of the relationship between the test variables; specifically tests included the chi-square test, phi, Cramer's V, contingency coefficient C, Mantel Haenzel % Square, Mahalanbis D square, Hotteling T square and the ANOVA F value. The analysis was directional using an alpha of 0.05.

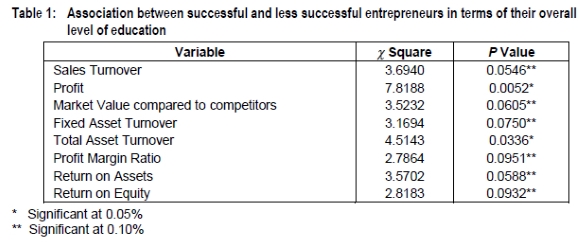

Table 1 indicates the statistically significant relationships found between successful and less successful entrepreneurs in terms of their overall level of education, with respect to the various items measuring firm success. The general level of education was associated with several success items at a 10 percent significance level, while profit and total asset turnover were statistical significance at a 5 percent level (table 1).

Moreover, 78 percent of the successful entrepreneurs indicated a tertiary level of educational attainment. This clearly indicates a strong relationship between education and entrepreneurial success. Finance, marketing, human resources, and legal education all had a positive association with numerous success items at a 5 percent significance level.

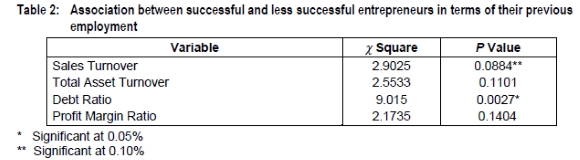

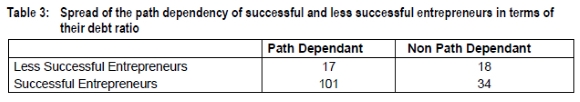

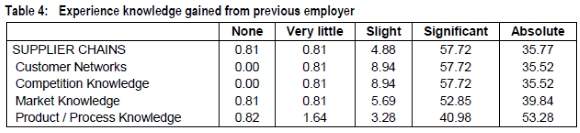

Tables 2, 3 and 4 can be read in conjunction where it was found that 69 percent of the entrepreneurs had followed a path dependent route (table 3), stressing the importance of gaining experience from previous employment in the following areas: supplier chains, customer networks, competitive knowledge, market knowledge, and product/process knowledge (table 4). This means that two success items are statistically significant for those respondents who had previous employment experience; particularly the level of sales turnover and debt ratios (table 2).

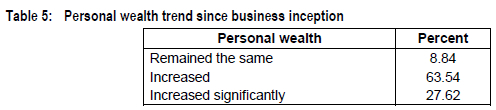

Similar to other findings (Ulrich 1998: 25), Table 5 supports the notion that the vast majority of entrepreneurs (91 percent) experienced an increase in personal wealth since their inception of their businesses.

6 CONCLUSIONS

The results find extensive support for the hypothesis in terms of business knowledge and work experience being positively associated with entrepreneurial success of high-growth entrepreneurs. Generally the results affirm the studies discussions on rapid-growth firms and their founders' characteristics. The systematic accumulation of human and social capital appears to represent potent influences on high-expectancy entrepreneurs.

An entrepreneur's previous work experience can be interpreted as providing unique knowledge and may be considered a real asset to the firm. Experience based knowledge, both explicit and tacit, are linked to improved skills in resource acquisition and identification of appropriate resources. Industry experience contributes to success in attracting the correct mix of resources towards achieving favorable means of operating at profitable levels (Hisrich 2000:80). Experience results in greater success with start-up problems such as generating sales, developing marketing strategies and tactics, obtaining external financing, dealing with internal financial and general management issues (Wiklund 1999:40).

The typical aim of fostering entrepreneurship is often cited as the development of a cadre of entrepreneurs who will promote economic growth and create employment (North 2002:25). Moreover, the emergence of potential entrepreneurs in transitional economies depends on the entrepreneurial potential of the society, which is, in turn, largely a function of systematic efforts of developing entrepreneurs with a high potential. Instead of hoping for a massive capital infusion to improve business prospects, transitional economies may well be advised to implement formal entrepreneurship programs to foster individual initiative for entrepreneurial development (Luthans et al 2000:20).

Limitations and Future Research

Despite some of the significant findings, a large amount of the variance in entrepreneurial success remains unexplained, which warrants further investigations.

As with similar studies, the results obtained may suffer from survivor bias (Wiklund 1999:45). Based on the likelihood that entrepreneurs with poorer performance are more reluctant to divulge performance information, bias in the results of entrepreneurial success could have influenced findings.

Although performance questions were intended to cover the last three years, a possible "halo" effect could have influenced the responses to be over inflated.

Practical Implications

Policy makers in South Africa (SA) should appreciate the important differences between necessity and opportunity entrepreneurs and highly selective policy measures must be considered in terms of expected job creation from these different types of entrepreneurs.

Moreover, congruence between national framework conditions and high-expectancy entrepreneurs, especially where positive correlations have been found, must be fostered. Social interventions designed to curb unemployment, through entrepreneurship, in developing nations need to take into account the target population, since significant differences across different types of potential entrepreneurs can be salient.

In SA where the goal of government policy is to support job creation through entrepreneurial activity, policy makers should be aware of the highly skewed distribution of job creation expectations; investment in human capital is required which is ultimately a long term endeavour without immediate political pay-offs.

BIBLIOGRAPHY

ALDRICH H.E. & FIOL C.M. 1994. Fools rush in? The institutional context of industry creation. Academy of Management Review, 19:645-670. [ Links ]

ALDRICH H.E. & MARTINEZ M.A. 2001. Many Are Called, But Few Are Chosen: An Evolutionary Perspective for the Study of Entrepreneurship. Entrepreneurship Theory and Practice, 25(4):41-56. [ Links ]

AUTIO E. 2005. Report on high-expectancy entrepreneurship. Global Entrepreneurship Monitor, HEC Lausanne: Babson. [ Links ]

BODEN J.R. & NUCCI A.R. 2000. Prospects of Men's and Women's New Business Ventures, Journal of Business Venturing, 15:347-362. [ Links ]

BYGRAVE W. 1989. The entrepreneurship paradigm (II). Chaos and catastrophes among quantum jumps. Entrepreneurship Theory and Practice, 14:7-26, Winter [ Links ]

CHRISMAN J.J. & MCMULLAN E.W. 2000. A preliminary assessment of outsider assistance as a knowledge resource: the longer-term impact of new venture counselling. Entrepreneurship Theory and Practice, 24(3):37-53. [ Links ]

COOPER D.R. & SCHINDLER P.S. 2001. Business research methods. 7th Edition. Singapore: McGraw-Hill. [ Links ]

COVIN J.G. & SLEVIN D.P. 1997. High growth transitions: theoretical perspectives and suggested directions. In SEXTON DL & SMILOR. RW (eds). Entrepreneurship 2000. Chicago: Upstart Publishing:99-126. [ Links ]

ENSLEY M.D., PEARSON A.W. & AMASON A.C. 2002. Understanding the dynamics of new venture top management teams cohesion, conflict, and new venture performance. Journal of Business Venturing, 17:365-386. [ Links ]

ERIKSON T. 2002. Entrepreneurial Capital: The emerging venture's most important asset and competitive advantage. Journal of Business Venturing, 17:275-290. [ Links ]

FIET J.O. 2000. The pedagogical side of entrepreneurship Theory. Journal of Business Venturing, 16:101-117. [ Links ]

GALBRAITH J. 1982. The Stages of Growth. Journal of Business Strategy, 3(4):70-79. [ Links ]

GARTNER W.B., STARR A.J. & BHAT S. 1998. Predicting new venture survival: an analysis of anatomy of a startup. Cases from Inc. magazine. Journal of Business Venturing, 14:214-232. [ Links ]

HISRICH R.D. 2000. Entrepreneurial dimensions: the relationship of individual, venture, and environmental factors to success. Entrepreneurship Theory and Practice, 24(4):79-90. [ Links ]

HONING B. 2001. Learning strategies and resources for entrepreneurs and intrapreneurs. Entrepreneurship Theory and Practice, 26(1):21-35. [ Links ]

LAU C.M. & BUSENITZ L.W. 2001. Growth intentions of entrepreneurs in a transitional economy: the people's republic of china. Entrepreneurship Theory and Practice, 26(1):5-20. [ Links ]

LÉVESQUE M., SHEPARD D.A. & DOUGLAS E.J. 2002. Employment or self-employment a dynamic utility-maximizing model. Journal of Business Venturing, 17:189-210. [ Links ]

LOW M. & MACMILLAN I. 1998. Entrepreneurship: past research and future challenges. Journal of Management, 14(2):139-161. [ Links ]

LUIZ J. 2006. Managing business in Africa. Practical management theory for an emerging market. South Africa: Oxford University Press. [ Links ]

LUTHANS F., STAJKOVIC A.D. & IBRAYEVA E. 2000. Environmental and psychological challenges facing entrepreneurial development in transitional economies. Journal of World Business, 35(1):3-25. [ Links ]

MAN T.W., LAU T. & CHAN K.F. 2002. The competitiveness of small and medium enterprises, a conceptualisation with focus on entrepreneurial competencies. Journal of Business Venturing, 17:123-142. [ Links ]

MCCALL J.R., LOMBARDO M.M. & MORRISON A.M. 1988. The Lessons of Experience. Lexington, MA: Lexington Books. [ Links ]

MCFARLIN D.B., COSTER E.A. & MOGALE C. 1999. South African Management Development in the Twenty First Century. Journal of Management Development, 18(1):63-78. [ Links ]

MEYER G.D., LENOIR R.M. & DEAN T.J. 1988. The Executive Limit Scenario in High Technology Firms. In LR GOMEZ-MEHIA & MW LAWLESS (eds). Proceedings: Managing the High Technology Firm. Boulder, C.O: University of Colorado:342-349. [ Links ]

NORTH E. 2002. A decade of entrepreneurship education in South Africa. South African Journal of Education, 22(1):24-27 [ Links ]

ORFORD J., WOOD E., FISCHER C., HERRINGTON M. & SEGAL N. 2003. South African Executive Report Update. Global Entrepreneurship Monitor, Graduate School of Business: Cape Town. [ Links ]

PRETORIUS M. & VAN VUUREN J. 2002. The contribution of support and incentive programs to entrepreneurial orientation and start up culture in South Africa. Presented At South African Entrepreneurship and Small Business Association Conference at Sun City: 4-6 Aug. [ Links ]

SHANE S. & VENKATARAMAN S. 2001. Entrepreneurship as a field of research: A Response to Zahra & Dess, Singh, & Erikson. Academy of Management Review, 26(1):13-18. [ Links ]

SHANE S., KOLVEREID L. & WESTHEAD P. 1991. An exploratory examination of the reasons leading to new firm formation across country and gender. Journal of Business Venturing, 6:431-446. [ Links ]

SHEPARD D.A., DOUGLAS E.J. & SHANLEY, M. 2000. New venture survival: Ignorance, external shocks, and risk reduction strategies. Journal of Business Venturing, 15(5-6): 393-410. [ Links ]

TEGARDEN L.F., ECHOLS A.E. & HATFIELD D.E. 2000. The value of patience and start-up firms: a re-examination of entry timing for emerging markets. Entrepreneurship Theory and Practice, 24(4):41-58. [ Links ]

ULRICH D. 1998. Intellectual Capital = Competences X Commitment. Sloan Management Review, 39(4):15-27. [ Links ]

VECCHIO R.P. 2003. Entrepreneurship and leadership: common trends and common threads. Human Resource Management Review, 13:303-327. [ Links ]

VENKATARAMAN S. 1997. The distinctive domain of entrepreneurship research. In J. KATZ (ed). Advances in Entrepreneurship Firm Emergence and Growth. Greenwich, C.T. JAI:139-202. [ Links ]

VESPER K.H. 1990. New Venture Strategies. Englewood Cliffs, NJ: Prentice Hall. [ Links ]

WIKLUND J. 1999. The sustainability of the entrepreneurial orientation-performance relationship. Entrepreneurship Theory and Practice, 24(1):37-48. [ Links ]

YU F.T. 2000. Hong Kong's entrepreneurship: behaviours and determinants. Entrepreneurship and Regional Development, 12:179-194. [ Links ]