Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Contemporary Management

versão On-line ISSN 1815-7440

JCMAN vol.2 no.1 Meyerton 2005

BUSINESS CASE STUDY

SwissIT: New horizons in stormy waters Management opportunities and dilemmas in IT offshoring

J Wilkens

Identification:

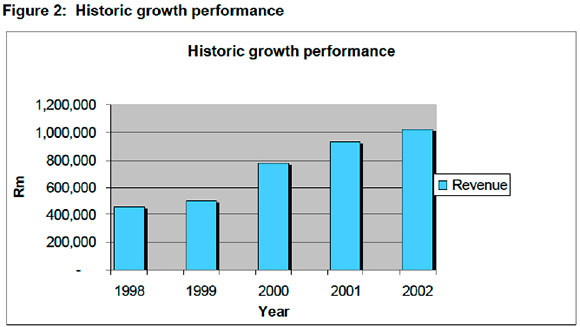

Length: Medium

Academic level: Post-graduate

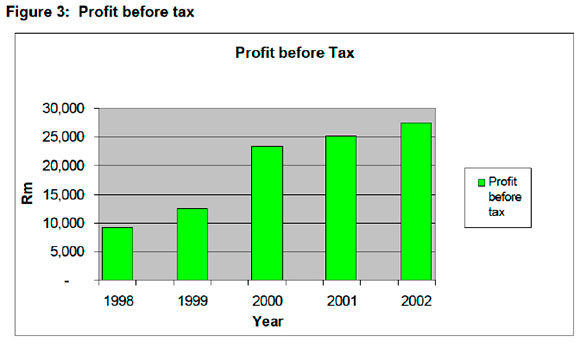

Subject: Strategic management, general management, international business management and human resource management

Business form: Multinational company

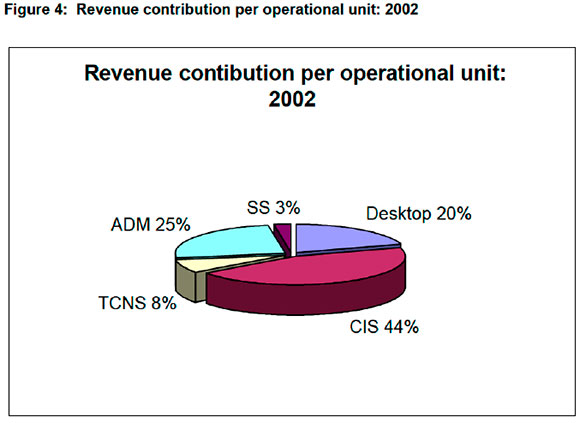

Business size: Medium

Industry sector: Technology

Classification: The case is based on a real company, but details have been changed to protect privacy

Theme: General management's reaction to various opportunities and dilemmas

Core aspect: The depreciation in the Rand and globalisation of the world economy has created various opportunities for South African businesses. Whilst international business has never been a foreign concept, due to South Africa's huge commodity exports, most businesses were more familiar with importing capital goods or products for wholesale or retail trade purposes. It has, however, become quite evident that a wide variety of services can be offered to foreign buyers. In these cases tourism is well established, but technology-based development services are quite new to this category. This case study explores various management dilemmas, opportunities and challenges that a business has to face before venturing into this market.

Aspects for discussion:

· Business strategy and structure

· International management

· Marketing and sales

· Human resource management

Duration: Preparation for learners: 1½ to 2½ hours Class discussion: 2 to 4 hours

LIST OF ACRONYMS USED IN THE CASE

ADM: Application development and maintenance

CIS: Computing information services

Desktop: Personal computer support services

ERP: Enterprise resource planning

ICT: Information and communication technology

ISIS: ISIS Technology (Pty) Ltd

PC: Personal computer

SS: Software sales

TCNS: Telecommunications and network services

WMC: World monitoring centre

BUSINESS CASE STUDY

Present day

1. Harold Meier, CEO of SwissIT South Africa, walks pensively to the bar and asks for a drink. As he rests against the counter he stares through the glass window panes towards the colourful sunset in the west. He has just officially opened the world monitoring centre (WMC) at their Johannesburg-based offices in South Africa in full view of more than 150 selected guests. The WMC monitors 2000 Europe-based computer servers by utilising SwissTelco's global data networks and complex monitoring systems. The people joining him for the post-opening cocktail party are high ranking foreign business people, local business leaders and IT managers as well as his head office colleagues from SwissIT Switzerland.

2. Even more surprising was his announcement that SwissIT South Africa has clinched a major SAP implementation project for a Swedish car manufacturer. While the majority of the project will be managed in South Africa, 25% will call for 'onsite' management in Sweden by the appointed South African project team. The fact that the SwissIT South Africa's proposal was approximately 30% cheaper than those submitted by rival Europe companies and the excellent South African reference implementation in Austria practically sealed the deal.

3. Hilda Ertz, chief financial officer for SwissIT South Africa, taps him on the shoulder jolting him back to reality. He turns around and smiles politely, knowing he was caught daydreaming. "Your dream has become a reality," she says smiling. "Who would have believed a year ago that we would finally pull off this type of growth through offshoring deals?" she asks.

4. Harold gleams with excitement, not answering immediately. "I must admit that we accomplished this against all odds. At one point the Rand was just getting too strong, the brain-drain phenomenon was taking its toll and the motivation for selling outsourcing locally was low, not even mentioning selling outsourced services internationally," he exclaims. "I even thought of giving up on fighting our case in Switzerland due to the aggressive competition from India and Brazil. Luckily we endured!" he concludes. {Click the number for an overview of the Rand's performance 38}1

5. The pair is soon joined by another two executive members: Tom Smith, general manager for application development and maintenance (ADM) and Rudi Schoeman, general manager for computing information services (CIS). Catching the tail-end of Harold's answer, Tom fondly remembers the early days when the company started. The quartet shares their perspectives and so the trip down memory lane begins. Soon their boisterous laughter can be heard above the din in the crowded bar as they reminisce about how they beat the odds, how they changed strategies and amended operations to successfully position the company as a force that can compete internationally.

6. Tom immediately admits that he had to re-adjust his pessimistic views on offshoring saying: "If somebody told me five years ago that I would be managing an offshoring unit that consists of 75 IT consultants developing and maintaining systems that are 12 000 kilometres from Johannesburg, I would have said you are joking. Not to mention the fact that two of my consultants and I have to learn German and French in six months!" "Das ist nich wahr mein Herr, Sie sprechen nur Auslânder Deutsch!" teases Hilda.2

7. The main issues regarding offshoring became a focal point of the discussion. Harold explains how his definition of offshoring changed. In the beginning he thought offshoring was simply sending contractors to do software development for months on end in foreign countries. In his mind it was nothing different from moving financial resources to the Channel-Islands for tax purposes. "I was quite surprised to learn that 80% of all development took place in our country and that the customers were actually offshoring to us. The penny really dropped during my visit to India and seeing the buildings filled with software developers, programming new packages for huge American corporations at half the dollar cost!" he concludes.

8. They say "change is the only certainty in life" and SwissIT was no exception. Most notably new services were developed and introduced into the market, but it is also fair to say that the company has its roots deeply imbedded in generic IT services such as infrastructure outsourcing management. Most of these generic offerings are still valid today, even though it has taken on a few improvements and additions. It is clear, however, that in order to envision the future you have to understand and use your past experience and knowledge as a reference point. Today marked the beginning of this future for SwissIT and this is road that led to it.

The beginning

9. It all began in May 1997. Harold Meier looked at his new employees and started his speech by saying: "We will be the best IT company in South Africa and become a model for both the Europeans and the Americans. SwissIT will not be a test lab or business cum holiday destination for its international investors. It will lead from the front." These were bold words after closing his first IT outsourcing deal with Bavaria Motors, but proved to be quite prophetic in the years to come. The deal turned the company from a four man sales team into an IT services concern with 48 employees overnight. It also paved the way for the establishment of its initial services, namely:

■ personal computer (PC) and desktop application support (operating system, office)

■ application server support

■ mainframe operation and hosting

■ database operation and administration

■ local and wide area network operation and support.

10. SwissIT, as an international company, had its roots back in 1989, when German industrial giant Bavaria Motors created its own IT division to provide economical IT services to its subsidiaries. Then known as ISIS, it was introduced into countries where Bavaria Motors already had a presence, with Malaysia and South Africa being its first forays outside Europe.

11. It was under the aegis of ISIS that Harold embarked on his South African mission, and once he had convinced Bavaria Motors SA to entrust its IT infrastructure to this fledgling operation with the promise of improved service quality and lower costs, the proverbial wheels were set into motion.

12. The addition of Momentual insurance's outsourcing contract changed ISIS' fortunes forever. For Harold an even more significant milestone was the acquisition and absorption of a tiny company called E-tech. This changed the company's focus from being a pure outsource provider to becoming an application solutions provider. It changed the business culture, the approach, even the go-to-market model.

13. Another piece of the puzzle fell into place when SwissTelco bought ISIS from Bavaria Motors in 2000, changing its name to SwissIT in the process. This meant that SwissIT was in the unique position to combine IT and telecommunications into cost-effective solutions. More importantly though, SwissIT had a shareholder that would give it the freedom to explore its entrepreneurial spirit, which formed one of the cornerstones of the company's growing success. It was not long before the entrepreneurial fires started burning and the hunger for more growth directed Harold and his team to acquire Software-Corp, a software distribution company, in 2001. The company was incorporated into the structure as a new unit called: Software Sales.

14. Rapid momentum in its growth led the company to adopt a very simple strategic vision. The strategy was based on getting the most out of its new combination with SwissTelco and as Sarel Botha, the head of strategy explained: "Our business vision is simple. We want to be the leading provider of ICT (Information and Communication Technology) services, creating and managing innovative solutions that deliver superior business flexibility and value to our customers."{Click the number for a more comprehensive overview of the strategic objectives 40 }

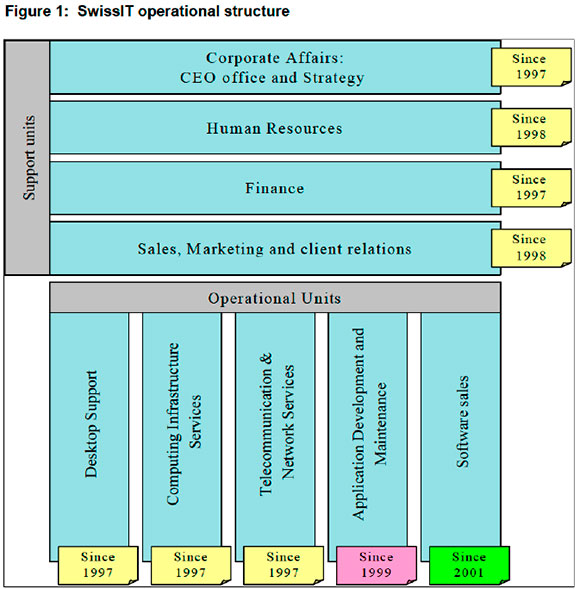

15. The growth and business drive during its first five years of existence, led SwissIT to the development of a robust operational organisational structure (Figure 1) that had the intention to motivate co-operation between different units, thus creating value for its customers. The operational structure was divided into supporting and operational units. The operational units were responsible for profit and loss, whilst the supporting units were purely overhead functions. The only exception was the sales and marketing unit, which was measured on a revenue generation basis.

16. The robust structure was primarily motivated due to aggressive expansion and cross-selling as Hilda Ertz explained during a stakeholder meeting in 2002: "Our structure has grown tremendously in the past few years. It is primarily based on market demands and changes. We have reacted to new opportunities presented in 1999 and 2001. ADM has gained momentum after a strategic acquisition, whilst Software Sales (SS) was created through a buy-out during the severe IT downturn in 2001." The welcome growth in the late nineties created through new business, assisted the company to develop its service portfolio in more detail. This also allowed for a more defined management structure within the organisation.{Click the number for more information regarding the functional decomposition of the organisation 41}

The changing tide

17. The economy has proven itself over the years to be cyclical. The only unknown factor that remains is the length of the cycle and how it relates to every business. This was also true in the case of SwisslT. From its humble beginnings in 1997 to its steadfast growth in the early 2000's the company proved to be quite successful. Hilda was understandably proud at the executive meeting held at the end of 2002 stating that: "The company has exceeded growth expectations by far." She was specifically referring to the historic growth performance (Figure 2) of the company, which showed strong growth in the past three years.

18. A comparison of revenue growth (Figure 2) in 1999 and 2000 indicates a rise of 56%, which was due to a new contract with financial services giant Momentual. In comparison to 2000 growth was 15% and 10% lower in 2001 and 2002 respectively. Although growth was more than expected, it confirmed a slowdown in new business that was having an adverse effect on growth.

19. This reality was confirmed by Rudi Schoeman in early 2003 when he presented the overall profit before tax (Figure 3) to his management team. He quite anxiously explained that: "An assessment of profit before interest and tax shows good performance over the past five years, although growth has been slower in the past two years. Our long term infrastructure outsourcing contracts are coming to an end soon, and we will have to look at new income producing streams."

20. The management team was withholding one additional factor - this was the rise in the underlying cost of the company that had a negative influence on the profit situation. They knew that this situation underlined the need for a new income stream and possibly a cost rightsizing exercise in the near future.

21. The penny dropped on a rainy February morning whilst Harold was sitting at his desk re-assessing the financial results of 2002. As he wearily turned page after page contemplating ways to stop the slowdown, one chart in particular caught his eye (Figure 4). The company was doing so well that he never saw the need to analyse each business unit's contribution in depth. Today was different. He was looking for answers.

22. The contribution to revenue as depicted in Figure 4 gave him a clear indication that CIS [excluding desktop because its call centre acted as the central point of contact for all business units] was the biggest single source of income, making this unit the company's cash cow. This also meant that there was no new market demand and that most of the revenue was produced due to a high return on assets. CIS was also under pressure with its long term outsourcing contracts coming to an end. The perception that SS was not making an impact also became clear. Two areas that did show promise was ADM and desktop because they had a combined revenue contribution of 45%. Harold realised that something had to be done. The market was changing; competition was rife and customers were becoming more and more demanding. Other avenues had to be explored. {Click the number for an overview of SwissIT' major customers and competitors 43}

New opportunities

23. In March 2003 SwissIT held a special business review meeting with all managers. Harold opened the meeting with the following statement: "Our year-to-date financial performance clearly shows that we need a new stream of income. The company is too reliant on its current customer base and services. I'm also of the opinion that the outsourcing market is changing very fast and that the days of double digit growth are gone. There is a clear trend that IT offshoring is becoming a viable option for our company, being driven by changing macro economic determinants and customer requirements. By adapting the offshoring model we can use it in all our units, especially where the service does not have to be rendered on the customer premises. I also have it on good authority that our holding company is very interested in investing in such a capability. They will even consider developing more than one of our units if it is viable. This is our opportunity to use cost, location and capability as a competitive advantage over our competitors."

24. SwissIT was in a unique position because it had the credibility of a large international company and local capability and capacity. Offshoring is a business model where a job or function is moved from a high cost production facility to a lower cost location outside the country. The cost saving achieved for the customer is significant whilst the income generated offshore by the service provider stimulates economic growth. This model is not new and has been used quite successfully in "older" manufacturing industries.[Nike, the sports apparel manufacturer, has used cheaper Asian production facilities, as apposed to the more expensive United States based factories to produce its products cost effectively (Kotler 2000:713).] IT offshoring mainly renders services, but the basis stays the same, namely the benefit gained out of utilising lower labour cost through virtual space. The service is intangible, but its worth is vested in what information it can provide; process it can support or business continuity it can ensure.

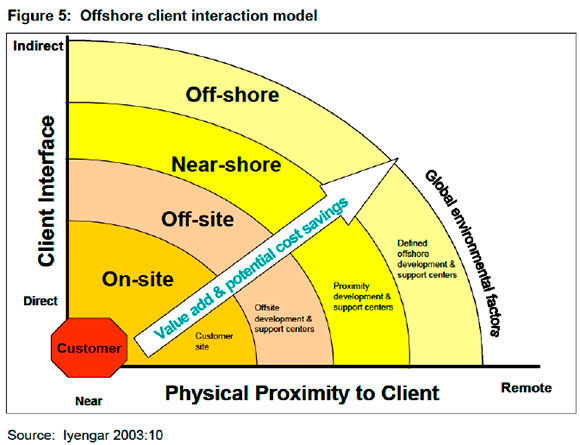

25. The cost saving value that is derived within the offshoring model grows with distance and a decrease in customer interaction (Figure 5). By using the model presented in Figure 5 it can be deducted that offshoring adds value and potential cost savings. This is a model that SwissIT had to adapt to their own services as lucrative opportunities exist across the spectrum of developments, support, and infrastructure service functions.

26. The offshoring model (Figure 5) required SwissIT management to rethink their services and how these could be adapted to the offshoring model. Management had to understand the various stages in offshoring. The first two stages are applicable when application development solutions are in a specification phase and regular interaction with the client is required, the so called onsite and offsite developments. As the solution is finalised and consensus is reached the development can take place at a low cost near-shore or off-shore site, increasing financial benefit.

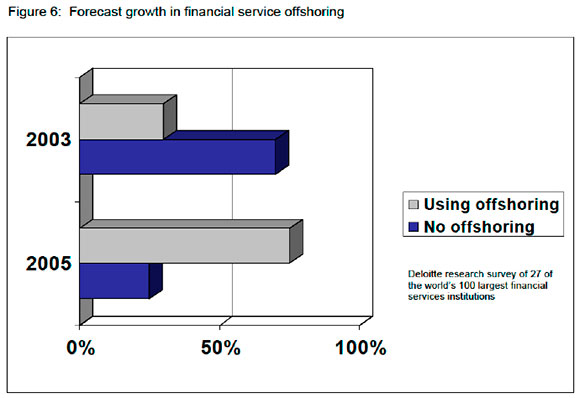

27. The meeting was a significant event and the SwissIT management team was quite impressed with the growth possibilities offshoring offered (Figure 6). The expected growth was just phenomenal. According to the research done by Deloitte (Rosenthal 2003:1) there is an anticipated growth of 150% in offshoring from 2003 to 2005 in the financial services industry alone. Seeing that SwissIT had some exposure to this industry, developing an offshoring capability was a strategic imperative, as other industries will follow this trend in due course.

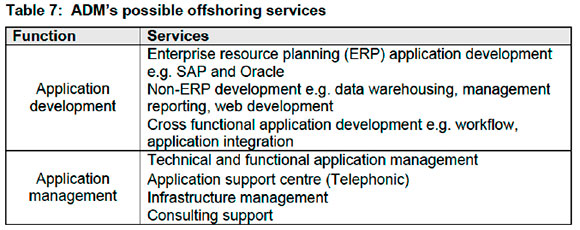

28. In order for SwissIT to adopt the offshoring model it immediately identified the ADM unit as the most likely unit pioneering such a model. The ADM unit had a number of services that could be delivered directly to foreign based clients and created teams that focussed on offshoring delivery activities, such as consulting, development, roll-out planning, training and maintenance. Tom was quick to point out to his colleagues: "ADM's application solution portfolio is perfect for offshoring simply because we don't have to be on site 100% of the time to develop a SAP solution. In fact, ADM will be able to develop any technology solution given the specification is comprehensive enough." Although this was quite optimistic, the ADM team conducted an analysis of what services could be viable as an offshoring proposition. They developed a comprehensive table (Table 7) that depicted which services fit within the application solution function and which services could be rendered as part of an application management function.

New challenges

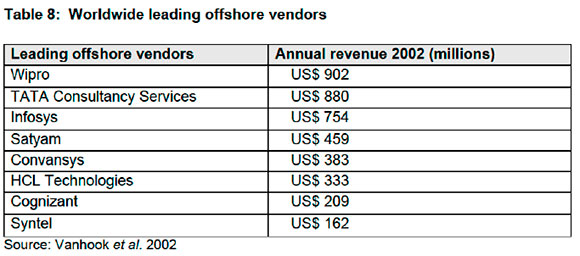

29. During the winter months a colder reality was slowly dawning on some of the executives. The rand remained stronger than anyone imagined and various challenges were identified as managers were engaged in planning sessions and workshops. Sarel Botha remained confident though, and during one of the workshops he mentioned: "We realise we have stiff competition and that the market conditions are harsh. Our own economic situation is also challenging, not to mention the competition, but let's remember that the top eight competitors command a market share of more than four billion dollars (Table 8). Sure there are challenges, but I believe we have the skills, capacity and partnerships to overcome them. Even if we capture 1% of that market, it will make sense for us."

30. Sarel was specifically referring to the competitors that were already well established thereby making entry into the market difficult (Table 8). Companies based in India provided the major source of competition as they established a reputation of capability and cost competitiveness over the past few years, making them formidable competitors.

31. The management team also had to understand the major customer requirements. Input was received from a well known IT research house3 that listed a number of key trends that would become visible in the market in the course of the next years:

- offshore becomes popular and widely accepted by customers in general • intense focus on competitive delivery cost for offshoring services

- general service requirements expand into a wide variety of additional requirements including infrastructure management

- demand for standardised and pre-packaged generic solutions that require limited customisation and can be rolled out easily

- a requirement for niche solutions were generic packages are not available ■ global support and delivery capability with applicable support structures

- a greater focus on an established set of best practices.

32. In addition to these trends the management team had to take cognisance of what customers required before choosing a vendor for offshoring services:

■ delivery capability of the vendor

- vertical market experience

. knowledge transfer time

- amount of on / off site time spend by the vendor

■ project management methods.

33. All these requirements aside, a number of basic operational issues were identified in a workshop with functional consultants. Some of these included the ability to communicate understandably with customers during projects, working across time zones and addressing basic infrastructure issues such as SwissIT's ability to deliver services with a certain level of reliability. The Vanhook et al. (2002) indicated that in 15% of offshoring cases, discrepancies, misunderstandings, confusion, terminology differences, and other issues arise when dealing with non-English-speaking countries.

New horizons to present day

34. A little more than a year since the offshoring idea gained momentum in SwissIT, a number of business components were put in place. Herald visited India to gain some insight into how the competition was conducting business. A sales and marketing plan was devised and it was decided that the initial target market would be European companies. The plan was to leverage experience gained out of their current client and industry base and gain competitive advantage when targeting similar European companies.

35. In addition to the sales and marketing plan, a number of partnership agreements with suppliers were finalised. Great emphasis was placed on companies where SwissIT were already providing services. The agreements stipulated that any offshoring requirement from Europe based companies would be passed on from the vendor to SwissIT and full support would be rendered. The following partnerships were finalised:

■ SAP Germany - Certified installer of SAP applications;

■ Oracle South Africa - Agreement to implement and support all Oracle databases;

■ Microsoft South Africa - Agreement to implement all Microsoft business suite application;

■ HP South Africa - Agreement to host all HP server products;

■ IBM South Africa - agreement as an accredited mainframe support specialist vendor and DB2 database installation partner.

36. The partnership agreements quickly yielded results. A lead was received from SAP Switzerland for the implementation of a SAP solution for a private banking group in Austria. Seeing that the opportunity ideally suited Tom's ADM unit, they grabbed the opportunity and immediately assembled a proposal team incorporating the local SAP and HP offices. The results were astonishing. The Rand / Euro differential provided ample margin and only 25% of the total project time was scoped for on-site work in Austria, keeping costs low. The total cost of the proposal was 20% cheaper than the most competitive European contender and because the customer wanted support and hosting included, limited time zone disruption was required. More requirements followed as the sales and marketing plan was implemented.

37. Back at the empty bar Harold was smirking, glass in hand, looking at the sun setting in the west. "I wish it was that easy" he sighed ...

1 The number in the bracket is hyperlinked and refers to a paragraph number in the appendix. This allows electronic users to interact with the case and toggle to additional information by clicking the hyperlinked number.

2 Translated as: "That is not true sir, you only speak foreign German!"

3 A combination of META Group 2002 & Gartner Group 2003.

APPENDIX: ADDITIONAL INFORMATION

Economic challenges

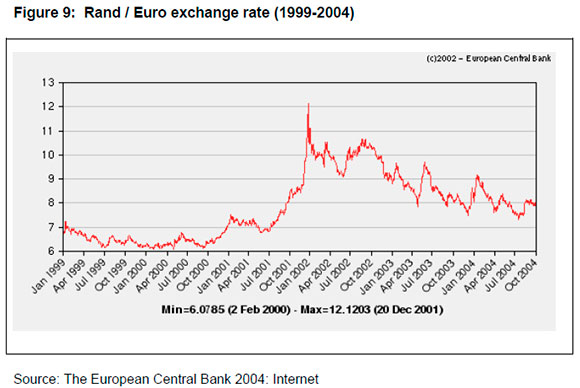

38. The Rand / Euro exchange rate has changed since a low at R12,20 to the Euro in 2001 to a rate of approximately R8,00 to the Euro in 2004 (Figure 9). A strengthening currency does not bode well for export services, but a stabile level created more predictability in SwissIT cost structures. This is important for selling and managing offshoring contracts.

39. The SwissIT management team collectively decided to use foreign exchange contracts to manage the risk caused by an erratic currency. Foreign exchange contracts are useful when a currency depreciates in short spans of time. During the period January to April 2003 the Rand depreciated with more than one Rand to the Euro (Figure 9). Such a move can hurt margins seriously in any business. Exchange rate fluctuations are one of many factors that can negatively influence any international company. SwissIT management also had to take cognisance of the following economic factors:

■ Inflation - This is an important factor because it determines in real terms how positive or negative the business is growing. It is also an important determinant of global competitiveness, as a high inflation rate can force (for example) labour cost higher than a competitive level.

. Economic growth - The growth in economic output is a determinant for economic prospects and confidence. It measures the output of the economy in gross domestic production and is a very good measure to see if the economy in a growth or slowdown phase. It is more important for the economy to growth beyond inflation, as it creates capacity for investment and new business creation. A growing economy creates confidence and is usually a reflection of monetary and fiscal stability. {Click the number to return to the text 5}

Key performance areas and strategic objectives

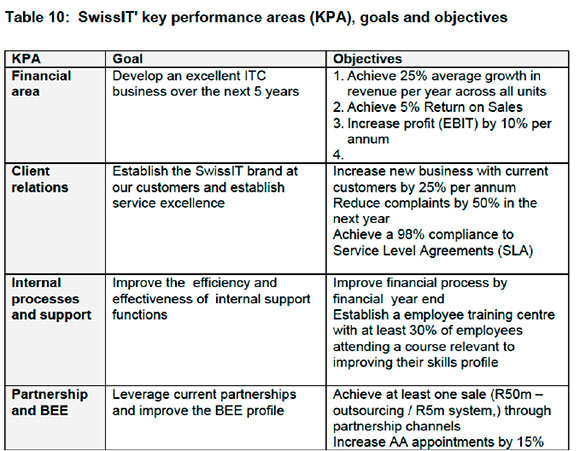

40. The SwissIT strategy defined four key performance areas (KPAs) as depicted in Table 10. Each key performance area has a long term goal associated to it, supported by corresponding short term strategic objectives. The management requires that any new venture should fit with the goals of the organisation and support the objectives.

{Click the number to return to the text 15}

Functional decomposition of the organisation

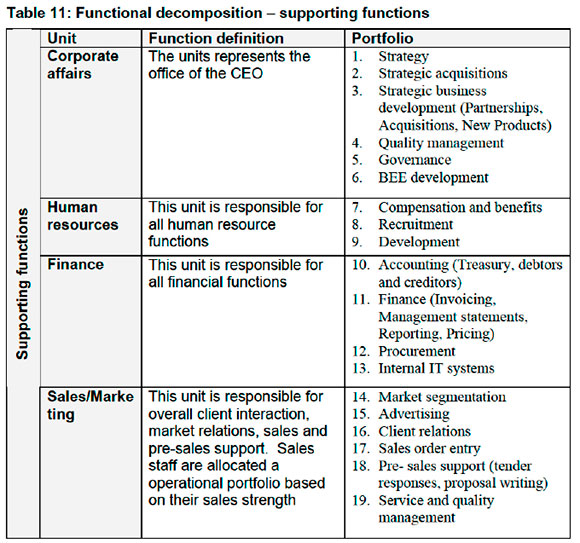

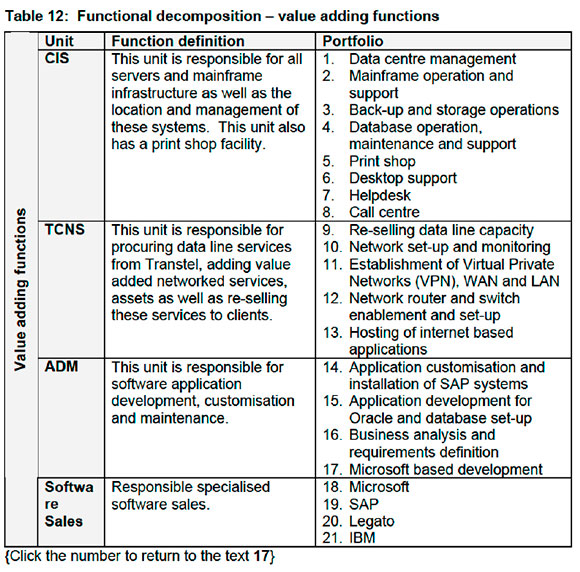

41. The functional decomposition of SwissIT is presented in Tables 11 and 12. The purpose of the functional decomposition is to provide a concise view of the business according to its current value chain activities. It also indicates at a high level management's portfolio responsibilities and how they relate to the overall supporting and value adding functions. An added benefit is the detail operational functions that is indicated and cross referenced to management function and unit.

42. It is possible to use the functional decomposition as an initial base to re-arrange activities or to restructure the business with the use of business models such as the value chain. Care should, however, be taken before arbitrarily applying traditional models as some of them are based on manufacturing concerns and not service businesses such as SwissIT finds itself in.

Marketing and sales

43. SwissIT has developed a diversified client base and provides a wide variety of services to each of its customers. Each customer is serviced by a customer relationship manager who is responsible for ensuring service levels are met and also responsible for on-selling and new business development in customer accounts. The sales process is as follows: new business is sourced through dedicated account executives who have been allocated target accounts based on market research and matching the service portfolio to prospective client's business drivers and anticipated requirements. This strategy is well supported by press and promotional articles. This process is further strengthened by an internationally recognized brand, in the form of SwissTelco as overall holding company and SwissIT. These companies, with their extensive resources, reach and networks across the world give SwissIT a definite market differentiator.

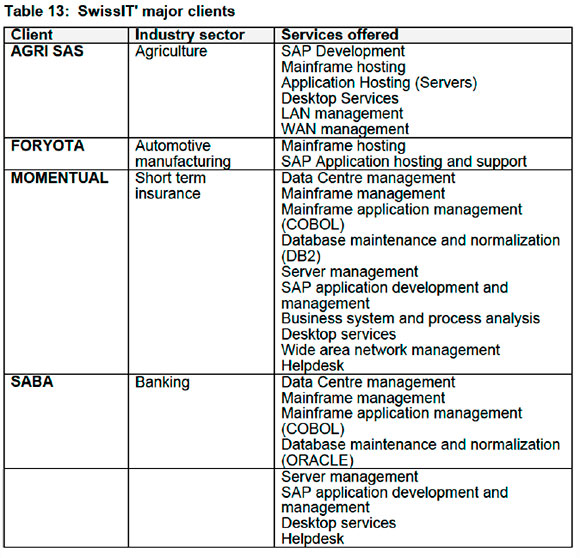

44. The sales strategy has proved fruitful and a number of major accounts were won (Table 13). More importantly a wide range of industries have been targeted in the process. A closer analysis of services offered, as presented in Table 13, indicates that all of SwissIT clients make use of CIS, but not all make use of ADM, which indicates some opportunities in the current client profile.

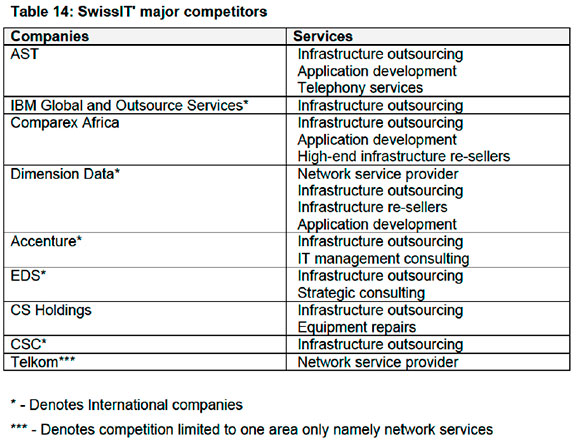

45. The company has a number of competitors in the IT outsourcing and services segment (Table 14). Most of these competitors compete head-on with SwissIT for major business and five of its current competitors are also international companies. Various competitive or substitute services are also provided by SwisslTs competitors.

46. Further competitor analysis (Table 14) shows that eight companies compete with the CIS unit, but only three compete with the ADM unit in SwissIT. This confirms the growth opportunity locally and abroad for focusing on application development services. {Click the number to return to the text 23}

CASE BIBLIOGRAPHY

IYENGAR P. 2003. Sourcing application services: what, when & why? Gartner Group [Presentation 21 August.]

KOTLER P. 1999. Marketing Management. 10th ed. Upper Saddle River: Prentice Hall.

ROSENTHAL BE. June 2003. Deloitte study discovers 75 percent of global financial institutions plan to outsource offshore. [Internet: http://www.outsourcing-financial-services.com/deloitte.html Date accessed: 2004/09/27]

THE EUROPEAN CENTRAL BANK. October 2004. Euro / Rand exchange rate graph. [Internet: http://www.ecb.int/stats/exchange/eurofxref/html/eurofxref-graph-zar.en.html. Date accessed: 2004/10/04]

VANHOOK H, DAVISON D, O'DONNELL G & SANDER K. 2002. Going the distance: getting onboard offshore. Meta Group [Teleconference transcript 26 September.]

QUESTIONS

1. Conduct an internal (strengths and weaknesses) and external (opportunities and threats) analysis of SwissIT South Africa. The analysis must be based on the current operational structure as well as the new opportunities presented. Refer to possible generic (business level) strategies that may be followed based on the SWOT analysis.

2. Devise a value chain for the offshoring unit, by adapting Porter's value chain model. Logically cluster the service units and devise an organisational structure.

3. By critically evaluating the value chain identify the major cost elements of an offshoring unit.

4. How can cost be optimised and economies of scale be realised across all units if offshoring is implemented successfully?

5. Define the major operational dilemmas that a management team may face in a typical offshoring operation and how it can be addressed.

6. Devise a ROI financial model based on the initial investment and operational cost of an offshoring model.

7. What macro economic factors can influence the direct success of offshoring by taking the South African situation into account? Please refer in your answer to applicable local and world economic issues and specifically address: economic growth, currency fluctuations, and inflation

8. What would be the competitive advantages for SwissIT to enter into this new service offering if compared to countries like Brazil or India?

9. What mechanisms can be used or negotiated to manage exchange control risk.

10. If you were a potential customer of offshoring services, what would be important business drivers for you to make use of this service?

11. What additional opportunities exist for SwissIT for other related services that can also fit into an offshore business model?

12. If you were a consultant in SwissIT, what would you propose the company does in terms of its investment strategy i.e. focus on current units through reinvestment or invest in offshoring? Motivate your answer.

13. Define the potential target markets for SwissIT's offshoring service. Explain how these markets can be targeted by referring to sales channels.

14. What are the human resource issues that need to be taken into consideration if contemplating an offshoring model?