Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Potchefstroom Electronic Law Journal (PELJ)

versión On-line ISSN 1727-3781

PER vol.18 no.7 Potchefstroom 2015

http://dx.doi.org/10.4314/pelj.v18i7.12

NOTES

RAF v Sweatman (162/2014) [2015] ZASCA 22 (20 March 2015). A simple illustration of the SCA's statutory misinterpretation of section 17(4)(c) of the Road Accident Fund Act 56 of 1998

S FickI; P van der MerweII

ILLB LLM (University of Stellenbosch). Lecturer in Private Law, University of Cape Town, South Africa. Email: sarah.fick@uct.ac.za

IIBCom (Hons) Actuarial Science (University of Stellenbosch). Actuarial Consultant, Munro Forensic Actuaries, South Africa. Email: paul@munrofa.com

SUMMARY

In Road Accident Fund v Sweatman (162/2014) [2015] ZASCA 22 (20 March 2015) (hereafter Sweatman) the Supreme Court of Appeal was faced with the interpretation of section 17(4)(c) of the Road Accident Fund Act 56 of 1998 (the "cap provision"). The purpose of this note is to assess the court's interpretation of the "cap provision" to determine whether this interpretation is sound. This is achieved by explaining the purpose of the Road Accident Fund and the Amendment Act. Thereafter the general method of calculating loss of income is explored, together with the different interpretations of the "cap provision" and the application thereof. The abovementioned decision of the SCA on the most appropriate interpretation is then critically analysed. It is argued that the court, in Sweatman, misunderstood the implication of its decision and was therefore incapable of interpreting the provision correctly. The effect is that one of the primary purposes of the Amendment Act is circumvented.

Keywords: Road Accident Fund; interpretation of statutes; quantification of damages; expert witnesses

1 Introduction

The problems associated with what Freckelton calls the "knowledge gap"1 (between judges and expert witnesses) carry with them the inherent danger that judicial decision-makers engage in deliberations and come to conclusions on the basis of evidence that they do not fully comprehend.2

The recent decision of Road Accident Fund v Sweatman (162/2014) [2015] ZASCA 22 (20 March 2015) (hereafter Sweatman) highlighted this danger. In this matter the Supreme Court of Appeal was faced with the interpretation of section 17(4)(c) of the Road Accident Fund Act 56 of 1998 (hereafter the Act). Since the application of this section often involves actuarial calculations, the court relied on evidence led by actuaries to decide the matter. The knowledge gap between the court and these expert witnesses is evident in the fact that the resultant interpretation of the section defeats the purpose of an earlier amendment of the Act.

The Act provides for the compensation by a public fund for "loss or damage wrongfully caused by the driving of motor vehicles".3 This includes loss of income as a result of a motor vehicle accident. In the 2005 amendment of the Act,4 the compensation for loss of income is limited to R 160 000 per year.5 This limitation is referred to as "the cap" on compensation for loss of income.6 Although application of the cap might seem straightforward, recent case law has proven otherwise.7 Not only are there different ways of interpreting the section and applying the cap, but the different interpretations have extreme effects. The practical and obvious difference is that the amount that the claimant should receive can differ by more than R 2 000 000.8 Yet, perhaps more distressing is the fact that some interpretations can defeat the purpose of the "cap provision"9 altogether.

The purpose of this note is to assess the interpretation of the "cap provision" upheld by Sweatman, to determine whether or not this interpretation is sound. This is achieved by explaining the purpose of the Road Accident Fund and the Amendment Act. Thereafter the general method of calculating loss of income is explored, together with the different interpretations of the "cap provision"10 and the application thereof. The abovementioned decision of the SCA on the most appropriate interpretation is then critically analysed. It will be argued that the court in Sweatman misunderstood the implication of its decision and was, therefore, incapable of interpreting the provision correctly. The effect is that one of the primary purposes of the Amendment Act is circumvented.

2 The Road Accident Fund Act

As stated above, the purpose of the Act is to create a public fund, called the Road Accident Fund (the RAF), for the compensation of people who suffer damage or loss as a result of a motor vehicle accident.11 The wrongful party is, therefore, indemnified against liability and no claim can be lodged against him.12 The RAF is financed "by way of a fuel levy in respect of all fuel sold within the Republic and by raising loans".13 Despite extensive financing the RAF has been technically insolvent for over 30 years.14 This is due to large claims, including a half a billion rand claim by a Swiss motorcyclist.15

To reduce its liability the RAF introduced, amongst other measures, an annual cap on all loss of income claims for accidents that occurred after 1 August 2008.16 The cap limits the amount claimable from the RAF to R 160 000 per year, to be adjusted quarterly to counter the effects of inflation.17 In the following section the general approach to calculating loss of income is discussed. This is necessary to explain the effect of the cap on this approach.

3 Calculation of loss

Quantifying a loss of income can be very complicated. A court needs to estimate the present value of the loss.18 In other words, a court needs to establish what single sum of money should be paid now, in order to cover all future loss of income. There are two general approaches to this task. On the one hand, a judge can estimate an amount that he deems fair and reasonable. This, however, amounts to "a matter of guesswork, a blind plunge into the unknown".19 A more reliable way, on the other hand, is to use mathematical calculations grounded in evidence-based assumptions.20 This is done by actuaries and our courts have indicated a preference for this approach.21

Actuaries adopt a commonly accepted method in determining the present value of a loss.22 The first step is to determine the actual loss of the claimant. This is achieved by first determining the income that the person would have received had he not been in the accident and continued to work as normal (future income but for the accident). Second, the reduced earnings that the person is able to receive as a result of the accident are determined (future income notwithstanding the accident). Third, the latter amount is deducted from the former amount. The result represents the actual loss of income of the claimant. The second step is to determine the single sum that should be paid by the RAF to cover the loss. Actuaries use a method called "discounting" to calculate this amount.23 In discounting the actual loss of income of the claimant, the present value of the loss (the amount to be awarded by the court) is determined. The rest of this section explains these two steps in greater detail.

3.1 Estimating future earnings

To estimate both the claimant's future income but for and notwithstanding the accident, actuaries often rely upon industrial psychologists' reports. The industrial psychologist assesses the claimant and reports on the probable employment prospects but for the injury, on the one hand, and notwithstanding the injury, on the other hand. Actuaries use this report to make assumptions regarding the claimant's future income but for and notwithstanding the accident, using mathematical calculations.24 Factors taken into account are the education of the claimant, his current vocation, the vocation he is likely to follow after the accident (if different), probable promotion opportunities, the number of years before retirement and any retirement benefits.25

Certain deductions and adjustments are made to the amounts calculated above.26These deductions relate to the tax that the claimant would have paid on the income he would have received but for and notwithstanding the accident,27 the likelihood of the claimant passing away before retirement age (mortality)28 and other unpredictable circumstances that might influence the calculations (general contingencies).29 Subsequent to these deductions and adjustments being made, the estimated future income as a result of the accident is subtracted from the income that the claimant would have earned had he not been injured.30 This indicates the actual loss of the claimant.

3.2 Discounting actual loss

After calculating the actual loss of the claimant, the loss is discounted to determine the present value of the loss.31 This means that actuaries have to calculate the amount that should be awarded at the date of the injury,32

... which, if invested at an appropriate rate of interest, would provide him with the amount ... (which we assume to be his loss of earnings) at the time when he would have received it had the injury not been sustained. In this way he would be placed in the same position as that in which he would have been if the delict had not been committed.33

It is this idea of discounting that caused the knowledge gap between the SCA and the actuaries in Sweatman. To explain this knowledge gap and the effect thereof a simple analogy is used to illustrate the concept of discounting. The simplicity of this analogy in academic writing is in no way meant to offend the reader, but is preferred to ensure that this gap is bridged and to appeal to a broad legal readership.

3.2.1 The growth of trees as an analogy for discounting

The idea of discounting can best be illustrated by drawing an analogy between the steady growth of planted trees and invested money.34 To draw this analogy, the following factual scenario is useful.35

John, a farmer, has 10 tree plantations. Each plantation comprises of 10 trees. The trees in each plantation are in a different stage of growth. This is because John has specifically planted them so that every year, for the next ten years, the trees in a different plantation will be big enough to harvest and sell. His profit on a full grown tree is R 100. He, therefore, makes R 1 000 per year.36

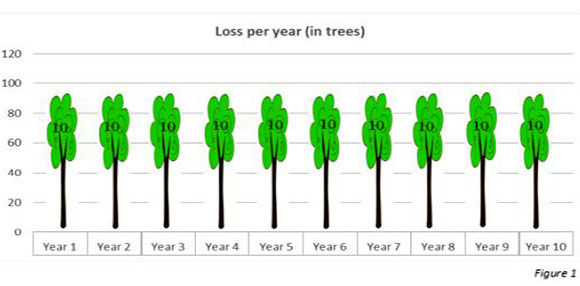

One day all ten of John's plantations burn down. John's loss can be expressed as R 1 000 per year for 10 years (his annual profit). It can, however, also be expressed as 10 full grown trees per year (the number of trees he sells per year). This discussion focuses, first, on John's loss expressed in terms of trees and, thereafter, on his loss expressed in terms of income. Figure 1, below, illustrates John's loss in trees per year.

Assume, for purposes of this illustration, that trees grow at a rate of 10% of their full-grown size every year. This growth is illustrated by figure 2 below.

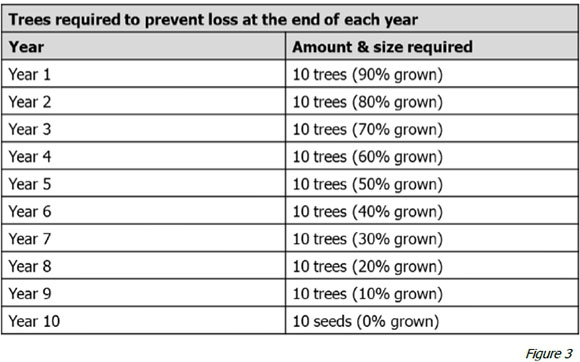

One way to prevent John's future loss of 10 full grown trees per year is to give him new trees. If someone were to have to give him all of the lost trees at once (100 trees), then that person would take into account that the trees will start growing as soon as John plants them. To prevent the loss John would have suffered at the end of Year 1, ten of the trees should, therefore, be very close to their full grown size, but not yet fully grown (90%). However, the ten trees that are planted to prevent the loss at the end of Year 8 do not have to be that big. They can be very small (20% of their full grown size) because they still have eight years to grow. The table below, figure 3, indicates the number and size of the trees that John should receive and plant now, to prevent his future loss.

From figure 3 it is clear that when the differently sized trees are received they do not all have equal value (based on the assumption that bigger trees have more value). Nevertheless, they will render the same value if planted now and harvested at the time that the loss would have been suffered. Calculating what John needs to get now in order to cover his loss in the future, taking into account the probable growth, is analogous to the idea of discounting in RAF loss of income calculations.

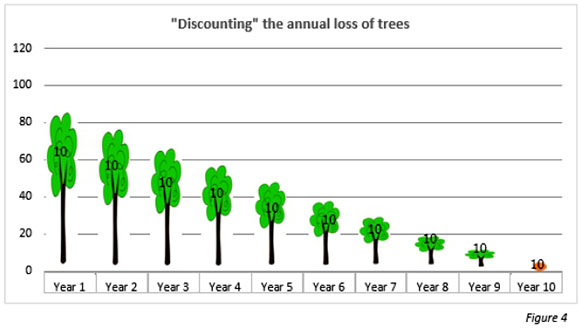

Since trees grow at 10% of their full grown size every year, the loss of 10 full grown trees per year is "discounted"37 at 10% per year. Figure 4, below, shows the size of trees to be planted now to cover the loss in a specific year in the future. The further away the loss is, the smaller the size of the trees must be that should be planted now. This is because the further away the loss is, the more time the trees have to grow. That is why the trees to be planted for the loss in Year 10 are so small (they might, in fact, only be seeds).38

3.2.1 Using the anabgy to Mustrate the discounting of annual loss of income

Instead of giving John new trees his loss can be prevented by giving him a single sum of money. The amount should be such that, if he invests it, he will have the same amount of money at the end of each year that he would have received from the sale of trees. As with the trees, money also grows (through investment). Therefore, although John's loss over the 10 years is R 1 000 per year or R 10 000 in total,39 the amount he needs now is much less.

Invested money does not, however, grow at the same rate as trees. This is because interest is calculated on the invested amount. In simple terms, the interest earned in Year 1 is added to the investment amount. This increases the investment amount. Since the amount of interest earned is based on a percentage of the investment amount, an increase in the investment amount leads to an increase in the subsequent interest earned. Therefore, if the investment amount is R 100 in Year 1 and the interest rate is 10% per annum, the interest earned in Year 1 will be R 10. This is added to the investment amount. The investment amount for Year 2 is R 110. Annual interest at 10% for Year 2 would be R 11. This growth rate of invested money is referred to as compound interest.40

A consequence of this difference in growth is that invested money, on the one hand, grows at a slow rate when first invested, i.e. the first few years. This growth rate accelerates the longer the money is invested. In the tree example, on the other hand, the growth rate remains consistent at 10% of the full grown size every year.41

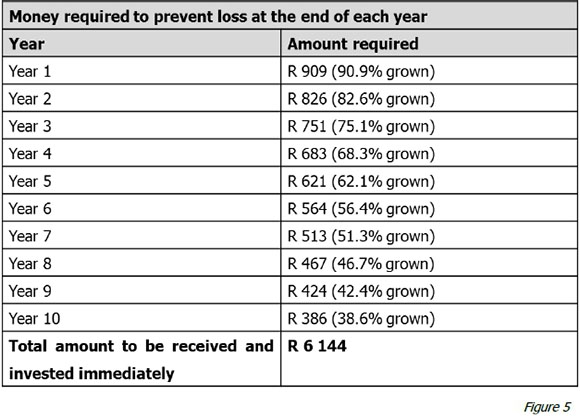

If the money John receives to cover his loss is invested at a compound interest rate of 10% per year then, to prevent his loss at the end of Year 1, he needs to receive only 90.9%42 of the money that he would have made (90.9% of his estimated annual loss for Year 1).43 This is because, if invested immediately, his investment will grow 10% before the end of Year 1. Similarly, to prevent his loss in Year 8, the amount he needs to receive and invest now needs to be only 46.7% (R 467) of the estimated annual loss for Year 8 (R 1 000). The money has 8 years to grow and at a rate of 10% per annum the amount of R467 is estimated to grow to R 1 000 by the end of Year 8. The table below, figure 5, indicates the amount of money that John should receive and invest now, to prevent his future loss.

The amounts needed for each year are called the discounted amounts. They have been discounted by a rate of 10% per annum (the rate the money will grow when invested).44 The sum of these amounts represents the present value of John's loss. If John receives and invests the sum of these amounts, R 6 144, it will cover his total loss of R 10 000. He, therefore, effectively receives the R 10 000 total loss calculated above.

3.3 Determining present value

The previous sections explained that the calculation of the present value of a loss of income involves a two-step process: first, the difference between what the claimant would have earned but for the accident and what the claimant is estimated to earn notwithstanding the accident is determined. This is referred to as the actual loss of income. Second, this amount is discounted to determine the lump sum, also known as the present value of the loss, to be paid and invested now to cover that loss.

Actuaries generally agree on this calculation. The dispute, as is evident in Sweatman, lies in the stage at which the cap on annual loss is applied during their calculations. Applying the cap at different stages of the calculations can make a considerable difference to the amount to be paid to the claimant.45

4 Interpretation of the cap provision

Disagreement exists on several aspects pertaining to the stage at which the cap, in the calculation of loss of income, is to be applied.46 This note focuses on the disagreement regarding whether the cap should be applied before or after discounting the actual loss. In March this year the SCA, in Sweatman, had the opportunity to resolve this disagreement.47 This case involved a claim against the RAF for loss of income. The matter was on appeal from the Western Cape Division of the High Court.

One of the legal issues before the court was whether the interpretation of section 17(4)(c) of the Act (the "cap provision") favoured application of the cap before or after discounting. The court found, in favour of the respondent (the claimant), that the cap should be applied after discounting.48

To analyse the court's interpretation of this provision, certain tools of interpretation can be applied. There are different interpretative tools when dealing with statutory provisions. Most popular is the "literalist-cum-intentionalist" tool,49 better known as the "golden rule" for interpreting statutory provisions.50 This rule involves interpreting statutes based on the actual wording of the provision "unless this would lead to an absurdity or to a result contrary to the intention of the legislature".51

That the court, in Sweatman, employed this tool is evident from the judgment. In explaining its interpretative process it refers, first, to its "reading" of the provision and then to its having "regard to its purpose".52 The analysis of the court's decision in this note involves applying this exact same tool to the cap provision to determine whether the court's application thereof was correct. By separating the tool's two parts, a two-step process of interpretation is followed. Firstly, the wording of the cap provision is considered to determine what a literal interpretation thereof would entail. Secondly, this literal interpretation is measured against the purpose of the provision.53

4.1 The wording of the cap provision

To consider the literal interpretation of the cap provision, it is necessary to examine the wording thereof. The cap provision reads:

[w]here a claim for compensation ... includes a claim for loss of income or support, the annual loss, irrespective of the actual loss, shall be proportionately calculated to an amount not exceeding . R 160 000 per year in the case of a claim for loss of income . [adjusted] quarterly, in order to counter the effect of inflation.

From the text above it is apparent that the meaning of the term "annual loss" is central to resolving the disagreement regarding the stage at which the cap should be applied during calculation. A revisiting of the factual scenario created above can shed light on the meaning of this term.

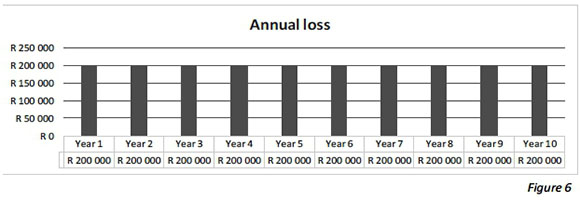

If, instead of having his plantations burned down, John the farmer was in a car accident and completely lost the ability to farm for 10 years, he might have a claim for that loss of income against the RAF. Moreover, if he was actually selling 2 000 fully grown trees per year instead of 100, then his loss of income per year would be R 200 000,54 as illustrated by figure 6 below.

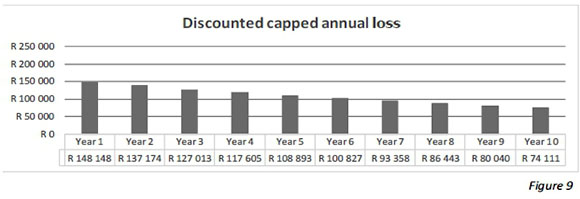

The loss per year (annual loss) over the 10 years would need to be discounted so that the fund can pay him a single amount immediately (present value of the loss). John can then invest that money, which investment should grow in such a way that it covers his annual loss every year, in the year it would have been lost. If the annual loss is discounted at a rate of 8% the discounted amounts will be as indicated in figure 7 below.55

The amount payable to John immediately would be all of the above amounts added together, namely R 1 342 017. This is significantly less than the sum of the total loss (R 2 000 000), but, as explained earlier, it represents the whole amount. If John receives the lesser amount from the RAF, he is effectively receiving his whole annual loss over the 10 years, namely R 200 000 per year for ten years. This is because the amount will grow upon investment.

As noted earlier, the dispute in Sweatman was about the stage at which the cap is to be applied: before or after discounting. From the above figures it is clear that the question is actually which amounts are to be capped? If the cap is applied before discounting, then the annual loss is capped (figure 6), but if the cap is applied after discounting, then the discounted amounts are capped (figure 7).

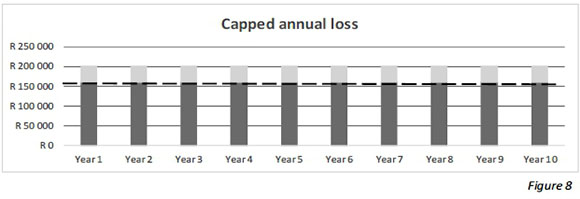

The "plain words"56 of the provision clearly require the cap to be applied to the annual loss (figure 6). In Sweatman the court required the cap to be applied to the discounted amounts (figure 7). At first glance the court's approach seems to contradict the plain words interpretation of the provision. For it to be in line with the act nonetheless, the effect of applying the cap to the discounted amounts should be the same as applying it to the annual loss. Figures 8-10below indicate the effect of applying the cap to the annual loss as opposed to the discounted amounts.

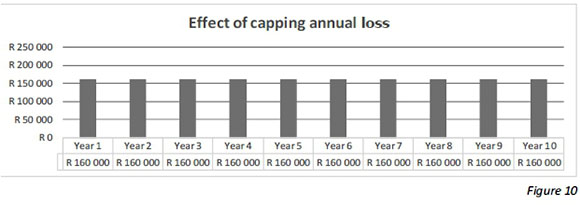

Figure 8 shows how the actual annual loss of R 200 000 is capped by the R 160 000 cap.57 Figure 9 shows how this amount is discounted to determine the present value of the loss. When these amounts are added together (R 1 073 613) they represent the amount that John should receive and invest to cover his capped annual loss of R 160 000). Figure 10 shows how this invested money (the R 1 073 613) is estimated to grow over the years and the loss that it should be able to cover annually. It is clear, from figure 10, that the effect of the cap and the discount is that John should effectively be able to receive R 160 000 per year as the invested money grows. John's actual annual loss of R 200 000 has been capped to an annual loss of R 160 000. This is in line with the wording of the act that, "irrespective of the actual loss" (the R 200 000 per annum), the annual loss should not exceed R 160 000.

To compare, figures 11-13 below indicate the effect of applying the cap to the discounted amounts as opposed to the annual loss.

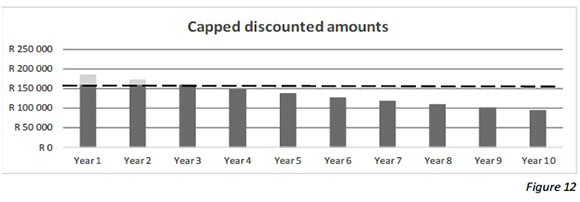

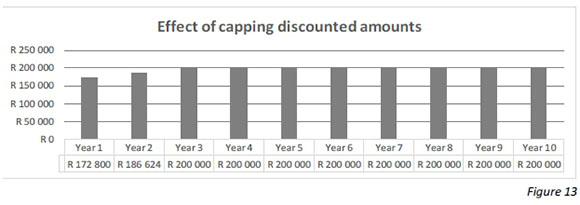

Figure 11 above shows how the annual loss is discounted before the cap is applied. These amounts (the discounted amounts), if added together (R 1 342 017) and invested, are estimated to cover John's total annual loss of R 200 000. Figure 12 shows how the cap is applied to the discounted amounts. In terms of the approach giving rise to this calculation, the present value of John's loss is, therefore, all of the amounts in figure 12 added together (R 1 305 364). Note that this amount is about R 230 000 more than the amount received in terms of the first approach.

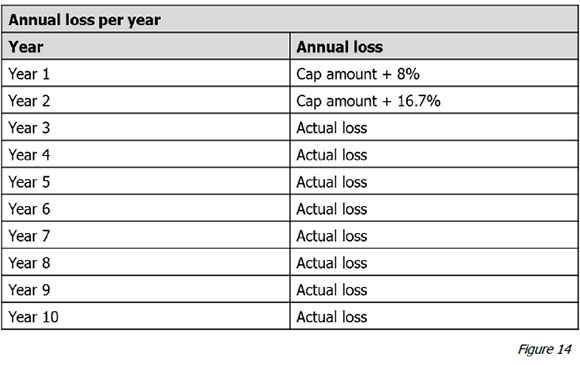

Figure 13 shows how, if invested, this money (the R 1 305 364) is estimated to grow over the years and the loss that it should be able to cover annually. It is clear from figure 13 that John's annual loss is not capped at R 160 000, as with the first approach. For the first three years his loss is capped, but after the third year he receives the full annual loss of R 200 000. Moreover, even the amounts to be received in the two "capped" years are not limited to R 160 000 per annum, but increase by the discount percentage each year, as is clear from figure 14 below.

The reason why the cap amounts seem to increase is because the R 160 000 received for Year 1, if invested, is expected to grow 8% by the end of Year 1 (the due date for the loss). Similarly, the R 160 000 received for Year 2, if invested, is expected to grow 8% in Year 1 and then another 8% in Year 2. So even though the amounts seem exactly the same: R 160 000 per year, the "capped" annual loss increases each year. This is not in line with the act, which limits the annual loss to R 160 000 and makes no provision for yearly increases of the cap by the discounted rate. Note that the annual loss of Year 4 and onwards is the actual annual loss. This is because the actual annual loss for these years falls below the increasing cap. (For Year 4, for example, the "cap" would be R 217 678 (R 160 000 + 36%),58 which is more than the actual loss of R 200 000.)

This subsection has confirmed that the literal interpretation of the cap provision cannot support the SCA's decision that the cap should be applied after discounting -in other words, to the discounted amounts. It does not comply with the actual wording of the provision that the annual loss be capped and neither does capping of the discounted amounts have the same effect as capping the annual loss. A justification for the court's preference of this approach might lie, however, in the second part of the golden rule of interpretation. Could it be argued that the capping of the discounted amounts, instead of the annual loss of the claimant, is necessary to fulfil the purpose of the provision?

4.2 The purpose of the cap provision

The cap provision provides for the quarterly adjustment of the cap to counter the effects of inflation.59 It could therefore be argued that the purpose of the provision is not only that the annual loss should be capped but that the cap amount should increase systematically.

As explained above, if the literal interpretation of the provision were used and the annual loss were capped, a claimant with a very high annual loss of, for example, one million rand per year would have exactly the same annual loss for every year subsequent to the accident. This would be because his annual loss for each year would be capped at the amount published in the last notice before the date of the accident.60

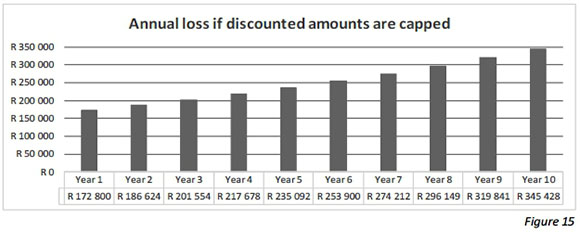

On the contrary, if the SCA's approach were used and the discounted amounts were capped, his annual loss would increase yearly by the discount rate used. Once the "cap'" for a certain year exceeds the actual annual loss for that same year, however, the increased cap has no effect any more. At that point the claimant will be entitled to his actual loss despite the fact that it exceeds R 160 000.61 Figure 15, below, illustrates the capped annual loss of someone with a very high actual annual loss of R 1 000 000.

As stated above, it could be argued that it is in line with the purpose of the act to increase the cap systematically due to the effects of inflation. As a result, the effect of the SCA's approach of an increasing cap might be in line with this purpose. However, although the act provides for an increase of the cap, it specifies that this increase should be in line with inflation. A more sound interpretation of the act would therefore be that the cap should increase with inflation. That would serve the purpose of the cap provision. It would also prevent the application of different increase rates to different claims. In practice actuaries do not apply a uniform discount rate.62 If the "cap" is, therefore, allowed to increase by the discount rate used by the actuary in that specific case, this would cause inequality amongst and uncertainty for claimants. Hence, to be in line with the literal and purposive interpretation of the cap provision, the annual loss of the claimant should be capped and the cap should be increased systematically to counter the effects of inflation.

This is what was argued by the appellants in Sweatman,63relying on an earlier High Court decision Jonosky v Road Accident Fund.64The SCA, however, rejected this argument.65 It specifically found that "[a] reading of s 17, even having regard to its purpose, does not lend itself to the interpretation that there is a different cap for each year after the accident".66 This statement makes it evident that there is a knowledge gap between the expert witness and the court. It is clear that the court failed to understand the effect of its decision: that the cap increases yearly. It is also abundantly clear that an increasing cap, in other words "a different cap for each year", was not something the court intended to endorse. The knowledge gap, therefore, caused the court to come to a conclusion that it did not fully comprehend or intend.

5 Conclusion

The purpose of this note was to assess the SCA's interpretation, in the Sweatman-decision, of section 17(4)(c) of the Act. This was achieved, firstly, by explaining the purpose of the RAF and the Amendment Act. Thereafter, the general method of calculating loss was explored, together with the different interpretations of the application of the cap. This note focussed on the difference between applying the cap before or after discounting.

In Sweatman the court found that an interpretation of section 17(4)(c) of the Act favoured the approach of applying the cap after discounting. It came to this conclusion by using the interpretative tool popularly referred to as the "golden rule". This rule requires courts to follow the literal wording of a provision, unless such an interpretation would be contrary to the purpose of the Act.

After exploring the meaning of discounting and the effect of the court's approach, it was evident that the court's interpretation is incorrect. This can be attributed to the knowledge gap between the expert witnesses and the court. The court's misapprehension and contrary intention are clear from its decision. By examining both the actual wording of the cap provision and the purpose thereof, the cap provision can be interpreted to mean that the cap should be applied to the annual loss of the claimant (before discounting). Furthermore, the cap should be increased systematically to account for inflation. This corresponds with the purpose expressed in the provision that the cap should be increased to achieve that objective.

Sweatman is a clear example of a case where a court is faced with a very technical matter. It highlights the risks of the court misunderstanding these technical concepts and indicates the extreme and adverse effects that such a misunderstanding might have. The effect of the misunderstanding in Sweatman is that a statutory provision is circumvented and this will (and has already) cost the RAF, and hence the South African road-users, a considerable sum of money. One can only hope that articles like this will alert the court to the detrimental effects of knowledge gaps and that the court will find creative ways to bridge such gaps before deciding similar technical matters.

BIBLIOGRAPHY

Literature

Du Plessis L Re-Interpretation of Statutes (Butterworths Cape Town 2002) [ Links ]

Freckelton I "Court Experts, Assessors and the Public Interest" 1986 Int'l J L & Psychiatry 161-188 [ Links ]

Koch RJ "Damages for Personal Injury and Death: Legal Aspects Relevant to Actuarial Assessments" 2011 SAAJ 111-133 [ Links ]

Meintjes-Van der Walt L "The Proof of the Pudding: The Presentation and Proof of Expert Evidence in South Africa" 2003 JAL 88-106 [ Links ]

Case law

Gwaxula v Road Accident Fund 2013 ZAGPJHC 240 (25 September 2013)

Jonosky v Road Accident Fund 2013 5 SA 256 (GSJ)

Road Accident Fund v Sweatman 2015 ZASCA 22 (20 March 2015)

SA Eagee Insurance Co Ltd v Hartley 1990 4 SA 833 (AD)

Sil v Road Accident Fund 2013 3 SA 402 (GSJ)

Southern Insurance Association Ltd v Bailey 1984 1 SA 98 (A)

Sweatman v Road Accident Fund (WCC) Unreported Case No 17258/11 of 3 December 2013 Venter v R 1907 TS 910

Legislation

Public Finance Management Act 1 of 1999

Road Accident Fund Act 56 of 1998

Road Accident Fund Amendment Act 19 of 2005

Government publications

BN 6 in GG 38419 of 30 January 2015

Internet sources

Benjamin C 2008 Lawyers Warn of Reduced Cover for Road Injuries http://www.bdlive.co.za/articles/2008/12/22/lawyers-warn-of-reduced-cover-for-road-injuries accessed 10 April 2015 [ Links ]

Doom J 2014 Big Trees Growing Faster Than Small Ones Will Absorb More Carbon http://www.bloomberg.com/news/articles/2014-01-15/big-trees-growing-faster-than-small-ones-will-absorb-more-carbon accessed on 10 April 2015 [ Links ]

Investopedia Date Unknown Investing 101: The Concept of Compounding http://www.investopedia.com/university/beginner/beginner2.asp accessed 10 April 2015 [ Links ]

IOL News 2008 Accident Fund's Largest Payout in History http://www.iol.co.za/news/south-africa/accident-fund-s-largest-payout-in-history-1.408114#.VRQOWfmUe3w accessed 10 April 2015 [ Links ]

Road Accident Fund Date Unknown Profile http://www.raf.co.za/About-Us/Pages/Profile.aspx accessed 10 April 2015 [ Links ]

Road Accident Fund 2014 Road Accident Fund Integrated Annual Report (2013/14) http://www.raf.co.za/Media-Center/Documents/RAF%20Annual%20Report%202014.pdf accessed 10 April 2015 [ Links ]

LIST OF ABBREVIATIONS

Int'l J L & Psychiatry International Journal of Law and Psychiatry

JAL Journal of African Law

RAF Road Accident Fund

SAAJ South African Actuarial Journal

1 Freckelton 1986 Int'/ J L & Psychiatry 161.

2 Meintjes-Van der Walt 2003 JAL 89.

3 Section 3 of the Road Accident Fund Act 56 of 1998 (the Act). The fund is owned by the South African public and is listed as a "national public entity" in terms of sched 3A of the Pubic Finance Management Act 1 of 1999. See RAF Date Unknown http://www.raf.co.za/About-Us/Pages/Profile.aspx.

4 Road Accident Fund Amendment Act 19 of 2005 (hereafter the Amendment Act).

5 Section 17(4)(c) of the Act was amended by s 6 of the Amendment Act. The section stipulates that this limit is to be adjusted quarterly to counter the effects of inflation. Also see Koch 2011 SAAJ 117. Note that this amendment limited not only the loss of income but also the loss of support. Since Road Accident Fund v Sweatman 2015 ZASCA 22 (20 March 2015) (hereafter Sweatman) focussed on loss of income, the scope of the note is limited to this, but the findings of Sweatman (and hence the conclusion of this note) can be applied to compensation for loss of support as well.

6 Koch 2011 SAAJ 117.

7 The most prominent cases are Sil v Road Accident Fund 2013 3 SA 402 (GSJ) and Jonosky v Road Accident Fund 2013 5 SA 256 (GSJ). Before Sweatman the findings in these two decisions caused a lot of uncertainty, since they offered contradictory approaches to the same issue.

8 Sweatman 10.

9 Section 17(4)(c) of the Act.

10 Section 17(4)(c) of the Act.

11 Section 3 of the Act.

12 Section 21 of the Act.

13 Section 5 of the Act.

14 RAF 2014 http://www.raf.co.za/Media-Center/Documents/RAF%20Annual%20Report% 202014.pdf 15.

15 IOL News 2008 http://www.iol.co.za/news/south-africa/accident-fund-s-largest-payout-in-history-1.408114#.VRQOWfmUe3w.

16 Benjamin 2008 http://www.bdlive.co.za/articles/2008/12/22/lawyers-warn-of-reduced-cover-for-road-injuries; S 6 of the Amendment Act; Koch 2011 SAAJ 117.

17 Section 17(4) of the Act.

18 Southern Insurance Association Ltd v Bailey 1984 1 SA 98 (A) 113F-114A; referred to in Sweatman para 6.

19 Southern Insurance Association Ltd v Bailey 1984 1 SA 98 (A) 113F-114A; referred to in Sweatman para 6.

20 Southern Insurance Association Ltd v Bailey 1984 1 SA 98 (A) 113F-114A; referred to in Sweatman para 6.

21 Sweatman para 7.

22 This is explained in the a quo decision of the Sweatman-case; Sweatman v Road Accident Fund (WCC) Unreported Case No 17258/11 of 3 December 2013 paras 7-10.

23 Sweatman paras 7-8. For a definition of "discount", see s 3.2 below.

24 Sweatman para 7.

25 Sweatman para 7.

26 Sweatman para 8.

27 Sweatman para 7; Koch 2011 SAAJ 118.

28 Koch 2011 SAAJ 116.

29 Sweatman para 8; Koch 2011 SAAJ121; Gwaxu/a v Road Accident Fund 2013 ZAGPJHC 240 (25 September 2013) para 25.

30 Sweatman v Road Accident Fund (WCC) Unreported Case No 17258/11 of 3 December 2013 paras 7-8.

31 Sweatman v Road Accident Fund (WCC) Unreported Case No 17258/11 of 3 December 2013 para 9.

32 Koch 2011 SAAJ 114.

33 SA EagLe Insurance Co Ltd v Harteey 1990 4 SA 833 (AD) para 9.

34 By drawing this analogy the authors do not mean to contend that the growing of trees and the growing of money are identical. The growing of trees differs vastly from the growing of invested money. However, since the growing of trees is easily understood and does explain the concept of the growing of invested money simply and sufficiently, this analogy is used. One of the main differences between the growth of these two things is the way in which growth occurs, as will be explained briefly in s 3.2.2 below.

35 This illustration is deliberately simply and the authors by no means attempted to or contend to give a realistic or precise explanation of timber farming.

36 R 100 x 10 trees = R 1 000.

37 The word discount or any form of the word, in reference to trees, is written in inverted commas to indicate that this does not refer to "actual" discounting as applied in RAF loss of income calculations. It is merely part of the analogy to explain what is meant by discounting in RAF loss of income calculations.

38 These trees still have ten years to grow at a rate of 10% of their full grown size every year. In fact, if they grow at 10% of their full grown size every year, these trees need to be 0% grown at the beginning of year one, ie seeds.

39 R 1 000 (per year) x 10 (years).

40 For more information on compound interest, see Investopedia Date Unknown http://www.investopedia.com/university/beginner/beginner2.asp. The formula for compound interest used in this note is 1/((1+interest)Ayears).

41 In reality, studies have shown that trees do, in fact, grow faster the bigger they get. See Doom 2014 http://www.bloomberg.com/news/articles/2014-01-15/big-trees-growing-faster-than-small-ones-will-absorb-more-carbon.

42 All percentages used are rounded to 1 decimal place.

43 To keep the explanation uncomplicated it is assumed that the money is invested at the beginning of the year and the loss is suffered at the end of the year. This is assumed throughout the note.

44 This is a very simplified description of discounting. The net discount rate is actually based on more than just the "expected rate of investment return" and also takes into account for example the "expected future rate of inflation". See, Sweatman v Road Accident Fund (WCC) Unreported Case No 17258/11 of 3 December 2013 para 9.

45 Sweatman para 10.

46 For example, another disagreement raised in Sweatman was whether the cap should be applied before or after the mortality of the claimant is taken into account. See Sweatman para 13.

47 Sweatman paras 1, 10.

48 Sweatman para 20.

49 Du Plessis Re-Interpretation of Statutes 100. Du Plessis explains that this rule was first applied in Venter vR 1907 TS 910 914-915, but that subsequent to that case various cases have confirmed it. See Du Plessis Re-Interpretation of Statutes 104 fn 128 for a list of these cases.

50 Du Plessis Re-Interpretation of Statutes 101.

51 Du Plessis Re-Interpretation of Statutes 103-104.

52 Sweatman para 15.

53 Absurdity is not dealt with in this note, since the authors do not consider it applicable.

54 This amount is simplified. It assumes a "net earnings (uninjured)" of R 200 000 and a "net earnings (injured)" of zero. To keep the example simple, deductions are not taken into account.

55 The discount rate used here is 8% per annum. Discount rates vary from actuary to actuary. See Koch 2011 SAAJ 113.

56 Du Plessis Re-Interpretation of Statutes 103.

57 This amount is used purely as illustration. Currently the cap amount is R 227 810 (since 31 January 2015). BN 6 in GG 38419 of 30 January 2015.

58 36.04% rounded to 1 decimal place.

59 Currently the cap amount is R 227 810 (since 31 January 2015). BN 6 in GG 38419 of 30 January 2015.

60 Sweatman para 15; the judge is referring to s 6 of the Amendment Act.

61 Or whatever amount the cap is at that moment.

62 Koch 2011 SAAJ 113.

63 Sweatman para 13.

64 Jonosky v Road Accident Fund 2013 5 SA 256 (GSJ).

65 65 Sweatman para 15.

66 66 Sweatman para 15.