Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Acta Commercii

versão On-line ISSN 1684-1999

versão impressa ISSN 2413-1903

Acta Commer. vol.23 no.1 Johannesburg 2023

http://dx.doi.org/10.4102/ac.v23i1.1180

ORIGINAL RESEARCH

Managerial ability and corporate cash holdings adjustment speed in South African listed firms

Trust ChirekaI; Tankiso MoloiII

IDepartment of Accounting and Finance, Faculty of Business Science, Walter Sisulu University, East London, South Africa

IIJohannesburg Business School, University of Johannesburg, Johannesburg, South Africa

ABSTRACT

ORIENTATION: There is little evidence on how managerial traits influence corporate cash holdings decisions.

RESEARCH PURPOSE: The study investigated the relationship between managerial ability (MA) and the speed of adjustment of corporate cash holdings back to their optimal levels.

RESEARCH DESIGN, APPROACH AND METHOD: A quantitative research approach was used by deploying the two-step generalised method of moments (GMM) and the system-GMM estimations to test how MA influenced corporate cash holdings speed of adjustment (CH-SOA). The study sample consisted of 143 non-financial firms listed on the Johannesburg Stock Exchange (JSE) for the period from 2000 to 2020.

MOTIVATION FOR THE STUDY: While prior studies have found that managerial ability drives corporate decisions and performance, there remains a dearth in empirical studies linking managerial ability with CH-SOA.

MAIN FINDINGS: This study found evidence of the existence of optimal cash holding levels and that the average speed of partial adjustment is 75.6% for South African firms. However, the speed of adjustment was lower in firms managed by highly able managers.

PRACTICAL IMPLICATIONS: The study has practical implications for managers, particularly, low-ability managers, who can learn how their more able counterparts manage and adjust cash holdings. Policy makers can clearly observe how different institutional and macroeconomic conditions affect business proclivity to making or delaying investments by holding cash.

CONTRIBUTION: The study provides new evidence on how MA influences CH-SOA. Previous cash holdings studies have ignored the role of MA. Additionally, we provide evidence of the existence of optimal corporate cash holding levels using data from South African firms. We find that firms partially adjust any deviations from the optimal levels considering firm-specific, institutional and macroeconomic conditions.

Keywords: corporate cash holdings; partial adjustment; managerial ability; macroeconomic factors; dynamic panel data.

Introduction

Rising corporate cash holdings is a global phenomenon that has aroused the interest of academics, activists and policy makers alike. In South Africa, corporates especially non-financial corporates (NCFs) are alleged to be on an investment strike, preferring to accumulate cash holdings rather than promoting real investment (Karwowski 2018). Accordingly, several studies have sought to understand the corporate cash holdings phenomenon in South Africa (Chireka 2020; Chireka & Fakoya 2017; Karwowski et al. 2022; Machokoto, Chipeta & Ibeji 2021). These studies have largely focussed on firm-specific and institutional factors that determine the optimal corporate cash holdings levels. However, to have a better understanding of corporate cash holdings, it is crucial to analyse the dynamic nature of cash management (Yung & Long 2022).

The dynamics of cash holdings involves understanding if firms have target cash levels, how quickly they adjust deviations from the target level and the factors that determine the speed of adjustment (Dittmar & Duchin 2010). This study seeks to fill this lacuna by investigating the determinants of cash holdings speed of adjustment (CH-SOA) towards the optimal cash level. Our results add to the scant literature that has investigated firm-specific determinants (Dittmar & Duchin 2010; Martínez-Sola, Garcia-Teruel & Martínez-Solano 2018) and institutional determinants (Cho, Choi & Kim 2018; Diaw 2021; Orlova & Sun 2018) of CH-SOA, by incorporating macroeconomic factors and a key managerial attribute, managerial ability (MA).

Past CH-SOA studies have generally not considered macroeconomic factors and MA as determinants of CH-SOA (Anand et al. 2018). In the aftermath of the global financial crisis, it has become important to consider the influence that macro factors exert on corporate policies (Anand et al. 2018). Majority of these studies have focussed on firms listed in the US and other western countries (Guariglia & Yang 2018). However, we find that the South Africa firms have higher cash holdings than corporates in these developed countries. With growing allegations of engaging in investment strikes, understanding the dynamics of corporate cash holdings in South African firms is of great importance.

Recent studies suggest that high ability managers significantly drive corporate financial performance and reduce information asymmetry between themselves and the shareholders (Gan & Park 2017). It is therefore crucial to investigate how managers of differing abilities manage cash holdings and how quickly they adjust any deviations from the target levels.

We use published secondary data from 2000 to 2020. For firm-specific factors, we draw data from NCFs listed on the Johannesburg Stock Exchange (JSE), while institutional and macro data are drawn from databases such as the Business Economic Research, World Bank and Federal Reserve Economic Data. The study adopts the model of Demerjian, Lev and McVay (2012) to construct managerial ability (MA) scores.

Literature review

Partial adjustment of corporate cash holdings

While the static trade-off theory posits that firms would have corporate cash holdings at the optimum levels and instantly adjust back to these levels whenever there are deviations, in practice, cash holdings do deviate from the target levels and firms are unable to return to optimum levels without delays (Orlova & Rao 2018). Market imperfections impose frictions, costs and delays to the speed with which firms adjust their cash holdings back to the optimum levels. Orlova and Sun (2018) refer to this rate of adjustment as the CH-SOA and point out that there are limited empirical studies on the determinants of CH-SOA.

How firms manage and adjust their cash policy in the long run remains unclear. As deviations from the optimal cash holdings level have consequences on shareholder value, whether managers aspire to return to these optimal levels and the determinants of CH-SOA remain an important research question (Orlova & Rao 2018). Dittmar and Duchin (2010) estimated the corporate cash holdings adjustment process and found that firms intentionally adjust their cash holdings towards their optimal levels. However, the reversion is imperfect, and firms exhibit heterogenous speeds of adjustment because of the presence of adjustment costs.

Cash holdings speed of adjustment can be used to ascertain whether an optimal cash holding level exists. The static trade-off theory of corporate cash holdings assumes that firms instantaneously adjust back to the target cash holding level, implying a high adjustment speed closer to 1.0 (Orlova & Rao 2018). On the contrary, slower adjustment speeds (further from 1.0) would imply the prevalence of the dynamic trade-off theory were the presence of significant financial and investment impediments affects the ability of firms to instantaneously revert to target levels (Venkiteshwaran 2011). Dittmar and Duchin (2010) found that US firms had cash holdings speed of adjustment between 21% and 46%. They argued that the speed of adjustment was driven by firm age and financial performance. Jiang and Lie (2016) found that firms with excess cash (cash above the optimal level) had faster CH-SOA than firms with cash holdings lower than the optimal level. The study explained that it is less onerous for firms to draw down their cash holdings, through debt settlements and share buybacks, compared accumulating cash holdings through costly capital markets. Orlova and Rao (2018) found that corporates in financial distress have slower adjustment speed compared to their unconstrained peers.

Xie et al. (2017) observed that financing frictions explain the differences in the speed of adjustment between firms. For instance, public insurers have higher CH-SOA compared to private stock insurers in times of severe cash shortages, yet their adjustment speed will be similar when they are enjoying excess cash. Martínez-Sola et al. (2018) found that for Spanish small and medium-sized enterprises (SME), speed of adjustment is driven by the precautionary motive of cash holdings. The study found that SMEs with greater investment opportunities adjust faster to their optimum cash holdings that affords them the much-needed financial flexibility to implement future profitable investment opportunities. Moreover, Martínez-Sola et al. (2018) established that SMEs in financial difficulties seek to avoid financial distress costs by having higher CH-SOA while all SMEs increase their CH-SOA in times of macroeconomic crisis.

While literature identifies several determinants of CH-SOA, the focus has predominantly been on developed economies (Orlova 2020). There remains a dearth of studies focusing on emerging economies. To the best of our knowledge, no studies have investigated the CH-SOA in the South African context. This is despite South African firms having been, over the years, accused of holding abnormally high cash holdings. To fully understand the corporate cash holdings situation in South Africa, it is important to study the way in which cash holdings deviate from and are adjusted back to the target levels. Therefore, this study seeks to fill this lacuna by investigating the CH-SOA on South African listed firms.

Past studies have generally focussed on firm-specific determinants of CH-SOA, ignoring the influence of institutional and macroeconomic factors (Orlova 2020). While Orlova and Sun (2018) investigate the impact of institutional factors on CH-SOA, this study does not factor in the effects that the macroeconomic environment has on CH-SOA. Orlova (2020) attempts to fill this gap by investigating the role of cultural and macroeconomic factors on CH-SOA. However, this study fails to include macroeconomic variables that mostly affect emerging economies such as business confidence, economic policy uncertainty and monetary policy. According to Dadam and Viegi (2018), emerging economies are susceptible to systemic risk, which often manifests as policy uncertainty and business confidence, which adversely affect investment. Our study extends the work of Orlova and Sun (2018) and Orlova (2020) by including macroeconomic variables more pertinent to the economic plight of emerging economies.

Further, these previous studies have focussed on cross-country data (Batuman, Yildiz & Karan 2022; Guizani & Ajmi 2021; Orlova 2020). However, Radebaugh, Gray and Black (2006) argued that preference must be given to single country studies as they avoid disparities in country-specific conditions such as culture, economic and socio-political systems.

Mediating role of managerial ability

The upper echelons theory postulates that the idiosyncratic traits of the managers such as experience, values, perceptions and other personal attributes influence organisational output (Hambrick 2007; Hambrick & Mason 1984). A recent stream of research has thus tested the influence of managerial characteristics on a wide range of corporate decisions. For instance, Liu, Wei and Xie (2016) investigated the impact of the gender of the chief finance officer (CFO) on earnings management. Huang, Rose-Green and Lee (2012) investigated the association between the age of the chief executive officer (CEO) and the financial reporting quality. Others investigated the nexus between CEO reputation and firm performance (Pham & Tran 2020); CEO overconfidence and corporate cash holdings (Chen, Ho & Yeh 2020) and managerial style and shareholder value (Lopatta, Kaspereit & Gastone 2020).

Managerial ability has recently emerged as a key managerial characteristic that researchers believe to drive many corporate decisions such as tax avoidance (Prakosa & Sari 2019), real earnings management (Huang & Sun, 2017), investment (Gan 2019) and firm performance (Andreou, Ehrlich & Louca 2013). There remains a dearth in studies that investigate the influence of MA in corporate cash holdings. This study predicts that MA affects corporate cash holdings speed of adjustment. However, the direction of the influence remains an empirical issue.

Cho et al. (2018) predicted that higher MA firms will adjust their cash holdings back to the optimal level quicker than firms with lower MA. This is because high-ability managers understand the financial consequences of having cash deficits and will therefore find immediate ways of accumulating more cash. For instance, firms with cash shortages will struggle to service their debt and to execute positive net present value (NPV) investments, hence would have to rely on expensive external funding (Opler et al. 1999). High-ability managers will move swiftly to avoid high transaction costs and the opportunity costs that come with missing out on investment opportunities because of financial constraints (Cho et al. 2018). Similarly, when firms have excess cash holdings, high-ability managers will seek to optimise shareholder wealth by distributing the surplus cash back to the shareholders (Cho et al. 2018). This is consistent with the agency theory's argument that excess cash holdings will be disgorged on value-diminishing investment projects by self-interested managers (Jensen 1986; Myers & Majluf 1984). Against this backdrop, it can be predicted that there is a positive relationship between MA and CH-SOA.

There is also a case for a negative relationship between MA and CH-SOA. For instance, high-ability managers have good networks with lenders and suppliers that guarantee quick access to finance and other services in times of need. Bonsall, Holzman and Miller (2017) and De Franco, Hope and Lu (2017) corroborate this view by positing that high MA firms have more favourable credit ratings and lower interest charged on bank loans. As such, high-ability managers in firms with low cash holdings will not have any pressure to adjust cash holdings upwards. On the other hand, when faced with excess cash, high-ability managers are well-capable of putting the cash to good use by investing in positive NPV projects (Goodman et al. 2014).

Cho et al. (2018) and Gholamrezapoor, Kazemi and Amirniya (2022) found evidence of a negative relationship between MA and CH-SOA in Korean and Iranian listed firms, respectively. This relationship was particularly significant for firms with excess cash, while MA had no significant impact on the CH-SOA of firms whose cash holdings were below their target levels. These studies concur that high MA firms expend excess cash only on value-maximising projects and often have lower information asymmetry. As such, managers in these firms have no pressure to quickly dissipate excess cash holdings. However, the two studies do not control for the effects of institutional and macroeconomic factors on CH-SOA. Our study contributes to this nascent literature by adding evidence from South African listed firms while including factors outside the firms (institutional and macroeconomic factors). Firms do not operate in a vacuum, and high-ability managers will consider the institutional and macroeconomic environment before making important corporate decisions, such as cash holdings management.

H0: Managerial ability has a statistically significant effect on CH-SOA

Research methodology

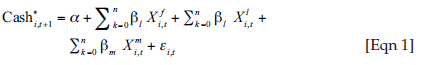

Patterning after past studies, this study estimates that the target cash holdings envisaged by the static trade-off theory can be estimated as follows:

where:  stands for firm-specific variables,

stands for firm-specific variables,  stands for institutional factors at time t and

stands for institutional factors at time t and  represent macroeconomic variables at time t. These variables are described in detail in Table 1.

represent macroeconomic variables at time t. These variables are described in detail in Table 1.

To test the relationship between MA and CH-SOA, the study incorporates the MA score into the partial adjustment model used by Dittmar and Duchin (2010) and Orlova and Sun (2020) and determine the deviation from the optimal with MA. Orlova and Sun (2020) calculate the deviation from the target (DEV) as the estimated target cash holdings  for the year less the actual cash holding level for that year.

for the year less the actual cash holding level for that year.

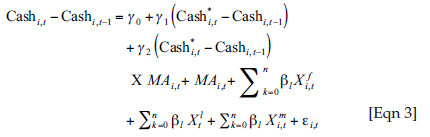

This study modifies the partial adjustment model of Orlova and Sun (2020) by including the influence of MA on CH-SOA. The model also incorporates firm-specific, institutional and macroeconomic factors:

If highly competent managers swiftly adjust corporate cash holdings back to the optimal levels, the coefficient of the interaction between cash deviation and MA (γ2) will be negative. However, γ2 will be significantly positive when MA and CH-SOA are significantly negatively correlated.

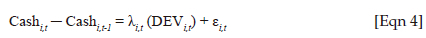

To test whether CH-SOA is affected by institutional and macroeconomic factors, the study employs Equation (4) as used in Orlova (2020) and Orlova and Sun (2020).

where: λi,t represents institutional and macroeconomic factors.

The next sub-section discusses how this study will measure managerial ability.

Measurement of managerial ability

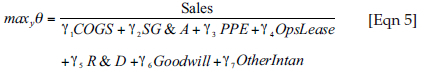

This study adopts Demerjian et al.'s (2012) MA measure. The measure quantifies MA from managers' ability to generate revenues. Demerjian et al. (2012) adopt a two-step method to measure MA. Firstly, they use the optimisation model that makes use of data envelopment analysis (DEA) to quantify the relative firm efficiency by industry and year. Data envelopment analysis estimates that firm output (Sales) is a function of the usage of the seven key inputs: cost of sales (COGS), selling, general and administrative expenses (SG&A), property, plant and equipment (PPE), operating leases (OpsLease), research and development expenses (R&D), goodwill and other intangible assets (OtherIntan).

The optimisation model used is shown subsequently:

The relative efficiency measure (ϴ) calculated in the optimisation model above can assume any value from 0 to 1 (0 < ϴ > 1).

The DEA score measure of efficiency includes both the firm factor and managerial factor, like the traditional proxies of MA such as return on assets (ROA). To obtain a better measure of MA, Demerjian et al. (2012) used a second step to measure operational efficiency by separating the managerial factor from the firm-related factor. Relative firm efficiency is regressed against the following five firm-specific factors that either complement or hinder managerial efforts: firm size, market share, positive cash flow, firm age and international operations. The authors estimate a Tobit regression as follows:

Firm Efficiency = α +β1In(Total Assetsi,t)+ β2MarketSharei,t + β3PositiveFreeCashFlowi,t+ β4In(Agei,t)+ β5ForeignCurrencyt+ εi,t (1.6)

Positive free cash flow is an indicator variable equal to 1 if operating cash flow is positive and 0 if otherwise. Foreign currency indicator is another indicator variable that assumes the value of 1 if the firm has export sales and 0 if otherwise. As MA is also considered as a factor driving firm efficiency, although it cannot be measured using accounting information, Demerjian et al. (2012) show that MA can be estimated using the residual of model (1.6) discussed earlier. The higher the MA of a particular firm, the higher the MA of the firm.

The MA construct of Demerjian et al. (2012) has been extensively accepted as the most comprehensive measure of MA (Doukas & Zhang 2021; Khan, Naeem & Xie 2022). Thus, this study adopts the Demerjian et al. (2012) construct to analyse the effect of MA in determining the speed of adjustment of cash holdings (CH-SOA).

Ethical considerations

This study makes use of non-human secondary data that are publicly available in databases (IRESS, World Bank and FRED). As such there are no ethical considerations to be reported. However, the study was part of a Doctoral study approved by School of Accounting Research Ethics Committee (SAREC) with the ethical clearance number: SAREC20221124/04. The variables used in the study are defined in Table 1. These variables have been used in past studies (Opler et al. 1999; Orlova 2020; Thakur & Kannadhasan 2019).

Discussion of results

Descriptive statistics

Table 2 exhibits the summary statistics of the variables employed in this study. The main variable is cash holdings (CASH), which is computed as cash and cash equivalents deflated by total assets. Cash holdings has a mean value of 13.2%, which shows that the average South African non-financial company (NFC) has cash holdings equal to 13.2% of its total assets. Therefore, corporate cash holdings in South Africa are closest to the 13% reported by Wang and Kabiraj (2016) for Chinese firms. However, they are much higher than the 7.8% average cash holdings of UK firms found by Le et al. (2018), 7.9% for Korean firms (Cho et al. 2018) and the average of 7% from 16 emerging market economies (Thakur & Kannadhasan 2019).

The mean for MA is 0.607 suggesting that majority of the listed firms employ highly skilled managers. The average firm size is 14.989, which indicates that the sample firms are relatively larger than listed firms in the cross-country study of Orlova (2020). Orlova (2020) found the average size of US firms to be 3.3, 3.8 for UK firms, 7167 for Chinese firms and 10.552 for Japanese firms. The average JSE-listed NCF has a leverage ratio of 55%, higher than the 30% reported by Anand et al. (2018) for Indian firms. The average market to book (MTB) ratio is 2.384 showing that the growth in the past two decades has been very low for South African NFCs.

Table 3 shows the Pearson correlations for the variables selected for this analysis. We find that there is a negative correlation between corporate CASH and MA. The correlations between the different variables are very low to suggest the presence of multicollinearity problems.

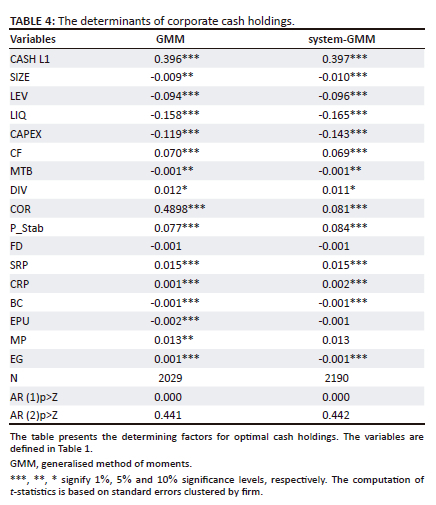

Determinants of corporate cash holdings

In order to analyse the effects of MA on CH-SOA, we must first determine the target cash holdings level to which firms adjust back to. We employ a modified version of the model by Opler et al. (1999). The modified model regresses CASH on firm-specific, institutional and macroeconomic factors (Equation 1). To estimate this model, we deploy the system generalised method of moments (GMM) estimator (Arellano & Bover 1995; Blundell & Bond 1998) as it enables us to comprehend the dynamic manner of cash holdings adjustment. System-GMM estimator is preferred as it controls for the possible endogeneity of the independent variables (Guariglia & Yang 2018). We also show results from the first difference GMM for robustness.

The results presented in Table 4 show that optimal cash holdings are driven by firm-specific, institutional and macroeconomic factors. Specifically, we find that the firm-specific factors, firm size, leverage, liquid asset substitutes, capital expenditure and growth opportunities (proxied by MTB) and business confidence have a negative effect on cash holdings. However, cash flow, dividend payments, corruption, political stability, shareholder rights protection, creditor rights protection and economic growth all positively influence cash holdings.

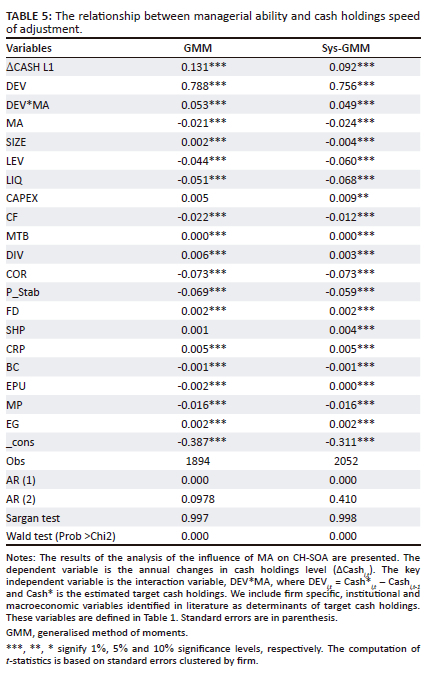

Managerial ability and cash holdings speed of adjustment

Hypothesis H0 predicts that the level of ability of managers influences CH-SOA. To test this hypothesis, this study interacts the MA score with DEV (actual cash holdings subtracted from target cash holdings i.e.  and runs the partial adjustment model (Equation 3). The dependent variable is the difference between current year's cash holdings and prior year's cash holdings (Cashi,t - Cashi,t-1).

and runs the partial adjustment model (Equation 3). The dependent variable is the difference between current year's cash holdings and prior year's cash holdings (Cashi,t - Cashi,t-1).

The results of Equation (3) are presented in Table 5. As shown in Table 5, the Arellano-Bond tests show that, unlike the GMM estimation, system-GMM has no second-order serial correlation. This implies that there is no serial correlation in the disturbance terms. The Sargan test shows that there is no evidence to reject the null hypothesis that the instruments used in the estimation are valid. The Wald test is also significant showing that the independent variables used are significant. Our results are consistent in both estimations suggesting that our findings are robust.

The coefficient (γ2) of the interacted variable DEV*MA is positive and significant at 1%, indicating that MA is negatively related with CH-SOA. This is interpreted to mean that highly skilled managers will show lower speeds of reverting cash holdings back to their target levels. This is also consistent with the negative coefficient found for the stand-alone MA variable. On the other hand, the coefficient for DEV (deviation from target cash holdings level) is 0.756, suggesting that a typical South African NFC will close 75.6% of the cash holdings deviation within a year. This means that cash is an extremely strategic asset for South African firms, and they will quickly adjust back to the target levels, regardless of the adjustment costs. However, firms in our sample do not instantaneously revert to optimal cash holding levels, as suggested by the static trade-off theory, because of market frictions. Our result supports gradual correction of cash holdings as envisaged by the dynamic trade-off theory.

We argue that high-ability managers exhibit slower CH_SOA because they have good networks with lenders and suppliers that guarantee quick access to finance and other services in times of need. This view is supported by Bonsall et al. (2017) and De Franco et al. (2017) who found that firms with talented managers have better credit ratings and lower interest charged on bank loans. As such, high-ability managers in firms with low cash holdings will not have any pressure to adjust cash holdings upwards. On the other hand, when faced with excess cash, high-ability managers are well capable of putting the cash to good use by investing in positive NPV projects (Goodman et al. 2014). As such shareholders will not pressure capable managers to quickly reduce cash holdings leading to slower CH-SOA.

The current study's finding of the negative impact of MA on CH-SOA is corroborated by Cho et al. (2018) and Gholamrezapoor et al. (2022) found evidence of a negative relationship between MA and CH-SOA in Korean and Iranian listed firms, respectively. These studies concur that high MA firms expend excess cash only on value-maximising projects and often have lower information asymmetry. As such, managers in these firms have no pressure from the external markets to quickly dissipate excess cash holdings. However, the two studies do not control for the effects of institutional and macroeconomic factors on CH-SOA.

This study adds to this nascent literature by providing evidence from South African listed firms while incorporating factors outside the firms (institutional and macroeconomic factors). Firms will consider the institutional and macroeconomic environment before making important corporate decisions, such as cash holdings management. Our results show that corruption and political stability negatively impact CH-SOA. Financial development, shareholder rights protection and creditor rights protection result in higher CH-SOA. Our results are consistent with Das, Kumar and Bhattacharyya (2023) and Guizani and Ajmi (2021) who found that firms adjust back to their optimal cash holdings level faster in times of greater financial development, which brings improved shareholder and creditor rights. Business confidence and monetary policy are negatively and significantly related to CH-SOA while economic growth and economic policy uncertainty show significant positive impact on CH-SOA.

Institutional factors and cash holdings speed of adjustment

There is a dearth in empirical studies that investigate how institutional factors impact on CH-SOA. Corruption (COR), political stability (P_Stab), financial development (FD), shareholder rights protection (SHP) and creditors' rights protection (CRP) are the institutional variables identified from past studies (Guizani & Ajmi 2021; Orlova & Sun 2020). We interact each of these five variables with DEV (deviation from target level), estimating each variable separately. Equation (4) is estimated using the Pooled Ordinary Least Squares (pooled OLS) estimator. The results are shown in Table 6.

The results show that the interaction variable between shareholder rights protection and deviation from optimal cash level (SHP*DEV) and financial development and deviation from optimal cash holdings (FD*DEV) have no significant impact on CH_SOA. However, corruption (COR*DEV) positively influences CH-SOA, indicating that a corrupt environment forces firms to adjust quickly to their optimal cash holding levels. Political stability (DEV*P_Stab) and creditor rights protection (DEV*CRD) are inversely related to CH-SOA. Albanez and Schiozer (2022) found a similar relationship between creditor rights protection and capital structure speed of adjustment. Our results support the agency theory of cash holdings that aver that less-developed institutional systems increase agency costs and as such firms are forced to quickly adjust any deviations from their target levels. High creditor rights protection means creditors have no incentives to force managers to maintain cash levels near their target levels as their investment is secured by collateral. As such firms in environments with high creditor rights will have lower CH-SOA. Our results are consistent with the view that CH-SOA is influenced by agency cost and market frictions (Orlova 2020).

We argue that high-ability managers establish good relationships with financial institutions and are able to gain the trust of the external markets and will, thus, encounter fewer huddles when raising external capital. Furthermore, high-ability managers tend to efficiently utilise company resources to optimise shareholder wealth. High-ability managers mitigate the adverse effects of macroeconomic uncertainties and are able to forecast with considerable accuracy even in volatile times. They seek to lower information asymmetries by quality disclosures, thus reducing the agency motives of cash holdings. This study thus concludes that capable managers will reduce CH_SOA.

Macroeconomic factors and cash holdings speed of adjustment

Results presented in Table 7 show how sensitive CH-SOA is to the macroeconomic environment. We find that business confidence, monetary policy and economic growth exert a negative and significant influence on CH-SOA while economic policy uncertainty impacts positively on CH-SOA. This is consistent with the argument that firms adjust cash holdings faster during economic boons than they do in recessions (Anand et al. 2018). The relationship between monetary policy and CH-SOA is negative as also found by Guizani and Ajmi (2021). The results show that during periods of economic growth and high business confidence, firms will have slower CH-SOA as they use cash to take advantage of available growth opportunities. When the monetary policy is contractionary, firms will also lower the speed of adjusting cash holdings. Firms face high adjustment costs when the monetary policy is contractionary (compared to when monetary policy is expansionary), leading to slower (faster) adjustment speeds.

Conclusion

This study investigates the institutional and macroeconomic determinants of CH-SOA and how MA impacts on CH-SOA. We use a sample of 143 JSE-listed non-financial companies for the period from 2000 to 2020 and find that MA is inversely related to CH-SOA. While the static trade-off theory argues that firms instantly adjust any deviations from optimal cash holdings, our results contradict this view in favour of the dynamic trade-off theory's view of partial adjustment of corporate cash holdings. Further, we find that higher MA leads to slower speeds of adjusting cash holdings back to the target level. Our study provides important insights by including the idiosyncratic MA as a determinant of CH-SOA. Previous studies ignore the effects of managerial attributes on the CH-SOA variable largely missed by extant literature.

Previous studies have failed to reach a consensus on the determinants of corporate CH-SOA as they have failed to factor in country-level factors (Orlova 2020). This paper contributes to literature by showing that institutional and macroeconomic factors also impact on CH-SOA. Our results show that managers take cognisance of the institutional and macro environment before determining the speed of adjusting cash holdings to target levels. Institutional and macroeconomic factors have an impact on adjustment costs, market frictions, as well as on management forecasts resulting in differential adjustment speeds. For instance, in periods of economic boom and high financial development, CH-SOA will be high. High economic policy uncertainty, business confidence and contractionary monetary policy all lead to slower adjustment speeds.

The study has several implications for various players. First for academics, the study contributes to the debate on the role of MA, institutional and macroeconomic factors on corporate decisions and performance. Our results provide empirical support for the upper echelons theory that posits that the top management drives corporate decisions such as corporate cash holding management. For managers, especially those judged to be less competent, this study opens a window for them to understand how highly competent managers approach cash holdings dynamics. Lastly, this study enables policy makers and regulators to assess the influence of institutional and macroeconomic determinants on corporate cash holdings dynamics. Cash holdings represent 'lazy capital' and as such regulators and policy makers need to develop frameworks of encouraging optimal cash holdings.

This study focussed only on firms listed on the JSE as financial data for these firms are readily accessible. Future studies can try to understand CH-SOA in unlisted firms that face higher financial constraints. Future studies could also use the events study approach to investigate how the coronavirus disease 2019 (COVID-19) pandemic impacted on CH-SOA. We use the model of Demerjian et al. (2012) to measure MA. Future studies could apply alternative measures for MA to confirm our findings.

Acknowledgements

Competing interests

The authors declare that they have no financial or personal relationship(s) that may have inappropriately influenced them in writing this article.

Authors' contributions

T.C. was responsible for the conceptualisation of this work, methodology, data collection, curation and analysis of data. T.M. was responsible for supervising the work, critiquing and reviewing it.

Funding information

The authors received no financial support for the research, authorship, and/or publication of this article.

Data availability

Data used for this study are publicly available from the IRESS, World Bank, FRED and BER databases. Data is also available from the corresponding author, T.C. upon request.

Disclaimer

The views and opinions expressed in this article are those of the authors and are the product of professional research. It does not necessarily reflect the official policy or position of any affiliated institution, funder, agency, or that of the publisher. The authors are responsible for this article's results, findings, and content.

References

Albanez, T. & Schiozer, R., 2022, 'The signaling role of covenants and the speed of capital structure adjustment under poor creditor rights: Evidence from domestically and cross-listed firms in Brazil', Journal of Multinational Financial Management 63, 100704. https://doi.org/10.1016/j.mulfin.2021.100704 [ Links ]

Anand, L., Thenmozhi, M., Varaiya, N. & Bhadhuri, S., 2018, 'Impact of macroeconomic factors on cash holdings? A dynamic panel model', Journal of Emerging Market Finance 17(1_Suppl), S27-S53. https://doi.org/10.1177/0972652717751536 [ Links ]

Andreou, P.C., Ehrlich, D. & Louca, C., 2013, 'Managerial ability and firm performance: Evidence from the global financial crisis', in European Financial Management Association, Annual Conference, viewed n.d., from https://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2013-Reading%20old/papers/EFMA2013_0542_fullpaper.pdf. [ Links ]

Arellano, M. & Bover, O., 1995, 'Another look at the instrumental variable estimation of error-components models', Journal of Econometrics 68(1), 29-51. https://doi.org/10.1016/0304-4076(94)01642-D [ Links ]

Baker, S.R., Bloom, N. & Davis, S.J., 2016, 'Measuring economic policy uncertainty', The Quarterly Journal of Economics 131(4), 1593-1636, viewed n.d., from https://www.nber.org/system/files/working_papers/w21633/w21633.pdf. [ Links ]

Batuman, B., Yildiz, Y. & Karan, M.B., 2022, 'The impact of the global financial crisis on corporate cash holdings: Evidence from Eastern European countries', Borsa Istanbul Review 22(4), 678-687. https://doi.org/10.1016/j.bir.2021.10.002 [ Links ]

Blundell, R. & Bond, S., 1998, 'Initial conditions and moment restrictions in dynamic panel data models', Journal of econometrics 87(1), 115-143. https://doi.org/10.1016/S0304-4076(98)00009-8 [ Links ]

Bonsall, S.B., IV, Holzman, E.R. & Miller, B.P., 2017, 'Managerial ability and credit risk assessment', Management Science 63(5), 1425-1449. https://doi.org/10.1287/mnsc.2015.2403 [ Links ]

Chen, Y., Ho, K. & Yeh, C., 2020, 'CEO overconfidence and corporate cash holdings', Journal of Corporate Finance 62, 101577. https://doi.org/10.1016/j.jcorpfin.2020.101577 [ Links ]

Chireka, T., 2020, 'Corporate life cycle and cash holding decisions: A South African study', Investment Management & Financial Innovations 17(4), 102, viewed n.d., from http://corporatereportingjournals.com/wp-content/uploads/2023/03/JCGR-Volume-4-Issue-1-002.pdf#page=103. [ Links ]

Chireka, T. & Fakoya, M.B., 2017, 'The determinants of corporate cash holdings levels: evidence from selected South African retail firms', Investment Management and Financial Innovations 14(2), 79-93, viewed n.d., from https://www.businessperspectives.org/images/pdf/applications/publishing/templates/article/assets/8779/imfi_2017 _02_Chireka.pdf. [ Links ]

Cho, H., Choi, S. & Kim, M., 2018, 'Cash holdings adjustment speed and managerial ability', Asia-Pacific Journal of Financial Studies 47(5), 695-719. https://doi.org/10.1111/ajfs.12235 [ Links ]

Dadam, V. & Viegi, N., 2018, Systemic, sectoral risk and the myth of a corporate savings glut, World Bank, viewed n.d., from https://openknowledge.worldbank.org/server/api/core/bitstreams/353b6775-3f29-5841-857f-9003c6be38b6/content. [ Links ]

Das, S., Kumar, A. & Bhattacharyya, A., 2023, 'The impact of institutional factors on corporate mechanism of cash adjustment - New evidence from emerging Asia', International Journal of Managerial Finance 19(1), 108-135. https://doi.org/10.1108/IJMF-01-2021-0032 [ Links ]

De Franco, G., Hope, O. & Lu, H., 2017, 'Managerial ability and bank-loan pricing', Journal of Business Finance & Accounting 44(9-10), 1315-1337. https://doi.org/10.1111/jbfa.12267 [ Links ]

Demerjian, P., Lev, B. & McVay, S., 2012, 'Quantifying managerial ability: A new measure and validity tests', Management Science 58(7), 1229-1248. https://doi.org/10.1287/mnsc.1110.1487 [ Links ]

Diaw, A., 2021, 'Corporate cash holdings in emerging markets', Borsa Istanbul Review 21(2), 139-148. https://doi.org/10.1016/j.bir.2020.09.005 [ Links ]

Dittmar, A.K. & Duchin, R., 2010, 'The dynamics of cash', Ross School of Business Paper, no. 1138, viewed n.d., from https://deepblue.lib.umich.edu/bitstream/handle/2027.42/65067/1138_Duchin_may.pdf;sequence=3. [ Links ]

Doukas, J.A. & Zhang, R., 2021, 'Managerial ability, corporate social culture, and M&As', Journal of Corporate Finance 68, 101942. https://doi.org/10.1016/j.jcorpfin.2021.101942 [ Links ]

Gan, H., 2019, 'Does CEO managerial ability matter? Evidence from corporate investment efficiency', Review of Quantitative Finance and Accounting 52(4), 1085-1118. https://doi.org/10.1007/s11156-018-0737-2 [ Links ]

Gan, H. & Park, M.S., 2017, 'CEO managerial ability and the marginal value of cash', Advances in Accounting 38(C), 126-135. https://doi.org/10.1016/j.adiac.2017.07.007 [ Links ]

Gholamrezapoor, M., Kazemi, P. & Amirniya, N., 2022, 'Cash holding adjustment speed: The role of managerial ability and moderating role of political connections in Tehran stock exchange', Advances in Mathematical Finance and Applications 7(3), 759-776. [ Links ]

Goodman, T.H., Neamtiu, M., Shroff, N. & White, H.D., 2014, 'Management forecast quality and capital investment decisions', The Accounting Review 89(1), 331-365. https://doi.org/10.2308/accr-50575 [ Links ]

Guariglia, A. & Yang, J., 2018, 'Adjustment behavior of corporate cash holdings: The China experience', The European Journal of Finance 24(16), 1428-1452. https://doi.org/10.1080/1351847X.2015.1071716 [ Links ]

Guizani, M. & Ajmi, A.N., 2021, 'Do macroeconomic conditions affect corporate cash holdings and cash adjustment dynamics? Evidence from GCC countries', International Journal of Emerging Markets ahead-of-print. https://doi.org/10.1108/IJOEM-03-2020-0291 [ Links ]

Hambrick, D.C., 2007, 'Upper echelons theory: An update', Academy of Management Review 32(2), 334-343. https://doi.org/10.5465/amr.2007.24345254 [ Links ]

Hambrick, D.C. & Mason, P.A., 1984, 'Upper echelons: The organization as a reflection of its top managers', Academy of Management Review 9(2), 193-206. https://doi.org/10.2307/258434 [ Links ]

Huang, H., Rose-Green, E. & Lee, C., 2012, 'CEO age and financial reporting quality', Accounting Horizons 26(4), 725-740. https://doi.org/10.2308/acch-50268 [ Links ]

Huang, X.S. & Sun, L., 2017, 'Managerial ability and real earnings management', Advances in Accounting 39, 91-104. https://doi.org/10.1016/j.adiac.2017.08.003 [ Links ]

Jensen, M.C., 1986, 'Agency costs of free cash flow, corporate finance, and takeovers', The American Economic Review 76(2), 323-329. [ Links ]

Jiang, Z. & Lie, E., 2016, 'Cash holding adjustments and managerial entrenchment', Journal of Corporate Finance 36, 190-205. https://doi.org/10.1016/j.jcorpfin.2015.12.008 [ Links ]

Karwowski, E., 2018, 'Corporate financialization in South Africa: From investment strike to housing bubble', Competition & Change 22(4), 413-436. https://doi.org/10.1177/1024529418774924 [ Links ]

Karwowski, E., Szymborska, H., Lesame, K. & Thoka, T., 2022, 'Determinants of corporate cash holdings in South Africa', WIDER Working Paper (No. 2022/85), viewed n.d., from https://www.econstor.eu/bitstream/10419/267834/1/1814675132.pdf. [ Links ]

Khan, M.K., Naeem, K. & Xie, M., 2022, 'Does managerial ability transform organization from the inside out? Evidence from sustainability performance of financially constrained firms in an emerging economy', Borsa Istanbul Review 22(5), 897-910. https://doi.org/10.1016/j.bir.2022.06.006 [ Links ]

Le, H., Tran, P.L., Ta, T.P. & Vu, D.M., 2018, 'Determinants of corporate cash holding: Evidence from UK listed firms', Business and Economic Horizons 14(3), 561-569. https://doi.org/10.15208/beh.2018.40 [ Links ]

Liu, Y., Wei, Z. & Xie, F., 2016, 'CFO gender and earnings management: Evidence from China', Review of Quantitative Finance and Accounting 46(4), 881-905. https://doi.org/10.1007/s11156-014-0490-0 [ Links ]

Lopatta, K., Kaspereit, T. & Gastone, L., 2020, 'Managerial style in cost asymmetry and shareholder value', Managerial and Decision Economics 41(5), 800-826. https://doi.org/10.1002/mde.3139 [ Links ]

Machokoto, M., Chipeta, C. & Ibeji, N., 2021, 'The institutional determinants of peer effects on corporate cash holdings', Journal of International Financial Markets, Institutions and Money 73, 101378. https://doi.org/10.1016/j.intfin.2021.101378 [ Links ]

Martínez-Sola, C., García-Teruel, P.J. & Martínez-Solano, P., 2018, 'Cash holdings in SMEs: Speed of adjustment, growth and financing', Small Business Economics 51, 823-842. https://doi.org/10.1007/s11187-018-9990-y [ Links ]

Myers, S.C. & Majluf, N.S., 1984, 'Corporate financing and investment decisions when firms have information that investors do not have', Journal of Financial Economics 13(2), 187-221. https://doi.org/10.1016/0304-405X(84)90023-0 [ Links ]

Opler, T., Pinkowitz, L., Stulz, R. & Williamson, R., 1999, 'The determinants and implications of corporate cash holdings', Journal of Financial Economics 52(1), 3-46. https://doi.org/10.1016/S0304-405X(99)00003-3 [ Links ]

Orlova, S.V., 2020, 'Cultural and macroeconomic determinants of cash holdings management', Journal of International Financial Management & Accounting 31(3), 270-294. https://doi.org/10.1111/jifm.12121 [ Links ]

Orlova, S.V. & Rao, R.P., 2018, 'Cash holdings speed of adjustment', International Review of Economics & Finance 54, 1-14. https://doi.org/10.1016/j.iref.2017.12.011 [ Links ]

Orlova, S.V. & Sun, L., 2018, 'Institutional determinants of cash holdings speed of adjustment', Global Finance Journal 37, 123-137. [ Links ]

Pham, H.S.T. & Tran, H.T., 2020, 'CSR disclosure and firm performance: The mediating role of corporate reputation and moderating role of CEO integrity', Journal of Business Research 120, 127-136. https://doi.org/10.1016/j.jbusres.2020.08.002 [ Links ]

Prakosa, R.A. & Sari, D., 2019, 'The effect of managerial ability on corporate tax avoidance', in 3rd Asia-Pacific Research in Social Sciences and Humanities Universitas Indonesia Conference (APRISH 2018), pp. 323-331, Atlantis Press, viewed n.d., from https://www.atlantis-press.com/proceedings/aprish-18/125919002 [ Links ]

Radebaugh, L.H., Gray, S.J. & Black, E.L., 2006, International accounting and multinational enterprises, John Wiley & Sons, Hoboken (N.J. [ Links ]).

Thakur, B.P.S. & Kannadhasan, M., 2019, 'Corruption and cash holdings: Evidence from emerging market economies', Emerging Markets Review 38, 1-17. https://doi.org/10.1016/j.ememar.2018.11.008 [ Links ]

Venkiteshwaran, V., 2011, 'Partial adjustment toward optimal cash holding levels', Review of Financial Economics 20(3), 113-121. https://doi.org/10.1016/j.rfe.2011.06.002 [ Links ]

Wang, M. & Kabiraj, S., 2016, 'Dynamics of corporate cash holdings in Chinese firms: An empirical investigation of asymmetric adjustment rate and financial constraints', Asian Academy of Management Journal of Accounting & Finance 12(2), 127-152. https://doi.org/10.21315/aamjaf2016.12.2.6 [ Links ]

Xie, X., Wang, Y., Zhao, G. & Lu, W., 2017, 'Cash holdings between public and private insurers - A partial adjustment approach', Journal of Banking & Finance 82, 80-97. https://doi.org/10.1016/j.jbankfin.2017.05.008 [ Links ]

Yung, K. & Long, X., 2022, 'CEO overconfidence and the adjustment speed of leverage and cash: Evidence on cash is not the same as negative debt', Empirical Economics 63(2), 1081-1108. https://doi.org/10.1007/s00181-021-02158-5 [ Links ]

Correspondence:

Correspondence:

Trust Chireka

tchireka@wsu.ac.za

Received: 24 June 2023

Accepted: 21 Sept. 2023

Published: 21 Dec. 2023