Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Acta Commercii

On-line version ISSN 1684-1999

Print version ISSN 2413-1903

Acta Commer. vol.23 n.1 Johannesburg 2023

http://dx.doi.org/10.4102/ac.v23i1.1097

ORIGINAL RESEARCH

Blockchain technology in the clearing and settlement industry in South Africa

Musimuni DowelaniI; Chioma OkoroI; Abel OlaleyeI, II

IDepartment of Finance and Investment Management, College of Business and Economics, University of Johannesburg, Johannesburg, South Africa

IIDepartment of Estate Management, Faculty of Environmental Sciences, Obafemi Awolowo University, Ile-Ife, Nigeria

ABSTRACT

ORIENTATION: The monopolistic nature of the clearing and settlement industry in South Africa impedes competition and the adoption of new technologies on account of profitability and total market share; there is little incentive to adopt new technologies such as blockchain. Clearing and settlement is currently administrated by shares transactions totally electronic (STRATE) using a centralised database. Blockchain technology is a decentralised advanced database mechanism allowing multiple institutional contributors to the database.

RESEARCH PURPOSE: This study's objective was to identify perspectives on the potential role of blockchain technology in the securities clearing and settlement industry in South Africa.

MOTIVATION FOR THE STUDY: The emergence and adoption of blockchain technology across industries warrants research on the perceived impact of its adoption in the securities clearing and settement industry.

RESEARCH DESIGN, APPROACH AND METHOD: A qualitative research approach using semi-structured interviews was employed to collect data among stakeholders in the securities value chain in South Africa. Using social media, participants were identified through a combination of purposive and snowball sampling. Data were analysed using thematic data analysis with the aid of Atlas.ti software.

MAIN FINDINGS: The study found that stakeholders are of the view that blockchain technology has the potential to improve settlement speed, increase automation of the process, increase efficiency, remove human error, remove the single point of failure, increase market size, create a more secure database, improve auditability, increase transparency, improve current infrastructure, eliminate intermediaries, and reduce the cost to users in the South African context.

PRACTICAL/MANAGERIAL IMPLICATIONS AND CONTRIBUTION/VALUE-ADD: The contribution to practice is illustrated by two alternatives: the adoption of blockchain technology through the formation of a consortium, or a private network.

Keywords: blockchain technology; clearing and settlement; securities; central securities depository; South Africa; JSE; distributed ledger.

Introduction

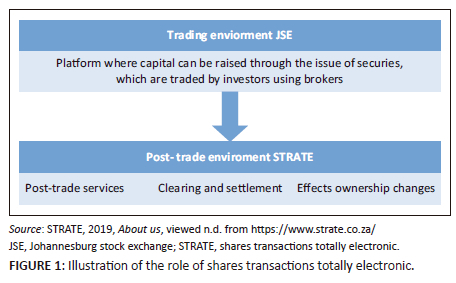

The process of securities trading entails confirming the identity and quantity of the security, the transaction price and date and the identity of the buyer and seller, and subsequently, payment to the seller and delivery of the security certificate or transferring its ownership to the buyer (Benos, Garratt & Gurrola-Perez 2017). This process is facilitated by an intermediary, a central securities depository (CSD), shares transactions totally electronic (STRATE). The STRATE ensures the effectiveness and efficiency of the industry (Braeckevelt 2006) by performing all necessary steps between the transaction date and settlement. This is termed a clearing and settlement cycle denoted as 'T+X', which is short hand for 'trade date plus x number of days' (Chiu & Koeppl 2019). The Johannesburg stock exchange (JSE) and STRATE are considered as the providers of market infrastructure, while the users of market infrastructure include issuers, stock brokers, authorised users, participants and investors. Figure 1 depicts the role of the JSE and STRATE in the trade enviroment, including post-trade services.

The settlement cycle is the interval between when the trade is booked into the broker-dealer accounting (BDA) system by a broker on the JSE and the time it takes for ownership to be transferred from seller to buyer by STRATE. The role of STRATE, as a CSD, includes:

[T]he safekeeping and administration of securities and financial instruments on behalf of third parties, this custody and settlement role is the core service provided by STRATE to stakeholders across the bonds, equities, and money markets. (STRATE 2021:para 1)

The buyer and seller (investor) cannot deal directly with STRATE; investors trade using a broker who is a client of a CSD participant. The STRATE is responsible for guaranteeing that funds and assets are distributed to the CSD participants. The CSD participants will then distribute to their clients. A participant is defined in the Financial Markets Act as:

[A] person authorized by a licensed CSD to perform custody and ad-ministration services or settlement services or both in terms of the CSD rules, and includes an external participant, where appropriate. (STRATE 2018:11)

The South African banking system operates on an advanced real-time gross settlement (RTGS) system also referred to as the South African multiple option settlement (SAMOS) system run by the South African Reserve Bank (SARB) (Bank for International Settlement [BIS] 2012) to clear cash. The STRATE does not hold a banking licence; therefore, all clearing and settlement services for cash go through a clearing bank that holds a SAMOS account at the SARB and is a CSD participant with STRATE. The STRATE has accepted and supervised eight equities participants:

Citibank NA - South Africa Branch

Computershare Proprietary Ltd

FirstRand Bank Ltd

Link Investor Services

Nedbank Ltd

Société Générale - Johannesburg Branch

The Standard Bank of South Africa Ltd

Standard Chartered Bank - Johannesburg Branch

Markets with integrated trade, execution, clearing and settlement experience improved efficiency by economising on transaction costs (Pirrong 2007). Vertical integration of trading and post-trading activities in the European context supports improved efficiency, increased speed, safety and risk management (Schaper 2012; Schmiedel, Malkamäki & Tarkka 2006). Concerns around integration have been raised as it can impede competition (Pirrong 2007). When local CSDs hold a permanent monopoly, as is the case in South Africa, these firms are usually profitable. However, despite having the financial resources to innovate, they lack the motivation to do so because they already dominate the market. The main disadvantage of a centralised database for clearing and settlement is having a single point of failure, a possible performance bottleneck or susceptibility to attacks. In addition, STRATE oversees the industry at a fee and like most CSDs has been characterised by a lack of transparency during the auctioning process for the trader (Pop et al. 2018).

The current clearing and settlement process is limited by several factors, including a lack of interoperability, unnecessary complexity, expensive procedures, long settlement cycles, limited automation and manual processes with risk of errors (Pinna & Ruttenberg 2016). These limitations stem from outdated technology, multiple intermediaries and an extended settlement cycle. Challenges facing the current system include vulnerability to technology threats, long settlement cycles because of complexity, inadequate capacity for continuous processing, human error and insufficient automation (De Meijer 2018).

Blockchain technology is a database mechanism where information can be shared directly through the decentralised ledger (Lewis, McPartland & Ranjan 2017; Manning 2016). Allowing all participants access to copies of a single authoritative ledger, the need for reconciling duplicative and at times conflicting records would be eliminated (Seretakis 2019). The primary objective of adopting blockchain technology in securities clearing and settlement is to improve efficiency and liquidity, not to eliminate trusted intermediaries like the CSD (De Meijer 2016; Priem 2020). These potential results are simplified processes, reduced costs, and increased efficiency and security (Benos et al. 2017). Given that the traditional equity trading system can no longer meet the current trading needs, it is categorised by problems such as low operating efficiency and serious homogeneity (Peng 2021). This article addresses the question: 'What are stakeholders' perspectives on the potential role of blockchain adoption, including their knowledge and understanding of blockchain technology and prospects of adoption?'

The primary challenge faced by the securities clearing and settlement industry is to optimise the clearing and settlement processes, leading to a reduction in transaction costs and an increase in trade volumes and liquidity (Schmiedel et al. 2006). The adoption of evolving technology in equity markets has led to a reduction in communication and transaction costs and a growth in trading activity (Hasan, Malkamäki & Schmiedel 2003). Automated trading platforms have played a significant role in achieving these benefits by providing low-cost independent access to the market for institutional and private investors (Poser 1992). Friday (2014) further asserts that technology has revolutionised the equity markets by lowering transaction costs and reducing information asymmetry, resulting in a more level playing field for investors and issuers. However, despite these advancements, risks remain, primarily because of the length of the settlement period for trades (Priem 2020). Previous similar studies have highlighted the benefits and risks of blockchain technology for the clearing and settlement of exchange-traded securities; these studies have described blockchain technology's potential role for central counterparties and central securities depositories and attempted to show that blockchain technology can resolve legacy technological and operational issues (Mainelli & Milne 2016; Manning 2016; Nair & Bhagat 2020; Priem 2020). However, the securities clearing and settlement process remains a slow, expensive and complicated process because of the involvement of multiple parties (De Meijer 2016; DTCC 2012), which makes it necessary to streamline the processes and reduce the cost per transaction (Schmiedel et al. 2006). Despite the increasing interest in blockchain technology as a disruptive innovation with the potential to transform traditional financial systems, there is a dearth of research for the adoption of blockchain in South Africa, where securities clearing and settlement practices and legislative requirements vary from other countries. This study aims to fill this research gap by providing insights into the potential role of blockchain technology in the South African clearing and settlement cycle industry.

Literature review

Significance of blockchain adoption

The application of blockchain technology has potential benefits for many industries because its practical capabilities in solving many issues, such as recording and sharing transactional data, establishing automated and efficient supply chain processes, and enhancing transparency across the whole value chain (Al-Jaroodi & Mohamed 2019). The main application method of blockchain is using it as a data management and storage system (Fekih & Lahami 2020). The relevance of blockchain technology compared with other systems is based on the fact that industries operate on information and benefit from receiving fast and accurate information. This makes blockchain an ideal method of delivering information because it provides immediate, shared and completely transparent information stored on an immutable ledger (Laurence 2019). The second application of blockchain technology in industries is based on the functionality that allows users to track orders, payments, account and production. In addition, members of a network share a single view of the truth, enabling them to view all details of a transaction end to end. This provides greater confidence as well as new efficiencies and opportunities (Laurence 2019).

If blockchain is utilised in the clearing and settlement industry, it could provide four ssignificant benefits to stakeholders. These benefits align with the industry's primary goal of bringing buyers and sellers together to contract for securities sales and purchases, as well as facilitating the transfer of ownership and cash between parties (Miraz & Donald 2018:2). The use of dematerialised share certificates has streamlined the trade and settlement process, eliminating friction and increasing transaction speed (Mkhize & Msweli-Mbanga 2006). In addition, replacing the multitude of ledgers with a single source of truth could significantly enhance efficiency. Furthermore, reducing settlement time has the potential to decrease transaction costs. Finally, smart contracts could be utilised to automate rules governing dividend and interest payouts, rights issues, proxy votes and other services (Credit Suisse 2016; De Meijer 2016). Blockchain implementation could lead to improved efficiency and lower costs in securities clearing and settlement (Benos et al. 2017). This is because automation reduces the need for manual processes, such as data reconciliation and operations, which constitute the majority of clearing and settlement expenses (Mainelli & Milne 2016).

Potential application areas in securities clearing and settlement

From the literature the potential role of blockchain adoption on the clearing and settlement industry can be summarised into the following four main categories.

Process and operational efficiency

Burger et al. (2009) determine that process efficiency can be increased by improving the quality of the process execution. The authors provide evidence that the proportion of manual to automatic processing time influences process efficiency. A change in operational efficiency following automation is measured by the change in the bid-ask spread (Blennerhassett & Bowman 1998). Aitken et al. (2004) provided support to this assertion by investigating the impact of automation of trading process in the London International Financial Futures and Options Exchange, the Sydney Futures Exchange and the Hong Kong Futures Exchange. Their study found that automation of trading process can facilitate higher levels of liquidity and lower transaction costs relative to floor traded markets, thus providing process and operation efficiency.

Chen and Wang (2020) combine market observations and expert surveys (in the form of interviews). They find that given the potential to streamline processes and workflows in the pre-issuance process and post-trade environment, blockchain technology can lead to an integrated European debt capital market. Integration through blockchain will enhance the functioning of debt markets as fragmentation limits the efficiency with which capital is distributed and transferred across Europe. The current European Union (EU) debt capital market infrastructure lacks full financial integration and the EU-wide risk sharing of a single capital market.

Cost efficiency

The major cost savings in using blockchain technology will come from reduction in the operational cost achieved by changing the existing business processes (Santo et al. 2016). Schmiedel et al. (2006) define cost efficiency as the cost per trade using time as a proxy for the influence of technological progress. They determine that, over time, settlement institutions are able to become more cost-effective on an average yearly rate of 4.5% of cost reduction made possible by the intensive use and investment in new technologies and system update. In an electronic environment, the cost of maintaining one account should be lower than the cost of maintaining and reconciling in a manual environment (Micheler & Von der Heyde 2016). This is supported by Avgouleas and Kiayias (2019) who contend that the automation of processes lead to the reduction in reconciliation and data management costs.

Time efficiency

Over the last two decades, settlement cycles have undergone significant reductions, largely attributable to the dematerialisation of securities and technological advancements that have enabled a high degree of automation and eliminated paper from the settlement process (Thomas Murray Ltd 2014). However, problems are still encountered with the current system even with the application of technologies. Blockchain technology has the ability to speed up settlement by removing a fragmented post-trade infrastructure and by implementing a more flexible settlement cycle (Chiu & Koeppl 2019). Currently, data stored in database are centralised, with a master copy controlled by a central authority. In the case of clearing and settlement, this authority is the CSD. The data are organised and stored in tables that users can update and search (Lewis et al. 2017). Time inefficiencies are a result of database reconciliation, manual processing and long custody chains, which can be eliminated by blockchain (Priem 2020).

Chiu and Koeppl (2019) affirm through a quantitative modelling benchmark that securities, in the form of corporate debt, can be settled through blockchain, in a faster and more flexible settlement manner, reducing cost in the range of 1-4 basis points relative to existing legacy settlement systems in a fragmented United States (US) market, which settles debt on a T+2 settlement cycle. The study's limitations include: (1) the absence of exploration into the equity market, which operates on a T+3 settlement cycle, (2) higher trade volumes, (3) and a greater number of participants.

Risk management

Smart contracts have the ability to effectively manage settlement risk by providing automatic delivery versus payment (DvP) in the absence of a central authority. These contracts are written in computer code and executed automatically when specified conditions are met, replacing traditional legal language. By utilising distributed ledgers in tandem with smart contracts, certain events within a contract's life cycle can be automated (Manning 2016). Pop et al. (2018) expand on how smart contracts can manage risk. Smart contract's purpose is to replace the third-party as they act according to a predefined set of rules. By programming smart contract, triggers are put in place to perform functions of validation and verification of transactions as well as settlement.

The current issue with a central database is that it represents a single point of failure; if the central authority fails, the database is lost (Lewis et al. 2017). The distributed ledger provides a method of storing information, and recording changes to that information, in a distributed fashion rather than relying solely on a trusted central party (e.g. CSD).

Research methods and design

To address the research aim, a qualitative approach was chosen, as it is suitable for gaining a comprehensive and detailed understanding of blockchain technology through individuals' shared stories, contexts or settings (Creswell 2007). This approach allowed the researcher to describe the potential impact of blockchain adoption without relying on quantitative measurements or comparisons of events (Thomas 2003). The data were collected through semi-structured interviews, which provided the flexibility to explore issues in unexpected directions. The interviews were recorded to facilitate analysis and member checks (Fontana & Frey 1994). Furthermore, the semi-structured format allowed participants to express their individual opinions and experiences in an open-ended manner (Lampard & Pole 2015).

Sampling method and size

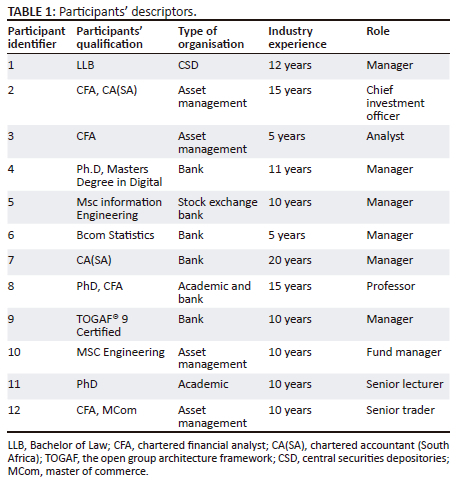

To obtain a heterogenous sample, a combination of purposive and snowball sampling techniques was used to identify individuals involved in the South African clearing and settlement industry or with a role in the securities trading value chain. The researcher utilised various channels, including email to participants with whom they had previously worked, LinkedIn and referrals from other participants. LinkedIn provided a targeted platform to connect with appropriate participants who might be difficult to reach through other means, making purposive sampling suitable (Dusek, Yurova & Ruppel 2015). Table 1 lists the participants and their respective organisations who were part of this study.

The sample comprised participants from different stages of the securities trading value chain in the South African clearing and settlement industry. The sample size included individuals working in asset management, public and private assessment management, banks, JSE and STRATE. The participants included analysts, traders, portfolio managers and in-house brokers. The interviews were conducted online via Zoom and Microsoft Teams because of coronavirus disease 2019 (COVID-19) lockdown restrictions and precautions, with an average duration of 45 min. The semi-structured e-interviews were held from November 2020 to March 2021.

From the population, the study has a sample size of 12, which is within acceptable range of saturation. The minimum sample size when conducting interviews should be between 5 and 25 (Saunders, Lewis & Thornhill 2016). Sample adequacy in a qualitative study refers to the appropriateness of the sample composition and size. This is important in evaluating the trustworthiness of the research methodology. The sample size is guided by the criterion of saturation, which is the point where no new information is elicited by sampling more units (Vasileiou et al. 2018). Theoretical saturation is reached at 6 in-depth interviews and definitely evident at 12 in-depth interviews (Boddy 2016). A similar study by Akaba et al. (2020) also employed semi-structured interviews with 12 stakeholders and experts in public procurement, private-sector procurement, blockchain technology and advocacy for transparency and technology adoption in the Nigerian public sector procurement. In addition to saturation, the nature of this study on blockchain adoption in the securities value chain limits who can participate because of infancy stage of practice and research of this technology in the industry (Lustenberger, Malešević & Spychiger 2021). The interviews were recorded, transcribed and analysed with the aid of the Atlas-ti software:

Data analysis

Thematic content analysis based on the guidelines of Braun and Clarke (2006), as well as Erlingsson and Brysiewicz (2017), was employed to analyse the data. Phase one was familiarisation with the text - The initial ideas and observations were observed based on the objective of the study and literature (Braun & Clarke 2006). The perceived role of blockchain technology in the securities clearing and settlement processes was sought. Text related to the stakeholders' knowledge, understanding and views on the potential of adopting blockchain were read and identified and engaged with.

Phase two was the generation of initial codes - Codes were generated in a meaningful and systematic manner (Braun & Clarke 2006) through the utilisation of ATLAS.ti v9, a qualitative data analysis software. Initial codes were automatically generated using the function Auto Coding in ATLAS.ti v9. These codes were continuously modified throughout the process, in which certain codes were disregarded and several others were merged. Phase three was searching for themes. The final codes generated were examined to determine similar codes and sort them into potential themes. The following potential themes emerged from this phase within the 'role of blockchain' category sought:

Participants' understanding of blockchain

I can't see us adopting blockchain

I forsee the adoption of blockchain

BA advanatge: automation

BA advanatge: reduction of fees

BA advantage: removal of human error

BA advantage: improved infrastructure

BA advantage: increased efficiency

BA advantage: more secure

BA advantage: speed

BA advantage: transparency

BA would eliminate middlemen making exchanges cheaper

BA: could help with auditing

Blockchain can be private or public

The themes emerged as advantages of blockchain technology adoption. Phase four was reviewing the themes. Once the potential preliminary themes were drawn within phase three, the developed themes were refined and the researcher was able to progress to phase four in which the developed themes were refined (Braun & Clarke 2006).

Phase five was defining the themes; here the category were further grouped into the four themes identified in the literature review. From the literature, the potential role of blockchain adoption on the clearing and settlement industry can be summarised into four main categories, namely process and operational efficiency, cost efficiency, time efficiency and risk management. Phase six was to analysis and write-up. With a full set of fully worked-out themes, this phase involved the final analysis of the data as well as the write-up of the report (Braun & Clarke 2006).

The findings are presented in the next section.

Ethical considerations

Participants were asked to share information with the full knowledge that it is to be included and published in this study. Participants signed a consent letter or form to indicate their willingness to participate in the study. Any information collected from participants will not be made public without permission of participants. The study will not publish any information about the identities of any specific individuals, the organisations they work for or are affiliated with. The researcher received ethical approval to conduct the interviews and collected data by using a questionnaire from the Department of Finance and Investment before conducting any interviews - 20SOM20.

Results

The findings presented here focus on participants' perspectives regarding the role of blockchain technology in the securities clearing and settlement industry in South Africa. These findings consider the participants' varying levels of familiarity with blockchain technology, ranging from being familiar to unfamiliar. Some stakeholders demonstrated a clear understanding of blockchain's application to clearing and settlement, while others only associated it with Bitcoin:

'I know that it's the technology that's used, Bitcoin.' (Participant 1, LLB, manager, CSD)

In addition, educational background is a significant indicator of familiarity:

'I have been doing an MSc in financial engineering, so there was a module on it. I am very familiar with blockchain.' (Participant 10, MSc, fund manager, asset management)

Based on their familiarity level, participants believed that competition, early adopters and demand from end users will drive the adoption of blockchain technology in the industry. End users are the buyers and sellers of equity:

'End user demand is going to force adoption.' (Participant 1, LLB, manger, CSD)

If adopted in clearing and settlement, participants identified and discussed areas in which blockchain adoption could be beneficial and the role it would play in the industry. Some participants also identified the taxonomy of blockchain technology, describing it as either private or public:

'Blockchain can be your public or private.' (Participant 5, Msc, manager, stock exchange)

'Blockchain can be a network and algorithm or programme is used to run it.' (Participant 1, LLB, manger, CSD)

There were two distinct views on whether adopting the technology was possible in the South African clearing and settlement industry. These views informed what the stakeholders believed would be the potential impact of adoption. The first is that blockchain technology adoption will not happen soon. Participants suggest that South Africa may take 5, 7 or even 10 years to make the change. This contrasts with the theme, 'I foresee the adoption of blockchain technology':

'I think in five to ten years, we will see more widespread adoption.' (Participant 2, CFA, CA(SA), CIO, asset management)

'I am convinced it will take some years.' (Participant 7, CA(SA), manager, bank)

The second is that blockchain adoption is inevitable.

'It's inevitable … it's going to be adopted.' (Participant 1, LLB, manager, CSD)

This is reiterated by:

'South Africa would be a bit of a follower in terms of international - adoption of blockchain, because we aren't the biggest.' (Participant 12, CFA, MCom, senior trader, asset management)

There is evidence of early-stage adoption by STRATE through the e-voting system, which could indicate the willingness to adopt:

'Adoption is happening in smaller non-core functions. So, for instance, we have a voting product.' (Participant 2, CFA, CA(SA), CIO, asset management)

The aforementioned indicates that participants are familiar with blockchain technology and that adopting the technology in clearing and settlement is inevitable. The nature of the current trading system is that individuals who want to participate in the equity market need a broker, bank or other intermediaries to transact. And this comes at a fee. The adoption of blockchain can remove intermediaries and reduce costs. This could allow individuals who were not trading because of the cost to participants in the market and, thus growing market size:

'Blockchain can potentially grow the size of that market as well in terms of when it can generate efficiencies there.' (Participant 3, CFA, analyst, asset management)

'Blockchain may increase the transaction volumes.' (Participant 9, TOGAF® 9 certified, manager, bank)

Therefore, it can be concluded that growth in market size through increased volumes will be because of increased access created by the adoption of blockchain technology. The rest of the findings are categoriesed into the four areas of impact, namely process and operations effienciency, cost efficiency, time efficiency and risk mananagement.

Process and operational efficiency

According to Burger et al. (2009), automating the clearing and settlement process can improve process and operational efficiency. This study found that the clearing and settlement process in South Africa involves many manual processes that can cause delays. Blockchain technology could be a viable solution to this issue, as it provides a chain of automated events. Furthermore, adopting blockchain technology could reduce administrative activities because increased transparency removes the need for extensive vetting processes, thereby reducing the risk of human error and freeing up time and resources. This could potentially result in layoffs, as one participant observed:

'[C]ertain processes in the cycle are actually done manually. Blockchain can be programmed to automatically store information on a database in the clearing value chain, as well as instantly transfer the security value from the buyer to the seller.' (Participant 5, Msc, manager, stock exchange)

Participant 9 and Participant 8 reiterated this by stating that the blockchian will reduce manual interventions and smart contracts allow for programming, so they can be adopted to speed up the process by eliminating any manual process in-between.

Automatisation, which leads to process and operational efficiency, has several benefits to the industry, namely a transparent and increased audit trail and almost instant clearing. The benefit of an audit trail is revelant to the regulator allowing for better compliance management:

'The benefit to FSCA [financial sector conduct authority] is based on the audit trail. Blockchain will automate regulatory compliance within contract management, trading, or any other process.' (Participant 3, CFA, analyst, asset management)

The adoption of blockchain technology can potentially improve the auditability of processes and documentation in the industry. This is achieved through blockchain immutability characteristic:

'Immutability is when something is recorded, once it's recorded on the blockchain, it cannot be erased. So that is a positive in the sense that it can enhance audit trail.' (Participant 8, PhD, CFA, professor, academic and bank)

'It will be easier to track the transactions.' (Participant 9, TOGAF® 9 certified, manager, bank)

'Transations within blockchain are traceable.' (Participant 12, CFA, MCom, senior trader, asset management)

Participant 2, CFA, CA(SA) (CIO, asset management), added that with specific reference to the internal operations of STRATE, blockchain technology would allow for the combination of processes that are carried out in the settlement, compiling and reconciling of the registry (referred to the registry function):

'The advantages of blockchain is that it has multiple functions, for instance a settlement and a registry function bound into one single process, whereas in traditional mechanisms we have an entire system set up for settlement and we have an entire different system set up for registry.' (Participant 2, CFA, CA(SA), CIO, asset management)

This is because of the ability of blockchain technology to be programmed to have chain reactions, using smart contracts as identified by:

'Blockchain operates based on a chain reaction. Once an action is confirmed, it triggers the next leg of the transaction to happen and so forth and it becomes like an instant transaction.' (Participant 11, PhD, senior lecturer, academic)

Some process inefficiencies are the result of a system's dependence on humans. The adoption of blockchain technology can potentially reduce the rate of human errors in the process, leading to improved accuracy and efficiency:

'Reduced reliance on human beings will lead to more accuracy by eliminating human error element.' (Participant 5, Msc, manager, stock exchange)

An example of human error is the misallocation of trades:

'Individuals can misallocate trades to people.' (Participant 1, LLB, manager, CSD)

Improved accuracy benefits the overall capital market and the user of capital market data. The reduction of the manual process through increased automation leads to increased time efficiencies. Participants were of the opinion that blockchain technology had the ability to enhance efficiency and that this enhanced efficiency would minimise transaction errors. They attributed this to its ability to automate processes as discussed earlier and expand on further benefits of automation:

'Automation make the system more efficient and transparent, allowing participants in the industry like STRATE and CSD participants to receive information simultaneously.' (Participant 6, Bcom, manager, bank)

In contrast to the current system, blockchain technology adoption involves everyone in the process and everyone can see the process taking place - they can follow the footsteps of the process step by step, increasing visibility and transparency:

'Transparency. So the market would have full transparency, real-time transparency of where a stock sits. We would have true transparency of all the trades that happen, so all of the trade information will be recorded on the blockchain and they would be able to see asset flows and have real-time settlement.' (Participant 4, PhD, manager, bank)

'Transparency will reduce miscommunication in anything in that point in time, everyone is on the same page, everyone sees the same information.' (Participant 6, Bcom, manager, bank)

The reduction of intermediation and involvement of humans through automation will lead to more efficiencies:

'Automation brings more efficiencies that should minimise fraud and errors.' (Participant 7, CA(SA), manager, bank)

'Share certificate will be electronic. The need for CSD participants to do verifications will be eliminated.' (Participant 7, CA(SA), manager, bank)

'Automation will result in cost savings.' (Participant 9, TOGAF® 9 certified, manager, bank)

Cost efficiency

Blockchain adoption would eliminate intermediaries, including the STRATE, CSD participants and brokers. In turn, this would reduce costs involved with exchanges, according to the participants:

'All other things being equal, the adoption of blockchain technology will lead to T plus 0 where we settle everything at a go because I am transacting directly without the middle man.' (Participant 8, PhD, CFA, professor, academic and bank)

'The biggest player in that value chain is the CSD. I believe the need for a CSD will fall away if we move to blockchain technology.' (Participant 4, PhD, manager, bank)

By eliminating STRATE (CSD), you eliminate the CSD participants, leaving buyers and sellers to deal directly with the JSE. This will lead to cost savings to the buyers and sellers:

'Intermediaries such as your CSDs and CSD participants will fall away, because the need to manage your securities and your cash will be automated. That means all the costs associated with STRATE and all of that, CSDPs and all of that falls away - so reduced costs.' (Participant 4, PhD, manager, bank)

'The industry has multipe intermediaries, resulting in transaction costs for participants, which means the process takes long and cost efficiency is not achieved.' (Participant 9, TOGAF® 9 certified, manager, bank)

It is possible and desirable to remove CSD participants as they were only introduced into the industry during the period 1998-2000. There is evidence that the industry can operate without them. However, their market power would cause a challenge to their removal. A CSD participant's presence is viewed as of little value and their existence adds a considerable amount of cost to transactions. Central securities depository participants were instrumental 20 years ago because they created a link between the CSD and the ultimate client. Compared with brokers, CSD participants were viewed to be larger contributors to cost:

'The benefit of eliminated intermediaries is lower costs. Certain roles in the value chain, such as back office functions, might actually end up falling off.' (Participant 11, PhD, senior lecturer, academic)

Regarding the securities trading value chain, the aspect of clearing and settlement is identified that clearing and settlement firms were under threat:

'In securities value chain, settlement or clearing is in trouble.' (Participant 3, CFA, analyst, asset management)

'The technology has the potential to eliminate some players, if not totally eliminating some players, it may just reduce their revenues.' (Participant 5, Msc, manager, stock exchange)

Although Participant 11, thought the technology would be a threat to the existence of brokers and CSD participants, they were also of the view that the industry as a whole stood to benefit and that jobs and roles would be created:

'Blockchain is a threat to specific roles but not to the industry.This includes admin and data capturing staff.' (Participant 11, PhD, senior lecturer, academic)

The reduction in fees is related to the elimination of intermediaries. Transaction fees would be reduced as intermediaries would be eliminated from the cycle. Because when blockchain is applied, information and processes are centralised so cost can be reduced:

'Cost efficiency will be the result of combined processes.' (Participant 2, CFA, CA(SA), CIO, asset management)

Therefore, reducing the number of intermediaries will result in reduced costs, leading to an efficient allocation of resources. When blockchain is adopted, information and processes will be centralised, automated and integrated, thus cost can be reduced. Elements such as staff and office space will be removed.

Time efficiency

Almost instatenous clearing is benefical to the buyer and seller of securieties:

'Instantly transferring the value of the security from the buyer to the seller, is a major benefit.' (Participant 5, Msc, manager, stock exchange)

A shorter settlement cycle has positive implications for the volume of transactions, market liquidity and the opportunity cost associated with the provision of collateral (Mori 2016; Seretakis 2019; Workie & Jain 2017). If funds because of the seller are held up for a number of days, the seller cannot reinvest it quickly. With a shorter settlement cycle, the seller is able to receive funds faster and reinvest them into the market (Fin24, 2016). A reduction in settlement cycle leads to an improvement in liquidity; this is because liquidity is defined as 'the ease and speed with which agents can convert assets into purchasing power at agreed prices' (Levine 1997:692). Blockchain has the ability to improve the speed of settlement, thus reducing the settlement cycle:

'Blockchain technology could possibly solve the speed of settlement.' (Participant 1, LLB, manager, CSD)

'Settlement and clearing becomes quicker. You have eliminated certain parties in the process. … on the time aspect a transaction can be executed, cleared and settled almost instantly through some of sort of automation programming in the technology. This solves inefficiency related to humans.' (Participant 5, Msc, manager, stock exchange)

'Blockchain technology reduces the lag time, the time it takes to clear. That one we eliminate, we can completely eliminate that time. So we can go straight to T plus 0 like money market if we adopt it.' (Participant 8, PhD, CFA, professor, academic and bank)

Therefore, blockchain has the ability to reduce the lag time between trade and settlement through automated process, leading to the industry being time efficient.

Risk management

The adoption of blockchain technology would improve current infrastructure as it is more secure and automated. This technology can also be used across industries and lead to further innovation. Furthermore, the massive body of data collected throughout the process could be fed to an AI, which could automate processes even more. Blockchain should be viewed as a technological tool that can be used in the current system and not a tool to create an alternative ecosystem. Participant 4 went into extensive detail on how blockchain technology should not replace current infrastructure but rather be used to change the business model in place. They added that blockchain technology provides an opportunity to eliminate reliance on a CSD and humans:

'To eliminate trust in humans and services that are provided by central entities.' (Participant 4, PhD, manager, bank)

'Basically you have a secure improved financial industry infrastructure, with the adoption of blockchain technology you are building an infrastructure.' (Participant 6, Bcom, manager, bank)

It can be concluded that technological innovation is a driver of efficiency in the financial industry; there has been the rise of Fintech and mobile services. Technology allows for the efficient transfer of surplus funds to and from investors to those who need capital.

One of the qualities of blockchain technology refers to blockchain technology being more secure. Blockchain leaves footprints that can be followed and cannot be deleted, which could assist in identifying insider trading. It uses digital identification that cannot be faked, requires constant verification, uses keys and can aid in the reduction of people selling things they do not have, according to the participants. This is linked to the improved auditability element discussed in the benefits of automation:

'Blockchain is without human intervention. This allows processes to be more secure, for example, there is a human intervention for the probabaity of unauthorised private information leak. In addition, it's more secure in terms of transfer of ownership. There are no chances for fake documentation because of digital identification. Thus reducing risk, making it more safe and secure.' (Participant 5, MSc, manager, stock exchange)

In the light of regulations such as The Protection of Personal Information (POPI) Act, blockchain in the form of a consortium and private network provides more information security.

However, the participants were not very knowledgeable on the technicalities of how blockchain would manage counterparty risk:

'Blockchain can also manage counterparty risk.' (Participant 3, CFA, analyst, asset management)

Therefore, improving counterparty risk management is possible through the adoption of blockchain. This is because parties' verification of ownership by seller and cash by a buyer can be performed before settlement of a transaction.

The share register in its current form is a single point of failure, as data are currently captured, reconciled and stored by STRATE at a central point. The adoption of blockchain technology can counter this:

'Blockchain has no single point of failure. So for example, if STRATE today had a system issue and they went down, the whole market would go down, and we won't be able to settle anything.' (Participant 4, PhD, manager, bank)

In addition to solving the issue of a 'single failure point', blockchain technology's decentralised nature allows for information dissemination and access to multiple users simultaneously: 'A blockchian network allows for everyone to receive information at the same time' (Participant 6, BCom, manager, bank).

In conclusion, should STRATE be under a cyberattack, there is a risk that data will be compromised. When stored via blockchain, this risk is eliminated through the decentralisation of information.

Discussion

Blockchain adoption has the potential to improve securities clearing and settlement processes, reduce the time it takes to settle and clear, reduce the cost and improve risk management. These finding are in line with Benos et al. (2017) and Mainelli and Milne (2016). The study found that blockchain technology will play a role in shortening the settlement cycle, therefore increasing or improving settlement speed. This is consistent with findings by Chiu and Koeppl (2019), who affirm, through a quantitative modelling benchmark that securities, in the form of corporate debt can be settled through blockchain in a faster and more flexible settlement manner. This study has limitations in the sense that it did not focus on the equity market. However, this is addressed by Shetty and Damle (2020), who, in a qualitative study of the Indian market, found that blockchain had the potential to improve settlement speed, which supports the findings of this study.

A shorter settlement cycle reduces counterparty and/or settlement risk (DTCC 2021). This is important because one of the core purposes of the industry is to manage this risk (counterparty and/or settlement risk) (STRATE 2021). The current importance of STRATE and other CSDs is dependent on their ability to manage this risk. Their ability and success in doing so has been evident in the presence of little to no settlement failures. The study found that blockchain had the potential to improve counterparty risk management by, firstly, removing the number of days over which the risk is spread from T+3 to T+0. Secondly, if applied in the same manner in which it is applied in cryptocurrency trade, users have to show the proof of ownership of an asset and have cash on hand. This verification prior to transacting will also reduce the possibility of transaction failure. The validation and verification process can be performed through smart contracts (Pop et al. 2018).

The shorter settlement cycle is achieved through the automation of manual processes and procedures carried out by humans. The study found that blockchain would be able to improve automation in areas of transaction capturing, data storage and reconciliation. The current industry is characterised by manual processes. The current system involves a master copy controlled by a central authority that is organised and stored in tables that users can update and search, which is maintained by humans. The removal of this master copy and automation capturing, maintenance and reconciliation process of the centralised database through the application of blockchain technology will lead to industry efficiencies (Lewis et al. 2017).

The study finds that there is a link between cost savings that will be experienced by users (buyers and sellers of equity) and the following benefits of blockchain technology: improved efficiency, automation, elimination of the middleman and settlement speed. This is supported by Hasan et al. (2003). They contend that evolving technology has led to the reduction of communication cost, transaction cost and growth in trading in the global equity markets. These benefits of technology adoption are reiterated by Friday (2014), who argues that technology has fundamentally changed the global equity markets by lowering transaction costs and reducing asymmetric information, therefore levelling the playing field for investors and issuers (Panisi, Buckley & Arner 2019).

The adoption of blockchain technology has the potential of increasing market size and the number of buyers and sellers. This is confirmed by Dicle and Levendis (2013) who find that a benefit of technology adoption and improvement in the South African context has led to increased trade capacity and liquidity, which can be linked to the growth in market size as identified by the participants in this study.

Blockchain has the ability to provide a more secure database. This is in line with Lewis et al. (2017) and Benos et al. (2017). In addition to the database being more secure, it also provides increased transparency into the industry. The increased transparency is beneficial to all users, specifically when it comes to the share register giving users access to the same information at the same time. Investors will have direct access to their holdings, and issuers will find it easier to identify their ultimate shareholders (Panisi et al. 2019). Priem (2020) was of the view that this is a disadvantage. Their view is that when applied to financial markets, high transparency levels will cause privacy and completion issues breaching applicable laws. This is in line with six regulatory/legal challenges identified by Cermeño (2016) that blockchain would have to overcome before it can be adopted. This includes the legal nature of blockchain and the distributed ledger.

The cost of managing a central database is passed on to users by the CSD. The elimination of intermediaries such as the CSD and brokers will lead to the reduction of fees. In addition, the elimination of intermediaries allows for users to trade directly with each other or with the stock exchange. The study's outcome validates the discoveries made by Shetty and Damle (2020) as well as Petrov (2019), who contend that the removal or reduction in the role of intermediaries in the clearing and settlement process will lead to accelerated processes and reduced costs. The elimination of intermediaries will be supported by blockchain's distributed ledger technology, which is known to facilitate disintermediation, thereby reducing costs and lowering latency (Shah & Jani 2018). One of the major benefits of blockchain is increasing efficiency and reducing cost, which will be achieved through disintermediation. Disintermediation achieves this by reducing the number of intermediaries in the industry and simplifying processes (Yi 2020).

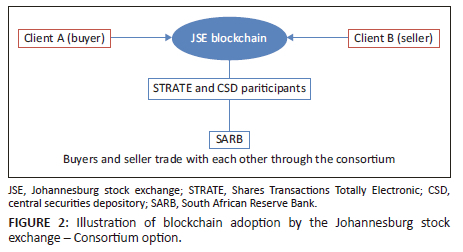

Reduced manual processes and the elimination of intermediaries or reduction of intermediation through the adoption of blockchain technology will lead to the integration of trade, execution and post-trade services. In South Africa, this would see the removal of intermediaries such as brokers, CSD participants and STRATE, leading to improved processes and cost efficiency. This efficiency can be achieved through forming a consortium, a permissioned network and public only to a privileged group. Through the consortium, the JSE would house the blockchain technology and give permission to the SARB and CSD participants (banks) to facilitate payments and STRATE to manage the share register as illustrated in Figure 2. This adoption would allow for the full integration of trade, execution, clearing and settlement while allowing STRATE to stay operational and reducing the impact on unemployment. In a high unemployment environment, eliminating STRATE, brokers and CSD participants would negatively impact the economy.

Brokers would be eliminated, as clients could open trade accounts directly with the consortium. Cash settlement will continue to be facilitated through the SARB with the use of their SAMOS system, which communicates with STRATE to facilitate the movement of funding between CSD participants.

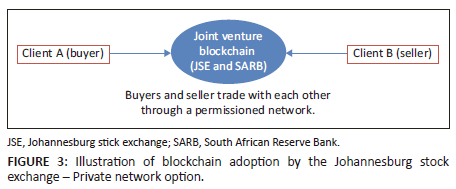

An alternative to the consortium is blockchain adoption as a joint venture private network where the JSE maintains the database and facilitates payment through the SARB, leading to the elimination of both brokers, STRATE, and the CSD participants, as illustrated in Figure 3.

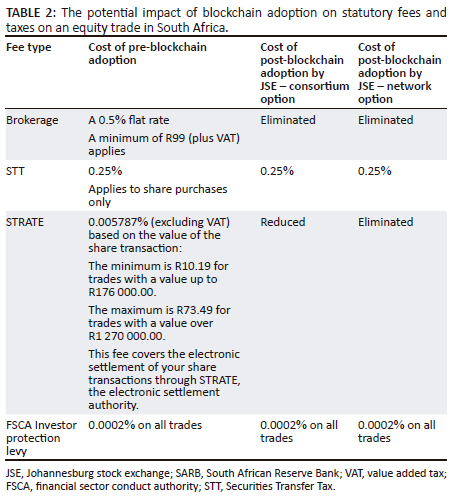

The two alternatives are given in the context of the current market regulation where the JSE, the licenced exchange STRATE, is the only CSD. The automation of the settlement cycle in the first alternative would lead to reduced cost to users but not the elimination of cost as STRATE would still be a functional organisation. In the second alternative, the JSE would absorb the functions of STRATE and operate as both the trade and post-trade entity, eliminating the total cost attributable to STRATE. The potential impact on statutory fees and taxes per alternative is summarised in Table 2.

The table compares the potential costs associated with various types of fees paid on a equity trade before and after the adoption of blockchain technology. The pre-adoption costs include a 0.5% flat rate and a minimum of R99.00 (plus value added tax [VAT]) for brokerage fees, 0.25% for securities transfer tax (STT) applied to share purchases only, 0.005787% (excluding VAT) for STRATE and a 0.0002% FSCA Investor Protection Levy on all trades. Post-adoption costs through the consortium option by JSE eliminate brokerage fees and reduce fees for STRATE, while the network option eliminates brokerage and STRATE fees altogether. The adoption of blockchain technology, thus has a potential of reducing costs associated with certain fee types, providing potential benefits for investors and market participants.

Conclusion

The potential outcome of blockchain adoption is that information and processes will be decentralised, automated and integrated, thus cost can be reduced. Elements such as staff cost, office space and office supplies will be removed. This would mean that the new formed processes do not need much money as fund and the intermediary therefore does not need to pass on the cost to the users of the system (seller and buyers).

This study recommends the adoption of blockchain in the clearing and settlement industry. This should be housed by the JSE in the form of a consortium or private network. This is possible because the JSE currently authorises trade through broker accounts and STRATE is a subsidiary of the JSE. Furthermore, the reconsideration of current regulation and the role of CSD participants in the current settlement cycle should be undertaken.

The primary limitation of the study is its failure to include the perspectives and opinions of regulators, including participants from the SARB and FSCA, who are outside the securities value chain. This limitation is because of the study's findings that the regulatory environment and existing regulations are critical factors that will impact the potential adoption of blockchain technology. Given the highly regulated nature of the financial system, future studies should aim to include a more diverse sample, including regulatory stakeholders.

Acknowledgements

This article is partially based on the author's thesis of the PhD, entitled Blockchain technology adoption in the securities clearing and settlement industry in South Africa, in the Department of Finance and Investment Management at the University of Johannesburg, South Africa, with supervisors Dr Chioma Okoro and Prof. Abel Olaleye.

Competing interests

The authors declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

Authors' contributions

M.D. was responsible for conceptualisation, methodology, formal analysis, investigation and writing the original draft. C.O. was responsible for conceptualisation, validation, resources, supervision writing, review and editing. A.O. was responsible for Validation, supervision writing, review and editing.

Funding information

The research was funded by the University of Johanessburg in the form of PhD study bursary as part of the Accelerated Academic Mentorship Programme (AAMP).

Data availability

Data is available from the corresponding author upon reasonable request.

Disclaimer

The views and opinions of this research reflect those of the authours and not the official policy or position of the University of Johannesburg.

References

Aitken, M.J., Frino, A., Hill, A.M. & Jarnecic, E., 2004, 'The impact of electronic trading on bid-ask spreads: Evidence from futures markets in Hong Kong, London, and Sydney', Journal of Futures Markets: Futures, Options, and Other Derivative Products 24(7), 675-696. https://doi.org/10.1002/fut.20106 [ Links ]

Akaba, T.I., Norta, A., Udokwu, C. & Draheim, D., 2020, 'A framework for the adoption of blockchain-based e-procurement systems in the public sector: A case study of Nigeria', Responsible Design, Implementation and Use of Information and Communication Technology 12066, 3. https://doi.org/10.1007/978-3-030-44999-5_1 [ Links ]

Al-Jaroodi, J. & Mohamed, N., 2019, 'Blockchain in industries: A survey', IEEE Access 7, 36500-36515. https://doi.org/10.1109/ACCESS.2019.2903554 [ Links ]

Avgouleas, E. & Kiayias, A., 2019, 'The promise of blockchain technology for global securities and derivatives markets: The new financial ecosystem and the "holy grail" of systemic risk containment', European Business Organization Law Review 20(1), 81-110. https://doi.org/10.1007/s40804-019-00133-3 [ Links ]

Bank for International Settlement (BIS), 2012, Payment, clearing and settlement systems in South Africa, viewed n.d., from https://www.bis.org/cpmi/publ/d105_za.pdf. [ Links ]

Benos, E., Garratt, R. & Gurrola-Perez, P., 2017, The economics of distributed ledger technology for securities settlement, Staff Working Paper 670, Bank of England, London. [ Links ]

Blennerhassett, M. & Bowman, R.G., 1998, 'A change in market microstructure: The switch to electronic screen trading on the New Zealand Stock Exchange', Journal of International Financial Markets, Institutions and Money 8(3-4), 261-276. https://doi.org/10.1016/S1042-4431(98)00048-1 [ Links ]

Boddy, C.R., 2016, 'Sample size for qualitative research', Qualitative Market Research: An International Journal 19(4), 426-432. [ Links ]

Braeckevelt, F., 2006, 'Clearing, settlement and depository issues', BIS Papers 30, 284. [ Links ]

Braun, V. & Clarke, V., 2006, 'Using thematic analysis in psychology', Qualitative Research in Psychology 3(2), 77-101. https://doi.org/10.1191/1478088706qp063oa [ Links ]

Burger, A., Dohmen, A., Moormann, J., Burger, A., Dohmen, A. & Moormann, J., 2009, 'Efficiency measurement on a process level using data envelopment analysis: An application to securities settlement and clearing', in Proceedings of the 22nd Australasian banking and finance conference, vol. 16, no. 18.12, p. 2009, Sydney. [ Links ]

Cermeño, J.S., 2016, 'Blockchain in financial services: Regulatory landscape and future challenges for its commercial application', BBVA Research Paper 16, 20. [ Links ]

Chen, W. & Wang, Q., 2020, The role of blockchain for the European Bond Market, FSBC Working Paper. viewed n.d., from http://explore-ip.com/2020_The-Role-of-Blockchain-for-the-European-Bond-Market.pdf. [ Links ]

Chiu, J. & Koeppl, T.V., 2019, 'Blockchain-based settlement for asset trading', The Review of Financial Studies 32(5), 1716-1753. https://doi.org/10.1093/rfs/hhy122 [ Links ]

Credit Suisse, 2016, Blockchain - The trust disrupter, viewed n.d., from http://www.vivanest.com/wp-content/uploads/2016/09/Blockchain-The%20Trust%20Disrupter-Report%20of%20Credit%20Suisse.pdf. [ Links ]

Creswell, J.W., 2007, Qualitative inquiry and research design. Choosing among five approaches, 2nd edn., Sage, Thosand Oaks, CA. [ Links ]

De Meijer, C.R., 2016, 'The UK and blockchain technology: A balanced approach', Journal of Payments Strategy & Systems 9(4), 220-229. [ Links ]

De Meijer, C.R., 2018, What future role for CDSs in blockchain post-trade environment?, viewed n.d., from https://www.finextra.com/bloggers/blockchain%20observations. [ Links ]

Depository Trust & Clearing Corporation (DTCC), 2012, Cost benefit analysis of shortening the settlement cycle, viewed n.d., from https://www.dtcc.com~/media/Files/Downloads/WhitePapers/CBA_BCG_Shortening_the_Settlement_Cycle_October2012.pdf. [ Links ]

Dicle, M.F. & Levendis, J., 2013, 'The impact of technological improvements on developing financial markets: The case of the Johannesburg Stock Exchange', Review of Development Finance 3(4), 204-213. https://doi.org/10.1016/j.rdf.2013.09.001 [ Links ]

DTCC, 2021, A shorter settlement cycle: T+1 will benefit investors and market participant firms by reducing systemic and operational risks, viewed n.d., from https://www.sifma.org/resources/news/a-shorter-settlement-cycle-t1-will-benefit-investors-and-market-participant-firms-by-reducing-systemic-and-operational-risks/. [ Links ]

Dusek, G., Yurova, Y. & Ruppel, C.P., 2015, 'Using social media and targeted snowball sampling to survey a hard-to-reach population: A case study', International Journal of Doctoral Studies 10, 279. https://doi.org/10.28945/2296 [ Links ]

Erlingsson, C. & Brysiewicz, P., 2017, 'A hands-on guide to doing content analysis', African Journal of Emergency Medicine 7(3), 93-99. https://doi.org/10.1016/j.afjem.2017.08.001 [ Links ]

Fekih, R.B. & Lahami, M., 2020, 'Application of blockchain technology in healthcare: a comprehensive study', in The impact of digital technologies on public health in developed and developing countries: 18th International Conference, ICOST 2020, Springer International Publishing, Hammamet, Tunisia, June 24-26, 2020, pp. 268-276. [ Links ]

Fin24, 2016, JSE ready for shorter settlement cycle, viewed n.d., from https://www.fin24.com/Companies/Financial-Services/jse-ready-for-shorter-settlement-cycle-20160607. [ Links ]

Fontana, A. & Frey, J., 1994, 'The art of science', in The handbook of qualitative research, pp. 361-376, Sage, Thousand Oaks, CA. [ Links ]

Friday, D.B., 2014, 'The impact of information technology on global capital market operations a critical appraisal of some selected developed and emerging markets', Journal of Information Engineering and Application 4(10), 40-47. [ Links ]

Hasan, I., Malkamäki, M. & Schmiedel, H., 2003, 'Technology, automation, and productivity of stock exchanges: International evidence', Journal of Banking & Finance 27(9), 1743-1773. https://doi.org/10.1016/S0378-4266(03)00099-2 [ Links ]

Lampard, R. & Pole, C., 2015, Practical social investigation: Qualitative and quantitative methods in social research, Routledge, London. [ Links ]

Laurence, T., 2019, Blockchain for dummies, John Wiley & Sons, Hoboken, NJ. [ Links ]

Levine, R., 1997, 'Financial development and economic growth: Views and agenda', Journal of Economic Literature 35(2), 688-726. [ Links ]

Lewis, R., McPartland, J. & Ranjan, R., 2017, 'Blockchain and financial market innovation', Economic Perspectives 41(7), 1-17. [ Links ]

Lustenberger, M., Malešević, S. & Spychiger, F., 2021, 'Ecosystem readiness: Blockchain adoption is driven externally', Frontiers in Blockchain 4, 720454. https://doi.org/10.3389/fbloc.2021.720454 [ Links ]

Mainelli, M. & Milne, A., 2016, The impact and potential of blockchain on the securities transaction lifecycle, SWIFT institute working paper no. 2015-007, viewed October 2021, from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2777404. [ Links ]

Manning, M., 2016, 'Distributed Ledger Technology in securities clearing and settlement: Some issues', JASSA 3, 30. [ Links ]

Micheler, E. & von der Heyde, L., 2016, 'Holding, clearing and settling securities through blockchain/distributed ledger technology: creating an efficient system by empowering investors', Journal of International Banking & Financial La 31(11), 11. [ Links ]

Miraz, M.H. & Donald, D.C., 2018, 'Application of blockchain in booking and registration systems of securities exchanges', in 2018 international conference on computing, electronics & communications engineering (iCCECE), IEEE, University of Essex, Southend, UK, August 16-17, 2018, pp. 35-40. [ Links ]

Mkhize, H. & Msweli-Mbanga, P., 2006, 'A critical review of the restructuring of the South African capital market', International Review of Business Research Papers 2(2), 80-91. [ Links ]

Mori, T., 2016, 'Financial technology: Blockchain and securities settlement', Journal of Securities Operations & Custody 8(3), 208-227. [ Links ]

Nair, R. & Bhagat, A., 2020, 'An application of blockchain in stock market', in Transforming businesses with bitcoin mining and blockchain applications, pp. 103-118, IGI Global, Hershey, Pennsylvania. [ Links ]

Panisi, F., Buckley, R.P. & Arner, D.W., 2019, Blockchain and public companies: A revolution in share ownership transparency, proxy-voting and corporate governance?', Stanford Journal of Blockchain Law & Policy. viewed n.d., from https://stanfordjblp.pubpub.org/pub/blockchain-and-public-companies. [ Links ]

Peng, K., 2021, 'Blockchain equity system transaction method and system research based on machine learning and big data algorithm', Wireless Communications and Mobile Computing 2021, 1-14, a3457967. https://doi.org/10.1155/2021/3457967 [ Links ]

Petrov, D., 2019, 'The impact of blockchain and distributed ledger technology on financial services', Industry 4.0 4(2), 88-91. [ Links ]

Pinna, A. & Ruttenberg, W., 2016, Distributed ledger technologies in securities post-trading revolution or evolution?, ECB Occasional Paper 172, European Central Bank (ECB), Frankfurt. [ Links ]

Pirrong, C., 2007, The industrial organization of execution, clearing and settlement in financial markets (No. 2008/43), CFS Working Paper, Goethe University Frankfurt, Center for Financial Studies (CFS), Frankfurt. [ Links ]

Pop, C., Pop, C., Marcel, A., Vesa, A., Petrican, T., Cioara, T. et al., 2018, 'Decentralizing the stock exchange using blockchain an ethereum-based implementation of the bucharest stock exchange', in R.R. Slavescu (eds.), 2018 IEEE 14th international conference on intelligent computer communication and processing (ICCP), IEEE, Cluj-Napoca, Romania, Septermber 6-8, 2018, pp. 459-466. [ Links ]

Poser, N.S., 1992, 'Automation of securities markets and the european community's proposed investment services directive', Law & Contemporary Problems 55, 29. https://doi.org/10.2307/1192104 [ Links ]

Priem, R., 2020, 'Distributed ledger technology for securities clearing and settlement: Benefits, risks, and regulatory implications', Financial Innovation 6(1), 1-25. https://doi.org/10.1186/s40854-019-0169-6 [ Links ]

Santo, A., Minowa, I., Hosaka, G., Hayakawa, S., Kondo, M., Ichiki, S. et al., 2016, Applicability of distributed ledger technology to capital market infrastructure, Japan Exchange Group, Tokyo. [ Links ]

Saunders, M., Lewis, P. & Thornhill, A., 2016, Research methods for business students, 7th edn., Pearson Education Limited, Harlow, TX. [ Links ]

Schaper, T., 2012, 'Organising equity exchanges', Information Systems and e-Business Management 10(1), 43-60. https://doi.org/10.1007/s10257-010-0155-z [ Links ]

Schmiedel, H., Malkamäki, M. & Tarkka, J., 2006, 'Economies of scale and technological development in securities depository and settlement systems', Journal of Banking & Finance 30(6), 1783-1806. https://doi.org/10.1016/j.jbankfin.2005.09.003 [ Links ]

Seretakis A.L., 2019, 'Blockchain, securities markets and central banking', in P. Hacker, I. Lianos, G. Dimitropoulos & S. Eich (eds.), Regulating blockchain techno-social and legal challenges, Oxford University Press, Oxford. [ Links ]

Shah, T. & Jani, S., 2018, Applications of blockchain technology in banking & finance, Parul University, Vadodara. [ Links ]

Shetty, S. & Damle, M., 2020, 'Blockchain in the stock market: Assessment of drawbacks in trading process and proposed solution for trading process using Blockchain', PalArch's Journal of Archaeology of Egypt/Egyptology 17(6), 4945-4961. [ Links ]

STRATE, 2018, Rules of STRATE (PTY) Ltd, viewed n.d., from https://www.strate.co.za/wp-content/uploads/2021/08/lg_strate_pty_ltd_rules_-_october_2018_0.pdf. [ Links ]

STRATE, 2019, About us, viewed n.d. from https://www.strate.co.za/. [ Links ]

STRATE, 2021, Who are we?, viewed n.d., from https://www.strate.co.za/. [ Links ]

Thomas Murray Ltd, 2014, CMI in focus: Equities settlement cycles, viewed n.d., from https://thomasThomasMurrayLtd.com/sites/default/files/CMI/pdf/20130101%20CMI%20In%20Focus%20-%20Equities%20Settlement%20Cycles.pdf. [ Links ]

Thomas, D.R., 2003, 'A general inductive approach for qualitative data analysis', American Journal of Evaluation 27(2), 237-246. [ Links ]

Vasileiou, K., Barnett, J., Thorpe, S. & Young, T., 2018, Characterising and justifying sample size sufficiency in interview-based studies: Systematic analysis of qualitative health research over a 15-year period', BMC Medical Research Methodology 18(1), 1-18. https://doi.org/10.1186/s12874-018-0594-7 [ Links ]

Workie, H. & Jain, K. 2017, 'Distributed ledger technology: Implications of blockchain for the securities industry', Journal of Securities Operations & Custody 9(4), 347-355. [ Links ]

Yi, D., 2020, 'Why financial infrastructures and intermediaries are actively promoting blockchain application although it means disruption to them', Journal of Securities Operations & Custody 12(4), 377-385. [ Links ]

Correspondence:

Correspondence:

Musimuni Dowelani

mdowelani@uj.ac.za

Received: 26 Aug. 2022

Accepted: 12 June 2023

Published: 09 Nov. 2023