Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Acta Commercii

versão On-line ISSN 1684-1999

versão impressa ISSN 2413-1903

Acta Commer. vol.23 no.1 Johannesburg 2023

http://dx.doi.org/10.4102/ac.v23i1.1142

ORIGINAL RESEARCH

The relationship between financial literacy and financial access among SMES in the Ekurhuleni municipality

Memory Changwesha; Ashley T. Mutezo

Department of Finance, Risk Management and Banking, Faculty of Economic and Management Sciences, University of South Africa, Pretoria, South Africa

ABSTRACT

ORIENTATION: Among the numerous factors affecting small and medium enterprises' (SMEs) ability to access funding, financial literacy or the lack thereof continues to rank high. The below-average levels of financial literacy among entrepreneurs inevitably restrict their access to finance, thereby adding to the already soaring rate of small business failure.

RESEARCH PURPOSE: The main research objective of this article is to determine the underlying financial literacy-financial access relationship among SMEs in the Ekurhuleni Metropolitan Municipality in South Africa.

MOTIVATION OF THE STUDY: Understanding the relationship between financial literacy and financial access among small businesses is imperative as they are key players in economic development. Empirical literature outlining this relationship is sparse. Therefore, the study made an original empirical contribution to the financial literacy-financial access nexus in the metropolitan.

RESEARCH DESIGN, APPROACH AND METHOD: A quantitative descriptive research design was followed. The survey method was used to gather data, where structured questionnaires were distributed to the respondents. The study considered a targeted population of 5609 registered SMEs in Ekurhuleni with a sample size of 384 prospective participants. A total of 310 responses were obtained from the owners and managers of SMEs in the municipality. The Statistical Package for Social Sciences was used to compute all statitical analyses for the study. Descriptive statistics were used to establish the SMEs' financial literacy and financial access relationship. Data were analysed using factor analysis, regression analysis and correlation analysis.

MAIN FINDINGS: Entrepreneurs in Ekurhuleni were found to have a limited understanding of basic financial concepts implying low levels of financial knowledge. Additionally, the study established that financial access was significantly challenging for most SMEs. The findings further revealed a positive relationship between financial literacy and financial access.

PRACTICAL MANAGERIAL/ IMPLICATIONS: The knowledge from this article may assist entrepreneurs and financial institutions in bridging the financial literacy gap, thereby increasing the likelihood of accessing funding by SMEs. It may also assist in influencing the development and implementation of micro and macroeconomics policies to raise financial literacy levels and leniency from financing sources towards SMEs.

Keywords: Ekurhuleni; employment rate; financial access; financial knowledge; financial literacy; SMEs; SMEs failure; South Africa.

Introduction

Across the globe, small and medium enterprises (SMEs) are the keystone for advancing the economy, alleviating poverty and creating employment. Small and medium enterprises' role in realising sustainable development goals (SDGs) remains crucial at all developmental levels worldwide. These goals include promoting an inclusive and sustainable economy that creates employment and fosters innovation and equal income distribution (Organisation for Economic Co-operation and Development 2017).

Small and medium enterprises in South Africa face numerous challenges, adversely affecting their growth and overall economic contribution. Ranking at the top of these challenges is the inability to access finance, inadequate financial know-how and limited comprehension of finance fundamentals (Chimucheka & Rungani 2011). Additionally, small businesses encounter a shortfall in skills, insufficient internal management practices and little education and training (World Bank 2018). This, inturn, creates the financial literacy-financial access gap. Therefore, the continuous growth of the SME sector in South Africa has become one of the government's key focus areas.

The preceding challenges inevitably encountered by SMEs have resulted in 75% of the businesses failing after being operational for just two years (Fatoki & Odeyemi 2010). The financial illiteracy levels of most entrepreneurs in South Africa contribute to the mismanagement of business funds, leading to the failure of SMEs in the country. Therefore, it is exceedingly crucial that small business owners are financially literate to ensure that their finances are efficiently managed, and effective decisions are made (Wise 2013). Hence, to effectively evaluate the importance of the relationship between financial literacy and financial access among small businesses, it is essential to understand the prevalence of these variables within the enterprises. Furthermore, it is essential to understand the underlying factors in determining financial literacy and financial access among small businesses. Therefore, although many research studies focus on financial literacy and financial access, it is to the best of the authors' knowledge that existing literature does not investigate the underlying relationship between these two variables.

This study's main objective was to determine a possible relationship between SMEs' financial literacy and financial access. In relation to the preceding section, the study reported in this article sought to achieve the following sub-objectives:

-

To establish the factors influencing financial literacy among SMEs.

-

To establish the indicators of financial access among SMEs.

-

To investigate the relationship between financial literacy and access to finance among SMEs.

Small and medium enterprises in South Africa

Statistics South Africa (2023) reports that the current unemployment rate in South Africa stands at 32,9%, with the SME sector identified by the government as being fundamental in tackling unemployment. Despite the support rendered by the government in South Africa, small businesses still encounter several challenges, including an increased lack of financing and limited financial management knowledge among entrepreneurs (Brixiova 2010). As a result, SMEs tend to find it challenging to acquire funding and comprehend and access financial products offered by financial institutions (Fatoki 2014).

On a global scale, research shows that of most existing businesses, approximately 90% are represented by SMEs, creating over 50% of the world's employment (World Bank 2022). Similarly, according to Statistics South Africa (2019), of all formal businesses in South Africa, SMEs account for most businesses, contributing 34% to the country's gross domestic product (GDP) while employing between 50% and 60% of the country's population. Close to 5.6 million small businesses are operational within the SME sector, creating roughly 11.6 million job opportunities (FinScope Small Business Survey 2010).

However, the success rate of South African small businesses remains significantly low owing to unsuitable practices in business and management, an unskilled labour force, a shortage of intellectual and technical personnel, insufficient skills in finance and incompetent managers (Musara & Fatoki 2012). According to Maredza and Ikhide (2013), countless initiatives have been implemented by both the public and private sectors to support small businesses as they develop and expand. However, several of these entities have been seen to fail regardless. Therefore, many failing small businesses restrict their prospects of creating jobs and alleviating poverty (Fatoki & Odeyemi 2014). An argument, therefore, arises that small businesses in emerging economies such as South Africa need to focus not only on financial access to fund their entities but also direct their attention to critical success factors (CFS), which will allow them to gain a competitive advantage in a given market (Osano 2019).

Financial literacy of small and medium enterprises in South Africa

As financial literacy continues to gain more acclaim across the globe, copious definitions of the concept have evolved. As the current study assesses financial knowledge, financial awareness, financial attitude and financial behaviour of entrepreneurs, the definition aligns with that of Atkinson and Messy's (2012). Accordingly, the authors define financial literacy as consolidating knowledge, attitudes, behaviour and awareness needed to develop efficient and effective financial decisions. Furthermore, the authors elaborate that an increase in the intricacy of the financial landscape has led to financial literacy becoming instrumental in functioning in such an environment. Moreover, financial institutions responsible for providing the necessary financial products and services to consumers mistakenly assume that consumers are already financially literate and believe that they (the consumers) have the required knowledge, capabilities and skills to carry out related financial activities (Shambare & Rugimbana 2012). However, to date, only a select number of individuals have the necessary skills to make decisions around money, including saving, investing and spending (Nanziri & Leibbrandt 2018). Therefore, for consumers to make profound financial decisions, they must possess the capability and confidence to utilise their financial knowledge (Beckmann 2013). The lack of adequate knowledge and training remains a prime justification for the lack of entrepreneurial development and the soaring SME failure rates in South Africa. Therefore, a strong association exists between financial literacy and business survival (Hastings, Madrian & Skimmyhorn 2013). Providing initiatives and programmes which could assist and inform prospective users of financial product offerings in South Africa requires an in-depth comprehension of financial literacy nationwide. However, one of the challenges associated with providing such initiatives is the scarcity or unavailability of publicly available micro-data on financial knowledge, attitude, skills and behaviour (Human Sciences Research Council 2010). Similarly, Bumcrot, Lin and Lusardi (2013) concur that SMEs' use of financial services is explained by the owners' level of financial literacy. Therefore, entrepreneurs' understanding and evaluation of the different financial products on offer are primarily determined by their level of financial literacy (Altman 2012).

Small and medium enterprises financial access in South Africa

Previous literature has found that small businesses are significantly disadvantaged in acquiring financing, especially bank financing, compared to larger firms (Beck et al. 2008). In other words, although small businesses fuel economies in developed and developing countries, their size limits their access to external funding more than their bigger counterparts (Abraham & Schmukler 2017). This inevitably creates a financing gap for SMEs. A survey conducted in 2018 reported that a mere 6% of small businesses in South Africa had access to government funds, while the private sector could fund 9% of the enterprises (Cunha et al. 2020). It is, therefore, crucial to understand the SME financing problem and investigate the indicators of financial access. Financing is deemed a pre-requisite when creating and expanding a firm's operations, advancing products, and when there is an investment for production and hiring new personnel (Fatoki & Asah 2011). Fatoki (2014) emphasises that it is highly imperative that adequate and readily accessible financing be made available for small businesses to facilitate their continuous development.

Several SMEs in South Africa depend on internal financing, ranging from the owner's contribution to contributions from friends and family (Fatoki & Smit 2011). However, internal financing sources alone are barely sufficient for small business development and sustenance (Mutezo 2013). Consequently, SMEs resort to external financing from financial institutions such as banks. However, SMEs fail to readily access bank finance as they rarely satisfy bank requirements, including possessing sound business plans and meeting all collateral demands (Moloi & Ntshakala 2016). Banks in South Africa, therefore, tend to hold back when requested for finance by SMEs, especially those in their infancy stages, as most of them: (1) are primarily illiquid; (2) are unable to supply trustworthy details on the entrepreneur, hence providing a non-traceable record; and (3) are usually in debt (Markova & Petkovska-Mircevska 2009). It is also important to mention that demand and supply factors could describe small businesses' notably low use of banking services. Issues on the supply-side occur when SMEs have lucrative investment projects but fail to access adequate external funding (Abraham & Schmuckler 2017). Hence, owing to market imperfections, information asymmetries tend to make the SMEs' credit worthiness assessment, action monitoring and repayment enforcement a mammoth task (Shikimi 2013). Issues on the demand-side arise when small businesses are not perceived as credit worthy, implying that except when lending is subsidised, SMEs will not receive credit, as this will result in a loss for the lender (Gianetti 2015).

Literature review

Theoretical framework

This article is anchored on the Resource-Based View (RBV), Credit Rationing, and Pecking-Order (POT) Theory.

The Resource-Based Theory

Many researchers comprehend the RBV as one of the perspectives with possibly the most significant influence in the study of organisations (Kellermans et al. 2016). With the roots of this theory embedded in the literature by Penrose (1959), the author defines an organisation as a 'bundle' of resources according to the services it can provide to its consumers. Later formalised in 1984 by Wenerfelt and again by Barney in 1991, the RBV is one of the most widely cited theories used to analyse sustained competitive advantage globally (Delery & Roumpi 2017). Therefore, the RBV theory provides an all-important framework which describes the firm's performance and competitive advantage. Barney (1991) asserts that a firm's resources must be uncommon, inimitable and hard to substitute. Hence, the RBV implies that a firm's actions must depend on its characteristics focusing primarily on the activities it is likely to gain (Wenerfelt 2013).

The Credit Rationing Theory

Most SMEs rely heavily on loan and overdraft facilities from banks and supplier credit to finance their businesses early, resulting from an external equity deficit (Fatoki & Aregbeshola 2013). Most developing countries generally have limited access to debt finance (Hashi & Toçi 2010). Stiglitz and Weiss (1981) indicate that private-sector financial institutions fail to allocate loans among small businesses primarily because of substantial information asymmetry (Irwin & Scott 2010). This scenario is commonly referred to as credit rationing. Stiglitz and Weiss (1981) assert that credit rationing is primarily caused by adverse selection and moral hazards. The issue of adverse selection occurs when borrowers conceal private yet critical information regarding their behaviour and/or prospective traits before the beginning of the credit relationship (Colquitt 2017). Therefore, the absence of sufficient information restricts bankers from distinctively differentiating between desirable and undesirable firms. In such instances, lenders tend to either reject loan applications or ration the value of the credit (Zambaldi et al. 2009). If the lender approves the loan, there is a possibility that the borrower may inappropriately misuse the funds resulting in the likely failure to pay back the loan as initially agreed in the contract. This improper use of the loan is referred to as a moral hazard.

The Credit Rationing Theory therefore highlights a condition whereby lenders limit extending credit to borrowers although they are willing to accept it at much higher prices (Lubanga 2013). When credit rationing occurs amidst loan applicants with similar characteristics, only a few will receive credit while the remaining applicants are declined. There is a distinct faction among the population that does not have credit access even at higher prices (Fatoki & Smit 2011). The core argument is that lenders may extend loans at varied interest rates, causing potential loan applicants to be denied access to credit (Fatoki & Odeyemi 2010). The theory implies that funding availability could result in its productive use. Nonetheless, evidence suggests that funding accessed through the formal financial sector remains difficult to acquire (Fatoki & Odeyemi 2010).

The Pecking Order Theory

Authors Myers and Majluf, at a later stage, reinvented the POT, introduced by Donaldson (1961) in 1984. The basis of the author's contention was founded on information asymmetry. This irregularity in information between owners and investors leads to financial strain among firms, causing them to select financing sources hierarchically (Serrasqueiro & Caetano 2015). Therefore, the 'pecking order' is derived from how firms structure their balance sheet in financing projects initially using internal equity, after that debt, and finally, external equity, as Myers (1984) observed.

The POT has also been tested on SMEs, mainly owing to the assumption that a firm's ability to access equity markets is limited, increasing the probability of financing debt with a deficit (Serrasquerio & Caetano 2015). Moreover, Gonzalez and Gonzalez (2012) link information asymmetry to small businesses by affirming the predominance of the POT. However, Laery and Roberts (2010) argue that there is no material effect of the changing degrees of information asymmetry on the financial behaviour of the POT but instead suggest that ageing conflicts determine the POT.

Empirical literature

In a study conducted in the United Kingdom (UK) (Midlands region), Hussain, Salia and Karim (2018) examined the relationship between financial literacy, financial access and growth among SMEs. The authors' primary objective was to assess SMEs' ability to subdue information asymmetry, extenuate collateral needs, optimise capital structure and improve access to funding. The study's findings suggested that improved financial literacy levels lowered the costs of monitoring and optimised the firm's capital structure which positively affects the growth of small businesses. Knowledge in managing finances was recognised as a critical resource aiding SME owners in making effective decisions.

Damen and Rodriguez (2014) performed financial analysis, determining levels of financial comprehension and established the preparation of financial statements in reaching management decisions by small business owners in Florida. The study found that the financial strength of small businesses was strongly associated with the business owner's attitude regarding their financial statements. However, about 50% of the SMEs indicated that the owners did not subsequently review their financial statements.

Lusardi and Scheresberg (2013) examined financial literacy and methods of borrowing at high costs in the United States. These included different types of loans (payday, auto title and refund anticipation loans) and pawnshops. The analysis of the study revealed that most of those who borrowed at a high cost portrayed low financial literacy levels. The study further established that it was less likely that financially literate SMEs would borrow at high prices.

Financial access is one of the significant challenges several small businesses encounter worldwide. In South Africa, findings from a study by Makina et al. (2015) on SME financial access and SME size found that access to formal credit constituted sole proprietorships as measured by the number of employees. Distinguishing factors also positively affected SME sizes were turnover and business sophistication. However, informal credit was found not to impact SME size significantly. Lastly, access to credit (formal and informal) depended on the SME's location. For example, higher GDP provinces like Gauteng and KwaZulu-Natal (KZN) showed that most SMEs had access to formal credit. However, small businesses mainly relied on informal credit in poorer provinces such as Limpopo and the Eastern Cape.

Osano and Languitone (2016) discussed the underlying factors affecting financial access by small businesses in Mozambique. Factors such as the structure financial sector, awareness of opportunities available for financing, and the prerequisites for collateral and support services for small businesses were analysed. The study found that all four factors were related to access to finance.

Wachira and Kihiu (2012) examined financial literacy and its impact on consumers' access to Kenya's financial services. Their paper, however, established a significantly high chance that a financially illiterate individual might remain financially excluded; hence, reversing the trend would require increased investment to improve financial literacy.

Research methods and design

The article adopted the positivist approach in which actual knowledge can be obtained through observation and experimentation (Rahi 2017). Positivism details the position of a scientist and entails the production of generic principles while employing a discernible social reality (Saunders, Lewis & Thornhill 2015). The study reported in this article used a descriptive design. Salkind (2014) points out that descriptive research primarily describes the status quo of the study period, where the researcher has to rely on a prior understanding of the underlying problem. However, definitive evidence in primary data form is needed to address the problem and establish the most suitable action (Wiid & Diggines 2015).

Therefore, the primary data for the study report on this article was collected through a survey. The questionnaire was made up of three sections. Section A required the respondents to complete their demographic details, while sections B and C consisted of questions associated with financial literacy and financial access, respectively. Participants were rated on a 5-point Likert scale where '1' represented 'strongly disagree' and '5' represented 'strongly agree'. The research population comprised 5609 registered SMEs from all industry sectors. The chosen sampling technique for the study was systematic random sampling, which according to Rahi (2017), entails randomly selecting the initial point of sampling while the consequent points are selected systematically. Furthermore, a sample size of 384 SMEs was determined using Fischer's formula, given a 95% confidence level was maintained. Hence, 400 questionnaires were distributed to the entrepreneurs, of which 324 were returned. Of the 324 returned questionnaires, only 310 were deemed suitable for analysis. Table 1 shows Section A (financial literacy) and Section B (financial access) of the questionnaire and statements which entrepreneurs responded to during the data collection phase of the study.

The questionnaires were pre-tested before gathering data for the main study in a pilot study. The questionnaires were distributed to 20 SMEs. Participants were requested to complete consent forms before being informed of the intention of undertaking the survey process. The aim of the pilot study was twofold. Firstly, it allowed the researchers to detect potential problems while serving as a guideline in the research plan development and assessing that the practical methods work and that the overall research is feasible (Doody & Doody 2015). Secondly, the pilot study was conducted to establish whether alterations needed to be implemented in the research design, ensuring that protocols of intervention were followed through before conducting the primary research study on a large scale. After data collection and analysis, the necessary amendments to the questionnaire were made and implemented accordingly. To determine the internal consistency of the questionnaire, Cronbach's alpha was used. Hence, an alpha coefficient value of 0.771 was established, and the questionnaire was deemed reliable.

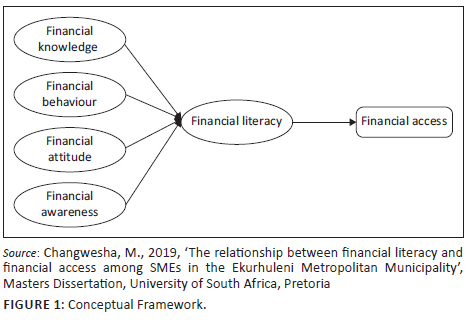

The study employed descriptive statistics to compute the mean, and standard deviations were calculated. As defined by Maree et al. (2016), factor analysis determines which items 'belong together', grouping them according to the similarities in answers, thereby measuring identical factors. Furthermore, the ANOVA test was used to test the significance of the model at the 5% significance level. Regression analysis was also used to establish the possibility of an existing financial literacy-financial access relationship. Correlation analysis was also used to determine the relationships among the study variables. Figure 1 depicts the conceptual framework of the study.

Ethical considerations

The University of South Africa Department of Finance, Risk Management and Banking Ethical Review Committee approved the study. The ethical approval number is 2018/CEMS/FRMB/020. All study procedures involving human participants were followed according to the institution's ethical standards and the Helsinki Declaration. All participants consented to participate in the study.

Results

The following sections highlight the financial literacy determinants and financial access indicators used before presenting and discussing the study results. Financial literacy was measured using financial knowledge (FK), financial behaviour (FB), financial attitude (FA) and financial awareness (FAW). Accordingly, financial knowledge was used to test entrepreneurs' comprehension of basic financial concepts and investigate whether SMEs prepared, reviewed and analysed company financial statements. Financial behaviour aimed to understand the participants' management of finances while FA sought to evaluate the entrepreneurs' stance regarding budgeting, saving and spending habits while attempting to understand their attitude towards life in general. Lastly, FAW assessed how conscious entrepreneurs were of financial products and service offers at financial institutions. Indicators used to measure the financial access variable included business operations (FAC_1), sources of funds (FAC_2), loan convenience (FAC_3) and government regulations (FAC_4). Firstly, FAC_1 sought to establish the degree of difficulty in accessing finance by small businesses. Secondly, the FAC_2 variable evaluated the various funding options available to SMEs. Here, participants were asked to state which financing options they mostly used. Next, the FAC_3 measure assessed the crucial factors affecting entrepreneurs when obtaining loans. Finally, FAC_4 probed possible actions by the government that could facilitate less cumbersome funding for SMEs.

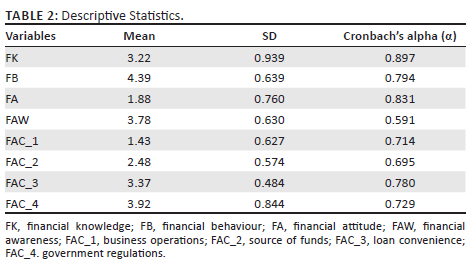

Descriptive statistics

Table 2 presents a summary of the descriptive statistics results. Entrepreneurs provided neutral feedback regarding financial management concepts. However, a positive mean value of 4.39 was recorded for financial behaviour, indicating that the entrepreneurs were optimistic regarding their financial behaviour. Entrepreneurs responded negatively to accessing finance for business operations, showing that most agreed that accessing finance for business use was a massive challenge. They also concurred that they did not receive better financing than their competitors. Small and medium enterprises were also impartial about accessing funding sources, as shown by the mean value of 2.48. Similarly, entrepreneurs were uncertain of conveniently accessing loans from a financial institution, depicted by a mean value of 3.37. Lastly, financial access by entrepreneurs was significantly impeded by government laws.

Factor analysis

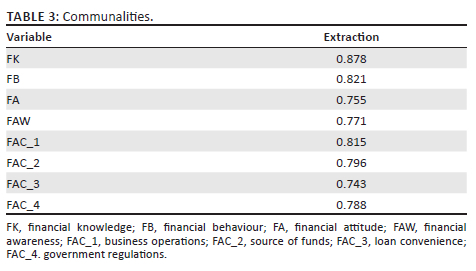

Principal Component Analysis (PCA) was used as the extraction method in determining the factor analysis results on the variables of the study. The resultant component matrix is shown in Table 3.

The preceding component matrix shows that financial knowledge recorded the highest value of 0.878, with financial behaviour recording the second-highest value of 0.821. The variables with the highest values indicate a positive variance.

Correlations

Table 4 provides the correlation matrix for the study and indicates a positive correlation between FK and FB. A non-significant relationship was, however, found between the two variables. Financial knowledge and FA were negatively correlated, with a value of -0.245. Financial knowledge and FAC_1 affected SMEs' ability to source funds. A positive correlation is further established between financial knowledge and loan convenience, source of funds and government regulations. Financial behaviour positively correlated with FK and FAW, Loan convenience and FAC_4, were negatively correlated with FA, FAC_1 and FAC_2, respectively. There was a positive correlation between FA and FAC_3. Financial attitude was negatively correlated with FAW, FAC_2 and FAC_4.

Financial attitude correlated with the four financial access indicators positively. There was a positive correlation between FAC_1 and FAC_2 while a negative correlation existed between the FAC_3 and FAC_4. Table 3 also shows that FAC_2 was negatively correlated with the source of funds and government regulations. Lastly, a positive correlation was established between FAC_3 and FAC_4.

Regression analysis

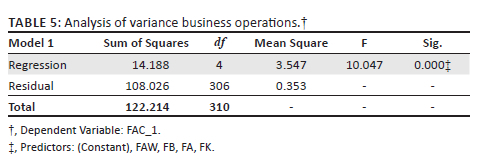

Regression analysis was conducted on the financial access indicators of the study to establish the degree to which the independent variable (financial literacy) affected the dependent variable (financial access). The results of the regressions are presented next.

The ANOVA findings at a 5% significance level show that the F statistic calculated is 10.047, with F critical at 0.338, as shown in Table 5. Since the F value is greater than the F-critical value (10.047 > 0.3338), the overall model was significant, meaning that financial literacy and access to finance through business operations are significantly related. The p-value of 0.000 indicated a statistically significant relationship between financial literacy and financial access in FAC_1.

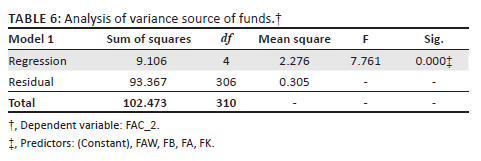

At a 5% significance level, the ANOVA findings show that the F statistic calculated is 7.761, with F critical at 0.338.The F value calculated is greater than the critical value (7.761 > 0.338). Hence, the overall model was therefore significant, revealing a significant relationship between financial literacy and access to finance through sources of funds. The p-value of 0.000 indicated that financial literacy and financial access to sources of funds were highly significant. The findings of the ANOVA are highlighted in Table 6.

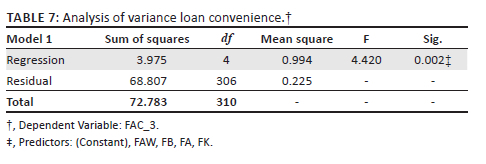

At a 5% significance level, the ANOVA findings show that the F statistic calculated is 4.420, with F critical at 0.338. The overall model was significant since the F value is greater than the critical value (4.420 > 0.3338). A significant relationship exists between financial literacy and access to finances through loan convenience. The p-value of 0.002 indicated that financial literacy and financial access to FAC_3 were significantly related, as depicted in Table 7.

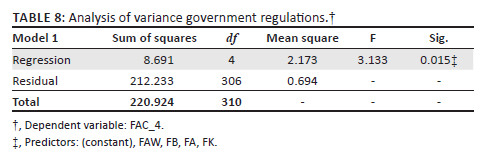

At a 5% significance level, the ANOVA findings show that the F statistic calculated is 3.133, with F critical at 0.338.The F value calculated is greater than the F critical value (3.133 > 0.3338), meaning that the overall model was significant. Therefore, a significant relationship between financial literacy and access to finances through government action is highlighted. The p-value of 0.015 indicated no significant financial literacy and financial access relationship regarding government action. Table 8 highlights the analysis of variance.

Discussion

Financial literacy

The results showed that entrepreneurs in the Ekurhuleni municipality had a limited understanding of basic financial literacy concepts. The results align with those of Klapper et al. (2015), wherein the authors established that a mere third of the adult population comprehends the general concepts surrounding financial literacy across the globe. However, the entrepreneurs prepared financial statements (income statement and balance sheet), indicating their relevance in their business operations. Oseifuah (2010) found that 85.3% of respondents also prepared financial statements in his study. Overall, entrepreneurs in the study showed little or no understanding of the fundamental financial concepts concurring with Lusardi, Mitchell and Curto (2010) and Fatoki (2010), who concluded that the financial literacy of individuals was generally less than average or exceedingly low.

Ekurhuleni's entrepreneurs' financial behaviour was admirable, implying a reasonable budget and spending approach. They cautiously supervised how they spent their money, refraining from spending impulsively and planning for their businesses. Diebold and Yilmaz (2009) and Scott (2010) assert that for funds to be effectively managed, there is a need for one to understand the necessary skills in finance clearly. Therefore, from the preceding results, the financial behaviour of SMEs in Ekurhuleni was remarkable. Similarly, Oseifuah's (2010) study highlighted that at least 64.8% of participants were careful in spending their money, while 66.7% of entrepreneurs admitted to having kept a budget and tracked their spending.

Entrepreneurs in Ekurhuleni portrayed negative financial attitudes and were uncertain of how to manage money while portraying an attitude of impartiality towards their general well-being. According to Atkinson and Messy (2012), consumers with negative attitudes towards saving for the future are less likely to save. Intrinsically, if the needs in the short run take precedence over those in the long run, consumers are usually not willing to spend their savings reserved for unforeseen circumstances. Although this study's participants perceived themselves as risk-takers regarding their money when saving and investing, the overall results indicated a negative attitude toward their financial matters. However, these results contrasted with those of Oseifuah (2010), who found that respondents had a positive attitude toward their finances.

Entrepreneurs in Ekurhuleni are generally aware of financial institutions' various service and product offerings and their accessibility. According to the FinScope (2010) surveys, there are fewer chances of using and taking up financial products if the individual is unaware of the financial institutions' products. Xu and Zia (2012) assert that there is a variation among countries in awareness of financial products, with several individuals cognisant of savings accounts and insurance products.

However, entrepreneurs in this study exhibited a significant awareness of the various externally provided services and financial product offerings at financial institutions. Eniola and Enterbang (2017), in their research, revealed results of varying nature in Nigeria, where small business owners showed seemingly low levels of financial awareness.

Financial access

Most SMEs concurred that they experienced challenges with financial access for business use and were in disaccord with obtaining funding than their respective counterparts. Chimucheka and Rungani (2011) highlight that the reasons SMEs fail to access finances include failure to receive prompt feedback on the accessibility of financing, inability to meet the required collateral terms, mediocre business plans, impractical business ideas, and the foreign ownership of the businesses. Suffice it to say, Ekurhuleni SMEs also experienced difficulties accessing business funding. This is also found in previous research studies (Chimucheka & Rungani 2011; Fatoki 2014; Tadesse 2014), where access to finance proved challenging for entrepreneurs.

Entrepreneurs were uncertain about FAC_3. The study showed that most businesses were financed by internal funds or retained earnings, such as those in Ethiopia, where just over a third of businesses were financed using internal sources (Tadesse 2014). The POT stipulates that internal finances must be used before utilising financing from external sources (Myers 1984). However, since internal finance is usually a SMEs' first option, it is usually insufficient for survival and growth (Fatoki & Smit 2011). Therefore, the study results revealed that funding sources were inadequate for small businesses, leading to ineffective business operations owing to the lack of financing. Similarly, a study by Tadesse (2014) revealed that SMEs' access to bank financing and financing from different sources were somewhat restrained, resulting in most businesses depending primarily on internal sources.

Entrepreneurs in Ekurhuleni indicated that their location was convenient and required the various services offered to be available and accessible in one financial institution. The entrepreneurs responded uniformly regarding the quality of service, excluding collateral and prompt loan processing, agreeing that they were paramount in obtaining loans. In the Debris Marko Town in Ethiopia, Tadesse (2014) found that processing loans for SMEs varied from one to four or five weeks. The author further inquired about the convenience of the repayment period for small businesses. Participants totalling 32.4% indicated very brief loan periods, negatively affecting repayment within the specified period. However, entrepreneurs gave mixed responses on the convenience of their services when obtaining loans.

The government also determined the entrepreneur's ability to access finances. SME owners and managers were in unison to access funding if taxes were lowered, the simplification of the process of registering a company and subsidising loans from the government to retain employees on the payroll. According to Eniola and Entebang (2015), regulations posed by the government tend to limit entrepreneurship. Therefore, amid the various obstacles that SMEs encounter, government regulatory enforcement plays a significant role in SMEs' inability to access finance. Therefore, the government needs to actively provide a continuous support system for small businesses and assist them in overcoming the numerous challenges they encounter when accessing funding. It remains clear that several small business owners are still unaware of government programmes and initiatives implemented to provide them with the required assistance for their businesses (Chimucheka & Rungani 2011).

A strong correlation was found between FB, FA and FAC_1. Furthermore, financial attitude, financial awareness and financial behaviour were positively related. Financial behaviour was also positively correlated with FAC_1 and FAC_3. In the same light, results from regressions revealed multiple relationships between the study's two core variables (financial literacy and financial access). A significant relationship was also established between FK and FAW. Lastly, the determinants of financial literacy and the indicators of financial access were also all positively related.

In light of the foregoing discussion, it suffices that small businesses are faced with the genuine struggle of accessing finance. Their critical role in the economy, however, requires the various stakeholders (government, financial institutions, small businesses) to find ways to facilitate initiatives to ease the enterprises' burden. For instance, the South African government could offer small businesses quarterly financial education, development and awareness training programmes. Such programmes will be aimed at providing a solid foundation for emerging businesses. In contrast, existing businesses will have the opportunity to benefit and later apply the much-needed financial principles to their businesses accordingly. Furthermore, the government could look into strategising, formulating and implementing policies that speak to financial institutions and how best they can cater for small businesses' ability to access funding.

In the same light, financial institutions too could play a vital role in creating a conducive borrowing environment for small businesses. As a starting point, banks and other lending institutions could educate entrepreneurs on the various product and service offers and financing options available before they apply for financing. With such information, there is likely to be a creation of financial awareness and an increase in financial knowledge for the owners and managers of small businesses. Similarly, financial institutions could strive to place less stringent measures for small businesses by introducing initiatives which allow small businesses to actively participate as a prerequisite to receive funding. For instance, entrepreneurs could attend workshops and/or programmes on financial literacy and access, acquiring the necessary knowledge on basic financial concepts. Additionally, entrepreneurs could be taught to create and maintain financial statements. As a result, financial institutions can request that entrepreneurs present their coherent and structured financial statements (and business plans) as one of the primary requisites of securing access to credit.

It is critical for entrepreneurs, in their capacity, to also go the extra mile to invest in the necessary financial education they require to navigate the financial landscape effectively. Capitalising on the various programmes offered by both the government and the private sector could be highly beneficial and much needed in increasing their levels of financial literacy, hence a step closer to bridging the financial literacy-financial access gap.

Limitations and future research

The study had three significant limitations. Firstly, the measuring instrument contained closed-ended questions. As a result, several entrepreneurs were less responsive in their opinions or apprehensive about disclosing sensitive information such as their level of education, annual income and a select number of financial literacy questions. Secondly, the electronic administration of questionnaires to entrepreneurs resulted in a bias towards those with access to computers, laptops and WiFi. Additionally, some entrepreneurs encountered difficulties in clearly comprehending the instructions, making the results less generalisable to the broader population of SMEs. Lastly, the study only considered registered SMEs within the Ekurhuleni Metropolitan Municipality. Although a list and the details of SMEs from the municipality database were made available to the researcher, some businesses included in the sample frame were no longer operational. A total of 400 questionnaires were distributed. However, only 310 were considered useful for the study. Therefore, the results drawn were interpretable primarily for small Ekurhuleni businesses or those with similar settings.

Future research can commit to investigating the reasons why financial literacy levels are generally low among SMEs. Considering the significant role of small businesses in economic development, the possible government influence on low financial literacy levels could also be investigated. Future researchers could also conduct a longitudinal study which may concede additional findings, especially on financial literacy and the financing of small businesses over time. The study was limited to registered SMEs in Ekurhuleni, suggesting that the results cannot be generalised to other municipalities and South Africa. Hence, future researchers could replicate this study's empirical section using data that geographically represents small businesses from the various municipalities countrywide.

Conclusion

Financial literacy and financial access have been widely researched in South Africa. However, empirical literature highlighting the relationship between these variables, especially among SMEs, still needs to be explored. Therefore, this article contributed to existing knowledge and possibly prompted an argument on the financial literacy and financial access relationship. The quantitative and descriptive nature of the study revealed three main findings. Firstly, regarding financial literacy, the article established that entrepreneurs in the Ekurhuleni Metropolitan Municipality needed a greater understanding of basic financial terms. This further revealed low levels of financial literacy among entrepreneurs. Secondly, most businesses confirmed that this factor was their most significant obstacle regarding SME access to financing. Overall, the article established a positive relationship between entrepreneurs' financial literacy and their ability to access financing in Ekurhuleni.

Acknowledgements

The authors would like to acknowledge and express their sincere gratitude to Juanita du Toit for her expertise in the language editing of this article.

Competing interests

The authors declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

Authors' contributions

M.C. is the main author of this article. This article is based on a master's dissertation for M.C., and A.T.M. assisted with the conceptualisation and supervision of the study.

Funding information

This research received no specific grant from any funding agency in the public, commercial or not-for-profit sectors.

Data availability

The data is available from the corresponding author, M.C., upon reasonable request.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Abraham, F. & Schmuckler., S.L., 2017, 'Addressing the SME finance problem', World Bank Research and Policy Briefs 120333. [ Links ]

Altman, M., 2012, 'Implications of behavioural economies for financial literacy and public policy', Journal of Socio-Economics 41(5), 677-690. [ Links ]

Atkinson, A. & Messy, F., 2012, 'Measuring financial literacy: Results of the OECD / international network on financial education (INFE) pilot study', OECD Working Papers on Finance, Insurance and Private Pensions, No. 15, OECD Publishing, Paris. [ Links ]

Barney, J., 1991, 'Firm resources and sustained competitive advantage', Journal of Management 17(1), 99-120. [ Links ]

Beck, T.A., Demirgüç-Kunt, A., Laeven, L. & Maksimovic, V., 2008, 'The determinants of financing obstacles', Journal of International Money and Finance 25, 932-952. [ Links ]

Beckmann, E., 2013, 'Financial literacy in household savings in Romania' Numeracy 6(2), 55-59. [ Links ]

Brixiova, Z., 2010, 'Unlocking productive entrepreneurship in Africa's least developed countries, African Development Review 22(3), 440. [ Links ]

Bumcrot, C., Lin, J. & Lusardi, A., 2013, 'The Geography of financial literacy', Numeracy 6(2), 1-6. [ Links ]

Cant, M.C. & Wiid, J.A., 2013, 'Establishing the challenges affecting South African SMEs', International Business and Economics Research Journal 12(6), 707-715. [ Links ]

Changwesha, M., 2019, 'The relationship between financial literacy and financial access among SMEs in the Ekurhuleni Metropolitan Municipality', Masters Dissertation, University of South Africa, Pretoria. [ Links ]

Chimucheka, T. & Rungani, E.G., 2011, 'The impact of inaccessibility to bank finance and lack of financial management knowledge to small, medium and micro enterprises in Buffalo City Municipality, South Africa', African Journal of Business Management 5(14), 5509-5577. [ Links ]

Cunha, L., Entwisle, D., Jeenah, U. & William, F., 2020, A credit lifeline: How banks can serve SMEs in South Africa better, McKinsey & Company, New York, NY. [ Links ]

Dahmen, P. & Rodriguez, E., 2014, 'Financial literacy and the success of small businesses: An observation from a small business development centre', Numeracy 7(1), 1-14. [ Links ]

Delery, J.E. & Roumpi D., 2017, 'Strategic human resource management, human capital and competitive advantage: is the field going in circles?', Human Resource Management Journal 27(1), 1-21. [ Links ]

Diebold, F.X. & Yilmaz, K., 2009, 'Measuring financial asset return and volatility spill over's, with application to global equity markets', The Economic Journal 199(534), 158-171. [ Links ]

Donaldson, G., 1961, Corporate debt capacity: A study of corporate debt policy and the determination of corporate debt capacity, Harvard Graduate School of Business Administration, Boston, MA. [ Links ]

Doody, O. & Doody, C.M., 2015, 'Conducting a pilot study: A case study of a novice researcher', British Journal of Nursing 24(21), 91-99. [ Links ]

Fatoki, O., 2014, 'The causes of failure of new small to medium enterprises in South Africa', Mediterranean Journal of Social Sciences 5(20), 922-929. [ Links ]

Fatoki, O. & Odeyemi, A., 2010a 'The determinants of access to trade credit by new SMEs in South Africa', African Journal of Business Management 4(13), 2763-2770. [ Links ]

Fatoki, O. & Aregbeshola, R.A., 2013, SMEs, financial reporting and trade credit: An international study, Certified Accountant Educational Trust, London. [ Links ]

Fatoki, O. & Smit, A. 2011, 'Constraints to credit access by new SMEs in South Africa: A supply-side analysis', African Journal of Business Management 5(4), 1413-1425. [ Links ]

Fatoki, O. & Asah, F., 2011, 'The impact of firm and entrepreneurial characteristics on access to debt finance by SMEs in King Williams Town, South Africa', International Journal of Business Management 6(9), 170-179. [ Links ]

FinMark Trust, 2010, FinScope South Africa small business survey, viewed 03 July 2018, from http://www.finmark.org.za/wp-content/uploads/pubs/FS-Small-Business-reportFNL1.pdf. [ Links ]

Giannetti, C., 2015, 'Relationship lending and firm innovativeness', Journal of Empirical Finance 19(5), 762-781. [ Links ]

Gonzales, V.M. & Gonzalez, F., 2012, 'Firm size and capital structure: Evidence using dynamic panel data', Applied Economics 44(36), 4745-4754. [ Links ]

Hashi, M. & Toçi, S., 2010, 'Financing constraints, credit rationing and financing obstacles from firm-level in South-Eastern Europe', Economic and Business Review 12(1), 29-60. [ Links ]

Hastings, J.S., Madrian, B.C. & Skimmyhorn, W.L., 2013, 'Financial literacy, financial education, and economic outcomes', Annual Review of Economics 5(1), 347-373. [ Links ]

Hussain, J., Salia, S. & Karim, A., 2018, 'Is knowledge that powerful? Financial literacy and access to finance: An analysis of enterprises in the UK', Journal of Small Business and Entrepreneurship Development 2(4), 1-20. [ Links ]

Irwin, D. & Scott, J. M. 2010, 'Barriers faced by SMEs in raising bank finance', International Journal of Entrepreneurial Behaviour and Research 16(3), 245-259. [ Links ]

Kellermans, F., Walter, J., Russel Crook, T., Kemmer, B. & Narayan, V., 2016, 'The RBV in entrepreneurship: A content analytical comparison of resources and entrepreneurs' views', Journal of Small Business Management 54(1), 26-48. [ Links ]

Laery, M.T. & Roberts, M.R., 2010, 'The pecking order, debt capacity and information asymmetry', Journal of Financial Economics 95(3), 332-335. [ Links ]

Lubanga, L.S.N., 2016, 'The relationship between financial literacy and access to credit among youth in rural areas: A case of Kimilili constituency', Masters dissertation, University of Namibia, Windhoek. [ Links ]

Lusardi, A., Mitchell, O.S. & Curto, V., 2010, 'Financial literacy among the young,' Journal of Consumer Affairs 44(2), 358-380. [ Links ]

Lusardi, A. & Scheresberg, C.D.B., 2013, Financial literacy and high-cost borrowing in the United States, Working Paper, National Bureau of Economic Research, Cambridge. [ Links ]

Makina, D., Fanta, A.B., Mutsonziwa, K., Khumalo, J. & Maposa, O., 2015, 'Financial access and SME size in South Africa', Paper prepared for FinMark Trust, University of South Africa, Pretoria. [ Links ]

Maredza, A. & Ikhide S., 2013, 'The impact of the global financial crisis on efficiency and productivity of the banking system in South Africa,' Mediterranean Journal of Social Sciences 4(6), 553-559. [ Links ]

Markova, S. & Petkovska-Mircevska, T., 2009, 'Financing options for entrepreneurial ventures', Economic Interferences 11(2), 89-96. [ Links ]

Moloi, G. & Ntshakala, T., 2016, 'Micro-finance institutions (MFIs): Assessing their performance through the lens of an entrepreneur', Journal of Management and Administration 2 (1) 65-83. [ Links ]

Musara, M. & Fatoki, O., 2012, 'Access to finance in the SME Sector: A South African Perspective', African Journal of Business Management 4(1), 58-67. [ Links ]

Mutezo, A.T., 2013, 'Credit rationing and risk management for SMEs: The way froward for South Africa', Corporate Ownership and Control 10(2), 153-163. [ Links ]

Myers, S.C. & Majluf, N.S., 1984, 'Corporate financing and investment decisions when firms have information investors do not have', Journal of Financial Economics 13(2), 187-221. [ Links ]

Myers, S.C., 1984, 'The capital structure puzzle', The Journal of Finance 39(3), 575-583. [ Links ]

Nanziri, E.L. & Leibbrandt, M., 2018, 'Measuring and profiling financial literacy in South Africa', South African Journal of Economic and Management Sciences 21(1), 1-17. [ Links ]

Organisation for Economic Co-operation and Development (OECD), 2017, South African Economy, viewed 08 September 2018, from www.oecd.org/economy/south-africa-economic-snapshot/. [ Links ]

Osano, H.M., 2019, 'Global expansion of SMEs: role of global market strategy for Kenyan SMEs', Journal of Innovation and Entrepreneurship 8(1), 13. [ Links ]

Osano, H.M. & Languitone, H., 2016, 'Factors influencing access to finance by SMEs in Mozambique: Case of SMEs in Maputo central business district' Journal of Innovation Entrepreneurship 5(13), 1-16. [ Links ]

Penrose, E., 1959, 'Contributions to the resource-based view of strategic management', Journal of Management Studies 41(1), 183-191. [ Links ]

Rahi, S., 2017, 'Research design and methods: A systematic review of research paradigm, sampling issues and instruments development', Journal of Economic Management Sciences 6(2), 1-5. [ Links ]

Saunders, M., Lewis, P. & Thornhill, A. 2012, Research methods for business students, Pearson Education, London. [ Links ]

Serrasqueiro, Z. & Caetano, A., 2015, 'Trade-off theory versus pecking order theory: Capital structure decisions in a peripheral region of Portugal', Journal of Business Economics and Management 16(2), 445-466. [ Links ]

Shambare, R. & Rugimbana, R., 2012, 'Financial literacy among the educated: An exploratory study of selected university students in South Africa', Thunderbird International Business Review 54(4), 581-590. [ Links ]

Shikimi, M., 2013, 'Do firms benefit from multiple banking relationships? Evidence from small and medium-sized firms in Japan', International Economic Policy 10, 127-157. [ Links ]

Statistics South Africa (Stats SA), 2023, Quarterly Labour Force Survey- QLFS Q4:2020- Statistics South Africa, viewed 11 July 2023, from http://www.statssa.gov.za/?publications/page_id=1856&PPN=P0211&SCH+72942. [ Links ]

Stiglitz, J. & Weiss, A., 1981, 'Credit rationing in markets with imperfect information', American Economic Review 71(2) 393-410. [ Links ]

The World Bank, 2015, Annual Report, viewed 07 October 2018, from http://www.worldbank.org/en/about/annual-report-2015. [ Links ]

Wachira, M.I. & Kihiu, E.N. 2012, 'Impact of financial literacy on access to financial services in Kenya', International Journal of Business and Social Science 3(19), 1-45. [ Links ]

Wenerfelt, B., 1984, 'A resource-based view of the firm', Strategic Management Journal 5(2), 171-180. [ Links ]

Wiid, J. & Diggines, C., 2015, Marketing research, 3rd edn., Juta and Company, Durban. [ Links ]

Wise, S., 2013, 'The impact of financial literacy on new venture survival', International Journal of Business Management 8(23), 30-39. [ Links ]

Zambaldi, F., Aranha, F., Lopes, H. & Politi, R., 2011, 'Credit granting to small firms: A Brazilian case', Journal of Business Research 64(3), 309-315. [ Links ]

Correspondence:

Correspondence:

Memory Changwesha

mchangwesha@yahoo.com

Received: 14 Mar. 2023

Accepted: 19 July 2023

Published: 26 Sept. 2023