Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Acta Commercii

versão On-line ISSN 1684-1999

versão impressa ISSN 2413-1903

Acta Commer. vol.22 no.1 Johannesburg 2022

http://dx.doi.org/10.4102/ac.v22i1.1072

ORIGINAL RESEARCH

ESG performance measures for executive pay: Delphi inquiry strategy and experts' opinion

Reon MatemaneI; Tankiso MoloiII; Michael AdelowotanII

IDepartment of Financial Management, Faculty of Economic and Management Sciences, University of Pretoria, Pretoria, South Africa

IIDepartment of Accountancy, College of Business and Economics, University of Johannesburg, Johannesburg, South Africa

ABSTRACT

ORIENTATION: Rising levels of executive compensation amidst the widening inequality, unemployment, poverty and other socio-economic challenges have raised questions among policymakers, academics and practitioners alike on the best ways to resolve this conundrum.

RESEARCH PURPOSE: The main objective of this study was to identify a composite mix of environmental, social and governance (ESG) indicators that can be used in executive compensation plans.

MOTIVATION FOR THE STUDY: Whereas the importance of incorporating the ESG in executive compensation plans is well documented, it is not known which indicators are appropriate and can be used in the South African context.

Research design, approach and method: A sequential exploratory research design was used in this study. The ESG-based indicators were identified from the literature and then subjected to three rounds of surveys in a Delphi enquiry strategy.

MAIN FINDINGS: An eclectic mix of nonfinancial performance measures (NFPMs) based on the ESG philosophy were identified, confirmed and validated by a diverse team of international experts.

PRACTICAL/MANAGERIAL IMPLICATIONS: In order to curb rising executive compensation and to disincentivise short-termism associated with sole reliance on profits as the only yardstick for performance, NFPMs identified in this study should be integrated into the executive compensation designs.

CONTRIBUTION/VALUE-ADD: On an empirical front, the study proffers novel NFPMs for executive compensation plans that are predicated on ESG philosophy. The methodological contribution lies in the use of a Delphi inquiry strategy, which has never been used in the area of executive compensation.

Keywords: Delphi; experts; Environmental, social and governance (ESG); nonfinancial; performance measures; executive compensation.

Introduction

Rising executive compensation is a topic that has attracted debates, not only in academic circles but also on social media. Questions are being raised on the morality of these pay packages and on whether they are socially justifiable (Adu, Al-Najjar & Sitthipongpanich 2022; Jan, Marimuthu & Hassan 2019). Such questions are pertinent in the South African context where inequality as measured by Gini coefficient is among the highest in the world (Deysel & Kruger 2015; Van der Berg 2014). Unemployment is also rising rapidly, while poverty is rampant (Wesson et al. 2018). At the heart of the controversy surrounding executive compensation packages is the fact that they are mostly driven by financial performance measures (FPMs) such as profits and share prices (Urson 2016).

Executives are being measured on how well they can maximise profits. The sole use of FPMs in determining executive compensation has a number of shortcomings that are well documented in the literature. Firstly, they are prone to manipulation (Healy & Wahlen 1999). When their remuneration is based on FPMs, executives have an incentive to embark on undesirable actions such as earnings management and creative accounting. This is carried out in order to inflate and embellish the financial measures, which will in turn secure higher bonuses and similar rewards for the executives. Secondly, they encourage short-termism (Gong & Ho 2021; Nikolov 2018). Executives tend to focus on the immediate increase in profits, share price and related FPMs without any regard for the company's long-term sustainability. Climate change is a direct result of this parochial posture of companies and their executives, who have been focusing on profits without considering the effects of their activities on environment and humanity (Becker & Sparks 2018; Nardi 2019).

The global financial crisis (GFC) and corporate scandals such as Enron and many others that took place all over the world are testament to the problems associated with the sole use of FPMs in determining executive compensation (Day 2020; Edmans 2020). South Africa has not been immune to corporate scandals propagated by greed and myopia among the executives both in the private and public sectors, as illustrated in the recent state capture inquiry. Steinhoff, Tongaat Hullet and even some of the auditing firms have all been implicated because of the manner in which the executives are being rewarded (Cassim 2022; Nel, Scholtz & Engelbrecht 2022; Rossouw & Styan 2019). These scandals are a clear clarion call for a reform in executive compensation and incentives.

According to Adu et al. (2022), companies' reward systems therefore need to be repurposed to combat the short-termism and myopia that has plagued governance within the entities. Integrating nonfinancial performance measures (NFPMs) in executive compensation designs is of special importance not only in light of the shortcomings associated with the FPMs but also because of the emerging topical issues such as climate change, pandemics and the need for inclusive economic growth. Consumers want to buy from companies whose activities do not have negative impact on the environment, employees want to associate with companies that care about their well-being and society at large are supportive of companies that do not ignore the socio-economic challenges that they are facing (Adu et al. 2022; Cassim 2022).

This study contributes to the literature on executive compensation in two ways: methodological and empirical contributions. The use of a Delphi inquiry strategy represents the methodological contribution. While the literature has rightly pointed out the need for NFPMs in executive compensation design, an attempt has never been made to scientifically solicit the experts' opinions on such measures and their importance. On the empirical front, the main contribution lies in the development of a metric. Literature on executive compensation is silent on the specific indicators that can be used for executive compensation design. The ensuing passage discusses the literature review, followed by research methods and designs. Results are then presented and discussed. Lastly, the conclusion is made.

Literature review

Extensive scholarly debates have been conducted on the topic of executive compensation. However, there are some specific elements within this topic that are still not well understood. These elements include the theoretical framework underpinning the debates, pay-performance relationship, the importance of NFPMs and the use of experts, which are each discussed next.

Theoretical framework

According to Cui et al. (2021), executive compensation is a corporate governance mechanism used mainly to ensure that there is goal congruency between the executives and the shareholders. Executives are therefore rewarded when there is a maximisation of shareholders' wealth (Jensen & Meckling 1976). It is for this reason that the streams of literature on the topic mainly use agency theory to explain the executive compensation and its determinants such as a firm's performance. Therefore, agency theory encourages the executives to narrowly focus on maximising profits to benefit themselves and shareholders only. Other stakeholders are neglected. This dyed in the wool agency theory thus encourages shareholders' primacy.

Meanwhile, executive compensation has evolved to be such a complex topic that it cannot be explained by a simplistic agency theory which is underpinned by shareholders' primacy. It is the submission of this study that stakeholder theory and legitimacy theory should instead be used in explaining executive compensation. Stakeholder theory suggests that other stakeholders such as customers, employees, suppliers and society in general should form an integral part of decision-making processes in an organisation (Atkins & Maroun 2015; Scholtz & Smit 2012; Selvam et al. 2016). Executives should therefore be incentivised to maximise company's long-term value to benefit all the other stakeholders as well (Ezeani & Williams 2017).

Legitimacy theory is also relevant in understanding executive compensation. Legitimacy theory suggests that the company's standpoint in terms of how it behaves and is seen to behave in society is what gives it a social license to operate (Dowling & Pfeffer 1975; Samkin & Deegan 2012). Therefore, companies cannot look the other way and not intervene when socio-economic challenges such as inequality, unemployement and inequality are plaguing societies such as South Africa. Climage change is another global social challnge that has emerged. To be legitimate, companies are expected to contribute in resolving all these issues, while pursuing profits.

Pay-performance relationship

Executive compensation is a topical subject that is extensively researched. However, the studies and the underlying theories are mostly concentrated in the Global North (Filatotchev, Ireland & Stahl 2021; Yoshikawa, Nippa & Chua 2021). Another shortcoming identified from the scholarly work on the subject is that the studies predominantly investigate the relationship between executive compensation and financial performance with inconclusive results (Kartadjumena & Rodgers 2019; Kirsten & du Toit 2018).

According to Gan, Park and Suh (2020), studies on executive compensation are also silent on the important topic of nonfinancial measures. Hence, this study contributes to the literature by identifying a composite mix of NFPMs that can be used in executive compensation design. In contrast to the existing literature, this study goes further by incorporating the use of a Delphi inquiry strategy and soliciting the experts' opinion on the indicators. This is an important contribution because the current literature largely draws conclusions based on secondary data without any attempt to seek opinions of the experts, including both the executive and nonexecutive directors who are more informed about the executive compensation plans of the different companies.

Importance of nonfinancial performance measures

Kartadjumena and Rodgers (2019) contend that in the era leading up to the GFC and the proliferation of corporate scandals such as Enron, the emphasis of corporate governance debates has always been on how well companies are faring in maximising profits and shareholders' wealth. This is arguably the cause of all the corporate failures, because the executives have been measured based on profit maximisation, sometimes even if it is to the detriment of the environment, society or even the long-term sustainability of the company.

In recent years, the issues of climate change, pandemics, growing populations and inequalities have brought into question the appropriateness of a laser focus on profit maximisation and shareholder primacy models. This has triggered the debates on corporate social responsibility, the use of NFPMs and how companies should be responsive to the aforementioned social challenges (Adams & Zutshi 2004; Campbell 2007; Carroll 1991). There is a growing body of scientific evidence that confirms the importance of nonfinancial measures with regard to a company's long-term sustainability.

The importance of nonfinancial measures is also reflected in companies' balance sheets in the current era. For example, Ocean Tomo (2020) posits that S&P 500-listed companies' intangible assets value only constituted 17% in 1975 but suddenly increased to more than 90% in 2020. This reflects a shift from the use of financial, natural and manufacturing capitals to social, relationship, human capital. Despite this evidence, the literature has not begun to scratch the surface in attempting to incorporate the NFPMs into executive compensation designs (Farmer, Archbold & Alexandrou 2013). Embracing and incorporating NFPMs in executive compensation designs is of particular importance in a developing economy context such as South Africa. Developing economies such as South Africa are not only plagued by poverty, unemployment and inequality, but they also stand to suffer the more devastating effects of global warming if no measures are taken for effective adaptation and mitigation of the risk (Amusan & Olutola 2016; Mpandeli et al. 2018).

The use of input from the experts

To the best of our knowledge, this study is among the first to invoke the use of the Delphi inquiry strategy coupled with soliciting experts' opinion on the nonfinancial metric. In contrast, literature on executive compensation is primarily based on the use of secondary data without any input from the experts. The nonfinancial performance metric that this study proposes would also serve as an accountability mechanism in the sense that the executives will also be penalised when their companies' activities are impacting negatively on any of the indicators identified in the ESG model. Mülbert and Sajnovits (2021) contend that the ESG factors, while noble, have suffered challenges with regard to their implementation and the actual operationalisation in practice. Therefore, soliciting the experts' opinion ensures that the suggested metric is not just theoretical and abstract but actually something that can be used in practice. This is because most of the experts who participated in this study are practitioners and can therefore add a practical element to the suggested metric.

Research methods and design

Data sources for the indicators

This study identified a composite mix of nonfinancial performance indicators that are proposed to be used as part of the key performance indicators (KPI) in designing executive compensation plans. Firstly, a broad spectrum of possible indicators was identified from multiple sources in the literature.

The sources of these indicators are organisations that have endeavoured to encourage sustainability over the years and include the Yale University Environmental Performance Index, International Labour Organization (ILO) Decent Work Indicators, the Tenth Principle Against Corruption, Behind the Brands Score Indicators, the Availability, Accessibility, Acceptability and Quality (AAAQ) Framework, Access to Medicine Index, Aquastat, Business Call to Action, Carbon Disclosure Project (CDP) - Disclosure Insight Action (2017 climate change, forests and water), Chief Executive Officer (CEO) Water Mandate's Corporate Water Disclosure Guidelines, Development of Guidance on Extended Producer Responsibility, Global Innovation Index, Global Sustainable Tourism Council Criteria and Suggested Performance Indicators for Hotels and Tour Operators, International Union for Conservation of Nature (IUCN) Red List, Kepler/Cheveux Inequality Footprint, Quick Guide to the Aichi Biodiversity Targets, the Women's Empowerment Principles: Reporting on Progress, United Nations (UN) Global Compact-Oxfam Poverty Footprint, United Nations Conference on Trade and Development (UNCTAD) proposed core Sustainable Development Goals (SDGs) reporting, Women's World Banking Gender Performance Indicators, UN Sustainable Development Solutions Network (UNSDSN) indicators, World Bank World Development Indicators (WDI), the World Health Organization (WHO) and Global Health Observatory indicator.

Bartolacci et al. (2022) lament the voluminous disclosure frameworks available on NFPMs. This hodgepodge of disclosure frameworks pertaining to ESG and nonfinancial information does not only cause confusion to the preparers and the users of this information, but there is also a challenge with regard to greenwashing where companies merely report their positive intentions on ESG matters without accountability and follow-through (Bakerjian 2022; Bartolacci et al. 2022; Pizzi et al. 2022). Secondly, experts' opinion was solicited on these indicators' usability in designing executive compensation plans for South African listed companies. Soliciting the experts' opinion therefore helped in refining the indicators and isolating only those that can be deemed important for within the South African corporate sector. Thus, three rounds of surveys were used in this study in the form of a Delphi approach.

Delphi inquiry strategy

Delphi is an inquiry strategy that uses a series of repetitive questionnaires to solicit opinion on a consensus basis from a panel of experts in a particular field (Dalkey & Helmer 1963; Okoli & Pawlowski 2004). While it constitutes a qualitative research approach, the collected data are ultimately analysed quantitatively to draw conclusions on the consensus reached. The Delphi enquiry strategy provides anonymity and confidentiality for each expert because they do not learn each other's views on the subject (Bampton & Cowton 2002). Peer pressure and the problems of suppressing others' views are also avoided because the surveys are sent to individual experts electronically (San-Jose & Retolaza 2018).

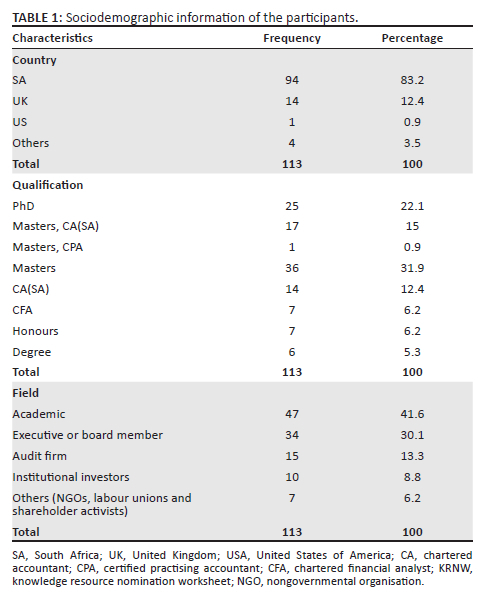

In this study, the experts were identified from various sources, including the literature they have written and companies' integrated reports for those who serve as directors of the listed companies. Furthermore, snowballing was employed as the identified experts were also requested to refer other experts. This process culminated in the compilation of the knowledge resource nomination worksheet (KRNW) as suggested by Okoli & Pawlowski (2004). In the KRNW, the details of each expert were documented, including their contact details, their role and the companies they are affiliated to, their qualifications and other bibliographic data. Table 1 is a summary of the sociodemographic profile of the participants compiled from a detailed KRNW, which is available on request from the corresponding author.

A total of 83.2% of the potential participants documented in the KRNW are based in South Africa. The high concentration of South African participants does not in any way compromise the integrity and the academic rigour of this study because the proposed metric is targeted at South African-listed companies. Another upside for having a dominance of local experts is their familiarity with South Africa's historic and contextual setting. On the other hand, the remaining 16.8% of the participants is still adequate to provide some international expert input on the metric.

A significant percentage, about 70%, of participants are chartered accountants, have master's degrees or PhDs. This is not surprising, as it reflects their expertise in accounting, governance and the topic under investigation, executive compensation. Academicians and those who serve as board members of different listed companies also formed a significant portion, 72% of the potential participants. This provides a balance of views between the academicians and practitioners.

Reliability and validity

In order to achieve reliability and validity, a number of interventions were implemented. These interventions included the use of a pilot study and the use of statistical analysis in the form of the mean inter-item correlation analysis. A pilot study can be used to buttress the validity and the reliability of the research instrument (Kamran, Farooq & Zia-ur-Rehman 2020). Consistent with this argument, the pilot study survey was sent out to 11 experts who were given 1 week to provide feedback on the clarity of the questions and the instructions. They were also requested to provide any input that could improve the questionnaire. There were some outliers with regard to the time it took the participants to complete the survey in the pilot study.

In the pilot study, one respondent, for example, took 7 h to complete the questionnaire, while the other four took approximately 7 min on average. These were then eliminated, resulting in an average completion time of 43 min, which was in line with the initial estimated time of 30 min - 45 min. The respondents also pointed out some of the questions that were either ambiguous or duplicated in the governance pillar of the ESG-based indicators. They also recommended that the functionality must be improved to allow them to go back to the previous questions. All these recommendations were implemented, resulting in an improved questionnaire ready for the first round.

Average inter-item correlation analysis was used in conjunction with Cronbach's alpha to determine the internal consistency (reliability) of the items in each of the three pillars. In round one, the rating scale used was a three-point scale (decline, amend and accept), and in round two, a five-point scale (extremely important, very important, moderately important, slightly important and not at all important) was used. Both results are presented because Cronbach's alpha decreases as the number of response options decreases, specifically when there are only three options (Lozano, García-Cueto & Muñiz 2008). Lozano et al. (2008) indicated that this trend is maintained for different sample sizes used and for different sizes of correlations between items of scale. Furthermore, Cronbach's alpha is also influenced by the number of items in a scale. In the first round, the inter-item correlation (Cronbach's alpha) was calculated at 0.241 (0.760), 0.283 (0.537) and 0.291 (0.892) for environmental, social and governance (ESG) pillars, respectively. These values were calculated at 0.718 (0.888), 0.521 (0.958) and 0.434 (0.962), respectively, in the second round.

It was not necessary to compute the inter-item correlation (Cronbach's alpha) in the third round because the survey therein was merely aimed at confirming the importance of each indicator and obtaining consensus therein from the participants. The average inter-item correlation in both the first and the second rounds are well within the 0.15 and 0.55 range recommended in the literature (Els, Meyer & Ellis 2022). Therefore, the indicators in both the first and the second rounds truly measured and represented the social, governance and social pillars as intended, indicating that there is internal consistency in the research instrument as well as in the constructs that were measured.

Results

Based on the KRNW constructed, the first round survey was e-mailed to all the 113 identified experts following the modification of the research instruments incorporating the comments from the pilot study conducted. From 113 potential participants, only 48 agreed to participate in the study. Meanwhile, when the first-round survey was sent out, an additional five new participants responded, resulting in 53 total responses in the first round. In the second round, 10 participants dropped out and a total of 43 responded. Finally, the third round ended up with 42 responses, indicating that one dropped out from the second round. The overall response rate in all three rounds is considered satisfactory because it is way above the average of between 8 and 10 as suggested by authors such as Hallowell and Gambatese (2010) and Sahari et al. (2018).

First round

In the first round, the participants were exposed to a number of indicators in each pillar of ESG as obtained from multiple literature sources listed in the 'Research methods and design' section. The participants were required to evaluate each indicator by either declining it, amending it or accepting it as is for potential use in executive compensation plans. They further had to provide their level of confidence for their choice. Should the participants choose to decline or amend an indicator, they would then be required to provide a new alternative indicator or an alternative wording. Figure 1 summarises the essence of the research instrument used in the first round.

The decision was made to roll forward the indicators, which were accepted by 50% or more of the participants, with 50% or more declaring that they were either fairly confident or very confident with accepting such an indicator. As a result of this, all the 10, 21 and 31 indicators that were initially obtained from the literature on ESG pillars, respectively, were accepted by the panel of experts, indicating that they were either very confident or fairly confident with their choice. Furthermore, one additional indicator was suggested in each of the environmental and governance pillars, respectively. The panel of experts suggested the following as an additional indicator under environmental pillar:

'Reduction in total kilometres driven with internal combustion engine (ICE) vehicles and initiatives in place to encourage the use of electric vehicles (EV's).'

This relates to the efforts that the companies and their executives can make towards decarbonisation. This is significant in view of the imminent climate change and global warming, which have been buzzwords throughout the world. It supports the argument made by Wang et al. (2017), who contended that the increase in usage of cars and the resultant growth in the automobile sector have sparked debates about their impact both on energy consumption and the environment.

The panel of experts further suggested the following additional indicator pertaining to the governance pillar, which arguably explains the South African contextual setting:

'Mentoring Programmes in place by the Executives and implementation of the same.'

Legacies of apartheid and colonialism resulted in the exclusion of the black South Africans, who are the majority, not only in the mainstream economy but also in board membership and leadership positions in companies (Geldenhuys 2020; McCallaghan, Jackson & Heyns 2020). It is against this background that the corporate South Africa, including its executives, cannot extricate itself from the responsibility of redressing the imbalances in their boardrooms but should actively mentor the previously disadvantaged groups, hence the suggestion of mentoring programmes. The additional indicators suggested by the panel of experts resulted in 11, 21 and 33 indicators in ESG pillars, respectively, that were rolled over to round two.

Second round

Next, additional indicators in the environment and governance pillars as discussed here were recommended by the panel of experts in the first round. In the second round, all these indicators, 11, 21 and 33 in ESG pillars, respectively, were again exposed to the panel of experts. The panel of experts was requested to evaluate the indicators in the order of importance by a way of a five-point Likert scale (1 = extremely important, 2 = very important, 3 = moderately important, 4 = slightly important and 5 = not at all important). Figure 2 illustrates the structure of the questionnaire used in the second round.

A 50% threshold was once again used to establish which indicators were deemed to be important. For each indicator in the ESG pillars, the participants had to choose whether such an indicator was extremely important, very important, moderately important, slightly important or not at all important. Therefore, for each indicator, if 50% of the participants chose both extremely important and very important, such an indicator was deemed to be important overall and rolled forward to the third round. All the indicators that were rolled forward from the first round were deemed to be important, because 50% or more of the participants indicated that they were either extremely important or very important. This was observed with the exception of two indicators, one of which falls within the environmental pillar and was recommended by the experts. The other one that did not meet the 50% threshold falls under the governance pillar and was originally obtained from the literature. These indicators are:

-

Environmental pillar:

'Reduction in total kilometres driven with internal combustion engine (ICE) vehicles and initiatives in place to encourage the use of electric vehicles (EV's).'

-

Governance pillar:

'Percentage of employees belonging to collective bargaining councils (trade unions).'

Only 45.5% of the participants deemed the 'reduction in total kilometres driven with internal combustion engine (ICE) vehicles and initiatives in place to encourage the use of electric vehicles (EV's)' as important overall, while 13.6% deemed it extremely important and 31.8% very important in the environmental pillar. The percentage of importance was below the 50% threshold and had disqualified the indicator to be rolled forward to the third round. This resulted in only 10 environmental indicators that were rolled forward to the third round.

On the other hand, only 34.9% of the participants deemed the 'Percentage of employees belonging to collective bargaining councils (trade unions)' as important overall, 7% extremely important and 27.9% very important. This again was below the 50% threshold and relegated the indicator to an insignificant status. Therefore, from a total of 33 governance indicators that were obtained from the first round, only 32 were rolled forward from the second round to the third round.

Third round

The main purpose of the third round was to obtain consensus from the panel of experts on the ranking of the indicators, from the most important to the least important. The difference between the third round and the second round is that in the third round, the panel of experts had to pick, group and rank the indicators in the order of importance in each ESG dimension. By so doing, it could be easily established, for example, what the top 5 indicators are in each dimension according to the collective input and consensus from the experts. Figure 3 illustrates the format of the questionnaire used in the third round.

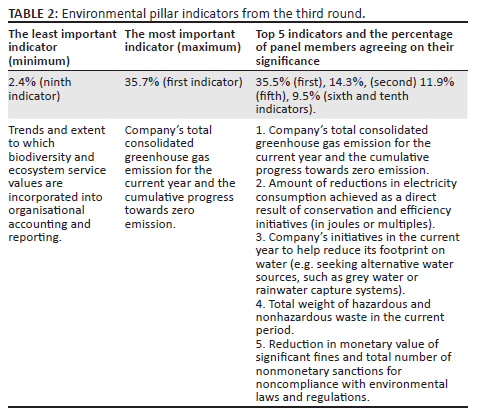

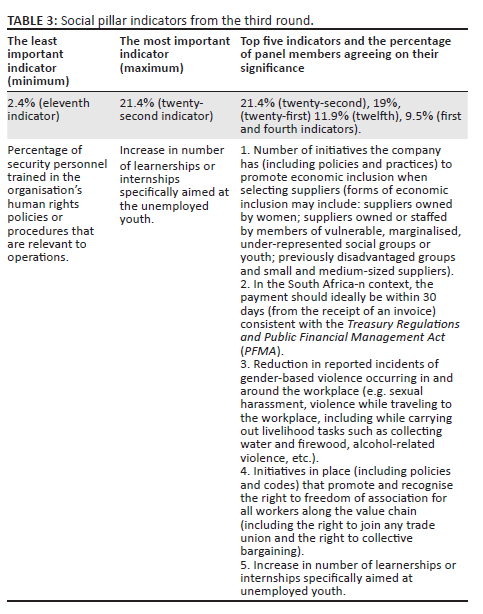

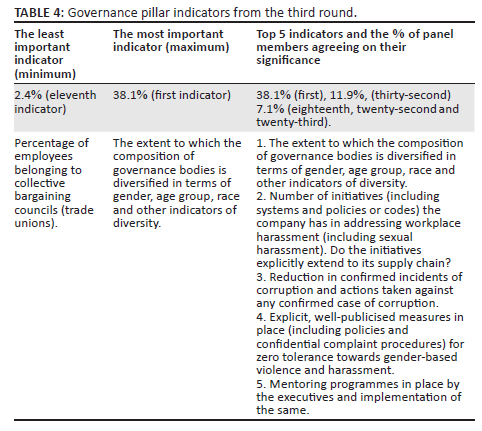

Based on the drag and drop evaluation in round three, the indicators that were ranked by most members of the panel as the top ones were selected. Tables 2 to Table 4 summarise the indicators, including the top five, that were prioritised in round three under each ESG dimension.

In the environmental pillar, most members of the panel (35.7%) chose the first indicator, 'company's total consolidated greenhouse gas (GHG) emission for the current year and the cumulative progress towards zero emission' as number one in the third round. This choice is very interesting because it relates to the reduction of GHG emission efforts of the companies. Corporate South Africa is expected to contribute to the efforts to reduce the GHG emissions, as already mentioned.

On the contrary, the ninth indicator, 'trends and extent to which biodiversity and ecosystem service values are incorporated into organisational accounting and reporting' was selected as the least important. Only 2.4% of the panel members selected it as important. Comparing the two indicators, the first one relating to GHG is applied to all the companies in South Africa because they all use electricity, which is mostly sourced from carbon-intensive coal, and therefore they can all do something to decarbonise. In contrast, the least important indicator that relates to biodiversity would mostly be applicable to the companies whose capital is mostly made up of natural capital out of the six capitals identified in the International Integrated Reporting framework (IIRC 2013). This is arguably the reason why the panel of experts did not attach much importance to such an indicator.

Another interesting point to note from the panel of experts is the consensus pertaining to the indicators in the environmental pillar in the third round is that among the 10 indicators identified from the literature and subjected to their opinions in round one and two, the following indicators were actually rated the same in the third round; 9.5% of the panel members rated them as number one:

-

Proactive initiatives and efforts to minimise GHG (third).

-

Total weight of hazardous and nonhazardous waste in the current period (sixth).

-

Reduction in monetary value of significant fines and total number of nonmonetary sanctions for noncompliance with environmental laws and regulations (tenth).

Among the given indicators, the one that scored the highest in the order of importance in the second round is the third indicator; 41.3% of the members of the panel considered it extremely important in the second round. On the other hand, 34.8% and 28.3% of the members of the panel scored the tenth and sixth indicators as extremely important, respectively. Although the third indicator was rated higher in the second round and rated the same as the sixth and the tenth in the third round, the sixth indictor is instead selected to be part of the top five indicators. This is because the third indicator deals with what the first indicator deals with, namely GHG. Otherwise, the insights from the second round indicate that the third indicator should be preferred over the sixth indicator. Based on this logic and taking from the three indicators that share the same ranking in the third round, the sixth and the tenth indicators formed part of the top five indicators, although they were ranked the same in the third round, together with the third indicator, which has fallen through.

As per the summary in Table 3, the top five indicators were identified in the social dimension of the ESG model in the third round. The eleventh indicator, 'percentage of security personnel trained in the organisation's human rights policies or procedures that are relevant to operations' was identified as the least important. Only 2.4% of the members of the panel ranked it number one. The indicator is focused on security personnel, which is perhaps not considered an influential and powerful group of employees when looking at the typical hierarchical structures of the companies.

The twenty-second indicator, 'increase in number of learnerships or internships specifically aimed at unemployed youth' was ranked as number one by the highest percentage of the members of the panel (21.4%). The rationale behind this consensus from the panel of experts is arguably against the backdrop of the higher unemployment rate that has plagued the country, especially among the youth. Therefore, it is of paramount importance that corporate South Africa contributes to the efforts of reducing unemployment in the country, among other social welfare activities. The advent of coronavirus disease 2019 (COVID-19) has further shone light on this predicament.

The indicators in the governance dimension of the ESG model in the third round as summarised in Table 4 are more revealing on the intersectionality among the dimensions, especially considering the contextual setting of South Africa. Noteworthy is the highest percentage, 38.1%, of panel members that ascribed significance to the first indicator, 'the extent to which the composition of governance bodies is diversified in terms of gender, age group, race and other indicators of diversity'. The highest percentages hitherto have only been 35.7% and 21.4%, ascribed to the top indicators in the first two dimensions, environmental and social, in Table 2 and Table 3. Diversity, equity and inclusivity in the higher echelons of a company are particularly important in the South African context, and this is supported by the King IV report which suggests that the composition of the company's management and the board should mirror the racial and gender demographics of the country (IOD 2016). Therefore, this indicates that ascribing higher importance to this indicator is not surprising.

The lowest percentage, 2.4% of the panel members ascribed importance to the eleventh indicator, 'percentage of employees belonging to collective bargaining councils (trade unions)'. Although this indicator was duly identified from the literature as potentially relevant and important in the South African context, all the members of the panel have a university degree at a minimum with quite a significant portion having master's degrees. It is likely that the panel deemed this indicator as disruptive and unnecessary in the bigger scheme of things. This is in the light of the influence that the unions have and their ability to disrupt business operations and the economy, as evident in the Marikana massacre (Bonga 2021; Moloi 2015; Onyebukwa 2021). Another train of thought could be the fact that the unions should have no role to play if there is sufficient accountability, transparency and fairness on the part of executives. In other words, unions would not be needed if the executives simply did their job. It is arguably for these reasons that the panel members saw the eleventh indicator as less important.

The following three indicators, eighteenth, twenty-second and twenty-third were considered important by the same percentage of panel members, 7.1%:

-

Number of initiatives (including systems and policies or codes) the company has in addressing workplace harassment (including sexual harassment). Do the initiatives explicitly extend to its supply chain?

-

Reduction in confirmed incidents of corruption and actions taken against any confirmed case of corruption.

-

Explicit, well-publicised measures in place (including policies and confidential complaint procedures) for zero tolerance towards gender-based violence and harassment.

The percentage of panel members, 7.1%, who reached consensus on the importance of the given indicators was the third largest percentage after 38.1% and 11.9%, attributable to the first and the thirty-second indicators. In addition to the given indicators, the fourth indicator, 'percentage of total workforce represented in formal joint management - worker health and safety committees that help to monitor and advise on occupational health and safety programmes' also had 7.1% of the panel members ascribing importance to it. However, the fourth indicators mentioned here were perceived to be extremely important in the second round by only 13% of the members of the panel. This pales in comparison to 34.8%, 37% and 45.7% of the panel members that indicated that the eighteenth, twenty-second and twenty-third indicators are extremely important, respectively. This is the reason that the fourth indicator fell off from the top five indicators in the third round.

Overall top five indicators selected from the third round

The iterative process involved in all the three rounds of the Delphi inquiry strategy resulted in the top five refined indicators that are deemed to be the most significant NFPMs to be integrated in executive compensation designs in the South African context. These NFPMs should be coupled with the conventional FPMs such as Earnings per share (EPS), Economic value added (EVA), Market value added (MVA), Return on assets (ROA) and Return on equity (ROE), Tobin's Q and similar measures that derived from the financial statements. Figure 4 represents the nonfinancial performance metric developed in this study.

The top five indicators in each pillar of the ESG model are guided by other studies that used the Delphi inquiry strategy. For example, Schuster et al. (2020) finally picked five key indicators for emergency care in the medical field based on a Delphi inquiry strategy. Sobota, Shah and Mack (2017) are the other scholars who used a Delphi inquiry strategy and picked the top five indicators for some transition procedure in the medical field. Therefore, these indicators as depicted in Figure 4 represent a model that can be used by companies.

Discussion

The overall nonfinancial performance metric consisting of five indicators in each ESG pillar as depicted in Figure 4 are targeted at South African-listed companies, but consideration has been given to the developments of the ESG in global context. Furthermore, while the majority of the members of the panel are South African, others are from other countries including the United States and the United Kingdom.

Overall, the top five nonfinancial performance indicators suggested by the experts concentrated on the issues that are currently topical in the society. Consider the indicators suggested for the environmental pillar: the panel of experts mainly suggested that the executives should be held accountable on their efforts in reducing GHGs, efficient use of electricity and water, the extent to which their companies comply with environmental laws and how they manage wastage. All these are pertinent issues and relate to climate change risk that the planet is facing, while they also reflect the contextual setting of South Africa in which GHG is a major issue exacerbated by the country's dependence on coal for generating electricity (Uhunamure et al. 2021). The five indicators suggested by the experts in the environmental pillar are discussed as follows (see Figure 4):

-

First indicator - As a signatory to the Paris Agreement, South Africa is expected to reduce GHGs to net zero by the mid-century, 2050 (Bataille 2020). As discussed here, the country's energy source is dominated by fossil fuels in the form of coal. This means most of the listed companies, if not all, depend on this energy source for their operations. If the companies' executives are measured on how well they are able to reduce GHGs, the country can make serious strides towards the net zero emission goal by 2050 as required by the Paris Agreement.

-

Second indicator - South Africa does not only rely heavily on fossil fuels, coal, for its electricity needs as discussed here (Uhunamure et al. 2021), but its primary public power utility, Eskom has instituted power cuts since 2007-2008 because of inadequate electricity generation capacity (Sehlapelo & Inglesi-Lotz 2022). It is against this backdrop that the executives of the listed companies should be held accountable on how efficiently their companies are using this resource that has suddenly become scarce.

-

Third indicator - According to Haroun et al. (2019), water is among the most important resource for human lives and livelihoods. However, the world might be on the verge of a severe water shortage because of factors such as population growth, urbanisation and climate change (Haroun et al. 2019; Maja & Ayano 2021). In the South African context, the drought that lasted for 3 years, from 2016 to 2018, is a testament to this looming crisis (Ndeketeya & Dundu 2019). Although provision of fresh water is the government's responsibility, the private sector can play a significant role in mitigating the looming water shortage when the executives are also evaluated on how their companies are efficiently using this resource.

-

Fourth indicator - The total global solid waste is estimated to reach 3.40 billion tonnes by 2050 (Kaza et al. 2018). As the waste is released to the environment, the climate change risk is exacerbated because such a release is accompanied by emission of methane and other GHGs into the rivers and oceans (Kaza et al. 2018). Adler Mansi and Pandey (2022) contend that the developing countries stand to suffer the consequences of poor waste management and the resultant climate change because of a lack of infrastructure. Therefore, private companies can contribute in mitigating this risk by measuring the extent to which the total weight of waste is reduced on a yearly basis and incorporating such a metric in executive compensation plans as recommended by the panel of experts surveyed in this study. Fakoya (2020) supports this argument and contends that companies that embark on effective waste management benefit from avoiding fines for environmental degradation, among other avoidable environmental costs.

-

Fifth indicator - While the panel of experts ranked this indicator as the least important in the environmental pillar, their consensus view is not misplaced, because the metric cannot equally apply in all the industries. Service sectors such as education and consulting, for example, might not be as prone to environmental-related fines and penalties as extractive industries such as mining, oil and gas. Nevertheless, South Africa is dominated by extractive industries (Andreasson 2018); as such, this indicator can assist to curb environmental degradation if incorporated into the executive compensation plans.

The top five indicators suggested under the social pillar are also indicative of the challenges facing South Africa that the corporate sector can contribute to resolving when the executive compensation plans are designed. The indicators specifically confront the pertinent issues of unemployment, poverty and inequality that are somewhat the legacies of the apartheid regime. The first indicator seeks to achieve inclusion of the previously marginalised groups, while the other indicators seek to boost employment by requesting companies to have learnership programmes and pay their suppliers within a reasonable period. The challenges of poverty, inequality and unemployment remain a threat for South African companies as they tend to result in riots and social unrest such as those that have taken place around July 2021 dominating Gauteng and KwaZulu-Natal (Carmichael 2022). Each of the top five indicators suggested by the panel of experts with regard to the social pillar are discussed as follows:

-

First indicator - According to Nyandeni (2018), the South African economy, including ownership of the listed companies, is still dominated by white people despite the black economic empowerment (BEE) policies that were meant to redress the injustices of the apartheid regime to allow black people to meaningfully participate in the economy. This indicator therefore seeks to advance the ideals of BEE and more specifically the preferential procurement aspects thereof (Horner 2022; Mofokeng, Giampiccoli & Jugmohan 2018).

-

Second indicator - Mukole (2010) contended that companies should contribute to promoting entrepreneurship and the survival of small-, medium- and micro-enterprises (SMMEs), which have proven to be effective in creating employment. It is in line with this train of thought that the listed companies should evaluate and measure their executives on how quickly they pay their suppliers. This is important in the South African context, because the big businesses tend to pay their suppliers as late as after 120 days from the date of invoicing (Goga, Bosiu & Bell 2019).

-

Third indicator - Gender-based violence is among the top challenges facing South Africa (Mbunge 2020). As such, the corporate sector can contribute to addressing this national social challenge by incorporating the corresponding metric in executive compensation plans. The consensus from the panel of experts on the importance of this indicator is consistent with Morrissey (2018), who argues that the companies' board of directors are likely to face criticism from the shareholders if they fail to address issues of sexual harassment and gender-based violence as highlighted in the #MeToo movement that gained media attention worldwide since 2017.

-

Fourth indicator - South Africa is among the most unequal societies in the world, as measured by a Gini coefficient of above 0.6 (Mtapuri & Tinarwo 2021). The gap between what the top management and the general workers earn is ever widening (Bassier & Woolard 2021), which is among the reasons for widespread labour unrest and strikes (Alford & Phillips 2018). This state of affairs makes it necessary for the companies to have policies that promote unionisation of workers and collective bargaining.

-

Fifth indicator - According to Geza et al. (2022), unemployment is one of the biggest changes facing South Africa, alongside poverty and inequality. Unemployment among youth was estimated at 46.5% by Statistics South Africa in the second quarter of 2022 (Stats 2022). Therefore, by intentionally incorporating the companies' learnership initiatives in executive compensation plans, the private sector can contribute in addressing unemployment in South Africa.

Finally, the governance pillar also emphasises topical issues of diversity, equity and inclusivity, which are very relevant in the South African corporate sector, whose management is mostly dominated by white men (Mans-Kemp, Viviers & Collins 2018; Young et al. 2021). In particular, the experts suggested that the companies' executives should be held accountable for the extent to which their governance structures are diversified in terms of gender, race and other measures of diversity (first indicator). Mentoring of young executives, together with other initiatives necessary to bring about social justice in the South African context, are also recommended (fifth indicator). Economic development and foreign direct investments are important in an emerging economy setting such as South Africa. However, this can be easily undermined by rampant corruption (Rothstein & Varraich 2017). It is for this reason that the private sector should have a metric specifically aimed at addressing this problem, as suggested by the panel of experts in this study (third indicator). The panel of experts also unanimously reached a consensus on the significance of the two other indicators under the governance pillar (second and fourth indicators). While these indicators are specific to the governance pillar, they mirror one of the indicators discussed here under the social pillar (third indicator). These indicators are also consistent with Sustainable Development Goals 5, 8, 10 and 16, which deal with gender equality, decent work, reduced inequality, peace, justice and strong institutions (Bose & Khan 2022; Haywood et al. 2019).

Conclusion

The main objective of the study was to develop a nonfinancial performance metric that can be coupled with the FPMs, which have always been in use when designing executive compensation plans. The study has demonstrated the way forward in the midst of many attempts to rein in runaway executive compensation, the determinant of which has always been highly skewed towards the FPMs. The top five indicators on which the panel of experts have reached a consensus reflect the socio-economic challenges facing South Africa as a developing country. The corporate sector can contribute significantly to addressing most of these challenges by simply embracing the stakeholder inclusivity approach and having a purpose bigger than a sole pursuit of profits at the expense of people and the planet.

The advantages of using a Delphi inquiry strategy and soliciting experts' opinions on a complex subject matter such as executive compensation are well documented. Despite these advantages, its use is sparse in corporate governance literature generally and in executive compensation in particular. Therefore, the study contributes to the executive compensation literature methodologically when the views of diverse panel of experts are used in developing the metric. Policymakers and standard setters can benefit from this study by mandating the proposed metric as a minimum requirement for listed companies' executive compensation plans. Future studies can expand on this topic by incorporating the analytical hierarchy process in order to determine the relative importance of the pillars within the ESG model, as well as the relative importance of each of the five indicators proposed from the Delphi enquiry strategy employed in this study.

Acknowledgements

The authors would like to acknowledge the Black Academic Advancement grant issued by the National Research Foundation, a South African-based institution to support the PhD study on which this manuscript is based.

Competing interests

The authors have declared that no competing interest exists.

Authors' contributions

All the authors have substantially contributed to the manuscript.

Ethical considerations

Ethical clearance to conduct this study was obtained from the University of Johannesburg School of Accounting Research Ethics Committee (SAREC) (ref. no. SAREC20210415/01).

Funding information

This research received no specific grant from any funding agency in the public, commercial or not-for-profit sectors.

Data availability

Data were collected through Qualtrics software for all the surveys and are available from the corresponding author on request.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Adams, C. & Zutshi, A., 2004, 'Corporate social responsibility: Why business should act responsibly and be accountable', Australian Accounting Review 14(34), 31-39. https://doi.org/10.1111/j.1835-2561.2004.tb00238.x [ Links ]

Adler, R., Mansi, M. & Pandey, R., 2022, 'Accounting for waste management: A study of the reporting practices of the top listed Indian companies', Accounting & Finance 62(2), 2401-2437. https://doi.org/10.1111/acfi.12869 [ Links ]

Adu, D.A., Al-Najjar, B. & Sitthipongpanich, T., 2022, 'Executive compensation, environmental performance, and sustainable banking: The moderating effect of governance mechanisms', Business Strategy and the Environment 31(1), 1439-1463. https://doi.org/10.1002/bse.2963 [ Links ]

Andreasson, S., 2018, 'The bubble that got away? Prospects for shale gas development in South Africa', The Extractive Industries and Society 5(4), 453-460. https://doi.org/10.1016/j.exis.2018.07.004 [ Links ]

Alford, M. & Phillips, N., 2018, 'The political economy of state governance in global production networks: Change, crisis and contestation in the South African fruit sector', Review of International Political Economy 25(1), 98-121. https://doi.org/10.1080/09692290.2017.1423367 [ Links ]

Amusan, L. & Olutola, O., 2016, 'Addressing climate change in southern Africa: Any role for South Africa in the post-Paris Agreement?', India Quarterly 72(4), 395-409. https://doi.org/10.1177/0974928416671592 [ Links ]

Atkins, J. & Maroun, W., 2015, 'Integrated reporting in South Africa in 2012: Perspectives from South African institutional investors', Meditari Accountancy Research 23(2), 97-221. https://doi.org/10.1108/MEDAR-07-2014-0047 [ Links ]

Bakerjian, L., 2022, 'The aesthetic nature of corporate social responsibility and greenwashing', Oradea Journal of Business and Economics 7(1), 98-108. https://doi.org/10.47535/1991ojbe141 [ Links ]

Bampton, R. & Cowton, C.J., 2002, 'The e-interview', Forum Qualitative Sozialforschung/Forum: Qualitative Social Research 3(2), 9-20. [ Links ]

Bartolacci, F., Bellucci, M., Corsi, K. & Soverchia, M., 2022, 'A systematic literature review of theories underpinning sustainability reporting in non-financial disclosure', Non-financial Disclosure and Integrated Reporting 1(1), 87-113. https://doi.org/10.1007/978-3-030-90355-8_4 [ Links ]

Bassier, I. & Woolard, I., 2021, 'Exclusive growth? Rapidly increasing top incomes amid low national growth in South Africa', South African Journal of Economics 89(2), 246-273. https://doi.org/10.1111/saje.12274 [ Links ]

Bataille, C.G., 2020, 'Physical and policy pathways to net-zero emissions industry', Wiley Interdisciplinary Reviews: Climate Change 11(2), 1-20. https://doi.org/10.1002/wcc.633 [ Links ]

Becker, S. & Sparks, P., 2018, 'Talking about climate change mitigation: People's views on different levels of action', Sustainability 10(5), 1357. https://doi.org/10.3390/su10051357 [ Links ]

Bonga, W.G., 2021, 'Impact of repetitive protests on economic development: A case of South Africa', Quest Journals' Journal of Research in Humanities and Social Science 9(8), 34-39. [ Links ]

Bose, S. & Khan, H.Z., 2022, 'Sustainable development goals (SDGs) reporting and the role of country-level institutional factors: An international evidence', Journal of Cleaner Production 335(1), 1-13. https://doi.org/10.1016/j.jclepro.2021.130290 [ Links ]

Campbell, J.L., 2007, 'Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility', Academy of Management Review 32(3), 946-967. https://doi.org/10.5465/amr.2007.25275684 [ Links ]

Carmichael, T.R., 2022, 'Is protest action in South Africa bringing positive change or is it threatening our human right to security?', South African Journal of Bioethics and Law 14(2), 1-2. https://doi.org/10.7196/SAJBL.2022.v15i1.795 [ Links ]

Carroll, A.B., 1991, 'The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders', Business Horizons 34(4), 39-48. https://doi.org/10.1016/0007-6813(91)90005-G [ Links ]

Cassim, R., 2022, 'An analysis of trends in shareholder activism in South Africa', African Journal of International and Comparative Law 30(2), 149-174. https://doi.org/10.3366/ajicl.2022.0402 [ Links ]

Cui, X., Xu, L., Zhang, H. & Zhang, Y., 2021, 'Executive compensation and firm performance: Evidence from cross-listed AH-share firms', International Journal of Finance & Economics 26(1), 88-102. https://doi.org/10.1002/ijfe.1778 [ Links ]

Dalkey, N. & Helmer, O., 1963, 'An experimental application of the Delphi method to the use of experts', Management Science 9(3), 458-467. https://doi.org/10.1287/mnsc.9.3.458 [ Links ]

Day, C., 2020, 'Goodwill impairment testing disclosures-South African compliance in 2018', South African Journal of Accounting Research 34(1), 45-62. https://doi.org/10.1080/10291954.2019.1668120 [ Links ]

Deysel, B. & Kruger, J., 2015, 'The relationship between South African CEO compensation and company performance in the banking industry', Southern African Business Review 19(1), 137-169. https://doi.org/10.25159/1998-8125/5837 [ Links ]

Dowling, J. & Pfeffer, J., 1975, 'Organizational legitimacy: Social values and organizational behavior', Pacific Sociological Review 18(1), 122-136. https://doi.org/10.2307/1388226 [ Links ]

Edmans, A., 2020, Grow the pie: How great companies deliver both purpose and profit, Cambridge University Press, Cambridge. [ Links ]

Els, R., Meyer, H. & Ellis, S., 2022, 'A measurement scale developed to investigate the effect of leaders' perceptions regarding attitudes towards and commitment to quality management of training', International Journal of Training and Development 26(1), 120-144. https://doi.org/10.1111/ijtd.12243 [ Links ]

Ezeani, E.C. & Williams, E., 2017, 'Regulating corporate directors' pay and performance: A comparative review', African Journal of International and Comparative Law 25(4), 482-506. https://doi.org/10.3366/ajicl.2017.0208 [ Links ]

Fakoya, M.B., 2020, 'Investment in hazardous solid waste reduction and financial performance of selected companies listed in the Johannesburg Stock Exchange Socially Responsible Investment Index', Sustainable Production and Consumption 23(1), 21-29. https://doi.org/10.1016/j.spc.2020.03.007 [ Links ]

Farmer, M., Archbold, S. & Alexandrou, G., 2013, 'CEO compensation and relative company performance evaluation: UK evidence', Compensation & Benefits Review 45(2), 88-96. https://doi.org/10.1177/0886368713492116 [ Links ]

Filatotchev, I., Ireland, R.D. & Stahl, G.K., 2021, 'Contextualizing management research: An open systems perspective', Journal of Management Studies 10(1), 1-22. [ Links ]

Gan, H., Park, M.S. & Suh, S., 2020, 'Non-financial performance measures, CEO compensation, and firms' future value', Journal of Business Research 110(1), 213-227. https://doi.org/10.1016/j.jbusres.2020.01.002 [ Links ]

Geldenhuys, J., 2020, 'Employment equity in tertiary education: The pitfalls of fast-tracking academics', South African Journal of Higher Education 34(3), 65-88. https://doi.org/10.20853/34-3-3480 [ Links ]

Geza, W., Ngidi, M.S.C., Slotow, R. & Mabhaudhi, T., 2022, 'The dynamics of youth employment and empowerment in agriculture and rural development in South Africa: A scoping review', Sustainability 14(9), 1-20. https://doi.org/10.3390/su14095041 [ Links ]

Goga, S., Bosiu, T. & Bell, J., 2019, 'Linking IDC finance to structural transformation and inclusivity in post-apartheid South Africa', Development Southern Africa 36(6), 821-838. https://doi.org/10.1080/0376835X.2019.1696181 [ Links ]

Gong, Y. & Ho, K.C., 2021, 'Corporate social responsibility and managerial short-termism', Asia-Pacific Journal of Accounting & Economics 28(5), 604-630. https://doi.org/10.1080/16081625.2018.1540941 [ Links ]

Hallowell, M.R. & Gambatese, J.A., 2010, 'Qualitative research: Application of the Delphi method to CEM research', Journal of Construction Engineering and Management 136(1), 99-107. https://doi.org/10.1061/(ASCE)CO.1943-7862.0000137 [ Links ]

Haroun, M., Punjabi, S., Suboyin, A., Anastasiou, S. & De Bakker, J., 2019, 'Integrated management of water resources: A novel approach for water-stressed regions', Systems Research and Behavioral Science 36(6), 827-834. https://doi.org/10.1002/sres.2649 [ Links ]

Haywood, L.K., Funke, N., Audouin, M., Musvoto, C. & Nahman, A., 2019, 'The sustainable development goals in South Africa: Investigating the need for multi-stakeholder partnerships', Development Southern Africa 36(5), 555-569. https://doi.org/10.1080/0376835X.2018.1461611 [ Links ]

Healy, P.M. & Wahlen, J.M., 1999, 'A review of the earnings management literature and its implications for standard setting', Accounting Horizons 13(4), 365-383. https://doi.org/10.2308/acch.1999.13.4.365 [ Links ]

Horner, R., 2022, 'Global value chains, import orientation, and the state: South Africa's pharmaceutical industry', Journal of International Business Policy 5(1), 68-87. https://doi.org/10.1057/s42214-021-00103-y [ Links ]

Institute of Directors in South Africa (IoDSA), 2016, King Report on corporate governance in South Africa, viewed 26 April 2021, from https://www.saica.co.za/Technical/LegalandGovernance/King/tabid/2938/language/en-ZA/Default.aspx. [ Links ]

International Integrated Reporting Council (IIRC), 2013, The International framework, viewed 02 June 2019, from http://integratedreporting.org/resource/international-ir-framework/. [ Links ]

Jan, A., Marimuthu, M. & Hassan, R., 2019, 'Sustainable business practices and firm's financial performance in islamic banking: Under the moderating role of islamic corporate governance', Sustainability 11(23), 1439-1463. https://doi.org/10.3390/su11236606 [ Links ]

Jensen, M.C. & Meckling, W.H., 1976, 'Theory of the firm: Managerial behavior, agency costs and ownership structure', Journal of Financial Economics 3(4), 305-360. https://doi.org/10.1016/0304-405X(76)90026-X [ Links ]

Kamran, M., Farooq, F. & Zia-ur-Rehman, M., 2020, 'Corporate governance and organisational performance: An empirical analysis', Review of Applied Management & Social Science 3(3), 323-338. https://doi.org/10.47067/ramss.v3i3.67 [ Links ]

Kartadjumena, E. & Rodgers, W., 2019, 'Executive compensation, sustainability, climate, environmental concerns, and company financial performance: Evidence from Indonesian commercial banks', Sustainability 11(6), 1-21. https://doi.org/10.3390/su11061673 [ Links ]

Kaza, S., Yao, L., Bhada-Tata, P. & Van Woerden, F., 2018, What a waste 2.0: A global snapshot of solid waste management to 2050, World Bank Publications, Washington, DC. [ Links ]

Kirsten, E. & Du Toit, E., 2018, 'The relationship between remuneration and financial performance for companies listed on the Johannesburg Stock Exchange', South African Journal of Economic and Management Sciences 21(1), 1-10. https://doi.org/10.4102/sajems.v21i1.2004 [ Links ]

Lozano, L.M., García-Cueto, E. & Muñiz, J., 2008, 'Effect of the number of response categories on the reliability and validity of rating scales', Methodology: European Journal of Research Methods for the Behavioral and Social Sciences 4(2), 73-79. https://doi.org/10.1027/1614-2241.4.2.73 [ Links ]

Maja, M.M. & Ayano, S.F., 2021, 'The impact of population growth on natural resources and farmers' capacity to adapt to climate change in low-income countries', Earth Systems and Environment 5(2), 271-283. https://doi.org/10.1007/s41748-021-00209-6 [ Links ]

Mans-Kemp, N., Viviers, S. & Collins, S., 2018, 'Exploring the causes and consequences of director overboardedness in an emerging market', International Journal of Disclosure and Governance 15(4), 210-220. https://doi.org/10.1057/s41310-018-0048-9 [ Links ]

Matemane, R., 2022, 'Towards value adding performance: A metric for executive compensation', Doctoral Thesis, University of Johannesburg, Johannesburg. [ Links ]

Matemane, R., Moloi, T. & Adelowotan, M., 2022, 'Appraising executive Compensation ESG-based indicators using analytical hierarchical process and delphi techniques', Journal of Risk and Financial Management. [ Links ]

Mbunge, E., 2020, 'Effects of COVID-19 in South African health system and society: An explanatory study', Diabetes & Metabolic Syndrome: Clinical Research & Reviews 14(6), 1809-1814. https://doi.org/10.1016/j.dsx.2020.09.016 [ Links ]

McCallaghan, S., Jackson, L.T. & Heyns, M.M., 2020, 'Servant leadership, diversity climate, and organisational citizenship behaviour at a selection of South African companies', Journal of Psychology in Africa 30(5), 379-383. https://doi.org/10.1080/14330237.2020.1821310 [ Links ]

Moloi, T., 2015, 'A critical examination of risks disclosed by South African mining companies' pre and posts Marikana event', Problems and Perspectives in Management 13(4), 168-176. [ Links ]

Mofokeng, N.E.M., Giampiccoli, A. & Jugmohan, S.N., 2018, 'Black economic empowerment led transformation within the South African accommodation industry: The case of Clarens', African Journal of Hospitality, Tourism and Leisure 7(11), 1-16. [ Links ]

Morrissey, E.M., 2018, '# MeToo Spells Trouble for Them Too: Sexual Harassment Scandals and the Corporate Board', Tulane Law Review 93(1), 177-205. [ Links ]

Mpandeli, S., Naidoo, D., Mabhaudhi, T., Nhemachena, C., Nhamo, L., Liphadzi, S., Hlahla, S. & Modi, A.T., 2018, 'Climate change adaptation through the water-energy-food nexus in southern Africa', International Journal of Environmental Research and Public Health 15(10), 1-19. https://doi.org/10.3390/ijerph15102306 [ Links ]

Mukole, K., 2010, 'Job creation versus job shedding and the role of SMEs in economic development', African Journal of Business Management 4(11), 2288-2295. [ Links ]

Mülbert, P.O. & Sajnovits, A., 2021, 'The inside information regime of the MAR and the rise of the ESG era', European Company and Financial Law Review 18(2), 256-290. https://doi.org/10.1515/ecfr-2021-0013 [ Links ]

Mtapuri, O. & Tinarwo, P., 2021, 'From apartheid to democracy: Patterns and trends of inequality in South Africa', Southern African Journal of Demography 21(1), 104-133. [ Links ]

Nardi, B., 2019, 'Design in the age of climate change', She Ji: The Journal of Design, Economics, and Innovation 5(1), 5-14. https://doi.org/10.1016/j.sheji.2019.01.001 [ Links ]

Ndeketeya, A. & Dundu, M., 2019, 'Maximising the benefits of rainwater harvesting technology towards sustainability in urban areas of South Africa: A case study', Urban Water Journal 16(2), 163-169. https://doi.org/10.1080/1573062X.2019.1637907 [ Links ]

Nel, G., Scholtz, H. & Engelbrecht, W., 2022, 'Relationship between online corporate governance and transparency disclosures and board composition: Evidence from JSE listed companies', Journal of African Business 23(2), 304-325. https://doi.org/10.1080/15228916.2020.1838831 [ Links ]

Nikolov, A.N., 2018, 'Managerial short-termism: An integrative perspective', Journal of Marketing Theory and Practice 26(3), 260-279. https://doi.org/10.1080/10696679.2018.1450633 [ Links ]

Nyandeni, R., 2018, 'The state of black business since the democratisation of South Africa in 1994', Skills at Work: Theory and Practice Journal 9(1), 19-33. [ Links ]

Ocean Tomo, O., 2020, Intangible asset market value study, viewed 15 April 2021, from http://www.oceantomo.com/intangible-asset-market-value-study/. [ Links ]

Okoli, C. & Pawlowski, S.D., 2004, 'The Delphi method as a research tool: An example, design considerations and applications', Information & Management 42(1), 15-29. https://doi.org/10.1016/j.im.2003.11.002 [ Links ]

Onyebukwa, C.F., 2021, 'The Dilemma of natural resources and upsurge of conflicts in Africa: A cursory look at the Marikana management approaches in South Africa', in K.J. Ani, V. Ojakorotu & K. Bribena (eds.), Political economy of resource, human security and environmental conflicts in Africa, pp. 277-296, Springer, Singapore. [ Links ]

Pizzi, S., Del Baldo, M., Caputo, F. & Venturelli, A., 2022, 'Voluntary disclosure of Sustainable Development Goals in mandatory non-financial reports: The moderating role of cultural dimension', Journal of International Financial Management & Accounting 33(1), 83-106. https://doi.org/10.1111/jifm.12139 [ Links ]

Rossouw, J. & Styan, J., 2019, 'Steinhoff collapse: a failure of corporate governance', International Review of Applied Economics 33(1), 163-170. [ Links ]

Rothstein, B. & Varraich, A., 2017, Making sense of corruption, Cambridge University Press, Cambridge. [ Links ]

Sahari, S., Tinggi, M., Cheuk, S. & Nordin, N.A., 2018, 'A review of Delphi technique in developing human capital disclosure index', Academy of Accounting and Financial Studies Journal 22(4), 1-9. [ Links ]

Samkin, G. & Deegan, C., 2012, New Zealand financial accounting, McGraw-Hill Education Australia, North Ryde, New South Wales. [ Links ]

San-Jose, L. & Retolaza, J.L., 2018, 'Ethics in finance research: Recommendations from an academic experts Delphi panel', Journal of Academic Ethics 16(1), 19-38. https://doi.org/10.1007/s10805-017-9293-y [ Links ]

Scholtz, H.E. & Smit, A., 2012, 'Executive remuneration and company performance for South African companies listed on the Alternative Exchange (AltX)', Southern African Business Review 16(1), 22-38. [ Links ]

Schuster, S., Singler, K., Lim, S., Machner, M., Döbler, K. & Dormann, H., 2020, 'Quality indicators for a geriatric emergency care (GeriQ-ED)- An evidence-based delphi consensus approach to improve the care of geriatric patients in the emergency department', Scandinavian Journal of Trauma, Resuscitation and Emergency Medicine 28(1), 1-7. https://doi.org/10.1186/s13049-020-00756-3 [ Links ]

Sehlapelo, T. & Inglesi-Lotz, R., 2022, 'Examining the determinants of electricity consumption in the nine South African provinces: A panel data application', Energy Science & Engineering 10(1), 2487-2496. https://doi.org/10.1002/ese3.1151 [ Links ]

Selvam, M., Gayathri, J., Vasanth, V., Lingaraja, K. & Marxiaoli, S., 2016, 'Determinants of firm performance: A subjective model', International Journal of Social Science Studies 8(4), 90-100. https://doi.org/10.11114/ijsss.v4i7.1662 [ Links ]

Sobota, A.E., Shah, N. & Mack, J.W., 2017, 'Development of quality indicators for transition from pediatric to adult care in sickle cell disease: A modified Delphi survey of adult providers', Pediatric Blood & Cancer 64(6), 1-6. https://doi.org/10.1002/pbc.26374 [ Links ]

Stats, S., 2022, Quarterly Labour Force Survey: Quarter 2 2022, Statistics South Africa, Pretoria. [ Links ]

Uhunamure, S.E., Agyekum, E.B., Durowoju, O.S., Shale, K., Nethengwe, N.S., Ekosse, G.I.E. & Adebayo, T.S., 2021, 'Appraisal of nuclear energy as an alternative option in south africa's energy scenario: A multicriteria analysis', Applied Sciences 11(21), 1-22. https://doi.org/10.3390/app112110349 [ Links ]

Urson, M., 2016, 'CEO pay ratios and company performance: A study of JSE-listed consumer goods and services companies', Master's thesis, University of Cape Town. [ Links ]

Van der Berg, S., 2014, 'Inequality, poverty and prospects for redistribution', Development Southern Africa 31(2), 197-218. https://doi.org/10.1080/0376835X.2013.871196 [ Links ]

Wang, Z., Zhao, C., Yin, J. & Zhang, B., 2017, 'Purchasing intentions of Chinese citizens on new energy vehicles: How should one respond to current preferential policy?', Journal of Cleaner Production 161(1), 1000-1010. https://doi.org/10.1016/j.jclepro.2017.05.154 [ Links ]

Wesson, N., Smit, E., Kidd, M. & Hamman, W.D., 2018, 'Determinants of the choice between share repurchases and dividend payments', Research in International Business and Finance 45(1), 180-196. [ Links ]

Yoshikawa, T., Nippa, M. & Chua, G., 2021, 'Global shift towards stakeholder-oriented corporate governance? Evidence from the scholarly literature and future research opportunities', Multinational Business Review 29(1), 321-347. https://doi.org/10.1108/MBR-10-2020-0200 [ Links ]

Young, K.L., Goldman, S.K., O'Connor, B. & Chuluun, T., 2021, 'How white is the global elite? An analysis of race, gender and network structure', Global Networks 21(2), 365-392. https://doi.org/10.1111/glob.12309 [ Links ]

Correspondence:

Correspondence:

Reon Matemane

reon.matemane@up.ac.za

Received: 15 June 2022

Accepted: 27 Sept. 2022

Published: 14 Nov. 2022