Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Acta Commercii

On-line version ISSN 1684-1999

Print version ISSN 2413-1903

Acta Commer. vol.22 n.1 Johannesburg 2022

http://dx.doi.org/10.4102/ac.v22i1.993

ORIGINAL RESEARCH

The dividend relevance pay-out model in the context of an emerging economy

Freddy MunzheleleI, II; Hendrik WolmaransII; John HallII

IDepartment of Accountancy, Faculty of Management, Commerce and Law, University of Venda, Thohoyandou, South Africa

IIDepartment of Financial Management, Faculty of Economic and Management Sciences, University of Pretoria, Pretoria, South Africa

ABSTRACT

ORIENTATION: The dividend pay-out policy remains one of the key functional areas of corporate finance, more so in that it is through the receipt of dividends that shareholders can at least share in the profits of their investments.

RESEARCH PURPOSE: Because of the importance of the dividend decision (especially for emerging economies) as well as its possible link to value creation, the present study sought to providing results with recommendations on pay-out policy to improve dividend decision-making and establish a more defined link between dividends and value creation for management and shareholders alike.

MOTIVATION FOR THE STUDY: The endeavours of the current study lie in its contribution to the pay-out debate as it taps into a research area that has been explored minimally in emerging markets, yet it is still among the very topical functional areas of financial decisions.

Research design, approach and method: The panel data of 110 Johannesburg Stock Exchange (JSE) listed sample companies for the period 2006-2018 were used. The sample was further grouped into value and growth companies. Dynamic panel estimators were used to analyse data..

MAIN FINDINGS: The study confirmed results of similar previous research and identified further trends relating to the South African corporate setting. Specifically, the study found that companies have target pay-out ratios, which they adjust towards. Furthermore, managers are reluctant to change (increase) dividends, which may have to be cut again later, and in their endeavour to create and maximise value, they may have to sacrifice paying dividends. These trends are evident more with growth companies

PRACTICAL IMPLICATIONS: These results mirror those of developed markets. Furthermore, the results present South African financial managers with an enhanced platform to create and maximise value for shareholders, relatively the same way as their counterparts in developed markets.

CONTRIBUTION/VALUE-ADD: This study includes value-based variables among the explanatory variables. It is submitted that this process will enhance the endeavours of financial managers in creating values for shareholders through dividend pay-out.

Keywords: dividend relevance; emerging market; growth companies; value companies; panel data.

Introduction

The corporate pay-out policy remains one of the most relevant functional areas and well-researched topics in finance. The reason for this is that the phenomenon is a puzzle with many pieces that do not necessarily fit well with each other (Marsh & Merton 1987:35). Furthermore, through receipt of dividends, shareholders are at least able to measure returns on their investments (Baker & De Ridder 2018:138; Erasmus 2013:13; Nyere & Wesson 2019:13; Rahman & Al Mamun 2015:181). With the recent global corporate scandals, uncertainties and failures arising largely from inadequate project management, risk management and failure to adhere to best governance practice at Enron (Healy & Palepu 2003:3) and recently Steinhoff (Matemane & Wentzel 2019:128; Rossouw & Styan 2019:163), shareholders are now more than before keeping their eyes closed on their investments. The spate of these corporate problems makes one wonder if similar events may return in the near future. With the dividend pay-out policy being one of the key decision areas in corporate finance, it follows that it will continue to attract debates and interest from researchers.

Indeed, the pay-out policy has been researched extensively since the first empirical study on dividend relevance, which emphasised that dividends matter in that, large companies have long-term pay-out targets, and managers are reluctant to make dividend changes, especially if new payments may not be sustainable (Baker & De Ridder 2018:138; Lintner 1956:97; Nowak et al. 2021:24). Although there were attempts to discredit dividend relevance propositions by Miller and Modigliani (1961:411), the attempts failed; in fact, the criticism made the debate more enticing to an extent that numerous additional theories were developed as researchers sought to solve the pay-out puzzle. The theories developed include agency theory (Jensen & Meckling 1976:78), life cycle hypothesis (Mueller 1972:199), signalling theory (Bhattacharya 1979:259; John & Williams 1985:1053; Miller & Rock 1985:1031), residual theory (Myers 1984:585) and catering theory (Baker & Wurgler 2004:1158).

As with developed markets, shareholders in emerging markets expect to be compensated on their investments, at least through receipt of dividends as a means by which their investments are looked after (Abubakar 2019:14; Zondi & Sibanda 2015:233; Olarewaju, Sibanda & Migiro 2017:87). Corporate dynamics and problems include competition, governance and scandals and advances in technology (Nworji, Adebayo & David 2011:16; Rajagopalan & Zhang 2009:545; Rossouw & Styan 2019:167). The end results are that largely all these issues impact negatively on the maximisation of value. With dividend pay-outs serving as the least means by which shareholders' value is maximised, researchers have to closely keep their eyes on pay-out decisions. Moreover, the situation in emerging markets is that research has been minimal in this regard. The current study reviews extended versions of dividend relevance pay-out models, thus also adding more explanatory variables to account for value creation and maximisation of dividends in the South African setting. Because of the importance of the dividend decision (especially for emerging economies) as well as its possible link to value creation, the present study wants to build a model to improve dividend decision-making and establish a more defined link between dividends and value creation for management and shareholders alike.

The strength of the current study lies in its contribution to the pay-out debate as it taps into a research area that has been barely explored in emerging markets. The overall study enhances existing literature and provides additional context for future research. The study also facilitates enhanced decision-making processes for South African financial managers regarding their fiduciary duties for their principals (shareholders) in that it presents them with comprehensive evidence for comparison with counterparts in other emerging as well as in developed markets about value-tested and enhanced modernised versions and application of dividend relevance pay-out policies. The goals of this study, particularly, as it directly adds value-related variables to dividend pay-out policy, have not been attempted empirically for the emerging markets. Hence, the results will significantly enhance financial decision alternatives and significantly contribute to existing literature.

The remainder of the study consists of the following sections, which proceed in the given order: (1) literature review, (2) preliminary methodology matters, (3) research design and methodology, (4) results and discussion and lastly, (5) conclusion, implications and suggestions for future research.

Literature review

The seminal work of Lintner (1956:97-113) sets the tone for the dividend policy debate. Attempts by Miller and Modigliani (1961:411-433) to criticise the validity of Lintner's (1956:97-113) work made the dividend debate rather more interesting, thus attracting reactions from scholars and researchers. Lintner (1956:97) advanced the view that companies set pay-out targets, which they adjust towards and that dividend changes tend to follow sustainable changes in earnings. These results suggest that companies smoothen dividends. A considerable number of studies have been undertaken to test Lintner's model. Firstly, studies have attempted to apply the original model. Then, some have attempted to apply some extended versions of the model. In the process, other related patterns of pay-outs have emerged. The next section thus discusses in detail the application of Lintner's (1956:100) model, with distinctions made in the application of the model between developed and emerging countries.

Review of dividend relevance and related models - Empirical evidence from developed markets

Fama and Babiak (1968:1132) expanded Lintner's model by including lagged earnings and application of the model at the individual company level. Decades later, Turakpe and Fiiwe (2017:13) explained that Lintner's model was further developed to account for dividend policy and performance. The common elements in the reviews mentioned above show that the dividend relevance and related model explicate better issues around dividends, policies and corporate perfomance. Subsequently, relatively similar results to those of Lintner's model show that the extended version, as explained by Turakpe and Fiiwe (2017:13) provided some improvement in the predictive influence of the model. Evidently, tests regarding the original Lintner's (1956:97) and Fama and Babiak (1968:1132) models conducted by Kwan (1981:193) at quarterly intervals, each of which was treated as a full year, revealed results similar to those of the original versions of these models. In line with these results, Fernau and Hirsch (2019:255) investigated what drives dividend smoothing, and they used a meta regression anaylsis of the Lintner model. The results revealed that Lintner's dividend pay-out model may also provide guidance for investors' expectations and dividend smoothing. Thus, studies by both Kwan (1981:193) and Fernau and Hirsch (2019:255) claimed that the revised Lintner model can identify some useful potential dividend information, which can provide guidance for investors' expectations. Through testing the original model of Lintner and expanding the survey (thus including specific questions on signalling and clienteles), Baker, Farrelly and Edelman (1985:78) provided results relatively similar to those of Lintner (1956:97). Nakamura and Nakamura (1985:606) and Fernau and Hirsch (2019:255) extended Lintner's model the same way Fama and Babiak (1968:1132) did, but with the notable difference being that their expected sign of the coefficient of lagged earnings is positive, whereas Fama and Babiak's is a negative sign.

Following in the path of dividend relevance, Marsh and Merton (1987:35) developed an aggregate dividend model, which is a function of change in sustainable earnings. Lending support to a testing dividend at the aggregate level, Garrett and Priestley (2000:173) proposed a model that assumes that managers minimise costs associated with being away from pay-out target. They argue that modelling dividend behaviour at the aggregate level provides a platform for the detection of pay-out factors that may not have been identified at the individual company level.

Ang (1998:81) developed what they termed 'the analytical solution dividends'. Their analysis provides the basis for the introduction of new concepts of dividend equilibrium, which also recognises pay-out behaviour at the company-specific level. Using a survey, Allen (1992:9) investigated the perceptions of United Kingdom (UK) companies' executives in respect of target pay-out ratios. The study simply tested Lintner's model in the UK setting and found that executives in the UK recognise the importance of maintaining stable dividends, and that previous dividends are key determinants of current dividends. Goergen, Renneboog and Correia da Silva (2005:375) investigated the patterns of dividends changes for German companies and established that German companies have relatively more flexible pay-out policies than their United States (US) counterparts. Lending support to the results of Goergen et al. (2005:375), Andres et al. (2009:175) concluded that German companies prefer more flexible pay-outs than their US and UK counterparts and that German companies tend to base their pay-out decisions on cash flow rather than earnings.

Leary and Michaely (2011:3197) and Koussis and Makrominas (2019:1030) investigated the determinants of dividend smoothing and the evolvement of this smoothing over time in the US and well as European Union (EU) banks. Leary and Michaely (2011:3197) referred to some models that seem to affect dividend models, and these are agency costs and information asymmetry models. Their study is unique in that it explores smoothing behaviour over a longer period than was ever done before. Firstly, they note some trends among different groups of companies, and that younger companies, low dividend yielding companies, high earnings volatility and return volatility companies and those with less predictor following do not necessarily smooth dividends. Secondly, the companies that are exposed to more agency costs tend to smooth more. Thirdly, they observe that there is a substantial increase in the extent of smoothing over the past century. As Leary and Michaely (2011:3197) argued, although the use of share repurchases to distribute cash to shareholders may have contributed to this trend, most increases occurred before share repurchases became widespread. Similarly, Koussis and Makrominas (2019:1030) showed that agency-based support of bank dividend behaviour has higher pay-out ratio smoothing for banks with higher (initial) dividend pay-outs, lower ownership absorption, public banks and banks with lower growth opportunities and weaker investor protection. Regarding the dividend models highlighted above, the study found that companies that experience the most uncertainties and asymmetric information smooth the least. Consistent with agency cost theory, Leary and Michaely (2011:3197) documented that smoothing is prevalent among companies that have access to external capital finance and high pay-out levels.

Lambrecht and Myers (2012:1761) developed what they called a 'dynamic agency model', in which managers make dividend pay-out, investment and financing decisions to maximise the managerial rents they receive from a company. They found that managers tend to smooth dividend pay-out to then smooth the flow of managerial rents. Secondly, risk-averse managers tend to underinvest although the extent of underinvestment is observed to be mitigated by habit formation. Liu and Chen (2015:194) tested the signalling and free cash flow hypotheses in respect of US companies. They discovered that managers use dividends to signal their previous earnings and for catering to clientele. Moreover, they established that free cash flow and investment sets are not key determinants of pay-out policy. In summary, the application of Lintner's (1956:97) model and its extension confirm that the model holds very strong relevance in the developed markets even after more than six decades as it was proposed. Booth and Zhou (2015:145) note that larger companies tend to have more market power, but they are more likely to pay dividends than would other companies.

Although the German situation shows relatively less smoothing, the systematic Lintner (1956:97) pay-out behaviour seems to prevail. Goergen et al. (2005:375) lend support to the German case by documenting that earnings are major determinants of decision to change pay-outs. Furthermore, there are questions as to whether emerging markets share similar empirical evidence or not, particularly on the extension of the model. The answer to this question is in the next section, which discusses related empirical evidence from the emerging markets.

The level of cash holding (CH) has also shown some impact on companies' propensity to pay dividends. Kalcheva and Lins (2007:1109), Mikkelson and Partch (2003:276), Tong (2011:741) and Uyar and Kuzey (2014:1035) observed that the level of CH presents companies with the opportunity to make trade-off balance between investments and paying dividends. Accordingly, Erasmus (2008:70) Kumar and Sharma (2011:105) noted that, whenever used, the economic value added (EVA) shows its prowess regarding value creation for shareholders.

Review of dividend relevance and related models - Empirical evidence from emerging markets

Seneque and Gourley (1983:35) surveyed dividend pay-out policies in South Africa. These studies notably recognise the earlier survey of Lintner (1956:97) conducted in the United States of America. Similarly, Elmagrhi et al. (2017:459) and Enow and Hugh (2018:44) conducted studies on corporate governance and dividend pay-out policy in the United Kingdom and dividend pay-out and firm profitability in the financial services sector in South Africa. From these surveys, some common factors are identified as influential in determining the dividend pay-out policy, namely current earnings, company prospects, dividend pay-out stability, cash flow, current liquidity, future cash needs, expectations of shareholders and maintenance of long-term target pay-out ratio. Consistent with their UK counterparts, Seneque and Gourley (1983:35), Elmagrhi et al. (2017:459) and Enow and Hugh (2018:44) submitted that the dividend policies of South African companies are influenced by the factors mentioned above. Specifically, pay-outs of South African companies are influenced by current earnings and continuity and stability of pay-outs.

Wolmarans' study (2003:243) is more focused as he investigates whether Lintner's (1956:97) model could be used to explain pay-out patterns of South African companies. The study recognises that Lintner's model does not seem to provide a reliable fit for the South African pay-out policy situation. Wolmarans (2003:243), however, acknowledged that the small sample size used in the study may have influenced the generalisation of the results. The study had targeted the largest 200 Johannesburg Stock Exchange (JSE)-listed companies as of 31 December 2000, but because of some not having been listed for sufficient periods, only 97 made it into the final sample.

Through a survey, Firer, Gilbert and Maytham (2008:5) concluded that South African managers exhibit attitudes like those of their counterparts in the United States of America as documented by Lintner (1956:97), that is, they have a target pay-out ratio and they are reluctant to increase dividend that they may be forced to cut in future. Furthermore, South African managers tend to focus more on pay-out targets, as opposed to their US counterparts who prefer maintaining the growth in nominal value of pay-outs (Firer et al. 2008:5). Erasmus (2013:13) examined the relationship between dividend pay-outs, their stability and share returns. Their study recognises some shortcomings with respect to sample sizes and survivorship bias experienced by similar studies, notably Wolmarans' (2003:243) study. Erasmus (2013:13) found that the stability of dividend pay-outs influences share returns as much as the dividend pay-outs themselves. This suggests that South African shareholders perceive the importance of stable pay-outs relatively the same way as their managers, an argument that is shared by Firer et al. (2008:5) above. Furthermore, Firer and Viviers (2011:18) researched the dividend policies of 95 South African-listed large companies for over 21 years (1989-2010). They also note the complete association between dividends, investments and financing decisions. Importantly, they report that South African managers are more conservative than their US counterparts when they pay dividends, and that they target a specific pay-out ratio.

Viviers, Firer and Muller (2013:15) reviewed dividends payments of South African-listed companies over a 36-year period (1977-2011) and reported similar results. Specifically, among other results, they uncovered that fewer companies are paying dividends and that paying companies tend to be larger. Equally, Sibanda (2014:333) examined pay-out policies and appropriateness of Lintner's smoothing pattern for 45 non-financial listed South African companies for over 18 years. The study found, among other key results, that South African companies indeed smooth dividends and have target dividend levels towards that they adjust.

Naceur, Goaied and Belanes (2006:18) tested whether Tunisian companies smooth dividends. The results show that Tunisian companies tend to rely more on both current earnings and previous dividends to determine their current dividends. Moreover, they document that, dividends tend to be more sensitive to current earnings than previous dividends. Waweru (2010:8) discovered relatively similar pay-out patterns in respect of the Kenyan situation. Specifically, there is a strong positive relationship between pay-outs and share returns in Kenya (Waweru 2010:8). Similarly, Omet (2004:1083) examined whether Jordanian companies smooth dividends. The study also investigated the sensitivity of the current dividend to current earnings and previous dividends. Omet found that Jordanian companies follow stable pay-out policies and that current pay-outs are more sensitive to previous pay-outs than current earnings. Zurigat and Gharaibeh (2011:60) provided support for Omet's (2004:1083) evidence above as they suggest that Jordanian companies have a target dividend pay-out, with a low target rate of adjustment.

Ahmed and Javid (2008:148) undertook a study on the dynamics and determinants of dividend policy for 320 non-financial companies over 6 years (2001-2006) in Pakistan. Using Lintner's (1956:97) model as a baseline for their data modelling, they conclude that profitable companies' stable net earnings seem to have larger free cash flow and thus are more able to pay larger dividends. They also note a negative correlation between investment sets, leverage and pay-out policy, which is interpreted as an indication of the fact that Pakistan companies prefer to reinvest in their assets rather than paying higher dividends. This practice further confirms the reluctance of managers to increase dividends even when earnings increase, hence the dividend smoothing pattern.

Musa (2009:555) explored whether selected variables, namely current earnings, previous dividends, cash flow, investment opportunities and net current assets have an impact on dividend policies of companies listed on the Nigerian Stock Exchange. In line with the smoothing pattern of pay-out model as proposed by Lintner (1956:97), Musa found that current earnings, previous dividends and cash flows have a significant impact on dividends policies of companies. Furthermore, although Musa (2009:555) had predicted that bigger companies should be more liquid, have low growth rates and thus should be able to pay higher dividends, the study results did not seem to capture the size effect of companies. Consistently, Olarewaju et al. (2017:87) and Abubakar (2019:14) found that larger companies are more likely to smooth dividends, indicating that they have stable dividends. Bodla and Kumar (2012:1148) examined the financial management practices of the Indian service industry on aspects such as financing pattern, capital structure and pay-out choices. Their conclusion was that the Lintner model applies to Indian companies, specifically that current pay-outs are determined by current earnings and previous pay-outs. Hu and Chen (2012:98) observed a similar pay-out pattern for Chinese companies. Chinese companies have a long-term pay-out target ratio, and they adjust to the target level and the smoothing is related to company value (Hu & Chen 2012:98). Jeong (2013:76) identified a similar smoothing pattern for the Korean market, observing that Korean companies smooth less than their US counterparts. Musiega et al. (2013:253) examined the determinants of the pay-out policy of 30 non-financial companies listed on the Nairobi Stock Exchange for over 5 years (2007-2011). They established a positive correlation between ROE, investment sets and pay-out policy. These results are similar with those of Ahmed and Javid (2008:148) highlighted above.

Pelcher (2019:7) did a study to establish whether pay-out decisions of Top 40 JSE listed companies for the period 2007-2016 had an impact on shareholders as may be reflected on share volatility. It was observed that dividend decisions are still relevant to investors, that is, they believe that information being conveyed in this regard is an indication of the current and future prospects of the company. Consistently, Nyere and Wesson (2019:13) noted that dividend pay-out increased amidst global financial crisis between 2007 and 2008. They then interestingly found that there is a growing propensity to pay dividends among sampled industrial South African companies during the period 2008-2014, which they attributed to at least the replacement of secondary tax on companies with dividend withholding tax and the opportunity to substitute dividend payments with share repurchases as means to distribute wealth to shareholders.

The empirical evidence on the Lintner (1956:97) model from emerging markets has largely been on the model's application and related pay-out behaviour. There is, however, minimal review of modernised versions of the same model, a gap that this study sought to fill. The pay-out decisions have some link with creation and maximisation of value particularly through return on investment (also called total shareholder return). The return on investment consists of dividends distributed and capital gains, thus the EVA, a principal value-based performance measure and the CH have an impact on both the company's pay-out decisions and the speed of target dividend adjustment coefficient (DeAngelo et al. 2006:227, 2007:11; Yoon & Starks 1995:995). The size of company has shown to have some impact on dividend pay-out decision. Several studies have tested the impact of firm size on the dividend pay-out ratio. Redding (1997:240) and Fama and French (2001:35) indicated that large firms distribute a larger amount of their net profits as cash dividends than do small firms. Al-Kuwari (2009:57) and Labhane and Mahakud (2016:70) agree that size has a positive relationship with dividend pay-out ratio. In contrast, Arfianny (2020:222) found, in a study of Indonesian companies, that firm size has a negative effect on the dividend pay-out ratio. This could be motivated in accordance with the residual theory that states that large companies that have good investment opportunities, will likely distribute less of their earnings as dividends. Nguyen and Bui (2016:70) (for Vietnamese companies) and Pandoyo and Ugut (2021:255) (for Indonesian companies) also found a significant negative relationship between firm size and dividend pay-out ratio.

Preliminary methodology matters: Units of analysis

The outline of the introduction and literature review above has prompted some introspection on the distinction between value and growth companies. The overall purpose of this study was to review extended versions of dividend relevant pay-out models, thus adding further explanatory variables to account for value creation and maximisation in dividends in the South African setting. Furthermore, the study set out to test whether the South African corporate setting regarding the theme of this study mirrors that of developed markets such as of the United States and the European Union. Several studies, including those of Fama and Babiak (1968:1132), Ahmed and Javid (2008:148), Leary and Michaely (2011:3197), Hu and Cheng (2012:98), Viviers et al. (2013:15), Abubakar (2019:14), Baker and De Ridder (2018:138), Nowak et al. (2021:24), Tekin and Polat (2021:200), tap into the smoothing pattern of dividends, thus testing whether the phenomenon is the same between small and large companies and found that smoothing pattern is more prevalent among large companies. Consistently, Lehn and Makhija (1997:90), Crowther, Davies and Cooper (1998:30), Fama and French (2001:36), De Mortanges and Van Riel (2003:521), DeAngelo, DeAngelo and Stulz (2006:227) and Tekin and Polat (2021:200) note that larger and more profitable companies can pay and sustain dividends.

The issue of sustaining payment of dividends is crucial to the extent that shareholders who would survive on dividend receipts will be interested in consistent dividend-paying companies as opposed to those investors preferring reinvestment of earnings. The ability of a company to pay dividends consistently to the extent that the pay-out represents a significant portion of earnings has been attributed to several factors, among them the size of the company as reflected in Leary and Michaely (2011:3197), which companies may be considered mature. Barclay and Smith (2005:36) and Smith et al. (2005:36) define the same as 'value' companies, that is, those that exhibit features such as paying a significant portion of their earnings as dividends consistently, and that do not aggressively pursue investment opportunities. The companies that do not exhibit these features are then classified as 'growth'. The distinction of companies in this regard is relative to an extent that a company that has been in existence for many decades or even a century may still be classified as 'growth', that is if it does not possess attributes of 'value' company (Munzhelele 2019:99; Munzhelele, Wolmarans & Hall 2021:4). Thus, the current study has adopted the basis of the distinction between value and growth companies as outlined here. In this regard, the trend of companies listed on the JSE has been observed closely for the current study. As listing on the JSE is onerous, companies that have consistently listed on its Main Board for more than 20 years are considered to have shown maturity, thus withstanding the ever-changing business and economic dynamics, and related regulations. These, therefore, are classified as value companies. Equally, and informed by preliminary scrutiny by authors of the current study, companies that have only been listed since 2006 may be classified as 'growth' as they exhibit features in contrast to those of value companies, that is, they seem to pursue growth opportunities aggressively and do not prioritise paying dividends. The listing referred to here is of the Main Board of JSE as transfers from JSE's AltX listing or directly from non-listing.

Research design and methodology

This section presents and discusses the data sample, collection, model specification and estimations. The section closes with the development of hypotheses.

Data sample and collection

The study utilised secondary data. The data was drawn from the published financial statements of South African listed companies, which are stored by IRESS. The IRESS has been used in South Africa successfully for the past few decades by researchers and other professionals to report reliable financial information. The sample companies are those listed on the main board of the JSE. The sample period is 13 years (2006-2018), a period considered sufficient for this study's intended purpose and recent enough to capture for topical dynamics in pay-out studies. Furthermore, the period covered was up to 2018 as the study was done in 2019. The total companies that made the sample, that is, whose information could be reliably obtained from IRESS for this study (analysed below as Panel 1) were 110. After distinguishing value and growth companies, 85 (Panel 2) and 25 (Panel 3) companies were confirmed, respectively.

Data model specification and estimation procedures

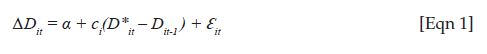

The purpose of this study is to review extended versions of dividend relevance models, hence including some company-specific variables and selected key value-based measures of financial performance, as explanatory variables. The ultimate objective is to test the extent of dividend relevance fitting to the emerging market setting such as that of South Africa, more so with the addition of explanatory variables to account for value creation and maximisation in dividends. The pioneer pay-out model (Lintner 1956:100) is stated as:

where:

ΔDit is change in dividend payments for company i in period t

αi is constant term

ci is the speed of adjustment coefficient

D*it is desired dividend pay-out for company i in period t

Dit-1 is lagged dividends for company i in period t

The target dividend, D*it, can be expressed in basic form as follows:

ri is target pay-out ratio

Eit is current earnings for a company i in period t

Substitute riEit in Equation 1, the following equation is deduced:

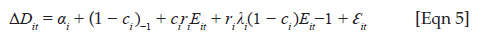

Fama and Babiak (1968:1132) extend this model by including lagged earnings. They propose that earnings adjust to dividends by a certain speed and dividends adjust to expected earnings. Specifically, Fama and Babiak (1968:1132) suggest an inclusion of earnings partial adjustment model, which they define as:

where:

(1+ƛi)Ei,t-1 represents partial adjustment term.

With Fama and Babiak's (1968:1132) proposition above, namely that dividends adjust to expected earnings, the extended pay-out model becomes:

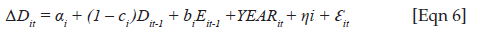

Andres et al. (2009:175) extend this model by including a dummy variable, so as to capture the possible effects of time on the pay-out behaviour of companies. The simplified model in this regard is:

where:

YEARit is dummy variable for company i in period t

ηi is company-specific unobserved effect.

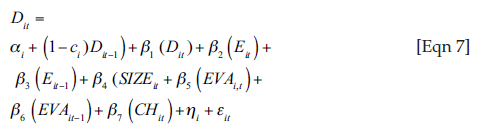

According to the discussion above, particularly the endeavour by the current study to focus on value maximisation, the speed of adjustment may also be influenced by a company's size (SIZE), EVA and CH. It has been recognised that receipt of dividends is the least means by which shareholders earn returns on their investments. In addition to inclusion of lagged earnings by Fama and Babiak (1968:1132), the current study lags dividends and EVA to manage the problem of endogeneity. The current study ignores the application of dummies dynamics adopted by Andres et al. (2009:75), as the existence of any possible time and unobserved company effect may be controlled through the management of errors in model building. Furthermore, Andres et al. (2015:56) observe that the model yields relatively similar results even if dummy effects are ignored.

In summary, the basis of the relationship between the dependent and explanatory variables here is more in line and is a contribution to Lintner's (1956:97) propositions reiterated in the section just above. Thus, the final regression model for the study is

where:

SIZEit is size of company i in period t

EVAit is EVA for company i in period t

Ɛit is error term

Following the above discussion, the deduced hypotheses are:

Hypothesis 1 (H1): Dividend per share depends on the earnings per share

Hypothesis 2 (H2): Dividend per share is positively related to changes in dividend per share.

Hypothesis 3 (H3): There is a positive relation between the size of a company and the changes in dividends per share

Hypothesis 4 (H4): Changes in dividends per share depends on the level of cash holdings of a company.

Hypothesis 5 (H5): Companies have target pay-out ratios towards that they adjust overtime

Hypothesis 6 (H6): A company's EVA is influenced by changes in the dividend per share

Corporate finance research has largely used econometric data estimation procedures to run regressions in this regard. In capital structure and pay-out decisions, the widely used estimators have been the ordinary least square (OLS), fixed effects (FE) and random effects (RE). These fundamental estimators have proven to be useful although they generally lack capabilities to handle common errors, such as heterogeneity and endogeneity, which have wrecked corporate finance research, particularly in the modelling of data (Munzhelele 2019:99; Munzhelele et al. 2021:4). Thus, some advanced estimators are recommended in the literature to address these problems and have proven to be robust. These include the difference generalised methods of moment (Diff GMM) of Arellano and Bond (1991:277), system generalised methods of moment (Sys GMM) of Blundell and Bond (1998:115) and the least square dummy variable correction (LSDVC) proposed by Bruno (2005:361). See Flannery and Hankins (2013:4) and Moyo (2016:209) for justified robustness of these estimators. Following Andres et al. (2009:175) and Andres et al. (2015:56) who used a combination of fundamental and dynamic estimators successfully, the current study adopted a combination of OLS, Diff GMM and Sys GMM to test the regression models. The LSDVC is superior over these estimators as it is bias-correcting and capable of providing better coefficient estimation consistency in the presence of dynamics in datasets, and hence it is used to test for robustness of estimation. The data winsorisation technique is applied on all variables included in the data analyses at 1% and 99% percentiles to manage the possible effects of data outliers. All data analyses are generated using the STATA program.

Ethical considerations

This study made use of data on JSE listed companies. This data is available for public consumption, and it was decided that the study does not have to undergo the ethic process.

Results and discussion

The results and discussions are presented starting in terms of subsections, namely model validity and reliability, descriptive analysis and then the regressions. The regression details start with testing and treatment of collinear explanatory variables.

Model validity and reliability

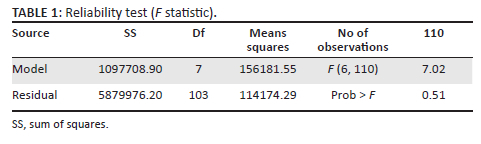

The use of secondary data enabled the researcher to test for reliability and validity of the model Firstly, the use of 110 companies validates the data as it defeats the exponential law or few observations error (Olabode, Olateju & Bakare 2019:27). This rendered the data valid. Subsequently, to test for reliability of the model, F statistics and the corresponding probability in STATA were used. This method was chosen because it allows the test goodness fit of the model. As such, the F statistics compare the power of the restricted model and that of the unrestricted model to validate the model used (Kasper, Schulz-Heidorf & Schwippert 2021:52). The F statistics and the corresponding probability for the model show how reliable the model is in explaining the relationship between exogeneous and endogenous variables. The results are presented in Table 1.

Given the outcome in Table 1, the researcher made use of di invFtail (7, 110) and the computed statistic was 2.182. The computed F-statistic 6.25 is less than the critical value (2.182); hence the null hypothesis is not rejected. This is also supported by the computed probability of 0.51 (>5%) as shown in Table 1. As such, the null hypothesis, which states that the model is correctly specified, is not rejected. Thus, the specified model (Equation 7) is correctly specified, and it is reliable to give meaningful results.

Descriptive analysis

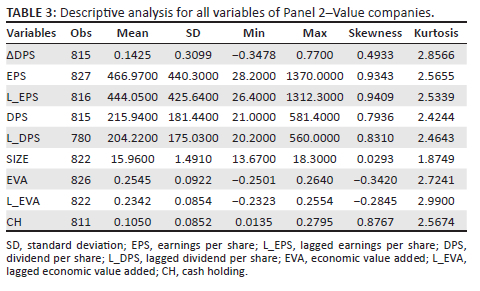

Table 2 presents descriptive statistics for the 110 sample companies (as Panel 1), Table 3 disaggregated 85 value companies (Panel 2) and Table 3 presents 25 growth companies (Panel 3). The presentation of data in Table 2, Table 3 and Table 4 is followed by discussions.

The dependent variable is ΔDPS and explanatory variables are earnings per share (EPS), L_EPS, DPS, L_DPS, SIZE, EVA, L_EVA and CH. ΔDPS refers to change in dividends. Earnings per share (in cents) measured as earnings attributable to ordinary shareholders, as ratio of weighted average number of shares. L_EPS is lagged earnings per share while DPS is dividend per share (in cents) measured as dividend declared or paid as ratio of weighted average number of shares. L_DPS is lagged dividend per share and SIZE is size of company measured by natural log of assets. Economic value added measured as net operating profit after tax less related capital employed and then deflated by total assets at the beginning of the year. L_EVA is lagged economic value added. Cash holding is ratio of cash and cash equivalents to total assets. Obs stands for number of observations.

The ΔDPS mean shows not much difference in all panels (Panel 1: 0.1411, Panel 2: 0.1425 and Panel 3: 0.1416). This suggests that managers (irrespective of company size) were reluctant to make changes in dividends over the respective research periods. The value companies (Panel 2) achieved a much higher mean for explanatory variables such as DPS and the EPS, as well as higher standard deviation (SD) than full sample companies (Panel 1) and growth companies (Panel 3). This trend was to be expected as value companies are higher and relatively mature companies compared with those in the full sample panel, namely growth companies; the later should have lower DPS and EPS than the former. The higher EPS for value companies over others is an indication of the maturity status of companies on this panel. The high SD is an indication of high variation among the sample of value companies.

The growth companies show relatively higher mean than value companies in respect of the CH, that is, Panel 3: 0.117 versus Panel 2: 0.105, which suggests that these companies withhold more cash to optimise investment pursuit. Growth companies are mainly smaller companies which, because of information asymmetry, have limited access to external finance and hence utilise internal funds to pursue investments. The SIZE ranges between full sample companies and value companies are relatively similar, that is, 13.27-18.10 and 13.67-18.30 respectively, as opposed to that of growth companies (11.85-16.28). The sample with the biggest SIZE SD is Panel 1 for full sample. This was to be expected as this sample comprises of value companies and growth companies, that is, two sets of companies with different distinguishing features than the disaggregated Panels 2 and 3. The growth companies achieved a higher EVA mean of 24 707.60 compared with 18 882.72 of value companies.

Regression analysis

The regression results are presented in Table 5 (full sample, Panel 1) and Table 6 and Table 7 (disaggregated comparative analyses for Panels 2 and 3, respectively). The grouping of panels follows that of the descriptive analysis. All these tables present results on several explanatory variables, specifically on their impact on the change in dividends and, more importantly, for SIZE, EVA, L_EVA and CH as they are additional variables that this study brings to the extended models by Fama and Babiak (1968:1132) and Andres et al. (2009:175). The tables also present estimation of the speed of adjustment coefficients. The OLS, Diff GMM, Sys GMM and LSDVC were used to perform the regressions. After the presentation of Table 5, Table 6 and Table 7, a comparative discussion of the same follows.

Before regressions were performed, the data was tested for existence of multicollinearity among some explanatory variables, as its existence may distort the strength of model specification. The multicollinearity was tested using the variance inflation factor (VIF) and accompanying test, the tolerance factor at the base levels of 10 and 0.10 values, respectively. Thus, if VIF equals or is more than 10 and simultaneously tolerance factor is less than 0.10, multicollinearity problem is suspected among explanatory variables. These tests are considered more advanced in testing multicollinearity than the correlation matrix (Musa 2009:555). In this study and for all the data panels, only L_EPS fell outside the base lines for VIF and tolerance factor and thus excluded from regressions analysis. Test results of multicollinearity are presented in Table 8.

From all panels (1, 2 and 3), model specification tests, namely Wald test and R2, are satisfied for all panels, which indicates that the model provides good fit for the data. The Sargan test of over-identifying restrictions is valid for applicable regression estimators, thus confirming the Diff GMM and Sys GMM to be suitable estimators in the circumstances.

For Panels 1, 2 and 3, EPS is moderately correlated with ΔDPS, that is, skewed positive correlation for majority of estimators (see Panel 1), positive correlation for Panel 2 and negative correlation for Panel 3 and the correlation is significant particularly for Panels 1 and 2. The positive correlation for Panel 2 arises as this panel composes of value companies that generally do not have problems paying dividends as opposed to growth companies (Panel 3 and hence negative correlation). Hypothesis 1 is thus accepted. The DPS is positively and significantly correlated with ΔDPS in respect of all panels. This confirms that current dividends are important determinants of pay-out policy. Hypothesis 2 thus is accepted. The SIZE shows a mixed but significant correlation with ΔDPS, particularly in respect of value companies. The direction of this association was not necessarily expected as one would have anticipated an outright positive correlation, that is, trend of value/bigger companies paying more dividends. This means that bigger companies are expected to be more liquid, have lower growth rates as they do not aggressively pursue investments and hence should pay higher dividends (see Andres et al. (2009:175) and Musa (2009:555) for the basis of expected direction of correlation). Hypothesis 3 is thus accepted. For the companies considered, these results suggest that larger companies may not necessarily pay higher dividends but rather may reinvest earnings in their assets. This phenomenon is in line with results of Ahmed and Javid (2008:148) and Musiega et al. (2013:253) for Pakistan and Kenya, respectively.

The EVA has a relative significant negative correlation with ΔDPS (all panels 1, 2 and 3). This correlation suggests that, in their pursuit to create value for shareholders, managers may sacrifice decisions to pay dividends. In fact, for growth companies, it is expected that they do not prioritise paying dividends, as is shown by the descriptive analysis above (see Table 3). Hypothesis 6 is thus rejected. These results are in line with the recognised strengths of EVA in creating value as noted by, among other scholars, Lehn and Makhija (1997:90).

Then, for all panels, the CH shows an insignificant positive correlation with ΔDPS, particularly for Panels 1 and 2, suggesting that, probably, keeping higher cash levels enables value companies to pay higher dividends. This confirms that a company's level of CHs is a key determinant of pay-out policy, which inferred association is in line with the predictions of the free cash flow hypothesis (Yoon & Starks 1995:995). Hypothesis 4 may also be accepted. These results are consistent with those of Andres et al. (2009:175), Musa (2009:555) and Liu and Chen (2015:194). In respect of observed target dividend levels, our regression analysis estimates a target speed of adjustment of almost 1 for all panels (1, 2 and 3). This is relative evidence of companies not necessarily smoothing dividends, that is, speed of adjustment equals to 1 or more; hence further evidence that the dividend relevance model may not provide good fit for South African pay-out policy (see Wolmarans 2003:243). Thus, hypothesis 5 is rejected. The speed of adjustment of almost 1 is relatively higher than that of Sibanda (2014:333) of 72.61% also for South African listed companies between 1995 and 2011, but it is still in line with the trend of non-smoothing of dividends.

Several factors may have contributed to the differences of speed of adjustments between the current study and Sibanda's. Firstly, the sample of the current study included all economic sectors, whereas Sibanda's study excluded public utility and financial services. Moreover, the data specifications, model building, management of possible errors in data modelling and choice of estimation procedures seem to differ significantly. Nonetheless, the two studies observe and confirm that South African companies target specific pay-out ratios.

Other notable South African studies, namely Firer et al. (2008:5), Firer and Viviers (2011:18), Pelcher (2019:7), Nyere and Wesson (2019:13) and similar studies from key economic regions in Africa, for example Musa (2009:555) on Nigeria and Musiega et al. (2013) on Kenya, do not estimate the speed of adjustment coefficients. It is important to indicate that the speed of adjustments observed by the current study and by Sibanda (2014:333) as reported above are much higher than those from reported trends in some developed economies. The speed of adjustments for the developed nations ranges from 12 to 45%.

Conclusion and recommendations

The purpose of this study was to review extended versions of dividend relevant pay-out models and add further explanatory variables to account for value creation and maximisation through dividends in an emerging economy, in this regard South Africa. The data of 110 sample companies were analysed. These companies were also divided into two groups, namely 85 value companies and 25 growth companies. The panel data estimators, namely OLS, Diff GMM, Sys GMM and LSDVC, were used and several results, both in terms of confirming results of previous researchers and relatively new observed trends as they relate to the South African setting, were noted. The study found current dividends and earnings to be key determinants of change in dividends. The size of company and level of CH were found to have insignificant correlation with current dividend. A closer look at the change in dividends trend among both value and growth companies suggests that irrespective of company type, corporate managers in South Africa are reluctant to change dividends that may have to be cut later.

Some further unique results have been noted: firstly, that EVA has a negative and significant correlation with the change in dividends. This suggests that growth companies sacrifice paying dividends in their pursuit of growth projects. Secondly, the level of CHs is a key determinant of pay-out decisions. The reported correlation among several explanatory variables, which include earnings and current dividends is observed as confirming that South African companies target certain pay-out ratios. Thirdly, in respect of noteworthy evidence for South Africa, it was also observed that in their endeavour to create and maximise value, managers may have to sacrifice paying dividends. This trend was evident more with growth companies than with value companies. Finally, it was noted that holding of a higher level by value companies affords them the opportunity to utilise the same to make pay-out decisions. The study also confirmed the results of similar previous research and observed some current trends relating to the South African corporate setting. Thus, it was found that companies have target pay-out ratios towards that they adjust. Furthermore, managers are reluctant to change (increase) dividends, which may have to be cut later. The novel contribution of this study is that it is one of the first studies of the impact of different variables on changes in dividends over time, executed in an emerging market.

The study provided recommendations that will be of benefit to practitioners and/or financial managers, policy makers, shareholders and academics. For practitioners and financial managers, the study provided them with enhanced alternatives regarding distribution decisions. This is confirmed through empirical evidence, notably, firstly, the sacrifice of dividend payments to use earnings generated to pursue investment opportunities. Secondly, the reluctance by managers to increase dividends as increases have to be sustainable. Thirdly and lastly, it is a unique finding for South Africa that growth companies create more value for shareholders than value companies. These are enhanced decision alternatives for financial managers in their endeavours to create and maximise value for shareholders, particularly in emerging markets. Implications for shareholders are that they should be better able to evaluate the creation of wealth by companies, particularly as it would arise from the distinction between value and growth companies. For example, the findings or results that 'growth' companies seem to show potential to create more value than 'value' companies should encourage shareholders not to undermine the value-creating prowess of growth companies. The policy developers have been blessed with more alternative dividend decision issues for the consideration in their endeavours. Implications for academics include that the study contributes to the debate regarding the importance of the distribution policy, by providing a platform to improve on dividend decision making research particularly regarding the creation of value.

Limitations of the study and areas for future research

Some limitations can be identified for this study. Firstly, the study focused on companies listed for the whole period, which raises the question of survivorship bias. What would the relationships between the variables addressed in this study be for companies who may have experienced financial distress and went bankrupt or were merged with other companies? This question is not addressed in this study. Secondly, the study only concentrated on listed companies. Could the relationship between the variables that were studies be different for unlisted companies? Thirdly, estimating the speed of adjustment to selected optimal pay-out ratios was not done in this study. Fourthly, the impact of share repurchases was not studied. More research to overcome these limitations is suggested for future researchers. It submitted that this study has contributed significantly to the debate regarding the importance of the distribution policy.

Acknowledgements

This article is an extract from a PhD study by the first author. The contents of this article are thus similar to some parts of that PhD study.

Competing interests

The authors declare that there are no competing interests whatsoever that could have influenced them on the writing of this article.

Authors' contributions

As a PhD student/graduate, F.M. prepared the full article. As supervisors and co-supervisors, respectively, on the project/article, H.W. and J.H. reviewed and advised on the key areas of the article.

Funding information

This project received no funding from any agency or entity.

Data availability

Data on this article may be made available by authors on request

Disclaimer

The views and opinions expressed in this research are of the authors not their affiliated or associated institutions.

References

Abubakar, N., 2019, 'Does level of information asymmetry determines dividend smoothing behaviour? Evidence from listed goods firms in Nigeria', Journal of Management Science and Entrepreneurship 17(7), 14-27. [ Links ]

Ahmed, H. & Javid, A.Y., 2008, Dynamics and determinants of dividend policy in Pakistan: Evidence from Karachi stock exchange non-financial listed, pp. 148-171, Working paper, viewed 22 February 2021, from https://mpra.ub.uni-muenchen.de/37342/1/MPRA_paper_37342.pdf. [ Links ]

Allen, D.E., 1992, 'Target payout ratios and dividend policy: British evidence', Managerial Finance 18(1), 9-21. https://doi.org/10.1108/eb018440 [ Links ]

Al-Kuwari, D., 2009, 'Determinants of the dividend policy in emerging stock exchanges: The case of the GCC countries', Global Economy and Finance Journal 2(2), 38-63. [ Links ]

Andres, C., Betzer, A., Goergen, M. & Renneboog, L., 2009, 'Dividend policy of German firms: A panel data analysis of partial adjustment models', Journal of Empirical Finance 16(2), 175-187. https://doi.org/10.1016/j.jempfin.2008.08.002 [ Links ]

Andres, C., Doumet, M., Fernau, E. & Theissen, E., 2015, 'The Lintner model revisited: Dividends versus total payouts', Journal of Banking and Finance 55, 56-69. https://doi.org/10.1016/j.jbankfin.2015.01.005 [ Links ]

Ang, J.S., 1998, 'An interpretation of the Lintner dividend model', Journal of Financial Education 24 (Spring), 81-83. [ Links ]

Arellano, M. & Bond, S., 1991, 'Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations', Review of Economic Studies 58(2), 277-297. https://doi.org/10.2307/2297968 [ Links ]

Arfianny, A., 2020, 'Factors affecting payout ratio dividends with foreign ownership as moderating variables in manufacturing companies on the Indonesian Stock. Exchange', Journal of Public Budgeting and Finance 3(1), 215-226. [ Links ]

Baker, H.K. & De Ridder, A., 2018, 'Payout policy in industrial and financial firms', Global Finance Journal 37, 138-151. https://doi.org/10.1016/j.gfj.2018.05.005 [ Links ]

Baker, H.K., Farrelly, G.E. & Edelman, R.B., 1985, 'A survey of management views on dividend policy', Financial Management 14(3), 78-84. https://doi.org/10.2307/3665062 [ Links ]

Baker, M. & Wurgler, J., 2004, 'A catering theory of dividends', Journal of Finance 59(3), 1125-1165. https://doi.org/10.1111/j.1540-6261.2004.00658.x [ Links ]

Barclay, M.J. & Smith, C.W., 2005, 'The capital structure puzzle: The evidence revisited', Journal of Applied Corporate Finance 17(1), 8-17. https://doi.org/10.1111/j.1745-6622.2005.012_2.x [ Links ]

Bhattacharya, S., 1979, 'Imperfect information, dividend policy, and "the bird in the hand" fallacy', Bell Journal of Economics 10(1), 259-270. https://doi.org/10.2307/3003330 [ Links ]

Blundell, R. & Bond, S., 1998, 'Initial conditions and moment restrictions in dynamic panel data models', Journal of Econometrics 87(1), 115-143. https://doi.org/10.1016/S0304-4076(98)00009-8 [ Links ]

Bodla, S.B. & Kumar, R., 2012, 'An Empirical Study of Financial Management Practices in Service Industry in India', International Journal of Research in IT and Management 2(2), 1148-1169. [ Links ]

Booth, L. & Zhou, J., 2015, 'Market power and dividend policy', Managerial Finance 41(2), 145-163. https://doi.org/10.1108/MF-12-2013-0346 [ Links ]

Bruno, G.S.F., 2005, 'Approximating the bias of the LSDV estimator for dynamic unbalanced panel data models', Economics Letters 87(3), 361-366. https://doi.org/10.1016/j.econlet.2005.01.005 [ Links ]

Crowther, D., Davies, M.L. & Cooper, S.M., 1998, 'Evaluating corporate performance: A critique of economic value added', Journal of Applied Accounting Research 4(2), 3-34. [ Links ]

DeAngelo, H. & DeAngelo, L., 2007, 'Payout policy pedagogy: What matters and why', European Financial Management 13(1), 11-27. https://doi.org/10.1111/j.1468-036X.2006.00283.x [ Links ]

DeAngelo, H., DeAngelo, L. & Stulz, L., 2006, 'Dividend policy and the earned/contributed capital mix: A test of the life-cycle theory', Journal of Financial Economics 81(2), 227-254. https://doi.org/10.1016/j.jfineco.2005.07.005 [ Links ]

De Mortanges, C. & Van Riel, A., 2003, 'Brand equity and shareholder value', European Management Journal 21(4), 521-527. [ Links ]

Erasmus, P., 2013, 'The influence of dividend yield and dividend stability on share returns: Implications for dividend policy formulation', Journal of Economic and Financial Sciences 6(1), 13-31. [ Links ]

Erasmus, P.D., 2008, 'Evaluating the information content of nominal and inflation-adjusted versions of the measure Economic Value Added (EVA)', Meditari Accountancy Research 16(2), 69-87. https://doi.org/10.1108/10222529200800013 [ Links ]

Elmagrhi, M.H., Ntim, C.G., Crossley, R.M., Malagila, J.K., Fosu, S. & Vu, T.V., 2017, 'Corporate governance and dividend pay-out policy in UK listed SMEs: The effects of corporate board characteristics', International Journal of Accounting and Information Management 25(4), 459-483. https://doi.org/10.1108/IJAIM-02-2017-0020 [ Links ]

Enow, S.T. & Hugh, I.E., 2018, 'Dividend pay-out and firms' profitability. Evidence in the financial service sector in South Africa', Journal of Accounting and Management 8(1), 44-51. [ Links ]

Fama, E.F. & Babiak, H., 1968, 'Dividend policy: An empirical analysis', Journal of the American Statistical Association 63(324), 1132-1161. [ Links ]

Fama, E.F. & French, K.R., 2001, 'Disappearing dividends: Changing firm characteristics or lower propensity to pay?', Journal of Financial Economics 60(1), 3-43. https://doi.org/10.1016/S0304-405X(01)00038-1 [ Links ]

Firer, C., Gilbert, E. & Maytham, A., 2008, 'Dividend policy in South Africa', Investment Analysts Journal 37(68), 5-20. https://doi.org/10.1080/10293523.2008.11082500 [ Links ]

Firer, C. & Viviers, S., 2011, 'Dividend policies of JSE-listed companies: 1989-2010', Management Dynamics 20(4), 2-22. [ Links ]

Fernau, E. & Hirsch, S., 2019, 'What drives dividend smoothing? A meta regression analysis of the Lintner model', International Review of Financial Analysis 61, 255-273. https://doi.org/10.1016/j.irfa.2018.11.011 [ Links ]

Flannery, M.J. & Hankins, K.W., 2013, 'Estimating dynamic panel models in corporate finance', Journal of Corporate Finance 19, 1-19. https://doi.org/10.1016/j.jcorpfin.2012.09.004 [ Links ]

Garrett, I. & Priestley, R., 2000, 'Dividend behaviour and dividend signalling', Journal of Financial and Quantitative Analysis 35(2), 173-189. https://doi.org/10.2307/2676189 [ Links ]

Goergen, M., Renneboog, L. & Correia da Silva, L., 2005, 'When do German firms change their dividends?', Journal of Corporate Finance 11(1), 375-399. [ Links ]

Healy, P.M. & Palepu, K.G., 2003, 'The fall of Enron', Journal of Economic Perspectives 17(2), 3-26. https://doi.org/10.1257/089533003765888403 [ Links ]

Hu, F. & Chen, X., 2012, 'Dividend smoothing and firm value: Evidence from Chinese firms', paper presented at the International Conference on Information Management, Innovation Management and Industrial Engineering, pp. 98-101, Sanya, 20-21st October. [ Links ]

Jensen, M.C. & Meckling, W.H., 1976, 'Theory of the firm: Managerial behavior, agency costs, and ownership structure', Journal of Financial Economics 3(4), 78-79. https://doi.org/10.1016/0304-405X(76)90026-X [ Links ]

Jeong, J., 2013, 'Determinants of dividend smoothing in emerging market: The case of Korea', Emerging Markets Review 17, 76-88. https://doi.org/10.1016/j.ememar.2013.08.007 [ Links ]

John, K. & Williams, J., 1985, 'Dividends, dilution, and taxes: A signalling equilibrium', Journal of Finance 40(4), 1053-1070. [ Links ]

Kalcheva, I. & Lins, K.V., 2007, 'International evidence on cash holdings and expected managerial agency problems', Review of Financial Studies 20(4), 1087-1112. https://doi.org/10.1093/rfs/hhm023 [ Links ]

Kasper, D., Schulz-Heidorf, K. & Schwippert, K., 2021, 'Multiple group comparisons of the fixed and random effects from the generalized linear mixed model', Sociological Methods and Research 20(10), 1-57. [ Links ]

Koussis, N. & Makrominas, M., 2019, 'What factors determine dividend smoothing by US and EU banks?', Journal of Business Finance and Accounting 46(7-8), 1030-1059. https://doi.org/10.1111/jbfa.12399 [ Links ]

Kumar, S. & Sharma, A.K., 2011, 'Further evidence on relative and incremental information content of EVA and traditional performance measures from select Indian companies', Journal of Financial Reporting and Accounting 9(2), 104-118. https://doi.org/10.1108/19852511111173086 [ Links ]

Kwan, C.C., 1981, 'Efficient market tests of the informational content of dividend announcements: Critique and extension', Journal of Financial and Quantitative Analysis 16(2), 193-206. https://doi.org/10.2307/2330646 [ Links ]

Labhane, N.B. & Mahakud, J., 2016, 'Factors affecting the likelihood of paying dividends: Evidence from Indian companies', Journal of Management Research 16(2), 59-76. [ Links ]

Lambrecht, B.M. & Myers, S.C., 2012, 'A Lintner model of payout and managerial rents', Journal of Finance 67(5), 1761-1810. https://doi.org/10.1111/j.1540-6261.2012.01772.x [ Links ]

Leary, M.T. & Michaely, R., 2011, 'Determinants of dividend smoothing: Empirical evidence', Review of Financial Studies 24(10), 3197-3249. https://doi.org/10.1093/rfs/hhr072 [ Links ]

Lehn, K. & Makhija, A.K., 1997, 'EVA, accounting profits, and CEO turnover: An empirical examination, 1985-1994', Journal of Applied Corporate Finance 10(2), 90-97. https://doi.org/10.1111/j.1745-6622.1997.tb00139.x [ Links ]

Lintner, J., 1956, 'Distribution of incomes of corporations among dividends, retained earnings', and taxes', American Economic Review 46, 97-113. [ Links ]

Liu, C. & Chen, A.S., 2015, 'Do firms use dividend changes to signal future profitability? A simultaneous equation analysis', International Review of Financial Analysis 37, 194-207. https://doi.org/10.1016/j.irfa.2014.12.001 [ Links ]

Marsh, T.A. & Merton, R.C., 1987, 'Dividend behaviour for the aggregate stock market', Journal of Business 60(1), 1-40. https://doi.org/10.1086/296383 [ Links ]

Matemane, M.R. & Wentzel, R., 2019, 'Integrated reporting and financial performance of South African listed banks', Banks and Bank Systems 14(2), 128-139. [ Links ]

Mikkelson, W.H. & Partch, M.M., 2003, 'Do persistent large cash reserves hinder performance?', Journal of Financial and Quantitative Analysis 38(2), 275-294. [ Links ]

Miller, M.H. & Modigliani, F., 1961, 'Dividend policy, growth, and the valuation of shares', Journal of Business 34(4), 411-433. https://doi.org/10.1086/294442 [ Links ]

Miller, M.H. & Rock, K., 1985, 'Dividend policy under asymmetric information', Journal of Finance 40(4), 1031-1051. https://doi.org/10.1111/j.1540-6261.1985.tb02362.x [ Links ]

Moyo, V., 2016, 'Dynamic capital structure adjustment: Which estimator yields consistent and efficient estimates?', Journal of Economic and Financial Sciences 9(1), 209-227. https://doi.org/10.2307/2098055 [ Links ]

Mueller, D.C., 1972, 'A life cycle theory of the firm', Journal of Industrial Economics 20(3), 199-219. [ Links ]

Munzhelele, F., 2019, 'Distribution policy and creation of shareholders' wealth: A study of firms listed on the Johannesburg Stock Exchange', doctoral dissertation, University of Pretoria. [ Links ]

Munzhelele, N.F., Wolmarans, H. & Hall, J., 2021, 'Corporate life cycle and dividend payout: A panel data analysis of companies in an emerging market', Journal of Economic and Financial Sciences 14(1), 1-9. https://doi.org/10.4102/jef.v14i1.701 [ Links ]

Musa, I.F., 2009, 'The dividend policy of firms quoted on the Nigerian Stock Exchange: An empirical analysis', African Journal of Business Management 3(10), 555-566. [ Links ]

Musiega, M.G., Alala, O.B., Musiega, D., Maokomba, O.C. & Egessa, R., 2013, 'Determinants of dividend payout policy among non-financial firms on Nairobi Securities Exchange, Kenya', International Journal of Scientific and Technology Research 2(10), 253-266. [ Links ]

Myers, S.C., 1984, 'The capital structure puzzle', The Journal of Finance 39(3), 574-592. https://doi.org/10.1111/j.1540-6261.1984.tb03646.x [ Links ]

Naceur, S., Goaied, M. & Belanes, A., 2006, 'On the determinants and dynamics of dividend policy', International Review of Finance 6(1-2), 1-23. https://doi.org/10.1111/j.1468-2443.2007.00057.x [ Links ]

Nakamura, A. & Nakamura, M., 1985, 'Rational expectations and the firm's dividend behavior', The Review of Economics and Statistics 67(4), 606-615. https://doi.org/10.2307/1924805 [ Links ]

Nguyen, D.Q. & Bui, Q.H., 2016, 'Factors affecting a firm's propensity to pay dividends: Evidence from Vietnamese listed companies', Journal of International Economics and Management 87, 77-99. [ Links ]

Nowak, S., Mrzygłód, U., Mosionek-Schweda, M. & Kwiatkowski, J.M., 2021, 'What do we know about dividend smoothing in this millennium? Evidence from Asian Markets', Emerging Markets Finance and Trade 57(13), 3677-3706. https://doi.org/10.1080/1540496X.2019.1711367 [ Links ]

Nworji, I.D., Adebayo, O. & David, A.O., 2011, 'Corporate governance and bank failure in Nigeria: Issues, challenges and opportunities', Research Journal of Finance and Accounting 2(2), 1-19. [ Links ]

Nyere, L. & Wesson, N., 2019, 'Factors influencing dividend payout decisions: Evidence from South Africa', South African Journal of Business Management 50(1), 1-16. https://doi.org/10.4102/sajbm.v50i1.1302 [ Links ]

Olabode, S.O., Olateju, O.I. & Bakare, A.A., 2019, 'An assessment of the reliability of secondary data in management science research', International Journal of Business and Management Review 7(3), 27-43. [ Links ]

Olarewaju, O.M., Sibanda, M. & Migiro, S.O., 2017, 'Dynamics of Lintner's model in the dividend payment process of Nigerian banks', SPOUDAI-Journal of Economics and Business 67(3), 79-94. [ Links ]

Omet, G., 2004, 'Dividend policy behaviour in the Jordanian capital market', International Journal of Business 9(3), 1083-4346. [ Links ]

Pandoyo, C.C. & Ugut, G.S.S., 2021, 'Factors affecting dividend payout ratios in LQ-45 (non-banking) companies listed in the Indonesian Stock Exchange, 2011-2019'. Enrichment: Journal of Management 11(2), 225-230, viewed 24 June 2022, from https://www.enrichment.iocspublisher.org/index.php/enrichment/article/view/73. [ Links ]

Pelcher, L., 2019, 'The role of dividend policy in share price volatility', Journal of Economic and Financial Sciences 12(1), 1-10. https://doi.org/10.4102/jef.v12i1.221 [ Links ]

Rahman, D.M. & Al Mamun, M.A., 2015, 'Lintner Model of dividend policy and its relevance - Evidence from Bangladesh', Journal of Business 36(2), 181-197. [ Links ]

Rajagopalan, N. & Zhang, Y., 2009, 'Recurring failures in corporate governance: A global disease?', Business Horizons 52(6), 545-552. https://doi.org/10.1016/j.bushor.2009.06.007 [ Links ]

Redding, L., 1997, 'Firm size and dividend payouts', Journal of Financial Intermediation 6(3), 224-248. https://doi.org/10.1006/jfin.1997.0221 [ Links ]

Rossouw, J. & Styan, J., 2019, 'Steinhoff collapse: A failure of corporate governance', International Review of Applied Economics 33(1), 163-170. https://doi.org/10.1080/02692171.2019.1524043 [ Links ]

Seneque, P.J.C. & Gourley, B.M., 1983, 'Dividend policy and practice in South Africa', Investment Analysts Journal 12(21), 35-41. https://doi.org/10.1080/10293523.1983.11082209 [ Links ]

Sibanda, M., 2014, 'Do firms smooth their dividends over time? Evidence from the Johannesburg Stock Exchange', Journal of Economics 5(3), 333-339. https://doi.org/10.1080/09765239.2014.11885009 [ Links ]

Smith, C.W., Ikenberry, D., Nayar, A., Anda, J., McVey, M. & Stewart, B., 2005, 'Morgan Stanley Roundtable on capital structure and payout policy', Journal of Applied Corporate Finance 17(1), 36-54. https://doi.org/10.1111/j.1745-6622.2005.023_1.x [ Links ]

Tekin, H. & Polat, A.Y., 2021. 'Do market differences matter on dividend policy?', Borsa Istanbul Review 21(2), 197-208. https://doi.org/10.1016/j.bir.2020.10.009 [ Links ]

Tong, Z., 2011, 'Firm diversification and the value of corporate cash holdings', Journal of Corporate Finance 17(3), 741-758. https://doi.org/10.1016/j.jcorpfin.2009.05.001 [ Links ]

Turakpe, M.J. & Fiiwe, J.L., 2017, 'Dividend policy and corporate performance: A multiple model analysis', Equatorial Journal of Finance and Management Sciences 2(2), 1-16. https://doi.org/10.2139/ssrn.2947308 [ Links ]

Uyar, A. & Kuzey, C., 2014, 'Determinants of corporate cash holdings: Evidence from the emerging market of Turkey', Applied Economics 46(9), 1035-1048. https://doi.org/10.1080/00036846.2013.866203 [ Links ]

Viviers, S., Firer, C. & Muller, C., 2013, 'A review of the dividend payments of South African listed companies during the period 1977-2011', Management Dynamics 22(4), 2-19. [ Links ]

Waweru, N.M., 2010, 'Do dividends matter? Some evidence from an emerging market', South African Journal of Accounting Research 24(1), 1-11. https://doi.org/10.1080/10291954.2010.11435144 [ Links ]

Wolmarans, H.P., 2003, 'Does Lintner's dividend model explain South African dividend payments?', Meditari Accountancy Research 11(1), 243-254. https://doi.org/10.1108/10222529200300015 [ Links ]

Yoon, P.S. & Starks, L.T., 1995, 'Signaling, investment opportunities, and dividend announcements', Review of Financial Studies 8(4), 995-1018. https://doi.org/10.1093/rfs/8.4.995 [ Links ]

Zondi, S. & Sibanda, M., 2015, 'Managerial ownership and firm performance on selected JSE listed firms', Corporate Ownership and Control 12(3), 233-241. https://doi.org/10.22495/cocv12i3c2p3 [ Links ]

Zurigat, Z. & Gharaibeh, M., 2011, 'Do Jordanian firms smooth their dividends? Empirical test of symmetric and asymmetric partial adjustment models', International Research Journal of Finance and Economics 81, 60-88. [ Links ]

Correspondence:

Correspondence:

Freddy Munzhelele,

freddy.munzhelele@univen.ac.za

Received: 15 Dec. 2021

Accepted: 08 July 2022

Published: 08 Nov. 2022