Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Acta Commercii

On-line version ISSN 1684-1999

Print version ISSN 2413-1903

Acta Commer. vol.22 n.1 Johannesburg 2022

http://dx.doi.org/10.4102/ac.v22i1.1028

ORIGINAL RESEARCH

Investigating the antecedents and outcome of commitment in a business-to-consumer service environment

Mornay Roberts-Lombard; Fulufhelo H. Nemadzhilili; Gabriella S.M.Q. Coelho; Onnalena S. Mangope

Department of Marketing Management, University of Johannesburg, Johannesburg, South Africa

ABSTRACT

ORIENTATION: Over the past two decades, a new school of thought has emerged that requires investigation into the multidimensional nature of commitment on loyalty.

RESEARCH PURPOSE: The study explores the extent to which the affective and calculative commitment of retail banking customers is influenced by selected antecedents, on the one hand, and its influence on loyalty on the other.

MOTIVATION FOR THE STUDY: Greater knowledge of the factors that influence the affective and calculative commitment of bank customers becomes important to enhance their loyalty in the competitive banking industry of South Africa.

RESEARCH DESIGN, APPROACH AND METHOD: The collection of data was secured from 400 retail bank customers through self-administered questionnaires and analysed using descriptive statistics and standard multiple regression.

MAIN FINDINGS: Perceived value, customer orientation, and expertise have a significant and positive influence on affective commitment and calculative commitment. Furthermore, affective commitment has a positive and significant influence on calculative commitment, while both affective and calculative commitment have a positive and significant influence on customer loyalty.

PRACTICAL/MANAGERIAL IMPLICATIONS: The study guides South African retail banks in developing an improved understanding of the importance of commitment (affective and calculative) as a precursor to loyalty in an emerging African market context. Moreover, it emphasises the importance of selected commitment stimuli that influence the future strengthening of the commitment-loyalty link.

CONTRIBUTION/VALUE-ADD: Through the application of a relationship marketing and social exchange theoretical framework, selected commitment (affective and calculative) stimuli are investigated to uncover their influence on strengthening the commitment-loyalty link.

Keywords: expertise; customer orientation; perceived value; service fairness; trust; customer loyalty.

Introduction

Loyalty has been widely acknowledged as a critical component in long-term relationship-building with customers (Affran, Dza & Buckman 2019; Jo & Mo 2018). Marketing scholars like Alam, Karim and Habiba (2021) and Omoregie et al. (2019) have claimed that the future loyalty intention of customers will increasingly depend on their level of commitment. As a result, enhanced knowledge of the multidimensional nature of commitment and its potential influence on the attitudinal and behavioural loyalty of customers is important in highly competitive environments (Boonlertvanich 2019). According to Wu, Cheng and Hussein (2019), loyalty encompasses the preparedness to repurchase a product or service continuously in the future. This results in the ongoing purchase of similar products or services from the brand, although competitors are offering better value offerings that could stimulate the willingness to switch. Over the past two decades, a new school of thought has emerged that requires investigation into the multidimensional nature of commitment on loyalty. An understanding of the multidimensional nature of commitment is important to strengthen the commitment-loyalty link (Khan et al. 2020). Park and Kim (2018) and Tabrani, Amin and Nizam (2018) argued in favour of understanding commitment from a multidimensional perspective, as it can assist banks in better understanding their customers' commitment needs. Fatima et al. (2020) and Hwang, Baloglu and Tanford (2019) agreed with this, stating that customers' future loyalty intentions are guided by their affective and calculative commitment to the service providers. These findings are imperative because affective and calculative commitments have been confirmed as important drivers of bank customers' future loyalty intentions (Petzer & Van Tonder 2019; Rather et al. 2019). Furthermore, affective and calculative commitments are perceived as important variables to strengthen the commitment-loyalty link (Kaur & Soch 2018).

The gentle make-up of the commitment-loyalty link can be ascribed to enhanced customer expectations. Increasingly, customers do not illustrate a willingness to commit to a service provider if the satisfaction of their needs and wants cannot be secured (Barnes & Krallman 2019). This argument is supported by Terblanche and Taljaard (2018), who stated that customers increasingly search for financial benefits and convenience when considering whether to remain in a relationship with a provider. Consequently, customers are less willing to commit and be loyal to their banks if their expectations are not exceeded (Alnaser, Ghani & Rahi 2018). Scholars (e.g. Reydet & Carsana 2017; Tabrani et al. 2018) represent a new school of thought arguing that to reinforce customer loyalty, customer commitment needs to be strengthened through an in-depth understanding of customers' emotional and financial needs and expectations. Moreover, Marinkovic and Obradovic (2015) and Quddoos et al. (2021) validated that the commitment-loyalty link can be strengthened when banks provide their customers with a service experience that is joyful, easy to use and engaging, whilst also offering economic benefits that customers perceive as favourable.

Relationship marketing studies have largely focused on the direct relationships between perceived value, expertise, customer orientation, service fairness, commitment and loyalty. In addition, commitment in relationship marketing studies has been explored mainly from a unidimensional perspective in a services marketing environment. The role of commitment as a multidimensional construct between its stimuli and loyalty remains unexplored in a banking environment in South Africa, an emerging African environment. Exploring such relationships is crucial, as loyalty reflects a longing by a customer to repurchase a specific product or service in the future (Li et al. 2021). Moreover, this is very important to understand in the competitive nature of the banking industry in an emergent market like Africa, where retail customers' loyalty cannot be secured. Consequently, customer commitment will directly influence the future loyalty of banking customers, thereby impacting the future survival of traditional banks (Ali, Isa & Ibrahim 2021; Islam et al. 2021).

The overall importance of commitment in its relationship with customer loyalty has been broadly explored (Aldaihani & Ali 2019). However, the lack of research on measuring the relationship between commitment as a multidimensional variable, its stimuli and customer loyalty in the South African banking industry remains unexplored. To explore this research gap, the primary focus of this study is to investigate the extent to which banking customers' affective and calculative commitment is influenced by perceived value, customer orientation, expertise and service fairness. The degree to which commitment influences customer loyalty is also explored. The banking industry in South Africa is the focus of this study, where high levels of competition are prevalent in the industry (BusinessTech 2018). In addition, there are low switching barriers in the industry, emphasising the importance of understanding the factors that influence customers' commitment (affective and calculative) and loyalty. The development of such knowledge will guide banks in South Africa to improve their customers' overall customer experience, which can positively influence their long-term loyalty intention. Ali et al. (2021) contended that customer commitment is a differentiating factor that could strengthen the future loyalty intentions of customers to their banks. Such a loyalty intention could also improve the sustainability of a bank in a highly competitive South African banking industry. Therefore, greater knowledge of the factors that influence the affective and calculative commitments of bank customers becomes important, and it is relevant to understand how such commitments influence their loyalty.

This study adds to theory, as it argues the importance of two relationship-building theories (namely relationship marketing theory and social exchange theory [SET]) in a continuously evolving services marketing setting of an emergent African market. In addition, the research establishes the significance of fostering affective and calculative commitment in reinforcing the commitment-loyalty link. Moreover, the study proposes a model that validates the relationships between affective and calculative commitment, its stimuli and outcome in South Africa. Regarding its practical contribution, the study guides banks in better understanding the factors that influence affective and calculative commitments and how these forms of commitment can strengthen customers' future loyalty intentions. Furthermore, banks can develop enhanced knowledge of the role of commitment as a multidimensional construct in future relationship building with customers over a long-term period. Finally, the normative dimension of commitment is not included in the study, because the psychological connection that a customer has with the bank was not measured in a South African banking industry context. Normative commitment was not considered a critical element that drives future loyalty in a banking context. The relevance of this is founded on the principle that normative commitment is guided by duty and not influence, which displays feelings of guilt (Fatima, Razzaque & Di Mascio 2015).

This article starts with a broad overview of the focus and background of the study, followed by the proposed theoretical framework that validates the hypotheses formulated for the study. The article ends with an orientation towards the methodology applicable to the study, the key findings and the practical implications proposed.

Theoretical framework and hypotheses testing

This study is guided by the relationship marketing theory and the SET. Relationship marketing theory is widely acknowledged as an important strategy in developing relationships with a long-term orientation towards customers (Khoa 2020; Magasi 2015). It is validated as a critical philosophy in the management of customer relationships from a purely transactional focus to a long-term relational approach (Casais, Fernandes & Sarmento 2020). Djajanto, Afiatin and Haris (2019) argued that relationship marketing is a strong driver of customer retention, because it is built on continuous customer engagement and collaboration. This sentiment is supported by scholars like Al-Dmour, Ali and Al-Dmour (2019) and Wongsansukcharoen (2022), who have stated that the management of customer relationships should be founded on the principle of engagement to strengthen loyalty. Considering this, relationship building should benefit all parties to the relationship and support long-term relationship-building elements, such as customer commitment and customer loyalty (Ahrholdt, Gudergan & Ringle 2019). Hence, a relationship marketing approach towards customer management requires an in-depth understanding of customers' expectations to strengthen their loyalty intentions towards the business (Sayil, Akyol & Simsek 2019). Consequently, businesses will benefit from maintaining the relationships with their customers by interacting with them, encouraging customer participation through surveys and offering incentives, which will increase customer retention and result in customer loyalty (Zaid 2020).

Social exchange theory departs from the principle of voluntary exchange between partners, such as a service provider and a customer (Cook et al. 2013). Social exchange theory can be described as an inclusive theory applied by multiple research disciplines (e.g. management, social psychology and anthropology) in a social sciences environment (Cropanzano et al. 2017). This theory implies that parties in a relationship expect to secure value exchange that is all-around beneficial (Molm 1994). As a result, the theory is built on the belief of mutual benefit, which guides all future exchanges between relational partners (Lioukas & Reuer 2015). Scholars (e.g. Quach et al. 2021; Yang et al. 2019) have validated that trust and loyalty are key elements of SET, emphasising their importance in future relationship building. Consequently, SET is perceived as a theory guided by social behaviour in the exchange process, where the level of trust between parties influences their future loyalty intentions (Boonlertvanich 2019).

Perceived value

Perceived value refers to the value exchange perception of the customer in terms of the benefits received versus the costs incurred to obtain the product or service (Pandey et al. 2020). Zietsman, Mostert and Svensson (2020) argued that perceived value is two-dimensional in nature. The first dimension encompasses the extrinsic nature (value is based on the product or service offering itself) of value. The second dimension considers value from an intrinsic (value is guided by the usage experience of the product or service) perspective. For the purpose of this study, both dimensions of perceived value (namely extrinsic and intrinsic) were measured (Nyadzayo 2010).

Expertise

Numerous scholars in the marketing field have described expertise as the knowledge ability of employees to manage the needs and expectations of customers (Vy & Tam 2021). For the purpose of this study, expertise encompasses customer opinion regarding employee knowledge and standing to secure future engagement and commitment to a supplier (Lombardi, Sassetti & Cavaliere 2019). In a South African context, expertise is viewed as a critical element in securing long-term relationship building in a competitive market context (Taoana, Quaye & Abratt 2021.)

Customer orientation

In a business context, a customer-orientated approach encompasses a deep and centred attitude towards understanding and addressing customer needs (Tseng 2019). Customer orientation encompasses a professional orientation towards service delivery that is guided by an in-depth understanding of the expectations of customers to strengthen long-term customer satisfaction (Mistrean 2021).

Service fairness

The customers of a service provider (such as a bank) perceive service fairness to be aligned with the level of service quality received (Seiders & Berry 1998). Consequently, the service experience of a customer can be assessed as either fair or unfair in the context of the service delivery process (Bhatt 2020). Considering this, service fairness for the purpose of this study is described as the customers' assessment of the level of justice received through a service engagement with a provider. Customers expect a service provider to satisfy them through an experience that is perceived as reasonable and that secures the satisfaction of their needs in an equitable manner (Hwang et al. 2019).

Affective commitment

In the marketing literature, affective commitment is used to measure the emotional attachment of a customer with a service provider, such as a bank (Van Tonder & Petzer 2021). Affective commitment is guided by consumer emotion, which influences their future intention to commitment to a service provider (Suhartanto et al. 2020). As a result, factors such as feelings of happiness, joy, belonging and association guide a customer's affective commitment to their service provider in this study (Fatima & Mascio 2020).

Calculative commitment

Calculative commitment is founded on relationships that are more economical in nature (Gezhi, Jingyan & Xiang 2020). This form of commitment is based on a customer's evaluation of the benefits received from the relationship versus the cost of remaining in the relationship (Anouze, Alamro & Awwad 2019). Consequently, the calculative commitment of a customer to a service provider in this study is guided by a rational assessment of the benefit-cost ratio as well as the availability of competitors at a given time (Ryu & Park 2020; Zhang & Zhang 2021).

Loyalty

Loyalty has been extensively validated in the marketing literature as an important element in the relationship-building process. Numerous scholars have confirmed the significance of measuring loyalty from a multidimensional perspective (namely, attitudinal and behavioural loyalty) (Rasool, Shah & Tanveer 2021). In a service context, the perception of the customer towards the level of service quality and overall value received, as well as the level of satisfaction attained, influences both attitudinal and behavioural loyalty (Christian, Anning-Dorson & Tackie 2021; El-Manstrly et al. 2011). Therefore, to strengthen the foretelling ability of loyalty, both attitudinal and behavioural loyalties were applied to the study (Pritchard & Howard 1997).

Theoretical model development

The inter-relationship between perceived value and affective commitment

Hansopaheluwakan et al. (2020) defined perceived value as the total performance measurement that consumers hold over a product or service, determining their future perceptions of this product or service. The move from traditional marketing to relationship marketing has led to brands focusing more on the consumers' affective commitment to better understand them and provide the best-quality products and services (Maheshwari, Lodorfos & Jacobsen 2014). Affective commitment, which is the customers' emotional attachment to the brands, is influenced by the value the customers perceive. The level of perceived value of a service impacts the customers' emotional bond with the brands. Therefore, it is hypothesised that:

H1a: Perceived value has a positive and significant influence on affective commitment.

The inter-relationship between perceived value and calculative commitment

According to Ali et al. (2018), customers who get quality services view the service providers positively and are more committed, less complaining, more agreeable and prepared to pay premium prices, which can lead to a more noteworthy profit. A brand's ability to meet and exceed the customers' perceived economic expectations and to keep its promises leads to calculative commitment, as customers' perceived switching costs are higher compared to the benefits of committing to a brand (Kim & Kim 2020). Kungumapriya and Malarmathi (2018) concurred, stating that the calculative commitment of a customer will be high if the rewards of remaining associated with the provider are more than the costs to remain in the relationship, as well as if the cost to switch to a competitor is high. This implies that customers perceive the value to remain in the relationship positively, strengthening the overall calculative commitment (Petzer & Van Tonder 2019). Against this discussion, the following hypothesis is formulated:

H1b: Perceived value has a positive and significant influence on calculative commitment.

The inter-relationship between customer orientation and affective commitment

Customer orientation embraces a service-engaging approach that is founded on the identification and management of customer needs and expectations in a professional manner. This approach intends to strengthen the long-term satisfaction and ultimately the potential loyalty of customers (Alavi et al. 2018). Alteren and Tudoran (2016) proposed that customer orientation is vital in strengthening affective commitment. When customers have identified a positive customer focus in their engagement with a service provider, they give positive feedback by feeling attached to the provider (e.g. a bank) and want to maintain the relationship (Van Tonder & Petzer 2021). Wang (2016) concurred with this finding, arguing that emotional attachment to a particular brand will arise once a service provider goes all out to seek customers' opinions and track their feelings. Consequently, it is hypothesised that:

H2a: Customer orientation has a positive and significant influence on affective commitment.

The inter-relationship between customer orientation and calculative commitment

From a service provider's perspective, customer orientation can be described as the engagement between the service and the customer that leads to the customer's positive behaviour towards a service provider (Jung & Yoo 2019). This is especially true from an economical perspective, as a customer anticipates the economic benefits from the relationship with the provider (e.g. a bank) to be more than the costs incurred when continuing with the relationship (Vera & Trujillo 2013). As a result, the financial benefits accrued from the relationship should exceed the costs of remaining in the relationship to sustain the customer's willingness to support the service provider (Petersen et al. 2018). Hence, it is hypothesised that:

H2b: Customer orientation has a positive and significant influence on calculative commitment.

The inter-relationship between expertise and affective commitment

Expertise is the capability that the staff members of an organisation possess to assist customers to fulfil their needs based on the customers' judgement (Dickson, McVittie & Kapilashrami 2018). Petzer and Roberts-Lombard (2021) argued that expertise encompasses having favourable skills and knowledge to execute the service rendered. Employee expertise strengthens the overall brand quality perception of organisations and positively affects customer commitment, creating a competitive advantage for the service provider (Makanyeza & Mumiriki 2016). Expertise directly influences customers' emotional well-being through the perception developed of the service experience attained (Lombardi et al. 2019). Accordingly, customers feel emotionally attached to service providers if they perceive employees to be well-trained, knowledgeable and professional in their ability to service their needs and expectations (Bahadur, Aziz & Zulfiqar 2018). Thus, it is hypothesised that:

H3a: Expertise has a positive and significant influence on affective commitment.

The inter-relationship between expertise and calculative commitment

Employee expertise offers customers the reassurance that employees possess the right skills and knowledge (Lombardi et al. 2019). Scholars (e.g. Saxena & Singh 2015; Suhartanto et al. 2020) argue that customers measure the benefit of remaining with the service provider against their level of engagement with employees, determining whether the latter provides a service experience that validates the service fees or costs paid for the service. Customers want to feel that the cost of remaining in the relationship with the bank is less than the value received from the expertise of the bank employees (Ali et al. 2018). According to Saxena and Singh (2015) and Yuan, Lai and Chu (2019), employee expertise makes it economically worthwhile to remain in the relationship, as its value-add exceeds the financial cost of leaving the bank. As a result, it is hypothesised that:

H3b: Expertise has a positive and significant influence on calculative commitment.

The inter-relationship between service fairness and affective commitment

Service fairness is the assessment made by customers relating to the level of justice which businesses present through their behaviour (Crisafulli & Singh 2016; Gokmenoglu & Amir 2021). Customers determine service fairness through their engagement with the providers when purchasing products and services (Bhatt 2020; Namkung & Jang 2010). Customers evaluate their encounters directly with individuals (e.g. employees) and perceive the outcome as just or unjust, which can affect their emotional state, opinions and behaviour (Sofiana & Prihandono 2019). Affective commitment remains strong when customers perceive that it is emotionally beneficial to be committed to the relationship in the long term (Farooq & Moon 2020). Therefore, it is hypothesised that:

H4a: Service fairness has a positive and significant influence on affective commitment.

The inter-relationship between service fairness and calculative commitment

Service fairness influences customers' calculative commitment with service providers, such as banks (Kim & Kim 2020). Calculative commitment is formed when customers choose to develop a sustainable relationship with service providers in the future (Dalziel, Harris & Laing 2021). However, this will depend on the customers having to remain in the relationship in future. This need will be guided by the overall cost of switching to a competitor, amongst other factors. The perceived termination of switching costs associated with leaving for an alternative service provider is also considered (Shukla, Banerjee & Singh 2016). Kim, Shin and Koo (2018a) contended that when customers recognise positive levels of fairness in the service provided, it positively affects their calculative commitment, as the customers' perceived service fairness of the service providers can influence the economic benefit or cost of being associated with the organisations (Evanschitzky et al. 2017). Consequently, it is hypothesised that:

H4b: Service fairness has a positive and significant influence on calculative commitment.

The inter-relationship between affective commitment and calculative commitment

Affective commitment involves a customer's emotional response concerning a service provider, determining the level of attachment to the brand (Iglesias, Markovic & Rialp 2019). According to Sari and Wijaya (2019), customers' affective commitment is guided by their emotional attachment with the service business, such as a bank. The customer's affective commitment is built on aspects such as attachment with the brand, feeling of belonging to the brand and overall level of attachment with the service provider (Shukla et al. 2016). When customers feel an emotional bond with the brands, it positively influences their calculative commitment, because the customers' emotional connection to the brands can influence the economic benefit or cost of being associated with them (Kim & Kim 2020). In addition, the emotional connection of customers with service providers influences their affective commitment to the supplier brands (Khan et al. 2020). Therefore, if customers feel emotionally committed to a brand, it influences their economical perception of remaining in the relationship. Hence, affective commitment influences calculative commitment (Poushneh & Vasquez-Parraga 2019). Considering this, it can be hypothesised that:

H5: Affective commitment has a positive and significant influence on calculative commitment.

The inter-relationship between affective commitment and loyalty

Mikulić, Šerić and Milković (2017) explained that the level of affective commitment is significant in influencing customer loyalty towards a service business. Customers will show a greater intention to establish long-term relationships with service providers when there is a favourable emotional attachment to the services rendered (Al Samman & Mohammed 2021). Scholars like Chuang et al. (2016) and Lacroix, Rajaobelina and St-Onge (2020) agreed that when a customer feels emotionally attached to a service provider, an emotional bond is developed, stimulating a future intent to become loyal to the service brand. Hence, if customers are emotionally attached to the service providers through feelings of belonging and identification with the brands, their affective commitment is strengthened and thereby their loyalty (Junaidi, Wicaksono & Hamka 2021). From the above, the following hypothesis is formulated:

H6: Affective commitment has a positive and significant influence on customer loyalty.

The inter-relationship between calculative commitment and customer loyalty

Calculative commitment is a customer's feeling of responsibility towards a service business when less attractive alternatives can be considered or when there are no other providers to be considered (Shukla et al. 2016). Dessart, Aldás-Manzano and Veloutsou (2019) argued that a customer's calculative commitment towards a provider will only be established if the overall benefits of remaining in the relationship exceed the costs of remaining in the relationship. Consequently, calculative commitment will positively influence the customer's future loyalty. This is specifically relevant when the benefit-cost ratio for the customer contains more benefits than costs (Carvalho & Fernandes 2018). Ojeme, Robson and Coates (2018) stated that a customer's calculative commitment to a provider will remain strong when the economic benefits of such a relationship outweigh the cost of remaining in the relationship. However, when the cost of switching providers is very high, the customer may remain in the relationship for economic reasons, thus strengthening positive behavioural intentions (Richard & Zhang 2012). Consequently, the customer's loyalty to a service provider will remain strong when the economic cost of remaining in the relationship is lower than the value obtained to continue with the relationship in future (Izogo & Jayawardhena 2019). Thus, it is hypothesised that:

H7: Calculative commitment has a positive and significant influence on customer loyalty.

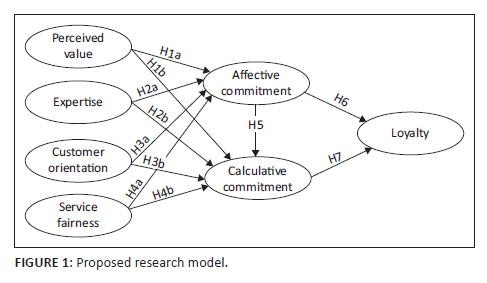

Considering the discussion above, a research model is proposed in Figure 1.

Methodology

This study used a descriptive research design, and data were collected from retail banking customers in South Africa, aged 18 years and older, holding a bank account at one of the major retail banks in the country (Amalgamated Banks of South Africa [ABSA], First National Bank [FNB], Nedbank, Standard Bank and Capitec Bank). These bank customers embodied the sampling units and elements included in the study. Retail banking customers who had been with their bank for one year or longer were selected to determine the extent to which customers were committed, ultimately influencing their future loyalty intentions. In addition, screening questions and quotas were applied to ensure that the sample selected adhered to the specified prerequisites to participate in the study.

Five fieldworkers residing in South Africa's Gauteng province were employed to collect data. The fieldworkers were expected to identify people in their circle of friends, family and coworkers who adhered to the prerequisites to partake in the study. In addition, these fieldworkers had to fill quotas based on the gender and age of respondents in a purposeful manner, thereby ensuring that the target population was well represented in the study. A nonprobability sampling approach, through the application of quota sampling, was followed to select the sample included in the study. A paper-based self-administered questionnaire was used to collect the data over a three week period. A total of 400 questionnaires were used for data collection purposes.

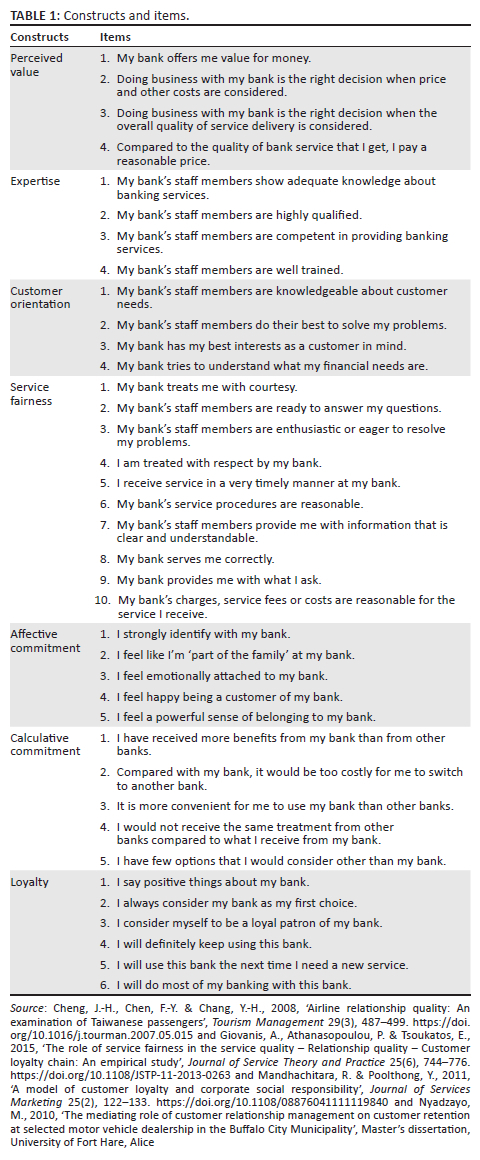

Regarding the questionnaire, the first part contained three screening questions to ensure the respondents adhered to the quota requirements stipulated by the study. Furthermore, the questionnaire encompassed a section requesting information on the retail banking customers' demographic profile and sections on the different constructs included in the study. These constructs (i.e. perceived value, expertise, customer orientation, service fairness, affective commitment, calculative commitment and loyalty) were measured using a seven-point Likert scale. The items that measured perceived value were adapted from Nyadzayo (2010); the items measuring expertise and customer orientation were adapted from Cheng, Chen and Chang (2008); and the items measuring service fairness and affective and calculative commitments were adapted from Giovanis, Athanasopoulou and Tsoukatos (2015). Finally, the attitudinal and behavioural loyalty constructs were measured with adapted items from Mandhachitara and Poolthong (2011) (see Table 1).

Following the data coding, capturing and editing process, the Statistical Package for Social Sciences (SPSS) version 24 was used in this study to analyse the results. The application of Cronbach's alpha values secured the establishment of construct reliability of the measurement items used in the research instrument. In addition, the research instrument was proved to be valid by aligning the measurement items with the study's proposed objectives, thereby ensuring that the study indeed measured its intended aim. Data analysis techniques, such as descriptive statistics and standard multiple regression analysis, were used to establish whether the proposed relationships between affective and calculative commitment, its stimuli and outcome in a retail banking environment were valid.

Results

The discussion of the results is based on a presentation format adapted from the works of various authors to secure clarity of presentation. This format provides a general overview of the results in an easy to read and understand manner (Jaiyeoba, Chimbise & Roberts-Lombard 2018; Roberts-Lombard & Du Plessisi 2012; Roberts-Lombard et al. 2020).

Exploratory factor analysis

An exploratory factor analysis (EFA) was conducted to perform a first-order factor analysis. Williams, Onsman and Brown (2010) stated that EFA can be perceived as a method of measure applied to establish how variables in a data set are testing formulated hypotheses. The application of an EFA is secured when constructs are used in their original form or when the inclusion or exclusion of constructs is secured for further data analysis. Furthermore, the measure of sampling adequacy for the anti-image correlation secured from SPSS indicated that the communality values for all the items of the seven constructs were above the minimum value limit of 0.377 (Pallant 2016; Zikmund et al. 2017). Therefore, the constructs used in the study (inclusive of their items) were perceived as satisfactory to secure further data analysis.

Reliability and validity

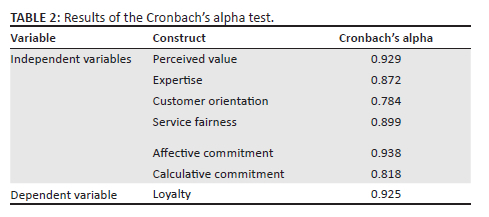

The application of Cronbach's alpha values was secured to establish internal consistency. Cronbach's alpha implies value as a measure of scale reliability, where an acceptable value is 0.7, with a preferred value being 0.8 or higher. Saunders, Lewis and Thornhill (2016) stated that values below 0.7 do not reflect reliability. Considering this, the Cronbach's alpha values obtained for this study reflected reliability, as illustrated by Table 2. As the Cronbach's alpha values for all the constructs in the study exceeded the 0.7 cut-off, internal consistency reliability was achieved.

The various scale items used in the questionnaire and applied to the study were assessed by the researchers. Moreover, a pilot study was conducted to determine the validity of the questionnaire as the research instrument applied to the study. The pilot study intended to determine the validity of the questionnaire before it was formally fielded.

Exploring the means, standard deviations and the correlation matrix calculated

Regarding the different constructs in the study, different statistics such as the mean ( ) and standard deviation (σ) were calculated. Table 3 illustrates the Pearson's product-moment correlation matrix, and the different mean and standard deviation values for each of the constructs applied to the study.

) and standard deviation (σ) were calculated. Table 3 illustrates the Pearson's product-moment correlation matrix, and the different mean and standard deviation values for each of the constructs applied to the study.

To establish whether the correlations between the constructs are significant, the R-value should be between 1 and -1, where 1 suggests a perfect relationship and a value below -1 suggests a negative relationship between the constructs or variables. From the data in Table 3, it is clear that the relationships between the constructs are positive, as all the Pearson coefficient values are greater than 0.05 (R > 0.05). This also confirms that none of the constructs have a negative relationship, as they are all positive values. In conclusion, the relationship between the constructs can be accepted as positive, with the highest relationship being between customer orientation and expertise, with a Pearson correlation value of 0.890.

Demographics

All respondents participating in the study had their own bank accounts at any one of the selected major banking brands applied to the study. On average, the respondents were 35 years old and, considering that the study required gender quotas to be filled, the sample was nearly equally split between male and female respondents. Most respondents spoke English as their first language (35.6%), followed by Sepedi (22.7%). Furthermore, the largest number of respondents (39.9%) stated that they were full-time employees of an organisation, had bank accounts with Capitec Bank (31.3%) and FNB (24.8%), had a savings account (74.8%) or a chequing account (38.5%) at their bank and spent on average R500 a month on banking charges (77.3%). Finally, most respondents held a post-matric qualification (65.8%), followed by those with a Grade 12 certificate (29.9%). The respondents had also been with their bank for approximately four or more years.

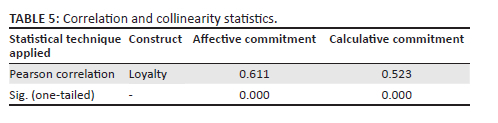

Assumptions of multiple regression analysis

Before a regression analysis was conducted, the assumptions of multiple regression analysis were confirmed. The sample size had to exceed 82 when considering the formula N > 50 + 8m (m = number of independent variables). In this study, the sample size consisted of 400 respondents (Tabachnick & Fidell 2007), exceeding the minimum required number of sample elements. In terms of multicollinearity, high correlation between the variables is only present if the Pearson's correlation coefficient (r) is equal to or higher than 0.9. In this study, all the relationships tested showed correlation, with no relational correlation being above 0.9 (see Table 4 and Table 5). As a result, multicollinearity was not perceived as a risk.

Furthermore, normality in the study was established by considering histograms where normal distribution is clear when the largest number of scores are concentrated around the central point. The histograms applied to the study illustrated normality for all formulated hypotheses. Finally, in terms of linearity, residuals should secure a linear relationship with the predicted dependent variable scores (Pallant 2010). Scatter plots were used to test linearity and all linear relationships were present across all hypotheses. Considering this, all assumptions were secured to conduct a multiple regression analysis.

Multiple regression analysis

The application of multiple regression analysis was secured to determine the inter-relationship between selected variables in the study. This discussion follows below.

The influence of independent variables on affective commitment

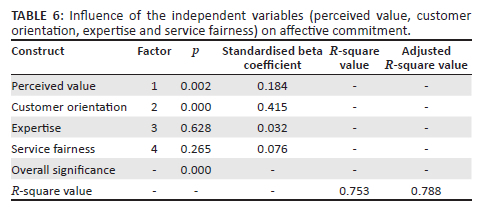

Multiple regression analysis was used to determine the inter-relationship between the selected independent variables (i.e. perceived value, expertise, customer orientation and service fairness) and affective commitment. The results are presented in Table 6.

From the data in Table 6, it is clear that customer orientation and perceived value have a positive and significant influence (p = 0.000) on affective commitment. The table further indicates that expertise and service fairness show a positive, although not significant, influence on affective commitment. This is because the p-values for expertise (p = 0.628) and service fairness (p = 0.265) in their relationship with affective commitment are larger than 0.05. The researchers applied a 95% level of confidence in the analysis of the data. This implies that a p-value of 0.05 or less indicates that it is unlikely that the results are the result of chance, according to the independent sample t-test. Table 6 reflects that a one-unit increase in customer orientation will increase affective commitment by 41.5%, whilst a one-unit increase in perceived value will increase affective commitment by 18.4%. Furthermore, the independent variables indicated around 78.8% (R-squared = 0.788) of the variance in affective commitment. The regression model for the constructs is significant at p < 0.000. Overall, the independent variables can be perceived as predictors of affective commitment. It can be argued that 78.8% of a possible change in the level of affective commitment in the South African banking industry is caused by perceived value, expertise, customer orientation and service fairness. In conclusion, the relationship between the independent variables and affective commitment is overall significant at p = 0.000.

The influence of independent variables on calculative commitment

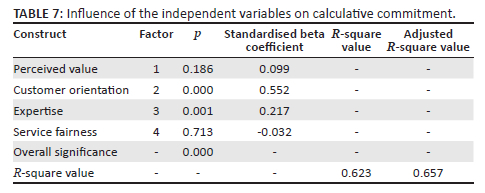

Multiple regression analysis was conducted to determine the inter-relationship between the selected independent variables (perceived value, expertise, customer orientation and service fairness) and calculative commitment.

As per Table 7, customer orientation and expertise have a positive and significant influence (p = 0.000) on calculative commitment. The table further indicates that perceived value has a positive, but not a significant, influence on calculative commitment, as the p-value is above 0.05 (p = 0.186). In addition, service fairness has a negative and nonsignificant influence on calculative commitment, as the p-value is above 0.05 (p = 0.713). The researchers applied a 95% level of confidence in the analysis of the data. Therefore, a p-value of 0.05 or less indicates that it is unlikely that the results are because of chance, according to the independent sample t-test. Table 8 shows that a one-unit increase in customer orientation will increase trust by 55.2%. Similarly, a one-unit increase in employee expertise will increase trust by 21.7%. Moreover, the independent variables indicated around 65.7% (R-squared = 0.657) of the variance in calculative commitment. The regression model for the constructs is significant at p < 0.000. Thus, the independent variables can be perceived as predictors of calculative commitment. As a result, it can be argued that 65.7% of a possible change in the level of calculative commitment in the South African banking industry is caused by perceived value, expertise, customer orientation and service fairness. In conclusion, the relationship between the independent variables and calculative commitment is overall significant at p = 0.000.

The influence of affective commitment on calculative commitment

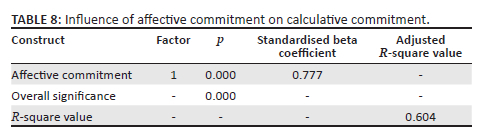

Multiple regression analysis was conducted to determine the inter-relationship between the affective commitment and calculative commitment.

From Table 8, it is clear that affective commitment has a positive and significant influence (p = 0.000) on calculative commitment. The researchers applied a 95% level of confidence in the analysis of the data. This implies that a p-value of 0.05 or less indicates that it is unlikely that the results are because of chance, according to the independent sample t-test. Table 8 illustrates that a one-unit increase in affective commitment will increase calculative commitment by 77.7%. Similarly, a one-unit increase in employee expertise will increase trust by 21.6%. Affective commitment indicated around 60.4% (R-squared = 0.604) of the variance in customer loyalty. The regression model for the constructs is significant at p < 0.000. Therefore, affective commitment can be perceived as a predictor of customer loyalty, as a one-unit increase in affective commitment will increase calculative commitment by 77.7%, when considering beta. Thus, it can be argued that the relationship between affective commitment and calculative commitment is significant at p = 0.000.

The influence of affective commitment on customer loyalty

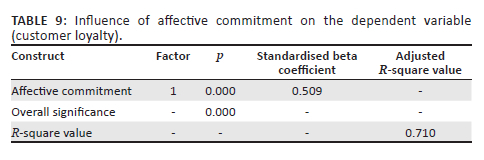

Multiple regression analysis was conducted to determine the inter-relationship between affective commitment and customer loyalty.

From Table 9, it is clear that affective commitment has a positive and significant influence (p = 0.000) on customer loyalty. The researchers applied a 95% level of confidence in the analysis of the data. This implies that a p-value of 0.05 or less indicates that it is unlikely that the results are because of chance, according to the independent sample t-test. Table 9 indicates that a one-unit increase in affective commitment will increase loyalty by 50.9%. Affective commitment indicated around 71.10% (R-squared = 0.710) of the variance in customer loyalty. The regression model for the constructs is significant at p < 0.000. Therefore, affective commitment can be perceived as a predictor of customer loyalty, as a one-unit increase in affective commitment will increase customer loyalty by 50.9%, when considering beta. Hence, it can be argued that the relationship between affective commitment and customer loyalty is significant at p = 0.000.

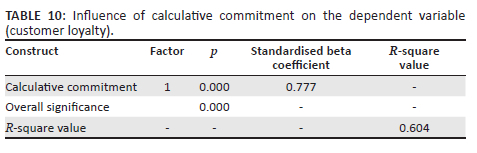

The influence of calculative commitment on customer loyalty

Multiple regression analysis was conducted to determine the inter-relationship between calculative commitment and the dependent variable (customer loyalty).

It is clear from Table 10 that calculative commitment has a positive and significant influence (p = 0.000) on customer loyalty. The researchers applied a 95% level of confidence in the analysis of the data. This implies that a p-value of 0.05 or less indicates that it is unlikely that the results are because of chance, according to the independent sample t-test. Table 10 indicates that a one-unit increase in calculative commitment will increase loyalty by 77.7%. Calculative commitment indicated around 60.40% (R-squared = 0.604) of the variance in customer loyalty. The regression model for the constructs is significant at p < 0.000. Overall, calculative commitment can be perceived as a predictor of customer loyalty, as a one-unit increase in calculative commitment will increase customer loyalty by 77.7%, considering beta. As a result, it can be argued that the relationship between calculative commitment and customer loyalty is significantly positive at p = 0.000.

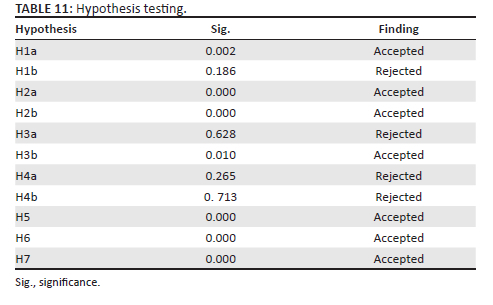

Against the background of the discussion above, hypotheses H1a, H2a, H2b, H3b, H5, H6 and H7 are accepted. Table 11 presents the outcomes of the formulated hypotheses in the study.

Discussion

The importance of customer loyalty in differentiating a service provider in a competitive market is widely acknowledged (Kuksov & Zia 2021; Makudza 2021). This is vital considering the competitive nature of the banking environment in South Africa (Willemse-Snyman 2020). Although numerous scholars have asserted that loyalty is an outcome of commitment (Petzer & Van Tonder 2019), there is a growing school of thought contending that loyalty must be explored from multiple commitment perspectives in different industries (Khraiwish et al. 2022; Kim, Kim & Lee 2018b). As a result, exploring the potential influence of affective and calculative commitments on loyalty to strengthen the commitment-loyalty link has been proposed.

Supported by relationship marketing theory and SET, the aim of this study was to explore the role of affective and calculative commitments in strengthening the commitment-loyalty link of retail banking customers in an emergent African market, such as South Africa. Perceived value and customer orientation have been validated as important elements in strengthening customer commitment (Karjaluoto et al. 2019; Kumra & Sharma 2022; Taleghani, Gilaninia & Mousavian 2011). In this study, the results revealed that perceived value (β = 0.184, p = 0.002) and customer orientation (β = 0.415, p = 0.000) have a positive and significant influence on affective commitment. In addition, it was established that customer orientation (β = 0.552, p = 0.000) and expertise (β = -0.217, p = 0.010) have a positive and significant influence on calculative commitment. Furthermore, affective commitment (β = 0.604, p = 0.000) has a positive and significant influence on calculative commitment, and affective commitment (β = 0.509, p = 0.000) positively and significantly influences customer loyalty. Finally, it was determined that calculative commitment (β = 0.777, p = 0.000) has a positive and significant influence on customer loyalty in the banking industry of South Africa as an emerging African market. These findings are consistent with research by Nora (2019) and Suhartanto et al. (2018), which established that customer commitment and loyalty are driven by a service experience that is characterised by a positive customer orientation, value-adding services and expertise. This implies that the selected stimuli of commitment are strong predictors of affective and calculative commitments. Hence, it is argued that the selected stimuli of commitment (both affective and calculative) strengthen customers' commitment to their banks, ultimately strengthening their future loyalty intentions.

The results further show a positive and significant relationship between affective commitment (β = 0.777, p = 0.000) and calculative commitment (β = 0.777, p = 0.000) and customer loyalty (β = 0.509, p = 0.000). This suggests that affective and calculative commitments are directly related to customer loyalty. This finding aligns with previous research findings establishing that affective and calculative commitments are strong precursors to customers' loyalty (Khan et al. 2020; Schirmer et al. 2018; Van Tonder & De Beer 2018). These two types of commitment act as stimuli to the strengthening of customer loyalty in South Africa's banking industry. This research established that when customers identify strongly with their banks through an emotional connection that makes them happy, and when the benefits of remaining with their banks outweigh the costs of remaining with their bank, they will show a greater intent to remain with their banks in the long term. As a result, bank customers will continue to use the services offered by their banks, as they can positively identify with them through feelings of attachment and economic benefit.

Theoretical implications

The study findings conclude that customer orientation, perceived value and expertise have a significant and positive influence on affective and calculative commitment. Furthermore, affective and calculative commitments have a positive and significant influence on customer loyalty. Previous research (Herjanto & Amin 2020; Komulainen & Saraniemi 2019; Nora 2019) has confirmed that the more knowledgeable, service-orientated and understanding banks are of their customers' service and product expectations, the more committed, and ultimately loyal, their customer base will become to the banking brands. Moreover, scholars (e.g. Ganaie & Bhat 2020; Schirmer et al. 2018) have confirmed that enhanced levels of affective and calculative commitment strengthen customer loyalty.

The results of this study also validate that the scales used to measure perceived value, expertise, customer orientation, service fairness, affective commitment, calculative commitment and customer loyalty regarding banking services in South Africa are reliable and valid. The proposed hypothesised model has been validated, endorsing the relationship between affective and calculative commitments and their stimuli, and the influence on the loyalty intention of banking customers in South Africa.

Improved understanding of the stimuli of calculative commitment, strengthening the commitment-loyalty link

The findings of this study confirm the inter-relationship between selected stimuli of affective commitment, calculative commitment and customer loyalty. An understanding of these direct relationships is imperative, as it has implications for the discipline of marketing. Customers' loyalty is built on an in-depth understanding of the factors that influence their affective and calculative commitments. Additionally, it is reasonable to believe that if customers feel emotionally attached and perceive the benefits received from remaining in a relationship with the service provider as positive, their commitment is enhanced and their loyalty is strengthened (Evanschitzky et al. 2006; Poushneh & Vasquez-Parraga 2019). Moreover, when customers feel attached to a brand and experience feelings of happiness and contentment, they are more inclined to be loyal to the service provider (refer to Table 5 and Table 6) (Šeinauskienė, Maščinskienė & Jucaitytė 2015). Numerous studies have supported the relevance of commitment as a precursor to loyalty in business-to-consumer (B2C) studies (Aksoy et al. 2015). Nevertheless, the present results enhance research findings on the customer commitment-loyalty link by expanding on the role of affective commitment and calculative commitment as critical precursors to loyalty.

A perspective on affective commitment in strengthening customer loyalty

Considering the findings, there is support for the precursor role of affective commitment in strengthening customer loyalty (Khan et al. 2020; Mainardes, Rosa & Nossa 2020). Scholars (e.g. Lubis et al. 2020; Quddoos et al. 2021) have widely argued that affective commitment is a critical factor to enhance the overall loyalty intention of customers in multiple settings and should be more intensively explored in studies that investigate the commitment-loyalty link. Therefore, although the business sector needs to develop an understanding of the factors that positively influence affective commitment in a B2C environment (customer orientation and perceived value), it must also understand that affective commitment remains crucial in the strengthening of future loyalty intentions. Studies in the marketing domain could consider expanding on the results of this study by looking at the mediating role of affective commitment in the strengthening of future loyalty intentions in a services or product environment.

A perspective on calculative commitment in strengthening customer loyalty

The research findings support the precursor role of calculative commitment in strengthening customer loyalty (Khan et al. 2020; Ojeme et al. 2018). Scholars (e.g. Ali & Javaid 2020; Farooq & Moon 2020) have argued that calculative commitment is an important variable that can influence the overall loyalty intention of customers in multiple settings and should be more intensively explored in research investigating the commitment-loyalty link. As a result, although industry should create knowledge of the factors that positively influence affective commitment in a B2C environment (customer orientation and expertise), it must also understand that calculative commitment remains imperative to strengthening future customer loyalty. Marketing studies could expand on the results of this study by looking at the mediating role of calculative commitment in the strengthening of future loyalty intentions in a services or product environment.

Managerial implications

It is notable that retail banks should make the commitment-loyalty link stronger by applying strategies that will improve customers' affective and calculative commitment. For example, banks should ensure that their customers develop a feeling of belonging that is based on the principles of inclusion, respect and identification. Retail bank customers want to be engaged with their banks through multiple platforms that reflect both offline and online channels. They want bank products to be developed with them, not for them, and want service delivery to encompass their service needs expectations. Consequently, banks should secure an enjoyable customer experience that is characteristic of service qualities such as friendliness, knowledgeable staff, engagement through open communication channels and convenience.

Banks should also develop extensive knowledge of the financial product needs of their customers. Through active research engagement (both qualitative and quantitative research techniques can be applied), banks can regularly determine the financial product expectations of their customer segments, whether such expectations are changing and how new benefits can be developed to address customers' evolving needs. Furthermore, banks can provide customers with new, innovative products that are deconstructed. This implies that customers only pay for services they use, thereby lowering their service fees and banking costs.

Furthermore, retail banks should focus on building an end-to-end customer experience that is able to combine customer data as well as operations in all applications and call centres. This will make it difficult for customers to switch to competitor products and services. Banks can also reward customers who continually show repeat actions with the brand, and these actions include repeat purchases. Loyalty programmes in the form of coupons, discounts and vouchers are a great way of encouraging repeat purchases for customers. Rewarding customer actions is important to secure future customer commitment. Customers want to feel part of a company when their actions are rewarded through appreciation strategies. Hence, retail banks can reward customers holding any account at the bank for three years and more with a R400 voucher when they reach three years with proven loyalty and reward a customer of five years' standing with free 300 shopping points for four months. Moreover, service providers can send personalised appreciation messages to their customers every quarter of the financial year and ask for feedback on service delivery through a short survey.

Finally, banks need to become more focused on the provision of a value-driven service through an omnichannel approach. This will ensure that customers are enabled to use various channels to enhance their overall bank experience. Through this approach, convenience is strengthened, and opportunity costs are reduced. Banks can also support their customers through continuous 24/7 service support in the form of live chats and chatbot engagements. This technological support can secure service provision to customers continuously, rather than within the framework of limited business hours.

Conclusions, limitations and areas of future research

The purpose of this study was to investigate the influence of customer orientation, expertise, perceived value and service fairness on affective and calculative commitments and the influence of affective and calculative commitments on loyalty. The study concluded that customer orientation, expertise, perceived value and service fairness influence affective and calculative commitment and that commitment (both affective and calculative) influence customer loyalty. Therefore, retail banks in emerging markets need to develop an understanding of the factors that influence the affective and calculative commitment of retail banking customers, ultimately impacting their future loyalty towards the banks. This study is limited as only four stimuli of affective and calculative commitment (customer orientation, expertise, perceived value and service fairness) were considered in a single service context. Despite this, the study secures focused understandings into these four stimuli of affective and calculative commitment in a retail banking setting, as well as into the extent to which affective and calculative commitments influence loyalty. Future research could consider measuring affective and calculative commitments as mediating variables in a different industry context or emerging market.

Acknowledgements

The authors want to thank the University of Johannesburg for their support in conducting the research study.

Competing interests

The authors declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

Authors' contributions

M.R-L., F.H.N, G.S.M.Q.C. and O.S.M., contributed equally to the writing and research of this article.

Ethical considerations

Ethical clearance to conduct this study was obtained from the University of Johannesburg, College of Business and Economics (CBE), Research Ethics Committee (clearance number: 2021SCiiS016).

Funding information

This research received no specific grant from any funding agency in the public, commercial or not-for-profit sectors.

Data availability

The data that support the findings of this study can by made available by the corresponding author, M.R-L., upon reasonable request.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Affran, S., Dza, M. & Buckman, J., 2019, 'Empirical conceptualization of customer loyalty on relationship marketing and sustained competitive advantage', Journal of Research in Marketing 10(2), 798-806. [ Links ]

Ahrholdt, D.C., Gudergan, S.P. & Ringle, C.M., 2019, 'Enhancing loyalty: When improving consumer satisfaction and delight matters', Journal of Business Research 94, 18-27. https://doi.org/10.1016/j.jbusres.2018.08.040 [ Links ]

Aksoy, L., Keiningham, T.L., Buoye, A., Larivière, B., Williams, L. & Wilson, I., 2015, 'Does loyalty span domains? Examining the relationship between consumer loyalty, other loyalties and happiness', Journal of Business Research 68(12), 2464-2476. https://doi.org/10.1016/j.jbusres.2015.06.033 [ Links ]

Alam, M.M.D., Karim, R.A. & Habiba, W., 2021, 'The relationship between CRM and customer loyalty: The moderating role of customer trust', International Journal of Bank Marketing 39(7), 1248-1272. https://doi.org/10.1108/IJBM-12-2020-0607 [ Links ]

Alavi, S., Habel, J., Schmitz, C., Richter, B. & Wieseke, J., 2018, 'The risky side of inspirational appeals in personal selling: When do customers infer ulterior salesperson motives?', Journal of Personal Selling & Sales Management 38(3), 323-343. https://doi.org/10.1080/08853134.2018.1447385 [ Links ]

Aldaihani, F.M.F. & Ali, N.A.B., 2019, 'Impact of relationship marketing on customers loyalty of Islamic banks in the state of Kuwait', International Journal of Scientific & Technology Research 8(11), 788-802. [ Links ]

Al-Dmour, H.H., Ali, W.K. & Al-Dmour, R.H., 2019, 'The relationship between customer engagement, satisfaction, and loyalty', International Journal of Customer Relationship Marketing and Management (IJCRMM) 10(2), 35-60. https://doi.org/10.4018/IJCRMM.2019040103 [ Links ]

Ali, M., Iraqi, K.M., Rawat, A.S. & Mohammad, S., 2018, 'Role of customer service skills on customer satisfaction and its effects on customer loyalty in Pakistan banking industry', South Asian Journal of Management 12(2), 210-223. https://doi.org/10.21621/sajms.2018122.06 [ Links ]

Ali, N., Isa, Z.M. & Ibrahim, D., 2021, 'The role of commitment and trust towards online loyalty in the banking industry', Journal of Business Management and Accounting 11(2), 25-40. https://doi.org/10.32890/jbma2021.11.2.2 [ Links ]

Ali, W. & Javaid, R., 2020, 'A systematic mapping study on customers loyalty in Islamic banking: Comparative analysis by using PLS-MGA', Journal of Xi'an University of Architecture & Technology 12(3), 5489-5514. [ Links ]

Alnaser, F.M.I., Ghani, M.A. & Rahi, S., 2018, 'Service quality in Islamic banks: The role of PAKSERV model, customer satisfaction and customer loyalty', Accounting 4(2), 63-72. https://doi.org/10.5267/j.ac.2017.8.001 [ Links ]

Al Samman, A.M. & Mohammed, A.T.I., 2021, 'The mediating role of job satisfaction and affective commitment in the relationship between internal marketing practices and customer orientation', International Journal of Organizational Analysis 29(4), 847-872. https://doi.org/10.1108/IJOA-06-2020-2254 [ Links ]

Alteren, G. & Tudoran, A.A., 2016, 'Enhancing export performance: Betting on customer orientation, behavioral commitment, and communication', International Business Review 25(1), 370-381. https://doi.org/10.1016/j.ibusrev.2015.07.004 [ Links ]

Anouze, A.L.M., Alamro, A.S. & Awwad, A.S., 2019, 'Customer satisfaction and its measurement in Islamic banking sector: A revisit and update', Journal of Islamic Marketing 10(2), 565-588. https://doi.org/10.1108/JIMA-07-2017-0080 [ Links ]

Bahadur, W., Aziz, S. & Zulfiqar, S., 2018, 'Effect of employee empathy on customer satisfaction and loyalty during employee-customer interactions: The mediating role of customer affective commitment and perceived service quality', Cogent Business & Management 5(1), Article No. 1491780. https://doi.org/10.1080/23311975.2018.1491780 [ Links ]

Barnes, D.C. & Krallman, A., 2019, 'Customer delight: A review and agenda for research', Journal of Marketing Theory and Practice 27(2), 174-195. https://doi.org/10.1080/10696679.2019.1577686 [ Links ]

Bhatt, K., 2020, 'Measuring service fairness and its impact on service quality and satisfaction: A study of Indian banking services', Journal of Financial Services Marketing 25(1), 35-44. https://doi.org/10.1057/s41264-020-00069-7 [ Links ]

Boonlertvanich, K., 2019, 'Service quality, satisfaction, trust, and loyalty: The moderating role of main-bank and wealth status', International Journal of Bank Marketing 37(1), 278-302. https://doi.org/10.1108/IJBM-02-2018-0021 [ Links ]

BusinessTech, 2018, 'A warning to South Africa's big four banks - competition is coming', BusinessTech, September 10, 2018, viewed 01 July 2021, from https://businesstech.co.za/news/banking/270411/a-warning-to-south-africas-big-four-banks-competition-is-coming/. [ Links ]

Carvalho, A. & Fernandes, T., 2018, 'Understanding customer brand engagement with virtual social communities: A comprehensive model of drivers, outcomes and moderators', Journal of Marketing Theory and Practice 26(1-2), 23-37. https://doi.org/10.1080/10696679.2017.1389241 [ Links ]

Casais, B., Fernandes, J. & Sarmento, M., 2020, 'Tourism innovation through relationship marketing and value co-creation: A study on peer-to-peer online platforms for sharing accommodation', Journal of Hospitality and Tourism Management 42, 51-57. https://doi.org/10.1016/j.jhtm.2019.11.010 [ Links ]

Cheng, J.-H., Chen, F.-Y. & Chang, Y.-H., 2008, 'Airline relationship quality: An examination of Taiwanese passengers', Tourism Management 29(3), 487-499. https://doi.org/10.1016/j.tourman.2007.05.015 [ Links ]

Christian, I.O., Anning-Dorson, T. & Tackie, N.N., 2021, 'Customer loyalty and value anticipation: Does perceived competition matter?', African Journal of Economic and Management Studies 12(2), 321-335. https://doi.org/10.1108/AJEMS-09-2020-0443 [ Links ]

Chuang, H.-M., Chen, Y.-S., Lin, C.-Y. & Yu, P.-C., 2016, 'Featuring the e-service quality of online website from a varied perspective', Human-Centric Computing and Information Sciences 6(1), Article No. 6. https://doi.org/10.1186/s13673-016-0058-1 [ Links ]

Cook, K.S., Cheshire, C., Rice, E.R.W. & Nakagawa, S., 2013, 'Social exchange theory', in J. DeLamater & A. Ward (eds.), Handbook of social psychology, pp. 61-88, Springer, Dordrecht. [ Links ]

Crisafulli, B. & Singh, J., 2016, 'Service guarantee as a recovery strategy: The impact of guaranteed terms on perceived justice and firm motives', Journal of Service Management 27(2), 117-143. https://doi.org/10.1108/JOSM-10-2015-0309 [ Links ]

Cropanzano, R., Anthony, E.L., Daniels, S.R. & Hall, A.V., 2017, 'Social exchange theory: A critical review with theoretical remedies', Academy of Management Annals 11(1), 479-516. https://doi.org/10.5465/annals.2015.0099 [ Links ]

Dalziel, N., Harris, F. & Laing, A., 2011, 'A multidimensional typology of customer relationships: From faltering to affective', International Journal of Bank Marketing 29(5), 398-432. https://doi.org/10.1108/02652321111152918 [ Links ]

Dessart, L., Aldás-Manzano, J. & Veloutsou, C., 2019, 'Unveiling heterogeneous engagement-based loyalty in brand communities', European Journal of Marketing 53(9), 1854-1881. https://doi.org/10.1108/EJM-11-2017-0818 [ Links ]

Dickson, C.A.W., McVittie, C. & Kapilashrami, A., 2018, 'Expertise in action: Insights into the dynamic nature of expertise in community-based nursing', Journal of Clinical Nursing 27(3-4), e451-e462. https://doi.org/10.1111/jocn.13950 [ Links ]

Djajanto, L., Afiatin, Y. & Haris, Z.A., 2019, 'The impact of relationship marketing on customer value, satisfaction and loyalty: Evidence from banking sector in Indonesia', International Journal of Economic Policy in Emerging Economies 12(2), 207-214. https://doi.org/10.1504/IJEPEE.2019.099695 [ Links ]

El-Manstrly, D., Paton, R., Veloutsou, C. & Moutinho, L., 2011, 'An empirical investigation of the relative effect of trust and switching costs on service loyalty in the UK retail banking industry', Journal of Financial Services Marketing 16(2), 101-110. [ Links ]

Evanschitzky, H., Iyer, G.R., Plassmann, H., Niessing, J. & Meffert, H., 2006, 'The relative strength of affective commitment in securing loyalty in service relationships', Journal of Business Research 59(12), 1207-1213. https://doi.org/10.1016/j.jbusres.2006.08.005 [ Links ]

Evanschitzky, H., Malhotra, N., Wangenheim, F.V. & Lemon, K.N., 2017, 'Antecedents of peripheral services cross-buying behavior', Journal of Retailing and Consumer Services 36, 218-224. https://doi.org/10.1016/j.jretconser.2017.02.006 [ Links ]

Farooq, A. & Moon, M.A., 2020, 'Service fairness, relationship quality and customer loyalty in the banking sector of Pakistan', Pakistan Journal of Commerce and Social Sciences (PJCSS) 14(2), 484-507, viewed 07 July 2021, from https://www.researchgate.net/publication/342955766_Service_Fairness_Relationship_Quality _and_Customer_Loyalty_in_the_Banking_Sector_of_Pakistan. [ Links ]

Fatima, J.K. & Mascio, R.D., 2020. 'Synchronizing relational benefits with customer commitment profiles', Journal of Strategic Marketing 28(4), 366-378. https://doi.org/10.1080/0965254X.2019.1619089 [ Links ]

Fatima, J.K., Mascio, R.D., Quazi, A. & Johns, R., 2020, 'The dynamic role of rapport on satisfaction-commitment relationship: Testing alternative models', International Journal of Bank Marketing 38(4), 917-932. https://doi.org/10.1108/IJBM-01-2020-0005 [ Links ]

Fatima, J.K., Razzaque, M.A. & Di Mascio, R., 2015, 'Modelling roles of commitment on rapport and satisfaction', International Journal of Bank Marketing 33(3), 261-275. https://doi.org/10.1108/IJBM-11-2013-0130 [ Links ]

Ganaie, T.A. & Bhat, M.A., 2020, 'Relationship marketing practices and customer loyalty: A review with reference to banking industry', International Journal of Engineering and Management Research 10(4), 118-125. https://doi.org/10.31033/ijemr.10.4.18 [ Links ]

Gezhi, C., Jingyan, L. & Xiang, H., 2020, 'Collaborative innovation or opportunistic behavior? Evidence from the relational governance of tourism enterprises', Journal of Travel Research 59(5), 864-878. https://doi.org/10.1177/0047287519861170 [ Links ]

Giovanis, A., Athanasopoulou, P. & Tsoukatos, E., 2015, 'The role of service fairness in the service quality - Relationship quality - Customer loyalty chain: An empirical study', Journal of Service Theory and Practice 25(6), 744-776. https://doi.org/10.1108/JSTP-11-2013-0263 [ Links ]

Gokmenoglu, K.K. & Amir, A., 2021, 'The impact of perceived fairness and trustworthiness on customer trust within the banking sector', Journal of Relationship Marketing 20(3), 241-260. https://doi.org/10.1080/15332667.2020.1802642 [ Links ]

Hansopaheluwakan, S., Polla, J.R., Kristiyanto, J., Prabowo, H., Hamsal, M. & Lukmanto, B., 2020, 'The influence of social media marketing, website quality, e-WOM, and perceived value on the purchase intention (Case study: PT. Vita Nova Atletik's local brand sports shoes)', in proceedings of 2020 International conference on Information Management and Technology (ICIMTech), pp. 916-921, IEEE, Piscataway, NJ. [ Links ]

Herjanto, H. & Amin, M., 2020, 'Repurchase intention: The effect of similarity and client knowledge', International Journal of Bank Marketing 38(6), 1351-1371. https://doi.org/10.1108/IJBM-03-2020-0108 [ Links ]

Hwang, E., Baloglu, S. & Tanford, S., 2019, 'Building loyalty through reward programs: The influence of perceptions of fairness and brand attachment', International Journal of Hospitality Management 76, 19-28. https://doi.org/10.1016/j.ijhm.2018.03.009 [ Links ]

Iglesias, O., Markovic, S. & Rialp, J., 2019, 'How does sensory brand experience influence brand equity? Considering the roles of customer satisfaction, customer affective commitment, and employee empathy', Journal of Business Research 96, 343-354. https://doi.org/10.1016/j.jbusres.2018.05.043 [ Links ]

Islam, R., Ahmed, S., Rahman, M. & Al Asheq, A., 2021, 'Determinants of service quality and its effect on customer satisfaction and loyalty: An empirical study of private banking sector', The TQM Journal 33(6), 1163-1182. https://doi.org/10.1108/TQM-05-2020-0119 [ Links ]

Izogo, E.E. & Jayawardhena, C., 2019, 'Building committed online shoppers through shopping goals and switching cost', Journal of Marketing Analytics 7, 127-140. https://doi.org/10.1057/S41270-019-00051-W [ Links ]

Jaiyeoba, O.O., Chimbise, T.T. & Roberts-Lombard, M., 2018, 'E-service usage and satisfaction in Botswana', African Journal of Economic and Management Studies 9(1), 2-13. https://doi.org/10.1108/AJEMS-03-2017-0061 [ Links ]

Jo, A. & Mo, A., 2018, 'Factors influencing customer satisfaction and loyalty to Internet banking services among undergraduates of a Nigerian university', Journal of Internet Banking and Commerce 23(1), 1-21. [ Links ]

Junaidi, J., Wicaksono, R. & Hamka, H., 2021, 'The consumers' commitment and materialism on Islamic banking: The role of religiosity', Journal of Islamic Marketing. https://doi.org/10.1108/JIMA-12-2020-0378 [ Links ]

Jung, J.H. & Yoo, J., 2019, 'The effects of deviant customer-oriented behaviors on service friendship: The moderating role of co-production', Journal of Retailing and Consumer Services 48, 60-69. https://doi.org/10.1016/j.jretconser.2019.02.012 [ Links ]

Karjaluoto, H., Shaikh, A.A., Saarijärvi, H. & Saraniemi, S., 2019, 'How perceived value drives the use of mobile financial services apps', International Journal of Information Management 47, 252-261. https://doi.org/10.1016/j.ijinfomgt.2018.08.014 [ Links ]

Kaur, H. & Soch, H., 2018, 'Satisfaction, trust and loyalty: Investigating the mediating effects of commitment, switching costs and corporate image', Journal of Asia Business Studies 12(4), 361-380. https://doi.org/10.1108/JABS-08-2015-0119 [ Links ]

Khan, I., Hollebeek, L.D., Fatma, M., Islam, J.U. & Riivits-Arkonsuo, I., 2020, 'Customer experience and commitment in retailing: Does customer age matter?', Journal of Retailing and Consumer Services 57, Article No. 102219. https://doi.org/10.1016/j.jretconser.2020.102219 [ Links ]

Khoa, B.T., 2020, 'The antecedents of relationship marketing and customer loyalty: A case of the designed fashion product', The Journal of Asian Finance, Economics, and Business 7(2), 195-204. https://doi.org/10.13106/jafeb.2020.vol7.no2.195 [ Links ]

Khraiwish, A., Al-Gasawneh, J.A., Joudeh, J.M.M., Nusairat, N.M. & Alabdi, Y.F., 2022, 'The differential impacts of customer commitment dimensions on loyalty in the banking sector in Jordan: Moderating the effect of e-service quality', International Journal of Data and Network Science 6(2), 315-324. https://doi.org/10.5267/j.ijdns.2022.1.006 [ Links ]

Kim, B. & Kim, D., 2020, 'Attracted to or locked in? Explaining consumer loyalty toward Airbnb', Sustainability 12(7), Article No. 2814. https://doi.org/10.3390/su12072814 [ Links ]

Kim, M.-S., Shin, D.-J. & Koo, D.-W., 2018a, 'The influence of perceived service fairness on brand trust, brand experience and brand citizenship behavior', International Journal of Contemporary Hospitality Management 30(7), 2603-2621. https://doi.org/10.1108/IJCHM-06-2017-0355 [ Links ]

Kim, S.H., Kim, J.H. & Lee, W.J., 2018b, 'Exploring the impact of product service quality on buyer commitment and loyalty in B to B relationships', Journal of Business-to-business Marketing 25(2), 91-117. https://doi.org/10.1080/1051712X.2018.1454628 [ Links ]

Komulainen, H. & Saraniemi, S., 2019, 'Customer centricity in mobile banking: A customer experience perspective', International Journal of Bank Marketing 37(5), 1082-1102. https://doi.org/10.1108/IJBM-11-2017-0245 [ Links ]

Kuksov, D. & Zia, M., 2021, 'Benefits of customer loyalty in markets with endogenous search costs', Management Science 67(4), 2171-2190. https://doi.org/10.1287/mnsc.2020.3668 [ Links ]

Kumra, R. & Sharma, P.K., 2022, 'Mediating role of trust in the impact of perceived empathy and customer orientation on intention to continue relationship in Indian banks', Journal of Financial Services Marketing. https://doi.org/10.1057/s41264-021-00137-6 [ Links ]

Kungumapriya, A. & Malarmathi, K., 2018, 'The impact of service quality, perceived value, customer satisfaction in calculative commitment and customer loyalty chain in Indian mobile telephone sector', IOSR Journal of Business and Management 20(5), 72-82. [ Links ]

Lacroix, C., Rajaobelina, L. & St-Onge, A., 2020, 'Impact of perceived experiential advertising on customers' responses: A multi-method approach', International Journal of Bank Marketing 38(6), 1237-1258. https://doi.org/10.1108/IJBM-12-2019-0451 [ Links ]

Li, F., Lu, H., Hou, M., Cui, K. & Darbandi, M., 2021, 'Customer satisfaction with bank services: The role of cloud services, security, e-learning and service quality', Technology in Society 64, Article No. 101487. https://doi.org/10.1016/j.techsoc.2020.101487 [ Links ]

Lioukas, C.S. & Reuer, J.J., 2015, 'Isolating trust outcomes from exchange relationships: Social exchange and learning benefits of prior ties in alliances', Academy of Management Journal 58(6), 1826-1847. https://doi.org/10.5465/amj.2011.0934 [ Links ]

Lombardi, S., Sassetti, S. & Cavaliere, V., 2019, 'Linking employees' affective commitment and knowledge sharing for an increased customer orientation', International Journal of Contemporary Hospitality Management 31(11), 4293-4312. https://doi.org/10.1108/IJCHM-03-2018-0261 [ Links ]

Lubis, A., Dalimunthe, R., Absah, Y. & Fawzeea, B.K., 2020, 'The influence of customer relationship management (CRM) indicators on customer loyalty of sharia based banking system', Journal of Management & Marketing Review 5(1), 84-92. https://doi.org/10.35609/jmmr.2020.5.1(8) [ Links ]