Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Acta Commercii

versión On-line ISSN 1684-1999

versión impresa ISSN 2413-1903

Acta Commer. vol.20 no.1 Johannesburg 2020

http://dx.doi.org/10.4102/ac.v20i1.773

ORIGINAL RESEARCH

Modelling key predictors that stimulate the entrepreneurial performance of small and medium-sized enterprises (SMEs) and poverty reduction: Perspectives from SME managers in an emerging economy

Eugine T. MaziririI; Abigail ChivandiII

IDepartment of Business Management, University of the Free State, Bloemfontein, South Africa

IISchool of Economic and Business Sciences, University of the Witwatersrand, Johannesburg, South Africa

ABSTRACT

ORIENTATION: In this ever-changing business milieu, poverty alleviation has turned into an important issue after the publication of the 2015 United Nations Sustainable Development Goals, which aim at eradicating poverty in all its forms and dimensions by 2030.

RESEARCH PURPOSE: This study investigates the effect of entrepreneurship education, budgeting financial literacy and access to credit facilities on entrepreneurial performance and poverty reduction.

MOTIVATION FOR THE STUDY: There is a lack of literature that studies the effect of entrepreneurship education, budgeting financial literacy and access to credit facilities on entrepreneurial performance and poverty reduction in an emerging economy, such as South Africa.

RESEARCH DESIGN, APPROACH AND METHOD: The study adopted a quantitative approach. The examination was completed in the Vhembe District of Limpopo province, South Africa, where many people live in poverty. A structured questionnaire was used to collect data from 150 managers of rural small and medium-sized enterprises (SMEs). To test the hypothesised model, structural equation modelling (SEM) analysis was employed using the Smart partial least squares (PLS) software.

MAIN FINDINGS: The findings uncovered that entrepreneurship education, budgeting financial literacy and access to credit facilities positively impact entrepreneurial performance of SMEs and reduce poverty.

PRACTICAL/MANAGERIAL IMPLICATIONS: The present research provides theoretical implications for academics in the field of entrepreneurship, precisely, by enhancing an understanding of the link between entrepreneurship education, budgeting financial literacy, access to credit facilities, entrepreneurship performance and poverty reduction. On the practitioners' side, this work offers avenues for SME managers to improve entrepreneurial ventures and eventually eliminate household poverty. Moreover, this study also offers policy implications. Existing policies, for example, can be updated, with the goal of improving entrepreneurial performance of SMEs and reducing poverty.

CONTRIBUTION/VALUE-ADD: This article provides useful insights into and suggestions on the way forward. Furthermore, it contributes to the existing knowledge base in the field of entrepreneurship. As such, this research is important for SME managers because most of them endeavour to enhance entrepreneurial performance and alleviate poverty in their communities.

Keywords: entrepreneurship education; budgeting financial literacy; access to credit facilities; poverty reduction; entrepreneurial performance.

Introduction

A primary issue for academics, managers and policymakers is the role of business in poverty reduction in the least developed countries (LDCs). Business is imperative in alleviating poverty, 'since they sell, employ, or can be established by people living in poor countries' (Maksimov, Wang & Luo 2017).

According to the World Bank's 'Voices of the Poor' report (Maksimov et al. 2017), 60 000 poor individuals unequivocally state that generating income from their own business or earning wages in employment is the most effective way to escape poverty. Whilst home governments and large enterprises, both foreign and domestic, have an important role to play, small and medium-sized enterprises (SMEs) (Djankov et al. 2005, 2006) are the main vehicles for poverty eradication in the LDC development process.

This view is echoed by Fiseha and Oyelana (2015) who emphasise the crucial role of SMEs in addressing poverty and its effects. Researchers have responded positively to the targeting of SMEs to drive economic growth and eradicate poverty. Agyapong (2010), Okpara (2011) and Manyara and Jones (2007) all examine the effectiveness of SMEs in reducing poverty in Nigeria, Ghana and Kenya, respectively. LDC SMEs include self-employed and 'micro' companies with less than 10 employees (UN 2015). These businesses are 'on the front lines of poverty alleviation' (Brainard et al. 2005:9) as they tend to hire the poorest of the poor.

According to Reynolds, Fourie and Erasmus (2019), South African SMEs, in the contemporary African business environment, contribute up to 22% of the economy's gross domestic product (GDP). This aligns with the view of various scholars (Desiree & Kengne 2016; Mafini, Pooe & Loury-Okoumba 2016; Mafundu & Mafini 2019; Oyelana & Adu 2015) who maintain that SMEs are key drivers of economic growth and job creation as they introduce innovations to tap new markets, boost competition and efficiency across the economy, and reduce poverty and inequality. Mahadea and Kaseeram (2018) also share the same sentiments by asserting that SMEs can reduce the high level of unemployment and contribute to the GDP of the local economy in South Africa. Therefore, SMEs are essential in improving a society's living standards and a country's stability (Cant, Wiid & Meyer 2016).

Apart from the impact of SMEs on the economy, it is important to note that the primary objective of this study is to determine the impact of entrepreneurship education, budgeting financial literacy and access to credit facilities on the entrepreneurial performance of SMEs and poverty reduction in the Vhembe District of Limpopo province, South Africa.

This study contributes to the gap in literature on this topic by linking entrepreneurship education, budgeting financial literacy and access to credit facilities with entrepreneurial performance and poverty reduction in South Africa. It also contributes to the field by providing a quantitative study on the subject matter, the results of which will be helpful to policymakers who are aware of the importance of SMEs in the country's economy, and therefore may use the results of the study to create better policies for SME support.

Small and medium-sized enterprise managers may benefit from this study by understanding and pursuing entrepreneurship education, budgeting financial literacy and access to credit facilities to enhance the performance of their entrepreneurial ventures. If SMEs flourish, they will be able to provide employment and, subsequently, alleviate poverty and improve the standards of living for SME managers and their employees. This study will assist other scholars and researchers in further developing this research field.

The article is organised as follows: the next section focuses on the study's demarcation area, followed by the problem statement, literature review, conceptual model development and the hypotheses. The methodology that guides the study is discussed hereafter and, subsequently, the study results, discussions, implications, recommendations and conclusions are presented.

Study demarcation area: Limpopo province

This study analyses data that can be used to improve business enterprises in the Limpopo province of South Africa (Figure 1).

The Limpopo province (previously the Northern province [NP]) is one of the poorest areas in South Africa (Wanka 2014). Beyers (2015) mentions that the Limpopo area has a housing deficiency, which is exacerbated by the salary differential in the nation and the widening gap between rich and poor people.

Limpopo has the second highest unemployment rate in South Africa and poor families typically have low levels of education (some lack school materials like course readings); limited access to fuel, water and other fundamental needs; and few lucrative business opportunities (Department of Basic Education 2012). The province has a poor education rate of around 46% and the second highest unemployment rate in the country (Wanka 2014). The Limpopo region has the highest number of poor individuals as indicated by the census count (Bosch 2008; Mears & Blaauw 2010). Moreover, amongst the South African provinces, Limpopo has the highest growth rate in the number of newly registered SMEs (34%), followed by Gauteng (14%) (Rungani & Potgieter 2018). It can, therefore, be deduced that the study's demarcation area is a profound rustic region, where poverty is a reality for some entrepreneurs.

Problem statement and research gap

The slow rate of SME development is worrying. Cant, Wiid and Kallier (2015) claim that this slow development rate is the result of a lack of aptitude, education and capacity. Fatoki (2014) notes that ineffective foundations as well as political and common brutality influence SME survival. This article identifies the hypothetical gaps in the literature and fills these gaps with desired outcomes. Although researchers make many hypothetical commitments, there is a limited number of literature and studies that provide an understanding of how entrepreneurship education, budgeting financial literacy and entrepreneurship education enhance the entrepreneurial performance of SMEs and help with poverty reduction.

Some researchers have examined the motivation to become an entrepreneur amongst a sample of black South African entrepreneurs (Chinyamurindi 2016), barriers to student entrepreneurship in South Africa (Shambare 2013), the influence of entrepreneurial orientation on business performance (Matchaba-Hove, Farrington & Sharp 2015), the challenges affecting SMEs in South Africa (Cant & Wiid 2013), the role of SMEs in the economy (Robu 2013), government support for SMEs (Maleka & Fatoki 2016) and the role of open innovation in SMEs (Brunswicker & Van De Vrande 2014). Other matters that researchers have investigated include access to finance for innovative SMEs after the financial crisis (Lee, Sameen & Cowling 2015), elements of e-trade appropriation by SMEs in emerging economies (Rahayu & Day 2015), product lifecycle information management for SMEs (Soto-Acosta, Placer-Maruri & Perez-Gonzalez 2016), groupings for benefit development in SMEs (Kowalkowski, Witell & Gustafsson 2013) and factors that hold back high-growth firms (Lee 2014).

Despite an avalanche of research studies focused on SMEs, it is imperative to note that there seems to be a scarcity of studies that investigate the impact of entrepreneurship education, budgeting financial literacy and access to credit facilities on entrepreneurial performance, as well as poverty reduction. The fundamental motivation behind this investigation is to fill this gap. In addition, to the best knowledge of the researchers, none or very few researchers have used structural equation modelling (SEM) to test the causal relationships of the variables under investigation (entrepreneurship education, budgeting financial literacy, access to credit facilities, entrepreneurial performance and poverty reduction). With regard to the conceptual model proposed in this study, it can be noted that it is one of a kind, as there still remains a dearth of empirical evidence in studies that have tested the variables in the proposed model in relation to the South African context.

Theoretical grounding

This study is grounded in two theories, namely, the empowerment theory and the human capital theory. If entrepreneurs are empowered and human capital is available, SME performance will improve and, ultimately, poverty will be reduced. These theories will be discussed in detail in the following section.

The empowerment theory

Discussions about notions of empowerment and empowerment theory developed in the 1960s and 1970s, out of concern for the powerlessness of specific groups in society (Naidoo 2015). The empowerment theory acts as an agent of change in influencing networks to determine how to perceive states of disparity and foul play in order to build the forces of those viewed as frail (Budeli 2012). This theory suggests that views of the self can contribute to individual, community and social change (Naidoo 2015). As such, the empowerment theory creates a platform for human behaviour transformation and, subsequently, opportunities for structural reform in society. This enables people to build expertise and trust and create new opportunities for action (Delp, Brown & Domenzain 2005). Robbins, Chatterjee and Canda (1998) identify the points of empowerment as looking at social stratification, distinguishing the individual and political obstructions, offering structures for advancing human freedom and recognising pragmatic systems for defeating persecution and accomplishing social equity, thereby expanding on individuals' quality, flexibility and assets. The empowerment theory describes how to develop business enterprise and invigorate the entrepreneurial behaviour of business people in South Africa. From the aforementioned explanations, it can be deduced that the notion of empowerment can help SME managers and their staff in growing, learning, taking initiatives and duties, feeling empowered enough to create choices, taking measured personal and professional hazards, developing their autonomy, experimenting with fresh performance alternatives, focusing on attaining outcomes and usually increasing the value of their organisation.

Human capital theory

The human capital theory originated in the mid-20th century from the works of Mincer (1958), Schultz (1961) and Becker (1962). This theory has been widely debated as it emphasises the importance of human capital in entrepreneurship (Amin 2018). SMEs play a key role in the economic growth of South Africa, but the performance of these entrepreneurial ventures mainly depends on entrepreneurial human capital (Amin 2018). According to Fix (2018), the idea behind the human capital theory is that individuals can gain skills (human capital) that will make them more productive. Human capital theory suggests that education or training raises the productivity of workers by imparting useful knowledge and skills, subsequently raising the workers' future income and lifetime earnings (Olabisi & Olagbem 2012). This theory is based on the principle that the more workers invest in education and training, the higher their earnings (Jones, Macpherson & Thorpe 2010). Based on the aforementioned discussion, the human capital theory proposes that the level of education, area of education, previous entrepreneurial experience, previous business experience and business skills all influence the type of venture started. If the human capital theory is taken into consideration, it can enhance the development of entrepreneurship, as well as stimulate entrepreneurial attitudes, performance and the activities of the working population in the Limpopo province. The human capital theory can help SME managers and employees to be more active in business, thereby improving their living standards.

Empirical literature

This section of the literature review discusses the different research variables undertaken as part of this study.

Entrepreneurship education

According to Manyaka-Boshielo (2019:2), entrepreneurship education is defined as 'the skills and knowledge that individuals acquire through investment in schooling, on-the-job training and other types of experience'.

According to Ndofirepi and Rambe (2018), entrepreneurship education refers to the deliberate transmission of entrepreneurial knowledge, which encompasses thoughts, expertise and mindsets relevant to venture creation and survival. Gamede and Uleanya (2017) define entrepreneurship education as the purposeful intervention by an educator in the life of a learner to impact entrepreneurial qualities and skills to enable the learner to survive in the business world. Furthermore, Manyaka-Boshielo (2019) describes entrepreneurship education as a structured, formal conveyance of entrepreneurial competencies, which, in turn, refers to the concepts, skills and mental awareness used by individuals during the process of starting and developing their growth-orientated business venture. Iwu et al. (2019) contend that entrepreneurship education enables the acquisition of entrepreneurial knowledge, skills, attitudes and behaviours. The development of entrepreneurship education is considered a fundamental precondition for augmenting entrepreneurs' innovation skills in a rapidly changing environment (Ndou, Mele & Del-Vecchio 2018). As a result, several universities and governments worldwide have started to support and promote entrepreneurship education by developing (and investing in) curricula and programmes related to entrepreneurship and new venture creation (Ndou et al. 2018). It can, therefore, be noted that tertiary education institutions seek to provide individuals with the knowledge, skills and motivation to encourage entrepreneurial success in a variety of settings. Moreover, it is essential to note that most studies on entrepreneurship education (Fayolle & Gailly 2015; Matlay 2008; Nowiński et al. 2019; Oosterbeek,Van Praag & Ijsselstein 2010) have determined the effect of entrepreneurship education on entrepreneurial intentions, entrepreneurial attitudes, entrepreneurship abilities, motivation for entrepreneurship and interpersonal activity. The effect of entrepreneurship education on entrepreneurial performance and poverty reduction, however, was not discussed. Therefore, the need for this current study has arisen.

Budgeting financial literacy

Budgeting can be characterised as a needed piece of management control frameworks for promoting coordination and correspondence between sub-units within a project, providing a mechanism for assessing execution that ultimately persuades managers and various employees (Østergren & Stensaker 2011). Warue and Wanjira (2013) define budgeting as the process of preparing a financial document that is used to project future income and expenses. On the other hand, Fatoki (2014) states that financial literacy incorporates the capacity to comprehend monetary decisions; for example, money-related proficiency calls for astute spending. In addition, Agyei (2018) contends that financial literacy levels of SME managers can influence their financial decisions in controlling financial resources, allocating funds and selecting investment vehicles. The SME managers' financial literacy also determines their awareness of growth funding options that can enhance SME performance. Considering all the aforementioned, budgeting financial literacy can be described as the process of gaining skills and developing the ability to create a plan on how to spend business money, as well as having the ability to comprehend monetary decisions. Past studies such as the one conducted by Warue and Wanjira (2013) concur that budgeting financial literacy entails focusing on the competency and the ability to plan how the entrepreneurial venture's funds will be spent and understanding monetary statements.

Moreover, Maziriri, Mapuranga and Madinga (2018) assert that the absence of budgeting financial literacy amongst SMEs greatly affects their performance, and rural SME managers must acquire some financial literacy competencies - specifically budgeting financial literacy - to make good financial decisions.

Access to credit facilities

In all economies, developing and developed, easy access to credit is imperative in accelerating investment and job creation, and transforming small businesses into strong enterprises (Mole & Namusonge 2016).

Pergelova and Angulo-Ruiz (2014) note that:

[L]egislature monetary help through advances and value can permit new pursuits not exclusively to amass resources and to get access to basic assets (e.g. innovation, licenses and hardware), yet in addition to put resources into inside firm procedures, for example, representative preparing, and in exercises that would bring market acknowledgment, for example, constructing a brand name. (p. 11)

Fletschner (2008) explains that rural SME's access to financial resources is restricted by one-sided loans, the result of banks thinking of them as smaller, less experienced and, in this way, less appealing to customers. Another reason is that establishments simply do not have the learning to offer items customised to SME needs. Drawing from the aforementioned explanations, it can be deduced that access to credit facilities is important for the enrichment of entrepreneurial performance amongst SMEs.

Furthermore, it is important to state that most of the research on access to credit facilities (Karimi 2014; Musah, Gakpetor & Pomaa 2018; Omondi & Jagongo 2018; Ratna et al. 2018; Sibanda, Hove-Sibanda & Shava 2018) have determined the impact of access to credit facilities on SME development, economic results, export behaviour of SMEs and profitability. However, to the best knowledge of the researchers, there are not so many valid studies that have examined the effect of access to credit facilities on entrepreneurial performance and poverty reduction, and therefore the need for this present research.

Entrepreneurial performance

Comprehending the importance of performance is essential for measuring and overseeing entrepreneurial performance (Kotler & Armstrong 2012). As indicated by Hove, Sibanda and Pooe (2014), business performance refers to how innovation empowers every firm movement, such as cost decrease, income improvement and aggressiveness. Vieira (2010) states that performance may be characterised as taking every necessary step whilst keeping the desired outcomes in mind. Reijonen (2008), who observed a rural small-scale tourism business, characterises performance as a pointer that measures business proficiency and adequacy in accomplishing objectives. Performance can be determined by examining the capacity of a business to achieve set targets (O'Regan, Sims & Gallear 2008). Wongrassamee, Gardiner and Simmons (2003) posit that entrepreneurial performance refers to the ability of a business to fulfil the needs of workers, clients and different partners, as well as its capacity to accomplish planned business objectives. As indicated by Sebikari (2014), entrepreneurial performance is the accomplishment of defined entrepreneurial objectives. According to Ladzani and Van Vuuren (2002), entrepreneurial performance uses accessible opportunities to develop business thought. Entrepreneurial performance of an SME includes the viability and effectiveness of an entrepreneurial venture in achieving its planned goals, as well as the degree to which the entrepreneurial venture can exceed expectations in addressing the needs of its partners. Moreover, it is important to mention that most researchers who have examined entrepreneurial performance (Elert, Andersson & Wennberg 2015; Gao et al. 2018; Hiatt, Carlos & Sine 2018; Shan, Song & Ju 2016) have overlooked an interrogation that is centred on determining the effect of entrepreneurial performance on poverty reduction. Therefore, the need for this present research has arisen.

Poverty reduction

Poverty reduction remains a focus of various governments worldwide and various organisations such as SMEs. According to Ijaiya et al. (2011), the characteristics of poverty include the absence of wages and gainful assets adequate to guarantee manageable vocation, ailing health, poor well-being, limited access to training and other fundamental services, increased mortality because of disease, vagrancy, risky conditions, as well as social segregation and rejection. Mitigating poverty along these lines requires an increased rate of financial development and the effective distribution of its advantages to the general public (Agyemang 2015). Furthermore, Mbuli (2009) proposes the following poverty reduction strategies to enhance the businesses of poor people:

-

Creating (work and business) open doors for the poor inside business sectors.

-

Increasing benefits to the poor through the local environment because it is essential in job creation, extends human services and training, expands efficiency, offers pay and benefits and sustains the youth (with the intention of keeping them away from, inter alia, drugs, which could negatively affect business profitability).

-

Making globalisation work better for poor people, by building up and actualising new, reasonable tenets for worldwide exchange.

-

Encouraging the business sector to implement good administration practices, as this will also benefit the poor.

-

Tackling gender disparities.

-

Creating poverty reduction strategy papers (PRSPs), which generate greater interest in well-being and education.

-

Ensuring food security for the poor.

Khatib (2015) led an examination which explored the impact of SMEs on poverty reduction in Zanzibar.

Khatib's discoveries demonstrate that entrepreneurs address the needs of individuals at various levels as they provide regular wages. Keeping the end goal in mind, it can be concluded that poverty reduction (and enhancing the living state of the poor) can be achieved through an arrangement of measures, both monetary and philanthropic, that aim to lift individuals out of poverty. Moreover, Akinwale and Ogundiran (2014) asserted that small businesses can break the yoke of poverty that has imprisoned their employee's households.

Therefore, it can be pointed out that if there is entrepreneurial performance or if SMEs are booming in their entrepreneurial ventures, it implies more revenue for SMEs and there is job creation as SMEs are probable to grow by opening other branches. Thus, these SMEs will alleviate poverty at household level and eventually at community level.

Conceptual model and hypothesis development

The conceptual model presented in Figure 2 was developed for this study. The model suggests that entrepreneurship education, budgeting financial literacy and access to credit facilities are the independent or predictor variables (constructs). In addition, the theoretical model indicates that entrepreneurial performance of SMEs is the mediating variable. Moreover, the dependent or outcome variable is poverty reduction.

Entrepreneurship education and entrepreneurial performance of small and medium-sized enterprises

It is necessary to clarify the nexus between entrepreneurship education and entrepreneurial performance.

Van Der Sluis, Van Praag and Vijverberg (2008) contend that if education prompts a higher level of entrepreneurial performance, investment in the education of (imminent) business visionaries should be supported. The human capital theory confirms that the already procured information assumes a basic part in scholarly execution and aids the combination and gathering of new learning and the reconciliation and adjustment to new circumstances (Weick 1996). In addition, Van Der Sluis et al. (2008) note that education benefits the entrepreneur's performance in different ways as well, for example, business survival, firm development or the association's arrival on speculation. Deriving from the previously mentioned examples, the following hypothesis is suggested:

H1: Entrepreneurship education positively and significantly impacts entrepreneurial performance of SMEs.

Budgeting financial literacy and entrepreneurial performance of small and medium-sized enterprises

Siekei, Wagoki and Kalio (2013) explain that the successful usage of financial literacy skills prompts changes in entrepreneurial performance because of enhanced capacity to track business opportunities. In addition, Chepngetich (2016) posits that limited understanding of SMEs regarding finance and marketing appears to positively affect SME performance. Joshi, Al-Mudhaki and Bremser's (2003) examination of budgeting financial literacy via a survey of 54 medium and extensively measured organisations in Bahrain found that an expansion in the firm size led to firms executing more far-reaching planning procedures to accomplish better performance. Chepngetich (2016) explored the connection between financial literacy and the performance of SMEs in Uasin Gishu County and found that financial literacy significantly affects SME performance. In a comparable vein, Maziriri and Mapuranga's (2017) analysis of the effect of bookkeeping practices on the business execution of SMEs in South Africa indicated that planning emphatically impacts the entrepreneurial performance of SMEs. Additionally, an investigation by Chidi and Shadare (2011) in Nigeria, concentrating on challenges facing human capital improvement in SMEs, found that a lack of understanding of the budgeting process impedes the execution of the SMEs. As such, the following can be hypothesised:

H2: Budgeting financial literacy positively and significantly impacts entrepreneurial performance of SMEs.

Access to credit facilities and entrepreneurial performance of small and medium-sized enterprises

Chege's (2014) investigation of the impact of access to credit facilities on the development of the 100 best SMEs in Kenya found that access to credit facilities has a significant impact on the development of these enterprises. It can therefore be said that execution of an entrepreneurial venture relies on the entrepreneur's access to finance. Enhancing the poor's access to financial services empowers them to develop beneficial resources and improve their profitability and potential for manageable jobs (Green, Kirkpatrick & Murinde 2006). When an SME has access to credit facilities, it improves the execution of its entrepreneurial endeavours. As such, the following hypothesis can be formulated:

H3: Access to credit facilities positively and significantly impacts entrepreneurial performance of SMEs.

Entrepreneurship education and poverty reduction

Nwokolo, Dywili and Chimucheka (2017) posit that:

[E]ntrepreneurship education assumes a vital part in advancing entrepreneurial abilities, business enterprise culture and advancing confidence and self-autonomy among college understudies keeping in mind the end goal to lessen the poverty rate in South Africa. (p. 1)

Nkang (2013) claims that refocusing entrepreneurship education at advanced education levels will create youth employment opportunities and reduce poverty. Mensah and Benedict (2010) conducted a desk research and quantitative analysis on the poorest communities in South Africa to determine the effect of government activities in mitigating poverty through business advancement and discovered that the preparation in business (entrepreneurship education) and the arrangement of different offices can give poor proprietors of small businesses the chance to develop their organisations and get themselves, as well as others, out of poverty. Considering the aforementioned fact, the following hypothesis can be made:

H4: Entrepreneurship education positively and significantly impacts poverty reduction.

Entrepreneurial performance of small and medium-sized enterprises and poverty reduction

Matchaba-Hove et al. (2015) explain that small businesses play a major role in strengthening development, advancement and aggressiveness, as well as reducing unemployment and destitution. Sokoto and Abdullahi (2013) maintain that SMEs improve rivalry and enterprise, thereby increasing total profitability. SMEs are, for the most part, more beneficial than large firms; however, institutional disappointments and monetary problems hinder their growth. The development of SMEs supports the creation of employment opportunities more than large firms as they are serious about work.

As such, any endeavour to establish SMEs will significantly aid poverty reduction systems in emerging economies (Sokoto & Abdullahi 2013). In another investigation, Yasa et al. (2015) found that SME performance changes decidedly and fundamentally influence poverty reduction. The higher SME performance changes, the higher the poverty reduction (Yasa et al. 2015). The following can, therefore, be hypothesised:

H5: Entrepreneurial performance of SMEs positively and significantly impacts poverty reduction.

Access to credit facilities and poverty reduction

Siakwa (2010)'s investigation of microcredit as a system for poverty reduction, youth and women empowerment in Ghana posits that microcredit can be used as a technique for poverty reduction, particularly amongst women. Guided by the thought that the poor can be dynamic operators of progress, the researcher uses a credit venture model to clarify how microcredit could help change the endless poverty loop. In this way, in specific cases, the point is to utilise microcredit as a method for reacting rapidly to the vagaries of fluctuating work. In light of the encounters of the recipients, the researcher finds that the effect of microcredit has been blended. Certain recipients are fruitful, others are somewhat effective and some have neglected to utilise the advances to enhance their lives. Despite the fact that microcredit has its drawback, it can be noted that when the correct systems and structures are set up and actualised cautiously, it could act as an impetus to get individuals out of poverty. In their investigation on the effect of access to credit facilities on youth financial improvement, particularly adolescents of the Mwanzo domain in Uasin Gishu County, Kurgat, Owembi and Omwono (2017) found that access to credit facilities contributes positively towards poverty reduction. Drawing from the aforesaid clarifications, the following hypothesis is presented:

H6: Access to credit facilities positively and significantly impacts poverty reduction.

Methodology and design

This study preferred the positivist paradigm as it intends to test several a priori hypotheses to determine relationships between the independent and dependent variables. The authors selected a quantitative research approach as it increases accuracy through statistical analysis. The design justified requesting the required data related to entrepreneurship education, budgeting financial literacy, access to credit facilities, entrepreneurial performance and poverty reduction.

Study population

Population alludes to the number of units that qualify to participate in an examination (Salkind 2012). In this study, the target population comprised all SMEs in the Vhembe District of Limpopo province, specifically the areas of Thulamela, Makhado and Mutale. The respondents comprised SME managers, as they are the rightful decision-makers in the business entities. In addition, the respondents included SME managers responsible for decision-making in their SMEs because previous research has found that top managers provide valid and reliable data (Khan et al. 2019; Zhang et al. 2010). The target population is centred on SME managers as most of them endeavour to increase the entrepreneurial performance of their SMEs and alleviate poverty in their communities. The Vhembe District Municipality is one of the five districts of the Limpopo province. It is situated at 22°56'S and 30°28'E in the far north and borders Zimbabwe in the north, Mozambique in the east and Botswana in the northwest (Netshifhefhe, Kunjeku & Duncan 2018; Van Averbeke 2013).

Sample size

Roets (2013) describes a sample size as a multiple of the number of variables included in the investigation.

Based on the 10-times rule of thumb, which requires that data analysed using PLS should equate to at least 10 times the largest number of formative indicators used to measure one construct, or 10 times the largest number of inner model paths directed at a particular construct in the inner model, the minimum sample size using such criteria has been met in this study (Chinomona & Chinje 2015; Hair et al. 2014). By applying the 10-times rule of thumb to this study's data, the minimum sample when using the above-mentioned criteria is 30 (representing the largest number of paths pointing to a construct, which is three). When applying the 10-times rule of thumb, this number is multiplied by 10 or 50 (representing the largest number of indicators as five, which is linked to the five measure items found under the social media information construct). When applying this rule of thumb, this number is multiplied by 10. Thus, the sample size for this study is 150, which exceeds the minimum sample size of 80 required when applying PLS in this study.

Sampling technique

The Limpopo province is the geographic location of the sample. Both male and female rural SME managers, who are 18 years and older, were included in the study. However, a lack of a reliable and accurate list of participants means that the study was amenable to non-probability-based sampling procedures. The convenience sampling technique was used as it has been cited as very beneficial, in the absence of a suitable sampling frame (Churchill, Brown & Suter 2010). Convenience sampling enables countless requirements to be met inside a brief timeframe (Malhotra 2010). A non-probability convenience sampling method was chosen for the purpose of this study because the characteristics of this method appeal to financial and time constraints. Moreover, convenience sampling allows many respondents to be interviewed in a relatively short period of time (Malhotra 2010).

Measurement instrument and questionnaire design

For this study, a self-administered questionnaire was used to collect the necessary data. As with any empirical work, it is important to consider how the proposed variables should be measured. Hence, measurement scales were operationalised from previous studies. The questionnaire was divided into six sections. Section A comprised questions pertaining to the respondents' demographic factors, such as gender, age, marital status and working experience. Section B assessed 'entrepreneurship education' and was measured using a four-item scale adapted from Nwokolo (2015). Section C measured 'budgeting financial literacy' and used a four-item scale adapted from Chepngetich (2016). Section D assessed 'poverty reduction' and used a four-item scale adapted from Kurgat et al. (2017). Section E measured 'access to credit facilities' with a five-item scale adapted from Kurgat et al. (2017). Section F comprised questions on entrepreneurial performance which are measured using an 11-item scale adapted from Kavari (2016). All were measured on a five-point Likert-type scale - 1 (strongly disagree) to 5 (strongly agree) - to express the degree of agreement.

Sample composition

Information was gathered from SME managers in the Vhembe District of Limpopo province.

Of the 170 surveys circulated, 150 usable questionnaires were completed, providing a response rate of 89%.

All respondents had to answer the questionnaire with reference to entrepreneurship education, budgeting financial literacy and access to credit facilities on entrepreneurial performance, as well as poverty reduction.

The sample comprised 58% men (n = 87) and 42% women (n = 63). The average age of the respondents was under 30 years (n = 82; 54.6%). Most of the respondents were married (n = 90; 60%) and the rest (40%) were single. The majority of the respondents had less than 5 years' work experience (n = 71; 47.3%), followed by respondents who had 5-10 years' work experience (n = 59; 39.3%) and the remainder of the sample had over 10 years' work experience (n = 18; 12.1%).

Ethical considerations

Permission was granted by the management of the Small Enterprise Development Agency (SEDA). The researchers acquired the permission letter which allowed the researchers to collect data from SMEs registered with SEDA, before questionnaires were given out to respondents. Ethical consideration was approved unconditionally and this research study acted in accordance with ethic the ethical standards of academic research, which among other things, is protecting the identities and interest of respondents and assuring confidentiality of information provided by the participants. Respondents gave their informed consent to this research and were informed beforehand about the reason and the nature of the investigation to ensure that participants were not misled. Despite all the above-mentioned precautions, it was made clear to the participants that the research was only for academic research purpose and their participation in it was absolutely voluntary. No one was forced to participate.

Data analysis and results

A Microsoft Excel spreadsheet was utilised to capture the information. To examine the information received, the Statistical Packages for Social Sciences (SPSS) and the Smart PLS software for SEM strategy were utilised to code information and run results. According to Dlodlo (2017), Smart PLS is more advantageous than other covariance-based methods (CBMs) because it requires fewer data points (small sample size) to accurately estimate loadings, whilst the procedure is not sensitive to data normality violation. As the present investigation test estimate is moderately small (n = 150), Smart PLS was more suitable. PLS-SEM is a statistical tool that has emerged as a powerful approach to test relationships amongst variables even under conditions of non-normality (Chinomona & Surujal 2012). It successfully determined the causal relationships between the variables under investigation.

Reliability analysis

The statistical measures of accuracy tests (see Table 1) indicate the distinct measures that were utilised to survey the reliability and validity of the constructs for the investigation. The table presents means and standard deviations, item to total connections, Cronbach's alpha values, average variance extracted (AVE), composite reliability (CR) and factor loadings.

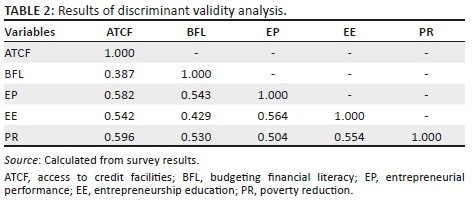

A confirmatory factor analysis (CFA) was used and the SEM was estimated using PLS data. Table 2 and Figure 3 depict the CFA findings, whereas Table 3 and Figure 2 summarise the SEM findings. The CFA was used to evaluate the measurement model, representing the outer model in PLS. Maziriri et al. (2018) mentioned that the purpose of the measurement model is to evaluate the reliability and validity of variables. Table 1 shows that the item-total correlation value lies between 0.531 and 0.794, which is above the cut-off point of 0.5 recommended by Anderson and Gerbing (1988). The higher inter-item correlations reveal convergence amongst the measured items. Nunnally and Bernstein (1994:1) explained that 'alpha values should exceed 0.6'. All variables in this study represent good reliability, with the Cronbach's alpha between 0.674 and 0.867.

The study also used CR values in testing the reliability of the five research constructs. The CR values vary between 0.790 and 0.894. The obtained values from CR are above the acceptable reliability score of 0.7, thus validating the internal consistency of the five research construct measures, according to Nunnally and Bernstein (1994). The results show that the AVE of this study is between 0.463 and 0.627. These AVE values are above the recommended 0.40, indicating a satisfactory measure (Anderson & Gerbing 1988).

As shown in Table 1, 'loadings of all items should be more than the suggested value of 0.5' (Hair et al. 2006:23). Factor loadings in this study ranged from 0.544 to 0.843, meeting the specification of the recommended value of 0.5. Items EE1 and EP11 were deleted because of the low factor loadings (below 0.5). The remaining items fulfil the requirements of reliability and convergent validity. According to Hair et al. (2017), discriminant validity refers to items measuring different concepts. Table 2 presents the results of the discriminant validity analysis.

Nunnally and Bernstein (1994) demonstrated that one of the strategies used to observe the discriminant validity of the research was the determination of whether the connections amongst latent constructs are under 0.60. A correlation estimate of under 0.60 is prescribed in the empirical literature to affirm the presence of discriminant validity (Nunnally & Bernstein 1994). As shown in Table 2, the inter-construct correlation estimates run from 0.387 to 0.596, which is below the dependable guideline of 0.60 (Nunnally & Bernstein 1994), showing the accomplishment of discriminant validity. Table 2 demonstrates that the outcomes additionally approve the presence of discriminant validity.

Assessment of the goodness of fit

Overall, R2 for entrepreneurial performance and poverty reduction in Figure 3 indicate that the research model explains 69.3% and 57.2%, respectively, of the variance in the endogenous variables. The following formula given by Tenenhaus et al. (2005) was used to calculate the global goodness of fit (GOF) statistic for the research model:

where AVE represents the average of all AVE values for the research variables, whilst R2 represents the average of all R2 values in the full path model. The calculated global GOF is 0.57, which exceeds the threshold of GOF > 0.36 suggested by Wetzels, Odekerken-Schröder and Van Oppen (2009). Therefore, it can be concluded that the research model has a good overall fit.

Path model results and factor loadings

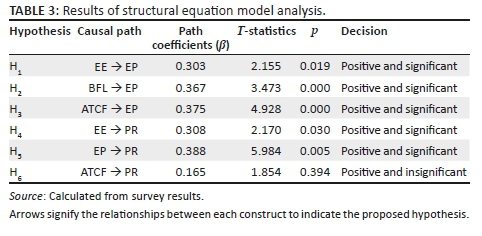

The PLS estimation results for the structural model and the item loadings for the research constructs are shown in Figure 3. The findings of the structural model are presented in Table 3.

Outcome of hypotheses testing

In this study, hypotheses testing was conducted by path coefficient values, as well as the t-values for the structural model obtained from the bootstrapping algorithm. According to Beneke and Blampied (2012), t-values indicate whether or not a significant relationship exists between variables in the model and path coefficients, demonstrating the strength of the relationships in the model. Figure 3 and Table 3 show the standardised path coefficients and their corresponding t-values. A statistically significant relationship is expected to have a t-value that exceeds 1.96 at a 5% level of significance (Chin 1998).

Outcome of testing hypothesis 1: Entrepreneurship education and entrepreneurial performance of small and medium-sized enterprises

The primary hypothesis expresses that entrepreneurship education emphatically and fundamentally impacts entrepreneurial performance of SMEs. In this examination, this speculation was bolstered. It can be seen in Figure 3 and Table 3 that entrepreneurship education applied a positive impact (β = 0.303) and was statistically significant (t = 2.155) in foreseeing entrepreneurial performance. This outcome proposes that the higher the level of entrepreneurial instruction, the higher the level of entrepreneurial execution in SMEs. Along these lines, this examination fails to dismiss H1. It is important to mention that these outcomes are in accordance with the research of Van Der Sluis et al. (2008) who contend that education leads to a higher quality of entrepreneurial performance. As such, investment in the education of (prospective) entrepreneurs is advocated.

Outcome of testing hypothesis 2: Budgeting financial literacy and entrepreneurial performance of small and medium-sized enterprises

The second hypothesis states that budgeting financial literacy positively and significantly impacts entrepreneurial performance of SMEs. In this study, this supposition is upheld. It can be seen in Figure 3 and Table 3 that budgeting financial literacy exerts a positive influence (β = 0.367) and was measurably critical (t = 3.473) in anticipating entrepreneurial performance. This outcome recommends that the higher the level of budgeting financial literacy, the higher the level of entrepreneurial performance in the SMEs. Subsequently, this investigation supports H2. These outcomes are in line with researchers, such as Chepngetich (2016), who investigated the connection between financial literacy and performance of SMEs in the Uasin Gishu County and discovered that budgeting financial literacy significantly affects SME performance.

Outcome of testing hypothesis 3: Access to credit facilities and entrepreneurial performance of small and medium-sized enterprises

The third hypothesis states that access to credit facilities positively and significantly impacts entrepreneurial performance of SMEs. In this study, this hypothesis is upheld. Figure 3 and Table 3 indicate that access to credit facilities exerts a positive impact (β = 0.375) and is factually noteworthy (t = 4.928) in anticipating entrepreneurial performance. This outcome recommends that the higher the level of access to credit facilities, the higher the level of entrepreneurial performance in the SMEs. Thus, this study supports H3. These results are in line with the work of Chege (2014) who investigated the impact of access to credit facilities on the development of the 100 best SMEs in Kenya and found that access to credit facilities emphatically impacts the development of these enterprises.

Outcome of testing hypothesis 4: Entrepreneurship education and poverty reduction

The fourth hypothesis states that entrepreneurship education positively and significantly impacts poverty reduction. This study supports this hypothesis. It can be observed from Figure 3 and Table 3 that entrepreneurship education exerts a positive influence (b = 0.308) and is statistically significant (t = 2.170) in predicting entrepreneurial performance. This result suggests that the higher the level of entrepreneurship education, the higher the level of entrepreneurial performance in the SMEs. The results obtained in the current study coincide with the work of Nkang (2013) who contends that refocusing entrepreneurship education would lead to poverty reduction.

Outcome of testing hypothesis 5: Entrepreneurial performance of small and medium-sized enterprises and poverty reduction

The fifth hypothesis states that entrepreneurial performance positively and significantly impacts poverty reduction. In this study, this hypothesis is supported. It can be observed from Figure 3 and Table 3 that entrepreneurial performance exerts a positive influence (b = 0.388) and is statistically significant (t = 5.984) in predicting entrepreneurial performance. This result suggests that the higher the level of entrepreneurial performance, the higher the level of poverty reduction. The results obtained in this study are in line with the work of Yasa et al. (2015) who found that entrepreneurial performance positively and significantly affects poverty reduction.

Outcome of testing hypothesis 6: Access to credit facilities and poverty reduction

The sixth hypothesis states that access to credit facilities positively and significantly impacts poverty reduction. In this study, this hypothesis result emerged to be positive, but insignificant. As shown in Figure 3 and Table 3, access to credit facilities exerts a positive influence (b = 0.165) and is statistically insignificant (t = 1.854) in predicting poverty reduction. This result suggests that the higher the level of access to credit facilities, the higher the level of poverty reduction. These findings mirror the work of Kurgat et al. (2017) who posited that access to credit facilities contributes positively towards poverty reduction.

Implications of the study

This study's implications are centred around three themes: theoretical implications, practical implications and policy implications.

Theoretical implications

The present investigation offers suggestions for academics. For instance, an examination of the findings demonstrates that entrepreneurship performance and poverty reduction has the most impact on each hypothesis, as shown by a path coefficient of 0.388 when compared to other research findings. For academics in the field of entrepreneurship, this improves the understanding of the connection between entrepreneurship performance and poverty reduction, as it contributes to existing literature on these two variables.

Practical implications

On the practitioners' side, this investigation presents ways in which SME managers can improve businesses.

Given the strong connection between budgeting financial literacy and entrepreneurial performance (0.367), entrepreneurs inside SMEs should focus on securing budgeting financial literacy for their occupation, which will eventually enhance the business performance.

Policy implications

This study offers suggestions for strategists who seek to reduce poverty. Existing policies can be changed, keeping in mind the goal to enhance SME entrepreneurial performance and reduce poverty. The outcomes obtained from this research can be utilised to produce new policies or revise existing policies. For example, this study has confirmed that entrepreneurship education positively and significantly impacts entrepreneurial performance and poverty reduction. A major suggestion of this study (with respect to policy) is that managers of educational establishments and governmental departments in charge of higher education should seriously consider the importance of entrepreneurship education by introducing entrepreneurship as a discipline in courses presented at universities. Policymakers and academic practitioners must work together to design curricula and course content that incorporate the relevant theoretical ingredients to motivate entrepreneurial drive.

Recommendations

Based on literature analysis and specifically in light of empirical research results, the following propositions are offered:

-

Credit finance enhances development by allowing SMEs to conduct profitable undertakings that often require heavy capital investment. Therefore, financial lending organisations should consider setting lower collateral demands to make it simpler for SMEs to access the same and promote their activities.

-

High loan costs are amongst the problems that prevent SMEs from accessing loan finance. Therefore, loan organisations should review loan expenses such as processing fees that push elevated loan expenses.

-

To make good financial decisions, it is also recommended that SME executives need to obtain some financial literacy skills - specifically budgeting financial literacy.

-

Because entrepreneurship education aims at providing expertise, entrepreneurial abilities and inspiration amongst entrepreneurs, entrepreneurship education centres for SMEs should be set up in the Vhembe county of Limpopo province, South Africa, where SME managers can have courses in entrepreneurship education and financial literacy. For example, if financial literacy coaching is acquired, SMEs would adopt more risky ventures, diversify investments and raise capital for growth and transformation into stronger companies.

-

Adequate attention should be given to SMEs by channelling more resources to the sector. This would to a great extent reduce poverty in South Africa.

-

Lastly, it is appropriate to suggest that potential scholars in this area should extend their research to cover a broader spectrum of poverty reduction approaches in South Africa.

Limitations and future research suggestions

This study has some limitations that must be considered, even though it has made a significant contribution to various fields. Future research should continue exploring and increasing knowledge in the small business management field. With the utilisation of a moderately small sample size, the findings cannot decisively be summarised, even though various statistic questions were utilised to decide how extensive the sample of the target population should be. In future research, a larger population of SMEs should be examined. An examination of SMEs from different provinces, for example, the Eastern Cape province of South Africa where poverty is at its zenith, would be advantageous. As this research was quantitative in nature, future research can centre around triangulation techniques to avoid this bias.

Future researchers can focus on other factors that influence entrepreneurial performance and alleviate poverty. These factors can comprise social capital, green marketing strategies in SMEs and innovation.

Comparative studies between the results of this study and those obtained from other emerging economies can be considered in the future. This may lead to insights that were not captured in the present study.

Conclusion

This research was undertaken with the aim of investigating the impact of entrepreneurship education, budgeting financial literacy and access to credit facilities on entrepreneurial performance, as well as poverty reduction in South Africa. The study confirms that factors such as entrepreneurship education, budgeting financial literacy and access to credit facilities are instrumental in stimulating entrepreneurial performance and poverty reduction.

Entrepreneurial performance was found to have a robust influence on poverty reduction in comparison to entrepreneurship education and access to credit facilities. A robust relationship was also found between budgeting financial literacy and entrepreneurial performance. The findings support all the stated hypotheses, except for hypothesis 6, which, although positive, was insignificant. Managerial implications of the findings were discussed, and limitations and future research directions were indicated. This study will add new knowledge to the existing body of entrepreneurship and small business management literature in the African setting - a research context that is currently under-researched and overlooked in academia.

Acknowledgements

The authors would like to thank the editor and all the anonymous reviewers for their invaluable comments and feedback. The authors are also thankful to the rural SME managers who responded to this study.

Competing interests

The authors declare that they have no financial or personal relationships which may have inappropriately influenced them in writing this article.

Authors' contributions

E.T.M. initiated this research and was the project leader, concept developer, article structure designer, writer and data analyst. A.C reviewed the empirical literature section of the article and contributed to the writing of the research introduction and ramifications.

Funding information

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

Data availability statement

Data sharing is not applicable to this article as no new data were created or analysed in this study.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Agyapong, D., 2010, 'Micro, small and medium enterprises' activities, income level and poverty reduction in Ghana: A synthesis of related literature', International Journal of Business and Management 5(12), 196-201. https://doi.org/10.5539/ijbm.v5n12p196 [ Links ]

Agyei, S.K., 2018, 'Culture, financial literacy, and SME performance in Ghana', Cogent Economics & Finance 6(1), 1463813. https://doi.org/10.1080/23322039.2018.1463813 [ Links ]

Agyemang, E., 2015, 'Economic growth, income inequality and poverty reduction: A regional comparative analysis', Doctoral dissertation, University of Lethbridge, Canada. [ Links ]

Akinwale, O. & Ogundiran, O., 2014, 'The impacts of small business on poverty reduction in Eastern Cape Province, South Africa', Mediterranean Journal of Social Sciences 5(15), 156-164. https://doi.org/10.5901/mjss.2014.v5n15p156 [ Links ]

Amin, S., 2018, 'Does the entrepreneurial human capital is important for organizational performance?' Business and Economics Journal 9(350), 2-12. https://doi.org/10.4172/2151-6219.1000350 [ Links ]

Anderson, J.C. & Gerbing, D.W., 1988, 'Structural equation modeling in practice: A review and recommended two-step approach', Psychology Bulletin 1(3), 411-423. https://doi.org/10.1037/0033-2909.103.3.411 [ Links ]

Becker, G.S., 1962, 'Investment in human capital: A theoretical analysis', Journal of Political Economy 70(5), 9-49. [ Links ]

Beneke, J. & Blampied, S., 2012, 'Driving consumer perceptions through Facebook: An investigation into empowering brands in the 21st century', in J.M.M. Van Den Berg (ed.), Conference proceedings of the 24th annual conference of SAIMS - 2012, Stellenbosch University, Stellenbosch, September 09-11, 2012, pp. 47-61. [ Links ]

Beyers, L.J.E., 2015, 'A review of the housing policy in Limpopo Province, South Africa', Journal of Human Ecology 52(3), 246-251. https://doi.org/10.1080/09709274.2015.11906948 [ Links ]

Bosch, A., 2008, 'An empirical analysis of the adequacy of the infrastructure delivery rate to address poverty in South Africa', Unpublished master's dissertation, Department of Economics and Econometrics, University of Johannesburg, Johannesburg. [ Links ]

Brainard, L., LaFleur, V., Blum, R.C. & Talbott, S., 2005, Expanding enterprise, lifting the poor: The private sector in the fight against global poverty, Global Economy and Development, Brookings Institution, Washington, DC. [ Links ]

Brunswicker, S. & Van De Vrande, V., 2014, 'Exploring open innovation in small and medium-sized enterprises', New Frontiers in Open Innovation 1, 135-156. https://doi.org/10.1093/acprof:oso/9780199682461.003.0007 [ Links ]

Budeli, M.C., 2012, 'Barriers and coping capacities experienced by people living with disability in the Nzhelele area of Limpopo Province', Unpublished thesis, University of Johannesburg, Johannesburg. [ Links ]

Cant, M.C. & Wiid, J.A., 2013, 'Establishing the challenges affecting South African SMEs', The International Business & Economics Research Journal (Online) 12(6), 707. https://doi.org/10.19030/iber.v12i6.7869 [ Links ]

Cant, M.C., Wiid, J.A. & Kallier, S.M., 2015, 'Product strategy: Factors that influence product strategy decisions of SMEs in South Africa', Journal of Applied Business Research 31(2), 621-721. https://doi.org/10.19030/jabr.v31i2.9158 [ Links ]

Cant, M.C., Wiid, J.A. & Meyer, A., 2016, 'SMEs: Do they follow a shotgun or rifle approach when it comes to target marketing?', Problems and Perspectives in Management 14(3), 504-511. https://doi.org/10.21511/ppm.14(3-2).2016.06 [ Links ]

Chege, G.S., 2014, 'The effect of access to credit facilities on the growth of top 100 small and medium enterprises in Kenya', Unpublished Master of Business Administration dissertation, University of Nairobi, Kenya. [ Links ]

Chepngetich, P., 2016, 'Effect of financial literacy and performance SMEs: Evidence from Kenya', American Based Research Journal, viewed 1 September 2019, from https://ssrn.com/abstract=2882997. [ Links ]

Chidi, C.O. & Shadare, O.A., 2011, 'Managing human capital development in small and medium-sized enterprises for sustainable national development in Nigeria', International Journal of Management and Information Systems 15(2), 95-101. [ Links ]

Chin, W.W., 1998, 'Issues and opinion on structural equation modelling', MIS Quarterly 22(1), 7-16. [ Links ]

Chinomona, R. & Chinje, N.B., 2015, 'Digital natives and information sharing on social media platforms: Implications for managers', Journal of Contemporary Management 12(1), 795-814. [ Links ]

Chinomona, R. & Surujal, B., 2012, 'The influence of student internship work experience on their self-improvement and professionalism in sport management', African Journal for Physical, Health Education, Recreation and Dance 18(4), 885-899. [ Links ]

Chinyamurindi, W.T., 2016, 'A narrative investigation on the motivation to become an entrepreneur among a sample of black entrepreneurs in South Africa: Implications for entrepreneurship career development education', Acta Commercii 16(1), 1-9. http://doi.org/10.4102/ac.v16i1.310 [ Links ]

Churchill, G.A. Brown, T.J. & Suter, T.A., 2010, Basic marketing research, 7th edn., Cengage Learning, Stamford. [ Links ]

Delp, L., Brown, M. & Domenzain A., 2005, 'Fostering youth leadership to address workplace and community environmental health issues', Health Promotion Practice 6(3), 270-285. https://doi.org/10.1177/1524839904266515 [ Links ]

Department of Basic Education, 2012, 'Quality education for rural schools in South Africa: Challenges and solutions', South Africa Rural Educator 1, 9-12. [ Links ]

Desiree, B. & Kengne, S., 2016, 'Mixed-gender ownership and financial performance of SMEs in South Africa', International Journal of Gender and Entrepreneurship 8(2), 117-136. https://doi.org/10.1108/IJGE-10-2014-0040 [ Links ]

Djankov, S., Miguel, E., Qian, Y., Roland, G. & Zhuravskaya, E., 2005, 'Who are Russia's entrepreneurs?' Journal of the European Economic Association 3(2-3), 1-11. https://doi.org/10.1162/jeea.2005.3.2-3.587 [ Links ]

Djankov, S., Qian, Y., Roland, G. & Zhuravskaya, E., 2006, Entrepreneurship in Brazil, China, and Russia, CEFIR working paper no. 66., Center for Economic and Financial Research, Moscow. [ Links ]

Dlodlo, N., 2017, 'A second chance to serve South African private banking consumers: The role of post-transgression forgiveness', Banks and Bank Systems 12(3), 166-178. https://doi.org/10.21511/bbs.12(3-1).2017.02 [ Links ]

Elert, N., Andersson, F.W. & Wennberg, K., 2015, 'The impact of entrepreneurship education in high school on long-term entrepreneurial performance', Journal of Economic Behavior & Organization 111, 209-223. https://doi.org/10.1016/j.jebo.2014.12.020 [ Links ]

Fatoki, O., 2014, 'The financial literacy of micro entrepreneurs in South Africa', Journal of Social Sciences 40(2), 151-158. https://doi.org/10.1080/09718923.2014.11893311 [ Links ]

Fayolle, A. & Gailly, B., 2015, 'The impact of entrepreneurship education on entrepreneurial attitudes and intention: Hysteresis and persistence', Journal of Small Business Management 53(1), 75-93. https://doi.org/10.1111/jsbm.12065 [ Links ]

Fiseha, G.G. & Oyelana, A.A., 2015, 'An assessment of the roles of small and medium enterprises (SMEs) in the local economic development (LED) in South Africa', Journal of Economics 6(3), 280-290. https://doi.org/10.1080/09765239.2015.11917617 [ Links ]

Fix, B., 2018, 'The trouble with human capital theory', Real-world economics review 86(1), 15-30. [ Links ]

Fletschner, D., 2008, 'Women's access to credit: Does it matter for household efficiency?', American Journal of Agricultural Economics 90(3), 669-683. https://doi.org/10.1111/j.1467-8276.2008.01143.x [ Links ]

Gao, Y., Ge, B., Lang, X. & Xu, X., 2018, 'Impacts of proactive orientation and entrepreneurial strategy on entrepreneurial performance: An empirical research', Technological Forecasting and Social Change 135, 178-187. https://doi.org/10.1016/j.techfore.2017.11.019 [ Links ]

Gamede, B.T. & Uleanya, C., 2017, 'The role of entrepreneurship education in secondary schools at further education and training phase', Academy of Entrepreneurship Journal 23(2), 1-12. [ Links ]

Green, C.J., Kirkpatrick, C.H. & Murinde, V., 2006, 'Finance for small enterprise growth and poverty reduction in developing countries', Journal of International Development 18(7), 1017-1030. https://doi.org/10.1002/jid.1334 [ Links ]

Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E. & Tatham, R.L., 2006, Multivariate data analysis, Pearson Prentice-Hall, Uppersaddle River, NJ. [ Links ]

Hair, J.F., Sarstedt, M., Hopkins, L. & Kuppelwieser, V.G., 2014, 'Partial least squares structural equation modelling (PLS-SEM)', European Business Review 26(2), 106-121. https://doi.org/10.1108/EBR-10-2013-0128 [ Links ]

Hair Jr, J. F., Sarstedt, M., Ringle, C. M. & Gudergan, S. P., 2017, Advanced issues in partial least squares structural equation modeling, Sage, Thousand Oaks, CA. [ Links ]

Hiatt, S.R., Carlos, W.C. & Sine, W.D., 2018, 'Manu Militari: The institutional contingencies of stakeholder relationships on entrepreneurial performance', Organization Science 29(4), 633-652. https://doi.org/10.1287/orsc.2017.1178 [ Links ]

Hove, P., Sibanda, K. & Pooe, D., 2014, 'The impact of Islamic banking on entrepreneurial motivation, firm competitiveness and performance in South African small and medium enterprises', Mediterranean Journal of Social Sciences 5(15), 165-174. https://doi.org/10.5901/mjss.2014.v5n15p165 [ Links ]

Ijaiya, G.T., Ijaiya, M.A., Bello, R.A. & Ajayi, M.A., 2011, 'Economic growth and poverty reduction in Nigeria', International Journal of Business and Social Science 2(15), 147-154. https://doi.org/10.5901/mjss.2014.v5n15p165 [ Links ]

Iwu, C.G., Opute, P.A., Nchu, R., Eresia-Eke, C., Tengeh, R.K., Jaiyeoba, O. & Aliyu, O.A., 2019, 'Entrepreneurship education, curriculum and lecturer-competency as antecedents of student entrepreneurial intention', The International Journal of Management Education 43(1), 116-120. https://doi.org/10.1016/j.ijme.2019.03.007 [ Links ]

Jones, O., Macpherson, A. & Thorpe, R., 2010, 'Promoting learning in owner-managed small firms: Mediating artefacts and strategic space', Entrepreneurship & Regional Development 22(7), 649-673. https://doi.org/10.1080/08985620903171368 [ Links ]

Joshi, P.L., Al-Mudhaki, J. & Bremser, W.G., 2003, 'Corporate budget planning, control and performance evaluation in Bahrain', Managerial Auditing Journal 18(9), 737-750. https://doi.org/10.1108/02686900310500505 [ Links ]

Karimi, N.E., 2014, 'The effect of credit financing on profitability of small and medium sized enterprises in Nairobi County', Master of Business Administration Degree Research Project, University of Nairobi, Nairobi. [ Links ]

Kavari, U.J., 2016, 'Modelling an agricultural-entrepreneurial developmental resolution', Doctoral dissertation, University of Pretoria. [ Links ]

Khan, K.U., Xuehe, Z., Atlas, F. & Khan, F., 2019, 'The impact of dominant logic and competitive intensity on SMEs performance: A case from China', Journal of Innovation & Knowledge 4(1), 1-11. https://doi.org/10.1016/j.jik.2018.10.001 [ Links ]

Khatib, J.A., 2015, 'The role of small and medium enterprises on poverty alleviation in Zanzibar urban west region Zanzibar', Unpublished doctoral dissertation, Mzumbe University. [ Links ]

Kotler, P. & Armstrong, G., 2012, Principles of marketing, 14th edn., Pearson Education, Cranbury, NJ. [ Links ]

Kowalkowski, C., Witell, L. & Gustafsson, A., 2013, 'Any way goes: Identifying value constellations for service infusion in SMEs', Industrial Marketing Management 42(1), 18-30. https://doi.org/10.1016/j.indmarman.2012.11.004 [ Links ]

Kurgat, F., Owembi, K.O. & Omwono, G.A., 2017, 'Impact of access to credit facilities on youth economic development: A case of Mwanzo youths in Uasin Gishu County, Kenya', International Journal of Research in Business Studies and Management 4(1), 24-36. http://doi.org/10.22259/ijrbsm.0401004 [ Links ]

Ladzani, W.M. & Van Vuuren, J.J., 2002, 'Entrepreneurship training for emerging SMEs in South Africa', Journal of Small Business Management 40(2), 151-161. https://doi.org/10.1111/1540-627X.00047 [ Links ]

Lee, N., 2014, 'What holds back high-growth firms? Evidence from UK SMEs', Small Business Economics 43(1), 183-195. https://doi.org/10.1007/s11187-013-9525-5 [ Links ]

Lee, N., Sameen, H. & Cowling, M., 2015, 'Access to finance for innovative SMEs since the financial crisis', Research Policy 44(2), 370-380. [ Links ]

Mafini, C., Pooe, D.R.I. & Loury-Okoumba, V.W., 2016, 'Interrogating antecedents to SME supplier performance in a developing country', Southern African Business Review 20, 259-285. [ Links ]

Mafundu, R.H. & Mafini, C., 2019, 'Internal constraints to business performance in black-owned small to medium enterprises in the construction industry', The Southern African Journal of Entrepreneurship and Small Business Management 11(1), 1-10. https://doi.org/10.4102/sajesbm.v11i1.165 [ Links ]

Mahadea, D. & Kaseeram, I., 2018, 'Impact of unemployment and income on entrepreneurship in post-apartheid South Africa: 1994-2015', The Southern African Journal of Entrepreneurship and Small Business Management 10(1), a115. https://doi.org/10.4102/sajesbm.v10i1.115 [ Links ]

Maksimov, V., Wang, S.L. & Luo, Y., 2017, 'Reducing poverty in the least developed countries: The role of small and medium enterprises', Journal of World Business 52(2), 244-257. https://doi.org/10.1016/j.jwb.2016.12.007 [ Links ]

Maleka, A.M. & Fatoki, O., 2016, 'The role of government in developing small, medium and micro enterprises in South Africa', Journal of Social Sciences 49(3-2), 307-310. https://doi.org/10.1080/09718923.2016.11893625 [ Links ]

Malhotra, N.K., 2010, Marketing research: An applied orientation, Prentice Hall, Upper Saddle River, NJ. [ Links ]

Manyaka-Boshielo, S.J., 2019, 'Towards entrepreneurship education: Empowering township members to take ownership of the township economy', HTS Teologiese Studies/Theological Studies 75(1), 1-7. https://doi.org/10.4102/hts.v75i1.5166 [ Links ]

Manyara, G. & Jones, E., 2007, 'Community-based tourism enterprises development in Kenya: An exploration of their potential as avenues of poverty reduction', Journal of Sustainable Tourism 15(6), 628-644. https://doi.org/10.2167/jost723.0 [ Links ]

Matchaba-Hove, T., Farrington, S. & Sharp, G., 2015., 'The entrepreneurial orientation-Performance relationship: A South African small business perspective', The Southern African Journal of Entrepreneurship and Small Business Management 7(1), 36-68. https://doi.org/10.4102/sajesbm.v7i1.6 [ Links ]

Matlay, H., 2008, 'The impact of entrepreneurship education on entrepreneurial outcomes', Journal of Small Business and Enterprise Development 15(2), 382-396. https://doi.org/10.1108/14626000810871745 [ Links ]

Maziriri, E.T. & Mapuranga, M., 2017, 'The impact of management accounting practices (MAPS) on the business performance of small and medium enterprises within the Gauteng Province of South Africa', Journal of Accounting and Management 7(2), 12-25. [ Links ]

Maziriri, E.T., Mapuranga, M. & Madinga, N.W., 2018, 'Self-service banking and financial literacy as prognosticators of business performance among rural small and medium-sized enterprises in Zimbabwe', The Southern African Journal of Entrepreneurship and Small Business Management 10(1), 1-10. https://doi.org/10.4102/sajesbm.v10i1.180 [ Links ]

Mbuli, B.N., 2009, 'Poverty reduction strategies in South Africa', Master of Commerce: Economics, University of South Africa. [ Links ]

Mears, R.R. & Blaauw, P.F., 2010, 'Levels of poverty and the poverty gap in rural Limpopo', Acta Commercii 10(1), 89-106. https://doi.org/10.4102/ac.v10i1.118 [ Links ]

Mensah, S.A. & Benedict, E., 2010, 'Entrepreneurship training and poverty alleviation: Empowering the poor in the Eastern Free State of South Africa', African Journal of Economic and Management Studies 1(2), 138-163. https://doi.org/10.1108/20400701011073464 [ Links ]

Mincer, J., 1958, Progress in human capital analysis of the distribution of earnings, National Bureau of Economic Research, Cambridge, MA. [ Links ]

Mole, S.A. & Namusonge, G.S., 2016, 'Factors affecting access to credit by small and medium enterprises: A case of Kitale town', International Journal of Social Sciences and Humanities Invention 3(10), 2904-2917. https://doi.org/10.18535/ijsshi/v3i10.12 [ Links ]

Musah, A., Gakpetor, E.D. & Pomaa, P., 2018, 'Financial management practices, firm growth and profitability of small and medium scale enterprises (SMEs)', Financial Management 10(3), 25-37. https://doi.org/10.22610/imbr.v10i3.2461 [ Links ]

Naidoo, J., 2015, 'Pedagogic strategies: Using empowerment theory to confront issues of language and race within mathematics education', Power and Education 7(2), 224-238. https://doi.org/10.1177/1757743815586522 [ Links ]

Ndofirepi, T.M. & Rambe, P., 2018, 'A qualitative approach to the entrepreneurship education and intentions nexus: A case of Zimbabwean polytechnic students', The Southern African Journal of Entrepreneurship and Small Business Management 10(1), 1-14. [ Links ]

Ndou, V., Mele, G. & Del Vecchio, P., 2018, 'Entrepreneurship education in tourism: An investigation among European universities', Journal of Hospitality, Leisure, Sport & Tourism Education 16(1), 1-10. https://doi.org/10.1016/j.jhlste.2018.10.003 [ Links ]

Netshifhefhe, S.R., Kunjeku, E.C. & Duncan, F.D., 2018, 'Human uses and indigenous knowledge of edible termites in Vhembe District, Limpopo Province, South Africa', South African Journal of Science 114(1-2), 1-10. https://doi.org/10.17159/sajs.2018/20170145 [ Links ]

Nkang, I.E., 2013, 'Re-engineering entrepreneurship education for employment and poverty alleviation in the Niger Delta Region of Nigeria', Journal of Education and Practice 4(2), 88-94. [ Links ]

Nowiński, W., Haddoud, M.Y., Lančarič, D., Egerová, D. & Czeglédi, C., 2019, 'The impact of entrepreneurship education, entrepreneurial self-efficacy and gender on entrepreneurial intentions of university students in the Visegrad countries', Studies in Higher Education 44(2), 361-379. https://doi.org/10.1080/03075079.2017.1365359 [ Links ]

Nunnally, J.C. & Bernstein, I., 1994, Psychometric theory, 3rd edn., McGraw-Hill, New York. [ Links ]

Nwokolo, E., 2015, 'Entrepreneurship education as a strategy for the promotion of entrepreneurship culture and poverty reduction among university students', Master's Degree in Management and Commerce dissertation, University of Fort Hare. [ Links ]

Nwokolo, E.E., Dywili, M. & Chimucheka, T., 2017, 'Entrepreneurship education as a viable tool for the reduction of poverty', Journal of Social Sciences 51(1-3), 53-64. https://doi.org/10.1080/09718923.2017.1305574 [ Links ]

O'regan, N., Sims, M.A. & Gallear, D., 2008, 'Leaders, loungers, laggards: The strategic planning environment performance relationship re-visited in manufacturing SMEs', Journal of Manufacturing Technology Management 19(1), 6-21. https://doi.org/10.1108/17410380810843426 [ Links ]

Okpara, J.O., 2011, 'Factors constraining the growth and survival of SMEs in Nigeria: Implications for poverty alleviation', Management Research Review 34(2), 156-171. https://doi.org/10.1108/01409171111102786 [ Links ]

Olabisi, S.Y & Olagbem, A.A., 2012, 'Human capital and women entrepreneurs in tye and dye micro-business in Ogun State, Nigeria', Global Journal of Human Social Science 12(5), 33-42. [ Links ]