Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Acta Commercii

On-line version ISSN 1684-1999

Print version ISSN 2413-1903

Acta Commer. vol.18 n.1 Johannesburg 2018

http://dx.doi.org/10.4102/ac.v18i1.466

ORIGINAL RESEARCH

The relationship between foreign direct investment and economic growth in South Africa: Vector error correction analysis

Tshepo S. Masipa

Economics Department, School of Economics and Management, University of Limpopo, South Africa

ABSTRACT

ORIENTATION: From the Growth, Employment and Redistribution (GEAR) strategy of 1996 to the currently implemented National Development Plan (NDP), the need to attract more foreign investors and promote exports in pursuit of economic growth and job creation has been emphasised.

RESEARCH PURPOSE: It is within this context that the purpose of this article was to determine the nexus between foreign direct investment (FDI) inflows and economic growth from 1980 to 2014.

RESEARCH DESIGN, APPROACH AND METHOD: The vector error correction model is employed to determine and estimate the long-run relationship between the variables in the model.

MAIN FINDINGS: From the findings, it was found that economic growth shares a positive relationship with both FDIs and the real effective exchange rate, while sharing a negative long-run relationship with government expenditure.

PRACTICAL AND MANAGERIAL IMPLICATIONS: The article contributes towards the on going debates on the impact of FDIs on economic growth and job creation in the recipient countries. Accordingly, its findings reinforce the importance of attracting FDIs in South Africa and to what extent they affect economic growth and employment.

CONTRIBUTION OR VALUE-ADD: From a policy perspective, the attraction of foreign investors must target sources that can create jobs and boost the South African economy. It is vital for the government to strengthen its machinery to fight corruption to create an environment conducive for foreign investors. Hence, this article suggests that South Africa's capacity to grow and create jobs also depends on the country's performance to enhance gross domestic product growth and attract more FDIs. The attraction of FDIs should, however, not be seen as an end in itself but also as a means of supporting other initiatives such as eradicating poverty and inequalities in South Africa.

Introduction

In spite of it being over 22 years since the advent of democracy, unemployment, poverty and inequality remain the fundamental socio-economic challenges facing contemporary South Africa. Despite the progress made to address these challenges, the struggle against 'jobless' growth, poverty and high inequalities still persists in contemporary South Africa. Over the past two decades, the official rate of unemployment has increased from 17% in 1994 to around 26% in the last quarter of 2015 (StatsSA 2015). The gross domestic product (GDP) is growing at about 0% - 1%, which is less than the much desired 5% annual growth. Looking at the rate of unemployment, especially for the youth, it is clear that job creation is one of the prime challenges facing South Africa. In its quest to enhance economic growth, development and job creation, the government has introduced a number of policy stances to address the challenges of poverty and joblessness. These policies range from Growth, Employment and Redistribution (GEAR), Accelerated and Shared Growth Initiative for South Africa (AsgiSA), New Growth Path (NGP) to the currently implemented National Development Plan (NDP) (The Presidency, 2011). Imbedded in these policies is the need to attract more foreign investors with the view to enhance economic growth, create jobs and supplement domestic expenditure which accounts for a larger portion of the total government expenditure and investments. In addition, the President of the Republic of South Africa in his State of Nation Address (SONA 2014) also emphasised the need to attract more foreign investors, as he argues that it is one of the solutions to unemployment, poverty and high inequality (SONA 2014). Various scholars also subscribe to the notion that foreign direct investment (FDI) inflows and exports are panacea for economic growth and job creation in emerging economies. These include, amongst others, Asiedu (2006), Xolani (2011), Mpanju (2012) and Fuhrmann (2013). These proponents of FDIs have noted and emphasised the importance of attracting foreign direct investors to enhance the growth of emerging economies via the transfer of technology and skills, job creation, improving domestic infrastructure and other positive externalities that come with the foreign investors. It is therefore within this context that this article attempts to determine the relationship between FDI inflows and economic growth in South Africa from 1980 to 2014.

Do foreign direct investments and exports translate to economic growth and job creation?

The question of whether FDIs and exports are key factors to promote growth, development and job creation in emerging economies has been the subject of debate for a number of scholars and policymakers over the past decades. Foreign direct investment-led growth and export-led growth hypotheses are believed to enhance growth, employment and development in most developing economies.

Foreign direct investment-led growth hypothesis

In support of the FDI-led growth hypothesis, Denisia (2010) argues that FDIs can increase productivity and competitiveness in the host country. According to Denisia, encouraging more FDIs in the country can also increase GDP by increasing the output produced, especially in the manufacturing sector, which will help increase exports. Ncunu (2011) argues that FDI inflows can create new jobs and also access modern technologies, resulting in positive effects on the balance of payments. In his study, Ncunu (2011) further posits that FDI is also a catalyst for economic development in Central and Eastern European countries. In addition, Madariaga and Poncet (2007) examined the causal relationship between foreign trade and FDI inflows to China from 19 countries during 1984-1998 through panel data analysis. Their results indicate that exports volume is affected by FDI inflows to China. Chaudhuri and Banerjee (2010), on the other hand, studied the impact of FDIs on agricultural land in developing economies using a Three-Sector General Equilibrium model with the simultaneous unemployment for both skilled and unskilled labour. Their results ascertained that FDI in agriculture can increase the social welfare by creating employment opportunities for the unskilled labour in the host country due to the fact that agriculture is more labour intensive and requires less technical skills.

Vacaflores (2011) studied the effect of FDIs on job creation for a group of Latin American countries for the period 1980-2006. Annual data were collected from 12 Latin American economies, and the findings revealed that FDI had a positive and a significant effect on job creation in those 12 countries. Similarly, Rusike (2007) posits that FDIs contribute to employment in local economies by directly adding new jobs and indirectly when local spending increases because of the purchases of goods and services by new employees. According to Rusike (2007), all these are expected to have positive multiplier effects on the host country's economy. Furthermore, FDI is also believed to be important especially for developing countries because these countries have much potential in human capital but lack the technology and capital necessary for development and growth. Foreign direct investment is, therefore, seen as a stimulus for capital accumulation and technology transfer in these economies.

Helpman and Kruman (1995) argue that there are many ways in which export-oriented FDI can help to enhance the host country's economy. In order to attract this type of investment and ensure that it translates into development gains, they mentioned that the host country needs to find the most effective ways of making the choice of locations as well as the target segments conducive to the kind of export activities the host country aims to foster. Helpman and Kruman (1995) reiterate that export-oriented FDI can be an effective means of providing resources such as skills, training, technology, capital goods and intermediate inputs needed to exploit a country's existing comparative advantages. Moreover, Khan and Afia (1995) also noted that the attraction of FDIs can help the host country in its efforts to raise exports in all kinds of industries by providing the missing elements that they need in order to compete and improve locally based skills. Moeti (2005) emphasises that governments should adopt friendly attitudes towards investors and provide incentives with efforts to attract the right type of FDI. However, Dunning (2008) argues that FDI is not always good for the host country, particularly resource-seeking FDI, because it could imply low value-adding activity and low capital expenditure on plant and equipment with the exception of extractive industries. He emphasises that multinational enterprises (MNEs) should thus be encouraged to invest in higher value-adding activities, which could come in the form of market-seeking and other asset-exploiting activities.

Export-led growth hypothesis

Developing countries around the world have been liberalising their trade regimes and moving away from import-substitution investment regimes to export-promotion development policies (Mpanju 2012). In light of these trends, much of the investment that has sought entry into developing countries in recent years has been investment oriented towards export markets. It is, however, important to note that the flow of foreign investments into the host differs through the types and motives of investments the host country wishes to attract; this ranges from resource-seeking, market-seeking to efficiency-seeking investments. According to Mpanju (2012), the basic idea of increasing exports is that it increases total factors of production because of its impact on economies of scale and other positive externalities such as transfer of technology, improving skills of local workers, managerial skills and productive capacity of the economy. Ramaphosa (2013) noted that a stronger export sector also drives job creation. Increasing exports, particularly in manufacturing, may be crucial for job creation for low-skilled workers, which is necessary to substantially reduce high unemployment, particularly amongst the youth. Exports are especially critical amid South Africa's widening current account deficit and the external vulnerability arising from its reliance on volatile capital flows to fund the deficit (Ramaphosa 2013).

The Department of Trade and Industry (DTI) reported that the export sectors in South Africa are underperforming. The report suggests that South Africa must improve on its export performance to achieve the targeted 6% per year of export growth. In addition, the NDP also proposed that to increase employment and growth, South Africa should increase exports focusing on the areas where it has a comparative advantage. These include areas such as mining, construction, agriculture, tourism and business services (DTI 2013). In 2013, the United Nations Conference on Trade and Development (UNCTAD) published a report of regional sources of FDIs in South Africa for the period 2001-2010.

The preceding trends and analyses show Europe as the largest source of FDIs in South Africa, followed by America, Asia, Africa and Australia. Total inward FDI stock from Europe amounted to R4 758 177 million, accounting for 84.2% of the total inward FDIs from all regions (UNCTAD 2013). Moreover, SARB (2014) noted that the success of exports in South Africa is neither determined solely by trade-specific issues, such as tariff and non-tariff barriers, trade facilitation costs and export promotion, nor is it determined solely by the real exchange rate. Many causes shape firm and sector competitiveness, including deep, economy-wide structural factors that impact how exports respond to real exchange rate movements.

However, unreliable power supply has become a key constraint to growth and competitiveness in South Africa. This was also noted by President Jacob Zuma who in his State of the Nation Address in 2015 suggested that the impediments to electricity supply had become the key constraint to the country's economic growth (Zuma 2015). The President stressed that the government will move quickly to address the issue of electricity as it has negative repercussions on the economy. From the discussion, FDIs and exports seem to be interconnected. This was also noted by Nguyen (2011) who stated that FDIs and exports are related. However, the relationship may be positive or negative depending on whether FDI is market-seeking or efficiency-seeking and, therefore, he indicates that FDIs and the volume of exports are complementary. In South Africa, government spending usually accounts for the greater portion of the total investments; therefore, attracting additional investments would assist and complement domestic spending by the government.

The determinants of foreign direct investment inflows to the host country

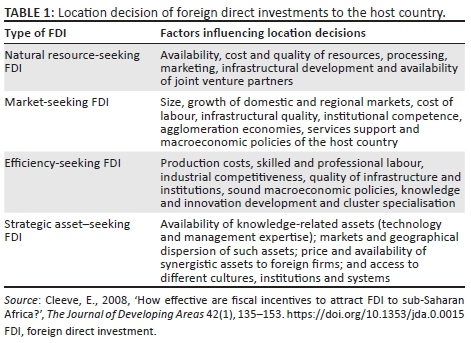

In search of new resources, cost-efficient processes and large markets, foreign investors seek opportunities and locate their multinational corporations (MNCs) in foreign countries. Table 1 summarises some of the factors influencing the types of FDI that flow into the host country.

Though it is generally accepted that these types of FDIs are important for the host country's economy, it is also worth noting that a host country's decision on which type of investment to attract depends on a wide range of factors and the country's long-term objectives. Such a decision is also informed by considering the risks, as each type of FDI comes with its own risks and uncertainties. This notion is also emphasised by Wei (2000), who suggests that each country needs to make its own judgement in the light of its conditions and the framework of its broader long-term development objectives. It also needs to assess the trade-offs involved, whether related to efficiency, the distribution of income, access to markets or various non-economic objectives.

Trends of foreign direct investment inflows to South Africa

Thomas and Leape (2005) explained that because of the nature of FDI in the 1950s and 1960s, the mining sector continued to receive flows of FDI, although some flows were in the manufacturing and service sectors. After 1994, there was a gradual increase in FDI inflow, from around R1.3 billion to R3.5 billion in 1996. According to Thomas and Leape (2005), this was perhaps as a result of the political democratisation and subsequent openness of the economy. In 1997, there was a marked increase in FDI inflow, from R3.5 billion to R17.6 billion. The large inflow of investment in 1997 is a reflection of foreign participation in the partial privatisation of Telkom. There was also a huge increase of 196% in 1999, from R3.104 billion in 1998 to R9.184 billion in 1999. However, Thomas and Leape (2005) further showed that the FDI inflow dropped to R5.1 billion in 2004. In 2005, inward FDI increased by 671% to R39.7 billion from R5.1 billion in 2004. They argue that this was a result of a large transaction in the acquisition of ABSA (South Africa) by Barclays (the United Kingdom) for R33 billion. It would appear that FDI has increased over time since the political democratisation process in 1994, but relative to the size of South Africa's economy and other similar developing countries classified as emerging markets, FDI performance is still below expected levels (Thomas & Leape 2005).

According to the World Investment Report (WIR) (2010), approximately 65% of FDI into South Africa takes the form of mergers and acquisitions, largely as a result of state-leveraged deals and the privatisation of state assets such as the Airports Company SA (ACSA), South African Airways (SAA) and Telkom. The most prominent foreign investors in South Africa have been the United Sates, the United Kingdom, Australia, Germany, Japan, Malaysia, Switzerland, China and Canada. Foreign direct investment in South Africa is also in the form of acquisitions of bonds. In 2005, Barclays paid about R30 billion for a 56.65% stake in ABSA, while Vodafone paid R16 billion to increase its stake in Vodacom (WIR 2010). In the manufacturing sector, the stock of FDI rose from US$ 11 billion in 2001 to US$ 29 billion in 2009. The UNCTAD report shows that, since 2010, a number of foreign manufacturing MNEs have expanded their activities in South Africa (UNCTAD 2011).

According to the DTI (2009), South Africa has an open investment climate, and the FDI has played a crucial role in the development of its economy. Since the end of apartheid, South Africa has undertaken substantial economic reforms in order to attract more FDI. Since 1980, FDI has remained low in relation to other growing market economies (DTI 2009). The services sector accounted for a larger share of FDI in South Africa than the primary and secondary sectors in 2001 as well as 2009. The FDI stock in the service sector rose from US$ 19 billion in 2001 to US$ 40 billion in 2009. However, in 2011, South Africa continued to perform relatively poorly as compared to other countries with FDI inflows at 1.4% of GDP, compared to 2.9% in Poland, 3.6% in Hungary, 4.3% in Malaysia and 7.0% in Chile, (UNCTAD 2011). The SARB (2014) reports that the strong growth of FDI inflows in the manufacturing industry in South Africa has been as a result of well-managed government policies, particularly in the motor industry. The DTI and Trade and Investment South Africa (TISA 2011) have provided a number of incentives to investors through the following strategic programmes:

-

Strategic Investment Programme (SIP)

-

Foreign Investment Grant (FIG)

-

Motor Industry Development Plan (MIDP)

-

Bilateral agreements

-

Strategic Industrial Project Incentive Scheme (SIPIS)

The identified strategic programmes are coordinated by TISA. According to TISA (2011), it is anticipated that the different sectorial policy initiatives will continue to have a positive impact on FDI in South Africa as opposed to the past. TISA aims to achieve the following key objectives:

-

to place South Africa amongst the top 10 investment destinations

-

to include TISA in the top 5 world-class investment promotion agencies

-

to attract an investment pipeline of R115 billion within 3 years

-

to drive targeted and coordinated investments amongst all stakeholders

-

to reduce the cost of doing business and administrative barriers

-

to enhance common messaging and brand identity.

Foreign direct investment-related programmes in South Africa

Stable macroeconomic and political environments are believed to be the key ingredients for attracting more foreign investors. The emphasis of providing incentives for foreign investors is also linked to the theoretical notion advanced by Moeti (2005), who argues that governments should adopt friendly attitudes towards investors and provide incentives in an effort to attract the right kind of FDI. The DTI and TISA have provided a number of incentives to investors through the following strategic programmes:

Strategic Investment Programme

The main aim of SIP, which was introduced in November 2001, is to contribute to the growth, development and competitiveness of specific industrial sectors such as manufacturing (Barbour 2005). The government should provide tax relief to qualifying industrial projects. The reason is to provide an initial capital allowance of 50% or 100%, depending on the qualifying scores. For points to be awarded, strategic goals and employment creation are assessed (Fuhrman 2013). According to Coega (2005), large investments should be allowed a deduction against taxable income for investment in specified industrial assets. Specifically, a minimum investment of R50 million, a 50% investment allowance, is provided for projects capped at R300 million, while 100% is granted to projects capped at R600 million. Coega (2005) indicates that the key objective of SIP is to attract industrial investments in South Africa that will serve to improve the industry and create employment opportunities. Potential foreign investors can invest in any business sector of their choice without prior approval from the government because of the few or no restrictions on the extent or level of foreign investment.

Foreign Investment Grant

The FIG, which was introduced in September 2000, is a cash incentive scheme to foreign investors who invest in new manufacturing in South Africa (DTI 2007). It was also implemented to assist firms to establish plants in South Africa through the provision of grants to partially offset the costs of importing capital equipment. The FIG provides a cost recovery of 15% (up to a maximum of R3 million per entity) for foreign entrepreneurs to transfer new machinery and equipment to South Africa as part of their invested capital (DTI 2007).

Motor Industry Development Plan

According to the Business Map Foundation (2005), the MIDP was crafted along the lines of the Australian motor industry development programme. Since the implementation of MIDP, substantial investments have been made in the industry, accompanied by the rapid growth of both exports and imports. The MIDP has been successful in encouraging considerable investments from most major auto manufacturers: Ford investment in April 2002, Toyota SA in July 2002 and Volvo SA in October 2002 (Business Map Foundation 2005). Moeti (2005) explains that other measures by the DTI include the FDI scheme, the Export Marketing and Investment Assistance Scheme (EMIA) and the Inward Investment Missions Scheme (IIMS), which are aimed at providing financial assistance to exporters so that they can partially cover the cost incurred in recruiting inward FDI to South Africa.

Minerals Policy

The 1998 Green Paper on Mineral Policy in South Africa provides legislation and a structure that is specific to the mining industry to attract FDI. With regard to mining, the Income Tax Act provides for a deduction of capital expenditure for tax purposes. The reason for the mining incentives is to lower the costs of exploration and mining in South Africa to make the sector competitive globally, thus attracting investors (DTI 2007).

Bilateral agreements

For trade-related purposes, South Africa has entered a number of bilateral agreements with other countries. These include Bilateral Investment and Protection Agreements (BIPAs) where investors are granted the most favoured nation status (DTI 2007). Indeed, developing countries, such as South Africa, sign bilateral investment treaties (BTIs) in order to attract more foreign investors. One of the strategies of BTIs states that the purpose of BTIs is to promote the flow of FDI. However, do such agreements fulfil their intended purpose and attract more FDI to developing countries? Despite an increasing number of BTIs signed, there is still little evidence to answer this question. It is, therefore, important for the government to review its strategies to check if the BTIs are indeed achieving their intended objectives.

Strategic Industrial Project Incentive Scheme

Through the SIPIS, South Africa has been able to attract projects worth billions of rands from foreign investors. These included India's TATA Iron and Steel Company whose investment South Africa won over Australia by offering better incentives: the Pegasus ceramic floor plant and the Fibre Core Africa fibre optic plant (Business Map Foundation 2005). The Business Map Foundation (2005) shows that South Africa's automotive sector has been one of the biggest FDI successes, while clothing, footwear and food have lagged behind. Major car manufactures such as Volkswagen, Daimler Chrysler, General Motors and Ford are amongst those that have plants in the country. According to the DTI, long-term manufacturing growth has been slow compared to other developing economies, including other African countries. This has been reflected in the reduction in manufacturing value added per head and in share of world exports (DTI 2007). It is also important to point out that South Africa's FDI strategy places greater emphasis on private investment in stimulating growth compared to government investment. GEAR (1996) cited in Moeti (2005) also focused on improving domestic savings as well as gradual reductions in the fiscal deficit. While fiscal deficits have been gradually reduced, domestic savings have remained very low, hampering the desired increases in foreign investments.

In order to supplement the low savings and investment rates in South Africa, an industrial policy, Spatial Development Initiatives (SDIs), was introduced in 1996 by the DTI to stimulate and foster sustainable industrial development. Spatial Development Initiatives are based on the principle of a desired increase in private investment and less government participation, thus placing more emphasis on private investors (Moeti 2005). According to Streak (1998), another strategy relies on industrial development zones (IDZs) that aim to encourage export-oriented manufacturing FDI. He argues that this is done through providing investors duty-free status for imported raw materials, tax incentives, easy access to airports and seaports, world-class infrastructure and services, the latest IT and first class IDZ management. The above discussed FDI-related programmes and incentives are aimed at encouraging and increasing foreign investments in South Africa. These strategic programmes are coordinated by TISA. According to TISA (2011), it is anticipated that the different sectorial policy initiatives will continue to have a positive impact on FDI into South Africa as opposed to the past.

Methodological framework and findings

The article is quantitative in nature and employs annual secondary data spanning the period of 1980-2014. Data for the GDP growth rate, FDI inflows and trade openness are sourced from the World Bank's World Development Indicators (WDI), while data for the real effective exchange rate and government expenditure are sourced from the South African Reserve Bank databases.

Unit root tests

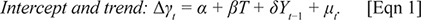

Prior to any econometric estimation on the time series variables, it is important to conduct stationarity tests. This article used the augmented Dickey-Fuller (ADF) and Philips-Perron (PP) to test for stationarity of the variables. For unit root test, equations are as follows:

For the PP test, the regression equation is estimated as follows:

Model specification

Priory expectations on the long-run model

where:

GDPt = The rate of South Africa's real GDP growth. This is the dependent variable.

FDIt = The ratio of FDI inflows to South Africa's GDP. The coefficient (elasticity) is expected to be positive in the long-run model as a rise in the level of FDI is expected to positively contribute to economic growth.

GEXt = The ratio of government expenditure to South Africa's GDP. The coefficient is expected to either be positive or negative. Every time the government increases its spending, there will be spillovers to other sections of the economy, hence a stimulatory effect on economic growth.

REERt = The real effective exchange rate, which is calculated based on the flow of trade between South Africa and 20 of its major trading partners. The coefficient is expected to be negative in order for a depreciation to improve economic growth. South Africa indirectly quotes the effective exchange rates; thus, an increase is an appreciation and a decrease is a depreciation of the ZAR.

TGDPt = The ratio of total trade (exports + imports) to real GDP. This is also known as trade openness. The coefficient is expected to be positive as more willingness to trade will provide stimuli to economic growth; that is, more exports contribute positively to the economic growth according to the Keynesian model, and more imports of capital goods will also translate into expanded production and thereby economic growth.

εt = represents the error term, accounting for other variables that may affect the relationship but were not included.

It is worth noting that all these techniques employed are guided by the steps outlined in Gujarati and Porter (2009).

Research findings

Unit root tests - Augmented Dickey-Fuller and Phillips-Perron

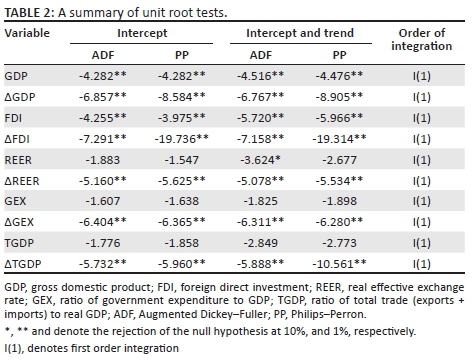

Table 2 presents the summarised results of the stationary test conducted using ADF and PP tests.

As reported in Table 2, all variables exhibit non-stationary properties at level form, I(0); hence, the null hypothesis of non-stationarity cannot be rejected. However, when ADF and PP tests are applied to the first difference, I(1), the time series shows evidence of stationarity. Hence, we conclude that all variables in the model are integrated of the first order.

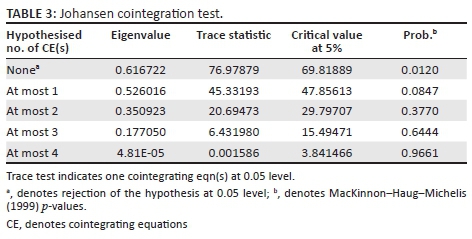

The Johansen cointegration test shows that there is cointegration between the variables in the model as evidenced by the trace statistic of 76.97879, which is greater than the critical value of 0.0120 at 5% level of significance (Table 3). That is to say, the variables have a long-run cointegrating relationship. The long-run cointegrating coefficients are also confirmed by the eigenvalue of 0.616722 which is greater than the 5% level of significance. As a long-run relationship has been established, the article then proceeds to estimate the vector error correction model (VECM) for the economic growth model (Table 4).

Vector error correction model

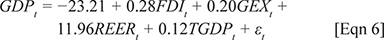

Long-run cointegrating equation:

Firstly, the coefficients from the long-run normalised cointegrating equation in Table 5 are multiplied by (−1) to give a more accurate picture shown in equation 6. The results show that FDI does influence a surge in economic growth in the long run. A 1% increase in the inflow of FDI will lead to a 0.28% increase in economic growth. This result satisfies the priory expectation. Government expenditure is found to have a negative relationship with economic growth as a 1% increase in government spending will lead to a 0.2% decrease in economic growth. This result also meets the priory expectation of a (±) coefficient, and it means that the increase in government spending displaces the investment in the economy (the crowding-out effect).

The coefficient for the exchange rate is reported positive, and keeping in mind the fact that South Africa indirectly quotes the real effective exchange rate, it means that a 1% appreciation of the ZAR will lead to an 11.96% decrease in economic growth. This result does not meet the priory expectation for this article. However, the result makes perfect sense as an appreciation of the domestic currency makes domestically produced goods (exports to the rest of the world) more expensive and undesirable, hence a decrease in the volume of exports, and foreign-produced goods (imports to South Africa) cheaper, hence an increase in the volume of imports. Thus, the Keynesian model hypothesises that a rise in imports, compared to exports, will have a negative impact on real GDP via the trade balance. The trade openness variable shows a positive relationship with economic growth as expected. The long-run coefficient indicates a positive significant impact of trade openness on economic growth and vice versa, indicating that international integration is a beneficial strategy for growth.

Results from the VECM presented in Table 5 show that the speed of adjustment is, as expected, negative and ranges between 0 and −1. According to the results, 58.19% of the disequilibrium in the current period will be corrected in the next period. This suggests that the variables converge to equilibrium relatively faster.

Conclusion and recommendations

The aim of this article was to determine the relationship between inward FDI and economic growth in South Africa for the period 1980-2014. For this purpose, unit root test, cointegration test and VECM were conducted. From the analysis, the unit root test shows evidence of non-stationarity at level form I(0), but when first differenced I(I), the variables exhibited properties of stationarity; hence, we conclude that all variables are integrated at first order. The results of the cointegration test indicate the existence of a long-run relationship between the variables, thus indicating that the trace statistic is greater than the critical value at 5% level of significance. The speed of adjustment reported by the VECM results is negative, and it ranges between 0 and −1; this implies that the variables converge to equilibrium relatively faster. The nature of this relationship supports the traditional notion and empirical evidence that the attraction of FDIs and increase in GDP enhance economic growth in developing economies. Hence, we suggest that South Africa's capacity to grow, develop and create jobs for its citizens also depends on the country's performance to enhance GDP growth and attract more FDIs.

From the analysis, the article found that the major determinants of FDI inflows to South Africa are, amongst others, the cost of labour which seems to be high as compared to other developing economies, corruption and crime. Therefore, labour unions need to implements policies that ensure workers and their wages correspond to the level of the output. High levels of crime in the country also discourage the inflow of foreign investors, as many complain about the state of security in South Africa. The government, on the contrary, should also strengthen its strategies of fighting corruption, as it can discourage foreign investors to come and invest in South Africa. However, a number of factors which make South Africa a good investment destination were discussed; these factors include, amongst others, the ease of doing business, well-developed financial systems and banking regulations and the 'well embraced democratic Constitution' of the country. From the drawn conclusion, a number of recommendations can therefore be made: firstly, though there is a prime need to attract more foreign investors to South Africa, it is important to concede that attracting inward FDIs alone is not enough for sustainable economic growth, development and poverty reduction. The government needs to implement and have holistic policies in place, which should also encompass equitable distribution of income, create sustainable jobs and reduce the extreme levels of poverty in South Africa. Therefore, the attraction of FDIs should not only be seen as an end in itself but also be seen as a means of addressing socio-economic problems facing South Africa. Secondly, there is a need to improve infrastructure, such as roads, rail and telecommunications, necessary to bring down the comparatively high investment costs for foreign investors. Thirdly, measures should be taken to provide skills to the labour force and job-seekers, so that they can be absorbed in a foreign, modern technologically advanced environment. Trade unions should focus more on stabilising labour disputes and strikes, especially in the mining sector. More importantly, the government must also prioritise entrepreneurship development in order to create awareness regarding self-employment opportunities for the youth. The government should introduce programmes especially for the youth to be equipped with the necessary skills to become more job-creators than job-seekers.

Acknowledgements

The author would like to acknowledge and extend his sincerest appreciation to his family, especially his mother, Leah Leshata Famu, who has been very supportive throughout his studies and without whom he would have been unable to even begin studying. She has always been the pillar of his strength and the compass of his direction. To her, the author does not know how many suitable words he could use to express his gratitude for having taught him the virtue of resilience and determination except to just simply say `thank you very much for being my mother'.

Competing interests

The author declares that he has no financial or personal relationships that may have inappropriately influenced him in writing this article.

References

Asiedu, E., 2006, Foreign direct investment in Africa: The role of natural resources, market size, government policy, institutions and political instability, University of Kansas, Missouri, USA, pp. 63-75. [ Links ]

Barbour, P., 2005, An assessment of South Africa's investment incentive regime with a focus on the manufacturing sector, Economic and Statistics Analysis Unit, 14, Overseas Development Institute, London. [ Links ]

Business Map Foundation, 2005, Angola remains the favored FDI destination into SADC in 2005, Business Map Foundation, Johannesburg. [ Links ]

Chaudhuri, S. & Banerjee, D., 2010, 'FDI in agricultural land, welfare, and unemployment in a developing economy', Research in Economics 64(4), 229-239. https://doi.org/10.1016/j.rie.2010.05.002 [ Links ]

Cleeve, E., 2008, 'How effective are fiscal incentives to attract FDI to sub-Saharan Africa?', The Journal of Developing Areas 42(1), 135-153. https://doi.org/10.1353/jda.0.0015 [ Links ]

Coega, 2005, Support for investors, viewed 10 April 2016, from http://www.coega.co.za/files/FIL81 [ Links ]

Denisia, V., 2010, 'Foreign direct investment theory: An overview of the main FDI theories', European Journal of Interdisciplinary Studies 3,53-59. [ Links ]

Department of Trade and Industry (DTI), 2007, Foreign Investment Grant, viewed 16 August 2016, from http://www.dti.gov.za/offerings/offering.asp?offeringid=130 [ Links ]

Department of Trade and Industry (DTI), 2009, Measuring economic impacts of investment in the research base and innovation: A new framework for measurement, Department of Trade and Industry, Pretoria. [ Links ]

Department of Trade and Industry (DTI), 2013, Industrial Policy Action Plan (IPAP) 2013/14 to 2015/16, Government Printer, Pretoria. [ Links ]

Dunning, J., 2008, Multinational enterprises and the global economy, 2nd edn., Edward Elgar, Cheltenham, UK. [ Links ]

Fuhrmann, R.C., 2013, Okun's law: Economic growth and unemployment, viewed 26 August 2017, from www.investopedia.com/articles/economics/12/okun-law.asp [ Links ]

Gujarati, D.N. & Porter, D.C., 2009, Basic econometrics (international edition), 5th edn., McGraw-Hill/Irwin, New York. [ Links ]

Helpman, E. & Kruman, P.R., 1995, Market structure and foreign trade, MIT Press, Cambridge, MA. [ Links ]

Khan, A. & Afia, C., 1995, 'Export growth and causality: An application of co-integration and ECM model', Pakistan Development Review 33, 123-132. [ Links ]

Madariaga, N. & Poncet, S., 2007, 'FDI in Chinese cities: Spillovers and impact on growth', The World Economy 30(5), 837-862. [ Links ]

Moeti, K.B., 2005, 'Rationalization of government structures concerned with foreign direct investment policy in South Africa', unpublished doctoral thesis, Faculty of Economic and Management Sciences, University of Pretoria, Pretoria. [ Links ]

Mpanju, A.K., 2012, 'The impact of foreign direct investment on employment creation in Tanzania', International Journal of Business Economics & Management Research 2(1), 126-139. [ Links ]

Ncunu, A.E., 2011, 'The dynamics of foreign direct investments in central and Eastern Europe under the impact of international crisis of 2007', CES Working Papers 3(1), 81-91. [ Links ]

Nguyen, D., 2011, 'Exports, growth and causality in developing countries', Journal of Development Economics 18, 1-12. [ Links ]

Ramaphosa, S., 2013, Fixing SA, job by job, City Press, Johannesburg, p. 23. [ Links ]

Rusike, T.G. 2007, Trends and determinants of inward foreign direct investment to South Africa, Rhodes University, Alice. viewed 12 April 2016, from http://eprints.ru.ac.za/1124/1/Rusike-MCom-2008. [ Links ]

South African Reserve Bank (SARB), 2014, Annual economic report, viewed 24 August 2016, from http://www.resbank.co.za/Reports/Documents/AnnualReport [ Links ]

Statistics South Africa, 2015, Quarterly employment statistics, Government Printer, Pretoria. [ Links ]

Streak, J., 1998, The determinants of FDI and South Africa's industrial development strategy: Towards a research agenda, School of Economics, University of Cape Town, Cape Town, South Africa. [ Links ]

The Presidency, 2011, National Development Plan (NDP) 2030. National Planning Commission, Government Printer, Pretoria, South Africa. [ Links ]

Thomas, L. & Leape, J., 2005, Foreign direct investment in South Africa: The initial impact of the trade, development, and cooperation agreement between South Africa and the European Union, CREFSA, London School of Economics, London. [ Links ]

Trade Investment South Africa (TISA), 2011, National treasury annual report 2010/11, Government Printer, Pretoria. [ Links ]

United Nations Conference on Trade and Development (UNCTAD), 2011, Investment country profiles: South Africa, United Nations, Geneva. [ Links ]

United Nations Conference on Trade and Development (UNCTAD), 2013, Investment country profiles, South Africa, Geneva. [ Links ]

Vacaflores, D.E., 2011, 'Was Latin America correct in relying in foreign direct investment to improve employment rates?', Applied Econometrics and International Development 11(2), 101-122. [ Links ]

Wei, S.J., 2000, 'How taxing is corruption on international investors?', Review of Economics and Statistics 8, 3-12. https://doi.org/10.1162/003465300558533 [ Links ]

Xolani, H., 2011, The employment spillover of foreign direct investment and host country, Gordon Institute of Business Science, University of Pretoria, Pretoria, South Africa. [ Links ]

Zuma, J., 2015, State of the nation address. Joint Sitting of Parliament National Council of Provinces and the National Assembly, Republic of South Africa, Cape Town. [ Links ]

Correspondence:

Correspondence:

Tshepo Masipa

masipatshepo@gmail.com

Received: 27 Jan. 2017

Accepted: 04 Feb. 2018

Published: 31 May 2018