Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Acta Commercii

versão On-line ISSN 1684-1999

versão impressa ISSN 2413-1903

Acta Commer. vol.17 no.1 Johannesburg 2017

http://dx.doi.org/10.4102/ac.v17i1.394

ORIGINAL RESEARCH

Segmenting the Latin American travel market to South Africa

Martinette Kruger; W.Z. Snyman

Tourism Research in Economic Environs and Society, North-West University, South Africa

ABSTRACT

ORIENTATION AND MOTIVE OF RESEARCH: Tourism growth to South Africa is in decline resulting in an emphasis shift to identify new markets to offset the slowdown in tourism growth.

PURPOSE OF RESEARCH: This study identified viable target markets within the Latin America tourist market using market segmentation based on motivations to travel to South Africa.

RESULTS AND FINDINGS: Four viable segments were identified that should be catered for and, based on the distinct characteristics of each market, marketing strategies are proposed.

PRACTICAL IMPLICATIONS: This study makes a valuable contribution to the current tourism literature by expanding current knowledge of the profile and motives of a, to date, relatively unknown tourist market.

Introduction and research rationale

The total contribution of travel and tourism to the gross domestic product (GDP) worldwide was $7170.3 billion (9.8% of GDP) in 2015, and is forecast to rise by 3.5% in 2016 (World Travel & Tourism Council [WTTC] 2016a). The tourism industry continues to play a major role in the South African economy (Statistics South Africa [Stats SA] 2016a). According to the WTTC (2016b), the total contribution of travel and tourism to the South African GDP was South African rand (R) 375.5bn (9.4% of GDP) in 2015, and is forecast to rise by 3.0% in 2016 and to rise by 3.7% per annum to R555.1bn (10.6% of GDP) in 2026. The latest Tourism Satellite Account for South Africa report (Stats SA 2016b) provides an overview of tourism's contribution regarding spending, employment and impact on the GDP. According to the report, during 2013, 14.3 million non-resident visitors visited South Africa, increasing from 13.1 million in 2012 and 12.1 million in 2011. The number of persons employed in the tourism industry also continues to increase, and the tourism industry employs about 4.4% of all employed persons in South Africa. Apart from the importance of tourism in terms of economic value, for developing countries such as South Africa, tourism is essential to creating a positive image of the country as a tourist destination, infrastructure development and increasing the quality of life of the local people (Butler & Rogerson 2016; Kaplanidou et al. 2013; Leibold & Seibert 2015; Rogerson 2015). Hence, it is vital to increase both domestic and international travels to South Africa.

South Africa offers both domestic and international tourists a wide variety of options, among others the scenic natural landscape and game reserves, diverse cultural heritage and highly regarded wines. According to South African Tourism (SAT 2016a), the main reasons for visiting the country include affordability, natural beauty and wildlife, world-class facilities, adventure opportunities, favourable climate, diverse culture, and history. It is evident from statistics that the United Kingdom, United States of America (USA), Germany, France, the Netherlands, Australia, China, India, Canada and Italy are the top sources of overseas tourists visiting South Africa (Stats SA 2016a). However, according to the World Bank Group (World Bank 2015), there will be a slower than expected recovery and economic growth from the Eurozone from where the majority of overseas travellers to South Africa originate. This is mainly due to the financial stress in Greece as well as the political tensions in the Ukraine. In 2015, the volume of departures of foreign travellers was lower than that of arrivals throughout a 15-year period (2001-2015) (Stats SA 2016a). The number of tourists, however, increased by 14% from August 2015 to August 2016, while the number of overseas tourists grew by 22.6% over the same period (Stats SA 2016a).

Nevertheless, to counterbalance the slowdown of travellers from developed countries, new regions for growth in international tourism need to be identified. Van Niekerk and Saayman (2013) explain that countries are competing against each other not only in tourism arrivals but also in tourism receipt. To enhance their overall tourism product and competitiveness, many countries have therefore embarked on comprehensive tourism awareness programmes to strengthen not only domestic tourism but also international tourism and the tourism industry as a whole. A region to consider as a potential tourism market to South Africa is Latin America (Central and South America including Mexico). Latin America is defined as the 'areas of America whose official languages are Spanish and Portuguese, derived from Latin: South America, Central America, Mexico and certain islands in the Caribbean' (Kittleson, Lockhart & Bushnell 2016). Over 50 000 tourists travelled to South Africa in 2015 with 58% of tourists travelling from Brazil, while tourists travelling from Argentina, Mexico, Peru, Colombia and Venezuela are also increasing (Stats SA 2016c). Holiday (96%) remains the main reason for Latin American tourists' visits to South Africa. Data gathered from Stats SA (2016d) confirm the basic picture of the Latin American market, that is, that Latin American tourists' motives to visit South Africa were primarily for holiday purposes and secondarily for transit reasons. Seeing as Brazil accounts for the largest percentage of Latin American tourists to the country, SAT analysed the Brazilian tourism market to help market South Africa in the country (SAT 2010). However, the needs of tourists from other Latin American countries, especially those forming part of the Pacific Alliance (Chile, Argentina, Mexico, Peru, Colombia and Venezuela), remain unexplored. Market segmentation is, therefore, essential to identify the needs of these tourists.

The purpose of this exploratory research is, therefore, to narrow the gap in the current tourism literature by determining the motives of Latin American tourists to South Africa, and, based on these motives, identify and profile different market segments. While research conducted by SAT (2010, 2016b) and Stats SA (2016a, 2016b, 2016c) mainly distinguish between 'holiday', 'business', 'visiting friends and relatives' and 'other' (including shopping, medical reasons and religious purposes) tourists, this research will identify potential market segments beyond these categories. This research, therefore, proposes a motivation-based typology of Latin American tourists descriptive of their needs and main reasons for travelling to South Africa. This information is invaluable in designing a marketing strategy to expand this, to date, undervalued market.

Literature review

The literature review covers the relevant literature regarding market segmentation and its application in the context of the study as well as an overview of the Latin American markets' travel behaviour.

Market segmentation

Market segmentation is a fundamental element of strategic marketing and planning. Many marketing scholars and practitioners have proposed different definitions of market segmentation; however, the definitions of Kotler (1972) and Smith (1956) are represented in the academic approach to market segmentation, that is, a consumer approach (Cano 2003). Smith (1956:6) defines segments as directly derived from the heterogeneity of customer wants and proposes that 'market segmentation involves viewing a heterogeneous market as a number of smaller homogenous markets, in response to differing preferences, attributable to the desire of consumers for an absolute satisfaction of their varying wants'. Consistent with Smith's definition, Kotler (1972:166) proposes market segmentation as 'the subdivision of a market into homogeneous subsets of customers, where any subset may conceivably be selected as a market target to be reached with a distinct marketing mix'.

Segmentation tries, ultimately, to match the expectations of different groups of tourists with offers made from tourist services suppliers. The market identified can be subdivided and profiled into five different segmentation bases through the process of market segmentation, namely geographical segmentation, socio-economic segmentation, demographic segmentation, psychographic segmentation, a product sought and product-related segments (Dibb & Simkin 2016; Nacar & Uray 2016). Once the market has been segmented into different segments or target markets, a customised marketing mix aimed at each segment is designed to position the product for each market (Dolnicar et al. 2014; Schiffman & Kanuk 2004). Dolnicar et al. (2012), as well as D'Urso et al. (2013), emphasise that focusing only on one or two target markets increases the chances of marketing success, long-term sustainability and profitability of a tourism product or destination.

Motivation-based segmentation or typology is well documented in tourism literature. It is very popular due to the extent of information that can be provided, as well as the tendency to evaluate the needs of the market and the manner in which to satisfy and enhance the service offerings (Kruger, Viljoen & Saayman 2013). Furthermore, marketers and brand managers have the ability to identify efficiently and supply the products and services directly to the target audience, which is more cost effective and less time consuming (Kim & Ritchie 2012). Motivations are also measured to identify and segment types of tourists for the purpose of product development and market promotion (Smith, Costello & Muenchen 2010). A motive is an internal factor that arouses, directs and integrates a person's behaviour (Iso-Ahola 1980, 1982). Fodness (1994) mentions that motivation is the driving force behind all behaviour, while Crompton and McKay (1997) also indicate that motives are the starting points that launch decision processes. It is, however, important to note that motivation differs from person to person and can be greatly influenced by the type and nature of a destination (Sung, Chang & Sung 2016; Iversen, Hem & Mehmetoglu 2016). Applying a segmentation technique aimed at identifying market segments provides several advantages, including: (1) effectively determining market niches based on similarities, (2) classifying groups of tourists, (3) establishing theories related to tourist groups and (4) testing whether the tourist groups are present in the market (Cross, Belich & Rudelius 2015; Dibb & Simkin 2016; Kotler et al. 2015; Mazanec 2015).

In the context of the present study, market segmentation can, therefore, be defined as 'the process of identifying and profiling different Latin American tourist market segments based on their motivations for travelling to South Africa as a tourist destination, towards designing personalised and cost effective marketing campaigns in an effort to increase tourist numbers from this region'.

The travel behaviour of Latin American tourists

In 2012, the Brazilian market generated a total of 8.6 million foreign tourists and, out of this figure, 2.7 million travelled within the South American region, while 5.9 million (68.9%) travelled to long-haul destinations (ITB World Travel Trends Report [WTTR] 2014). Brazil is emerging as one of the most promising markets in the luxury segment with growth driven by the increase of millionaires within the country with more disposable income. Given the major economic indicators for these markets further outbound growth is set to continue. In the first eight months of 2013, the number of international trips taken by Latin Americans has increased by 6% over those of 2012. The ITB WTTR for 2013/2014 confirmed that South America has continued to grow in outbound tourist arrivals and has outpaced North America once again. There was also continuous growth in travel to South Africa from Latin America from 2011 to 2013 with a sharp decline in 2014 (SAT 2015). Although the South American outbound market slowed down, it still managed to grow by 5%. This was partly due to the hosting of the football World Cup in Brazil (ITB WTTR 2014). Brazilians' love of short shopping trips is also one of the key factors behind this growth and is the primary source market from the South American region.

Academic researchers such as Sarigöllü and Huang (2005) segment North American tourists to Latin America based on the benefits sought, and Barros, Correia and Crouch (2008) identify the determinants of the length of stay in Latin American tourism destinations. Brida, Risso and Bonapace (2008), Eugenio-Martin, Martín Morales and Scarpa (2004) and Fayissa, Nsiah and Tadesse (2011) similarly analyse the tourism and economic growth in Latin American countries. Torres (2003) focuses on the linkages between tourism and agriculture in Mexico while Paus (2009) analyses the implications of the rapid economic rise of China for the development prospects of Latin America. An earlier study by Dimanche and Moody (1998) determined the destination perceptions of Latin American intermediary travel buyers. However, none of these studies attempted to segment the Latin American travel market based on their motives to travel to a destination.

While various studies profiled tourist markets to destinations (see for example Hennessey, Yun and MacDonald 2014; Legohérel, Hsu and Daucé 2015; Li et al. 2013; Prayag et al. 2015), limited academic studies have focused on analysing the Latin American market regarding their profile and motivations to travel. International reports are however available from the World Tourism Organisation (UNWTO) regarding tourism to the Americas (both North and South America) (UNWTO 2013), and from the ITB WTTR (2015) and WTTC (2016a) reports on the economic impacts of travel and tourism in Latin America. Certain differences exist between South American countries, but the UNWTO (2013) also confirms some similarities. Table 1 outlines Latin American tourists' profile to Europe as identified by the UNWTO, to Australia as studied by Tourism Research Australia (2009), in general as analysed by the ITB WTTR (2015) as well as Brazilian tourists' profile to South Africa by SAT (2010).

Collectively the findings in Table 1 show that some travel behaviour comparisons exist among the Latin American tourists travelling to the different countries analysed. Regarding market characteristics, Latin American tourists travel mainly from Brazil, are aged between 30 and 50 years, and are professionals in a middle-income to high-income class with a high average spending per trip. Online sales and travel agents are the primary sources for information and bookings and the main reason for travel are for holiday and leisure purposes. However, differences in the markets' travel behaviour are also evident. Depending on the region, the average length of stay ranges between 7 and 10 days, indicating that these tourists have the potential to have a significant economic impact in the destinations visited. It appears that their travel preferences are undeterred by the season of travel since the market can travel throughout the year (to Europe during the northern hemisphere's summer months and to South Africa during the southern hemisphere's summer months). While shopping was identified as a primary motive for Latin Americans to travel to cities in Europe, the findings from the SAT (2010) report indicated that shopping was the lowest rated motive for Brazilian tourists to South Africa with wildlife, scenery and hospitality rated the highest. This implies that the essence of a destination (distinct characteristics) should feature strongly in marketing campaigns aimed at attracting the market. In this regard, South Africa has the potential to tap into the market especially with its unrivalled scenery and wildlife. The biggest challenges identified in growing outbound travel from Latin America were mainly external shocks such as weakening economic conditions, recessions, volatile currency exchanges and the lack of direct air services, especially between countries such as South Africa and Australia.

Similar to the academic research studies done to date, the research reports summarised in Table 1 did not segment the Latin American market. Uys (2003) is the only study, to the authors' knowledge, that profiles a tourist market, namely Dutch tourists, to South Africa. However, as in the case of all previous studies, only a basic overview of the markets' profile and travel behaviour is given, and an investigation is not made regarding whether different market segments may exist and if their needs might differ. Moreover, other than these statistics and information on the Brazilian travel market (SAT 2010), not much is known about the travel motives of the Latin American tourists choosing to travel to South Africa. Knowledge of the profile and motives of specific segments within the market can assist in the development of a cost effective and tailor-made marketing strategy for the Latin American region.

Method of research

This exploratory research was quantitative in nature and made use of an electronic questionnaire.

The questionnaire

The questionnaire was divided into four sections. Section A measured sociodemographic profile questions of Latin American tourists (age, gender, marital status, home language, country of residence and highest level of education). Section B measured the Latin American consumer profile (when they decided to travel, who initiated the travel, which other destinations were considered as well as those they had travelled to before, how many times they travel during a year, expenditure during travel and which accommodation, activities and packages they chose or would choose during their stay). Both section A and section B were based on the demographic and travel behaviour measured by ITB WTTR (2015), SAT (2010), Tourism Research Australia (2009) and UNWTO (2013) (refer to Table 1). Section C determined the main motivational factors of why Latin American tourists chose to travel to South Africa. The items were measured on a five-point Likert scale of agreement and were adapted from the work done by SAT (2010), Stats SA (2016a, 2016b, 2016c) and UNWTO (2013). In 2002, Du Plessis performed the first study to determine the competitive advantages of South Africa as a global tourism destination. The factors that emerged as most important in this respect were safety and security, quality of service, value for money, geographical features and attitude towards tourists (Du Plessis 2002). In a follow-up study, Du Plessis, Saayman and Van der Merwe (2015) identified nine factors that contribute towards South Africa's tourism competitiveness, namely (1) quality and variety of foods, (2) tourism services, (3) location, (4) economic benefits, (5) attributes, (6) entertainment and activities, (7) stability, (8) African experience and (9) brand and image. These factors were also considered and included in the motivational section.

The following steps, as proposed by Field (2005) and Tustin et al. (2005) were followed to design and validate the questionnaire: (1) Content validity: an in-depth literature analysis was conducted to identify the relevant travel behaviour and motivational factors of Latin American tourists (see Table 1); (2) face validity: statistical consultation services at the North-West University, Potchefstroom campus, advised on the formulation of the statements, as well as the measurement scales used; (3) construct validity: factor analysis was performed on the motivational factors in order to determine the degree to which the statements measure what they claim and purport to; (4) reliability: establishing the reliability of the identified factors by means of reliability coefficients (Cronbach's alpha) which were calculated by applying inter-item correlations. The statistical analysis section below discusses how the reliability of the identified factors was measured.

Sampling method and survey

The survey consisted of an online questionnaire designed in Adobe® FormsCentral. The link to the online questionnaire was sent to the various outbound operators who work in close collaboration with Wilderness Safaris within the Latin American region (tour operators were sourced from central sales databases QlikView® and Tourplan®). With operating camps and safaris in Botswana, Kenya, Namibia, Malawi, South Africa, Zambia, Zimbabwe and the Seychelles, Wilderness Safaris describes itself as a 'responsible luxury ecotourism company that exists to protect pristine wilderness areas and the flora and fauna they support'. Wilderness Safaris already has a well-established reputation for offering specialised safari products in their main sales markets of Europe and Australasia with their main focus being the USA. To recreate their success in the North American market and to offset the slowdown from the developed regions, Wilderness Safaris has expanded into the Latin American market. In the case of Wilderness Safaris, sales from the Latin American region showed a 12.3% growth in the 2013 financial year (01 March 2012 to 28 February 2013) compared to the same period in the previous year. A total of R10 796 565 in sales for the 2012 financial year (01 March 2011 to 29 February 2012) grew to R12 125 886 in the 2013 financial year (01 March 2012 to 28 February 2013). Sales slowed down in the 2015 financial year (01 March 2014 to 28 February 2015) to R12 318 949 with sales for the period March 2015 to June 2015 (as part of the 2016 financial year), reflecting a total of R11 058 490 (J. Momberg [Latin American sales figures from wilderness safaris] pers. comm., 18 August 2015). When interviewed on 16 July 2015, Palazzo (2013), the sales manager for Wilderness Safaris to the Latin American region, stated that South Africa is still seen as an 'exotic and high-end destination for the affluent societies of the top sales producing markets of Brazil, Chile and Mexico'. She also states that the Brazilian, Chilean and Mexican economies perform well and continue to grow. This means that tourists from those countries have more disposable income to spend on travelling to South Africa. Therefore, there is great potential for growth within this market. According to Momberg (2015), Wilderness Safaris expects growth of 5% to 10% in this particular market for the 2016 financial year. This company, therefore, presented the ideal platform to analyse the needs of the Latin American market.

The tour operators were requested to send the link to the questionnaire to the respondents for completion. Respondents were selected according to their past travel behaviour to South Africa and to Wilderness Safaris for their future plans to travel to these destinations. Snowball sampling was implemented in that the respondents were requested to send the online questionnaire to acquaintances or friends that have done the same. Respondents were briefed in an email beforehand on the reason for the study. This was to ensure that their participation was voluntary. In the 2013 financial year (01 March 2012 to 28 February 2013), 250 Latin American tourists travelled to South Africa through Wilderness Safaris. During this period, more than 65 000 Latin American tourists travelled to South Africa (Stats SA 2013). Based on the formula and table of Krejcie and Morgan (1970), at least 384 questionnaires were required based on the Stats SA (2013) figure. However, based on the number of Latin American tourists who travelled to the country through Wilderness Safaris, 152 questionnaires had to be completed to achieve a representative sample. To further enhance the precision of the study, the minimum sample size was increased to 200 questionnaires. The questionnaires were continuously sent out from July 2014 to May 2015. A total of 195 completed questionnaires were returned, thus validating the sample.

Profile of respondents

Latin American respondents were predominately male, aged 44 years, spoke Portuguese (56%) or Spanish (34%) and lived in Brazil (38%), Argentina (16%), Peru, Chile and Mexico (12% each). They reported being in a relationship (64%) and their highest level of education was a university or college diploma or degree (39%). Respondents indicated a preference to make travel arrangements six months in advance (59%). The main initiator for their trip to South Africa was family (37%) with this being their first trip to South Africa and staying eight nights or more. The average travel group size consisted of four people with the majority not travelling with children or family (62%) and only paying for two persons in that group. The average spending was $18 762 (R265 779) per trip with the main provinces visited in South Africa being the Western Cape (92%), Gauteng (91%) and Mpumalanga (86%). Other African countries visited during their trip included Botswana (74%) and Mozambique (55%). Other destinations considered as alternatives to South Africa were Europe (50%), Asia (47%) and Australia and the Pacific Islands (47%). The main destinations previously visited were Central and South America (80%) and Europe (71%). The respondents travel either once (37%) or twice (34%) a year on individual arrangements (52%) with the main reason for their trip to South Africa being safari (99%) while staying in a hotel, motel, resort or lodge (100%). Their main activities included outdoor and nature activities (99%) and they heard about South Africa through friends and family (90%). The main travel agent or tour operator that Latin Americans used for their arrangements to South Africa was the International Travel Group as they provided services in their home language.

Statistical analysis and results

Data was exported from Adobe® FormsCentral to Microsoft© Excel© and IBM Statistical Package for the Social Sciences (SPSS, version 22, 2015) software was used for basic data analysis while Statistica version 11 (Statsoft, Inc. 2015) was used to perform the cluster analysis. The analysis was done in three stages: a factor analysis, a cluster analysis and an analysis of significant differences between motivational segments of Latin American tourists to South Africa.

Results from the factor analysis: Motives to travel to South Africa

A principal axis factor analysis, using an Oblimin rotation with Kaiser normalisation, was performed on the 25 motivation items to explain the variance-covariance structure of a set of variables through a few linear combinations of these variables. The Kaiser-Meyer-Olkin measure of sampling adequacy was used to determine whether the covariance matrix was suitable for factor analysis. Kaiser's criteria for the extraction of all factors with eigenvalues larger than unity were used because it was considered that they explained a significant amount of variation in the data. All items with a factor loading greater than 0.3 were considered as contributing to a factor, and all items with loadings less than 0.3 as not correlating significantly with this factor (Steyn 2000). Any item that cross-loaded on two factors with factor loadings both greater than 0.3 was categorised in the factor where interpretability was best. A reliability coefficient (Cronbach's alpha) was computed for each factor to estimate its internal consistency. All factors with a reliability coefficient above 0.6 were considered to be acceptable in this study (Pallant 2016). The average inter-item correlations were also computed as another measure of reliability; these, according to Clark and Watson (1995), should lie between 0.15 and 0.55.

Using an Oblimin rotation with Kaiser normalisation, the pattern matrix of the principal component factor analysis identified 11 possible factors. However, the factors yielded unreliable Cronbach's alpha values and inter-item correlations. Factor analysis was then performed on the items the authors regarded as relevant to a particular factor. Again, certain factors were unreliable. For this reason, it was decided to exclude some items from the third round of analysis and regard them as unique factors. Statements that were excluded due to unreliability were: For the benefit of my children, To relax, South Africa has various historical attractions, South African has a variety of entertainment on offer, South Africa has a variety of sports and recreational opportunities on offer, South Africa has ideal shopping opportunities, South Africa has quality of services and accommodation on offer, South Africa has developed infrastructure and tourism supra-structure, South Africa has unrivalled scenery and To see the Big 5 (lion, leopard, elephant, buffalo and rhino). Two factors were extracted as shown in Table 2, namely Unique country attributes and Country attractiveness. These were labelled according to similar characteristics and accounted respectively for 54% and 48% of the total variance. All had relatively high reliability coefficients, and the average inter-item correlation coefficients also implied internal consistency for all factors. Moreover, all items loaded on a factor with a loading greater than 0.3, and the relatively high factor loadings indicated a reasonably high correlation between the factors and their component items. The Kaiser-Meyer-Olkin measures of sampling adequacy of 0.63 for both factors also indicated that patterns of correlation were relatively compact and yielded distinct and reliable factors (Field 2013). Bartlett's test of sphericity also reached statistical significance (p < 0.001) in the case of both factors, supporting the factorability of the correlation matrix (Pallant 2016). Factor scores were calculated as the average of all items contributing to a particular factor to interpret them on the original five-point Likert scale. Unique country attributes obtained the higher mean value (4.25) compared to Country attractiveness (4.10) (although still important according to the Likert scale rating).

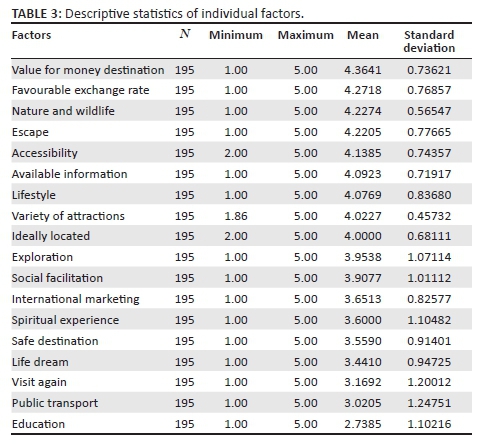

The items regarded as factors on their own are: Life dream (travelling to South Africa is a lifelong dream), Spiritual experience (travelling to South Africa is a spiritual experience), Visit again (I had visited South Africa before and wanted to do so again), Exploration (to explore a new destination), Lifestyle (travelling is part of my lifestyle), Social facilitation (to spend time with friends and family), Value for money destination (travelling to South Africa is value for money), Favourable exchange rate (South Africa has a favourable exchange rate), Accessible destination (South Africa is easily accessible as a travel destination), Ideally located (South Africa is ideally located as a long-haul destination), Escape (to escape from my daily routine), International marketing (South Africa is extensively marketed in my home country), Public transport (public transport is available in South Africa), Available information (information on South Africa is easily available), Safe destination (South Africa is a safe destination to travel to), Education (primarily for educational reasons, that is, to learn things, increase my knowledge), Variety of attractions (South Africa has a variety of attractions on offer) and Nature and wildlife (South Africa has unprecedented nature and wildlife). Table 3 shows the mean values of the factors. Value for money destination obtained the highest mean value (4.36) and was thus regarded as the most important motive to travel to South Africa. This was followed by Favourable exchange rate (4.27) and Unique country attributes (4.25 as shown in Table 2 above). This was followed by Nature and wildlife (4.22), Escape (4.22), Accessible destination (4.13), Country attractiveness (4.10), Available information (4.09), Lifestyle (4.07), Variety of attractions (4.02), Ideally located (4.00), Exploration (3.95), Social facilitation (3.90), International marketing (3.65), Spiritual experience (3.60), Safe destination (3.55), Life dream (3.44), Visit again (3.16), Public transport (3.02) and Education (2.73).

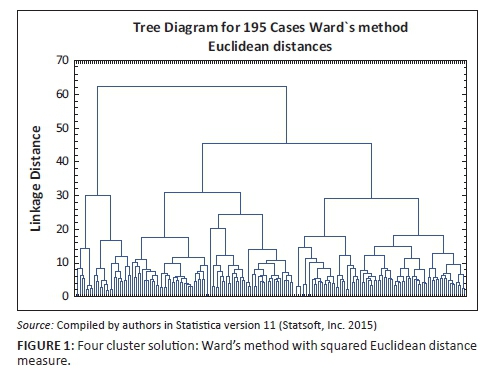

Results from the cluster analysis

An exploratory cluster analysis based on all cases in the data was performed on the motivational factors. A hierarchical cluster analysis, using Ward's method of Euclidean distances, was used to determine the structures of the clusters based on the motivation factors. A four cluster solution was selected as the most discriminatory (Figure 1). The results of the multivariate analysis were used to identify the four clusters (segments) and to indicate that significant differences existed between them (p < 0.05).

Identified market segments

Analysis of variances (ANOVA) with Tukey's post hoc tests was used to investigate any significant differences between the identified market segments. Effect sizes were used to identify further any significant differences between the segments. The purpose of effect size is to establish whether any differences exist between the segments, in this case in which combination of segments the mean values of the motives and the averages of the sociodemographic and behavioural variables had the smallest or largest effect. Cohen (1988) and Ellis and Steyn (2003) offer the following guidelines for the interpretation of effect sizes: small effect d = 0.2, medium effect d = 0.5 and large effect d = 0.8.

As shown in Table 4, ANOVAs indicate that all 20 motivational factors contributed to differentiating between the four motivational segments (p < 0.05) with large effect size differences (d > 0.08). Segment 1 contained the largest sample of respondents (66) and, compared with the other three segments, had the highest mean values for the motives Exploration, Social facilitation, International marketing and Public transport. This segment seems to see an opportunity to travel to and explore South Africa but, due to their lack of experience in travelling to the country, they rely on aspects such as marketing in their home country and the availability of public transport. Hence, this segment was labelled Opportunistic explorers. Segment 2, the second largest segment with 54 respondents, rated Spiritual experience and Safe destination higher and was the only segment that seemed to regard Education as an important motive. Thus, this segment was labelled Enlightened spiritualists as they seem to value the intangible aspects of the travel experience more. Segment 3, with 39 respondents, regarded Favourable exchange rate and Available information as being more important. Since they seem to value the practical aspects behind travelling especially regarding monetary aspects, this segment was labelled Practical economists. Finally, Segment 4, the smallest segment with 36 respondents, rated the majority of the motives higher than the other three segments, indicating Nature and wildlife, Value for money destination and Unique country attributes as the most important motives. This segment seems to be indulged by the entire experience and is motivated by South Africa as a whole and the country's distinct features especially Nature and wildlife. Hence, this segment was labelled Comprehensive indulgers.

ANOVAs, Tukey's post hoc multiple comparisons and effect sizes were further used to determine the differences between the respondents by their sociodemographic and behavioural characteristics. As Table 5 shows, there were statistically significant differences between the segments based on age (p = 0.005), number of previous visits to the South Africa (p = 0.001), length of stay (p = 0.001), number of people paid for in group (p = 0.003), number of times travelling per year (p = 0.001) and the spending categories accommodation (p = 0.002), food (p = 0.038), road transport (p = 0.001) and souvenirs and jewellery (p = 0.001). While the following variables were not statistically significant (p > 0.05), Tukey's post hoc tests indicated significant differences based on spending on return flights (p = 0.066) and visas (p = 0.120), total spending (p = 0.057) and spending per person (p = 0.017). The effect size differences were small to medium (d < 0.2 or d > 0.5). Opportunistic explorers were the youngest with an average age of 37.76 years while Enlightened spiritualists were the oldest (average age of 44.70 years). For Opportunistic explorers, 2014 was their first visit to South Africa while the other three segments had visited the country at least once before in the last four years. Comprehensive indulgers and Practical economists stayed the longest during their last visit (an average of respectively five and four nights) while Opportunistic explorers stayed for only one night. Practical economists were financially responsible for the most people during the trip (an average of three people) compared to the other three segments who paid for two people. Enlightened spiritualists and Practical economists travel the most during the year (an average of respectively 2.41 and 2.77 times) compared to Opportunistic explorers and Comprehensive indulgers who travel respectively 1.67 and 1.75 times per year. Regarding spending, Practical economists paid the most for accommodation ($9667.59), food ($1509.74), road transport ($697.85) and visas ($298.72) while Enlightened spiritualists spent the most on return flights ($10 027.59) and Comprehensive indulgers spending the most on souvenirs and jewellery ($694.72). Due to their larger travel group and longer length of stay, Practical economists had the highest total spending ($23 195.08) and Comprehensive indulgers the lowest total spending ($14 983.68) while Enlightened spiritualists and Opportunistic explorers had the highest average spending per person ($10 434.68 and $10 400.65, respectively).

Chi-squared test results

Chi-squared tests were further used to investigate any significant differences between the identified market segments based on their demographic and travel behaviour characteristics. Phi values were used to further identify any significant differences between the segments. Cohen (1988) gives the following criteria for interpreting phi values: 0.1 for a small effect, 0.3 for a medium effect and 0.5 for a large effect. Table 6 indicates the statistically significant differences between the segments.

Regarding demographic differences, the majority of Opportunistic explorers, Enlightened spiritualists and Practical economists were male (53%, 63% and 69%, respectively) while more Comprehensive indulgers were female (61%). Opportunistic explorers were mainly Spanish (46%) and Portuguese (44%) speaking while Enlightened spiritualists, Practical economists and Comprehensive indulgers were mainly Portuguese speaking (67%, 59% and 58%, respectively). More Comprehensive indulgers were also English speaking (22%). The majority in all four segments indicated that they were in a relationship (61%, 66%, 69% and 58%, respectively) while more Opportunistic explorers were single (26%) and more Enlightened spiritualists divorced (15%). Regarding the level of education, Opportunistic explorers, Enlightened spiritualists and Practical economists indicated a high school diploma as their highest level of education (45%, 35% and 49%, respectively) while more Comprehensive indulgers had a professional qualification (39%). Country of residence (p = 0.072) yielded no statistically significant differences. All four segments originated mainly from Brazil (48%, 26%, 46% and 32%); however, Enlightened spiritualists also originated from Argentina and Chile (20% each) and Comprehensive indulgers also from Argentina and Peru (27% and 18%, respectively).

Concerning travel behaviour, the majority in all four segments made their decision to travel to South Africa more than six months in advance (62%, 57%, 69% and 54%, respectively) while more Opportunistic explorers made their decision a month before their trip (35%). Opportunistic explorers and Comprehensive indulgers (100% each) planned to travel to the Western Cape while more Comprehensive indulgers (61%) planned to visit KwaZulu-Natal. Significantly more Opportunistic explorers and Comprehensive indulgers (96% and 92%, respectively, compared to 76% and 77%, respectively, in the other two segments) planned to visit Mpumalanga while more Opportunistic explorers and Enlighted spiritualists planned to travel to Limpopo (65% each). More Enlightened spiritualists and Practical economists also planned to visit Zimbabwe (42% and 36%) while Practical economists were the only segment who also planned to travel to Swaziland (5%). Regarding the alternative destinations considered, significantly more Enlightened spiritualists considered rather travelling to North America (63%) and Central South America (61%) while this segment along with Practical economists and Comprehensive indulgers (56%, 51%, 69%, respectively) further considered Europe as an alternative destination. Opportunistic explorers and Enlightened spiritualists made use of a packaged tour (58% and 57%, respectively) while Practical economists and Comprehensive indulgers (59% and 69%, respectively) made use of non-packaged tours. Significantly more Comprehensive indulgers rented a house (56%) or stayed in a bed and breakfast or guesthouse (81%) compared to the other segments who preferred to stay at a resort or lodge (100%).

Regarding the type of holiday and activities, all four segments indicated safari as their main type of holiday (100% each) while significantly more Opportunistic explorers, Enlightened spiritualists and Practical economists (85%, 87% and 77%, respectively) had a cultural holiday compared to Comprehensive indulgers (50%). Opportunistic explorers preferred active outdoor and sports activities (52%) and shopping (52%) during their trip while indigenous culture was preferred by Enlightened spiritualists (91%), Opportunistic explorers (74%) and Practical economists (67%). Interestingly, more Comprehensive indulgers were also interested in shopping (81%). In terms of media sources, Comprehensive indulgers made use of websites (100%), television (86%) and Twitter (33%) to gather information on the country while Enlightened spiritualists similar to this segment also made use of magazines (64% each) and relied on previous visits (54% and 50%). Opportunistic explorers, Enlightened spiritualists and Practical economists (99%, 94% and 85%, respectively) made use of travel agents while more Opportunistic explorers and Comprehensive indulgers (57% and 64%) made use of Facebook. More Opportunistic explorers also consulted Internet blogs (35%) and brochures and pamphlets (58%).

Findings and implications

This research segmented Latin American tourists to South Africa based on the main motives for travelling to the country to determine whether different market segments can be identified. The research furthermore identified the statistically significant differences between the identified segments based on their socio-demographics and travel behaviour. This research has the following findings and implications.

General profile of Latin American tourists to South Africa

The general profile of the respondents corresponds with the findings from the ITB WTTR (2015), SAT (2010), Tourism Research Australia (2009), as well as UNWTO (2013). Similarities include the predominantly male respondents (SAT 2010), the average age (44 years) (SAT 2010; UNWTO 2013), their high level of education, longer length of stay, the tendency to take at least one annual international trip that they book through travel agents (SAT 2010; Tourism Research Australia 2009; UNWTO 2013) and originating mainly from Brazil (ITB WTTR 2015; SAT 2010; Tourism Research Australia 2009). Confirming the findings from the ITB WTTR (2015), Argentina was also identified as a primary market. Similar to the findings by Tourism Research Australia, the majority of respondents travelled without children. The total average spending per trip ($18 762 or R265 779) was significantly higher compared to the R10 100 found in the SAT report. Confirming the findings from the SAT report, the Western Cape and Gauteng were the most visited provinces during trips to South Africa while Mozambique was also identified as a popular African country visited. However, contradictory to Mauritius indicated as a preferred destination found by SAT, Botswana was recognised as the second most preferred African country in the present study. Confirming the findings by Tourism Research Australia and UNWTO, Europe was identified as a preferred alternative destination. However, contradictory to those reports, North America was only preferred after Asia and Australia and the Pacific islands. Similarly to the UNWTO and ITB WTTC reports, the majority of respondents made individual travel arrangements. Furthermore, confirming the findings by SAT, safari was the main reason for their trip to South Africa while making use of paid accommodation (hotels, motels, resorts or lodges). The respondents' main source of information was word of mouth referrals from family and friend confirming the UNWTO report's findings. It is evident that similarities among Latin American tourists exist. However, since the SAT report, changes in the market to South Africa are also evident especially regarding average spending and preferred destinations. This emphasises the need for continuous research to identify changing marketing trends.

Motives to travel to South Africa

The particular combination of motives found in this research has not been identified in previous academic research. This research identified 20 factors that motivate Latin American tourists to travel to South Africa, namely, in order of importance, Value for money destination, Favourable exchange rate, Unique country attributes, Nature and wildlife, Escape, Accessible destination, Country attractiveness, Available information, Lifestyle, Variety of attractions, Ideally located, Exploration, Social facilitation, International marketing, Spiritual, Safe destination, Life dream, Visit again, Public transport and Education. Contradicting the results of previous research conducted by SAT (2010), scenery and wildlife were not the main motives, indicating a change in their needs. In the present research, Latin American tourists seem to be motivated more by financial aspects. This could be explained by the worsening economic climate in all Latin American countries (Breene 2016). This finding emphasises that Latin American tourists travelling to South Africa cannot be regarded as homogeneous and that the markets' needs are continuously changing. Compared to other studies that focused on the factors that influence or drive South Africa's competitiveness by Du Plessis (2002) and Du Plessis et al. (2015), however, this research reveals some interesting insights. Factors such as location, attractions, safety, geographical features, brand and image as well as value for money correspond, which can be used to marketers' advantage as there is a link between Latin American tourists' motives and the factors that influence South Africa's competitiveness.

To attract more Latin American tourists to the country, marketing campaigns should emphasise the country's favourable exchange rate and that it is a value for money travel destination. South Africa also needs to be promoted as a 'Universal bucket-list destination' emphasising the unique attributes of all nine provinces regarding history and cultural diversity and unrivalled nature and wildlife. Emphasis should be placed on high levels of service excellence to encourage positive word of mouth referrals and return visits. South Africa is the ideal safari destination and marketing should continue to emphasise this. This promotional plan can also form part of a South-South Corporation, a term from the United Nations that essentially incorporates all of the major emerging economies (Ro 2013). According to the United Nations Development Programme (UNDP), South-South trade offers developing countries access to affordable capital goods that are often more appropriate to their needs than are capital goods from richer countries and that are therefore more likely to be acquired, adopted and imitated. Apart from China and major petroleum and gas exporters, Vietnam, Egypt, India, Turkey, Peru, Colombia, Brazil, Mexico and Chile are among the economies that have expanded the most in the South-South trade during last two decades (United Nations Conference on Trade and Development [UNCTAD] Handbook of Statistics 2013). In travel exports, developing economies hold over 40% of the global market and this trade relationship can greatly expand tourism from the Latin American region to South Africa.

Identified market segments and essential differences

This research showed that motivation is a useful segmentation base, especially for destination marketers wanting to understand a specific travel market in more depth compared to the traditional 'holiday', 'business', 'visiting friends and relatives' and 'other' distinctions usually made. Segmenting based on the motivational factors revealed the existence of Latin American tourist segments that ought to be catered for namely Opportunistic explorers, Enlightened spiritualists, Practical economists and Comprehensive indulgers. These segments were labelled according to the motives most important to them. Opportunistic explorers had the highest mean values for the motives Exploration, Social facilitation, International marketing and Public transport. This segment has the shortest length of stay and seems to move on quickly from one destination to another. This segment, however, had the highest spending per person, indicating a potential growth market. This can be achieved if the marketing of South Africa can entice them to stay longer and explore more regions within the country while actively participating in a broad range of activities, which will lead to higher spending. Since they regard Public transport important, South Africa must focus on promoting the Gautrain, which makes it easier to connect from the O.R. Tambo International Airport to Johannesburg and Pretoria as well as the MyCiti bus system in Cape Town, which links the city with surrounding areas.

Enlightened spiritualists rated Spiritual experience and Safe destination higher and were the only segment that seems to regard Education as an important motive. This segment has the second highest total spending, making this segment an affluent traveller, implying that destinations should promote inner and self-actualised well-being experiences. Practical economists valued the practical aspects behind travelling especially financial aspects and regarded Favourable exchange rate and Available information more important. This segment has the highest average total spending, travels in the largest groups and travels the most during the year, making it the most lucrative market to attract. Since Unique country attributes were also regarded as important, this segment should be tempted to experience South Africa's truly unique and high-end offerings, especially since they are a return visit market, and could ultimately act as ambassadors.

Finally, Comprehensive indulgers value the entire experience and are motivated by South Africa as a whole and the country's distinct features especially Nature and wildlife. This segment also rated Country attractiveness as important and thus this segment should be exposed to South Africa's breathtaking vistas and natural heritage. This segment furthermore rated Lifestyle the highest compared to the other segments, while the length of stay was the longest, making this segment an important market especially regarding making the most of the holistic South African experience.

Developing tailor-made marketing strategies

Destination marketers should expand all four segments as they are all viable markets to attract and retain. The main objective should be to increase loyalty and repeat visits among all four segments. Based on their ratings of the motives as well as preferred activities, the following marketing strategies are proposed for each identified segment:

• Opportunistic explorers preferred outdoor and sport activities and shopping. To enhance the motive Exploration (which was the primary motive for this segment), South Africa should brand itself as the ultimate adventure destination by highlighting the country's various outdoor adventure activities such as hiking, river rafting, bungee jumping, scuba diving and shark cage diving, to name but a few. Adventure activities are present in all nine provinces, and this can be an ideal way to give exposure to lesser known provinces and promote the entire country. The focus should not only be on well-known provinces and destinations such as the Table Mountain in the Western Cape and the Kruger National Park in Limpopo and Mpumalanga. Regarding promoting more sports activities, the 2020 Commonwealth Games to be hosted in Durban can be an ideal opportunity to attract more sport tourists. Opportunistic explorers seem to be looking for an opportunity to travel, and this strategy can expand this market.

• Enlightened spiritualists preferred indigenous culture activities. For this segment, spiritual experience is also highly regarded, and spiritual retreats in South Africa should be marketed more intensively as an ideal getaway and wellness holidays. For this segment, education is also particularly important. To further enhance these motives, marketing campaigns should highlight that South Africa is the 'Rainbow Nation' with 11 official languages and four major Black ethnic groups, Nguni (Zulu, Xhosa, Ndebele and Swazi), Sotho, Shangaan-Tsonga and Venda. The diverse cultural history and customs of the indigenous people should also be emphasised to educate tourists and to entice their curiosity. National icons such as Nelson Mandela and the Nelson Mandela Route should additionally be promoted intensively. Cultural heritage sites such as Mapungubwe Cultural Landscape, Robben Island, Vredefort Dome and the Fossil Hominid Sites of Sterkfontein (the Cradle of Humankind) should feature strongly in marketing campaigns. The discovery of Homo Naledi in 2015, a previously-unknown species of extinct hominid, discovered within the Dinaledi Chamber of the Rising Star cave system, the Cradle of Humankind, should be capitalised on and promoted. To enhance the motive Education further, well-managed and interactive interpretation centres should be present at all attractions. Since Opportunistic explorers and Practical economists also preferred indigenous culture activities, these marketing efforts can help to expand these segments as well. For Practical economists, the emphasis should also fall on value for money.

• Comprehensive indulgers were motivated by an array of motives especially Nature and wildlife and preferred shopping activities which confirm the UNWTO's (2013) finding that Latin Americans are motivated by shopping to visit city destinations. This was the only segment that had more female respondents and South Africa should be marketed along with its wildlife, also as an ideal shopping destination by emphasising noteworthy shopping centres such as Sandton City in Johannesburg and the Gateway Theatre of Shopping in Durban, currently the largest shopping centre in Africa, as well as the newly built 'Mall of Africa' in Midrand, Gauteng, set to open in April 2016 which will be Africa's largest mall constructed in a single phase.

Expanding the Latin American tourism market to South Africa

Similar to the reports by the ITB WTTR (2015), SAT (2010), Tourism Research Australia (2009) as well as UNWTO (2013), the identified segments were in the age groups 30-50 years, preferred scenery, nature and wildlife, enjoyed shopping and made use of travel agents. The characteristics of the Enlightened spiritualists also confirm the findings by the UNWTO that for the more affluent Latin American traveller, the focus shifts towards strong emotional and experiential tourism. Confirming the results of the ITB WTTR and SAT reports, the majority of respondents in all four segments originated from Brazil. However, Enlightened spiritualists also originated from Argentina and Chile and Comprehensive indulgers also from Argentina and Peru, showing that South Africa also appeals to these regions. Marketing campaigns of the country should therefore also be visible in these regions. South African Airways (SAA) should emphasise its agreements with fellow Star Alliance partners and other major airlines operating between São Paulo and Buenos Aires, as well as to and from other key South American destinations to market South Africa as an accessible long-haul destination.

Emphasis needs to be placed on a value for money experience (as also emphasised by the high rating of this motive) as this will help the country gain a competitive advantage above alternative destinations such as Europe, North America and Central and South America as well as neighbouring countries such as Botswana, Mozambique and Namibia. South Africa can be more competitive regarding developing all-inclusive holiday packages that include flights, road transport and accommodation. Since SAA is the only airline providing a direct connection between the two regions, discount on flights between Latin America and South Africa can be supplied as part of a larger promotional plan (e.g. South-South trade). Inviting telenovella soap stars and famous actors from Latin America to film some of their episodes or films in South Africa can significantly influence Latin American tourists' opinion on selecting South Africa as their next travel destination.

The four segments indicated the use of a variety of marketing mediums with the Comprehensive indulgers and Opportunistic explorers being the most ardent information searchers. South Africa should be promoted, making use of above- and below-the-line marketing mediums. Comprehensive indulgers made use of the Internet and social media sites the most. Facebook, Twitter and Internet blogs should thus be used as vehicles to promote South Africa's beauty and wildlife to the Latin American public. This can be done by suggesting links to the public that leads them to the main website page, and by placing reviews on TripAdvisor. Travel agents were influential in the decision by Opportunistic explorers, Enlightened spiritualists and Practical economists to travel to South Africa. South Africa needs to collaborate more with inbound tour operators to promote the entire destination at, for example, trade shows such as the annual World Travel Market in Latin America. Services should be offered in tourists' home languages of Portuguese and Spanish. The use of printed media should not be disregarded as Enlightened spiritualists made use of magazines and Opportunistic explorers gained information from brochures and pamphlets. SAA's in-flight magazine (Sawubona) can successfully be used for this purpose.

Ethical consideration

Ethical approval was obtained from the Ethics Committee of North-West University (Potchefstroom campus).

Limitations

This study has some limitations in that it analysed only a small sample of Latin American tourists to South Africa. Future and ongoing research could further expand on the topic by analysing a larger sample possibly through collaboration with SAT to obtain a comprehensive picture of the needs of this undervalued tourism market.

Conclusion

This research filled the gap in the current tourism literature regarding the existence of specific Latin American market segments that travel to South Africa. The study contributes to the field in three ways. The results firstly confirm that Latin American tourists have a variety of motives for their trip and that the main motives are rather financial aspects such as Value for money destination and Favourable exchange rate. Secondly, the results showed that segmenting tourists by their motivations is a useful market segmentation tool as it gives a clear and direct profile and understanding of different types of tourists within a larger travel market and their travel preferences. The results confirmed the existence of four distinct market segments, Opportunistic explorers, Enlightened spiritualists, Practical economists and Comprehensive indulgers. The identified segments differ significantly from each other based on their motives to travel to South Africa as well as regarding their travel behaviour. Moreover, based on the results, marketing strategies were proposed to retain and expand each segment. Marketers of South African tourism can apply these recommendations to increase the country's appeal as a tourist destination to the Latin American tourist market. Compared to the SAT (2010) report, changes in the travel trends and needs of the Latin American market to South Africa were also evident, emphasising the need for continuous research.

Longitudinal research on the Latin American region is therefore recommended to enhance the understanding of the market as well as to determine any differences in profile and motives as well as travel behaviour. Further research concerning experiential tourism, which was identified as a new travel trend for Latin American tourists, is further highly recommended not only in this market but also in all international markets. Similar research is also recommended into other emerging markets, such as India and China, to determine whether there are similarities among emerging markets as well for comparison with the source markets of Europe, USA and Australasia.

Acknowledgements

The authors gratefully acknowledge the financial assistance from the National Research Foundation (NRF). The authors would also like to extend their sincere gratitude and appreciation to Wilderness Safaris and all the respondents who formed part of the survey.

Competing interests

The authors declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

Authors' contributions

This research forms part of W.Z.S.'s master's degree in Tourism Management while M.K. was his study leader.

References

Barros, C.P., Correia, A. & Crouch, G., 2008, 'Determinants of the length of stay in Latin American tourism destinations', Tourism Analysis 13(4), 329-340. [ Links ]

Breene, K., 2016, 5 things to know about Latin America's economy, viewed on 2 February 2017 from https://www.weforum.org/agenda/2016/01/5-things-to-know-about-latin-america-s-economy/ [ Links ]

Brida, J.G., Risso, W.A. & Bonapace, A., 2008, 'The contribution of tourism to economic growth: an empirical analysis for the case of Chile', viewed on 27 June 2016 from https://www.researchgate.net/profile/Juan_Gabriel_Brida/publication/228239760_The_Contribution_of_Tourism_to_Economic_Growth_An_Empirical_Analysis_for_the_Case_of_Chile/links/0fcfd508e8ccf23fc6000000.pdf [ Links ]

Butler, G. & Rogerson, C.M., 2016, 'Inclusive local tourism development in South Africa: Evidence from Dullstroom', Local Economy 31(1-2), 264-281. https://doi.doi.org/10.1177/0269094215623732 [ Links ]

Cano, C., 2003, 'The recent evolution of market segmentation concepts and thoughts primarily by marketing academics', in E. Shaw (ed.), The romance of marketing history, Proceedings of the 11th Conference on Historical Analysis and Research in Marketing (CHARM), AHRIM, Boca Ranton, FL. [ Links ]

Clark, L.A. & Watson, D., 1995, 'Constructing validity: Basic issues in objective scale development', Psychological Assessment 7(3), 309-319. https://doi.doi.org/10.1037/1040-3590.7.3.309 [ Links ]

Cohen, J., 1988, Statistical power analysis for the behavioural sciences, 2nd edn., Erlbaum, Hillsdale, NJ. [ Links ]

Crompton, J.L. & McKay, S.L., 1997, 'Motives of visitors attending festival events', Annals of Tourism Research 24(2), 425-439. https://doi.doi.org/10.1016/S0160-7383(97)80010-2 [ Links ]

Cross, J.C., Belich, T.J. & Rudelius, W., 2015, 'How marketing managers use market segmentation: An exploratory study', in Proceedings of the 1990 Academy of Marketing Science (AMS) Annual Conference, pp. 531-536, Springer International Publishing, viewed 13 October 2016, from http://link.springer.com/chapter/10.1007/978-3-319-13254-9_107 [ Links ]

Dibb, S. & Simkin, L., 2016, 'Market segmentation and segment strategy', in M.J. Baker and M. Saren (Eds.), Marketing theory: A student text, Sage, Los Angeles, pp. 251-279. [ Links ]

Dimanche, F.R. & Moody, M., 1998, 'Perceptions of destination image: A study of Latin American intermediary travel buyers', Tourism Analysis 3, 173-180. [ Links ]

Dolnicar, S., Grün, B., Leisch, F. & Schmidt, K., 2014, 'Required sample sizes for data-driven market segmentation analyses in tourism', Journal of Travel Research 53(3), 296-306. https://doi.doi.org/10.1177/0047287513496475 [ Links ]

Dolnicar, S., Kaiser, S., Lazarevski, K. & Leisch, F., 2012, 'Biclustering: Overcoming data dimensionality problems in market segmentation', Journal of Travel Research 51(1), 41-49. https://doi.doi.org/10.1177/0047287510394192 [ Links ]

Du Plessis, E., 2002, Competitiveness of South Africa as a tourist destination, MA Dissertation, Potchefstroom University for CHE, Potchefstroom. [ Links ]

Du Plessis, E., Saayman, M. & Van Der Merwe, A., 2015, 'What makes South African tourism competitive?', African Journal of Hospitality, Tourism and Leisure 4(2), 1-14. [ Links ]

D'Urso, P., De Giovanni, L., Disegna, M. & Massari, R., 2013, 'Bagged clustering and its application to tourism market segmentation', Expert Systems with Applications 40(12), 4944-4956. https://doi.doi.org/10.1016/j.eswa.2013.03.005 [ Links ]

Ellis, S.M. & Steyn, H.S., 2003, 'Practical significance (effect sizes) versus or in combination with statistical significance (p values): Research note', Management Dynamics: Journal of the Southern African Institute for Management Scientists 12(4), 51-53. [ Links ]

Eugenio-Martin, J.L., Martín Morales, N. & Scarpa, R., 2004, Tourism and economic growth in Latin American countries: A panel data approach, viewed 1 December 2016, from http://www.feem.it/userfiles/attach/Publication/NDL2004/NDL2004-026.pdf [ Links ]

Fayissa, B., Nsiah, C. & Tadesse, B., 2011, 'Research note: Tourism and economic growth in Latin American countries-further empirical evidence', Tourism Economics 17(6), 1365-1373. https://doi.doi.org/10.5367/te.2011.0095. [ Links ]

Field, A., 2005, Discovering statistics using SPSS, 2nd edn., Sage, Thousand Oaks, CA. [ Links ]

Field, A., 2013, Discovering statistics using IBM SPSS statistics, 4th edn., Sage, Thousand Oaks, CA. [ Links ]

Fodness, D., 1994, 'Measuring tourist motivation', Annals of Tourism Research 21(3), 555-581. https://doi.doi.org/10.1016/0160-7383(94)90120-1 [ Links ]

Hennessey, S., Yun, D. & MacDonald, R.M., 2014, 'Segmenting and profiling the cultural tourism market for an island destination', International Journal of Management and Marketing Research 7(1), 15-28. [ Links ]

Iso-Ahola, S.E., 1980, The social psychology of leisure and recreation, W.C. Brown Company Publishers, Dubuque, IA. [ Links ]

Iso-Ahola, S.E., 1982, 'Toward a social psychological theory of tourism motivation: A rejoinder', Annals of Tourism Research 9(2), 256-262. https://doi.doi.org/10.1016/0160-7383(82)90049-4 [ Links ]

ITB World Travel Trends Report (ITB WTTR), 2014, ITB World Travel Trends Report December 2014, Messe Berlin GmbH, Berlin. [ Links ]

ITB WTTC, 2015, ITB World Travel Trends Report 2015/2016, viewed 1 December 2016, from http://www.ITB_World_Travel_Trends_Report_2015_2016.pdf [ Links ]

Iversen, N.M., Hem, L.E. & Mehmetoglu, M., 2016, 'Lifestyle segmentation of tourists seeking nature-based experiences: The role of cultural values and travel motives', Journal of Travel & Tourism Marketing 33(sup1), 38-66. [ Links ]

Kaplanidou, K.K., Karadakis, K., Gibson, H., Thapa, B., Walker, M., Geldenhuys, S., et al., 2013, 'Quality of life, event impacts, and mega-event support among South African residents before and after the 2010 FIFA world cup', Journal of Travel Research 52(5), 631-645. https://doi.doi.org/10.1177/0047287513478501 [ Links ]

Kim, J.H. & Ritchie, B.W., 2012, 'Motivation-based typology an empirical study of golf tourists', Journal of Hospitality & Tourism Research 36(2), 251-280. https://doi.doi.org/10.1177/1096348010388661 [ Links ]

Kittleson, R.A., Lockhart, J. & Bushnell, D., 2016, History of Latin America, viewed 1 December 2016, from https://global.britannica.com/place/Latin-America [ Links ]

Kotler, P., 1972, Management: Analysis, planning, and control, Prentice Hall International, Upper Saddle River, NJ. [ Links ]

Kotler, P., Burton, S., Deans, K., Brown, L. & Armstrong, G., 2015, Marketing, Pearson Higher Education, Melbourne, Australia. [ Links ]

Krejcie, R.V. & Morgan, D.W., 1970, 'Determining sample size for research activities', Educational and Psychological Measurement 30(3), 607-610. https://doi.doi.org/10.1177/001316447003000308 [ Links ]

Kruger, M., Viljoen, A. & Saayman, M., 2013, 'Who pays to view wildflowers in South Africa?', Journal of Ecotourism 12(3), 146-164. https://doi.doi.org/10.1080/14724049.2013.871286 [ Links ]

Legohérel, P., Hsu, C.H. & Daucé, B., 2015, 'Variety-seeking: Using the CHAID segmentation approach in analyzing the international traveller market', Tourism Management 46, 359-366. https://doi.doi.org/10.1016/j.tourman.2014.07.011 [ Links ]

Leibold, M. & Seibert, K., 2015, 'Developing a strategic model for branding South Africa as an international tourism destination, with special consideration of multicultural factors', in Proceedings of the 1998 Multicultural Marketing Conference, pp. 45-47, Springer International Publishing, Cham, Switzerland. [ Links ]

Li, X.R., Meng, F., Uysal, M. & Mihalik, B., 2013, 'Understanding China's long-haul outbound travel market: An overlapped segmentation approach', Journal of Business Research 66(6), 786-793. https://doi.doi.org/10.1016/j.jbusres.2011.09.019 [ Links ]

Maslen, R., 2013, SAA closes Argentine service, viewed 12 May 2014, from http://www.routesonline.com/news/29/breaking-news/226177/saa-closes-argentine-service-in-network-restructuring/ [ Links ]

Mazanec, J.A., 2015, Segmentation, tourism, viewed 1 December 2016, from http://link.springer.com/referenceworkentry/10.1007/978-3-319-01669-6_169-1 [ Links ]

Nacar, R. & Uray, N., 2016, 'The challenge of international market segmentation in emerging markets', in N. Zakaria, A. Abdul-Talib & N. Osman (eds.), Handbook of research on impacts of international business and political affairs on the global economy, pp.42-61, Business Science Publisher, Hershey, PA. [ Links ]

Pallant, J., 2016, SPSS survival manual. A step by step guide to data analysis using IBM SPSS, 6th edn., Open University Press, New York. [ Links ]

Paus, E., 2009, 'The rise of China: Implications for Latin American development', Development Policy Review 27(4), 419-456. https://doi.doi.org/10.1111/j.1467-7679.2009.00454.x [ Links ]

Prayag, G., Disegna, M., Cohen, S.A. & Yan, H.G., 2015, 'Segmenting markets by bagged clustering young Chinese travellers to western Europe', Journal of Travel Research 54(2), 234-250. https://doi.doi.org/10.1177/0047287513514299 [ Links ]

Ro, S., 2013, In O'Neill: This brilliant chart demonstrates how world trade is going through a huge evolution, viewed 20 November 2015, from http://www.businessinsider.com/jim-oneill-south-south-vs-north-north-2013-12 [ Links ]

Rogerson, C.M., 2015, 'Restructuring the geography of domestic tourism in South Africa', Bulletin of Geography. Socio-Economic Series 29(29), 119-135. https://doi.doi.org/10.1515/bog-2015-0029 [ Links ]

Sarigöllü, E. & Huang, R., 2005, 'Benefits segmentation of visitors to Latin America', Journal of Travel Research 43(3), 277-293. https://doi.doi.org/10.1177/0047287504272032 [ Links ]

SAT, 2010, Marketing South Africa in Brazil, viewed 1 December 2016, from http://www.southafrica.net/uploads/legacy/1/287907/Brazil%20Booklet_final2.pdf [ Links ]

SAT, 2015, South African Tourism Annual Report for 2014, South African Department of Tourism, Pretoria. [ Links ]

SAT, 2016a, Top 10: Reasons to visit South Africa, viewed 1 December 2016, from http://www.southafrica.net/research/en/top10/entry/top-10-reasons-to-visitsouth-africa [ Links ]

SAT, 2016b, Quarterly performance - (April to June 2016), viewed 1 December 2016, from http://www.southafrica.net/uploads/files/Q2_2016_Consolidated_Report_v4_13102016.pdf [ Links ]

Schiffman, L.G. & Kanuk, L.L., 2004, Consumer behaviour, 8th edn., Pearson Education, Inc., Upper Saddle River, NJ. [ Links ]

Smith, S., Costello, C. & Muenchen, R.A., 2010, 'Influence of push and pull motivations on satisfaction and behavioral intentions within a culinary tourism event', Journal of Quality Assurance in Hospitality & Tourism 11(1), 17-35. https://doi.doi.org/10.1080/15280080903520584 [ Links ]

Smith, W.R., 1956, 'Product differentiation and market segmentation as alternative marketing strategies', Journal of Marketing 21(1), 3-8. https://doi.doi.org/10.2307/1247695 [ Links ]

Statistical Package for Social Sciences (SPSS), 2015, Statistical Package for the Social Science, version 22, Computer software, IBM, Chicago, IL. [ Links ]

Stats SA, 2013, Tourism and migration, Statistical release P0351, Statistics South Africa, Pretoria. [ Links ]

Stats SA, 2016a, Tourism industry shows positive growth in August 2016, viewed 1 December 2016, from http://www.statssa.gov.za/?p=8653 [ Links ]

Stats SA, 2016b, Tourism Satellite Account for South Africa, final 2012 and provisional 2013 and 2014, viewed 1 December 2016, from http://www.statssa.gov.za/publications/Report-04-05-07/Report-04-05-072014.pdf [ Links ]

Stats SA, 2016c, Report-03-51-02 - Tourism, 2015, viewed 1 December 2016, from http://www.statssa.gov.za/publications/Report-03-51-02/Report-03-51-022015.pdf [ Links ]

Stats SA, 2016d, Tourism and migration, viewed 1 December 2016, from http://www.statssa.gov.za/publications/P0351/P0351April2016.pdf [ Links ]

StatSoft, Inc., 2015, STATISTICA (Data Analysis Software System), version 12, viewed 15 May 2015, from www.statsoft.com [ Links ]

Steyn, H.S., 2000, 'Practical significance of the difference in means', South African Journal of Industrial Psychology 26(3), 1-3. https://doi.doi.org/10.4102/sajip.v26i3.711 [ Links ]

Sung, Y.K., Chang, K. C. & Sung, Y.F., 2016, 'Market segmentation of international tourists based on motivation to travel: A case study of Taiwan', Asia Pacific Journal of Tourism Research, 21(8), 862-882. [ Links ]

Torres, R., 2003, 'Linkages between tourism and agriculture in Mexico', Annals of Tourism Research 30(3), 546-566. https://doi.doi.org/10.1016/S0160-7383(02)00103-2 [ Links ]

Tourism Research Australia, 2009, Latin American short-term visitor arrivals: The trends and outlook for Australia, viewed 13 May 2013, from http://www.ret.gov.au/tra [ Links ]

Tustin, D.H., Ligthelm, A.A., Martins, J.H. & Van Wyk, H.J., 2005, Marketing research in practice, Unisa Press, Pretoria. [ Links ]

United Nations Conference on Trade and Development (UNCTAD) Handbook of Statistics, 2013, South-south trade continues to increase, UNCTAD statistics show, viewed 15 November 2015, from http://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=673 [ Links ]

UNWTO, 2013, Understanding Brazilian outbound tourism. What the Brazilian blogosphere is saying about Europe, World Tourism Organization and European Travel Commission, Madrid, Spain. [ Links ]

Van Niekerk, M. & Saayman, M., 2013, 'The influences of tourism awareness on the travel patterns and career choices of high school students in South Africa', Tourism Review 68(4), 19-33. https://doi.doi.org/10.1108/TR-09-2013-0049 [ Links ]

World Bank (World Bank Group), 2015, Global economic prospect. The global economy in transition, International Bank of Reconstruction and Development/The World Bank, Washington, DC. [ Links ]

WTTC, 2016a, Travel and Tourism Economic impact 2016: World, viewed 1 December 2016, from http://www.wttc.org//media/files/reports/economic%20impact%20research/regions%202016/world2016.pdf [ Links ]

WTTC, 2016b, Travel and Tourism Economic impact 2016: South Africa, viewed 1 December 2016, from http://www.wttc.org/-/media/files/reports/economic-impact-research/countries2016/southafrica2016.pdf [ Links ]

Uys, M.C., 2003, 'A sustainable marketing strategy for Dutch tourists to South Africa', MA dissertation, University for CHE, Potchefstroom. [ Links ]

Correspondence:

Correspondence:

Martinette Kruger

martinette.kruger@nwu.ac.za

Received: 20 Apr. 2016

Accepted: 04 Dec. 2016

Published: 30 Mar. 2017