Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Fundamina

versão On-line ISSN 2411-7870

versão impressa ISSN 1021-545X

Fundamina (Pretoria) vol.20 no.2 Pretoria 2014

The (lack of) protection of bona fide pledgees in classical Roman law

Hendrik Verhagen

Professor of Private International Law, Comparative Law and Civil Law, Radboud University, Nijmegen; Professor of Roman Law (Conrat Chair), University of Amsterdam

ABSTRACT

This contribution discusses the position of the creditor who in good faith accepted security created by a non-owner or on property already burdened in favour of someone else. It appears that although as a rule the bona fide creditor in possession of the charged property was not protected as he is in modern legal systems, there were instances in which the elements of possession or good faith did put him into a more favourable position.

1. Introduction

Roman law did not recognise a general principle allowing third parties in good faith to rely on their counterparty's possession. The oldest right in rem prevailed, and could not be adversely affected by dispositions made without the consent of the titleholder.1 Neither in the city of Rome nor elsewhere in Roman Italy were there, even for immovable property, registers which the public could consult in order to find out who the owner was and whether the property had been burdened (although there were such registers in Roman Egypt).2 Roman law did have an institution that could have evolved into a general principle protecting third parties in good faith, namely usucapio. Even at a very early stage, however, the important category of stolen or embezzled property (res furtivae) was excluded from usucapio3. Moreover, usucapio could neither lead to the acquisition of a pledge created by a non-owner nor protect a secured creditor against an earlier pledge that was unknown to him. Nevertheless, in a number of cases a creditor's possession or good faith did put him in a more advantageous position. In this contribution, some of these cases will be explored.4

2. Multiple dispositions of the same assets by the owner

When debtor D created real security over an asset, firstly in favour of creditor C and later over the same asset in favour of creditor C2, what was the legal position of these competing creditors? Although there is good reason to assume that the non-possessory pledge was recognised relatively early,5 it took much longer for its 'logical sequel' (Kunkel) - the multiple pledge - to be recognised.6 For a long time, if a debtor granted a pledge to one creditor, the burdened property could not be pledged to another creditor. Originally, therefore, a pledge to C2 was invalid and no rules protected this party even when he was in good faith. In classical law, the impossibility of multiple pledges gradually disappeared and eventually it came to be accepted that such pledges with different rankings, could be unconditionally created over the same asset.7 A secured creditor would, however, still not be protected against a prior pledge, not even when the first pledge was non-possessory and the second creditor was in good faith when taking possession of the charged object.8

In some situations, the creditor's possession of the pledged property, or other factors, would place him in a better position. When the same asset was pledged by the same debtor to two creditors simultaneously, the creditor with the possessory pledge would prevail.9 It would seem that (in this situation), where two persons had equivalent rights, the person in possession would be in the stronger position: in pari causa possessor potior haberi debet (Ulp. D. 50.17.128 pr.).10 Wubbe sees the origin of this rule in the position of the defendant in ownership proceedings.11 Likewise, when C1 could not prove that he had been granted a right of pledge first, it is likely that a possessory pledge of C2 would prevail.12 Finally, a secured creditor could grant permission (which could be implied from the circumstances of the case) to the debtor to create a higher-ranking pledge in favour of someone else. From Marcian D. 20.4.12.4, it appears that the permission to grant a pledge to another creditor would already entail a reversal of the ranking of the pledges.13

3. Pledge created by non-owner: the 'relative' pledge

3.1 Debtor and creditor

From Lenel's reconstruction of the formula for the actio Serviana, it appears that the pledged assets had to be in bonis of the debtor at the time of the pledge agreement (eamque rem tunc, cum conveniebat, in bonis Lucii Titii fuisse).14 On the basis of an elaborate review of the sources, Ankum and Pool came to the conclusion that this meant that the debtor should either have owned the assets pleno iure or have had bonitary ownership (i.e. a res mancipi had been delivered by the civilian owner by means of traditio).15 This would mean that neither the 'bare' civilian owner (who had conferred bonitary ownership upon someone else) nor the usucaptor a non domino would have the property in bonis. In a Serviana procedure against the debtor, however, the secured creditor did not have to prove that the pledged property was in bonis of the debtor. It was regarded as unacceptable that a debtor, who had deliberately created a pledge in favour of his creditor, would later raise the defence against the creditor that when he had done so, he had not yet owned the pledged property. This would go against the principle of nemo contra factum suum proprium venire potest.16 The creditor could therefore recover the pledged property from the debtor with the actio Serviana. When the debtor raised the defence that at the time of the pledge agreement the pledged asset had not been in bonis of the debtor, the creditor could successfully override this defence with the 'replication of bad faith'.17 Consequently, the pledged asset would not be available for recourse by the debtor's other creditors, and in this respect, the secured creditor's preferential right of recourse would not be adversely affected. All this might be different, however, when the creditor knew that the debtor was pledging someone else's property. After establishing that the debtor's ignorance does not exempt him from contractual liability vis-á-vis the creditor when he has pledged someone else's property or property already charged to someone else, an opinion by Paul goes on to state:

D. 13.7.16.1 (Paulus libro 29 ad edictum): ... Sed si sciens creditor accipiat vel alienum vel obligatum vel morbosum, contrarium ei non competit. (On the other hand, if the creditor knowingly accepts a pledge which belongs to another, is already charged, or is diseased, he will not have the counteraction.)18

One would think that when - as this fragment indicates - the actio pigneraticia contraria must be denied to the creditor in bad faith, also the actio Serviana would be defeated (with the exceptio doli) when instituted by such creditor.19 Therefore, in the relationship between debtor and secured creditor the element of good faith was probably significant. The element of possession, on the other hand, was not.

3.2 Multiple pledges

In the relationship between creditor and debtor, the situation was therefore the same as if a valid and effective pledge had been created.20 From a fragment by Paul it may be deduced that this result can be extended to the relationship between creditors of the same debtor/non-owner who had both been granted a pledge over the same asset.

D. 20.4.14 (Paulus libro 14 adPlautium): Si non dominus duobus eandem rem diversis temporibus pigneraverit, prior potior est, quamvis, si a diversis non dominis pignus accipiamus, possessor melior sit. (If a non-owner pledges the same thing at different times to two persons, the earlier prevails, although, if we take a pledge from different non-owners, the possessor has the advantage.)

Apparently, the requirement of in bonis debitoris esse was also relaxed in Serviana proceedings between competing creditors deriving their 'right' of pledge from the same debtor.21 The creditor (C1) to whom the asset had been pledged first could recover it by means of the actio Serviana from the creditor (C2) to whom that asset had been pledged afterwards, while C1 could ward off an actio Serviana instituted by C2 by means of the exceptio rei sibi ante pigneratae. C1 and C2 acquired quasi-proprietary interests, which were subject to the prior tempore principle.22 Interestingly, when the pledges had been granted by different non-owners, the prior tempore principle did not apply; but the possession of the pledged asset determined the position of the competing secured creditors. Various explanations have been given of this difficult text.23 For the purposes of this contribution, it suffices to establish that between competing secured creditors the element of possession could be decisive. Moreover, by analogy with Paul D. 13.7.16.1, one would think that when one of the creditors lacked good faith this would jeopardise his legal position.

3.3 The 'relative' pledge

Wubbe, in particular, has argued that whenever a non-owner in factual possession of the pledged asset granted a pledge, the creditor could use the actio Serviana to recover the pledged assets from any possessor of those assets, except the owner pleno iure, the bonitary owner and their successors. According to Wubbe, in bonis debitoris meant nothing more than that the debtor had to be in factual control of the pledged asset in order to create a valid and enforceable pledge.24 Ankum and Pool, as we have seen, take the radically different view that in bonis debitoris esse meant that the debtor had to be the civil (pleno iure) or bonitary owner. An intermediate position is that in bonis debitoris meant that the debtor had to have praetorian ownership largo sensu, i.e. had to be a bona fide possessor in the process of acquiring civilian ownership through usucapio.25 In other words, not only the bonitary owner but also the usucaptor a non domino could create a pledge that would be enforceable against third parties through the actio Serviana. The only persons against whom the actio Serviana would fail would be the civilian (pleno iure) owner and the bonitary owner. A logical application of the nemo plus principle would entail that not only the bonitary owner but also the usucaptor a non domino could create a right of pledge that was enforceable against the same persons as the legal interest to which the person granting the pledge (the debtor) was entitled. It is difficult to see why, as long as the actio Publiciana was available to the debtor, the actio Serviana should not be available to the creditor. If the pledged asset were stolen, it would not be practicable for the creditor first to sue the debtor by means of the actio pigneraticia contraria, in order for the latter to sue the third party in possession of the pledged asset by means of the actio Publiciana. Allowing the creditor to institute the actio Serviana directly against the third party would be much more effective. From this point of view, a fragment such as Ulp. D. 20.1.21.1, which states that the creditor can institute the actio Serviana against the debtor, would not relate to a separate category of cases dealing with the creditor-debtor relationship only. Ulpian expressly mentions that the debtor had purchased someone else's slave bona fide. Why would he have done so other than to indicate that the debtor was a usucaptor a non domino? Another fragment which may support the view that in bonis debitoris esse includes the position of a usucaptor a non domino is Pap. D. 13.7.40 pr. This fragment speaks of cases in which the debtor (unsuccessfully) tries to recover the pledged property from the creditor before the debt is discharged. Papinian uses the words ' pignus petat aut dominium vindicat'. The last two words obviously refer to the rei vindicatio, to be instituted by the debtor when the pledged property is owned by him pleno iure. I agree with Ankum and Pool that the expression ' pignus petat' in all likelihood refers to the actio Publiciana. Since this action could also be instituted by a debtor who was a usucaptor a non domino, Pap. D. 13.7.40 pr. seems to confirm that such a debtor could create a valid right of pledge.26 The fundamental text, however, is an opinion by Paul:

D. 20.1.18 (Paulus libro 19 ad edictum): Si ab eo, qui Publiciana utipotuit quia dominium non habuit, pignori accepi, sic tuetur me per servianam praetor, quemadmodum debitorem per Publicianam. (If I have accepted a pledge from someone who, because he did not have ownership, could have used the Publiciana, the praetor protects me with the Serviana, in the same way as the debtor with the Publiciana.)

The gist of this opinion seems to be that the actio Serviana should be regarded as a derivative of the actio Publiciana, in the sense that the first action could be instituted against the same persons as the latter action. In other words, the actio Serviana is the counterpart of the actio Publiciana, which, given the fact that both actions probably originated in the same period, is not implausible.27 Potjewijd, however, strongly denies this, with reference to another fragment by Paul:

D. 41.4.2.17 (Paulus libro 54 ad edictum): Si eam rem, quam pro emptore usucapiebas, scienti mihi alienam esse vendideris, non capiam usu. (If you sell me a thing which you are usucapting as purchaser, and I know that it belongs to someone else, I will not usucapt it.)

Potjewijd claims that there can hardly be better proof of the thesis that the usucaptor a non domino did not have a right in rem of which he could dispose.28 This must be seriously questioned. It follows from D. 41.4.2.17 that the usucaptor's legal position cannot be 'transferred' to a mala fide purchaser, but it does not follow that the actio Serviana cannot be instituted by a creditor of the usucaptor. The analogy between D. 20.1.18 and D. 41.4.2.17 is not perfect. On the contrary, the crucial difference is that in the case of D. 20.1.18, after having pledged something, the debtor continues to usucapt the charged property, so that, contrary to what is said in D. 41.4.2.17, the actio Publiciana remains available to the debtor. The two fragments can also be distinguished from a procedural perspective. The formula of the actio Publiciana required that the person instituting this action should himself have acquired possession in good faith. In other words, when a seller/usucaptor a non domino sold and delivered the asset to a purchaser, the latter would only be entitled to the actio Publiciana if in good faith. This explains why Paul in D. 41.4.2.17 states that the purchaser's knowledge is an obstacle to usucapio by him. The formula of the actio Serviana, on the other hand, does not contain the requirement of bona fides.29 The pledged asset had to be in bonis of the debtor at the time of the pledge agreement; and Paul D. 20.1.18 appears to indicate that a usucaptor a non domino also satisfied this requirement.30

The element of possession would not be relevant if the usucaptor a non domino could also grant a valid right of pledge: the actio Serviana would then also be available to the creditor to whom a hypotheca had been granted. Whether the element of good faith could have played a role is more difficult to assess. We have seen that the actio pigneraticia contraria would be denied to a creditor in bad faith (Paul D. 13.7.16.1) and that an actio Serviana would probably also fail. However, if the actio Serviana was available whenever the debtor was a usucaptor (a domino or a non domino) this may very well have had the consequence that a creditor who knew that the debtor was not the (civilian or bonitary) owner could still institute the actio Serviana. This interpretation implies that the creditor only lacked good faith if he knew that the debtor himself was a mala fide acquirer.

4. Pledge by non-owner: convalescence and conditional pledge

The position of a creditor to whom someone else's property had been pledged became a strong one when the property was afterwards acquired by the debtor, for instance through purchase or inheritance.31 In that case, a 'convalescence' of the original imperfect pledge could take place, in the sense that the creditor would be granted an adapted actio Serviana (utilis), by means of which the pledged assets could be recovered from every possessor.32 We can see this in an opinion by Papinian:

D. 20.1.1 pr. (Papinianus libro 11 responsorum): Conventio generalis in pignore dando bonorum vel postea quaesitorum recepta est: in speciem autem alienae rei collata conventione, si non fuit ei qui pignus dabat debita, postea debitori dominio quaesito difficilius creditori, qui non ignoravit alienum, utilis actio dabitur, sed facilior erit possidenti retentio. (A general agreement to create a pledge is recognised also in respect of those assets that are acquired afterwards. But if the agreement covers specific property of another, which is not then owed to the pledgor but afterwards has become the ownership of the debtor, the creditor who was not unaware that it was someone else's is not so easily given an utilis actio for it, but it is easier for the possessor to retain it.)

According to Papinian the requirement of in bonis debitoris esse could be relaxed (i.e. could afterwards be satisfied) when the debtor, at the time of the pledge agreement, already had a legally relevant 'expectation' in respect of the pledged asset.33 When, on the other hand, the creditor merely speculated about the debtor's future ownership, he did not deserve to be protected. In other words, only the creditor in good faith (unaware of the debtor's lack of ownership), could afterwards rely on convalescence.34 However, even when the creditor knew that the property belonged to someone else, his possession of the pledged property would still put him in a better position: he would then have a right of retention, by means of raising the exceptio doli against the debtor's rei vindicatio.35 This may be explained as a case of venire contra factum proprium. The elements of good faith and possession therefore also play a role in the Roman law on the convalescence of unauthorised pledges (as perceived by Papinian).

All this was different when the creditor and debtor deliberately created a pledge over someone else's property, subject to the condition 'that the property shall have become the debtor's'. There was no doubt that once this condition materialised a valid and effective right of pledge would come into being.36 This condition could even be implied when it was evident to both parties that the pledged property was not yet owned by the debtor.37 The most obvious example is the general pledge - a pledge on all the debtor's fluctuating assets, which by its very nature is geared towards assets acquired afterwards.38 The creditor's knowing that the debtor did not own the pledged asset was therefore no obstacle to the perfection of a pledge when the pledge was conditionally granted.

5. Authorisation and ratification

Roman law also knew other techniques for validating a pledge created by a non-owner. The owner could authorise the creation of a pledge by someone else.39 Such authorisation could also be implied, for instance when someone managing public property took out a loan and granted a pledge to secure it.40 The owner could also afterwards ratify the unauthorised creation of a pledge by someone else.41 Ratification could also be implied from the circumstances of the case, as when someone agreed to be a guarantor (fideiussor) knowing that the debtor had pledged his (the guarantor's) assets for the same debt.42 An interesting text is a rescript by Septimius Severus and Caracalla from A.D. 205:

C. 8.15.2: Si probaveris praesidi hortos de quibus agebatur tuos esse, intellegis obligari eos creditori ab alio non potuisse, si non sciens hoc agi in fraudem creditoris ignorantis dissimulasti. (If you have proven to the governor that the gardens involved in the litigation are yours, you will understand that they could not be pledged to a creditor by another, unless you knew of that being done, and remained silent, in fraud of an innocent creditor.)43

The rescript holds that a pledge created without the owner's permission is invalid. It is different, however, when the owner knowingly allowed the pledge to be created. Because of the owner's fraudulent behaviour towards an innocent creditor, the invalidity of the pledge could not be invoked against a pledgee in good faith.44 In this rescript, one recognises two elements that are later to be found in European private law in relation to the protection of third persons who had acquired an interest in property from a non-owner: an element of causation on the part of the real owner and an element of good faith on the part of the other party.

6. Conclusion

In a number of cases, Roman law did protect a creditor against the invalidity of a pledge created by a non-owner. To this category belong texts dealing with a 'relative' pledge, convalescence and authorisation/ratification or equivalent conduct. The creditor's good faith appears to have been required for his protection whenever the pledge was created by a non-owner, except when the pledge was created conditionally. Moreover, in several of these cases, the creditor's protection depended on his possession of the pledged property. In case of multiple security interests created by the same owner, the second creditor would originally not even obtain a second ranking security interest. This later changed, but the second creditor was still not protected against a previously created right of pledge of which he could not have been aware. Neither the creditor's good faith nor his possession would (except in case of simultaneous pledges) put him in a better position. It was only many centuries later that in the laws of continental Europe a system of acquisition in good faith evolved which was based on two elements that - in this respect-only had incidental significance in classical Roman law: possession and good faith.45

1 For Roman precedents of the maxim nemo plus iuris ad alium transferre potest quam ipse haberet ('no one can transfer more rights to another than he himself has') as applied to pignus, see Pap. D. 20.1.3.1 and Ulp. D. 41.1.46. For the maxim prior tempore potior iure ('earlier in time, stronger in law') as applied to pignus see e.g. Ant. (Car.) C. 8.17.3.

2 See F. Lerouxel, Le marché du credit privé, la bibliothéque des acquets et les taches publiques en Égypte romaine, Annales HSS (2012), 943-976 (with further references).

3 M. Kaser, Das romische Privatrecht I Das altromische, das vorklassische und klassische Recht, 2nd. ed., München 1971, 137. [ Links ] This is not entirely without parallel in modern civilian jurisdictions, in which the owner is often allowed to recover stolen property within a certain period. See e.g. § 935 BGB, art. 3:86(3) BW.

4 The position of the purchaser of pledged property will not be discussed.

5 G. Kramer, Das besitzlose Pfandrecht, Entwicklungen in der romischen Republik und im frühen Prinzipat, Koln (etc.) 2007, passim. [ Links ]

6 W. Kunkel, Hypothesen zur Geschichte des romischen Pfandrechts, SZ 90 (1973), 15-170 at 155. [ Links ]

7 Marc. D. 44.2.19.

8 Marcian D. 20.4.12.10. This is a situation which in modern jurisdictions would result in C2's pledge taking priority over that of C1. See e.g. § 1208 BGB and art. 3:238(2) BW. The actio Serviana would be available to C2 for the recovery of pledged assets from third parties. However, after a successful recovery by C1, C2 could institute the actio Serviana against C2 in order to claim the pledged property. See Marcian D. 20.4.12 pr.

9 Ulp. D. 20.1.10.

10 The possessory interdicts were also available to the secured creditor where there was interference or threatened interference with his factual possession of the pledged object.

11 F.B.J. Wubbe, Res alienapignori data de verpanding van andermans zaak in het klassieke Romeinse recht, Leiden 1960, 107. [ Links ]

12 A. Wacke, Prozessformel und Beweislast im Pfandrechtpratendentenstreit, TR 37 (1969), 369-414 at 402-403.

13 See also e.g. Mod. D. 20.6.9.1, Paul. D. 20.6.12 pr. and Pap. D. 20.4.2.

14 O. Lenel, Das Edictum perpetuum. Ein Versuch zu seiner Wiederherstellung, 3rd. ed., Leipzig 1927 (repr. Amsterdam and Aalen 2010), 494-495. [ Links ]

15 See H. Ankum, M. van Gessel-de Roo and E. Pool, Die verschiedenen Bedeutungen des Ausdrucks in bonis alicuius esse/in bonis habere im klassischen romischen Recht, Abschnitt II, SZ 104 (1987), 369-436 (hereafter referred to as 'Ankum/Pool, In bonis II'); H. Ankum and E. Pool, Rem in bonis meis esse and rem in bonis meam esse: Traces of the Development of Roman Double Ownership, in: P. Birks (ed.), New Perspectives in the Roman Law of Property, Oxford 1989, 5-41 (hereafter referred to as Ankum/Pool, Rem in bonis) at 32-33. [ Links ] See also M. Kaser, Nochmals zu 'in bonis habere', in: M. Kaser, RomischeRechtsquellen und angewandte Juristenmethode, Vienna (etc.) 1986, 363-368. [ Links ]

16 Ulp. D. 20.1.21.1. See Ankum/Pool, In bonis II, 426; G.H. Potjewijd, Beschikkingsbevoegdheid, bekrachtiging en convalescentie, Deventer 1998, 38-39, 50. [ Links ]

17 Ankum/Pool, Rem in bonis, 17. Other modern authors hold that when the creditor instituted the actio Serviana against the debtor, the phrase eamque rem tunc, cum conveniebat, in bonis Lucii Titii fuisse was simply not included in the formula. Potjewijd, Beschikkingsbevoegdheid, 48 (n. 187). Ulp. D. 20.1.21.1 is strong evidence to the contrary.

18 English translations of all Digest texts in this article are taken from A. Watson (ed.), The Digest of Justinian, 4 vols., rev. English-language ed., Philadelphia 1998, [ Links ] as adapted where I preferred a different translation.

19 The view has been expressed in modern literature that the last sentence of D. 13.7.16.1 is an interpolation. Thus Stein thinks that it is not by Paul, but admits that the debtor would probably have an exceptio doli: P. Stein, Fault in the Formation of Contract in Roman Law and Scots Law, Edinburgh 1958, 131. Kaser also cites Pomp. D. 13.7.2 as indicating that the actio pigneraticia contraria was denied to the creditor in bad faith. However, this fragment only appears to say that no valid proprietary right of pledge comes into existence when someone else's property is pledged; M. Kaser, Studien zum romischen Pfandrecht, Napels 1982, 87 (n. 163).

20 From Ulp. D. 13.7.9.4 it appears that when the secured debt had been discharged, the (non-owning) debtor could institute the actio pigneraticia in order to recover the pledged property from the creditor.

21 Potjewijd, Beschikkingsbevoegdheid, 304-308.

22 See, however, Ulp. D. 20.4.7.1 and (more clearly) Paul. D. 13.7.20.1 on the (equal) ranking of pledges created simultaneously.

23 See e.g. Wubbe, Res alienapignori data, 104; Ankum/Pool, Rem in bonis, 28 and In bonis II, 430432; D. Schanbacher, Die Konvaleszenz von Pfandrechten im klassischen romischen Recht, Berlin 1987, 150-154; Potjewijd, Beschikkingsbevoegdheid, 304-308.

24 Wubbe, Res aliena pignori data, 58-62, 92.

25 F. Wieacker, Zur Verpfándung fremder Sachen, TR 30 (1969), 58-76 at 65 and the other authors mentioned by Ankum/Pool, In bonis II, 374.

26 Nor do the fragments by Julian, Gaius and Paul discussed by Ankum/Pool (In bonis II, 398-399) justify the conclusion that only the pleno iure and bonitary owner could grant a right of pledge.

27 F.B.J. Wubbe, Ius vigilantibus scriptum. Ausgewahlte Schriften [collected writings Wubbe edited by P. [ Links ] Pichonnaz], Freiburg 2003, 218-227.

28 Potjewijd, Beschikkingsbevoegdheid, 55.

29 This is not to say that good faith cannot be relevant in connection with the actio Serviana: see the next paragraph.

30 In this sense also Wieacker, Zur Verpfandung fremder Sachen, 69. For different interpretations, Ankum/Pool, Rem in bonis, 26-27.

31 See A. Wacke, Die Konvaleszenz der Verfügung eines Nichtberechtigten, SZ 114 (1997), 438-461 at 452.

32 On convalescence of rights of pledge see Schanbacher, Die Konvaleszenz, passim; Potjewijd, Beschikkingsbevoegdheid, 211-308, with further references.

33 According to Potjewijd (Beschikkingsbevoegdheid, 248) this fragment deals with the situation where a pledge had been created over a (e.g. a purchaser's) contractual claim for delivery. Although one cannot rule out this possibility, the text may also be interpreted as saying that convalescence was possible when the creditor had a legally relevant interest (here: a claim for delivery) in respect of the pledged property, without this interest itself necessarily also being pledged to the creditor. With regard to a similar fragment on convalescence - Pap. D. 20.4.3.1 - also Potjewijd (Beschikkingsbevoegdheid, 117 n. 46) admits that only the asset itself had been pledged and not the claim for its delivery.

34 See, however, Paul. D. 13.7.41 and Diocl. et Max. C. 8.15.5, where good faith is not required.

35 Wacke, Die Konvaleszenz, 454.

36 Marcian D. 20.1.16.7: Aliena res utiliter potest obligari sub condicione, si debitoris facta fuerit. See also Marc.-Ulp. D. 20.4.7.1; Diocl. et Max. C. 8.15.5.

37 Potjewijd, Beschikkingsbevoegdheid, 109-110.

38 Wacke, Die Konvaleszenz, 451-452. See e.g. Pap. D. 20.1.1 pr. quoted supra.

39 Scaev. D. 17.1.60.5; Ulp. D. 13.7.11.7; Paul. D. 13.7.20 pr.; Mod. D. 20.1.26.1. Where the security had been granted by someone else, the formula of the actio Serviana had to be adapted in order to reflect that at the time of the conventio pignoris the pledged property was in bonis of either the party creating the pledge or of the person with whose consent the pledge had been created (Marcian D. 22.3.23).

40 Marcian D. 20.1.11 pr.

41 Paul. D. 13.7.20 pr.; Marcian D. 20.1.16.1.

42 Marcian D. 20.2.5.2.

43 Translations from the Code are taken from the web edition of T. Kearly (ed.), Justice Fred H. Blume's Annotated Justinian Code, http//uwacadweb.uwyo.edu/blume&justinian/, as adapted where I preferred a different translation.

44 H. Ankum, Spátklassische Problemfálle bezüglich der Verpfándung einer res aliena, in: H. Altemeppen et al. (eds.), Festschrift fürRolf Knütelzum 70. Geburtstag, Heidelberg 2010, 35-44 at 37.

45 E.g. § 1207 and 1208 BGB; art. 3:238 BW.

Annexure

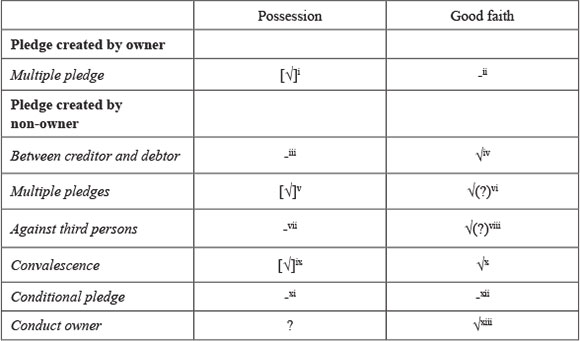

This table gives a schematic overview of the categories of situations in which possession and good faith were always (√), sometimes ([√]) or not (-) required. The accompanying notes do not refer to all the relevant fragments in the Digest but only to representative ones.

Notes

i Ulp. D. 20.1.10 (simultaneous pledges).

ii Marc. D. 42.2.19 (first pledge always prevails).

iii D. 20.1.21.1 (discusses both possessory and non-possessory pledge).

iv D. 13.7.16.1 (only for actio pigneraticia).

v D. 20.4.14 (when created by the same pledgor).

vi D. 13.7.16.1(?).

vii D. 20.1.18.

viii D. 13.7.16.1(?).

ix D. 20.1.1 pr. (no convalescence in case of bad faith, but creditor in possession has lien).

x D. 20.1.1 pr.

xi Marcian D. 20.1.16.7.

xii Marcian D. 20.1.16.7.

xiii C. 8.15.2.