Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Journal of Energy in Southern Africa

versión On-line ISSN 2413-3051

versión impresa ISSN 1021-447X

J. energy South. Afr. vol.32 no.1 Cape Town feb. 2021

http://dx.doi.org/10.17159/2413-3051/2021/v32i1a8362

ARTICLES

Sustainable energy supply and business collaborations for sustainability, resilience and competitiveness in the Zambian copper industry after Covid-19

K. ImasikuI, II, *; E. NtagwirumugaraI

IAfrican Center of Excellence in Energy for Sustainable Development, College of Science and Technology University of Rwanda, Kigali, Rwanda

IISouthern African Science Service Centre for Climate Change and Adaptive Land Management, Windhoek, Namibia

ABSTRACT

The mining industry in Zambia is energy-intensive, with hydro energy providing the required energy. But other sources of energy may need to be added, because hydro energy is subject to good rain patterns, threatened by the spectre of climate change, as already indicated by the current prolonged hours of load shedding by state-owned , Zambia Electricity Supply Company. This research looks at state-of-art mining technologies and collaborative business processes that leverage on the expected ramp in copper and cobalt (Cu-Co) global demand post-Covid-19, to help design resilient business systems by manufacturing, source goods and services within the Southern African Development Community (SADC) region to lower Cu-Co production costs, and maximise profits through shared resources and bilateral trade agreements. With evidence, projection and predictions by global leaders in the Cu-Co industry, this study evaluates the preparedness and resilience of the Zambian mining industry for sustainable energy supply, environmental sustainability, and suggests some possible business collaborations within the SADC region to share the following resources: metal refineries, transportation of goods and services, expertise and energy supplies within SADC, to enhance business sustainability. The study shows that the resilience of Cu-Co business in resource-rich nations like Zambia is complex and is heavily influenced by investment decisions, stakeholder interests, copper ore grades and extractive process types, reliable power supply, and socio-economic and political issues. The significance of this study is that it proposes some business collaborations within SADC that can increase energy reliability and supply, Cu-Co production, increase business resilience, improve global competitiveness and sustainability by exploring energy efficiency and generation-mix strategy.

Highlights

• A sustainable energy analysis for Zambia.

• Establishing the role of mine multi-national enterprises concerning environmental sustainability.

• Proposing copper business resilience collaborations within SADC.

• Developing a mining business resilience and sustainability model for sustainable power supply, high production, profitability and global competitiveness.

Keywords: sustainable energy, mining, copper and cobalt business, collaboration

1. Introduction

With mining being Zambia's major industry, its sus-tainability is critical, not only because it is a major employer, but also because it is a source of business opportunities for several mine contractors and multi-national enterprises (MNEs). The mining MNEs have a role to ensure that inclusive growth needs are adopted by all of them. However, this pathway is not easy to attain because of several socio-economic challenges faced in Zambia, like social inequity and the social licensing of artisanal miners to operate small-scale mine holdings that recycle copper wastes, improve copper and cobalt production. Further, the mining MNEs should develop new investment models and collaborations that meet future mine requirements to adopt initiatives like developing new infrastructure systems that benefit both the communities and the mines in a balanced hydro-renewable energy-mix portfolio for enhanced sustainability and reduced carbon footprints (Lane, 2016).

Cobalt is mainly mined as a by-product of copper and nickel mining in Zambia and the Democratic Republic of Congo (DRC). In 2017, in Zambia and the DRC, about 61% of cobalt was extracted from copper mining and 37% from nickel mining (Baraziet al, 2017). The main smelting processes used are py-rometallurgical, floatation, and hydrometallurgical, and these processes leave slag as a waste product which is leachable to as high as 0.5%, 3%, and 30% respectively. Other waste materials associated with copper ore refinery and metallurgical processes include tailings waste from mineral processing plants and sterile waste rock from the surface and underground mining. All these wastes present serious risks to the environment, animal and plant life, which reduces forex earning and gross domestic product (GDP) in Zambia (Kaniki & Tumba, 2018; Barazi et al, 2017). Further, these processes are energy-intensive and the mines consume more than 50% of Zambia's total produced hydropower, while the residential sector consumes about 33% of the produced hydropower (Energy Regulation Board of Zambia, 2018). There is a need to diversify to other renewable resources, alongside collaborating with other Southerm African Development Community (SADC) stakeholders to ensure that reliable energy is supplied to the mines at all times and simultaneously reduce hydro-dependency.

Apart from arguing for sustainable production, growth and profitability through business collaborations, this study supports a re-think to reduce over-dependency on hydropower, and suggests diversification of power generation using energy efficiency and a generation-mix strategy, with alternative sources like solar as a solution to increase energy reliability of energy in the mines. The copper and cobalt mining collaborations for energy supplies and other goods and services between the mines in Zambia and other SADC nations serves as a plausible growth strategy for enhancing global competitiveness, business growth and meeting the high copper and cobalt (Cu-Co) global demand expected once the conditions brought about by the Covid-19 pandemic are passed.

2. Energy sector in Zambia

According to the Zambian Energy Regulation Board, the installed electricity generation capacity as of 2018 in Zambia was 2892.94 MW, of which 84% was hydropower-generated. This total was lower than the 2017 capacity of 2896.91 MW, because the Zambia Electricity Supply Company (Zesco) decommissioned some diesel power plants in the North-Western province. The electrification rate in Zambia is, on average, about 31%, with an urban access ratio of 61%, and a rural one of only 4%. About 60% of people still rely on bio-fuel for cooking, with a marginal 16% having access to clean, modern cooking facilities (Zambia Development Agency, 2014; Energy Regulation Board of Zambia, 2018).

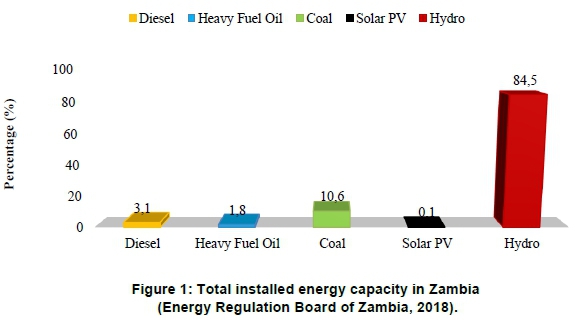

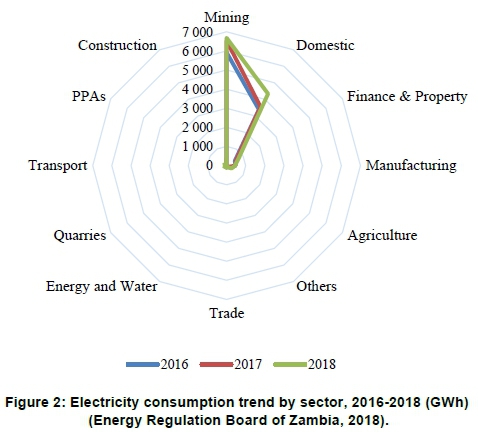

The total installed capacity percentages of energy sources in Zambia are given in Figure 1, and hydropower consumption by sector, as of 2018, is given in Figure 2. Figure 1 shows that most electricity is generated using hydropower, a dependency which presents an energy threat, given the spectre of drought and climate change.

Figure 2 shows the electricity consumption in gi-gawatt-hours (GWh) by economic sector for 2016 to 2018, with the mining MNEs the largest single consumers of power, accounting for about 51% of demand, and sharing the balance between retail and export consumers (Energy Regulation Board of Zambia, 2018). In 2018, the African Energy Commission gave a basic indicator for the overall efficiency of the energy system in Zambia for energy conversion and distribution losses from total primary energy supply (TPES) to total final consumption (TFC) as 10.3%, which translates to an almost 89.7% power system efficiency at consumption and this helps guide to calculate the available capacity (African Energy Commission, 2018). Although the installed capacity remains relatively high at 15 027.39 GWh, the available/consumed energy is lower and stands at about 13 080.23 GWh, for several reasons, including internal losses, waste, weather, climate change and even poor energy efficiency.

Figure 2 shows that the hydropower consumption in Zambia, skews to the mining sector with a consumption exceeding 50% of the total produced energy. Therefore, embracing energy efficiency or identifying energy-saving opportunities in copper mining would help save a substantial amount of energy for key processes like de-watering, blasting, digging, ventilation, materials handling, drilling, crushing, grinding, and processing or separations (BSC Inc, 2007; Curry, Ismay, & Jameson, 2013)

2.2 Energy efficiency and generation-mix strategy in Zambia

Energy efficiency is a critical strategy for ensuring safe, reliable, affordable and clean energy for all. Globally, including in Zambia, hydropower has a high generation efficiency and is relatively cheap compared to the fossil fuels. Modern hydropower turbines are capable of converting about 90% of the available energy into electricity while fossil fuel plants can only achieve about 50% efficiency (Alternative Energy, 2019).

An energy production-mix that includes renewable energy resources can help MNEs save energy costs because they are cheap and easy to maintain. Further, generation-mix is key to mine processes in the industry because it helps reduce overloading one energy source. For instance, lighting and powering simple basic electrical appliances can be solar-based, while heavy power processes like furnaces can be thermal- or hydropower-based. The total energy-saving opportunity is realised if more energy-efficient technologies are used (BCS Inc, 2007). In Zambia, the highest consumer of energy is the mines. As of 2018, the total installed capacity in Zambia was 15 027.39 GWh, while the available/consumed capacity was 13 080.23 GWh. This indicates that the entire power system has got an overall efficiency of 87.04%. Energy efficiency is necessary throughout the entire production process to cut back costs to free-up some electricity capacity for other users in Zambia.

Deploying hybrid power systems, especially so-lar-hydropower production, can displace the carbon-emission-intensive diesel generators that are also expensive to operate, due to the high cost of diesel fuel. Apart from the solar energy resource being renewable, it is cheap; and renewable energy resource technologies are easy to maintain and emit no carbon emissions. A comparison of solar power and diesel generators energy source in Zambia, based on previous studies, indicates that solar systems are more financially viable than diesel power. Calculating the LCOE using diesel for a 2 kW diesel generator costing USD 300, at a consumption rate of 0.76 litres per hour, the total fuel required to generate the required 30 kWh is 22.8 litres per day, and 461.79 liters of diesel will be required to produce 613 kWh annually. The total electricity production, including losses, is 1 073 kWh. Assuming that there are no fixed charge rates, a cost of USD 1/litre, gives a calculated LCOE diesel in Zambia of USD 1.2911 /kWh which is more expensive than the USD 0.697/kWh for a solar solution (Levin & Thomas, 2014). This indicates that the mine MNEs in Zambia could save up to 50% of their power if they deployed solar systems for less-energy-intensive loads, like lighting and electronic appliances.

The main mine MNEs in Zambia are Barrick Gold, Mopani, Konkola Copper Nines, Kalumbila, Lumwana Mines, First Quantum Minerals, and Glen-core (Energy World, 2018). Until 2019, Vedanta Resources was also a major Mine MNE in Zambia but now excluded from the list due to some legal disputes between the government of Zambia and the MNE. Despite such socio-economic/ political issues prevalent in the Zambian mine industry, the mine MNEs have the financial capacity to invest in energy-efficient technologies and renewable energy resources to enhance sustainable energy supply to the mines and embrace a more collaborative business approach with the entire SADC region, and take advantage of the expected global boost for the demand for copper and cobalt once the Covid-19 pandemic is over (Copper Price Outlook, 2020).

3. Post-Covid-19 global copper opportunities

3.1 Copper market performance trends, 2018-2019

The year 2020 has created a lot of uncertainties in the markets and the global economy after the onset of Covid-19. Furthermore, the most powerful countries, the US and China, have been struggling since 2019 over the red metal (copper), causing the copper prices to drop by 2.3% from USD 5,964 in 2018 to USD 5,822 in December 2019. The price of cobalt sulphate has also been dropping - it fell by almost 26.4% in the last quarter of 2019. This situation has several causes, especially the suspension of the construction of an ion-exchange plant by Glencore MNE in the DRC and operations by Eurasian Resources Group at its Boss mine in the DRC and at Chambishi refinery in Zambia. This was exacerbated by a 5% duty tax hike on imported cobalt concentrates in 2019 and complaints from the international refiners of battery chemicals against high cobalt prices compared to the low prices of the same commodity from artisanal miners in Zambia and the DRC. However, as of 21 September 2020, copper prices trended upward for most of the third quarter of 2020, trading as high as USD 6 837 per ton (Copper Price Outlook, 2020).

3.2 Copper-cobalt perceptions by global leaders of the post-Covid-19 market

It is against this backdrop that the key global players and mine MNEs leaders like the President and CEO of Nevada Copper, Matt Gili, Copper Fox Metals MNE President and CEO Elmer B. Stewart, CEO of Foran Mining Peter Soares, and Oroco Resource CEO Craig Dalziel, were all uncertain about what to expect in 2020 concerning copper. Despite the unprecedented impact Covid-19 has had on the Cu-Co production industry, alongside the backdrop in Cu-Co prices since 2018-2019, it is projected that the price will ramp upwards due to the rising global demand for Cu-Co products, especially in the electric vehicle industry, electrification, urbanisation, renewable power and other opportunities that will emerge from Covid-19, like medical electronics in hospitals. The underlying fact is that energy transition is a trend that is virtually unstoppable, and this has raised the price of copper, while the electronics industry is continually demanding carbon hydroxide and carbon concentrates for battery storage (Barrera, Priscila, 2020).

3.3 Post-Covid-19 projections of opportunities by Cu-Co leaders and MNEs

Some global leaders like Pumpkin Hollow feel that there is a scramble for a few remaining copper deposit resources globally. For Craig Dalziel, the lack of copper available to quench growing demand is a concern. Copper is a good long-term prospective metal, especially as the world moves toward electrification, EVs, urbanization, and renewable power. Investors should always perform their due diligence, and he recommended that investors focus on safe geopolitical jurisdictions. After Covid-19, the risk of investing in discovering new deposits will be too high and unattractive for MNEs but concentration will be on reliable Cu-Cu producers like Chile and Peru. However, the potential for massive production to meet the global demands cannot be met by Chile and Peru alone but can be supplemented by the Cu-Co rich resources in Zambia (Copper Price Outlook, 2020; Investing News Network, 2020).

Global leader Gianni Kovacevic of CopperBank Resources MNE has offered a USD 10 trillion stimulus package for Asia, Europe, and the USA. With valuable by-products like cobalt, copper is the enabler of green energy because energy transition programs that focus on green and clean electrification demand more copper. Further, it is expected that most of the stimulus package funds will be used in modern infrastructure to reduce the medical risks of future pandemics. Further, higher growth opportunities from new Cu-Co demands globally are expected post-Covid-19. For instance, it is expected that most hospitals will start using more Cu-Co products through hi-tech electronics equipment (Barrera, Priscila, 2020).

Strict Covid-19 health measures have restricted both Cu-Co production and international trade and this has resulted in copper prices being increased, because of reduced Cu-Co production expected to lead to supply shortages by late 2020 or early 2021. Since copper is an industrial metal that cannot be easily substituted, Matt Gili of Nevada Copper, predicts that the pending supply shortages will first manifest themselves in merger and acquisition activity globally, because the major mine MNEs will look to secure copper production opportunities (Barrera, Priscila, 2020).

3.4 Global impact predictions of copper and cobalt post-Covid-19

Wood Mackenzie Research Director Nick Pickens says that as the COVID-19 pandemic continues to affect mine operations daily, the uncertainty brought by the COVID-19 outbreak has continued to hit the copper market, with prices falling significantly during the COVID-19 pandemic. Miners also stepped up their response to slow down the spread of the virus. Some major operations are reducing workforces, delaying construction or ramping up activities, and smaller operations have been placed on care and maintenance. Further, the strict measures by governments concerning COVID-19 national control, paired with falling copper prices pose significant risks to global mine supply and project development. Kieran Clancy of Capital Economics says the measures put up to offset the COVID-19 impact will not assist to meet global demand and supply until the COVID-19 virus is contained globally (Barrera, Investing News Network, 2020; Copper Price Outlook, 2020; Investing News Network, 2020).

The Cu-Co supply in 2019 might suffer as a result, with countries also imposing restrictions on operations around the world to fight the virus. In 2019, copper production reached 20 million tons, down slightly from 2 018's 20.4 million tons, according to the US Geological Survey. It is estimated that the mine operations streamline will reduce global production by about 5% in 2020 (Barrera, 2020; Copper Price Outlook, 2020; Investing News Network, 2020).

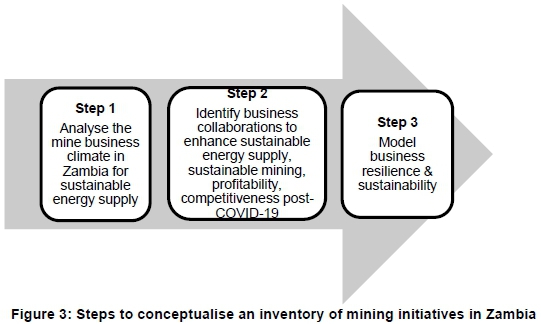

4. Method

This paper aims to develop an inventory of services that are needed to maintain sustainable energy supply to the copper mines, sustainable production of Cu-Co products, ensuring that sustainable delivery of the mined Cu-Co products to their port of exit is achieved without neglecting global demand, and the sustainable business planning approach that is expected to occur post-Covid-19. The study uses the principles of life cycle assessment (Sonnemann et al., 2004) and industrial ecosystem (Industrial Ecology Compendium, 2019) and sustainable business (Lenssen & Smith, 2019). The impact of unsustainable mining on the environment are first evaluated, then several business collaborations are identified within the entire Cu-Co supply chain network while taking advantage of the anticipated Cu-Co business boom/growth post-Covid-19. Third, a business resilience and sustainability model is given for MNEs, governments or investors to develop and customise strategies to protect their businesses from global challenges, maintain profitability and gain competitive advantage. Figure 3 gives a visual outline of the method adopted for the study.

5. Discussion

5.1 Step 1 - Analyse mine business climate for sustainable energy supply

A private firm, Copperbelt Energy, supplies power to the mines in Zambia and the DRC. The energy management system in Zambia is highly liberalised but subject to political governance, and this at times may compromise the mine productivity. Resolving such political issues may need a more sophisticated approach and methodology. However, the mine MNEs can take advantage of renewable energy resources that can be explored without permission from the government to reduce dependency on the Zesco grid. Because the mining industry has a lot of synergies, such as mines in Zambia, DRC and South Africa being owned by the same multi-national enterprises, ore concentrates mined in DRC or Zambia can be processed in Zambia or even South Africa depending on the availability of the needed mine refinery raw materials like acid, electrical power or processing equipment like smelters. Although Zam bia is politically stable, its economy may not be very favorable for business because of high import duty on copper concentrates, windfall taxes, high inflation rates and external debt, fiscal instability and corruption (Lundst0l & Isaksen, 2018). All these factors subtract from creating a conducive mine business climate. This background needs a careful evaluation of investment opportunities. The use of renewable energy and the promotion of energy efficiency in the mines to provide sustainable energy development and maintain a sustainable environment in such a business climate may present some challenges. Further, to enhance business sustaina-bility in the Zambian mining sector, there is a need to keep watch on ecological issues like physical, chemical, and biological damage to the environment (Imasiku & Ntagwirumugara, 2019).

5.2 Step 2 - Identify business collaborations

The business climate analysis in Zambia helps identify some possible business collaborations/ initiatives within Zambia, the DRC, and extending to other SADC countries like Tanzania, South Africa, Zimbabwe, and Botswana and then use them to develop a copper production framework for mining business in Zambia. Five initiatives are explored here regarding collaboration between Zambia and other SADC countries: (i) a power purchase agreement between Zesco and Africa's largest electric power utility, Eskom in South Africa; (ii) copper ore and raw material trade within SADC (especially between DRC and Zambia and South Africa); (iii) smelting collaboration deals; (iv) transportation collaboration deals for all mine goods and services; and (v) environmental sustainability collaborations between the environmental agencies and mines MNEs.

Exploring a power purchase agreement between Zesco and Eskom

Zambia has not taken advantage of the Southern African Power Pool (SAPP) which already includes high voltage power lines from South Africa at 330kV-400kV through Botswana, Zimbabwe, Namibia (330kV dc) and Mozambique to Zambia and at 220kV to the DRC.

Zambia is currently experiencing power deficits and load shedding in the residential and industrial sectors of up to 20 hours per day. This has also affected the mine sector, which depends on the affected communities and contracting firms for service support and goods supplies. Establishing energy trade collaborations between Zambia and other SADC nations can help maximise profits, increase copper and cobalt production through sharing critical resources in the copper mines.

As of 2019 Zambia had a deficit of 700 MW and requested Eskom to supply at least 300 MW to meet this shortfall with 300 MW for six months, but Eskom also has had a power deficit and load sheds about 1 000-6 000 MW daily out of the available 28 000 MW. However, Eskom, together with independent power producers (IPPs), plans to install a total capacity of about 50 000 MW from coal power, hydropower, renewable energy, solar and wind by 2030 (Kessides, 2020; Colling, 2020). The recovery capacity demonstrated by Eskom allows envisaging a favorable future scenario for a power purchase agreement (PPA) between Zesco and Eskom.

Copper ore trade collaboration between Zambia and SADC states

One notable collaboration strategy between DRC and Zambia concerning copper processing is that the copper ore mined in the DRC is processed in Zambia, because some multi-national enterprises own mines in both the DRC and Zambia. Since the DRC has fewer refinery facilities, it turns to Zambia to meet the deficit. An example of such collaboration is the Sentinel mine in DRC, which sends its concentrates to Kansanshi mine smelter in Zambia, because both mines are owned by First Quantum Minerals (First Quantum Minerals, 2018). The process of extracting the ore also presents another collaboration opportunity for copper smelting between Zambia, DRC, and South Africa because South Africa has the second-largest copper refinery capacity on the continent, after Zambia.

Smelting collaborations between South Africa, Zambia, and the DRC

There is a potential for copper and cobalt refinery business collaborations between DRC, Zambia and South Africa. Some critical collaboration includes smelting, environmental sustainability, and energy PPAs between the SADC nations.

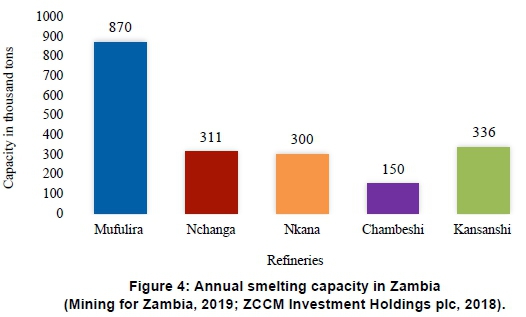

Figure 4 shows that the annual smelting capacities in Zambia exceed two million tons annually and these comprise: 311 000 tons - Nchanga smelter; 300000 tons - Nkana refinery; 870 000 tons - Mu-fulira smelter; 25000 tons of blister copper - Cham-bishi Metals; 150 000 tons of blister copper - Cham-bishi smelter; and 336000 tons - Kansanshi mine smelter (Energy World, 2018; USGS , 2014; ZCCM Investment Holdings plc, 2018).

The Kansanshi Mine smelter in the North-Western part of Zambia has three copper mines and produce more than 50% of Zambia's total processed copper annually. Second, First Quantum Minerals (FQM) has taken advantage of abundant acid and the Kansanshi Mine smelter to refine the copper ores that are mined at Sentinel mine in the DRC to save costs. The total energy consumption at Kansanshi smelter is 3 267 TJ, accounting for 1 646 TJ and 1 622TJ of electricity in 2017 and 2016 respectively (First Quantum Minerals, 2018).

Another existing collaboration between Zambia and the DRC is the Chambeshi mine smelter, which sources most of its concentrates from DRC since its installed refinery capacity is much higher than what is locally produced at Chambeshi. There are also some smelters, like Mufulira and Nchanga in Zambia, that have expanded their capacity to as high as 870 000 tons and 311 000 tons respectively, which is way beyond the available processing demand in Zambia.

Because of Zambia's large refinery capacity, an increase in processed copper output was obtained in 2018, partly attributed to the sound mining investment policies by the Zambian government, like tax relief on all copper ore concentrates imported from DRC, increasing mineral royalties to 10% from about 5% (Acheampong, 2019). Also, Zambia has Africa's largest refined copper-production capacity, surpassing the DRC and South Africa (Our outlook for Zambia's mining sector, 2018).

Transport collaborations between Zambia, Tanzania, Zimbabwe, Botswana, and South Africa The copper and cobalt that is processed in Zambia and DRC is shipped to customers abroad via Durban port in South Africa. Further, Zambia extracts more refined copper than is expected from the locally mined copper ore because the DRC supplies some copper concentrates to Zambia. This collaboration is possible because some mine MNEs in the DRC own smelters in Zambia, thereby making good use of the opportunities offered by Zambia's stable political situation. This has contributed to Zambia being the highest refined copper producer in Africa, coupled with a high annual smelting capacity (Figure 4) that exceeds two million tons.

This points to a possible cross-border trade agreement between the DRC, Zambia, Botswana, Zimbabwe, and South Africa concerning the trans portation of refined copper, mined copper ores, and copper processing raw materials like acid. The road network between the mines in Zambia and other SADC members may be maintained collaboratively to increase the efficiency of the transportation of raw materials, produced goods and even equipment. The DRC/Zambia to Dar es Salaam in Tanzania route is the shortest to the seaport, but remains unused for transporting copper by-products and other minerals compared to the South African route. Another shorter route to the nearest seaport worth exploring is DRC/Zambia to Windhoek in Namibia.

Environmental sustainability collaborations between the environmental agencies and the mines MNEs

Since the carbon emissions from the copper extraction process are different at different smelting stages, depending on the type of energy source deployed, the carbon emissions from a solar, diesel, coal, natural gas, hydropower, and other renewable resources will differ. Figure 5 gives the contribution of different mine operations activity to carbon emissions.

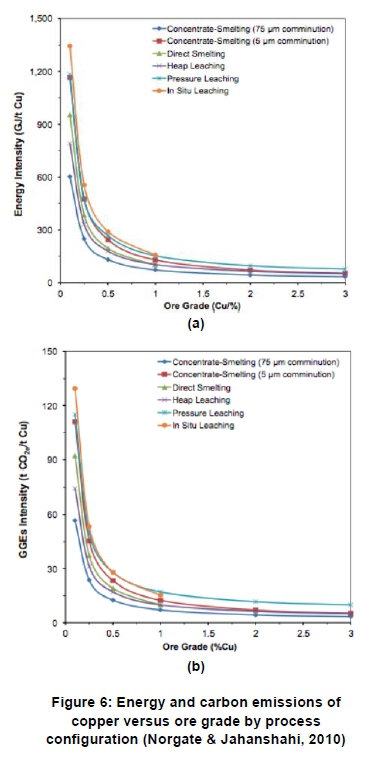

Figure 5 shows that the greatest carbon emission contribution within the mine operations is from the mining and milling operation. Since low-grade copper ore produces more carbon emissions than high-grade ore, Zambia emits fewer carbon emissions from copper refining, because of its high ore grades - about 2.5%, compared to other producers globally with very low ore grades of only about 0.1%. Figure 6 shows that, as ore grade decreases, the consumed energy increases during copper extraction, and more carbon emissions are emitted.

Collectively, mining activities in deeper mines with lower-grade ores are likely to produce more mine waste through tailings and waste rock that conjointly causes a higher consumption of energy. The processing of low-grade copper ore results in higher volumes of sulphur dioxide emissions, which cause acid rains (Norgate & Jahanshahi, 2010). Figure 6 shows that lower-grade ore produces higher carbon emissions, while deeper mines need more energy to mine the ore due to the complicated underground operations, like tunnelling, ventilation, electric systems, and water management.

Studies by McLellan et al (2012) concluded that, if the share of energy used is more than the proportion of the copper and cobalt production, then the mining MNEs ought to adopt energy efficiency as a strategy to meet the best global practices of using less energy per unit of non-ferrous metal ore processing. If the share of emissions is larger than the energy produced, then decarbonisation of the fuel mix becomes a crucial strategy to attain less carbon-intensive energy systems.

Apart from the waste, losses, and carbon emissions, failure to engage in socio-economic activities that benefit the community is a source of conflict. Other factors underlying these conflicts include lack of processing resources like acid and adequate energy for the mining activities, artisanal mining, ineffective engagement of native people in mining activities as a source of financial gain, corruption, economic opportunities, environmental issues, health insecurity, land use and re-settlement concerns (Hodge, 2014; ICMM, 2014). To harmonise these issues, the MNEs are supposed to collaborate with local people, other MNEs, and the government of Zambia. Further, artisanal mining should be legalised, to promote the growth of the mining industry and good mining practices.

Although Zambia remains hydropower-depend-ent, the mining business is very complex and unique to the MNE, availability of raw materials, geographical location, human and capital resources that enhance mining activities. It is also subject to governing policies, economic and political stability. This was evaluated and validated against the principles of basic LCA and industrial ecological principles in order to unravel how business collaborations can catalyse resilience and improve sustainable energy supply through bilateral collaborations, trade and-cross-border export corporations. Locally, the com munity would enjoy living in a clean carbon-free environment with less or no waste alongside energy efficiency to achieve sustainable mining. From an economic point of view, mine MNEs are also a source of employment to local people. Artisanal mining can also serve as a source of livelihood, especially if well managed and guided by the country mine regulatory authorities and in alignment with International Council on Mining and Minerals regulation.

Establishing collaborations between environmental agencies in Zambia and the mine MNEs concerning environmental sustainability, as shown in Figure 5, would help the governments and policy makers in Zambia and SADC region engage with the mine MNEs concerning the importance of optimising their mining and milling and smelting operations to reduce their carbon emissions from around 57% and 27%.

5.3 Step 3 - Copper production business resilience model for resilience and sustainability

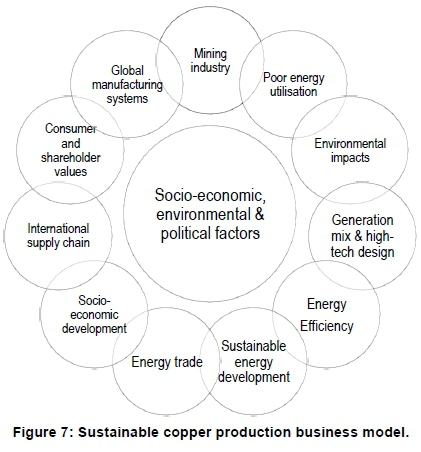

This step provides a business resilience evaluation for sustainability that would allow the mining MNEs to customise their strategies to protect their businesses from global challenges like Covid-19 and their impacts beyond 2020. The World Bank anticipates that about 93% of economies will experience recessions and shrink the GDP by 5-7% globally in 2020 and beyond (World Bank, 2020). The (ICMM, 2014)effect of this shrinkage is also compounding in nature and extends to developing nations. Therefore, building a resilient and innovative mining business in Zambia as part of the pandemic response, would help mine MNEs recover from the Covid-19 impact and adopt sustainable actions to safeguard profitability and prepare for growth post-Covid-19. To achieve this, a copper production business model for resilience in Zambia is developed and shown in Figure 7. Figure 7 conceptualises a business model to guide investors, policy makers, mine MNEs and end-users (especially those in the electronics industry), concerning the copper and cobalt production business in Zambia.

Figure 7 suggests the potential for mining collaboration to enhance the sustainable business corporation, concerning energy trade, cross border energy trade, and port of exit collaboration to exacerbate sustainable mining business throughout the copper mining, extraction process transportation, and export network. This model is in line with previous studies by Adisa Azapagic, which focused on coming up with a sustainable mining framework indicator that is compatible with those reported by the global reporting initiative (Azapagic, 2003); however, the model in Figure 7 is specific to Zambia and the SADC region. While both studies highlight that the stakeholders are more concerned with economic benefits than environmental and social issues, Adisa Azapagic's studies do not incorporate political factors.

Some mining activities result in excessive carbon emissions that lead to negative environmental impacts and consequently promote climate change. Therefore, applying environmental engineering, industrial ecology, and a generation-mix is found to be a suitable model of providing energy to the mines. This will be economically viable because renewable power sources, including solar photovolta-ics, hydropower, and wind, are increasingly cost-competitive. There is a need to design an approach that deploys a generation-mix strategy alongside energy-efficiency strategies and energy trade to resolve socio-economic issues like energy shortages, low smelting capacity, and lack of access to the sea.

Further, mining MNEs customers within the international supply chain increasingly demand that the suppliers of different goods and services should fulfill sustainability standards before engaging in business with them (Mark, 2018). Renewable energy usage solves societal issues related to the environment but also supports a sustainable international business model in the mining industry, because renewable resources provide an affordable and reliable energy supply. This gives a sense of responsibility by all stakeholder, which would assist in achieving corporate shared values.

A previous study by Ralph Hamann and Paul Kapelus on mining in Zambia and South Africa, argue that an approach based on corporate social responsibility (CSR) is not very profitable when it comes to business accountability and fairness. The studies also unravel the existence of gaps between mining MNEs, CSR approach when addressing mine MNE issues, business accountability and business fairness, and that CSR activities ought to be treated with caution because CSR is only greenwashing - or creates an impression that CSR is doing more to protect the environment than it really is (Ima-siku, Thomas, & Ntagwirumugara, 2019; Hamann & Kapelus, 2004). This study emphasises the corporate shared values (CSV) approach rather than a CSR approach, partly because CSV creates a sense of ownership while CSR is subject to political or individual will, and this is not an ideal approach for sustainability.

6. Conclusions

With a copper ore reserve capacity of about 20 million metric tons, high copper ore grades averaging about 2.5% (much higher than the global average of 0.6%), Zambia is a Cu-Co rich region. It is also a high energy consumer, and production heavily depends on a reliable energy supply, one which is sometimes in short supply, especially during drought-stricken seasons that affect hydropower production. Since these drought seasons affect the entire SADC region, energy trade with other SADC nations, that may have some excess hydropower, is plausible.

Since mining operations and mine subsidiaries or contractors that offer support services and goods all depend on having a stable power supply, the prevalent long hours of load shedding in Zambia affect the mine directly or indirectly. Although the Zambian mine sector has several socio-economic, environmental and political challenges, it has the potential to offer enormous investment benefits and profitable returns if it established power purchase agreements (PPAs) with regional power giants like Eskom in South Africa to ensure continuity of power supply and reduce the effects of the load shedding which affects productivity within the mine supply chain network. To supplement the proposed PPAs, generation-mix strategies that deploy solar-hydropower systems are highly encouraged at the Zambian mines. Further, trade relations with these SADC nations like Tanzania, Zimbabwe, Botswana can be enhanced by the establishment of copper transportation agreements from mine-to-port while the trade relations can be extended to copper refineries in South Africa.

Despite the Cu-Co production impact of Covid-19, alongside the drop in Cu-Co prices experienced in 2017-2019, it is projected that the price will increase, due to the rising global demand for Cu-Co products. Because of electrification, urbanisation, renewable power and other opportunities that will emerge from Covid-19, like medical electronics in hospitals, electric vehicle industry and because energy transition is a trend that is virtually unstoppable, the Cu-Co industry has a competitive advantage and investment potential.

To enhance Cu-Co business resilience and sus-tainability in Zambia, five collaborations within SADC region are proposed: exploring a power purchase agreement between Zesco and Eskom in South Africa; exploring copper ore trade collaboration between Zambia and SADC states; exploring smelting collaborations between South Africa, Zambia, and the DRC; establishing transport collaborations between Zambia, Tanzania, Zimbabwe, Botswana, and South Africa; and ensuring environmental sustainability collaborations between the environmental agencies and the mine MNEs.

Further enhancement of business sustainability and production can be achieved by ensuring that mine MNEs in Zambia maintain a balanced business profile that takes into consideration all three pillars of sustainability - people, profit, and planet - so as to promote social wellbeing, reduce waste, and ensure environmental sustainability within the Zam-bian mine community and throughout the SADC supply-chain network. Sustainable mine business collaborations would improve Cu-Co production in Zambia and increase competitiveness with other important Cu-Co producers like Chile and Australia, and take advantage of the post-Covid-19 Cu-Co opportunities to build a resilient Cu-Co business in Zambia.

Author roles

K. Imasiku was responsible for data curation, writing-original draft preparation, writing-review and editing visualisation, methodology, investigation and resource organisation.

E. Ntagwirumugara was responsible for visualisation, supervision of formal analysis, funding acquisition, writing-review and editing visualisation, project administration and resources.

Acknowledgement

The authors acknowledge and appreciate the support from Professor Valerie. M. Thomas of the Georgia Institute of Technology in USA and the African Center of Excellence in Energy for Sustainable Development at the University of Rwanda.

References

Acheampong, T. (2019). Zambian mineral royalties increase. Retrieved January 24, 2020, from https://ihsmarkit.com/research-analysis/zambian-mineral-royalties-increase.html [ Links ]

African Energy Commission. (2018). Africa Energy Data Base. Retrieved July 17, 2019, from afrec energy: https://afrec-energy.org/Docs/En/PDF/2018/statistics_2018_afrec.pdf [ Links ]

Alternative Energy. (2019). (Alan Davison for the Group) Retrieved July 13, 2019, from Alternative Energy Sollutions for the 21st Centuary: http://www.altenergy.org/renewables/hydroelectric.html [ Links ]

Azapagic, A. (2003, May). Developing a framework for sustainable development indicators for the mining and minerals industry. Journal of Cleaner Production. [ Links ]

Barazi, S. A., Näher, U., Vetter, S., Schütte, P., & Liedtke, M. (2017). Cobalt from The DR Congo - Potential, Risks and Significance for the Global Cobalt Market. Commodity Top News. [ Links ]

Barrera, P. (2020, April 28). Investing News Network. (Copper Investing News) Retrieved May 05, 2020, from Copper to Play Key Role in Post-COVID-19 World: https://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/copper-play-role-post-covid-19-world/ [ Links ]

Barrera, Priscila. (2020, April 20). Copper Investing News. Retrieved from Copper to Play Key Role in Post-COVID-19 World: https://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/copper-play-role-post-covid-19-world/ [ Links ]

BCS Inc. (2007). Mining Industry Energy bandwidith Study. US Department of Energy. [ Links ]

Colling, A. (2020, February 10). Power Supply Shortage Causes Disruptions in South Africa. Retrieved from https://www.worldaware.com/resources/blog/power-supply-shortage-causes-disruptions-south-africa [ Links ]

Copper Price Outlook. (2020). Investing News Network. Retrieved from Copper Price Outlook 2020 and Copper Stocks to Watch: https://investingnews.com/free-report-online/copper-market-outlook-and-copper-companies/ [ Links ]

Curry, J. A., Ismay, M. J., & Jameson, G. J. (2013, May 29). Mine operating costs and the potential impacts of energy and grinding. Elsevier, 56(2014), 70 - 80. [ Links ]

Energy Regulation Board of Zambia. (2018). Statistical Bulletin. Lusaka: ERB. [ Links ]

Energy World. (2018, June 21). Zambia aims for cost-reflective electricity prices by end 2018. (REUTERS, Producer) Retrieved July 13, 2019, from https://energy.economictimes.indiatimes.com/news/power/zambia-aims-for-cost-reflective-electricity-prices-by-end-2018/64681648 [ Links ]

First Quantum Minerals. (2018). Environmental Safety Report. [ Links ]

Hamann, R., & Kapelus, P. (2004, January 19). Corporate Social Responsibility in Mining in Southern Africa: Fair accountability or just greenwash? Springer, 85 - 92. [ Links ]

Hodge, R. A. (2014). Mining company performance and community conflict: moving beyond a seeming paradox. Journal of Cleaner Production, 1-2. [ Links ]

ICMM. (2014). Internal Staff Research. International Council on Mining and Metals, London. London: ICMM. Retrieved from Internal Staff Research. International Council on Mining and Metals, London. [ Links ]

Imasiku, K., & Ntagwirumugara, E. (2019). An impact analysis of population growth on energy-water-food-land nexus for ecological sustainable development in Rwanda. Food and Energy Security, 00(085), 1-17. [ Links ]

Imasiku, K., Thomas, V. M., & Ntagwirumugara, E. (2019). Unraveling Green Information Technology Systems as a Global Greenhouse Gas Emission Game-Changer. Administrative Sciences, 9(43), 1-29. [ Links ]

Industrial Ecology Compendium. (2019, March 06). National Pollution Prevention Center for Higher Education, University of Michigan. Industrial ecology compendium. (Center for Sustainable Systems, University of Michigan) Retrieved from http://www.umich.edu/~nppcpub/resources/compendia/ind.ecol.html [ Links ]

Investing News Network. (2020). Cobalt Market Forecast and Cobalt Stocks to Buy in 2020. Retrieved from Investing News Network: https://investingnews.com/free-report-online/cobalt-market-forecast-cobalt-stocks-buy/ [ Links ]

Kaniki, T., & Tumba, K. (2018, November). Management of mineral processing tailings and metallurgical slags of the Congolese copperbelt: environmental stakes and perspectives. Journal of Cleaner Production. [ Links ]

Kessides, I. N. (2020). The Decline and Fall of Eskom a South African Tragedy. Retrieved from The Global Warming Policy Foundation: https://www.thegwpf.org/content/uploads/2020/06/Decline-Fall-Eskom.pdf [ Links ]

Lane, A. (2016). Sustainable mining in Africa requires collaboration. Mining Review Africa. [ Links ]

Lenssen, G. G., & Smith, N. C. (2019). Managing Sustainable Business. Brussels: Springer. [ Links ]

Levin, T., & Thomas, V. M. (2014). Utility-maximizing financial contracts for distributed rural electrification. Energy, 69, 613-621. [ Links ]

Lundst0l, O., & Isaksen, J. (2018, May). Zambia's mining windfall tax. United Nations World Institute for Development Economic Research, 2018(51), pp. 1-27. [ Links ]

Mark, S. (2018). Apple Now Runs on 100% Green energy, and here's how it got there. Retrieved January 24, 2020, from https://www.fastcompany.com/40554151/how-apple-got-to-100-renewable-energy-the-right-way [ Links ]

McLellan, B., Corder, G., Giurco, D., & Ishihara, K. (2012). Renewable energy in the minerals industry: a review of global potential. Journal of Cleaner Production, 36. [ Links ]

Mining for Zambia. (2019, March 05). Mining for Zambia. Retrieved March 05, 2019, from Zambia's advanced, world-class smelter: https://miningforzambia.com/zambias-advanced-world-class-smelter/ [ Links ]

Mudd, G., Weng, Z., Memary, R., Northey, S., Giurco, D., Mohr, S., & Mason, L. (2012). Future Greenhouse Gas Emissions from Copper Mining: Assessing Clean Energy Scenarios. nstitute for Sustainable Futures: University of Technology, Civil Engineering. Sydney: National Research Flagship. [ Links ]

Norgate, T., & Jahanshahi, S. (2010). Low Grade Ores - Smelt, Leach or Concentrate? 23(2), 65-73. [ Links ]

Our outlook for Zambia's mining sector. (2018, August). Zambia's refined copper outlook positive. http://www.miningweekly.com/article/zambias-refined-copper-outlook-positive-2018-08-17/rep_id:3650. [ Links ]

Sonnemann, G., Castells, F., Schuhmacher, M., & Hauschild, M. (2004). Integrated Life-Cycle and Risk Assesment for Industrial Processes. LEWIS. [ Links ]

USGS . (2014). Zambia: Estimated Production of Production of Mineral Commodities. Table 1 - USGS Mineral Information Summary 2014 cell L14. USGS. [ Links ]

World Bank. (2020, June 20). The Global Economic Outlook During the COVID-19 Pandemic: A Changed World. Retrieved from https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world [ Links ]

Zambia Development Agency. (2014). Energy Sector Profile. [ Links ]

ZCCM Investment Holdings plc. (2018). Substantial cobalt and copper reserves & mining, refining & tolling of cobalt and copper. http://www.zccm-ih.com.zm/copper-cobalt-gold/chambishi-metals/. [ Links ]

Zyl, A. J. (2005, December 01). Industrial ecology framework for achieving cleaner production in the mining and minerals industry. Journal of Cleaner production, 14, 299-304. [ Links ]

* Corresponding author: email: katunduimasiku@gmail.com