Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of Energy in Southern Africa

On-line version ISSN 2413-3051

Print version ISSN 1021-447X

J. energy South. Afr. vol.26 n.1 Cape Town Feb. 2015

Aggregate and regional demand for electricity in Malaysia

Saeed SolaymaniI; Sayed Mohammad Bager NajafiI; Fatimah KariII; Nurulhuda Binti Mohd SatarII

IDepartment of Economics, Faculty of Social Science, Razi University, Kermanshah, Iran

IIDepartment of Economics, Faculty of Economics and Administration, University of Malaya, Kuala Lumpur, Malaysia

ABSTRACT

The main objective of this paper is the analysis of electricity consumption in Malaysia as a whole and its three regions, namely, Peninsular Malaysia, Sabah and Sarawak. This analysis has been carried out using distinguished data in sectoral level for 44 quarters (2000Q1-2010Q4). For this purpose, two log-log static and dynamic panel demand functions are estimated. The dynamic model, which is based on a partial adjustment approach, is used to compare with the static model. The aggregate and the three regional models are estimated based on their economic sectors in both the dynamic and static methods. This study seeks to reveal some features of electricity consumption in Malaysia and its regions. It is found that the short and long- run price elasticities of electricity demand in all regions of Malaysia are inelastic. Consumers' responsiveness to changes in electricity prices in the short-run is low, while they have a high response to the long-run changes in the entire Malaysian economy and its regions. This means that, while the short and long-run price elasticities of electricity demand are lower than one, the magnitudes of the long-run elasticities are greater than the short-run elasticities. Moreover, all elasticities in the dynamic models are smaller than the static models. The estimated short and long-run cross-price elasticities of Liquefied Petroleum Gas (LPG) are negative which suggests that LPG and electricity are complementary goods.

Keywords: electricity, Malaysia, elasticity

1. Introduction

Malaysia consists of thirteen states and three federal territories divided between Peninsular Malaysia (PPM.), which is part of mainland Southeast Asia, East Malaysia consisting of Sabah, and Sarawak, which are located on the northern edge of the island of Borneo. Most of the industries, commercial centres and, especially, the capital and main political centre are located in Peninsular Malaysia. The three differ in many respects such as differences in population, Gross Domestic product (GDP) and its growth, unemployment, level of industrialization and consumption of energy. For example, the Peninsular's GDP share of total GDP of Malaysia averaged 84.3% since 1997, and these shares for Sabah and Sarawak regions are 6.3% and 9.4%, respectively.

The energy demand is a function of the level of industrialization in the region. For instance, since 1997, in both Peninsular Malaysia and Sarawak, the industrial sector has had a high consumption of electricity, followed by the commercial sector. In constant, in Sabah, the reverse is the case, with the commercial sector being the highest electricity consumer, followed by the domestic sector and, in third position, the industrial sector.

Moreover, the average percentage shares of electricity consumption during this period in Peninsular Malaysia, Sabah and Sarawak have been 91.6%, 3.5% and 4.8%, respectively. Empirical evidence has shown that the electricity consumption has a significant impact on the economic growth of Malaysia (Chandran et al., 2010; Lean and Smyth, 2010a, 2010b; Tang, 2008; Tang and Tan, 2013; Yoo, 2006). The demand for electricity has facilitated Malaysia's overall economic growth while economic development of Malaysia's regions depended upon the availability of electricity supply to stimulate economic growth. Therefore, it is of utmost importance for this study to estimate the demand for electricity in Malaysia as a whole and in its three regions. The major contribution of this study is in applying the dynamic panel data models in Malaysia and its regions. As noted by Bond (2002), estimating the dynamic version of a static model is necessary because ignoring the estimation of the basic dynamic model leads to poor estimation results and significant information might be lost. If a dynamic model is estimated, while the coefficient on the lagged dependent variable is not of interest, dynamics are allowed for in the underlying processes, which are necessary for the recovery of consistent estimates of other parameters.

The reasons that increase the interest to study the demand for electricity in Malaysia are as follows: first, the electricity demand in Malaysia among the five ASEAN founding economies is the second highest, and third highest among all members (Figure 1). The electricity consumption per capita grows rapidly in this country as well as in other ASEAN countries, except for Indonesia and the Philippines. In 2010, the electricity consumption per capita in Malaysia has increased rapidly from 2577kWh per capita in 2000 to 3867kWh per capita. Second, in Malaysia, the electricity intensity, kWh/GDP (Kilowatt hours / 2005 USD), is the second highest among all ASEAN members. In 2010, the electricity intensity for Thailand was 0.67 while it was 0.62 for Malaysia. Third, to the best of the authors' knowledge, only a number of studies have examined demand for electricity in Malaysia such as Bekhet and Othman (2011) and Bazmi et al. (2012). Bazmi et al. (2012), by applying a Neuro-Fuzzy Network, estimated the demand for electricity in the state of Johor in Malaysia, while Bekhet and Othman (2011) estimated electricity consumption in rural and urban areas using a time series approach over the 1980-2009 period. In addition, the study by Aman et al. (2011) employed top-down and bottom-up approaches and thereby forecast demand for electricity in large steel mills industry, whereas Akhwanzada and Tahar (2012) applied a simulation based on system dynamics, and thereby forecast demand for electricity in the whole of the Malaysia economy.

By using a dynamic panel data, this study will differ from other studies on this subject, and by such means will form a significant contribution to the existing literature.

This study differs from previous studies on the subject in two ways. First, it uses both static and dynamic panel data approaches to compare the outcomes of both methods. Brañas-Garza et al. (2011) revealed that using a dynamic panel data in terms of experiments allows unravelling new relationships between experimental variables and highlighting new paths in behaviours. Second, despite using recent quarterly data on consumption of electricity, the focus of the paper is to estimate the demand for electricity at the aggregate level of the Malaysian economy and especially in its three regions.

The next section provides a review of literature, section 3 describes the methodology and the data employed. In section 4 the estimation results and their analyses are presented and finally, in section 5, conclusions are provided.

2. Review of literature

Demand for electricity has a strong background in international literature. In the aggregated level of demand for electricity, Amusa et al (2009), by using an autoregressive distributed lag (ARDL) method, estimated the aggregate demand for electricity in South Africa during the 1960-2007 period. The findings show that the main determinant of electricity demand in the long-run is only income, while in the short-run both income and electricity prices are significant. Similarly, Adom et al., (2012), using the ARDL bounds cointegration approach, examined the determinants of electricity demand function in the short and long-run in Ghana during 1975-2005. The results indicate that in the short-run, real per capita GDP, industry efficiency, and degree of urbanization are the main drivers of aggregate domestic electricity demand and long-run price and income elasticities are lower than the short-run estimates. Gam and Rejeb (2012) analysed the aggregated demand for electricity in Tunisia using annual data from 1976 to 2006 in a VAR method. The empirical findings suggest that in the long-run the price of electricity has a negative effect on electricity consumption, while the GDP and the past value of electricity consumption have positive effects. Amarawickrama and Hunt (2008) also examined the electricity demand for Sri Lanka by applying six econometric techniques (Static Engle and Granger method, Dynamic Engle and Granger method, Fully modified ordinary least squares method, Pesaran, Shin and Smith method, Johansen method, and Harvey approach). They found that the range of long-run income elasticity is from 1.0 to 2.0 and price elasticity is from 0 to -0.06. Therefore, the main determinants of electricity demand are GDP and prices of electricity with different methods, also long-run income and price elasticities are greater than those of the short-run.

Dilaver and Hunt (2011a) by applying the structural time series model to annual data over the period from 1960 to 2008 and Halicioglu (2007), using the bounds testing procedure to cointegration during 1968-2005, found that the long-run income and price elasticities of the residential electricity demand in Turkey are greater than the short-run elasticities. Ziramba (2008) applied the bounds testing approach to cointegration analysis to estimate residential electricity demand in South Africa during the 1978-2005 period. The results indicated that income is the main determinant of electricity demand in the short and long-run, while electricity price is insignificant.

In the industrial and manufacturing sectors, there are a number of studies on electricity demand in developing countries. For example, Dilaver and Hunt (2011b) estimated the demand function for the industrial sector using the structural time series technique over the 1960-2008 period. Their results show that both industrial output and price elasticities have a significant impact on electricity consumption and are inelastic in the long-run. Bölük and Koc (2010) estimated four demand functions for four production factors, namely capital, labour, intermediate input and electricity, using a translog cost function over the 1980-2001 period. The results indicate that the price of electricity is inelastic and electricity-labour and electricity-capital inputs are complementary.

Therefore, it can be concluded that the price of electricity and income are the main determinants of electricity demand functions with different methodologies and their long-run elasticities are greater than the short-run. As the literature shows, applying dynamic panel data to estimate the electricity demand in developing countries is a new method which is used in this study, while it has been used in many studies in developed economies such as Alberini and Filippini (2011), Filippini (2011), Alberini et al., (2011) and Leesombatpiboon and Joutz (2010).

3. The models and the data 3.1. The model

The production function of the composite energy commodity, E, is a function of electricity consumption, Ec, and capital stock of appliances, K, as follows (Filippini, 1999; 2011):

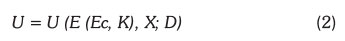

We also assumed that the consumer has a utility function with the usual properties of differentiability and curvature. The consumer utility is a function of the composite energy commodity, E, and aggregate consumption of good X that directly yields a utility. The utility function is influenced by other variables, D, such as household characteristics, weather and geographic characteristics which is illustrated by equation (2).

The consumer is then assumed to maximize its utility subject to the equation (1) and the budget constraint,

Where I is income, is the price of the composite energy commodity, and is the price of composite numeraire good X. (For more details of consumer production theory to electricity demand analysis see Filippini (1999) and Francisco (1988).)

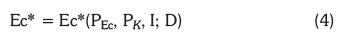

Finally, the demand functions for electricity and capital stock can be obtained as:

According to Filippini (2011), equations (4) and (5) show the long-run equilibrium of the consumers. This model is static in that it assumes instant adjustment in the equipment stock to variations in electricity demand, so that the short and long-run elasticities are similar.

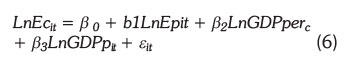

Based on equation (4), along with available data and using a log-log functional form, the following static empirical model of electricity demand can be specified as:

Where, the consumption of electricity, Ec, is a function of real price of electricity, Ep, per capita gross domestic product, GDPper (GDP by sector / number of electricity consumers), and the real price of Liquefied Petroleum Gas, LPGp, as a complimentary good. Filippini and Pachauri (2004) and Athukorala and Wilson (2010) used LPG prices in their models to test the hypothesis of whether this fuel is complimentary to or substitutes for electricity. All variables are measured in logarithm.

The subscript i denotes economic sectors, namely residential, commercial, industrial, and mining in both models for aggregate and Peninsular Malaysia electricity demand. Since mining is not a major consumer of electricity in Sabah and Sarawak, it is not included in the models for Sabah and Sarawak. The subscript t denotes the duration of data (2000Q1-2010Q4).

The sign for LnEp is expected to be negative following the demand theory. On the other hand, an increase in income is expected to increase the demand for electricity on the assumption that it is a normal good. Therefore, the sign of GDP is positive. The sign of LPGp nonetheless depends on how consumers perceived the use of LPG, whether it is complementary or substitute to electricity. For the case of Malaysia, the initial expectation for the sign on LPGp is negative since LPG and electricity are often consumed together, one of them for lighting and use in electrical instrument and another for heating. Since all variables are logarithmic values, the coefficients of them can be directly interpreted as demand elasticities.

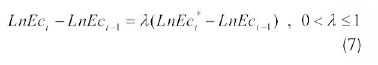

It is equally vital to consider that the actual consumption of electricity may differ from the long-run equilibrium consumption, because the equipment stock may not be able to adjust easily to the long-run equilibrium. To cope with this situation, researchers normally make use of a partial adjustment as suggested by Houthakker et al. (1974), Berndt and Samaniego (1984), Filippini (2011), and Alberini and Filippini (2011). This model assumes that the actual change between time periods t and t-1 in the quantity of electricity consumption- which is demanded- is equal to a fraction, λ, of the long-run change. Formally,

Where (LnEct - LnEct-1) is the actual change, and (LnEct* - LnEct-1) is the desired change.

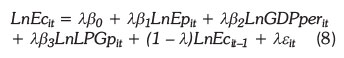

The dynamic versions of the electricity demand model can be specified by combining equations (6) and (7). The equation (6) can be rewritten as:

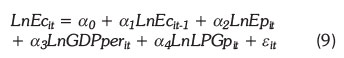

Summarizing the coefficients, the dynamic model can be declared as:

Where, Ect-1 is electricity consumption in the previous period (t-1). It is expected that the sign of this variable will be positive, because the consumption of the previous period has a positive impact on current consumption due to economic growth.

To estimate the dynamic equation derived from a partial adjustment approach, this study used a dynamic panel data method in order to take account of the correlation of the lag of electricity consumption with the error term in the right side of the equation 6.

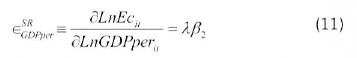

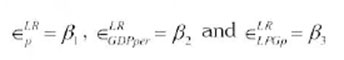

As noted by Berndt and Samaniego (1984) and Alberini and Filippini (2011), short-run price and income elasticities based on equation (8) are constant and equal to:

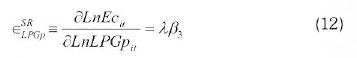

And accordingly, the cross-price elasticity can be written as below:

When the processing of the capital stock adjustment has been completed, the corresponding long-run elasticities are:

3.2. The data

The data for all variables in this study are quarterly data from the first quarter of the year 2000 to the fourth quarter of the year 2010 and comes from all three regions of Malaysia. The data on electricity consumption and real prices of electricity by states and sectors are collected from both the National Energy Balances and the Energy Commission of Malaysia. Household expenditure, GDP and population data by states and activities are gathered from the Department of Statistics, and the website of the Economic Planning Unit.

Real LPG prices by states are collected from the Economic Planning Unit website and the databank of the Bernama Library & Infolink Service (BLIS) website. The electricity consumption data is measured in terms of Kilowatt hours (kWh), the value of the GDP in terms of Million Malaysian Ringgit (RM) and, finally, the scales of real prices of electricity and LPG are in terms of Ringgit per kWh and Ringgit per litre, respectively.

4. Econometric methodology and estimation results

4.1. Econometric approach

We estimate equations (6) and (9) for a static and dynamic model, respectively. Since in the dynamic models one of the explanatory variables is the lagged dependent variable and leads to correlation with the error term, we follow Arellano and Bond (1991) and Arellano and Bover's (1995) approach based on the Generalized Method of Moments (GMM) approach which produces less biases.

The current study is based on T= 44 and N= 3 or 4 (as 'i' defined in section 4.1), and the dynamic panel models are estimated using the system GMM estimator. The panel root test was deployed based on Levin-Lin-Chu test. Table 1 reports the Levin-Lin-Chu t-test statistics along with the p-values.

4.2. Panel unit root test

The Levin-Lin-Chu t-test statistics along with the p-values are presented in Table 1. The p-values of this table show that the joint unit root null hypothesis for all variables at the 5 percent level of significance are rejected. This means that all variables are integrated in order of one and are stationary.

4.3. The estimation and the results

4.3.1. Results of the static model

The results of the static models from the demand function (6) are presented in Table 2. We add a dummy variable to take into account any structural break after the 2008 financial crisis. The results of Hausman specification tests show that in the aggregate model and the Sabah model the null hypothesis has been rejected. This means that there is no correlation between the individual effects and the explanatory variables in these models but, in the two other regions, namely, Peninsular Malaysia and Sarawak, the random effect estimators are consistent, and the null hypothesis has not been rejected. Because of a small difference between these two models and their random effect' estimations, only the fixed effect' estimations of these models are reported in Table 2.

The results of the aggregate model show that the coefficients of all variables are significant and have the expected signs. Since all regions experience instability in their electricity consumption during the time, the low R-sq. for the aggregate and P.M. models might be due to the fact that the electricity consumption in Malaysia depends more significantly on other variables such as government electricity and energy subsidies, population, consumption of other fuels and their prices, weather temperature and so on. However, there are many studies in the literature which have low levels of R-square. For example, Filippini (2011), Alberini and Filippini (2011), Alberini et al., (2011), Swadley and Yucel (2011), Gans et al,. (2013) found low values of R-sq in their static models. Therefore, in the whole of the economy, both the own-price elasticity and the per capita income are inelastic in the short-run.

According to the results of the regional estimates, the coefficients of electricity price in all three regions, except for P.M., are significant. The price elasticities of demand for electricity, in all regional models as well as the aggregated model, are inelastic. In all regional models, the income elasticities are greater than one and reveal that the electricity is a luxury good. However, the income elasticity of the aggregated model is less than one and shows that the electricity, in general, is a necessary good in Malaysia. In other words, the electricity consumption in the Malaysian regions reflects a strong reflect to the economic growth in those regions. The magnitude of the coefficients of own price of electricity, LPG price and per capita GDP for the P.M. model are smaller than all other models. This means that if each one of these variables changes one percent, the magnitude of the change in electricity demand in Peninsular Malaysia is less than the other regions and models. The negative values of the LPG price elasticities suggest that Liquefied Petroleum Gas (LPG) is a good complement commodity for electricity in Sabah and in the whole of the country. In comparison with the previous studies, this finding is similar to the Filippini and Pachauri (2004) study, but is inconsistent with Athukorala and Wilson (2010). This coefficient in Peninsular Malaysia and Sarawak models has a negative sign but an insignificant value. Furthermore, the coefficients of the dummy variable in all models are negative and significant and show that the financial crisis year has influenced the consumption of electricity in Malaysia and its regions.

4.3.2. Results of the dynamic model

Table 3 represents the estimated results of the dynamic equation (9) for the aggregate and regional models. The coefficients of the variables show that all variables have the expected signs. While the elasticities of electricity prices and LPG prices in all dynamic models are smaller than the static models, they are inelastic like the static models and have negative effects on demand for electricity. The elasticities of per capita income also are inelastic in all dynamic models, whereas they are elastic in all static models, except the aggregate model. In all dynamic models, the coefficients of the dummy variables are also smaller than the static models. These findings show that in the dynamic models the sensitivity of consumers to the shocks, which may acquire in the economy, are less than the static models.

The long-run own price and cross price elasticities are obtained and their results are reported in Table 4. The elasticity estimates suggest that consumers are more responsive to price and income changes in the long run, exactly as predicted by economic theory.

The estimated short-run own price elasticity in both the regional and the aggregate model are almost similar to elasticity estimates reported by Berndt and Samaniego (1984). The long-run elasticities for own and cross prices are varied where the long-run elasticities of real prices of electricity and LPG and income are greater than their corresponding values in the short-run implying that consumption, in the long run, is more responsive to changes in economic variables.

The long-run elasticities for own and cross prices are varied. However, the long-run elasticities of real prices of electricity, LPG and income are greater than their corresponding values in the short-run. These results are consistent with economic theory in which consumption, in the long run, is more responsive to changes in economic variables than in the short run. In the context of this study, electricity demand behaviour in the Malaysia' economy is consistent with standard economic predictions. In both short and long-run, the price elasticity of electricity for PPM. is smaller than other regions. It means that the responsiveness of those people that live in the Peninsular region and a change in electricity prices is less than the other regions.

5. Conclusion

This study estimates the aggregate and regional demand functions for electricity in Malaysia using quarterly data from 200Q1 to 2010Q4. For this purpose, an aggregate demand model for the whole of Malaysia and three regional models for each one of the regions of this country, namely Peninsular Malaysia, Sabah and Sarawak, were estimated using both static and dynamic panel data methods.

The empirical results have highlighted some characteristics of Malaysia in the aggregate level and its regions. The results from the static model show that the prices of electricity and LPG in all models are inelastic, while the income is elastic and its coefficients differs from 1 to 1.86. In contrast, in the dynamic models all coefficients of the real prices of electricity and LPG as well as per capita income are inelastic and smaller than their corresponding coefficients in the static models. In addition, the log-run elasticities for electricity prices, LPG prices and income are greater than the short-run ones. Therefore, in the short-run, consumer reactions to increasing the prices and income are relatively small, while this reaction has increased in the long-run. Furthermore, the negative values of the short and the long-run cross-price elasticities of LPG show that LPG and electricity are complementary goods.

The negative impacts and low-elasticities of the LPG prices indicate that the cross-price elasticities have important implications for policy makers. It suggests that increasing the price of electricity leads to an increase in the price of LPG. However, this impact is different in both the short and long-run from region to region. Given this, the complementary commodities, at least in the long-run, cannot be effective tools for achieving electricity conservation through raising the prices of these goods. In contrast, policy prices on substitution commodities such as natural gas, also peak and off-peak electricity price policy can be effective tools for electricity conservation. Nevertheless, the government regulatory structure of the electricity sector may impede any move to use prices as a mechanism to utilize the resources in an efficient manner. This has a significant implication in terms of the equity and distribution aspect of subsiding energy sectors in Malaysia. As such, this should be the future direction of research in terms of how the regulation on electricity price and tariff affects the economic well-being of the consumers across all sectors. In order to use electricity in an effective manner, we suggest rationalization of electricity tariffs in Malaysia and other countries. We suggest using general equilibrium models to find the impacts of this policy on a certain section of an economy, because these models have a potential structure to trace the impacts of government policies on the economy and the welfare of poor as well done by Solaymani and Kari (2013), Solaymani et al. (2014a) and Solaymani et al. (2014b) for Malaysia.

References

Adom, PK., Bekoe, W., and Akoena, S.K.K., (2012). Modelling aggregate domestic electricity demand in Ghana: An autoregressive distributed lag bounds cointegration approach. Energy Policy, 42, 530-537. [ Links ]

Akhwanzada, S.A., and Tahar, R.M., (2012). Strategic Forecasting of Electricity Demand Using System Dynamics Approach. International Journal of Environmental Science and Development, 3(4), 328-333. [ Links ]

Alberini, A., and Filippini, M., (2011). Response of residential electricity demand to price: The effect of measurement error. Energy Economics, 33 (5), 889-895. [ Links ]

Alberini, A., Gans, W., and Velez-Lopez, D., (2011). Residential consumption of gas and electricity in the U.S.: The role of prices and income. Energy Economics, 33(5), 870-881. [ Links ]

Aman, S., Ping, H.W., and Mubin, M., (2011). Modelling and forecasting electricity consumption of Malaysian large steel mills. Scientific Research and Essays, 6 (8), 1817-1830. [ Links ]

Amarawickrama, H., and Hunt, L.C., (2008). Electricity Demand for Sri Lanka: A time series analysis. Energy, 33, 724-739. [ Links ]

Amusa, H., Amusa, K., and Mabugu, R., (2009). Aggregate demand for electricity in South Africa: An analysis using the bounds testing approach to cointegration. Energy Policy, 37(10), 4167-4175. [ Links ]

Arellano, M., and Bond, S.R., (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58, 277-297. [ Links ]

Arellano, M., and Bover, O., (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68, 29-51. [ Links ]

Athukorala, PPA.W., and Wilson, C., (2010). Estimating short and long-term residential demand for electricity: New evidence from Sri Lanka. Energy Economics, 32, S34-S40. [ Links ]

Bazmi A.A., Davoody, M., and Zahedi, G., (2012). Electricity Demand Estimation Using an Adaptive Neuro-Fuzzy Network: A Case Study from the State of Johor, Malaysia. International Journal of Chemical and Environmental Engineering, 3 (4), 284-295. [ Links ]

Bekhet, H.A., and Othman, N.S., (2011). Assessing the Elasticities of Electricity Consumption for Rural and Urban Areas in Malaysia: A Non-linear Approach. International Journal of Economics and Finance, 3 (1), 208-217. [ Links ]

Berndt, E.R., and Samaniego, R., (1984). Residential electricity demand in Mexico: a model distinguishing access from consumption. Land Economics, 60 (3), 268-277. [ Links ]

Bölük, G., and Koç, A.A., (2010). Electricity demand of manufacturing sector in Turkey: A translog cost approach. Energy Economics, 32, 609-615. [ Links ]

Bond, S., (2002). Dynamic panel data models: a guide to microdata methods and practice, CeMMAP Working papers CWP09/02, Centre for Microdata Methods and Practice, Institute for Fiscal Studies. [ Links ]

Brañas-Garza, P, Bucheli, M., and Garcia-Muñoz, T., (2011). Dynamic panel data: A useful technique in experiments. Universidad de Granada, Working papers, 10-22. [ Links ]

Chandran, V.G.R., Sharma, S., and Madhavan, K., (2010). Electricity consumption-growth nexus: the case of Malaysia. Energy Policy, 38(1), 606-612. [ Links ]

Dilaver, Z., and Hunt, L.C., (2011a). Modelling and forecasting Turkish residential electricity demand. Energy Policy, 39 (6), 3117-3127. [ Links ]

Dilaver, Z., and Hunt, L.C., 2011b. Industrial electricity demand for Turkey: A structural time series analysis. Energy Economics, 33 (3), 426-436. [ Links ]

Erdogdu, E., (2007). Electricity demand analysis using cointegration and ARIMA modelling: A case study of Turkey. Energy Policy, 35, 1129-1146. [ Links ]

Filippini, M., (1999). Swiss residential demand for electricity. Applied Economics Letters, 6 (8), 533-538. [ Links ]

Filippini, M., (2011). Short- and long-run time-of-use price elasticities in Swiss residential electricity demand. Energy Policy, 39 (10), 5811-5817. [ Links ]

Filippini, M., and Pachauri, S., (2004). Elasticities of electricity demand in urban Indian households. Energy Policy, 32, 429-436. [ Links ]

Francisco, C.R., (1988). Demand for electricity in the Philippines: implications for alternative electricity pricing policies. The Philippine Institute for Development Studies, 1988. [ Links ]

Gam, I., and Rejeb, J.B., (2012). Electricity demand in Tunisia. Energy Policy, 45, 714-720. [ Links ]

Gans, W., Alberini, A., and Longo, A., (2013). Smart meter devices and the effect of feedback on residential electricity consumption: Evidence from a natural experiment in Northern Ireland. Energy Economics 36, 729-743. [ Links ]

Halicioglu, F, (2007). Residential electricity demand dynamics in Turkey. Energy Economics, 29, 199-210. [ Links ]

Houthakker, H.S., Verleger, PK..J., and Sheehan, D.P, (1974). Dynamic Demand Analyses for Gasoline and Residential Electricity. American Journal of Agricultural Economics, 56(2), 412-418. [ Links ]

Lean, H. H., and Smyth, R., (2010a). On the dynamics of aggregate output, electricity consumption and exports in Malaysia: Evidence from multivariate Granger causality tests. Applied Energy, 87, 1963-1971. [ Links ]

Lean, H.H., and Smyth, R., (2010b). Multivariate Granger causality between electricity generation, exports, prices and GDP in Malaysia. Energy, 35 (9), 3640-3648. [ Links ]

Leesombatpiboon, P, and Joutz, FL., (2010). Sectoral demand for petroleum in Thailand. Energy Economics 32, S15-S25. [ Links ]

Solaymani S, Kardooni, R., Kari, F, and Yusoff, S., (2014a). Economic and environmental impacts of energy subsidy reform and oil price shock on the Malaysian transport sector. Travel Behaviour and Society. DOI 10.1016/j.tbs.2014.09.001 [ Links ]

Solaymani S, Kari F, and Hazli R., (2014b). Evaluating the role of subsidy reform in addressing poverty level in Malaysia: A CGE poverty framework. Journal of Development Studies, 50 (4), 556-569. [ Links ]

Solaymani S, and Kari F., (2013). Environmental and economic effects of high petroleum prices on transport sector. Energy, 60, 435-441. http://dx.doi.org/10.1016/j.energy.2013.08.037 [ Links ]

Swadley, A., and Yucel, M., (2011). Did residential electricity rates fall after retail competition? A dynamic panel analysis. Energy Policy, 39, 7702-7711. [ Links ]

Tang, C.F, (2008). A re-examination of the relationship between electricity consumption and economic growth in Malaysia. Energy Policy, 36 (8), 3077-3085. [ Links ]

Tang, C.F, and Tan, E.C., (2013). Exploring the nexus of electricity consumption, economic growth, energy prices and technology innovation in Malaysia. Applied Energy, 104, 297-305. [ Links ]

Yoo, S.H., (2006). The causal relationship between electricity consumption and economic growth in the ASEAN countries. Energy Policy, 34 (18), 3573-3582. [ Links ]

Ziramba, E., (2008). The demand for residential electricity in South Africa. Energy Policy, 36, 3460-3466. [ Links ]

Received 7 November 2013

Revised 21 December 2014