Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Journal of Energy in Southern Africa

versión On-line ISSN 2413-3051

versión impresa ISSN 1021-447X

J. energy South. Afr. vol.25 no.4 Cape Town nov. 2014

Energy consumption and economic growth nexus: Panel co-integration and causality tests for Sub-Saharan Africa

Basiru Oyeniran Fatai

Trade Policy Research and Training Programme, Department of Economics, University of Ibadan, Nigeria

ABSTRACT

This study reassesses the causal relationships between energy consumption and economic growth in 18 Sub-Saharan Africa countries over the period 1980-2011. The Panel Unit Root Test results show that variables (both exogenous and endogenous) are stationary at their first difference with individual effects and individual linear trends, while the results of panel co-integration tests show that energy consumption and economic growth do have a stable long-run equilibrium relationship. There is unidirectional causality from energy consumption to economic growth in East and the Southern Africa Sub-region, which supports the growth hypothesis. As a result, the related authorities in the regions should take a special interest in different sources of energy and invest more in this sector, make suitable policies in this regard and find new alternative and cheap sources of energy. But, there is no causality between energy consumption and economic growth in Central and the West Africa Sub-region, which is in line with the neutrality hypothesis. In other words, both energy consumption and economic growth are neutral with respect to each other. Our results confirm the inconclusive nature of a causality relationship between energy consumption and economic growth.

Keywords: energy consumption, economic growth, panel co-integration, causal relationship

JEL classification codes: O13; Q43; C33

1. Introduction

Energy plays an essential role in an economy on both demand and supply. On the demand side, energy is one of the products a consumer decides to buy to maximise his or her utility. On the supply side, energy is a key factor of production in addition to capital, labour and materials and is seen to play a vital role in the economic and social development of countries, being a key factor in increasing economic growth and living standards. This implies that there should be a causal relationship running from energy consumption to national income or GDP and vice versa (Chontanawat et al., 2006).

Economic growth is among the most important factors to be considered in projecting changes in world energy consumption. In this regard, the analysis of the relationship between energy consumption and economic growth has received a great deal of attention during recent years. Indeed, whether the economic growth promotes energy consumption or energy itself is a stimulus for economic growth has motivated interest among economists and policymakers. Over the two last decades, there has been a large body of published research investigating the causal links between energy consumption and economic growth. This is because the direction of causality has significant policy implications. For instance, if energy consumption is a vital component in economic growth, energy conservation policies which reduce energy consumption may adversely affect real GDP However, a unidirectional causality running from economic growth to energy consumption signifies a less energy dependent economy such that energy conservation policies may be implemented with little or no adverse effect on economic growth (Eggoh et al., 2011).

Although energy is not included in the standard growth models as an input of economic growth, the importance of energy in a modern economy is unquestionable. For instance, Hall and Klitgaard (2012) emphasized the role that energy has played in economic growth and the limit to continued growth given our reliance on fossil fuels. Stern (2010) opined that when energy is scarce it imposes a strong constraint on the growth of the economy but when energy is abundant its effect on economic growth is much reduced. This explains the industrial revolution as a releasing of the constraints on economic growth due to the development of methods of using coal and the discovery of new fossil fuel resources. Also it was found that the elasticity of substitution between a capital-labour aggregate and energy is less than unity, which implies that when energy services are scarce they strongly constrain output growth resulting in a low income steady-state. When energy services are abundant the economy exhibits the behaviour of the 'modern growth regime' with the Solow model as a limiting case (Stern, and Kander, 2012).

The inconclusive nature of the relationship between energy consumption and economic growth led to four major views in the literature: The first view is the growth hypothesis, which suggests that energy consumption plays an important role in economic growth. It implies that economic growth is dependent on energy consumption just as a decrease in energy consumption may restrain economic growth. The second is the conservative hypothesis, which argues for unidirectional causality from economic growth to energy consumption. It suggests that energy conservation policies may have little or no impact on economic growth. The conservative hypothesis is supported if an increase in real GDP causes an increase in energy consumption. The third view is neutrality hypothesis, which argues that there is no causality between energy consumption and economic growth. In other words, both energy consumption and economic growth are neutral with respect to each other. While the last view is feedback hypothesis, which suggests that there is a bi-directional causal relationship between energy consumption and economic growth reflecting the interdependence and possible complementarities associated with energy policies and economic growth.

The contributions of this paper are the following: First, we employ recent data and methodology, for instance, in order to determine the variables' order of integration, the Levin, Lin and Chu Test, which assumes that there is homogeneity across the cross sections; likewise, the Im, Pesaran and Shin Test, ADF Fisher Chi Square Test and PP Fisher Chi Square tests which give room for heterogeneity across the cross-sections that were used. We also adopted a residual-based panel cointegration test (that is the Kao test), the Johansen-type panel cointegration test, and the error-correction-based panel cointegration tests developed by Westerlund (2007), which is general enough to allow for a large degree of heterogeneity, both in the long-run cointegrating relationship and in the short-run dynamics, and dependence within as well as across the cross-sectional units. Second, we consider specific analyses for prominent sub-regions in SSA namely, Central Africa, East Africa, Southern Africa and West Africa; to the best of our knowledge no study has broken SSA into these sub-regions.

The next section deals with the literature review, followed by the methodology employed in this study. Empirical results are presented in section four, while section five presents the Conclusion and Policy Implications.

2. Literature review

The relationship between energy consumption and economic growth has been examined thoroughly since the pioneer work of Kraft and Kraft (1978). However, the direction of causality between energy consumption and economic growth remained controversial.

Oh and Lee (2004) examined the causal relationship between energy and GDP in Korea over the period 1970-1999. The authors also included variables measuring capital and labour in their causality tests. There was a unidirectional causality from energy consumption to GDP in the short-run and bi-directional causality in the long-run. Odhiambo (2009) also found that there is a unidirectional causal relationship running from energy consumption to economic growth for Tanzania. But Cheng and Lai (1997) established a unidirectional causality from energy consumption to employment and also unidirectional causality from economic growth to energy consumption for Taiwan.

However, Jumbe (2004) found bi-directional causality between electricity consumption and economic growth but a unidirectional causality running from non-agricultural GDP to electricity consumption in Malawi; Lee and Chang (2005) established that, in the long-run energy acts as an engine of economic growth, and that energy conservation may harm economic growth in Taiwan; also a study by Belloumi (2009) assessed the causal relationship between per capita energy consumption and per capita gross domestic product for Tunisia. The results show a long-run bi-directional causal relationship between the two series and a short-run unidirectional causality from energy to gross domestic product; while, Ouedraogo (2010) found that there is evidence of a positive feedback causal relationship between electricity use and real GDP for Burkina Faso.

Wolde-Rufael (2006) found a unidirectional causality from economic growth to electricity consumption in 5 African countries, whereas bi-directional causality was found for 2 countries and no evidence for causal relationship in 7 African countries. While Akinlo (2008) employed the bounds cointegration test to examine the long-run relationship between energy consumption and economic growth in 11 SSA countries: Cameroon, Cote d'Ivoire, Congo, Gambia, Ghana, Kenya, Nigeria, Senegal, Sudan, Togo, and Zimbabwe. The author employed a multivariate framework which included energy consumption, GDP, government expenditure, and the consumer price index. The co-integration tests supported cointegration in 7 countries (Cameroon, Cote d' Ivoire, Gambia, Ghana, Senegal, Sudan and Zimbabwe. The Granger causality tests showed that economic growth causes energy in 2 countries (Sudan and Zimbabwe). Bi-directional causality was found for 3 countries (Gambia, Ghana and Senegal). For 5 countries (Cameroon, Cote d' Ivoire, Nigeria, Kenya and Togo) no causality was found.

In similar vein, Odhiambo (2010) reassessed the causal relationship between energy consumption and economic growth in three SSA countries. He added the prices as an additional variable because of its effects on both energy consumption and economic growth. He discovered that the causality between energy consumption and economic growth varies significantly across the three countries. The results indicated that for South Africa and Kenya there is a unidirectional causal relationship from energy consumption to economic growth, while for Congo (DRC) it is economic growth that drives energy consumption.

Wolde-Rufael (2005) investigated the causal relationship between energy and GDP using data for 19 African countries over the period 1971-2001. The author used the bounds test for co-integration and then employed the Toda and Yamamoto causality test. The bounds co-integration test showed the existence of a stable long-run relationship between energy and growth in 8 countries, while there was no cointegration in 11 countries. The results of causality tests showed that causality runs from economic growth to energy consumption in 5 countries (Algeria, Democratic Republic of Congo, Egypt, Ghana, and Cote d'Ivoire) while energy causes economic growth in 3 countries (Cameroon, Morocco and Nigeria). There was bi-directional causality in 2 countries (Gabon and Zambia) while no causality was found in 9 countries (Benin, Congo Republic, Kenya, Senegal, South Africa, Sudan, Togo, Tunisia and Zimbabwe).

Esso (2010) examined the long-run and the causality relationship between energy consumption and economic growth for seven SSA countries during the period 1970-2007. Using Gregory and Hansen (1996, 1997) testing approach to threshold cointegration, he found that energy consumption is cointegrated with economic growth in Cameroon, Ivory Coast, Ghana, Nigeria and South Africa. Furthermore, causality tests suggest bi-directional causality between energy consumption and real GDP in Ivory Coast and unidirectional causality running from real GDP to energy use in Congo and Ghana.

Masih and Masih (1996) examined the causal relationship between energy consumption and GDP in Asian countries, using data over the period 1955-1990 for India, Pakistan, Malaysia, Singapore, Indonesia, and the Philippines. The co-integration tests showed that energy consumption and GNP are co-integrated in India, Pakistan and Indonesia. There was no evidence of co-integration in Malaysia, Singapore and the Philippines. The results of causality tests showed that there is no causality between energy consumption and GDP in Malaysia, Singapore and the Philippines. The results showed unidirectional causality from GDP to energy consumption in Indonesia, unidirectional causality from energy consumption to GDP in India, and bi-directional causality in Pakistan. The authors attributed the divergent results to the fact the countries are implementing different energy-growth policies. But Apergis and Payne (2010) used panel causality and cointegration tests of nine South American countries over 1980-2005.They found both short-run and long-run causality from energy consumption to economic growth.

Chontanawat et al. (2006) examined causality between energy consumption and GDP using data for 108 countries. The sample consisted of 78 non-OECD and 30 OECD countries. For the non-OECD countries, the authors employed data over the period 1971 - 2000 while for the OECD countries, data was used over the period 1960 - 2000. Taking all countries together, the results of causality tests showed that there is unidirectional causality from GDP to energy consumption in 20 countries while unidirectional causality runs the other way in 23 countries. There was bi-directional causality in 34 countries while there was no causality in 31 countries. A breakdown of the results showed that there was a higher prevalence of causality in OECD than non-OECD countries. The authors' explanation for this finding was that less developed countries are predominantly agrarian based and thus less energy dependent.

The review of Literature shows the direction of causality between energy consumption and economic growth remained controversial, therefore making this paper a worthwhile exercise, especially with the use of recent data and methodology.

3. Methodology

3.1 Estimation procedure

The analyses in this paper are carried out in three phases. First, we conduct Panel unit root tests using prominent tests namely Levin, Lin and Chu Test, Im, Pesaran and Shin Test, ADF Fisher Chi Square Test and PP Fisher Chi Square Test. Second, we perform Panel cointegration tests using the Residual-Based DF and ADF Tests (Kao Tests), Johansen Fisher Panel Cointegration Test and the error-correction-based panel cointegration tests developed by Westerlund (2007). Third, we estimate Toda and Yamamoto Causality Analysis. We used many statistical tests so as to account for important similarities and differences of the sampled countries.

3.2 Data

Annual data over the period 1980 to 2011 for 18 SSA countries has been used in this study. As earlier mentioned, these countries are further divided into sub-regions for region-specific analyses.1 All data is from the World Development Indicators (WDI) Database. Energy consumption is energy use in kilotons of oil equivalent and real GDP is gross domestic product converted to international dollars using purchasing power parity rates. All variables are in natural logarithms.

3.3 The model

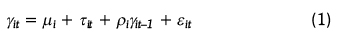

A number of panel data unit root tests have been proposed such as: Maddala and Wu (1999), Choi (2001), Levin, Lin and Chu (2002), and Im, Pesaran and Shin (2003). These tests are generally based on the AR(1) process:

Where t = 1,..., T is the number of periods and i = 1, N is the number of countries. τiis an individual trend, ßiis the country specific fixed effect, ρiis an autoregressive coefficient, and sitis the error term. There is a unit root in γitif /ρi/= 1. Panel unit root tests are broadly classified into two based on their assumptions concerning whether ρi is constant or varying.

In this study, the long-run relationship between energy consumption, and Real GDP will be estimated by the following equation:

Where i, t, αiand εitdenote the country, the time, the fixed country effect and the white noise stochastic disturbance term respectively. ß is the energy consumption elasticity of Real GDP (the variables are in natural logs, denoted Log).

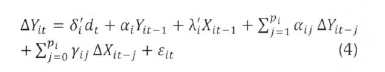

We also use the panel cointegration tests proposed by Westerlund (2007) to examine the relationship between real GDP, energy consumption and auxiliary variables in SSA countries. The Westerlund (2007) tests avoid the problem of common factor restriction and are designed to test the null hypothesis of no cointegration by inferring whether the error-correction term in a conditional error-correction model is equal to zero. Therefore, a rejection of the null hypothesis of no error-correction can be viewed as a rejection of the null hypothesis of no cointegration. The error-correction tests assume the following data-generating process:

Where dtcontains the deterministic components. Yitdenotes the natural logarithms of the real GDP and Xltdenotes a set of exogenous variables, including energy consumption. Equation (3) can be rewritten as:

Where  . The parameter αidetermines the speed at which the system

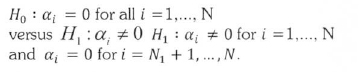

. The parameter αidetermines the speed at which the system  corrects back to the equilibrium after a sudden shock. If αi < 0. then the model is error correcting, implying that Yit and Xitare cointegrated. If αi = 0, then there is no error correction and, thus no cointegration. The null hypothesis for all countries of the panel is:

corrects back to the equilibrium after a sudden shock. If αi < 0. then the model is error correcting, implying that Yit and Xitare cointegrated. If αi = 0, then there is no error correction and, thus no cointegration. The null hypothesis for all countries of the panel is:

The alternative hypothesis allows α¡ differing across the cross-sectional units.

Westerlund (2007) proposed four different statistics to test panel cointegration, based on least squares estimates of α¡and its t-ratio. While two of the four tests are panel tests with the alternative hypothesis that the whole panel is cointegrated (H1 : αi = αi = α < 0 for all i), the other two tests are group-mean tests which test against the alternative hypothesis that for at least one cross-section unit there is evidence of cointegration (H1 : αi< 0 for at least one i). The panel statistics denoted Pτand Pα test the null hypothesis of no cointegration against the simultaneous alternative that the panel is cointegrated, whereas the group mean statistics GT and Gαtest the null hypothesis of no cointegration against the alternative that at least one element in the panel is cointegrated. The test proposed by Westerlund (2007) does not only allow for various forms of heterogeneity, but also provides p-values which are robust against cross-sectional dependencies via bootstrapping.

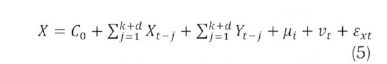

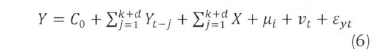

Following Toda and Yamamoto (1995), we estimate VAR(p) systems that are asymptotically x2distributed to employ Wald tests for k linear restrictions. The lag length p is the sum of k, the lag length indicated by Schwarz' information criteria (SBC) and dmax, i.e., the maximum order of integration, so p = k+d max. We include individual, state-specific effects (μ) and common time effects (vt). our VAR(p)s have the following form:

Where X represents logEC, and Y represents log RGDP: εxtand εyt denote the residuals.

4. Empirical results

4.1 Panel unit root test

Tables 1 and 2 present the results of the unit root tests conducted for all the variables both at their levels and first differences respectively. The tests are conducted for all the selected SSA countries sub-regions (namely, Central Africa, East Africa, Southern Africa, and West Africa). Descriptive statistics like the line plot reveal that the variables used have individual effects and individual linear trends. Hence, the unit root tests carried out take cognizance of these characteristics of the data used. The results show that all the variables (both exogenous and endogenous) are stationary at their first difference with individual effects and individual linear trend. Having established the order of integration of the variables, we further conduct the panel cointegration test.

4.2 Panel cointegration test

Having established that all my variables are integrated at the same order, we adopt a residual-based panel cointegration test (that is the Kao test), the Johansen-type panel cointegration test, and the error-correction-based panel cointegration tests developed by Westerlund (2007) to examine if there is a long run relationship among the variables used. As presented in Table 3a and 3b, the null hypothesis of no cointegrating relationship among the variables can be rejected and we accept that there is at least one cointegrating vector for the sub-regions at 5 percent level of statistical significance.

In order to check the robustness of the previous results, we considered four additional cointegration tests proposed by Westerlund (2007) that allow for cross-sectional dependence. Table 3b summarizes the outcome of Westerlund's cointegration tests.

The null hypothesis of no cointegration is rejected at the 1% significance level. The results with the bootstrapped p-values (that take cross-country dependence into account) provide stronger evidence of cointegration relationship between energy consumption, and Economic Growth.

4.3 Toda and Yamamoto causality analysis

The existence of long run relationship between the variables leads us to examine the direction of causality between Energy consumption and Real GDP using the Toda and Yamamoto (1995) test with maximum lag order 2 reported in Table 4. The results from the significance of the p-values of the Wald (WALD) statistics show causality from energy consumption to economic growth in the selected SSA countries, likewise, in East and Southern Africa Sub-region. But, there is no causality between energy consumption and Economic growth in Central and Western Africa Sub-region.

5. Discussion of results

Our findings that Energy Consumption in the East and Southern Africa Sub-region Granger, cause economic growth, and suggest that energy consumption plays an important role in economic growth. It implies that economic growth is dependent on energy consumption, and a decrease in energy consumption may restrain economic growth. This in some respects corroborates some earlier studies on energy consumption and Economic growth; see for example, Odhiambo (2009) for Tanzania; Adeniran (2009) for Nigeria; likewise, Odhiambo (2010) for South Africa, Kenya and Congo Democratic Republic; Apergis and Payne (2009), Khan and Qayyum (2007) for Pakistan, Bangladesh, India and Sri Lanka; and Soytas and Sari (2003) for France, Germany and Japan.

However, it was found that there is no causality between energy consumption and economic growth in the Central and Western Africa Subregion. In other words, both energy consumption and economic growth are neutral with respect to each other in the two sub-regions. Other studies that are in line with this neutrality hypothesis are; Sarkar et. al., (2010) for Bangladesh; Yu and Choi (1985) and Cheng (1995) for the United States as well as Menegaki (2010) for 27 European countries; and Acaravci and Ozturk (2010) for 15 Transition economies. Our results confirm the inconclusive nature of causality relationship between Energy consumption and Economic Growth.

6. Conclusion and policy implications

This paper reassessed the causality between energy consumption and Economic growth using data for 18 Sub-Saharan Africa countries for the period 1980 - 2011. We made use of panel unit root and co-integration tests to address order of integration and long run relationship respectively, likewise, Toda and Yamamoto causality analyses were conducted so as to give more efficient results, towards achieving the objectives of the paper.

We found a stable long-run relationship between energy consumption and Economic growth. The results of Toda and Yamamoto causality analyses supported growth hypothesis for the East and Southern Africa Sub-region, as we found causality from energy consumption to Economic growth. This indicates that energy is a force for economic growth in the long-run. We can say high Energy Consumption tends to come with high economic growth. In the light of this discussion, it is reflected that energy serves as an engine of economic growth and economic activity will be affected in the result of changes in Energy Consumption. This means that continuous energy use does produce a continuous increase in output. So the related authorities in the East and Southern Africa Sub-regions' economies should take a special interest in different sources of energy and invest more in this sector, and invite foreign investors to invest in this sector, and make suitable policies in this regard and find new alternate and cheap sources of energy. Enhancement in or establishment of Research and Development departments and increase their efficiency is also needed in time, so that it creates a multiplier effect on GDP and as a result prosperity will come into these economies.

On the other hand, it was found that there is no causality between energy consumption and economic growth in Central and Western Africa Subregion. This is in line with the neutrality hypothesis. In other words, both energy consumption and economic growth are neutral with respect to each other. The conservation policies in favour of the energy sector have no effect on economic growth.

References

Acaravci, A. and Ozturk, I. (2010). Electricity consumption and real GDP causality nexus: Evidence from ARDL bounds testing approach for 11 MENA countries. Applied Energy, 88, 2885-2892. [ Links ]

Adeniran, O. (2009). Does Energy Consumption Cause Economic Growth? An Empirical Evidence from Nigeria.Q @http://www.yasni.com/ext.php and Statistics 69(6), 709-748. [ Links ]

Akinlo, A.E. (2008). Energy Consumption and Economic Growth: Evidence from 11 Sub-Sahara African Countries, Energy Economics, 30, pp. 2391-2400. [ Links ]

Apergis, N., and Payne, J.E. (2009). Energy consumption and economic growth in Central America: evidence from a panel cointegration and error correction model. Energy Economics 31, 211-216. [ Links ]

Apergis, N., and Payne, J.E. (2010). Energy consumption and economic growth in South America: evidence from a panel error correction model. Energy Economics 32, 1421-1426. [ Links ]

Belloumi, M. (2009). Energy consumption and GDP in Tunisia: cointegration and causality analysis. 37 (7), 2745-2753.Cheng, B. S. (1995). An Investigation of Cointegration and Causality between Energy Consumption and Economic Growth. Journal of Energy and Development, 21, Pp.73-84. [ Links ]

Charles A. S. H. and Klitgaard, K. A. (2012) 'Energy and the Wealth of Nations: Understanding the Biophysical Economy'. Springer Publisher, New York, NY. [ Links ]

Cheng, B. S. and Lai, T. W. (1997). An Investigation of Co-integration and Causality between Energy Consumption and Economic Activity in Taiwan, Energy Economics, 19, pp. 435-444. [ Links ]

Choi, I. (2001). Unit Root Tests for Panel Data, Journal of International Money and Finance, 20, pp. 249-272. [ Links ]

Chontanawat, J., Hunt, L. C. and Pierse, R. (2006). Causality between Energy Consumption and GDP: Evidence from 30 OECD and 78 Non-OECD Countries, Discussion Paper no. 113, Surrey Energy Economics Centre, Department of Economics, University of Surrey. [ Links ]

Esso, L.J., (2010). Threshold cointegration and causality relationship between energy use and growth in seven African countries. Energy Economics 32, 1383-1391. [ Links ]

Im, K. S., Pesaran, M. H. and Shin, Y. (2003). Testing Unit Roots in Heterogeneous Panels, Journal of Econometrics, 115, pp. 53-74. [ Links ]

Jude C. Eggoh, J. C., Bangaké, C., and Rault C. (2011) 'Energy Consumption and Economic Growth Revisited in African Countries' CESIFO Working Paper No. 3590. [ Links ]

Jumbe, C.B.L. (2004). Cointegration and causality between electricity consumption and GDP: empirical evidence from Malawi. Energy Economics 26, 61-68. [ Links ]

Khan, M.A., and Qayyum, A. (2007). Dynamic Modelling of Energy and Growth in South Asia[], [ Links ] The Pakistan Development Review, Vol. 46(4), pp. 481-498.

Lee, C.C., and Chang, C.P. (2005). Structural breaks, energy consumption, and economic growth revisited: evidence from Taiwan. Energy Economics, 27, 415-427.

Levin, A., Lin, C. FF and Chu, C. S. J. (2002). Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties, Journal of Econometrics, 108, pp. 1-24.

Maddala, G. S. and Wu, S. (1999). A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test, Oxford Bulletin of Economics and Statistics, 61, pp. 621-652.

Masih, A. M. M. and Masih, R. (1996). Energy Consumption, Real Income and Temporal Causality: Results from a Multi-country Study Based on Co-integration and Error-correction Modelling Techniques, Energy Economics, 18, pp. 165-183.

Menegaki, A. (2010). Growth and renewable energy in Europe: A random effect model with evidence for neutrality hypothesis. Energy Economics. doi:10.1016/j.eneco.2010.10.004, pp.1-7.

Odhiambo, N.M. (2009). Energy consumption and economic growth nexus in Tanzania: An ARDL bounds testing approach. Energy Policy, 37, pp.617-622.

Odhiambo, N.M. (2010). Energy consumption, prices and economic growth in three SSA countries: A comparative study. Energy Policy 38(5), 2463-2469.

Oh, W., and Lee, K. (2004). Causal relationship between energy consumption and GDP revisited: the case of Korea 1970-1999. Energy Economics 26, 51-59.

Ouedraogo, I.M. (2010). Electricity consumption and economic growth in Burkina Faso: a cointegration analysis. Energy Economics 32(3), 524-531.

Sarkar, M., Rashid, A., and Alam, K. (2010). Nexus between electricity generation and economic growth in Bangladesh []. Asian Social Science, Vol. 6 (12). pp. 16-22.

Soytas, U., and Sari, R. (2003). Energy Consumption and GDP: Causality Relationship in G-7 Countries and Emerging Markets, Energy Economics, 25, pp.33- 37.

Stern, D. I. (2010) 'The Role of Energy in Economic Growth' CCEP working paper 3.10, Crawford School, The Australian National University.

Stern, D. I. and Kander, A. (2012) 'The Role of Energy in the Industrial Revolution and Modern Economic Growth' The Energy Journal, Vol. 33, No. 3.

Toda, H.Y. and Yamamoto, T. (1995). Statistical inferences in vector autoregressions with possibly integrated processes. Journal of Econometrics, 66, pp.225-250.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics Volume 69, Issue 6, pages 709-748.

Wolde-Rufael, Y. (2005). Energy Demand and Economic Growth: The African Experience, Journal of Policy Modelling, 27, pp. 891-903.

Wolde-Rufael, Y. (2006). Electricity consumption and economic growth: a time series experience for 17 African countries. Energy Policy 34, 1106-1114.

Yu, E. S. H., and Choi, J. Y. (1985). The Causal Relationship between Energy and GNP: an International Comparison. Journal of Energy and Development, 10, pp.249-72.

Received 13 January 2014

Revised 25 October 2014