Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of Energy in Southern Africa

versão On-line ISSN 2413-3051

versão impressa ISSN 1021-447X

J. energy South. Afr. vol.25 no.2 Cape Town Mai. 2014

South African renewable energy investment barriers: An investor perspective

Derick de Jongh; Dhirendra Ghoorah; Anesu Makina

Albert Luthuli Centre for Responsible Leadership, University of Pretoria, Pretoria, South Africa

ABSTRACT

As recently as the year 2010, renewable energy contributed less than 1% of all the energy sources in South Africa. Possible reasons include the lack of private sector investment in Renewable Energy technologies. By way of a structured interview methodology, this paper explores the reasons why private investors are reluctant to invest in renewables. The responses point to political, economic, social and technological barriers limiting private investment in renewable energy. Other barriers that were identified include poverty, low levels of education, limited technological readiness and access to the electricity grid. Some of these barriers are specific to the South African context. The paper concludes that a closer relationship between government and the private sector is required to stimulate innovation in the renewable energy sector.

Keywords: renewable energy, financial investments, investment barriers, South Africa

1. Introduction

The South African government has articulated its short, medium and long-term vision for an environmentally sustainable, climate-change resilient, low-carbon economy and just society. The vision is outlined in the Cabinet endorsed National Strategy for Sustainable Development and Action Plan (20112014), New Growth Path (2010) and National Development Plan (2011). Several sector policies and strategies, including the Integrated Resource Plan for Electricity: 2010-2030 (2011), Industrial Policy Action Plan (2010), National Biodiversity Strategies and Action Plans and the National Climate Change Response White Paper (2012) also endorse this vision.

Relative to fossil fuel-based energy, renewable energy1 (RE), has historically been expensive and still remains expensive for consumers (Pegels, 2010; Ogihara Gueye, King, & Mori, 2007). Limited innovation and investment in RE technologies is one of several reasons mentioned for the current high cost of RE prices (Pegels, 2010; Owen, 2006a). It has been shown that as a whole, the current level of global investment is substantially lower than that of countries like China, Japan and several other European countries (G20 Clean Energy Factbook, 2009). By analysing investment decisions in a typical RE project, this paper aims to identify the barriers to investment.

South Africa's position is unique, with a sophisticated financial system on the one hand, and very high income inequalities (a Gini coefficient of 53.8) on the other hand (UNDP 2009; Sanders & Chopra, 2006). As such, South Africa is a good example of an emerging economy, the ideal context to base this study on. The study was confined to South African energy projects, and focused on factors that influence investment decisions, including investor background, the nature of the investor, and political, economic, social and technological factors during the period of 2009 till 2011. Previous studies focused on barriers to renewable technologies in a broader sense, dealing with the associated costs and challenges for each type of RE source (Painuly, 2001; Verbruggen, Fischedick, Moomaw, Weir, Nadai, Nilsson, & Sathaye, 2010).

2. Implications of the study

In brief, this research aims to explore the factors limiting investment in RE technologies in South Africa from 2009 until 2011. This study offers almost a historic view of RE investment prior to 2011 and it therefore does not consider any socioeconomic changes post the date of 2011. Private sector investment can be viewed as a necessary arsenal with the aim of making RE prices attractive compared with conventional energy prices. In order to understand why investment in RE is limited, it is important to understand the investment considerations of potential private investors. The findings could serve to inform the investment community about the importance of RE resources in the value chain, and the importance of promoting RE projects more aggressively. RE project shareholders could use the findings of this research to tailor their respective projects so as to secure adequate funding by making their projects more attractive for investment.

3. Literature review

3.1 Challenges of renewable energy

3.1.1 Political

Kebede et al. (2010) argue that the energy industry is one of the bases of any stable economy. This industry is therefore typically subjected to heavy political intervention by governments as a means of controlling volatility in the economy. Ahborg and Hammer (2012) as well as Krupa and Burch (2011) point to a lack of government support as one of the main barriers to the wider acceptance of RE. This confirms Martinot and Macdoom's (2000) view. These authors argue that apart from all of the other barriers that are hindering the wider acceptance of RE, the politics around the generation of RE is prime.

Mandle (2008) argues that politics, through state intervention, can substantially influence the ability to mitigate climate change resulting from conventional fossil-fuel technologies. As such, legislation and policies can be powerful state- driven tools with which to shape and steer an economy. These instruments cannot be separated from the politics of a country because states are inherently political institutions. It was over three decades ago that Weidenbaum (1983) made a recommendation that the state implements a more effective policy, where tax policies could provide tax breaks and reduce obstacles to certain types of energy projects that the state is trying to promote. More recently, Shoock (2007) advocates the use of legislation to stimulate both the demand and the supply side of the economy with regard to promoting cleaner and alternative energy sources. In support of Shoock (2007), both Kline (2010) and Tavallali (2010) argue that, in addition to better funding models, tax-based incentives could also provide funding assistance to RE projects. However, Verbruggen et al. (2009) have an opinion contrary to these. They argue that, generally, governments do not have the policies in place to support or promote RE technologies, as these technologies are relatively new. Winkler (2005) draws the debate to the South African context, by arguing that RE policy will be more effective if the current energy policy is improved. The lack of support and alignment policies means that RE technologies cannot be developed further, indeed, from a legal perspective, with no appropriate enforceable policies in place, RE technologies will not enjoy appropriate levels of funding or subsidies (Bode & Michaelowa, 2003).

It seems that the current policy set is not enough to unwed South Africa from its coal dependency (Oxford Analytica, 2009). For example, the approved amount of RE to be delivered for the feed-in tariffs needs to be clearly articulated in order to ensure diversity of supply. The latter is critical in order to assess the incremental upfront cost relative to the future environmental benefits. In contrast to South Africa, other developing countries such as China and South Korea, as well as developed countries such as Australia, Japan, the UK and the USA, have energy policies which provide attractive financial incentives to promote low-carbon electricity (Vivid Economics, 2010). Sebitosi and Pillay (2008) thereby note that while the rest of the world is experiencing tremendous growth in their respective RE industry, South Africa appears to have stagnated due to its misaligned environmental and energy policies.

3.1.2 Economic

One of the major factors making RE technology very attractive at the moment is the high price of conventional fossil fuel (Smith, 2007).

Rafaj and Kypreos (2007) calculated that if external costs, such as environmental and health damages were included in the price of electricity, non-fossil energy sources such as RE becomes more competitive. It can be argued that developing economies such as South Africa need cheaper energy prices to compete globally in order to secure their market share in energy dependant industries as well as to attract Foreign Direct Investment (FDI) (Doppegieter, Du Toit & Liebenberg, 1999). This cost bias means that RE technologies are expected to be less attractive locally than conventional fossil-fuel based energy (Kerr, 2010). According to statistics published by the EIA (2010), it is clear that South African energy resources are biased towards the conventional sources, as shown in Figure 1 (EIA, 2010).

Mathews et al. (2010) argue that RE projects can be made more economically viable by reducing their cost base. They point out that so far only public funding has been considered for RE projects, and without the private finance sector's involvement, RE will remain expensive. Prior to 2011, RE projects in South Africa were funded through carbon trading schemes which originated from developed economies. However, the prices of carbon generated through those schemes have been dwindling from some time now. Sebisoti and Pillay (2008) for instance provide the example of the Johannesburg Stock Exchange (JSE) that offers counters that trade in emission futures. These authors however point to a hindrance with this model in that it is intended to offset emissions from overseas industries. Moreover, experience illustrates that international CDM investors have a preference for destinations such as India, Mexico, and China. In his article, Owen (2006b) suggests that one of the ways in which to reduce the cost of production is by achieving economies of scale. However, this can only be done by means of widespread adoption of technology that translates into increased social acceptance.

The Kyoto Protocol, a legal platform for countries committed to reducing Green House Gases (GHG) emissions (UNFCCC, 1997) underwrites several objectives. In order to achieve these objectives, three main mechanisms were developed -Emission Trading (ET), Clean Development Mechanisms (CDM), and Joint implementation (JI) (Dutschke & Michaelowa, 1998). Certified Emission Reduction (CERs), Emission Reduction Units (ERUs), Voluntary Emission Reduction (VERs), EU-Allowances (EUAs) and Assigned Amount Units (AAUs) are the five main types of certificates generated from these mechanisms. Unfortunately, most of the CDM projects have been underperforming which actually results in minimal sustainable benefits (Schneider, 2007). The resulting CERs from these types of projects together with the low cost base could have a negative impact on emerging markets of emission credits by driving the CERs prices down through market saturation (Olsen, 2007). It is therefore argued that other higher local sustainable projects, such as RE projects, can be less favoured from an economic point of view (Sterk & Wittneben, 2005). Nussbaumer (2009) concludes that while the CERs cost will vary with the types and stage of projects considered they remain a pivotal means of reducing GHG emissions.

3.1.3 Social

Aside from economic and political matters, social dynamics play a role in RE uptake. The social acceptance of RE policy programmes and projects is particularly important. Wustenhagen, Wolsink & Burer (2006), identify three dimensions of social acceptance of RE Innovation: socio-political, community and market acceptance. They argue that both policies and technologies need to be adopted by society at large in order for an initiative to be successful. This is followed by community acceptance of decisions and RE projects by local stakeholders, residents and local authorities. Simon & Wustenhagen (2006) found that acceptance increases when stakeholders are directly involved with a specific type of RE project, such as wind farms. For example, according to Rogers (1995), market acceptance depends on the communication process between the potential adopting party and its environment, as this process facilitates the adoption of innovative technologies.

South Africa is in a very different situation from other developing countries, as the majority of the population cannot even afford basic cheap energy (Bennett, 2008). As a result, the social system is biased towards cheap and dirty sources of power (Lloyd, Cowan & Mohlakoana, 2004). In order to increase the adoption rate of RE sources, the country needs to first uplift its communities to the point where they can afford the basics, in order to then switch to RE sources (Bennett, 2008; Visagie & Prasad, 2006).

3.1.4 Technological

Fossil-fuel technologies have long been considered to be mature, but in most countries, they still attract substantial research and development funds to increase efficiencies, with the exception of a few countries such as Sweden, Spain, Switzerland and the United Kingdom (Schilling & Esmundo, 2009). Manne and Richels (2004) confirm that innovation can reduce RE production costs. Therefore, in order to make RE more competitive, technological innovations are necessary (Russell, 1999).

Painuly (2001) highlights other technological barriers such as a lack of standards, codes and certification and technical skills, lack of infrastructure such as the ability to link up to the grid, and a weak technological culture. Most importantly, lack of funding to sustain technological innovation is regarded as a limiting factor for cheaper renewable technology. In South Africa, some RE technologies have to be imported as they cannot be made more cheaply locally, for example solar panels, wind turbine blades and Concentrated Solar Power (CSP) equipment (Bennett, 2008).

The nature and maturity of RE technology also influences any investment decision. Accordingly, a mature and established technology such as solar photovoltaic (PV) energy will attract more funding than any other type of RE technology (Jacobsson & Bergek, 2004). The post 2011 RE landscape in South Africa through the roll out of the Renewable Energy Independent Power Producer Programme (REIPPP) proves this point since most of the solar farms generate CSP, which feeds into the national grid.

3.2 Factors influencing investment in renewable energy

3.2.1 Political

Tyner (2007) argues that since the US government subsidised ethanol in 1978, the ethanol industry has experienced substantial growth. This subsidy was in line with the government's mandate to support the farming industry, environmental concerns and energy security. Tyner (2007) argues that the success of this industry resulted from state intervention, enabling its growth. Karagöz (2010) points out that private investors are particularly sensitive to political risks, which include political stability and the stability of policy implementation; this sensitivity can be extended to the facilitation of infrastructure (Karagöz, 2010). It can therefore be argued that investment decisions can be influenced by political factors.

3.2.2 Economic

Bennett (2008) argues that due to limited local manufacturing capability (infrastructure, patents and innovation of RE technologies), most of the RE technologies used in South Africa are imported. It follows that any investment in these types of projects will be subject to foreign exchange exposure. This exposure increases the risk profile of the investment because for a higher risk portfolio investors expect a higher return, this can make some RE projects unviable (Shefrin, 2001). The South Africa Rand has a history of intense fluctuations.

3.2.3 Social

It is argued that volatility is also a deterrent to investment (McDermott & Tavares, 2008). Over the last decade, the world has experienced substantial fluctuations in crude oil prices, as shown in Figure 2. Accordingly, as the price of oil rises, RE investments become more attractive. Similarly, as the price decreases, RE investments become less attractive (Wakeford, 2006). It has been proposed that price volatility could be mitigated through government intervention, by diversifying the energy portfolio to include RE (Janczura, 2010).

3.2.4 Technology

From an investment perspective, RE technologies are relatively new while some technologies, like wind and PV solar power, are more established, others, such as geothermal and solar CSP, are still in their infancy (Sorensen, 1991; Visagie & Prasad, 2006). Generally, investors consider the respective maturity levels of the RE technology in their investment decisions.

3.3 Conclusion

The arguments presented confirm that RE adoption is influenced by political, economic, social and technological factors. It was therefore considered important to explore these factors in order to understand the prevailing industry situation.

4. Research methodology

While there have been many studies dealing with the barriers to the adoption or penetration of RE globally, there was a paucity in literature specific to South Africa and its unique barriers available from South African academic databases. Literature addressing investment in RE in South Africa, with a focus on investment from the investor's perspective, was even scarcer.

This may be attributed to the fact that the RE industry in South Africa is a relatively new field. As this is an emerging field of interest, an exploratory survey-based research design was considered to be the most appropriate method to use (Zikmund, 2003:54). Pragmatic researchers need to appreciate and use both qualitative and quantitative methods in their research (Onwuegbuzie & Leech, 2005). This research design therefore included the use of both quantitative and qualitative research methods. Since this research was designed to gather data at a specified point in time, it is categorised as a cross-sectional study. The unit of analysis was the financial investment decision made by investors when investing in RE technologies.

In order to achieve its objectives, this research was broken down into three phases: Phase One identified potential factors which investors considered during their RE investment decision. Phase Two tested whether these factors were in fact considered by South African RE investors when making investment decisions. The research and interview questions are included in Appendix A. The final phase of this research comprised the data analysis.

The sample consisted of 16 South African based companies, which covered each segment of the investment community so that it would be representative of the general population of relevance. These investment companies are shareholders in various energy projects in South Africa. Part of their finance portfolio includes RE Projects. The selection was through convenience sampling, as the number of respondents available was limited. These included financial and other types of institutions that invest in RE technologies. A total of 10 companies agreed to take part in the survey, resulting in a response rate of 62.5 per cent. The companies were represented by individuals who make or contribute to the investment decisions into energy projects.

Owing to time constraints and limited sample availability, an adapted cognitive interview technique was chosen (Beatty & Willis, 2007). It was adapted in the sense that the structured questionnaire was answered by the respondent during the interview. The interviews were conducted by the researcher in person. This methodology provided the researcher with the opportunity to explore further, insights raised in the response. With a generic, distributed, self-administered questionnaire, qualitative responses can sometimes be incomplete or misunderstood and therefore misinterpreted, which can influence the data analysis and may skew results.

Since data consistency allows responses to be analysed appropriately, therefore a structured questionnaire was used and the same set of questions was presented to each respondent. The questionnaire was designed in such a way that the responses were automatically categorised into the six predefined sections, namely Introduction, Political, Economic, Socio-cultural, Technological and General. It also contained an open-ended section in which the respondents could make additional contributions to any section of the questionnaire. The Questions contained in the questionnaire were mostly closed and required short narrative responses. Some questions in the respective sections required the respondent to select an appropriate response from several alternative statements. If the response was vague or inadequate in terms of richness, then a follow-up question was asked. This method ensured that the required narrative response was of sufficient relevance and substance to be used in the analysis. A consent form was included in the first section of the questionnaire.

A preamble and background information about the research was sent to the respondent a few days before the actual interview session. Interview questions themselves were not sent to the respondent prior to the interview session, in order to prevent any response bias. The interviews were conducted by the researcher and captured in an audio format with prior permission from the respondent. A hard copy of the questionnaire was used to record important response aspects. All audio recordings were critically reviewed to confirm and highlight key insights, which the researcher might have overlooked during the interview.

The primary data obtained from the questionnaire was both quantitative and qualitative in nature. A frequency analysis method was used to analyse the quantitative data, while narrative content analysis was used to analyse the qualitative data. Microsoft Excel and NCSS software packages were used to conduct the frequency analysis. The first step in the narrative content analysis was to group the narrative responses to the same question from each respondent on one page. The responses were then categorised under different headings after which, similarities, differences and new insights were noted (Saunders, Lewis & Thornhill, 2003). These were analysed in relation to the literature review conducted and the pertinent factors limiting investments in RE technologies.

5. Discussion of results

5.1 Financial viability

The financial viability of the respective potential projects was mentioned by 60% of respondents. Investors were very concerned about the financial viability of their investments and factors such as high capital costs, the price of products, tax benefits, grants, subsidies and means of raising capital through debt and equity were mentioned as being prime considerations when making investments. Simply put, investors will not invest in any type of technology if it is not financially viable. Financial viability related to a number of factors mentioned by the respondents, such as capital, operational costs, market, selling price and foreign currency risks. This is illustrated in Figure 3.

It can therefore be argued that until the cost of RE technologies can compete with traditional fossil based technologies, investment in RE will remain lower than investments in fossil fuel based technologies. In order to address this imbalance, competitiveness level of RE technologies may be improved through political interventions through its policies as recommended by Martinot and Macdoom's (2000) as well as Jacobsson and Lauber (2006). It follows that if the political climate, objectives and instruments, such policies and tax breaks, are aligned with the promotion of RE based technologies, then the cost of RE technologies will be able to compete with traditional fossil based technologies.

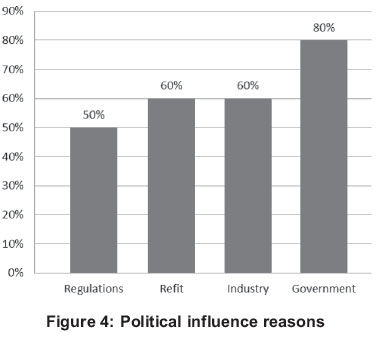

5.2 Need for clarity

One of the areas the research attempted to establish was the nature of political influence on RE investment decisions. The respondents were asked if the current South African political climate was conducive to RE investment. The responses are documented in Figure 4 and show that investors did not believe that the political climate was conducive to substantial investment in this industry. The reasons are a lack of clear regulations and government support, a preference for conventional fossil-fuel based energy, and the use of political forces to shape the energy industry with the government's own monopoly. Responses to some of the questions were extremely divided, rendering inconclusive results. One such question was on whether the current set of regulations and incentives were sufficient to promote or hinder RE investments. However, some themes kept reappearing, such as the need for clarity on the prevailing set of incentives and regulations.

The respondents were of the opinion that the South African government was currently unsure of its course of action. They demonstrated this point by noting the inconsistent policies and initiatives, such as those involving the RE Feed In Tariff System (REFIT) system. The latter is a mechanism to promote the deployment of RE and places an obligation on specific entities to purchase the output from qualifying RE generators at pre-determined prices. The REFIT Guideline document made references to platforms that have not yet been finalised or endorsed, such as the Independent Power Producers (IPP) and the Integrated Resource Plan (IRP) (NERSA, 2009). According to REFIT, the financial capital requirements for joining the grid with any type of RE are substantial. This automatically limits investors in their decisions. As of August 2013, a Renewable Energy Independent Power Producer Program (REIPPP) has since been approved and is currently operational. Three rounds of bidding have taken place under the auspices of this program with the first round already having generators on line (Kane and Shiao, 2013).

The need for clarity therefore suggests that until there is alignment of the political objective and its various instruments, investment in RE technologies will remain lower than fossil-fuel based technologies. Furthermore, investment in RE technologies will remain financially unviable, supporting the previous finding, which asserts that the political climate needs to be conducive by making its policies and goals clear.

5.3 South African barriers

This section unpacks the barriers to RE investment specific to South Africa and goes beyond the financial, political, social, technological and economic aspects. The results obtained mentioned three key challenges for South Africa in this area namely: poverty and inadequacies regarding grid access, education and technology. These were believed to be hindering the adoption of and investment in RE technologies. In a developing country, these barriers are to be expected; however, it was perceived that South Africa in particular had tougher challenges than other developing countries.

5.3.1 Poverty in South Africa The 2012 report titled: 'Monitoring the changing face of South Africa's poverty,' illustrates that the poverty is still a harsh reality for large numbers of people. The figures are measured according to the poverty line adopted by the government of US2 per day or below.

Based on this, it could be seen that poverty is indeed a challenge for South Africa. With the prevailing levels of poverty, it can be understood why the market for RE, a more expensive alternative to electricity is not large. Respondents confirmed that with the high levels of poverty in South Africa, for domestic purposes, cheaper alternatives such as paraffin will always be the default choice making RE even less attractive. Stats SA (2013) showed that 12.6% of South Africans mainly in rural provinces still use wood for cooking. This barrier to RE adoption was confirmed by the sample surveyed.

5.3.1 Insufficient grid access Despite the fact that South Africa had 85.3% electrification in 2011, approximately 15% of the population still did not have access to electricity through the grid (Stats SA, 2013). It can be concluded that a large area of the country remains detached from the grid. If RE feeds into the grid, generating more power, the social impacts will not be felt by those who need electrification. Therefore, the statement made by respondents that access to the grid was a problem is justified and it can be concluded that access to the grid has an influence on the social component of RE investment.

5.3.2 Inadequacies in education

One of the most serious challenges facing South Africa is education. According to the Global Competitiveness Report 2010/2011, released by the World Economic Forum, South Africa ranked 129th for primary education and 75th for secondary education out of 139 countries in 2009 (Schwab, 2010). Approximately 24% of children are in the wrong grade for their age and 6% are not in school (Barnes, Wright, Noble & Dawes 2007).

However, in 2008 that number decreased slightly to 34. 3% or a figure of 6. 8 million (Hall, 2010). With this number of citizens lacking basic education, it was not surprising to find that investors were nervous about the low social acceptance of a new technology, especially at domestic level.

In order for society to adapt to RE and technology, people must be able to comprehend its benefits, which requires sufficient education to understand and appreciate the possibly disastrous consequences of current energy use. Referring to the 2007 European Conference on Local Energy, Sebitosi and Pillay (2008) highlight that traditional school curricula often do not offer the flexibility to integrate such subjects in teaching. Whilst industry experts do exist, these persons often lack access to schools where they can offer their knowledge and information which in turn can impact the skills force and innovation base for the future. As mentioned in the foregoing, the majority of the RE technology in South Africa in imported. This point supports the proceeding factor about challenges in technology.

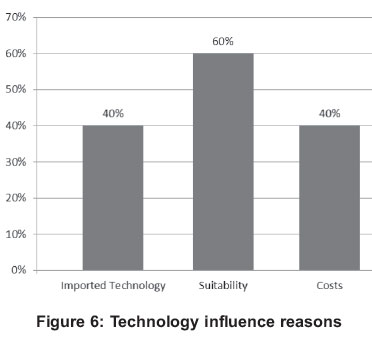

5.3.3 Challenges in technology

According to the Global Competitiveness Report 2010/2011 released by the World Economic Forum, South Africa ranked 76th in technological readiness out of 139 countries in 2009 (Schwab, 2010). It is clear from the results of this study (which are shown in Figure 6) that there is a correlation between the RE investment decisions and technological factors. Many of those countries ranked higher than South Africa are ahead in RE technology investments, innovation and policy. A major factor highlighted by respondents was the use of technologies developed and produced outside South Africa. While some might believe that these technologies are unsuitable for the local market, it would be difficult to overlook these technologies entirely, as most of them have already been developed and tested. It would be easier for South Africa to adapt itself to suit the technology, rather than the other way around.

5.3.4 Other barriers

From the responses to the open ended questions, two non-classified issues were raised namely, quality of labour force and infrastructure. Since RE is a relatively new field in South Africa, skills will definitely be a challenge. With the limited human capital that South Africa possesses, it will be difficult to find qualified and experienced skilled labour to service the industry.

South Africa has one of the best developed infrastructure systems on the African continent yet the major relevant infrastructure related constraint that remains is access to the grid. Whilst infrastructure, including roads, ports and a well-established railway system, provides South Africa with an unquantifiable advantage, in terms of RE investments, this bears little mileage

6. Conclusions

This study was undertaken to investigate the factors limiting financial investment in RE technologies from an investor's perspective (Ghoorah, 2010). Consequently, a survey was conducted using exploratory interviews, which revealed that five aspects mainly influenced RE investment decisions, namely investor background, political factors, economic factors, social factors, and technological factors. However, it was found that, despite the influence of all the other factors investigated, the financial viability of the potential project was the most important criterion that investors considered when making investment decisions. The other major finding was that the majority of the organisations aimed at optimising return on investment.

Politically, it was clear that South African RE investment decisions were affected by political and legal frameworks, as stated by Martinot and Macdoom (2000), Painuly (2001) and Krupa and Burch (2011). Prior to 2010, the South African political environment was not conducive for optimising such investment. The absence of clear objectives, lack of alignment of state substructures and lack of government support were the major reasons given for this situation, which are in line with the findings of Robert & Weightman (1994) and Mandle (2008).

Findings showed that South African RE investment decisions were influenced by economic factors, as stated by Martinot & Macdoom (2000). These factors mainly consisted of demand and supply, foreign exchange and access to capital. With the price of electricity being controlled and capped, it was difficult for any investors to influence and manage a return on their investment. Since most of the RE technologies were imported, projects that needed capital to bring in these technologies were exposed to foreign currency risks despite investors expecting guaranteed returns. In addition, raising capital in this economy is another constraint, as the amount of capital needed is substantially higher than that for conventional energy projects. Prior to 2010, there were very few incentives for investors to raise capital for this type of project.

The lack of social awareness was a major stumbling block for investors, as it limited the RE technology adoption rate, which in turn, limited the RE market. It was found that, according to investors, South African society is not aware of the current environmental issues, the need for RE technologies and alternatives available to them; this is in line with the findings by Simon & Wustenhagen (2006). Other constraints mentioned included the poverty, lack of grid access, and lack of education in South Africa (Bennett, 2008).

It was also found that most RE technologies were imported into South Africa, as the country does not produce its own technology. The positive result is the adoption of international standards, for example ISO 50001, 23045, 13790, 81400, and certification, for example, ISO/IEC 17020, that accompany these imported technologies. Owing to the fact that the South African RE industry is in its infancy, relevant skills and expertise are scarce, despite advanced infrastructure. RE related infrastructure, such as access to the electricity grid, needs to be improved to enable growth in the RE industry.

The need for clarity on the prevailing set of incentives and regulations was a major topic that was identified. Investors were of the opinion that the South African government was currently unsure of its course of action. They demonstrated this point by noting the inconsistent South African RE policies and initiatives.

From an organisational perspective, almost all investment companies allocate their resources strategically in order to optimise their returns. This was proved to be the case in this study, where all the organisations surveyed had a mandate to maximise their returns in different ways (Shefrin, 2005; Tetlock & Mellers, 2002).

As with all research, there were some limitations of the study that point to suggestions for future studies. With regard to the research methodology, among the most common errors was non-response bias (which is normally caused by respondents choosing not to respond to some questions for personal, sensitivity or other reasons). Then there was response bias (where the response is influenced by the respondent's perception of what the researcher wants to hear). There could also be extremity bias, whereby respondents exaggerate issues by responding at the extreme end of the scale to highlight certain issues. In addition, there may be interviewer bias, in which the interviewer may lead respondents to make responses which they would not normally have given, or influence the response obtained.

Although it would have been interesting to compare the findings of this study with those of the rest of the Brazil, South Africa, India and China (BASIC) countries, this fell outside its scope. Such a comparison would be useful, as each country could use the findings as a point of reference to improve their investment profile. This is an opportunity for future research. Other avenues also include the study of potential factors, which could prove to be important in affecting investment decisions in the RE field. A study of various initiatives, such as a 'greenbond', REFIT, IPP Tradable Renewable Energy Certificates (TREC) and their effectiveness in promoting RE could also be useful.

Notes

1. The Integrated Resource Plan: 2010-2030 (2011) provides for the disaggregation of renewable energy technologies to explicitly display solar photovoltaic (PV), concentrated solar power (CSP) and wind options.

References

Ahlborg, H. & Hammar, L. (2012). Drivers and barriers to rural electrification in Tanzania and Mozambique-Grid extension, off-grid, and renewable energy technologies. Renewable Energy, 1-8. [ Links ]

Barnes, H., Wright, G., Noble, M., & Dawes, A. (2007). The South African Index of Multiple Deprivation for Children Census 2001. The Human Sciences Research Council. Available at: http://www.casasp.ox.ac.uk/docs/TheSouthAfricanIndexofMultipleDeprivationforChildren.pdf [Accessed 31/10/2010] [ Links ]

Beatty, P. C. & Willis, G. B. (2007). Research Synthesis: The Practice of Cognitive Interviewing. Public Opinion Quarterly, 71(2), 287-311. [ Links ]

Bennett, K. (2008). Interview March 18: Possibilities for renewable energy in South Africa. Ultimate guide to business, trade and investment in South Africa. Available at http://www.tradeinvestsa.co.za/feature_articles/316476.htm [Accessed 31/10/2010]. [ Links ]

Bode, S. & Michaelowa, A. (2003). Avoiding perverse effects of baseline and investment additionality determination in the case of renewable energy projects. Energy Policy, 31: 505-517. [ Links ]

Doppegieter, J. J. , Du Toit, J. & Liebenberg, J. (1999). Energy indicators 1999/2000. ESKOM (Electricity Supply Commission). Annual Report 2009, 2010. Available at http://www.eskom.co.za/annreport09/ar_2009/info./img/revistas/jesa/v25n2/2010.htm [Accessed 15/10/2010]. [ Links ]

Dutschke, M., & Michaelowa, A. (1998). Creation and sharing of credits through the clean development mechanism under the Kyoto Protocol. HWWA Discussion Paper 62. Available at [http://opus.zbwkiel.de/volltexte/2003/1070/pdf/62.pdfS, [Accessed 28/03/2012]. [ Links ]

Department of Minerals and Energy, Digest of South African Energy statistics, (2009). Republic of South Africa. http://www.energy.gov.za/files/media/explained/2009%20Digest%20PDF%20version.pdf. [ Links ]

Department of Minerals and Energy South Africa (2011). Integrated Resource Plan for Electricity 2010-2030. Revision 2. Final Report. 25 March 2011. Available at: http://www.doe-irp.co.za/content/IRP2010_updatea.pdf. [ Links ]

Department of Trade and Industry (2007). Industrial Policy Action Plan (IPAP), Government Printer, Pretoria Available at www. thedti. gov. za/nipf/IPAP_r1. pdf [Accessed 14/08/2013]. [ Links ]

Energy Information Administration (United States) (2013). South Africa Country Analysis. Available at http://www.eia.gov/countries/cab.cfm?fips=SF [Accessed 30/04/2014]. [ Links ]

Ghoorah, D. K. (2010). South African Renewable Energy Investment Barriers: An Investor Perspective. MBA Dissertation. Gordon Institute of Business Science University of Pretoria. [ Links ]

G20 Clean Energy Factbook: The Pew Trusts (2009). Who is winning the clean energy race? Growth, competition and opportunity in the world's largest economies. Available at::http://www.pewtrusts.org/uploadedFiles/./img/revistas/jesa/v25n2/Reports//img/revistas/jesa/v25n2/G-20Report.pdf [Accessed 20/10/2010]. [ Links ]

Hall, K. (2010). Income and Social Grants - Unemployment in the household, Statistics on Children in South Africa. Available at: http://www.childrencount.ci.org.za/indicator.php?id=2&indicator=52 [Accessed 31/10/2010]. [ Links ]

Jacobsson, S. & Bergek, A. (2004). Transforming the energy sector: the evolution of technological systems in renewable energy technology. Industrial and Corporate Change, 13(5): 815-849. doi: 10. 1093/icc/dth032. [ Links ]

Jacobsson, S. & Lauber, V. (2006). The politics and policy of energy system transformation: explaining the German diffusion of renewable energy technology. Energy Policy, 34:256-276. doi: 10. 1016/j. enpol.2004. 08. 029. [ Links ]

Janczura, K. (2010). Price volatility and the efficient energy portfolio for the United States. Atlantic Economic Journal, 38(2): 239-239. [ Links ]

Karagöz, K. (2010). Determining factors of private investments: an empirical analysis for Turkey. Sosyoekonomi, 6(1): 7-25. [ Links ]

Kebede, E., Kagochi, J. & Jolly, C. M. (2010). Energy consumption and economic development in Sub-Sahara Africa. Energy Economics, 32, 532-537. [ Links ]

Kerr, R. A. (2010). Do we have the energy for the next transition? Science, 329(5993):780-781. doi: 10.1126/science. 329. 5993. 780. [ Links ]

Kline, C. M. (2010). Financing alternative energy in 2010 and beyond: new incentives for new priorities. Journal of Equipment Lease Financing, 28(2): 1-8. [ Links ]

Krapels, E. (1993). The commanding heights: international oil in a changed world. International Affairs (Royal Institute of International Affairs 1944), 69(1):71-88. [ Links ]

Krupa, J. & Burch, S. (2011). A new energy future for South Africa: The political ecology of South African renewable energy. Energy Policy, 39, 6254-6261. [ Links ]

Leatt, A. (2006). Income Poverty in South Africa. South African Child Gauge 2006. Available at http://uct.academia.edu/AnnieLeatt/Papers/566457/Income_poverty_in_South_Africa [Accessed 25/10/2010]. [ Links ]

Lloyd, P., Cowan, B. & Mohlakoana, N. (2004). Improving access to electricity and stimulation of economic growth and social upliftment. Eskom Conference Centre, Midrand, July. [ Links ]

Mandle, J. (2008). Reconciling development, global climate change, and politics. Challenge, 51(6), November/December: 81-90. [ Links ]

Manne, A. & Richels, R. (2004). The impact of learning-by-doing on the timing and costs of CO2 abatement. Energy Economics, 26:603-619. [ Links ]

Martinot, E. & Macdoom, O. (2000). Promoting energy efficiency and renewable energy: GEF climate change projects and impacts. Washington, DC: Global Environment Facility. [ Links ]

Mathews, J. A., Kidney, S., Mallon, K. & Hughes, M. (2010). Mobilizing private finance to drive an energy industrial revolution. Energy Policy, 38: 3263-3265. [ Links ]

Mcdermott, S. & Tavares, C. (2008). Is credit the new equity? Global Investment Agencies. Available at: http://www2.goldmansachs.com/ideas/investment-insights/commercial-credit/research-docs/revised-credit. pdf [Accessed 31/10/2010]. [ Links ]

National Energy Regulator of South Africa. (2009). South Africa Renewable Energy Feed-in Tariff. Available at http://www.futurepolicy.org/fileadmin/user_upload/Axel/SouthAfrica_FIT_2009. pdf [Accessed 29/10/2010]. [ Links ]

National Strategy for Sustainable Development and Action Plan (2011-2014). Available from https://www.environment.gov.za/sites/default/files/docs/sustainabledevelopment_actionplan_strategy.pdf [Accessed 14/08/2013]. [ Links ]

National Climate Change Response White Paper. Available from http://www.info.gov.za/view/downloadfileaction?id=152834 [Accessed 14/08/2013]. [ Links ]

National Biodiversity Strategies and Action Plans (NBSAPS). Available from: http://www.cbd.int/nbsap/. [ Links ]

National Development Plan: Vision for 2030. Government of South Africa. 11 November 2011. Available from: http://www.npconline.co.za/medialib/downloads/home/NPC%20National%20Development%20Plan%20Vision%202030%20-lo-res.pdf [Accessed 14/08/2013]. [ Links ]

New Growth Path: Executive Summary, South African Government. No date [cited 2011 Mar 02]. Available from: http://www.info.gov.za/about-govt/programmes/new-growth-path/. [ Links ]

Nussbaumer, P (2008). On the contribution of labelled Certified Emission Reductions to sustainable development: A multi-criteria evaluation of CDM projects. Energy Policy. Available at: http://0-www.sciencedirect.com.innopac.up.ac.za/science/article/pii/S0301421508003959. [Accessed 14/08/2013]. [ Links ]

Ogihara, A., Gueye, M. K. , King, P. N. & Mori, H. (2007). Policies to ease the transition to a post-fossil fuel era. International Review for Environmental Strategies, 7(1): 63-79. [ Links ]

Olsen, K. H. , (2007). The clean development mechanism's contribution to sustainable development: a review of the literature. Climatic Change, 84, 59-73. [ Links ]

Onwuegbuzie, A. & Leech, N. L. (2005). On becoming a pragmatic researcher: the importance of combining quantitative and qualitative research methodologies. International Journal of Social Research Methodology, 8(5):375-387 doi:10.1080/13645570500402447 [ Links ]

Owen, A. D. (2006a). Evaluating the costs and benefits of renewable energy. The Australian Economic Review, 39(2): 207-215. [ Links ]

Owen, A. D. (2006b). Renewable energy RE: externality costs as market barriers. Energy Policy, 34:632-642. [ Links ]

Oxford Analytica Daily Brief Service_(2009). South Africa: Renewable energy strategy takes shape. Available at: http://search.proquest.com/docview/192457809?accountid=14717. [Accessed on 29/03/2012]. [ Links ]

Painuly, J. P. (2001). Barriers to renewable energy penetration: a framework for analysis. Renewable Energy, 24:73-89. [ Links ]

Pegels, A. (2010). Renewable energy in South Africa: Potentials, barriers and options for support. Energy policy, 38(9), 4945-4954. [ Links ]

Rafaj P. & Kypreos, S. (2007). Internalisation of external cost in the power generation sector: Analysis with Global Multi-regional MARKAL model, Energy Policy. 35(2): 828-843. [ Links ]

Robert, S. & Weightman, F. (1994). Cleaning up the world with renewable energy: from possibilities to practicalities. Renewable Energy, 5(2): 1314-1321. [ Links ]

Rogers, E. M. (1995). Diffusion of innovations. New York: The Free Press. [ Links ]

Russell, D. (1999). Financing renewable energy. Management Accounting: Magazine for Chartered Management Accountants, 77(1):36. [ Links ]

Sanders, D. & Chopra, M. (2006). Key challenges to achieving health for all in an inequitable society: the case of South Africa. The American Journal of Public Health, 96(1):73-78. [ Links ]

Saunders, M., Lewis, P. & Thornhill, A. (2003). Research methods for business students. Harlow: Pearson. [ Links ]

Schilling, M. A. & Esmundo, M. (2009). Technology S-curves in renewable energy alternatives: analysis and implications for industry and government. Energy Policy, 37:1767-1781. [ Links ]

Schneider, L. (2007). Is the CDM fulfilling its environmental and sustainable development objectives? An evaluation of the CDM and options for improvements. Institute for Applied Ecology. Available at: /http://www.oeko.de/oekodoc/622/2007-162-en.pdf, [Accessed 28/03/2012]. [ Links ]

Schwab, K. (2010). The Global Competitiveness Report 2010/2011. Available at: http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2010-11.pdf [Accessed 31/10/2010]. [ Links ]

Schwabe, CA (2012). Monitoring the changing face of South Africa's poverty. Available at: http://www.eepublishers.co.za/images/upload/positionit_2012/changing-face_visu_june12.pdf [Accessed 14/08/2013]. [ Links ]

Sebitosi, A, P , & Pillay, P (2008). Grappling with a half-hearted policy: The case of renewable energy and the environment in South Africa, Energy Policy, 36(7): 2513-2516. [ Links ]

Shefrin, H. (2001). Do investors expect higher returns from safer stocks than from riskier stocks? The Journal of Psychology and Financial Markets, 2(4): 176-181. [ Links ]

Shoock, C. S. (2007). Blowing in the wind: how a two-tiered national renewable portfolio standard, a system benefits fund, and other programs will reshape American energy investment and reduce fossil fuel externalities. Fordham Journal of Corporate & Financial Law, 12(6): 1011-1077. [ Links ]

Simon, A. & Wustenhagen, R. (2006). Social acceptance of renewable energy innovation: factors influencing the acceptance of wind energy in Switzerland. Tramelan (Switzerland), 2006. Available at http://www.iwoe.unisg.ch/energy [Accessed 28/10/2010]. [ Links ]

Smith, R. (2007). Renewable energy poised to offer multiple advantages. Western Farm Press, 28(19):15-21. [ Links ]

Sorensen, B. (1991). A history of renewable energy technology. Energy Policy, 19(1):8-12. doi: 10. 1016/0301- 4215(91)90072-V. [ Links ]

South African Green Economy Modelling Report (SAGEM). May 2013. Department of Environmental Affairs. [ Links ]

Statistics SA (2013). PO318- General Household Survey Series Volume V Energy 2002- 2012. Online http://www.statssa.gov.za/publications/statsabout.asp?PPN=P0318&SCH Accessed 12/05/2014. [ Links ]

Sterk, W., & Wittneben, B. (2005). Addressing opportunities and challenges of a sectoral approach to the clean development mechanism. Wuppertal Institutfür Klima, JIKO Policy Paper 1/2005. Available at /http://www.wupperinst.org/uploads/tx_wibeitrag/addressing-opportunities.pdfS, [Accessed 28/03/2012]. [ Links ]

Tavallali, R. (2010). Energy crisis and the impact of taxes and incentives on conservation. Journal of Applied Business and Economics, 1:58-62. [ Links ]

Tetlock, P E. & Mellers, B. A. (2002). The great rationality debate. Psychological Science, 13:94-99. [ Links ]

Tyner, W. (2007). Policy alternatives for the future biofuels industry. Journal of Agricultural & Food Industrial Organization, 5(2):1-11. [ Links ]

United Nations Development Programme (UNDP). (2009). Human development report, overcoming barriers: human mobility and development. Available at: http://hdr.undp.org/en/reports/ebooks/ [Accessed 31/10/2010]. [ Links ]

United Nations Framework Convention on Climate Change (UNFCCC), (1997). Kyoto Protocol to the United Nations framework convention on climate change. Available at /http://unfccc.int/essential_background/kyoto_protocol/back-ground/items/1351.phpS, [Accessed 28/03/2012]. [ Links ]

Verbruggen, A., Fischedick, M., Moomaw, W., Weir, T. , Nadai, A., Nilsson, L. J., Nyboer, J. & Sathaye, J. (2009). Renewable energy costs, potentials, barriers: Conceptual issues. Energy Policy 38, 850-861. [ Links ]

Visagie, E. & Prasad, G. (2006). Renewable energy technologies for poverty alleviation, South Africa: Biodiesel and solar water heaters. Energy Research Centre, 1:1-27. [ Links ]

Vivid Economics. (2010). The implicit price of carbon in the electricity sector of six major economies. The Climate Institute. Available at http://www.climateinstitute.org.au/images/reports/vivid_tci_implicitcarbonpricingreport.pdf. [Accessed on 29/03/2012]. [ Links ]

Wakeford, J. J. (2006). The impact of oil price shocks on the South African macro economy: history and prospects. South African Reserve Bank Conference. Available at: http://www.reservebank.co.za/internet/Publication. nsf/LADV/B42C57D795BE6A3A4225729D0034363F/$File/Wakeford.pdf [Accessed 30/10/2010] [ Links ]

Weidenbaum, M. L. (1983). Energy development and US government policy: some recommendations for using market forces to achieve optimum national goals. The American Journal of Economics and Sociology, 42(3): 257-274. [ Links ]

Williams, J. L. , (2009). Oil Price History and Analysis. WTRG Economics. Available at http://www.wtrg.com/prices.html [Accessed 31/10/2010]. [ Links ]

Winkler, H. (2005). Renewable energy policy in South Africa: policy options for renewable electricity, Energy Policy. 33: 27-38. [ Links ]

Wustenhagen, R., Wolsink, M. & Burer, M. J. (2006). Social acceptance of renewable energy innovation: an introduction to the concept. Energy Policy, 35: 2683-2691. [ Links ]

Zikmund, W. G. (2003). Business research methods. 7th ed. United States of America: South-Western Educational. [ Links ]

Received 19 September 2013

Revised 15 May 2014