Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of the South African Institution of Civil Engineering

versão On-line ISSN 2309-8775

versão impressa ISSN 1021-2019

J. S. Afr. Inst. Civ. Eng. vol.53 no.1 Midrand Abr. 2011

TECHNICAL PAPER

Positioning technology development in the South African construction industry: a technology foresight study

F C Rust; R Koen

ABSTRACT

Internationally infrastructure is ageing rapidly and there is increased utilisation of infrastructure due to urbanisation and globalisation. Significant amounts are invested globally to address this issue, although funding fluctuates from year to year. One response to this situation is to position the construction industry with advanced technological solutions. However, the construction industry is renowned for low levels of innovation and the South African government has also underfunded research into infrastructure. There is a need to stimulate innovation in the construction industry to develop the uniquely South African technological solutions required to provide and maintain economic and social infrastructure. An investment in construction innovation should be based on a review of the current state of construction technology and the industry and an analysis of the drivers and trends that will shape the future construction industry landscape. Technology foresight studies are recognised as one way to determine the future factors that will influence a specific economic sector. This article describes a new approach to conducting a technology foresight study within the South African construction industry. The methodology, as well as initial results from it, is reported. A review is provided of the current state of the construction industry and its potential drivers and trends. Future work will include scenario development and the development of pathways and interventions to take the industry forward from its current position to a desired future state.

Key words: technology foresight, construction sector, construction drivers, research and development

BACKGROUND TO THE STUDY

Investment in the construction industry

In many countries infrastructure is ageing or inadequate, particularly in developing countries where economic growth over the past decade has been significantly higher than the long-term average. The World Bank estimates that the projected funding gap for infrastructure in the USA is a significant US$ 1,6 trillion over a five-year period, while Asia will need an estimated US$ 1 trillion over the same period (ULI 2007). In South Africa there are also significant needs for infrastructure development, as is reflected in the Medium Term Strategic Framework (MTSF 2009) that refers to a "massive programme to build economic and social infrastructure", and by the recent special investment of R600 billion by the South African government into infrastructural development (Van der Merwe 2008).

Factors such as migration, urbanisation and population growth have created the situation where infrastructure is increasingly being overloaded. Consequently, and particularly in developing countries, the rate of increase in service delivery (electricity, water, sanitation, access roads and adequate housing) cannot keep up with demand (Rust et al 2008). Governments and the private sector around the world are investing significant amounts in gross fixed capital formation (GFCF), with the result that the construction industry has been growing despite the economic downturn. In South Africa the construction industry has grown by more than 15% per annum over a five-year period (SAFCEC 2008). SAFCEC (2010) also reports that, even though the industry was facing a significant slowdown in 2010, it was still projected to show real growth in the next 10-year period. SAFCEC (2010) states furthermore that this slowdown is not due to the completion of the infrastructure for the 2010 Soccer World Cup, but rather to a lack of national planning coordination.

In addition to the fluid economic situation, the construction industry also faces severe challenges related to skills shortages, increasing emphasis on environmental issues and energy shortages. However, the technology used in construction has aged and not kept up with advances in other sectors of the economy. In a recent survey in the UK, 66% of respondents indicated that the construction industry is not innovative enough (CIOB 2007). In South Africa this is also evident in the low levels of investment into research, development and innovation in the industry (Rust et al 2008b, HSRC 2006).

Why construction industry foresight?

In view of these challenges faced by the construction industry (be it in times of prosperity or in times of economic downturn), it is opportune to conduct the research, development and innovation (RD&I) projects that will position the industry more appropriately for the future. A rekindled RD&I activity in the South African construction industry will only provide maximum benefit if the appropriate focus for investment is selected. The purpose of a technology foresight study is to provide the information and basis for this investment decision.

Role players and purpose of the study

The Council for Scientific and Industrial Research (CSIR) and Murray & Roberts embarked on a joint project in 2008 to conduct a construction industry foresight study. The purpose of the ongoing work is to:

understand and anticipate industry and market dynamics

inform changes in strategic approach

determine the required competencies to respond to market and industry needs, and

provide the basis for decision-making in the investment of RD&I funding to develop the key solutions required to address current and future market needs.

Naturally, some of the information emanating from this study is of a confidential nature. Nevertheless, the results of general interest obtained thus far are reported here. The two phases of the study being conducted by the CSIR are indicated below. This article describes the findings of Phase 1.

RESEARCH METHODOLOGY

Approach

The ongoing study is planned in two phases. Phase 1 is aimed at developing a view of the current reality facing the industry in terms of drivers and trends in the industry. This will provide a basis for planning future strategic direction. Phase 2 will be aimed at the development of possible future scenarios for the construction industry in South Africa, which would inform desired key solutions and planning of the interventions and actions required to take the industry from the current reality to a future desired state. Phase 1 of the study has been completed, and this article describes the findings deriving from it.

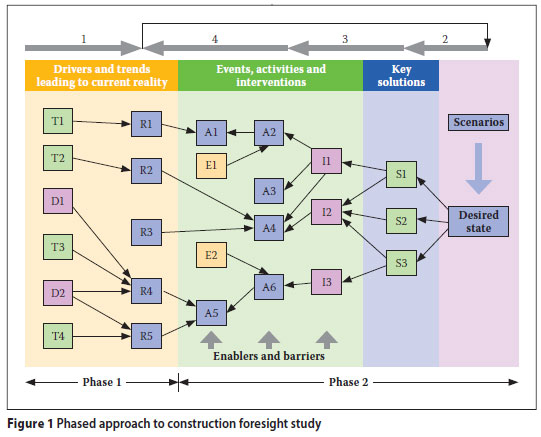

Figure 1 depicts the overall methodology developed by the authors for this study. It is depicted as a network of drivers, trends, realities, events, actions and future outcomes that are interlinked and interdependent. The phased approach allows the development of a view of current reality in the construction industry and then 'leapfrogs' into the future to develop the potential future scenarios for the industry. From this point a backwards analysis can be conducted to determine the potential paths of interventions and activities that will be required to take the industry forward to the required future outcomes. The elements of the network can be weighted (using ratings from a user group) and a statistical analysis conducted to determine the most likely paths the industry should follow to reach the desired future state.

Methodology

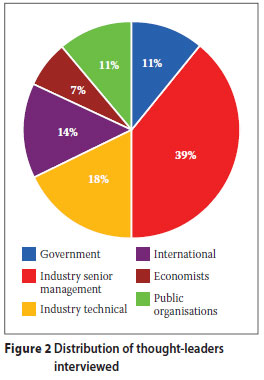

The work done for Phase 1 of this study was mostly of a qualitative nature, combined with some quantitative analysis to support the qualitative findings. The qualitative research started with a desktop study to assess the current state of the construction industry locally and internationally, and the drivers of change in the industry. This work was augmented through 56 interviews with eminent thought-leaders from government, private sector, academia, research organisations and financial institutions. The distribution of the thought-leaders interviewed is shown in Figure 2. These interviews included, for example, the South African Construction Industry Development Board (CIDB) to provide information on the challenges experienced by contractors of all grading levels.

The qualitative analysis of the information gained during the desktop study led to the definition of 12 main drivers of change in the construction industry, as well as 24 trends in the industry. The interviews with the thought-leaders aimed to identify the major drivers, trends and potential disruptive forces or wild cards that could influence the industry in the medium term without sharing the desktop study information with them. The information gained from these interviews was then analysed to assess the importance attached by the thought-leaders to each of the drivers and trends identified in the desktop study. A simple key word count was used to score the importance of the drivers on a normalised five-point scale.

The drivers and trends were then presented to a group of 49 operational managers at middle management level in companies in the Murray & Roberts Group and the participants were asked to evaluate the importance of the drivers and trends to the construction industry, both in the medium and short term. A five-point Likert scale was used (with a score of 5 indicating the highest importance) and the scores were analysed using statistical factor analysis as provided in the SAS version 9 statistical software. Using the results of the factor analysis, the 24 trends were distilled into seven 'mega-trends'.

Finally, the information was analysed to identify the short- to medium-term focus areas where the construction industry should focus its innovation activity.

CURRENT REALITIES FACING THE CONSTRUCTION INDUSTRY

During the desk-top study, various realities influencing the construction industry were identified from local and international publications. These included drivers such as world-wide ageing of infrastructure, fluctuating economies, emphasis on environmental impact and an inherent low level of innovation in the construction industry. These are discussed below.

State of infrastructure

There is concern about the ageing state of infrastructure all over the world. The Urban Land Institute in the USA states that:

"The United States, in particular, and most of Europe stumble to repair and retool aging roads, plants, and levees that may no longer serve a changing paradigm for how people will live and work in the future." (ULI 2007).

In 2006 the South African Institution of Civil Engineering (SAICE) assessed the state of infrastructure in South Africa and developed an infrastructure report card (SAICE 2006). SAICE reported that, although the South African government had embarked on a programme of increased infrastructure spending, there is still a failure to invest in the maintenance and renewal of infrastructure. According to SAICE, most of the infrastructure in South Africa is in a fair, poor or very poor state.

Industry contribution

The built environment and construction industry play a significant role in sustainable growth and development. The built environment constitutes more than half of gross fixed capital investment in most countries, and construction output, as a global average, represents as much as 10% of global gross national product. Of the estimated US$ 3 000 billion annual global output of the industry, developing countries contribute 23%, while accounting for 75% of total global employment of construction workers (CICA 2002).

The relationship between economic growth and gross fixed capital formation (GFCF) is recognised internationally. Figure 3 shows the relationship for a selection of developed and developing countries (Investec 2005). As an enabler of economic growth, the construction industry stimulates growth by increasing the productive capacity of the economy through the provision of infrastructure to all sectors - both public and private. An established global benchmark is that GFCF should vary between 20% and 30% of GDP and that construction investment should represent between 20% and 30% of GFCF (4% to 9% of GDP), in order to generate a consistent economic growth rate of 5% and more (Murray & Roberts 2008).

Historic fluctuation in construction activity

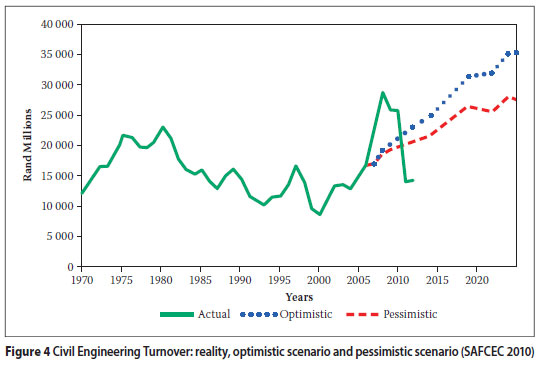

The trend in construction GFCF in South Africa over the past 50 years is not one of steady and consistent growth. Historic peaks in construction works coincided with the two oil shocks in 1973 and 1978, and the Mossgas project in the late 1980s. In the same period, building activity responded with a similar pattern. From 1975 to 2000, both industry segments were "bumping along the bottom" and the contribution of construction to GDP, GFCF and employment halved. Since 2001, however, the industry has experienced dramatic growth (Langenhoven 2007). This is depicted in Figure 4. This growth was tempered in late 2008 and 2009 due to the sub-prime crisis in the USA and the UK, especially in the residential building sector. Due to the recent investment in infrastructure by government, growth continued, but since the middle of 2009 there has been a significant downturn (SAFCEC 2010).

Importance of Science, Engineering and Technology

SET (Science, Engineering and Technology) has a broad impact on society, including the stimulation of economic growth, socioeconomic impact and the environment. Kuittinen et al (2007) showed that R&D intensity has a significant impact on the financial performance of companies. The role of technology in the development of a country was also highlighted by Roux (2007) who indicated the relationship between the UN Technology Achievement Index (TAI), Gross Domestic Product (GDP) per capita and the Human Development Index (HDI), as illustrated in Figure 5. The data indicates that technology development (and therefore R&D to generate these new technologies) has a significant impact on both economic development and social development. The impact of R&D and SET on the construction industry is wide - for example, the enabling role of information and communication technology (ICT) in construction (Fischer and Kunz 2004), the use of new materials in house construction to reduce environmental impact (Morela et al 2000) and the impact of alternative materials in road construction (Rust et al 1994) - to name but a few examples.

The construction industry SET base is diverse with gaps in knowledge identified in areas such as local environmental conditions, local construction materials, urban form relating to apartheid legacy and rural development requirements (Rust et al 2008).

The national R&D strategy has set a target of 1% of GDP to be spent on R&D. In many developed countries this figure is in excess of 2%. Rust et al (2008b) have found that investment in construction-related R&D in South Africa by the public sector is very low at about 0,3% of the total budget of the government departments. The National R&D survey found that from 2003 to 2005 less than 0,33% was spent on construction research by the private sector, public sector and universities. Thus technological development in the construction industry has fallen behind many other industries, with the consequent use of ageing technologies (Manseau and Seadon 2001).

CONSTRUCTION INDUSTRY DRIVERS AND TRENDS

Drivers of change

Phase 1 of this study focused on the identification of the drivers of change and trends that could influence the construction industry in the medium- to long-term future. For the purposes of this study, a driver of change is defined as a force external to the industry that influences its behaviour and current situation. The 12 drivers and their key characteristics (obtained from the desktop study) are summarised in Table 1.

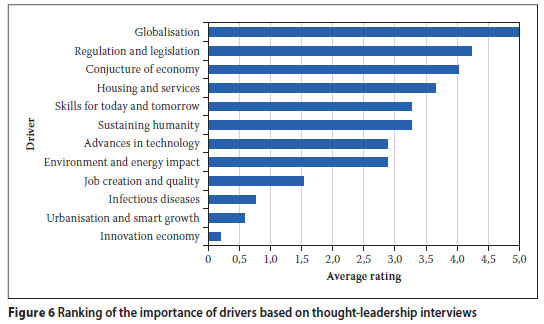

The qualitative information gathered from the thought-leadership interviews was analysed by counting the frequency of the use of specific key words relating to each of the drivers by the interviewees. The score for each of the drivers was then normalised to a 5-point scale. This was used to rank the importance of the drivers as seen by the 56 thought-leaders interviewed. The results are shown in Figure 6.

These drivers can be grouped into three categories: high-order strategic drivers (global issues, regulation and the economy), more locally focused drivers (housing, sustaining humanity, local advances in technology, environmental and energy issues), and a grouping of drivers with lesser importance.

A questionnaire provided to the Murray & Roberts review group of 49 middle (operational) managers was used to rate the importance of the drivers in the medium as well as the long term. The top four drivers ranked by this group in terms of their perceived long-term importance were:

Advances in technology

Environment and energy impact

Skills for today and tomorrow, and

Job creation and quality.

This indicates that the more operationallyoriented middle-management group rated the technical drivers higher in importance than the industry thought-leaders. They also rated issues pertaining to their operational performance as more important (e.g. skills shortage and job quality). Both these viewpoints should be considered in the development of a balanced portfolio of innovation focus areas that address both short-term and long-term needs.

Trends in the construction industry

The study identified 24 trends in the construction industry, where a trend is defined as the change in the characteristics of a phenomenon over time. The information gained from the thought-leadership interviews was analysed in the same manner as for the case of the drivers to determine the relative importance of the trends as seen by the thought-leaders. The ranking of the trends from this analysis is shown in Figure 7.

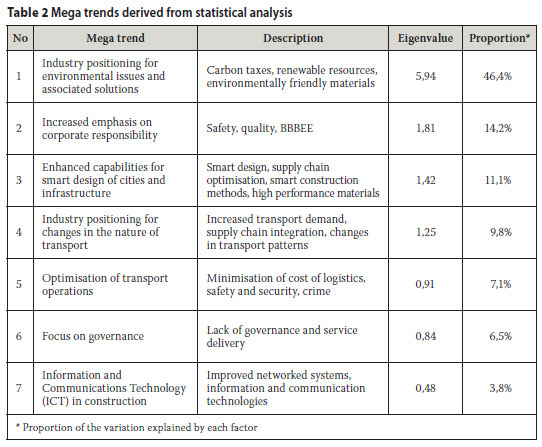

The ratings of the trends by the construction industry middle-management group was used to conduct a factor analysis in order to group them into possible 'mega trends' occurring in the construction industry that were viewed as important by the survey respondents. Seven such 'mega trends' were indentified, as shown in Table 2. The table indicates the eigenvalue of each individual factor (or mega trend), as well as the proportion of the variation in the data explained by that factor. The seven mega trends combined explain more than 95% of the variation in the importance ratings received from the participants, indicating that they are representative of the information provided by the respondents.

TECHNOLOGY RESPONSES AND FOCUS AREAS

The information gained from the qualitative and quantitative analyses, as well as further inputs from the thought-leaders and construction industry middle management group, was used to derive a number of technology focus areas and potential technology responses that the construction industry should consider. These focus areas and their link to the drivers and trends are shown in Table 3. The focus areas related to technological development are:

Advanced materials and products

ICT and robotics

Alternative energy systems for the built environment, especially solar power Housing and alternative technologies for municipal service delivery

Clean processes and technologies, and

Logistics and supply chain optimisation. The authors view these focus areas as an initial result from Phase 1. Detailed interventions required in each of the focus areas and their associated innovation projects will be determined during Phase 2.

CONCLUDING REMARKS

The construction industry in South Africa is an important contributor to and facilitator of socio-economic development and economic growth. The increasing load on infrastructure, the fact that infrastructure is ageing, and the impact of external drivers on the industry, emphasise the need for the industry as a whole to face its challenges with innovative solutions. However, the construction industry is notorious for low levels of innovation and there is a need in South Africa to enhance and focus innovation efforts in construction and the supporting R&D programmes. The initial results from this study have highlighted twelve drivers external to the construction industry that are expected to influence it in the medium term. The analysis of the ratings from the middle management group also identified seven 'mega trends' in the construction industry that will be shaping its immediate future. The inputs from the middle management group, as well as the analysis of drivers and trends, were also used to define important focus areas for innovation in the construction industry.

The industry requires solutions that are specific to South Africa's needs. This implies that R&D and Innovation related to infrastructure should receive a higher priority in South Africa from government and the industry alike to facilitate such development.

ACKNOWLEDGEMENT

This paper is published with the permission of the Executive: Innovation, Murray & Roberts, and the Executive Director, CSIR Built Environment. A special word of thanks goes to Murray & Roberts for their partial funding of the work, as well as for their participation in the study.

REFERENCES

CICA 2002. Industry as a partner for sustainable development: Construction. Confederation of International Contractors' Associations (CICA), Paris, France. [ Links ]

CIOB 2007. Innovation in construction: Ideas are the currency of the future: Survey 2007. The Chartered Institute of Building, Berkshire, UK. [ Links ]

Fischer, M & Kunz, J 2004. The scope and role of infor mation technology in construction. CIFE Technical Report No 156, Stanford University, US. [ Links ]

HSRC 2006. National survey of research & experimental development 2005/06. Human Sciences Research Council of South Africa, Pretoria. [ Links ]

Investec 2005. Prospects 2004-2009: Gross domestic fixed investment outlook. SA Economic Research, 1st Quarter 2005. [ Links ]

Kuittinen, H, Puumalainen, K & Jantunen, A 2007. Effect of R&D intensity on firm performance - sectoral differences. Proceedings of the 16th International Association of Management of Technology Conference (IAMOT), Florida, US, pp 772-785. [ Links ]

Langenhoven, H P 2007. Long-term scenarios for construction. South African Federation of Civil Engineering Contractors, Bedfordview. [ Links ]

Manseau, A & Seadon, G 2001. Innovation in construction: An international review of public policies. London: Spon Press, p 2. [ Links ]

Morela J C, Mesbaha A, Oggerob, M & Walker P 2001. Building houses with local materials: means to drastically reduce the environmental impact of construction. Building and Environment, 36: 1119-1126. [ Links ]

MTSF 2009. Medium Term Strategic Framework for period 2009-2014. Presidency of South Africa, Pretoria. [ Links ]

Murray & Roberts 2008. Murray & Roberts Annual Report 2008, Johannesburg, p 32. [ Links ]

Roux, A 2007. Business Futures 2007. Institute for Futures Research, University of Stellenbosch, South Africa. [ Links ]

Rust, F C, Vos, R M, Myburgh, P A & Maree, J H 1994. Impact of the Sabita/CSIR asphalt research programme on the South African roads industry. Proceedings of the Sixth Conference on Asphalt Pavements for Southern Africa, Cape Town. [ Links ]

Rust, F C, Botha, C, Van Wyk, L, Steyn, W, Du Plessis, C, Landman, K & Coetzee, M 2008a. South African Construction Industry Technology Foresight Study: Summary report of desktop study. CSIR Technical Report: CSIR/BE/SRM/ER/2008/0063/B, October 2008, CSIR, Pretoria. [ Links ]

Rust F C, Van Wyk, L, Ittmann, H & Kistan, K 2008b. The role of R&D in transport infrastructure in South Africa. Proceedings of the South African Annual Transportation Convention, July 2008, Pretoria. [ Links ]

SAFCEC 2008. State of the Industry Report. 2nd Quarter 2008. South African Federation of Civil Engineering Contractors, Bedfordview. [ Links ]

SAFCEC 2010. State of the Industry Report 2nd Quarter 2010. South African Federation of Civil Engineering Contractors, Bedfordview [ Links ]

SAICE 2006. The SAICE Infrastructure Report Card for South Africa: 2006. The South African Institution of Civil Engineering, Midrand, South Africa. [ Links ]

ULI 2007. Infrastructure 2007: A global perspective. The Urban Land Institute and Ernst & Young, Washington D.C. [ Links ]

Van der Merwe, C 2008. South Africa pushes ahead with R600 bn infrastructure plan. Creamer Media's Engineering News, October 2008. [ Links ]

Contact details:

Contact details:

Strategic Innovation Manager CSIR Built Environment Unit

PO Box 295

Pretoria 0001 South Africa

T: +27 (0)12 841 2927 F: +27 (0)12 842 7100

E: crust@csir.co.za

Contact details:

Senior Researcher CSIR Built Environment Unit

PO Box 295 Pretoria 0001 South Africa

T: +27 (0)12 841 3045 F: +27 (0)12 842 7100

E: rkoen@csir.co.za

| CHRIS RUST holds a PhD in Civil Engineering from the University of the Witwatersrand and is currently the Strategic Innovation Manager at the CSIR Built Environment Unit. He is a registered professional civil engineer and has 25 years' experience in research in infrastructurerelated topics. His fi elds of expertise include pavement engineering, pavement materials, strategic planning and strategic research management. |

| RENÉE KOEN holds a BSc Hons degree in mathematical statistics and an MSc degree in Operations Research. She is a member of the Operations Research Society of South Africa and currently works as senior researcher at the CSIR Built Environment Unit. Areas of specialisation include statistics (specifi cally data collection and analysis) and operations research (including problem formulation, data modelling and multi-criteria decision analysis). |