Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Agricultural Extension

On-line version ISSN 2413-3221

Print version ISSN 0301-603X

S Afr. Jnl. Agric. Ext. vol.51 n.3 Pretoria 2023

http://dx.doi.org/10.17159/2413-3221/2023/v51n3a14539

ARTICLES

Smallholder Maize Farmer's Willingness to Join Index Insurance in Vhembe District: Limpopo Province

Mukwevho H.I; Luvhengo U.II; Letsoalo S.S.III; Lekunze J.N.IV

IPhD Student at North-West University School of Agricultural Sciences, South Africa. P/Bag X2046 Mmabatho 2745; E-mail: hulimukwevho230@gmail.com

IILecturer at North-West University School of Agricultural Sciences, South Africa. P/Bag X2046 Mmabatho 2745; E-mail: luvhengousapfa@gmail.com

IIIProfessor at North-West University School of Agricultural Sciences, South Africa. P/Bag X2046 Mmabatho 2745; E-mail: simon.letsoalo@nwu.ac.za

IVResearch Manager at North-West University Business School, South Africa. P/Bag X2046 Mmabatho 2745; E-mail: nembolekunze1234@gmail.com

ABSTRACT

Only a negligible proportion of smallholder farmers in South Africa have crop insurance to mitigate production risks. This article analyses the demand for index-based crop insurance by smallholder farmers in the Vhembe district of Limpopo Province in South Africa based on their willingness to join a proposed insurance product. Questionnaires were used to collect once-off data from smallholder farmers. The contingent valuation method was used to analyse the willingness to buy a crop insurance product. Analysis revealed that 86% of the farmers were willing to purchase index-based crop insurance. Further analysis using the Probit regression model found that age, farm size, and risk management strategies such as government assistance and crop diversification influenced smallholder farmers' willingness to join the proposed crop insurance products. This study has shown that smallholder crop farmers' willingness to join crop insurance is high in the Vhembe district. The study recommends awareness and education concerning crop insurance purchases for smallholder farmers.

Keywords: Index-Insurance, Smallholder Farmers, Vhembe District, Willingness to Join.

1. INTRODUCTION

Crop production is vulnerable to different risks, such as weather, pests, diseases, and theft (Lyu & Barre, 2015). The unpredictability of weather, pest outbreaks, and theft have been maize farmers' main challenges. Exposure of maize production to various environmental risks necessitates agricultural insurance for the farmers to enable continuous production even after a loss (Kpodo, 2017). Insurance as a risk management tool is commonly used by other lines of insurance business, such as property and life, but not so much in the agricultural sector, specifically for smallholder farmers (Jepchumba, 2015). Demand for crop insurance by smallholder farmers is still deficient in South Africa, with only a negligible number of smallholder farmers participating in agricultural insurance, especially in rural areas (Partridge & Wagner, 2016). The crop insurance demand gap must be filled as insurance is an essential financial tool for risk management strategy (Fonta et al., 2018). The insurance market for smallholder farmers is not well established, and most farmers lack knowledge and understanding concerning insurance (Partridge & Wagner, 2016). Smallholder farmers generally have inadequate resources, meaning that if a loss occurs, resulting in a poor harvest, the smallholder farmers will suffer a loss of income and might not be able to continue farming.

Vhembe district municipality is dominated by rural areas where smallholder crop farmers do not have access to affordable insurance that is simple and easy to understand, making them the target market for emerging index insurance. Smallholder farmers are the most vulnerable as they are defined by FAO (2012), stating that smallholder farmers are agricultural producers that own a small-based plot of land onto which they produce for subsistence purposes with a portion to sell while mainly relying on family labour and less expensive technology. According to Masara and Dube (2017), farmers have adopted several risk mitigation strategies, such as crop diversification, crop rotation, and mixed farming. Although the strategies farmers apply are helpful, they are not enough to sustain their productivity, especially during unforeseen circumstances and uncalculated risk events. Thus, crop insurance is one of the solutions used by most large-scale commercial farmers to manage production risk in many countries. (Daninga & Qiao, 2014). Crop insurance is a financial instrument that transfers the crop production risk of loss from the farmers to the insurers for a specified premium (Iturrioz, 2009). In this way, it stabilises the farmer's financial status by offering protection against the impacts of crop failure and increasing the chances of farmers obtaining loans (Masara & Dube, 2017).

Worldwide, different types of crop insurance can be used as risk management tools, such as multi-peril crop insurance, named peril crop insurance, and index-based crop insurance (Iturrioz, 2009). According to Ntukamazina et al. (2017), index-based crop insurance is linked to indices, which can either be weather or average yield rather than focusing on the actual yield of an individual farmer. Index insurance solution solves most problems that limit traditional insurance application in rural areas. The main difference between traditional insurance and index insurance is that traditional insurance indemnifies the farmer's claims based on the actual loss on the farm, which requires loss assessment. In contrast, index insurance covers shared risks amongst farmers with similar traits. Index insurance uses a proxy and sets up a threshold as a trigger for a payout; therefore, it does not require loss assessment (Burke, Janvry & Quintero, 2010). The key advantage of index-based insurance for smallholders is that insurance costs are lower than traditional solutions and, therefore, affordable to smallholders (Barnett & Mahul, 2007). The advantages of index insurance on the insurer's side are that no intense loss assessment is required, a simpler distribution channel, and lower adverse selection (Mapfumo, Groenendaal & Dugger, 2017). Index-based crop insurance avoids moral hazards such as perverse incentives where farmers would prefer their crops to fail to receive a payout.

One of the challenges in developing countries is that the information about the demand for the agricultural insurance market in rural areas is limited (Tlholoe, 2015). In South Africa, the demand for crop insurance is mainly related to commercial farmers, and only a negligible number of smallholder farmers take insurance as a risk management tool (Masara & Dube, 2017). There is still very little experimental focus in the literature about the demand side of insurance products; therefore, more attention is required (Daninga & Qiao, 2014). The knowledge gap about factors influencing farmers' interest in insurance participation still exists, and this study seeks to identify the main factors that influence farmers' willingness to participate in index-based crop insurance.

2. RESEARCH METHODOLOGY

2.1. Study Area

Vhembe district municipality is the selected study area, and it is one of the five district municipalities in Limpopo province with the highest number of households, amounting to over 300 000 (Ofoegbu, 2016). Limpopo is located in the northern part of South Africa. Vhembe comprises four local municipalities: Makhado, Musina, Thulamela and Collins Chabane. The mean annual rainfall is about 820mm, of which rainy seasons begin in October and end in the February/March months (Mpandeli, 2014).

The study area was selected because maize production in Limpopo has recently suffered production losses, which are reflected by the decline in the maize production statistics (DAFF, 2018). The fall armyworm outbreak in Limpopo, specifically in the Vhembe district, has also resulted in maize production losses; therefore, this area requires attention. In addition, the assumption that rural communities have little or no agricultural insurance as a risk mitigation tool strategy contributed to the choice of the study area (Tlholoe, 2015). Smallholder farmers in developing countries such as South Africa face limited access to financial services and adequate risk management products (Makaudze, 2012).

2.2. Sampling Procedures and Data Collection

For this paper, primary data was used. The stratification of farmers was applied. According to the municipalities in the district, the smallholder farmers were stratified as this was already a natural division and simple random sampling was used to obtain the number of smallholder farmers required from each municipality. Data were collected in all four municipalities of the Vhembe district, namely Makhado, Mutale, Musina, and Thulamela (following the old district structure due to data availability). According to the data available, there were about 60,478 agricultural households involved in crop production activity (excluding vegetable farmers) in the district and in terms of the proportion, 55% were based in Thulamela, 37% in Makhado, 8% in Mutale and only 1% in Musina (Stats SA, 2011).

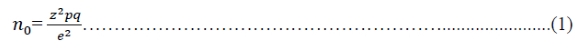

Cochran's formula was used to calculate the ideal sample size of the smallholder farmers used in all four municipalities. The sample size was determined to be 173 smallholder maize farmers using Equation 1 below.

Where no is the sample size, p is the estimated proportion of the population that comprises the attributes that are in question, q is equal to 1- p, e is the desired level of precision (margin of error), and z is the value found on the Z table according to the desired confidence interval. The sample size was obtained considering a 90% confidence interval, a 5% margin of error, and a 20% estimated proportion of the population comprising the attributes in question.

Data was collected using a structured questionnaire and an in-depth interview with smallholder crop farmers in the study area.

2.3. Data Analysis

Descriptive statistics were used as percentages, tables, t-tests, and frequency distributions to analyse the data. Statistical packages such as SPSS and STATA were used for data entries.

From the willingness to join (WTJ) questions, percentages and numbers of smallholder farmers interested in participating in index insurance and those not interested are presented. It is also essential to analyse and understand the factors affecting the willingness to participate in the presented insurance product.

A Probit model was used to determine the factors influencing the decision of smallholder farmers to join in the participation of the index insurance product. Probit models are discrete choice models derived from utility theory (Jeyakrishnam & Umashnkar, 2015). The utility function assumes that farmers will always maximise their utility (Balana, Catacutan & Makela, 2013).

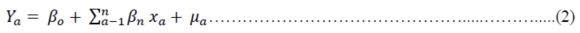

This model was chosen based on the ability to take two dependent variables: the willingness and unwillingness of smallholder farmers to participate in the index-based crop insurance product. Trang (2013) used the same model to analyse the willingness to join the Area Yield Index for Rice farmers in Vietnam with the following general Probit model.

The general Probit model is equation (2) below:

Ya = The dependent variable, in this case, is the willingness or unwillingness to join in the participation of the index insurance product.

Ya = 1, if the farmers respond that they are willing to join in the participation of the index insurance product.

Ya = 0, if the farmers respond that they are not willing to participate in index insurance products.

βo = intercept

βn = the coefficients that explain the probability of farmers' willingness

μa = the error term

xa = The independent variable that is selected based on a literature review.

3. RESULTS AND DISCUSSION

The results in Table 1 indicate that most farmers in the area of interest are females. According to Mbonane (2018), most farmers are females, as the males typically migrate for employment to urban areas.

Age is important in understanding the farmer's perceptions, awareness, and understanding of farming, risks, and solutions. According to Mbonane (2018), older farmers have better farming experience and knowledge, whereas younger farmers are known to better understand innovative solutions. This study's finding revealed that most farmers in the study area are older, averaging 54 years.

Education is also important as it forms part of the characteristics that improve rural household competitiveness through farm income generation and knowledge (Tlholoe, 2015). The level of education may also influence farmers' perceptions, understanding, and awareness of risks and insurance, influencing the demand for insurance. As Tafese (2016) indicated, a higher education level allows for adopting better farming systems and quickly absorbing new and innovative information. The farmer may further understand farm management and agricultural marketing principles better. Most of the interviewed farmers did not have tertiary education, as shown in Table 1.

The study's results revealed that the average household size is six members in the study area. Larger household size is generally linked to higher consumption expenses, which may affect their affordability for additional expenses and further impact the demand for insurance and the risk management strategies used. However, a household with a larger size may also be more motivated to invest in their production through better risk management strategies or demand insurance to protect household livelihood since there are more dependents (Tlholoe, 2015).

Income is a fundamental factor determining affordability in adopting better, innovative risk management solutions such as crop insurance. Income, therefore, may influence farmers' demand for crop insurance regardless of whether they see it as an important tool, but mainly influenced by affordability (Ellis, 2016). Table 1 shows that most farmers receive less income to manage their household needs.

Most farmers indicated that their farm size is less than 5 hectares, and only 2.3% of farmers had more than 5 hectares. Most of the farmers were farming on schemes that mainly were divided equally among the farmers. According to the FAO (2012), smallholder farmers normally own small plots of land onto which they produce for subsistence purposes and a portion to sell.

More than seventy percent (70.5%) of the farmers who participated in the survey had more than 15 years of farming experience. This may imply that the experienced farmers, who are the majority, understand their risks better and may be more confident in their risk management strategies. On the contrary, experienced farmers may also be open to crop insurance based on their loss experience and understanding that production risks have increased over the years due to climate change and are becoming more challenging to manage (Khan, Chander & Bardhan, 2012).

Most farmers indicated good quality seed as the most used risk management strategy, followed by fertilisation. None of the farmers made use of insurance. Savings was also the least used strategy of the seven mentioned above after insurance.

It is important to understand the farmers' knowledge or familiarity with crop insurance as it may influence how they demand crop insurance products. Awareness has proven to be one of the main barriers to insurance (Swiss Re, 2017). The observation from Table 1 is that only 35.8% of the farmers were aware of crop insurance. Most of the farmers understood what insurance was concerning other types of insurance such as car and life insurance. Still, they had no idea that crop insurance could also be used as a risk management tool to protect crops in case of losses.

4. EMPIRICAL RESULTS

4.1. Factors Affecting Farmers' Willingness to Join

4.1.1. Farmer 's Interest in Joining Index-Based Crop Insurance

After the index products were thoroughly explained to the farmers, they were asked if they would be interested in participating in the index-based crop insurance product without attaching any price or premium rate to the question. The results for willingness to join are summarised in Figure 1. The chart indicates that most farmers were willing to participate in the proposed insurance product. These results are similar to those of Trang (2013), who found that most farmers were willing to join the insurance scheme in three different districts as they mainly wanted to protect themselves from unexpected disasters.

When asked why the farmers were not interested in joining and participating in the index-based crop insurance, farmers were presented with five different reasons to choose from: not at risk, don't trust insurance, insurance is expensive, insurance is not necessary and others. This question was only directed to farmers unwilling to join (not interested) in participating in the presented insurance product. Seventy-point-eight percent (70.8%) of the farmers mentioned that they were not interested in index crop insurance because they do not trust insurance, as shown in Table 2. Farmers did not trust that insurance was for their benefit, while the rest thought that insurance was expensive.

A Probit model was applied to analyse the factors influencing the willingness to join. Table 3 presents the Probit model's results on different explanatory variables. The statistical results showed that the model was significant at 5% through a chi-square value, and the pseudo also measures the goodness of fit R2 value of 0.19, which indicates that 19% of the farmers' decision to join in the index-based crop insurance variation participation was properly explained by the explanatory variables used. The smallest variable factor is used as the baseline factor by default.

The only variables that showed statistical significance are age at 10%, farm size at 1%, and the two risk management strategies applied, crop diversification and government assistance and both significant at 1% and 5%, respectively. This means that the above-mentioned important variables do influence the willingness of farmers to join index-based crop insurance. Table 3 shows the explanatory variables' coefficients and their significance level. The significant variables in this study are different from those of a study by Masara and Dube (2017), except for age. Masara and Dube (2017) found that some significant variables were age, income, and years in farming.

4.2. Significant Factors

Age negatively influences farmers' decisions on their willingness to participate in index insurance or their interest in the product thereof. The negative influence indicates that older farmers are less likely to join index insurance than younger farmers. These results agree with the expected results, which was that older farmers might not prefer crop insurance due to their level of insurance understanding, according to Tlholoe (2015). However, this influence is contrary to the study done by Masara and Dube (2017), which indicated that older farmers are more likely to take up insurance compared to younger farmers.

The size of the farm positively influences the willingness to join in the participation of index-based crop insurance, meaning that farmers with larger farm sizes are more likely to join in the participation of index crop insurance compared to the farmers with smaller farm sizes. These results corroborate the expected results, which were that farmers with larger farm sizes might be more willing to join insurance to protect their production as they have more to lose than those with smaller farm sizes. Ellis (2016) argued that farmers with larger farm sizes are more likely to join and pay for insurance as they may have enough income and may need to ensure productivity on their large farms.

4.3. Risk Management Strategies Applied

The use of crop diversity is at a significant level. It negatively influences farmers' decision to join index insurance, meaning that farmers who apply crop diversification to their farming are less likely to join index insurance. The results could mean crop diversification as a strategy may be enough to protect the farmers on its own; hence, the farmers do not feel the need for insurance. These results are aligned with Falco, Adinolfi, Bozzola and Capitanio's (2014) study that identified crop diversification as a substitute for crop insurance in Ethiopia.

Government assistance as a risk management strategy negatively influences the farmers' willingness to join index-based crop insurance significantly. The negative influence indicates that farmers who receive assistance from the government to manage their risks are less likely to join index insurance. The results are what was expected, as the assumption is that farmers who already receive government assistance may use this strategy to substitute the need for insurance as they will depend on government assistance as a solution to manage their risks.

5. CONCLUSION AND RECOMMENDATIONS

5.1. Conclusion

Crop insurance's use as a risk management tool by the smallholder maize farmers in the Vhembe district is non-existent. Farmers are not exposed to enough information about crop insurance as there is little awareness of this type of insurance. Farmers were interested and willing to join the index-based crop insurance product if it was to be provided to them.

The main factor influencing the willingness to join is farm size, a positive influence, and this shows that farmers with larger farm sizes tend to prioritise their produce as they have invested much. The willingness to join was also strongly influenced by the risk management strategies that the farmers apply, and this is an indication that if the farmers find their risk management strategies to be effective, they will be less willing to participate in insurance. Younger farmers were more open to taking crop insurance. The farmers who were unwilling to join the insurance product indicated that they thought insurance was expensive. In contrast, others simply did not trust that insurance is for their benefit, which implies that insurance trust is also an important aspect of the willingness to join index-based crop insurance.

5.2. Recommendations

Insurance providers should prioritise increasing crop insurance awareness and education for smallholder farmers. Insurance regulators should also consider inclusive insurance policies to accommodate the smallholder farmers in rural areas with smaller farm sizes and lower income through index-based crop insurance as the demand exists.

Insurers, regulators, and the government should strive to defuse farmers' false perception of insurance, believing that insurance is untrustworthy and only expensive. Policymakers need to ensure that there are insurance support policies for smallholder farmers, and the insurance regulations should ensure that the farmers are protected as insurance customers and that the index-based crop insurance product is fairly developed to meet the farmers' needs.

REFERENCES

BALANA, B.B., CATACUTAN, D. & MÄKELÄ, M., 2013. Assessing the willingness to pay for reliable domestic water supply via Catchment Management: Results from a contingent valuation survey in Nairobi City, Kenya. J. Environ. Plan. Manag., 56(10): 1511-1531. [ Links ]

BARNETT, B.J. & MAHUL, O., 2007. Weather index insurance for agriculture and rural areas in lower-income countries. Am. J. Agric. Econ., 89(5): 1241-1247. [ Links ]

BURKE, M., JANVRY, A.D. & QUINTERO, J., 2010. Providing index-based agricultural insurance to smallholders: Recent progress and future promise. California: CEGA, University of California at Berkeley. [ Links ]

DEPARTMENT OF AGRICULTURE, FORESTRY AND FISHERIES (DAFF)., 2018. Abstract of Agricultural Statistics 2018. Pretoria: Department of Agriculture, Forestry and Fisheries. [ Links ]

DANINGA, P.D. & QIAO, Z., 2014. Factors influencing holding of drought insurance contracts by smallholder farmers in Bunda. IJDES., 2(5): 16-30. [ Links ]

ELLIS, E. 2016. Farmers willingness to pay for crop insurance: Evidence from Eastern Ghana. Masters Thesis, McGill University. [ Links ]

FALCO, S.D., ADINOLFI, F., BOZZOLA, M. & CAPITANIO, F., 2014. Crop insurance as a strategy for adapting to climate change. Am. J. Agric. Econ., 65(2): 485-504. [ Links ]

FOOD AND AGRICULTURE ORGANIZATION (FAO)., 2012. Smallholder and family farmers. Rome: Food and Agriculture Organization. [ Links ]

FONTA, W.M., SANFO, S., KEDIR, A.M. & THIAM, D.R., 2018. Estimating farmers' willingness to pay for weather index-based crop insurance uptake in West Africa: Insight from a pilot initiative in Southwestern Burkina Faso. Agric. Food Econ., 6(11): 1-20. [ Links ]

ITURRIOZ, R., 2009. Agricultural insurance. Washington, DC: The World Bank. [ Links ]

JEPCHUMBA, A., 2015. The influence of agricultural insurance as a risk management tool on large-scale Maize farmers ' performance in Kesses subcounty, Uasin Gishu county, Kenya. Nairobi: Department of Business Administration, University of Nairobi. [ Links ]

JEYAKRISHNAM, V. & UMASHNKAR, K., 2015. factors affecting consumers' willingness to join (WTJ) and willingness to pay (WTP) for rain water harvesting system (RWHS) for household needs: A case study in the northern part of Sri Lanka. Trop. Agric. Res., 27(1): 75-87. [ Links ]

KHAN, M.A., CHANDER, M. & BARDHAN, D., 2012. Willingness to pay for cattle and buffalo insurance: An analysis of dairy farmers in Central India. Trop Anim Health Prod., 45(1): 461-468. [ Links ]

KPODO, H.S., 2017. Drought Index Insurance and the Risk Behavior of Smallholder Maize Crop Farmers in the Northern Region of Ghana. Trondheim: Department of Geography, Norwegian University of Science and Technology. [ Links ]

LYU, K. & BARRE, T., 2015. Crop insurance program purchase decision and role of risk aversion: Evidence from maize production areas in China. Milan Italy, Institute of Agricultural Economics and Development, Chinese Academy of Agricultural Sciences. [ Links ]

MAKAUDZE, E., 2012. Weather Index Insurance for smallholder farmers in Africa - Lessons learnt and goals for the future. Stellenbosch: Sun Media Stellenbosch. [ Links ]

MAPFUMO, S., GROENENDAAL, H. & DUGGER, C., 2017. Risk modelling for appraising named peril index insurance products. Washington, DC: The World Bank. [ Links ]

MASARA, C. & DUBE, L., 2017. Socio-economic factors influencing uptake of agriculture insurance by smallholder maize farmers in Goromonzi district of Zimbabwe. J. Agric. Econ. Rural. Dev., 3(1): 160-166. [ Links ]

MBONANE, N.D. 2018. An analysis of farmers' preferences for crop insurance: a case of maize farmers in Swaziland, Pretoria: Department of Agricultural Economics, Extension and Rural Development, University of Pretoria. [ Links ]

MPANDELI, S., 2014. Managing climate change risks using seasonal climate forecast information in Vhembe district. J. Sustain. Dev., 7(5): 1913-9071. [ Links ]

NTUKAMAZINA, N., ONWONGA, R.N., SOMMER, R., RUBYOGO, J.C., MUKANKUSI, C.M., MBURU, J. & KARIUKI, R., 2017. Index-based agricultural insurance products: Challenges, opportunities, and prospects for uptake in sub-Saharan Africa. JARTS., 118(2): 171-185. [ Links ]

OFOEGBU, C., 2016. Perception-based analysis of climate change effects on forest-based livelihood: the case of Vhembe district South Africa. Jamba- Journal Of Disaster Risk Studies., 8(1): 1984-1997. [ Links ]

PARTRIDGE, A.G. & WAGNER, N.J., 2016. Risky business: Agricultural insurance in the face of climate change. Elsenburg Journal., 13(3): 49-53. [ Links ]

STATS SA., 2011. Statistics by placeLocal municipality. Available from http://www.statssa.gov.za/?page_id=993&id=thulamela-municipality [ Links ]

SWISS, R.E., 2017. Insurance: adding value to development in emerging markets, Sigma no 4, Zurich: Swiss Re Management. [ Links ]

TAFESE, S.M., 2016. Willingness to pay for tomato insurance: The case study of Moambadistrict, Mozambique. Maputo: Department of Agricultural Economics, and Agricultural Development, Eduardo Mondlane University. [ Links ]

TLHOLOE, M.M., 2015. Smallholder livestock farmers' willingness to buy index-based insurance in South Africa: Evidence from Ngaka Modiri Molema District Municipality, Northwest province. Department of Agricultural Economics, Northwest University. [ Links ]

TRANG, N.M., 2013. Willingness to pay for area yield index insurance of farmers in Mekong Delta, Vietnam. Wageningen City: Wageningen University and Research Centre. [ Links ]

Correspondence:

Correspondence:

H. Mukwevho

Email: hulimukwevho230@gmail.com