Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Agricultural Extension

versão On-line ISSN 2413-3221

versão impressa ISSN 0301-603X

S Afr. Jnl. Agric. Ext. vol.39 no.1 Pretoria Jan. 2011

Farmer support and extension to land reform farms in the Central Karoo - part 2: a baseline assessment of farm-level economic viability

J. W. JordaanI; H. J. F. GroblerII

IDepartment of Agricultural Management, Nelson Mandela Metropolitan University, Saasveld Campus, George. Tel. 044-8015111. E-mail: johan.jordaan@nmmu.ac.za

IIFSD, Extension and Advisory Services, Central Karoo, Western Cape Department of Agriculture, Beaufort-West. Tel. 044-8732736. E-mail: manieg@elsenburg.com

ABSTRACT

A study was undertaken on land reform farms acquired over the past ten years in the Central Karoo district of the Western Cape in South Africa. On-farm personal interviews with the managing members/decision makers of 15 farms were conducted in 2008 in order to establish a baseline measurement of the infrastructural, production and economic viability at farm level. This paper focuses on the economic viability of farms and some implications for extension support. Data from individual enterprises were analysed at the gross margin level and the full farm at net farm income level in order to assess farm efficiency and return on investment. Baseline evidence suggests lower than expected returns. Amongst the main findings reported in the paper is the fact that farms in general are too small to provide a sustainable income, given the resource potential and number of owners/beneficiaries per farm. Stock losses due to problem-animals, together with low reproduction performance and drought related mortalities negatively influenced the capacity to generate sufficient returns. In addition, farm management knowledge, skills and experience are at low levels. Baseline evidence suggests that agricultural extension services and institutions involved in land reform policies need to upscale on farm economics and viability assessments of farm operations. Management information systems need to be established and maintained to record physical and financial information in order to assist emerging farmers with agricultural economics extension.

Keywords: baseline study; land reform; economic viability; extension.

1. INTRODUCTION

After 15 years of democracy in South Africa the impact of the government's land reform policies are increasingly being questioned across the political and social spectrum (Kirsten and Machete, 2005; Anseeuw and Mathebula, 2008; Lahiff, 2008). Available statistics on land reform achievements mostly report on the number of hectares redistributed from white to black owners, but little empirical data is available on the impact in terms of livelihood effects and agricultural productivity (Turner, 2001; Hall, 2007; Lahiff, 2008). Even though the sustainable livelihoods framework is widely used internationally for planning and evaluation purposes, Hall (2007) states that impact evaluation is often hampered by the absence of baseline data and longitudinal studies. In the context of agricultural extension Düvel (2007) confirms the importance of baseline information as a requirement for monitoring and evaluation in extension delivery. He continues to state the importance of economic efficiency criteria as some of the most important and meaningful baseline indicators to be used in monitoring and evaluation.

This paper reports baseline data from an economic viability assessment of 15 "land reform" farms in the Central Karoo. The purpose of the viability assessment was to provide data for extension program planning, monitoring and evaluation. The paper starts with a brief background of the farms in terms of farm size, grazing capacity and livestock enterprises (this is discussed in more detail in Jordaan & Grobler (2011)). The capital investment is analysed next, followed by an assessment of the economic viability of farms. The economic viability of individual livestock enterprises are done first by assessing gross margins, followed by an assessment of the farm operation's net farm income, farm profit, solvency, farm efficiency and return on investment. The paper concludes with a brief account of the financial management practices on farms and some implications for extension delivery.

2. METHODOLOGY

a. Data collection

A questionnaire was administered to each of the farms which have been established through the Settlement Land and Acquisition Grant Scheme (SLAG) and the Land Redistribution for Agricultural Development (LRAD) programmes of the Department of Land Affairs. The first farm for land redistribution in the Central Karoo was acquired in 1999; with a further seven farms over the period 2002 to 2005. Another four farms were acquired since 2007. Three of the farms are so-called Agrarian farms which have been in possession of the families for more than a generation. All LRAD and SLAG farms (n=12) and Agrarian farms (n=3) were surveyed. Data was collected by way of on-farm personal interviews with the group of managing members/decision makers of each farm. Data on capital investment, production, sales and farm management knowledge and practices of each farm was collected.

b. Data analysis

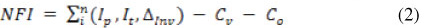

Data from the different individual enterprises on each farm were first analysed at the gross margin (GM) level. Gross margin is the value of the output of an individual enterprise (gross value of production), less the variable costs directly attributable to generating the value (Boehlje and Eidman, 1984). For a livestock enterprise, the gross value of production (GVP) consists of product income (value of products produced), trading income (value of livestock sales plus on-farm consumption minus value of livestock purchases) and the change in inventory (increase or decrease in the value of the herd). The general gross margin relationship can be stated as:

Where GM is gross margin,  is product income,

is product income,  . is trading income,

. is trading income,  is the change in inventory value and Cv is variable costs directly allocatable to the enterprise.

is the change in inventory value and Cv is variable costs directly allocatable to the enterprise.

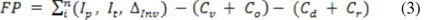

An aggregate total farm analysis for each farm was done at the levels of net farm income (NFI) and farm profit (FP). Net farm income is the total gross margin of all enterprises combined less overhead costs (Co). The NFI represents the total returns to all assets employed in the production process (Barry, Ellinger, Hopkin and Baker, 1996). The general net farm income relationship can be stated as:

Farm profit is net farm income less the cost of foreign production factors and represents the returns to equity investment (Standard Bank, 2005). The general farm profit relationship can be stated as:

Where Cd is the cost of debt (interest) and Cr is the cost of hired assets (rent).

The baseline financial position of farms were further analysed in terms of solvency, farm efficiency and return on investment.

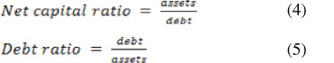

For solvency, the following ratios were analysed:

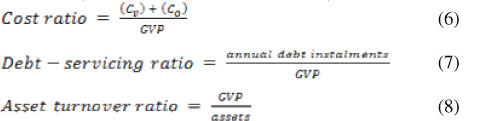

For farm efficiency, the following ratios were analysed:

For return on investment, the following ratio was analysed:

Analyses were conducted for each farm separately for the 2007/2008 year to serve as baseline for future monitoring and evaluation. Results were distributed to the relevant farms and subsequently discussed with each farm's management group separately. The performance outcomes are presented in terms of averages for the group of 15 farms collectively, with an indication of minimum and maximum performance of individual farms where applicable to show variation within the group.

3. BACKGROUND OF FARMS

Farms range in size from 846 ha to 6033 ha, with the average size 2684 ha. More than 60 % of the farms are 3000 hectares or less, which seems to be small compared to the typical commercial farm (> 5000 ha) in the region (Grobler, 2009). The carrying capacity of the veld ranges from 24 ha/LSU to 42 ha/LSU and the current stocking rate was found to be 46.92 ha/LSU on average. This underutilisation is mainly due to the fact that more than one third of the farms have being transferred to the new owners only two years prior to the study and were still in a stock build-up phase. The main enterprises are Dorper sheep Merinos, Afrino/crossbreds, and Angora goats, which are typical for the region (Geyer, 2007). The majority of farms are organised in community property trusts with an average number of 23 beneficiaries per trust group (min = 2; max = 69). This relates to an average farm size of 115 hectares per beneficiary.

4. RESULTS AND DISCUSSION

a. Capital investment

The capital investment per main asset class category is depicted in Table 1. All assets were valued at current market value. The current baseline market value of developed farmland was taken at R1000/ha. Fixed improvements were valued at current replacement value minus accumulated depreciation (buildings depreciated over 50 years for 25 years; stock watering over 20 years for 10 years; fencing over 30 years for 15 years). The average capital investment per farm amounts to R3.05 million, which is equivalent to an investment of R1 137/ha. Of this investment 88% consist of fixed capital, confirming one of the structural characteristics of agriculture, namely that most of the capital investment needed to start farming is tied up in the form of sunken capital (invested capital not available for operational purposes).

The proportion of average directly-productive capital investment (land and livestock) amounts to 79 %. Usually, the higher this figure, the more favourable it is. In farms where carrying capacity or stocking rates are low, or poor quality/low value animals are kept, the directly-productive capital will tend to be relatively low. Similarly, when a proportionately higher capital investment in non-directly productive capital such as fixed improvements and machinery is found will the directly productive capital be lower.

The average total capital investment per trust member amounts to R130 821. Substantial infrastructure investments have been made by the government through post-settlement support via CASP funding. (The extent of these investments was not quantified in this study).

The debt registered against capital investment range between R43 000 and R570 000 for those farms with debt, with the average amounting to R237 000 per farm. Five farms, of which three Agrarian farms and two others who have applied for loans, have currently no debt registered. The average cost of debt (interest) amounts to R17 923 per farm (R7/ha or R46/SSU) at an estimated interest rate of 11.84 %. The full annual instalment (interest plus capital redemption) per farm currently amounts to R22 047 on average.

A total of 40 267 ha with a total capital investment value of more than R45 million were transferred to 350 beneficiaries over a period of less than 10 years. This is equivalent to a capital investment of R130 821 per beneficiary of which R124 049 represents equity. On a macro level, the metrics of land reform programmes in the Central Karoo seem impressive. However, a more appropriate baseline measurement is needed on the micro level: what is the capacity to generate a return on these investments - a return sufficient for paying debts, sustaining a livelihood and further growing the income generating capacity of the business? An assessment of the economic viability of farms is presented next.

b. Economic viability of farms

a) Returns from livestock enterprises

The economic viability of the main enterprises is given in Table 2. Since all farms reported exceptionally dry conditions for the two seasons prior to the baseline study, results need to be interpreted in that context. Some farms received drought assistance from the government in the form of feed for livestock. For that reason two sets of profitability figures are reported: profitability excluding drought feeding cost and profitability including drought feeding cost.

1. Dorper sheep enterprise

The average gross value of production (GVP) per small stock unit amounts to R54.86, with direct costs R76.24 and a resultant gross margin of -R21.38/SSU. Included in the direct cost is drought feeding to the amount of R65.62. Assuming drought feeding can be excluded from the calculation when more normal conditions would prevail, direct costs amount to R10.96/SSU, resulting in a positive gross margin of R44.23/SSU. It is important to note that gross value of production does not represent cash income, but rather the total value that is produced within a production year.

The trading income for the Dorper enterprise is negative (-R20/SSU), indicating that animal sales are lower than purchases. Most of the herds are in a build-up phase, hence the effect on purchases. This can also be seen from the positive capital income (increase in herd value) of R74.86/SSU. Although reliable records are not available, the main reasons given for low sales include low reproduction and losses due to problem animals and drought related mortalities. A low lamb marketing percentage (number of lambs sold per number of ewes mated) ranging between 9.5% and 56.7% is indicative of the above.

It seems that the major area for improvement in Dorper sheep enterprises is to increase the gross value of production rather than to save on costs.

2. Afrino - and Afrino crossbred sheep

The average GVP/SSU for Afrino and Afrino crossbreds amounts to R106.24, with direct costs R180.04 and a resultant gross margin of -R73.80/SSU. Assuming drought feeding can be excluded from the calculation when more normal conditions would prevail, the gross margin would be R93.35/SSU. It seems however that the major area for improvement is to increase the income (GVP). The product income (wool sales) amounts to R1.66/SSU on average. This low figure is misleading since three of the four farmers have only recently acquired sheep and have not had a wool clip yet. The trading income is negative (-R54.81/SSU), indicating that animal sales are lower than purchases. As with Dorpers, most of the herds are in a build-up phase, hence the effect on trading income. This can also be seen from the positive capital income (increase in herd value) of R159.40.86/SSU. As with Dorper sheep, the main reasons given for low livestock sales include low reproduction and losses due to problem animals and drought related mortalities.

3. Merino sheep

A total of 677 SSU Merino sheep were farmed by one of the farms in a type of share-agreement with a commercial farmer acting as a mentor. The breeding herd was the property of the commercial farmer, but half the lamb crop and wool clip were to be retained by the trust annually in order to derive an income and simultaneously build up an own herd. The average GVP/SSU is R84.95, with direct costs R29.43 and a resultant gross margin of R55.52/SSU. The product income (wool sales) amounts to R106.57/SSU on average. The trading income is R28.34/SSU, indicating a positive, but low sales figure. Contrary to the other farms, this farm is fully stocked and should therefore reflect a stable capital income. This is however not the case as capital income is negative at -R49.96/SSU, indicating a decrease in herd value. As with other farms, the main reasons given include low reproduction and losses due to problem animals and drought related mortalities.

4. Angora goats

A total of 357 SSU Angora goats were farmed by 4 of the farms. The average GVP/SSU amounts to -R41.37, with direct costs R77.19 and a resultant gross margin of -R118.56/SSU. Included in the direct cost is drought feeding to the amount of R49.39/SSU. Assuming drought feeding can be excluded from the calculation when more normal conditions would prevail, the gross margin would be -R69.17/SSU. As for the other enterprises the major area for improvement is also to increase the income (GVP). The product income (mohair sales) amounts to R200.59/SSU on average. The trading income is however negative (-R104.95/SSU), indicating that sales are lower than purchases. As with Dorpers and Afrinos, some of the herds are in a build-up phase, hence the effect on the trading income. Two of the farmers however indicated their intention of phasing out Angora goats in favour of mutton sheep. As with the other three enterprises, the main reasons given for low livestock sales include low reproduction and losses due to problem animals and drought.

Except for Angora goats, all the enterprises show economic viability when drought feeding costs are not taken into account, however much lower than what is possible when compared to existing commercial farmers (Geyer, 2008). What is more important however is to realise that the reported group average performance figures obscure individual farms that are able to generate substantially higher results, evident from the maximum performance as depicted in Table 2.

b) Total farm returns

The profitability of farms is depicted in Table 3. The total gross value of production range between -R48 981 and R88 214 per farm, with 10 of the farms generating a positive gross value of production. The average gross value of production of R23 099 per farm relates to a "gross income" of about R990 earned per beneficiary per year. It is important to note that this is not disposable income as is often being assumed, since production costs still need to be taken into account. With 115 hectares available per beneficiary at a carrying capacity of 33.4 ha/LSU, the average of 21 SSU that can be kept per beneficiary hardly supplies a living income.

This fairly low gross value of production is due to a combination of factors already mentioned in the discussion on enterprise viability. The average direct costs (excluding drought feed), amount to R5 795 per year, with gross margin amounting to R17 305. Six of the farms generated a negative gross margin.

The gross margin should be sufficiently large to cover overhead costs, which in this case clearly is a problem. Overhead costs amount to R65 316 per year. Overheads are usually difficult to calculate without accurate records. For the purposes of this analysis, overhead costs consist of labour costs, estimated fuel costs and estimated depreciation on capital invested in fencing, stock watering, buildings/kraals and vehicles/machinery/equipment. Subtracting overhead costs (excluding interest costs) from the gross margin yields the net farm income, which measures the profitability of the total farm. The net farm income per farm ranges from -R128 828 to R13 143, with the average amounting to -R48 011.

The net farm income of a business should be large enough to pay interest costs. It is evident that the average net farm income is not sufficient to pay the interest of R17 923. Quite a number of farmers indicated an inability to pay annual debt and some have defaulted on payments, presumably due to the drought situation. Only two farms managed to generate a positive NFI in 2007/2008. The one farm is an Agrarian farm with no debt and the other farm sold off all its livestock in 2007/2008 in order to repay loans. Apart from the one farm that sold off all its livestock, none of the land reform farms managed to generate a positive NFI in 2007/2008. The situation is aggravated when drought feeding costs are taken into account: the average gross margin per farm then decreases to -R6 359, the net farm income to -R71 651 and farm profit (loss) to -R90 770.

The Central Karoo farms are in a healthy solvency position. The net capital ratio is 12.88:1, which indicates that for each R1 of debt there is a corresponding asset value of R12.88. The average debt ratio is 5.36 %, which is fairly low in comparison to established commercial farms. The maximum debt ratio amounts to 21.37%, which can be regarded as well below the general rule of thumb of less than 50 % (Standard Bank, 2005). Despite this, the debt servicing ratio is 0.95:1 indicating that for each R1 of annual gross value of production (turnover), there is a commitment of R0.95 in terms of instalments that need to be paid. The total cost ratio is 3.91:1 indicating that for each R1 of gross value of production generated by the average farm, the cost amounts to R3.91.

The asset turnover ratio provides the reason for the unsatisfactory economic performance - the ratio of 0.01: 1 indicates that for each R1 of capital invested in the farm R0.01 (one cent) of production value is generated annually, which is clearly not sustainable in the long run. A low asset turnover can be caused either by a low gross value of production or by an abnormally high investment in unproductive capital. In this case it seems to be an income problem - generating too little gross value of production per unit of investment. In more general terms it indicates low factor productivity, ultimately influencing profitability. This confirms the situation of the negative net farm income discussed earlier and is obviously a matter of concern. The real problem currently seems to be the capacity of the average farm to generate sufficient income with the assets at its disposal. This is evident from the negative return on investment which amounts to - 1.57% annually. A continuation of this trend in future will lead to an erosion of the capital invested in farm operations and a real chance of beneficiaries losing their investment. In the event of a trust member wishing to opt out of the trust, currently no farm would have sufficient funds to pay out such members.

5. FARM FINANCIAL MANAGEMENT, KNOWLEDGE AND PRACTICES

An assessment of financial management practices of managing members revealed that respondents were not able to produce records or readily furnish information of financial performance from records. There were no formal management information systems in place. Most income and cost records are in the form of receipts or invoices handed over to accountants or lawyers for accounting purposes. An assessment of financial management knowledge revealed that of all the farms surveyed, 60% were in a position to sufficiently explain the concept "profit". More than 90% could not explain vaguely what cash flow statements, income statements and balance sheets were, indicating a lack of financial knowledge.

6. SUMMARY AND IMPLICATIONS FOR EXTENSION

On a macro level, land reform programmes in the Central Karoo seem to have contributed to the economic empowerment of people. Progress has been made in land reform in terms of ownership transfer. From a sustainable livelihoods perspective, an increase in natural capital (land and water), physical capital (infrastructure and assets) and financial capital (money and loans) of trust groups were observed. The greater part of the capital investment consist of directly productive capital, allowing the opportunity to generate economic returns.

Farms in general portray a sound solvency position and debt burdens are low. The average farm however experiences difficulty in generating sufficient profits from operations. Gross value of production from enterprises is low, seemingly due to a combination of factors such as low reproduction, stock losses through problem animals and drought related mortalities. This is aggravated in certain instances by the lack of farming knowledge and experience, notably farm financial management knowledge. Direct costs of production are fairly low, while overhead costs seem high. The latter is partly due to fixed costs associated with capital investment in infrastructure. Farms in general seem to be too small to provide a sustainable livelihood on the individual level, given the number of trust beneficiaries and the resource potential of the land. A low asset turnover suggests low factor productivity which influences the debt servicing capacity and ultimately results in a negative return on investment.

From an extension perspective it seems that extension programmes need to upscale on farm economics and viability assessments of farm operations. Management information systems need to be established and maintained to record physical and financial information in order to assist farmers with agricultural economics extension. A focus on improvement of general business management knowledge and skills of farmers, including aspects such as entrepreneurial development, budgeting, record-keeping, financial management and marketing knowledge and skills are needed in addition to technical/scientific knowledge. The implication is that extension professionals need to be sufficiently equipped to deal with extension across such a broad range of disciplines. An integrated and co-ordinated agricultural extension programme, driven by a team of trained and knowledgeable specialists in the fields of animal production, agricultural economics, veld/natural resources and people management, could render the much-needed momentum towards the development of new farmers.

REFERENCES

ANSEEUW, W. & MATHEBULA, N., 2008. Evaluating South Africa's redistributive land reform: policy and pre/post settlement implications. Paper presented at the 2008 Agricultural Economics Association of South Africa. 23 - 26 September 2008. [ Links ]

BARRY, P.J., ELLINGER, P.N., HOPKIN, J.A. & BAKER, C.B., 1995. Financial Management in Agriculture. Danville, Illinois: Interstate Printers. [ Links ]

BOEHLJE, M. D. & EIDMAN, V.R., 1984. Farm Management. New York: Wiley. [ Links ]

DUVEL, G.H., 2007. Monitoring in extension: from principles to practical implementation. South African Journal of Agricultural Extension, 36:78-93. [ Links ]

GEYER, A., 2008. Study group results: 2007-2008. Grootfontein Agricultural Research Centre, National Department of Agriculture, Middelburg, South Africa. [ Links ]

GROBLER, H. J. F., 2009. Baseline survey at extensive farms in the Central Karoo, 2008 - evaluation of small stock production. Agri-Probe (Jan.2009). Western Cape Department of Agriculture, Elsenburg. [ Links ]

HALL, R., 2007. The impact of land restitution and land reform on livelihoods. Cape Town: University of the Western Cape, PLAAS, Research Report 32. [ Links ]

JORDAAN, J.W. & GROBLER, H.J.F., 2011. Farmer support and extension to land reform farms in the Central Karoo - part 1: a baseline survey of farm potential, farmer profiles and farm management knowledge and practices. South African Journal of Agricultural Extension, 39 (1). [ Links ]

KIRSTEN, J. & MACHETE, C., 2005. Appraisal of land reform projects in NorthWest Province. Pretoria: Unpublished report, University of Pretoria. [ Links ]

LAHIFF, E., 2008. Land reform in South Africa: a status report 2008. Cape Town: University of the Western Cape, PLAAS, Research Report 38. [ Links ]

STANDARD BANK, 2005. Finance and Farmers. Johannesburg: Standard Bank of South Africa. [ Links ]

TURNER, S., 2001. Sustainable development: what's land got to do with it? Cape Town: University of the Western Cape, PLAAS, Policy Brief nr. 2. [ Links ]