Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Education

versão On-line ISSN 2076-3433

versão impressa ISSN 0256-0100

S. Afr. j. educ. vol.41 supl.2 Pretoria Dez. 2021

http://dx.doi.org/10.15700/saje.v41ns2a1978

The challenges of implementing the Curriculum and Assessment Policy Statement in accounting

Mantekana J. Letshwene; Elize C. du Plessis

Department of Curriculum and Instructions Studies, School of Teacher Education, University of South Africa, Pretoria, South Africa. dplesec@unisa.ac.za

ABSTRACT

South African schools have experienced several curriculum changes over the past few years. In this article we report on the findings regarding the challenges experienced by heads of department (HODs) with the implementation of the Curriculum and Assessment Policy Statement (CAPS) in accounting. A qualitative approach, modelled on the interpretative perspective, was used to explore these challenges, namely: medium of instruction; time allocated to complete the syllabus; poor subject content foundation; progression of learners; and the integration of economic and management sciences (EMS). Open-ended individual interviews with 12 HODs were used as a data-collection technique. The findings indicate that the time allocated in the annual teaching plan (ATP) for accounting may have a negative impact on effective teaching and learning and learner performance. It has also been noted that EMS teachers are not sufficiently competent to teach financial literacy, which may affect learners' subject choices prior to Grade 10. Grade 8 and 9 learners lack exposure to accounting due to subject integration and learner progression. Furthermore, accounting textbooks do not prepare learners for school-based assessments (SBAs) or examinations. Recommendations include that subject choice should occur in Grade 8, rather than Grade 10, and that a secondary school improvement programme (SSIP) should start from Grade 10, and not Grade 12.

Keywords: CAPS; curriculum; curriculum change; secondary school improvement programme

Introduction and Background

Social change often prompts changes in curricula in order to accommodate new developments (Maimela, 2015). As changes happen around the world, school curricula need to be updated. Such changes pose challenges to curriculum developers and implementers (Tshiredo, 2013) and South Africa has undergone many curriculum changes in the past decades. As a result of the challenges experienced with Curriculum 2005 (C2005) and the National Curriculum Statement (NCS), the CAPS was introduced in 2012 for Grade 10 learners, with the aim to strengthen the NCS, and to clearly specify what should be taught and which topics should be covered, as well as to provide guidelines on assessment (Department of Basic Education [DBE], Republic of South Africa [RSA], 2016).

Working closely with the DBE is the Council for Quality Assurance in General and Further Education and Training (Umalusi), which accredits providers of education and training. The main functions of Umalusi are to set assessment standards for qualifications on the General and Further Education and Training Qualifications Framework, and to ensure that assessment for certification in schools, further education and training colleges, and adult education and training centres is of the required standard. According to Kerry (2014), changes in accounting as subject came about in response to challenges experienced with the NCS. Umalusi, having reviewed the accounting curriculum, noted that the NCS was lacking in terms of skills and competencies, since the emphasis was on calculating and recording, with no mention being made of interpretation and evaluation (Kerry, 2014). Peens (2018) observes that Further Education and Training (FET) accounting teachers lack subject content knowledge.

According to Venter (2016), the challenges of implementing the CAPS in accounting include a lack of content knowledge among subject teachers, learners' lack of previous accounting knowledge, and their lack of commitment. In the experience of one of the authors of this article, Grade 10 learners lack accounting exposure because, in Grades 8 and 9, learners dabble in financial literacy to a limited extent. In some schools, EMS is taught by teachers who are not skilled to teach financial literacy. The aim of our research was to determine which challenges HODs faced with regard to the implementation of the CAPS in accounting.

Factors Hampering Effective Implementation of the CAPS in Accounting

The following factors can be identified as hampering the effective implementation of the CAPS.

Medium of instruction

One of the challenges of the CAPS is language as a barrier to learning (Mbatha, 2016). English is regarded as the medium of instruction in the majority of South African schools: the majority of rural and township schools offer English Home Language, while some of the schools offer English First Additional Language (FAL). The above concern is not taken into consideration, however, when examiners set national question papers for subjects such as accounting. Accounting deals with the analysis and interpretation of financial statements, problem-solving questions, case studies, and the implementation of internal control measures and ethics questions (DBE, RSA, 2011a). For this reason, competency in English is a priority. Msimanga (2017) notes that learners would like the teacher to code-switch to their home language, because they understand EMS better if it is explained in their home language. The language barrier could lead to learners experiencing difficulties in interpreting the examinations. If learners do not understand the concepts, it becomes very difficult for them to record an entry, resulting in poor performance (Sikhombo, 2018).

Lack of competent teachers

Research conducted by Du Plessis and Mbunyuza (2014) revealed that some teachers lacked the knowledge and skills to meet CAPS-related challenges. Workshops do not adequately prepare teachers for the challenges they experience in the classroom - they mainly ensure that teachers understand the policy (Moodley, 2013). Teachers are the main resources in the learning process, and learner performance is determined partly by the qualification and motivation of their teachers (Department for International Development, 2011). The CAPS for accounting introduced calculations where learners need to solve "x", for instance in calculating rent using percentage increases (e.g., for 11 or 13 months), but most teachers were unable to do the calculations and explain them to learners. One of the authors of this article, a tutor in the SSIP, noted this lack of competence on the part of accounting teachers. There is a clear lack of qualified teachers (also EMS teachers) who are competent enough to teach financial literacy. Msimanga (2017) asserts that EMS should be taught by teachers who are competent in all three subjects, namely economics, business studies and accounting, because they lay the foundation for FET.

Time allocated to complete the syllabus

The time allocated for teaching and learning is a factor that influences learners' performance (Reche, Bundi, Riungu & Mbugua, 2012). Teachers cannot spend enough time with slower learners, as they have to rush through the syllabus if they are to complete the content within the prescribed time allocated for each subject (Moodley, 2013). Each subject has an ATP which guides the teacher with regard to the time allocated for each topic. The weekly instructional time for EMS in Grades 7 to 9 is 2 hours (DBE, RSA, 2011a). This subject involves accounting (the development of financial literacy skills), economics (understanding how the economy works) and business studies (the development of entrepreneurial skills of learners in Grades 7, 8 and 9). One hour per week must be used for financial literacy, as stipulated in the ATP (DBE, RSA, 2011a). In our experience, the time allocated for financial literacy is not enough to equip learners with the content knowledge required for Grade 10 accounting. The time allocated for teaching accounting consists of 4 hours per week for Grades 10, 11 and 12 (DBE, RSA, 2011b). It was suggested that budget, cost and value added tax (VAT)-related concepts are removed from the Grade 10 syllabus to allow more time for the analysis and interpretation of financial accounting, and for developing problem-solving and decision-making skills (Kerry, 2014). Even though some concepts have since been removed from the Grade 10 syllabus, it is still congested, given the time allocated. Sikhombo (2018) recommends that the DBE should extend the time allocated per period, especially for Grades 10 and 11, to lay the required foundation.

Poor subject content foundation

If learners do not perform well in the lower grades, it affects their understanding of the subject in the FET phase (Grades 10 to 12) (Gegbe & Sheriff, 2015). Many learners in Grades 10 and 11 drop out or even repeat a year, because they did not acquire the foundational skills in the earlier grades (United Nations [UN], 2013). Grade 8s and 9s are expected to have acquired the necessary accounting content knowledge by Grade 10, but this is not always the case. Notably, the NCS is considered to be a 3-year curriculum covering Grades 10, 11 and 12. The accounting curriculum is a progression from Grade 10 to 12 and, therefore, if a learner did not grasp the content knowledge in Grade 10, it is likely to affect him/her in Grade 12. Poor subject content knowledge may also be attributed to the introduction of a progression policy, which allows learners to move from one grade to the next, irrespective of whether they have acquired the requisite subject content foundation and skills to be able to advance.

Progression of learners

According to the DBE, RSA (2016), legislation pertaining to progression was introduced in the best interests of the learners, and to minimise unnecessary school dropout. That means that every learner has an opportunity to achieve an exit qualification (such as the NSC). However, Mola (2016) argues that learners who are progressed are the ones who are most likely to drop out because they are out of touch with what is happening in the classroom, and do not have the foundational knowledge required to be in that grade. With Grade 12 being a 3-year study programme, if the learners do not understand the Grade 10 and 11 curricula, their chances of passing Grade 12 are slim. A learner may fail accounting in Grades 10 and 11, but, due to the progression policy, is allowed to move on to Grade 12. We believe that such a learner is sure to fail accounting in Grade 12, because of poor subject content knowledge.

Theoretical Framework in the Context of the Accounting Curriculum

This article is founded on the theoretical insights outlined in Tyler's (1949) curriculum development theory, which provides a step-by-step plan for designing a curriculum. This model consists of four steps, namely educational purpose, educational experience, organisation of learning experience and evaluation. Tyler's curriculum development model positions the school curriculum as a tool for improving community life, where the needs and problems of the social environment become the main focus of the curriculum (Maheshwari, 2015). Ward (2015), however, argues that the South African curriculum does not equip learners with the skills they will need to confront the difficulties of life, and that learning materials need to be improved.

Tyler (1949, in Flinders & Thornton, 2013) further states that, in developing any curriculum plan of instruction, a number of questions must be answered, and these are discussed below.

What educational purposes should the school seek to attain?

Before determining the purpose of a school, it is crucial to first determine the educational objectives of the curriculum. These objectives provide guidelines regarding the materials to select; they define the content and indicate how to develop instructional procedures, and prepare tests and examinations (Tyler, 1949, in Flinders & Thornton, 2013). Schools are expected to determine their pass percentage target, and each subject teacher must then determine his/her objectives by setting targets for the subject. The learners must also determine what they hope to achieve with each task. Every term, learners need to complete tasks and tests to determine whether the learning objectives have been achieved.

In accounting, the prescribed content does prepare learners for the world of work, because it has been infused with skills that will enable them to make financial decisions. For example, the Grade 12 syllabus now includes an audit report, which requires learners to identify what kind of report it is, and how it affects a share price on the Johannesburg Stock Exchange (JSE). Learners are also given financial information on three different companies, and are asked to identify which problems each is experiencing, based on the stock levels, whether cash or stock is missing, and whether there are too many product returns. The learners are expected to advise each company on how to improve such situations.

Once the first step of setting objectives has been achieved, the selection and organisation of learning experiences (as the means of achieving the outcomes) begin. We commend the DBE for the accounting Grade 12 curriculum, which provides learners with learning experiences applicable to the world of work.

What educational experiences can be provided that are likely to attain these purposes?

For objectives to be attained, a learner must have learning experiences which encompass interaction between the learner and external conditions in the environment to which s/he responds (Tyler, 1949). Learning experiences are assessed primarily in terms of a teacher's ability to implement the curriculum, and secondly, in terms of learners' ability to learn from the curriculum (Schiro, 2013). To achieve the set targets, the teacher must arrange learning activities that cater for learners with different learning abilities. In the textbooks, accounting activities are arranged from simple to complex, but that complexity does not match what is expected of learners in the SBA and the examination. It seems as if the standard of accounting textbooks is very low, compared to the standard set in the examination. When learners write the SBA or examination, they seem to be completely out of their depth. This leads them to believe that accounting is difficult, and they end up changing subjects.

We have noted that SSIP residential camps (where they take specified groups of Grade 12 learners during school holidays) and walk-in camps (certain schools identified for remaining Grade 12s) are organised to cater for learners' capabilities, which makes it easier for the teacher to work at a specific pace in the classroom. We have noted that the material used for SSIPs seems to be better than what is contained in most accounting textbooks because it prepares the learners for the SBA and the examination. We concur with Ngwenya and Arek-Bawa (2019) that it is imperative for accounting teachers and subject specialists to use two prescribed accounting textbooks to supplement each other as some accounting textbooks are inadequate to enhance learning. Once a learning experience has taken place, the organisation of learning experiences can commence.

How can these educational experiences be effectively organised?

Educational experiences can be effectively organised by evaluating the set objectives. As Tyler (1949) indicates, this is where the teacher instructs the learners to complete an assignment, without receiving any assistance, to test whether they can work independently. If they can successfully complete the work on their own, it means that the objectives have been achieved. External assessment in South Africa happens only once in 12 years, and that is in Grade 12. This is inadequate to prepare learners for the final year. In the Foundation Phase (Grades R to 2) the SBA constitutes 100%; in the Intermediate Phase (Grades 3 to 6) the SBA constitutes 75% and examinations 25%; in the Senior Phase (Grades 7 to 9) the SBA constitutes 60% and the examinations 40%; and in the FET phase (Grades 10 to 12) the SBA constitutes 25% and the examinations 75% of the mark (DBE, RSA, 2011a). It would appear that the SBAs make it easier for learners to meet the promotion requirements. For example, if a learner scored 20 in the SBA, it means that s/he will be working for 20 marks in order to achieve 40%, or 10 marks in order to achieve the 30% promotion requirement. It is our opinion that learners move easily form one grade to another owing to the promotion requirements.

We further believe that SSIPs should be introduced in Grade 10 rather than in Grade 12, as Grade 12 learning already commences in Grade 10. Considering that the CAPS provides a progression pathway from Grades 10 to 12, it is imperative to acquire the content knowledge in Grade 10 in order to excel in Grade 12. For example, the Grade 10 curriculum covers financial statements and financial indicators of a sole trader. In Grade 11, the same topic is applied to partnerships. The Grade 12 curriculum again explores this topic, but in relation to companies. This segment of the work carries approximately 50% of the marks awarded in the final examination, across all grades. If a Grade 10 learner has difficulties grasping financial statements, then s/he will carry over those challenges to Grade 12. These educational experiences have been effectively organised by the DBE to provide learners with the required content knowledge from Grade 10 to 12.

How can we determine whether the set purposes are being attained?

According to Tyler (1949, as cited in Maheshwari, 2015), this question can be answered by matching initial expectations with the outcomes achieved by learners. The school, teachers and learners need to assess whether the set objectives have been achieved. Evaluation encompasses teachers' evaluation of learners, learners' evaluation of teachers, an evaluation of the learning materials, and evaluation by means of tests and examinations (Srivastava, 2013). According to Tyler (1949), evaluation is a process of collecting evidence which requires innovative thinking about ways to demonstrate whether core purposes in the curriculum have been fulfilled.

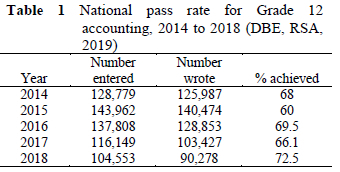

The accounting curriculum includes external assessments, emanating from the district or province. These assessments are only distributed to schools 2 days before the learners complete them. This strategy is aimed at ensuring that teachers do not hurriedly teach learners the material covered in the test or the SBA. It also helps teachers to measure how effective their teaching has been. It is imperative to scrutinise accounting learners' performance nationally: from 2014 to 2018 approximately 60 to 70 per cent of Grade 12 learners passed the national accounting examinations. As indicated in Table 1, which reflects the national pass rates in the subject, measures need to be put in place to improve the performance of accounting learners.

As indicated in Table 1, the number of learners taking accounting as a subject dropped from 128,779 to 104,553 between 2014 and 2018.

The number of learners who registered for the subject, compared to those who wrote the subject, also declined. The question is whether measures are being put in place to promote accounting as a subject. Prior to the curriculum change in 2011, learners could choose accounting as a subject without taking mathematics. When the CAPS came into effect in 2014, learners had to take mathematics in order to select accounting as a subject. This heralded a decline in the number of learners taking accounting. Some learners could not cope with mathematics and had to change to mathematical literacy, but nonetheless wished to continue with accounting as a subject.

In 2017, the DBE decided that mathematics would no longer be a compulsory subject for learners taking accounting. This decision did not change university requirements, however. To study a Bachelor of Commerce degree in accounting, learners need to take mathematics as a subject.

As seen in Table 1, between 2017 and 2018 there was still a decline of more than 10,000 learners registered for the examination. Approximately 30% of Grade 12 learners failed accounting over the period 2014 to 2018. These concerns need to be addressed.

Methodological Choice

Empirical studies served as the basis for the research process (Brown & Hale, 2014). Research typically relates to one or more aspects of a reallife situation, and deals with facts that provide a basis for testing the external validity of research results (Kumar, 2011:97). Furthermore, research is guided by evidence obtained from systematic investigations, rather than personal experience (McMillan & Schumacher, 2010:9). Accordingly, the empirical nature of the research on which this article is based dictates the use of in-depth, open-ended, individual interviews with HODs as a data-collection technique. This instrument was designed to extract information from interviewees about the curriculum challenges they experience on a daily basis in the teaching of accounting.

By undertaking an interpretive enquiry, we aimed to interpret, describe and report on the reflections and lived experiences of those HODs who participated in the research. A qualitative approach was employed, which provides a more in-depth and detailed account of how people understand the world, society and its institutions (Tracy, 2013). It produces findings that cannot be arrived at when using a quantitative approach (Rahman, 2017), and helps us understand complex phenomena that are impossible to capture quantitatively (Kumar, 2011). The rationale for the empirical research was to ensure that the recommendations for improving accounting learner performance are based on HODs' perceptions and experiences of the implementation of the CAPS.

Selection of Participants

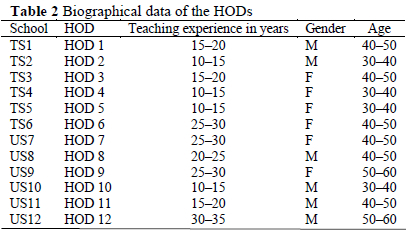

Six urban secondary schools and six township schools in Ekurhuleni North were purposefully selected to investigate the dynamics in different settings of schools, and present evidence to confirm the validity of the results. Purposive selection was performed to conduct individual interviews with the accounting HODs at the 12 secondary schools. The criterion for inclusion was a minimum of 10 years' teaching experience. As such, these teachers would have been competent because they would have experienced three curriculum changes, namely, C2005, NCS and the CAPS. Ethical considerations were adhered to. For ethical reasons, the participants' names were withheld and each was referred to by a number. The codes used in this article are TS, representing township schools, and US representing urban schools. Similarly, M is used to represent males and F for females. In a covering letter to the participants, the purpose of the research, the participants' role in the study and their withdrawal without penalty were explained. It was also made clear that the participants were under no obligation to participate and that their participation was purely voluntary. The biographical data of the HODs are presented in Table 2.

As shown in Table 2, there were six male and six female participants, ranging in age from 30 to 60 years, with between 10 and 35 years of teaching experience in accounting.

In-Depth Individual Interviews as Data-collection Instrument

Data collection is more than simply deciding on whether to interview or observe participants and sites. It also involves determining the types of data to be collected, developing data-collection forms and administering the process in an ethical manner (Creswell, 2012:204). One author conducted the in-depth semi-structured open-ended interviews with the 12 participants, who were all accounting HODs. An interview schedule was used. Permission was obtained in advance and the consent forms were signed prior to the commencement of the interviews. All interviews were audio-recorded.

Each individual interview lasted between 45 and 60 minutes.

Data Analysis and Interpretation

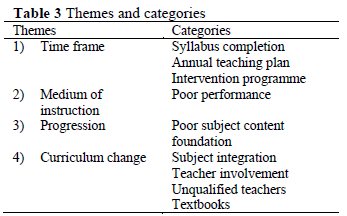

Data interpretation is a process by which the researcher draws conclusions based on the data that has been collected and analysed, and compares these with the conclusions advanced by others (Blaxter, Hughes & Tight, 2010). The transcribed data collected from the interviews were analysed by means of inductive analysis, which involves a procedure during which qualitative researchers summarise and make sense of the data (McMillan & Schumacher, 2014; Oltmann, 2016). To arrive at themes and categories, we divided the text into segments of information. We made notes, became immersed in the data (to identify patterns) and subsequently generated themes. We discussed the themes and interpreted the empirical data according to the literature review. Each of the themes in Table 3 represents the questions that were posed to participants during the interviews. These themes were not intended to be seen as mutually exclusive or definitive, but as complementing or overlapping one another. As outlined in Table 3, four major themes emerged from the empirical data.

The data were discussed according to the themes in Table 3 and thereafter interpretation of each theme followed. The findings are presented by reflecting the voices of the participants in the form of verbatim quotes. Their opinions are discussed and linked to the literature, as well as the theoretical framework.

Theme 1: Time frame

The time allocated for completing the scope of the curriculum is insufficient. Teachers are now focused on rushing through the work. Even though all learners do not understand what is being taught, it does not matter - as long as the syllabus is completed. Accounting is a subject which requires learners to complete many activities to strengthen their grasp of the material, but unfortunately the time allocated does not accommodate that, or caters for learners with different learning capabilities. The curriculum is not flexible and uses a one-size-fits-all approach. Tyler's (1949) theory indicates that teachers must devote more time to the setting and formulation of objectives. We noted that training in the new curriculum was normally done in 2 to 3 days maximum, which is not enough to adequately prepare teachers. This confirms the findings of Moodley (2013) on the limited time available to implement curriculum-related changes. In our experience, teachers were unfamiliar with concepts, and they rushed through the work, blaming it on time constraints. Time constraints forced teachers to come up with intervention programmes. The DBE expects of teachers to implement such programmes despite not being trained to do so. They thus come up with their own programmes and own activities, teach the required number of classes, mark learners' work, keep registers, keep proof of the work done and create and compile files

- all of which is time-consuming and involves a vast amount of paperwork.

All participants mentioned that the time allocated to complete the syllabus was insufficient, and thus unfair on both the teachers and learners. They added that the time allocated to complete the syllabus was not in line with the ATP. All participants indicated that they were able to complete the syllabus, but admitted that not all learners mastered the content in the process. The participants confessed that they could only cover the entire syllabus if they arranged extra classes. With further probing, the participants stated the following:

The other problem I do have, especially with Grade 10, what I found is work that's in the work schedule is too much, for example we have to do income statement, balance sheet and analysis (TS3HOD3).

I think at this stage the time is quite an issue, especially in Grade 10. You've got a very full syllabus. You move on to the next section where maybe you could have spent another week on the old section, so I think maybe they must relook at the syllabus to see [...] if it's necessary to have that much, especially for Grade 10 because, I think they need to look at the gap between Grade 9 and Grade 10. Time allocated to complete the syllabus is totally not enough. (US7HOD7)

Theme 2: Medium of instruction

The learners seem to struggle with English. Accounting is taught in English, and if learners do not fully understand the language, they experience problems interpreting the content and understanding the questions. This results in poor performance and demotivated learners who lose interest in the subject. Mindful of Msimanga's (2017) view that learners experience greater difficulty in understanding accounting due to poor interpretation of English, we found that learners often did not understand a scenario question unless the teacher read and explained it sentence by sentence. In accounting one needs to read, understand and then interpret the question.

Ten participants complained that the learners did not sufficiently understand English, which contributed to their poor performance in accounting

- especially with regard to interpretation and analysis of information. This is evident from the following comments:

Accounting is purely English; first you must understand English then you must learn to do the calculations. It doesn't mean that they don't understand: they don't know the concepts, because of this language barrier. If I can swap and teach them in Zulu, that child will understand me better. Because of the language barrier, the subject contentsuffer[s]. (TS3HOD3) First of all, language barrier, because our learners cannot express themselves in English and they lack some of.... It's not that they do not have the content or they cannot understand the question, it's just that the problem is the language, they cannot understand what is asked there. (US7HOD7)

Theme 3: Progression

In our experience, progression means that learners are pushed through the educational system without gaining any knowledge; as a consequence, some learners in Grade 12 have a level of reasoning which is on par with that of Grade 8 learners. The time allocated does not cater for progressed learners, and even assessment follows a one-size-fits-all approach. Tyler (1949) provided curriculum developers with a clear, step-by-step plan on how to develop a curriculum that caters for all learners with their different learning abilities, but these principles have not been applied in developing the CAPS curriculum for accounting.

It was clear from the interview data that progressed learners did not study, did not do their homework and even refused to participate in classwork activities, because they knew that they would eventually reach Grade 12 without much effort on their part. The data also revealed that these learners usually caused discipline problems, giving vent to their frustrations when they could not assimilate what was happening in class.

All participants were opposed to the concept of progression, deeming it to be a major contributor to poor performance in accounting. Even if a learner fails accounting, s/he will continue to move to the next grade, ultimately reaching Grade 12 without the required accounting knowledge. In this regard, the participants commented as follows:

Firstly, the poor performance in accounting is mainly of the progression introduced, because you will find the learners from Grade 8 and 9 without any knowledge of accounting. Even from Grade 10 they progress without passing accounting and they struggle when they get to Grade 12. (TS3HOD3) The problem is, we expect learners to do well in Grade 12 but the problem that we have is, our learners are in Grade 12 but unfortunately are not ready to be in Grade 12, for example, our foundation phase is not good. There is a gap between Grade 9 and 10 accounting and Grade 10 syllabus is a progression to Grade 12. It doesn't help for you to have a very beautiful house with a weak foundation and then you put a nice roof up there; it's not good because we don't have a good foundation but we expect results in Grade 12. That's why our emphasis is on Grade 12 with SSIP, so that is the problem with the CAPS. (US12HOD12)

Progression leads to poor content knowledge, because learners move from one grade to another without acquiring the required foundational knowledge for Grade 12. These learners cannot build on what was taught in the previous grades if they failed to master that content in the first place. Their comments confirm this:

In Grade 10 it's a big challenge, the reason being [... ] they were not doing accounting, specifically from Grade 8 and 9. They were doing EMS, and I realised that educators, those who are teaching EMS, they don't teach this part of accounting. (US11HOD11).

Well, the main thing is that they haven't got accounting exposure, so the exposure they get is very little. When you get them, it's like teaching them a new language, they haven't heard of it. When they get to Grade 10, [...] you have to teach them from scratch, that's the biggest challenge I've got. (TS3HOD3)

Theme 4: Curriculum changes The integration of EMS in Grades 8 and 9 is a serious challenge for the teachers. For example, EMS is a combination of accounting, economics and business studies. The problem is that some teachers did not specialise in accounting, and because they are unfit to teach the subject, their learners suffer or opt not to take the subject from Grade 10 onwards, thus confirming the view of Msimanga (2017) and Venter (2016).

Ten of the participants expressed concern about the integration of subjects. They indicated that teachers experienced difficulties with the integration of accounting, economics and business studies, as they only specialised in a specific subject. If teachers are not skilled in certain subjects, no effective teaching and learning will take place. Two of the participants commented as follows:

The way they have integrated the subjects I don't think is it proper, like in EMS, they have integrated accounting, economics and business studies. There are teachers who don't know accounting at all, so how are they going to teach accounting sections? (TS2HOD2)

In my school, there is a teacher who does not know accounting at all. It gives me a challenge as an HOD, because every now and then I have to make arrangements to go and teach the accounting sections for him. It becomes impossible, because this teacher is teaching four classes of Grade 8 and four classes of Grade 9. (US12HOD12)

We noted that teachers were not involved in designing new curricula. They were simply given a policy, which the DBE expected them to implement. It is imperative that all stakeholders (teachers, parents, school governing bodies [SGBs] and the relevant authorities) are included in drawing up new policies and designing curricula. This aligns with the recommendation made by Du Plessis and Marais (2015) that, to improve learner performance, teachers - rather than politicians -must actively assist in curriculum development.

All participants believed that, in order to improve the results, teachers needed to be involved in curriculum design, because they were the ones who best knew the learners. They were the ones who were faced with challenges on a daily basis, and who interacted with the learners. The participants claimed that they could formulate the best policy based on what they had learned from C2005 and CAPS, because they already knew that assessment had to be outcomes-based. They suggested that curriculum matters should be left to them as professionals. Their responses were as follows:

Another thing in their plan in changing the curriculum, the biggest mistake that they are doing, they don't involve teachers. We are not involved; we are just being told that this is a new curriculum and this is how it works. (TS1HOD1). If they take teachers right now and [...] give them 2 weeks to come up with policy that suits South Africa, they will come up with the policy. Teachers, we are not talking about somebody who's got a degree, who's sitting in an office, [but] teachers. They must choose teachers who have been in the classroom. I'm telling you, they will come up with something that is based on C2005 (OBE -[outcomes-based education]) and the CAPS. They will formulate something that will work. (US7HOD7)

Accounting textbooks of good quality will enhance learning. Textbooks are regarded as tools to ensure effective teaching and learning. It is imperative for accounting textbook to be aligned with the CAPS document. We strongly believe that accounting textbook activities should be compiled according to what is set in the examinations. We concur with Ngwenya and Arek-Bawa (2019) that accounting teachers should use more than one prescribed textbook in order to have access to a variety of learning activities.

All the participants indicated that accounting textbooks did not prepare learners for the examination. In their view, the standard of the accounting textbooks was too low. They acknowledged that textbooks were important resources which should help to ensure that learners perform better. Two of the participants observed as follows:

Accounting textbooks do not prepare learners for examination. They have easy activities and when the test or SBA comes it is definitely something completely different. It is not fair on the learners and it makes learners believe that accounting is difficult. (TS2HOD2)

I use the textbook in most of the cases but I again use past papers. I realise that if I use past papers it becomes easier for the learners to pass, because they get used to the standard. Textbook is just an introduction to show us how to deal with that kind of'[...] chapter. The textbook is not giving them enough practice to prepare them for the exams. (US9HOD9)

Summary, Recommendations and Conclusion

The challenges experienced with the implementation of the CAPS in accounting are identified in this article. The participants reported that the time allocated to complete the syllabus had a negative impact on effective teaching and learning and on learner performance. Thorough teaching falls by the wayside when teachers are more concerned about meeting the requirements of the ATP.

The findings reveal that progression, among others, is a major contributor to learners' poor performance in accounting.

Teacher involvement in curriculum design was another challenge identified by the participants. Teachers are the drivers of the curriculum, and if they are not competent and confident about the new curriculum, the desired results will not be achieved. This, in turn, will be detrimental to learner performance.

Based on the findings of this investigation, we recommend that each province selects a task team consisting of current teachers, of whom the majority should hold at least a master's degree and have more than 20 years of teaching experience, to scrutinise all the curricula (even those of the past) and to select the best examples regarding curriculum implementation.

Subject integration in Grades 7 to 9 has contributed to incompetent teachers teaching financial literacy. Ultimately, this affects learners' subject choices when they reach the FET phase. If teachers are not empowered and skilled, thorough teaching and learning will not take place. It is recommended that learners choose subjects from Grade 8, rather than Grade 10, which means that they should start learning accounting-specific content from Grade 8. Too many learners are burdened with subjects that will not benefit them in the future world of work, and they lose interest in integrated subjects.

To ensure that accounting teachers are competent to teach, it is recommended that they write a Grade 12 accounting paper every 3 years. As teachers are the main resources in the learning process, learner performance largely depends on their skills. Teachers who achieve less than an 80% pass mark should have to attend workshops or refresher courses which are based on the subject content. It is further recommended that the SSIP should start from Grade 10, not only in Grade 12. If the basics are instilled early on in the phase, learners will not struggle as much in their final year of school.

In conclusion. The main challenges are the lack of involvement of teachers in the curriculum development process and the progression of learners by the DBE. Most saliently, progression rewards poor learner performance - not only in accounting, but across all subjects.

Authors' Contributions

Mantekana Letshwene collected and analysed the data and wrote 60% of the manuscript, including the theoretical framework. Elize du Plessis wrote the introduction and background, sections from the literature and both authors reviewed the final manuscript.

Notes

i. This article is based on the doctoral thesis of Mantekana Jacobine Letshwene.

ii. Published under a Creative Commons Attribution Licence.

iii. DATES: Received: 30 December 2019; Revised: 12 August 2020; Accepted: 19 November 2020; Published: 31 December 2021.

References

Blaxter L, Hughes C & Tight M 2010. How to research (4th ed). Berkshire, England: Open University Press. [ Links ]

Brown M & Hale K 2014. Applied research methods in public and non-profit organizations. San Francisco, CA: Jossey-Bass. [ Links ]

Creswell JW 2012. Educational research: Planning, conducting, and evaluating qualitative and quantitative research (4th ed). Boston, MA: Pearson. [ Links ]

Department for International Development 2011. Annual report and accounts 2011-12. London, England: The Stationery Office. Available at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/67353/Annual-report-accounts-2011-12.pdf. Accessed 10 March 2017. [ Links ]

Department of Basic Education, Republic of South Africa 2011a. Curriculum and Assessment Policy Statement Grades 7-9: Economic and Management Sciences. Pretoria: Author. Available at https://www.education.gov.za/Portals/0/CD/National%20Curriculum%20Statements%20and%20Vocational/CAPS%20SP%20%20EMS%20WEB.pdf?ver=2015-01-27-160127-353. Accessed 31 December 2021. [ Links ]

Department of Basic Education, Republic of South Africa 2011b. Curriculum and Assessment Policy Statement Grades 10-12: Accounting. Pretoria: Author. Available at https://docplayer.net/634482-National-curriculum-statement-ncs-curriculum-and-assessment-policy-statement-accounting-further-education-and-training-phase-grades-10-12.html. Accessed 31 December 2021. [ Links ]

Department of Basic Education, Republic of South Africa 2016. 2015 National Senior Certificate examination: School performance report. Pretoria: Author. Available at https://www.education.gov.za/Portals/0/Documents/Reports/2015%20NSC%20School%20Performance%20Report.pdf?ver=2016-01-04-161424-000. Accessed 31 December 2021. [ Links ]

Department of Basic Education, Republic of South Africa 2019. Report on the 2018 National Senior Certificate examination. Pretoria: Author. Available at https://www.ecexams.co.za/2018_Nov_Exam_Results/NSC%202018%20Examination%20Report%20WEB.pdf. Accessed 31 December 2021. [ Links ]

Du Plessis E & Marais P 2015. Reflections on the NCS to NCS (CAPS): Foundation phase teachers' experiences. The Independent Journal of Teaching and Learning, 10:114-126. Available at https://journals.co.za/doi/pdf/10.10520/EJC179015. Accessed 31 December 2021. [ Links ]

Du Plessis EC & Mbunyuza MM 2014. Does the Department of Basic Education take the international call to provide quality education for all seriously? Journal of Social Sciences, 41(2):209-220. https://doi.org/10.1080/09718923.2014.11893357 [ Links ]

Flinders DJ & Thornton SJ (eds.) 2013. The Curriculum Studies Reader (4th ed). London, England: Routledge. [ Links ]

Gegbe BSA & Sheriff VK 2015. Factors contributing to students' poor performance in Mathematics at West African Secondary School Certification Examination (A case study: Kenema City, Eastern Province Sierra Leone). International Journal of Engineering Research and General Science, 3(2):1040-1055. Available at http://pnrsolution.org/Datacenter/Vol3/Issue2/147.pdf. Accessed 31 December 2021. [ Links ]

Kerry C 2014. What's in the CAPS package? A comparative study of the National Curriculum Statement (NCS) and the Curriculum and Assessment Policy Statement (CAPS): Further Education and Training (FET) phase: Overview report. Pretoria, South Africa: Umalusi. [ Links ]

Kumar R 2011. Research methodology: A step by step guide for beginners (3rd ed). Thousand Oaks, CA: Sage. [ Links ]

Maheshwari VK 2015. Ralph W. Tyler (1902-1994) -Curriculum development model. Available at http://www.vkmaheshwari.com/WP/?p=1894. Accessed 25 July 2017. [ Links ]

Maimela HS 2015. Impact of curriculum changes on primary school teachers in Seshego Circuit, Limpopo province. MEd dissertation. Pretoria, South Africa: University of South Africa. Available at https://uir.unisa.ac.za/bitstream/handle/10500/19836/dissertation_maimela_hs.pdf?sequence=1&isAllowed=y. Accessed 3 June 2019. [ Links ]

Mbatha MG 2016. Teachers' experiences of implementing the Curriculum and Assessment Policy Statement (CAPS) in Grade 10 in selected schools at Ndedwe in Durban. MEd dissertation. Pretoria, South Africa: University of South Africa. Available at https://uir.unisa.ac.za/bitstream/handle/10500/20076/dissertation_mbatha_mg.pdf?sequence=1&isAllowed=y. Accessed 2 April 2017. [ Links ]

McMillan JH & Schumacher S 2010. Research in education: Evidence-based inquiry (7th ed). New York, NY: Pearson. [ Links ]

McMillan JH & Schumacher S 2014. Research in education: Evidence-based inquiry (7th ed). Boston, MA: Pearson. [ Links ]

Mola T 2016. Education system must be overhauled to prepare matriculants. Mail & Guardian, 16 March. Available at https://mg.co.za/article/2016-03-16-education-system-must-be-overhauled-to-prepare-matriculants/. Accessed 20 July 2017. [ Links ]

Moodley G 2013. Implementation of the Curriculum and Assessment Policy Statements: Challenges and implications for teaching and learning. MEd dissertation. Pretoria, South Africa: University of South Africa. Available at https://uir.unisa.ac.za/bitstream/handle/10500/13374/dissertation_moodley_g.pdf?sequence=1&isAllowed=y. Accessed 2 June 2017. [ Links ]

Msimanga MR 2017. Teach and assess: A strategy for effective teaching and learning in Economic and Management Sciences. PhD thesis. Bloemfontein, South Africa: University of the Free Sate. Available at https://scholar.ufs.ac.za/bitstream/handle/11660/7745/MsimangaMR.pdf?sequence=1&isAllowed=y. Accessed 17 August 2020. [ Links ]

Ngwenya J & Arek-Bawa O 2019. Exploring the quality of Grade 12 accounting education textbooks. The Journal for Transdisciplinary Research in Southern Africa, 15(1):a662. https://doi.org/10.4102/td.v15i1.662 [ Links ]

Oltmann SM 2016. Qualitative interview: A methodological discussion of the interviewer and respondent contexts. Forum: Qualitative Social Research, 17(2). https://doi.org/10.17169/fqs-17.2.2551 [ Links ]

Peens S 2018. Enhancing Further Education and Training Accounting teacher training capacity at a University of Technology: Educational implications for theory and practice. MEd dissertation. Bloemfontein, South Africa: Central University of Technology. Available at http://ir.cut.ac.za/handle/11462/1931. Accessed 17 August 2020. [ Links ]

Rahman MS 2017. The advantages and disadvantages of using qualitative and quantitative approaches and methods in language "testing and assessment" research: A literature review. Journal of Education and Learning, 6(1):102-112. https://doi.org/10.5539/jel.v6n1p102 [ Links ]

Reche GN, Bundi TK, Riungu JN & Mbugua ZK 2012. Factors contributing to poor performance in Kenya Certificate of Primary Education in public day primary schools in Mwimbi Division, Maara District, Kenya. International Journal of Humanities and Social Science, 2(5): 127-133. Available at http://41.89.230.28/handle/20.500.12092/1702. Accessed 31 December 2021. [ Links ]

Schiro MS 2013. Curriculum theory: Conflicting visions and enduring concerns (2nd ed). Singapore: Sage. [ Links ]

Sikhombo ZN 2018. Academic performance of Grade 12 learners in Accounting in the Zululand district. MEd dissertation. Richards Bay, South Africa: University of Zululand. Available at http://uzspace.unizulu.ac.za/bitstream/handle/10530/1717/Academic%20performance%20of%20Grade%2012%20learners%20in%20accounting%20in%20the%20Zululand%20District.pdf?sequence=1&isAllowed=y. Accessed 17 August 2020. [ Links ]

Srivastava S 2013. Curriculum [PowerPoint presentation]. Available at https://www.slideshare.net/shivalisrivastava12/curriculum-24133230. Accessed 20 October 2017. [ Links ]

Tracy SJ 2013. Qualitative research methods: Collecting evidence, crafting analysis, communicating impact. Chichester, England: Wiley-Blackwell. [ Links ]

Tshiredo LL 2013. The impact of the curriculum changes in the teaching and learning of science: A case study in under-resourced schools in Vhembe District. MEd dissertation. Pretoria, South Africa: University of South Africa. Available at http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.916.7623&rep=rep1&type=pdf. Accessed 2 August 2017. [ Links ]

Tyler RW 1949. Basic principles of curriculum and instruction. Chicago, IL: University of Chicago Press. [ Links ]

United Nations 2013. Millennium development goals. Available at https://www.un.org/millenniumgoals/bkgd.shtml. Accessed 2 December 2018. [ Links ]

Venter A 2016. Cognitive preparation of NSC (Grades 10 - 12) Accounting learners for studies at a University of Technology. MEd thesis. Cape Town, South Africa: Cape Peninsula University of Technology Available at http://etd.cput.ac.za/bitstream/20.500.11838/2367/1/212285963-Venter-A-Mtech-M%20Ed-Edu-2016.pdf. Accessed 2 April 2017. [ Links ]

Ward T 2015. Critical education theory. Available at http://www.tonywardedu.com. Accessed 5 January 2017. [ Links ]