Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Science

versão On-line ISSN 1996-7489

versão impressa ISSN 0038-2353

S. Afr. j. sci. vol.119 no.9-10 Pretoria Set./Out. 2023

http://dx.doi.org/10.17159/sajs.2023/16594

COMMENTARY

Liquified petroleum gas provides a technically viable and financially feasible means to reduce Eskom's diesel cost burden by 30% to 40%

Stephen R. Clark; Craig McGregor

Department of Mechanical and Mechatronic Engineering, Stellenbosch University, Stellenbosch, South Africa

ABSTRACT

SIGNIFICANCE:

In early 2022, we analysed the benefits of switching the fuel for the Ankerlig peaking plant from diesel to LPG (liquified petroleum gas or 'bottled' gas) to reduce cost, improve greenhouse gas emissions and provide for the long-term needs of the South African electricity grid. That analysis was published in May 2022 (Clark et al. J Energy South Afr. 2022;33(2):15-23). With increased load shedding and the higher cost of diesel fuel, this recommended fuel change has become even more relevant. In this commentary, we summarise the conclusions from that paper and related studies and update the results to reflect the latest situation within the country.

Keywords: LPG, energy generation, diesel, Eskom, load shedding

Background

Nearly everyone in South Africa knows that load shedding is a significant and growing problem for the country. A recent review in Daily Maverick reported that the country suffered over 200 days of load shedding in 2022, with indications that 2023 would be worse.1 The first day of this year without any load shedding was 19 March 2023. Load shedding up to Stage 6 has become the norm, where Eskom implements rolling blackouts to remove 6 GW of demand from the grid. This major problem must be resolved as quickly as reasonably possible. The cost to the South African economy has been estimated to be more than ZAR500 billion per year.2 However, long-term planning must be considered to ensure that temporary solutions do not have long-term negative impacts on the system. These include shifting to expensive mid-merit or baseload natural gas fuelled generation, such as offshore gas-fired plants.

In the 2018 iteration of the government's Integrated Resource Plan (IRP), it was assumed that the short-term needs of the system were well provided for, and that no new generation capacity was needed until sometime after 2025. Eskom believed it would improve the energy availability factor of its baseload coal-fuelled plants and was busy commissioning two new plants, Medupi and Kusile, which would add approximately 20% new generation capacity. Almost before the 2018 IRP was finalised, Eskom found significant problems with the new coal plants and performance challenges with the existing plants. The short- to medium-term problems noted in the 2018 update of the IRP led to another IRP update in 2019. These problems at Eskom led to load shedding in late 2018. Unfortunately, the problems with unplanned outages increased in 2019, and so did load shedding. In December 2019, this resulted in Stage 6 load shedding for the first time. These problems have only intensified in subsequent years. This generation shortfall has been mitigated by extensive use of the dispatchable generation provided by the diesel-fuelled gas turbine peaking plants, which has led to high diesel consumption.

As detailed in the 2019 IRP the short-term problems will be challenging to resolve. Load shedding will be around for several years, with new generation capacity taking years to implement. In 2022, according to a CSIR analysis, the additions to the Eskom generation fleet were 720 MW of coal from the commissioning of the last train of the Kusile plant, plus 419 MW of wind and 75 MW of solar photovoltaic (PV). These additions were more than offset by the continued decrease in the availability of the existing coal fleet, as reported by CSIR: "Eskom fleet average EAF [was] 58.1% for 2022 (relative to 2021 of 61.7%, 2020 of 65%, 2019 of 66.9%)."3 The decrease in the energy availability factor (EAF) has effectively reduced the system generation capacity by 3.4 GW from 2019 through to 2022. In the meantime, the South African Department of Mineral Resources and Energy (DMRE) is making slow progress with the Renewable Independent Power Producer Programme, awarding 1 GW of solar PV projects in October 2022 for bid round 6 after awarding 1600 MW of wind and 975 MW of solar PV projects in round 5 in October 2021.4

The cheapest, most flexible solution to the load shedding problem is the rapid development of renewable generation (solar and wind) at all system levels - whether residential rooftop systems, commercial installations, industrial applications, or utility-scale projects. These projects have been highlighted in the government's report on 'Actions to End Load Shedding and Achieve Energy Security'.5 The most significant elements of this plan are to expedite the review and approval of the queue of 6 GW of proposed private renewable generation projects and the commitment to encourage and enable commercial, industrial and residential rooftop solar projects. Once approvals are in place, these projects can be implemented quickly at any appropriate size.

One element that is often overlooked in the move towards rapid increases in solar and wind generation is the continued need for firm dispatchable power to provide generation when wind and solar do not meet the demand.6 Firm capacity is generating capacity that is available at all times, whilst dispatchable capacity can be adjusted or turned on or off as the grid requires. In an interview on Eskom's diesel usage, a South African energy expert, Anton Eberhard, described these firm dispatchable (or peaking) generators as essential in maintaining the balance of the power system.7 The need for firm dispatchable generation is not just a South African issue; it is true of all power systems and becomes more critical with the increased use of variable generation sources.8,9

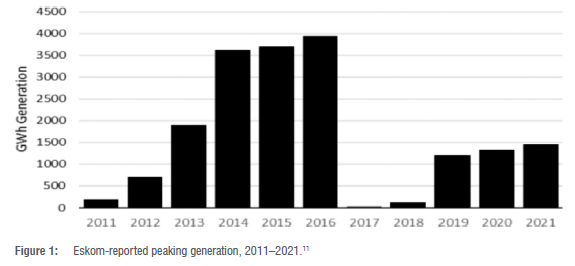

Because of the significant load shedding due to the shortage of baseload generation capacity, Eskom has been using its peaking generation facilities much more than planned. These plants are fuelled with diesel. For 2022, Eskom forecasted that, with the increased diesel price, the expenditure for diesel fuel for its peaking plants would increase to over ZAR6.5 billion for the year.10 The peaking generation in 2022 and associated diesel costs were twice this forecast. Eskom's latest information (12 January 2023) was that it had expended over ZAR14.7 billion for diesel fuel in the last year.7 This expenditure did not meet all the needs as the operator was budget-constrained. These budget constraints have led to Eskom using these plants at a lower rate than previously, even with the increased load shedding, as shown in Figure 1.11

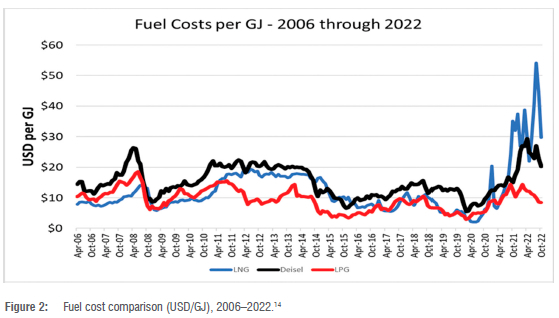

Two plants, Ankerlig (1340 MW) and Gourikwa (740 MW), provide the bulk of the Eskom peaking capacity. Both plants were commissioned in 2007 and are approximately halfway through their 30-year expected lifespan.12,13 It is technically possible to convert these plants to gas-fired if a gas source were available. As natural gas has traditionally been significantly less expensive on an energy basis than diesel (per GJ), Eskom made plans to make this change. However, they do not have access to gas. The assumption throughout the development of the various IRPs was that gas would be provided by importing liquefied natural gas (LNG). However, importing LNG has proven economically challenging due to the high upfront capital cost and low expected utilisation rates of importation facilities. While natural gas prices have traditionally been approximately half the price of diesel fuel, the last year has seen international natural gas prices at twice the price of diesel, as shown in Figure 2.14 The prices of all fossil fuels worldwide have been impacted by the limitations placed on importing natural gas from Russia into Europe. In particular, the high demand for gas in Europe has changed the price balance between oil and gas.15 The International Energy Agency (IEA) indicates that gas prices will remain challenged for some years. In their 2022 World Energy Outlook, the IEA predicted that relatively high natural gas prices would remain until the mid-2020s when new gas sources could bring the prices more in line with their long-term pricing relationship. They predicted that these high prices would discourage the construction of new natural gas fuelled power plants.

Liquefied petroleum gas (LPG), or 'bottled' gas, is another option for diesel replacement for peaking plants. It is a hydrocarbon gas and, much like natural gas, is a suitable fuel for gas turbine usage and would provide many of the same benefits as LNG. As noted by the World LPG Association:

As governments are looking to replace polluting coal, diesel or heavy oil plants, LPG offers a cost-efficient and low emissions alternative for areas that are not connected to the natural gas grid.16

Hitachi, a manufacturer of gas turbine generation plants, has an entire line of systems designed for use with LPG and has installed over 120 plants using LPG as their prime fuel. These are smaller systems designed for local use where natural gas is not readily available.17 Hitachi reports that running these plants on LPG slightly increases their output compared to diesel fuel and reduces maintenance by 20-30%.

In 2019, as part of an experiment related to solar thermal energy, students at Stellenbosch University converted a Rover 1S/60 gas turbine that was set up to run on kerosene fuel to propane.18 This is a direct comparison to the conversion of gas turbines fuelled with diesel being converted to LPG fuel. In the experiment, the turbine ran successfully with propane fuel. While in the experiment there was a decrease in the output of turbine from approximately 88% of the rated power using kerosene to 77% using propane, the analysis of the experimental results concluded that this decrease was due to the experimental setup rather than anything to do with the fuel change. The experiment's conclusion was that propane fuel was quite suitable for this gas turbine.18 As the manufacturers of the Ankerlig gas turbines have indicated that those turbines can be run on LPG fuel, there is no reason to believe that the results from this experimental setup cannot be achieved at Ankerlig.19

In their product brochures, Siemens confirms that their V94.2 turbines (model SGT5-2000E), used in Ankerlig and Gourikwa, can utilise LPG as fuel. At Ankerlig and Gourikwa, LPG is currently utilised as a start-up gas for diesel operations as it is easier to start up the turbines with LPG than diesel.12 However, LPG is currently not available in sufficient volumes onsite to be considered for full-time use in these plants. Fulltime operation using LPG as a fuel should be feasible after installing an appropriate LPG storage and delivery system.

In 2017, Sunrise Energy commissioned an LPG importation facility in Saldanha Bay.20 LPG has the advantage of easy storage and transport (much like diesel) and is much less expensive than diesel. In addition to LPG being cheaper than diesel, it also has lower carbon dioxide emissions. Unlike natural gas (predominantly methane), LPG is not classified as a greenhouse gas.

Change to LPG

Clark et al.11 reviewed the relationship between diesel and LPG prices over the past 15 years. That analysis showed that the average LPG price was approximately 60% of the diesel price (on an energy basis). Since this analysis, significant movements in the energy market have occurred due to COVID, the European Energy Crisis and the war in Ukraine. The international energy prices for LNG, diesel and LPG (updated through 2022) are shown in Figure 2 (based on prices published by the US Energy Information Agency for prices at the US Gulf Coast export point).14 While LNG had a considerable increase in 2021 and 2022, diesel did not change nearly as much, whilst the LPG price hardly changed.

The DMRE-stated March 2023 wholesale price for diesel in South Africa was ZAR20.94 per litre, and the wholesale price for LPG was ZAR9.46 per litre.21 Converting these to an energy equivalent basis (USD/GJ) gives USD31.84 /GJ for diesel and USD22.19 /GJ for LPG. Therefore, LPG in South Africa is currently priced at 69% of the price of diesel on an energy basis. These numbers are reasonably consistent with the longer-term relationship between these fuels. At ZAR20.94 per litre for diesel, the fuel input cost for electricity is over ZAR5.5 per kWh. Eskom pays approximately 80% of the DMRE-stated retail price rather than the wholesale price. However, it can be expected that the price relationship between the two fuels should be approximately the same.

LPG importation and storage

LPG is currently imported into Saldanha Bay; no new importation facilities would be needed to bring the required volumes of LPG into the area. The Sunrise Energy importation facility currently contains 5500 tonnes of LPG storage. Avedia Energy also has an import facility in Saldanha Bay, commissioned in 2019, with 2200 tonnes of LPG storage. As for all fuels, the challenge remains in the cost-effective storage and delivery of the fuel at high rates for dispatchable usage. Besides being locally available, one advantage of LPG is that it is in a liquid phase at ambient temperature and slightly above atmospheric pressure. Liquid fuels require significantly lower volumes to store.

There is some question regarding the throughput capacity of the Sunrise and Avedia LPG import facilities in Saldanha Bay and their ability to meet the need for the Ankerlig demand. The issue to be determined is the amount of additional LPG storage that might be required. It would likely be necessary for the Saldanha Bay facilities to be expanded to provide additional LPG storage. In addition, LPG fuel storage at the Ankerlig plant itself would also be necessary. In Richards Bay, Bidvest has recently constructed an LPG storage and delivery project. The project has four LPG tanks, each storing 10 000 m3 (4 x 5500 tonnes). The cost of the plant was listed as less than ZAR1 billion. Bidvest completed the project within 2 years from project commencement. A duplicate of this plant would provide 40 000 m3 of LPG storage or 1 PJ of fuel. The current diesel storage at Ankerlig is 32 million litres or 1.2 PJ energy. The 40 000 m3 would be enough to run the 1.3 GW Ankerlig plant for 76 hours, or slightly more than 3 days.

Fuel delivery to Ankerlig

The Ankerlig generation plant is approximately 100 km from the Saldanha Bay LPG importation facilities. A pipeline would be the lowest-cost means for natural gas and LPG delivery. For diesel delivery to the Ankerlig plant, as the plant is designed for low-capacity peaking use, Eskom has chosen to deliver the fuel by truck, avoiding the capital cost of a pipeline. The 1.3 GW Ankerlig plant requires seven truckloads of diesel per hour of generation. The onsite storage for diesel holds the equivalent of 640 truckloads. As can be deduced from Figure 1, during the maximum usage period for the peaking plants by Eskom, 2014 through 2016, the Ankerlig plant produced over 2000 GWh per year to the grid. As Ankerlig provides approximately 64% of the indicated Eskom peaking capacity, this energy output indicates a capacity factor of over 20% for the plant for these years. In November 2014, it was reported that Eskom operated Ankerlig for over 200 hours at a capacity above 30%. While questions were raised in the press about this operation, Eskom did not report any problems in meeting this need using fuel delivery by truck.22

It can be assumed that this same option would likely be considered for LPG delivery to the plant. Compared to seven truckloads of diesel, ten truckloads of LPG would be required to operate the plant per hour of generation. Duplicating the energy storage of diesel would require an LPG storage facility equivalent to the Bidvest Richards Bay LPG plant to be constructed at Ankerlig. Even with the high-capacity operation under periods of load shedding, the number of deliveries of LPG would be only slightly higher than that currently done for diesel. A pipeline delivery system from Saldanha to Ankerlig remains an alternative to truck delivery. However, it is expected that Eskom would not decide to make this investment due to the intermittent usage of the plant.

Economics of change out to LPG

Assuming the current South African relationship of LPG at 69% of the price of diesel, it is possible to make an economic comparison of the annual cost savings from the fuel changeout. As importation facilities are in place and no pipeline or alternative delivery system investment is required, developing a Bidvest-equivalent LPG storage and delivery system should be the only investment required to allow LPG delivery to Ankerlig. With the ZAR14.7 billion budget for diesel fuel for the year and Ankerlig providing 64% of the dispatchable power, a change to LPG - at 69% of the diesel price - would result in a 1-year savings of ZAR 2.9 billion. As laid out in the original analysis, the cost of making the change should be around ZAR1 billion. Thus, the payout to make the fuel change would be a matter of a few months, with an expected savings of over ZAR1.7 billion in the first year of usage and significant continued savings in subsequent years. Eskom might also have some minor costs to modify the fuel intake and control system for the turbines for full-time LPG usage, but this is not likely to materially change the economics of the fuel change.

Business structure

Given the probability of load shedding by Eskom continuing for the next several years, this concept should be followed up immediately with all interested parties, including potential investors, Eskom as the customer, and the government as the coordinating party. Companies can bid on the supply of LPG fuel to the Eskom Ankerlig plant, which could be done on a capacity plus usage payment or a simple competitive supply arrangement. With the expected remaining lifespan for the Ankerlig plant of over 15 years and the quick payout time for the expected conversion costs, Eskom should be able to present an attractive contractual arrangement for this fuel change. Outside investors would likely be interested in building the required infrastructure with a suitable fuel supply agreement for Ankerlig.

Even with the planned fuel change, there is no reason for Eskom to abandon the existing diesel storage system, as these units could be converted back to diesel use as necessary. Assuming the diesel fuel system is maintained, Eskom would have complete flexibility to use either LPG or diesel, increasing the fuel security of this plant.

Effect on load shedding

The change of fuel from diesel to LPG will not solve load shedding, either in the short or long term. However, it will lower the cost of providing the firm dispatchable power that must be provided to keep the system in balance. It will also make it easier for Eskom to use this generation source as needed with less concern about their fuel budget. With the lower fuel cost, should Eskom choose to use these plants at the level it did in 2014 through 2016, it could add over 2000 GWh of generation into the system.

Successful conversion of the Ankerlig peaking plant to readily available lower-cost LPG could also become a model for implementing firm dispatchable generation plants. These facilities will be needed to maintain system balance as the base generation transitions from large coal-fuelled power plants to a system based on variable renewable energy sources from solar and wind.6

Conclusions

The conclusions reached in the 2022 analysis are still valid today and will have increased relevance for the current situation.

• The current load-shedding challenges with the South African grid indicate that the diesel peaking plants will continue to be used at very high levels for the coming years.

• Diesel fuel costs will remain a significant burden on Eskom's finances.

• Switching out the diesel at Ankerlig to LPG fuel can significantly reduce this cost via a low-risk, low-capital project.

• This fuel change would be feasible, with minimal cost to Eskom, as it can be done as a service provided by a private company.

• The fuel changeout should have a quick payback with long-lasting benefits, even when load shedding is resolved. This change should be pursued urgently to reduce the burden on Eskom from the current cost of diesel.

• The fuel changeout will also reduce greenhouse gas emissions.

Competing interests

We have no competing interests to declare.

References

1. O'Regan V. Eskom's ability to provide power is steadily worsening, CSIR stats show. Daily Maverick. 2023 February 22. Available from: https://www.dailymaverick.co.za/article/2023-02-22-eskoms-ability-to-provide-power-is-steadily-worsening-csir-stats-show [ Links ]

2. Daily Investor. South Africa lost R560 billion in 2022 because of loadshedding. Daily Investor. 2022 December 14. Available from: https://dailyinvestor.com/south-africa/6860/south-africa-lost-r560-billion-in-2022-because-of-load-shedding/ [ Links ]

3. Pierce W, Le Roux M. Statistics of utility-scale power generation in South Africa 2022 [document on the Internet]. c2023 [cited 2023 Mar 25]. Available from: https://www.csir.co.za/sites/default/files/Documents/Statistics%20ofX20power%20in%20SA%202022-CSIR-%5BFINAL%5D.pdf [ Links ]

4. South African Department of Mineral Resources and Energy (DMRE). Independent Power Producer Procurement Programme. Pretoria: DMRE; 2022. [ Links ]

5. Government of South Africa. Confronting the energy crisis: Actions to end load shedding and achieve energy security [document on the Internet]. c2023 [cited 2023 Mar 25]. Available from: https://www.stateofthenation.gov.za/assets/downloads/confronting_the_energy_crisis_to_end_load_shedding.pdf [ Links ]

6. Clark S, Van Niekerk J, Petrie J, McGregor C. The role of natural gas in facilitating the transition to renewable electricity generation in South Africa. J Energy South Afr. 2022;33(3):22-35. https://doi.org/10.17159/2413-3051/2022/v33i3a12742 [ Links ]

7. Eskom's massive diesel conundrum. BusinessTech. 2023 January 12. Available from: https://businesstech.co.za/news/energy/655567/eskoms-massive-diesel-conundrum/ [ Links ]

8. IEA-ETSAP Renewable energy integration in power grids [document on the Internet]. c2015 [cited 2023 Mar 25]. Available from: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2015/IRENA-ETSAP_Tech_Brief_Power_Grid_Integration_2015.pdf [ Links ]

9. Sepulveda NA, Jenkins JD, De Sisternes FJ, Lester RK. The role of firm low-carbon electricity resources in deep decarbonization of power generation. Joule. 2018;2(11):2403-2420. https://doi.org/10.1016/j.joule.2018.08.006 [ Links ]

10. Creamer T. Eskom seeks to show prudency of running diesel plants as its pegs cost of load-shedding at R9.53/kWh. Engineering News. 2022 January 20. Available from: https://www.engineeringnews.co.za/article/eskom-seeks-to-show-prudency-of-running-diesel-plants-as-its-pegs-cost-of-load-shedding-at-r953kwh-2022-01-20 [ Links ]

11. Clark S, McGregor C, Van Niekerk JL. Using liquefied petroleum gas to reduce the operating cost of the Ankerlig peaking power plant in South Africa. J Energy South Afr. 2022;33(2):15-23. https://doi.org/10.17159/2413-3051/2022/v33i2a13453 [ Links ]

12. Eskom. Ankerlig and Gourikwa gas turbine power stations. 2014 [2020, September 20]. Available from: https://www.eskom.co.za/sites/heritage/Pages/ANKERLIG-AND-GOURIKWA.aspx [ Links ]

13. Hulisani. Avon and Dedisa peaking power [webpage on the Internet]. c2021 [cited 2023 Apr 07]. Available from: https://hulisani.co.za/project/avon-and-dedisa-peaking-power [ Links ]

14. US Energy Information Administration (EIA). Petroleum & other liquids - Spot prices [database on the Internet]. c2022 [cited 2022 Jan 23]. Available from: https://www.eia.gov/dnav/pet/PET_PRI_SPT_S1_M.htm [ Links ]

15. International Energy Agency (IEA). World energy outlook 2022 [webpage on the Internet]. c2022 [cited 2023 Mar 25]. Available from: https://www.iea.org/reports/world-energy-outlook-2022 [ Links ]

16. World LPG Association. The role of LPG in shaping the energy transition: 2018 Edition [document on the Internet]. c2018 [cited 2023 Mar 25]. Available from: https://www.wlpga.org/wp-content/uploads/2018/10/The-role-of-LPG-in-shaping-the-energy-transition-2018.pdf [ Links ]

17. Hitachi. LPG burning gas turbine for power generation [document on the Internet]. c2014 [cited 2023 Apr 07]. Available from: https://lpg-apps.org/uploads/Modules/Library/power-generation-lpg-gas-turbines-kuba_hitachi_mitsubishi_japan.pdf [ Links ]

18. Marsh DA. Conversion of a kerosene-fuelled gas turbine to run on propane [Meng thesis]. Stellenbosch: Stellenbosch University; 2019. Available from: https://scholar.sun.ac.za/bitstream/handle/10019.1/106094/marsh_conversion_2019.pdf?sequence=1&isAllowed=y [ Links ]

19. Siemens. Siemens gas turbine portfolio [document on the Internet]. c2020 [cited 2020 Sep 20]. Available from: https://assets.new.siemens.com/siemens/assets/api/uuid:10f4860b140b2456f05d32629d8d758dc00bcc30/gas-turbines-siemens-interactive.pdf [ Links ]

20. South Africa opens Sunrise Energy LPG terminal. Riviera Newsletters. 2017 September 14. Available from: https://www.rivieramm.com/news-content-hub/news-content-hub/south-africa-opens-sunrise-energy-lpg-terminal-27227 [ Links ]

21. South African Department of Minerals Resources and Energy (DMRE). Breakdown of petrol, diesel and paraffin prices as on 05 March 2023 [document on the Internet]. c2023 [cited 2023 Mar 25]. Available from: http://www.energy.gov.za/files/esources/petroleum/February2020/Breakdown-of-Prices.pdf [ Links ]

22. Mackenzie-Hoy T. Logistical questions hang over Ankerlig's Nov 2014 diesel burn. Engineering News. 2015 March 24. Available from: https://www.engineeringnews.co.za/article/logistical-questions-hang-over-ankerligs-nov-2014-diesel-burn-2015-03-24/rep_id:4136 [ Links ]

Correspondence:

Correspondence:

Stephen Clark

Email: sclark@sun.ac.za

Published: 31 August 2023