Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Science

versão On-line ISSN 1996-7489

versão impressa ISSN 0038-2353

S. Afr. j. sci. vol.118 spe Pretoria 2022

http://dx.doi.org/10.17159/sajs.2022/12465

RESEARCH ARTICLE

Transitioning towards a circular bioeconomy in South Africa: Who are the key players?

Takunda Y Chitaka; Catherina Schenck

DSI/NRF/CSIR Chair in Waste and Society, University of the Western Cape, Cape Town, South Africa

ABSTRACT

The transition towards a circular economy is becoming a priority in many countries globally. However, the circular bioeconomy has received relatively less attention. In South Africa, the valorisation of organic waste is a priority area as demonstrated by national goals to divert organic waste from landfill. To support the growth of the organic waste value chain it is important to gain an understanding of the different value chain actors and their activities. Through a series of semi-structured interviews across the industry, this paper unpacks the organic waste value chain including the roles of different actors and the interlinkages amongst them. Interviewed actors were those involved in the waste treatment sector, including consultants, composters and technology providers and installers. The value chain is characterised by a number of partnerships, including sub-contracting and outsourcing, which enable value chain actors to offer services that they do not necessarily have the in-house skills or capacity to deliver on their own. The majority of actors were not directly engaged in activities related to the treatment of waste, with many of them engaging in support activities to facilitate the treatment of waste. This finding may be attributed to the fact that support activities have relatively lower barriers to entry. This has the potential to create a bottleneck, in which there will be limited capacity for waste treatment as new entrants opt for engaging in support activities. Greater investment is needed from both private and public sources in the waste treatment sector, including support for new entrants. This investment will help enable the country to meet its goals for organic waste diversion whilst contributing to job creation.

SIGNIFICANCE:

• The majority of participants in the organic waste value chain were engaged in support activities.

• The organic waste value chain is characterised by a series of partnerships.

• Greater investment is needed for the development of waste treatment facilities.

Keywords: circular bioeconomy, organic waste, waste economy, waste treatment

Introduction

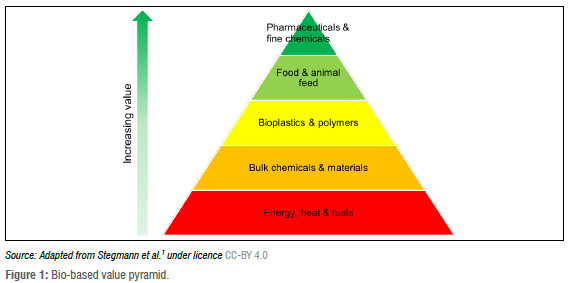

Circular bioeconomy is a concept that is gaining popularity amongst academia, industry and policymakers. The term 'circular bioeconomy' first emerged in 2015 and has been increasingly used since 2016.1 It may be considered as the intersection of bioeconomy and circular economy with an emphasis on resource efficiency and the use of residues and wastes as a resource.1,2 A key aspect of circular bioeconomy is the cascading use of resources in products that create the most value over time to optimise the value of the resource over multiple lifetimes within the circular bioeconomy.1-3 However, strictly adhering to cascading use may not be possible for economies based on differing priorities (e.g. energy production) or financial constraints.2,4 To provide guidance for optimising the value of biomass over time, Stegmann et al.1 present a bio-based value pyramid. This pyramid illustrates the increasing value of bio-based products in relation to the number of resources that can be utilised (Figure 1). The pyramid may also be seen as a one-dimensional view of cascading use, whereby the use of resources cascades downwards from high-value products.

From a value perspective, it is recognised that so-called 'low-value' applications may result in greater environmental and socio-economic benefits depending on the context.1 Furthermore, circular bioeconomy has been identified as a potential avenue for the realisation of some Sustainable Development Goals including those related to responsible consumption and production (SDG 12) and climate change (SDG 13).5-7

Sustainable organic waste management is an integral aspect of the circular bioeconomy.1,3,8,9 In South Africa, the enhancement of waste management practices was highlighted as a priority area in the South African Bioeconomy Strategy released in 2013.10 In 2017, it was estimated that approximately 19.2 million tonnes of organic waste was generated in South Africa.11 The National Waste Management Strategy 2020 (NWMS) identifies diversion of organic waste from landfills as a priority area, setting a national target of 40% diversion within 5 years.12 The need to reduce organic waste to landfill is for a number of reasons including rapidly dwindling airspace. For example, the Western Cape Province, in order to preserve their remaining airspace, has set goals to divert 50% of organic waste from landfill by 2022, with a total landfill ban in 2027.13 In addition, the waste economy is gaining more traction nationally as a potential avenue for job and income creation as well as for economic growth.12,14 Ultimately, progress in organic waste diversion from landfill will see an increase in the circularity of the bioeconomy in South Africa.

Circular bioeconomy research is often focused on the treatment and/ or production of different bio-based products in the context of the circular economy. With the promulgation of bioeconomy policies and strategies in recent years, research has emerged on the analyses of these, particularly in European countries.1,7 In South Africa, the majority of research concerning organic waste has focused on treatment options from the lens of technical or economy feasibility.15 Relatively fewer studies have been conducted into the practicalities of implementing different treatment options including investigations into the value chain. Thus, there is limited understanding of the functioning of the value chain. This presents a limitation during the development of strategies and policies aimed towards the organic waste sector.

Approaches for the prioritisation of different bio-based products differ; for example, implementation of cascading use or implementation of different processes simultaneously depends on the priorities of the different stakeholders.4 Thus, it is important to establish the different stakeholders and their roles, rights and responsibilities. However, this identification remains an understudied area of research in the organic waste sector.

A functional value chain analysis provides a detailed profile of the industry including operations.16 However, such an analysis is yet to be applied to the organic waste value chain. This paper presents the results of a functional value chain analysis conducted on the South African organic waste value chain from collection to treatment, including identification of value chain actors, their activities and the interlinkages amongst them. In addition, the services which support the value chain are explored. The results are analysed in the context of South Africa's national priorities.

Value chain analysis

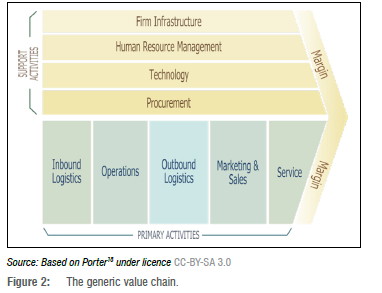

A value chain can be described as the full range of activities required to bring a product or service from conception (design) through the different phases of production to delivery to final customers and final disposal after use.17 The concept was initially introduced by Porter18 as a tool to enable a firm to assess its activities in order to identify potential sources of competitive advantage. Porter18 proposed that a firm's activities could be categorised into primary and support activities according to Figure 2. There have been a variety of concepts developed for chain activities and end products similar to value chains: 'supply chains' is a generic term used for the input-output structure of value adding activities from raw materials to finished product, 'commodity chains' place emphasis on internal governance structures, and the French filière approach has generally been applied domestically on primary agricultural export commodities as well as value streams.17,19 The value chain approach is perceived to encompass all the tenets of the full range of possible chain activities and has gained importance globally in industry as well as in policymaking.

Value chains can be mapped and analysed using value chain analysis which focuses on the dynamics of interlinkages within sectors.20 A functional value chain analysis aims to provide a detailed profile of the industry,16 including the identification of actors, activities and the physical flows of commodities.

The analysis can include both qualitative and quantitative tools. Hellin and Meijer20 recommend a combination of both tools whereby the quantitative study is preceded by a short qualitative study. A purely qualitative research approach is also recommended (for data collection) in scenarios where funds and time are limited, with the reasoning that prices and quantities can be sourced from questionnaires and secondary sources such as national statistics.20

Value chain analysis is commonly applied as a strategic management tool used to enhance a firm's competitive advantage.21 It has also been applied in studies of international trade from a political economy focusing on different actors in the chain and their differential capacities for wealth appropriation.17,21 However, both applications are concerned with identifying opportunities for profits to be sustained over time. Value chain analysis not only helps to identify bottlenecks and weak links that require attention16,22, it also brings to light knock-on effects and complex interdependencies along the chain16,17,22.

Value chain analysis is gaining importance as an analytical tool for policymakers, at national and local levels, who are required to make important social and economic decisions, particularly in countries that are trying to upgrade their industries.22 Value chain analysis for policymaking can be described as follows16:

• Assessing a value chain according to its sustainability performance, including social, environmental and economic criteria.

• Identifying areas of potential improvement that could be implemented via public policy measures.

• Assessing the likely sustainability impacts of the available measures along the value chain.

Organic waste treatment in South Africa

In order to contextualise the value chain, it is important to have an understanding of the organic waste sector in South Africa. According to the State of Waste Report, in 2017, an estimated 49.2 % of managed waste was recovered/recycled.11 However, it is important to note that there is a notable proportion of waste that is mismanaged in South Africa with Stats SA reporting that in 2020, 37.4 % of households did not have access to refuse removal which often resulted in dumping.23

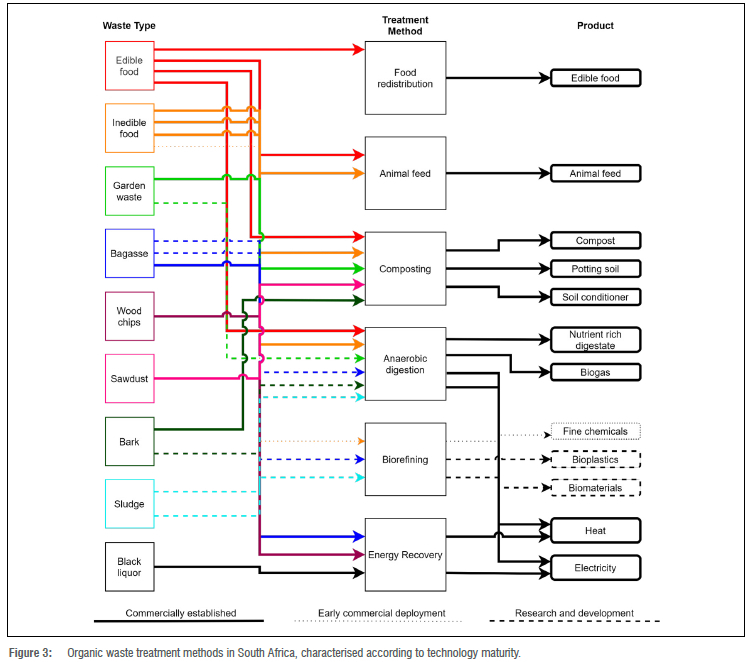

There are a variety of treatment methods for the valorisation of organic waste. In South Africa, the level of development of these options ranges from research and development to commercially established as shown in Figure 3. There a number of factors influencing the selection of a treatment method including feedstock composition, technology availability, and economic, policy and regulatory aspects.15,24,25 Feedstock availability and quality are critical to the development of sustainable industries; different treatment options require different feedstocks and have different tolerances for variations in quality.3 In general, treatment methods using more advanced technology are associated with higher capital expenditure and operating costs.15,24 26

Food redistribution

Food redistribution can take place at various stages of the food supply chain, depending on whether the generated output is fit for human consumption. In South Africa, food redistribution is dominated by two major non-profit organisations (NPOs): FoodForward SA and SA Harvest. These NPOs serve to facilitate the redistribution of surplus food to those in need via services such as soup kitchens and food pantries.27,28

Animal feed

Both edible and inedible food may be used as a feedstock for animal feed. The food may be done directly without any conversion or it may be further processed. For example, food waste is utilised as a feedstock by Agriprotein (South Africa) for the commercial production of black soldier fly larvae which provide a source of protein for animals.29

Composting

A number of composting methods are employed in South Africa, including open windrow, vermicomposting and in-vessel. A survey conducted nationally in 201230 found that open-windrow was the most popular method employed. This popularity may be attributed to its relatively lower capital and operating costs and low skills requirements.24,31

Composting is the primary treatment method for garden waste in South Africa.11 However, there are different methods for its diversion from municipal landfills. Municipalities may contract a company for the chipping and composting of waste or they may set up an in-house composting facility. The model employed depends on a variety of factors including the infrastructure and finances available to the municipality. Further to garden waste, composting is also used to treat wood waste (e.g. sawdust, bark and wood chips), food waste, and manure and poultry droppings.11,30,32

Anaerobic digestion

Anaerobic digestion is a well-established technology in South Africa, with adoption dating back to the 1990s.15 In 2018, a review estimated that there were over 700 installations across the country including domestic and industrial digesters.33 Digesters can process a variety of feedstocks including harvesting and abattoir waste, manure and food processing waste.34,35 Digesters can also be used to treat wastewater from breweries and distilleries as well as sludge from wastewater treatment plants.

Biorefining

Biorefining has been identified as an opportunity to develop South Africa's bioeconomy, particularly in relation to the sugar industry.10,36-38 Sugarcane bagasse can be utilised as a feedstock for the manufacture of chemicals including bioethanol, lactic acid and furfural. Globally, South Africa is one of the largest bio-based furfural producers.38,39

The potential for biorefining is not isolated to the sugar industry, with other residues from agriculture and food production being potential feedstocks. For example, Brenn-o-kem utilises grape pomace from the surrounding winelands to produce calcium tartrate, wine spirits, grape seed oil and tannin.40

Energy recovery

Waste produced during industrial processes is often used as an energy source within the process. For example, in sugar mills, bagasse is used as a feedstock in boilers to supplement the plant's energy requirement.38 Similarly, wood offcuts and residues in the forestry, paper and pulp industries are used as a source of process heat.41

Methods

The study was informed by primary data collected via interviews with key value chain actors. Semi-structured interviews were conducted from March to August 2021. Semi-structured interviews were selected as they have open-ended questions which allow for the interviewer to ask probing questions to elicit further information.42 Interviews were conducted electronically or telephonically in adherence with COVID-19 protocols. The interviews lasted from 30 min to 60 min depending on the activities of the participant. Audio recordings were made of each interview which were later transcribed. Interview analysis was conducted using the software Atlas.ti 9. A priori analysis was employed whereby themes were identified when preparing the interview protocol based on the aims of the research.43

Value chain actors' roles in the organic waste value chain, including their activities and their business journeys, were explored through the interviews. The value chain actors were all from the waste treatment sector, including consultants, composters, and technology designers and installers. Value chain actors were selected based on their role in the organic waste value chain with the aim of ensuring a diverse sample pool. This selection was combined with availability sampling as not all contacted value chain actors were willing to participate in the study. Snowball sampling was also used, whereby some interviewees were willing to introduce the researcher to other actors in the sector.

Not all interviewees' companies were focused solely on organic waste related activities. However, their other activities were also waste related. In such cases, they were interviewed only about their organic waste related activities.

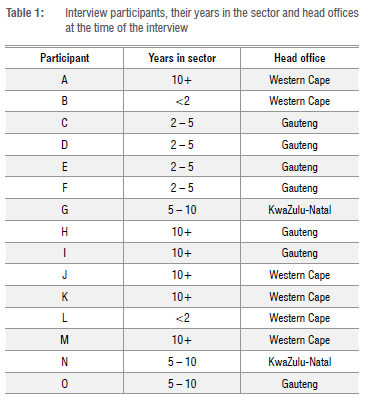

In total, 15 interviews were conducted. As shown in Table 1, the interviewees had varying years of experience in the sector. The interviewees' head offices were based in three provinces: Gauteng, KwaZulu-Natal and the Western Cape. However, it should be noted that many of them operated nationwide depending on the feasibility of the activity. For example, consultants are able to provide their expertise nationally whilst composters are restricted to the location of their operations. The activities of the actors are shown in Table 2.

The participants' identities have been anonymised and efforts have been made to exclude any identifying information.

This research was approved by the University of the Western Cape Humanities and Social Science Research Ethics committee (number HS18/2/5).

Results and discussion

Business origins

Participants had various motivations for entering into the organic waste management sector. Some participants had a direct interest in organic waste beneficiation which motivated them to enter the sector. Participants B and D cited their personal experiences with waste as their motivation whilst Participant H stated it was a personal home project that expanded. Two of the participants were already working in the broader waste sector so expanding their services into organic waste was a natural progression for them.

The desire to contribute to the transition towards a circular bioeconomy was only brought up by two participants: A and K. They emphasised the importance of putting in place solutions that close the loop in the circular bioeconomy. Nonetheless, all participants were participating in the circular bioeconomy, regardless of intent.

Sector activities

Actors in the organic waste value chain often participate in multiple activities related to the recovery of organic waste, as shown in Table 2. Treatment options have been shown for those who participate in waste treatment and/or technology design and/or installation as part of their activities. It is interesting to note that the majority of treatment methods encountered mirrored those that are emphasised by the NWMS, namely composting and anaerobic digestion.

On-site waste management

On-site waste management services often relate to the recovery of source separated and can extend to its on-site treatment. Common services offered are the provision of sorting bins and training of on-site staff. The separated organic waste is then transported off-site for treatment. In some cases, waste generators may opt for an on-site treatment option, depending on their waste generation rates and their internal needs for the products (e.g. compost, biogas).

Consulting

The increasing popularity of a circular economy has placed a spotlight on responsible waste management. When coupled with the national goals for the diversion of organic waste from landfill (as discussed in the Introduction), waste generators are under increasing pressure to find solutions. To address this, they have been turning to waste consultants for answers.

Waste consultants offer a myriad of services, including developing strategies for waste management which are aligned with the waste hierarchy and, more recently, the circular economy. Potential solutions consultants may present include waste minimisation strategies as well as recommendations for more sustainable waste treatment methods. Consultants also facilitate connections between clients and companies offering the treatment options of interest. Essentially, consultants have carved out a space to act as intermediaries between waste generators and treaters, thus eliminating the direct communication line between the two. However, according to Participant G, in the initial phases, 'There was suddenly push back... they were like, why can't we deal with the decision makers directly?'.

Waste consulting was a popular activity amongst interviewed actors. This popularity may be attributed to a low barrier of entry, as consulting does not require high start-up costs or a lot of infrastructure. However, actors highlighted that the key to being a successful consultant lies in having 'connections' within the industry to bolster their reputation. Participant D stated succinctly, 'Your network is your net worth'.

It is important to note that not all participants were consulting as their primary activity of choice. Participant F expressed that they were only consulting as a means of keeping their business afloat until their activities of choice grew enough to be their primary source of income. They described consulting as a 'means to an end'.

Waste brokering

A broker is a person who arranges or facilitates the sale and purchase of goods between actors. Waste brokering is not a practice that is unique to South Africa.44-46 Globally, waste brokers facilitate the transboundary movement of waste, largely from developed to developing nations.45 In the organic waste sector, brokers can be considered intermediaries who do not physically handle the waste but facilitate its treatment or diversion to a manufacturing process. This facilitation may be done through a series of partnerships or via subcontracting (discussed further under 'Interlinkages amongst actors').

Similarly to consulting, waste brokering can be considered to have a low barrier of entry from a financial and infrastructure perspective. As stated by Participant C:

You know if you're going to be a waste treater, you have to have access to land - you've got to lease or you own it. You've got to service that. You've got to get people to go there. A waste broker can sit behind the phone; if he's got the connections he can connect A and B.

He further emphasised the importance of having industry contacts to become a waste broker:

No, you can't become a waste broker until you've got contacts, and contacts take years to develop. So you've got to pay some school fees for a couple of years. Unless you've been in a similar or related industry or something. You can't just suddenly become a waste broker.

Technology design, distribution and installation

The technology aspect is broken down into specific activities as a company may not participate in the entire process from design to operation. Some actors have seen an opportunity to become distributors for international technologies. This was particularly noted in the composting sector for in-vessel composters. For anaerobic digestors, technology providers are more likely to be involved in the design aspect. For example, Participants N and O were technology installers working in partnership with an anaerobic digester provider. It was noted that the anaerobic digestion technology providers and installers did not operate the technology; instead they chose to train on-site workers to operate the equipment. Participant I specifically cited their desire to contribute to capacity development in the sector, supporting small operators who install their technology. At most, a provider may monitor the technology off-site and conduct maintenance. Participant J had a similar hands-off approach:

The only thing to do is support from a technical perceptive, we don't provide any operator on site, assistance apart from training, we don't measure and we don't record. We don't have anything to do with the day-to-day operational systems that they put in place.

Waste treatment

Waste treaters are actively engaged in the treatment of waste, converting it from its original form to a different product. Whilst technology providers provide the means for waste treatment, they are not involved in the day-to-day running of the process. In essence, they facilitate the treatment of waste. Furthermore, the product of these technologies may require further treatment. For example, some in-vessel composting units produce a precursor to compost which still needs to be further composted in open composting facilities.

As mentioned previously, composting and anaerobic digestion are well-established technologies in South Africa. Furthermore, the NWMS specifically cites these methods when it comes to the treatment of organic waste.12 Thus, unsurprisingly, the majority of interviewed waste treaters were involved in these sectors (Table 2). Furthermore, those not involved directly in waste treatment referred to these methods.

When discussing organic waste treatment options, the same waste treaters were mentioned multiple times by different actors. This suggests a relatively small waste treatment network. Cost is a major factor when selecting waste treatment methods. Significant start-up costs are required when developing a waste treatment facility. A study conducted in 2014 estimated capital costs for small scale windrow systems with capacities of 5-500 kt/year to range from ZAR6 million to ZAR10 million.26 As the technology requirements increase, so do the capital costs. For example, the aforementioned study estimated capital costs of ZAR120 million to ZAR220 million for a 2500 t/year plant.26 When looking at operating costs, a similar trend is observed whereby open windrow composting is associated with lower operating costs than anaerobic digestion.47

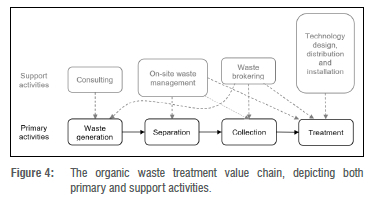

There is relatively less focus on the production of high-value goods (Figure 4) in South Africa. Whilst biorefining of organic waste is a priority research area48, this has not translated to industry action as of yet. For example, residues from sugar mills can be used as feedstocks for a variety of chemicals and thereby provide an opportunity to develop the local bioeconomy.10,36-38 However, a study found that the economic returns were not high enough to attract investment.36 Thus, it may be suggested that, from an economic perspective, low-value treatment options are more attractive due to lower capital and operating costs.

Organic waste value chain

The activities that occur in a value chain may be categorised into primary and support activities. In the organic waste value chain, the primary activities are the generation of waste and its separation into desired fractions followed by its collection and transportation to waste treatment facilities (as shown in Figure 4). For firms which opt for on-site treatment, transportation to a facility is not necessary. The same activities were identified by Campitelli and Schebek44 in a review of waste management systems.

Support activities facilitate the functioning of the value chain. As outlined in the section on 'On-site waste management', this aspect comprises a suite of services across the value chain. All the primary activities can take place on the same site as waste generation. Consulting services provide support to waste generators through advising on how they can best manage their waste. Whilst waste broking facilitates the linkages between the waste generators, transporters and treaters.

As demonstrated above under 'Waste treatment', in comparison to waste brokering and consulting, setting up a waste treatment facility is associated with higher start-up costs. Furthermore, as the technology requirements of the treatment methods increase, so do the capital and operating costs.49 The high costs may serve as a barrier for new entrants into waste treatment. Thus, new entrants in the sector may opt to engage in support activities. This scenario creates the risk for a bottle neck to develop in the value chain, whereby there will not be enough capacity for the treatment of organic waste, but many actors to facilitate its diversion from landfill.

Interlinkages amongst actors

The functioning of the value chain is underpinned by the relationships that exist between actors. The relationships can take multiple forms including symbiotic relationships, informal as-needed relationships and more formal arrangements. Whether or not money flows between actors in a partnership is highly dependent on the situation. Common partnerships that exist are those between consultants and technology providers and waste treaters. As consultants do not necessarily have the infrastructure to treat the waste, they must rely on others in order to make this offering to their clients. Thus, a consultant may partner with a technology provider on the understanding that the consultant gets paid a commission for each successful recommendation. A consultant may also partner with a waste treater such as a composter; they may or may not be charged gate fees depending on the arrangement.

A common partnership that was raised by a number of participants is that with waste management companies. Participant H stated: 'the [Their] business model is to partner with waste companies, rather than compete against them.' Waste management companies often have existing contracts with commercial clients. Thus, to market their services to the client, actors must work with the existing waste management company. This work may include training their employees in the separation of waste or the operation of their technology offering.

In some cases, an actor may need to bring on other consultants who need to be paid for their work. This may be considered to be a form of subcontracting. Subcontracting is not an unusual practice in the organic waste sector. Larger companies may also subcontract smaller companies that have the expertise to deliver on the services the former has advertised. Outsourcing is another common practice within the organic waste sector. It is particularly prevalent for transportation for the collection of waste from the generator.

Partnerships are not unusual in supply chains.50 One of the key motivations for partnerships is the focus on core competencies, whereby a business may choose to develop partnerships for activities that they do not deem to be their core competencies. As such, it is not unusual for actors in the sector to advertise services they do not have the in-house expertise to fulfil. They instead rely on outsourcing, subcontracting or partnering with other companies to fill the gap. This situation creates an interdependency amongst actors in the organic waste sector. Only one participant, Participant M, spoke negatively about partnerships: 'No its a recipe for disaster that. No, I've been there, done that, got burnt.'

Employment

The majority of participants had direct employees within their firms but Participants B, F and K worked alone. Participants D, N and O also worked alone but hired people on an ad-hoc basis. For Participant C, creating employment was not a high priority:

From a commercial point of view, employment is less important, not saying it's not important because we employ a lot of people... but that's not the reason we're in business, primarily we're looking for solutions.

Participant H held similar views: 'So the objective of our business is not employment, the objective, we see ourselves as a technology business not as an operating business.' In contrast, Participant I considered creating employment opportunities as part of their business model. They partnered with SMMEs (small, medium and micro enterprises) to install the technology, providing training and business mentorship.

In South Africa, the waste economy is commonly touted as an opportunity for job creation.12,14 Participant A holds the same view: 'The green economy, bio-economy, has a massive role to play in job creation in sustainable economic inclusion, in developing countries around the world'. However, in the organic waste sector, the question really comes down to where these jobs exist. Many large commercial waste generators often already have either an in-house waste management system or a contract with a waste management company for the separation of recyclables from general waste. Should an actor wish to pitch their services for organic waste treatment, this might include working with the already present waste management company (as mentioned above). In such cases the existing on-site staff would be trained on the new system and/or technology. Thus, there is a reduced need to bring in new employees and low potential for job creation. Moving further down the value chain, the potential for job creation increases, especially for offsite waste treatment. There are potential employment opportunities for the transportation of waste as the volumes increase.

When comparing the job creation potential of different waste treatment options, open windrow composting is associated with higher potential in comparison with in-vessel composting and anaerobic digestion.47 For anaerobic digestion, jobs are created for the construction and operation of the digestion. However, it must be noted that construction jobs are not necessarily permanent jobs as people may be recruited from the surrounding area to complete the task. According to the Southern African Biogas Industry Association51, significantly more jobs are created during the construction phase in comparison to direct permanent jobs. For composting, low technology composting methods require more employees.30 Labour is required not only for tending to the windrows, but also for separation and unpackaging of pre-consumer waste.

It is important to take into consideration the types of jobs that may be created and the associated skill level. Participants involved in waste treatment stated that there are job opportunities for unskilled workers as on-the-job training is provided. Specifically, Participant A stated:

I think the waste sector has such an important role to play in job creation for people with no or little skills that can be easily transferred where they can earn a decent wage, support their family back home in the Eastern Cape, get the kids though school, and start contributing to tax and income tax, and all of those attributes lacking in most of the sectors in the economy.

Participant J expanded on the issue of skills requirements:

So the school level is, from our point of view, is it's all self taught and self learnt. So you don't have to have a degree; you don't have to have a diploma. You just have to have a laptop and read and absorb and understand the process. But I think a lot of it is learnt through practical, observing and seeing.

These sentiments are supported by research conducted in the biogas sector34 and composting sector30,52.

Conclusions and recommendations

The results indicate that there are relatively more value chain actors participating in support activities than in primary activities. This finding may be attributed to the relatively higher barriers to entry for primary activities (e.g. waste treatment). This scenario may potentially lead to an imbalance in the sector, whereby there are more actors who recommend alternatives to disposal than there is treatment capacity. Furthermore, as the sector grows, there is a risk that new entrants will shy away from treatment activities, creating a potential bottleneck in the organic waste value chain.

To facilitate the transition towards a circular bioeconomy, interventions are required to ensure the growth of the waste treatment sector. Whilst the South African government has set national goals for the diversion of organic waste from landfill, there has been little guidance provided as to how these goals will be achieved. Specific focus should be on the development of capacity in the treatment sector in the form of new waste treatment facilities. Capacity development should not be limited to the private sector, but should include participation from provincial and local governments. Furthermore, the focus on the treatment of waste will also facilitate the creation of jobs and income opportunities.

Acknowledgements

We thank all the actors who participated in this study. This work was supported by the National Research Foundation of South Africa (NRF) within the Community of Practice: Waste to Value (grant UID 128149). The NRF cannot be held liable for any of the authors' stated opinions, findings and conclusions.

Competing interests

We have no competing interests to declare.

Authors' contributions

T.Y.C.: Conceptualisation; methodology; data collection; data analysis; writing - the initial draft; writing - revisions; project management. C.S.: Conceptualisation; writing - revisions; project leadership; funding acquisition.

References

1. Stegmann P Londo M, Junginger M. The circular bioeconomy: Its elements and role in European bioeconomy clusters. Resour Conserv Recycl X. 2020;6, Art. #100029. https://doi.org/10.10167j.rcrx.2019.100029 [ Links ]

2. Philp J, Winickoff D. Realising the circular bioeconomy. OECD Science, Technology and Industry Policy Papers 60. Paris: OECD Publishing; 2018. [ Links ]

3. Paes LAB, Bezerra BS, Deus RM, Jugend D, Battistelle RAG. Organic solid waste management in a circular economy perspective - A systematic review and SWOT analysis. J Clean Prod. 2019;239, Art. #118086. https://doi.org/10.1016/j.jclepro.2019.118086 [ Links ]

4. San Juan MG, Bogdanski A, Dubois O. Towards sustainable bioeconomy [document on the Internet]. c2019 [cited 2021 Feb 12]. Available from: http://www.fao.org/3/a-bs923e.pdf [ Links ]

5. Calicioglu 0, Bogdanski A. Linking the bioeconomy to the 2030 sustainable development agenda: Can SDG indicators be used to monitor progress towards a sustainable bioeconomy? N Biotechnol. 2021;61:40-19. https://doi.org/10.1016/j.nbt.2020.10.010 [ Links ]

6. Heimann T. Bioeconomy and SDGs: Does the bioeconomy support the achievement of the SDGs? Earth's Future. 2019;7:43-57. https://doi.org/10.1029/2018EF001014 [ Links ]

7. Dietz T, Borner J, Forster JJ, Von Braun J. Governance of the bioeconomy: A global comparative study of national bioeconomy strategies. Sustainability. 2018;10, Art. #3190. https://doi.org/10.3390/su10093190 [ Links ]

8. Mak TMW, Xiong X, Tsang DCW, Yu IKM, Poon CS. Sustainable food waste management towards circular bioeconomy: Policy review, limitations and opportunities. Bioresour Technol. 2020;297, Art. #122497. https://doi.org/10.1016/j.biortech.2019.122497 [ Links ]

9. Maina S, Kachrimanidou V Koutinas A. A roadmap towards a circular and sustainable bioeconomy through waste valorization. Curr Opin Green Sustain Chem. 2017;8:18-23. https://doi.org/10.1016/j.cogsc.2017.07.007 [ Links ]

10. South African Department of Science and Technology (DST). The bioeconomy strategy. Pretoria: DST; 2013. [ Links ]

11. South African Department of Environmental Affairs (DEA). South Africa -State of waste report. Pretoria: DEA; 2018. [ Links ]

12. South African Department of Environment, Forestry and Fisheries (DEFF). National waste management strategy 2020. Pretoria: DEFF; 2020. [ Links ]

13. GreenCape. Food loss and waste: A case for reduction, recovery and recycling. Cape Town: GreenCape; 2020. [ Links ]

14. South African Department of Environmental Affairs (DEA). Operation Phakisa: Chemicals and waste economy lab outcomes. Pretoria: DEA; 2017. [ Links ]

15. Greben HA, Oelofse SHH. Unlocking the resource potential of organic waste: A South African perspective. Waste Manag Res. 2009;27:676-684. https://doi.org/10.1177/0734242X09103817 [ Links ]

16. Bellu LG. Value chain analysis for policy making: Methodological guidelines for a quantitative approach. Rome: Food and Agricultural Organization of the United Nations; 2013. [ Links ]

17. Kaplinsky R, Morris M. A handbook for value chain research. Ottawa: International Development Research Centre; 2001. [ Links ]

18. Porter M. The value chain and competitive advantage. In: Competitive advantage: Creating and sustaining superior performance. New York: Free Press; 1985. p. 33-61. [ Links ]

19. Gereff G, Humphrey J, Kaplinsky R, Sturgeon TJ. Introduction: Globalisation, value chains and development. IDS Bull. 2001;32:1-8. https://doi.org/10.1111/j.1759-5436.2001.mp32002001.x [ Links ]

20. Hellin J, Meijer M. Guidelines for value chain analysis. Rome: Food and Agricultural Organization of the United Nations; 2006. [ Links ]

21. Dahlstrom K, Ekins R Combining economic and environmental dimensions: Value chain analysis of UK iron and steel flows. Ecol Econ. 2006;58:507-519. https://doi.org/10.1016/j.ecolecon.2005.07.024 [ Links ]

22. Schmitz H. Value chain analysis for policy-makers and practitioners. Geneva: International Labour Office; 2005. [ Links ]

23. Statistics South Africa (Stats SA). General household survey 2020. Pretoria: Stats SA; 2021. [ Links ]

24. Epstein E. Industrial composting: Environmental engineering and facilities management. Boca Raton, FL: CRC Rress; 2011. https://doi.org/10.1201/b10726 [ Links ]

25. Kigozi R, Muzenda E, Aboyade AO. Biogas technology: Current trends, opportunities and challenges. Raper presented at: 6th International Conference on Green Technology, Renewable Energy & Environmental Engineering; 2014 November 27-28; Cape Town, South Africa. [ Links ]

26. Soos R, Whiteman A, Gheorghiu D. Financial implications of advanced waste treatment. Rretoria: Department of Environmental Affairs; 2014. [ Links ]

27. SA Harvest [homepage on the Internet]. No date [cited 2021 Sep 26]. Available from: https://saharvest.org [ Links ]

28. FoodForward SA. Welcome to FoodForward SA [webpage on the Internet]. No date [cited 2021 Sep 26]. Available from: https://foodforwardsa.org [ Links ]

29. Agriprotein [homepage on the Internet]. No date [cited 2021 Feb 11]. Available from: https://www.agriprotein.com/ [ Links ]

30. South African Department of Environmental Affairs (DEA). The national organic waste composting strategy - final status quo report. Pretoria: DEA; 2013. [ Links ]

31. Schaub SM, Leonard JJ. Composting: An alternative waste management option for food processing industries. Trends Food Sci Technol. 1996;7:263-268. https://doi.org/10.1016/0924-2244(96)10029-7 [ Links ]

32. Western Cape Department of Environmental Affairs & Development Rlanning (DEADR). Provincial organic waste strategy. Cape Town: DEADR; 2020. [ Links ]

33. Mutungwazi A, Mukumba R, Makaka G. Biogas digester types installed in South Africa: A review. Renew Sustain Energy Rev. 2018;81:172-180. https://doi.org/10.1016/j.rser.2017.07.051 [ Links ]

34. Southern African Biogas Industry Association (SABIA). Biogas industry in South Africa - An assessment of the skills need and estimation of the job potential. Rretoria: GIZ; 2016. [ Links ]

35. Nagel BM. An update on the process economics of biogas in South Africa based on observations from recent installations [MSc dissertation]. Cape Town: University of Cape Town; 2019. [ Links ]

36. Gorgens J, Mandegari M, Farzad S, Dafal A, Haigh K. A biorefinery approach to improve the sustainability of the South African sugar industry: An assessment of selected scenarios. Green Economy Research Report. Rretoria/Johannesburg: DEA/Green Fund/DBSA; 2015. [ Links ]

37. Farzad S, Mandegari MA, Guo M, Haigh KF, Shah N, Gorgens JF. Multi-product biorefineries from lignocelluloses: A pathway to revitalisation of the sugar industry? Biotechnol Biofuels. 2017;10, Art. #87. https://doi.org/10.1186/s13068-017-0761-9 [ Links ]

38. Rachon ER, Vaskan R Raman JK, Gnansounou E. Transition of a South African sugar mill towards a biorefinery. A feasibility assessment. Appl Energy. 2018;229:1-17. https://doi.org/10.1016/j.apenergy.2018.07.104 [ Links ]

39. De Jong W, Marcotullio G. Overview of biorefineries based on co-production of furfural, existing concepts and novel developments. Int J Chem React Eng. 2010;8(1). https://doi.org/10.2202/1542-6580.2174 [ Links ]

40. Brenn-o-kem. Our range of products [webpage on the Internet]. No date [cited 2021 Feb 11]. Available from: https://www.brenn-o-kem.co.za/products/ [ Links ]

41. Stafford W, De Lange W, Nahman A, Chunilall V Lekha R Andrew J. et al. Forestry biorefineries. Renew Energy. 2020;154:461-475. https://doi.org/10.1016/j.renene.2020.02.002 [ Links ]

42. Given LM, editor. The SAGE encyclopedia of qualitative research methods. Thousand Oaks, CA: SAGE Rublishing; 2008. [ Links ]

43. Miles MB, Huberman AM, Saldana J. Qualitative data analysis: A methods sourcebook. 3rd ed. Thousand Oaks, CA: SAGE Rublishing; 2014. [ Links ]

44. Campitelli A, Schebek L. How is the performance of waste management systems assessed globally ? A systematic review. J Clean Rrod. 2020;272, Art. #122986. https://doi.org/10.1016/j.jclepro.2020.122986 [ Links ]

45. WynneB. The toxic waste trade: International regulatory issues and options.Third World Q. 1989;11:120-146. https://doi.org/10.1080/01436598908420177 [ Links ]

46. Burneo D, Cansino JM, Yniguez R. Environmental and socioeconomic impacts of urban waste recycling as part of circular economy. The case of Cuenca (Ecuador). Sustainability. 2020;12(8), Art. #3406. https://doi.org/10.3390/su12083406 [ Links ]

47. South African Department of Environmental Affairs (DEA). Alternative waste treatment guide [webpage on the Internet]. No date [cited 2020 Sep 09]. Available from: http://awtguide.environment.gov.za/ [ Links ]

48. South African Department of Science and Technology (DST). Research projects: South African Biorefinery Research Rlatform [webpage on the Internet]. No date [cited 2020 Mar 21]. Available from: http://wasteroadmap.co.za/biorefinery/research-projects/ [ Links ]

49. Schwehn E, Whiteman A, Frith R, Gower-Jackson S. Appropriate technology for advanced waste treatment. Rretoria: Department of Environmental Affairs; 2014. [ Links ]

50. Ayers JB. Introduction to the supply chain. In: Handbook of supply chain management. Boca Raton, FL: CRC Rress; 2000. p. 3-8. https://doi.org/10.1201/9781420025705 [ Links ]

51. Southern African Biogas Industry Association (SABIA). Market position paper. Johannesburg: SABIA; 2021. [ Links ]

52. Sehlabi R, Morton McKay T. Municipalities, commercial composting and sustainable development: The case of Johannesburg, South Africa. Environ Econ. 2016;7:53-59. https://doi.org/10.21511/ee.07(1).2016.07 [ Links ]

Correspondence:

Correspondence:

Takunda Chitaka

Email: chitakaty@gmail.com

Received: 28 Sep. 2021

Revised: 29 Mar. 2022

Accepted: 29 Mar. 2022

Published: 31 Aug. 2022

Editor: Jennifer Fitchett

Funding: South African National Research Foundation (grant UID 128149)