Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Science

On-line version ISSN 1996-7489

Print version ISSN 0038-2353

S. Afr. j. sci. vol.116 n.9-10 Pretoria Sep./Oct. 2020

http://dx.doi.org/10.17159/sajs.2020/7966

RESEARCH ARTICLE

Structure of the sunflower plant breeders' rights landscape in South Africa

Charity R. Nhemachena; Binganidzo Muchara

Department of Finance and Economics, Graduate School of Business Leadership, University of South Africa, Pretoria, South Africa

ABSTRACT

Varietal innovations and protection of plant breeders' rights (PBRs) contribute to the development of any crop's ability to produce higher yields relatively consistently. Producing yields under adverse weather conditions and the overall characteristic of drought tolerance, make the sunflower an attractive crop for producers in dryland production regions. The main objective of this study was to give an overview of the structure of the South African sunflower breeding programme, focusing on the construction of PBRs and the leading players in sunflower breeding and seed production in South Africa. We compiled a detailed database of sunflower varietal innovations in South Africa from 1979 to 2019 using various sources such as the South African Grain Laboratory, the Department of Agriculture's Plant Variety Journals and the Crop Estimation Committee. This data set was then analysed using descriptive statistics and trend analysis to determine the main trends in ownership of PBRs and sunflower varieties. We looked at the inclusion of new sunflower varieties on the national variety list for sunflower varietal improvements in South Africa over this period. A total of 76 PBR sunflower varietal applications were lodged for the period - an average of 1.9 applications per year. The principal applicants for varietal inclusions on the national variety list were Pannar with 102 varieties (23.8%), Pioneer seeds with 51 varieties (11%), Saffola seed with 42 varieties (9.8%) and Agricultural Research Council with 10 varieties (2.3%). In order for breeders to benefit from their investment in research and avoid exploitation of their work, they need to be protected and receive returns on their investments. Innovation can be stimulated by proper collaboration between the private and public sectors, aided by broader variety sector legislation that encourages all players to invest.

SIGNIFICANCE:

• The study addresses the absence of empirical proof on the patterns and trends of sunflower varietal improvements in South Africa.

• The study provides evidence on the evolution of varietal rights, the extent of varietal rights granted, and which sunflower varieties were included on the national variety list and the breeders and owners of the varieties.

Keywords: varieties, breeder, research, plant

Introduction

There is increased investment from the private sector in the agriculture and seed industry in South Africa, which has triggered a significant debate on intellectual property rights.1 Several legislations have been formulated at a national and international level on intellectual property rights. The protection of intellectual property rights of plant breeders was recognised in the 19th century. The International Union for the Protection of New Varieties of Plants (UPOV) was established in 1961 and seeks to coordinate plant variety protection laws and standards of protection across member countries. Plant variety protection allows exclusively the protection granted for plant-related innovations.1

South Africa became the tenth member of UPOV in 1977. In 2001, there were more than 50 member countries, and the number increases every year. The main objectives of UPOV are to bring about standard laws on plant breeders' rights, to standardise procedures for the testing of new varieties and to promote cooperation between member countries. The advantage of being a UPOV member is the privilege of any person within a member country to apply for plant breeders' rights in any other member country. Plant breeders' rights (PBRs) are a form of intellectual property rights that are valid only in the country in which they were granted.2 PBRs can be granted to a variety in different countries. Since 1996, the country has not acceded to UPOV 1991 through amendment of the Plant Breeders' Rights Act3which was enacted in 19764. PBR provides for the acquisition of legal rights in terms of this Plant Breeders' Rights Act, to obtain royalties as a return on research efforts and investments made during the process of breeding of a new plant variety. The whole process provides the owner of a variety the opportunity to obtain a financial reward for their efforts, as the breeding and development of a new variety are expensive and time consuming. It is important to develop new and improved plant varieties as there is a continuous demand for better quality, higher yields, better processing properties and increased disease resistance.

A PBR is valid for a term of 20 or 25 years, depending on the type of plant. During the first 5 to 8 years (the period of sole right for the breeder), the owner has the sole right to multiply and market propagating material of the variety. During the next 15 years, the holder is required to issue licences to other persons who also desire to use the material. If the holder off the right refuses to issue licences, these individuals may apply to the Registrar for a compulsory licence.2 During the term of the right, the holder may continue to claim royalties from all licensees for any propagating material produced and sold. It is only after the expiration of the full term of the plant breeder's right, that the variety becomes openly accessible to the public, and anyone may then propagate and sell it.2 Foreign breeders and variety owners are not keen to supply propagating material to individuals in other countries if such material cannot be protected under PBR. Hitherto, very little foreign propagating and breeding material would be available in South Africa if we did not have a PBR system.2 Pardey et al.5 argue that plant varietal rights are subject to ongoing public policy scrutiny and debate. To inform these policy discussions, there is a need to understand the evolution of varietal rights and the extent of the varietal rights granted. It is also essential to follow changes in the rights on offer over time such as changing ownership of the rights (including a comparison between public and private as well as domestic and foreign breeders) and the impact of plant variety protection on varietal development.

In this study, we focused on sector analysis in the South African sunflower industry regarding intellectual property rights in the form of PBR and the leading role players in sunflower breeding and production in South Africa. We provide insight into the pattern of application for and granting of PBR and also the inclusion of a variety on the national variety list, with a focus on the main players in the sector. The trend analysis of PBR application for the period 1979-2019 helps to define the technology trend in the application of PBR and the registration sunflower varieties on the national variety list. The analysis further determines the focus of local public and private, and foreign public and private sector research through the inclusion of sunflower varieties on the national variety list.

An overview of the sunflower industry

Sunflower is a native wild crop from North America which originated around the Fertile Crescents or South and Central America, and native Americans used it as a food source. In North America, it was crushed or pounded into flour for cakes and bread.6,7 Europeans were exposed to sunflower cultivation from places like southern Canada and Mexico to Spain. Spain was the first gateway of sunflowers into Europe, and then the crop spread until it reached Russia.7 It was in Russia where the first commercial production started.6 In the early 19th century, Russian farmers were growing over 810 000 hectares of sunflower seed. Russia began to produce high oils from sunflower seed in 1860 and this increased oil content from 28% to almost 50%. These oils from Russia were exported into the USA after World War II, which stirred world interest in the crop.7 The first commercial hybrid of sunflower was released in 1972, and it produced a 25% higher yield than the normal variety.8 The genetic modification allowed for the release of short-stemmed and high-yield varieties that enabled efficient mechanised cropping, resulting in sunflower being a major oilseed crop.8

In South Africa, sunflower is listed as the third most important crop after maize and wheat, and the Crop Estimation Committee reported a yield of 820 000 tons in the 2017/2018 production season.9 Sunflower has been classified as an ideal crop because of its characteristics of thriving under marginalised and low-input farming conditions. Sunflower has the ability to produce consistent yields under hostile weather conditions. It is drought tolerant and hence attractive to dryland farmers. The crop can grow in marginal soils with little or no fertiliser. In South Africa, it is regarded as a low input and beneficial cash crop following maize.10 Sunflower can take advantage of residual nitrogen and subsoil moisture that is underutilised by other crops; hence, it is a useful crop for crop rotation.

Sunflower seed is mainly used for human consumption for oil production and cake feed for animals, especially in the dairy industry.9 Although the whole seed is utilised, sunflower constitutes about 10-20% of the volumes of crops produced in South Africa each year. The prices for confectionery sunflower seed are significantly higher than sunflower seed that is used for oil processing. Some confectionery sunflower is processed into foods such as granola bars, healthy multigrain breads, roasted as a snack or for other baking purposes. The sunflower seed also produces oil cake, that is mainly used for animal feeds as sunflower oilcake meal because of its high protein content. Sunflowers can be used as an alternative for peanut butter to make sun butter for people with nut allergies. It is also mixed with rye flour to make bread (in Germany, this is called Sonnenblumenkernbrot - literally: sunflower whole seed bread).6 Sunflower seeds are sold as food for birds and can be used directly in cooking and salads. Sunflower and soybeans are important sources of oils and protein for both household and industrial purposes.11 When seeds are dehulled, the seed can be consumed or made into different oils. Sunflower oil is used daily by restaurants, food industries and households as cooking oil, margarine and spreads. Sunflower oil can also be converted into biodiesel.12

Sunflower also has non-consumption uses, such as purple dye for textiles, body painting and cosmetics. The other various parts of the plant are used medicinally for the skin and hair, and the dried stalk is used as building material. The plant is also used as an ornamental flower in Europe.6 Sunflowers are also used to produce latex; they are a subject of experiments to improve their suitability as an alternative crop for producing hypoallergenic rubber.

Production areas of sunflower in South Africa

Sunflower seed is produced in six of the nine provinces in South Africa. The Free State and North West Provinces are the major producers of sunflower seed, followed by Limpopo, Mpumalanga and Gauteng.2 Of the area planted with sunflower in the 2011-2016 period, 54% was in the Free State, 34% in the North West, 11% in Limpopo and 1% in Mpumalanga.13 The area planted with sunflower increased in the drought-affected season of 2016 due to sunflower's better performance in dry conditions and its late planting window relative to maize.10

Figure 1 shows trends in sunflower area and yield in South Africa between 1936 and 2018. The patterns indicate an overall increasing trend in both area and production. The hectares planted for sunflower seed have been volatile for the past 10 years, with an average annual growth of only 1.8%. Only in recent seasons have the number of hectares planted stabilised at around 600 000 hectares per annum. The sunflower crop yield of the 2017/2018 season, as shown in Figure 1 is over 600 000 tons. The crop decreased by 1.4% (12 000 tons) in this period. The major sunflower-producing provinces, namely the Free State and North West, contributed 95% of the total crop.

Research methods and data

Plant breeders' rights with respect to sunflowers in South Africa were analysed to assess the sources of intellectual property rights. We used secondary data collected from various sources on sunflower variety policies and changes in sunflower PBRs. Some studies analysed changes in plant variety protection focusing on trends and changes in plant variety including protection policies.5,14,15 These studies analysed trends to understand the evolution of plant varietal protection. We applied the same approach in order to understand changes that have shaped the South African sunflower varietal improvement landscape to date. The findings allow comparison with other countries in future.

Data on sunflower varietal innovations in South Africa from 1979 to 2019 were collected from the Plant Variety Journal which is compiled under the supervision of the Registrar of Agriculture in the South African Department of Agriculture, Forestry and Fisheries. The database provides information to assess changing amounts and forms of sunflower PBRs as well as changes in the types of applicants of the rights and inclusion of the South African seed variety list. The database includes data on applications and granting of the PBRs and applications for additions on the national variety list. Further information captured in the database includes plant variety name, alias name, applicant name, applicant type, application date of PBR, grant date of PBR and application date for the varieties to be included on the national variety list. A supplementary file was provided to show the principal applicants and the sunflower varieties they own.

Overview of sunflower varietal releases in South Africa

Trends of sunflower inclusion on the national varietal list

Figure 2 shows the trends of annual applications for PBRs for sunflower varieties lodged in South Africa. The total number of PBRs submitted for sunflower varieties were 76 during the period from 1979 to 2019 - an average of 1.9 applications per year. The period starts in 1979 because that is the year that PBR applications began to be recorded in the Plant Variety Journal. Data on the number of sunflower PBRs lodged since 1979 show changes over time, with some years having a high number of applications while others recorded very low applications. The highest number of applications (14 in total) was made in 2016. There were no applications from 1979 up to 1980 and between 1982 and 2000. Furthermore, no applications were lodged in 2005, 2011, 2013, 2014 and 2017. It can be argued that the gaps could be because most breeders and seed sellers focused on registering their sunflower varieties on the national variety list. Applications for sunflower varietal inclusions on the national variety list are typically recorded in the Plant Variety Journal before application for new varieties. The total number of PBRs lodged for sunflower varieties were compared to maize and wheat which have a very high number of PBRs applications.

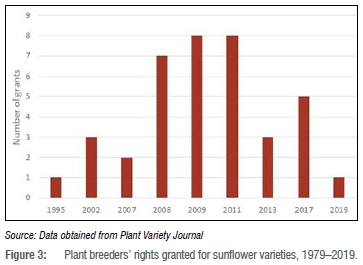

Figure 3 presents an analysis of the PBRs for sunflower varieties that were granted. A total of only 38 PBRs grants were approved in the period 1979-2019, with the first approval in 1995. The political situation before 1994 could have contributed to this low number as most of the applicants were private companies partnering with foreign companies. The highest number of PBRs were granted in 2009 and 2011 with both years recording nine grants. The average waiting period between application for and granting of protection is more than 365 days and this overall period may be threatening innovation in this sector.

Figure 4 shows the applications that were lodged by breeders and seed companies for their sunflower varieties to be included on the national seed varieties list. A total of 429 applications were submitted for inclusion of sunflower varieties on the national variety list in the study period. The highest number of applications was recorded in 1991 with approximately 38 applications and the lowest number of applications (2) was recorded in 2010. In the sunflower industry, there are more applications from plant breeders for inclusion on the national variety list than for protection of PBRs.

It is important to note that, despite no new applications being lodged between 1982 and 2000 (Figure 2), there were large numbers of applications for inclusion of varieties in the national list for the same period (Figure 4). Breeders were therefore focusing on listing their varieties instead of continuing to produce new varieties whose listing on the national varietal list was not certain. The registration of new varieties on the national list is driven by government entities, while breeding is mostly done by private companies. Synchronisation of the activities and processes is important to minimise delays in the processing of applications as well as granting of PBRs. Often breeders are directly affected by the delays in the registration system with potential revenue losses. The knock-on effect is that breeders are discouraged from continued investment in new varieties and consequently the sector, as well as the economy, is negatively affected.

Applicants for inclusion of sunflower varieties on national variety list

We analysed the nature of applicants seeking inclusion of sunflower varieties on the South Africa national variety list for the period 1979- 2019. The focus was on identifying the changing public, private and foreign owners' roles in the sunflower national variety list. Table 1 presents the composition of applicants (breeders and seed sellers) of sunflower varieties on the national variety list. Based on analysis of shares of sunflower varieties included on the national variety list since the first publication of the South African Plant Variety Journal in 1979, there were 54 applicants and the main applicants were Pannar with 102 varieties (23.8%), Pioneer seeds with 51 varieties (11%), Saffola seed with 42 varieties (9.8%) and the Agricultural Research Council (ARC) with 10 varieties (2.3%). The public sector represented by ARC came into play to apply for inclusion of their sunflower varieties on the national variety list in 1995, which shows that the public sector was not dealing much with sunflower. The main applicants and also owners of sunflower varieties are private companies in South Africa and foreign private companies that collaborate with local private companies. These foreign companies are Syngenta South Africa and Syngenta France, Cargill SA and Cargill USA and Pioneer Seeds and Sipco Sun Products. In a study done in the Netherlands, Louwaars et al.16 found that the public sector (universities, government bodies and private non-profit organisations) submitted 23.8% of plant based patents, while in a study done in the USA, public bodies were granted 21.9%. Furthermore, Louwaars et al.16 found that in the Netherlands, private companies dominated the number of plant-based patents granted in the country. In South Africa, the wheat sector is also governed by the private sector with companies like Sensako and Pannar.15

Figure 5 presents the changing composition of applicants of sunflower varietal inclusion on the national variety list. The majority of the varietal inclusion applications for sunflower varieties were filed by local private companies like Pannar, Pioneer, Sensako, Cargill, Carnia, Agroseed and more.

The local private sector constituted the largest share, accounting for 77% of varietal inclusion applications on the national variety list. We further found that the percentage of collaborations between local companies and foreign companies as the second-highest applications, at 19%. Partnerships are formed with local companies when they apply for foreign sunflower varieties to be included on the national variety list on behalf of a foreign company. These companies include Syngenta USA, Syngenta France, Pioneer Hi Brid USA, Dow Grow Sciences Argentina and Bio seed USA. In the South African sunflower industry, the public sector, especially the ARC, continues to play a minor role in the development of sunflower varieties with only a 1% share in the applications of varietal inclusions on the national variety list, and an indication of less activity from the public sector in sunflower production.

The future of the sunflower industry in South Africa

The ARC is exploring the use of crop breeding and engineering principles to produce advanced biofuel. There are various crops identified in South Africa for biodiesel and renewable diesel that include sunflower, soybean and canola. The ARC has been exploiting selected cultivars of sunflower for production of renewable (green) diesel, which is known to meet the requirements for use in a diesel engine. South Africa's White Paper on Renewable Energy highlights the aim of achieving 2-5% levels of biofuels in the national liquid fuel supplies, which currently stand at 400 million litres per annum.12 Sunflower, canola and soybeans have since been proposed for the production of biodiesel in the country. Biodiesel from plant oils is widely recommended to be an ecofriendly, renewable energy source which can be a suitable replacement for petroleum fuel-derived diesel. Sunflower is one of the leading oil crops in South Africa and one of the biofuel mandates by the government for biodiesel production. Indeed, mandatory blending with renewables might become applicable at various filling stations in South Africa.12 However, the success of sunflower-dependent industries depends on the success and level of innovation in the release and registration of new sunflower varieties in South Africa. Hybrid varieties are often more productive to meet the ever-growing demand in the renewable energy sector, hence a more efficient seed breeding programme, variety registration and granting of breeders' rights is required to ensure long-term growth and sustainability of the sector.

Conclusion and recommendations

We analysed the evolving landscape of sunflower plant breeders' rights to address the absence of empirical proof of the patterns and trends of sunflower varietal improvements in South Africa. The aim of the study was to provide evidence on the evolution of varietal rights, the extent of varietal rights granted, and which sunflower varieties were included on the national variety list and the breeders and owners of the varieties. The changes of the rights over time, changing ownership of PBRs (including comparison between public and private as well as domestic and foreign breeders) and the impact of plant variety protection on sunflower development were analysed. We put together a detailed and novel count and attribute database of sunflower varietal innovations in South Africa from 1979 to 2019, using information from Plant Variety Journal, Department of Agriculture Forestry and Fisheries, South African National Library and ARC. The empirical analyses were based on descriptive statistics, trend analysis and graphical representation of trends and ownership of PBRs of sunflower varietal improvements and applications of sunflower for inclusion of varieties on the national variety list.

A total of 76 PBR sunflower varietal applications were lodged during the period under study with an average of 1.9 applications per annum. The breeders of new varieties need to be protected for them to receive returns on their investments into varietal improvement research. This can be done by improving the efficiency of the registration and processing of applications related to PBRs. Furthermore, innovations can be stimulated by strong collaborations between the private and public sectors, which can be achieved by improving legislation that governs all players in the sector.

Acknowledgements

We thank the anonymous reviewers who provided comments on this manuscript.

Competing interests

We declare that there are no competing interests.

Authors' contributions

C.R.N. and B.M. were jointly responsible for the paper.

References

1. Srivastava M, Chaudhary V, Pilania D. Intellectual property rights on plant varieties in India: A sector-wise analysis [document on the Internet]. [ Links ] c2015 [cited 2019 Jun 19]. Available from: http://nopr.niscair.res.in/handle/123456789/31288

2. South African Department of Agriculture Forestry and Fisheries (DAFF). Plant Breeders' Rights policy [webpage on the Internet]. [ Links ] c2011 [cited 2019 Jun 27]. Available from: https://www.gov.za/services/plant-production/plant-breeders-rights?

3. Nhemachena C, Kirsten J, Muchara B. The effects of Plant Breeders' Rights on wheat productivity and variety improvement in South Africa. Paper presented at: Agricultural Economics Association of South Africa (AEASA) Annual Conference; 2018 September 25-27; Cape Town, South Africa. https://doi.org/10.22004/ag.econ.284783 [ Links ]

4. Moephuli S, Moselakgomo M, Phehane V. The Agricultural Research Council's role in plant variety protection and technology transfer - promoting publicly funded research. Paper presented at: UPOV Workshop; 2012 March 05; Zanzibar, Tanzania. [ Links ]

5. Pardey P, Koo B, Drew J, Horwich J, Nottenburg C. The evolving landscape of plant varietal rights in the United States, 1930-2008. Nat Biotechnol. 2013;31(1):25-29. [ Links ]

6. Boshoff ID. The factors that influence the price of sunflower in South Africa [thesis]. Potchefstroom: North-West University; 2008.

7. South African Department of Agriculture, Forestry and Fisheries (DAFF). Sunflower production guideline 2010 [document on the Internet]. [ Links ] c2010 [cited 2019 May 19]. Available from: https://www.nda.agric.za/docs/Brochures/prodGuideSunflower.pdf

8. Blamey FPC, Zollinger RK, Schneiter AA. Sunflower production and culture. In: Schneiter AA, editor. Sunflower technology and production. Volume 35. Madison, WI: The American Society of Agronomy; 2015. p. 1-19. https://doi.org/10.2134/agronmonogr35.c12 [ Links ]

9. Ma'ali S. Delayed planting impacts sunflower yield [webpage on the Internet]. [ Links ] c2017 [cited 2019 June 19]. Available from: https://www.grainsa.co.za/delayed-planting-impacts-sunflower-yield

10. South African Bureau for Food and Agricultural Policy (BFAP). The South African sunflower complex: A report by the Bureau for Food and Agricultural Policy (BFAP). Compiled for the Oilseed and Protein Advisory Development Trust and Oilseed Advisory Committee (OAC). Pretoria: BFAP; 2015 [cited 2019 June 16]. [ Links ] Available from: https://www.bfap.co.za/the-south-african-sunflower-complex/

11. Dlamini TS, Magingxa L, Liebenberg F. Estimating the economic value of the national cultivar trials in South Africa: A case for sorghum, sunflower, soybeans and dry beans. Paper presented at: The Fourth Congress of the Italian Association of Agricultural and Applied Economics (AIEAA); 2015 June 11-12; Ancona, Italy. https://doi.org/10.22004/ag.econ.207288 [ Links ]

12. South African Agricultural Research Council (ARC). Annual report. Pretoria: ARC; 2018. Available from: https://www.arc.agric.za/Documents/Annual%20Reports/ARCAnnualReport-OCTOBER2019-low%20res.pdf [ Links ]

13. United States Department of Agriculture (USDA). Southern Africa: Crop production map [webpage on the Internet]. [ Links ] c2020 [cited 2020 May 02]. Available from: https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/safrica/SouthAfrica_Sunflower.gif

14. Srinivasan CS. Concentration in ownership of plant variety rights: Some implications for developing countries. Food Policy. 2003;28(5-6):519-546. https://doi.org/10.1016/j.foodpol.2003.10.003 [ Links ]

15. Nhemachena CR, Liebenberg FG, Kirsten J. The evolving landscape of plant breeders' rights regarding wheat varieties in South Africa. S Afr J Sci. 2016;112(3-4), Art. #2015-0164, 8 pages. http://dx.doi.org/10.17159/sajs.2016/20150164 [ Links ]

16. Louwaars N, Dons H, Van Overwalle G, Raven H, Arundel A, Eaton DJ, et al. Breeding business. The future of plant breeding in the light of developments in patent rights and plant breeder's rights. CGN Report 2009-14. Wageningen: Centre for Genetic Resources, Wageningen University and Research Centre; 2009. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1720088 [ Links ]

17. South African Grain Information Services (SAGIS) [homepage on the Internet]. [ Links ] No date [cited 2019 Jun 23]. Available from: http://www.sagis.org.za/

Correspondence:

Correspondence:

Charity Nhemachena

Email: nhemachenacharity@gmail.com

Received: 17 Feb. 2020

Revised: 23 May 2020

Accepted: 28 May 2020

Published: 29 Sep. 2020

Editors: Teresa Coutinho, Salmina Mokgehle

Funding: None